Exhibit 4.1

ANNUAL INFORMATION FORM

FOR HYDRO ONE LIMITED

FOR THE YEAR ENDED DECEMBER 31, 2017

March 29, 2018

TABLE OF CONTENTS

| GLOSSARY |

1 | |||

| PRESENTATION OF INFORMATION |

5 | |||

| FORWARD-LOOKING INFORMATION |

6 | |||

| ELECTRICITY INDUSTRY OVERVIEW |

10 | |||

| General Overview |

10 | |||

| Overview of an Electricity System |

10 | |||

| THE ELECTRICITY INDUSTRY IN ONTARIO |

10 | |||

| Regulation of Transmission and Distribution |

10 | |||

| Transmission |

12 | |||

| Distribution |

12 | |||

| Recent Developments at Hydro One |

13 | |||

| Recent Legislative Amendments Affecting the Electricity Industry Generally and Related Issues |

13 | |||

| Legislative Provisions Specific to Hydro One |

16 | |||

| Elimination of Certain Legislation With Respect to Hydro One |

17 | |||

| RATE-REGULATED UTILITIES |

18 | |||

| Rate Applications in Ontario |

18 | |||

| CORPORATE STRUCTURE |

19 | |||

| Incorporation and Office |

19 | |||

| Corporate Structure and Subsidiaries |

19 | |||

| GENERAL DEVELOPMENT OF THE BUSINESS |

21 | |||

| Chronological Development of the Business |

21 | |||

| General Development of the Business |

25 | |||

| BUSINESS OF HYDRO ONE |

26 | |||

| Business Segments |

26 | |||

| Transmission Business |

27 | |||

| Distribution Business |

34 | |||

| Other Business |

39 | |||

| Indigenous Communities |

40 | |||

| Outsourced Services |

40 | |||

| Employees |

41 | |||

| Health, Safety and Environmental Management |

41 | |||

| Environmental Regulation |

42 | |||

| Insurance |

43 | |||

| Ombudsman |

43 | |||

| Reorganizations |

44 | |||

| RISK FACTORS |

44 | |||

| DIVIDENDS |

45 | |||

| Dividend Policy |

45 | |||

i

| Dividend Reinvestment Plan |

46 | |||

| DESCRIPTION OF CAPITAL STRUCTURE |

46 | |||

| General Description of Capital Structure |

46 | |||

| Common Shares |

46 | |||

| Preferred Shares |

47 | |||

| Convertible Debentures and Instalment Receipts |

48 | |||

| CREDIT RATINGS |

49 | |||

| MARKET FOR SECURITIES |

50 | |||

| Trading Price and Volume |

50 | |||

| DIRECTORS AND OFFICERS |

51 | |||

| Directors and Executive Officers |

51 | |||

| Information Regarding Certain Directors and Executive Officers |

56 | |||

| Corporate Cease Trade Orders and Bankruptcies |

56 | |||

| Penalties or Sanctions |

57 | |||

| Conflicts of Interest |

57 | |||

| Indebtedness of Directors and Executive Officers |

57 | |||

| AUDIT COMMITTEE |

57 | |||

| Relevant Education and Experience |

58 | |||

| Pre-Approval Policies and Procedures |

60 | |||

| Auditors’ Fees |

60 | |||

| AGREEMENTS WITH PRINCIPAL SHAREHOLDER |

61 | |||

| Governance Agreement |

61 | |||

| Registration Rights Agreement |

67 | |||

| INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS |

68 | |||

| Relationships with the Province and Other Parties |

68 | |||

| MATERIAL CONTRACTS |

70 | |||

| LEGAL PROCEEDINGS AND REGULATORY ACTIONS |

71 | |||

| INTEREST OF EXPERTS |

72 | |||

| TRANSFER AGENT AND REGISTRAR |

72 | |||

| ADDITIONAL INFORMATION |

73 | |||

| SCHEDULE “A” |

74 | |||

| AUDIT COMMITTEE MANDATE |

74 | |||

ii

GLOSSARY

When used in this annual information form, the following terms have the meanings set forth below unless expressly indicated otherwise:

“$” or “dollar” means Canadian Dollars.

“2016 Underwriting Agreement” has the meaning given to it under “Material Contracts”.

“2017 Long-Term Energy Plan” has the meaning given to it under “Electricity Industry in Ontario – Recent Legislative Amendments Affecting the Electricity Industry Generally – 2017 Long-Term Energy Plan”.

“Agreement and Plan of Merger” has the meaning given to it under “Material Contracts”.

“Annual MD&A” means management’s discussion and analysis for Hydro One Limited for the year ended December 31, 2017, as filed on SEDAR under Hydro One Limited’s profile at www.sedar.com.

“Auditor General Act” means the Auditor General Act, RSC 1985, c A-17.

“Board” means the Board of Directors of Hydro One Limited.

“Bridge Facilities” has the meaning given to it under “General Development of the Business – Chronological Development of the Business – 2017 – Acquisition of Avista Corporation”.

“Burden Reduction Act” means the Burden Reduction Act, 2017, SO 2017, c 2 - Bill 27.

“Canada Business Corporations Act” means the Canada Business Corporations Act, RSC 1985, c C-44.

“CDM” means conservation and demand management.

“Climate Change Mitigation and Low-carbon Economy Act” means the Climate Change Mitigation and Low-carbon Economy Act, 2016, SO 2016, c 7.

“common shares” means the common shares in the capital of Hydro One Limited.

“Companies’ Creditors Arrangement Act” means Companies’ Creditors Arrangement Act, RSC 1985, c C-36.

“Convertible Debenture Offering” has the meaning given to it under “General Development of the Business – Chronological Development of the Business – 2017 – Convertible Debenture Offering”.

“Custom IR Method” has the meaning given to it under “Business of Hydro One – Transmission Business – Regulation – Transmission Rate Setting”.

“Debentures” has the meaning given to it under “Description of Capital Structure – Convertible Debentures and Instalment Receipts”.

“DMS” has the meaning given to it under “Business of Hydro One – Distribution Business – Regulation – Capital Expenditures”.

“Electricity Act” means the Electricity Act, 1998, SO 1998, c 15, Schedule A.

1

“Energy Statute Law Amendment Act” means the Energy Statute Law Amendment Act, 2016, SO 2016, c 10.

“Environmental Assessment Act” means the Environmental Assessment Act, RSO 1990, c E-18.

“Fair Hydro Act” means the Ontario Fair Hydro Plan Act, 2017, SO 2017, c 16, Schedule 1.

“Final Instalment” has the meaning given to it under “Description of Capital Structure – Convertible Debentures and Instalment Receipts”.

“Final Instalment Date” has the meaning given to it under “Description of Capital Structure – Convertible Debentures and Instalment Receipts”.

“Financial Administration Act” means the Financial Administration Act, RSC 1985, c F-11.

“First Nations Delivery Credit” means the credit pursuant to the First Nations Delivery Credit (On-Reserve Consumers Under Section 79.4 of the Act), O Reg 197/17, enacted pursuant to the Ontario Energy Board Act.

“Governance Agreement” means the governance agreement dated November 5, 2015 between Hydro One Limited and the Province.

“Great Lakes Power” means Great Lakes Power Transmission LP.

“Green Energy Act” means the Green Energy Act, 2009, SO 2009, c 12, Schedule A.

“GWh” means gigawatt-hours.

“Haldimand Hydro” means Haldimand County Utilities Inc.

“Hydro One” or the “Company” have the meanings given to such terms set out under “Presentation of Information”.

“Hydro One Inc.” has the meaning given to it under “Presentation of Information”.

“Hydro One Limited” has the meaning given to it under “Presentation of Information”.

“Hydro One Sault Ste. Marie LP” has the meaning given to it under “General Development of the Business – Chronological Development of the Business – 2016 – Acquisition of Great Lakes Power”.

“IESO” means the Independent Electricity System Operator.

“Income Tax Act” means the Income Tax Act, RSC 1985, c 1 (5th Supp).

“Indian Act” means the Indian Act, RSC 1985, c I-5.

“Instalment Receipt Agreement” has the meaning given to it under “Material Contracts”.

“July 2017 Underwriting Agreement” has the meaning given to it under “Material Contracts”.

“kV” means kilovolt.

“kW” means kilowatt.

2

“Make-Whole Payment” has the meaning given to it under “Description of Capital Structure – Convertible Debentures and Instalment Receipts”.

“management” has the meaning given to it under “Presentation of Information”.

“Market Rules” means the rules made under section 32 of the Electricity Act that are administered by the IESO.

“May 2017 Underwriting Agreement” has the meaning given to it under “Material Contracts”.

“Merger” has the meaning given to it under “General Development of the Business – Chronological Development of the Business – 2017 – Acquisition of Avista Corporation”.

“Minister of Energy” means the minister of the Ministry of Energy for the Province.

“National Energy Board Act” means the National Energy Board Act, RSC 1985, c N-7.

“NERC” has the meaning given to it under “The Electricity Industry in Ontario – Regulation of Transmission and Distribution – IESO”.

“Net Metering Regulation” means the Net Metering, O Reg 541/05, enacted pursuant to the Ontario Energy Board Act.

“Norfolk Power” means Norfolk Power Inc.

“NPCC” has the meaning given to it under “The Electricity Industry in Ontario – Regulation of Transmission and Distribution – IESO”.

“Nuclear Fuel Waste Act” means the Nuclear Fuel Waste Act, SC 2002, c 23.

“OBCA” means the Business Corporations Act (Ontario), RSO 1990, c B-16.

“OEB” means the Ontario Energy Board.

“Ontario” or the “province” has the meaning given to it under “Presentation of Information”.

“Ontario Energy Board Act” means the Ontario Energy Board Act, 1998, SO 1998, c 15, Schedule B.

“Ontario Fair Hydro Plan” has the meaning given to it under “Electricity Industry in Ontario – Recent Legislative Amendments Affecting the Electricity Industry Generally and Related Issues – Ontario Fair Hydro Plan”.

“Ontario Rebate for Electricity Consumers Act” means the Ontario Rebate for Electricity Consumers Act, 2016, SO 2016, c 19.

“OPEBs” means other post-employment benefits.

“Operating Credit Facility” has the meaning given to it under “Description of Capital Structure – Convertible Debentures and Instalment Receipts”.

“Orillia Power” means Orillia Power Distribution Corporation.

“PCB” means polychlorinated biphenyls.

3

“Protecting Vulnerable Energy Consumers Act” means the Protecting Vulnerable Energy Consumers Act, 2017, SO 2017, c 1 - Bill 95.

“Province” has the meaning given to it under “Presentation of Information”.

“Registration Rights Agreement” means the registration rights agreement dated November 5, 2015 between Hydro One Limited and the Province.

“Removal Notice” has the meaning given to it under “Agreements with Principal Shareholder – Governance Agreement – Governance Matters – Election and Replacement of Directors – Province’s Right to Replace the Board”.

“Reserve” means a “reserve” as that term is defined in the Indian Act.

“Revenue Cap Index” has the meaning given to it under “Business of Hydro One – Transmission Business – Regulation – Transmission Rate Setting”.

“RRF” has the meaning given to it under “Business of Hydro One – Distribution Business – Regulation – Distribution Rates”.

“Share Ownership Restrictions” has the meaning given to it under “The Electricity Industry in Ontario – Legislative Provisions Specific to Hydro One – 10% Ownership Restriction”.

“shares” has the meaning given to it under “Agreements with Principal Shareholder – Registration Rights Agreement – Demand Registration”.

“Special Board Resolution” has the meaning given to it under “Agreements with Principal Shareholder – Governance Agreement – Governance Matters – Board Approvals Requiring a Special Resolution of the Directors”.

“Specified Provincial Entity” has the meaning given to it under “Agreements with Principal Shareholder – Governance Agreement – Governance Matters – Nomination of Directors – Independence”.

“Taxation Act” means the Taxation Act, 2007, SO 2007, c 11, Schedule A.

“trust assets” has the meaning given to it under “Interest of Management and Others in Material Transactions – Relationships with the Province and Other Parties – Transfer Orders”.

“TS” means transmission station.

“TSX” means the Toronto Stock Exchange.

“TWh” means terawatt-hours.

“U.S. GAAP” means United States Generally Accepted Accounting Principles.

“Voting Securities” means a security of Hydro One Limited carrying a voting right either under all circumstances or under some circumstances that have occurred and are continuing.

“Woodstock Hydro” means Woodstock Hydro Holdings Inc.

4

PRESENTATION OF INFORMATION

Unless otherwise specified, all information in this annual information form is presented as at December 31, 2017.

Capitalized terms used in this annual information form are defined under “Glossary”. Words importing the singular number include the plural, and vice versa, and words importing any gender include all genders. The Annual MD&A and the audited consolidated financial statements of Hydro One Limited as at and for the year ended December 31, 2017, are specifically incorporated by reference into and form an integral part of this annual information form. Copies of these documents have been filed with the Canadian securities regulatory authorities and are available on SEDAR at www.sedar.com.

Unless otherwise noted or the context otherwise requires, references to “Hydro One” or the “Company” refer to Hydro One Limited and its subsidiaries taken together as a whole. References to “Hydro One Inc.” refer only to Hydro One Inc. and references to “Hydro One Limited” refer only to Hydro One Limited.

In addition, “Province” refers to the Province of Ontario as a provincial government entity, and “Ontario” or the “province” in lower case type refers to the Province of Ontario as a geographical area. References to “management” in this annual information form mean the persons who are identified as executive officers of Hydro One Limited and its subsidiaries, as applicable, in this annual information form. Any statements made by or on behalf of management are made in such persons’ respective capacities as executive officers of Hydro One Limited and its subsidiaries, as applicable, and not in their personal capacities. See “Directors and Officers” for more information.

This annual information form refers to certain terms commonly used in the electricity industry, such as “rate-regulated”, “rate base” and “return on equity”. Rate base is an amount that a utility is required to calculate for regulatory purposes, and refers to the net book value of the utility’s assets for regulatory purposes. Return on equity is a percentage that is set or approved by a utility’s regulator and represents the rate of return that a regulator allows the utility to earn on the equity component of the utility’s rate base. See also “Rate-Regulated Utilities”.

In this annual information form, all dollar amounts are expressed in Canadian dollars unless otherwise indicated. All references to “$” or “dollars” refers to Canadian dollars. Hydro One Limited and Hydro One Inc. prepare and present their financial statements in accordance with U.S. GAAP.

5

FORWARD-LOOKING INFORMATION

Certain information in this annual information form contains “forward-looking information” within the meaning of applicable Canadian securities laws. Forward-looking information in this annual information form is based on current expectations, estimates, forecasts and projections about Hydro One’s business and the industry in which Hydro One operates and includes beliefs of and assumptions made by management. Such statements include, but are not limited to, statements related to: Hydro One’s strategy and goals; the Company’s transmission and distribution rate applications, and resulting rates and impacts; expected impacts of changes to the electricity industry; the Company’s maturing debt and standby credit facilities; expectations regarding the Company’s financing activities; credit ratings; ongoing and planned projects and/or initiatives, including expected results and timing; expected future capital expenditures, the nature and timing of these expenditures, including the Company’s plans for sustaining and development capital expenditures for its distribution and transmission systems; expectations regarding allowed return on equity; expectations regarding the ability of the Company to recover expenditures in future rates; the OEB; the motion and the appeal in respect of the OEB’s September 28, 2017 decision, including the expected impact on Hydro One if the OEB’s decision is upheld; future pension contributions, the pension plan and valuations; impacts of OEB treatment of pension and OPEB costs; expectations regarding the ability to negotiate collective agreements consistent with rate orders and to maintain stable outsourcing arrangements; expectations related to work force demographics; expectations regarding taxes; occupational rights; expectations regarding load growth; the regional planning process; expectations related to Hydro One’s CDM requirements and targets; the Company’s customer focus and related initiatives; statements related to the Company’s relationships with Indigenous communities; statements related to environmental matters, and the Company’s expected future environmental and remediation expenditures; expectations related to the effect of interest rates; the Company’s reputation; cyber and data security; the Company’s relationship with the Province; future sales of shares of Hydro One; acquisitions and consolidation opportunities, including the Company’s acquisition of Orillia Power and Avista Corporation; participation in Hydro One’s Winter Relief Program; expectations regarding the Governance Agreement and other agreements with the Province; expectations regarding Hydro One’s earnings per common share following completion of the Merger; the Debentures; the Province’s waiver of its pre-emptive right under the Governance Agreement to participate in the Convertible Debenture Offering; the Company’s financing strategy and foreign currency hedging relating to the acquisition of Avista Corporation; litigation relating to the Merger; expectations regarding the manner in which Hydro One will operate; expectations regarding Hydro One’s dividend policy and the Company’s intention to declare and pay dividends, including the target payout ratio of 70% to 80% of net income; implementation of the 2017 Long-Term Energy Plan; the Fair Hydro Plan, including expected outcomes and impacts; potential conflicts of interest; and legal proceedings in which Hydro One is currently involved.

Words such as “aim”, “could”, “would”, “expect”, “anticipate”, “intend”, “attempt”, “may”, “plan”, “will”, “believe”, “seek”, “estimate”, “goal”, “target”, and variations of such words and similar expressions are intended to identify such forward-looking information. These statements are not guarantees of future performance and involve assumptions and risks and uncertainties that are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed, implied or forecasted in such forward-looking information. Hydro One does not intend, and it disclaims any obligation to update any forward-looking information, except as required by law.

6

The forward-looking information in this annual information form is based on a variety of factors and assumptions including, but not limited to: no unforeseen changes in the legislative and operating framework for Ontario’s electricity market; favourable decisions from the OEB and other regulatory bodies concerning outstanding and future rate and other applications, including the required regulatory approvals relating to the Merger and other conditions precedent to closing the Merger; no unexpected delays in obtaining the required approvals; no unforeseen changes in rate orders or rate setting methodologies for Hydro One’s distribution and transmission businesses; no unfavourable changes in environmental regulation; continued use of U.S. GAAP; a stable regulatory environment; the ability to obtain a bridge credit facility to finance a portion of the cash purchase price of the Merger and Merger-related costs; the ability to obtain permanent financing in respect of the Merger; and no significant event occurring outside the ordinary course of business. These assumptions are based on information currently available to Hydro One, including information obtained from third-party sources. Actual results may differ materially from those predicted by such forward-looking information. While Hydro One does not know what impact any of these differences may have, Hydro One’s business, results of operations, financial condition and credit stability may be materially adversely affected if any such differences occur. Factors that could cause actual results or outcomes to differ materially from the results expressed or implied by forward-looking information include, among other things:

| • | risks associated with the Province’s share ownership of Hydro One and other relationships with the Province, including potential conflicts of interest that may arise between Hydro One, the Province and related parties; |

| • | regulatory risks and risks relating to Hydro One’s revenues, including risks relating to rate orders, actual performance against forecasts and capital expenditures; |

| • | the risk that the Company may be unable to comply with regulatory and legislative requirements or that the Company may incur additional costs for compliance that are not recoverable through rates; |

| • | the risks relating to the Merger, including (i) the risk that Hydro One may fail to complete the Merger, (ii) uncertainty regarding the length of time required to complete the Merger, (iii) the risk that the purchase price for Avista Corporation could increase, and (iv) the risk that the anticipated benefits of the Merger may not materialize or may not occur within the time periods contemplated by Hydro One; |

| • | the risk of exposure of the Company’s facilities to the effects of severe weather conditions, natural disasters or other unexpected occurrences for which the Company is uninsured or for which the Company could be subject to claims for damage; |

| • | public opposition to and delays or denials of the requisite approvals and accommodations for the Company’s planned projects; |

| • | the risk that Hydro One may incur significant costs associated with transferring assets located on Reserves; |

7

| • | the risks associated with information system security and with maintaining a complex information technology system infrastructure, including risks of cyber-attacks or unauthorized access to corporate and information technology systems; |

| • | the risks related to the Company’s work force demographic and its potential inability to attract and retain qualified personnel; |

| • | the risk of labour disputes and inability to negotiate appropriate collective agreements on acceptable terms consistent with the Company’s rate decisions; |

| • | the risk that the Company is not able to arrange sufficient cost-effective financing to repay maturing debt and to fund capital expenditures; |

| • | the risks related to the financing of the Merger, including (i) the potential unavailability of a bridge credit facility to finance a portion of the cash purchase price of the Merger and Merger-related costs, and (ii) alternative sources of funding that would be used to replace the Bridge Credit Facility may not be available when needed; |

| • | risks related to Hydro One substantially increasing the amount of its indebtedness following the Merger; |

| • | risks associated with fluctuations in interest rates and failure to manage exposure to credit risk; |

| • | the risk that the Company may not be able to execute plans for capital projects necessary to maintain the performance of the Company’s assets or to carry out projects in a timely manner; |

| • | the risk of non-compliance with environmental regulations or failure to mitigate significant health and safety risks and inability to recover environmental expenditures in rate applications; |

| • | the risk that assumptions that form the basis of the Company’s recorded environmental liabilities and related regulatory assets may change; |

| • | the risk of not being able to recover the Company’s pension expenditures in future rates and uncertainty regarding the future regulatory treatment of pension, other post-employment benefits and post-retirement benefits cost; |

| • | the potential that Hydro One may incur significant expenses to replace functions currently outsourced if agreements are terminated or expire before a new service provider is selected; |

| • | the risks associated with economic uncertainty and financial market volatility; |

8

| • | the inability to prepare financial statements using U.S. GAAP; and |

| • | the impact of the ownership by the Province of lands underlying the Company’s transmission system. |

Hydro One cautions the reader that the above list of factors is not exhaustive. Some of these and other factors are discussed in more detail under the heading “Risk Management and Risk Factors” in the Annual MD&A. You should review such section in detail, including the matters referenced therein.

In addition, Hydro One cautions the reader that information provided in this annual information form regarding Hydro One’s outlook on certain matters, including potential future expenditures, is provided in order to give context to the nature of some of Hydro One’s future plans and may not be appropriate for other purposes.

9

ELECTRICITY INDUSTRY OVERVIEW

General Overview

The electricity industry is made up of businesses that generate, transmit, distribute and sell electricity. While traditionally a mature and stable industry, innovation and technological change are expected to have a significant impact on the industry in the foreseeable future. Hydro One’s business is focused on the transmission and distribution of electricity.

| • | Transmission refers to the delivery of electricity over high voltage lines, typically over long distances, from generating stations to local areas and large industrial customers. |

| • | Distribution refers to the delivery of electricity over low voltage power lines to end users such as homes, businesses and institutions. |

Overview of an Electricity System

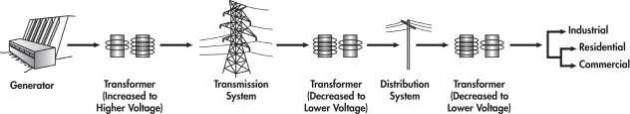

The basic configuration of a typical electricity system showing electricity generation, transmission and distribution is illustrated in the following diagram:

Transmission and distribution networks are sometimes referred to as the “electricity grid” or simply “the grid”. For simplicity, the diagram above does not show customers directly connected to the transmission system or distributed generation sources or other distributors that may be connected to the distribution system.

THE ELECTRICITY INDUSTRY IN ONTARIO

Regulation of Transmission and Distribution

General

The Electricity Act and the Ontario Energy Board Act establish the general legislative framework for Ontario’s electricity market. The activities of transmitters and distributors in Ontario are overseen by three main regulatory authorities: (i) the OEB, (ii) the IESO, and (iii) the National Energy Board. The Minister of Energy is responsible for developing long-term energy plans and has the power to issue directives to the IESO and the OEB regarding implementation of such plans.

10

Ontario Energy Board

The OEB is an independent regulatory agency. The Ontario Energy Board Act provides the OEB with the authority to regulate Ontario’s electricity market, including the activities of transmitters and distributors.

The OEB has the following legislated objectives in relation to the electricity industry:

| • | to protect the interests of consumers with respect to prices and the adequacy, reliability and quality of electricity service, |

| • | to promote the education of consumers, |

| • | to promote economic efficiency and cost effectiveness in the generation, transmission, distribution, sale and demand management of electricity and to facilitate the maintenance of a financially viable electricity industry, |

| • | to promote electricity conservation and demand management in a manner consistent with the policies of the Province, including having regard to the consumer’s economic circumstances, |

| • | to facilitate the implementation of a smart grid in Ontario, and |

| • | to promote the use and generation of electricity from renewable energy sources in a manner consistent with the policies of the Province, including the timely expansion or reinforcement of transmission systems and distribution systems to accommodate the connection of renewable energy generation facilities. |

The OEB is responsible for, among other things, approving transmission and distribution rates in Ontario. It also approves the construction, expansion, or reinforcement of transmission lines greater than two kilometres in length, as well as mergers, acquisitions, amalgamations and divestitures involving distributors, transmitters and other entities which it licenses. The activities of transmitters and distributors are subject to the conditions of their licenses and a number of industry codes issued by the OEB. These codes and other requirements prescribe minimum standards of conduct and service for licensed participants in the electricity market.

On December 14, 2017, the Province announced that it is establishing a panel to modernize the OEB. The panel has been given a mandate including reviewing how the OEB can continue to protect consumers amidst a rapidly changing sector, support innovation and new technologies, and how the OEB should be structured and resourced to deliver on its changing role. The panel is expected to report back to the Province by the end of 2018.

On December 18, 2017, the OEB posted its Strategic Blueprint: Keeping Pace with the Evolving Energy Sector. This document sets out the OEB’s commitment to modernize its approach to regulation over the next five years.

11

IESO

The IESO delivers key services across the electricity sector including managing the power system in real-time, planning for Ontario’s future energy needs, enabling conservation and designing a more efficient electricity marketplace to support sector evolution. It is governed by a board whose chair and directors are appointed by the Province. The IESO also coordinates province-wide conservation efforts.

Transmitters and other wholesale market participants must comply with the Market Rules issued by the IESO. The Market Rules require transmitters to comply with mandatory North American reliability standards for transmission issued by the North American Electric Reliability Corporation (“NERC”) and the Northeast Power Coordinating Council, Inc. (“NPCC”). The IESO enforces these reliability standards and coordinates with system operators and reliability agencies in other jurisdictions to ensure energy adequacy and security across the interconnected bulk electricity system in North America.

National Energy Board

The National Energy Board is an independent federal regulatory agency. Most of the National Energy Board’s responsibilities are set out in the National Energy Board Act and it has jurisdiction over the construction and operation of international power lines, as well as interprovincial lines that are designated as being under federal jurisdiction (of which there are currently none). As Hydro One owns and operates 11 active international power lines connecting Ontario’s transmission system with transmission systems in Michigan, Minnesota and New York, Hydro One is required to hold several certificates and permits issued by the National Energy Board and is subject to its mandatory electricity reliability standards and reporting requirements.

Transmission

Transmission companies own and operate transmission systems that deliver electricity over high voltage lines. Hydro One’s transmission system accounts for approximately 98% of Ontario’s electricity transmission capacity based on the revenues approved by the OEB. The Company’s transmission system is interconnected to systems in Manitoba, Michigan, Minnesota, New York and Quebec and is part of the North American electricity grid’s Eastern Interconnection. The Eastern Interconnection is a contiguous electricity transmission system that extends from Manitoba to Florida and from east of the Rocky Mountains to the North American east coast. Being part of the Eastern Interconnection provides benefits to Ontario, such as greater security and stability for Ontario’s transmission system, emergency support when there are generation constraints or shortages in Ontario, and the ability to exchange electricity with other jurisdictions.

Distribution

Distributors own and operate distribution systems that deliver electricity over power lines at voltages of 50kV or less to end users. In Ontario, as per the OEB’s 2016 Yearbook of Electricity Distributors, as at December 31, 2016, 68 local distribution companies provided electricity to approximately five million customers. The distribution industry in Ontario is fragmented, with the 15 largest local distribution companies accounting for approximately 80% of the province’s customers.

12

Through its wholly-owned subsidiary Hydro One Inc., Hydro One owns the largest local distribution company in Ontario, which serves over 1.3 million predominantly rural customers, or approximately 26% of the total number of customers in Ontario.

A local distribution company is responsible for distributing electricity to customers in its OEB-licensed service territory, and in some cases to other distributors. A service territory may cover large portions or all of a particular municipality, or an otherwise-defined geographic area. Distribution customers include homes, commercial and industrial businesses and institutions such as governments, schools and hospitals.

Recent Developments at Hydro One

On March 16, 2018, the OEB issued a letter which expects Hydro One Networks Inc. to file (i) a 4-year transmission rate application in 2019-2022; and (ii) a joint distribution-transmission rate application for 2023-2027.

Recent Legislative Amendments Affecting the Electricity Industry Generally and Related Issues

Tax Incentives

Tax incentives were included in the 2015 Ontario Budget to promote consolidation in the electricity distribution sector. The 2015 Ontario Budget announced a reduction in the tax rate for transfers of electricity assets from 33% to 22% and to NIL for distributors with fewer than 30,000 customers. In addition, the budget also introduced a capital gains exemption where capital gains arise as a result from exiting the payments in lieu of corporate taxes regime. These changes apply for the period beginning January 1, 2016, and ending December 31, 2018.

Energy Statute Law Amendment Act

The Energy Statute Law Amendment Act came into force in 2016. This act amended various sections of the Ontario Energy Board Act, the Electricity Act and the Green Energy Act. In particular, the Energy Statute Law Amendment Act amended the Electricity Act to require the Minister of Energy to produce long-term energy plans that may require the OEB and the IESO to issue implementation plans to achieve the objectives of those plans and to guide the OEB by such plans’ objectives in exercising its powers and performing its duties.

Ontario 2017 Long-Term Energy Plan

In 2017, the Province released its 2017 Long-Term Energy Plan, which sets out a number of initiatives for Ontario’s energy system over the coming years, including: ensuring affordable and accessible energy, ensuring a flexible energy system, innovating to meet the future, improving value and performance for consumers, strengthening our commitment to energy conservation and efficiency, responding to the challenge of climate change, supporting First Nation and Métis capacity and leadership, and supporting regional solutions and infrastructure. Additional details about certain key aspects of the 2017 Long-Term Energy Plan are set out below.

13

The Minister of Energy issued directives to the IESO and the OEB to develop implementation plans to meet objectives outlined in the 2017 Long-Term Energy Plan, such implementation plans to be submitted to the Minister of Energy by January 31, 2018. The IESO and OEB submitted their implementation plans to the Minister on January 31, 2018 and on February 15, 2018, the Minister of Energy approved the implementation plans. Certain aspects of the 2017 Long-Term Energy Plan are detailed below, in “Ontario Fair Hydro Plan” and “Expanded Net Metering”.

Ontario Fair Hydro Plan

In March 2017, the Province announced the Ontario Fair Hydro Plan, which proposed measures to reduce electricity bills by an average of 25% for residential customers as well as initiatives to reduce costs for businesses. This plan includes the eight percent electricity bill rebate that was introduced in January 2017 (through the Ontario Rebate for Electricity Consumers Act) and builds on previously announced government initiatives to deliver rate relief on electricity bills.

The Fair Hydro Act, which act came into force on June 1, 2017, puts in place the framework for giving effect to the Fair Hydro Plan initiatives.

The Ontario Fair Hydro Plan includes:

| • | Refinancing a portion of the global adjustment over a longer period of time. The global adjustment is payable by Ontario electricity customers, and was established by the Province to pay costs associated with contracted and rate-regulated generation, as well as conservation and demand management programs in Ontario. |

| • | Provision for or broadening of electricity accessibility and assistance programs, including, |

| ¡ | Establishing an Affordability Fund to provide energy conservation and efficiency measures to certain Ontario electricity customers who are not eligible for low-income conservation programs and who need support to improve the energy efficiency of their homes. |

| ¡ | Enhancing distribution rate protection for eligible rural customers of Hydro One and certain other distributors whose customers have higher distribution charges compared to other areas. |

| ¡ | Establishing a First Nations Delivery Credit to eliminate electricity delivery charges for all on-reserve First Nations residential customers of local distribution companies. |

| ¡ | Expanding the existing Ontario Electricity Support Program, which is an OEB program that lowers electricity bills for lower-income households by providing a monthly bill credit to eligible customers. |

| • | Allowing smaller manufacturers and greenhouses with average monthly peak demand greater than 500 kW to participate in the Industrial Conservation Initiative, effective July 1, 2017. The Industrial Conservation Initiative lowers electricity costs for eligible consumers who reduce |

14

| consumption during the five highest peak periods of the year, providing an incentive to lower their consumption during peak hours and reduce their bills by an average of one-third. |

| • | The Ontario Rebate for Electricity Consumers program, which commenced on January 1, 2017, as per the Ontario Rebate for Electricity Consumers Act. This program provides financial assistance to residential, farm, small business and other eligible consumers in respect of electricity costs, equal to a rebate of eight percent of the base invoice amount for each billing period. This rebate appears as a line item on eligible consumers’ electricity bills. |

Expanded Net Metering

As part of the commitment in the 2017 Long-Term Energy Plan to give customers new ways to participate in renewable electricity generation, amendments were made to the Net Metering Regulation. Net metering is a billing arrangement with a local distribution company that allows customers to offset the electricity they buy from their local distribution company with electricity generated by their own renewable energy systems, and receive credits on their electricity bill for the electricity they send to the grid, reducing their total bill charges.

Effective July 1, 2017, the amendments expanded the net metering rules to include renewable generators of any size as eligible for net metering, provided that electricity is generated primarily for the generator’s own use, and provided that the generator is not party to any agreement other than a net metering agreement for the sale of electricity into the distribution system. The amendments also allow generators to use energy storage systems in combination with conveying their excess generated electricity into the distribution system.

Climate Change Mitigation and Low-carbon Economy Act

Pursuant to the Climate Change Mitigation and Low-carbon Economy Act, the Province introduced a cap and trade program in Ontario beginning January 1, 2017. The program capped the amount of greenhouse gas emissions for Ontario homes and businesses and lowers that limit over time. Hydro One Networks Inc., an indirect wholly-owned subsidiary of Hydro One Limited, was deemed a mandatory participant in the cap and trade program based on its annual carbon dioxide equivalent emissions. As required, Hydro One Networks Inc. registered under the program in November 2016, and continues to comply with its reporting requirements.

Burden Reduction Act

The Burden Reduction Act amended various statutes, including the Ontario Energy Board Act and the Electricity Act. The Burden Reduction Act, among other things, amended the Ontario Energy Board Act in a number of ways related to deferral and variance account review and oversight and review of transactions between transmitters and distributors and electricity generators.

15

Protecting Vulnerable Energy Consumers Act

The Protecting Vulnerable Energy Consumers Act impacts a distributor’s ability to disconnect customers by broadening the power of the OEB to prescribe, as a condition of a distributor’s licence, periods during which disconnections of low-volume consumers may not take place. In February 2017, the OEB issued a decision and order amending the licenses of all Ontario electricity distributors prohibiting the disconnection of residential customers by reason of non-payment for the balance of the 2017 winter period. In November 2017, the OEB issued a decision and order banning licensed electricity distributors from disconnecting homes for non-payment during the winter. See “General Development of the Business – Customer Focus – Winter Moratorium and Winter Relief Program” for more information.

OEB Consultation on Pension and Other Post-Employment Benefits

In May 2015, the OEB initiated a consultation on the regulatory treatment of pension and OPEBs in the electricity industry. The aim of the consultation was to develop standard principles to guide the OEB’s review of pension and OPEBs costs, to establish specific information requirements for applications, and to establish appropriate regulatory mechanisms for cost recovery which can be applied consistently among rate-regulated entities.

The OEB completed its consultation on pension and OPEBs costs with a cumulative report in September 2017. The OEB concluded that the default method will be the accrual accounting method to set rates for pension and OPEBs amounts. The OEB will permit another method if that method results in just and reasonable rates and the OEB will adopt certain practices in its treatment of pension and OPEBs costs.

The OEB concluded that utilities must establish a variance account to track the differences between forecasted accrual amount in rates and actual cash payments made with carrying charges at rates determined by OEB to be applied to the differences in favour of ratepayers. There is no set-aside charge for OPEBs.

Legislative Provisions Specific to Hydro One

In addition to legislation in Ontario that impacts all transmitters and distributors, there is legislation that is specific to Hydro One. Specifically, the Electricity Act requires Hydro One’s head office and principal grid control centre to be maintained in Ontario, restricts the disposition of substantially all of its OEB-regulated transmission or distribution business, prohibits any change to its jurisdiction of incorporation, requires the Company to have an ombudsman, contains a 10% ownership restriction with respect to Voting Securities and restricts the Province from selling Voting Securities if it would own less than 40% of the Voting Securities of any class or series as a result of the sale.

Ombudsman

The Electricity Act requires the Company to have an ombudsman to act as a liaison with customers and to establish procedures for the ombudsman to inquire into and report to the Board on matters raised with the ombudsman by or on behalf of customers. See “General Development of the Business – Chronological Development of the Business – 2015 – Ombudsman” for more information.

16

10% Ownership Restriction

The Electricity Act imposes share ownership restrictions on the Voting Securities. These restrictions provide that no person or company (or combination of persons or companies acting jointly or in concert) may beneficially own or exercise control or direction over more than 10% of any class or series of Voting Securities, including common shares of the Company (the “Share Ownership Restrictions”). The Share Ownership Restrictions do not apply to Voting Securities held by the Province, nor to an underwriter who holds Voting Securities solely for the purpose of distributing those securities to purchasers who comply with the Share Ownership Restrictions. The articles of Hydro One Limited provide for comprehensive enforcement mechanisms that are applicable in the event of a contravention of the Share Ownership Restrictions.

Maintenance of 40% Ownership

As of December 31, 2017, the Province owned approximately 47.4% of Hydro One Limited’s common shares. The Province has indicated that it does not intend to sell additional common shares of Hydro One. See the Annual MD&A under the heading “Risk Management and Risk Factors” for more information.

The Electricity Act restricts the Province from selling Voting Securities (including common shares of Hydro One Limited) if it would own less than 40% of the outstanding number of Voting Securities of that class or series after the sale. If as a result of the issuance of additional Voting Securities by Hydro One Limited, the Province owns less than 40% of the outstanding number of Voting Securities of any class or series, the Province must, subject to the approval of the Lieutenant Governor in Council and the necessary appropriations from the Legislature, take steps to acquire as many Voting Securities of that class or series as are necessary to increase the Province’s ownership to not less than 40% of the outstanding number of Voting Securities of that class or series. The manner in which, and the time by which, the Province must acquire these additional Voting Securities will be determined by the Lieutenant Governor in Council.

The Province has been granted pre-emptive rights by Hydro One Limited to assist it in meeting its ownership requirements under the Electricity Act as described under “Agreements with Principal Shareholder – Governance Agreement – Other Matters – Pre-emptive Rights”.

Elimination of Certain Legislation With Respect to Hydro One

In 2015 and 2016, Hydro One Inc. and its subsidiaries ceased to be subject to a number of Ontario statutes that apply to entities owned by the Province. Hydro One Limited is similarly not subject to those statutes. Notwithstanding the elimination of certain legislation with respect to Hydro One, the Company is required under the Financial Administration Act and the Auditor General Act to provide financial information to the Province for the Province’s public reporting purposes.

17

RATE-REGULATED UTILITIES

Rate Applications in Ontario

Framework

The term “rate-regulated” is used to refer to an electricity business whose rates for transmission, distribution or other services are subject to approval by a regulator. The rate base of a rate-regulated utility refers to the net book value of the utility’s assets for regulatory purposes, plus an allowance for working capital. Rate base differs from a utility’s total assets for accounting purposes, primarily because it includes the regulated assets of a utility. The OEB is the regulator that approves electricity transmission and distribution rates in Ontario. Transmission rates have historically been determined based on a cost-of-service model, while distribution rates are generally determined using a performance-based model. These models are reviewed and modified by the OEB from time to time.

In 2016, the OEB updated the filing requirements for electricity transmission applications and introduced new revenue requirement setting options. The requirements changed the framework for setting a transmitter’s revenue requirement from a cost-of-service approach to a performance-based approach similar to that outlined in the RRF for electricity distributors. To facilitate the transition to the new framework, existing transmitters may still apply for revenue requirement approval based on a one or two year cost-of-service application for their first application following the issuance of the new filing requirements.

In a cost-of-service model, a utility charges rates for its services that allow it to recover the costs of providing its services and earn an allowed return on equity. A utility’s return on equity or “ROE” is the rate of return that a regulator allows the utility to earn on the equity portion of the utility’s rate base. The costs of providing its services must be prudently incurred. Cost savings are typically passed on to customers in the form of lower rates reflected in future rate decisions. In a cost-of-service model, the utility has the potential to retain cost savings that are achieved in the intervening years between rate decisions.

|

Cost of Service ($) + Return on Equity ($) = Revenue Requirement ($) |

In a performance-based model, a utility also charges rates for its services that allow it to recover the costs of providing its services and earn an allowed return on equity. However, the rates charged by the utility in a performance-based model assume that the utility becomes increasingly efficient over time, resulting in lower costs to provide the same service. If a utility achieves cost savings in excess of those established by the regulator, the utility may retain some or all of the benefits of those cost savings, which may permit the utility to earn more than its allowed return on equity.

18

CORPORATE STRUCTURE

Incorporation and Office

Hydro One Limited was incorporated on August 31, 2015, under the OBCA. Its registered office and head office is located at 483 Bay Street, 8th Floor, South Tower, Toronto, Ontario M5G 2P5.

On October 30, 2015, the articles of Hydro One Limited were amended to authorize the creation of an unlimited number of Series 1 preferred shares and an unlimited number of Series 2 preferred shares, with the Series 1 preferred shares to be issued to the Province.

On October 31, 2015, all of the issued and outstanding shares of Hydro One Inc. were acquired by Hydro One Limited from the Province in exchange for the issuance to the Province of common shares and Series 1 preferred shares of Hydro One Limited.

On November 4, 2015, the articles of Hydro One Limited were amended to authorize the consolidation of its outstanding common shares such that 595,000,000 common shares of Hydro One Limited were issued and outstanding.

Corporate Structure and Subsidiaries

The following is a simplified chart showing the organizational structure of Hydro One and the name and jurisdiction of incorporation of certain of its subsidiaries. This chart does not include all legal entities within Hydro One’s organizational structure. Hydro One Limited owns, directly or indirectly, 100% of the voting securities of all of the subsidiaries listed below.

19

Notes:

| (1) | As of December 31, 2017, the Province directly owned approximately 47.4% of Hydro One Limited’s outstanding common shares and 100% of the outstanding Series 1 preferred shares. |

| (2) | Indirectly held through a wholly-owned subsidiary of Hydro One Limited that acts as a holding company for Hydro One’s non-rate-regulated businesses. |

Certain of Hydro One’s subsidiaries are described below:

| • | Hydro One Inc. – acts as a holding company for Hydro One’s rate-regulated businesses. Its publicly-issued debt continues to be outstanding. |

| • | Hydro One Networks Inc. – the principal operating subsidiary that carries on Hydro One’s rate-regulated transmission and distribution businesses. |

| • | Hydro One Remote Communities Inc. – generates and supplies electricity to remote communities in northern Ontario. |

| • | Hydro One Telecom Inc. – carries on Hydro One’s non-rate-regulated telecommunications business. |

20

GENERAL DEVELOPMENT OF THE BUSINESS

Chronological Development of the Business

The following key events occurred from 2015 to early 2018 in respect of Hydro One.

2015

Incorporation and Initial Public Offering

On August 31, 2015, Hydro One Limited was incorporated by the Province as its sole shareholder.

On November 5, 2015, Hydro One Limited completed its initial public offering on the TSX by way of a secondary offering of 81,100,000 common shares by the Province at a price of $20.50 per share for aggregate gross proceeds to the Province of $1,662,550,000. On November 12, 2015, the underwriters in the initial public offering exercised their option to purchase an additional 8,150,000 common shares from the Province at a price of $20.50 per share for additional aggregate gross proceeds to the Province of $167,075,000. Hydro One Limited did not receive any proceeds from the initial public offering.

Acquisition of Hydro One Inc.

Prior to the closing of the initial public offering, all of the issued and outstanding common shares of Hydro One Inc. were acquired by Hydro One Limited. Under applicable Canadian securities laws, the acquisition of all of the issued and outstanding shares of Hydro One Inc. was considered a “significant acquisition”. Hydro One Limited filed a business acquisition report in respect of the acquisition on January 14, 2016. See “Business of Hydro One – Reorganizations” for more information.

Hydro One Brampton Networks Inc.

On August 31, 2015, all of the issued and outstanding shares of Hydro One Brampton Networks Inc. were transferred to the Province. Hydro One was not a participant in nor did it receive any proceeds from the transfer of Hydro One Brampton Networks Inc. to the Province.

Following the transfer to the Province, Hydro One provided certain management, administrative and smart meter network services to Hydro One Brampton Networks Inc. pursuant to service level agreements. These agreements terminated as of February 28, 2017.

Ombudsman

In 2015, the Electricity Act was amended to require that the Company have an ombudsman to act as a liaison with customers and to establish procedures for the ombudsman to inquire into and report to the Board on matters raised with the ombudsman by or on behalf of customers. These procedures are set out in a written mandate and terms of reference. See “Business of Hydro One – Ombudsman” for more information.

21

2016

2016 Secondary Common Share Offering

On April 14, 2016, the Province completed a secondary offering of 72,434,800 common shares of Hydro One Limited at a price of $23.65 per share for aggregate gross proceeds to the Province of $1,713,083,020. On April 29, 2016, the underwriters in the secondary offering exercised their option to purchase an additional 10,865,200 common shares from the Province at a price of $23.65 per share for additional aggregate gross proceeds to the Province of $256,961,980. Following the completion of this offering, the Province held approximately 70.1% of Hydro One’s total issued and outstanding common shares. Hydro One Limited did not receive any proceeds from the sale of the common shares by the Province.

Agreement to Acquire Orillia Power

In August 2016, the Company reached an agreement to acquire Orillia Power, an electricity distribution company located in Simcoe County, Ontario, for approximately $41 million, including the assumption of approximately $15 million in outstanding indebtedness and regulatory liabilities, subject to closing adjustments. The acquisition is subject to regulatory approval by the OEB. For more information, see “Business of Hydro One – Distribution Business – Acquisitions – Agreement to Acquire Orillia Power”.

Integration of Haldimand Hydro and Woodstock Hydro

In September 2016, the Company successfully completed the integration of Haldimand Hydro and Woodstock Hydro, two Ontario-based local distribution companies acquired by the Company in 2015, including the integration of employees, customer and billing information, business processes, and operations.

Acquisition of Great Lakes Power

On October 31, 2016, following receipt of regulatory approval of the transaction by the OEB, Hydro One completed the acquisition of Great Lakes Power, an Ontario regulated electricity transmission business operating along the eastern shore of Lake Superior, north and east of Sault Ste. Marie, Ontario. The total purchase price for Great Lakes Power was approximately $376 million, including the assumption of approximately $150 million in outstanding indebtedness. On January 16, 2017, Great Lakes Power’s name was changed to Hydro One Sault Ste. Marie LP.

2017

2017 Secondary Common Share Offering

On May 17, 2017, the Province completed a secondary offering of 120,000,000 common shares of Hydro One Limited at a price of $23.25 per share for aggregate gross proceeds to the Province of approximately $2.79 billion. Following completion of this offering, the Province held approximately 49.9% of Hydro

22

One’s total issued and outstanding common shares. Hydro One did not receive any of the proceeds from the sale of the common shares by the Province.

Exemptive Relief

On June 6, 2017, the Canadian securities regulatory authorities granted (i) the Minister of Energy, (ii) Ontario Power Generation Inc. (on behalf of itself and the segregated funds established as required by the Nuclear Fuel Waste Act) and (iii) agencies of the Crown, provincial Crown corporations and other provincial entities (collectively, the Non-Aggregated Holders) exemptive relief, subject to certain conditions, to enable each Non-Aggregated Holder to treat securities of Hydro One that it owns or controls separately from securities of Hydro One owned or controlled by the other Non-Aggregated Holders for purposes of certain takeover bid, early warning reporting, insider reporting and control person distribution rules and certain distribution restrictions under Canadian securities laws. Hydro One was also granted relief permitting it to rely solely on insider reports and early warning reports filed by Non-Aggregated Holders when reporting beneficial ownership or control or direction over securities in an information circular or annual information form in respect of securities beneficially owned or controlled by any Non-Aggregated Holder subject to certain conditions.

Acquisition of Avista Corporation

On July 19, 2017, Hydro One reached an agreement to acquire Avista Corporation (the “Merger”) for approximately U.S. $5.3 billion in an all-cash transaction, comprised of an equity purchase price of U.S. $3.4 billion and the assumption of U.S. $1.9 billion of debt. Avista Corporation is an investor-owned utility providing electric generation, transmission and distribution services. It is headquartered in Spokane, Washington, with service areas in Washington, Idaho, Oregon, Montana and Alaska. The closing of the Merger, which is expected to occur in the second half of 2018, is subject to receipt of certain regulatory and government approvals, and the satisfaction of customary closing conditions.

On September 14, 2017, Hydro One and Avista Corporation filed applications with state utility commissions in Washington, Idaho, Oregon, Montana, and Alaska, as well as with the Federal Energy Regulatory Commission, requesting regulatory approval of the Merger on or before August 14, 2018. On November 21, 2017, the Merger was approved by the shareholders of Avista Corporation. On January 16, 2018, the Federal Energy Regulatory Commission approved the Merger application. Required filings with a number of other agencies will be made in the coming months, including with the Committee of Foreign Investment in the United States, the Federal Communications Commission, and the Department of Justice and the Federal Trade Commission pursuant to the Hart-Scott-Rodino Antitrust Improvements Act of 1976. On March 27, 2018, a settlement agreement was filed with the Washington Utilities and Transportation Commission, which remains subject to approval by the Washington Utilities and Transportation Commission.

The cash purchase price of the Merger and the Merger-related costs will be financed at the closing of the Merger with a combination of some or all of the following sources: (i) net proceeds of the first instalment from the Convertible Debenture Offering (described below); (ii) net proceeds of any subsequent bond or other debt offerings; (iii) amounts drawn under the Operating Credit Facility; (iv) amounts drawn under one or more bridge credit facilities which Hydro One plans to obtain from a syndicate of banks prior to

23

closing of the Merger (the “Bridge Facilities”); and (v) existing cash on hand and other sources available to Hydro One.

Convertible Debenture Offering

On August 9, 2017, in connection with the acquisition of Avista Corporation, the Company and its wholly-owned subsidiary, 2587264 Ontario Inc., completed the sale of $1.54 billion aggregate principal amount of 4.00% convertible unsecured subordinated debentures of Hydro One Limited represented by instalment receipts (the “Convertible Debenture Offering”)

The Province waived its pre-emptive right to participate in the Convertible Debenture Offering under the Governance Agreement. In consideration of granting the waiver, Hydro One Limited agreed that until July 19, 2018: (i) the Company shall not issue common shares pursuant to the Company’s equity compensation plans and any dividend reinvestment plan in an aggregate number that exceeds 1% of the common shares outstanding as of July 19, 2017; and (ii) the Company shall not issue voting securities (or securities convertible into voting securities) pursuant to any acquisition transaction without complying with the pre-emptive right provisions of the Governance Agreement.

First Nations and Hydro One Limited Shares

In December 2017, the Province sold approximately 14 million common shares of Hydro One Limited to OFN Power Holdings LP, a limited partnership wholly-owned by Ontario First Nations Sovereign Wealth LP, which is in turn owned by 129 First Nations in Ontario. This represented approximately 2.4% of the outstanding common shares of Hydro One Limited owned by the Province. Following this transaction, the Province owns approximately 47.4% common shares of the Company. Hydro One Limited was not a party to this transaction. Hydro One Limited did not receive any proceeds from the sale of the shares by the Province.

Strategy

In 2017, the Company’s Board of Directors approved Hydro One’s strategy which details the Company’s goal to become North America’s leading utility, centered around three key pillars: (i) optimization and innovation, (ii) diversification and (iii) growth.

2018

New Chief Financial Officer

On January 28, 2018, Hydro One announced the appointment of Paul Dobson as its new Chief Financial Officer effective March 1, 2018. Mr. Dobson was most recently the Chief Financial Officer at Direct Energy Ltd. in Houston, Texas. Mr. Dobson replaces Mr. Vels, who resigned on May 19, 2017.

24

New Chief Corporate Development Officer

On February 21, 2018, Hydro One announced the appointment of Patrick Meneley as Executive Vice President and Chief Corporate Development Officer effective March 1, 2018. Mr. Meneley was most recently the Executive Vice President, Wholesale Banking at TD Bank Group and Vice Chair and Head of Global Corporate and Investment Banking for TD Securities.

General Development of the Business

In addition to the chronological development of the business, the following general developments in the business have occurred and continue to be relevant.

Acquisitions Generally

The Company intends to continue to evaluate local distribution company consolidation opportunities in Ontario and intends to pursue those acquisitions which deliver value to the Company and its shareholders. Over time, the Company may also consider larger-scale, vertically integrated acquisition opportunities or other strategic initiatives outside of Ontario to diversify its asset base and leverage its strong operational expertise. These acquisition opportunities may include other providers of electric transmission, distribution and other similar services in Canada and in the United States.

Customer Focus

Hydro One remains in transition from a Crown corporation to an industry leading investor owned utility. Our continued focus on customer service remains a critical aspect of our success as a Company. Greater corporate accountability for performance outcomes, and company-wide improvements in productivity and efficiency, align with our customer’s expectations of how Hydro One should operate.

Customer Service

Hydro One is committed to delivering significant value to customers by becoming easier to do business with, being available when customers need assistance, and always staying connected. This includes specific, measurable commitments to customers that encompass all areas of service. Hydro One’s billing system is stable and outperforming its previous system in terms of timeliness, accuracy and reliability. In 2017, the Company launched a new mobile-friendly corporate website, improved its self-service portal, and introduced a newly designed customer bill. Additionally, the Company is committed to increasing the availability of customer service at the local level, and increasing face to face customer engagement throughout the province. In March 2018, Hydro One transitioned the customer contact centre from a third party provider back to Hydro One in order to improve customer service. For more information on these services, please refer to “Business of Hydro One – Outsourced Services”.

Review of Operations

Hydro One has been focused on the identification of opportunities for improved corporate performance and the development of strategies to drive more efficient, cost-effective operations. Hydro One conducts

25

regular reviews of key corporate activities and programs, covering areas such as construction services and project management practices, asset deployment and controls, information technology and cybersecurity, vegetation management practices, fleet services and utilization, supply chain management and business continuity planning. Operational improvements in capital planning and execution have already been observed, and improvements have been made to work execution process. The OEB’s rate decisions also contain directions to Hydro One to become more cost efficient and improve value to customers.

Winter Moratorium and Winter Relief Program

Hydro One has an existing voluntary policy (the winter disconnection moratorium) that from December 1 to March 31 it will not disconnect residential customers whose accounts are in arrears.

Hydro One announced its Winter Relief Program, as an extension of its existing winter disconnection moratorium. This initiative is intended to help residential customers facing extreme hardship and who have had their electricity service disconnected by reaching out to these customers directly to help re-connect their electricity service for the remainder of the winter. As part of the program, Hydro One waives reconnection fees and works with customers to determine payment options to bring their accounts up-to-date and to evaluate various support programs in which certain customers may be eligible to participate. In November 2017, the OEB issued a decision and order banning licensed electricity distributors from disconnecting homes for non-payment during the winter.

BUSINESS OF HYDRO ONE

Business Segments

Through its wholly-owned subsidiary Hydro One Inc., Hydro One is Ontario’s largest electricity transmission and distribution utility with approximately $25.7 billion in assets and 2017 revenues of approximately $6.0 billion. Hydro One owns and operates substantially all of Ontario’s electricity transmission network and is the largest electricity distributor in Ontario by number of customers. The Company’s regulated transmission and distribution operations are owned by Hydro One Inc. Hydro One delivers electricity safely and reliably to over 1.3 million customers across the province of Ontario, and to large industrial customers and municipal utilities. Hydro One Inc. owns and operates approximately 30,000 circuit kilometres of high-voltage transmission lines and approximately 123,000 circuit kilometres of primary low-voltage distribution lines.

Hydro One has three business segments: (i) transmission; (ii) distribution; and (iii) other business. Each of the three segments is described below.

Hydro One’s transmission and distribution businesses are both operated primarily through Hydro One Networks Inc. This allows both businesses to utilize common operating platforms, technology, work processes, equipment and field staff and thereby take advantage of operating efficiencies and synergies. For regulatory purposes, Hydro One Networks Inc. files separate rate applications with the OEB for each of its licensed transmission and distribution businesses.

26

Transmission Business

Overview

Hydro One’s transmission business consists of owning, operating and maintaining Hydro One’s transmission system, which accounts for approximately 98% of Ontario’s transmission capacity based on revenue approved by the OEB. All of the Company’s transmission business is carried out by its wholly-owned subsidiary Hydro One Inc., through its wholly-owned subsidiary Hydro One Networks Inc. and through other wholly-owned subsidiaries of Hydro One Inc. that own and control Great Lakes Power (now Hydro One Sault Ste. Marie LP), as well as through the Company’s 66% interest in B2M Limited Partnership. Hydro One’s transmission business represented approximately 53% of its total assets as at December 31, 2017, and accounted for approximately 51% of its total revenue in 2017, net of purchased power and 51% of its total revenue in 2016, net of purchased power.

The Company’s transmission business is a rate-regulated business that earns revenues mainly from charging transmission rates that are subject to approval by the OEB. In February 2016, the OEB updated the filing requirements for electricity transmission applications and introduced new revenue requirement setting options. During 2017 and 2018, the Company’s transmission rates are determined based on a cost-of-service model as permitted by the OEB during the transition to a performance-based model. Transmission rates are collected by the IESO and are remitted by the IESO to Hydro One on a monthly basis, which means that Hydro One’s transmission business has no direct exposure to end-customer counterparty risk.

Transmission rates are based on monthly peak electricity demand across Hydro One’s transmission network. This gives rise to seasonal variations in Hydro One’s transmission revenues, which are generally higher in the summer and winter due to increased demand, and lower during other periods of reduced demand. Hydro One’s transmission revenues also include revenues associated with exporting energy to markets outside of Ontario. Ancillary revenue includes revenues from providing maintenance services to generators and from third party land use.

Business

The Company’s transmission system serves substantially all of Ontario and transported approximately 132 TWh of energy throughout the province in 2017. Hydro One’s transmission customers consist of 43 local distribution companies (including Hydro One’s own distribution business) and 88 large industrial customers connected directly to the transmission network, including automotive, manufacturing, chemical and natural resources businesses. Electricity delivered over the Company’s transmission network is supplied by 129 generators in Ontario and electricity imported into the province through interties. Interties are transmission interconnections between neighbouring electric systems that allow power to be imported and exported.

The high voltage power lines in Hydro One’s transmission network are categorized as either lines which form part of the “bulk electricity system” or “area supply lines”. Power lines which form part of the bulk electricity system typically connect major generation facilities with transmission stations and often cover long distances, while area supply lines serve a local region. Ontario’s transmission system is connected to

27

the transmission systems of Manitoba, Michigan, Minnesota, New York and Quebec through the use of interties, allowing for the import and export of electricity to and from Ontario.

Hydro One’s transmission assets were approximately $14 billion as at December 31, 2017 and include transmission stations, transmission lines, a control centre and telecommunications facilities. Hydro One has approximately 308 in-service transmission stations and approximately 30,000 circuit kilometres of high voltage lines whose major components include cables, conductors and wood or steel support structures. All of these lines are overhead power lines except for approximately 270 circuit kilometres of underground cables located in certain urban areas.

B2M Limited Partnership is Hydro One’s partnership with the Saugeen Ojibway Nation with respect to the Bruce-to-Milton transmission line. B2M Limited Partnership owns the transmission line assets relating to two circuits between Bruce TS and Milton TS, while Hydro One owns the transmission stations where the lines terminate. Hydro One maintains and operates the Bruce-to-Milton line. Hydro One has a 66% economic interest in the partnership.

Hydro One’s transmission network is managed from a central location. This centre monitors and controls the Company’s entire transmission network, and has the capability to remotely monitor and operate transmission equipment, respond to alarms and contingencies and restore and reroute interrupted power. There is also a backup facility which would be staffed in the event of an evacuation of the centre.

Hydro One uses telecommunications systems for the protection and operation of its transmission and distribution networks. These systems are subject to very stringent reliability and security requirements, which help the Company meet its reliability obligations and facilitate the restoration of power following service interruptions.

In 2016, Hydro One completed the acquisition of Great Lakes Power, an Ontario regulated transmission business operating along the eastern shore of Lake Superior, north and east of Sault Ste. Marie, Ontario. The total purchase price for Great Lakes Power was approximately $376 million, including the assumption of approximately $150 million in outstanding indebtedness. On January 16, 2017, Great Lakes Power’s name was changed to Hydro One Sault Ste. Marie LP. See “General Development of the Business – Chronological Development of the Business – 2016 – Acquisition of Great Lakes Power”.

Regulation

Transmission Rate Setting

As discussed under “Rate-Regulated Utilities”, transmission rate setting in Ontario has changed. The OEB has created two new revenue plan options: the Custom Incentive Rate Setting Plan (the “Custom IR Method”) and the Incentive Index Rate Setting Plan (the “Revenue Cap Index”).

Under the Custom IR Method, the revenue requirement is adjusted though the rate term using a custom index proposed by the transmitter to reflect forecasts, and internal and external benchmarking evidence.

28

Under the Revenue Cap Index the first year’s revenue requirement reflects the transmitter’s cost of service, and annually thereafter, this amount is subject to a formulaic increase reflecting productivity and stretch commitments proposed by the transmitter. Revenue Cap Index applicants can request incremental capital funding.

The OEB sets transmission rates based on a two-step process. First, all transmitters apply to the OEB for the approval of their revenue requirements. Second, the OEB aggregates the total revenue requirements of all transmitters in Ontario and applies a formula to arrive at a single set of rates that are charged to ratepayers for the three types of transmission services applicable in Ontario, namely: network services, line connection services and transformation connection services. The three separate rates charged for these services are the same for all transmitters and are referred to as “uniform transmission rates”. Uniform transmission rates for all transmitters are set by the OEB on an annual basis, using the revenue requirements set out in the most recent rate decision issued for each transmitter.