UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10-K

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||||||||

For the fiscal year ended | |||||||||||

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to | |||||

Commission file number 001-38335

(Exact name of Registrant as specified in its charter)

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |||||||

| | ||||||||

| (Address of Principal Executive Offices) | (Zip Code) | |||||||

Registrant’s telephone number, including area code: (441 ) 295-5950 or (303) 925-6000

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbols | Name of Each Exchange on Which Registered | ||||||

Securities registered pursuant to Section 12(g) of the Act: none

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes þ No ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. Check one:

| ☑ | Accelerated Filer | ☐ | Non-Accelerated Filer | ☐ | |||||||||||||

| Smaller Reporting Company | Emerging Growth Company | ||||||||||||||||

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the Registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Yes ☐ No þ

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $1.1 billion.

The number of outstanding common shares of Liberty Latin America Ltd. as of January 31, 2023 was: 42.3 million Class A; 2.1 million Class B; and 171.2 million Class C.

DOCUMENTS INCORPORATED BY REFERENCE

LIBERTY LATIN AMERICA LTD.

ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

| Page Number | ||||||||

| PART I | ||||||||

| Item 1. | Business | I-1 | ||||||

| Item 1A. | Risk Factors | I-29 | ||||||

| Item 1B. | Unresolved Staff Comments | I-50 | ||||||

| Item 2. | Properties | I-50 | ||||||

| Item 3. | Legal Proceedings | I-51 | ||||||

| Item 4. | Mine Safety Disclosures | I-51 | ||||||

| PART II | ||||||||

| Item 5. | Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities | II-1 | ||||||

| Item 6. | [Reserved] | II-3 | ||||||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | II-4 | ||||||

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | II-32 | ||||||

| Item 8. | Financial Statements and Supplementary Data | II-36 | ||||||

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | II-36 | ||||||

| Item 9A. | Controls and Procedures | II-36 | ||||||

| Item 9B. | Other Information | II-38 | ||||||

| Item 9C. | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | II-38 | ||||||

| PART III | ||||||||

| Item 10. | Directors, Executive Officers and Corporate Governance | III-1 | ||||||

| Item 11. | Executive Compensation | III-1 | ||||||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters | III-1 | ||||||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | III-1 | ||||||

| Item 14. | Principal Accountant Fees and Services | III-1 | ||||||

| PART IV | ||||||||

| Item 15. | Exhibits and Financial Statement Schedules | IV-1 | ||||||

| Item 16. | Form 10-K Summary | IV-4 | ||||||

GLOSSARY OF DEFINED TERMS

Unless the context requires otherwise, references to Liberty Latin America, “we,” “our,” “our company” and “us” in this Annual Report on Form 10-K (as defined below) may refer to Liberty Latin America Ltd. or collectively to Liberty Latin America Ltd. and its subsidiaries. We have used several other terms in this Annual Report on Form 10-K, most of which are defined or explained below.

| 2020 Share Repurchase Program | The share repurchase program that was authorized by our Directors on March 16, 2020 that authorized us to repurchase from time to time up to $100 million of our Class A and/or Class C common shares and expired in March 2022 | ||||

| 2022 Share Repurchase Program | The share repurchase program that was authorized by our Directors on February 22, 2022 that authorizes us to repurchase from time to time up to $200 million of our Class A and/or Class C common shares through December 2024 | ||||

| 2026 C&W Senior Notes | $500 million principal amount 7.5% senior notes due October 15, 2026 issued by C&W Senior Finance Limited (repaid during 2021) | ||||

| 2026 SPV Credit Facility | $1.0 billion principal amount LIBOR + 5.0% term loan facility due October 15, 2026 issued by LCPR Loan Financing (repaid during 2021) | ||||

| 2027 C&W Senior Notes | $1.2 billion aggregate principal amount 6.875% senior notes due September 15, 2027 issued by C&W Senior Finance | ||||

| 2027 C&W Senior Notes Add-on A | $300 million principal amount issued at 99.205% of par under the existing 2027 C&W Senior Notes indenture | ||||

| 2027 C&W Senior Notes Add-on B | $220 million principal amount issued at 103.625% of par under the existing 2027 C&W Senior Notes indenture | ||||

| 2027 C&W Senior Secured Notes | $495 million aggregate principal amount 5.75% senior secured notes due September 7, 2027 issued by Sable International Finance Limited | ||||

| 2027 C&W Senior Secured Notes Add-on | $150 million principal amount issued at 106.0% of par under the existing 2027 C&W Senior Secured Notes indenture | ||||

| 2027 LPR Senior Secured Notes | $1.2 billion aggregate principal amount 6.75% senior secured notes due October 15, 2027 issued by LCPR Senior Secured Financing | ||||

| 2027 LPR Senior Secured Notes Add-on | $90 million principal amount issued at 102.5% of par under the existing 2027 LPR Senior Secured Notes indenture | ||||

| 2028 CWP Term Loan | $435 million principal amount 4.25% term loan facility due January 18, 2028 issued by CWP | ||||

| 2028 LPR Term Loan | $620 million principal amount LIBOR + 3.75% term loan facility due October 15, 2028 issued by LCPR Loan Financing | ||||

| 2028 VTR Senior Notes | $483 million principal amount 6.375% senior notes due July 15, 2028 issued by VTR Finance N.V. | ||||

| 2028 VTR Senior Secured Notes | $474 million principal amount 5.125% senior secured notes due January 15, 2028 issued by VTR Comunicaciones SpA | ||||

| 2029 LPR Senior Secured Notes | $820 million principal amount 5.125% senior secured notes due July 15, 2029 issued by LCPR Senior Secured Financing | ||||

| 2029 VTR Senior Secured Notes | $392 million principal amount 4.375% senior secured notes due April 15, 2029 issued by VTR Comunicaciones SpA | ||||

| 2031 LCR Term Loan A | $50 million principal amount 10.875% senior secured term loan due January 15, 2031 issued by Liberty Servicios; from July 15, 2028 and thereafter, the applicable interest rate will increase by 0.125% per annum for each of the Sustainability Performance Targets (as defined in the credit agreement) not achieved by the Liberty Costa Rica by no later than December 31, 2027 | ||||

| 2031 LCR Term Loan B | $400 million principal amount 10.875% senior secured term loan due January 15, 2031 issued by Liberty Servicios; from July 15, 2028 and thereafter, the applicable interest rate will increase by 0.125% per annum for each of the Sustainability Performance Targets (as defined in the credit agreement) not achieved by the Liberty Costa Rica by no later than December 31, 2027 | ||||

| ACODECO | Authority of Competition and Consumer Protection | ||||

| ACP | Affordable Connectivity Program | ||||

| Acquisition Agreement | Stock purchase agreement entered into between Liberty Communications PR and Liberty Latin America and AT&T to acquire the AT&T Acquired Entities | ||||

GLOSSARY OF DEFINED TERMS

| Adjusted OIBDA | Operating income or loss before share-based compensation, depreciation and amortization, provisions and provision releases related to significant litigation and impairment, restructuring and other operating items. Other operating items include (i) gains and losses on the disposition of long-lived assets, (ii) third-party costs directly associated with successful and unsuccessful acquisitions and dispositions, including legal, advisory and due diligence fees, as applicable, and (iii) other acquisition-related items, such as gains and losses on the settlement of contingent consideration. | ||||

| Adjusted Term SOFR | SOFR U.S. dollar denominated loans adjusted as follows: (i) 0.11448% for a one-month interest period, (ii) 0.26161% for a three-month interest period and (iii) 0.42826% for a six-month interest period | ||||

| América Móvil | América Móvil S.A.B. de C.V. | ||||

| Annual Report on Form 10-K | Annual Report on Form 10-K as filed with the SEC under the Exchange Act | ||||

| ARPU | Average monthly subscription revenue per average fixed RGU or mobile subscriber, as applicable | ||||

| ASEP | Authority of Public Services | ||||

| ASU | Accounting Standards Update | ||||

| AT&T | AT&T Inc. | ||||

| AT&T Acquisition | October 31, 2020 acquisition of all of the outstanding shares of the AT&T Acquired Entities | ||||

| AT&T Acquired Entities | Collectively, Liberty Mobile Inc., Liberty Mobile Puerto Rico Inc. and Liberty Mobile USVI Inc. | ||||

| AT&T TSA | Transition services agreement dated October 31, 2020 by and between AT&T Liberty Communications PR Holding, a wholly-owned subsidiary of Liberty Latin America, for a period up to 36 months following the closing of the AT&T Acquisition | ||||

| B2B | Business-to-business | ||||

| BBVI Acquisition | December 31, 2021 acquisition of 96% of Broadband VI, LLC | ||||

| BEPS | Base Erosion and Profit Shifting | ||||

| Cable Onda | Cable Onda S.A. | ||||

| C&W | Cable & Wireless Communications Limited and its subsidiaries | ||||

| C&W Bahamas | The Bahamas Telecommunications Company Limited, a 49%-owned subsidiary of C&W that owns all of our operations in the Bahamas | ||||

| C&W Caribbean | Reportable segment that includes all subsidiaries of C&W, excluding those within our C&W Panama and C&W Networks & LatAm segments | ||||

| C&W Credit Facilities | Senior secured credit facilities of certain subsidiaries of C&W comprised of: (i) C&W Term Loan B-6 Facility; (ii) C&W Term Loan B-5 Facility; (iii) C&W Revolving Credit Facility; and (iv) C&W Regional Facilities | ||||

| C&W Jamaica | Cable & Wireless Jamaica Limited, a 92%-owned subsidiary of C&W | ||||

| C&W Networks & LatAm | Reportable segment comprising our managed services and wholesale business, which primarily operates through our subsea and terrestrial fiber optic cable networks; the segment comprises certain subsidiaries of C&W | ||||

| C&W Notes | The senior and senior secured notes of C&W comprised of: (i) 2027 C&W Senior Secured Notes; and (ii) 2027 C&W Senior Notes | ||||

| C&W Panama | Reportable segment for our operations in Panama | ||||

| C&W Regional Facilities | Primarily comprised of credit facilities at CWP, Columbus Communications Trinidad Limited and C&W Jamaica | ||||

| C&W Revolving Credit Facility | $630 million LIBOR + 3.25% revolving credit facility, $50 million of which is due June 30, 2023 and $580 million due January 30, 2027, of C&W | ||||

| C&W Senior Finance | C&W Senior Finance Limited, a wholly-owned subsidiary of C&W | ||||

| C&W Term Loan B-4 Facility | $1,640 million principal amount term loan B-4 facility of C&W (repaid during 2020) | ||||

| C&W Term Loan B-5 Facility | $1,510 million principal amount LIBOR + 2.25% term loan B-5 facility due January 31, 2028 of C&W | ||||

| C&W Term Loan B-6 Facility | $590 million principal amount LIBOR + 3.00% term loan B-6 facility due October 15, 2029 of C&W | ||||

| CAGR | Compound annual growth rate | ||||

GLOSSARY OF DEFINED TERMS

| Capped Calls | Capped call option contracts issued in connection with the issuance of our Convertible Notes | ||||

| CBRS | Citizens Broadband Radio Service | ||||

| Chile JV | Joint venture between Liberty Latin America and América Móvil that is 50:50 owned by each investee | ||||

| Chile JV Entities | Represents the entities that were contributed to the Chile JV, consisting of Lila Chile Holding BV and its subsidiaries, which include VTR | ||||

| Chile JV Transaction | October 6, 2022 formation of the Chile JV | ||||

| CIP | Construction-in-process | ||||

| Claro Panama | América Móvil's operations in Panama | ||||

| Claro Panama Acquisition | July 1, 2022 acquisition of Claro Panama | ||||

| Class C Right | Pro rata subscription rights granted to holders of our Class A, Class B and Class C common shares in connection with the Rights Offering | ||||

| CLEC | Competitive local exchange carrier | ||||

| CLP | Chilean peso | ||||

| Communications Act | The United States Communications Act of 1934, as amended | ||||

| Convertible Notes | $403 million principal amount 2% convertible senior notes due July 15, 2024 issued by Liberty Latin America | ||||

| Conversion Option | A conversion option associated with the Convertible Notes, which is subject to certain conditions, and adjustments if certain events occur (as specified in the indenture governing the Convertible Notes) | ||||

| COP | Colombian peso | ||||

| CPE | Customer premises equipment | ||||

| CRC | Costa Rican colón | ||||

| CRU | Corporate Responsible User | ||||

| CWP | Cable & Wireless Panama, S.A., a 49%-owned subsidiary of C&W that owns most of our operations in Panama | ||||

| CWP Credit Facilities | Credit facilities of CWP comprised of: (i) 2028 CWP Term Loan; and (iii) CWP Revolving Credit Facility | ||||

| CWP Revolving Credit Facility | $20 million principal amount at Adjusted Term SOFR + 3.75% revolving credit facility due January 18, 2027 issued by CWP | ||||

| CWSF | Cable & Wireless Superannuation Fund | ||||

| Digicel | Digicel Group Ltd. | ||||

| Directors | Members of Liberty Latin America’s board of directors | ||||

| DirecTV | DIRECTV Latin America Holdings, Inc. | ||||

| Dish Network | Dish Network Corporation | ||||

| DOCSIS | Data over cable service interface specification | ||||

| DOJ | United States Department of Justice | ||||

| DSL | Digital subscriber line | ||||

| DTH | Direct-to-home | ||||

| DTT | Digital terrestrial television | ||||

| DVR | Digital video recorder | ||||

| EBU | Equivalent billing unit | ||||

| ECTEL | The Eastern Caribbean Telecommunications Authority | ||||

| EIP | Equipment installment-plan | ||||

| Employee Incentive Plan | Liberty Latin America Ltd. 2018 Incentive Plan | ||||

| EPS | Earnings or loss per share | ||||

| ETC | Eligible Telecommunications Carrier | ||||

| ETECSA | La Empresa de Telecomunicaciones de Cuba S.A. | ||||

GLOSSARY OF DEFINED TERMS

| EURIBOR | Euro Interbank Offered Rate | ||||

| Exchange Act | Securities Exchange Act of 1934, as amended | ||||

| Executives | Liberty Latin America's Principal Executive Officer and Principal Financial Officer | ||||

| FASB | Financial Accounting Standards Board | ||||

| FCC | United States Federal Communications Commission | ||||

| FCPA | United States Foreign Corrupt Practices Act of 1977, as amended | ||||

| FTA | Free-to-air | ||||

| FTTH | Fiber-to-the-home/-cabinet/-building/-node | ||||

| FX | Foreign currency translation effects | ||||

| HD | High definition | ||||

| HFC | Hybrid fiber coaxial cable networks | ||||

| Hurricane Dorian | Hurricane impacting our operations in the Bahamas during September 2019 | ||||

| Hurricane Fiona | Hurricane impacting our operations in Puerto Rico during September 2022 | ||||

| ICE | The Costa Rican Electricity Institute | ||||

| ILEC | Incumbent local exchange carrier | ||||

| Infrastructure Act | The Infrastructure Investment and Jobs Act of 2021 | ||||

| IPTV | Internet protocol television | ||||

| ISPs | Internet service providers | ||||

| JMD | Jamaican dollar | ||||

| Law 213 | The Puerto Rico Telecommunications Act of 1996 | ||||

| LCPR | Liberty Communications of Puerto Rico LLC | ||||

| LCPR Loan Financing | LCPR Loan Financing LLC, a consolidated special purpose financing entity that was created for the primary purpose of facilitating the issuance of certain term loan debt. LCPR is required to consolidate LCPR Loan Financing as a result of certain variable interests in LCPR Loan Financing, for which LCPR is considered the primary beneficiary. | ||||

| LCPR Senior Secured Financing | LCPR Senior Secured Financing Designated Activity Company, a consolidated special purpose financing entity that was created for the primary purpose of facilitating the issuance of certain debt offerings. Liberty Mobile is required to consolidate LCPR Senior Secured Financing as a result of certain variable interests in LCPR Senior Secured Financing, of which Liberty Mobile is considered the primary beneficiary. | ||||

| LCR Credit Facilities | Senior secured credit facilities of Liberty Servicios comprised of: (i) Liberty Servicios Term Loan B-1 Facility; (ii) Liberty Servicios Term Loan B-2 Facility; and (iii) Liberty Servicios Revolving Credit Facility | ||||

| LCR Revolving Credit Facility | $15 million LIBOR + 4.25% revolving credit facility due August 1, 2024 of Liberty Servicios (amended and restated subsequent to December 31, 2022, refer to note 9 of our consolidated financial statements for additional information) | ||||

| LCR Term Loan B-1 Facility | $277 million principal amount LIBOR + 5.50% term loan facility, 50% of which is due February 1, 2024 and 50% due August 1, 2024, of Liberty Servicios | ||||

| LCR Term Loan B-2 Facility | CRC 80 billion principal amount TBP + 6.75% term loan facility, 50% of which is due February 1, 2024 and 50% due August 1, 2024, of Liberty Servicios | ||||

| Liberty Communications PR | Liberty Communications PR Holding LP and its subsidiaries, which include LCPR and Liberty Mobile and its subsidiaries | ||||

| Liberty Costa Rica | Reportable segment comprising Liberty Servicios and Liberty Telecomunicaciones | ||||

| Liberty Global | Liberty Global plc | ||||

| Liberty Latin America Shares | Collectively, Class A, Class B and Class C common shares of Liberty Latin America | ||||

| Liberty Mobile | Liberty Mobile Inc. and it subsidiaries | ||||

| Liberty Puerto Rico | Reportable segment comprising Liberty Communications PR, which has operations in Puerto Rico and the U.S. Virgin Islands | ||||

| Liberty Servicios | Liberty Servicios Fijos LY, S.A. (formerly known as Cabletica, S.A.), an indirectly 80%-owned subsidiary in Costa Rica, and its subsidiaries, including Liberty Telecomunicaciones | ||||

GLOSSARY OF DEFINED TERMS

| Liberty Telecomunicaciones | Liberty Telecomunicaciones de Costa Rica LY, S.A. (formerly known as Telefónica de Costa Rica TC, S.A.), an indirectly 80%-owned subsidiary in Costa Rica and it's subsidiary | ||||

| Liberty Telecomunicaciones Acquisition | August 9, 2021 acquisition of Telefónica’s wireless operations in Costa Rica | ||||

| LIBOR | London Inter-Bank Offered Rate | ||||

| LILAK | Class C common shares of Liberty Latin America | ||||

| LNP | Local number portability | ||||

| LPR Credit Facilities | Senior secured credit facilities of Liberty Puerto Rico comprised of: (i) 2028 LPR Term Loan; and (ii) LPR Revolving Credit Facility | ||||

| LPR Revolving Credit Facility | $173 million LIBOR + 3.5% revolving credit facility due March 15, 2027 of LCPR | ||||

| LPR Senior Secured Notes | Senior secured notes of Liberty Puerto Rico comprised of: (i) 2029 LPR Senior Secured Notes; (ii) 2027 LPR Senior Secured Notes; and (iii) 2027 LPR Senior Secured Notes Add-on | ||||

| LTE | Long term evolution standard | ||||

| MICITT | Ministry of Science and Technology and Telecommunications of Costa Rica | ||||

| Millicom | Millicom International Cellular S.A. | ||||

| MMG Program | The Middle Mile Broadband Infrastructure Grant Program established by the Infrastructure Act | ||||

| Network Extensions | Network extension and upgrade programs across Liberty Latin America | ||||

| Nonemployee Director Incentive Plan | Liberty Latin America Ltd. 2018 Nonemployee Director Incentive Plan | ||||

| NTIA | National Telecommunications and Information Administration | ||||

| OECD | Organization for Economic Cooperation and Development | ||||

| OFAC | Office of Foreign Assets Control | ||||

| OTT | Over-the-top | ||||

| OUR | Office of Utilities Regulation in Jamaica | ||||

| PRTC | Telecommunications Of Puerto Rico, Inc. | ||||

| PSARs | Performance-based stock appreciation rights | ||||

| PSUs | Performance-based restricted stock units | ||||

| Quarterly Report on Form 10-Q | Quarterly Report on Form 10-Q as filed with the SEC under the Exchange Act | ||||

| RGU | Revenue generating unit | ||||

| Rights Distribution | Authorized distribution of Class C Rights to acquire Class C common shares in the Rights Offering | ||||

| Rights Offering | September 2020 rights offering whereby we distributed 0.269 of a Class C Right for each share of Class A, Class B and Class C commons shares held as of the record date | ||||

| RSUs | Restricted stock units | ||||

| SARs | Stock appreciation rights | ||||

| SEC | U.S. Securities and Exchange Commission | ||||

| SDWAN | Software defined wide area network | ||||

| Share Repurchase Programs | Collectively, the 2020 Share Repurchase Program and the 2022 Share Repurchase Program | ||||

| SIM | Subscriber identification module | ||||

| SOFR | Reference rate based on secured overnight financing rate administered by the Federal Reserve Bank of New York | ||||

| SOHO | Small office / home office | ||||

| Sutel | Costa Rican Telecommunications Superintendence | ||||

| TAB | Tasa Activa Bancaria interest rate | ||||

| TB | The Puerto Rico Telecommunications Regulatory Bureau | ||||

| TBP | Tasa Básica Pasiva interest rate | ||||

| Tbps | Terabits per second | ||||

GLOSSARY OF DEFINED TERMS

| Telefónica | Telefónica, S.A., a telecommunications company with operations primarily in Europe and Latin America | ||||

| Telefónica Acquisition Agreement | The agreement dated July 30, 2020 with Telefónica for our acquisition of their operations in Costa Rica | ||||

| TSTT | Telecommunications Services of Trinidad and Tobago Limited | ||||

| U.K. | United Kingdom | ||||

| UPR Fund | Uniendo a Puerto Rico Fund | ||||

| U.S. | United States | ||||

| USD | United States Dollar | ||||

| U.S. GAAP | Generally accepted accounting principles in the United States | ||||

| USF | Universal Service Fund | ||||

| USVI | U.S. Virgin Islands | ||||

| UTS | United Telecommunication Services N.V. | ||||

| VAT | Value-added taxes | ||||

| VDSL | Very high-speed DSL | ||||

| VoD | Video-on-demand | ||||

| VoIP | Voice-over-internet-protocol | ||||

| VTR | VTR Finance N.V. and its subsidiaries, a reportable segment through the date of close of the Chile JV | ||||

| VTR Credit Facilities | Senior secured credit facilities of VTR comprising: (i) VTR RCF – A; and (ii) VTR RCF – B | ||||

| VTR Finance Senior Notes | $1.4 billion principal amount senior notes issued by VTR (repaid in 2020) | ||||

| VTR RCF – A | CLP 45 billion TAB + 3.35% revolving credit facility due June 15, 2026 of VTR | ||||

| VTR RCF – B | $200 million LIBOR + 2.75% revolving credit facility due June 15, 2026 of VTR | ||||

| VTR TLB-1 Facility | CLP 141 billion principal amount ICP +3.8% term loan facility of VTR (repaid during 2021) | ||||

| VTR TLB-2 Facility | CLP 33 billion principal amount 7% term loan facility of VTR (repaid during 2021) | ||||

| Weather Derivatives | Weather derivative contracts that provide insurance coverage for certain weather-related events | ||||

PART I

Item 1. BUSINESS

(a) General Development of Business

Liberty Latin America Ltd. is a registered company in Bermuda that primarily includes: (i) C&W; (ii) Liberty Communications PR; (iii) LBT CT Communications, S.A. (a less than wholly-owned entity) and its subsidiaries, which include Liberty Servicios and, as of August 9, 2021 and as further described in note 4 to our consolidated financial statements, Liberty Telecomunicaciones; and (iv) prior to the closing of the formation of the Chile JV, VTR. C&W owns less than 100% of certain of its consolidated subsidiaries, including C&W Bahamas, C&W Jamaica and CWP.

We are an international provider of fixed, mobile and subsea telecommunications services. We provide:

A.residential and B2B services in:

i.over 20 countries across Latin America and the Caribbean through two of our reportable segments, C&W Caribbean and C&W Panama;

ii.Puerto Rico, through our reportable segment Liberty Puerto Rico;

iii.Costa Rica, through our reportable segment Liberty Costa Rica;

iv.Chile, through our reportable segment VTR through September 30, 2022; and

B.through our reportable segment C&W Networks & LatAm, (i) B2B services in certain other countries in Latin America and the Caribbean, and (ii) wholesale communication services over its subsea and terrestrial fiber optic cable networks that connect approximately 40 markets in that region.

Effective September 29, 2021, in connection with the pending formation of the Chile JV, as further described in note 8 to our consolidated financial statements, we began accounting for the Chile JV Entities as “held for sale.” Accordingly, the assets and liabilities of the Chile JV Entities, excluding certain cash balances, are included in assets held for sale and liabilities associated with assets held for sale, respectively, on our December 31, 2021 consolidated balance sheet. Consistent with the applicable guidance, we have not reflected similar reclassifications to exclude the Chile JV Entities from continuing operations in our consolidated statements of operations or cash flows and related footnote disclosures during the period they were accounted for as held for sale. In October 2022, we contributed the Chile JV Entities to the Chile JV and began accounting for our 50% interest in the Chile JV as an equity method investment. For additional information, see note 8 to out consolidated financial statements.

Developments in the Business

We have expanded our footprint through fixed network new build and upgrade projects, mobile coverage expansion, and strategic acquisitions. Our new build projects consist of network programs pursuant to which we pass additional homes and businesses with our broadband communications network. We are also upgrading networks to increase broadband speeds and the services we can deliver for our customers. During the past three years, we passed or upgraded approximately 1 million additional homes and commercial premises. We have made strategic acquisitions to drive scale benefits across our business, enhancing our ability to innovate and deliver quality services, content and products to our customers. Within the last three years, we have completed the following transactions:

•on October 6, 2022, we completed the formation of the Chile JV pursuant to an agreement with América Móvil to contribute the Chile JV Entities to América Móvil’s Chilean operations. The Chile JV is owned 50:50 by Liberty Latin

I-1

America and América Móvil. Beginning in October 2022, we began accounting for our 50% interest in the Chile JV as an equity method investment;

•on July 1, 2022, we completed the acquisition of América Móvil’s operations in Panama in an all-cash transaction based upon an enterprise value of $200 million on a cash- and debt-free basis;

•on August 9, 2021, we completed the acquisition of Telefónica’s operations in Costa Rica (the Liberty Telecomunicaciones Acquisition), in an all-cash transaction based upon an enterprise value of $500 million on a cash- and debt-free basis; and

•on October 31, 2020, we completed the acquisition of AT&T’s wireless and wireline operations in Puerto Rico and the U.S. Virgin Islands in an all-cash transaction based upon an enterprise value of $1.95 billion.

For information regarding our material financing transactions, see note 9 to our consolidated financial statements.

Forward-looking Statements

Certain statements in this Annual Report on Form 10-K constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. To the extent that statements in this Annual Report on Form 10-K are not recitations of historical fact, such statements constitute forward-looking statements, which, by definition, involve risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. In particular, statements under Item 1. Business, Item 1A. Risk Factors, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations and Item 7A. Quantitative and Qualitative Disclosures About Market Risk may contain forward-looking statements, including statements regarding: our business, product, foreign currency and finance strategies; our property and equipment additions; grants or renewals of licenses; subscriber growth and retention rates; changes in competitive, regulatory and economic factors; our anticipated integration plans, synergies, opportunities and integration costs in Puerto Rico following the AT&T Acquisition, in Costa Rica following the Liberty Telecomunicaciones Acquisition and in Panama following the Claro Panama Acquisition; the UPR Fund; changes in our revenue, costs or growth rates; debt levels; our liquidity and our ability to access the liquidity of our subsidiaries; credit risks; the interest rate risks associated with the transition of LIBOR; internal control over financial reporting and remediation of material weaknesses; foreign currency risks; compliance with debt, financial and other covenants; our future projected sources and uses of cash; and other information and statements that are not historical fact. Where, in any forward-looking statement, we express an expectation or belief as to future results or events, such expectation or belief is expressed in good faith and believed to have a reasonable basis, but there can be no assurance that the expectation or belief will result or be achieved or accomplished. In evaluating these statements, you should consider the risks and uncertainties discussed under Item 1A. Risk Factors and Item 7A. Quantitative and Qualitative Disclosures About Market Risk, as well as the following list of some but not all of the factors that could cause actual results or events to differ materially from anticipated results or events:

•economic and business conditions and industry trends in the countries in which we operate;

•the competitive environment in the industries in the countries in which we operate, including competitor responses to our products and services;

•fluctuations in currency exchange rates, inflation rates and interest rates;

•our relationships with third-party programming providers and broadcasters, some of which are also offering content directly to consumers, and our ability to maintain access to desirable programming on acceptable economic terms;

•our relationships with suppliers and licensors and the ability to maintain equipment, software and certain services;

•instability in global financial markets, including sovereign debt issues and related fiscal reforms;

•our ability to obtain additional financing and generate sufficient cash to meet our debt obligations;

•the impact of restrictions contained in certain of our subsidiaries’ debt instruments;

•consumer disposable income and spending levels, including the availability and amount of individual consumer debt;

I-2

•changes in consumer viewing preferences and habits, including on mobile devices that function on various operating systems and specifications, limited bandwidth, and different processing power and screen sizes;

•customer acceptance of our existing service offerings, including our video, broadband internet, fixed-line telephony, mobile and business service offerings, and of new technology, programming alternatives and other products and services that we may offer in the future;

•our ability to manage rapid technological changes;

•the impact of 5G and wireless technologies on broadband internet;

•our ability to maintain or increase the number of subscriptions to our video, broadband internet, fixed-line telephony and mobile service offerings and our average revenue per household and mobile subscriber;

•our ability to provide satisfactory customer service, including support for new and evolving products and services;

•our ability to maintain or increase rates to our subscribers or to pass through increased costs to our subscribers;

•the impact of our future financial performance, or market conditions generally, on the availability, terms and deployment of capital;

•changes in, or failure or inability to comply with, government regulations in the countries in which we operate and adverse outcomes from regulatory proceedings;

•government intervention that requires opening our broadband distribution networks to competitors;

•our ability to renew necessary regulatory licenses, concessions or other operating agreements and to otherwise acquire future spectrum or other licenses that we need to offer new mobile data or other technologies or services;

•our ability to obtain regulatory approval and satisfy other conditions necessary to close acquisitions and dispositions, and the impact of conditions imposed by competition and other regulatory authorities in connection with acquisitions;

•our ability to successfully acquire new businesses and, if acquired, to integrate, realize anticipated efficiencies from and implement our business plan with respect to the businesses we have acquired or that we expect to acquire, such as with respect to the AT&T Acquisition, the Liberty Telecomunicaciones Acquisition, and the Claro Panama Acquisition;

•changes in laws or treaties relating to taxation, or the interpretation thereof, in the U.S. or in other countries in which we operate and the results of any tax audits or tax disputes;

•changes in laws and government regulations that may impact the availability and cost of capital and the derivative instruments that hedge certain of our financial risks;

•the ability of suppliers and vendors, including third-party channel providers and broadcasters to timely deliver quality products, equipment, software, services and access;

•the availability of attractive programming for our video services and the costs associated with such programming, including retransmission and copyright fees payable to public and private broadcasters;

•uncertainties inherent in the development and integration of new business lines and business strategies;

•our ability to adequately forecast and plan future network requirements, including the costs and benefits associated with our network extension and upgrade programs;

•the availability of capital for the acquisition and/or development of telecommunications networks and services, including property and equipment additions;

•problems we may discover post-closing with the operations, including the internal controls and financial reporting process, of businesses we acquire, such as with respect to the AT&T Acquisition, the Liberty Telecomunicaciones Acquisition and the Claro Panama Acquisition;

•our ability to profit from investments in joint ventures that we do not solely control;

I-3

•the effect of any of the identified material weaknesses in our internal control over financial reporting;

•piracy, targeted vandalism against our networks, and cybersecurity threats or other security breaches, including the leakage of sensitive customer data, which could harm our business or reputation;

•the outcome of any pending or threatened litigation;

•the loss of key employees and the availability of qualified personnel;

•the effect of any strikes, work stoppages or other industrial actions that could affect our operations;

•changes in the nature of key strategic relationships with partners and joint venturers;

•our equity capital structure;

•our ability to realize the full value of our intangible assets;

•changes in and compliance with applicable data privacy laws, rules, and regulations;

•our ability to recoup insurance reimbursements and settlements from third-party providers;

•our ability to comply with anti-corruption laws and regulations, such as the FCPA;

•our ability to comply with economic and trade sanctions laws, such as the U.S. Treasury Department’s OFAC;

•the impacts of climate change such as rising sea levels or increasing frequency and intensity of certain weather phenomena; and

•events that are outside of our control, such as political conditions and unrest in international markets, terrorist attacks, malicious human acts, hurricanes and other natural disasters, pandemics, including the COVID-19 pandemic, and other similar events.

The broadband distribution and mobile service industries are changing rapidly and, therefore, the forward-looking statements of expectations, plans and intent in this Annual Report on Form 10-K are subject to a significant degree of risk. These forward-looking statements and the above described risks, uncertainties and other factors speak only as of the date of this Annual Report on Form 10-K, and we expressly disclaim any obligation or undertaking to disseminate any updates or revisions to any forward-looking statement contained herein, to reflect any change in our expectations with regard thereto, or any other change in events, conditions or circumstances on which any such statement is based. Readers are cautioned not to place undue reliance on any forward-looking statement.

(b) Description of Business

Overview

We are a leading communications company with operations in Puerto Rico, Panama, Costa Rica, the Caribbean, including Jamaica, and other parts of Latin America. The communications and entertainment services that we deliver to our residential and business customers include video, broadband internet, telephony and mobile services. In most of our operating footprint, we offer bundles of services, including video, broadband internet and telephony products in one subscription. We are also focused on leveraging our full-service product suite to deliver fixed-mobile convergence offerings.

Our business products and services also include enterprise-grade connectivity, data center, hosting and managed solutions, as well as IT solutions with customers ranging from small and medium enterprises to international companies and governmental agencies. We also operate an extensive subsea and terrestrial fiber optic cable network that connects approximately 40 markets in the region, providing connectivity solutions both within and outside our operating footprint.

We are the largest fixed-line provider of high-speed broadband and video services across a number of our markets, including Puerto Rico, Jamaica and Trinidad and Tobago. In addition, we offer mobile services across our operating footprint. As a network operator across most of our markets, we are able to offer a full range of voice and data services, including value-added, data-based and fixed-mobile converged services. For a breakdown of revenue by major category, see note 20 to our consolidated financial statements in Part II of this Annual Report on Form 10-K.

I-4

Our operating brands include the following:

| C&W | Liberty Puerto Rico | Liberty Costa Rica | ||||||||||||||||||||||||

|  |  | ||||||||||||||||||||||||

| ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

I-5

Operating Data

The following tables present certain operating data as of December 31, 2022. The tables reflect 100% of the data applicable to each of our reportable segments, regardless of our ownership percentage. For additional information regarding terms used in the following tables, see the Operating Data Glossary below.

| Homes Passed | Two-way Homes Passed | Fixed Line Customer Relationships | Total RGUs | Video RGUs | Internet RGUs | Telephony RGUs | Total Mobile Subscribers | Prepaid | Postpaid | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| C&W Caribbean: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jamaica | 685,700 | 685,700 | 331,800 | 741,100 | 132,000 | 308,200 | 300,900 | 1,193,700 | 1,120,000 | 73,700 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Bahamas | 120,900 | 120,900 | 35,900 | 62,300 | 5,600 | 23,100 | 33,600 | 170,400 | 146,400 | 24,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Trinidad and Tobago | 340,900 | 340,900 | 155,600 | 336,300 | 101,800 | 140,300 | 94,200 | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Barbados | 140,400 | 140,400 | 84,300 | 184,000 | 38,000 | 75,700 | 70,300 | 128,000 | 87,600 | 40,400 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 336,000 | 316,100 | 215,100 | 376,600 | 74,400 | 187,200 | 115,000 | 433,300 | 333,200 | 100,100 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Total C&W Caribbean | 1,623,900 | 1,604,000 | 822,700 | 1,700,300 | 351,800 | 734,500 | 614,000 | 1,925,400 | 1,687,200 | 238,200 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| C&W Panama | 829,200 | 829,200 | 251,700 | 566,600 | 159,300 | 207,400 | 199,900 | 2,178,900 | 1,820,700 | 358,200 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total C&W | 2,453,100 | 2,433,200 | 1,074,400 | 2,266,900 | 511,100 | 941,900 | 813,900 | 4,104,300 | 3,507,900 | 596,400 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Liberty Puerto Rico (a) | 1,173,600 | 1,173,600 | 551,100 | 1,024,200 | 242,800 | 524,000 | 257,400 | 1,085,600 | 182,300 | 903,300 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Liberty Costa Rica (b) | 700,300 | 694,400 | 299,200 | 528,400 | 204,800 | 268,200 | 55,400 | 2,979,600 | 2,162,400 | 817,200 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total | 4,327,000 | 4,301,200 | 1,924,700 | 3,819,500 | 958,700 | 1,734,100 | 1,126,700 | 8,169,500 | 5,852,600 | 2,316,900 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

(a)Postpaid mobile subscribers include 206,700 CRUs. A CRU represents an individual receiving mobile services through an organization that has entered into a contract for mobile services with us and where the organization is responsible for the payment of the CRU’s mobile services.

(b)Our homes passed in Liberty Costa Rica include 57,000 homes on a third-party network that provides us long-term access.

I-6

Operating Data Glossary

Customer Relationships – The number of customers who receive at least one of our video, internet or telephony services that we count as RGUs, without regard to which or to how many services they subscribe. To the extent that RGU counts include EBU adjustments, we reflect corresponding adjustments to our customer relationship counts. For further information regarding our EBU calculation, see Additional General Notes below. Customer relationships generally are counted on a unique premises basis. Accordingly, if an individual receives our services in two premises (e.g., a primary home and a vacation home), that individual generally will count as two customer relationships. We exclude mobile-only customers from customer relationships.

Homes Passed – Homes, residential multiple dwelling units or commercial units that can be connected to our networks without materially extending the distribution plant. Certain of our homes passed counts are based on census data that can change based on either revisions to the data or from new census results.

Internet (Broadband) RGU – A home, residential multiple dwelling unit or commercial unit that receives internet services over our network.

Mobile Subscribers – Our mobile subscriber count represents the number of active SIM cards in service rather than services provided. For example, if a mobile subscriber has both a data and voice plan on a smartphone this would equate to one mobile subscriber. Alternatively, a subscriber who has a voice and data plan for a mobile handset and a data plan for a laptop (via a dongle) would be counted as two mobile subscribers. Customers who do not pay a recurring monthly fee are excluded from our mobile telephony subscriber counts after periods of inactivity ranging from 60 to 90 days, based on industry standards within the respective country. In a number of countries, our mobile subscribers receive mobile services pursuant to prepaid contracts.

RGU – RGU is separately a video RGU, internet RGU or telephony RGU. A home, residential multiple dwelling unit, or commercial unit may contain one or more RGUs. For example, if a residential customer subscribed to our video service, fixed-line telephony service and broadband internet service, the customer would constitute three RGUs. RGUs are generally counted on a unique premises basis such that a given premises does not count as more than one RGU for any given service. On the other hand, if an individual receives one of our services in two premises (e.g., a primary home and a vacation home), that individual will count as two RGUs for that service. Each bundled video, internet or telephony service is counted as a separate RGU regardless of the nature of any bundling discount or promotion. Non-paying subscribers are counted as RGUs during their free promotional service period. Some of these subscribers may choose to disconnect after their free service period. Services offered without charge on a long-term basis (e.g., VIP subscribers or free service to employees) generally are not counted as RGUs. We do not include subscriptions to mobile services in our externally reported RGU counts. In this regard, our RGU counts exclude our separately reported postpaid and prepaid mobile subscribers.

SOHO - Small office/ home office customers.

Telephony RGU – A home, residential multiple dwelling unit or commercial unit that receives voice services over our network. Telephony RGUs exclude mobile subscribers.

Two-way Homes Passed – Homes passed by those sections of our networks that are technologically capable of providing two-way services, including video, internet and telephony services.

Video RGU – A home, residential multiple dwelling unit or commercial unit that receives our video service over our network primarily via a digital video signal while subscribing to any recurring monthly service that requires the use of encryption-enabling technology. Video RGUs that are not counted on an EBU basis are generally counted on a unique premises basis. For example, a subscriber with one or more set-top boxes that receives our video service in one premises is generally counted as just one RGU.

Additional General Notes:

Most of our operations provide telephony, broadband internet, data, video or other B2B services. Certain of our B2B service revenue is derived from SOHO customers that pay a premium price to receive enhanced service levels along with video, internet or telephony services that are the same or similar to the mass marketed products offered to our residential subscribers. All mass marketed products provided to SOHO customers, whether or not accompanied by enhanced service levels and/or premium prices, are included in the respective RGU and customer counts of our operations, with only those services provided at premium prices considered to be “SOHO RGUs” or “SOHO customers.” To the extent our existing customers upgrade from a residential product offering to a SOHO product offering, the number of SOHO RGUs and SOHO customers will increase, but there is no impact to our total RGU or customer counts. With the exception of our B2B SOHO customers, we generally do not count customers of B2B services as customers or RGUs for external reporting purposes.

I-7

Certain of our residential and commercial RGUs are counted on an EBU basis, including residential multiple dwelling units and commercial establishments, such as bars, hotels, and hospitals, in Puerto Rico. Our EBUs are generally calculated by dividing the bulk price charged to accounts in an area by the most prevalent price charged to non-bulk residential customers in that market for the comparable tier of service. As such, we may experience variances in our EBU counts solely as a result of changes in rates.

While we take appropriate steps to ensure that subscriber and homes passed statistics are presented on a consistent and accurate basis at any given balance sheet date, the variability from country to country in (i) the nature and pricing of products and services, (ii) the distribution platform, (iii) billing systems, (iv) bad debt collection experience and (v) other factors add complexity to the subscriber and homes passed counting process. We periodically review our subscriber and homes passed counting policies and underlying systems to improve the accuracy and consistency of the data reported on a prospective basis. Accordingly, we may from time to time make appropriate adjustments to our subscriber and homes passed statistics based on those reviews.

Fixed Network and Product Penetration Data (%)

| Panama | Jamaica | The Bahamas | Trinidad and Tobago | Barbados | Other C&W | Costa Rica | Puerto Rico | ||||||||||||||||||||||||||||||||||||||||

| Network data: | |||||||||||||||||||||||||||||||||||||||||||||||

Two-way homes passed (1) | 100 | % | 100 | % | 100 | % | 100 | % | 100 | % | 94 | % | 99 | % | 100 | % | |||||||||||||||||||||||||||||||

| Homes passed: | |||||||||||||||||||||||||||||||||||||||||||||||

Cable (2) | 43 | % | 40 | % | — | % | 99 | % | — | % | 58 | % | 84 | % | 91 | % | |||||||||||||||||||||||||||||||

FTTH (2) | 53 | % | 37 | % | 54 | % | 1 | % | 100 | % | 38 | % | 16 | % | 9 | % | |||||||||||||||||||||||||||||||

VDSL (2) | 4 | % | 23 | % | 46 | % | — | % | — | % | 4 | % | — | % | — | % | |||||||||||||||||||||||||||||||

| Product penetration: | |||||||||||||||||||||||||||||||||||||||||||||||

Television (3) | 16 | % | 19 | % | 5 | % | 30 | % | 27 | % | 22 | % | 29 | % | 21 | % | |||||||||||||||||||||||||||||||

Broadband internet (4) | 25 | % | 45 | % | 19 | % | 41 | % | 54 | % | 59 | % | 39 | % | 45 | % | |||||||||||||||||||||||||||||||

Fixed-line telephony (4) | 24 | % | 44 | % | 28 | % | 28 | % | 50 | % | 36 | % | 8 | % | 22 | % | |||||||||||||||||||||||||||||||

Double-play (5) | 32 | % | 49 | % | 50 | % | 18 | % | 30 | % | 35 | % | 44 | % | 13 | % | |||||||||||||||||||||||||||||||

Triple-play (5) | 47 | % | 37 | % | 12 | % | 49 | % | 44 | % | 20 | % | 17 | % | 36 | % | |||||||||||||||||||||||||||||||

(1)Percentage of total homes passed that are two-way homes passed.

(2)Percentage of two-way homes passed served by a cable, FTTH or DSL network, as applicable. “VDSL” refers to both our DSL and very high-speed DSL technology networks.

(3)Percentage of total homes passed that subscribe to television services.

(4)Percentage of two-way homes passed that subscribe to broadband internet or fixed-line telephony services, as applicable.

(5)Percentage of total customers that subscribe to two services (double-play customers) or three services (triple-play customers) offered by our operations (video, broadband internet and fixed-line telephony), as applicable.

I-8

Video, Broadband Internet & Fixed-Line Telephony and Mobile Services

| Panama | Jamaica | The Bahamas | Trinidad and Tobago | Barbados | Other C&W | Costa Rica | Puerto Rico | ||||||||||||||||||||||||||||||||||||||||

| Video services: | |||||||||||||||||||||||||||||||||||||||||||||||

Network System (1) | VDSL/HFC/FTTH | VDSL/HFC/FTTH | VDSL/FTTH | HFC | FTTH | VDSL/HFC/FTTH | HFC/FTTH | HFC / FTTH | |||||||||||||||||||||||||||||||||||||||

Broadband internet service: | |||||||||||||||||||||||||||||||||||||||||||||||

Maximum download speed offered (Mbps) | 1,000 | 500 | 600 | 500 | 1,000 | ~450 (2) | 450 | 1,000 | |||||||||||||||||||||||||||||||||||||||

| Mobile services: | |||||||||||||||||||||||||||||||||||||||||||||||

Network Technology (3) | LTE | LTE | LTE | — | LTE | LTE | LTE | 5G | |||||||||||||||||||||||||||||||||||||||

(1) These are the primary systems used for delivery of services in the countries indicated. “HFC” refers to hybrid fiber coaxial cable networks.

(2) Represents an average as speeds vary by market.

(3) Fastest available technology. “LTE” refers to the Long Term Evolution Standard.

I-9

Products and Services

We offer our customers a comprehensive set of converged mobile, broadband, video and fixed-line telephony services. In the table below, we identify the services we offer in each of the countries in the Caribbean and Latin America where we have operations.

| Mobile | Broadband internet | Video | Fixed-line telephony | ||||||||||||||||||||

| C&W: | |||||||||||||||||||||||

| Anguilla | X | X | X | X | |||||||||||||||||||

| Antigua & Barbuda | X | X | X | — | |||||||||||||||||||

| Barbados | X | X | X | X | |||||||||||||||||||

| Bonaire | X | — | — | — | |||||||||||||||||||

| British Virgin Islands | X | X | X | X | |||||||||||||||||||

| Cayman Islands | X | X | X | X | |||||||||||||||||||

| Curaçao | X | X | X | X | |||||||||||||||||||

| Dominica | X | X | X | X | |||||||||||||||||||

| Grenada | X | X | X | X | |||||||||||||||||||

| Jamaica | X | X | X | X | |||||||||||||||||||

| Montserrat | X | X | — | X | |||||||||||||||||||

| Saba | X | — | — | — | |||||||||||||||||||

| St. Eustatius | X | — | — | — | |||||||||||||||||||

| St. Maarten | X | X | — | — | |||||||||||||||||||

| St. Martin | X | — | — | — | |||||||||||||||||||

| St. Kitts & Nevis | X | X | X | X | |||||||||||||||||||

| St. Lucia | X | X | X | X | |||||||||||||||||||

| St. Vincent & the Grenadines | X | X | X | X | |||||||||||||||||||

| The Bahamas | X | X | X | X | |||||||||||||||||||

| Trinidad and Tobago | — | X | X | X | |||||||||||||||||||

| Turks & Caicos | X | X | X | X | |||||||||||||||||||

| Panama | X | X | X | X | |||||||||||||||||||

| Liberty Puerto Rico: | |||||||||||||||||||||||

| Puerto Rico | X | X | X | X | |||||||||||||||||||

| USVI | X | X | — | X | |||||||||||||||||||

| Costa Rica | X | X | X | X | |||||||||||||||||||

We believe that our ability to offer our customers greater choice and selection in bundling their services enhances the attractiveness of our service offerings, improves customer retention, minimizes churn and increases overall customer lifetime value.

Residential Services

Mobile Services. We offer mobile services throughout our operating footprint. We are a mobile network operator, delivering high-speed services in Puerto Rico and the USVI, Panama, Costa Rica and all but one of our Caribbean markets. As a mobile network provider, we are able to offer a full range of voice and data services, including value-added services. Where available, we expect our mobile services will allow us to provide an extensive converged product offering with video, internet and fixed-line telephony, allowing our customers connectivity in and out-of-the-home. We hold spectrum licenses as a mobile network provider, with terms typically ranging from 10 to 15 years across our C&W markets. In Puerto Rico and the USVI, spectrum licenses are typically held for perpetuity with the exception of CBRS spectrum which has a priority term of 10 years. We also hold mobile spectrum licenses in Costa Rica with a 15-year term that may be extended for an additional 10 year term.

I-10

Subscribers to our mobile services pay varying monthly fees depending on whether the mobile service is bundled with one of our other services or includes mobile data services over their phones, tablets or laptops. Our mobile services are available on a postpaid or prepaid basis. We offer our customers the option to purchase mobile handsets with purchase terms typically related to whether the customer selects a prepaid or postpaid plan. Customers selecting a prepaid plan or service, pay in advance for a pre-determined amount of airtime and/or data and generally do not enter into a minimum contract term. Customers subscribing to a postpaid plan generally enter into contracts ranging from 12 to 24 months. Customers subscribing to a postpaid plan in Puerto Rico are offered installment agreements if they buy a new handset with acceleration provisions if they cancel the account without penalty. Long-term contracts are often taken with a subsidized mobile handset.

Broadband Internet Services. To support our customers’ connectivity demands, we are expanding our networks to make high-speed broadband available to more people. This includes investment in the convergence of our fixed and mobile data systems and through our next generation WiFi products, which enable us to maximize the impact of our broadband networks by providing reliable, high-speed wireless connectivity anywhere in the home. These gateway products can be self-installed and have an automatic WiFi optimization function, which selects the best possible wireless frequency. During 2022, our Network Extension programs (as defined and described below) upgraded or passed approximately 484,400 homes across Liberty Latin America.

The internet speeds we offer are one of our differentiators, as customers spend more time streaming video and other bandwidth-heavy services on multiple devices. As a result, we are continuing to invest in additional bandwidth and technologies to increase internet speeds throughout our Latin America and Caribbean footprint. We plan to continue the upgrade and expansion of our fixed networks so that we can deploy high-speed internet service to additional customers in the coming years.

Our residential subscribers access the internet predominantly via FTTH or HFC networks and with modems connected to their internet capable devices, including personal computers, or wirelessly via next generation WiFi and telephony gateway products. In each of our markets, we offer multiple tiers of internet service. The speed of service depends on location and the tier of service selected by our subscribers.

Our value-added services include security measures and online storage. Mobile broadband internet services are also available through our mobile services described above. Subscribers to our internet service pay a monthly fee based on the tier of service selected. In addition to the monthly fee, customers pay an activation service fee upon subscribing to an internet service. This one-time fee may be waived for promotional reasons. We determine pricing for each different tier of internet service through an analysis of speed, market conditions and other factors.

Video Services. We offer video services in Puerto Rico, Costa Rica, and in most of C&W’s residential markets. In most markets, we are enhancing our video offerings with next generation, market-leading digital television platforms that enable our customers to control when and where they watch their programming. These advanced services are predominantly delivered over our FTTH and HFC networks and customers access a range of features that include a DVR, a VoD offering and an advanced user interface including an electronic programming guide, voice search and recommendation. These video customers can pause their programming while a live broadcast is in progress, return to the start and find programs they may have missed. They can also stream a selection of channels and non-linear content on their own devices through “TV Everywhere” mobile applications such as, “Flow Sports” in the Caribbean, “Liberty Go” in Puerto Rico, “+movil Total” in Panama and “Liberty Go” in Costa Rica.

Our operations with video services typically offer multiple tiers of digital video programming starting with affordable entry or skinny and basic video service tiers. Subscribers have the option to select extended and/or premium subscription packages combining linear channels and VoD. Subscribers to our digital video services pay a fixed monthly fee and, in most of our markets, all tiers include a number of HD channels as well as access to enhanced features. In addition, through our latest generation of video CPE, subscribers can access most leading internet streaming services. Discounts to our monthly service fees are generally available to a subscriber who selects a bundled service of at least two of the following services: video, internet and fixed-line telephony.

We tailor our video services in each country of operation based on local preferences, culture, demographics and regulatory requirements. We aim to offer the most relevant mix of content to our subscribers, combining general entertainment, sports, movies, documentaries, lifestyle, news, adult, children and foreign channels, as well as local, regional and international broadcast networks. We also operate several channels in the Caribbean, including a leading Caribbean sports network, Flow Sports, and through a consolidated joint venture, RUSH, a sports channel available across the Caribbean (excluding Puerto Rico and the US Virgin Islands).

I-11

Telephony Services. C&W is the incumbent fixed-line telephony service provider in most of its residential markets. In Puerto Rico and Costa Rica we also offer telephony services over our respective networks.

We offer multi-feature telephony service over our various fixed networks, including HFC cable, FTTH and copper networks. Depending on location, these services are provided via either circuit-switched telephony or VoIP technology. As we continue to develop and invest in new technologies that will enhance our customers’ experiences, we are replacing obsolete switches with VoIP technology and older copper networks with modern fiber optics. These digital telephony services cover international and domestic services.

Business Services

B2B Services. We offer B2B services across our operations, leveraging our high-speed and extensive fixed and mobile infrastructure. In C&W, we have our most developed B2B business and are the largest provider of services in many of our markets, representing a significant portion of C&W’s revenue. Our B2B offerings by Liberty Puerto Rico and Liberty Costa Rica are less developed and provide an opportunity for future growth.

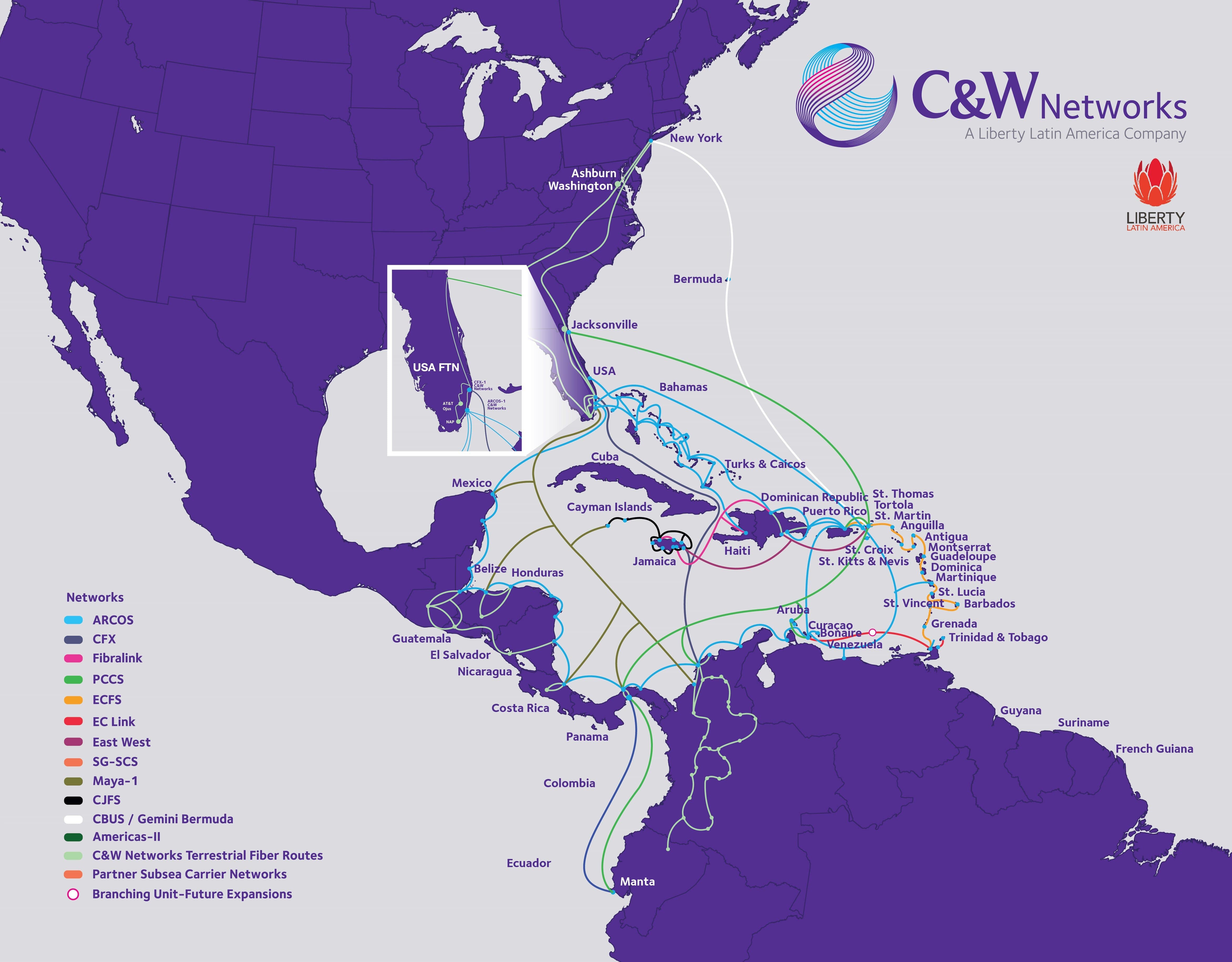

C&W Networks & LatAm. We offer cloud-based integrated communication services, connectivity and wholesale solutions to carriers and businesses throughout the Caribbean and in parts of Latin America via our subsea and terrestrial fiber optic cable networks. Our systems include long-haul terrestrial backbone and metro fiber networks that provide service to major commercial zones, wireless carrier cell sites and customers in key markets within our operating footprint. Our networks deliver critical infrastructure for the transport of growing traffic from businesses, governments and other telecommunications operators across the region, particularly to the high-traffic destination of the United States.

Below is a map of our subsea and terrestrial fiber networks within C&W Networks & LatAm.

I-12

With approximately 50,000 km of fiber optic cable, and activated capacity of over 10 Tbps, C&W Networks & LatAm is able to carry large volumes of voice and data traffic on behalf of our customers, businesses and carriers. Our networks also allow us to provide point-to-point, clear channel wholesale broadband capacity services and IP transit, superior switching and routing capabilities and local network services to telecommunications carriers, ISPs and large corporations. In the case of network outage or maintenance activity, our network provides built-in resiliency through our traffic re-routing capability.

Across our regional footprint we also provide services to business customers in various segments, from small and medium businesses to larger corporate and enterprise organizations including multi-national companies and governments. We work with our business customers to customize the best end-to-end solutions, using standardized best in class products to fit their service needs. We target specific industry segments, such as financial institutions, the hospitality sector, education institutions and government ministries and agencies. We have agreements to provide our services over fully managed and monitored dedicated IP networks, wavelength and metro-access fiber lines. We offer tailored solutions that combine our standard services with value-added features, such as dedicated customer care, professional services and enhanced service performance monitoring, to meet specific customer requirements. Our business products and services include voice, broadband, enterprise-grade connectivity, network security, software defined networking, unified communications and a range of cloud-based IT solutions, such as Infrastructure as a Service, disaster recovery and other service offerings. We also offer a range of data, voice and internet services to carriers, ISPs and mobile operators. Our extensive fiber optic cable networks allow us to typically deliver redundant, end-to-end connectivity backed by a strong service level agreement guarantee. Our networks also allow us to provide our services over dedicated access fiber lines, and local and international private networks which are dedicated to our business customers.

Our business services fall into five broad categories:

•VoIP and circuit-switch telephony;

•Data services for internet access, virtual private networks, high capacity point-to-point, point-to-multi-point and multi-point-to-multi-point services, managed networking services such as wide area, SDWAN and WiFi networks;

•Wireless services for mobile voice and data; and

•Value added Managed Services, including:

◦Private and Public Cloud Infrastructure Services and integration, including Disaster Recovery Backup Services;

◦Cloud and premise based Private Branch eXchange solutions, conferencing options and Hosted Contact Center solutions;

◦Cyber Security Services, including structured solutions, rapid response, and other professional services;

◦Emerging technologies in Software Defined Networking, Internet of Things, Digitalization and Digital Currencies; and

◦Specialized services such as Tele-Health, Digital Signage, and Retail Analytics.

The extensive reach of our network and assets, as well as our comprehensive set of capabilities positions us to meet the needs of carriers, businesses and government customers that are searching for a capable, progressive provider to manage their ever more complex communications, connectivity and information technology needs.

Technology

In many of our markets, we transmit our broadband internet, video and fixed-line telephony services over an HFC cable network, and increasingly through FTTH networks. An HFC network consists primarily of fiber networks that we connect to the home over the last few hundred meters by coaxial cable and an FTTH network uses fiber-to-the-home/-cabinet/-building/-node. In a minority of cases, we transmit our services over a fixed network consisting of VDSL or DSL copper lines. Approximately 95% of our networks allow for two-way communications and are flexible enough to support our current services as well as new services.

I-13

We closely monitor our network capacity and customer usage. We continue to take actions and explore improvements to our technologies that will increase our capacity and enhance our customers’ connected entertainment experience. These actions include:

•recapturing bandwidth and optimizing our networks by:

◦increasing the number of nodes in our markets;

◦increasing the bandwidth of our hybrid fiber coaxial cable networks;

◦converting analog channels to digital;

◦bonding additional DOCSIS 3.0 channels and adding DOCSIS 3.1 channels;

◦replacing copper lines with modern fiber optic lines; and

◦using digital compression technologies.

•freeing spectrum for high-speed internet, VoD and other services by encouraging customers to move from analog to digital services;

•increasing the efficiency of our networks by moving head-end functions (encoding, transcoding and multiplexing) to cloud storage systems;

•enhancing our network to accommodate further business services;

•using our wireless technologies to extend services outside of the home;

•offering remote access to our video services through laptops, smart phones and tablets;

•expanding the availability of next generation decoder and set-top boxes and related products, as well as developing and introducing online media sharing and streaming or cloud-based video; and

•testing new technologies.

We are engaged in network extension and upgrade programs across Liberty Latin America. We collectively refer to these network extension and upgrade programs as the “Network Extensions.” Through the Network Extensions, we continue to expand our fixed networks pursuant to which we pass or upgrade homes and businesses with our broadband communications network. In addition, we look for mobile service opportunities where we have established cable networks and have expanded our fixed-line networks where we have a strong mobile offering. This will allow us to offer converged fixed-line and mobile services to our customers.

We deliver high-speed data and fixed-line telephony over our various fixed networks, including HFC and FTTH networks. These networks are further connected via our subsea and terrestrial fiber optic cable networks that provide connectivity within and outside the region. Our subsea network cables terminating in the United States carry over 10 Tbps, which represent less than 20% of their potential capacity based on current deployed technology, presenting us with significant growth opportunities. In Puerto Rico, our network includes a fiber ring around the island that provides enhanced interconnectivity points to the island’s other local and international telecommunications companies.

As noted above, we operate one of the largest subsea fiber networks in the region and our systems include long-haul terrestrial backbone and metro fiber networks that provide access to major commercial zones, wireless carrier cell sites and customers in key markets within our operating footprint. For more information about our subsea network, see —Business Services above.

We continue to expand our wireless coverage and capacity across our markets. We have built our region-wide 5G core and upgraded all of our Puerto Rico wireless network to 5G.

I-14

Mobile

We operate mobile networks in all of our consumer markets except Trinidad & Tobago. Our networks deliver high-speed services, with over 90% LTE population coverage. Our wireless networks predominantly use LTE technologies, which we offer in most of the countries where we operate. In Puerto Rico and USVI we operate 5G networks and across other markets we aim to increase the speed of transmission of our data services and have been expanding our LTE coverage. We transmit wireless calls and data through radio frequencies that we use under spectrum licenses. We have a diversified portfolio of frequencies which support LTE and 5G (Puerto Rico & USVI only) technologies. Spectrum is a limited resource, and, as a result, we may face spectrum and capacity constraints on our wireless network in certain countries. We believe our current spectrum portfolio will allow us to meet subscribers’ needs in the coming years and minimal further investment, although we will continue to evaluate our need to acquire additional frequencies to supplement our existing spectrum portfolio. For example, in 2020, we acquired CBRS (3.5 GHz) spectrum in Puerto Rico and the USVI in the auction for that frequency. In Puerto Rico and USVI the 700 MHz FirstNet (Band 14) is usable by us (when not occupied by first responders’ traffic) but owned by AT&T and the First Responders Public Private Partnership. In 2022, AWS spectrum was allocated to our Panama operations, and we acquired additional spectrum in Barbados and Cayman.

We continue to invest significant capital in expanding our network capacity and reach and to address spectrum and capacity constraints on a market-by-market basis. Our prime 5G deployed market is Puerto Rico and USVI where approximately 95% of the population is served by our 5G capable network. We continually look for opportunities to expand our 5G footprint to other countries where a positive business case exists. Similarly, we are investing to build a new mobile core in Puerto Rico, which when built, will be virtualized, and redundant. These redundant network elements will be connected by our owned and operated diverse submarine cable routes with automatic alternate routing. Across all our mobile operations we continually strive to improve our network performance by commissioning annual competitive performance benchmarking studies and undertaking customer experience improvement programs. In Puerto Rico and the USVI, we are a part of the national US Firstnet (Emergency/First Responders) network, which necessitates above-average network resilience and other customer performance requirements, subject to governmental penalties for non-compliance.

Supply Sources

Content

Content is one of the key drivers for customers in selecting a provider of video, broadband and/or wireless services. Therefore, we aim to provide products that allow our customers to consume content whenever and wherever they want and feature content that matters the most to our customers. Our programming strategy is based on:

•product (enabling access through home and mobile screens at anytime, including live, catch-up, restart with the ability to pause programming, personal recording, on-demand and internet streaming apps);

•proposition (meeting our customers’ content and entertainment expectations by offering access to a wider range of channels and on-demand content, and internet streaming services at affordable and competitive price points);

•partnering (alliances with content partners and leading distributors to aggregate the best linear, on-demand and streaming content); and

•variety (expanding the content offering from video to other categories and creating an ecosystem across music, sports, retail, culinary, fitness etc. through the convenience of our products, broadband and wireless connectivity services).