Table of Contents

As confidentially submitted to the Securities and Exchange Commission on July 17, 2018

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Studio City International Holdings Limited

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

| Cayman Islands* | 7011 | Not Applicable | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

[36/F, The Centrium

60 Wyndham Street

Hong Kong]

[+852 2598-3600]

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

[Cogency Global Inc.

10 East 40th Street, 10th Floor

New York, NY 10016

(800) 221-0102]

(Name, address, including zip code, and telephone number, including area code, of agent for service)

copies to:

| David T. Zhang, Esq. Jacqueline Wenchen Tang, Esq. Kirkland & Ellis International LLP c/o 26th Floor, Gloucester Tower, The Landmark 15 Queen’s Road Central, Hong Kong +852 3761 3300 |

James C. Lin, Esq. Davis Polk & Wardwell LLP c/o 18th Floor, The Hong Kong Club Building 3A Chater Road, Central Hong Kong +852 2533 3300 |

Approximate date of commencement of proposed sale to the public: as soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of each class of securities to be registered | Proposed maximum aggregate offering price(2)(3) |

Amount of registration fee | ||

| Class A ordinary shares, par value US$0.0001 per share(1) |

US$ | US$ | ||

|

| ||||

|

| ||||

| (1) | American depositary shares issuable upon deposit of the Class A ordinary shares registered hereby will be registered under a separate registration statement on Form F-6 (Registration No. 333- ). Each American depositary share represents Class A ordinary shares. |

| (2) | Includes Class A ordinary shares initially offered and sold outside the United States that may be resold from time to time in the United States either as part of their distribution or within 40 days after the later of the effective date of this registration statement and the date the Class A ordinary shares are first bona fide offered to the public, and also includes Class A ordinary shares that may be purchased by the underwriters pursuant to an option to purchase additional ADSs. These Class A ordinary shares are not being registered for the purpose of sales outside the United States. |

| (3) | Estimated solely for the purpose of determining the amount of registration fee in accordance with Rule 457(o) under the Securities Act of 1933. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to such Section 8(a), may determine.

* Prior to the completion of this offering, Studio City International Holdings Limited will undergo a series of organizational transactions, as a part of which it will redomicile by way of continuation as an exempted company incorporated with limited liability under the laws of the Cayman Islands.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell the securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting any offer to buy these securities in any jurisdiction where such offer or sale is not permitted.

Subject to Completion, Dated , 2018

American Depositary Shares

Studio City International Holdings Limited

Representing Class A Ordinary Shares

This is an initial public offering of American depositary shares, or ADSs, by Studio City International Holdings Limited. We are offering ADSs to be sold in the offering. Each ADS represents Class A ordinary shares, or SC Class A Shares.

Prior to this offering, there has been no public market for the ADSs or SC Class A Shares. We anticipate the initial public offering price will be between US$ and US$ per ADS. We [have applied] to list the ADSs on the New York Stock Exchange under the symbol “MSC.”

Upon completion of this offering, we will have two authorized classes of ordinary shares: SC Class A Shares and Class B ordinary shares, or SC Class B Shares. Holders of the SC Class A Shares and SC Class B Shares are entitled to one vote per share and will vote together as a single class on all matters presented to our shareholders for their vote or approval, except as otherwise required by applicable law or our memorandum of association and articles of association. Holders of the SC Class B Shares do not have any right to receive dividends or distributions upon our liquidation or winding up or to otherwise share in the profits or surplus assets of the Company.

Upon completion of this offering, the investors in this offering will collectively own ADSs, representing SC Class A Shares and a % voting and economic interest in our company. As described under “Use of Proceeds,” we will contribute the net proceeds from this offering to our subsidiary, MSC Cotai Limited, or MSC Cotai, in exchange for ordinary shares of MSC Cotai, or MSC Cotai Shares. MCE Cotai Investments Limited, or MCE Cotai, will own SC Class A Shares, representing a % voting and economic interest in Studio City International. New Cotai will own SC Class B Shares, representing a % voting, non-economic interest in our company. New Cotai will also have a participation interest, or Participation Interest, in MSC Cotai, which will entitle New Cotai to receive from MSC Cotai an amount equal to % of the amount of any distribution, dividend or other consideration paid by MSC Cotai to us, subject to adjustments, exceptions and conditions. Immediately following the conclusion of this offering, SC Class A Shares will collectively represent approximately % of the voting power in our company and SC Class B Shares will collectively represent approximately % of the voting power in our company.

Following the completion of this offering and the Assured Entitlement Distribution, we will be a “controlled company” within the meaning of the New York Stock Exchange corporate governance rules because Melco Resorts, through MCE Cotai, will hold % of our then outstanding SC Class A Shares, assuming the underwriters do not exercise their over-allotment option, or % of our then outstanding SC Class A Shares if the underwriters exercise their over-allotment option in full. See “Principal Shareholders.”

Investing in the ADSs involves a high degree of risk. See “Risk Factors ” beginning on page 22.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| Per ADS | Total | |||||||

| Initial public offering price |

US$ | US$ | ||||||

| Underwriting discounts and commissions(1) |

US$ | US$ | ||||||

| Proceeds, before expenses, to us |

US$ | US$ | ||||||

| (1) | For a description of compensation payable to the underwriters, see “Underwriting.” |

The underwriters have an option to purchase up to an additional ADSs from us at the initial public offering price, less the underwriting discounts and commissions, within 30 days from the date of this prospectus.

The underwriters expects to deliver the ADSs against payment in U.S. Dollars in New York, New York, to purchasers on or about , 2018.

| Deutsche Bank Securities | Credit Suisse | Morgan Stanley |

Prospectus dated , 2018

Table of Contents

We have not authorized anyone to provide any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we may have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the underwriters have not authorized any other person to provide you with different or additional information. We are offering to sell, and seeking offers to buy, the ADSs offered hereby, but only under circumstances and in jurisdictions where offers and sales are permitted and lawful to do so. The information contained in this prospectus is current only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the ADSs.

Neither we nor any of the underwriters have taken any action that would permit a public offering of the ADSs outside the United States or permit the possession or distribution of this prospectus or any related free-writing prospectus outside the United States. Persons outside the United States who come into possession of this prospectus or any related free-writing prospectus must inform themselves about and observe any restrictions relating to the offering of the ADSs and the distribution of the prospectus outside the United States.

i

Table of Contents

Until , 2018 (the 25th day after the date of this prospectus), all dealers that buy, sell or trade ADSs, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the obligation of dealers to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

ii

Table of Contents

The following summary is qualified in its entirety by, and should be read in conjunction with, the more detailed information, financial statements and related notes appearing elsewhere in this prospectus. In addition to this summary, we urge you to read the entire prospectus carefully, especially the risks of investing in the ADSs discussed under “Risk Factors,” before deciding whether to buy the ADSs.

Our Business

Studio City is a world-class gaming, retail and entertainment resort located in Cotai, Macau. Studio City Casino has 250 mass market gaming tables and approximately 970 gaming machines, which we believe provide higher margins and attractive long-term growth opportunities. The mass market focus of Studio City Casino is complemented with junket and premium direct VIP rolling chip operations, which include 45 VIP rolling chip tables. Our cinematically-themed integrated resort is designed to attract a wide range of customers by providing highly differentiated non-gaming attractions, including the world’s first figure-8 Ferris wheel, a Warner Bros.-themed family entertainment center, a 4-D Batman flight simulator, an exclusive night club and a 5,000-seat live performance arena. Studio City features approximately 1,600 luxury hotel rooms, diverse food and beverage establishments and approximately 35,000 square meters (approximately 377,000 square feet) of complementary retail space. Studio City was named Casino/Integrated Resort of the Year in 2016 by the International Gaming Awards.

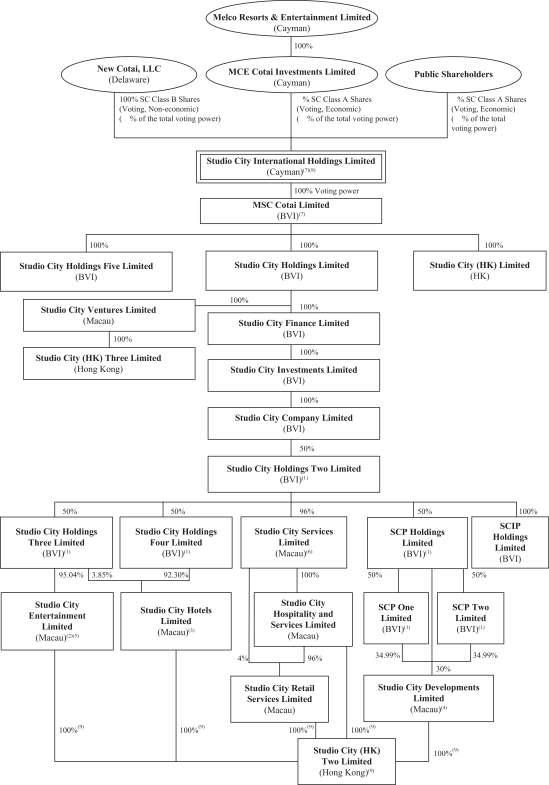

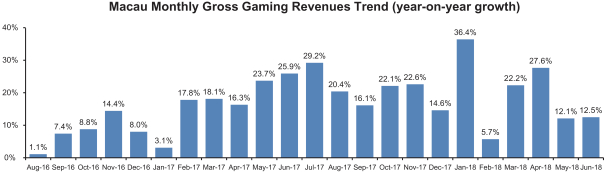

Macau is the world’s largest gaming market, with gross gaming revenue in 2017 approximately 5.1 times that of the Las Vegas Strip and approximately 7.2 times that of Singapore, according to the Gaming Inspection and Coordination Bureau, or DICJ, the Nevada Gaming Control Board and Bloomberg Intelligence. The recent growth of the Macau gaming market has been robust, with gross gaming revenue increasing by 18.9% compared to the prior year period for the first six months of 2018 to US$18.7 billion, and monthly gross gaming revenue

1

Table of Contents

growing for each of the 23 months from August 2016 to June 2018 on a year-on-year basis, according to the DICJ.

Macau is also a limited gaming concession market, with only six gaming concessions and subconcessions currently granted by the local government. We believe we are well-positioned to take advantage of this large and growing, supply-constrained market.

Studio City is strategically located in Cotai, as the only property directly adjacent to the Lotus Bridge immigration checkpoint and one of the few dedicated Cotai hotel-casino resort stops planned on the Macau Light Rail Transit Line. The Lotus Bridge connects Cotai with Hengqin Island in Zhuhai, China, a designated special economic district in China undergoing significant business and infrastructure development.

Studio City is rapidly ramping up since commencing operations in October 2015. We have grown total revenues from US$69.3 million in 2015 to US$424.5 million in 2016 and further to US$539.8 million in 2017, and generated net losses of US$232.6 million, US$242.8 million and US$76.4 million, respectively, for these periods. We increased our adjusted EBITDA from US$6.3 million in 2015 to US$123.0 million in 2016 and further to US$279.1 million in 2017, and expanded our adjusted EBITDA margin from 9.1% to 29.0% and further to 51.7%, respectively, for these periods. Our total revenues increased from US$121.4 million in the three months ended March 31, 2017 to US$156.9 million in the three months ended March 31, 2018 and we had net loss of US$26.5 million in the three months ended March 31, 2017 and net income of US$8.8 million in the three months ended March 31, 2018. Our adjusted EBITDA increased from US$56.8 million in the three months ended March 31, 2017 to US$93.0 million in the three months ended March 31, 2018 and our adjusted EBITDA margin expanded from 46.8% to 59.3% in these periods, respectively.

Studio City Casino is operated by Melco Resorts Macau, or the Gaming Operator, one of the subsidiaries of Melco Resorts and a holder of a gaming subconcession, and we operate the non-gaming businesses of Studio City.

Our Industry

Macau has been the world’s largest gaming destination in terms of gross gaming revenues since 2006. Macau’s gross gaming revenues amounted to US$33.2 billion in 2017, which is approximately 5.1 times that of the Las Vegas Strip and approximately 7.2 times that of Singapore. The growth momentum of Macau’s gaming market has been robust in 2018 to date, with gross gaming revenues of US$18.7 billion recorded over the first six months of 2018, reflecting a year-on-year increase of 18.9%.

2

Table of Contents

Macau is well-positioned and strategically important in the overall gaming market across the Asia Pacific region. The expansion of the gaming industry has also spurred investment and employment activities in related non-gaming industries, including retail, dining, entertainment, conference and convention sectors.

The Macau gaming market consists of two primary segments: the mass market and VIP rolling chip segments. The mass market segment consists of both mass market table games and gaming machines for primarily cash stakes. Mass market gaming revenues have grown significantly in recent years and amounted to US$13.0 billion in 2016 and US$14.4 billion in 2017, reflecting a year-on-year increase of 10.4%, and US$4.2 billion in the three months ended March 31, 2018, according to the DICJ. VIP rolling chip players in Macau typically play mostly in dedicated VIP rolling chip rooms for higher stakes. VIP rolling chip gross gaming revenues amounted to US$14.8 billion in 2016 and US$18.8 billion in 2017, reflecting a year-on-year increase of 26.7%, and US$5.4 billion in the three months ended March 31, 2018, according to the DICJ.

We believe the development of the Macau gaming market has been driven by and will continue to be driven by a combination of factors, including:

| • | Close proximity to approximately 3.5 billion people in nearby regions in Asia and expansion of mainland China out-bound tourism to Macau; |

| • | Continuing economic development and emergence of a wealthier demographic in China; |

| • | Diversified range of gaming segments; |

| • | Increased diversification in non-gaming offerings further enhancing visitation and game play; |

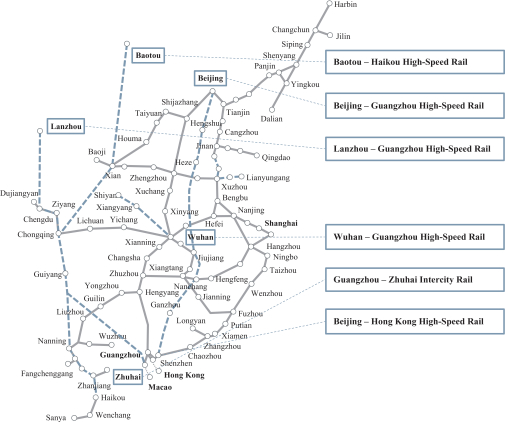

| • | Further improvement of transportation and infrastructure driving visitation; and |

| • | Hengqin Island development initiatives. |

Our Strengths

We believe that the following strengths contribute to our success and set us apart from our peers:

| • | fully integrated destination resort focused on the attractive mass market segment; |

| • | strategic location with strong and improving accessibility; |

| • | well-positioned to capitalize on an improving market environment; |

| • | experienced and dedicated management team; and |

| • | significant operational experience and the extensive network of our controlling shareholder. |

Our Strategies

We intend to pursue the following strategies to further develop our business:

| • | continue to focus on the mass market segment; |

| • | complement the mass market business of Studio City Casino with VIP rolling chip operations; |

| • | continue to drive visitation and revenue growth through innovative non-gaming attractions; |

| • | continue to pursue strategic marketing initiatives and differentiate the “Studio City” brand; and |

| • | prudently manage our capital structure. |

3

Table of Contents

Our Challenges

Our ability to achieve success and implement our strategies is subject to risks and uncertainties that include the following:

| • | we have a short operating history compared to many of our competitors and we have a history of net losses and may have net losses in the future; |

| • | we do not hold a gaming license in Macau and Studio City Casino is operated by a subconcessionaire, Melco Resorts Macau, which is a subsidiary of Melco Resorts; |

| • | we utilize services provided by subsidiaries of Melco Resorts, including hiring and training of personnel for Studio City; |

| • | we face concentration risk in relation to our operation of Studio City; |

| • | we have a substantial amount of existing indebtedness and are subject to certain covenants which may restrict our ability to engage in certain transactions; |

| • | Studio City Casino’s gaming operations are subject to various risks relating to the gaming operations in Macau; |

| • | we are subject to risks in operating our non-gaming offerings; |

| • | if we fail to fully develop our remaining project under the land concession contract by July 24, 2021, or receive a further extension of the development period from the Macau government, we may be forced to forfeit all or part of our investment in the granted land, along with our interest in Studio City; and |

| • | our remaining project for Studio City is subject to significant development and construction risks and uncertainties. |

In addition, we face risks and uncertainties related to our compliance with applicable regulations and policies in our operations in Macau.

See “Risk Factors” and other information included in this prospectus for a detailed discussion of the above and other challenges, risks and uncertainties.

CORPORATE HISTORY AND ORGANIZATIONAL STRUCTURE

Corporate History

We were established as an international business company, limited by shares, under the laws of the British Virgin Islands as Cyber One Agents Limited on August 2, 2000 and subsequently re-registered as a business company, limited by shares, under the British Virgin Islands Business Companies Act, 2004. New Cotai acquired a 40% equity interest in us on December 6, 2006. New Cotai is a private limited liability company organized in Delaware that is indirectly owned by investment funds managed by Silver Point Capital, L.P., Oaktree Capital Management, L.P. and other third party investors. MCE Cotai, a wholly owned subsidiary of Melco Resorts, acquired a 60% equity interest in us on July 27, 2011. Melco Resorts is an exempted company incorporated with limited liability under the laws of the Cayman Islands and its American Depositary Shares are listed on the NASDAQ Global Select Market in the United States. On January 17, 2012, our name was changed from Cyber One Agents Limited to Studio City International Holdings Limited.

In October 2001, we were granted a land concession in Cotai by the Macau government for the development of Studio City, a cinematically-themed and integrated entertainment, retail and gaming resort. Studio City commenced operations on October 27, 2015. We conduct our principal activities through our subsidiaries, which are primarily located in Macau. We currently operate the non-gaming operations of Studio City. The Gaming Operator operates the Studio City Casino. See “Business—Our Relationship with Melco Resorts” and “Related Party Transactions—Material Contracts with Affiliated Companies.”

4

Table of Contents

Prior to or concurrently with the completion of this offering, we will engage in a series of “Organizational Transactions,” described below, through which substantially all of our assets and liabilities will be contributed to our subsidiary, MSC Cotai, a business company limited by shares incorporated in the British Virgin Islands, in exchange for all of the outstanding equity interests in MSC Cotai. In connection with the “Organizational Transactions” described below, we will redomicile by way of continuation as an exempted company incorporated with limited liability under the laws of the Cayman Islands.

Immediately prior to the Organizational Transactions, 60% of the equity interest in us was directly held by MCE Cotai and 40% of the equity interest in us was directly held by New Cotai.

Organizational Transactions

Each of the following transactions, referred to collectively as the “Organizational Transactions,” has been or will be completed prior to or in connection with the completion of this offering. The Organizational Transactions are conducted pursuant to an implementation agreement, or the Implementation Agreement, among MCE Cotai, Melco Resorts, New Cotai, MSC Cotai and us. See “Corporate History and Organizational Structure—Implementation Agreement.”

| • | MSC Cotai was incorporated as a business company limited by shares in the British Virgin Islands. |

| • | We will enter into a transfer agreement, or the Transfer Agreement, with MSC Cotai to provide for the transfer by us and the assumption by MSC Cotai of substantially all of our assets and liabilities, in exchange for all of the outstanding equity interests in MSC Cotai. See “Corporate History and Organizational Structure—Transfer Agreement.” |

| • | We will amend and restate our memorandum of association and articles of association to, among other things, authorize two classes of ordinary shares, the SC Class A Shares and the SC Class B Shares. See “Description of Share Capital.” Each SC Class A Share and each SC Class B Share will entitle its holder to one vote on all matters to be voted on by shareholders generally and holders of SC Class A Shares and SC Class B Shares will vote together as a single class on all matters presented to our shareholders for their vote or approval, except as otherwise required by applicable law or our memorandum of association and articles of association. See “Description of Share Capital—Voting Rights.” Holders of the SC Class B Shares do not have any right to receive dividends or distributions upon our liquidation or winding up or to otherwise share in our profits and surplus assets. |

| • | MCE Cotai’s 60% equity interest in our company will be reclassified into SC Class A Shares. |

| • | New Cotai’s 40% equity interest in our company will be exchanged for SC Class B Shares, which have only voting and no economic rights. Through its SC Class B Shares, New Cotai will have voting rights in us, and we will control MSC Cotai. |

| • | In addition, New Cotai will have a non-voting, non-shareholding economic participation interest, or Participation Interest, in MSC Cotai, the terms of which will be set forth in a participation agreement, or the Participation Agreement, that will be entered into by MSC Cotai, New Cotai and us. See “Corporate History and Organizational Structure—Participation Agreement.” |

| • | The Participation Interest will entitle New Cotai to receive from MSC Cotai an amount equal to 66-2/3% of the amount of any distribution, dividend or other consideration paid by MSC Cotai to us, subject to adjustments, exceptions and conditions as set out in the Participation Agreement and further described in “Corporate History and Organizational Structure—Participation Agreement.” The 66-2/3% represents the equivalent of New Cotai’s 40% interest in us prior to the Organizational Transactions. |

5

Table of Contents

| • | The Participation Agreement will also provide that, following the expiration of the lock-up period of [●] days, New Cotai will be entitled to exchange all or a portion of its Participation Interest for a number of SC Class A Shares subject to exceptions and adjustments as set out in the Participation Agreement. See “Corporate History and Organizational Structure—Participation Agreement.” When New Cotai exchanges all or a portion of the Participation Interest for SC Class A Shares pursuant to the terms of exchange set forth in the Participation Agreement and described herein, a proportionate number of SC Class B Shares will be deemed surrendered and automatically cancelled for no consideration as set out in the Participation Agreement. |

| • | We will redomicile by way of continuation as an exempted company incorporated with limited liability under the laws of the Cayman Islands prior to the completion of this offering. |

In connection with the completion of this offering, we will issue ADSs (representing SC Class A Shares) to the investors in this offering (or ADSs, representing SC Class A Shares, if the underwriters exercise their option in full to purchase additional SC Class A Shares in the form of ADSs) in exchange for net proceeds of approximately US$ million (or approximately US$ million if the underwriters exercise their option in full to purchase additional SC Class A Shares in the form of ADSs), after deducting underwriting discounts and commissions and estimated offering expenses payable by us. Upon the completion of this offering, we will contribute the proceeds of this offering to MSC Cotai in exchange for MSC Cotai Shares.

As a result of the Organizational Transactions and this offering, immediately following this offering:

| • | the investors in this offering will collectively own ADSs (representing SC Class A Shares) representing a % economic and voting interest in our company; |

| • | MCE Cotai will own SC Class A Shares, representing a % voting and economic interest in our company; |

| • | New Cotai will own SC Class B Shares, representing a % voting, non-economic interest in our company; |

| • | New Cotai will have a Participation Interest, which will entitle New Cotai to receive from MSC Cotai an amount equal to % of the amount of any distribution, dividend or other consideration paid by MSC Cotai to us, subject to adjustments, exceptions and conditions; |

| • | SC Class B Shares will collectively represent approximately % of the voting power in us; and |

| • | we will own all MSC Cotai Shares, representing 100% of the outstanding equity interests in MSC Cotai and 100% of the voting power in MSC Cotai. |

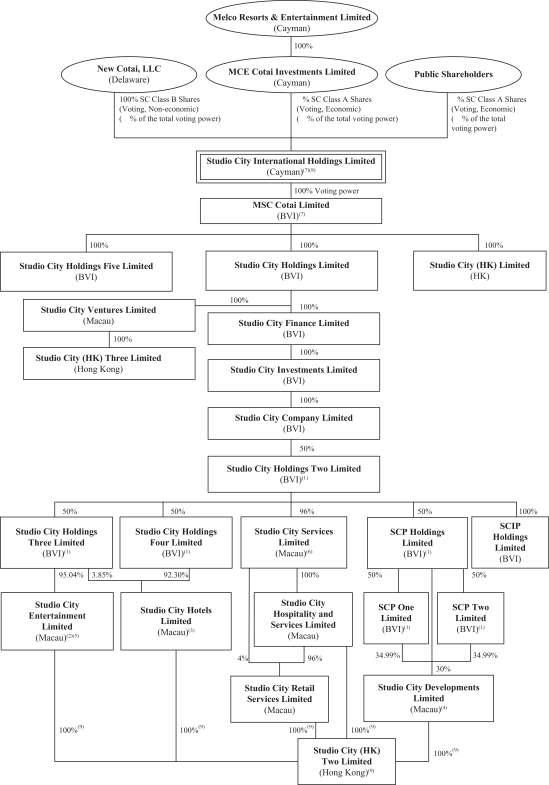

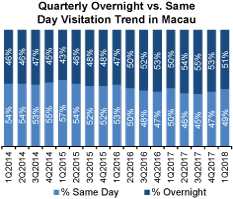

The diagram below depicts our expected organizational structure immediately following completion of this offering. This diagram is provided for illustrative purposes only and does not purport to represent all legal entities owned or controlled by us, or owning a beneficial interest in us.

6

Table of Contents

7

Table of Contents

| (1) | Studio City Holdings Five Limited also holds 50% in one non-voting share. |

| (2) | Studio City Holdings Five Limited also holds 1% of the voting equity interest. |

| (3) | Studio City Holdings Five Limited also holds 3.85% of the voting equity interest. |

| (4) | Studio City Holdings Five Limited also holds 0.02% of the voting equity interest. |

| (5) | Studio City Holdings Four Limited also holds 3.96% of the voting equity interest. |

| (6) | Studio City Company Limited also holds 4% of the voting equity interest. |

| (7) | Upon the completion of this offering, New Cotai will have a Participation Interest in MSC Cotai, which will represent its economic right to receive an amount equal to % of the dividends, distributions or other consideration paid to us by MSC Cotai, if any, from time to time. New Cotai may exchange all or a portion of its Participation Interest for SC Class A Shares, subject to certain conditions. See “Corporate History and Organizational Structure—Participation Agreement.” |

| (8) | Prior to the completion of this offering, Studio City International Holdings Limited will undergo a series of organizational transactions, as a part of which it will redomicile by way of continuation as an exempted company incorporated with limited liability under the laws of the Cayman Islands. |

| (9) | Jointly owned by Studio City Hospitality and Services Limited, Studio City Hotels Limited, Studio City Entertainment Limited, Studio City Retail Services Limited and Studio City Developments Limited. |

Corporate Information

Our principal executive offices are located at [36/F, The Centrium, 60 Wyndham Street, Central, Hong Kong]. Our telephone number at this address is [+852 2598-3600]. Our registered office in the Cayman Islands is at the offices of [●]. Our agent for service of process in the United States is [Cogency Global Inc., located at 10 East 40th Street, 10th Floor, New York, NY 10016].

Investors should contact us for any inquiries through the address and telephone number of our principal executive offices. Our website is www.studiocity-macau.com. The information contained on our website is not a part of this prospectus.

Basis of Presentation and Conventions Which Apply to This Prospectus

In connection with the completion of this offering, we will effect certain Organizational Transactions. Unless otherwise stated or the context otherwise requires, all information in this prospectus reflects the completion of the Organizational Transactions and this offering. See “Corporate History and Organizational Structure” for a description of the Organizational Transactions and a diagram depicting our anticipated structure after giving effect to the Organizational Transactions and this offering.

Unless we state otherwise or the context otherwise requires, the terms “we,” “us,” “our,” “our business”, “our company” or “Studio City International” refer to, and similar references refer to, Studio City International Holdings Limited and its consolidated subsidiaries, including MSC Cotai.

This prospectus contains the historical financial statements of our company and its consolidated subsidiaries. The unaudited pro forma consolidated financial information of our company presented in this prospectus has been derived from the application of pro forma adjustments to the historical consolidated financial statements of our company and its subsidiaries included elsewhere in this prospectus. These pro forma adjustments give effect to the Organizational Transactions and related transactions as described in “Corporate History and Organizational Structure” as if all such transactions had occurred on January 1, 2015. See “Unaudited Pro Forma Condensed Consolidated Financial Information” for a complete description of the adjustments and assumptions underlying the unaudited pro forma consolidated financial information included in this prospectus.

Except where the context otherwise requires:

| • | “2012 Notes” refers to 8.50% senior notes due 2020 in an aggregate principal amount of US$825,000,000 issued by Studio City Finance Limited, or Studio City Finance, on November 26, 2012; |

| • | “2013 Project Facility” refers to the senior secured project facility, dated January 28, 2013 and as amended from time to time, entered into between, among others, Studio City Company Limited, or Studio City Company, as borrower and certain subsidiaries as guarantors, comprising a term loan |

8

Table of Contents

| facility of HK$10,080,460,000 (approximately US$1,300 million) and revolving credit facility of HK$775,420,000 (approximately US$100 million), and which has been amended, restated and extended by the 2016 Credit Facility; |

| • | “2016 Credit Facility” refers to the facility agreement dated November 23, 2016 with, among others, Bank of China Limited, Macau Branch, to amend, restate and extend the 2013 Project Facility to provide for senior secured credit facilities in an aggregate amount of HK$234.0 million, which consist of a HK$233.0 million (approximately US$29.9 million) revolving credit facility and a HK$1.0 million (approximately US$129,000) term loan facility; |

| • | “2016 Notes” refers to (i) 5.875% senior secured notes due 2019 in an aggregate principal amount of US$350,000,000, or the 2016 5.875% Notes, and (ii) 7.250% senior secured notes due 2021 in an aggregate principal amount of US$850,000,000, or the 2016 7.250% Notes, both issued by Studio City Company on November 30, 2016; |

| • | “ADRs” refers to the American depositary receipts evidencing our ADSs; |

| • | “ADSs” refers to our American depositary shares, each of which represents SC Class A Shares; |

| • | “average daily rate” refers to total room revenues including the retail value of complimentary rooms (less service charges, if any) divided by total rooms occupied, including complimentary rooms, i.e., average price of occupied rooms per day; |

| • | “China, ” “mainland China” or “PRC” refers to the People’s Republic of China, excluding, for the purpose of this prospectus only, Taiwan and the special administrative regions of Hong Kong and Macau; |

| • | “Coloane” refers to one of the two main islands of Macau and which is located south of Taipa; |

| • | “concession” refers to a government grant for the operation of games of fortune and chance in casinos in Macau under an administrative contract pursuant to which a concessionaire, or the entity holding the concession, is authorized to operate games of fortune and chance in casinos in Macau; |

| • | “Cotai” refers to an area of reclaimed land located between the islands of Taipa and Coloane in Macau; |

| • | “gaming machine” refers to slot machine and/or electronic gaming table; |

| • | “gaming machine handle” refers to the total amount wagered in gaming machines; |

| • | “gaming machine win rate” refers to gaming machine win expressed as a percentage of gaming machine handle; |

| • | “Gaming Operator” refers to Melco Resorts (Macau) Limited (formerly known as Melco Crown (Macau) Limited), or Melco Resorts Macau, a company incorporated under the laws of Macau that is a subsidiary of Melco Resorts, the holder of a subconcession under the Subconcession Contract and the operator of Studio City Casino. The equity interest of the Gaming Operator is 90% owned by Melco Resorts and 10% owned by Mr. Lawrence Ho, the managing director of the Gaming Operator; |

| • | “gaming promoter,” also known as a junket operator, refers to an individual or corporate entity who, for the purpose of promoting rolling chip and other gaming activities, arranges customer transportation and accommodation, provides credit in its sole discretion if authorized by a gaming operator and arranges food and beverage services and entertainment in exchange for commissions or other compensation from a gaming concessionaire or subconcessionaire; |

| • | “HK$,” “H.K. dollar(s)” or “Hong Kong Dollar(s)” refers to the legal currency of Hong Kong; |

| • | “Hong Kong” refers to the Hong Kong Special Administrative Region of the PRC; |

| • | “Macau” or “Macao” refers to the Macau Special Administrative Region of the PRC; |

9

Table of Contents

| • | “Macau Peninsula” refers to the part of Macau which is geographically connected to mainland China and located north of Taipa; |

| • | “mass market” refers to both table games and gaming machines played by mass market players primarily for cash stakes; |

| • | “mass market table games drop” refers to the amount of table games drop in the mass market table games segment; |

| • | “mass market table games hold percentage” refers to mass market table games win as a percentage of mass market table games drop; |

| • | “Master Service Providers” refer to certain of our affiliates with whom we entered into a master service agreement and a series of work agreements with respect to the non-gaming services at the properties in Macau, and that are also subsidiaries of Melco Resorts, including Melco Crown (COD) Developments Limited (now known as COD Resorts Limited), Altira Developments Limited (now known as Altira Resorts Limited), the Gaming Operator, MPEL Services Limited (now known as Melco Resorts Services Limited), Golden Future (Management Services) Limited, MPEL Properties (Macau) Limited, Melco Crown Security Services Limited (now known as Melco Resorts Security Services Limited), MCE Travel Limited (now known as Melco Resorts Travel Limited), MCE Transportation Limited and MCE Transportation Two Limited (now known as MCO Transportation Two Limited); |

| • | “Melco International” refers to Melco International Development Limited, a public limited company incorporated in Hong Kong with its shares listed on The Stock Exchange of Hong Kong Limited, or the Hong Kong Stock Exchange; |

| • | “Melco Resorts” refers to Melco Resorts & Entertainment Limited, a company incorporated in the Cayman Islands with its American depositary shares listed on the NASDAQ Global Select Market; |

| • | “MICE” refers to Meetings, Incentives, Conventions and Exhibitions, an acronym commonly used to refer to tourism involving large groups brought together for an event or specific purpose; |

| • | “MOP” or “Macau Pataca(s)” refers to the legal currency of Macau; |

| • | “occupancy rate” refers to the average percentage of available hotel rooms occupied, including complimentary rooms, during a period; |

| • | “remaining project” refers to the part of the Studio City project comprised of a gross floor area of approximately 229,968 square meters, which is required to be developed under the land concession contract; |

| • | “REVPAR” refers to revenue per available room, calculated by dividing total room revenues including the retail value of complimentary rooms (less service charges, if any) by total rooms available, thereby representing a combination of hotel average daily room rates and occupancy; |

| • | “RMB” or “Renminbi” refers to the legal currency of China; |

| • | “rolling chip” or “VIP rolling chip” refers to non-negotiable chip primarily used by rolling chip patrons to make wagers; |

| • | “rolling chip patron” refers to a player who primarily plays on rolling chip or VIP rolling chip tables and typically plays for higher stakes than mass market gaming patrons; |

| • | “rolling chip volume” refers to the amount of non-negotiable chips wagered and lost by the rolling chip market segment; |

| • | “rolling chip win rate” refers to rolling chip table games win (calculated before discounts and commissions) as a percentage of rolling chip volume; |

10

Table of Contents

| • | “MSC Cotai” refers to MSC Cotai Limited, a business company limited by shares incorporated in the British Virgin Islands as part of the Organizational Transactions described in “Corporate History and Organizational Structure—Organizational Transactions;” |

| • | “shares” or “ordinary shares” refers to our ordinary shares which, upon completion of this offering, will comprise two classes of ordinary shares, the SC Class A Shares and the SC Class B Shares; |

| • | “subconcession” refers to an agreement for the operation of games of fortune and chance in casinos between the entity holding the concession and a subconcessionaire, pursuant to which the subconcessionaire is authorized to operate games of fortune and chance in casinos in Macau; |

| • | “Subconcession Contract” refers to the subconcession contract executed between the Gaming Operator and Wynn Resorts (Macau) S.A., or Wynn Resorts Macau, on September 8, 2006, that provides for the terms and conditions of the subconcession granted to the Gaming Operator by Wynn Resorts Macau; |

| • | “Taipa” refers to one of the two main islands of Macau and which is located north of Coloane, south of the Macau Peninsula; and |

| • | “US$,” “U.S. Dollar(s),” “$” or “dollars” refers to the legal currency of the United States. |

Our reporting currency is the U.S. Dollar and functional currencies are the U.S. Dollar, Hong Kong Dollar and Macau Pataca. This prospectus contains translations of certain Macau Pataca, Hong Kong Dollar and Renminbi amounts into U.S. Dollars for the convenience of the reader. Unless otherwise stated, all translations of Hong Kong Dollar and Renminbi amounts into U.S. Dollars in this prospectus have been made at the rates of HK$7.7800 to US$1.00 and RMB6.5063 to US$1.00, respectively. On March 30, 2018, the noon buying rate in The City of New York for cable transfers in Hong Kong Dollars and Renminbi as certified for customs purposes by the Federal Reserve Bank of New York set forth in the H.10 statistical release of the U.S. Federal Reserve Board for translation into U.S. Dollars was HK$7.8484 to US$1.00 and RMB6.2726 to US$1.00, respectively. The Federal Reserve Bank of New York does not certify for customs purposes a noon buying rate for cable transfers in Macau Pataca. The Macau Pataca is pegged to the Hong Kong Dollar at a rate of MOP1.03 to HK$1.00. Unless otherwise stated, all translations from Macau Patacas to U.S. Dollars in this prospectus were made at the exchange rate of MOP8.0134 to US$1.00. We make no representation that the Macau Pataca, Hong Kong Dollar, Renminbi or U.S. Dollar amounts referred to in this prospectus could have been, or could be, converted into U.S. Dollars, Macau Patacas and Hong Kong Dollars, as the case may be, at any particular rate or at all. On July 6, 2018, the noon buying rate for Hong Kong Dollars and Renminbi was HK$7.8479 and RMB6.6396 to US$1.00, respectively.

Certain figures included in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be exact arithmetic aggregations or percentages of the figures that precede them.

11

Table of Contents

The following assumes that the underwriters will not exercise their option to purchase additional ADSs in the offering, unless otherwise indicated.

| Issuer |

Studio City International Holdings Limited. |

| Offering Price |

We expect that the initial public offering price will be between US$ and US$ per ADS. |

| ADSs Offered by Us |

ADSs (or ADSs if the underwriters exercise their option to purchase additional ADSs in full). |

| ADSs Outstanding Immediately After This Offering |

ADSs (or ADSs if the underwriters exercise their option to purchase additional ADSs in full). |

| If all of New Cotai’s Participation Interest was exchanged for newly-issued SC Class A Shares in accordance with the terms of exchange set forth in the Participation Agreement and described in “Corporate History and Organizational Structure” (based upon an assumed offering price of US$ per ADS, which is the mid-point of the estimated range of public offering price set forth on the front cover of this prospectus), ADSs representing SC Class A Shares (or ADSs representing SC Class A Shares if the underwriters’ option is exercised in full) would be outstanding. |

| SC Class B Shares Outstanding Immediately After This Offering |

SC Class B Shares. |

| Immediately after this offering, New Cotai will own 100% of the outstanding SC Class B Shares. |

| The ADSs |

Each ADS represents SC Class A Shares. The ADSs may be evidenced by ADRs. |

| The depositary will hold the SC Class A Shares underlying your ADSs and you will have rights as provided in the deposit agreement. |

| We do not expect to pay dividends in the foreseeable future. If, however, we declare dividends on our SC Class A Shares, the depositary will pay you the cash dividends and other distributions it receives on our SC Class A Shares, after deducting its fees and expenses. |

| You may turn in your ADSs to the depositary in exchange for SC Class A Shares. The depositary will charge you fees for any exchange. We may amend or terminate the deposit agreement without your consent. If you continue to hold your ADSs, you agree to be bound by the deposit agreement as amended. |

| To better understand the terms of the ADSs, you should carefully read the “Description of American Depositary Shares” section of this prospectus. You should also read the deposit agreement, which is filed as an exhibit to the registration statement that includes this prospectus. |

12

Table of Contents

| Option to Purchase Additional ADSs |

We have granted to the underwriters an option, exercisable within 30 days from the date of this prospectus, to purchase up to additional ADSs. |

| Voting |

Each share of our SC Class A Shares and SC Class B Shares entitles its holder to one vote on all matters to be voted on by shareholders generally. |

| Holders of our SC Class A and SC Class B Shares vote together as a single class on all matters presented to our shareholders for their vote or approval, except as otherwise required by applicable law or our memorandum of association and articles of association. |

| Upon completion of this offering, we will be controlled by Melco Resorts through its ownership of MCE Cotai. Upon completion of this offering, Melco Resorts, through MCE Cotai, will control approximately % of the voting power in us (or approximately % if the underwriters exercise their option in full to purchase additional SC Class A Shares in the form of ADSs). See “Corporate History and Organizational Structure.” |

| Voting Power of SC Class A Shares |

% (or 100% if all of the Participation Interest was exchanged for newly-issued SC Class A Shares in accordance with the terms of exchange set forth in the Participation Agreement as described in “Corporate History and Organizational Structure”). |

| Voting Power of SC Class B Shares |

% (or 0% if all of the Participation Interest was exchanged for newly-issued SC Class A Shares in accordance with the terms of exchange set forth in the Participation Agreement as described in “Corporate History and Organizational Structure”). |

| Use of Proceeds |

We estimate that we will receive net proceeds of approximately US$ million from this offering and the Assured Entitlement Distribution (or US$ million if the underwriters exercise their option to purchase additional ADSs in full), after deducting underwriting discounts and commissions and estimated offering expenses payable by us and assuming an initial public offering price of US$ per ADS, being the mid-point of the estimated range of the initial public offering price shown on the front cover of this prospectus. |

| We intend to apply the net proceeds of this offering and the Assured Entitlement Distribution to acquire newly-issued MSC Cotai Shares. In turn, MSC Cotai intends to apply the net proceeds it receives from us primarily for the following purposes: |

| • | US$ million for repayment of certain of our existing indebtedness; and |

| • | the remainder for working capital and other general corporate purposes. |

| See “Use of Proceeds” for additional information. |

13

Table of Contents

| Lock-up |

[We and our existing shareholders have agreed with the underwriters, subject to certain exceptions, not to sell, transfer or otherwise dispose of any ADSs, SC Class A Shares or similar securities or any securities convertible into or exchangeable or exercisable for our SC Class A Shares or ADSs, for a period ending [●] days after the date of this prospectus, subject to certain exceptions. See “Underwriting” for more information.] |

| Listing |

We intend to apply to have the ADSs listed on the New York Stock Exchange under the symbol “MSC.” Our ADSs and shares will not be listed on any other stock exchange or traded on any automated quotation system. |

| Payment and Settlement |

The underwriters expect to deliver the ADSs against payment therefor through the facilities of The Depository Trust Company on , 2018. |

| Depositary |

Deutsche Bank Trust Company Americas. |

| Assured Entitlement Distribution |

Pursuant to Practice Note 15 under the Rules Governing The Listing of Securities on The Stock Exchange of Hong Kong Limited, in connection with this offering, Melco International intends to make available to its shareholders an “assured entitlement” to a certain portion of our ordinary shares. |

| As our ordinary shares are not expected to be listed on any stock exchange, Melco International intends to effect the Assured Entitlement Distribution by providing to its shareholders a “distribution in specie,” or distribution of our ADSs in kind. The distribution will be made without any consideration being paid by Melco International’s shareholders. Melco International’s shareholders who are entitled to fractional ADSs, who elect to receive cash in lieu of ADSs and who are located in the United States or are U.S. persons, or are otherwise ineligible holders, will only receive cash in the Assured Entitlement Distribution. |

| Concurrently with this offering as a separate transaction, Melco International intends to purchase from us new SC Class A Shares needed for the distribution in specie at the public offering price per SC Class A Share, which is the public offering price per ADS divided by the number of SC Class A Shares represented by one ADS. Melco International currently intends to provide an assured entitlement with an aggregate value of approximately US$[●] million. The Assured Entitlement Distribution will only be made if this offering is completed. |

| The purchase of SC Class A Shares and distribution in specie of ADSs by Melco International are not part of this offering. |

| Exchange Arrangements |

Following the expiration of the lock-up period and subject to certain conditions, New Cotai and its permitted transferees may exchange all or part of their Participation Interest for a number of SC Class A Shares. |

14

Table of Contents

| If New Cotai exchanges all or a portion of the Participation Interest for SC Class A Shares, it will also be deemed to have surrendered a corresponding number of SC Class B Shares, and any such SC Class B Shares so surrendered will be automatically cancelled for no consideration. See “Corporate History and Organizational Structure—Participation Agreement.” |

15

Table of Contents

SUMMARY HISTORICAL AND UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL AND OPERATING DATA

The following summary historical consolidated statements of operations data for the years ended December 31, 2017, 2016, and 2015 and summary historical consolidated balance sheets data as of December 31, 2017 and 2016 have been derived from our audited consolidated financial statements included elsewhere in this prospectus. Our consolidated financial statements are prepared and presented in accordance with U.S. generally accepted accounting principles, or U.S. GAAP. The consolidated statements of operations data for the three months ended March 31, 2018 and 2017 and summary consolidated balance sheet data as of March 31, 2018 have been derived from our unaudited condensed consolidated financial statements included elsewhere in this prospectus. The unaudited condensed consolidated financial statements have been prepared on the same basis as our audited consolidated financial statements, except for the adoption of Accounting Standards Codification 606, Revenue from Contracts with Customers (“New Revenue Standard”) using the modified retrospective method on January 1, 2018. Amounts for the period beginning after January 1, 2018 are presented under the New Revenue Standard, while prior period amounts are not adjusted and continue to be reported in accordance with the previous basis. There was no material impact on our financial position as of March 31, 2018 and our results of operations and cash flows for the three months ended March 31, 2018 as a result of the adoption of the New Revenue Standard. The unaudited condensed consolidated financial statements include all adjustments, consisting of normal recurring adjustments, that we consider necessary for a fair statement of our financial position and operating results for the periods presented. The consolidated statement of operations data for the year ended December 31, 2014 and the consolidated balance sheet data as of December 31, 2015 have been derived from our audited consolidated financial statements which are not included in this prospectus. The consolidated statement of operations data for the year ended December 31, 2013 and the summary consolidated balance sheets data as of December 31, 2014 and 2013 were not included in this section because Studio City did not commence operations until October 2015. Our historical results are not necessarily indicative of results expected for future periods. You should read this “Summary Historical and Unaudited Pro Forma Condensed Consolidated Financial and Operating Data” section together with our consolidated financial statements and the related notes and the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section included elsewhere in this prospectus.

The summary unaudited pro forma condensed consolidated financial information presented below has been derived from our unaudited pro forma condensed consolidated financial statements included elsewhere in this prospectus. The unaudited pro forma condensed consolidated statements of operations for the three months ended March 31, 2018 and 2017 and for the years ended December 31, 2017, 2016 and 2015 and summary unaudited pro forma condensed consolidated balance sheets as of March 31, 2018 and December 31, 2017 and 2016, give pro forma effect to the Organizational Transactions and related transactions as described in “Corporate History and Organizational Structure,” as if all such transactions had occurred on January 1, 2015, and are based on available information and certain assumptions we believe are reasonable, but are subject to change. See “Unaudited Pro Forma Condensed Consolidated Financial Information” for a complete description of the adjustments and the underlying assumptions of the unaudited pro forma condensed consolidated financial information.

16

Table of Contents

| For the Year Ended December 31, | For the Three Months Ended March 31, |

|||||||||||||||||||||||

| 2017 | 2016 | 2015(1) | 2014(1) | 2018(2) | 2017 | |||||||||||||||||||

|

(US$ thousands, except for share and per share data) |

||||||||||||||||||||||||

| Consolidated Statements of Operations Data: |

||||||||||||||||||||||||

| Operating revenues: |

||||||||||||||||||||||||

| Provision of gaming related services |

295,638 | 151,597 | 21,427 | — | 98,401 | 59,225 | ||||||||||||||||||

| Rooms |

88,699 | 84,643 | 14,417 | — | 21,833 | 21,822 | ||||||||||||||||||

| Food and beverage |

60,705 | 61,536 | 9,457 | — | 16,053 | 14,818 | ||||||||||||||||||

| Entertainment |

18,534 | 35,155 | 6,730 | — | 3,655 | 4,863 | ||||||||||||||||||

| Services fee |

39,971 | 51,842 | 7,968 | — | 9,651 | 10,767 | ||||||||||||||||||

| Mall |

29,498 | 34,020 | 6,999 | — | 6,434 | 8,202 | ||||||||||||||||||

| Retail and other |

6,769 | 5,738 | 2,336 | 1,767 | 872 | 1,696 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total revenues |

539,814 | 424,531 | 69,334 | 1,767 | 156,899 | 121,393 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Operating costs and expenses: |

||||||||||||||||||||||||

| Provision of gaming related services |

(24,019 | ) | (25,332 | ) | (462 | ) | — | (5,495 | ) | (6,070 | ) | |||||||||||||

| Rooms |

(21,750 | ) | (22,752 | ) | (4,113 | ) | — | (5,421 | ) | (5,437 | ) | |||||||||||||

| Food and beverage |

(54,266 | ) | (62,200 | ) | (12,549 | ) | — | (13,905 | ) | (13,425 | ) | |||||||||||||

| Entertainment |

(16,364 | ) | (41,432 | ) | (7,404 | ) | — | (3,341 | ) | (4,138 | ) | |||||||||||||

| Mall |

(9,098 | ) | (11,083 | ) | (3,653 | ) | — | (3,134 | ) | (2,575 | ) | |||||||||||||

| Retail and other |

(4,750 | ) | (3,696 | ) | (579 | ) | — | (653 | ) | (910 | ) | |||||||||||||

| General and administrative |

(130,465 | ) | (135,071 | ) | (34,245 | ) | (3,071 | ) | (31,942 | ) | (32,065 | ) | ||||||||||||

| Pre-opening costs |

(116 | ) | (4,044 | ) | (153,515 | ) | (14,951 | ) | (42 | ) | 19 | |||||||||||||

| Amortization of land use right |

(3,323 | ) | (3,323 | ) | (9,909 | ) | (12,104 | ) | (831 | ) | (831 | ) | ||||||||||||

| Depreciation and amortization |

(173,003 | ) | (168,539 | ) | (31,056 | ) | (26 | ) | (41,648 | ) | (43,119 | ) | ||||||||||||

| Property charges and other |

(22,210 | ) | (1,825 | ) | (1,126 | ) | — | (2,363 | ) | — | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total operating costs and expenses |

(459,364 | ) | (479,297 | ) | (258,611 | ) | (30,152 | ) | (108,775 | ) | (108,551 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Operating income (loss) |

80,450 | (54,766 | ) | (189,277 | ) | (28,385 | ) | 48,124 | 12,842 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Non-operating income (expenses): |

||||||||||||||||||||||||

| Interest income |

2,171 | 1,152 | 4,641 | 8,901 | 743 | 245 | ||||||||||||||||||

| Interest expenses, net of capitalized interest |

(152,318 | ) | (133,610 | ) | (23,285 | ) | (18,047 | ) | (38,080 | ) | (38,079 | ) | ||||||||||||

| Amortization of deferred financing costs |

(7,600 | ) | (25,626 | ) | (16,295 | ) | (10,642 | ) | (2,002 | ) | (1,857 | ) | ||||||||||||

| Loan commitment fees |

(419 | ) | (1,647 | ) | (1,794 | ) | (15,153 | ) | (103 | ) | (103 | ) | ||||||||||||

| Foreign exchange gains (losses), net |

466 | (3,445 | ) | 435 | (2,710 | ) | 148 | 290 | ||||||||||||||||

| Other income, net |

574 | 1,163 | 379 | — | 66 | 144 | ||||||||||||||||||

| Loss on extinguishment of debt |

— | (17,435 | ) | — | — | — | — | |||||||||||||||||

| Costs associated with debt modification |

— | (8,101 | ) | (7,011 | ) | — | — | — | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total non-operating expenses, net |

(157,126 | ) | (187,549 | ) | (42,930 | ) | (37,651 | ) | (39,228 | ) | (39,360 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

17

Table of Contents

| For the Year Ended December 31, | For the Three Months Ended March 31, |

|||||||||||||||||||||||

| 2017 | 2016 | 2015(1) | 2014(1) | 2018(2) | 2017 | |||||||||||||||||||

|

(US$ thousands, except for share and per share data) |

||||||||||||||||||||||||

| (Loss) income before income tax |

(76,676 | ) | (242,315 | ) | (232,207 | ) | (66,036 | ) | 8,896 | (26,518 | ) | |||||||||||||

| Income tax credit (expense) |

239 | (474 | ) | (353 | ) | — | (47 | ) | 5 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net (loss) income |

(76,437 | ) | (242,789 | ) | (232,560 | ) | (66,036 | ) | 8,849 | (26,513 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (Loss) earnings per share: |

||||||||||||||||||||||||

| Basic and diluted |

(4,217 | ) | (13,393 | ) | (12,829 | ) | (4,190 | ) | 488 | (1,463 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Weighted average shares outstanding used in (loss) earnings per share calculation: |

||||||||||||||||||||||||

| Basic and diluted |

18,127.94 | 18,127.94 | 18,127.94 | 15,759.02 | 18,127.94 | 18,127.94 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Pro forma net (loss) income attributable to participation interest(3) |

||||||||||||||||||||||||

| Pro forma net (loss) income attributable to Studio City International(3) |

||||||||||||||||||||||||

| Pro forma (loss) earnings per Class A ordinary share(3) |

||||||||||||||||||||||||

| Basic |

||||||||||||||||||||||||

| Diluted |

||||||||||||||||||||||||

| Pro forma weighted average Class A ordinary shares outstanding used in (loss) earnings per share calculation(3) |

||||||||||||||||||||||||

| Basic |

||||||||||||||||||||||||

| Diluted |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| (1) | We commenced operations in October 2015. |

| (2) | We adopted the New Revenue Standard using the modified retrospective method from January 1, 2018. Amounts for the period beginning after January 1, 2018 are presented under the New Revenue Standard, while prior period amounts are not adjusted and continue to be reported in accordance with the previous basis. There was no material impact on our results of operations for the three months ended March 31, 2018 as a result of the adoption of the New Revenue Standard. |

| (3) | See “Unaudited Pro Forma Condensed Consolidated Financial Information” for the description of the assumptions underlying the pro forma calculation. |

18

Table of Contents

| As of December 31, | As of March 31, | |||||||||||||||

| 2017 | 2016 | 2015 | 2018(1) | |||||||||||||

| (US$ thousands) | ||||||||||||||||

| Summary Consolidated Balance Sheets Data: |

||||||||||||||||

| Total current assets |

460,927 | 397,218 | 661,074 | 447,079 | ||||||||||||

| Cash and cash equivalents |

348,399 | 336,783 | 285,067 | 293,800 | ||||||||||||

| Bank deposits with original maturities over three months |

9,884 | — | — | 4,987 | ||||||||||||

| Restricted cash |

34,400 | 34,333 | 301,096 | 72,479 | ||||||||||||

| Amounts due from affiliated companies |

37,826 | 1,578 | 40,837 | 47,197 | ||||||||||||

| Total non-current assets |

2,466,640 | 2,624,781 | 2,731,509 | 2,434,194 | ||||||||||||

| Property and equipment, net |

2,280,116 | 2,419,410 | 2,518,578 | 2,249,032 | ||||||||||||

| Land use right, net |

125,672 | 128,995 | 132,318 | 124,841 | ||||||||||||

| Restricted cash |

130 | 130 | — | 130 | ||||||||||||

| Total assets |

2,927,567 | 3,021,999 | 3,392,583 | 2,881,273 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total current liabilities |

178,070 | 193,439 | 327,213 | 129,667 | ||||||||||||

| Accrued expenses and other current liabilities |

155,840 | 156,495 | 214,004 | 103,013 | ||||||||||||

| Current portion of long-term debt, net |

— | — | 74,630 | — | ||||||||||||

| Amounts due to affiliated companies |

19,508 | 33,462 | 34,763 | 22,024 | ||||||||||||

| Long-term debt, net |

1,999,354 | 1,992,123 | 1,982,573 | 2,001,255 | ||||||||||||

| Other long-term liabilities |

9,512 | 19,130 | 23,097 | 4,210 | ||||||||||||

| Total liabilities |

2,187,524 | 2,205,519 | 2,333,236 | 2,135,713 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total shareholders’ equity(1) |

740,043 | 816,480 | 1,059,347 | 745,560 | ||||||||||||

| Total liabilities and shareholders’ equity(1) |

2,927,567 | 3,021,999 | 3,392,583 | 2,881,273 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Pro forma total shareholders’ equity(2) |

||||||||||||||||

| Pro forma participation interest(2) |

||||||||||||||||

| Pro forma total shareholders’ equity and participation interest(2) |

||||||||||||||||

| Pro forma total liabilities, shareholders’ equity and participation interest(2) |

||||||||||||||||

|

|

|

|

|

|

|

|||||||||||

| (1) | We adopted the New Revenue Standard using the modified retrospective method from January 1, 2018 and recognized an increase in opening balance of accumulated losses of US$3.3 million due to the cumulative effect of adopting the New Revenue Standard. Amounts for the period beginning after January 1, 2018 are presented under the New Revenue Standard, while prior period amounts are not adjusted and continue to be reported in accordance with the previous basis. |

| (2) | See “Unaudited Pro Forma Condensed Consolidated Financial Information” for the description of the assumptions underlying the pro forma calculations. |

19

Table of Contents

Key Operating Data

The following table presents the key operating data of Studio City for the periods indicated since the commencement of its operation on October 27, 2015.

| For the Year Ended December 31, |

For the Three Months Ended March 31, |

|||||||||||||||||||

| 2017 | 2016 | 2015 | 2018 | 2017 | ||||||||||||||||

| Selected Key Operating Data |

||||||||||||||||||||

| Mass market table games |

||||||||||||||||||||

| Mass market table games drop (US$ million) |

2,913.0 | 2,480.0 | 365.3 | 825.2 | 656.3 | |||||||||||||||

| Mass market table games hold percentage |

26.1% | 24.7% | 22.4% | 27.4% | 26.4% | |||||||||||||||

| Mass market table games gross gaming revenue(1) (US$ million) |

759.1 | 611.6 | 81.8 | 226.3 | 173.2 | |||||||||||||||

| Gaming machine |

||||||||||||||||||||

| Gaming machine handle (US$ million) |

2,120.5 | 2,002.3 | 264.9 | 581.6 | 497.4 | |||||||||||||||

| Gaming machine win rate |

3.7% | 3.8% | 4.9% | 3.7% | 3.7% | |||||||||||||||

| Gaming machine gross gaming revenue(2) (US$ million) |

78.2 | 76.0 | 12.9 | 21.2 | 18.4 | |||||||||||||||

| Average net win per gaming machine per day (US$) |

225 | 189 | 168 | 250 | 211 | |||||||||||||||

| VIP rolling chip(3) |

||||||||||||||||||||

| VIP rolling chip volume (US$ million) |

19,003.9 | 1,343.6 | — | 6,630.8 | 3,553.9 | |||||||||||||||

| VIP rolling chip win rate |

3.16% | 1.39% | — | 2.68% | 2.39% | |||||||||||||||

| VIP rolling chip gross gaming revenue(4) (US$ million) |

600.8 | 18.6 | — | 178.0 | 84.8 | |||||||||||||||

| Hotel |

||||||||||||||||||||

| Average daily rate (US$) |

140 | 136 | 136 | 139 | 139 | |||||||||||||||

| REVPAR (US$) |

138 | 133 | 133 | 139 | 138 | |||||||||||||||

| Occupancy rate |

99% | 98% | 98% | 100% | 99% | |||||||||||||||

| (1) | Mass market table games gross gaming revenue is calculated by multiplying mass market table games drop by mass market table games hold percentage. |

| (2) | Gaming machine gross gaming revenue is calculated by multiplying gaming machine handle by gaming machine win rate. |

| (3) | VIP rolling chip operations commenced in November 2016. There is no assurance such VIP tables at the Studio City Casino will continue to be in operation after October 1, 2019. |

| (4) | VIP rolling chip gross gaming revenue is calculated by multiplying VIP rolling chip volume by VIP rolling chip win rate. |

Non-GAAP Financial Measures

To supplement our consolidated financial statements, which are prepared and presented in accordance with U.S. GAAP, we use adjusted EBITDA, a non-GAAP financial measure, as described below, to understand and evaluate our core operating performance. This non-GAAP financial measure, which may differ from similarly titled measures used by other companies, is presented to enhance investors’ overall understanding of our financial performance and should not be considered a substitute for, or superior to, the financial information prepared and presented in accordance with U.S. GAAP.

Adjusted EBITDA is defined as earnings before interest, taxes, depreciation, amortization, pre-opening costs, property charges and other, other non-operating income and expenses. We believe that adjusted EBITDA provides useful information to investors and others in understanding and evaluating our operating results. This non-GAAP financial measure eliminates the impact of items that we do not consider indicative of the performance of our business. While we believe that this non-GAAP financial measure is useful in evaluating our business, this information should be considered as supplemental in nature and is not meant as a substitute for the related financial information prepared in accordance with U.S. GAAP. It should not be considered in isolation or

20

Table of Contents

construed as an alternative to net income/loss, cash flow or any other measure of financial performance or as an indicator of our operating performance, liquidity, profitability or cash flows generated by operating, investing or financing activities.

The use of adjusted EBITDA has material limitations as an analytical tool, as adjusted EBITDA does not include all items that impact our net income/loss. Investors are encouraged to review the reconciliation of the historical non-GAAP financial measure to its most directly comparable GAAP financial measure.

The table below presents the reconciliation of net (loss) income to adjusted EBITDA for the periods indicated.

| For the Year Ended December 31, | For the Three Months Ended March 31, |

|||||||||||||||||||||||

| 2017 | 2016 | 2015(2) | 2014(2) | 2018(3) | 2017 | |||||||||||||||||||

| (US$ thousands) | ||||||||||||||||||||||||

| Net (loss) income |

(76,437 | ) | (242,789 | ) | (232,560 | ) | (66,036 | ) | 8,849 | (26,513 | ) | |||||||||||||

| Income tax (credit) expense |

(239 | ) | 474 | 353 | — | 47 | (5 | ) | ||||||||||||||||

| Interest and other non-operating expenses, net |

157,126 | 187,549 | 42,930 | 37,651 | 39,228 | 39,360 | ||||||||||||||||||

| Property charges and other |

22,210 | 1,825 | 1,126 | — | 2,363 | — | ||||||||||||||||||

| Depreciation and amortization |

176,326 | 171,862 | 40,965 | 12,130 | 42,479 | 43,950 | ||||||||||||||||||

| Pre-opening costs |

116 | 4,044 | 153,515 | 14,951 | 42 | (19 | ) | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Adjusted EBITDA |

279,102 | 122,965 | 6,329 | (1,304 | ) | 93,008 | 56,773 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Adjusted EBITDA margin(1) |

51.7 | % | 29.0 | % | 9.1 | % | N/A | 59.3 | % | 46.8 | % | |||||||||||||

| (1) | Adjusted EBITDA margin is calculated by dividing adjusted EBITDA by total revenues. |

| (2) | We commenced operations in October 2015. |

| (3) | We adopted the New Revenue Standard using the modified retrospective method from January 1, 2018. Amounts for the period beginning after January 1, 2018 are presented under the New Revenue Standard, while prior period amounts are not adjusted and continue to be reported in accordance with the previous basis. There was no material impact on our results of operations and Adjusted EBITDA for the three months ended March 31, 2018 as a result of the adoption of the New Revenue Standard. |

21

Table of Contents

An investment in our ADSs involves significant risks. You should consider carefully all of the information in this prospectus, including the risks and uncertainties described below, before making an investment in our ADSs. Any of the following risks could have a material and adverse effect on our business, financial condition and results of operations. In any such case, the market price of our ADSs could decline, and you may lose all or part of your investment.

Risks Relating to Our Business

We have a short operating history compared to many of our competitors and are therefore subject to significant risks and uncertainties. Our short operating history may not be indicative of our future operating results and prospects.

We have a short business operating history compared to many of our competitors, and there is limited historical information available about us upon which you can base your evaluation of our business and prospects. Studio City commenced operations in October 2015. As a result, you should consider our business and prospects in light of the risks, expenses, uncertainties and challenges that we may face given our short operating history in the intensely competitive market of the gaming business. The historical performance at the other casinos operated by the Gaming Operator should not be taken as an indication of Studio City Casino’s future performance or the performance of our remaining project once it commences operations.

We may encounter risks and difficulties frequently experienced by companies with early stage operations, and those risks and difficulties may be heightened by challenging market conditions of the gaming business in Macau and other challenges our business faces. Certain of these risks relate to our ability to:

| • | operate, support, expand and develop our operations and our facilities; |

| • | respond to economic uncertainties; |

| • | respond to competitive market conditions; |

| • | fulfill conditions precedent to draw down or roll over funds from current and future credit facilities; |

| • | comply with covenants under our existing and future debt issuances and credit facilities; |

| • | respond to changing financial requirements and raise additional capital, as required; |

| • | complete the development of our remaining project for Studio City on time and in compliance with the conditions under the relevant land concession contract; |

| • | obtain the necessary authorizations, approvals and licenses from the relevant governmental authorities for the development of our remaining project for Studio City; |

| • | attract and retain customers and qualified staff; |

| • | maintain effective control of our operating costs and expenses; |

| • | maintain internal personnel, systems, controls and procedures to assure compliance with the extensive regulatory requirements applicable to our business as well as regulatory compliance as a public company; and |

| • | assure compliance with, and respond to changes in the regulatory environment and government policies. |