REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| Title of Each Class |

Trading Symbol |

Name of Each Exchange on Which Registered | ||

| each representing four Class A ordinary shares |

|

|

| Large accelerated filer ☐ |

☒ |

Non-accelerated filer ☐ |

Emerging growth company ☐ |

| ☒ |

International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ |

Other ☐ |

| Page |

||||

| 1 |

||||

| 4 |

||||

| 7 |

||||

| 8 |

||||

| 8 |

||||

| 8 |

||||

| 9 |

||||

| 9 |

||||

| 12 |

||||

| 12 |

||||

| 13 |

||||

| 58 |

||||

| 58 |

||||

| 58 |

||||

| 80 |

||||

| 82 |

||||

| 82 |

||||

| 82 |

||||

| 83 |

||||

| 95 |

||||

| 99 |

||||

| 99 |

||||

| 101 |

||||

| 101 |

||||

| 102 |

||||

| 103 |

||||

| 103 |

||||

| 106 |

||||

| 107 |

||||

| 112 |

||||

| 114 |

||||

| 115 |

||||

| 115 |

||||

| 116 |

||||

| 122 |

||||

| Page |

||||

| 122 |

||||

| 122 |

||||

| 123 |

||||

| 123 |

||||

| 123 |

||||

| 123 |

||||

| 124 |

||||

| 124 |

||||

| 124 |

||||

| 124 |

||||

| 124 |

||||

| 124 |

||||

| 124 |

||||

| 133 |

||||

| 133 |

||||

| 134 |

||||

| 139 |

||||

| 139 |

||||

| 139 |

||||

| 140 |

||||

| 140 |

||||

| 141 |

||||

| 141 |

||||

| 141 |

||||

| 141 |

||||

| 141 |

||||

| 143 |

||||

| 143 |

||||

| 143 |

||||

| 143 |

||||

| 144 |

||||

| 144 |

||||

| 144 |

||||

| 145 |

||||

| 145 |

||||

| 145 |

||||

| • | “2012 Notes” refers to the 8.50% senior notes due 2020 in an aggregate principal amount of US$825,000,000 issued by Studio City Finance on November 26, 2012 and as to which no amount remains outstanding following the redemption of all remaining outstanding amounts in March 2019; |

| • | “2012 Notes Tender Offer” refers to the conditional tender offer by Studio City Finance to purchase for cash any and all of the outstanding 2012 Notes, which commenced in January 2019 and settled in February 2019; |

| • | “2013 Project Facility” refers to the senior secured project facility, dated January 28, 2013 and as amended from time to time, entered into between, among others, Studio City Company, as borrower, and certain subsidiaries as guarantors, comprising a term loan facility of HK$10,080,460,000 (approximately US$1,300 million) and revolving credit facility of HK$775,420,000 (approximately US$100 million), and which has been amended, restated and extended by the 2016 Credit Facility; |

| • | “2016 Credit Facility” refers to the facility agreement dated November 23, 2016 with, among others, Bank of China Limited, Macau Branch, to amend, restate and extend the 2013 Project Facility to provide for senior secured credit facilities in an aggregate amount of HK$234.0 million, which consist of a HK$233.0 million (approximately US$29.9 million) revolving credit facility and a HK$1.0 million (approximately US$128,000) term loan facility; |

| • | “2016 Notes” refers to the (i) 5.875% senior secured notes due 2019 in an aggregate principal amount of US$350,000,000, or the 2016 5.875% Notes, which were fully repaid upon maturity in November 2019, and (ii) 7.250% senior secured notes due 2021 in an aggregate principal amount of US$850,000,000, or the 2016 7.250% Notes, both issued by Studio City Company on November 30, 2016; |

| • | “2019 Notes” refers to the 7.25% senior notes due 2024 in an aggregate principal amount of US$600,000,000 issued by Studio City Finance on February 11, 2019; |

| • | “ADSs” refers to our American depositary shares, each of which represents four Class A ordinary shares; |

| • | “Altira Macau” refers to an integrated casino and hotel development located in Taipa, Macau, that caters to Asian VIP rolling chip customers; |

| • | “board” and “board of directors” refer to the board of directors of our Company or a duly constituted committee thereof; |

| • | “China” and “PRC” refer to the People’s Republic of China, excluding the Hong Kong Special Administrative Region of the PRC (Hong Kong), the Macau Special Administrative Region of the PRC (Macau) and Taiwan from a geographical point of view; |

| • | “City of Dreams” refers to a casino, hotel, retail and entertainment integrated resort located in Cotai, Macau, which currently features casino areas and four luxury hotels, including a collection of retail brands, a wet stage performance theater and other entertainment venues; |

| • | “DICJ” refers to the Direcção de Inspecção e Coordenação de Jogos (the Gaming Inspection and Coordination Bureau), a department of the Public Administration of Macau; |

| • | “Greater China” refers to mainland China, Hong Kong and Macau, collectively; |

| • | “HK$” and “H.K. dollar(s)” refer to the legal currency of Hong Kong; |

| • | “Master Service Providers” refer to certain of our affiliates with whom we entered into a master service agreement and a series of work agreements with respect to the non-gaming services at the properties in |

| Macau, and that are also subsidiaries of Melco Resorts, including Melco Crown (COD) Developments Limited (now known as COD Resorts Limited), Altira Developments Limited (now known as Altira Resorts Limited), the Gaming Operator, MPEL Services Limited (now known as Melco Resorts Services Limited), Golden Future (Management Services) Limited, MPEL Properties (Macau) Limited, Melco Crown Security Services Limited (now known as Melco Resorts Security Services Limited), MCE Travel Limited (now known as Melco Resorts Travel Limited), MCE Transportation Limited and MCE Transportation Two Limited (now known as MCO Transportation Two Limited); |

| • | “MCO Cotai” refers to MCO Cotai Investments Limited (formerly known as MCE Cotai Investments Limited), a subsidiary of Melco Resorts and a shareholder of our Company; |

| • | “Melco International” refers to Melco International Development Limited, a Hong Kong-listed company; |

| • | “Melco Resorts” refers to Melco Resorts & Entertainment Limited, a Cayman Islands company and with its American depositary shares listed on the Nasdaq Global Select Market; |

| • | “Melco Resorts Macau” or the “Gaming Operator” refers to Melco Resorts (Macau) Limited, a company incorporated under the laws of Macau that is a subsidiary of Melco Resorts, the holder of a subconcession under the Subconcession Contract and the operator of Studio City Casino. The equity interest of the Gaming Operator is 90% owned by Melco Resorts and 10% owned by Mr. Lawrence Ho, the managing director of the Gaming Operator; |

| • | “MOP” or “Pataca(s)” refers to the legal currency of Macau; |

| • | “MSC Cotai” refers to our subsidiary, MSC Cotai Limited, which is a company incorporated in the British Virgin Islands with limited liability; |

| • | “New Cotai” refers to New Cotai, LLC, a Delaware limited liability company; |

| • | “New Cotai Holdings” refers to New Cotai Holdings, LLC, a Delaware limited liability company; |

| • | “Renminbi” and “RMB” refer to the legal currency of China; |

| • | “Studio City” refers to a cinematically-themed integrated entertainment, retail and gaming resort in Cotai, an area of reclaimed land located between the islands of Taipa and Coloane in Macau; |

| • | “Studio City Casino” refers to the gaming areas being operated within Studio City; |

| • | “Studio City Company” refers to our subsidiary, Studio City Company Limited, which is a company incorporated in the British Virgin Islands with limited liability; |

| • | “Studio City Developments” refers to our subsidiary, Studio City Developments Limited, a Macau company; |

| • | “Studio City Entertainment” refers to our subsidiary, Studio City Entertainment Limited, a Macau company; |

| • | “Studio City Finance” refers to our subsidiary, Studio City Finance Limited, which is a company incorporated in the British Virgin Islands with limited liability; |

| • | “Studio City Hotels” refers to our subsidiary, Studio City Hotels Limited, a Macau company; |

| • | “Studio City Investments” refers to our subsidiary, Studio City Investments Limited, which is a company incorporated in the British Virgin Islands with limited liability; |

| • | “Subconcession Contract” refers to the subconcession contract executed between the Gaming Operator and Wynn Resorts (Macau) S.A., or Wynn Resorts Macau, on September 8, 2006, that provides for the terms and conditions of the subconcession granted to the Gaming Operator by Wynn Resorts Macau; |

| • | “US$” and “U.S. dollar(s)” refer to the legal currency of the United States; |

| • | “U.S. GAAP” refers to the U.S. generally accepted accounting principles; and |

| • | “we,” “us,” “our,” “our Company” and “the Company” refer to Studio City International Holdings Limited and, as the context requires, its predecessor entities and its consolidated subsidiaries. |

| “average daily rate” or “ADR” |

calculated by dividing total room revenues including complimentary rooms (less service charges, if any) by total rooms occupied, including complimentary rooms, i.e., average price of occupied rooms per day | |

| “cage” |

a secure room within a casino with a facility that allows patrons to carry out transactions required to participate in gaming activities, such as exchange of cash for chips and exchange of chips for cash or other chips | |

| “chip” |

round token that is used on casino gaming tables in lieu of cash | |

| “concession” |

a government grant for the operation of games of fortune and chance in casinos in Macau under an administrative contract pursuant to which a concessionaire, or the entity holding the concession, is authorized to operate games of fortune and chance in casinos in Macau | |

| “dealer” |

a casino employee who takes and pays out wagers or otherwise oversees a gaming table | |

| “drop” |

the amount of cash to purchase gaming chips and promotional vouchers that is deposited in a gaming table’s drop box, plus gaming chips purchased at the casino cage | |

| “drop box” |

a box or container that serves as a repository for cash, chip purchase vouchers, credit markers and forms used to record movements in the chip inventory on each table game | |

| “electronic gaming table” |

table with an electronic or computerized wagering and payment system that allow players to place bets from multiple-player gaming seats | |

| “gaming machine” |

slot machine and/or electronic gaming table | |

| “gaming machine handle” |

the total amount wagered in gaming machines | |

| “gaming machine win rate” |

gaming machine win (calculated before non-discretionary incentives (including the point-loyalty programs) as administered by the Gaming Operator and allocating casino revenues related to goods and services provided to gaming patrons on a complimentary basis) expressed as a percentage of gaming machine handle | |

| “gaming promoter” |

an individual or corporate entity who, for the purpose of promoting rolling chip and other gaming activities, arranges customer transportation and accommodation, provides credit in its sole discretion if authorized by a gaming operator and arranges food and beverage services and entertainment in exchange for commissions or other compensation from a gaming concessionaire or subconcessionaire | |

| “integrated resort” |

a resort which provides customers with a combination of hotel accommodations, casinos or gaming areas, retail and dining facilities, MICE space, entertainment venues and spas | |

| “junket player” |

a player sourced by gaming promoters to play in the VIP gaming rooms or areas | |

| “marker” |

evidence of indebtedness by a player to the casino or gaming operator | |

| “mass market patron” |

a customer who plays in the mass market segment | |

| “mass market segment” |

consists of both table games and gaming machines played by mass market players primarily for cash stakes |

| “mass market table games drop” |

the amount of table games drop in the mass market table games segment | |

| “mass market table games hold percentage” |

mass market table games win (calculated before discounts, commissions, non-discretionary incentives (including the point-loyalty programs) as administered by the Gaming Operator and allocating casino revenues related to goods and services provided to gaming patrons on a complimentary basis) as a percentage of mass market table games drop | |

| “mass market table games segment” |

the mass market segment consisting of mass market patrons who play table games | |

| “MICE” |

Meetings, Incentives, Conventions and Exhibitions, an acronym commonly used to refer to tourism involving large groups brought together for an event or specific purpose | |

| “net rolling” |

net turnover in a non-negotiable chip game | |

| “non-negotiable chip” |

promotional casino chip that is not to be exchanged for cash | |

| “non-rolling chip” |

chip that can be exchanged for cash, used by mass market patrons to make wagers | |

| “occupancy rate” |

the average percentage of available hotel rooms occupied, including complimentary rooms, during a period | |

| “premium direct player” |

a rolling chip player who is a direct customer of the concessionaires or subconcessionaires and is attracted to the casino through direct marketing efforts and relationships with the gaming operator | |

| “progressive jackpot” |

a jackpot for a gaming machine or table game where the value of the jackpot increases as wagers are made; multiple gaming machines or table games may be linked together to establish one progressive jackpot | |

| “revenue per available room” or “REVPAR” |

calculated by dividing total room revenues including complimentary rooms (less service charges, if any) by total rooms available, thereby representing a combination of hotel average daily room rates and occupancy | |

| “rolling chip” or “VIP rolling chip” |

non-negotiable chip primarily used by rolling chip patrons to make wagers | |

| “rolling chip patron” |

a player who primarily plays on a rolling chip or VIP rolling chip tables and typically plays for higher stakes than mass market gaming patrons | |

| “rolling chip segment” |

consists of table games played in private VIP gaming rooms or areas by rolling chip patrons who are either premium direct players or junket players | |

| “rolling chip volume” |

the amount of non-negotiable chips wagered and lost by the rolling chip market segment | |

| “rolling chip win rate” |

rolling chip table games win (calculated before discounts, commissions, non-discretionary incentives (including the point-loyalty programs) as administered by the Gaming Operator and allocating casino revenues related to goods and services provided to gaming patrons on a complimentary basis) as a percentage of rolling chip volume | |

| “slot machine” |

traditional slot or electronic gaming machine operated by a single player | |

| “subconcession” |

an agreement for the operation of games of fortune and chance in casinos between the entity holding the concession, or the concessionaire, and a subconcessionaire, pursuant to which the subconcessionaire is authorized to operate games of fortune and chance in casinos in Macau |

| “table games win” |

the amount of wagers won net of wagers lost on gaming tables that is retained and recorded as casino revenues. Table games win is calculated before discounts, commissions, non-discretionary incentives (including the point-loyalty programs) as administered by the Gaming Operator and allocating casino revenues related to goods and services provided to gaming patrons on a complimentary basis | |

| “VIP gaming room” |

gaming rooms or areas that have restricted access to rolling chip patrons and typically offer more personalized service than the general mass market gaming areas |

| • | our goals and strategies; |

| • | the expected growth of the gaming and leisure market in Macau and visitation in Macau; |

| • | our ability to successfully operate Studio City; |

| • | our ability to obtain all required governmental approval, authorizations and licenses for the remaining project; |

| • | our ability to obtain adequate financing for the remaining project; |

| • | our ability to develop the remaining project in accordance with our business plan, completion time and within budget; |

| • | our compliance with conditions and covenants under the existing and future indebtedness; |

| • | construction cost estimates for the remaining project, including projected variances from budgeted costs; |

| • | our ability to enter into definitive contracts with contractors with sufficient skill, financial strength and relevant experience for the construction of the remaining project; |

| • | capital and credit market volatility; |

| • | our ability to raise additional capital, if and when required; |

| • | increased competition from other casino hotel and resort projects in Macau and elsewhere in Asia, including the three concessionaires (SJM, Wynn Resorts Macau and Galaxy) and subconcessionaires (including MGM Grand Paradise, S.A., or MGM Grand, and Venetian Macau Limited, or Venetian Macau) in Macau; |

| • | government policies and regulation relating to the gaming industry, including gaming license approvals and the legalization of gaming in other jurisdictions, and leisure market in Macau; |

| • | the uncertainty of tourist behavior related to spending and vacationing at casino resorts in Macau; |

| • | fluctuations in occupancy rates and average daily room rates in Macau; |

| • | the liberalization of travel restrictions on PRC citizens and convertibility of the Renminbi; |

| • | the completion of infrastructure projects in Macau; |

| • | our ability to retain and increase our customers; |

| • | our ability to offer new services and attractions; |

| • | our future business development, financial condition and results of operations; |

| • | the expected growth in, market size of and trends in the market in Macau; |

| • | expected changes in our revenues, costs or expenditures; |

| • | our expectations regarding demand for and market acceptance of our brand and business; |

| • | our ability to continue to develop new technologies and/or upgrade our existing technologies; |

| • | growth of and trends of competition in the gaming and leisure market in Macau; |

| • | general economic and business conditions globally and in Macau; and |

| • | other factors described under “Item 3. Key Information — D. Risk Factors.” |

ITEM 1. |

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

ITEM 2. |

OFFER STATISTICS AND EXPECTED TIMETABLE |

ITEM 3. |

KEY INFORMATION |

| Year Ended December 31, |

||||||||||||||||||||

| 2019 (2) |

2018 (3) |

2017 |

2016 |

2015 (1) |

||||||||||||||||

| (In thousands of US$, except for share and per share data) |

||||||||||||||||||||

| Consolidated Statements of Operations Data: |

||||||||||||||||||||

| Total operating revenues |

$ | 626,733 |

$ | 571,213 |

$ | 539,814 |

$ | 424,531 |

$ | 69,334 |

||||||||||

| Total operating costs and expenses |

$ | (448,737 |

) | $ | (433,351 |

) | $ | (459,364 |

) | $ | (479,297 |

) | $ | (258,611 |

) | |||||

| Operating income (loss) |

$ | 177,996 |

$ | 137,862 |

$ | 80,450 |

$ | (54,766 |

) | $ | (189,277 |

) | ||||||||

| Net Income (loss) |

$ | 43,629 |

$ | (20,745 |

) | $ | (76,437 |

) | $ | (242,789 |

) | $ | (232,560 |

) | ||||||

| Net income attributable to participation interest |

$ | (10,065 |

) | $ | (853 |

) | $ | — |

$ | — |

$ | — |

||||||||

| Net Income (loss) attributable to Studio City International Holdings Limited |

$ | 33,564 |

$ | (21,598 |

) | $ | (76,437 |

) | $ | (242,789 |

) | $ | (232,560 |

) | ||||||

| Net Income (loss) attributable to Studio City International Holdings Limited per Class A ordinary share (5) : |

||||||||||||||||||||

| Basic and diluted |

$ | 0.139 |

$ | (0.113 |

) | $ | (0.422 |

) | $ | (1.339 |

) | $ | (1.283 |

) | ||||||

| Net Income (loss) attributable to Studio City International Holdings Limited per ADS (4)(5) : |

||||||||||||||||||||

| Basic and diluted |

$ | 0.555 |

$ | (0.451 |

) | $ | (1.687 |

) | $ | (5.357 |

) | $ | (5.132 |

) | ||||||

| Weighted average Class A ordinary shares outstanding used in net income (loss) attributable to Studio City International Holdings Limited per Class A ordinary share calculation (5) : |

||||||||||||||||||||

| Basic and diluted |

241,818,016 |

191,533,455 |

181,279,400 |

181,279,400 |

181,279,400 |

|||||||||||||||

| (1) | We commenced operations in October 2015. |

| (2) | We adopted the New Leases Standard on January 1, 2019 under the modified retrospective method. There was no material impact on our results of operations for the year ended December 31, 2019 as a result of the adoption of the New Leases Standard. |

| (3) | We adopted the New Revenue Standard on January 1, 2018 under the modified retrospective method. There was no material impact on our results of operations for the year ended December 31, 2018 as a result of the adoption of the New Revenue Standard. |

| (4) | Each ADS represents four Class A ordinary shares. |

| (5) | In connection with the Company’s initial public offering on October 22, 2018, the Company underwent a series of organizational transactions. For the calculation of net loss attributable to Studio City International Holdings Limited per Class A ordinary share for periods prior to the initial public offering, including the year ended December 31, 2018 for which a portion of the period preceded initial public offering, the Company has retrospectively presented net loss attributable to Studio City International Holdings Limited per Class A ordinary share and the share capital as if the organizational transactions had occurred at the beginning of the earliest period presented. Such retrospective presentation reflects the redesignation of the then issued 18,127.94 ordinary shares of US$1 par value each into 181,279,400 Class A ordinary shares of US$0.0001 par value each for the years ended December 31, 2017, 2016 and 2015. For periods prior to the initial public offering date, the retrospective presentation does not include the exchange of 72,511,760 Class A ordinary shares into 72,511,760 Class B ordinary shares of US$0.0001 par value each and the issuance of 115,000,000 Class A ordinary shares in the initial public offering. |

| As of December 31, |

||||||||||||||||||||

| 2019 (1) |

2018 (2) |

2017 |

2016 |

2015 |

||||||||||||||||

| (In thousands of US$) |

||||||||||||||||||||

| Summary Consolidated Balance Sheets Data: |

||||||||||||||||||||

| Total current assets |

414,440 |

459,041 |

460,927 |

397,218 |

661,074 |

|||||||||||||||

| Cash and cash equivalents |

299,367 |

345,854 |

348,399 |

336,783 |

285,067 |

|||||||||||||||

| Bank deposits with original maturities over three months |

— |

— |

9,884 |

— |

— |

|||||||||||||||

| Restricted cash |

27,735 |

31,582 |

34,400 |

34,333 |

301,096 |

|||||||||||||||

| Amounts due from affiliated companies |

61,990 |

42,339 |

37,826 |

1,578 |

40,837 |

|||||||||||||||

| Total non-current assets |

2,297,800 |

2,343,297 |

2,466,640 |

2,624,781 |

2,731,509 |

|||||||||||||||

| Property and equipment, net |

2,107,457 |

2,175,858 |

2,280,116 |

2,419,410 |

2,518,578 |

|||||||||||||||

| Land use right, net |

118,888 |

121,544 |

125,672 |

128,995 |

132,318 |

|||||||||||||||

| Operating lease right-of-use assets(1) |

14,238 |

— |

— |

— |

— |

|||||||||||||||

| Restricted cash |

130 |

129 |

130 |

130 |

— |

|||||||||||||||

| Total assets |

2,712,240 |

2,802,338 |

2,927,567 |

3,021,999 |

3,392,583 |

|||||||||||||||

| Total current liabilities |

100,171 |

438,972 |

178,070 |

193,439 |

327,213 |

|||||||||||||||

| Accrued expenses and other current liabilities (1) |

82,553 |

62,825 |

155,840 |

156,495 |

214,004 |

|||||||||||||||

| Current portion of long-term debts, net |

— |

347,740 |

— |

— |

74,630 |

|||||||||||||||

| Amounts due to affiliated companies |

14,248 |

21,953 |

19,508 |

33,462 |

34,763 |

|||||||||||||||

| Long-term debt, net |

1,435,088 |

1,261,904 |

1,999,354 |

1,992,123 |

1,982,573 |

|||||||||||||||

| Operating lease liabilities, non-current (1) |

13,720 |

— |

— |

— |

— |

|||||||||||||||

| Other long-term liabilities |

3,149 |

4,017 |

9,512 |

19,130 |

23,097 |

|||||||||||||||

| Total liabilities |

1,553,581 |

1,705,937 |

2,187,524 |

2,205,519 |

2,333,236 |

|||||||||||||||

| Total shareholders’ equity (2) |

891,368 |

843,472 |

740,043 |

816,480 |

1,059,347 |

|||||||||||||||

| Participation interest |

267,291 |

252,929 |

— |

— |

— |

|||||||||||||||

| Total shareholders’ equity and participation interest (2) |

1,158,659 |

1,096,401 |

740,043 |

816,480 |

1,059,347 |

|||||||||||||||

| Total liabilities, shareholders’ equity and participation interest (2) |

2,712,240 |

2,802,338 |

2,927,567 |

3,021,999 |

3,392,583 |

|||||||||||||||

| (1) | We adopted the New Leases Standard on January 1, 2019 under the modified retrospective method and recognized operating lease right-of-use assets and operating lease liabilities of US$14.7 million and US$14.7 million, respectively as of January 1, 2019. As of December 31, 2019, operating lease right-of-use assets and operating lease liabilities were US$14.2 million and US$14.6 million, respectively. |

| (2) | We adopted the New Revenue Standard on January 1, 2018 under the modified retrospective method and recognized an increase to the opening balance of accumulated losses of US$3.3 million due to the cumulative effect of adopting the New Revenue Standard. |

| Noon Buying Rate |

||||||||||||||||

| Period |

Period End |

Average (1) |

High |

Low |

||||||||||||

| (H.K. dollar per US$1.00) |

||||||||||||||||

| March 2020 (through March 20, 2020) |

7.7554 |

7.7707 |

7.7863 |

7.7554 |

||||||||||||

| February 2020 |

7.7927 |

7.7757 |

7.7951 |

7.7630 |

||||||||||||

| January 2020 |

7.7665 |

7.7725 |

7.7889 |

7.7661 |

||||||||||||

| December 2019 |

7.7894 |

7.8045 |

7.8289 |

7.7850 |

||||||||||||

| November 2019 |

7.8267 |

7.8279 |

7.8365 |

7.8208 |

||||||||||||

| October 2019 |

7.8376 |

7.8421 |

7.8454 |

7.8371 |

||||||||||||

| September 2019 |

7.8401 |

7.8350 |

7.8425 |

7.8177 |

||||||||||||

| 2019 |

7.7894 |

7.8351 |

7.8499 |

7.7850 |

||||||||||||

| 2018 |

7.8305 |

7.8376 |

7.8499 |

7.8043 |

||||||||||||

| 2017 |

7.8128 |

7.7926 |

7.8267 |

7.7540 |

||||||||||||

| 2016 |

7.7534 |

7.7620 |

7.8270 |

7.7505 |

||||||||||||

| 2015 |

7.7507 |

7.7524 |

7.7686 |

7.7495 |

||||||||||||

| (1) | Annual averages are calculated from month-end rates. Monthly averages are calculated using the average of the daily rates during the relevant period. |

| • | operate, support, expand and develop our operations and our facilities; |

| • | respond to economic uncertainties, including the higher prospect of a global recession and a severe contraction of liquidity in the global credit markets as a result of the recent coronavirus (Covid-19) pandemic and recent decline in oil prices; |

| • | respond to competitive market conditions; |

| • | fulfill conditions precedent to draw down or roll over funds from current and future credit facilities; |

| • | comply with covenants under our existing and future debt issuances and credit facilities; |

| • | respond to changing financial requirements and raise additional capital, as required; |

| • | complete the development of our remaining project for Studio City on time and in compliance with the conditions under the relevant land concession contract; |

| • | obtain the necessary authorizations, approvals and licenses from the relevant governmental authorities for the development of our remaining project for Studio City; |

| • | attract and retain customers and qualified staff; |

| • | maintain effective control of our operating costs and expenses; |

| • | maintain internal personnel, systems, controls and procedures to assure compliance with the extensive regulatory requirements applicable to our business as well as regulatory compliance as a public company; and |

| • | assure compliance with, and respond to changes in, the regulatory environment and government policies. |

| • | dependence on the gaming, tourism and leisure market in Macau; |

| • | limited diversification of our business and sources of revenue; |

| • | a decline in air, land or ferry passenger traffic to Macau due to higher ticket costs, fears concerning travel, travel restrictions or otherwise, including as a result of the outbreak of widespread health epidemics or pandemics, such as the recent outbreak of the Covid-19, or social unrest in Hong Kong; |

| • | travel restrictions to Macau or from China, including due to the outbreak of infectious disease, such as the recent Covid-19 outbreak; |

| • | a decline in economic and political conditions in Macau, China or Asia, or an increase in competition within the gaming industry in Macau or generally in Asia; |

| • | inaccessibility to Macau due to inclement weather, road construction or closure of primary access routes; |

| • | austerity measures imposed now or in the future by the governments in China or other countries in Asia; |

| • | tightened control of cross-border fund transfers and/or foreign exchange regulations or policies effected by the Chinese or Macau governments; |

| • | any enforcement or legal measures taken by the Chinese government to deter gaming activities and/or marketing of gaming activities; |

| • | changes in Macau governmental laws and regulations, or interpretations thereof, including gaming laws and regulations, anti-smoking legislation, as well as China travel and visa policies; |

| • | natural and other disasters, including typhoons, outbreaks of infectious diseases, terrorism or violent criminal activities, affecting Macau; |

| • | relaxation of regulations on gaming laws in other regional economies that could compete with the Macau market; |

| • | government restrictions on growth of gaming markets, including policies on gaming table allocation and caps; and |

| • | a decrease in gaming activities and other spending at Studio City Casino. |

| • | if we fail to meet our payment obligations or otherwise default under the agreements governing our existing indebtedness, the applicable lenders or note holders under our indebtedness will have the right to accelerate such indebtedness and exercise other rights and remedies against us; |

| • | we may be limited in our ability to obtain additional financing, if needed, to fund our working capital requirements, capital expenditures, debt service, general corporate or other obligations, including our obligations with respect to the existing indebtedness; |

| • | we are required to use all or a substantial portion of our cash flow from operations of Studio City to service our indebtedness, which will reduce the available cash flow to fund our operations, capital expenditures and other general corporate purposes; |

| • | we may be limited in our ability to respond to changing business and economic conditions and to withstand competitive pressures, which may affect our financial condition; |

| • | under certain existing indebtedness, the interest rates we pay in respect of the indebtedness which we are not required to hedge will fluctuate with the current market rates and, accordingly, our interest expense will increase if market interest rates increase; |

| • | we may be placed at a competitive disadvantage to our competitors who are not as highly leveraged; and |

| • | in the event that we or one of our subsidiaries were to default, it may result in the loss of all or a substantial portion of our and/or our subsidiaries’ assets over which our creditors have taken or will take security. |

| • | pay dividends or distributions on account of our equity interests; |

| • | make specified restricted payments; |

| • | incur additional debt; |

| • | engage in other businesses or make investments; |

| • | create liens on assets; |

| • | enter into transactions with affiliates; |

| • | merge or consolidate with another company; |

| • | transfer and sell assets; |

| • | issue preferred stock; |

| • | create dividend and other payment restrictions affecting subsidiaries; and |

| • | designate restricted and unrestricted subsidiaries. |

| • | failure or delay in obtaining the necessary permits, authorizations, approvals and licenses from the relevant governmental authorities, including for any further extension of the development period; |

| • | lack of sufficient, or delays in availability of, financing; |

| • | changes to plans and specifications; |

| • | engineering problems, including defective plans and specifications; |

| • | changes in laws and regulations, or in the interpretation and enforcement of laws and regulations, applicable to leisure, real estate development or construction projects; |

| • | costs in relation to compliance with environmental rules and regulations in our development plans; |

| • | disruptions to key supply markets, including shortages of, and price increases in, energy, materials and skilled and unskilled labor, and inflation, including any disruptions resulting from the Covid-19 outbreak; |

| • | labor disputes or work stoppages; |

| • | shortage of qualified contractors and suppliers or inability to enter into definitive contracts with contractors with sufficient skills, financial resources and experience on commercially reasonable terms, or at all; |

| • | disputes with and defaults by or between suppliers, contractors and subcontractors and other counter-parties; |

| • | personal injuries to workers and other persons; |

| • | environmental, health and safety issues, including site accidents and the spread or outbreak of infectious diseases; |

| • | fires, typhoons and other natural disasters, including weather interferences or delays; and |

| • | other unanticipated circumstances or cost increases. |

| • | Inability to Collect Gaming Receivables from Credit Customers. |

| • | Limited Availability of Credit to Gaming Patrons. |

| • | Dependence on Relationships with Gaming Promoters. |

| competitors or the loss of relationships with certain gaming promoters by the Gaming Operator for the Studio City Casino. These developments may have a material adverse effect on the business, prospects, results of operation and financial condition of Studio City Casino. |

| • | Inability to Control Win Rates. |

| • | Risk of Fraud or Cheating of Gaming Patrons and Staff. |

| • | Risk of Counterfeiting. |

| • | Risk of Malfunction of Gaming Machines |

| • | Other Gaming, Retail and Entertainment Resorts in Macau. |

| • | Allocation of Business Opportunities |

| Macau, Melco Resorts may make strategic decisions to focus on their other projects rather than us, which could adversely affect our development and operation of Studio City and future growth. |

| • | Related Party Transactions. pre-agreed rates that we believe are commercially reasonable, the determination of such commercial terms were subject to judgment and estimates and we may have obtained different terms for similar types of services had we entered into such arrangements with independent third parties or had we not been a subsidiary of Melco Resorts. |

| • | Our Board Members and Executive Officers May Have Conflicts of Interest |

| • | Developing Business Relationships with Melco Resorts’ Competitors |

| • | tightening of travel restrictions to Macau or from China, including due to the outbreak of infectious diseases, such as the recent Covid-19 outbreak; |

| • | austerity measures which may be imposed by the Chinese government; |

| • | changes in government policies, laws and regulations, or in the interpretation or enforcement of these policies, laws and regulations; |

| • | changes in cross-border fund transfer and/or foreign exchange regulations or policies effected by the Chinese and/or Macau governments; |

| • | measures taken by the Chinese government to deter marketing of gaming activities to mainland Chinese residents by foreign casinos; |

| • | measures that may be introduced to control inflation, such as interest rate increases or bank account withdrawal controls; and |

| • | changes in the rate or method of taxation by the Macau government. |

| • | the company continues to hold, directly or indirectly, 100% of the equity interest of its subsidiary, Studio City Entertainment; |

| • | Melco Resorts continues to hold, directly or indirectly, at least 50.1% of the equity interest in us; |

| • | Melco International continues to hold, directly or indirectly, the majority of the equity interest in Melco Resorts; and |

| • | Mr. Lawrence Ho, directly or indirectly, continues to hold the majority of the equity interest in Melco International to control such entity. |

| • | limited public float of our ADSs; |

| • | developments in the Macau market or other Asian gaming markets, including disruptions caused by widespread health epidemics or pandemics, such as the Covid-19 outbreak; |

| • | uncertainties or delays relating to the financing, completion and successful operation of our remaining project for Studio City; |

| • | general economic, political or other factors that may affect Macau, where Studio City is located and/or the macroeconomic environment, including the Covid-19 outbreak or any other global pandemic or crisis; |

| • | changes in the economic performance or market valuations of the gaming and leisure industry companies; |

| • | changes in the Gaming Operator’s market share of the Macau gaming market; |

| • | regulatory developments affecting us or our competitors; |

| • | actual or anticipated fluctuations in our quarterly or annual operating results; |

| • | announcements of new investments, acquisitions, strategic partnerships or joint ventures by us or our competitors; |

| • | changes in financial estimates by securities analysts; |

| • | detrimental adverse publicity about us, Studio City or our industries; |

| • | additions or departures of key personnel; |

| • | fluctuations in the exchange rates between the U.S. dollar, H.K. dollar, Pataca and Renminbi; |

| • | release or expiration of lock-up or other transfer restrictions on our outstanding equity securities or sales of additional equity securities; |

| • | sales or perceived sales of additional shares or ADSs or securities convertible or exchangeable or exercisable for shares or ADSs; |

| • | potential litigation or regulatory investigations; and |

| • | rumors related to any of the above, irrespective of their veracity. |

| • | we have failed to timely provide the depositary with our notice of meeting and related voting materials; |

| • | we have instructed the depositary that we do not wish a discretionary proxy to be given; |

| • | we have informed the depositary that there is substantial opposition as to a matter to be voted on at the meeting; |

| • | a matter to be voted on at the meeting would have a material adverse impact on shareholders; or |

| • | voting at the meeting is made on a show of hands. |

ITEM 4. |

INFORMATION ON THE COMPANY |

| For the Year Ended December 31, |

||||||||||||

| 2019 |

2018 |

2017 |

||||||||||

| Average daily rate (US$) |

135 |

138 |

140 |

|||||||||

| REVPAR (US$) |

135 |

138 |

138 |

|||||||||

| Occupancy rate |

100 |

% | 100 |

% | 99 |

% | ||||||

| • | Golden Reel figure-8 and Asia’s highest Ferris wheel. The Golden Reel rises approximately 130 meters high between Studio City’s Art Deco-inspired twin hotel towers. The iconic landmark features 17 spacious Steampunk-themed cabins that can each accommodate up to ten passengers. During 2019, the Golden Reel attracted over 450,000 visitors. |

| • | Batman Dark Flight |

| • | Studio 8 “plug-in and play” facilities to create a fully operational television recording and broadcast studio. Studio 8 is a state-of-the-art studio facility with all the best-in-class infrastructure to support portable specialist equipment required for world-class TV production. |

| • | Studio City Event Center 5,000-seat multi-purpose arena representing the centerpiece of Studio City’s live entertainment offerings. The complex has a first-class premium seating level offering 16 |

| private VIP suites, in addition to approximately 242 luxury club seats and a deluxe club lounge. Each VIP suite is spacious and elegantly designed, coming fully equipped with stylish furnishings and a flat-screen TV. Playing host to concerts, theatrical shows, sporting events, family shows, award ceremonies and more, the Studio City Event Center is the next generation in versatile, innovative, premier and live entertainment venues. |

| • | RiverScape |

| • | Macau EStadium — e-Sports venue that can seat approximately 270 guests. Macau EStadium is equipped with virtual non-casino gaming facilities and cutting-edge technology capable of hosting an array of e-Sports events, including top multiplayer gaming tournaments and live-streaming of e-Sports events from other parts of the world. |

| • | Legend Heroes PVRk |

| • | ShowHouse Macau |

| • | to collaborate in the definition of gaming policies; |

| • | to supervise and monitor the activities of the concessionaires and subconcessionaires; |

| • | to investigate and monitor the continuing suitability and financial capacity requirements of concessionaires, subconcessionaires and gaming promoters; |

| • | to issue licenses to gaming promoters; |

| • | to license and certify gaming equipment; and |

| • | to issue directives and recommend practices with respect to the ordinary operation of casinos. |

| • | If the Gaming Operator violates the Macau Gaming Law, the Gaming Operator’s subconcession could be limited, conditioned, suspended, revoked, or subject to compliance with certain statutory and regulatory procedures. In addition, the Gaming Operator, and the persons involved, could be subject to substantial fines for each separate violation of the Macau Gaming Law or of the Subconcession Contract at the discretion of the Macau government. Further, if the Gaming Operator terminates or suspends the operation of all or a part of its gaming operations without permission for reasons not due to force majeure, or in the event of the insufficiency of the gaming facilities and equipment which may affect the normal operation of its gaming business, the Macau government would be entitled to replace the Gaming Operator during such disruption and to ensure the continued operation of the gaming business. Under such circumstances, the Gaming Operator would bear the expenses required for maintaining the normal operation of the gaming business. |

| • | The Macau government also has the power to supervise concessionaires and subconcessionaires in order to assure financial stability and capability. See “— The Gaming Operator’s Subconcession — The Subconcession Contract” below for more details. |

| • | Any person who fails or refuses to apply for a finding of suitability after being ordered to do so by the Macau government may be found unsuitable. Any shareholder of a concessionaire or subconcessionaire holding shares equal to or in excess of 5% of such concessionaire’s or subconcessionaire’s share capital who is found unsuitable will be required to dispose of such shares by a certain time (the transfer itself being subject to the Macau government’s authorization). If a disposal has not taken place by the time so designated, such shares must be acquired by the concessionaire or subconcessionaire. The Gaming Operator will be subject to disciplinary action if, after it receives notice that a person is unsuitable to be a shareholder or to have any other relationship with it, the Gaming Operator: |

| • | pays that person any dividend or interest upon its shares; |

| • | allows that person to exercise, directly or indirectly, any voting right conferred through shares held by that person; |

| • | pays remuneration in any form to that person for services rendered or otherwise; or |

| • | fails to pursue all lawful efforts to require that unsuitable person to relinquish his or her shares. |

| • | The Macau government also requires prior approval for the creation of a lien over shares or property comprising a casino and gaming equipment and utensils of a concession or subconcession holder. In addition, the creation of restrictions on its shares in respect of any public offering requires the approval of the Macau government to be effective. |

| • | The Macau government must give its prior approval to changes in control through a merger, consolidation, shares acquisition, or any act or conduct by any person whereby such person obtains control of the Gaming Operator. Entities seeking to acquire control of a concessionaire or subconcessionaire must satisfy the Macau government with regards to a variety of stringent standards prior to assuming control. The Macau government may also require controlling shareholders, officers, |

| directors and other persons having a material relationship or involvement with the entity proposing to acquire control, to be investigated for suitability as part of the approval process of the transaction. |

| • | implement internal procedures and rules governing the prevention of anti-money laundering and terrorism financing crimes which are subject to prior approval from DICJ; |

| • | identify and evaluate the money laundering and terrorism financing risk inherent to gaming activities; |

| • | identify any customer who is in a stable business relationship with the Gaming Operator, who is a politically exposed person or any customer or transaction where there is a sign of money laundering or financing of terrorism or which involves significant sums of money in the context of the transaction, even if any sign of money laundering is absent; |

| • | refuse to deal with any customers who fail to provide any information requested by the Gaming Operator; |

| • | keep records on the identification of a customer for a period of five years; |

| • | establish a regime for electronic transfers; |

| • | keep individual records of all transactions related to gaming which involve credit securities; |

| • | keep records of all electronic transactions for amounts equal to or exceeding MOP8,000 (US$997) in cases of occasional transactions and MOP120,000 (US$14,958) in cases of transactions that arose in the context of a continuous business relationship; |

| • | notify the Finance Information Bureau if there is any sign of money laundering or financing of terrorism; |

| • | adopt a compliance function and appoint compliance officers; and |

| • | cooperate with the Macau government by providing all required information and documentation requested in relation to anti-money laundering activities. |

| • | MOP30 million (equivalent to approximately US$3.7 million) per annum fixed premium; |

| • | MOP300,000 (equivalent to approximately US$37,394) per annum per VIP gaming table; |

| • | MOP150,000 (equivalent to approximately US$18,697) per annum per mass market gaming table; and |

| • | MOP1,000 (equivalent to approximately US$125) per annum per electric or mechanical gaming. |

| • | the operation of gaming without permission or operation of business which does not fall within the business scope of the subconcession; |

| • | abandonment of approved business or suspension of operations of our gaming business in Macau without reasonable grounds for more than seven consecutive days or more than fourteen non-consecutive days within one calendar year; |

| • | transfer of all or part of the Gaming Operator’s operation in Macau in violation of the relevant laws and administrative regulations governing the operation of games of fortune or chance and other casino games in Macau and without Macau government approval; |

| • | failure to pay taxes, premiums, levies or other amounts payable to the Macau government; |

| • | refusal or failure to resume operations following the temporary assumption of operations by the Macau government; |

| • | repeated opposition to the supervision and inspection by the Macau government and failure to comply with decisions and recommendations of the Macau government, especially those of the DICJ; |

| • | failure to provide or supplement the guarantee deposit or the guarantees specified in the subconcession within the prescribed period; |

| • | bankruptcy or insolvency of the Gaming Operator; |

| • | fraudulent activity harming public interest; |

| • | serious and repeated violation of the applicable rules for carrying out casino games of chance or games of other forms or damage to the fairness of casino games of chance or games of other forms; |

| • | systematic non-compliance with the Macau Gaming Law’s basic obligations; |

| • | the grant to any other person of any managing power over the gaming business of the Gaming Operator or the grant of a subconcession or entering into any agreement to the same effect; or |

| • | failure by a controlling shareholder in the Gaming Operator to dispose of its interest in the Gaming Operator, within ninety days from the date of the authorization given by the Macau government for such disposal, pursuant to written instructions received from the regulatory authority of a jurisdiction where the said shareholder is licensed to operate, which have had the effect that such controlling shareholder now wishes to dispose of the shares it owns in the Gaming Operator. |

| • | any person who directly acquires voting rights in the Gaming Operator will be subject to authorization from the Macau government; |

| • | the Gaming Operator will be required to take the necessary measures to ensure that any person who directly or indirectly acquires 5% or more of the shares in the Gaming Operator would be subject to authorization from the Macau government, except when such acquisition is wholly made through the shares of publicly-listed companies tradable at a stock exchange; |

| • | any person who directly or indirectly acquires 5% or more of the shares in the Gaming Operator will be required to report the acquisition to the Macau government (except when such acquisition is wholly made through shares tradable on a stock exchange as a publicly-listed company); |

| • | the Macau government’s prior approval would be required for any recapitalization plan of the Gaming Operator; and |

| • | the Chief Executive of Macau could require the increase of the Gaming Operator’s share capital, if deemed necessary. |

| • | Studio City Entertainment shall cooperate with the Macau government, making available any documents, information or data requested directly by the Macau government or through the Gaming Operator for the purposes of monitoring its activity, analysis of its accounts and performance of external audits; |

| • | Studio City Entertainment shall have an annual audit conducted by an external entity, independent and previously accepted by the DICJ, for certification of accounting documents and compliance with relevant legal provisions; |

| • | Studio City Entertainment accepts to be subject to the legal and contractual supervision of the Macau government applicable to gaming concessionaires and subconcessionaires, to ensure its own suitability and financial capacity, the suitability of its direct or indirect shareholders holding 5% or more of its share capital (except with respect to those shareholders holding shares tradeable on a stock exchange), and of its directors and key employees of the Studio City Casino; |

| • | the transfer of any rights under the Services and Right to Use Arrangements shall be subject to the prior authorization from the Macau government; and |

| • | the Gaming Operator and Studio City Entertainment are jointly and severally responsible for compliance with applicable laws, regulations and instructions issued by the Macau government, including those regarding anti-money laundering, anti-financing of terrorist acts, anti-corruption, operation of slot machines and minimum internal control requirements. |

| • | the Company continues to hold, directly or indirectly, 100% of the equity interest of its subsidiary, Studio City Entertainment; |

| • | Melco Resorts continues to hold, directly or indirectly, at least 50.1% of the equity interest in us; |

| • | Melco International continues to hold, directly or indirectly, the majority of the equity interest in Melco Resorts; and |

| • | Mr. Lawrence Ho, directly or indirectly, continues to hold the majority of the equity interest in Melco International to control such entity. |

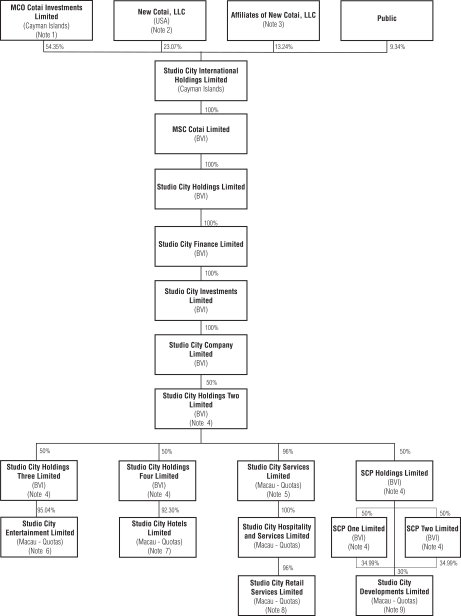

| 1) | Includes 747,288 Class A ordinary shares held by Melco International. See “Item 7. Major Shareholders and Related Party Transactions — A. Major Shareholders.” |

| (2) | New Cotai has a Participation Interest in MSC Cotai which represents its economic right to receive an amount equal to approximately 30.0% of the dividends, distributions or other consideration paid to the Company by MSC Cotai, if any, from time to time. New Cotai may exchange all or a portion of its Participation Interest for Class A ordinary shares, subject to certain conditions. See “Item 7. Major |

| Shareholders and Related Party Transactions — B. Related Party Transactions — Pre-IPO Organizational Transactions.” If New Cotai were to exercise its right to exchange all of the Participation Interest for Class A ordinary shares, New Cotai would receive 72,511,760 Class A ordinary shares and the corresponding number of Class B ordinary shares held by New Cotai would be surrendered and canceled. The issuance of such Class A ordinary shares to New Cotai would represent approximately a 23.1% voting interest in the Company. |

| (3) | As of February 26, 2020, certain affiliates of New Cotai beneficially owned ADSs representing 41,622,800 Class A ordinary shares. |

| (4) | The remaining 50% of the equity interests of these companies are owned by Studio City Holdings Five Limited, a wholly-owned subsidiary of the Company. The 50% interest held by Studio City Holdings Five Limited in various Studio City companies incorporated in the British Virgin Islands is non-voting. |

| (5) | 4% of the equity interests are owned by Studio City Company Limited. |

| (6) | 3.96% and 1% of the equity interests are owned by Studio City Holdings Four Limited and Studio City Holdings Five Limited, respectively. |

| (7) | 3.85% and 3.85% of the equity interests are owned by Studio City Holdings Five Limited and Studio City Holdings Three Limited, respectively. |

| (8) | 4% of the equity interests are owned by Studio City Services Limited. |

| (9) | 0.02% of the equity interests are owned by Studio City Holdings Five Limited. |

ITEM 4A. |

UNRESOLVED STAFF COMMENTS |

ITEM 5. |

OPERATING AND FINANCIAL REVIEW AND PROSPECTS |

| Year Ended December 31, |

||||||||||||

| 2019 |

2018 |

2017 |

||||||||||

| (in thousands of US$) |

||||||||||||

| Total operating revenues |

$ | 626,733 |

$ | 571,213 |

$ | 539,814 |

||||||

| Total operating costs and expenses |

(448,737 |

) | (433,351 |

) | (459,364 |

) | ||||||

| Operating income |

177,996 |

137,862 |

80,450 |

|||||||||

| Net income (loss) attributable to Studio City International Holdings Limited |

$ | 33,564 |

$ | (21,598 |

) | $ | (76,437 |

) | ||||

| • | Rolling chip volume: non-negotiable chips wagered and lost by the rolling chip market segment. |

| • | Rolling chip win rate: non-discretionary incentives (including the point-loyalty programs) as administered by the Gaming Operator and allocating casino revenues related to goods and services provided to gaming patrons on a complimentary basis) as a percentage of rolling chip volume. |

| • | Mass market table games drop: |

| • | Mass market table games hold percentage: non-discretionary incentives (including the point-loyalty programs) as administered by the Gaming Operator and allocating casino revenues related to goods and services provided to gaming patrons on a complimentary basis) as a percentage of mass market table games drop. |

| • | Table games win: non-discretionary incentives (including the point-loyalty programs) as administered by the Gaming Operator and allocating casino revenues related to goods and services provided to gaming patrons on a complimentary basis. |

| • | Gaming machine handle: |

| • | Gaming machine win rate: non-discretionary incentives (including the point-loyalty programs) as administered by the Gaming Operator and allocating casino revenues related to goods and services provided to gaming patrons on a complimentary basis) expressed as a percentage of gaming machine handle. |

| • | Average daily rate: |

| • | Occupancy rate: |

| • | Revenue per available room, or REVPAR: |

| • | Provision of gaming related services. |

| • | Rooms. all-suite Star Tower. Our room revenues decreased by US$2.3 million, or 2.7%, to US$86.0 million in 2019 from US$88.3 million in 2018. Studio City’s average daily rate, occupancy rate and REVPAR were US$135, 100% and US$135, respectively, in 2019, as compared to US$138, 100% and US$138, respectively, in 2018. |

| • | Food and beverage, entertainment, mall and retail and other |

| • | Services fee. |

| • | Provision of gaming related services |

| • | Rooms |

| • | Food and beverage, entertainment, mall and retail and other non-gaming services at Studio City and respective payroll expenses, increased by US$9.1 million, or 11.2% to US$90.8 million in 2019 from US$81.7 million in 2018, primarily due to the show operating costs for the stunt show Elēkrŏn. |

| • | General and administrative non-gaming departments. Expenses relating to services fee revenues are also included in the general and administrative expenses. |

| • | Pre-opening costs Pre-opening costs were US$2.6 million in 2019 as compared to US$4.6 million in 2018. Such costs primarily represent personnel, marketing and other costs incurred prior to the opening of new or start-up operations. Pre-opening costs in 2019 and 2018 were both mainly related to the marketing of the stunt show Elēkrŏn. |

| • | Amortization of land use right |

| • | Depreciation and amortization |

| • | Property charges and other. non-gaming attraction. Property charges and other expenses of US$4.5 million in 2018 were primarily attributable to a write-off of US$2.2 million in relation to the termination of a contract related to a non-gaming attraction and US$2.0 million repairs and maintenance costs incurred as a result of Typhoon Hato and Typhoon Mangkhut. |

| • | Interest expenses. |

| • | Loan commitment fees |

| • | Loss on extinguishment of debt. |

| • | Costs associated with debt modification. |

| • | Provision of gaming related services. |

| • | Rooms. all-suite Star Tower. Our room revenues remained stable at US$88.3 million and US$88.7 million in 2018 and 2017, respectively. Studio City’s average daily rate, occupancy rate and REVPAR were US$138, 100% and US$138, respectively, in 2018, as compared to US$140, 99% and US$138, respectively, in 2017. |

| • | Food and beverage, entertainment, mall and retail and other non-gaming attraction for remodeling in late 2017 and closure of certain retail shops for the expansion of the northeast entrance of Studio City in mid-2017. |

| • | Services fee. |

| • | Provision of gaming related services |

| • | Rooms |

| • | Food and beverage, entertainment, mall and retail and other non-gaming services at Studio City and respective payroll expenses, amounted to US$81.7 million and US$84.5 million in 2018 and 2017, respectively. |

| • | General and administrative |

| utilities, marketing and advertising costs, repairs and maintenance, legal and professional fees, and fees paid to the Master Service Providers for shared corporate services provided to non-gaming departments. Expenses relating to services fee revenues are also included in the general and administrative expenses. |

| • | Pre-opening costs Pre-opening costs were US$4.6 million in 2018 as compared to US$0.1 million in 2017. Such costs primarily represent personnel, marketing and other costs incurred prior to the opening of new or start-up operations. The higher pre-opening costs in 2018 was mainly related to the marketing of the stunt show Elēkrŏn. |

| • | Amortization of land use right |

| • | Depreciation and amortization |

| • | Property charges and other. non-gaming attraction and US$2.0 million repairs and maintenance costs incurred as a result of Typhoon Hato and Typhoon Mangkhut. Property charges and other expense of US$22.2 million in 2017 were primarily attributable to impairment of assets as a result of the remodeling of a non-gaming attraction, retail shops and a food station of US$19.6 million. |

| • | Interest expenses |

| • | Loan commitment fees |

| • | Loss on extinguishment of debt. |

| Year Ended December 31, |

||||||||||||

| 2019 (2) |

2018 (3) |

2017 |

||||||||||

| (in thousands of US$) |

||||||||||||

| Net income (loss) attributable to Studio City International Holdings Limited |

$ | 33,564 |

$ | (21,598 |

) | $ | (76,437 |

) | ||||

| Net income attributable to participation interest |

10,065 |

853 |

— |

|||||||||

| Net income (loss) |

43,629 |

(20,745 |

) | (76,437 |

) | |||||||

| Income tax expense (credit) |

402 |

544 |

(239 |

) | ||||||||

| Interest and other non-operating expenses, net |

133,965 |

158,063 |

157,126 |

|||||||||

| Property charges and other |

8,521 |

4,464 |

22,210 |

|||||||||

| Depreciation and amortization |

171,943 |

167,891 |

176,326 |

|||||||||

| Pre-opening costs |

2,567 |

4,550 |

116 |

|||||||||

| Adjusted EBITDA |

$ | 361,027 |

$ | 314,767 |

$ | 279,102 |

||||||

| Adjusted EBITDA margin (1) |

57.6 |

% | 55.1 |

% | 51.7 |

% | ||||||

| (1) | Adjusted EBITDA margin is calculated by dividing Adjusted EBITDA by total operating revenues. |

| (2) | We adopted the New Leases Standard on January 1, 2019 under the modified retrospective method. There was no material impact on our results of operations and Adjusted EBITDA in 2019 as a result of the adoption of the New Leases Standard. |

| (3) | We adopted the New Revenue Standard on January 1, 2018 under the modified retrospective method. There was no material impact on our results of operations and Adjusted EBITDA in 2018 as a result of the adoption of the New Revenue Standard. |

| (1) | Complimentary services provided to Studio City Casino’s gaming patrons are deducted from the gross gaming revenues and are measured based on stand-alone selling prices under the New Revenue |

| Standard, replacing the previously used retail values. The non-gaming revenues associated with the provision of these complimentary services by us are measured on the same basis. This change impacts the amount of revenues from the provision of gaming related services received by us with corresponding changes to the non-gaming revenues. |

| (2) | The New Revenue Standard changes the measurement basis for the non-discretionary incentives (including the loyalty program) provided to Studio City Casino’s gaming patrons, as administered by the Gaming Operator, from previously used estimated costs to standalone selling prices. The non-discretionary incentives are deducted from the gross gaming revenues by the Gaming Operator and impact the amount of revenues from provision of gaming related services received by us. Similarly, the redemption of the non-discretionary incentives for non-gaming services provided by us are measured on the same basis. At the adoption date on January 1, 2018, we recognized an increase in the opening balance of accumulated losses of US$3.3 million with a corresponding decrease in amounts due from affiliated companies. |

| Year Ended December 31, |

||||||||||||

| 2019 |

2018 |

2017 |

||||||||||

| (in thousands of US$) |

||||||||||||

| Net cash provided by operating activities |

$ | 228,504 |

$ | 139,518 |

$ | 68,313 |

||||||

| Net cash used in investing activities |

(90,922 |

) | (147,515 |

) | (55,345 |

) | ||||||

| Net cash (used in) provided by financing activities |

(189,976 |

) | 5,152 |

(1,285 |

) | |||||||

| Effect of foreign exchange on cash, cash equivalents and restricted cash |

2,061 |

(2,519 |

) | — |

||||||||

| Net (decrease) increase in cash, cash equivalents and restricted cash |

(50,333 |

) | (5,364 |

) | 11,683 |

|||||||

| Cash, cash equivalents and restricted cash at beginning of year |

377,565 |

382,929 |

371,246 |

|||||||||

| Cash, cash equivalents and restricted cash at end of year |

$ | 327,232 |

$ | 377,565 |

$ | 382,929 |

||||||

| Issuer |

As of December 31, 2019 |

|||||

| (in thousands of US$) |

||||||

| 2016 Credit Facility |

Studio City Company |

$ | 128 |

|||

| 2016 7.250% Notes |

Studio City Company |

850,000 |

||||

| 2019 Notes |

Studio City Finance |

600,000 |

||||

| Total |

$ |

|

||||

| • | The impact of the Covid-19 outbreak, including its severity, magnitude and duration, and any recovery from such impact, which will be significantly affected by the duration of travel and visa restrictions |

| and customer sentiment, including the length of time before customers will resume travelling and participating in entertainment and leisure activities at high-density venues, all of which are highly uncertain. The disruptions to our operations caused by the Covid-19 outbreak have had a material effect on the Company’s financial condition, operations and prospects during the first quarter of 2020 and as such disruptions are ongoing, such material adverse effects will continue, and may worsen, beyond the first quarter of 2020. |

| • | Policies and campaigns implemented by the Chinese government, including restrictions on travel, anti-corruption campaigns, heightened monitoring of cross-border currency movement and adoption of new measures to eliminate perceived channels of illicit cross-border currency movements, restrictions on currency withdrawal, increased scrutiny of marketing activities in China or new measures taken by the Chinese government to deter marketing of gaming activities to mainland Chinese residents by foreign casinos, as well as any slowdown of economic growth in China, may lead to a decline and limit the recovery and growth in the number of patrons visiting our property and the spending amount of such patrons; |

| • | The gaming and leisure market in Macau is developing and the competitive landscape is expected to evolve as more gaming and non-gaming facilities are developed in Macau. More supply of integrated resorts in the Cotai region of Macau will intensify the competition in the businesses that we and the Gaming Operator operate; |

| • | The impact of new policies and legislation implemented by the Macau government, including travel and visa policies, anti-smoking legislation as well as policies relating to gaming table allocations and gaming machine requirements; |

| • | Greater regulatory scrutiny, including increased audits and inspections, in relation to movement of capital and anti-money laundering and other financial crime. Anti-money laundering, anti-bribery and corruption and sanctions and counter-terrorism financing laws and regulations have become increasingly complex and subject to greater regulatory scrutiny and supervision by regulators globally and may increase our compliance costs and any potential non-compliances of such laws and regulations could have an adverse effect on our reputation, financial condition, results of operations or cash flows; |

| • | Enactment of new laws, or amendments to existing laws with more stringent requirements, in relation to personal data, including, among others, collection, use and/or transmission of personal data, and as to which there may be limited precedence on their interpretation and application, may increase operating costs and/or adversely impact our ability to market to our customers and guests. In addition, any non-compliance with such laws may result in damage or reputation and/or subject us to lawsuits, fines and other penalties as well as restrictions on our use or transfer of data; and |

| • | Gaming promoters in Macau are experiencing increased regulatory scrutiny that has resulted in the cessation of business of certain gaming promoters, a trend which may affect Studio City Casino’s operations in a number of ways: |

| – | a concentration of gaming promoters may result in such gaming promoters having significant leverage and bargaining strength in negotiating agreements with gaming operators, which could result in gaming promoters negotiating changes to the Gaming Operator’s agreements with them or the loss of business to a competitor or the loss of certain relationships with gaming promoters, any of which may adversely affect our results of operations; |

| – | if any of Studio City Casino’s gaming promoters ceases business or fails to maintain the required standards of regulatory compliance, probity and integrity, their exposure to patron and other litigation and regulatory enforcement actions may increase, which in turn may expose us and the Gaming Operator to an increased risk for litigation, regulatory enforcement actions and damage to our reputations; and |

| – | since the Gaming Operator depends on gaming promoters for its VIP gaming revenue, difficulties in their operations may expose the Studio City Casino to higher operational risk to the extent Studio City Casino continues to conduct VIP rolling chip operations. |

| Payments Due by Period |

||||||||||||||||||||

| Less than 1 year |

1-3 years |

3-5 years |

More than 5 years |

Total |

||||||||||||||||

| (in millions of US$) |

||||||||||||||||||||

| Long-term debt obligations (1) : |

||||||||||||||||||||

| 2016 Credit Facility |

$ | — |

$ | 0.1 |

$ | — |

$ | — |

$ | 0.1 |

||||||||||

| 2016 7.250% Notes |

— |

850.0 |

— |

— |

850.0 |

|||||||||||||||

| 2019 Notes |

— |

— |

600.0 |

— |

600.0 |

|||||||||||||||

| Fixed interest payments |

105.1 |

143.5 |

48.4 |

— |

297.0 |

|||||||||||||||

| Operating leases (2) |

0.9 |

2.1 |

2.3 |

34.8 |

40.1 |

|||||||||||||||

| Construction costs and property and equipment retention payables |

1.1 |

0.8 |

— |

— |

1.9 |

|||||||||||||||

| Other contractual commitments: |

||||||||||||||||||||

| Construction costs and property and equipment acquisition commitments (3) |

223.6 |

257.8 |

— |

— |

481.4 |

|||||||||||||||

| Total contractual obligations |

$ | 330.7 |

$ | 1,254.3 |

$ | 650.7 |

$ | 34.8 |

$ | 2,270.5 |

||||||||||

| (1) | See note 8 to the consolidated financial statements included elsewhere in this annual report for further details on these debt facilities. |

| (2) | See note 9 to the consolidated financial statements included elsewhere in this annual report for further details on these lease liabilities. |

| (3) | See note 15(a) to the consolidated financial statements included elsewhere in this annual report for further details on construction costs and property and equipment acquisition commitments. |

ITEM 6. |

DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES |

| Directors and Executive Officers |

Age |

Position/Title | ||||

| Lawrence Yau Lung Ho |

43 |

Director | ||||

| Evan Andrew Winkler |

45 |

Director | ||||

| Clarence Yuk Man Chung |

57 |

Director | ||||

| Geoffrey Stuart Davis |

51 |

Director and Chief Financial Officer | ||||

| Stephanie Cheung |

57 |

Director | ||||

| Akiko Takahashi |

66 |

Director | ||||

| David Anthony Reganato |

40 |

Director | ||||

| Timothy Paul Lavelle |

35 |

Director | ||||

| Dominique Mielle |

51 |

Independent Director | ||||

| Kevin F. Sullivan |

67 |

Independent Director | ||||

| Nigel Alan Dean |

66 |

Independent Director | ||||

| Geoffry Philip Andres |

53 |

Property President | ||||

| • | convening shareholders’ annual general meetings and reporting its work to shareholders at such meetings; |

| • | declaring dividends and distributions; |

| • | appointing officers and determining the term of office of officers; |

| • | exercising the borrowing powers of our company and mortgaging the property of our company; and |

| • | approving the transfer of shares of our company, including the registering of such shares in our share register. |

| • | the audits of the financial statements of our company; |

| • | the qualifications and independence of our independent auditors; |

| • | the performance of our independent auditors; |

| • | the account and financial reporting processes of our company and the integrity of our systems of internal accounting and financial controls; |

| • | legal and regulatory issues relating to the financial statements of our company, including the oversight of the independent auditors, the review of the financial statements and related material, the internal audit process and the procedure for receiving complaints regarding accounting, internal accounting controls, auditing or other related matters; |