UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| [ ] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For The Fiscal Year Ended _______________________

or

| [X] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from July 1, 2019 to December 31, 2019

Commission File Number 333-220144

AGAPE ATP CORPORATION

(Exact name of registrant issuer as specified in its charter)

| Nevada | 36-4838886 | |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

1705 – 1708, Level 17, Tower 2, Faber Towers, Jalan Desa Bahagia,

Taman Desa, 58100 Kuala Lumpur, Malaysia.

(Address of principal executive offices, including zip code)

Registrant’s phone number, including area code

(60) 192230099

Securities registered pursuant to Section 12(b) of the Securities Exchange Act:

Common Stock, $0.0001 par value

(Title of Class)

The OTC Market – Pink Sheets

(Name of exchange on which registered)

Securities registered pursuant to Section 12(g) of the Securities Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES [X] NO [ ]

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (section 232.405 of this chapter) during the preceding twelve months (or shorter period that the registrant was required to submit and post such files). YES [X] NO [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer [ ] Accelerated Filer [X] Non-accelerated Filer [ ] Smaller reporting company [X]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

Emerging growth Company [X]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

The aggregate market value of the Company’s common stock held by non-affiliates computed by reference to the closing bid price of the Company’s common stock, as of the last business day of the registrant’s most recently completed second fiscal quarter:

$804,186,900.

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

| Class | Outstanding at March 25, 2020 | |

| Common Stock, $0.0001 par value | 376,275,500 |

AGAPE ATP CORPORATION

FORM 10-K

For the Fiscal Period Ended December 31, 2019

Index

| 2 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Transition Report on Form 10-K contains forward-looking statements. These forward-looking statements are not historical facts but rather are based on current expectations, estimates and projections. We may use words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “foresee,” “estimate” and variations of these words and similar expressions to identify forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted. These risks and uncertainties include the following:

| ● | The availability and adequacy of our cash flow to meet our requirements; | |

| ● | Economic, competitive, demographic, business and other conditions in our local and regional markets; | |

| ● | Changes or developments in laws, regulations or taxes in our industry; | |

| ● | Actions taken or omitted to be taken by third parties including our suppliers and competitors, as well as legislative, regulatory, judicial and other governmental authorities; | |

| ● | Competition in our industry; | |

| ● | The loss of or failure to obtain any license or permit necessary or desirable in the operation of our business; | |

| ● | Changes in our business strategy, capital improvements or development plans; | |

| ● | The availability of additional capital to support capital improvements and development; and | |

| ● | Other risks identified in this report and in our other filings with the Securities and Exchange Commission or the SEC. |

This report should be read completely and with the understanding that actual future results may be materially different from what we expect. The forward looking statements included in this report are made as of the date of this report and should be evaluated with consideration of any changes occurring after the date of this Report. We will not update forward-looking statements even though our situation may change in the future and we assume no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Use of Defined Terms

Except as otherwise indicated by the context, references in this Report to:

| ● | The “Company,” “we,” “us,” or “our,” “Agape” are references to Agape ATP Corporation, a Nevada corporation. | |

| ● | “Common Stock” refers to the common stock, par value $.0001, of the Company; | |

| ● | “U.S. dollar,” “$” and “US$” refer to the legal currency of the United States; | |

| ● | “Securities Act” refers to the Securities Act of 1933, as amended; and | |

| ● | “Exchange Act” refers to the Securities Exchange Act of 1934, as amended. |

| 3 |

PART I

1. ORGANIZATION AND BUSINESS BACKGROUND

Agape ATP Corporation, a Nevada corporation (“the Company”) was incorporated under the laws of the State of Nevada on June 1, 2016.

Agape ATP Corporation operates through its wholly owned subsidiary, Agape ATP Corporation, a Company organized in Labuan, Malaysia.

Agape ATP Corporation, incorporated in Labuan, Malaysia, is an investment holding company with 100% equity interest in Agape ATP International Holding Limited, a company incorporated in Hong Kong.

The Company and its subsidiaries provide health and wellness products and advisory services to the public. The principal activity of the Company and its subsidiaries is to supply high-quality health and wellness products, including supplement to assist in cell metabolism, detoxification, blood circulation, anti-aging and products designed to improve the overall health system in our body.

Details of the Company’s subsidiaries:

Subsidiary company name | Place and date of incorporation | Particulars of issued capital | Principal activities | Proportional of ownership interest and voting power held |

||||||||

| 1. | Agape ATP Corporation | Labuan, March 6, 2017 | 100 shares of ordinary share of US$1 each | Investment holding | 100 | % | ||||||

| 2. | Agape ATP International Holding Limited | Hong Kong, June 1, 2017 | 1,000,000 shares of ordinary share of HK$1 each | Health and wellness products and health solution advisory services | 100 | % | ||||||

Business Overview

Agape ATP Corporation is a company that provides health solution advisory services to our clients. We primarily focus our efforts on attracting customers in Malaysia. Our advisory services center on the “ATP Zeta Health Program”, which is a health program designed to effectively prevent diseases caused by polluted environments, unhealthy dietary intake and unhealthy lifestyles, and promotion of health. The program aims to promote improved health and longevity in our clients through a combination of modern medicine, proper nutrition and advice from skilled nutritionists and/or dieticians.

At its core, the ATP Zeta Super Health Program is focused upon biological energy, Adenosine Triphosphate (ATP), at the cellular level. The stimulation of ATP production at the cellular level can increase the metabolism and service to promote and maintain normal and healthy functioning of the body’s systems. As a strong advocator of “beauty from within”, our program shall emphasize nutrient absorption through the membrane ion channel to provide complete and balanced nutrients to improve cell health. Thus, ATP Zeta Super Health Program provides ionized and high zeta potential (high bioavailability) nutrients to enhance the absorption at the cellular level.

| 4 |

The ATP Zeta Super Health Program consists of eight products. None of these products are owned or produced by Agape ATP Corporation. In the event that any of these products are no longer produced, or are otherwise unavailable, we may have to devote significant effort to identifying and obtaining comparable replacement products. The ten products that comprise the ATP Zeta Super Health Program are ATP1s Survivor Select, ATP2 Energized Mineral Concentrate, ATP3 Ionized Cal-Mag, ATP4 Omega Blend, ATP5 BetaMaxx, AGN-Vege Fruit Fiber, AGP1-Iron and YFA-Young Formula.

At present, our products are mainly sold in Malaysia, and due to the contents and combination of the main ingredients in the products they are categorized as health food rather than medicines or drugs. As such, all products require authorization from the Food and Quality Division of Ministry of Health according to the Food Act of 1983 and Food Regulation 1985 in order to be sold in the country. All of the products in the ATP Zeta Super Health Program have obtained the appropriate authorizations.

As part of a continuous effort to increase market share of the health and wellness industry that is growing at an exponential rate, we will also evaluate adding additional products to the ATP Zeta Super Health Program; and considering the potential of the synergies between the health and beauty sectors, we will further involve ourselves in the topical approach of skin and hair regime.

Currently, all our products are acquired from unrelated third parties and rebranded by the Company. We have no expenditures or expenses relating to research and development of our products for our last two fiscal years. We leverage on the smart partnerships models that we have formed, collaborating with our customers and clients to understand the health and wellness market via a process of consultative review. We then communicate our findings and proposals to third-party suppliers to improve formulations, to bring about new products for customers who are ready to market to end-users. We refer to our approach as “the Power of 3”, which we take great pride in. In the future, we will explore sourcing from third party manufacturers located in Australia, the United States, Germany and Malaysia.

Our Products

ATP1s Survivor Select

ATP1s Survivor Select contains various essential nutrients required by the human body to maintain the normal metabolism, which includes productions of biological energy (ATP). Effective production of ATP enhances both physical as well as mental health, and helps the body to build up resistance to diseases.

| 5 |

It helps to:

| ● | Stimulate instant bio-energy production at the cellular level to ensure sufficient supply of bio energy for body cell. | |

| ● | Promote better metabolism at the cellular level. | |

| ● | Promote healthy and optimal growth of bones system, teeth structure and muscle tissue of children. | |

| ● | Improve the digestion and nutrient absorption powers of body cell. | |

| ● | Promote cell detoxification and repair capabilities in order to enhance cell self-healing ability. |

ATP2 Energized Mineral Concentrate

The ATP2 is a nutritional supplement made from the finest plant substances and also is a proprietary formulation of a super-energized colloidal concentrate developed from a dibase solution. Its formula supports and enhances nutritional biochemical activities.

It helps to:

| ● | Support and enhance nutritional biochemical activities (nutrient absorption and waste metabolism). | |

| ● | Break down or oxidised toxins and waste material to promote cellular detoxification and improve blood circulation. | |

| ● | Increase cellular respiration and energy production to reduce fatigue and maintain energy level. | |

| ● | Increase oxygen level in body cells to create a high oxygen environment in the body, which possibly help to prevent the growth of harmful pathogens that contribute to diseases. | |

| ● | Provide sufficient antioxidants that act as a superior scavenger of free radicals, to strengthen the body cells resistance against oxidative damages. |

| 6 |

ATP3 Ionized Cal-Mag

ATP3 Ionized Cal-Mag is a specialized calcium and magnesium minerals supplement that is designed to transform into ionic form completely before entering the body. This is compatible to the cellular ion channel theory, that all cellular metabolisms are dependent on ionic transmission to achieve the highest absorption rate. This product was tested for its nanoparticle by the National Measurement Institute of Australian Government, with proven content of nanosized calcium and magnesium that has better absorption and bio-availability.

It helps to:

| ● | Strengthen the bone system and promote better bone development. | |

| ● | Strengthen the teeth structure and prevent teeth damages. | |

| ● | Provide abundant of ionic calcium and magnesium to prevent chronic diseases through better blood circulation and acid-base regulation. | |

| ● | Promote better relaxing of nervous system and regulations of neurotransmitters which helps to enhance sleep quality. | |

| ● | Promote better relaxing of muscle to prevent muscle soreness and cramps. |

ATP4 Omega Blend

ATP4 Omega Blend is a proprietary oil blend that is rich in undamaged polyunsaturated essential fatty acid, which is fully extracted from plant-based ingredients. It provides a bio-effective balance of both essential fatty acids, Omega 3 and Omega 6 which are the important structural components of cell membranes that cannot be synthesized by humans.

| 7 |

It helps to:

| ● | Regulate cholesterol and triglycerides levels to promote better blood circulation. | |

| ● | Regulate inflammation, the unifying component of many diseases, and enhance cell repairing activities. | |

| ● | Regulate hormones production and functions in the body through supplies of the balanced ratio of Omega 3 and Omega 6. | |

| ● | Promote healthy functioning of the brain through the maintenance of healthy impulse transmission in brain cells that is crucial for memory and learning ability. |

ATP5 BetaMaxx

ATP5 BetaMaxx is derived from the cell wall of premium food-grade baker’s yeast and is a medical breakthrough result of more than 50 years of intensive research and studies by scientists and physicians. This product combines the immunostimulatory properties of perfectly molecularly structured beta 1-3, 1-6-D-glucan with other immunomodulating compounds that work in perfect synergy to make ATP5 a unique and effective natural product. It is a 100% natural immune enhancer, safe and does not cause any allergic reactions.

| 8 |

It helps to:

| ● | Strengthen the function of immune cells to build up a better immune response of body for external and internal protections | |

| ● | Promote better cell repairing and regulate inflammatory responses in wound healing. | |

| ● | Enhance the function of immune cell against damages caused by radiation. | |

| ● | Helps to normalize blood sugar levels. |

AGN-Vege Fruit Fiber

AGN-Vege Fruit Fiber is the special nutrition-based formula for intestines and stomach. It consists of four most essential components for gastrointestinal health effects such as fiber, probiotic the “friendly bacteria”, prebiotic fructooligosaccharides (FOS) as well as digestive enzymes.

| 9 |

It helps to:

| ● | Promote better bowel movement and prevent low-fiber diet-induced constipation. | |

| ● | Maintain bowel health. FOS helps increase intestinal bifidobacteria and helps maintain a good intestinal environment. | |

| ● | Slow the absorption of sugar and lipid into the bloodstream which helps improve blood sugar and cholesterol level. | |

| ● | Induce better satiety, which results in reduced total food intake and helps in achieving an ideal weight management. |

AGP1-Iron

AGP1-Iron is the purest and most advanced Colloidal Iron that is sourced from the remains of an ancient rainforest which contains the most active plant-based element from nature. The colloidal nanosized iron provides high zeta potential promotes better absorptivity and cellular iron uptake through the ion channel.

It helps to:

| ● | Promote better hemoglobin production to improve iron deficiency anemia. | |

| ● | Iron is a component of hemoglobin in red blood cell which carries oxygen to all part of the body. Therefore, it helps to improve blood circulation and prevent some oxygen deficiency symptoms through enhancement of oxygen delivery and nutrient circulation as well as toxins excretion. | |

| ● | Iron is a factor in red blood cell formation. It promotes hemoglobin production hence is suitable especially for women and individual who experienced accidental bleedings. |

| 10 |

YFA-Young Formula

YFA-Young Formula is a 100% natural unique formula, a combination of amino acid, vitamins, and minerals and is the best anti-aging and youthful maintenance supplement. It stimulates the pituitary gland to release endocrine hormones such as human growth hormone (HGH) to stimulate synergies thus achieving the efficacy of anti-ageing through the promotion of cells vitality and strengthening of organ function.

It helps to:

| ● | Enhance the production of bio-energy ATP and metabolism, which aids in reducing body fat accumulation and promote strong muscles building. | |

| ● | Stimulate the production of collagen to restore skin elasticity and reduce wrinkles. | |

| ● | Reduce pigmentation and dark spots on face caused by hormonal imbalances. | |

| ● | HGH builds and repairs tissues and thus has an effect on hair cells at the hair root to promote healthy hair growth. | |

| ● | Enhance memory and cardiovascular function and prevent various chronic diseases due to HGH deficiency. |

| 11 |

BEAUNIQUE Mito+ and Mitogize

We retire ATP Regal Mitogize on October 1, 2019. In its stead, an enhanced formula, the BEAUNIQUE Mito+ was introduced in November 2019. As a strong antioxidant drink with great flavor and taste, the preeminence of BEAUNIQUE Mito+ is its ability to further protect and stimulate mitochondria (the powerhouse of cells) in cellular energy (ATP) production with the added advantage of less total sugars and calories. The new formula comprises 11 Superfood including potent mangosteen skin extract. Backed by advanced scientific research and tested on 88 nutrigenomic profile, the new formulation revealed enhanced antioxidant properties. 96.34% DPPH Radical Scavenging activity, an approximate 22% increase compare to Mitogize.

It Promotes:

| Cellular health | ||

| ● | Effective antioxidants to protect from cellular oxidative damages. | |

| Immune health | ||

| ● | Enhance adaptive immune response. | |

| ● | Anti-inflammatory. | |

| ● | Strengthen immunity against bacteria and viruses. | |

| Metabolic health | ||

| ● | Reduce risk of obesity. | |

| ● | Reduce risk of vascular diseases. | |

| ● | Reduce risk of Type II Diabetic. | |

| Brain health | ||

| ● | Reduce risk of neurodegenerative diseases. | |

| Skin health | ||

| ● | Systemic photoprotection. | |

| ● | Reduce dark spot formation. | |

| ● | Alleviates skin wrinkle and inflammation induced by UV-B irradiation. | |

| 12 |

ORYC-Organic Youth Care Cleansing Bar

ORYC-Organic Youth Care Cleansing Bar is a natural, organic cleansing soap for skin. It contains pure Australian-accredited natural and organic plant oils acting as a high quality and natural skin lubricant. It maintains the softness of the skin while promoting skin beauty and radiance.

It helps:

| ● | With its biodynamic avocado oil and vanilla extract, remove impurities, leaving skin clear, fresh and clean. | |

| ● | With its biodynamic, coconut, almond and olive oil, moisturize and texturize the skin to prevent skin drying. | |

| ● | In acting as natural anti-bacterial and anti-inflammatory agents, reduce the risks of skin infections and allergies. |

*References alluding to the efficacy and effects of our products are based on client testimonials.

| 13 |

Beauty Products

The Company’s ENERGETIQUE series aim to provide a total dermal solution for a healthy skin beginning from the cellular level. The series is comprised of Energy Mask, Hyaluronic Acid Serum and Mousse Facial Cleanser.

ENERGY MASK SERIES

The Company’s Energetique Mask Series is formulated with triple action natural ingredients and advanced technologies. The innovative combination of award-winning patented liposome encapsulating the customized fast acting patented essence, produces micro-particle liposome which, combined with collagen peptide Tencel film, creates an effective formulation that benefits the skin at the cellular level.

There are three types of face masks in the Energetique Mask Series, each to suit a different skin requirement. They are: N°1 Med-Hydration; N°2 Med-Whitening; N°3 Med-Firming. Advanced genetic analysis and clinical trials conducted revealed the benefits and efficacies of the patented functional essence. The Energetique Mask Series has clinically shown deep penetration of liposomal essence into deep skin layers within 5 minutes of the application to deliver immediate, deep-reaching and long-lasting benefit of skin hydration, whitening, and firming.

N°1 Med-Hydration

Formulated with the patented Sea Grape (Caulerpa lentillifera) extract, the N°1 Med-Hydration enhances skin moisture and luminosity. This treatment effectively improves the moisture content of the inner skin layer and rejuvenate the skin barrier function to avoid moisture loss.

It helps:

| ● | locking the skin moisture and nutrients, strengthening the skin barrier function and boosting the skin’s moisture level. | |

| ● | to increase the skin’s natural moisturizing factor (PCA) and skin layer glycoprotein connectivity to maintain the skin’s moisture. | |

| ● | to effectively retain water, provides moisturization, restores skin elasticity, and promotes the growth of fibroblasts for moisturization, removes dryness, regains skin’s elasticity and smoothness. | |

| ● | immensely in delivering an instant boost of skin moisture content up to 45.7% in just 5 minutes of application and synergistically ensuring a profound and long-lasting skin moisturization and hydration. |

| 14 |

N°2 Med-Whitening

Formulated with patented Peach Blossom Stem Cell Extract, the N°2 Med-Whitening has clinically shown its efficacy in inhibiting the melanin synthesis, down-regulating the melanin synthesis gene, boosting skin moisture level and protecting skin against UV radiation.

It helps:

| ● | in suppressing melanin production and fight against UV radiation to protect skin cells and result in whitening effect. | |

| ● | to stimulate interstitial hyperplasia cell and helps in increasing the moisturizing ceramide by 7.4 times in order to remove skin roughness and smoothing skin. | |

| ● | to enhance the skin brightness up to 6.3% in just 5 minutes of application and synergistically rejuvenate a profound and long-lasting skin ability in anti-UV damage. |

N°3 Med-Firming

Formulated with the patented Djulis (Chenopodium formosanum Koidz) Seed Extract, the native cereal plant in Taiwan and traditionally called “ruby of cereals.” The formulation is clinically proven to be effective in stimulation of collagen secretion and anti-advances glycation end-products (AGEs) reducing the glycation of skin collagen, provide protection and maintenance of the basal skin collagen production.

| 15 |

It helps:

| ● | to suppress the skin collagen glycation process, reduces collagen loss, and enhancing collagen secretion. | |

| ● | repairing the dead skin tissue, smooth wrinkles to restore the smoothness and health of the skin. | |

| ● | preventing wrinkles formation and providing the essential skin moisture content. | |

| ● | to boost skin elasticity by up to 14.4%. and improve sagging skin by 135 in just 5 minutes of application. |

Unique Characteristics via Nutrigenomic

The Company’s BEAUNIQUE product series focuses on the research of diet’s impact on modifying gene expressions to address genetic variations and deliver a personalized nutrigenomic solution for every individual.

Trim+:

Trim+ is the first product launched under this series, utilizes the advanced technology to extract the patented active ingredients in foods. Trim+ has scientifically proven to be effective in inhibiting the activities of carbohydrates digestive enzymes, which results in a reduction of the breakdown and absorption of sugars.

It helps to:

| ● | Reduce total carbohydrates calories intake with the scientifically proven effect on weight management. | |

| ● | Regulate blood sugar levels with scientifically proven efficacy. | |

| ● | Improve cellular uptake of sugars for bioenergy ATP production. | |

| ● | Maintain insulin hormone balance, helps prevent diabetes. | |

| ● | Improve blood lipids composition, helps prevent cardiovascular disease. |

| 16 |

New Products Launches

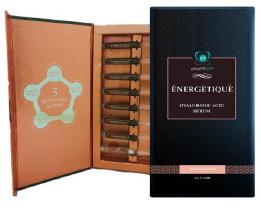

On 3rd November 2019, the Company expanded its beauty products under the ENERGETIQUE series, to include beauty essentials of the skincare routine, i.e. the ÉNERGÉTIQUE Mousse Facial Cleanser and ÉNERGÉTIQUE Hyaluronic Acid Serum. These new products have extended the ÉNERGÉTIQUE brand vision in offering a total dermal solution for a healthy skin beginning from the cellular level.

ÉNERGÉTIQUE Hyaluronic Acid (HA) Serum

Formulated with four functional hyaluronic acid and a unique peptide, this scientifically advanced and intensive quintuple action serum proven to deliver 5Rs dermal benefits. Filled in an innovative yet convenient and hygienics syringe packaging, this HA serum also ensure consumer-perceivable benefits for every skin type.

Benefits

| ● | REBALANCE - Hydrate the skin surface by forming a protection layer and keep skin moisturized even after cleansing | |

| ● | RECOVER – Repair the out-balanced lamellar layer to act as barrier to prevent skin moisture from evaporation | |

| ● | REGENERATE - Promote the production of Type I pro-collagen and boost skin’s own production of Hyaluronic Acid up to 3 times | |

| ● | REHYDRATE - Nano-sized particles with high capacity of water-holding allow deep penetration and bestows moisture from inside the skin. Long-lasting moisture retention up to 72 hours | |

| ● | REMODELLING - Proven to increase skin firmness +200% (cheek, under-eye and neck). Enhance skin viscoelasticity to improves skin roughness |

| 17 |

ÉNERGÉTIQUE Mousse Facial Cleanser

Formulated with the mildest surface-active agents available on the market, this facial cleanser was designed to deliver a distinct A to E cleansing benefits to consumers. The unique mousse like-foam delivers a comfortable and soft feeling of the skin during and after use without compromising the moisturizing level and viscoelastic properties of the skin.

Benefits

| A. | All Skin Type | |||

| a. | Hypoallergenic | |||

| b. | Non-comedogenic | |||

| B. | Balance | |||

| a. | pH-balanced formula with buffer capacity at pH 5.5 of the skin. | |||

| C. | Comfortable | |||

| a. | Mild to skin and eyes without irritating or drying your skin | |||

| b. | Comfortable and soft feeling – prolonged comfortable to skin before and after use. Accidental consuming would not be harmful to your body. | |||

| D. | Dense | |||

| a. | Mousse-like foam very fine porous foam and smooth skin-feel during use | |||

| E. | Effortlessly | |||

| a. | Easily remove light makeup, dirt and impurities. | |||

| b. | Easy to rinse with no residual. | |||

| 18 |

Future Plans

The World Health Organization or WHO, has since March 11, 2020 declared the corona virus or COVID-19 a pandemic. Malaysia, where our products are mainly sold at present, reported 553 cases of the COVID-19 on March 16, 2020; and the number is still rising. In view of the seriousness of the matter, the local government of Malaysia had, on the same day, imposed a nationwide lockdown effective March 18, 2020.

As the intermediary between our suppliers and our sole customer in Malaysia, the onslaught of the pandemic poses challenges to us at both sourcing and supplying our products. Our sole customer has confirmed that onward delivery of our products is via multi-level marketing or MLM to end users who are also members of the MLM group that make up consistent demand of our products. In an effort to embrace globalization, the MLM group has also embarked on e-commerce. The MLM group has synched up with a Malaysian e-commerce trading platform, which will make its debut in the next three months to commence e-marketing and e-trading of its products to members, as well as online e-recruitment of new members. The MLM group is positive that its online e-recruitment service which capitalizes on a large number of followers of well-known key products influencers will dramatically increase the number of members most expediently with minimal cost, thereby increasing demand of our products. Considering our products are health supplements, we also expect impressive demand growth at a time when everyone’s health is at risk. This should translate into sustainable growth once awareness of the importance of health is created.

Although some of the countries from which our products are sourced are experiencing lockdowns, industries involved in the provision of food, especially health products and pharmaceuticals, are normally exempted. We may experience slight delay in products delivery lead time, but barring unforeseen circumstances, the setback should be temporary.

We anticipate operating primarily in Malaysia and expanding into the Asian markets in the future, with a particular focus, at least initially, on expanding into Thailand, Indonesia and Taiwan. We will explore expansion via e-commerce. When the pandemic has subsided or is over and restrictions on travelling between nations are uplifted, we will set up offices in the countries in which we operate to better service our customers.

We plan to hire at least five to ten salespeople for every country in which we operate. At present, we do not have any salesforce. It will also be necessary for us to acquire office space to conduct operations, have meetings with potential clients, and store acquired inventory. At present, we do not have any distinct timeline in place for expansion into these countries.

We plan to hire additional employees to support our operations in different countries. We believe that hiring fifteen to twenty employees will be sufficient in order to support our operations. We also plan to allocate funds to research new products for the ATP Zeta Super Health Program. However, such development will require intensive research, development and testing. We cannot accurately determine a definitive timeline at present, nor have we determined an appropriate budget, for these future activities. We may also evaluate potential acquisitions in the future which we feel may have some synergy with our current operations.

Marketing

Agape ATP Corporation plans to penetrate the marketplace and attract customers by building our brand image through print ads, and possibly online paid advertisements, in order to create brand awareness. We are developing a corporate website which will introduce the ATP Zeta Super Health Program. We will market our advisory services through this corporate website and utilize marketing related search engines to attract potential clients to our website. Additionally, we will further our marketing activities through social networking websites.

| 19 |

Competition

The health and wellness industry, with a focus on health supplements in particular in Malaysia, where Agape ATP Corporation plans to operate, is rather competitive. Our focus is on the mature group of customers, i.e. adults ranging in age from 18-65 years old. We face competition from various retail health supplement providers, pharmacies, and Multi-Level Marketing Companies which supply health supplement products, such as Bio-Life Marketing Sdn Bhd, Elken Group, Usana Group, BMS Organics, NHF Group and their respective affiliates. These competitors are generating significant traffic to their marketing websites; and have established brand recognition and financial resources.

We believe that the principal competitive factors in our type of market include the quality of health supplements, the efficacies of the health supplements, strength and depth of relationships with clients, the ability to identify the changing needs and requirements of prospective clients, and the scope of services. Through utilizing our competitive strengths, we believe that we have a competitive edge over other competitors due to the breadth of our product offerings, one stop convenience, pricing, our services, our reputation and product safety. We are confident we can develop and enlarge our market share in the Malaysian market and potentially further into the overseas market.

Customers

Agape S.E.A. Sdn Bhd, a related party, remains our sole customer as at the end of the fiscal period ended December 31, 2019. Revenue generated for the six months ended December 31, 2019, years ended June 30, 2019 and 2018 were $429,362, $1,524,596 and $487,008 respectively.

Employees

We have no employees as of the date of this annual report, with the exception of our sole officer and director, Mr. How Kok Choong. Mr. How currently devotes approximately 30 hours per week to the Company’s matters. Mr. How Kok Choong plans to devote as much time as the Board of Directors determines is necessary for him to manage the affairs of the Company. As our business and operations increase, we plan to hire full time management and administrative support personnel.

Government regulation

At present, our products are mainly sold in Malaysia, and due to the contents and combination of the main ingredients in the products they are categorized as health food rather than medicines or drugs. As such, all products require authorization from the Food and Quality Division of Ministry of Health according to the Food Act of 1983 and Food Regulation 1985 in order to be sold in the country. All of the products in the ATP Zeta Super Health Program have obtained the appropriate authorizations.

| 20 |

Risks Related to our Business

We are exposed to concentration risk of heavy reliance on our major customer. A loss of our major customer may significantly impact on our business and results of operation.

For the six months ended December 31, 2019, we earned revenue of $429,362 from our major customer. Our major customer may terminate its business relationships with us at any time. We cannot assure you that our major customer will maintain current business relationship with us. If it chooses not to do so, our business, financial condition and operating results may suffer from a material adverse impact.

We are exposed to concentration risk of heavy reliance on our major supplier for the supply of our products, and any shortage of, or delay in, the supply may significantly impact on our business and results of operation.

For the six months ended December 31, 2019, we purchased $383,479 from two of our major suppliers. Our business, financial condition and operating results depend on the continuous supply of products from our major supplier and our continuous supplier-customer relationship with it. Our heavy reliance on our major supplier for the supply of our products will have significant impact on our business and results of operation in the event of any shortage of, or delay in the supply.

Our major supplier may terminate the distribution agreement by giving notice to us, in which case our business, financial condition and operating results may suffer from a material adverse impact.

As is customary in distribution arrangements of this type, the distribution agreement with our major supplier is terminable by either party by giving notice. There is no assurance that our major supplier will not terminate the distribution agreement. In the event that it terminates the distribution agreement, we will have to source products from other suppliers and we may not be able to secure supply of products with quantity and quality required to support our business or at all. Such termination may therefore have a material adverse impact on our business, financial condition and operating results if we fail to engage any other suppliers before the termination.

We are exposed to unforeseeable events of labor disputes, strike action or natural disasters or other accidents which may affect the supply of our products from our major supplier.

There is no assurance that our major supplier will continue to supply its products in the quantities and timeframes required by us to meet the needs of our customers or comply with its supply agreement with us. Our product supply may also be disrupted by potential labor disputes, strike action or natural disasters or other accidents affecting the supplier. If our supplier does not supply products to us in a timely manner or in sufficient quantities, our business, financial condition and operating results may be materially and adversely affected. Furthermore, in the event of any delay in delivery of the products to us, our cash flow or working capital may be materially and adversely affected as a result of the corresponding delay in delivery of our products to our customers, and hence the delay in our receipt of payment from our customers.

| 21 |

Our major supplier may change its existing sales or marketing strategy by changing its export strategy, reducing its sales or production volume, changing its selling prices or appointing other distributors which may compete with us in the market where we currently operate or which we plan to expand into.

Our major supplier may change its existing sales or marketing strategy in respect of the products supplied to us by changing its export strategy, reducing its sales or production volume or changing its selling prices. Consequently, there is no assurance that our major supplier will not appoint other dealers or distributors which may compete with us in the market where we operate. Furthermore, any significant increase in the selling prices of the products which we source from our supplier will increase our costs and may adversely affect our profit margin if we are not able to pass the increased costs on to our customers.

There is no assurance that there will be no deterioration in our relationship with our major supplier which could affect our ability to secure sufficient supply of products for our business. In the event that our major supplier changes its sales or marketing strategy or otherwise appoint other dealers or distributors who may compete with us, our business, financial condition and operating results may be materially and adversely affected.

We could be adversely affected by a change in consumer preferences, perception and spending habits and failure to develop or enrich our product offering or gain market acceptance of our new products could have a negative effect on our business.

The market we operate is subject to changes in consumer preference, perception and spending habits. Our performance depends significantly on factors which may affect the level and pattern of consumer spending in the market we operate. Such factors include consumer preference, consumer confidence, consumer income and consumer perception of the safety and quality of our products. Media coverage regarding the safety or quality of, or diet or health issues relating to, our products or the raw materials, ingredients or processes involved in their manufacturing, may damage consumer confidence in our products. A general decline in the consumption of our products could occur as a result of change in consumer preference, perception and spending habits at any time.

Any failure to adapt our product offering to respond to such changes may result in a decrease in our sales if such changes are related to certain of our products. Any changes in consumer preference could result in lower sales of our products, put pressure on pricing or lead to increased levels of selling and promotional expenses. In any event a decrease in customer demand on our products may also result in lower sales and slow down the consumption of our inventory to a low inventory turnover level. Any of these changes could result in a material adverse effect on our business, financial conditions or results of operations.

The success of our products depends on a number of factors including our ability to accurately anticipate changes in market demand and consumer preferences, our ability to differentiate the quality of our products from those of our competitors, and the effectiveness of our marketing and advertising campaigns for our products. We may not be successful in identifying trends in consumer preferences and developing products that respond to such trends in a timely manner. We also may not be able to effectively promote our products by our marketing and advertising campaigns and gain market acceptance. If our products fail to gain market acceptance, are restricted by regulatory requirements, or have quality problems, we may not be able to fully recover our costs and expenses incurred in our operation, and our business prospects, financial condition or results of operations may be materially and adversely affected.

| 22 |

We may incur losses resulting from product liability claims or product recalls.

We may incur losses resulting from product liability claims with respect to our products supplied by our supplier. We may face claims or liabilities which may arise if there exist any defects in quality of these products or any of these products are deemed or proven to be unsafe, defective or contaminated. In the event that the use or misuse of any product distributed by us results in personal injury or death, product liability and/or indemnity claims may be brought against us, in addition to our product recalls, and the relevant regulatory authorities in the market we operate may close down some of our related operations and take administrative actions against us. If we experience any business disruption and litigation, we may incur additional costs and have to divert our management’s attention and resources on such matters, which may adversely affect our business, financial condition and results of operations.

We operate in a heavily regulated industry.

Our business is principally regulated by various laws and regulations in the market we operate, such as in Malaysia the Food Act of 1983 and Food Regulation 1985 mandate authorization from the Food and Quality Division of the Ministry of Health for our Company’s products to be sold in the country.

Various registrations, certificates and/or licenses for the conduct of our business are required under the above laws, which also contain provisions for requirements on the storage, labelling, advertising and importation of some of our products.

Based on our experience, some of the laws and regulations of the place where we operate our business are subject to amendments, uncertainty in interpretation and administrative actions from time to time. Therefore, we cannot assure you that, for the implementation of our business plans and the introduction of any new product, we will be able to obtain all the necessary registrations, certificates and/or licenses. Any failure to comply with the above laws and regulations may give rise to fines, administrative penalties and/or prosecution against us, which may adversely affect our reputation, financial condition or results of operation.

Legal disputes or proceedings could expose us to liability, divert our management’s attention and negatively impact our reputation.

We may at times be involved in potential legal disputes or proceedings during the ordinary course of business operations relating to product or other types of liability, employees’ claims, labor disputes or contract disputes that could have a material and adverse effect on our reputation, operation and financial condition. If we become involved in material or protracted legal proceedings or other legal disputes in the future, the outcome of such proceedings could be uncertain and could result in settlements or outcomes which adversely affect our financial condition. In addition, any litigation or legal proceedings could incur substantial legal expenses as well as significant time and attention of our management, diverting their attention from our business and operations.

If we are not successful in our innovation activities, our results may be negatively affected.

Achieving our business growth objectives depends in part on our ability to successfully develop, introduce and market new products. The success of our innovation activities in turn depends on our ability to correctly anticipate customer and consumer acceptance and trends, obtain, maintain and enforce necessary intellectual property protections and avoid infringing on the intellectual property rights of others. If we are not successful in our innovation activities, we may not be able to achieve our growth objectives, which may have a negative impact on our financial results.

| 23 |

Fluctuations in foreign currency exchange rates could have a material adverse effect on our financial results.

We earn revenues, pay expenses, own assets and incur liabilities in countries using currencies other than the U.S. dollar, including Australian Dollar, Malaysian Ringgit and the Hong Kong Dollar. Because our consolidated financial statements are presented in U.S. dollars, we must translate revenues, income and expenses, as well as assets and liabilities, into U.S. dollars at exchange rates in effect during or at the end of each reporting period. Therefore, increases or decreases in the value of the U.S. dollar against other currencies affect our net operating revenues, operating income and the value of balance sheet items denominated in foreign currencies. We cannot assure you that fluctuations in foreign currency exchange rates, particularly the strengthening of the U.S. dollar against major currencies would not materially affect our financial results.

Our business depends on the continued contributions made by Mr. How Kok Choong, as our key executive officer, the loss of who may result in a severe impediment to our business.

Our success is dependent upon the continued contributions made by our CEO and President, Mr. How Kok Choong. We rely on his expertise in business operations when we are developing our business. We have no “Key Man” insurance to cover the resulting losses in the event that any of our officer or directors should die or resign.

If Mr. How Kok Choong cannot serve the Company or is no longer willing to do so, the Company may not be able to find alternatives in a timely manner or at all. This would likely result in a severe damage to our business operations and would have an adverse material impact on our financial position and operating results. To continue as a viable operation, the Company may have to recruit and train replacement personnel at a higher cost.

Additionally, if Mr. How Kok Choong joins our competitors or develops similar businesses that are in competition with our Company, our business may also be negatively impacted.

Our future success depends on our ability to attract and retain qualified long-term staff to fill management, technology, sales, marketing, and customer services positions. We have a great need for qualified talent, but we may not be successful in attracting, hiring, developing, and retaining the talent required for our success.

If we are not able to achieve our overall long-term growth objectives, the value of an investment in our Company could be negatively affected.

We have established and publicly announced certain long-term growth objectives. These objectives were based on, among other things, our evaluation of our growth prospects, which are generally driven by the sales potential of many product types, some of which are more profitable than others, and on an assessment of the potential price and product mix. There can be no assurance that we will realize the sales potential and the price and product mix necessary to achieve our long-term growth objectives.

We face risks related to health epidemics, severe weather conditions and other outbreaks.

In recent years, there have been outbreaks of epidemics in various countries, including Malaysia. Recently, there was an outbreak of a novel strain of coronavirus (COVID-19), which has spread rapidly to many parts of the world, including Malaysia. In March 2020, the World Health Organization declared the COVID-19 a pandemic. The epidemic has resulted in quarantines, travel restrictions, and the temporary closure of stores and facilities in Malaysia for the past few weeks.

Substantially all of our revenues are concentrated in Malaysia. Consequently, our results of operations will likely be adversely, and may be materially, affected, to the extent that the COVID-19 or any other epidemic harms the Malaysia and global economy in general. Any potential impact to our results will depend on, to a large extent, future developments and new information that may emerge regarding the duration and severity of the COVID-19 and the actions taken by government authorities and other entities to contain the COVID-19 or treat its impact, almost all of which are beyond our control. Potential impacts include, but are not limited to, the following:

| ● | temporary closure of offices, travel restrictions, financial impact of our customers or suspension supplies may negatively affected, and could continue to negatively affect, the demand for our products; |

| 24 |

| ● | our sole customer may require additional time to pay us or fail to pay us at all, which could significantly increase the amount of accounts receivable and require us to record additional allowances for doubtful accounts. We may have to provide significant sales incentives to our sole customer during the outbreak, which may in turn materially adversely affect our financial condition and operating results; | |

| ● | any disruption of our supply chain, logistics providers or customers could adversely impact our business and results of operations, including causing us or our suppliers to cease manufacturing for a period of time or materially delay delivery to our sole customer, which may also lead to loss of our sole customer; and | |

| ● | the global stock markets have experienced, and may continue to experience, significant decline from the COVID-19 outbreak and the marketable securities that we have invested in could be materially adversely affected, which may lead to significant impairment in the fair values of our investments and in turn materially adversely affect our financial condition and operating results. |

Because of the uncertainty surrounding the COVID-19 outbreak, the financial impact related to the outbreak of and response to the coronavirus cannot be reasonably estimated at this time. There is no guarantee that our total revenues will grow or remain at the similar level year over year in the next three quarters of 2020. We may have to record downward adjustments or impairment in the fair value of investments in the first quarter of 2020, if conditions have not been significantly improved and global stock markets have not recovered from recent declines.

In general, our business could be adversely affected by the effects of epidemics, including, but not limited to, the COVID-19, avian influenza, severe acute respiratory syndrome (SARS), the influenza A virus, Ebola virus, severe weather conditions such as flood or hazardous air pollution, or other outbreaks. In response to an epidemic, severe weather conditions, or other outbreaks, government and other organizations may adopt regulations and policies that could lead to severe disruption to our daily operations, including temporary closure of our offices and other facilities. These severe conditions may cause us and/or our partners to make internal adjustments, including but not limited to, temporarily closing down business, limiting business hours, and setting restrictions on travel and/or visits with clients and partners for a prolonged period of time. Various impact arising from a severe condition may cause business disruption, resulting in material, adverse impact to our financial condition and results of operations.

Risks Related to our Industry

Our business and reputation may be affected by product liability claims, litigation, customer complaints, product tampering, food safety issues, food-borne illnesses, health threats, quality control concerns or adverse publicity relating to our products. Product liability insurance of our supplier may not cover our liability sufficiently or at all.

Like other consumer product manufacturers, sale of our products involves an inherent risk of our products being found to be unfit for consumption or cause illness. Products may be rendered unfit for consumption due to raw materials or product contamination or degeneration, presence of microbials, illegal tampering of products by unauthorized third parties or other problems arising during the various stages of the procurement, production, transportation and storage processes. The occurrence of such problems may result in customer complaints, fines, penalties or adverse publicity causing serious damage to our reputation and brand, as well as product liability claims, other legal disputes and loss of revenues. Under certain circumstances, we may be required to recall our products. Even if a situation does not necessitate a product recall, we cannot assure you that product liability claims or other legal disputes will not be asserted against us as a result. Product liability insurance of our supplier may not cover our liability sufficiently or at all and will not cover liability that arises out of our default such as mishandling, poor storage condition and/or contamination of the products by us. As a result, a product liability or other judgment against us, or a product recall, could have a material adverse effect on our business, financial condition or results of operations.

| 25 |

Our business is susceptible to food-borne illnesses. We cannot assure you that we are able to effectively prevent all diseases or illnesses caused by our products or contamination of our products. Furthermore, our reliance on third-party product suppliers means that food-borne illness incidents could be caused by our suppliers outside of our control. New illnesses may develop in the future, or diseases with long incubation periods could arise that could give rise to claims or allegations on a retroactive basis. Reports in the media of instances of food-borne illnesses or health threats of our products or any of their major ingredients could adversely and significantly affect our sales, and have significant negative impact on our results of operations. This risk exists even if it were later determined that the illness or health threat in fact was not caused by our products.

In addition, adverse publicity about health and safety concerns, whether unfounded or not, may discourage consumers from buying our products. Even if a product liability claim is unsuccessful or is not fully pursued, the negative publicity surrounding any assertion that our products caused personal injury or illness could adversely affect our reputation and our corporate and brand image. If consumers were to lose confidence in our brand and reputation, we could suffer long-term or even permanent declines in our sales and results of operation. The amount of negative news, customers complaints and claims against us may also be very costly and may divert our management’s attention from our business operation.

Increased competition and capabilities in the marketplace could hurt our business.

The market where we operate is highly competitive. We compete with other companies that operate in multiple geographic areas, as well as numerous companies that are primarily regional or local in operation. Our ability to gain or maintain share of sales in the market where we operate or in various local markets may be limited as a result of actions by competitors. If we do not continue to strengthen our capabilities in marketing and innovation to maintain our brand loyalty and market share while we selectively expand into other product categories, our business could be negatively affected.

Risks Related to our Common Stock

The market price of our shares is likely to be highly volatile and subject to wide fluctuations in response to factors such as:

| ● | variations in our actual and perceived operating results, especially during this time when the COVID-19 pandemic poses a threat; | |

| ● | news regarding gains or losses of customers or suppliers by us or our competitors; | |

| ● | news regarding gains or losses of key personnel by us or our competitors; | |

| ● | announcements of competitive developments, acquisitions or strategic alliances in our industry by us or our competitors; | |

| ● | changes in earnings estimates or buy/sell recommendations by financial analysts; | |

| ● | potential litigation; | |

| ● | the imposition of fines or penalties related to our activities in the market where we operate and failure to comply with applicable rules and regulations; | |

| ● | general market conditions or other developments affecting us or our industry; and | |

| ● | the operating and stock price performance of other companies, other industries and other events or factors beyond our control. |

| 26 |

In addition, the securities markets have from time to time experienced significant price and volume fluctuations that are not related to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of the shares.

We may never be able to pay dividends and are unlikely to do so.

To date, we have not paid, nor do we intend to pay in the foreseeable future, dividends on our common stock, even if we become profitable. Earnings, if any, are expected to be used to advance our activities and for working capital and general corporate purposes, rather than to make distributions to stockholders. Since we are not in a financial position to pay dividends on our common stock and future dividends are not presently being contemplated, investors are advised that return on investment in our common stock is restricted to an appreciation in the share price. The potential or likelihood of an increase in share price is uncertain.

In addition, under Nevada law, we may only pay dividends subject to our ability to service our debts as they become due and provided that our assets will exceed our liabilities after the dividend. Our ability to pay dividends will therefore depend on our ability to generate sufficient profits.

Shareholders may be diluted significantly through our efforts to obtain financing and satisfy obligations through the issuance of securities.

Wherever possible, our board of directors will attempt to use non-cash consideration to satisfy obligations. In many instances, we believe that the non-cash consideration will consist of shares of our common stock, warrants to purchase shares of our common stock or other securities. Our board of directors has authority, without action or vote of the shareholders, to issue all or part of the authorized but unissued shares of common stock or warrants to purchase such shares of common stock. In addition, we may attempt to raise capital by selling shares of our common stock, possibly at a discount to market in the future. These actions will result in dilution of the ownership interests of existing shareholders and may further dilute common stock book value, and that dilution may be material. Such issuances may also serve to enhance existing management’s ability to maintain control of us, because the shares may be issued to parties or entities committed to supporting existing management.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

Business support services are rendered from:

Our principal executive office at 1705 – 1708, Level 17, Tower 2, Faber Towers, Jalan Desa Bahagia, Taman Desa, 58100 Kuala Lumpur, Malaysia. |

Room 2708-9, 2F, The Metropolis Tower, 10 Metropolis Drive, Hunghom, Kowloon, Hong Kong. |

| 27 |

ITEM 3. LEGAL PROCEEDINGS

From time to time, we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business. Litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business. There are currently no pending legal proceedings or claims that we believe will have a material adverse effect on our business, financial condition or operating results. None of our directors, officers or affiliates is involved in a proceeding adverse to our business or has a material interest adverse to our business.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

| 28 |

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our Common Stock is currently listed on the OTC Markets – Pink Sheets under the trading symbol “ATTP.” There is no active trading market in the Company’s securities.

Holders

As of December 31, 2019, we had 376,275,500 shares of our Common Stock par value, $0.0001 issued and outstanding. There were 1,208 record holders of our Common Stock.

Transfer Agent and Registrar

Our transfer agent is VStock Transfer, LLC, with an address at 18, Lafayette Place, Woodmere, New York 11598 and telephone number is +1 (212)828-843.

Dividend Policy

Any future determination as to the declaration and payment of dividends on shares of our Common Stock will be made at the discretion of our board of directors out of funds legally available for such purpose. We are under no contractual obligations or restrictions to declare or pay dividends on our shares of Common Stock. In addition, we currently have no plans to pay such dividends. Our board of directors currently intends to retain all earnings for use in the business for the foreseeable future.

Equity Compensation Plan Information

Currently, there are no equity compensation plan in place.

Unregistered Sales of Equity Securities

None.

Purchases of Equity Securities by the Registrant and Affiliated Purchasers

We have not repurchased any shares of our common stock during the six months ended December 31, 2019.

ITEM 6. SELECTED FINANCIAL DATA

The following table sets forth selected financial data as of December 31, 2019 and for our last four fiscal years (from the date of incorporation of the Company), This selected financial data should be read in conjunction with the consolidated financial statements and related notes included in Item 15 of this Annual Report.

| Years ended June 30, | ||||||||||||

| 2019 | 2018 | 2017 | ||||||||||

| Revenue | $ | 1,546,057 | $ | 487,005 | $ | - | ||||||

| Net loss | $ | (519,642 | ) | $ | (130,274 | ) | $ | (75,362 | ) | |||

| Net loss per share – (basic and diluted) | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | |||

| 29 |

| As of June 30, | ||||||||||||

| 2019 | 2018 | 2017 | ||||||||||

| Total assets | $ | 4,651,755 | $ | 5,128,531 | $ | 2,312,748 | ||||||

| Total liabilities | $ | 71,402 | $ | 29,750 | $ | 8,100 | ||||||

| Six months ended December 31, | ||||||||||||

| 2019 | 2018 | 2017 | ||||||||||

| (unaudited) | (unaudited) | |||||||||||

| Revenue | $ | 429,362 | $ | 685,288 | $ | 489,499 | ||||||

| Net loss | $ | (338,931 | ) | $ | (142,446 | ) | $ | (178,678 | ) | |||

| Net loss per share – (basic and diluted) | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | |||

| As of December 31, | ||||||||||||

| 2019 | 2018 | 2017 | ||||||||||

| (unaudited) | (unaudited) | |||||||||||

| Total assets | $ | 4,335,274 | $ | 5,198,181 | $ | 2,708,503 | ||||||

| Total liabilities | $ | 83,988 | $ | 241,847 | $ | 144,289 | ||||||

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion of our financial condition and results of operations should be read in conjunction with our audited consolidated financial statements and the notes to those financial statements appearing elsewhere in this Report.

Certain statements in this Report constitute forward-looking statements. These forward-looking statements include statements, which involve risks and uncertainties, regarding, among other things, (a) our projected sales, profitability, and cash flows, (b) our growth strategy, (c) anticipated trends in our industry, (d) our future financing plans, and (e) our anticipated needs for, and use of, working capital. They are generally identifiable by use of the words “may,” “will,” “should,” “anticipate,” “estimate,” “plan,” “potential,” “project,” “continuing,” “ongoing,” “expects,” “management believes,” “we believe,” “we intend,” or the negative of these words or other variations on these words or comparable terminology. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this filing will in fact occur. You should not place undue reliance on these forward-looking statements.

The forward-looking statements speak only as of the date on which they are made, and, except to the extent required by federal securities laws, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date on which the statements are made or to reflect the occurrence of unanticipated events.

Overview

Agape ATP Corporation, a Nevada corporation (“the Company”) was incorporated under the laws of the State of Nevada on June 1, 2016. Agape ATP Corporation operates through its wholly owned subsidiary, Agape ATP Corporation, a company organized in Labuan, Malaysia, which, in turn holds 100% of Agape ATP International Holding Limited, a Hong Kong Company.

| 30 |

Agape ATP Corporation is a company that provides health and wellness products and solution advisory services to our clients. We primarily focus our efforts on attracting customers in Malaysia. Our advisory services center on the “ATP Zeta Health Program”, which is a health program designed to effectively prevent diseases caused by polluted environments, unhealthy dietary intake and unhealthy lifestyles, and promotion of health. The program aims to promote improved health and longevity in our clients through a combination of modern medicine, proper nutrition and advice from skilled nutritionists and/or dieticians.

At its core, the ATP Zeta Super Health Program is focused upon biological energy, Adenosine Triphosphate (ATP), at the cellular level. The stimulation of ATP production at the cellular level can increase the metabolism and service to promote and maintain normal and healthy functioning of the body’s systems. As a strong advocator of “beauty from within”, our program shall emphasize nutrient absorption through the membrane ion channel to provide complete and balanced nutrients to improve cell health. Thus, ATP Zeta Super Health Program provides ionized and high zeta potential (high bioavailability) nutrients to enhance the absorption at the cellular level.

The ATP Zeta Super Health Program consists of ten products. None of these products are owned or produced by Agape ATP Corporation. In the event that any of these products are no longer produced, or are otherwise unavailable, we may have to devote significant effort to identifying and obtaining comparable replacement products. The ten products that comprise the ATP Zeta Super Health Program are ATP1s Survivor Select, ATP2 Energized Mineral Concentrate, ATP3 Ionized Cal-Mag, ATP4 Omega Blend, ATP5 BetaMaxx, AGN-Vege Fruit Fiber, AGP1-Iron, YFA-Young Formula, ATPR-Mito + and ORYC-Organic Youth Care Cleansing Bar.

At present, our products are mainly sold in Malaysia, and due to the contents and combination of the main ingredients in the products they are categorized as health food rather than medicines or drugs. As such, all products require authorization from the Food and Quality Division of Ministry of Health according to the Food Act of 1983 and Food Regulation 1985 in order to be sold in the country. All of the products in the ATP Zeta Super Health Program have obtained the appropriate authorizations.

As part of a continuous effort to increase market share of the health and wellness industry that is growing at an exponential rate, we will also evaluate adding additional products to the ATP Zeta Super Health Program; and considering the potential of the synergies between the health and beauty sectors, we will further involve ourselves in the topical approach of skin and hair regime.

Currently, all our products are acquired from unrelated third parties and rebranded by us. We have no expenditures or expenses relating to research and development of our products for our last two fiscal years. We leverage on the smart partnerships model that we have formed, collaborating with our customers and clients to understand the health and wellness market via a process of consultative review. We then communicate our findings and proposals to third-party suppliers to improve formulations, to bring about new products for customers who are ready to market to end-users. We refer to our approach as “the Power of 3”, which we take great pride in. In the future, we will explore sourcing from third party manufacturers located in Australia, the United States, Germany and Malaysia.

As of December 31, 2019, June 30, 2019, and December 31, 2018, our accumulated deficit was $1,089,209, $750,278 and $373,082 respectively. Our stockholders’ equity was $4,251,286, $4,580,353 and $4,956,334, respectively. We have generated $429,362 in revenue for the six months ended December 31, 2019.

| 31 |

Results of Operation

For the six months ended December 31, 2019 and 2018

Revenue

The Company generated revenue of $429,362 for the six months ended December 31, 2019 as compared to $685,288 for the six months ended December 31, 2018. The revenues were mainly derived from the sale of health and wellness products. The decrease in revenue mainly due to lower demand from our related party customer, whom spend less marketing effort to promote its products during the six months ended December 31, 2019 as compared to the same period in 2018.

Cost of Revenue

Cost of revenue for the six months ended December 31, 2019 amounted to $383,479 as compared to $619,355 for the six months ended December 31, 2018. The costs were predominantly cost of goods and packing materials. The decrease in cost of revenue was in line with the decease of revenues for the six months ended December 31, 2019 as compared to the same period in 2018.

Gross Profit

Gross profit for the six months ended December 31, 2019 amounted to $45,883 as compared to $65,933 for the six months ended December 31, 2018. Gross margin for the six months ended December 31, 2019 was approximately 10.7% as compared to approximately 9.6% for the six months ended December 31, 2018. The slightly increase of gross margin was mainly due to the slight increase of our selling price of our health and wellness products.

Operating Expenses

Selling, general and administrative (“SG&A”) expenses for the six months ended December 31, 2019 amounted to $312,270 as compared to $63,068 for the six months ended December 31, 2018. The amount mainly comprised of rental of office premises, travelling, licensing and professional fees which includes legal, audit, accounting and consulting services. The increase of SG&A expenses of approximately $249,000 or 395.1% are mainly due to the increase of professional fees of approximately $200,000 as we have recently hired new professional firm located in the U.S. and Hong Kong, including legal counsel, auditor, and financial reporting consultant, to strengthen our current Securities and Exchange Commission (“SEC”) listing reporting documents and continue to stay compliance as compared to the six months ended December 31, 2018, we were using local professional firms in Malaysia. Professional fee incurred by the U.S. and Hong Kong firms are generally higher than the professional fee incurred by the Malaysia firms. The increase of SG&A was also due to the increase of approximately $32,000 of travelling expenses for our CEO for potential business developments.

Other Income (Expenses)

For the six months ended December 31, 2019, we recorded an amount of $72,544 as other expenses, net as compared to $138,346 for the six months ended December 31, 2018. During the six months ended December 31, 2019, we recorded approximately $68,000 on unrealized holding loss on marketable securities upon the adoption of ASU 2016-01 on July 1, 2019. The net other expenses of $138,346 incurred during the six months ended December 31, 2018 comprised interest income of $43,000 and net foreign currency translation losses of $83,000 and approximately $98,000 on share of results of investee company from our equity investment.

| 32 |

Net Loss

The Company sustained net loss of $338,931 and $142,446 for the six months ended December 31, 2019 and 2018 respectively. The losses sustained from both of the financial periods were predominantly due to reasons as discussed above.

For the years ended June 30, 2019 and 2018

Revenues

The Company generated revenue of $1,546,057 for the year ended June 30, 2019 as compared to $487,005 for the year ended June 30, 2018. The revenue is mainly derived from the sale of health and wellness products. The increase in revenue mainly due to higher demand from our related party customer as the overall national economy in Malaysia has improved. The end users of our products, who purchase the products from our related party, has more to spend and increased their demand of using our health and wellness products during the year ended June 30, 2019 as compared to the same period in 2018. As a result, our related party has purchased more products from us.

Cost of Revenue

Cost of revenue for the year ended June 30, 2019 amounted to $1,436,705 as compared to $441,409 for the year ended June 30, 2018. The cost mainly consists of cost of goods and packing materials. The increase in cost of revenue was in line with the increase of revenues for the year ended June 30, 2019 as compared to the same period in 2018.

Gross Profit

Gross profit for the year ended June 30, 2019 amounted to $109,352 as compared to $45,596 for the year ended June 30, 2018. Gross margin for the year ended June 30, 2019 was approximately 7.1% as compared to approximately 9.4% for the year ended Jun 30, 2018. The decrease of gross margin was mainly due to the increased of freight in cost of the product labels that we specifically ordered from Taiwan and sent to our manufacturing vendors in the U.S., Germany and Australia during the year ended June 30, 2019.

Operating Expenses

Selling, general and administrative (“SG&A”) expenses for the year ended June 30, 2019 amounted to $240,522 as compared to $279,682 for the year ended June 30, 2018. The amount mainly comprised of rental of office premises, travelling, licensing and professional fees which includes legal, audit, accounting and consulting services. The decrease of SG&A expenses of approximately $39,000 or 14.0% are mainly due to the decrease of professional fees as we have incurred more professional fees during the year ended June 30, 2018 throughout the initial public offerings (“IPO”) stage from July 1, 2017 until the completion of IPO in March 2018 as compared to the year ended June 30, 2019, our professional fee was mainly incurred from regularly SEC compliance and reporting fee.

Other Income (Expenses)