UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2019

OR

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 001-38343

TARGET HOSPITALITY CORP.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

|

98-1378631 |

|

(State or other jurisdiction of |

|

|

(I.R.S. Employer |

|

incorporation or organization) |

|

|

Identification No.) |

2170 Buckthorne Place, Suite 440

The Woodlands, TX 77380-1775

(Address, including zip code, of principal executive offices)

(800) 832‑4242

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which is registered |

|

Common stock, par value $0.0001 per share |

TH |

The Nasdaq Capital Market |

|

Warrants to purchase common stock |

THWWW |

The Nasdaq Capital Market |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐ |

Accelerated filer ☒ |

|

Non-accelerated filer ☐ |

Smaller reporting company ☐ |

|

|

Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒.

The aggregate market value of common shares held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter, June 28, 2019, was $314,734,067.

There were 105,277,765 shares of Common Stock, par value $0.0001 per share, issued and 102,297,898 outstanding as of March 9, 2020.

Documents Incorporated by Reference

The information required by Part III of this Report, to the extent not set forth herein, is incorporated herein by reference from the registrant's definitive proxy statement relating to the Annual Meeting of Shareholders to be held in 2020, which definitive proxy statement shall be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year to which this Report relates.

Target Hospitality Corp.

Annual Report on FORM 10‑K

December 31, 2019

Unless the context otherwise requires, references to “we”, “us”, “our”, “the Company”, or “Target Hospitality” refer to Target Hospitality Corp. and its consolidated subsidiaries.

Overview

Our company, Target Hospitality, is the largest vertically integrated specialty rental and hospitality services company in the United States. We own an extensive network of geographically relocatable specialty rental accommodation units with approximately 13,800 beds across 25 sites. The majority of our revenues are generated under multi-year committed contracts which provide visibility to future earnings and cash flows. We believe our customers enter into contracts with us because of our differentiated scale and ability to deliver premier accommodations and in-house culinary and hospitality services across many key geographies in which they operate. Approximately 75.6% of our revenue was earned from specialty rental with vertically integrated hospitality, specifically lodging and related ancillary services, whereas the remaining 24.4% of revenues were earned through leasing of lodging facilities (18.6%) and construction fee income (5.8%) for the year ended December 31, 2019. For the year ended December 31, 2019, we generated revenues of $321.1 million.

For additional information on our revenue related to December 31, 2018 and 2017, refer to “Management’s Discussion and Analysis of Financial Condition and Results of Operations” located in Part II, Item 7 within this Annual Report on Form 10-K.

Our company was formed from two leading businesses in the sector, Target Logistics Management, LLC (“Target”) and RL Signor Holdings, LLC (“Signor’). Signor was founded in 1990, and Target, though initially founded in 1978, began operating as a specialty rental and hospitality services company in 2006. Our company operates across the U.S. primarily in the Permian Basin in the southwest U.S. and Bakken Basin in North Dakota, which are the highest producing oil and gas basins in the country. We also own and operate the largest family residential center in the U.S., serving asylum-seeking women and children. Using the “Design, Develop, Build, Own, Operate, and Maintain” (“DDBOOM”) business model, Target Hospitality provides comprehensive turnkey solutions to customers’ unique needs, from the initial planning stages through the full cycle of development and ongoing operations. We provide cost-effective and customized specialty rental accommodations, culinary services and hospitality solutions, including site design, construction, operations, security, housekeeping, catering, concierge services and health and recreation facilities.

We deliver end-to-end specialty rental and hospitality services across several end markets in the U.S. and are known for high quality accommodations and vertically integrated specialty rental and hospitality services.

We primarily operate in the Permian and Bakken basins, which are some of the most active oil and gas regions in the world. We have established a leadership position in providing a fully integrated service offering to our large customer base, which is comprised of major and independent oil producers, oilfield service companies, midstream companies, refineries, government and government service providers. Our company is built on the foundation of the following core values: safety, care, excellence, integrity and collaboration.

3

Background

Target Hospitality Corp. was originally known as Platinum Eagle Acquisition Corp. (“Platinum Eagle”) and was a blank check company incorporated on July 12, 2017 as a Cayman Islands exempted company formed for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses. We completed an initial public offering in January 2018, after which our securities were listed on the Nasdaq Capital Market (“Nasdaq”).

On March 12, 2019, we discontinued our existence as a Cayman Islands exempted company under the Cayman Islands Companies Law (2018 Revision) and, pursuant to Section 388 of the General Corporation Law of the State of Delaware (the “DGCL”), continued our existence under the DGCL as a corporation incorporated in the State of Delaware (the “Domestication”). Thereafter, on March 15, 2019, the Company changed its name to Target Hospitality in accordance with the terms of: (i) the agreement and plan of merger, dated as of November 13, 2018, as amended on January 4, 2019 (the “Signor Merger Agreement”), by and among Platinum Eagle, Signor Merger Sub LLC, a Delaware limited liability company and wholly owned subsidiary of Platinum Eagle and sister company to the Holdco Acquiror (as defined below) (“Signor Merger Sub”), Arrow Holdings S.a.r.l., a Luxembourg société à responsabilité limitée (the “Arrow Seller”) and Signor Parent (as defined below), and (ii) the agreement and plan of merger, dated as of November 13, 2018, as amended

4

on January 4, 2019 (the “Target Merger Agreement” and, together with the Signor Merger Agreement, the “Merger Agreements”), by and among Platinum Eagle, Topaz Holdings LLC, a Delaware limited liability company (the “Holdco Acquiror”), Arrow Bidco, LLC, a Delaware limited liability company (“Arrow Bidco”) Algeco Investments B.V., a Netherlands besloten vennootschap (the “Algeco Seller”) and Target Parent (as defined below). Pursuant to the Merger Agreements, Platinum Eagle, through its wholly-owned subsidiary, the Holdco Acquiror, acquired all of the issued and outstanding equity interests of Arrow Parent Corp., a Delaware corporation (“Signor Parent”) and owner of Arrow Bidco, the owner of Signor, from the Arrow Seller, and all of the issued and outstanding equity interests of Algeco US Holdings LLC, a Delaware limited liability company (“Target Parent”) and owner of Target, from the Algeco Seller. The transactions contemplated by the Merger Agreements are herein after referred to as the “Business Combination.”

On the effective date of the Domestication, our then issued and outstanding Class A ordinary shares and Class B ordinary shares automatically converted by operation of law, on a one-for-one basis, into shares of our Class A common stock (“Class A common stock”) and Class B common stock (“Class B common stock”), respectively, and our outstanding Warrants automatically became warrants to acquire the corresponding number of shares of Class A common stock. On the closing date of the Business Combination (the “Closing Date”), each of our then currently issued and outstanding shares of Class B common stock automatically converted, on a one-for-one basis, into shares of Class A common stock, in accordance with the terms of our Delaware certificate of incorporation (the “Interim Domestication Charter”). Immediately thereafter, each of our issued and outstanding shares of Class A common stock automatically converted by operation of law, on a one-for-one basis, into shares of Target Hospitality Corp.’s Common Stock, par value $0.0001 per share (the “Common Stock”). Similarly, all of our outstanding Warrants to acquire shares of Class A common stock became warrants to acquire the corresponding number of shares of Common Stock and no other changes were made to the terms of any outstanding Warrants.

Upon completion of the Business Combination, the Nasdaq trading symbols of our Common Stock and our Warrants were changed to “TH” and “THWWW,” respectively.

Business Model

Our DDBOOM model allows our customers to focus their efforts and resources on their core businesses. This makes us an integral part of the planning and execution phases for all customers.

We provide a safe, comfortable, and healthy environment to our guests, employees and workers across the U.S. and anywhere our customers need our facilities and services. Under our “Target 12” service model, we provide benefits to our customers, delivering high quality food, rest, connection, wellness, community, and hospitality, which optimizes our customers’ workforce engagement, performance, safety, loyalty, and productivity during work hours.

This facility and service model is provided directly by our employees, who deliver the essential services 24 hours per day for 365 days a year. We provide all of the hospitality services at our sites, and as a result, we believe we deliver more consistent and high-quality hospitality services at each community compared to our peers. Our company and employees are driven by our primary objective of helping our customers’ workforce reach their full potential every day. Our professionally trained hospitality staff has the unique opportunity to live with our customers as most of our employees live on location at the communities where our customers’ workforce reside. This allows our employees to develop powerful customer empathy, so we are better able to deliver consistent service quality and care through the Target 12 platform each day. Our employees are focused on “the other 12 hours”—the time our customers and their employees are not working—making sure we deliver a well fed, well rested, happier, loyal, safer and more productive employee every day. What we provide our customers’ workforce “off the clock” optimizes their performance when they are “on the clock.” The investment our customers make in their employees “the other 12 hours” is an essential part of their strategy and overall business and operations execution plan.

Using our expansive community network, DDBOOM and Target 12 models, we provide specialty rental and hospitality services that span the lifecycle of our oil and gas customers’ projects. Our services cover the entire value chain of oil and gas projects, from the initial stages of exploration, resource delineation and drilling to the long-term production,

5

pipeline transportation and final processing. Customers typically require accommodations and hospitality services at the onset of their projects as they assess the resource potential and determine how they will develop the resource. Our temporary accommodation assets are well-suited to support this exploratory stage where customers begin to execute their development and construction plans. As the resource development begins, we can serve customers’ needs with our specialty rental accommodation assets, and we are able to scale our facility size to meet customers’ growing needs. By providing infrastructure early in the project lifecycle, we are well-positioned to continue serving our customers throughout the full cycle of their projects, which can typically last for several decades.

Our integrated model provides value to our customers by reducing project timing and counterparty risks associated with projects. More broadly, our accommodations networks, combined with our integrated value-added hospitality and facilities services creates value for our customers by optimizing our customers’ engagement, performance, safety, loyalty, productivity, preparedness and profitability.

Summary of Value Added Services

We take great pride in the premium customer experience we offer across our range of community and hospitality services offerings. All of Target’s communities include in-house culinary and hospitality services. Our well-trained culinary and catering professionals serve more than 13,000,000 meals each year with fresh ingredients and many of our meals are made from scratch. We self-manage most culinary and hospitality services, which provides us with greater control over service quality as well as incremental revenue and profit potential. Our communities are designed to promote rest and quality of life for our customers’ workforces and include amenities such as:

Summary of Amenities:

|

● New Innovative Modular Design |

|

● Media Lounges and WIFI Throughout |

|

|

|

● Single Occupancy Design |

|

● Individual Xbox/PSII Pods |

|

|

|

● Swimming Pool, Volleyball, Basketball |

|

● Flat-Screen TVs in Each Room |

|

|

|

● Commercial Kitchen |

|

● 40+ Premium TV Channel Line-up |

|

|

|

● Fast Food Lounges |

|

● Personal Laundry Service |

|

|

|

● Full & Self Service Dining Areas |

|

● Individually Controlled HVAC System |

|

|

|

● TV Sport/Entertainment Lounges |

|

● Hotel Access Unity Lock Systems |

|

|

|

● Training/conference Rooms |

|

● 24 Hour No-Limit Dining |

|

|

|

● Core Passive Recreation Areas |

|

● Free DVD Rentals |

|

|

|

● Active Fitness Centers |

|

● Self Dispensing Free Laundry |

|

|

|

● Lodge Recreation Areas |

|

● Commercial Laundry |

|

|

|

● Locker/Storage/Boot-up Areas |

|

● Transportation to Project Site |

|

|

|

● Parking Areas |

|

● 24 Hour Gated Security |

|

|

|

● Waste Water Treatment Facility |

|

● Daily Cleaning & Custodial Service |

|

|

|

● On-site Commissary |

|

● Professional Uniformed Staff |

|

|

Our hospitality services and programming are designed to promote safety, security and rest, which in turn promote greater on-the-job productivity for our customers’ workforces. All of our communities strictly adhere to our community code of conduct, which prohibits alcohol, drugs, firearms, co-habitation and guests. We work closely with our customers to ensure that our communities are an extension of the safe environment and culture they aim to provide to their employees while they are on a project location. Our customer code of conduct is adopted by each corporate customer and enforced in conjunction with our customers through their documented health, safety and environmental policies, standards and customer management. We recognize that safety and security extends beyond the customers’ jobsite hours and is a 24-hour responsibility which requires 24-hour services by Target Hospitality and close collaboration with our customer partners.

6

History and Development

Target Hospitality’s legacy businesses of Signor and Target have grown and developed since they were created. The chart below sets out certain key milestones for each business.

|

1978-2000 |

|

2010-Present |

|

● 1978: Target Logistics was founded |

|

● 2011: Target expanded capacity in Williston, Stanley and Tioga with long-term customers Halliburton, Hess, ONEOK, Schlumberger, Superior Well Service, Key Energy Services and others |

|

● 1990: Signor Farm and Ranch Real Estate was founded |

|

● 2011: Signor Lodge opened in Midland, TX (84 rooms) |

|

● Target awarded contracts for logistics services for Olympics in 1984 (Sarajevo), 1992 (Barcelona), 1996 (Atlanta), 2000 (Sydney), 2002 (Salt Lake City), 2004 (Athens), 2006 (Turin) and 2010 (Vancouver) |

|

● 2011: Signor Barnhart Lodge opened in Barnhart, TX (160 beds) |

|

● The Vancouver project consisted of a 1,600 bed facility, a portion of which was subsequently transferred to North Dakota and remains in use today |

|

● 2012: Target developed additional North Dakota facilities in Dunn County (Q1), Judson Lodge(Q3), Williams County (Q3) and Watford City (Q4) |

|

● 2005: Target operated 1,100-bed cruise ship anchored in the Gulf of Mexico to support relief efforts during aftermath of Hurricane Katrina |

|

● 2012: Target expanded service into Texas with the opening of Pecos Lodge (90 beds) (Permian basin) in Q4 |

|

● In addition, built and managed 700-person modular camp in New Orleans with running water, electricity and on-site kitchen services |

|

● 2013: Target awarded TCPL Keystone KXL pipeline project to house and feed over 6,000 workers |

|

● 2007: Target hired by Freeport-McMoRan to build and operate 425-bed facility in Morenci, AZ in support of copper mining operations (re-opening 10/2012) |

|

● 2014: Target awarded lodge contract for new 200-bed community in the Permian |

|

● 2008: Target provided catering/food services for 600 personnel in support of relief operations in aftermath of Hurricane Ike |

|

● 2014: Target awarded contract and built 2,400-bed STRFC for U.S. federal government |

|

● 2009: Target provided housing and logistics services for 1,500 workers during a refurbishment of a refinery in St. Croix |

|

● 2015: Opened new community in Mentone, TX (Permian basin) in Q4 for Anadarko Petroleum Company |

|

● 2009: Signor Lodging was formed |

|

● 2016: Signor expanded Midland Lodge several phased expansions 1,000 beds |

|

● 2010: Target opened Williston Lodge, Muddy River, Tioga and Stanley Cabins in western North Dakota |

|

● 2016: Signor Kermit Lodge opens with 84 rooms |

|

|

|

● 2017: Signor opened Oria Lodge with 208 rooms |

|

|

|

● 2017: Target expanded Permian network with the expansion of both Wolf Lodge and Pecos Lodge (Permian basin) in Q2 |

|

|

|

● 2017: Target expanded presence in New Mexico (Permian basin) and West Texas with the acquisition of 1,000-room Iron Horse Ranch |

|

|

|

● 2017: Signor opened El Reno Lodge with 345 rooms |

|

|

|

● 2017: Target expanded Permian presence with 280-room Blackgold Lodge in Q3 |

|

|

|

● 2018: Target Logistics rebranded as Target Lodging in March 2018 |

|

|

|

● 2018: Target opened new 600-room community in Mentone-Permian basin |

|

|

|

● 2018: Target added approximately 1,600 rooms across Permian basin network |

|

|

|

● 2018: Target expanded community network in Permian and Anadarko basins through acquisition of Signor, adding 7 locations and approximately 4,500 beds to the network |

|

|

|

● 2019: Target announced new 400-bed community in the Permian basin |

|

|

|

● 2019: Target expanded its community network in the Permian Basin through the acquisitions of Superior and ProPetro, adding 4 locations and approximately 758 beds to the network. |

|

|

|

● 2019: El Capitan 200 beds |

|

|

|

● 2019: El Capitan expansion 100 beds |

|

|

|

● 2019: Seven Rivers expansion 200 beds |

Industry Overview

We are one of the few vertically integrated specialty rental and hospitality services providers that service the entire value chain from site identification to long-term community development and facilities management. Our industry divides specialty rental accommodations into three primary types: communities, temporary worker lodges and mobile

7

assets. We are principally focused on communities across several end markets, including oil and gas, energy infrastructure and U.S. government.

Communities typically contain a larger number of rooms and require more time and capital to develop. These facilities typically have commercial kitchens, dining areas, conference rooms, medical and dental services, recreational facilities, media lounges and landscaped grounds where climate permits. A substantial portion of our communities are built and underpinned by multi-year committed contracts which often include exclusivity provisions. These facilities are designed to serve the long-term needs of customers regardless of the end markets they serve. All of our communities provide fully-integrated and value-added hospitality services, including but not limited to: catering and food services, housekeeping, health and recreation facilities, laundry services and overall workforce community management, as well as water and wastewater treatment, power generation, communications and personnel logistics where required. In contrast, temporary lodges are usually smaller in number of rooms and generally do not include hospitality, catering, facilities services or other value-added on-site services and typically serve customers on a spot or short-term basis without long-term committed contracts. These temporary facilities are “open” for any customer who needs lodging services. Finally, mobile assets, or rig housing, are designed to follow customers’ activities and are generally used for drilling rig operators. They are often used to support conventional drilling crews and are contracted on a project-by-project, well-by-well or short-term basis.

Our specialty rental modular assets and hospitality services deliver the essential services and accommodations when and where there is a lack of sufficient accessible or cost-effective housing, infrastructure or local labor. Many of the geographic areas near the southern U.S. border lack sufficient temporary housing and infrastructure for asylum-seeking immigrants or may require additional infrastructure in the future. In the U.S. oil and gas sector, many of the largest unconventional and hydrocarbon reservoirs are in remote and expansive geographic locations, like the Permian and Bakken where limited infrastructure exists. Our industry supports the development of these natural resources by providing lodging, catering and food services, housekeeping, recreation facilities, laundry services and facilities management, as well as water and wastewater treatment, power generation, communications and personnel logistics where required. Our communities and integrated hospitality services allow our customers to outsource their accommodations needs to a single provider, optimizing employee morale, productivity, safety, and loyalty while focusing their investment on their core businesses and long term planning.

With our focus on large-scale community networks, large-scale stand-alone communities and hospitality services, our business model is a balanced combination of specialty rental assets and facilities services and is most similar to specialty rental companies like William Scotsman and Mobile Mini, and facilities services companies such as Aramark, Sodexo or Compass Group, and developers of lodging properties who are also owners or operators, such as Hyatt Hotels Corporation or Marriott International, Inc.

The U.S. specialty rental accommodations industry is segmented into competitors that serve components of the overall value chain, with very few integrated providers.

The family residential center we own, operate, or manage, as well as those facilities we own but are managed by other operators, are subject to competition for residents from other private operators. We compete primarily on siting, cost, the quality and range of services offered, our experience in the design, construction, and management of facilities, and our reputation. We compete with government agencies that are responsible for correctional, detention and residential facilities. Government sector demand for facilities is affected by a number of factors, including the demand for beds, general economic conditions and the size of the immigration-seeking population.

In the U.S. oil and gas sector, Target Hospitality represents 42.7% of the overall rental accommodations market, of which, the total integrated market is approximately 70%. There are only three other integrated accommodations and facilities services providers and they make up approximately 28% of the total U.S. integrated rental accommodations market, while private companies primarily provide lodging only or offer optional catering services through a third-party

8

catering company and also make up approximately 10% of the market. Two public manufacturing and/or leasing firms also participate in the U.S. market. Those companies primarily own and lease the units to customers, facility service companies or integrated providers. Facility service companies, manage third-party facilities, but do not invest in, or own, the accommodations assets.

Demand for accommodations and related services within our oil and gas end market is influenced by four primary factors: (i) available infrastructure, (ii) competition, (iii) workforce requirements, and (iv) capital spending. Anticipated capital spending, and our customers’ expectations for future capital spending as well as larger infrastructure requirements, influence customers’ development on current productive assets, maintenance on current assets, expansion of existing assets and development of greenfield, brownfield or new assets. In addition to capital requirements, different types of customer activity require varying workforce sizes, influencing the demand for accommodations. Also, competing locations and services influence demand for our assets and services.

Demand within our government end market is primarily influenced by immigration, including the ongoing need to accommodate asylum seekers as well as federal governmental policy and budgets. Continued increases in asylum seeking activity may influence government spending on infrastructure in immigration-impacted regions and consequentially demand for accommodations and related services.

Another factor that influences demand for our rooms and services is the type of customer we are supporting. Generally, oil producer customers require larger workforces during construction and expansionary periods and therefore have a higher demand for accommodations. Due to the contiguous nature of their land positions, a “hub and spoke” model is utilized for producers. Oilfield service companies also require larger and more mobile workforces which, in many cases, consist of employees sourced from outside of the work areas. These employees, described as rotational workers, permanently reside in another region or state and commute to the Permian or Bakken on a rotational basis (often, two weeks on and one week off). Rotational workers are also sometimes described as a fly-in-fly-out (“FIFO”) or drive-in-drive-out (“DIDO”) commuter work force.

In addition, proximity to customer activities influences occupancy and demand. We have built, own and operate the two largest specialty rental and hospitality services networks available to oil and gas customers operating in the Permian and Bakken. These networks allow our customers to utilize one provider across a large and expansive geographic area. Our broad network often results in us having communities that are the closest to our customers’ job sites, which reduces commute times and costs, and improves the overall safety of our customers’ workforce.

Generally, if a community is within a one hour drive of a customer’s work location, our contractual exclusivity provisions with our customers require the customers to have their crews lodge at one of our communities. Our communities provide customers with cost efficiencies, as they are able to jointly use our communities and related infrastructure (power, water, sewer and IT) services alongside other customers operating in the same vicinity.

Demand for our services is dependent upon activity levels, particularly our customers’ capital spending on exploration for, development, production and transportation of oil and natural gas and government immigration housing programs. Our customers’ spending plans generally are based on their view of commodity supply and demand dynamics, as well as the outlook for near-term and long-term commodity prices and annual government appropriations. Our current oil and gas footprint is strategically concentrated in the Permian, the largest basin in the world with approximately 140 billion barrels of oil equivalent (“bboe”) of recoverable oil while producing approximately 4.5 million barrels of oil equivalent (“mboe”) per day. The Permian stretches across the southeast corner of New Mexico and through a large swath of land in western Texas, encompassing hundreds of thousands of square miles and dozens of counties.

The Permian has experienced elevated drilling activity as the result of improved technologies that have driven down the cost of production. Additionally, the Permian is the lowest cost basin within the U.S., with a breakeven price below $40/bbl and multi-year drilling inventory economic at sub-$35 per barrel WTI prices in many areas, allowing operators

9

focused in the Permian to continue drilling economic wells even at low commodity price levels. Technological improvements in recent years and the extensive oil and gas reserves support sustained activity in the Permian for the foreseeable future.

Business Strengths & Strategies

Strengths

|

· |

Market Leader in Strategically Located Geographies. We are the nation’s largest provider of turnkey specialty rental units with premium catering and hospitality services including 25 strategically located communities with approximately 13,800 beds primarily in the highest demand regions of the Permian and Bakken. Utilizing our large network of communities with the most bed capacity, particularly within the Permian and Bakken, we believe we are the only provider with the scale and regional density to serve all of our customers’ needs in these key basins. Additionally, our network and relocatable facility assets allow us to transfer the rental fleet to locations that meet our customer service needs. We leverage our scale and experience to deliver a comprehensive service offering of vertically integrated accommodations and hospitality services. Our complete end-to-end accommodations solution, including our premium amenities and experience, provides our customers with a compelling economic value proposition. |

10

|

· |

Long-Standing Relationships with Diversified Large Integrated Customers. We have long standing relationships with our diversified base of approximately 300 customers, which includes some of the largest blue-chip, investment grade oil and gas and integrated energy infrastructure companies in the U.S. We serve the full energy value chain, with customers spanning across the upstream, midstream, downstream and service sectors. We believe we have also established strong relationships in our U.S. government end market with our contract partner and the federal agency we serve. We initially won our large government contract in 2014 based upon our differentiated ability to develop and open the large facility on an accelerated timeline. This contract was renewed and extended in 2016, demonstrating our successful execution and customer satisfaction. The relationships we have established over the past decade have been built on trust and credibility given our track record of performance and delivering value to our customers by providing a broad range of hospitality service offerings within a community atmosphere. Target’s customers’ desire and willingness to enter into multi- year committed contracts, and to renew them at a historical rate of approximately 90%, demonstrates the strength of these long-standing relationships. |

|

· |

Multi-year Contracts and Exclusivity Produce Highly Visible, Recurring Revenue. The vast majority of our revenues are generated under multi-year contracts. Of those long-term contracts, 82% are committed and 63% represent contracts to which our revenue generation is guaranteed regardless of occupancy levels. Further, 46% (by revenue) of our total committed contracts contain exclusivity provisions under which our customers agree to exclusively use our communities for all of their needs within the geographies we serve. Of our contracts that are not committed, approximately 80% have exclusivity. The weighted average term of our contracts is approximately 39 months and Target has maintained a client renewal rate of at least 90% over the last 5 years. Our committed customers secure minimum capacity commitments with us to ensure that sufficient accommodations and hospitality services are in place to properly care for their large workforces. Our multi-year committed customer agreements provide us with contracted recurring revenue and high visibility to future financial performance. |

|

· |

Proven Performance and Resiliency Through the Cycle. Our business model is well insulated from economic and commodity cycles, as evidenced by our ability to increase revenue and EBITDA despite a significant and prolonged decline in oil and related commodity prices in recent years. For example, in the fourth quarter of 2019, we secured contract renewals and extensions with four large oil and gas customers who represent approximately 20% of Target Hospitality’s 2019 revenue attributable to the energy end market, despite a greater than 25% decline in the U.S. oil rig count during the period. Our multi-year, committed, exclusive contracts with large integrated customers support stable performance through commodity and economic cycles. Further, we are able to efficiently optimize our modular assets and redeploy them, as warranted by customer demand. Our prior planning and strategic focus on the Permian Basin further supports consistent performance as the region’s oil production continues to grow. The Permian Basin is one of the largest basins in the world with high levels of sustained production expected to continue, further supported by the structural decline in breakeven prices in the region. |

|

· |

Long-lived Assets Requiring Minimal Maintenance Capital Expenditures. Our long-lived specialty rental assets support robust cash flow generation. Our rental assets have an average life in excess of 20 years, and we typically recover our initial investment within the first few years of initial capital deployment. We estimate our maintenance capital to be approximately 1% of annual revenue and maintain low maintenance capital expenditures, as cleaning and routine maintenance costs are included in day-to-day operating costs and recovered through the average daily rates that we charge our customers. This continual care of our assets supports extended asset lives and the ongoing ability to operate with only nominal maintenance capital expenditures. The investment profile of our rental assets underpins our industry leading unit economics. Our contract discipline underpins our investment decision making and spending on any new growth investments. Generally, we do not invest capital |

11

unless we expect to meet our internal returns thresholds. Due to the high revenue visibility from long-term contracts, we are poised to generate robust and stable cash flows driven by historical strategic growth investments and minimal future maintenance capital expenditure requirements. |

Strategies

We believe that we can further develop our business by, among other things:

|

· |

Maintaining and Expanding Existing Customer Relationships. Growing and maintaining key customer relationships is a strategic priority. We fill existing bed capacity within our communities, while optimizing our inventory for existing customer expansion or for new customers. Keeping this balance provides us with flexibility and a competitive advantage when pursuing new contract opportunities. We optimize our capacity, inventory and customers’ usage through data analytics, customer collaboration and forecasting demand. With the scale of our accommodations network, a significant number of our key customers are commercially exclusive to Target Hospitality as their primary and preferred provider of accommodations and hospitality services throughout the U.S. or for a designated geographic area. |

|

· |

Enhancing Contract Scope and Services. One of our strategic focus areas is to enhance the scope and terms of our customer contracts. We intend to continue our historical track record of renewing and extending these contracts at favorable commercial and economic terms, while also providing additional value added services to our customers. For example, following the Signor acquisition we added our vertically integrated suite of services, including catering, to the many legacy Signor contracts that included only accommodations. Replacing legacy third party providers allows us greater control over service quality and delivery and offers substantial incremental revenue potential. Additionally, we believe we have capacity to increase revenue within our existing communities without new growth capital expenditures through increased utilization rates or modest price increases over time. |

|

· |

Disciplined Growth Capital Expenditures to Increase Capacity. We selectively pursue opportunities to expand existing communities and develop new communities to satisfy customer demand. We employ rigorous discipline to our capital expenditures to grow our business. Our investment strategy is to only deploy new capital with visibility—typically a contract—to revenue and returns to meet our internal return hurdles. We target payback on initial investment within a few years. Due to the lower cost per bed, returns on investment are higher for the expansion of existing facilities. |

|

· |

Growing and Pursuing New Customer/Contract Opportunities. We continually seek additional opportunities to lease our facilities to government, energy and natural resources, manufacturing, and other third-party owners or operators in need of specialty rental and hospitality services. We have a proven track record of success in executing our specialty rental and facilities management model across several end markets for ongoing needs as well as major projects that have finite project life cycle durations. While special projects do not constitute a large portion of our business, it is typical for us to secure some special projects that can last anywhere from 1-5 years (or more). We have designated sales-related resources that focus on special finite life cycle projects and maintain a dynamic business pipeline which includes but is not limited to special projects across end markets. |

|

· |

Expansion Through Acquisitions and diversify our service offerings. We selectively pursue acquisitions and business combinations related to specialty rental and hospitality services in the markets we currently serve as well as adjacent markets that offer existing complimentary services to ours. Leveraging our core competencies related to facilities management, culinary services, catering and site services, we can further scale this segment of our business and replicate it in other geographies and end markets. We continue to assess targeted acquisitions and business combinations that would be accretive to us while also expanding our end markets. |

12

Sales and Marketing

Target has a tenured in-house sales and marketing team that is responsible for acquiring new customers and managing the relationships of our existing customers across the U.S. Our sales approach is based on a consultative empathy based value creation model. Our professionally trained sales organization is relentlessly focused on providing solutions to our customers’ challenges which has resulted in higher customer satisfaction and loyalty.

Business Operations

Target Hospitality provides specialty rental and hospitality services, temporary specialty rental and hospitality services solutions and facilities management services across the U.S. The company’s primary customers are investment grade oil, gas and energy companies, other workforce accommodation providers operating in the Permian and Bakken regions, and government contractors. The company’s specialty rental and hospitality services and management services are highly customizable and are tailored to each customer’s needs and requirements. Target Hospitality is also an approved general services administration (“GSA”) contract holder and offers a comprehensive range of housing, deployment, operations and management services through its GSA professional services schedule agreement. The GSA contract allows U.S. federal agencies to acquire our products and services directly from Target Hospitality which expedites the commercial procurement process often required by government agencies.

Target Hospitality operates its business in three key end markets: (i) government (“Government”), which includes the facilities, services and operations of its family residential center and the related support communities in Dilley, Texas (the “South Texas Family Residential Center”) provided under its lease and services agreement with CoreCivic; (ii) the Permian basin (the “Permian Basin”), which includes the facilities and operations in the Permian region and the 19 communities located across Texas, New Mexico and (iii) the Bakken basin (the “Bakken Basin”), which includes facilities and operations in the Bakken basin region and four communities in North Dakota

13

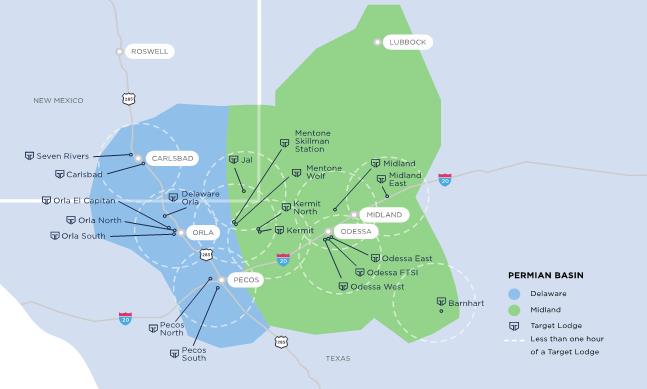

The map below shows the company’s primary community locations in the Permian Basin and the Bakken Basin (including the Company’s one location in the Anadarko).

14

The table below presents the Company’s lodges in the oil and gas end market.

|

Location |

|

Lodge Name |

|

Location |

|

Status |

|

Number of Beds |

|

Bakken |

|

Williams County Lodge |

|

Williston, North Dakota |

|

Own/Operate |

|

300 |

|

Bakken |

|

Judson Executive Lodge |

|

Williston, North Dakota |

|

Own/Operate |

|

100 |

|

Bakken |

|

Stanley Hotel |

|

Stanley, North Dakota |

|

Own/Operate |

|

345 |

|

Bakken |

|

Watford City Lodge |

|

Watford City, North Dakota |

|

Own/Operate |

|

334 |

|

Permian |

|

Dilley (STFRC) |

|

Dilley, Texas |

|

Own/Operate |

|

2,556 |

|

Permian |

|

Pecos North Lodge |

|

Pecos, Texas |

|

Own/Operate |

|

982 |

|

Permian |

|

Pecos South Lodge |

|

Pecos, Texas |

|

Own/Operate |

|

786 |

|

Permian |

|

Mentone Wolf Camp |

|

Mentone, Texas |

|

Own/Operate |

|

530 |

|

Permian |

|

Skillman Station Lodge |

|

Mentone, Texas |

|

Own/Operate |

|

706 |

|

Permian |

|

Orla North Lodge |

|

Orla, Texas |

|

Own/Operate |

|

170 |

|

Permian |

|

Orla South Lodge |

|

Orla, Texas |

|

Own/Operate |

|

240 |

|

Permian |

|

Delaware Orla Lodge |

|

Orla, Texas |

|

Own/Operate |

|

465 |

|

Permian |

|

El Capitan Lodge |

|

Orla, Texas |

|

Own/Operate |

|

429 |

|

Permian |

|

Odessa West Lodge |

|

Odessa, Texas |

|

Own/Operate |

|

805 |

|

Permian |

|

Odessa East Lodge |

|

Odessa, Texas |

|

Own/Operate |

|

280 |

|

Permian |

|

Odessa FTSI Lodge |

|

Odessa, Texas |

|

Own/Operate |

|

217 |

|

Permian |

|

Midland Lodge |

|

Midland, Texas |

|

Own/Operate |

|

1,567 |

|

Permian |

|

Midland East Lodge |

|

Midland, Texas |

|

Own/Operate |

|

168 |

|

Permian |

|

Kermit Lodge |

|

Kermit, Texas |

|

Own/Operate |

|

232 |

|

Permian |

|

Kermit North Lodge |

|

Kermit, Texas |

|

Own/Operate |

|

180 |

|

Permian |

|

Barnhart Lodge |

|

Barnhart, Texas |

|

Own/Operate |

|

192 |

|

Permian |

|

Carlsbad Lodge |

|

Carlsbad, New Mexico |

|

Own/Operate |

|

606 |

|

Permian |

|

Carlsbad Seven Rivers Lodge |

|

Carlsbad, New Mexico |

|

Own/Operate |

|

640 |

|

Permian |

|

Jal Lodge |

|

Jal, New Mexico |

|

Own/Operate |

|

626 |

|

Anadarko |

|

El Reno Lodge |

|

El Reno, Oklahoma |

|

Own/Operate |

|

345 |

|

Total Number of Beds |

|

|

|

|

|

|

|

13,801 |

Government

Historically, the Government segment has included, but is not limited to, two primary end markets which make up approximately 20.9% of our revenue for the year ended December 31, 2019:

|

· |

Residential Facilities. Residential facilities, including the South Texas Family Residential Center (discussed below), provide space and residential services in an open and safe environment to adult females with children who are seeking asylum and are awaiting the outcome of immigration hearings or the return to their countries of origin. Residential facilities offer services including, but not limited to, educational programs, medical care, recreational activities, counseling, and access to religious and legal services. |

|

· |

Community Corrections. Community corrections/residential reentry facilities offer housing and programs to offenders who are serving the last portion of their sentence or who have been assigned to the facility in lieu of a jail or prison sentence, with a key focus on employment, job readiness, and life skills. |

Target Hospitality built and currently leases and operates the South Texas Family Residential Center through a sub-lease and services agreement with CoreCivic, a government solutions company which provides correctional and detention management services. Target Hospitality owns and operates the facility by providing on-site services including catering, culinary, management, janitorial and light maintenance. The South Texas Family Residential Center includes 524,000 square feet of building space including residential housing units with 2,400 beds, as well as classrooms, a library, chapels, an infirmary with full medical, dental, pharmaceutical and x-ray capabilities, a dining hall, offices and an industrial laundry center.

15

We look forward to expanding the products and services of our Government segment through our GSA designations, specifically our designation to maintain the professional services schedule (“PSS”) for logistics service solutions, which are designed to assist federal agencies in procuring comprehensive logistics solutions, including planning, consulting, management, and operational support when deploying supplies, equipment, materials and associated personnel. GSA’s PSS is a multiple award schedule (“MAS”) contract for innovative solutions, offered to federal, state and local governments, for their professional service’s needs. Having a PSS signifies that we have been vetted as a responsible supplier, our pricing has been determined to be fair and reasonable and we are in compliance with all applicable laws and regulations. PSS is one of the GSA’s schedule contracts, which are indefinite delivery, indefinite quantity (“IDIQ”), long-term contracts under the GSA MAS program. GSA schedule contracts were developed to assist federal employees in purchasing products and services and they contain pre-negotiated prices, delivery terms, warranties, and other terms and conditions which streamline the buying process.

The Government segment generated 20.9% or $67.0 million of the company’s revenue for the year ended December 31, 2019.

Permian Basin

The Permian Basin is one of the oldest producing basins in the world, with production dating back to the early 1900s. It stretches across the southeast corner of New Mexico and a large swath of western Texas, encompassing hundreds of thousands of square miles and dozens of counties. The growth story comes from both unconventional and conventional drilling techniques into stacked reservoirs including the Wolfcamp, Bone Springs, Trend Area (Spraberry area) and Spraberry reservoirs. The basin consists of multiple sub-basins; the most targeted are the Delaware and Midlands Basins. Until the oil price decline in 2014, over 200 vertical rigs (most of all vertical rigs in the U.S.) were operating in the Permian using traditional drilling methods to vertically target and frac into multiple stacked pay zones, primarily in the Midland Basin’s Trend Area and Spraberry reservoirs. Horizontal production from the Delaware basin began in earnest in 2014, primarily in New Mexico. Horizontal drilling in the Texas portion of the Permian Basin followed shortly thereafter with horizontal drilling in the Spraberry and Trend Area reservoirs, which were traditionally vertical targets.

The Permian Basin market is the most prolific shale basin in the U.S. with an estimated 140 billion barrels of oil equivalent (bboe) of recoverable oil while producing approximately 4.5 one million barrels of oil equivalent (mboe) per day. This century-old oil basin has attracted investment from large and small companies for many decades. However, it took years of vertical drilling and multi-stage fracking of vertical wells (and simultaneous development of horizontal drilling and fracking outside of the Permian Basin) to learn enough about the stacked pay potential in order to drill it horizontally. The high proportion of vertical wells before 2014 evidences the recent realization of the Permian Basin’s potential—due in large part to its scale and geologic complexity.

While understanding the significant potential in the Permian Basin, Target entered the market in 2012, ahead of many of our competitors. We started in the Permian Basin with an 80-bed community in Pecos, TX.

As of December 31, 2019, Target Hospitality has two locations and over 1,700 beds in the Pecos area of the Permian Basin alone, which is located in the Delaware basin area. With 19 communities and approximately 9,821 beds across the Permian Basin, we offer the largest network of turnkey specialty rental accommodations and hospitality services in the basin, with the next largest provider having 5,000 beds or less and only six locations.

The Permian Basin segment generated 66.8% or $214.5 million of the company’s revenue for the year ended December 31, 2019. The map below shows the company’s primary community locations in the Permian Basin (including the Company’s one location in the Anadarko).

16

Bakken Basin

The Bakken Basin was the first of the unconventional oil regions to develop in the U.S. The Bakken Basin is one of the most prolific U.S. shale oil production formations to date. The basin spans territory in North Dakota, eastern Montana, and a small portion of northern South Dakota (in addition to portions in Saskatchewan and Manitoba in Canada). It is home to the Bakken Basin and Three Forks reservoirs and is often referred to simply as the Bakken Basin formation. North Dakota is home to most of the Bakken Basin production and has been the strongest growth area for many U.S. independent oil companies.

It was an older, conventional oil play that had endured several cycles, but had never really taken off in earnest. It followed on the tails of the shale gas boom and the advent of unconventional technology, particularly horizontal drilling and hydraulic fracturing. Experimental horizontal drilling, without fracking, was being done in the Bakken Basin in the 1990s.

The Bakken Basin drew attention and capital investment because operators were looking to find shale oil the same way they found shale gas, cracking open tight rocks and extracting oil.

The geology in the Bakken Basin was well known to geologists and was known for its vast reserves. It is a promising, clean and relatively simple geology in its structure. It is a large continuous oil accumulation with a simple Oreo cookie-like structure, with a layer of shale, sandstone, and then another layer of shale.

In 2009, Target entered the Bakken Basin market and built its first community in Williston, North Dakota for a large oilfield services company. The community was the first of its kind in the region and provided specialty rental and hospitality services for more than 150 remote rotational workers. As of December 31, 2019, Target Hospitality had four community locations and 1,079 rentable rooms serving the Bakken Basin. We are the largest specialty rental and

17

hospitality services provider in the region with approximately 50% of the market share with the next closest direct competitor having less than 15% of the market share.

The Bakken Basin segment generated 6.4% or $20.6 million of the company’s revenue for the year ended December 31, 2019. The map below shows the company’s primary community locations in the Bakken Basin.

Other

In addition to the three segments above, the company: (i) has facilities and operations for one community in the Anadarko Basin of Oklahoma; (ii) provides catering and other services to communities and other workforce accommodation facilities for the oil, gas and mining industries not owned by Target Hospitality (“Facilities Management”); and (iii) provides ongoing preparatory work and plans for facilities and services to be provided in connection with the TransCanada pipeline project.

The company provides specialty rental and hospitality services including concierge, culinary, catering, maintenance, security, janitorial and related services at facilities owned by other companies. We currently provide Facilities Management, culinary and catering services and site services for two facilities located in the Permian for which we do not own the specialty rental accommodation assets.

Future Pipeline Services Plans

We are contracted with TransCanada Pipelines (“TCPL”) to construct, deliver, cater and manage all accommodations and hospitality services in conjunction with the planned construction of the Keystone XL pipeline project. Our contract with TCPL was executed in 2013 and is currently pending full contract release, subject to TCPL’s final investment decision and formal notice to proceed. Our contract with TCPL is terminable at will by TCPL with ten days prior written notice and, in the event of such termination we are entitled to certain cancellation and termination fees for work performed prior to cancellation. In October 2018, we received partial release for certain pre-work related to the project and have commenced a limited scope of work based on work orders issued by TCPL.

18

The project is still pending a final investment decision by TCPL and, as a result, we cannot be certain that this project will commence in full on the expected timeline or at all.

This project continues to face legal challenges from various opposition groups. As a result, any adverse ruling or injunction from any current or future legal proceeding could adversely affect the timing and scope of work to be performed by the Company for TCPL in support of the Keystone XL project.

Segment information for December 31, 2018 and 2017

For additional information on our segments, including Government, Permian, Bakken, and Other, related to December 31, 2018 and 2017, refer to Note 25 of our audited consolidated financial statements located in Part II, Item 8 within this Annual Report on Form 10-K.

Customers and Competitors

Target Hospitality’s principal customers include investment grade oil and gas companies, energy infrastructure companies, and U.S. government and government contractors. For the year ended December 31, 2019, our largest customers were CoreCivic of Tennessee LLC and Halliburton, who accounted for approximately 20.8% and 12.5% of our revenues, respectively.

For the year ended December 31, 2019, our top five customers accounted for approximately 52% of our revenue.

For the year ended December 31, 2018, our largest customer was CoreCivic of Tennessee LLC, who accounted for approximately 27.7% of our revenues.

For the year ended December 31, 2017, our largest customers were CoreCivic of Tennessee LLC and Anadarko Petroleum Corporation who accounted for 50.5% and 11.8% of revenues, respectively.

Our primary competitors in the U.S. for our oil and gas segments are Cotton Logistics, Permian Lodging, Aries, and Civeo for temporary accommodations in the U.S. shale basins. For hospitality services and facilities management, our three primary competitors are: Sodexo, Aramark and Compass.

Our primary competitors in the Government segment are The GEO group and Management and Training Corporation (“MTC”).

The Company’s Community and Services Contracts

For the year ended December 31, 2019, revenue related to the Permian and Bakken regions represented 66.8% and 6.4% of our revenue, respectively, revenue related to our Government segment represented 20.9% of our revenue, and all other revenue represented less than 6% of our revenue.

Lease and Services Agreements

The company’s operations in the Permian and Bakken regions are primarily conducted through committed contractual arrangements with its customers. For certain of the company’s largest customers, it uses network lease and services agreements (“NLSAs”) which cover the customer’s full enterprise and are exclusive agreements with set terms and rates for all geographic regions in which the company operates. The NLSAs obligate the customers to use the company’s facilities and services across the U.S. The company’s NLSAs have an average set term of two to three years.

Certain other customers are subject to lease and services agreements (“LSAs”) which are more limited in geographic scope and cover only specified areas with the same structural commercial terms as the NLSAs. The LSAs have terms that range from six to thirty six months and generally do not have termination provisions in favor of the customer.

19

The company also has master services agreements (“MSAs”) with certain customers which are typically exclusive arrangements without the committed component of the NLSAs and LSAs and no minimum contractual liability for the customer.

CoreCivic

The company operates the South Texas Family Residential Center pursuant to a contractual arrangement with CoreCivic (the “CoreCivic Contract”). The CoreCivic Contract provides for the company’s sublease and ongoing operation of the South Texas Family Residential Center through September 2021. This facility, located in Dilley, Texas, is the largest family residential center in the U.S. and was built by the company in 2015. This facility has approximately 524,000 square feet of facilities on an 85-acre site. Target Hospitality leases the facilities to CoreCivic and provides onsite managed services including catering, culinary, facilities management, maintenance, and janitorial services of the common area facilities only.

The CoreCivic Contract depends on the U.S. government and its funding. Any impasse or delay in reaching a federal budget agreement, debt ceiling or government shut downs, and the subsequent lack of funding to the applicable government entity, could result in material payment delays, payment reductions or contract terminations. The government may terminate the contract with CoreCivic for convenience on 90 days’ notice; in the event this should occur, CoreCivic may terminate its agreement with Target upon 60 days’ notice.

Regulatory and Environmental Compliance

Our business and the businesses of the company’s customers can be affected significantly by federal, state, municipal and local laws and regulations relating to the oil, natural gas and mining industries, food safety and environmental protection. Changes in these laws, including more stringent regulations and increased levels of enforcement of these laws and regulations, and the development of new laws and regulations could impact the company’s business and result in increased compliance or operating costs associated with its or its customers’ operations.

To the extent that these laws and regulations impose more stringent requirements or increased costs or delays upon the company’s customers in the performance of their operations, the resulting demand for the company’s services by those customers may be adversely affected. Moreover, climate change laws or regulations could increase the cost of consuming, and thereby reduce demand for, oil and natural gas, which could reduce the company’s customers’ demand for its services. The company cannot predict changes in the level of enforcement of existing laws and regulations, how these laws and regulations may be interpreted or the effect changes in these laws and regulations may have on the company or its customers or on our future operations or earnings. The company also cannot predict the extent to which new laws and regulations will be adopted or whether such new laws and regulations may impose more stringent or costly restrictions on its customers or its operations.

Employees

As of December 31, 2019, Target Hospitality had approximately 826 employees. None of the Company’s employees are unionized or members of collective bargaining arrangements.

Intellectual Property

Target Hospitality owns a number of trademarks important to the business. Its material trademarks are registered or pending registration in the U.S. Patent and Trademark Office. The business operates primarily under the Target Hospitality brand.

20

Properties

Corporate Headquarters

Target Hospitality’s headquarters are located in The Woodlands, Texas. Its executive, financial, accounting, legal, administrative, management information systems and human resources functions operate from this single, leased office.

For a list of real property owned material to the operations of Target Hospitality, refer to Part I Item 2 within this Form 10-K.

Communities/Owned and Leased Real Estate

Target Hospitality operates 26 communities, of which it owns the underlying real property of 38%, leases the underlying real property of 31%, and both owns and leases the underlying real property of 4%. The remaining 12% are customer sites.

Legal Proceedings and Insurance

Target Hospitality is involved in various lawsuits, claims and legal proceedings, the majority of which arise out of the ordinary course of business. The nature of the company’s business is such that disputes occasionally arise with vendors including suppliers and subcontractors, and customers over contract specifications and contract interpretations among other things. The Company assesses these matters on a case-by-case basis as they arise. Reserves are established, as required, based on its assessment of exposure. Target Hospitality has insurance policies to cover general liability and workers’ compensation related claims. In the opinion of management, the ultimate amount of liability not covered by insurance, if any, under such pending lawsuits, claims and legal proceedings will not have a material adverse effect on its financial condition or results of operations. See the audited consolidated financial statements and the notes thereto of Target Hospitality Corp. located in Part II, Item 8 within this Annual Report on Form 10-K for additional information.

Available Information

Our website address is www.targethospitality.com. We make available, free of charge through our website, our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (the “Exchange Act”) as soon as reasonably practicable after such documents are electronically filed with, or furnished to, the United States Securities and Exchange Commission (the “SEC”). The SEC maintains an internet website at www.sec.gov that contains reports, proxy and information statements and other information regarding Target Hospitality Corp.

21

Operational Risks

Our operations are and will be exposed to operational, economic, political and regulatory risks.

Our operations could be affected by economic, political and regulatory risks. These risks include:

multiple regulatory requirements that are subject to change and that could restrict our ability to build and operate our communities and other sites;

inflation, recession, fluctuations in interest rates;

compliance with applicable export control laws and economic sanctions laws and regulations;

trade protection measures, including increased duties and taxes, and import or export licensing requirements;

ownership regulations;

compliance with applicable antitrust and other regulatory rules and regulations relating to potential future acquisitions;

different local product preferences and product requirements;

pressures on management time and attention due to the complexities of overseeing diverse operations;

challenges in maintaining, staffing and managing national operations;

different labor regulations;

potentially adverse consequences from changes in or interpretations of tax laws;

political and economic instability;

enforcement of remedies in various jurisdictions;

the risk that the business partners upon whom we depend for technical assistance or management and acquisition expertise will not perform as expected;

differences in business practices that may result in violation of our policies including but not limited to bribery and collusive practices.

These and other risks could have a material adverse effect on our business, results of operations and financial condition.

We face significant competition as a provider of specialty rental and hospitality services in the specialty rental sector. If we are unable to compete successfully, we could lose customers and our revenue and profitability could decline.

Although our competition varies significantly by market, the specialty rental and hospitality services industry, in general, is highly competitive. We compete on the basis of a number of factors, including equipment availability, quality, price, service, reliability, appearance, functionality and delivery terms. We may experience pricing pressures in our operations in the future as some of our competitors seek to obtain market share by reducing prices. We may also face reduced demand for our products and services if our competitors are able to provide new or innovative products or services that better appeal to our potential customers. In each of our current markets, we face competition from national, regional and local

22

companies who have an established market position in the specific service area. We expect to encounter similar competition in any new markets that we may enter. Some of our competitors may have greater market share, less indebtedness, greater pricing flexibility, more attractive product or service offerings, or superior marketing and financial resources. Increased competition could result in lower profit margins, substantial pricing pressure, and reduced market share. Price competition, together with other forms of competition, may materially adversely affect our business, results of operations, and financial condition.

We depend on several significant customers. The loss of one or more such customers or the inability of one or more such customers to meet their obligations could adversely affect our results of operations.

We depend on several significant customers. The majority of our customers operate in the energy industry. For a more detailed explanation of our customers, see the section of this Annual Report on Form 10-K entitled “Business.” The loss of any one of our largest customers in any of our business segments or a sustained decrease in demand by any of such customers could result in a substantial loss of revenues and could have a material adverse effect on our results of operations. In addition, the concentration of customers in the industries in which we operate may impact our overall exposure to credit risk, either positively or negatively, in that customers may be similarly affected by changes in economic and industry conditions.

As a result of our customer concentration, risks of nonpayment and nonperformance by our counterparties are a concern in our business. We are subject to risks of loss resulting from nonpayment or nonperformance by our customers. Many of its customers finance their activities through cash flow from operations, the incurrence of debt, or the issuance of equity. Additionally, many of our customers’ equity values have declined and could decline further. The combination of lower cash flow due to commodity prices, a reduction in borrowing bases under reserve-based credit facilities, and the lack of available debt or equity financing may continue to result in a significant reduction in our customers’ liquidity and could impair their ability to pay or otherwise perform on their obligations. Furthermore, some of our customers may be highly leveraged and subject to their own operating and regulatory risks, which increases the risk that they may default on their obligations to us. The inability or failure of our significant customers to meet their obligations to us or their insolvency or liquidation may adversely affect our financial results.

Our business depends on the quality and reputation of the Company and its communities, and any deterioration in such quality or reputation could adversely impact its market share, business, financial condition or results of operations.

Many factors can influence our reputation and the value of our communities, including quality of services, food quality and safety, availability and management of scarce natural resources, supply chain management, diversity, human rights and support for local communities. In addition, events that may be beyond our control could affect the reputation of one or more of its communities or more generally impact the reputation of the Company, including protests directed at government immigration policies, violent incidents at one or more communities or other sites or criminal activity. Reputational value is also based on perceptions, and broad access to social media makes it easy for anyone to provide public feedback that can influence perceptions of Target Hospitality and its communities, and it may be difficult to control or effectively manage negative publicity, regardless of whether it is accurate. While reputations may take decades to build, negative incidents can quickly erode trust and confidence, particularly if they result in adverse mainstream and social media publicity, governmental investigations or penalties, or litigation. Negative incidents could lead to tangible adverse effects on our business, including customer boycotts, loss of customers, loss of development opportunities or employee retention and recruiting difficulties. A decline in the reputation or perceived quality of our communities or corporate image could negatively affect its market share, reputation, business, financial condition or results of operations. (See “Risk Factors—Public resistance and potential legal challenges to, and increasing scrutiny of, the use of family residential facilities like our South Texas Residential Center could affect our ability to obtain new contracts or result in the loss of existing contracts and negatively impact our brand or reputation, each of which could have a material adverse effect on our business, financial condition and results of operations)

23

We derive a substantial portion of our revenue from the operation of the South Texas Family Residential Center for the U.S. government through a subcontract with a government contractor. The loss of, or a significant decrease in revenues from, this customer could seriously harm our financial condition and results of operations.

We derive a significant portion of our revenues from our subcontract with a government contractor for the operation of the South Texas Family Residential Center for the U.S. government. These revenues depend on the U.S. government and its contractors receiving sufficient funding and providing it with timely payment under the terms of our contract. If the applicable government entity does not receive sufficient appropriations to cover its contractual obligations, it may delay or reduce payment to its contractors and, as a result, our government contractor customer may delay or reduce payments to or terminate its contract with us. Any future impasse or struggle impacting the federal government’s ability to reach agreement on the federal budget, debt ceiling or any future federal government shut downs could result in material payment delays, payment reductions or contract terminations. Additionally, our current and potential future government contractor customers may request in the future that we reduce our contract rates or forego increases to those rates as a way for those contractors to control costs and help their government customers to control their spending and address their budgetary shortfalls. For additional information regarding our operation of the South Texas Family Residential Center, see “Business—Business Operations—Government Services” elsewhere in this Annual Report on Form 10-K.