UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

| [ ] | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) or (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| [X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

OR

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| [ ] | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

For the transition period from to

Commission file number 001-38396

BIOFRONTERA AG

(Exact name of Registrant as specified in its charter)

(Translation of Registrant’s name into English)

Germany

(Jurisdiction of incorporation or organization)

Hemmelrather Weg 201

D-51377 Leverkusen Germany

Telephone: 011 49 214 876 00

(Address of principal executive office)

Thomas Schaffer

Chief Financial Officer

Biofrontera AG

Hemmelrather Weg 201

51377 Leverkusen, Germany

Tel: +49 (0)214 873 3200, Fax: +49 (0)214 8763290

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

Title of each class |

Name of each exchange on which registered | |

American Depositary Shares, each representing two ordinary shares, nominal value €1.00 per share |

Nasdaq Capital Market | |

| Ordinary shares, nominal value €1.00 per share* | Nasdaq Capital Market |

| * | Not for trading, but only in connection with the registration of the American Depositary Shares. |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

Indicate the number of outstanding shares of each of the issuer’s class of capital or common stock as of the close of the period

Covered by the annual report.

Ordinary shares, nominal value €1.00 per share: 38,416,828 as of December 31, 2017

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

If this report is an annual or transition report, indicate by check mark, if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes [ ] No [X]

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [ ] Emerging Growth Company [X]

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. [ ]

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP [ ] | International Financial Reporting Standards as issued by the International Accounting Standards Board [X] |

Other [ ] |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow: Item 17 [ ] Item 18 [ ]

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. [ ] Yes [ ] No

TABLE OF CONTENTS

Unless otherwise indicated, all references in this annual report to “Biofrontera”, “we”, “us”, or “company” refer to Biofrontera AG and its consolidated subsidiaries, Biofrontera Pharma GmbH, Biofrontera Bioscience GmbH, Biofrontera Neuroscience GmbH, Biofrontera Development GmbH and Biofrontera Inc.

TRADEMARKS

We own or have rights to trademarks and trade names that we use in connection with the operation of our business, including our corporate name, logos, product names and website names. Other trademarks and trade names appearing in this annual report are the property of their respective owners. Solely for your convenience, some of the trademarks and trade names referred to in this annual report are listed without the® and TM symbols, but we will assert, to the fullest extent under applicable law, our rights, or the rights of the applicable licensor, to our trademarks and trade names.

PRESENTATION OF FINANCIAL INFORMATION

Unless otherwise indicated, the consolidated financial statements and related notes included in this annual report have been presented in euros, or €, and have been prepared in accordance with International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB. None of the consolidated financial statements in this annual report were prepared in accordance with United States generally accepted accounting principles. For any of our subsidiaries that use a functional currency that is not euros, the assets and liabilities have been translated at the closing exchange rate as of the relevant balance sheet date (twelve months ended December 31, 2017: 1.2022 U.S. dollars to 1 euro; December 31, 2016: 1.0516 U.S. dollars to 1 euro, December 31, 2015: 1.0906), while the income and expenses have been translated at the average exchange rates (twelve months ended December 31, 2017: 1.1301 U.S. dollars to 1 euro; December 31, 2016: 1.1066 U.S. dollars to 1 euro) applicable to the relevant period. The differences resulting from the valuation of equity at historical rates and applying the period-end exchange rates are reported as a change not affecting profit or loss and carried directly to equity within the other equity components. Transactions realized in currencies other than euros are reported using the exchange rate on the date of the transaction. Assets and liabilities are translated applying the closing exchange rate for each balance sheet date. Gains and losses arising from such currency translations are recognized in income. See “Summary of Significant Accounting Policies — Translation of Amounts in Foreign Currencies” in the notes to our consolidated financial statements included elsewhere in this annual report for more information.

Certain information in this annual report is expressed in U.S. dollars. The noon buying rate of the Federal Reserve Bank of New York for the euro on March 31, 2018 was €1.00 to $1.2320. We make no representation that the euro or U.S. dollar amounts referred to in this annual report could have been converted into U.S. dollars or euros, as the case may be, at any particular rate or at all. See “Risk Factors — Our international operations may pose currency risks, which may adversely affect our operating results and net income.” We use the symbol “$” to refer to the U.S. dollar and use the symbol “€” to refer to the euro herein.

All references in this annual report to “$,” “US$,” “U.S.$,” “U.S. dollars,” “dollars” and “USD” mean U.S. dollars and all references to “€” and “euros,” mean euros, unless otherwise noted. Throughout this annual report, references to ADSs mean American Depositary Shares or ordinary shares represented by ADSs, as the case may be.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report includes forward-looking statements that involve substantial risks and uncertainties. All statements, other than statements of historical facts, included in this annual report regarding our strategy, future operations, regulatory process, future financial position, future revenue, projected costs, prospects, plans, objectives of management and expected market growth are forward-looking statements. The words “believe”, “anticipate”, “intend”, “expect”, “target”, “goal”, “estimate”, “plan”, “assume”, “may”, “will”, “predict”, “project”, “would”, “could” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words.

| i |

The forward-looking statements in this annual report include, but are not limited to, statements about:

| ● | our ability to achieve and sustain profitability; | |

| ● | our ability to compete effectively in selling our products; | |

| ● | our ability to expand, manage and maintain our direct sales and marketing organizations; | |

| ● | our actual financial results may vary significantly from forecasts and from period to period; | |

| ● | our estimates regarding anticipated operating losses, future revenues, capital requirements and our needs for additional financing; | |

| ● | our ability to market, commercialize, achieve market acceptance for and sell our products and product candidates; | |

| ● | market risks regarding consolidation in the healthcare industry; | |

| ● | the willingness of healthcare providers to purchase our products if coverage, reimbursement and pricing from third party payors for procedures using our products significantly declines; | |

| ● | our ability to adequately protect our intellectual property and operate our business without infringing upon the intellectual property rights of others; | |

| ● | the regulatory and legal risks, and certain operating risks, that our international operations subject us to; | |

| ● | the fact that product quality issues or product defects may harm our business; | |

| ● | any product liability claims; | |

| ● | the progress, timing and completion of our research, development and preclinical studies and clinical trials for our products and product candidates; and | |

| ● | our expectations regarding the merits and outcomes of pending or threatened litigation. |

We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. We have included important factors in the cautionary statements included in this annual report, particularly the factors described in the “Risk Factors” section of this annual report, that could cause actual results or events to differ materially from the forward-looking statements that we make. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments that we may make.

You should read this annual report and the documents that we have filed as exhibits, completely and with the understanding that our actual future results may be materially different from what we expect. We have based these forward-looking statements on our current expectations and projections about future events. These forward-looking statements are subject to risks, uncertainties and assumptions about us, including those listed in the sections of this annual report entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in this annual report.

We do not assume any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

| ii |

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

A. Selected Financial Data

The following table sets forth a summary of the consolidated historical financial information of, and for the periods ended on, the dates indicated for Biofrontera AG. We prepare our consolidated financial statements in accordance with IFRS as issued by the IASB. The selected consolidated statement of operations data for the years ended December 31, 2017, December 31, 2016 and December 31, 2015, and the selected consolidated balance sheet data as of December 31, 2017, December 31, 2016 and December 31, 2015 have been derived from our audited consolidated financial statements.

The following selected consolidated financial data for the periods and as of the dates indicated are qualified by reference to and should be read in conjunction with our consolidated financial statements and related notes beginning on page F-1 of this annual report, as well as the sections titled “Operating And Financial Review And Prospects” and “Foreign Currency Exchange Rates” included elsewhere in this annual report.

Our historical results for any prior period do not necessarily indicate our results to be expected for any future period.

You should read the following summary of consolidated financial information in conjunction with the section of this annual report entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes contained elsewhere in this annual report.

| 1 |

| Year Ended December 31, | ||||||||||||

| 2017 | 2016 | 2015 | ||||||||||

| € | € | € | ||||||||||

| (amounts in thousands, except share and per share data) | ||||||||||||

| Statement of operations data: | ||||||||||||

| Sales Revenue | 12,025 | 6,130 | 4,138 | |||||||||

| Gross Margin | 85.73 | % | 73.05 | % | 70.14 | % | ||||||

| Research and development costs | (4,225 | ) | (4,640 | ) | (6,204 | ) | ||||||

| Sales costs | (16,922 | ) | (8,764 | ) | (4,170 | ) | ||||||

| General administrative costs | (3,097 | ) | (2,853 | ) | (2,759 | ) | ||||||

| Loss from operations | (13,934 | ) | (11,779 | ) | (10,231 | ) | ||||||

| Loss before income tax | (16,102 | ) | (10,579 | ) | (11,203 | ) | ||||||

| Year Ended December 31, | ||||||||||||

| 2017 | 2016 | 2015 | ||||||||||

| € | € | € | ||||||||||

| Per share data: | ||||||||||||

| Basic and diluted loss per share | (0.42 | ) | (0.36 | ) | (0.48 | ) | ||||||

| Basic and diluted operating loss per share | (0.37 | ) | (0.40 | ) | (0.44 | ) | ||||||

| Shares used in computing basic and diluted loss per share | 38,076,088 | 29,762,784 | 23,213,444 | |||||||||

| At December 31, | ||||||||||||

| 2017 | 2016 | 2015 | ||||||||||

| € | € | € | ||||||||||

| (amounts in thousands) | ||||||||||||

| Balance sheet data: | ||||||||||||

| Cash and cash equivalents | 11,083 | 15,126 | 3,959 | |||||||||

| Other current financial assets | 2,132 | 2,294 | 1,625 | |||||||||

| Other current assets | 5,239 | 4,561 | 1,639 | |||||||||

| Non-current Assets | 1,394 | 1,897 | 2,275 | |||||||||

| Total assets | 19,848 | 23,879 | 9,498 | |||||||||

| Long-term liabilities | 12,355 | 3,597 | 11,230 | |||||||||

| Current liabilities | 4,112 | 4,440 | 3,077 | |||||||||

| Total shareholders’ equity | 3,381 | 15,842 | (4,809 | ) | ||||||||

| (1) | See Note 22 to our consolidated financial statements for further details on the calculation of basic and diluted loss per ordinary share. |

| (2) | Per share data are calculated by dividing net consolidated loss by the weighted average number of outstanding shares during the year in accordance with IAS 33 (“Earnings per Share”). |

| 2 |

Exchange Rate Information

The following table sets forth, for each period indicated, the low and high exchange rates for euros expressed in U.S. dollars, the exchange rate at the end of such period and the average of such exchange rates on the last day of each month during such period, based on the Noon Buying Rates quoted by the Federal Reserve Bank in New York. The exchange rates set forth below are provided for reference only and to demonstrate trends in exchange rates. They should not be relied upon, and the actual exchange rates used throughout this annual report may vary. No representation is made that the euro or the U.S. dollar amounts referred to herein could have been or could be converted into U.S. dollars or euros, as the case may be, at any particular rate.

| Year Ended December 31, | ||||||||||||||||||||

| 2013 | 2014 | 2015 | 2016 | 2017 | ||||||||||||||||

| High | 1.3816 | 1.3927 | 1.2015 | 1.1516 | 1.2041 | |||||||||||||||

| Low | 1.2774 | 1.2101 | 1.0524 | 1.0375 | 1.0416 | |||||||||||||||

| Rate at end of period | 1.3281 | 1.2101 | 1.0859 | 1.0552 | 1.2022 | |||||||||||||||

| Average rate per period | 1.3779 | 1.3297 | 1.1096 | 1.1072 | 1.1301 | |||||||||||||||

The following table sets forth, for each of the periods indicated, the low and high exchange rates for euros expressed in U.S. dollars and the exchange rate at the end of the periods indicated based on the Noon Buying Rates quoted by the Federal Reserve Bank of New York.

| October 2017 | November 2017 | December 2017 | January 2018 | February 2018 | March 2018 | |||||||||||||||||||

| High | 1.1847 | 1.1936 | 1.2022 | 1.249 | 1.249 | 1.249 | ||||||||||||||||||

| Low | 1.1580 | 1.1577 | 1.1725 | 1.221 | 1.221 | 1.192 | ||||||||||||||||||

| Rate at end of period | 1.163 | 1.184 | 1.199 | 1.221 | 1.221 | 1.232 | ||||||||||||||||||

The noon buying rate for the euro on April 01, 2018 was quoted by the Federal Reserve Bank of New York at $1.2314 for €1.00.

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

We believe the following to be the principal risks and uncertainties facing our company. If any of these risks occur, our business, financial condition and performance could suffer and the trading price and liquidity of our securities could decline. Because any global pharmaceutical business of the kind in which we are engaged is inherently exposed to risks that become apparent only with the benefit of hindsight, risks of which we are not currently aware or which we do not currently consider to be material could also adversely impact our business, financial condition and performance, including our ability to execute our strategy. The order of presentation of the risk factors below does not necessarily indicate the likelihood of their occurrence or the potential magnitude of their consequences. This annual report also contains forward-looking information that involves risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of many factors, including the risks described below and elsewhere in this annual report.

| 3 |

Risks Related to Our Financial Position and Capital Requirements

We have a history of operating losses and anticipate that we will continue to incur operating losses in the future and that we may never sustain profitability.

We have incurred losses in each year since inception. Our net loss for the fiscal years ended December 31, 2017, December 31, 2016 and December 31, 2015 was €16.1 million, €10.6 and €11.2 million, respectively. Our net loss for fiscal year ended December 31, 2017 was €16.1 million. As of December 31, 2017, we had an accumulated deficit of €136.5 million.

Our ability to become profitable depends on our ability to further commercialize our principal product Ameluz®. Even if we are successful in increasing our product sales, we may never achieve or sustain profitability. We anticipate substantially increasing our sales and marketing expense as we attempt to exploit the recent regulatory approvals we have received to market Ameluz® in the U.S. for the photodynamic therapy treatment of actinic keratoses of mild-to-moderate severity on the face and scalp and in the EU for the treatment of field cancerization and basal cell carcinoma. There can be no assurance that our sales and marketing efforts will generate sufficient sales to allow us to become profitable. Moreover, of the numerous risks and uncertainties associated with developing and commercializing pharmaceutical products, we are unable to predict the extent of any future losses or when we will become profitable, if ever.

If we fail to obtain additional financing, we may be unable to complete the development and commercialization of our products and product candidates.

Our operations have consumed substantial amounts of cash since inception. We expect to continue to spend substantial amounts to pursue additional indications for which our products and product candidates may be commercialized, and to continue the clinical development of our product candidates, including further Phase III clinical trials. We also require significant additional funds in order to commercialize Ameluz® in the U.S.

We believe that our existing cash and cash equivalents, the credit facilities available to us under our finance contract with the European Investment Bank, or EIB, and revenue from product sales and future milestone or license payments will be sufficient to enable us to fund our operating expenses and to advance our commercialization strategy in the U.S. for the next 12 months. However, changing circumstances may cause us to consume capital significantly faster than we currently anticipate, and we may need to spend more money than currently expected because of circumstances beyond our control. After the next 12-month period, we may require additional capital for the further development and commercialization of our products. We may need substantial additional funds to fully develop, manufacture, market and sell our other potential products. Our future funding requirements, both near- and long-term, will depend on many factors, including, but not limited to:

| ● | the timing, costs and results of clinical trials for our product Ameluz®; | |

| ● | the outcome, timing and cost of regulatory approvals by the U.S. Food and Drug Administration, or FDA, the European Medicines Agency, or EMA, and comparable foreign regulatory authorities, including the potential for the FDA, EMA or comparable foreign regulatory authorities to require that we perform more studies than those that we currently expect; | |

| ● | the cost of filing, prosecuting, defending and enforcing any patent claims and other intellectual property rights; | |

| ● | the effects of competing technological and market developments; | |

| ● | the cost and timing of completion of commercial-scale manufacturing activities; and | |

● |

the cost of establishing sales, marketing and distribution capabilities for Ameluz® photodynamic therapy in the U.S. and in such other regions in which we are approved to market it and in which we choose to commercialize it. |

We cannot be certain that additional funding will be available on acceptable terms, or at all. If we are unable to raise additional capital in sufficient amounts and on terms acceptable to us, we may have to significantly delay, scale back or discontinue the commercialization of our products or development of product candidates. We also could be required to license our rights to our products and product candidates to third parties on unfavorable terms. In addition, any equity financing would likely result in dilution to our existing holders of our shares and ADSs, and any debt financing would likely involve significant cash payment obligations and include restrictive covenants that may restrict our ability to operate our business.

Any of the above events could significantly harm our business, prospects, financial condition and/or results of operations and could cause the price of our shares or ADSs to decline.

| 4 |

Our existing and any future indebtedness could adversely affect our ability to operate our business.

In May 2017, we entered into a finance contract with the EIB, under which EIB agreed to provide us with loans of up to €20 million in the aggregate. Our finance contract with EIB, which we refer to as the EIB credit facility, is unsecured, is guaranteed by certain of our subsidiaries, and is available to be drawn in tranches during a two year period. Future tranches require the achievement of certain milestones. Each tranche must be repaid five years after drawdown. The EIB credit facility contains undertakings by our company regarding the use of proceeds and limitations on debt, liens, mergers, acquisitions, asset sales, dividends and other restrictive covenants. As of the date of this annual report, we have borrowed €10 million under the EIB credit facility. On July 6, 2022, we will be required to repay this €10 million principal amount, plus €3 million in deferred interest and an additional amount of performance participation interest determined by reference to the change in our market capitalization between disbursement and maturity of the loan. Under the EIB credit facility, we are not permitted to incur additional third-party debt in excess of €1 million without the prior consent of the EIB (subject to certain exceptions, such as for ordinary course deferred purchase arrangements and, subject to maximum amounts, various types of leases).

In addition, in December 2016 we issued convertible bonds in the aggregate initial principal amount of €5.0 million maturing on January 1, 2021, of which €4.9 million has already been converted into shares. In January 2017, we issued convertible bonds maturing on January 1, 2022 in the aggregate initial principal amount of €5.0 million of which €2.3 million has already been converted into shares. The convertible bonds provide the holders of those bonds with the right to convert them into our ordinary shares at set conversion prices, depending upon time of conversion. The convertible bonds we issued in December 2016 provide the holders with the right to convert them, at any time, in whole but not in part, into our ordinary shares, at a conversion price per share equal to: €4.00 per share from January 1, 2017 until December 31, 2018 and €5.00 per share from January 1, 2018 until maturity. In March 2018 the conversion rate was changed from €5.00 to €4.75 in accordance with section 12 of the bond terms and conditions. The convertible bonds we issued in January 2017 provide the holders of those bonds with the right to convert them, at any time, in whole but not in part, into our ordinary shares, at a conversion price per share equal to: €4.00 per share from April 1, 2017 until December 31, 2018 and €5.00 per share from January 1, 2018 until maturity. In March 2018 the conversion rate was changed from €5.00 to €4.75 in accordance with section 11 of the bond terms and conditions. If all of the remaining bonds were converted, we would be required to issue up to 577,853 additional ordinary shares, which would result in additional dilution to shareholders.

Our indebtedness could have significant adverse consequences, including:

| ● | requiring us to dedicate a portion of our cash to the payment of interest and principal, reducing money available for working capital, capital expenditure, product development and other general corporate purposes; | |

| ● | increasing our vulnerability to adverse changes in general economic, industry and market conditions; | |

| ● | increasing the risk of dilution to the holders of our shares or ADSs in the event any of these bonds are exercised for or converted into our ordinary shares; | |

| ● | limiting our flexibility in planning for, or reacting to, changes in our business and the industry in which we compete; and | |

| ● | placing us at a competitive disadvantage to competitors that are better capitalized than we are. |

We may not have sufficient funds and may be unable to arrange for additional financing to pay the amounts due under our existing debt obligations, in particular the minimum €13 million payment that we must make on July 6, 2022. Failure to make payments or comply with other covenants under our existing debt could result in an event of default and acceleration of amounts due. If an event of default occurs and the lender or lenders accelerate the amounts due, we may not be able to make accelerated payments, and such lenders could file suit against us to collect the amounts due under such obligations or pursue other remedies. In addition, the covenants under our existing debt obligations could limit our ability to obtain additional debt financing.

| 5 |

Risks Related to Our Business and Strategy

Certain of our important patents will expire in 2019. Although the process of developing generic topical dermatological products presents specific challenges that may deter potential generic competitors, generic versions of Ameluz® could enter the market after expiration of these patents. If this happens, we may need to reduce the price of Ameluz® significantly and may lose significant market share.

The patent family that protects aminolevulinic acid hydrochloride, an active ingredient in Ameluz®, against copying by competitors will expire on November 12, 2019. This patent family includes U.S. Patent No. 6,559,183, which is listed in the FDA Orange Book and identified as covering aminolevulinic acid hydrochloride, the active ingredient in Ameluz®. Patent No. 6,559,183 serves as a significant barrier to entry into the market by generic versions of Ameluz®. Although the process of developing generic topical dermatological products presents specific challenges that may deter potential generic competitors, once this patent expires, generic versions of Ameluz® may not be prevented from entering the market and competing with Ameluz®. This may cause a significant price drop and, therefore, a significant drop in our profits. We may also lose significant market share for Ameluz.

Insurance coverage and medical expense reimbursement may be limited or unavailable in certain market segments for our products or product candidates, which could make it difficult for us to sell our products.

Government authorities and third party payors, such as private health insurers and health maintenance organizations or, in some jurisdictions such as Germany, statutory health insurance, decide which products they will cover and the amount of reimbursement. Reimbursement by a third party payor may depend upon a number of factors, including the government or third party payor’s determination that use of a product is:

| ● | a covered benefit under its health plan; | |

| ● | safe, effective and medically necessary; | |

| ● | reasonable and appropriate for the specific patient; | |

| ● | cost-effective; and | |

| ● | neither experimental nor investigational. |

Obtaining coverage and reimbursement approval for a product from a government or other third party payor is a time-consuming and costly process that could require us to provide to the payor supporting scientific, clinical and cost-effectiveness data for the use of our products. We may not be able to provide data sufficient to gain acceptance with respect to coverage and reimbursement or a particular reimbursement amount. If reimbursement of our future products or extended indications for existing products is unavailable or limited in scope or amount, or if pricing is set at unsatisfactory levels, we may be unable to achieve or sustain profitability.

The pricing of prescription pharmaceuticals is subject to governmental control in some of the countries in which we have received and/or seek to receive approval to commercialize certain of our products. We are approved to market certain of our products in the EU and the U.S., and we intend to seek approval to market our product candidates in selected other jurisdictions. If we obtain approval in one or more foreign jurisdictions for our product candidates, we will be subject to rules and regulations in those jurisdictions. In some countries, particularly those in the EU, the pricing of prescription pharmaceuticals is subject to governmental control. In these countries, pricing negotiations with governmental authorities can take considerable time after obtaining marketing approval for a product candidate. In addition, market acceptance and sales of our product candidates will depend significantly on the availability of adequate coverage and reimbursement from government or other third party payors for our product candidates and may be affected by existing and future health care reform measures. Without adequate levels of reimbursement by government health care programs and private health insurers, the market for our products will be limited. While we continue to support efforts to improve reimbursement levels to physicians and plan to work to improve coverage for our products, if our efforts are not successful, a broader adoption of our products and sales of our products could be negatively impacted.

| 6 |

Healthcare legislative changes may have a material adverse effect on our business and results of operations.

In the U.S. and certain other countries, there have been a number of legislative and regulatory changes to the health care system that could impact our ability to sell our products profitably. In particular, the Medicare Prescription Drug, Improvement, and Modernization Act of 2003 revised the payment methodology for many products under Medicare in the U.S., which has resulted in lower rates of reimbursement. In 2010, the Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act of 2010, or collectively, the Affordable Care Act, was enacted. On January 20, 2017, President Donald Trump signed an executive order stating that the administration intended to seek prompt repeal of the Affordable Care Act, and, pending repeal, directed by the U.S. Department of Health and Human Services and other executive departments and agencies to take all steps necessary to limit any fiscal or regulatory burdens of the Affordable Care Act. There is no guarantee whether the Affordable Care Act will remain in effect or be repealed/replaced. There is significant uncertainty about the future of the Affordable Care Act in particular and healthcare laws generally in the United States. This expansion of the government’s role in the U.S. healthcare industry may further lower rates of reimbursement for pharmaceutical products. We are unable to predict the likelihood of changes to the Affordable Care Act or other healthcare laws which may negatively impact our profitability.

The Affordable Care Act is a sweeping law intended to broaden access to health insurance, reduce or constrain the growth of healthcare spending, enhance remedies against fraud and abuse, add new transparency requirements for healthcare and the health insurance industry, impose new taxes and fees on the healthcare industry and impose additional health policy reforms. This law revises the definition of “average manufacturer price” for reporting purposes, which could increase the amount of Medicaid drug rebates to states once the provision is effective. Further, the law imposes a significant annual fee on companies that manufacture or import branded prescription drug products. Substantial new provisions affecting compliance have also been enacted, which may require us to modify our business practices with healthcare practitioners. While the U.S. Supreme Court upheld the constitutionality of most elements of the Affordable Care Act in 2012, other legal challenges are still pending final adjudication in several jurisdictions. In addition, Congress has also proposed a number of legislative initiatives, including possible repeal of the Affordable Care Act. At this time, there remains a significant amount of uncertainty related to the future of the Affordable Care Act, and whether there will be changes to certain provisions or its entirety. We can provide no assurance that the Affordable Care Act, as currently enacted or as amended in the future, will not adversely affect our business and financial results, and we cannot predict how future federal or state legislative or administrative changes relating to healthcare reform will affect our business.

| 7 |

Other legislative changes have been proposed and adopted in the U.S. since the Affordable Care Act was enacted. On August 2, 2011, the Budget Control Act of 2011, among other things, created measures for spending reductions by Congress. A Joint Select Committee on Deficit Reduction, tasked with recommending a targeted deficit reduction of at least $1.2 trillion for the years 2012 through 2021, was unable to reach required goals, thereby triggering the legislation’s automatic reduction to several government programs. This includes aggregate reductions of Medicare payments to providers up to 2 percent per fiscal year. The American Taxpayer Relief Act of 2012, or the ATRA, among other things, reduced Medicare payments to several providers, including hospitals, imaging centers and cancer treatment centers, and increased the statute of limitations period for the government to recover overpayments to providers from three to five years. Recently there has been increased government scrutiny regarding the manner in which manufacturers set prices for and market commercial products. If we become the subject of any government investigation with respect to our drug pricing, marketing, or other business practices, we could incur significant expense and could be distracted from operation of our business and execution of our strategy. Any such investigation could also result in reduced market acceptance and demand for our products, could harm our reputation and our ability to market our products in the future, and could have a material adverse effect on our business, financial condition, results of operations and growth prospects.

There have been, and likely will continue to be, legislative and regulatory proposals at the U.S. federal and state levels directed at broadening the availability of healthcare and containing or lowering the cost of healthcare. We cannot predict the initiatives that may be adopted in the future. Additionally, third party payors, including governmental payors, managed care organizations and private health insurers, are increasingly challenging the prices charged for medical products and services and examining their cost effectiveness. The continuing efforts of governments, insurance companies, managed care organizations and other payors of healthcare services to contain or reduce costs of healthcare and/or impose price controls may adversely affect:

| ● | the demand for our product candidates, if we obtain regulatory approvals; | |

| ● | our ability to set a price or obtain reimbursement that we believe is fair for our products; | |

| ● | our ability to generate revenues and achieve or maintain profitability; and | |

| ● | the level of taxes that we are required to pay. |

Any denial or reduction in reimbursement from Medicare or other programs or governments may result in a similar denial or reduction in payments from private payors, which may adversely affect our future profitability.

To date, we have engaged in only limited sales of our products, primarily in Germany and Spain and, more recently, in the U.S.

We have engaged in only limited sales of our products to date. In Germany, the majority of our sales have been generated in the private dermatology offices sector. Historically, our sales partners in European countries outside of Germany have experienced difficulty in selling Ameluz® because that process involves selling both drug combined with a procedure, an area in which our sales partners generally have little experience. We launched the commercialization of Ameluz® and BF-RhodoLED® for actinic keratosis in the U.S. in October 2016 and have a limited history of marketing our products there. Our products may never gain significant acceptance in the European or U.S. marketplace and, therefore, may never generate substantial revenue or profits for us. We must establish a larger market for our products and build that market through marketing campaigns to increase awareness of, and confidence by doctors in, our products. If we are unable to expand our current customer base and obtain market acceptance of our products, our operations could be disrupted and our business may be materially adversely affected. Even if we achieve profitability, we may not be able to sustain or increase profitability.

Competing products and technologies based on traditional treatment methods may make our products or potential products noncompetitive or obsolete.

Well-known pharmaceutical, biotechnology and medical device companies are marketing well-established therapies for the treatment of actinic keratosis and basal cell carcinoma. Doctors may prefer to use familiar therapies, rather than trying our products.

| 8 |

Our industry is subject to rapid, unpredictable and significant technological change and intense competition. Our competitors may succeed in developing, acquiring, or licensing on an exclusive basis products that are safer, more effective or more desirable than ours. Many of our competitors have substantially greater financial, technical and marketing resources than we have. In addition, several of these companies have significantly greater experience than we do in developing products, conducting preclinical and clinical testing, obtaining regulatory approvals to market products for health care, and marketing healthcare products.

Mergers and acquisitions in the pharmaceutical and biotechnology industries may result in even more resources being concentrated in our competitors. Competition may increase further as a result of advances in the commercial applicability of technologies and greater availability of capital for investment in these industries.

We cannot guarantee that new drugs or future developments in drug technologies will not have a material adverse effect on our business. Increased competition could result in price reductions, lower levels of government or other third party reimbursements, failure to achieve market acceptance and loss of market share, any of which could adversely affect our business, results of operations and financial condition. Further, we cannot give any assurance that developments by our competitors or future competitors will not render our technologies obsolete or less advantageous.

We face significant competition from other pharmaceutical and medical device companies and our operating results will suffer if we fail to compete effectively. We also must compete with existing treatments, such as simple curettage and cryotherapy, which do not involve the use of a drug but have gained significant market acceptance. We have recently lost market share in Germany to daylight photodynamic therapy products, and we have only recently in March 2018 received approval from the European Commission to market Ameluz® in combination with daylight photodynamic therapy.

The pharmaceutical and medical device industry is characterized by intense competition and rapid innovation. Our competitors may be able to develop other products that are able to achieve similar or better results for the treatment of actinic keratosis. We expect that our future competitors will include mostly established pharmaceutical companies, such as Sun Pharma and Galderma. Most of our competitors have substantially greater financial, technical and other resources, such as larger research and development staffs and experienced marketing and manufacturing organizations and well-established sales forces. Competition may increase further as a result of advances in the commercial applicability of technologies and greater availability of capital for investment in these industries.

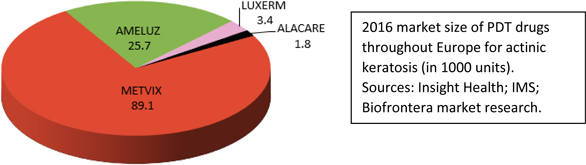

Our competitors may succeed in developing, acquiring or licensing products that are more effective or less costly than our products and product candidates. Metvix® has also recently been approved in the EU for use in daylight photodynamic therapy for which it is sold by Galderma under the brand name Luxerm® in Germany and Luxera® in other European countries. This gave that drug a competitive advantage compared to Ameluz®, as Ameluz® was not approved to be used in daylight photodynamic therapy to treat actinic keratosis until recently. We have obtained approval for Ameluz® to be used with daylight photodynamic therapy in March 2018. In recent months, the market share of Ameluz® of photodynamic therapy drugs for treatment of actinic keratosis dispensed by German public pharmacies has fallen from over 75% to approximately 60%, a decline which we believe resulted primarily from the introduction to the German market of Luxerm® in 2016. We believe that daylight photodynamic therapy products will play an increasingly important role in Europe in the future and will begin to be prescribed as an alternative to less effective, self-applied, topical prescription product creams (which have historically been market leaders in the EU in treating actinic keratosis). We applied to extend our indication for Ameluz® to daylight photodynamic therapy in the EU to better compete with Metvix® and Luxerm®, and in March 2018, the European Commission granted approval for label extension for the treatment of mild to moderate actinic keratosis on the face and scalp using Ameluz® in combination with daylight photodynamic therapy. There can be no assurance however that we will be able to successfully commercialize our products in this indication.

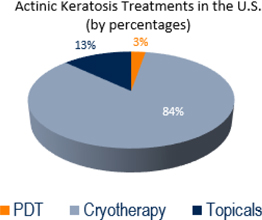

In addition, our products compete with other therapies, such as simple curettage and, particularly in the U.S., cryotherapy, which do not involve the use of a drug but have gained significant market acceptance.

If we are not able to compete effectively with the competitors and competing therapies discussed above, we may lose significant market share in the relevant markets, which could have a material adverse effect on our revenue, results of operations and financial condition.

| 9 |

If we are unable to establish effective marketing and sales capabilities or enter into agreements with third parties to market and sell our products, we may be unable to generate revenues.

In order to commercialize our products, we must further build our marketing, sales and distribution capabilities, in particular in the U.S. The establishment, development and training of our sales force and related compliance plans to market our products are expensive and time consuming and can potentially delay the commercial success of our products. In the event we are not successful in developing our marketing and sales infrastructure, we may not be able to successfully commercialize our products, which would limit our ability to generate product revenues.

We depend on a single unaffiliated contract manufacturer to manufacture Ameluz® and two unaffiliated contractors to produce 5-aminolevulinic acid, the active pharmaceutical ingredient in Ameluz®, for us. If we fail to maintain our relationship with these suppliers or if these suppliers are unable to continue to produce product for us, our business could be materially harmed.

We depend on a single unaffiliated contract manufacturer located in Switzerland to manufacture Ameluz® and two unaffiliated contractors to produce 5-aminolevulinic acid, the active pharmaceutical ingredient in Ameluz®, for us. The initial terms of our contracts with these suppliers begin to expire in June 2020, and the contracts renew automatically for one- or two-year periods, as applicable, until they are terminated. For more information on the terms of our contracts with these suppliers, see “Business—Commercial Partners and Agreements”. If we fail to maintain our relationship with these parties, we may be unable to obtain an alternative manufacturer of Ameluz® or suppliers of 5-aminolevulinic acid that could deliver the quantity of the product at the quality and cost levels that we require. Even if acceptable alternative suppliers could be found, we may experience delays in transitioning the manufacturing from our existing suppliers to our new suppliers (in particular with respect to our manufacturer of Ameluz®). Problems of this kind could cause us to experience order cancellations and loss of market share. The failure of the suppliers to supply Ameluz® or 5-aminolevulinic acid that satisfies our quality, quantity and cost requirements in a timely manner could impair our ability to deliver Ameluz® and could increase our costs, particularly if we are unable to obtain Ameluz® or 5-aminolevulinic acid from alternative sources on a timely basis or on commercially reasonable terms. In addition, our suppliers are regulated by the FDA and must comply with applicable laws and regulations, including home-country laws. If the suppliers fail to comply, this could harm our business.

If we fail to manufacture Ameluz® or BF-RhodoLED® or other marketed products and product candidates in sufficient quantities and at acceptable quality and cost levels, or to fully comply with current good manufacturing practice, or cGMP, or other applicable manufacturing regulations, we may face a bar to, or delays in, the commercialization of our products, breach obligations to our licensing partners or be unable to meet market demand, and lose potential revenues.

The manufacture of our products requires significant expertise and capital investment. Currently, all commercial supply for Ameluz® is manufactured by a single unaffiliated contract manufacturer. We would need to spend substantial time and expense to replace that manufacturer if it failed to deliver products in the quality and quantities we demand or failed to meet any regulatory or cGMP requirements. We take precautions to help safeguard the manufacturing facilities, including acquiring insurance, and performing on site audits. However, vandalism, terrorism or a natural or other disaster, such as a fire or flood, could damage or destroy manufacturing equipment or our inventory of raw material or finished goods, cause substantial delays in our operations, result in the loss of key information, and cause us to incur additional expenses. Our insurance may not cover our losses in any particular case. In addition, regardless of the level of insurance coverage, damage to our facilities may have a material adverse effect on our business, financial condition and operating results.

We must comply with federal, state and foreign regulations, including FDA regulations governing cGMP enforced by the FDA through its facilities inspection program and by similar regulatory authorities in other jurisdictions where we do business. These requirements include, among other things, quality control, quality assurance and the maintenance of records and documentation. For our medical device products, we are required to comply with the FDA’s Quality System Regulation, or QSR, which covers the methods and documentation of the design, testing, production, control, quality assurance, labeling, packaging, sterilization, storage and shipping of our medical device products.

| 10 |

Our contract facilities have been inspected by the FDA for cGMP compliance. If we do not successfully maintain cGMP compliance for these facilities, commercialization of our products could be prohibited or significantly delayed. Even after cGMP compliance has been achieved, the FDA or similar foreign regulatory authorities at any time may implement new standards, or change their interpretation and enforcement of existing standards for manufacture, packaging, testing of or other activities related to our products. For our commercialized medical device product, the FDA audits compliance with the QSR through periodic announced and unannounced inspections of manufacturing and other facilities. The FDA may conduct inspections or audits at any time. Similar audit rights exist in Europe and other foreign jurisdictions. Any failure to comply with applicable cGMP, QSR and other regulations may result in fines and civil penalties, suspension of production, product seizure or recall, imposition of a consent decree, or withdrawal of product approval, and would limit the availability of our product. Any manufacturing defect or error discovered after products have been produced and distributed also could result in significant consequences, including adverse health consequences, injury or death to patients, costly recall procedures, re-stocking costs, warning letters, Form 483 reports, civil monetary penalties, product liability, damage to our reputation and potential for product liability claims. If we are required to find a new manufacturer or supplier, the process would likely require prior FDA and/or equivalent foreign regulatory authority approval, and would be very time consuming. An inability to continue manufacturing adequate supplies of our products at any contract facilities could result in a disruption in the supply of our products. Delay or disruption in our ability to meet demand may result in the loss of potential revenue. We have licensed the commercial rights in specified foreign territories to market and sell our products. Under those licenses, we have obligations to manufacture commercial product for our commercial partners. If we are unable to fill the orders placed with us by our commercial partners in a timely manner, we may potentially lose revenue and be in breach of our licensing obligations under agreements with them.

Because of a lack of comprehensive public data regarding the market for actinic keratosis treatments in the U.S., the U.S. market size for Ameluz® for the treatment of actinic keratosis may be smaller than we have estimated.

Because of a lack of comprehensive public data regarding the market for actinic keratosis treatments in the U.S., some of our estimates and judgments are based on various sources which we have not independently verified and which potentially include outdated information, or information that may not be precise or correct, potentially rendering the U.S. market size for treatment of actinic keratosis with Ameluz® smaller than we have estimated, which may reduce our potential and ability to increase sales of Ameluz® and revenue in the U.S. Although we have not independently verified the data obtained from these sources, we believe that such data provide the best available information relating to the present market for actinic keratosis treatments in the U.S., and we often use such data for our business and planning purposes.

If we face allegations of noncompliance with the law and encounter sanctions, our reputation, revenues and liquidity may suffer, and our products could be subject to restrictions or withdrawal from the market.

Any government investigation of alleged violations of the law could require us to expend significant time and resources in response and could generate negative publicity. Any failure to comply with ongoing regulatory requirements may significantly and adversely affect our ability to commercialize and generate revenues from our products. If regulatory sanctions are applied or if regulatory approval is withdrawn, the value of our company and our operating results will be adversely affected. Additionally, if we are unable to generate revenues from our product sales, our potential for achieving profitability will be diminished and the capital necessary to fund our operations will be increased.

Even if we obtain regulatory approvals for our products and product candidates, they may not gain market acceptance among hospitals, physicians, health care payors, patients and others in the medical community.

In May 2016, we received approval from the FDA to market in the U.S. Ameluz® in combination with photodynamic therapy using our BF-RhodoLED® lamp for lesion-directed and field-directed treatment of actinic keratoses of mild-to-moderate severity on the face and scalp. We launched the commercialization of Ameluz® and BF-RhodoLED® for actinic keratosis in the U.S. in October 2016. Even after obtaining regulatory approval for our products or extending their indications, our products may not gain market acceptance among hospitals, physicians, health care payors, patients and others in the medical community. Market acceptance of any of our products and product candidates for which we receive approval depends on a number of factors, including:

| ● | the clinical indications for which they are approved, including any restrictions placed upon the product in connection with its approval, such as patient registry or labeling restriction; | |

| ● | the product labeling, including warnings, precautions, side effects, and contraindications that the FDA or other regulatory authorities approve; | |

| ● | the potential and perceived advantages of our product candidates over alternative products or therapies; |

| 11 |

| ● | relative convenience and ease of administration; | |

| ● | the effectiveness and compliance of our sales and marketing efforts; | |

| ● | acceptance by major operators of hospitals, physicians and patients of our products or candidates as a safe and effective treatment; | |

| ● | the prevalence and severity of any side effects; | |

| ● | product labeling or product insert requirements of the FDA or other regulatory authorities; | |

| ● | any Risk Evaluation and Mitigation Strategy that the FDA might require for our drug product candidates; | |

| ● | the timing of market introduction of our product candidates as well as competitive products; | |

| ● | the perceived advantages of our products over alternative treatments; | |

| ● | the cost of treatment in relation to alternative products; and | |

| ● | the availability of adequate reimbursement and pricing by third party payors and government authorities, including any conditions for reimbursement required by such third party payors and government authorities. |

If our products and product candidates are approved, but fail to achieve market acceptance among physicians, patients, payors, or others in the medical community, we will not be able to generate significant revenues, which would have a material adverse effect on our business, prospects, financial condition and results of operations.

With respect to our already approved products, we may be subject to healthcare laws, regulation and enforcement. Our failure to comply with those laws could have a material adverse effect on our results of operations and financial condition.

We may be subject to additional healthcare regulation and enforcement by the U.S. federal government and by authorities in the U.S., the EU and other jurisdictions in which we conduct our business. In certain jurisdictions outside of the U.S. where we currently commercialize certain of our products, we are already subject to such regulation and enforcement. Such U.S. laws include, without limitation, state and federal anti-kickback, federal false claims, privacy, security, financial disclosure laws, anti-trust, Physician Payment Sunshine Act reporting and fair trade regulation and advertising laws and regulations. Many states and other jurisdictions have similar laws and regulations, some of which are broader in scope. If our operations are found to be in violation of any of such laws or any other governmental regulations that apply to us, we may be subject to penalties, including, but not limited to, civil and criminal penalties, damages, fines, the curtailment or restructuring of our operations, the exclusion from participation in federal, state or other healthcare programs and imprisonment, any of which could adversely affect our ability to operate our business and our financial results.

A recall of our drug or medical device products, or the discovery of serious safety issues with our drug or medical device products, could have a significant negative impact on us.

The FDA, the EMA and other relevant regulatory agencies have the authority to require or request the recall of commercialized products in the event of material deficiencies or defects in design or manufacture or in the event that a product poses an unacceptable risk to health. Manufacturers may, under their own initiative, recall a product. A government-mandated or voluntary recall by us or one of our distributors could occur as a result of an unacceptable risk to health, component failures, manufacturing errors, design or labeling defects or other deficiencies and issues. Recalls of our products would divert managerial and financial resources and have an adverse effect on our reputation, financial condition and operating results, which could impair our ability to produce our products in a cost-effective and timely manner.

| 12 |

Further, under the FDA’s medical device reporting, or MDR, regulations, we are required to report to the FDA any event which reasonably suggests that our product may have caused or contributed to a death or serious injury or in which our product malfunctioned and, if the malfunction of the same or similar device marketed by us were to recur, would likely cause or contribute to death or serious injury. The FDA also requires reporting of serious, life-threatening, unexpected and other adverse drug experiences and the submission of periodic safety reports and other information. Product malfunctions or other adverse event reports may result in a voluntary or involuntary product recall and other adverse actions, which could divert managerial and financial resources, impair our ability to manufacture our products in a cost-effective and timely manner and have an adverse effect on our reputation, financial condition and operating results. Similar reporting requirements exist in Europe and other jurisdictions.

Any adverse event involving our products could result in future voluntary corrective actions, such as recalls or customer notifications, or regulatory agency action, which could include inspection, mandatory recall or other enforcement action. Any corrective action, whether voluntary or involuntary, will require the dedication of our time and capital, distract management from operating our business and may harm our reputation and financial results as well as threaten our marketing authority for such products.

Our medical device product, the BF-RhodoLED® lamp, is subject to extensive governmental regulation, and failure to comply with applicable requirements could cause our business to suffer.

The medical device industry is regulated extensively by governmental authorities, principally the FDA and corresponding state and European and other foreign governmental agencies. The regulations are very complex and are subject to rapid change and varying interpretations. Regulatory restrictions or changes could limit our ability to carry on or expand our operations or result in higher than anticipated costs or lower than anticipated sales. The FDA and other U.S. or European or other foreign governmental agencies regulate numerous elements of our business, including:

| ● | product design and development; | |

| ● | pre-clinical and clinical testing and trials; | |

| ● | product safety; | |

| ● | establishment registration and product listing; | |

| ● | distribution; | |

| ● | labeling, manufacturing and storage; | |

| ● | pre-market clearance or approval; | |

| ● | advertising and promotion; | |

| ● | marketing, manufacturing, sales and distribution; | |

| ● | relationships and communications with health care providers; | |

| ● | adverse event reporting; | |

| ● | market exclusivity; | |

| ● | servicing and post-market surveillance; and | |

| ● | recalls and field safety corrective actions. |

| 13 |

Before we can market or sell a new regulated product or a significant modification to an existing product in the U.S., we must obtain either marketing clearance under Section 510(k) of the Federal Food, Drug and Cosmetic Act, or FDCA, or approval of a Pre-Market Approval, or PMA, application from the FDA, unless an exemption from premarket clearance and approval applies. In the 510(k) clearance process, the FDA must determine that a proposed device is “substantially equivalent” to a device legally on the market, known as a “predicate” device, with respect to intended use, technology and safety and effectiveness, in order to clear the proposed device for marketing. Clinical data are sometimes required to support a finding of substantial equivalence. The PMA pathway requires an applicant to demonstrate the safety and effectiveness of the device based on extensive clinical data. The PMA process is typically required for devices that are deemed to pose the greatest risk, such as life-sustaining, life-supporting or certain implantable devices or products that do not have an adequate predicate product. The PMA process can be lengthy, expensive, and carries uncertainty of approval. Products that are approved through a PMA application generally need FDA approval before they can be modified. Similarly, some modifications made to products cleared through a 510(k) premarket notification submission may require a new 510(k) submission, including possibly with clinical data. Before we can offer our device products to any of the 31 nations within the EU and the European Free Trade Association, we must first satisfy the requirements for CE Mark clearance, a conformity mark that signifies a product has met all criteria of the relevant EU directives, especially in the areas of safety and performance. The process of obtaining regulatory clearances or approvals to market a medical device can be costly and time-consuming, and we may not be able to obtain these clearances or approvals on a timely basis, or at all for our products or proposed products. We obtained CE Mark clearance for our BF-RhodoLED® lamp in November 2012 and FDA approval for it, to be used in connection with Ameluz® gel, in May 2016.

The FDA can delay, limit or deny clearance or approval of a device for many reasons, including:

| ● | our inability to demonstrate that our products are safe and effective for their intended uses or substantially equivalent to a predicate device; | |

| ● | the data from our clinical trials may not be sufficient to support clearance or approval; and | |

| ● | the manufacturing process or facilities we use may not meet applicable requirements. |

In addition, the FDA and other regulatory authorities may change their respective clearance and approval policies, adopt additional regulations or revise existing regulations, or take other actions which may prevent or delay approval or clearance of our products under development or impact our ability to modify our currently cleared or approved products on a timely basis.

Any delay in, or failure to receive or maintain, clearance or approval for our products under development could prevent us from generating revenue from these products or achieving profitability. Additionally, the FDA and comparable foreign regulatory authorities have broad enforcement powers. Regulatory enforcement or inquiries, or other increased scrutiny of us, could dissuade some customers from using our products and adversely affect our reputation and the perceived safety and efficacy of our products.

Failure to comply with applicable regulations could jeopardize our ability to sell our products and result in enforcement actions such as fines, civil penalties, injunctions, warning letters, Form 483 reports, recalls of products, delays in the introduction of products into the market, refusal of the FDA or other regulators to grant future clearances or approvals, and the suspension or withdrawal of existing approvals by the FDA or other regulators. Any of these sanctions could result in higher than anticipated costs or lower than anticipated sales and have a material adverse effect on our reputation, business, financial condition and operating results.

Furthermore, we may evaluate international expansion opportunities in the future for our medical device products. As we expand our operations outside of the U.S. and Europe, we are, and will become, subject to various additional regulatory and legal requirements under the applicable laws and regulations of the international markets we enter. These additional regulatory requirements may involve significant costs and expenditures and, if we are not able comply with any such requirements, our international expansion and business could be significantly harmed.

Modifications to our medical device products, such as our BF-RhodoLED® lamp in Europe, may require reclassifications, new CE marking processes or may require us to cease marketing or recall the modified products until new CE marking is obtained.

A modification to our medical devices such as our BF-RhodoLED® lamp, which is approved for sale in Europe, could lead to a reclassification of the medical device and could result in further requirements (including additional clinical trials) to maintain the product’s CE marking. If we fail to comply with such further requirements we may be required to cease marketing or to recall the modified product until we obtain clearance or approval, and we may be subject to significant regulatory fines or penalties.

| 14 |

We are highly dependent on our key personnel, and if we are not successful in attracting and retaining highly qualified personnel, we may be unable to successfully implement our business strategy.

Our ability to compete in the highly competitive pharmaceutical industry depends upon our ability to attract and retain highly qualified managerial, scientific and medical personnel with specialized scientific and technical skills. We are highly dependent on our management, scientific, medical and operations personnel, including Prof. Hermann Lübbert, Ph.D., chairman of our management board and chief executive officer; Thomas Schaffer, member of our management board and chief financial officer and Christoph Dünwald, member of our management board and chief commercial officer. Our company does not maintain “key man” insurance for any of our officers. The loss of the services of any of our executive officers or other key employees and our inability to find suitable replacements could potentially harm our business, prospects, financial condition or results of operations.

Despite our efforts to retain valuable employees, members of our management, scientific and development teams may terminate their employment with us on short notice. Although we have employment agreements with our key employees, these employees could leave our employment at any time, with certain notice periods. We do not maintain “key man” insurance policies on the lives of these individuals or the lives of any of our other employees. Our success also depends on our ability to continue to attract, retain and motivate highly skilled junior, mid-level and senior managers as well as junior, mid-level and senior scientific and medical personnel and sales representatives.

Many of the other biotechnology and pharmaceutical companies that we compete against for qualified personnel have greater financial and other resources, different risk profiles and a longer history in the industry than we do. They may also provide more diverse opportunities and better chances for career advancement. Some of these characteristics may be more appealing to high quality candidates than what we can offer. If we are unable to continue to attract and retain high quality personnel, our ability to advance the development of our product candidates, obtain regulatory approval and commercialize our product candidates will be limited.

Our employees may engage in misconduct or other improper activities, including noncompliance with regulatory standards and requirements.

We are exposed to the risk of employee fraud or other misconduct. Misconduct by employees could include intentional failures to comply with FDA or EMA regulations, provide accurate information to the FDA or EMA, comply with manufacturing standards we have established, comply with healthcare fraud and abuse laws and regulations, report financial information or data accurately or disclose unauthorized activities to us. In particular, sales, marketing and business arrangements in the healthcare industry are subject to extensive laws and regulations intended to prevent fraud, kickbacks, self-dealing and other abusive practices in the U.S. and Europe as well as in other jurisdictions where we conduct our business. These laws and regulations may restrict or prohibit a wide range of pricing, discounting, marketing and promotion, sales commission, customer incentive programs and other business arrangements. Employee misconduct could also involve the improper use of information obtained in the course of clinical trials, which could result in regulatory sanctions, inability to obtain product approval and serious harm to our reputation. It is not always possible to identify and deter employee misconduct, and any precautions we take to detect and prevent this activity may not be effective in controlling unknown or unmanaged risks or losses or in protecting us from governmental investigations or other actions or lawsuits stemming from a failure to be in compliance with such laws or regulations. If any such actions are instituted against us, and we are not successful in defending ourselves or asserting our rights, those actions could have a significant impact on our business, including the imposition of significant fines or other sanctions.

We will need to grow the size of our organization and we may experience difficulties in managing this growth.

As of December 31, 2017, we had 123 employees. As our development and commercialization plans and strategies develop, and as we continue operating as a public company, we expect to need additional managerial, operational, sales, marketing, financial and other personnel. Future growth would impose significant added responsibilities on members of management, including:

| ● | identifying, recruiting, integrating, maintaining and motivating additional employees; | |

| ● | managing our internal development efforts effectively, including the clinical and FDA and EMA review process for our product candidates, while complying with our contractual obligations to contractors and other third parties; and | |

| ● | improving our operational, financial and management controls, reporting systems and procedures. |

| 15 |

Our future financial performance and our ability to commercialize our products will depend, in part, on our ability to effectively manage any future growth, and our management may also have to divert a disproportionate amount of its attention away from day-to-day activities in order to devote a substantial amount of time to managing these growth activities. To date, we have used the services of outside vendors to perform tasks including clinical trial management, statistics and analysis and regulatory affairs. Our growth strategy may also entail expanding our group of contractors or consultants to implement these tasks going forward. Because we rely on numerous consultants, effectively outsourcing many key functions of our business, we will need to be able to effectively manage these consultants to ensure that they successfully carry out their contractual obligations and meet expected deadlines. However, if we are unable to effectively manage our outsourced activities or if the quality or accuracy of the services provided by consultants is compromised for any reason, our clinical trials may be extended, delayed or terminated, and we may not be able to obtain regulatory approval for our product candidates or otherwise advance our business. There can be no assurance that we will be able to manage our existing consultants or find other competent outside contractors and consultants on economically reasonable terms, or at all. If we are not able to effectively expand our organization by hiring new employees and expanding our groups of consultants and contractors, we may not be able to successfully implement the tasks necessary to further develop and commercialize our products and product candidates that we develop and, accordingly, may not achieve our research, development and commercialization goals.

We may encounter difficulties growing our sales force.