| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

Non-accelerated filer |

☒ | Smaller reporting company | ||||

| Emerging growth company |

Title of Securities to be Registered |

Proposed Maximum Aggregate Offering Price (1) |

Amount of Registration Fee (2) | ||

Primary Offering, Class T, Class S, Class D and Class I Common Stock, par value $0.01 per share |

$6,000,000,000 |

$654,600 | ||

Distribution Reinvestment Plan, Class T, Class S, Class D and Class I Common Stock, par value $0.01 per share |

$1,500,000,000 |

$163,650 | ||

Total Class T, Class S, Class D and Class I Common Stock, par value $0.01 per share |

$7,500,000,000 |

$818,250 | ||

(1) |

The registrant reserves the right to reallocate shares of common stock being offered between the primary offering and the distribution reinvestment plan. |

(2) |

As discussed below, pursuant to Rule 415(a)(6) under the Securities Act, for purposes of calculating the registration fees due in connection with the filing of this registration statement, the registrant has assumed that $1,630,000,000 of unsold shares of common stock originally registered for sale pursuant to a prior registration statement will be carried forward to this registration statement. Pursuant to Rule 415(a)(6) of the Securities Act, the registration fees in the amount of $202,935 previously paid with respect to such unsold securities will continue to apply to such unsold securities. Accordingly, after taking into account the previously registered unsold securities and the payment of registration fees of $640,417 in connection with the filing of the Registrant’s registration statement filed on April 28, 2021 and pre-effective amendments thereto filed on July 15, 2021 and September 24, 2021, the registration fee due for this registration statement is $0. Calculated pursuant to Rule 457(o) under the Securities Act. |

| • | the resignation of the Sub-Adviser as the registrant’s adviser and the engagement of Brookfield REIT Adviser LLC as the registrant’s adviser; |

| • | the engagement of the Sub-Adviser as the registrant’s sub-adviser to (i) manage certain of the registrant’s real estate properties (the “Equity Option Investments”) and real estate-related debt investments (the “Debt Option Investments” and, together with the Equity Option Investments, the “Oaktree Option Investments”) acquired prior to the consummation of the Adviser Transition, and (ii) select and manage the registrant’s liquid investments; |

| • | the filing of a Second Articles of Amendment to the registrant’s charter to change the registrant’s name from “Oaktree Real Estate Income Trust, Inc.” to “Brookfield Real Estate Income Trust Inc.”; |

| • | the registrant’s entry into an Option Investments Purchase Agreement with Oaktree Capital Management, L.P. (together with its affiliates, “Oaktree”), pursuant to which Oaktree may purchase the entire interest of Brookfield REIT Operating Partnership L.P. (the “Operating Partnership”) in the Equity Option Investments or the Debt Option Investments, or both, subject to certain restrictions; |

| • | the expected contribution of certain properties to the registrant by Brookfield in exchange for shares of the registrant’s Class E common stock, Class E units of the Operating Partnership, or a combination thereof; |

| • | the disposition of certain of the registrant’s existing real estate properties and real estate-related debt investments; |

| • | the engagement of Brookfield Oaktree Wealth Solutions LLC as the dealer manager for this offering; |

| • | the resignation of members and the appointment of new members of the registrant’s board of directors; |

| • | the resignation of certain of the registrant’s executive officers and the appointment of certain new executive officers; |

| • | the filing of Articles Supplementary to the registrant’s charter designating a new class of common stock as Class E shares; and |

| • | the termination of the registrant’s line of credit with Oaktree Fund GP I, L.P. and the registrant’s expected entry into a credit agreement with an affiliate of Brookfield Asset Management Inc. providing for a new line of credit. |

• |

We have a limited operating history, our operating history should not be relied upon due to the changes to our business resulting from the Adviser Transition (as defined below), including the engagement of the Adviser and the Dealer Manager and the changes to our board of directors, our executive officers and our investment portfolio, and there is no assurance we will be able to successfully achieve our investment objectives. |

• |

We have only made limited investments to date and you will not have the opportunity to evaluate our future investments before we make them. |

• |

Since there is no public trading market for shares of our common stock, repurchase of shares by us will likely be the only way to dispose of your shares. Our share repurchase plan provides stockholders with the opportunity to request that we repurchase their shares on a monthly basis, but we are not obligated to repurchase any shares and may choose to repurchase only some, or even none, of the shares that have been requested to be repurchased in any particular month in our discretion. In addition, repurchases will be subject to available liquidity and other significant restrictions. Further, our board of directors may modify or suspend our share repurchase plan if it deems such action to be in our best interest and the best interest of our stockholders. As a result, our shares should be considered as having only limited liquidity and at times may be illiquid. |

• |

We cannot guarantee that we will make distributions, and if we do we may fund such distributions from sources other than cash flow from operations, and we have no limits on the amounts we may pay from such sources. We believe that the likelihood that we pay |

distributions from sources other than cash flow from operations, will be higher in the early stages of the offering. |

• |

The purchase and repurchase price for shares of our common stock will generally be based on our prior month’s NAV (subject to material changes as described herein) and will not be based on any public trading market. While there will be independent appraisals of our properties, the appraisal of properties is inherently subjective, and our NAV may not accurately reflect the actual price at which our assets could be liquidated on any given day. |

• |

We have no employees and are dependent on the Adviser to conduct our operations. The Adviser will face conflicts of interest as a result of, among other things, the allocation of investment opportunities among us and Other Brookfield Accounts (as defined herein), the allocation of time of its investment professionals and the substantial fees that we pay to the Adviser. |

• |

This is a “best efforts” offering. If we are not able to raise a substantial amount of capital in the near term, our ability to achieve our investment objectives could be adversely affected. |

• |

Principal and interest payments on any borrowings will reduce the amount of funds available for distribution or investment in additional real estate assets. |

• |

There are limits on the ownership and transferability of our shares. |

• |

If we fail to qualify as a REIT and no relief provisions apply, our NAV and cash available for distribution to our stockholders could materially decrease as a result of being subject to corporate income tax. |

Price to the Public (1) |

Upfront Selling Commissions (2) |

Dealer Manager Fees (2) |

Proceeds to Us, Before Expenses (3) |

|||||||||||||

Maximum Offering (4) |

$ |

6,000,000,000 |

$ |

116,370,386 |

$ |

7,246,377 |

$ |

5,891,161,562 |

||||||||

Class T Shares, per Share |

$ |

12.3873 |

$ |

0.3591 |

$ |

0.0598 |

$ |

11.9684 |

||||||||

Class S Shares, per Share |

$ |

12.2929 |

$ |

0.4157 |

— |

$ |

11.8772 |

|||||||||

Class D Shares, per Share |

$ |

12.1479 |

$ |

0.1795 |

— |

$ |

11.9684 |

|||||||||

Class I Shares, per Share |

$ |

11.9684 |

— |

— |

$ |

11.9684 |

||||||||||

Maximum Distribution Reinvestment Plan |

$ |

1,500,000,000 |

— |

— |

$ |

1,500,000,000 |

||||||||||

(1) |

The price per share shown for each of our classes of shares is the November 1, 2021 transaction price, which is equal to such class’s NAV as of September 30, 2021, plus applicable upfront selling commissions and dealer manager fees. Shares of each class will be issued on a monthly basis at a price per share generally equal to the prior month’s NAV per share for such class, plus applicable upfront selling commissions and dealer manager fees. The transaction price is the then-current offering price per share before applicable selling commissions and dealer manager fees and is generally the prior month’s NAV per share for such class. |

(2) |

The table assumes that all shares are sold in the primary offering, with 1/4 of the gross offering proceeds from the sale at Class T shares, 1/4 of the gross offering proceeds from the sale of Class S shares, 1/4 of the gross offering proceeds from the sale of Class D shares and 1/4 of the gross offering proceeds from the sale of Class I shares. The number of shares of each class sold and the relative proportions in which the classes of shares are sold are uncertain and may differ significantly from this assumption. For Class T shares sold in the primary offering, investors will pay upfront selling commissions of up to 3.0% of the transaction price and upfront dealer manager fees of 0.5% of the transaction price; provided, however, that such amounts may vary at certain participating broker-dealers, provided that the sum will not exceed 3.5% of the transaction price. |

| For Class S shares sold in the primary offering, investors will pay upfront selling commissions of up to 3.5% of the transaction price. For Class D shares sold in the primary offering, investors will pay upfront selling commissions of up to 1.5% of the transaction price. We will also pay the following selling commissions over time as stockholder servicing fees to the dealer manager, subject to Financial Industry Regulatory Authority, Inc. (“FINRA”) limitations on underwriting compensation: (a) for Class T shares only, an advisor stockholder servicing fee of 0.65% per annum, and a dealer stockholder servicing fee of 0.20% per annum, of the aggregate NAV for the Class T shares; provided, however, with respect to Class T shares sold through certain participating broker-dealers, the advisor stockholder servicing fee and the dealer stockholder servicing fee may be other amounts, provided that the sum of such fees will always equal 0.85% per annum of the NAV of such shares, (b) for Class S shares only, a stockholder servicing fee equal to 0.85% per annum of the aggregate NAV for the Class S shares and (c) for Class D shares only, a stockholder servicing fee equal to 0.25% per annum of the aggregate NAV for the Class D shares, in each case, payable monthly. No stockholder servicing fees will be paid with respect to the Class I shares. The total amount that will be paid over time for other underwriting compensation depends on the average length of time for which shares remain outstanding, the term over which such amount is measured and the performance of our investments. We will also pay or reimburse certain organization and offering expenses. See “Plan of Distribution,” “Estimated Use of Proceeds” and “Compensation.” |

| (3) | Proceeds are calculated before deducting stockholder servicing fees or organization and offering expenses payable by us, which are paid over time. |

| (4) | We reserve the right to reallocate shares of common stock between our distribution reinvestment plan and our primary offering. |

| • | a net worth of at least $250,000; or |

| • | a gross annual income of at least $70,000 and a net worth of at least $70,000. |

| • | meet the minimum income and net worth standards established in your state; |

| • | are or will be in a financial position appropriate to enable you to realize the potential benefits described in the prospectus; and |

| • | are able to bear the economic risk of the investment based on your overall financial situation. |

| i | ||||

| iv | ||||

| iv | ||||

| 1 | ||||

| 15 | ||||

| 41 | ||||

| 120 | ||||

| 123 | ||||

| 137 | ||||

| 142 | ||||

| 157 | ||||

| 171 | ||||

| 203 | ||||

| 213 | ||||

| 218 | ||||

| 219 | ||||

| 231 | ||||

| 235 | ||||

| 242 | ||||

| 269 | ||||

| 273 | ||||

| 279 | ||||

| 282 | ||||

| 287 | ||||

| 287 | ||||

| 288 | ||||

| 288 | ||||

| 288 | ||||

| 289 | ||||

A-1 |

||||

B-1 |

||||

C-1 |

||||

D-1 |

||||

F-1 |

Q: |

What is Brookfield Real Estate Income Trust Inc.? |

A: |

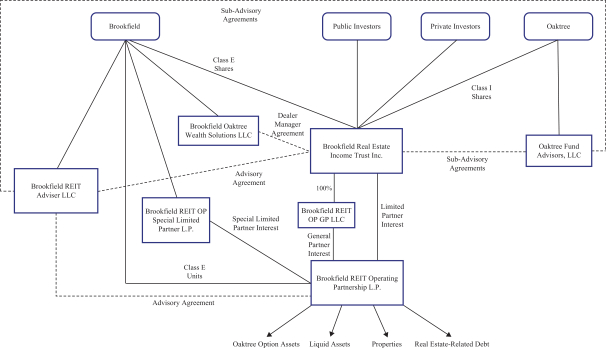

We are a Maryland corporation formed on July 27, 2017. We are externally managed by our adviser, Brookfield REIT Adviser LLC (the “Adviser”), a Delaware limited liability company. The Adviser is an affiliate of Brookfield Asset Management Inc. (together with its affiliates, “Brookfield”), our sponsor. We are structured as an “UPREIT,” which means that we own substantially all of our assets through Brookfield REIT Operating Partnership L.P. (the “Operating Partnership”). Brookfield REIT OP GP LLC, our wholly-owned subsidiary, is the sole general partner of the Operating Partnership. Brookfield REIT OP Special Limited Partner L.P., a Delaware limited partnership and an indirect subsidiary of Brookfield (the “Special Limited Partner”), owns a special limited partner interest in the Operating Partnership. We own, and plan to continue to own, all or substantially all of our assets through the Operating Partnership and its subsidiaries. |

Q: |

What is the Adviser Transition? |

A: |

Prior to the date of this prospectus, we were externally managed by Oaktree Fund Advisors, LLC (the “Sub-Adviser”), an affiliate of Oaktree Capital Management, L.P. (together with its affiliates, “Oaktree”). On July 15, 2021, we entered into that certain Adviser Transition Agreement with the Adviser and the Sub-Adviser, pursuant to which the Adviser became our external adviser on the date of this prospectus. Pursuant to the Adviser Transition Agreement, we consummated a series of related transactions and actions that we refer to collectively as the “Adviser Transition,” including, but not limited to, the following: |

| • | the resignation of the Sub-Adviser as our adviser and the engagement of the Adviser as our adviser; |

| • | the engagement of the Sub-Adviser to (i) manage certain of our real estate properties (the “Equity Option Investments”) and real estate-related debt investments (the “Debt Option Investments” and, together with the Equity Option Investments, the “Oaktree Option Investments”) that we acquired prior to the consummation of the Adviser Transition and (ii) select and manage our liquid assets (cash, cash equivalents, other short-term investments, U.S. government securities, agency securities, corporate debt, liquid real estate-related, equity or debt securities and other investments for which there is reasonable liquidity) (the “Liquidity Sleeve”); |

| • | the filing of an amendment to our charter to change our name from “Oaktree Real Estate Income Trust, Inc.” to “Brookfield Real Estate Income Trust Inc.”; |

| • | our entry into an Option Investments Purchase Agreement with Oaktree (the “Option Investments Purchase Agreement”), pursuant to which Oaktree may purchase the Operating Partnership’s entire interest in the Equity Option Investments or the Debt Option Investments, or both, subject to certain restrictions; |

| • | the expected contribution of certain properties to the Operating Partnership by Brookfield in exchange for shares of the registrant’s Class E common stock, Class E units of the Operating Partnership, or a combination thereof; |

| • | the disposition of certain of our existing real estate properties and real estate-related debt investments; |

| • | the engagement of Brookfield Oaktree Wealth Solutions LLC (the “Dealer Manager”) as the dealer manager for this offering; |

| • | the resignation of members and the appointment of new members of our board of directors; |

| • | the resignation of certain of our executive officers and the appointment of certain new executive officers; |

| • | the filing of Articles Supplementary to our charter designating a new class of common stock as Class E shares; and |

| • | the termination of our line of credit with the Oaktree Fund GP I, L.P. (the “Oaktree Investor”), an affiliate of Oaktree, and our entry into a credit agreement with an affiliate of Brookfield providing for a new line of credit. |

Q: |

Who is Brookfield? |

A: |

Brookfield is a leading global alternative asset manager with over $625 billion of assets under management as of June 30, 2021 across real estate, infrastructure, private equity and credit. Building on a history as an owner and operator that dates back more than 100 years, Brookfield invests in long-life assets and businesses—many of which help support the backbone of today’s global economy—as well as in the debt securities of these assets and businesses. Brookfield uses its global reach, access to large-scale capital and operational expertise to offer a range of alternative investment products to investors around the world—including public and private pension plans, endowments and foundations, sovereign wealth funds, financial institutions, insurance companies and private wealth. |

Q: |

What are Brookfield’s real estate capabilities? |

A: |

Brookfield’s real estate business is one of the world’s largest investors in real estate, with approximately $219 billion of assets under management as of June 30, 2021 across office, multifamily, logistics, retail, hospitality, mixed-use and alternative real estate (such as life sciences, manufactured housing, student housing and serviced apartments). Within the United States, Brookfield manages $136 billion in assets across more than 1,300 properties and significant on-the-ground |

Q: |

Who is Oaktree? |

A: |

Prior to the Adviser Transition, we were externally managed and advised by the Sub-Adviser. The Sub-Adviser is an affiliate of Oaktree, which is a leader among global investment managers specializing in alternative investments, with approximately $156 billion of assets under management as of June 30, 2021. Oaktree’s mission is to deliver superior investment results with risk under control and to conduct its business with the highest integrity. Oaktree emphasizes an opportunistic, value-oriented and risk-controlled approach to investing across real assets (including real estate), credit strategies, private equity and listed equities. Over more than two decades, Oaktree has developed a large and growing client base through its ability to identify and capitalize on opportunities for attractive investment returns in less efficient markets. |

Q: |

What is the relationship between Brookfield and Oaktree? |

A: |

On September 30, 2019, Brookfield acquired 61.2% of Oaktree’s business. Oaktree’s ability to invest across the capital structure has enabled Brookfield to cultivate a diversified mix of global investment strategies in credit, private equity, real assets and listed equities. |

Q: |

What is Brookfield’s and Oaktree’s shared investment philosophy? |

A: |

Together, Brookfield and Oaktree share a long-term, value-driven, contrarian investment style, focusing on sectors in which they believe their in-depth operating experience and market knowledge give the firms a competitive advantage. |

| • | Downside Protection: |

| • | Consistent Returns: |

| • | Client Focus: |

Q: |

What are your primary investment objectives? |

A: |

Our primary investment objectives are to: |

| • | Provide sustainable, stable income in the form of regular cash distributions to our stockholders; |

| • | Protect and preserve invested capital; |

| • | Generate appreciation from asset and market selection and hands-on direct property operations to grow cash flows; and |

| • | Provide an investment alternative for stockholders seeking to allocate a portion of their long-term investment portfolios to high-quality commercial and residential real estate with lower volatility than publicly traded companies. |

Q: |

What is your investment strategy? |

A: |

Our investment strategy is to invest in a diversified portfolio of: |

| • | Income-producing real estate |

| • | Real estate-related debt |

| • | Real estate-related securities |

Q: |

What potential competitive strengths do you offer? |

A: |

We believe that investing in our common stock may offer investors five primary benefits: |

| • | Access to a leading global real estate business with experience over multiple market cycles . mixed-use and alternative real estate (such as life sciences, manufactured housing, student housing and serviced apartments). Through its deep global sourcing network, Brookfield seeks to acquire high-quality assets in supply-constrained markets and execute operational enhancements to deliver consistent cash flows. Real estate is the largest of Brookfield’s four main business lines, and Brookfield’s real estate business has invested over $88 billion of equity in real estate since 1987. |

| • | Brookfield’s operational expertise . in-house expertise and operating capabilities to enhance value and execute business plans with certainty. |

| • | An investment team with the ability to access deal flow that is proprietary and less competitive . |

| • | Deep market knowledge and sector expertise . |

| • | 164 million square feet of Class-A office properties; |

| • | 29 million square feet of logistics properties; |

| • | approximately 57,000 owned and 23,000 managed multifamily units; |

| • | approximately 1,100 owned and 7,300 managed single-family rental properties; |

| • | approximately 44,000 hotel rooms; and |

| • | 141 million square feet of high-quality retail properties. |

| • | Access to Oaktree’s credit investing expertise . sub-advisory relationship with the Sub-Adviser will allow us to opportunistically pivot our debt investments across property types and throughout the capital structure to optimize investments and ensure adequate liquidity for our share repurchase plan and facilitating large acquisitions. |

Q: |

What are Brookfield’s real estate operating capabilities? |

A: |

Brookfield Properties is a fully-integrated affiliate of Brookfield that manages real estate investments, working across sectors to bring high-quality, sustainable real estate to life around the globe every day. Brookfield Properties raises the industry standard for quality and sustainability with its approach to operating and developing real estate across the multifamily, logistics, office, retail and hospitality sectors. |

| • | Property management : day-to-day operations of individual properties and managing the ongoing needs and relationships with tenants; |

| • | Sales and leasing : |

| • | Renovation and capital projects : |

Q: |

Who will direct your investment program? |

A: |

The Adviser will have the authority to implement our investment strategy, as determined by, and subject to the direction of, our board of directors. The Adviser has engaged the Sub-Adviser, an affiliate of Oaktree, to select and manage the Liquidity Sleeve and to manage the Oaktree Option Investments pursuant to sub-advisory agreements. The Sub-Adviser has substantial discretion, within our investment guidelines, to make decisions related to the acquisition, management and disposition of the Liquidity Sleeve and the management of the Oaktree Option Investments. |

Q: |

Do you currently own any investments? |

A: |

Yes, see “Investments in Real Estate and Real Estate Debt” for information about our investments. |

Q: |

What is a real estate investment trust, or REIT? |

A: |

We elected to be taxed as a REIT beginning with our taxable year ended December 31, 2019 and intend to continue to qualify as a REIT. In general, a REIT is a company that: |

| • | combines the capital of many investors to acquire or provide financing for real estate assets; |

| • | offers the benefits of a real estate portfolio under professional management; |

| • | satisfies the various requirements of the Internal Revenue Code of 1986, as amended (the “Code”), including a requirement to distribute to stockholders at least 90% of its REIT taxable income each year (determined without regard to the dividends-paid deduction and excluding net capital gain); and |

| • | is generally not subject to U.S. federal corporate income taxes on its net taxable income that it currently distributes to its stockholders, which substantially eliminates the “double taxation” (i.e., taxation at both the corporate and stockholder levels) that generally results from investments in a C corporation. |

Q: |

What is a non-exchange traded, perpetual-life REIT? |

A: |

A non-exchange traded REIT is a REIT whose shares are not listed for trading on a stock exchange or other securities market. We use the term “perpetual-life REIT” to describe an investment vehicle of indefinite duration, whose shares of common stock are intended to be sold by the REIT monthly on a continuous basis at a price generally equal to the REIT’s prior month’s net asset value (“NAV”) per share. In our perpetual-life structure, the investor may request that we repurchase their shares on a monthly basis, but we are not obligated to repurchase any shares and may choose to repurchase only some, or even none, of the shares that have been requested to be repurchased in any particular month in our discretion. While we may consider a liquidity event at any time in the future, we currently do not intend to undertake such consideration until at least 2025, seven years after we launched our investment program, and we are not obligated by our charter or otherwise to effect a liquidity event at any time. |

Q: |

How is an investment in shares of your common stock different from listed REITs? |

A: |

An investment in shares of our common stock generally differs from an investment in listed REITs in a number of ways, including: |

| • | Shares of listed REITs are priced by the trading market, which is influenced generally by numerous factors, not all of which are related to the underlying value of the entity’s real estate assets and liabilities. The estimated value of our real estate assets and liabilities will be used to determine our NAV rather than the trading market. The purchase price per share for each class of our common stock varies and generally equals our prior month’s NAV per share plus applicable upfront selling commissions and dealer manager fees, whereas investments in listed REITs often involve nominal to no upfront commissions. |

| • | An investment in our shares has limited or no liquidity and our share repurchase plan may be modified or suspended. In contrast, an investment in a listed REIT is a liquid investment, as shares can be sold on an exchange at any time. |

| • | Listed REITs are often self-managed, whereas our investment operations are managed by the Adviser, which is an affiliate of Brookfield. |

| • | Unlike the offering of a listed REIT, this offering has been registered in every state in which we are offering and selling shares. As a result, we include certain limits in our governing documents that are |

| not typically provided for in the charter of a listed REIT. For example, our charter limits the fees we may pay to the Adviser and its affiliates, limits our ability to make certain investments, limits the aggregate amount we may borrow, requires our independent directors to approve certain actions and restricts our ability to indemnify our directors, the Adviser and its affiliates. A listed REIT does not typically provide for these restrictions within its charter. A listed REIT is, however, subject to the governance requirements of the exchange on which its stock is traded, including requirements relating to its board of directors, audit committee, independent director oversight of executive compensation and the director nomination process, code of conduct, stockholder meetings, related party transactions, stockholder approvals, and voting rights. Although we expect to follow many of these same governance guidelines, there is no requirement that we do so. |

Q: |

What type of person might benefit from an investment in your shares? |

A: |

An investment in our shares may be appropriate for you if you: |

| • | meet the minimum suitability standards described above in “Suitability Standards;” |

| • | seek to allocate a portion of your investment portfolio to a direct investment vehicle with a portfolio of real estate and real estate-related investments primarily located in the United States capable of delivering a regular income stream with the potential for appreciation; |

| • | seek to receive current income through regular distribution payments; and |

| • | are able to hold your shares as a long-term investment and do not need liquidity from your investment quickly in the near future. |

Q: |

What is the difference between the classes of shares of common stock being offered? |

A: |

We are offering to the public four classes of shares of our common stock, Class T shares, Class S shares, Class D shares and Class I shares. The differences among the share classes relate to upfront selling commissions, dealer manager fees and ongoing stockholder servicing fees. No upfront selling commissions, dealer manager fees or stockholder servicing fees are paid with respect to Class I shares. We are also offering Class C shares of our common stock to third-party investors pursuant to a private offering. The Adviser may elect to receive all or a portion of its management fee in Class E shares of our common stock, and we may also issue Class E shares to Brookfield and certain of its affiliates and employees in one or more private placements. Neither the Class C shares, nor the Class E shares are being offered pursuant to this prospectus. See “Description of Capital Stock” and “Plan of Distribution” for a discussion of the differences among the classes of shares of our common stock. |

Q: |

What is the per share purchase price? |

A: |

Each class of shares will be sold at the then-current transaction price, which will generally be the prior month’s NAV per share for such class, plus any applicable upfront selling commissions and dealer manager fees. Although the offering price for shares of our common stock will generally be based on the prior month’s NAV per share, the NAV per share of such stock as of the date on which your purchase is settled |

| may be significantly different. We may, but are not obligated to, offer shares at a price that we believe reflects the NAV per share of such stock more appropriately than the prior month’s NAV per share, including by updating a previously disclosed offering price, in cases where we believe there has been a material change (positive or negative) to our NAV per share since the end of the prior month. Each class of shares may have a different NAV per share. See “Net Asset Value Calculation and Valuation Guidelines—Valuation of Investments” for examples of valuation adjustment events that may cause a material change to our NAV per share. |

Q: |

Will I be charged selling commissions? |

A: |

Investors in Class T shares will pay upfront selling commissions of up to 3.0%, and upfront dealer manager fees of 0.5%, of the transaction price of each Class T share sold in the primary offering. Investors in Class S shares will pay upfront selling commissions of up to 3.5%. Investors in Class D shares will pay upfront selling commissions of up to 1.5%. The Dealer Manager anticipates that all of the upfront selling commissions and dealer manager fees will be retained by, or reallowed (paid) to, participating broker-dealers. Stockholders will not pay selling commissions on Class I shares, or when purchasing shares under our distribution reinvestment plan. See “Plan of Distribution.” |

A: |

We have registered $6,000,000,000 in shares of our common stock, in any combination of our share classes, to be sold in our primary offering and up to $1,500,000,000 in shares to be sold pursuant to our distribution reinvestment plan. It is our intent, however, to conduct a continuous offering for an indefinite period of time, by filing for additional offerings of our shares, subject to regulatory approval and continued compliance with the rules and regulations of the Securities and Exchange Commission (the “SEC”) and applicable state laws. |

Q: |

What are the risks involved with buying your shares? |

A: |

Investing in our common stock involves a high degree of risk. These risks include, among others, that (1) we have a limited operating history, our operating history should not be relied upon due to the changes to our business resulting from the Adviser Transition, including the engagement of the Adviser, the Sub-Adviser and the Dealer Manager and the changes to our board of directors, executive officers and our investment portfolio, and there is no assurance we will be able to successfully achieve our investment objectives; (2) there is no public trading market for shares of our common stock and your ability to dispose of your shares will therefore likely be limited to repurchase by us; (3) the amount and frequency of distributions we make is uncertain, and we may pay distributions from sources other than cash flow from operations, particularly in the earlier part of this offering, which means we would have less cash available for investments and your overall returns may be reduced; (4) you will not have the opportunity to evaluate future investments we will make prior to purchasing shares of our common stock; and (5) we will pay substantial fees and expenses to the Adviser and its affiliates, which were not negotiated at arm’s length and may be higher than fees we could achieve from unaffiliated third parties. See “Risk Factors.” |

Q: |

Is there any minimum investment required? |

A: |

The minimum initial investment in Class T, Class S or Class D shares is $2,500, and the minimum subsequent investment in such shares is $500 per transaction. The minimum initial investment in Class I |

| shares is $1,000,000, and the minimum subsequent investment in such shares is $500 per transaction, unless such minimums are waived by the Dealer Manager. The minimum subsequent investment amount does not apply to purchases made under our distribution reinvestment plan. In addition, our board of directors may elect to accept smaller investments in its discretion. |

Q: |

What is a “best efforts” offering? |

A: |

A “best efforts” offering means that the Dealer Manager and the participating brokers are only required to use their best efforts to sell the shares in this offering. When shares are offered to the public on a “best efforts” basis, no underwriter, broker-dealer or other person has a firm commitment or obligation to purchase any of the shares. Therefore, we cannot guarantee that any minimum number of shares will be sold. |

Q: |

How will your NAV per share be calculated? |

A: |

Our NAV is calculated monthly based on the net asset values of our investments (including real-estate related investments), the addition of any other assets (such as cash on hand) and the deduction of any other liabilities. The calculation of our monthly NAV will be determined by the Adviser and our NAV per share is calculated by State Street Bank and Trust Company (“State Street”), a third-party firm that provides us with certain administrative and accounting services, and such calculation will be reviewed and confirmed by the Adviser. The Adviser is ultimately responsible for the determination of our NAV. Altus Group U.S. Inc., a valuation firm, was selected by the Adviser and approved by our board of directors, including a majority of our independent directors, to serve as our independent valuation advisor. Our independent valuation advisor is not responsible for, and does not calculate, our NAV. |

Q: |

When may I make purchases of shares? |

A: |

Subscriptions to purchase our common stock may be made on an ongoing basis, but investors may only purchase our common stock pursuant to accepted subscription orders as of the first calendar day of each month (based on the prior month’s transaction price), and to be accepted, a subscription request must be received in good order at least five business days prior to the first calendar day of the month (unless waived by the Dealer Manager). |

Q: |

When will the transaction price be available? |

A: |

Generally, within 15 days after the last calendar day of each month, we will determine our NAV per share for each share class as of the last calendar day of the prior month, which will generally be the transaction price for the then-current month for such share class. However, in certain circumstances, the transaction price will not be made available until a later time. We will disclose the transaction price for each month when available on our website at www.brookfieldREIT.com |

Q: |

May I withdraw my subscription request once I have made it? |

A: |

Yes. Subscribers are not committed to purchase shares at the time their subscription orders are submitted and any subscription may be canceled at any time before the time it has been accepted. You may withdraw your purchase request by notifying the transfer agent, through your financial intermediary or directly on our toll-free, automated telephone line, (833) 625-7348. |

Q: |

When will my subscription be accepted? |

A: |

Completed subscription requests will not be accepted by us before the later of (i) two business days before the first calendar day of each month and (ii) three business days after we make the transaction price (including any subsequent revised transaction price) publicly available by posting it on our website at www.brookfieldREIT.com |

Q: |

Will I receive distributions and how often? |

A: |

We have declared, and intend to continue to declare, monthly distributions as authorized by our board of directors (or a duly authorized committee of the board of directors) and have paid, and intend to continue to pay, such distributions to stockholders of record on a monthly basis. We commenced paying distributions in December 2019 and have paid distributions each month since such date. Any distributions we make are at the discretion of our board of directors, considering factors such as our earnings, cash flow, capital needs and general financial condition and the requirements of Maryland law. As a result, our distribution rates and payment frequency may vary from time to time. You will not be entitled to receive a distribution if your shares are repurchased prior to the applicable time of the record date. |

Q: |

Will the distributions I receive be taxable as ordinary income? |

A: |

Generally, distributions that you receive, including cash distributions that are reinvested pursuant to our distribution reinvestment plan, will be taxed as ordinary income to the extent they are paid from our current or accumulated earnings and profits. Ordinary dividends received from REITs are generally not eligible to be taxed at the lower U.S. federal income tax rates applicable to individuals for “qualified dividends” from C corporations (i.e., corporations generally subject to U.S. federal corporate income tax). However, under the Tax Cuts and Jobs Act that was enacted at the end of 2017, commencing with taxable years beginning on or after January 1, 2018 and continuing through 2025, individual taxpayers may be entitled to claim a deduction in determining their taxable income of 20% of ordinary REIT dividends (dividends other than capital gain dividends and dividends attributable to certain qualified dividend income received by us), which temporarily reduces the effective tax rate on such dividends. |

Q: |

May I reinvest my cash distributions in additional shares? |

A: |

Yes. We have adopted a distribution reinvestment plan whereby stockholders (other than Alabama, Idaho, Kansas, Kentucky, Maine, Maryland, Massachusetts, Nebraska, New Jersey, North Carolina, Ohio, Oregon, |

| Texas, Vermont and Washington investors and clients of certain participating broker-dealers that do not permit automatic enrollment in our distribution reinvestment plan) will have their cash distributions automatically reinvested in additional shares of our common stock unless they elect to receive their distributions in cash. Alabama, Idaho, Kansas, Kentucky, Maine, Maryland, Massachusetts, Nebraska, New Jersey, North Carolina, Ohio, Oregon, Texas, Vermont and Washington investors and clients of certain participating broker-dealers that do not permit automatic enrollment in our distribution reinvestment plan will automatically receive their distributions in cash unless they elect to have their cash distributions reinvested in additional shares of our common stock. See “Prospectus Summary—Distribution Reinvestment Plan” and “Description of Capital Stock—Distribution Reinvestment Plan” for more information regarding the reinvestment of distributions you may receive from us. For the complete terms of the distribution reinvestment plan, see Appendix B to this prospectus. |

Q: |

Can I request that my shares be repurchased? |

A: |

Yes. However, while stockholders may request on a monthly basis that we repurchase all or any portion of their shares pursuant to our share repurchase plan, we are not obligated to repurchase any shares and may choose to repurchase only some, or even none, of the shares that have been requested to be repurchased in any particular month in our discretion. In addition, our ability to fulfill repurchase requests is subject to a number of limitations. As a result, share repurchases may not be available each month. Under our share repurchase plan, to the extent we choose to repurchase shares in any particular month, we will only repurchase shares as of the opening of the last calendar day of that month (each such date, a “Repurchase Date”). Repurchases will be made at the transaction price in effect on the Repurchase Date, except that shares that have not been outstanding for at least one year will be repurchased at 95% of the transaction price (an “Early Repurchase Deduction”). The Early Repurchase Deduction may be waived in the case of repurchase requests arising from the death or qualified disability of the holder. To have your shares repurchased, your repurchase request and required documentation must be received in good order by 4:00 p.m. (Eastern time) on the second to last business day of the applicable month. Settlements of share repurchases will be made within three business days of the Repurchase Date. The Early Repurchase Deduction will not apply to shares acquired through our distribution investment plan. An investor may withdraw its repurchase request by notifying the transfer agent before 4:00 p.m. (Eastern time) on the last business day of the applicable month. |

Q: |

Will I be notified of how my investment is doing? |

A: |

Yes. We will provide you with periodic updates on the performance of your investment with us, including: |

| • | three quarterly financial reports and investor statements; |

| • | an annual report; |

| • | in the case of certain U.S. stockholders, an annual Internal Revenue Service (“IRS”) Form 1099-DIV or IRS Form 1099-B, if required, and, in the case of non-U.S. stockholders, an annual IRS Form 1042-S; |

| • | confirmation statements (after transactions affecting your balance, except reinvestment of distributions in us and certain transactions through minimum account investment or withdrawal programs); and |

| • | a quarterly statement providing material information regarding your participation in the distribution reinvestment plan and an annual statement providing tax information with respect to income earned on shares under the distribution reinvestment plan for the calendar year. |

Q: |

When will I get my detailed tax information? |

A: |

In the case of certain U.S. stockholders, we expect your IRS Form 1099-DIV tax information, if required, to be mailed by January 31 of each year. |

Q: |

Where can I find updated information regarding the Company? |

A: |

You may find updated information on our website, www.brookfieldREIT.com |

Q: |

What is the impact of being an “emerging growth company”? |

A: |

We are an “emerging growth company,” as defined by the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As an emerging growth company, we are eligible to take advantage of certain exemptions from various reporting and disclosure requirements that are applicable to public companies that are not emerging growth companies and we intend to take advantage of these exemptions. For so long as we remain an emerging growth company, we will not be required to: |

| • | have an auditor attestation report on our internal control over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act; |

| • | submit certain executive compensation matters to stockholder advisory votes pursuant to the “say on frequency” and “say on pay” provisions (requiring a non-binding stockholder vote to approve compensation of certain executive officers) and the “say on golden parachute” provisions (requiring a non-binding stockholder vote to approve golden parachute arrangements for certain executive officers in connection with mergers and certain other business combinations) of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010; or |

| • | disclose certain executive compensation related items, such as the correlation between executive compensation and performance and comparisons of the chief executive officer’s compensation to median employee compensation. |

Q: |

Who can help answer my questions? |

A: |

If you have more questions about this offering or if you would like additional copies of this prospectus, you should contact your financial adviser or our transfer agent: |

Upfront Selling Commissions |

Dealer Manager Fees |

Annual Stockholder Servicing Fees |

Maximum Stockholder Servicing Fees Over Life of Investment (Length of Time) |

Total (Length of Time) |

||||||||||||||||

| Class T |

$ | 300 | $ | 50 | $ | 85 | $556 (7 years) | $906 (6.5 years) | ||||||||||||

| Class S |

$ | 350 | — | $ | 85 | $556 (7 years) | $906 (6.5 years) | |||||||||||||

| Class D |

$ | 150 | — | $ | 25 | $738 (29.5 years) | $888 (29.5 years) | |||||||||||||

| Class I |

— | — | — | — | — | |||||||||||||||

| • | Real Estate mixed-use and alternative real estate (such as life sciences, manufactured housing, student housing and serviced apartments). Through its deep global sourcing network, Brookfield seeks to acquire high-quality assets in supply-constrained markets and execute operational enhancements to deliver consistent cash flows. |

| • | Infrastructure |

| • | Private Equity |

| • | Credit |

| • | Aligning Brookfield’s Interests with Those of its Investors |

| • | Cultivating long-term, mutually beneficial relationships with investors; |

| • | Using Brookfield’s permanent capital to serve as a significant investor in the funds that Brookfield sponsors; and |

| • | Focusing on managing each investment and portfolio to the best possible outcome for both Brookfield and its investors. |

| • | Maintaining an Ownership Mentality |

| • | Establishing well-resourced operations in strategic locations around the world to leverage real-time local market intelligence and bottom-up investment insights; |

| • | Prioritizing the defensive characteristics of high-quality assets in dynamic locations and strong companies that provide essential services; and |

| • | Taking a disciplined approach to identifying long-duration assets and businesses that Brookfield believes can generate attractive returns over the long term. |

| • | Investing on a Value Basis |

| • | Remaining patient in deploying capital but being prepared to invest decisively when the right opportunities emerge; |

| • | Pursuing investments with limited competition, where Brookfield believes that it possesses clear advantages, often via “off-market” transactions; |

| • | Seeking to execute acquisitions at a discount to replacement cost, thereby helping to reduce the risk of investments and enhancing the potential for strong long-term returns; and |

| • | Recognizing that generating attractive returns often requires taking a contrarian approach to evaluating assets, businesses, markets or sectors experiencing periods of distress. |

| • | Leveraging Resources and Operational Expertise |

| • | Building on a history of successfully operating assets and businesses through multiple market cycles; |

| • | Taking advantage of Brookfield’s in-house market knowledge, relationships and execution capabilities across sectors and regions, with the goal of maximizing risk-adjusted returns and optimizing dispositions; and |

| • | Focusing on generating consistent cash flows, which are particularly valuable in a volatile environment. |

| • | Provide sustainable, stable income in the form of regular cash distributions to our stockholders; |

| • | Protect and preserve invested capital; |

| • | Generate appreciation from asset and market selection and hands-on direct property operations to grow cash flows; and |

| • | Provide an investment alternative for stockholders seeking to allocate a portion of their long-term investment portfolios to high-quality commercial and residential real estate with lower volatility than publicly traded companies. |

| • | Income-producing real estate |

| • | Real estate-related debt |

| • | Real estate-related securities |

| • | We have a limited operating history, and our operating history should not be relied upon due to the changes to our business resulting from the Adviser Transition, including the engagement of the Adviser and the Dealer Manager and the changes to our board of directors, our executive officers and our investment portfolio. There is no assurance that we will be able to successfully achieve our investment objectives. |

| • | We have held our current investments for a short period of time and you will not have the opportunity to evaluate our future investments before we make them, which makes an investment in our common stock more speculative. |

| • | Since there is no public trading market for shares of our common stock, repurchase of shares by us will likely be the only way to dispose of your shares. Our share repurchase plan will provide stockholders with the opportunity to request that we repurchase their shares on a monthly basis, but we are not obligated to repurchase any shares and may choose to repurchase only some, or even none, of the shares that have been requested to be repurchased in any particular month in our discretion. In addition, repurchases will be subject to available liquidity and other significant restrictions. Further, our board of directors may modify or suspend our share repurchase plan if it deems such action to be in our best interest and the best interest of our stockholders. As a result, our shares should be considered as having only limited liquidity and at times may be illiquid. |

| • | We cannot guarantee that we will make distributions, and if we do we may fund such distributions from sources other than cash flow from operations, and we have no limits on the amounts we may pay from such sources. |

| • | The purchase and repurchase price for shares of our common stock will generally be based on our prior month’s NAV (subject to material changes as described herein) and will not be based on any public trading market. While there will be independent annual appraisals of our properties, the appraisal of properties is inherently subjective, and our NAV may not accurately reflect the actual price at which our assets could be liquidated on any given day. |

| • | We have no employees and are dependent on the Adviser to conduct our operations. The Adviser will face conflicts of interest as a result of, among other things, the allocation of investment opportunities among us and Other Brookfield Accounts, the allocation of time of its investment professionals and the substantial fees that we will pay to the Adviser. |

| • | This is a “best efforts” offering. If we are not able to raise a substantial amount of capital in the near term, our ability to achieve our investment objectives could be adversely affected. |

| • | Principal and interest payments on any borrowings will reduce the amount of funds available for distribution or investment in additional real estate assets. Borrowing also increases our risk of loss and exposure to negative economic effects. |

| • | There are limits on the ownership and transferability of our shares. See “Description of Capital Stock—Restrictions on Ownership and Transfer.” |

| • | Investing in commercial real estate assets involves certain risks, including but not limited to: tenants’ inability to pay rent; increases in interest rates and lack of availability of financing; tenant turnover and vacancies; and changes in supply of or demand for similar properties in a given market. |

| • | Our operating results will be affected by global and national economic and market conditions generally and by the local economic conditions where our properties are located, including changes with respect to rising vacancy rates or decreasing market rental rates; fluctuations in the average occupancy; |

| inability to lease space on favorable terms; bankruptcies, financial difficulties or lease defaults by our tenants; and changes in government rules, regulations and fiscal policies, such as property taxes, zoning laws, limitations on rental rates, and compliance costs with respect to environmental and other laws. |

| • | The novel coronavirus (“COVID-19”) may have an adverse impact on our NAV, results of operations, cash flows and fundraising, ability to source new investments, obtain financing, fund distributions to stockholders and satisfy repurchase requests, among other factors. |

| • | If we fail to maintain our qualification as a REIT and no relief provisions apply, our NAV and cash available for distribution to our stockholders could materially decrease as a result of being subject to corporate income tax. |

| • | fees of the Adviser and the Sub-Adviser; |

| • | allocation of investment opportunities; |

| • | investments where Other Brookfield Accounts or Other Oaktree Accounts (as defined below) hold related investments; |

| • | the engagement of affiliated service providers; |

| • | allocation of personnel; and |

| • | other conflicts. |

| Type of Compensation and Recipient |

Determination of Amount |

Estimated Amount | ||

Organization and Offering Activities |

||||

| Upfront Selling Commissions and Dealer Manager Fees— The Dealer Manager |

The Dealer Manager will be entitled to receive upfront selling commissions of up to 3.0%, and upfront dealer manager | The actual amount will depend on the number of Class T, Class S and Class D shares sold and the transaction price of | ||

| Type of Compensation and Recipient |

Determination of Amount |

Estimated Amount | ||

| fees of 0.5%, of the transaction price of each Class T share sold in the primary offering; provided, however, that such amounts may vary at certain participating broker-dealers provided that the sum will not exceed 3.5% of the transaction price. The Dealer Manager will be entitled to receive upfront selling commissions of up to 3.5% of the transaction price of each Class S share sold in the primary offering and up to 1.5% of the transaction price of each Class D share sold in the primary offering. The Dealer Manager anticipates that all of the upfront selling commissions and dealer manager fees will be retained by, or reallowed (paid) to, participating broker-dealers. No upfront or other selling commissions or dealer manager fees will be paid with respect to Class I or Class E shares, or shares of any class sold pursuant to our distribution reinvestment plan. |

each Class T, Class S and Class D share. Aggregate upfront selling commissions and dealer manager fees will equal approximately $123.6 million if we sell the maximum amount, in each case, in our primary offering, assuming payment of the full upfront selling commissions and upfront dealer manager fees, and that 1/4 of our offering proceeds are from the sale of each of Class T, Class S and Class D shares and that the transaction price of each of our Class T, Class S and Class D shares remains constant at $10.00. | |||

| Stockholder Servicing Fees— The Dealer Manager |

Subject to FINRA limitations on underwriting compensation, we will pay the Dealer Manager selling commissions over time as stockholder servicing fees for ongoing services rendered to stockholders by participating broker-dealers or broker- dealers servicing investors’ accounts, referred to as servicing broker-dealers: • with respect to our outstanding Class T shares equal to 0.85% per annum of the aggregate NAV of our outstanding Class T shares, consisting of an advisor stockholder servicing fee of 0.65% per annum, and a dealer stockholder servicing fee of 0.20% per annum, of the aggregate NAV of our outstanding Class T shares; provided, however, that with respect to Class T shares sold |

Actual amounts depend upon the per share NAVs of our Class T, Class S and Class D shares, the number of Class T, Class S and Class D shares purchased and when such shares are purchased. For each of Class T and Class S shares, the stockholder servicing fees will equal approximately $12.3 million per annum if we sell the maximum amount. For Class D shares, the stockholder servicing fees will equal approximately $3.7 million per annum if we sell the maximum amount. In each case, we are assuming that, in our primary offering, 1/4 of our offering proceeds are from the sale of Class T, Class S and Class D shares, and that the NAV per share of our Class T shares, Class S shares and Class D shares remains constant at $10.00. | ||

| Type of Compensation and Recipient |

Determination of Amount |

Estimated Amount | ||

| through certain participating broker-dealers, the advisor stockholder servicing fee and the dealer stockholder servicing fee may be other amounts, provided that the sum of such fees will always equal 0.85% per annum of the NAV of such shares; • with respect to our outstanding Class S shares equal to 0.85% per annum of the aggregate NAV of our outstanding Class S shares; and • with respect to our outstanding Class D shares equal to 0.25% per annum of the aggregate NAV of our outstanding Class D shares. We will not pay a stockholder servicing fee with respect to our outstanding Class I or Class E shares. The stockholder servicing fees will be paid monthly in arrears. The Dealer Manager will reallow (pay) the stockholder servicing fees to participating broker-dealers and servicing broker-dealers for ongoing stockholder services performed by such broker-dealers, and will waive stockholder servicing fees to the extent a broker-dealer is not eligible to receive it for failure to provide such services. Because the stockholder servicing fees are calculated based on the NAV for our Class T, Class S and Class D shares, they will reduce the NAV or, alternatively, the distributions payable, with respect to the shares of each such class, including shares issued under our distribution reinvestment plan. We will cease paying the stockholder servicing fee with respect to any Class T share, Class S share or Class D share held in a stockholder’s account at the end of the month in which the Dealer Manager in conjunction with the |

| Type of Compensation and Recipient |

Determination of Amount |

Estimated Amount | ||

| transfer agent determines that total upfront selling commissions, dealer manager fees and stockholder servicing fees paid with respect to the shares held by such stockholder within such account would exceed, in the aggregate, 8.75% (or, in the case of Class T shares sold through certain participating broker-dealers, a lower limit as set forth in the applicable dealer agreement between the Dealer Manager and a participating broker-dealer at the time such shares were issued) of the gross proceeds from the sale of such shares (including the gross proceeds of any shares issued under our distribution reinvestment plan with respect thereto). At the end of such month, such Class T share, Class S share or Class D share (and any shares issued under our distribution reinvestment plan with respect thereto) held in such stockholder’s account will convert into a number of Class I shares (including any fractional shares) with an equivalent aggregate NAV as such shares. Although we cannot predict the length of time over which the stockholder servicing fee will be paid due to potential changes in the NAV of our shares, this fee would be paid with respect to a Class T share or Class S share over approximately 6.5 years from the date of purchase and with respect to a Class D share held in a stockholder’s account over approximately 29.5 years from the date of purchase, assuming a limit of 8.75% of gross proceeds, payment of the full upfront selling commissions and dealer manager fees (as applicable), opting out of the distribution reinvestment plan and a constant NAV of $10.00 per share. Under these assumptions, if a stockholder holds his or her shares for these time periods, this fee with respect to a Class T share or Class S share would total approximately $0.56 and |

| Type of Compensation and Recipient |

Determination of Amount |

Estimated Amount | ||

| with respect to a Class D share would total approximately $0.74. In addition, we will cease paying the stockholder servicing fee on the Class T shares, Class S shares and Class D shares on the earlier to occur of the following: (i) a listing of Class I shares, (ii) our merger or consolidation with or into another entity in which we are not the surviving entity, or the sale or other disposition of all or substantially all of our assets, in each case in a transaction in which our stockholders receive cash, securities listed on a national exchange or a combination thereof, or (iii) the date following the completion of this offering on which, in the aggregate, underwriting compensation from all sources in connection with this offering, including upfront selling commissions, the stockholder servicing fee and other underwriting compensation, is equal to 10% of the gross proceeds from our primary offering. For a description of the services required from the participating broker-dealer or servicing broker-dealer, see the “Plan of Distribution—Underwriting Compensation—Stockholder Servicing Fees—Class T, Class S and Class D Shares.” |

||||

| Organization and Offering Expense Reimbursement— The Adviser |

The Adviser has agreed to advance all of our organization and offering expenses on our behalf (other than upfront selling commissions, dealer manager fees and stockholder servicing fees) through July 6, 2022. We will reimburse the Adviser for all such advanced expenses ratably over the 60 months following July 6, 2022. We will reimburse the Adviser for any organization and offering expenses that it incurs on our behalf as and when | We estimate our organization and offering expenses to be approximately $20.4 million if we sell the maximum offering amount. | ||

| Type of Compensation and Recipient |

Determination of Amount |

Estimated Amount | ||

| incurred after July 6, 2022. Our organization and offering expenses may include the organization and offering expenses of feeder vehicles primarily created to hold our shares, as well as certain expenses associated with the Adviser Transition. As part of the Adviser Transition, the Adviser has acquired the Sub-Adviser’s receivable related to the organization and offering expenses previously incurred by the Sub-Adviser and is to be reimbursed therefor.After the termination of the primary offering and again after termination of the offering under our distribution reinvestment plan, the Adviser has agreed to reimburse us to the extent that the organization and offering expenses that we incur exceed 15% of our gross proceeds from the applicable offering. |

||||

Investment Activities | ||||

| Acquisition Expense Reimbursement— The Adviser |

We do not intend to pay the Adviser any acquisition or other similar fees in connection with making investments, though our charter authorizes us to do so. We will, however, reimburse the Adviser for out-of-pocket |

Actual amounts are dependent upon actual expenses incurred and, therefore, cannot be determined at this time. | ||

Operational Activities | ||||

| Management Fee and Expense Reimbursements— The Adviser |

We will pay the Adviser a management fee equal to 1.25% of our NAV for the Class T, Class S, Class D, Class I and Class C shares per annum payable | Actual amounts of the management fee depend upon our aggregate NAV. The management fee will equal approximately $73.4 million per annum | ||

| Type of Compensation and Recipient |

Determination of Amount |

Estimated Amount | ||

| monthly. We do not pay the Adviser a management fee with respect to the Class E shares. The management fee may be paid, at the Adviser’s election, in cash, Class E or Class I shares. If the Adviser elects to receive any portion of its management fee in Class E or Class I shares, we may repurchase such shares from the Adviser at a later date. We expect to repurchase any such Class E or Class I shares as of a Repurchase Date at the transaction price in effect for repurchases made on such Repurchase Date under our share repurchase plan. Class E and Class I shares obtained by the Adviser will not be subject to the repurchase limits of our share repurchase plan or any Early Repurchase Deduction. In addition to the organization and offering expense and acquisition expense reimbursements described above, we will reimburse the Adviser for costs and expenses it incurs in connection with the services it provides to us, including, but not limited to, (1) the actual cost of goods and services used by us and obtained from third parties, including fees paid to administrators, consultants, attorneys, technology providers and other service providers, and brokerage fees paid in connection with the purchase and sale of investments and securities, (2) expenses of managing and operating our properties, whether payable to an affiliate or a non-affiliated person and (3) administrative service expenses, including, but not limited to, personnel and related employment costs incurred |

if we sell the maximum amount, in each case, in our primary offering, assuming that the NAV per share of each class of our common stock remains constant at $10.00 and before giving effect to any shares issued under our distribution reinvestment plan. Actual amounts of out-of-pocket |

| Type of Compensation and Recipient |

Determination of Amount |

Estimated Amount | ||

| by the Adviser or its affiliates in performing administrative services on our behalf (including legal, accounting, investor relations, tax, capital markets, financial operations services and other administrative services), provided that no reimbursement shall be made for expenses related to personnel of the Adviser and its affiliates who provide investment advisory services to us pursuant to the Advisory Agreement or who serve as our directors or executive officers as designated by our board of directors. The expense reimbursements that we will pay to the Adviser include expenses incurred by the Sub-Adviser on our behalf. See “Management—The Advisory Agreement—Management Fee, Performance Participation Interest and Expense Reimbursements.” |

||||

| Performance Participation Interest— The Special Limited Partner |

So long as the Advisory Agreement has not been terminated, the Special Limited Partner holds a performance participation interest in the Operating Partnership that entitles it to receive cash distributions (or Class E or Class I Operating Partnership units at its election) from the Operating Partnership equal to 12.5% of the Total Return, subject to a 5% Hurdle Amount and a High Water Mark, with a Catch-Up (each term as defined herein). Such distributions are paid annually.For a detailed explanation of how the performance participation is calculated, see “Summary of The Operating Partnership Agreement—Special Limited Partner Interest.” For a hypothetical calculation of the performance participation calculation, see “Compensation—Performance Participation Interest Example.” |

Actual amounts of the performance participation depend upon the Operating Partnership’s actual annual total return and, therefore, cannot be calculated at this time. | ||

| Type of Compensation and Recipient |

Determination of Amount |

Estimated Amount | ||

| Fees from Other Services— Affiliates of the Adviser |

We may retain third parties, including certain of the Adviser’s affiliates, for necessary services relating to our investments or our operations, including lending and loan special servicing; investment banking, advisory, consulting, brokerage and managing foreclosures and workouts; the placement and provision of insurance policies and coverage, including risk retention or insurance captives; entitlement, development, construction and design (including oversight thereof); portfolio company, real estate operations and property management (and oversight thereof) and leasing; legal, financial, compliance, tax, back office, corporate secretarial, accounting, human resources, bank account and cash management; supply or procurement of power and energy; transaction support; accounting and reporting (including coordinating onboarding, due diligence, reporting and other administrative services) and other financial operations services; hedging, derivatives, financing and other treasury services and capital markets services; data generation, analysis, collection and management services; physical and digital security, life and physical safety, and other technical specialties; information technology services and innovation; appraisal and valuation services; market research; cash flow modeling and forecasting; client onboarding; and other services or products. Any fees paid to the Adviser’s affiliates for any such services will not reduce the management fee or performance participation interest. Any such arrangements will subject to approval by a majority of our board of directors (including a majority of our independent directors) not otherwise interested in the transaction. | Actual amounts depend on whether affiliates of the Adviser are actually engaged to perform such services. | ||

| • | “Total Operating Expenses” are all costs and expenses paid or incurred by us, as determined under generally accepted accounting principles, including the management fee, any distributions made to the Special Limited Partner with respect to its performance participation interest and any operating expenses of feeder vehicles primarily created to hold our shares advanced by us, but excluding: (i) the expenses of raising capital such as organization and offering expenses, legal, audit, accounting, underwriting, brokerage, listing, registration and other fees, printing and other such expenses and taxes incurred in connection with the issuance, distribution, transfer, registration and listing of our capital stock, (ii) property-level expenses incurred at each property, (iii) interest payments, (iv) taxes, (v) non-cash expenditures such as depreciation, amortization and bad debt reserves, (vi) incentive fees paid in compliance with our charter, (vii) acquisition fees and acquisition expenses related to the selection and acquisition of assets, whether or not a property is actually acquired, (viii) real estate commissions on the sale of property and (ix) other fees and expenses connected with the acquisition, disposition, management and ownership of real estate interests, mortgage loans or other property (including the costs of foreclosure, insurance premiums, legal services, maintenance, repair and improvement of property). |

| • | “Average Invested Assets” means, for any period, the average of the aggregate book value of our assets, invested, directly or indirectly, in equity interests in and loans secured by real estate, including all properties, mortgages and real estate-related securities and consolidated and unconsolidated joint ventures or other partnerships, before deducting depreciation, amortization, impairments, bad debt reserves or other non-cash reserves, computed by taking the average of such values at the end of each month during such period. |

| • | “Net Income” means, for any period, total revenues applicable to such period, less the total expenses applicable to such period other than additions to, or allowances for, non-cash charges such as depreciation, amortization, impairments and reserves for bad debt or other similar non-cash reserves. |

| • | under Section 3(a)(1)(A), if it is, or holds itself out as being, engaged primarily, or proposes to engage primarily, in the business of investing, reinvesting or trading in securities; or |

| • | under Section 3(a)(1)(C), if it is engaged, or proposes to engage, in the business of investing, reinvesting, owning, holding or trading in securities and owns, or proposes to acquire, “investment securities” having a value exceeding 40% of the value of its total assets (exclusive of government securities and cash items) on an unconsolidated basis, which we refer to as the “40% test.” The term “investment securities” generally includes all securities except U.S. government securities and |

| securities of majority-owned subsidiaries that are not themselves investment companies and are not relying on the exemption from the definition of investment company under Section 3(c)(1) or Section 3(c)(7) of the Investment Company Act. |

| • | the limited size of our portfolio in the early stages of our development; |

| • | our inability to invest the proceeds from sales of our shares on a timely basis in income-producing properties; |

| • | our inability to realize attractive risk-adjusted returns on our investments; |

| • | high levels of expenses or reduced revenues that reduce our cash flow or non-cash earnings; and |

| • | defaults in our investment portfolio or decreases in the value of our investments. |

| • | staggering the board of directors into three classes; |

| • | requiring a two-thirds vote of stockholders to remove directors; |

| • | providing that only the board of directors can fix the size of the board; |

| • | providing that all vacancies on the board, regardless of how the vacancy was created, may be filled only by the affirmative vote of a majority of the remaining directors in office and for the remainder of the full term of the class of directors in which the vacancy occurred; and |

| • | providing for a majority requirement for the calling by stockholders of a special meeting of stockholders. |

| • | 80% of all votes entitled to be cast by holders of outstanding shares of our voting stock; and |

| • | two-thirds of all of the votes entitled to be cast by holders of outstanding shares of our voting stock other than those shares owned or held by the interested stockholder with whom or with whose affiliate the business combination is to be effected or held by an affiliate or associate of the interested stockholder. |

| • | interest rate fluctuations and lack of availability of financing; |

| • | changes in global, national, regional or local economic, demographic or capital market conditions; |

| • | acts of war or terrorism; |

| • | bank liquidity; |

| • | increases in borrowing rates; |

| • | changes in environmental and zoning laws; |

| • | overbuilding and increased competition for properties targeted by our investment strategy; |

| • | future adverse national real estate trends, including increasing vacancy rates, declining rental rates and general deterioration of market conditions; |

| • | changes in supply and demand fundamentals; |

| • | increases in property taxes; |

| • | casualty or condemnation losses; |

| • | bankruptcy, financial difficulty or lease default of a major tenant; |

| • | regulatory limitations on rent; |

| • | increased mortgage defaults and the availability of mortgage funds which may render the sale or refinancing of properties difficult or impracticable; |

| • | changes in laws, regulations and fiscal policies, including increases in property taxes and limitations on rental rates; and |

| • | wars, natural disasters, epidemics or pandemics, severe weather patterns, terrorist attacks and similar events. |

| • | changes in government policies or personnel; |

| • | restrictions on currency transfer or convertibility; |

| • | changes in labor relations; |