SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 1-K (the “Annual Report”) contains forward-looking statements. In some cases, you can identify these statements by forward-looking words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “would,” “project,” “plan,” “expect” or the negative or plural of these words or similar expressions. These forward-looking statements include, but are not limited to, statements concerning us, risk factors, plans and projections. You should not rely upon forward-looking statements as predictions of future events. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described under “Risk Factors” in Item 1 of this Annual Report. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this Annual Report may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

Except as required by law, neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. We undertake no obligation to update publicly any forward-looking statements for any reason after the date of this Annual Report to conform these statements to actual results or to changes in our expectations.

You should read this Annual Report, and the documents that we reference in this Annual Report and have filed with the Securities and Exchange Commission (the “SEC”) with the understanding that our actual future results, performance and events and circumstances may be materially different from what we expect.

1

| Item 1. | Business |

Overview

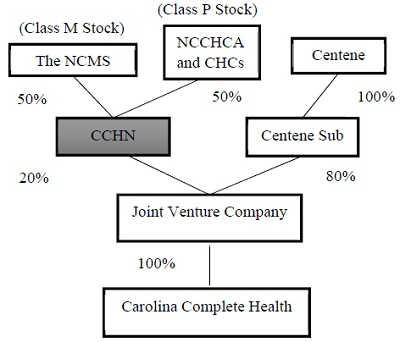

Carolina Complete Health Network, Inc. (“CCHN,” “we,” “us” or “our”) was formed as a wholly-owned subsidiary of the North Carolina Medical Society (the “NCMS”) in Delaware on May 19, 2016. CCHN’s primary purpose is to build and operate a network of health care professionals (the “Provider Network”) who will provide medical services under a patient-focused Medicaid health plan (the “Health Plan”) in response to the pending implementation of Medicaid reform in North Carolina. A North Carolina licensed insurance company, Carolina Complete Health, Inc. (“Carolina Complete Health”), will operate the Health Plan, which will be North Carolina’s first physician-led Medicaid prepaid health plan (“PHP”). The Health Plan will be owned and operated pursuant to a joint venture (the “Joint Venture”) among the NCMS, CCHN, Centene Corporation (“Centene”) and Centene Health Plan Holdings, Inc., a subsidiary of Centene (“Centene Sub,” and together with the NCMS, CCHN and Centene, the “Joint Venture Parties”). The closing of the Joint Venture transactions (the “Joint Venture Closing”) is anticipated to occur by September 30, 2019.

The current relationship among the entities participating in the Joint Venture is illustrated in the following diagram (in which the shaded box identifies our company):

CCHN and the NCMS believe that partnering with a large insurance company to create a new health plan will enable the NCMS to help lead the Medicaid reform process in North Carolina and will provide physicians with an alternative to traditional managed care options that some providers have historically disfavored. The Joint Venture Parties have deliberately separated the Provider Network from Carolina Complete Health, seeking to design a structure that will offer an independent open channel for physicians to provide meaningful input in the design and implementation of the Health Plan. The aim is that such physician involvement will lead to greater provider satisfaction with managed care and participation in a groundbreaking managed care option that increases efficiency and creates better patient outcomes.

CCHN is currently conducting an offering of up to 20,000 shares of our Class P Common Stock pursuant to Regulation A of the Securities Act of 1933, as amended, on a continuous basis (the “Offering”). We are offering one, but not more than one, share of Class P Common Stock, for a subscription price per share of $750.00, solely to physicians, physician assistants and nurse practitioners licensed or approved to practice, as applicable, in North Carolina who (i) participate in our health care provider network, (ii) reside in North Carolina, Georgia, South Carolina, Tennessee or Virginia and (iii) meet certain other eligibility criteria. The initial closing of the Offering will occur, if at all, prior to the Joint Venture Closing. The shares offered in the Offering represent in the aggregate a 46.5 percent direct equity interest in CCHN.

2

Medicaid Reform in North Carolina

Authorized by Title XIX of the Social Security Act of 1965 (the “Social Security Act”), Medicaid is an entitlement program providing medical coverage for low-income and disabled individuals, which is funded jointly by the federal and state governments and administered by the states. Each state establishes its own eligibility standards, benefit packages, payment rates and program administration within federal standards. Pursuant to the Social Security Act, the Secretary of Health and Human Services has the authority to approve experimental, pilot or demonstration projects that promote the objectives of the Medicaid program, thereby giving states additional flexibility to design Medicaid programs containing aspects that may differ from the federal standards in pursuit of improving care and patient outcomes, increasing efficiency and reducing costs.

In September 2015, the North Carolina legislature passed House Bill 372, S.L. 2015-245, a Medicaid reform bill with the stated purposes of ensuring (1) budget predictability through shared risk and accountability, (2) balanced quality, patient satisfaction and financial measures, (3) efficient and cost-effective administrative systems and structures and (4) a sustainable delivery system through the establishment of two types of PHPs: provider-led entities and commercial plans. To get the necessary federal approval of its proposed Medicaid reform plan, North Carolina submitted an application to the Centers for Medicare and Medicaid Services (“CMS”) requesting a waiver of certain portions of the Social Security Act under Section 1115 (the “Waiver Application”) in June 2016. In October 2016, the North Carolina legislature passed S.L. 2016-121 to address administrative and technical changes necessary to facilitate the ongoing implementation of Medicaid reform. These legislative changes and a change in North Carolina Department of Health and Human Services (“NCDHHS”) leadership caused North Carolina to submit an amended Waiver Application in November 2017 for CMS to review. CMS approved the amended Waiver Application in October 2018.

Now that the federal government has granted the request, North Carolina is cleared to complete the transformation of its current traditional fee-for-service program to one of capitated contracts. Under capitated contracts, PHPs receive a fixed amount of money per member per unit of time, for which the plans generally finance all covered Medicaid services provided to members enrolled in those plans. The reformed system is designed to remove focus from individual services and instead incentivize improved patient outcomes, community health and cost containment. North Carolina’s Medicaid program will allow eligible beneficiaries to choose from multiple PHPs, four of which will offer statewide coverage, and with the potential for one or two additional plans offering regional coverage in the beneficiary’s designated region of residence. See below under “Recent Developments” for further information regarding the status of North Carolina’s Medicaid reform process.

The Health Plan

The Health Plan will be operated by Carolina Complete Health, a licensed insurance company in the State of North Carolina, with the goals of maintaining profitability, offering competitive health insurance products and maximizing the use of value-driven systems of care. Value-driven systems of care are collaborative arrangements that integrate care coordination, access to data, evidence-based quality standards and payments systems to help achieve the goals enumerated below and, ultimately, provide high-quality, cost-effective care for patients. Value-driven systems of care simultaneously pursue three goals as defined and discussed by the Institute for Healthcare Improvement: controlling costs across a defined population, improving the health of the defined population and improving the experience of care. In North Carolina, a fourth goal of improving provider engagement and support focuses on collaboration with the medical community, other providers, beneficiaries and other stakeholders to provide innovative solutions to improve care and patient outcomes.

We believe the Health Plan will have the following differentiating features that will improve care for North Carolina Medicaid beneficiaries:

| ● | Peer-selected physicians serving on board committees; |

| ● | Participating providers serving on advisory board subcommittees; |

3

| ● | Board committees that adopt peer-developed, evidence-based medical coverage and benefit policies; |

| ● | Relationships with North Carolina physicians, community health centers and other providers that value independent professional judgment and flexibility in care for their patients; |

| ● | Efforts to limit interference in the doctor-patient relationship; and |

| ● | Priorities of the reduction of paperwork and bureaucracy, as well as prompt and accurate payment of claims and processing of pre-approval and authorization requests. |

The Joint Venture

Together with the other Joint Venture Parties, we believe that the best health outcomes occur when there is appropriate clinical input into the medical policy and oversight of a health plan. The Joint Venture Parties also believe that Medicaid reform in North Carolina should incentivize physicians and other providers to consider the overall best approach to improving the health of the Medicaid population as a whole and of individual patients, emphasizing primary and preventative care and decreasing the burdens of coverage provided on a test and task basis. The goal of the Joint Venture Parties is to bring a health plan to North Carolina that provides physicians greater flexibility in caring for their patients and improves the effectiveness of the plan itself. The structure of the Joint Venture will result in physicians being able to actively participate in the Health Plan’s governance, which we believe will give them more control over the development and implementation of the Health Plan than more traditional plan structures.

We believe the strategy of the Joint Venture Parties will deliver on the objectives articulated by the State of North Carolina to ensure that costs are controlled across a defined population, the health of the defined population is improved and the experience of care is improved. The Joint Venture unites the support of organizations respected in the North Carolina health care community with an organization that has significant financial resources and experience with establishing and maintaining Medicaid networks in other states. We believe that the Joint Venture Parties will create an innovative patient-focused Medicaid health plan that features a plan network that has its own management and governance, while also ensuring a role for health care providers in the plan’s governance.

The NCMS, which has been representing the interests of physicians and protecting the quality of patient care in North Carolina since 1849, has joined forces with Centene, with its financial resources and experience with regional and statewide Medicaid networks, to establish and serve the Health Plan. The NCMS is a professional member organization and is seeking to promote access to quality health care for all citizens in North Carolina and championing initiatives that seek to improve quality of care and promote patient safety. Centene is a diversified, multi-national health care enterprise that provides a portfolio of services to government sponsored and commercial health care programs focusing on under-insured and uninsured individuals. North Carolina’s federally-qualified health centers and aspiring health centers (collectively “CHCs”), represented by the North Carolina Community Health Center Association (the “NCCHCA”), will also play an important part in the Joint Venture as key providers of primary care services to Medicaid recipients in North Carolina. CHCs have a history of providing a broad spectrum of services to low-income and underserved populations, and we believe the Joint Venture will enable the CHCs to work more closely with physician specialists and health systems in their local communities to improve patient continuity of care, quality and cost.

The Joint Venture Parties have agreed to their respective operational roles and responsibilities with respect to the Health Plan in the Joint Venture Agreement. An affiliate of Centene Sub will manage the financial and daily operations of the Health Plan, while CCHN will provide services related to recruiting and retaining health care providers to participate in the Provider Network and oversight of programs and policies for such participating providers (see “Business of CCHN” below). For additional information about the structure, funding and management of the Joint Venture, see “Joint Venture” and “Governance” in our Offering Circular for the Offering, which was filed with the SEC on October 4, 2018 and may be accessed here, as the same may be updated from time to time by our subsequent filings under Regulation A (the “Offering Circular”).

4

Recent Developments

The State of North Carolina issued a request for proposal (the “RFP”) for new Medicaid PHPs – statewide and regional – in August 2018. Carolina Complete Health submitted a response to the RFP on October 19, 2018. On February 4, 2019, Carolina Complete Health was awarded a contract in North Carolina for the Medicaid program that, pending regulatory approval, would be effective February 1, 2020 for an initial three year term, with the option to renew for up to two additional years (the “N.C. Medicaid Contract”). Under the contract, Carolina Complete Health would provide Medicaid managed care services in NC Medicaid Regions 3 and 5 as defined by NCDHHS. On March 5, 2019, Carolina Complete Health submitted a letter to NCDHHS accepting the N.C. Medicaid Contract for Regions 3 and 5 and simultaneously requesting a protest meeting pursuant to the RFP procedures to discuss its concerns, and requesting corrective action in the form of expanding the scope of the N.C. Medicaid Contract to include the remaining Regions 1, 2, 4, and 6. On April 12, 2019, Carolina Complete Health was informed that the corrective action to expand the scope of the N.C. Medicaid Contract to other regions was denied. Please see “Risk Factors” below.

Anticipated Timeline to Launch

Based upon the information available to and the current assumptions of the Joint Venture Parties, the following represents the anticipated time period until the launch of the Health Plan. However, many factors beyond the Joint Venture Parties’ collective control could cause the following timeline to vary. For example, if Carolina Complete Health is unable to obtain a statewide N.C. Medicaid Contract, the Joint Venture as currently structured may not be financially viable, and in such case, we may not proceed with closing the Joint Venture.

| June 2016 | North Carolina submitted the Waiver Application to federal government |

| July 2017 | CCHN began building the Provider Network |

| August 2018 | North Carolina issued a request for proposal for plans to be offered in the reformed Medicaid program |

| October 2018 | Carolina Complete Health submitted the proposal for the Health Plan |

| October 2018 | North Carolina received approval of the Waiver Application |

| February 2019 | North Carolina awarded Carolina Complete Health N.C. Medicaid Contract for regions 3 and 5 |

| Spring-Summer 2019 | CCHN begins permanent employee hiring; North Carolina commences readiness review of the Health Plan |

| Spring – Fall 2019 | North Carolina concludes readiness review of the Health Plan; Medicaid beneficiaries enroll as members in Health Plan |

| September 2019 | Joint Venture Closing occurs |

| February 2020 | “Go live” date for Health Plan |

Business of CCHN

Our Operations

The Joint Venture Parties have agreed to their roles and responsibilities with respect to the Health Plan in the Joint Venture Agreement. Our core responsibilities relate primarily to the Provider Network. During the interim period from the signing of the Joint Venture Agreement to the announcement of the N.C. Medicaid Contract award in February 2019, CCHN conducted its activities primarily by outsourcing its needed functions to NCMS professionals and staff, independent contractors, professional consultancy firms, third-party vendors or other such entities that can provide the capabilities required to recruit and retain providers to participate in the Provider Network. Since the award of the N.C. Medicaid Contract to Carolina Complete Health, CCHN has begun hiring key senior staff positions that are needed in the implementation of the Health Plan and CCHN business operations; specifically in Finance and Administration; Quality, Performance and Analytics; and Network Development and Provider Engagement. The Company is recruiting a full-time Chief Executive Officer who will also serve as Chief Medical Officer of CCHN. We are on schedule to build out the Network Development and Provider Engagement and Quality, Performance and Analytics functions by the end of 2019 to be ready for the “go live” date of February 2020.

5

At the current time, our fundamental business is recruiting and building the Provider Network in NC Medicaid regions 3 and 5, the Health Plan’s area of responsibility, and assisting the Health Plan and Centene with the implementation. After the Joint Venture Closing and “go live” date in February 2020, we will focus on our two core missions: (1) growing, nurturing and promoting the success of the Provider Network for the purposes of optimizing services to Carolina Complete Health and the members of the Health Plan by, among other things, (a) continuing to recruit and retain providers to participate in the Provider Network, (b) maintaining and improving the Health Plan’s relationship with participating providers and provider employers, (c) facilitating the success of incentive programs and implementation of value-based models of care on the broadest possible scale, (d) providing practice-specific, data-driven performance and quality information to all participating providers and provider employers, and (e) optimizing value for holders of Provider Shares, as well as engaging shareholders to participate fully in the success of CCHN; and (2) the development and optimization of medical and clinical policies for the Health Plan through workgroups of generalists and specialists using medical evidence, cost data and experience in caring for Medicaid beneficiaries.

We will also work to improve the efficiency and accuracy of case management and claims by, among other things, (1) using and providing qualified participating providers access to a platform for value-based arrangements to more effectively and efficiently coordinate case management services, (2) together with a management company affiliate of Centene, continually conduct educational and training programs to allow for accurate and efficient submission of claims, (3) assisting with updating participating provider files to facilitate eligibility verification and claims adjudication and the efficient and timely responses to inquiries from participating providers, and (4) together with a management company affiliate of Centene, providing and periodically updating materials for distribution to the participating providers with regard to billing procedures, payment for services, a schedule of covered plan benefits and applicable risk-sharing arrangements.

Pursuant to the terms of the CCHN Services Agreement, we will provide the above described services to Carolina Complete Health in exchange for a monthly fee equal to a predetermined percentage of the projected net revenues of the Health Plan during such month in connection with the plan’s operation. The revenue percentage in any given month will depend in part upon the number of individuals who are participating providers in the Provider Network. We will also be entitled to receive an annual performance-based award based upon our Provider Network’s ability to facilitate the Health Plan’s achievement of certain quality-of-care performance goals established by the Carolina Complete Health Board. These quality-of-care performance goals will be based on performance measures established by the State of North Carolina, the Healthcare Effectiveness Data and Information Set established by the National Committee for Quality Assurance on an annual basis and the recommendations of the Medical Affairs Committee. In addition, if the State of North Carolina makes a final determination that the Provider Network is adequate and has timely satisfied all applicable provider participation requirements and such other network adequacy standards and requirements as the State of North Carolina shall establish, we will also be entitled to receive a one-time performance-based award.

While any indebtedness to Centene is outstanding, CCHN is not permitted to provide network access and/or management services to any party other than Centene and Carolina Complete Health. Nonetheless, CCHN may explore and, prior to paying off such indebtedness and with a waiver from Centene, if needed, may enter into additional business opportunities. Pursuant to the Joint Venture Agreement, Centene has agreed to provide to CCHN an option to acquire 20 percent of Centene’s Ambetter exchange product being offered in North Carolina on terms and conditions to be determined by the Joint Venture Parties. As CCHN’s first priority is building the Provider Network for the Health Plan, its primary consideration in pursuing any additional business opportunity will be the impact on the Provider Network and the Health Plan. While CCHN is open to exploring complementary businesses with or without Centene and/or Carolina Complete Health, it does not intend to pursue any opportunity that it believes will have a significant, long-term, adverse effect on its goal to build the Provider Network for the first physician-led Medicaid PHP offered in North Carolina.

6

Involvement of Centene

Pursuant to the terms of a services agreement by and between Centene and CCHN, Centene has agreed to support our operations by, among other things, (1) consulting with us and our personnel in order to develop our business plan, financial plan and capitalization plan, (2) providing us with access to data and analytics to facilitate the implementation of value-based models of care on the broadest possible scale, and (3) marketing and advertising the Provider Network and the Health Plan. We have also entered into certain financial arrangements with Centene, as described under “Joint Venture—Funding of CCHN” in our Offering Circular here. We will continue to be a standalone business, and neither Centene nor any of its affiliates will control or act as a guarantor of our operations.

Following the Joint Venture Closing, Centene, like us, will also be providing services to the Health Plan, primarily focused on the day-to-day business operations of the Health Plan. A management company affiliate of Centene will provide management services to the Health Plan, including with respect to, among other things, (1) program planning and development, (2) management information systems, (3) financial systems and services, (4) claims administration, (5) enrollee services and records, (6) premium billing and collections, and, together with CCHN, (7) utilization review, (8) quality improvement and assurance and (9) provider services and records. In addition to this administrative support, initially, Centene will have primary responsibility for incorporating ancillary service providers into the Provider Network.

In connection with the creation, recruitment, building, development, management, operation, education and maintenance of the Provider Network, Centene has granted to CCHN a non-exclusive, nontransferable, revocable license within the State of North Carolina to all of Centene’s proprietary and/or confidential information, trade secrets (patentable or otherwise), materials, data, know-how, processes and expertise (1) related to the formation, development, operation and management of programs, services and health plans in connection with the provision of services to government-sponsored health care programs and (2) embodied in or otherwise made a part of the services being provided to CCHN under the services agreement by and between a management company affiliate of Centene and CCHN.

Competition

The State of North Carolina established in law that four statewide PHPs and up to 12 regional provider-led entities would be selected to offer plans to Medicaid beneficiaries in North Carolina. With respect to regional provider-led entities, however, the State announced that due to variations in population distribution, it would award a maximum of 10 regional contracts. On February 4, 2019, the State of North Carolina awarded an N.C. Medicaid Contract to only one provider-led entity, Carolina Complete Health, but the award was only for two of six Medicaid regions in North Carolina. Carolina Complete Health will face competition from the four commercial health plans that have been awarded statewide N.C. Medicaid Contracts, two of which already have extensive provider networks to serve their commercial, non-Medicaid populations.

Since Carolina Complete Health was awarded a regional N.C. Medicaid Contract rather than a statewide N.C. Medicaid Contract, the scale of the Health Plan, and thus the scale of our operations, will be smaller, but the Joint Venture Parties plan to work diligently to expand the territories served and become the first choice plan for providers and members. In competing for additional regions, there would likely be competition from other provider-led entities seeking entry or expansion into such regions, as well as competitors holding statewide contracts that wish to establish a presence in serving the populations we seek to reach.

There will also be competition to enroll new members to the Health Plan and to retain existing members. Beneficiaries wishing to enroll in a PHP or to change plans typically choose based on the quality of care and services offered, ease of access to services, whether a specific provider is part of the network and the availability of supplemental benefits. We and Carolina Complete Health will also compete with other PHPs to enter into contracts with physicians, physician groups and other providers, although such providers are not limited with respect to the number of contracts into which they may enter. We believe the factors that providers consider in deciding whether to contract with us include the opportunity to participate in this Offering, existing and potential member volume, reimbursement rates, medical management programs, speed of reimbursement and the extent of administrative requirements.

7

In addition, on March 27, 2019, Centene signed a merger agreement with WellCare, pursuant to which Centene will acquire WellCare. WellCare was awarded one of the four statewide N.C. Medicaid Contracts. The merger will come under review by federal and state government agencies, which review may include consideration of Centene’s and WellCare’s operations in North Carolina.

Regulation

The business activities of certain of the Joint Venture Parties, particularly the activities of Carolina Complete Health, will be regulated at both the state and federal level. Government regulation of the provision of health care products and services is a changing area of law, and regulatory agencies generally have discretion to issue regulations and interpret and enforce laws and rules.

Carolina Complete Health is licensed to operate as an insurance company in the State of North Carolina and, together with CCHN, seeks to provide services as a PHP within the N.C. Medicaid program. The N.C. Department of Insurance (“NCDOI”) and NCDHHS will share primary regulatory responsibility at the state level for the activities of PHPs providing or arranging to provide services to Medicaid enrollees. At the federal level, CMS will also exercise a significant ongoing oversight role in PHP performance and the N.C. Medicaid program generally. The Health Plan will also have continuing obligations under various other federal laws, including those relating to health information, which are discussed below.

NCDOI Regulations and Oversight

Carolina Complete Health has obtained a license from NCDOI to operate as a PHP in North Carolina. Carolina Complete Health must comply with minimum statutory capital and other financial solvency requirements, such as minimum deposit and surplus levels. In addition, Carolina Complete Health will be required by NCDOI to file reports describing its capital structure, ownership, financial condition, intercompany transactions and general business operations. Carolina Complete Health will also need to meet certain criteria to secure NCDOI approval before implementing certain operational changes, including without limitation, changes to existing product offerings, the development of new product offerings, certain organizational restructurings or the expansion of geographical service areas.

CCHN may also be considered an insurance holding company under applicable North Carolina law and may be subject to certain regulatory provisions as a controlling person of an insurance company. Since the operational activities of CCHN will focus on building and maintaining the Provider Network, CCHN may also be required to comply with applicable operational regulations, including complying with utilization review requirements. In addition, depending on the size and nature of the transaction, there are various notice and reporting requirements that generally apply to transactions between insurance companies and their affiliates within an insurance holding company structure. Some insurance holding company laws and regulations require prior regulatory approval or, in certain circumstances, prior notice of certain material intercompany transfers of assets as well as certain transactions between insurance companies, their parent holding companies and affiliates.

Additionally, the holding company acts of North Carolina restrict the ability of any person to obtain control of an insurance company without prior regulatory approval. Under those statutes, without such approval or an exemption, no person may acquire any voting security of an insurance holding company, which controls an insurance company, or merge with such a holding company, if as a result of such transaction such person would “control” the insurance holding company. “Control” is generally defined as the direct or indirect power to direct or cause the direction of the management and policies of a company and is presumed to exist if a person directly or indirectly owns or controls 10 percent or more of the voting securities of a company.

NCDHHS Contract

In addition to insurance company licensure and oversight by NCDOI, Carolina Complete Health must periodically bid for and be selected to receive a PHP contract with NCDHHS before the Health Plan may participate in the N.C. Medicaid program. Upon executing a PHP contract, Carolina Complete Health would receive monthly payments based on specified capitation rates determined on an actuarial basis. These rates will differ by membership category, and will depend on state appropriations, as well as the specific benefits and policies that the State chooses to include in the PHP contract.

8

Throughout the contract term, NCDHHS will be responsible for administering the PHP contract and ensuring compliance with its provisions. The terms of the PHP contract will impose numerous operational requirements on Carolina Complete Health. In addition, the contract will be subject to regulation and oversight by CMS. For example, CMS has the right to audit Medicaid managed care organizations and their contracting health care providers and other vendors for the quality of care being rendered and the degree of compliance with CMS contracts and regulations.

Federal and State Medicaid Requirements

Title XIX of the Social Security Act of 1935, as amended, directs CMS to administer the Medicaid program in partnership with the states. Generally, CMS takes the lead role in providing funding, enacting regulations, and overseeing states that have been approved to implement Medicaid managed care programs. The Medicaid program is highly regulated and subject to frequent or substantial changes in state and federal law and regulation. Carolina Complete Health will be required to comply with the provisions of applicable updated regulations as they become effective.

In April 2016, CMS significantly revised its regulations relating to managed care programs under Title XIX with the “Medicaid and CHIP Managed Care Final Rule.” These regulations place extensive requirements on states and contracting Medicaid managed care organizations. We expect Carolina Complete Health to be subject to these regulatory provisions, which generally set forth the requirements for member eligibility; member enrollment and dis-enrollment processes; covered services; eligible providers; subcontractors; record-keeping and record retention; periodic financial and informational reporting; quality assurance; health education, wellness and prevention programs; timeliness of claims payments; financial standards; safeguarding of member information; fraud, waste and abuse detection and reporting; and appeals and grievances. Carolina Complete Health’s compliance with these requirements is expected to be subject to monitoring by state regulators and by CMS. We also expect Carolina Complete Health to be subject to periodic comprehensive quality assurance evaluations by a third-party reviewing organization, and potentially by NCDOI representatives as well.

Carolina Complete Health will be subject to the requirements of the federal False Claims Act, which prohibits the known filing of a false claim, the known use of false statements to obtain payment from the federal government, or improperly retaining overpayments from the government. If an entity is determined to have violated the False Claims Act, it may be required to pay up to three times the actual damages sustained by the government, plus additional civil penalties for each separate false claim. The periodic payment to PHPs under a PHP contract will include federal funds. There are a number of potential bases for liability under the False Claims Act, which could include submitting false claims or retaining overpayments in connection with a PHP contract.

Federal Requirements for Health Information

As part of their normal operations, certain of the Joint Venture Parties and Carolina Complete Health will collect, process and retain confidential member information. They will be subject to various federal and state laws and rules regarding the use and disclosure of confidential member information, including the Health Insurance Portability and Accountability Act of 1996 (“HIPAA”), the Health Information Technology for Economic and Clinical Health Act (“HITECH”) and the Gramm-Leach-Bliley Act, which require the protection of the privacy of medical records and the safeguarding of personal health information that is maintained and used. Privacy and security laws and regulations often change due to new or amended legislation, regulations or administrative interpretation. A variety of regulators enforce these laws, including but not limited to the U.S. Department of Health and Human Services (“HHS”), the Federal Trade Commission, the N.C. Attorney General and other state regulators.

HIPAA is designed to improve the portability and continuity of health insurance coverage, simplify the administration of health insurance through standard transactions and ensure the privacy and security of individual health information. Among the requirements of HIPAA are the Administrative Simplification provisions which include standards for processing health insurance claims and related transactions (“Transactions Standards”); requirements for protecting the privacy and limiting the use and disclosure of medical records and other protected health information (“Privacy Rule”); and standards and specifications for safeguarding protected health information which is maintained, stored or transmitted in electronic format (“Security Rule”).

9

HITECH amended certain provisions of HIPAA and enhanced data security obligations for covered entities and their business associates. HITECH also mandated individual notifications in instances of a data breach, provided enhanced penalties for HIPAA violations, and granted enforcement authority to states’ Attorneys General in addition to the HHS Office for Civil Rights. The HIPAA Omnibus Rule further enhanced the changes under the HITECH Act and the Genetic Information Nondiscrimination Act of 2008, which clarified that genetic information is protected under HIPAA and prohibited most health plans from using or disclosing genetic information for underwriting purposes. The Omnibus Rule enhances the privacy protections and strengthens the government’s ability to enforce the law. These regulations also establish significant criminal penalties and civil sanctions for non-compliance. The preemption provisions of HIPAA provide that the federal standards will not preempt state laws that are more stringent than the related federal requirements.

The Privacy and Security Rules and HITECH/Omnibus enhancements established requirements to protect the privacy of medical records and safeguard protected health information maintained and used by healthcare providers, health plans, healthcare clearinghouses and their business associates.

The Security Rule requires healthcare providers, health plans, healthcare clearinghouses and their business associates to implement administrative, physical and technical safeguards to ensure the privacy and confidentiality of health information electronically stored, maintained or transmitted. The HITECH Act and Omnibus Rule enhanced a federal requirement for notification when the security of protected health information is breached.

The requirements of the Transactions Standards apply to certain healthcare related transactions conducted using “electronic media.” Since “electronic media” is defined broadly to include “transmissions that are physically moved from one location to another using portable data, magnetic tape, disk or compact disk media,” many communications are considered to be electronically transmitted. Under HIPAA, health plans and providers are required to have the capacity to accept and send all covered transactions in a standardized electronic format. Penalties can be imposed for failure to comply with these requirements.

Employees

We currently have three employees, all of whom are full-time employees. Our executive officers are either NCMS employees or contracted consultants.

Risk Factors

We face risks and uncertainties that could affect us and our business. These risks are outlined under the heading “Risk Factors” contained in our Offering Circular, which may be accessed here, as modified and/or supplemented below.

The acceptance of a regional N.C. Medicaid Contract by Carolina Complete Health will reduce the scale of the Health Plan, may result in lower revenues and a longer timeframe until profitability, may prove not to be financially viable and may impact the Joint Venture Closing.

In February 2019, Carolina Complete Health was awarded a regional N.C. Medicaid Contract rather than one of the four statewide contracts. The Joint Venture business model was based on the ability to capitalize on management-related economies of scale available when operating a statewide N.C. Medicaid Contract. The award of only two of the six regions means that the scale of the Health Plan, and thus the scale of our operations, will be smaller, which may result in lower revenues and a longer timeframe until profitability, or the business model may prove not to be financially viable.

The two region N.C. Medicaid Contract may also negatively impact the ability to meet certain closing conditions, including, but not limited to attracting investors. The closing of Joint Venture is subject to a number of conditions including, among other conditions, (1) the number of investors purchasing shares in the Offering and the number of investors attributable to CHCs that subscribed in our 2018 private placement must be at least 10,000 in the aggregate prior to June 30, 2019; and (2) on or prior to the date that is 10 business days prior to the Joint Venture Closing, the Provider Network must have satisfied the provider participation requirements established by the State of North Carolina with respect to network adequacy. If the Joint Venture Closing does not occur, we are contractually required by the Stockholders’ Agreement to redeem all shares that may be sold in the Offering for $750.00 per share.

10

The timing of implementation of the N.C. Medicaid Contracts places Carolina Complete Health and CCHN at a competitive disadvantage compared to the four entities awarded statewide contracts.

NCDHHS awarded statewide N.C. Medicaid Contracts to four insurance companies (the “Statewide Contract Parties”). The Statewide Contract Parties will be allowed to provide Medicaid managed care services in NC Medicaid Regions 2 and 4 beginning in November 2019. Services in the remaining regions, including regions 3 and 5, will not begin until February 2020 at the earliest. As all of the statewide plans include Regions 2 and 4, the Statewide Contract Parties will begin operations in North Carolina ahead of Carolina Complete Health and CCHN, and thus will have a significant competitive advantage over Carolina Complete Health and CCHN. The three-month lead time afforded to the Statewide Contract Parties places Carolina Complete Health and CCHN at a competitive disadvantage in their ability to successfully develop and operate the Provider Network and enroll members in the Health Plan. Having too few members in the Health Plan would reduce Carolina Complete Health’s revenues, and in turn CCHN’s revenues, perhaps below a profitable level.

Litigation could delay the implementation of the Health Plan and impact the profitability of Carolina Complete Health and CCHN.

It is possible that one or more parties that submitted bids for, but were not awarded N.C. Medicaid Contracts will initiate litigation which may, among other things, delay the implementation of the Health Plan indefinitely. Such delay may impact the profitability of Carolina Complete Health and CCHN and may result in a longer timeframe until profitability. In mid-April, 2019, My Health by Health Providers, a consortium of a dozen hospital systems in North Carolina, filed a complaint with the N.C. Office of Administrative Hearings, seeking, among other things, to halt NCDHHS’s ongoing transition to managed care until a hearing can be held regarding its N.C. Medicaid Contract application.

The proposed merger between Centene and WellCare is subject to regulatory review.

On March 27, 2019, Centene signed a merger agreement with WellCare, pursuant to which Centene will acquire WellCare. WellCare was awarded one of the four statewide N.C. Medicaid Contracts. The merger will come under review by federal and state government agencies, which review may include consideration of Centene’s and WellCare’s operations in North Carolina. The success of our business is substantially dependent upon our contractual arrangements with Centene. In addition to providing us with necessary capital under our loan arrangements, Centene has agreed to provide services necessary for operations in providing services to the Health Plan, including consulting services with respect to, among other things, the formation of our business and commencement of operations; recruitment and retention of health care providers to participate in the Provider Network; development of a business plan, financial plan and capitalization plan; and provision of access to data and analytics to facilitate implementation of value-based models of care on the broadest possible scale. Without such services, we would not be able to fulfill our obligations in the Joint Venture or continue our business. If Centene fails to perform its obligations under the contractual arrangements, we may have to incur substantial costs and expend additional resources to enforce such arrangements, and there can be no assurance that any such enforcement efforts would be effective.

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

The following discussion should be read in conjunction with our financial statements and the related notes contained in Item 7 of this report. Some of the information contained in this discussion and analysis, including information with respect to our plans and strategy for our business, includes forward-looking statements that involve risks and uncertainties.

11

Overview

To date, our operations have been limited. During the interim period until the Joint Venture Closing, CCHN will conduct its activities primarily by hiring certain full-time employees, outsourcing its needed functions to NCMS professionals and staff, independent contractors, professional consultancy firms, third-party vendors or other such entities that can provide the capabilities required to recruit and retain providers to participate in the Provider Network. Until the commencement of the Health Plan’s operations, we do not expect to generate any significant revenue from operations.

The Joint Venture Closing is currently anticipated to occur by September 30, 2019 and the Health Plan is currently expected to “go live” in February 2020.

Results of Operations

For the twelve months ending December 31, 2018

As of December 31, 2018, we have yet to generate any revenue from operations.

Beginning in January 2017, Centene has agreed to reimburse us up to $300,000 annually for certain launch, start-up and operational expenses incurred during fiscal years 2017 and 2018. For the twelve months ending December 31, 2018, we recorded reimbursable expenses revenue of $300,000 for such expenses incurred.

For the twelve months ending December 31, 2018, we had no employees, and we relied exclusively on contracted assistance in connection with our preliminary activities related to building the Provider Network.

For the twelve months ending December 31, 2018, we incurred total operating costs and expenses of $2,173,904, of which $1,458,618 were general and administrative expenses related to contracted resources as well as attorney fees, outside consultants, related-party services and other administrative expenses associated with establishing and running our company. Of these expenses, we incurred expenses of $363,642 from NCMS to engage the resources and related expenses of the NCMS’s professional and administrative staffs to conduct and perform activities on our behalf. Going forward, we will continue to draw upon the NCMS professional and administrative staffs in the performance of some of our activities, and as such, we will incur additional costs associated with the NCMS staffs’ performance of these activities. In addition, we will continue to hire full-time employees that will take the place or reduce outside consultancy expenses. For the twelve months ending December 31, 2018, the remaining operating costs and expenses of $715,286 were related to quality and development expenses incurred to recruit and retain a network of health care providers who will provide medical services under the Health Plan.

For the twelve months ending December 31, 2018, we incurred $154,794 of interest expense under the Term Note “First Loan” described in Note 5, “Term Note,” to the financial statements contained in this report.

As a result of the foregoing, net loss for the twelve months ending December 31, 2018 was $2,018,520.

For the twelve months ending December 31, 2017

For the twelve months ending December 31, 2017, we had no employees and relied exclusively on contracted assistance in connection with our preliminary activities related to building the Provider Network.

For the twelve months ending December 31, 2017 we incurred total operating costs and expenses of $1,617,687 of which $1,232,348 were general and administrative expenses related to contracted resources as well as attorney fees, outside consultants, related-party services and other administrative expenses. Of these expenses, we incurred expenses of $441,495 from NCMS to engage the resources and related expenses of the NCMS’s professional and administrative staffs to conduct and perform activities on our behalf. The remaining operating costs and expenses of $385,339 were related to quality and development expenses incurred to recruit and retain a network of health care providers who will provide medical services under the Health Plan.

12

During the twelve months ending December 31, 2017, we incurred $36,254 of interest expense under the First Loan.

As a result of the foregoing, net loss for the twelve months ending December 31, 2017 was $1,353,010.

Provision for Income Taxes

CCHN recognizes deferred tax assets to the extent that we believe that these assets are more likely than not to be realized. In making such a determination, we consider all available positive and negative evidence, including future reversals of existing taxable temporary differences, projected future taxable income, tax-planning strategies and results of recent operations. CCHN assessed the need for a valuation allowance against our net deferred tax assets and determined a full valuation allowance is required as of December 31, 2018 and December 31, 2017 due to uncertainty regarding future revenue generating activities. Therefore, a full valuation allowance of $837,093 and $414,052 was recorded as of December 31, 2018 and December 31, 2017, respectively.

On December 22, 2017, the United States enacted the Tax Cuts and Jobs Act (the “Tax Act”). The Tax Act, among other changes, lowers the general corporate income tax rate to 21 percent for tax years beginning after December 31, 2017. See Note 8, “Income Taxes,” to the financial statements contained in this report.

CCHN does not have any uncertain tax positions. CCHN has not recorded any interest or penalties in the financial statements as of December 31, 2018 and December 31, 2017.

Liquidity and Capital Resources

As of December 31, 2018, we had established (1) a current receivable for reimbursable expenses revenue of $25,000, (2) a current payable due to outside vendors of $202,503 (3) current accrued expenses for services provided of $65,751 (4) a non-current amount due to the NCMS of $1,270,464 and (5) an outstanding amount under the First Loan of $3,161,291.

As of December 31, 2017, we had established (1) a current receivable for reimbursable expenses revenue of $52,016, (2) a current payable due to outside vendors of $278,481, (3) current accrued expenses for services provided of $37,570, (4) a current advance from investors of $979,250 for funds received for the purchase of Class P Common Stock in our 2018 private placement (as described in Note 7, “Common Stock and Stockholders’ Deficit,” to the financial statements contained in this report) that occurred on January 19, 2018, (5) a non-current amount due to the NCMS of $906,822 and (6) an outstanding amount under the First Loan of $1,412,277.

As part of the Joint Venture discussions and transaction, CCHN incurred transaction-related outside advisor expenses that were ineligible for reimbursement under the First Loan. When these expenses became due and payable to the outside advisors, the NCMS settled the transaction-related amounts due on behalf of CCHN. The settlement of these transaction-related advances by the NCMS on behalf of CCHN had been recorded as a non-current liability, “Due to Class M Stockholder,” and at December 31, 2017, CCHN had recorded $162,221 of such advances in the non-current liability, “Due to Class M Stockholder.” As of December 31, 2018, this advanced amount remains outstanding, and it continues to be recorded in the non-current liability, “Due to Class M Stockholder.”

Also, since our inception, we have relied upon the resources and related expenses of the NCMS’s professional and administrative staffs to establish, conduct and perform CCHN’s activities. The cost of the NCMS staff time incurred to support CCHN has been calculated, and the staff time cost has been used as a basis for allocating the related expenses associated with the NCMS staff’s support. In 2017 and for the twelve months ending December 31, 2018, CCHN recorded $441,495 and $363,642, respectively, as the cost of the NCMS staff time incurred and related expenses as a “General and Administrative” expense. These amounts have been recorded as a non-current liability, “Due to Class M Stockholder.” As of December 31, 2018, and December 31, 2017, the total amount recorded as a non-current liability, “Due to Class M Stockholder,” for the cost of NCMS staff time incurred and related expenses is $1,108,243 and $744,601, respectively.

Going forward, CCHN will continue to draw upon the NCMS professional and administrative staffs in the performance of CCHN’s activities, and as such, CCHN will incur additional costs associated with the staffs’ performance of these activities. The non-current liability, “Due to Class M Stockholder,” amount will be settled no earlier than the “go-live” date of the Health Plan, which is currently expected in February 2020.

13

Beginning in January 2017, Centene has agreed to reimburse CCHN up to $300,000 annually for certain launch, start-up and operational expenses incurred during fiscal years 2017 and 2018. For the twelve months ending December 31, 2018, we recorded reimbursable expenses revenue of $300,000 for such expenses incurred.

In addition, Centene has provided CCHN with the First Loan in an amount up to $2.5 million, secured by all of CCHN’s receivables from the CCHN Services Agreement, if any, and the partnership interest in the joint venture company. Borrowings under the term loan bear an interest rate of 6.75 percent. In addition, the First Loan requires CCHN to remit 60 percent of its Excess Cash Flows (as defined in our loan agreement with Centene) in repayment of amounts drawn. The loan amount may be increased in three increments of $500,000 up to an amount of $4.0 million if certain milestones are attained. CCHN received the first incremental increase of $500,000 in August 2018, the second incremental increase in December 2018, and the third incremental increase in February 2019. As of December 31, 2017, the principal balance outstanding on the First Loan was $1,412,277 with accrued interest of $39,068. As of December 31, 2018, the principal balance outstanding on the First Loan was $3,161,291 with accrued interest of $193,862.

On January 10, 2017, our loan agreement with Centene was amended and restated to include an additional funding provision that, if Carolina Complete Health is awarded and accepts a capitated Medicaid contract with the State of North Carolina, Centene has agreed to provide CCHN with a secondary multiple advance term loan, which, based upon the amount of net offering proceeds from the 2018 private placement and the Offering (as defined below), as well as CCHN’s use of net offering proceeds, could provide CCHN with a “Second Loan” (as described in Note 5, “Term Note,” to the financial statements contained in this report) of up to an additional $3.0 million in funding, which amount may be increased up to $4.0 million if, in consultation with Centene and in Centene’s sole discretion, CCHN has demonstrated good progress toward the establishment of the Provider Network.

On August 25, 2017, we entered the Second Amended and Restated Loan and Security Agreement (the “Second Amended Loan”), which amended and restated our prior loan agreement with Centene. Under the Second Amended Loan, the aggregate amount available under the Second Loan for payment of the qualifying expenses enumerated below will be reduced by an amount equal to 55 percent of the net offering proceeds, less the amount of such proceeds applied by CCHN to capital calls for Carolina Complete Health or to repay principal borrowed from Centene under the First Loan, the Second Loan or the Loan and Security Agreement to be entered upon the Joint Venture Closing (the “Loan and Security Agreement”).

The proceeds of the First Loan and Second Loan have been, will be, and may be, used for the following qualifying expenses: (1) personnel, consultants, third party service providers and other out-of-pocket operational, pre-operational and business development expenses related to (a) conducting and administering financings, (b) developing and retaining necessary operational capabilities, (c) ensuring regulatory compliance, (d) recruiting providers for the Provider Network and (e) compensating independent accountants and (2) legal expenses related to any financing and the development and review of provider agreements for the proposed Health Plan. In addition, the proceeds of the Second Loan may be used to repay amounts borrowed from Centene under the Loan and Security Agreement to fund a portion of CCHN’s initial capital contribution to the joint venture company at the Joint Venture Closing.

Based upon CCHN’s current operating plan, we believe, with the (1) continued deferral of payment for costs incurred for services provided to us by the NCMS, (2) up to $4.0 million currently available under the First Loan, (3) aggregate amount available under the Second Loan and (4) retention of an amount available from the net offering proceeds, we will be able to sufficiently manage our activities and cash flow needs until February 2020.

On January 19, 2018, CCHN completed a private placement to certain federally-qualified health centers and aspiring health centers and the NCCHCA of 1,505 shares of Class P Common Stock at a purchase price of $750.00 per share for an aggregate amount of approximately $1.13 million.

14

On March 12, 2018, the SEC qualified our offering statement on Form 1-A offering up to 20,000 shares of our Class P Common Stock pursuant to Regulation A of the Securities Act of 1933, as amended, on a continuous basis. We are offering one, but not more than one, share of Class P Common Stock, for a subscription price per share of $750.00, solely to physicians, physician assistants and nurse practitioners licensed or approved to practice, as applicable, in North Carolina who (i) participate in the Company’s health care provider network, (ii) reside in North Carolina, Georgia, South Carolina, Tennessee or Virginia and (iii) meet certain other eligibility criteria. The initial closing of the Offering will occur, if at all, prior to the Joint Venture Closing.

In connection with the Joint Venture Closing, we will be required to contribute 45 percent of the net offering proceeds from the 2018 private placement and the Offering, together with an advance under the Loan and Security Agreement, to the capitalization of the joint venture company. In addition, we will be required to commit capital to Carolina Complete Health to satisfy certain statutory requirements. If we are not generating sufficient revenue to cover such capital calls, Centene has agreed to provide additional funding in the form of additional loans.

In February 2019, Carolina Complete Health was awarded a regional N.C. Medicaid Contract, while each of its competitors that were awarded an N.C. Medicaid Contract received statewide contracts. The Joint Venture business model was based on the ability to capitalize on management-related economies of scale available when operating a statewide N.C. Medicaid Contract. The award of only two of the six regions means that the scale of the Health Plan, and thus the scale of our operations, will be smaller, which may result in lower revenues and a longer timeframe until profitability, or the business model may prove not the be financially viable. Please see the sections entitled “Competition” and “Risk Factors” in Item 1 of this report for a description of the potential impacts of the recent award of the N.C. Medicaid Contract for two regions and Centene’s merger agreement with WellCare.

Off-Balance Sheet Arrangements

We do not engage in any off-balance sheet financing activities. We do not have any interest in entities referred to as variable interest entities, which include special purpose entities and other structured finance entities.

Critical Accounting Policies and Estimates

Our discussion and analysis of our financial condition and results of operations are based upon our financial statements, which we prepared in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”). The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses and related disclosures of contingent assets and liabilities. “Critical accounting policies and estimates” are defined as those most important to the financial statement presentation and that require the most difficult, subjective or complex judgments. We base our estimates on various factors that we believe to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying value of assets and liabilities that are not readily apparent from other sources. Under different assumptions and/or conditions, actual results of operations may materially differ. The most significant estimates impacting our financial statements relate to income taxes. We also have other policies that we consider key accounting policies, but these policies typically do not require us to make estimates or judgments that are difficult or subjective.

Income Taxes – CCHN follows the asset and liability method of accounting for income taxes. This method requires recognition of deferred tax assets and liabilities for the expected future tax consequences of temporary differences between the carrying amounts and the tax basis of assets and liabilities. If it is more likely than not that some portion of a deferred tax asset will not be realized, a valuation allowance is recorded.

CCHN recognizes the tax benefit or liability from uncertain tax positions only if it is more likely than not that the tax position will be sustained on examination by the tax authorities, based on the technical merits of the position. The tax benefit is measured based on the largest benefit that has a greater than 50 percent likelihood of being realized upon ultimate settlement. CCHN recognizes interest and penalties related to income tax matters in income tax expense if incurred.

Subsequent Events – Subsequent events are events or transactions that occur after the balance sheet date but before the financial statements are issued. CCHN recognizes in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed at the date of the balance sheet, including the estimates inherent in the process of preparing the financial statements. CCHN’s financial statements do not recognize subsequent events that provide evidence about conditions that did not exist at the date of the balance sheet but arose after the balance sheet date and before financial statements are available to be issued. CCHN has evaluated subsequent events through April 30, 2019, which is the date the financial statements were available to be issued.

15

| Item 3. | Directors and Officers |

Directors, Executive Officers and Significant Employees

| Name | Position | Age | Term of Office | Approximate Hours per Week | ||||

| Executive Officer: | ||||||||

| Jeffrey W. Runge, MD | Director, President and Chief Executive Officer | 63 | March 14, 2017 – present | 30 | ||||

| Stephen W. Keene, MBA, JD, LLM | Secretary-Treasurer | 60 | May 19, 2016 – present | 24 | ||||

| Directors: | ||||||||

| John R. Mangum, MD | Director | 63 | March 15, 2017 – present | |||||

| Richard Hudspeth, MD | Director | 56 | January 24, 2018 – present | |||||

| Linda W. Lawrence, MD | Director | 59 | July 14, 2018 – present | |||||

Biographies

Jeffrey W. Runge, MD, our Chief Executive Officer, serves on the Board of Directors of the NCMS and Carolina Complete Health and has been serving as the Chief Medical Officer for Biospatial, Inc., a national biosurveillance and preparedness company, since 2017 and as President of Biologue, Inc., a biodefense consulting company, since 2008. Dr. Runge has also served with The Chertoff Group, a homeland security business consulting organization, since 2009, as a Principal and now as a Senior Advisor. He served as the Director and Principal Investigator of the National Collaborative for Biopreparedness at the University of North Carolina at Chapel Hill through the project’s commercialization in 2017. Prior to that, he served as the head of two Federal government agencies, first as the Administrator of the National Highway Traffic Safety Administration (2001-2005) and as the Chief Medical Officer and Assistant Secretary for Health Affairs in the U.S. Department of Homeland Security (2005-2008). Prior to his government service, he served 17 years on the faculty of the Department of Emergency Medicine at Carolinas Medical Center in Charlotte, North Carolina in a variety of academic, clinical and administrative roles.

Stephen W. Keene, MBA, JD, LLM, our Secretary-Treasurer, has served as General Counsel of the NCMS since 2001 and has served in the additional role of Chief Operating Officer of the NCMS since 2016. Mr. Keene joined the NCMS in 1994 as Director, Government Affairs and Medical Economics. Prior to his service at the NCMS, Mr. Keene held positions in a number of medical organizations, where he developed programs and policies to address health care legislation and economic issues affecting the practice of medicine. Mr. Keene received a B.B.A and an M.B.A. from Georgia Southern College, a J.D., cum laude, from North Carolina Central University School of Law and an L.L.M. from Loyola University Chicago School of Law.

John R. Mangum, MD has served as a family medicine physician with the Sanford Medical Group, a satellite of Pinehurst Medical Clinic that provides primary care and occupational health services, since 1984. He served on the Board of Directors of the NCMS from 2002 to 2012 and as President in 2010 and 2011. A member of the Board of Directors of The Carolinas Center for Medical Excellence since 2006, he served as Board Chair from 2011 to 2014 and again beginning in 2019. He received his M.D. at the University of North Carolina School of Medicine and completed his family medicine residency training at Carolinas Medical Center in Charlotte, North Carolina.

16

Richard Hudspeth, MD currently serves as the Chief Executive Officer (since April 2016) and Chief Medical Officer (since May 2015) of Blue Ridge Community Health Services, a non-profit community health center in Hendersonville, North Carolina. From October 2006 to June 2015, Dr. Hudspeth served as Medical Director of Community Care of Western North Carolina, a regional network of health care professionals based in Asheville, North Carolina. He has also served on the Clinical Faculty of the Hendersonville Family Medicine Residency Program since June 2005. Dr. Hudspeth received a B.A. from Duke University and an M.D. from the University of North Carolina School of Medicine, completed his family medicine residency at the University of Cincinnati and completed an obstetrics fellowship at the University of Utah.

Linda W. Lawrence, MD, is the owner and founding physician of Albemarle Pediatrics, which she founded in 1988. Also from 1988 until 2017, Dr. Lawrence served on the medical staff at Carolinas Healthcare System Stanly, intermittently serving as Chief of Pediatrics and on various executive committees during such time. She served as Chief of Staff at Stanley Regional Medical Center from 1999-2000. Dr. Lawrence currently serves on the Board of Directors of the John P. Murray Community Care Clinic and has previously served on the Board of Directors of the Stanly Regional Medical Center from 2001-2010. Dr. Lawrence received her B.S. in Zoology from the University of North Carolina at Chapel Hill, her M.D. from Wake Forest University and completed her residency in pediatrics at the Moses G. Cone Memorial Hospital in Greensboro, North Carolina.

Compensation of Our Management

Currently, our executive officers are either employees of the NCMS or contracted consultants, and we do not intend to directly hire any executive officers until the Joint Venture Closing. The proceeds from the Offering and our 2018 private placement will not be used to compensate or otherwise make payments to the officers or directors of CCHN prior to the Joint Venture Closing. The unique nature of our capital and governance structure will preclude us from compensating personnel with equity securities. Therefore, when we directly hire executive officers, we may need to offer substantial cash compensation to attract qualified individuals since we cannot include equity incentive awards as part of compensation packages.

The table below includes the annual compensation for the fiscal year ended December 31, 2018 of each of our executive officers for services rendered to CCHN. We do not currently compensate our directors for their services.

| Name | Capacities in which compensation was received | Cash Compensation ($) | Other compensation ($) | Total compensation ($) | ||||||||||

| Jeffrey W. Runge, MD | President and Chief Executive Officer | $ | 350,520 | (1) | $ | 350,520 | ||||||||

| Vincent T. Morgus, MBA, CPA(2) | Former Chief Operating Officer | $ | 275,000 | (3) | $ | 10,000 | (4) | $ | 285,000 | |||||

| Stephen W. Keene, MBA, JD, LLM | Secretary-Treasurer | $ | 113,722 | (5) | $ | 113,722 | ||||||||

| (1) | Pursuant to the Biologue Agreement (as defined below), this amount reflects professional fees paid of $343,171 and reimbursable expenses paid of $7,349 by CCHN to Biologue, Inc. |

| (2) | Mr. Morgus resigned from his position as CCHN’s Chief Operating Officer effective April 23, 2019. | |

| (3) | Reflects payments by the NCMS, which are reimbursable by CCHN, to Mr. Morgus for his services as Chief Operating Officer of CCHN, as well as an accrual of a bonus payment of $50,000 due to be paid to Mr. Morgus in 2019. These payments are more fully described below and in the section entitled “Interest of Management and Others in Certain Transactions.” |

| (4) | Reflects payments by the NCMS as matching 401(k) contributions to Mr. Morgus’s 401(k) account. |

| (5) | Reflects payments by the NCMS, which are reimbursable by CCHN, to Mr. Keene for his services as Secretary-Treasurer of CCHN. |

17

CCHN has entered into a master services agreement, effective January 2, 2017, with Biologue, Inc., pursuant to which Dr. Runge provides certain executive duties necessary for CCHN to build and operate the Provider Network (the “Biologue Agreement”). For the period of January 2, 2018 through September 30, 2018, Dr. Runge was to provide an aggregate of 1,080 billable work hours, with hours in excess of 120 hours per month to be agreed in advance by Dr. Runge and CCHN. For the period from October 1, 2018 through December 28, 2018, Dr. Runge was to provide an aggregate of 200 billable work hours, with hours in excess of 65 per month to be agreed in advance by Dr. Runge and CCHN. For 2019, CCHN and Dr. Runge have agreed that Dr. Runge will be compensated for no more than 60 billable work hours per month without written notice from CCHN. CCHN has agreed to compensate Dr. Runge for his time at a rate of $248 per hour in 2018 and $250 per hour in 2019, and has agreed to reimburse Dr. Runge for all reasonable out of pocket expenses incurred in the provision of his services, provided that expenses in excess of $250 are subject to prior approval of CCHN. The Biologue Agreement contains customary confidentiality and indemnification obligations on behalf of CCHN and Dr. Runge, and the Biologue Agreement will continue until either party provides 30 days’ written notice of termination.

Mr. Keene is, and Mr. Morgus was, an employee of the NCMS. As such, the NCMS is solely responsible for the payment and provision of all wages, bonuses and commissions, employee benefits, including 401(k) matching contributions, severance and worker’s compensation, and the withholding and payment of applicable taxes relating to their employment. CCHN reimburses certain expenses incurred by the NCMS on CCHN’s behalf, including (1) a proportional share of the salary, health benefits and other employment-related expenses paid by the NCMS or on behalf of the NCMS for Messrs. Morgus and Keene and (2) reasonable travel, lodging, meals and other out-of-pocket expenses incurred by Messrs. Morgus and Keene in the performance of their services to CCHN.

We do not currently compensate our directors for their services. According to our Amended and Restated Bylaws, directors may be paid their expenses, if any, of attendance at each meeting of the CCHN Board and may be paid a fixed sum for attendance at each meeting of the CCHN Board, a fixed quarterly fee or a stated salary as a director.

| Item 4. | Security Ownership of Management and Certain Securityholders |

The following table displays, as of April 30, 2019, the voting securities beneficially owned by (1) any individual director or officer who beneficially owns more than 10 percent of any class of our capital stock, (2) all executive officers and directors as a group and (3) any other holder who beneficially owns more than 10 percent of any class of our capital stock:

| Title of Class | Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class | Percent of CCHN Total Voting Power | ||||||||||

| Class M Common Stock | The NCMS (1) | 1 | 100.0 | % | 50.0 | % | ||||||||

| Class P Common Stock | Gaston Family Health Services (2) | 201 | 13.4 | % | 6.7 | % | ||||||||

| Class P Common Stock | The NCCHCA (3) | 334 | 22.2 | % | 11.1 | % | ||||||||

| Class P Common Stock | Stedman-Wade Health Services, Inc. (4) | 200 | 13.3 | % | 6.6 | % | ||||||||

| Class P Common Stock | Piedmont Health Services, Inc. (5) | 200 | 13.3 | % | 6.6 | % | ||||||||

| (1) | The business address of the NCMS is 222 N. Person Street, Raleigh, NC 27601. |

| (2) | The business address of Gaston Family Health Services is 200 E. Second Avenue, Gastonia, NC 28052. |

| (3) | The business address of the NCCHCA is 4917 Waters Edge Drive, Suite 165, Raleigh, NC 27606. |

| (4) | The business address of Stedman-Wade Health Services, Inc. is 7118 Main Street, Wade, NC 28395. |

| (5) | The business address of Piedmont Health Services, Inc. is 127 Kingston Drive, Chapel Hill, NC 27514. |

There is no person, including our officers or directors (either individually or as a group), who beneficially owns 10 percent or more of any class of capital stock other than as set forth in the table above. No options, warrants or other rights to purchase our securities are held by any person.

18

| Item 5. | Interest of Management and Others in Certain Transactions |

For a description of the arrangements between CCHN and each of Biologue, Inc., with respect to Dr. Runge’s service as President and Chief Executive Officer, and the NCMS, with respect to Mr. Morgus’s service as Chief Operating Officer and Mr. Keene’s service as Secretary-Treasurer, see “Compensation of Our Management” in Item 3 of this Annual Report.

Between July 2016 and March 2017, Mr. Morgus provided financial consulting services to the NCMS for the benefit of CCHN while serving as Managing Partner of The Fahrenheit Group – Carolinas, a management consulting firm focused on advising growth-oriented organizations (“Fahrenheit”), pursuant to an agreement between Fahrenheit and the NCMS. The NCMS, the sole owner of the Class M Common Stock of CCHN, paid an aggregate of $167,375 to Fahrenheit for professional fees plus $922 for reimbursable project-related expenses that were reimbursed to Mr. Morgus.

Pursuant to the Biologue Agreement, since our inception through December 31, 2018, CCHN has paid professional fees and reimbursable expenses in an aggregate of $526,508 to Biologue, Inc., of which Dr. Runge is the founder and President, and has incurred an additional aggregate of $85,549 that is to be paid to Biologue, Inc.

Since our inception through December 31, 2018, CCHN has incurred $464,000 for the services provided by Mr. Morgus to CCHN since becoming its Chief Operating Officer. CCHN has incurred $366,473 for the services provided by Mr. Keene to CCHN.

| Item 6. | Other Information |

Not applicable.

19

| Item 7. | Financial Statements |

INDEX TO FINANCIAL STATEMENTS

20

The Board of Directors and Stockholders of

Carolina Complete Health Network, Inc.

We have audited the accompanying financial statements of Carolina Complete Health Network, Inc. (the “Company”), which comprise the balance sheets as of December 31, 2018, and 2017, and the related statements of operations, changes in stockholders’ deficit and cash flows for the years then ended, and the related notes to the financial statements.

Management’s Responsibility for the Financial Statements