| REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

| |

| Large accelerated filer | ☐ | ☒ | Non-accelerated filer |

☐ | ||||||

| Emerging growth company | ||||||||||

| International Financial Reporting Standards as issued | Other ☐ | |||||||

| by the International Accounting Standards Board | ☐ |

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

Page |

||||

| INTRODUCTION |

||||

| 4 | ||||

| 4 | ||||

| 4 | ||||

| 4 | ||||

| 36 | ||||

| 66 | ||||

| 67 | ||||

| 90 | ||||

| 100 | ||||

| 101 | ||||

| 102 | ||||

| 102 | ||||

| 109 | ||||

| 110 | ||||

| 112 | ||||

| 112 | ||||

| 112 | ||||

| 112 | ||||

| 113 | ||||

| 113 | ||||

| 113 | ||||

| 114 | ||||

| 114 | ||||

| 114 | ||||

| 114 | ||||

| 115 | ||||

| 116 | ||||

| 116 | ||||

| 116 | ||||

| 116 | ||||

| • | “ADSs” refers to our American depositary shares, each of which represents two ordinary shares; |

| • | “ADRs” refers to the American depositary receipts, which, if issued, evidence our ADSs; |

| • | “China” or “PRC” refers to the People’s Republic of China, excluding, for the purpose of this annual report only, Taiwan, Hong Kong Special Administrative Region and Macau Special Administrative Region; |

| • | “courses” refer to our flagship courses (i.e., Rise Start, Rise On and Rise up), online courses, such as Can-Talk, and other major courses or services that we may have. As of the date of this annual report, our other major courses include courses and services for academic tutoring, test preparation and admissions consulting; |

| • | “greater China” refers to, for the purpose of this annual report only, the People’s Republic of China and the Hong Kong Special Administrative Region; |

| • | “new students enrolled” refers to the newly acquired students who enrolled in our courses during a given period of time; |

| • | “RMB” or “Renminbi” refers to the legal currency of China; |

| • | “regular courses” refers to our Rise Start and Rise On programs; |

| • | “shares” or “ordinary shares” refers to our ordinary shares, par value US$0.01 per share; |

| • | “students in class” refers to the students who were taking our courses as of a given date; |

| • | “students” or “teachers” refers to students or teachers, respectively, at self-owned learning centers unless otherwise specified; |

| • | “student retention rate” refers to the percentage of the number of students who continue to study at our self-owned learning centers after completing courses in a particular period to the total number of students who complete courses during the same period; |

| • | “tier-one cities” refers to Beijing, Shanghai, Guangzhou and Shenzhen; |

| • | “US$,” “U.S. Dollars,” “$” and “dollars” refer to the legal currency of the United States; and |

| • | “we,” “us,” “our company,” “our,” the “Company” or “RISE Education” refers to RISE Education Cayman Ltd, a Cayman Islands company, and, where appropriate in the context, its subsidiaries and its consolidated affiliates, including our viable interest entity, or VIE, and its subsidiaries and schools. |

| • | our goals and strategies; |

| • | our ability to retain our students in class and increase the number of our new students enrolled; |

| • | our ability to offer new courses and develop supplementary course materials; |

| • | our ability to engage, train and retain new teachers; |

| • | our future business development, financial condition and results of operations; |

| • | the expected growth in, market size of and trends in the markets for our course offerings in China; |

| • | expected changes in our revenues, costs or expenditures; |

| • | our expectations for demand for and market acceptance of our brand; |

| • | growth of and trends of competition in the junior English language teaching, or ELT, market in China; |

| • | regulatory developments in the ELT and private education industries in China; |

| • | government policies and regulations relating to our corporate structure; and |

| • | general economic and business conditions in China. |

ITEM 1. |

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

ITEM 2. |

OFFER STATISTICS AND EXPECTED TIMETABLE |

ITEM 3. |

KEY INFORMATION |

| A. | Selected Financial Data |

For the Year Ended December 31, |

||||||||||||||||||||||||

2016 |

2017 |

2018 |

2019 |

2020 |

||||||||||||||||||||

RMB |

RMB |

RMB |

RMB |

RMB |

US$ |

|||||||||||||||||||

(thousands, except for EBITDA margin) |

||||||||||||||||||||||||

| Selected Consolidated Statements of Operations Data: |

||||||||||||||||||||||||

| Revenues: |

||||||||||||||||||||||||

| Educational programs (1) |

618,326 | 835,298 | 1,102,254 | 1,332,372 | 872,877 | 133,774 | ||||||||||||||||||

| Franchise revenues (1) |

63,532 | 100,013 | 125,341 | 156,509 | 82,084 | 12,580 | ||||||||||||||||||

| Other revenues (1) |

29,135 | 33,964 | 44,293 | 40,566 | 3,506 | 537 | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total |

710,993 | 969,275 | 1,271,888 | 1,529,447 | 958,467 | 146,891 | ||||||||||||||||||

| Cost of revenues |

(363,579 | ) | (452,220 | ) | (576,530 | ) | (694,693 | ) | (602,934 | ) | (92,403 | ) | ||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Gross profit |

347,414 | 517,055 | 695,358 | 834,754 | 355,533 | 54,488 | ||||||||||||||||||

| Operating expenses: |

||||||||||||||||||||||||

| Selling and marketing |

(128,475 | ) | (177,993 | ) | (245,662 | ) | (307,339 | ) | (233,687 | ) | (35,814 | ) | ||||||||||||

| General and administrative |

(148,093 | ) | (339,690 | ) | (242,084 | ) | (304,626 | ) | (260,239 | ) | (39,884 | ) | ||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total operating expenses |

(276,568 | ) | (517,683 | ) | (487,746 | ) | (611,965 | ) | (493,926 | ) | (75,698 | ) | ||||||||||||

| Operating income/(loss) |

70,846 | (628 | ) | 207,612 | 222,789 | (138,393 | ) | (21,210 | ) | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Interest income |

16,622 | 19,559 | 26,376 | 17,952 | 15,091 | 2,313 | ||||||||||||||||||

| Interest expense |

(6,073 | ) | (26,589 | ) | (33,803 | ) | (34,093 | ) | (23,611 | ) | (3,619 | ) | ||||||||||||

| Foreign currency exchange (loss)/gain |

(2,741 | ) | 388 | (1,383 | ) | (1,506 | ) | (187 | ) | (29 | ) | |||||||||||||

| Other income, net |

4,391 | 6,594 | 15,397 | 10,115 | 26,961 | 4,132 | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Impairment loss on long-term investment |

— | — | — | — | (37,000 | ) | (5,670 | ) | ||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income/(loss) before income tax expense |

83,045 | (676 | ) | 214,199 | 215,257 | (157,139 | ) | (24,083 | ) | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income tax (expense)/benefit |

(32,202 | ) | (52,924 | ) | (71,763 | ) | (70,697 | ) | 15,695 | 2,406 | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net income/(loss) |

50,843 | (53,600 | ) | 142,436 | 144,560 | (141,444 | ) | (21,677 | ) | |||||||||||||||

| Net loss attributable to non-controlling interests |

3,080 | 5,626 | 522 | 3,540 | 9,011 | 1,381 | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net income/(loss) attributable to RISE Education Cayman Ltd |

53,923 | (47,974 | ) | 142,958 | 148,100 | (132,433 | ) | (20,296 | ) | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Non-GAAP Financial Measures: |

||||||||||||||||||||||||

| EBITDA (2) |

142,318 | 56,064 | 279,852 | 301,419 | (64,370 | ) | (9,865 | ) | ||||||||||||||||

| EBITDA margin (3) |

20.0 | % | 5.8 | % | 22.0 | % | 19.7 | % | -6.7 | % | ||||||||||||||

| Adjusted EBITDA (2) |

— | 242,510 | 300,204 | 349,308 | (9,371 | ) | (1,437 | ) | ||||||||||||||||

| Adjusted EBITDA margin (4) |

— | 25.0 | % | 23.6 | % | 22.8 | % | -1.0 | % | |||||||||||||||

| Non-GAAP net income/(loss) attributable to RISE Education Cayman Ltd(2) |

86,042 | 144,954 | 179,932 | 213,363 | (60,070 | ) | (9,207 | ) | ||||||||||||||||

| (1) | To be consistent with our management reporting framework, revenues from educational programs include revenues generated from Can-Talk starting from the first quarter of 2020. Revenues from educational programs in previous years have been adjusted to conform to the presentation in 2020. |

| (2) | To see how we define and calculate EBITDA, adjusted EBITDA, Non-GAAP net (loss)/income, a reconciliation between EBITDA and net (loss)/income and a discussion about the limitations of non-GAAP financial measures, see “Item 5. Operating and Financial Review and Prospects—A. Operating Results—Non-GAAP Financial Measures.” |

| (3) | EBITDA margin is calculated by dividing EBITDA by revenues. |

| (4) | Adjusted EBITDA margin is calculated by dividing adjusted EBITDA by revenues. |

As of December 31, |

||||||||||||||||||||||||

2016 |

2017 |

2018 |

2019 |

2020 |

||||||||||||||||||||

RMB |

RMB |

RMB |

RMB |

RMB |

US$ |

|||||||||||||||||||

(thousands) |

||||||||||||||||||||||||

| Selected Consolidated Balance Sheet Data: |

||||||||||||||||||||||||

| Total current assets |

707,738 | 1,142,445 | 1,402,270 | 1,084,866 | 744,568 | 114,110 | ||||||||||||||||||

| Cash and cash equivalents |

639,999 | 1,055,982 | 1,288,080 | 999,012 | 554,620 | 84,999 | ||||||||||||||||||

| Prepayments and other current assets |

45,517 | 40,571 | 71,537 | 51,420 | 94,556 | 14,491 | ||||||||||||||||||

| Total non-current assets |

792,560 | 813,893 | 878,504 | 1,717,089 | 1,681,837 | 257,753 | ||||||||||||||||||

| Property and equipment, net |

75,673 | 100,177 | 128,412 | 137,340 | 107,537 | 16,481 | ||||||||||||||||||

| Intangible assets, net |

225,951 | 200,615 | 198,057 | 210,346 | 185,647 | 28,452 | ||||||||||||||||||

| Goodwill |

461,686 | 475,732 | 491,969 | 665,416 | 659,255 | 101,035 | ||||||||||||||||||

| Total assets |

1,500,298 | 1,956,338 | 2,280,774 | 2,801,955 | 2,426,405 | 371,863 | ||||||||||||||||||

| Total current liabilities |

763,366 | 1,030,700 | 1,278,872 | 1,233,518 | 1,168,355 | 179,058 | ||||||||||||||||||

| Current portion of long-term loan |

38,186 | — | 82,506 | 134,015 | 226,744 | 34,750 | ||||||||||||||||||

| Accrued expenses and other current liabilities |

96,158 | 171,099 | 159,882 | 202,808 | 164,193 | 25,164 | ||||||||||||||||||

| Deferred revenue and customer advances |

601,324 | 812,821 | 1,002,796 | 716,637 | 563,736 | 86,396 | ||||||||||||||||||

| Total non-current liabilities |

338,505 | 629,906 | 561,068 | 944,136 | 756,544 | 115,946 | ||||||||||||||||||

| Long-term loan |

333,102 | 623,439 | 502,356 | 370,163 | 191,397 | 29,333 | ||||||||||||||||||

| Total liabilities |

1,101,871 | 1,660,606 | 1,839,940 | 2,177,654 | 1,924,899 | 295,004 | ||||||||||||||||||

| Total RISE Education Cayman Ltd shareholders’ equity |

407,200 | 310,131 | 455,755 | 608,896 | 495,112 | 75,879 | ||||||||||||||||||

| Non-controlling interests |

(8,773 | ) | (14,399 | ) | (14,921 | ) | 15,405 | 6,394 | 980 | |||||||||||||||

| Total equity |

398,427 | 295,732 | 440,834 | 624,301 | 501,506 | 76,859 | ||||||||||||||||||

| Total liabilities, non-controlling interests and shareholders’ equity |

1,500,298 | 1,956,338 | 2,280,774 | 2,801,955 | 2,426,405 | 371,863 | ||||||||||||||||||

| B. | Capitalization and Indebtedness |

| C. | Reasons for the Offer and Use of Proceeds |

| D. | Risk Factors |

| • | exercise effective control over our consolidated affiliates; |

| • | receive substantially all of the economic benefits from our consolidated affiliates; and |

| • | have a call option to purchase all or part of the equity interests in Beijing Step Ahead when and to the extent permitted by the relevant laws. |

| • | revoking the business licenses and/or operating licenses of Rise (Tianjin) Education Information Consulting Co., Ltd., or Rise Tianjin, and/or Beijing Step Ahead and its subsidiaries and schools; |

| • | discontinuing or restricting the conduct of any transactions between Rise Tianjin and Beijing Step Ahead and its subsidiaries and schools; |

| • | limiting our business expansion in China by way of entering into contractual arrangements; |

| • | imposing fines and penalties, confiscating the income from Beijing Step Ahead and its subsidiaries and schools, or imposing other requirements we or Beijing Step Ahead and its subsidiaries and schools may not be able to comply with; |

| • | shutting down our servers or blocking our websites; |

| • | requiring us to restructure our ownership structure or operations, including terminating the contractual arrangements with Beijing Step Ahead and its subsidiaries and schools and deregistering the pledges on the equity of Beijing Step Ahead; |

| • | restricting or prohibiting our use of the proceeds of our future offering to finance our business and operations in China; |

| • | restricting the use of financing sources by us or our consolidated affiliates or otherwise restricting our or their ability to conduct business; |

| • | imposing additional conditions or requirements we may not be able to comply with; or |

| • | take other regulatory or enforcement actions against us that could be harmful to our business. |

| • | regulatory developments affecting us or our industry, and customers of our education services; |

| • | actual or anticipated fluctuations in our quarterly results of operations and changes or revisions of our expected results; |

| • | changes in the market condition, market potential and competition in education services; |

| • | announcements by us or our competitors of new education services, expansions, investments, acquisitions, strategic partnerships or joint ventures; |

| • | fluctuations in global and Chinese economies; |

| • | changes in financial estimates by securities analysts; |

| • | adverse publicity about us; |

| • | additions or departures of our key personnel and senior management; |

| • | release of lock-up or other transfer restrictions on our outstanding equity securities or sales of additional equity securities; and |

| • | potential litigation or regulatory investigations. |

| • | we have a board of directors that is composed of a majority of independent directors, as defined under the NYSE listing rules; |

| • | we have a compensation committee that is composed entirely of independent directors; and |

| • | we have a nominating and governance committee that is composed entirely of independent directors. |

| • | the rules under the Exchange Act requiring the filing of quarterly reports on Form 10-Q or current reports on Form 8-K with the SEC; |

| • | the sections of the Exchange Act regulating the solicitation of proxies, consents, or authorizations in respect of a security registered under the Exchange Act; |

| • | the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and |

| • | the selective disclosure rules by issuers of material nonpublic information under Regulation FD. |

| • | we have failed to timely provide the depositary with notice of meeting and related voting materials; |

| • | we have instructed the depositary that we do not wish a discretionary proxy to be given; |

| • | we have informed the depositary that there is substantial opposition as to a matter to be voted on at the meeting; or |

| • | a matter to be voted on at the meeting would have a material adverse impact on shareholders. |

ITEM 4. |

INFORMATION OF THE COMPANY |

| A. | History and Development of the Company |

| B. | Business Overview |

As of December 31, |

||||||||||||

2018 |

2019 |

2020 |

||||||||||

| Self-owned |

76 | 89 | 92 | |||||||||

| Franchised |

304 | 383 | 420 | |||||||||

| Total learning centers |

380 | 472 | 512 | |||||||||

| 6 months to 1 year prior to opening |

• Seek suitable site and negotiate leasing arrangements | |

| 3 months prior to opening |

• Sign leasing agreement | |

| • Initiate regulatory approval procedures | ||

| 2 months prior to opening |

• Begin designing and remodeling center interior | |

| • Hire principal and other supervisors | ||

| • Begin hiring teachers and other staff | ||

| • Conduct market research to formulate marketing plan | ||

| 1 month prior to opening |

• Begin team building process and teacher training | |

| • Advertising and promotion | ||

| • Technology checks | ||

| Opening |

• Opening ceremony | |

| • Enroll students and begin classes | ||

| • | live interactive courses, together with self-adaptive performance appraisal and tailored assistance; |

| • | various types of learning resources, such as Rise Library Online, rTunes, Jelly phonics, Go for Grammar, Spelling Star, Rise+ Studio and Magic Grammar, through multi-functional capacities; |

| • | efficient communication channels, which enable parents to communicate with teachers and keep track of their children’s learning performance and study goals; and |

| • | simplified procedures for tuition payment and class enrollment through the mobile application. |

| • | brand recognition; |

| • | scope and quality of course offerings; |

| • | capability of product development and teacher training; |

| • | standardized management and scalable business model; |

| • | customer satisfaction; and |

| • | ability to effectively market course offerings to a broad base of prospective customers. |

| • | registration of 36 domain names, including our risecenter, rdchina, risechina, riseedu, risehongkong, seerabj, riselinkedu e-learningkid |

| • | 243 registered trademarks, including Rise, Rise Immersion Subject English, Rismart, Pre-Rise, Mini Rise, Rise Pro, Rise Sat, Rise AP, Rise Act, Rise On, Rise Up, Rise Start Rise Link |

| • | 125 copyright registration in China; and |

| • | one patent in China. |

| • | Profit distribution. for-profit schools may adopt the form of a corporation under the PRC Company Law, which are entitled to retain the profits and proceeds from the schools and the operation surplus may be allocated to the sponsors, i.e. the shareholders, pursuant to the PRC Company Law and other relevant laws and regulations. Sponsors of non-profit schools are not entitled to the distribution of profits or proceed from the non-profit schools and all operation surplus of non-profit schools shall be used for the operation of the non-profit schools; |

| • | Tuition. For-profit private schools are entitled to set their own tuition and other miscellaneous fees without the need to seek prior approvals from the relevant government authorities. The collection of fees by non-profit schools, on the other hand, shall be regulated by the provincial, autonomous regional or municipal governments; |

| • | Government Support. for-profit private schools are still unclear as more specific provisions are yet to be introduced. On the other hand, non-profit schools enjoy more supportive measures than for-profit schools, such as government subsidies, fund awards and incentive donations. For example, non-profit schools will enjoy the same preferential tax treatments as public schools. Furthermore, non-profit schools enjoy the same treatment as public schools with respect to the supply of land, which will be supplied by the government through allocation or other means, while land will be supplied to for-profit schools in accordance with applicable laws; and |

| • | Liquidation. for-profit schools shall be distributed to the sponsors in accordance with the PRC Company Law, while the remaining assets of non-profit private schools after liquidation shall continue to be used for the operation of non-profit schools. |

| • | Article 5 of the MOJ Draft provides that FIEs incorporated and social organizations established in the PRC whose ultimate controlling owners are foreign nationals shall not invest or participate in investing, or have ultimate and actual control over, any private school engaged in compulsory education; |

| • | Article 12 of the MOJ Draft provides that the social organization that manages private schools within a group is prohibited from controlling any non-profit private schools through mergers and acquisitions, or franchising or controlling contracts. Clause 1(6) of the explanatory note to the MOJ Draft clarifies that, in view of the fact that some private schools are concurrently sponsored by, or operated by, the same sponsor, Article 12 of the MOJ Draft recognizes such operations of the existing group schools; |

| • | Article 16 provides that any institution that uses Internet technology to engage in online education activities shall obtain the ICP license and make a filing with the education department of the relevant provincial government for records. Those institutions that provide academic education services through Internet technology would need to obtain the private school operating permits; and |

| • | Article 45 provides that related party transactions by private education institutions shall be transparent, just and fair, and shall not jeopardize the interests of the state, the private education institutions, and the teachers and students. The private education institutions shall establish information disclosure mechanism for such transactions. Article 45 further provides that for agreements between non-profit private education institutions and their related parties, which involve material interests or are long-term and recurring, the relevant government authorities shall review and audit such agreements regarding their necessity, legitimacy and compliance. |

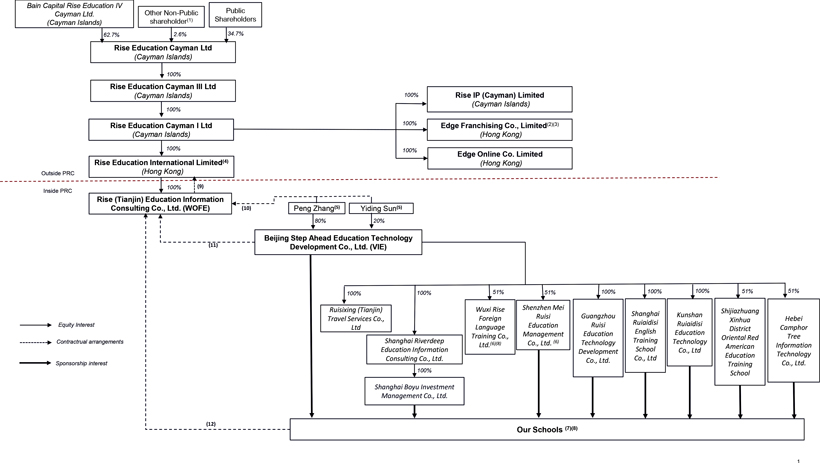

| C. | Organizational Structure |

| (1) | As of March 31, 2021, 2.6% equity interest (which does not include the number of shares that such non-public shareholders have the right to acquire within 60 days after the date of this annual report) were held by other non-public shareholders, including certain directors and senior management of ours. See “Item 6. Directors, Senior Management and Employees — E. Share Ownership.” |

| (2) | We acquired 100% equity interest in Edge Franchising Co. Limited from the Edge Learning Centers Limited in November 2017. See “Item 7. Major Shareholders and Related Party Transactions — B. Related Party Transactions.” |

| (3) | As of December 31, 2020, we had one franchised learning center in Singapore that was operated by our franchise partner in Singapore through a franchise agreement with Edge Franchising Co. Limited. |

| (4) | As of December 31, 2020, we had two self-owned learning centers in Hong Kong that were operated through Rise Education International Limited. |

| (5) | Mr. Peng Zhang, a former employee of an affiliate of our principal shareholder, Bain Capital Rise Education IV Cayman Limited, and Mr. Yiding Sun, our vice chairman and director, holding 80% and 20% of the VIE’s equity interests, respectively. |

| (6) | The remaining 49% equity interests are owned by an unrelated third party. |

| (7) | Under PRC law, entities and individuals who establish and maintain ownership interests in private schools are referred to as “sponsors.” The rights of sponsors vis-à-vis vis-à-vis |

| (8) | Learning centers are not legal entities under PRC law. As of December 31, 2020, we had 90 self-owned learning centers across China, 83 of which were operated by the 26 schools for which we are the sponsor and seven of which were operated by non-school enterprises. |

| (9) | Consulting Services Agreement. |

| (10) | Loan Agreements, Proxy Agreement, Call Option Agreement, Equity Pledge Agreement, Business Cooperation Agreement. |

| (11) | Proxy Agreement, Business Cooperation Agreement, Service Agreement, Call Option Agreement, Equity Pledge Agreement, Consulting Service Agreement and License Agreement. |

| (12) | License Agreements, License Agreements with respect to the Management System, Service Agreements, and Framework Agreements on Purchase of Teaching Materials. |

| • | exercise effective control over our VIE and its subsidiaries and schools; |

| • | receive substantially all of the economic benefits of our VIE and its subsidiaries and schools; and |

| • | have a call option to purchase all or part of the equity interests in our VIE when and to the extent permitted by PRC law. |

| D. | Property, Plants and Equipment |

ITEM 4A. |

UNRESOLVED STAFF COMMENTS |

ITEM 5. |

OPERATING AND FINANCIAL REVIEW AND PROSPECTS |

| A. | Operating Results |

For the Year Ended December 31, |

||||||||||||||||||||||||||||

2018 |

2019 |

2020 |

||||||||||||||||||||||||||

RMB |

Percentage of Revenues |

RMB |

Percentage of Revenues |

RMB |

US$ |

Percentage of Revenues |

||||||||||||||||||||||

(thousands, except for percentages) |

||||||||||||||||||||||||||||

| Educational programs |

1,102,254 | 86.7 | 1,332,372 | 87.1 | 872,877 | 133,774 | 91.1 | |||||||||||||||||||||

| Franchise revenues |

125,341 | 9.9 | 156,509 | 10.2 | 82,084 | 12,580 | 8.6 | |||||||||||||||||||||

| Other revenues |

44,293 | 3.4 | 40,566 | 2.7 | 3,506 | 537 | 0.3 | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Revenues |

1,271,888 | 100.0 | 1,529,447 | 100.0 | 958,467 | 146,891 | 100.0 | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

For the Year Ended December 31, |

||||||||||||||||||||||||||||

2018 |

2019 |

2020 |

||||||||||||||||||||||||||

RMB |

Percentage of Revenues |

RMB |

Percentage of Revenues |

RMB |

US$ |

Percentage of Revenues |

||||||||||||||||||||||

(thousands, except for percentages) |

||||||||||||||||||||||||||||

| Personnel costs |

227,691 | 17.9 | 298,710 | 19.5 | 276,797 | 42,421 | 28.9 | |||||||||||||||||||||

| Rental costs |

181,457 | 14.3 | 220,912 | 14.4 | 202,446 | 31,026 | 21.1 | |||||||||||||||||||||

| Share-based compensation |

1,315 | 0.1 | 2,617 | 0.2 | 1,821 | 279 | 0.2 | |||||||||||||||||||||

| Others |

166,067 | 13.0 | 172,454 | 11.3 | 121,870 | 18,677 | 12.7 | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total |

576,530 | 45.3 | 694,693 | 45.4 | 602,934 | 92,403 | 62.9 | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

For the Year Ended December 31, |

||||||||||||||||||||||||||||

2018 |

2019 |

2020 |

||||||||||||||||||||||||||

RMB |

Percentage of Revenues |

RMB |

Percentage of Revenues |

RMB |

US$ |

Percentage of Revenues |

||||||||||||||||||||||

(thousands, except for percentages) |

||||||||||||||||||||||||||||

| Selling and marketing |

245,662 | 19.3 | 307,339 | 20.1 | 233,687 | 35,814 | 24.4 | |||||||||||||||||||||

| General and administrative |

242,084 | 19.0 | 304,626 | 19.9 | 260,239 | 39,884 | 27.2 | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total operating expenses |

487,746 | 38.3 | 611,965 | 40.0 | 493,926 | 75,698 | 51.6 | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

For the Year Ended December 31, |

||||||||||||||||||||||||||||

2018 |

2019 |

2020 |

||||||||||||||||||||||||||

RMB |

Percentage of Revenues |

RMB |

Percentage of Revenues |

RMB |

US$ |

Percentage of Revenues |

||||||||||||||||||||||

(thousands, except for percentages) |

||||||||||||||||||||||||||||

| Revenues: |

||||||||||||||||||||||||||||

| Educational programs (1) |

1,102,254 | 86.7 | 1,332,372 | 87.1 | 872,877 | 133,774 | 91.1 | |||||||||||||||||||||

| Franchise revenues (1) |

125,341 | 9.9 | 156,509 | 10.2 | 82,084 | 12,580 | 8.6 | |||||||||||||||||||||

| Other revenues (1) |

44,293 | 3.4 | 40,566 | 2.7 | 3,506 | 537 | 0.3 | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total |

1,271,888 | 100.0 | 1,529,447 | 100.0 | 958,467 | 146,891 | 100.0 | |||||||||||||||||||||

| Cost of revenues |

(576,530 | ) | (45.3 | ) | (694,693 | ) | (45.4 | ) | (602,934 | ) | (92,403 | ) | (62.9 | ) | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Gross profit |

695,358 | 54.7 | 834,754 | 54.6 | 355,533 | 54,488 | 37.1 | |||||||||||||||||||||

| Operating expenses: |

||||||||||||||||||||||||||||

| Selling and marketing |

(245,662 | ) | (19.3 | ) | (307,339 | ) | (20.1 | ) | (233,687 | ) | (35,814 | ) | (24.4 | ) | ||||||||||||||

| General and administrative |

(242,084 | ) | (19.0 | ) | (304,626 | ) | (19.9 | ) | (260,239 | ) | (39,884 | ) | (27.2 | ) | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total operating expenses |

(487,746 | ) | (38.3 | ) | (611,965 | ) | (40.0 | ) | (493,926 | ) | (75,698 | ) | (51.6 | ) | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Operating income/(loss) |

207,612 | 16.3 | 222,789 | 14.6 | (138,393 | ) | (21,210 | ) | (14.5 | ) | ||||||||||||||||||

| Interest income |

26,376 | 2.1 | 17,952 | 1.2 | 15,091 | 2,313 | 1.6 | |||||||||||||||||||||

| Interest expense |

(33,803 | ) | (2.7 | ) | (34,093 | ) | (2.2 | ) | (23,611 | ) | (3,619 | ) | (2.5 | ) | ||||||||||||||

| Foreign currency exchange (loss)/gain |

(1,383 | ) | (0.1 | ) | (1,506 | ) | (0.1 | ) | (187 | ) | (29 | ) | 0.0 | |||||||||||||||

| Other income, net |

15,397 | 1.2 | 10,115 | 0.7 | 26,961 | 4,132 | 2.9 | |||||||||||||||||||||

| Impairment loss on long-term investment |

— | — | — | — | (37,000 | ) | (5,670 | ) | (3.9 | ) | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Income/(loss) before income tax expense |

214,199 | 16.8 | 215,257 | 14.1 | (157,139 | ) | (24,083 | ) | (16.4 | ) | ||||||||||||||||||

| Income tax (expense)/benefit |

(71,763 | ) | (5.6 | ) | (70,697 | ) | (4.6 | ) | 15,695 | 2,406 | 1.6 | |||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net income/(loss) |

142,436 | 11.2 | 144,560 | 9.5 | (141,444 | ) | (21,677 | ) | (14.8 | ) | ||||||||||||||||||

| Net loss attributable to non-controlling interests |

522 | — | 3,540 | 0.2 | 9,011 | 1,381 | 1.0 | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net income/(loss) attributable to RISE Education Cayman Ltd |

142,958 | 11.2 | 148,100 | 9.7 | (132,433 | ) | (20,296 | ) | (13.8 | ) | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Non-GAAP Financial Measures: |

||||||||||||||||||||||||||||

| EBITDA (2) |

279,852 | 301,419 | (64,370 | ) | (9,865 | ) | ||||||||||||||||||||||

| EBITDA margin (3) |

22.0 | % | 19.7 | % | -6.7 | % | ||||||||||||||||||||||

| Adjusted EBITDA |

300,204 | 349,308 | (9,371 | ) | (1,437 | ) | ||||||||||||||||||||||

| Adjusted EBITDA margin |

23.6 | % | 22.8 | % | -1.0 | % | ||||||||||||||||||||||

| Non-GAAP net income/(loss) attributable to RISE Education Cayman Ltd |

179,932 | 213,363 | (60,070 | ) | (9,207 | ) | ||||||||||||||||||||||

| (1) | To be consistent with our management reporting framework, revenues from educational programs include revenues generated from Can-Talk starting from the first quarter of 2020. Revenues from educational programs in previous years have been adjusted to conform to the presentation in 2020. |

| (2) | To see how we define and calculate EBITDA, a reconciliation between EBITDA and net (loss)/income and a discussion about the limitations of non-GAAP financial measures, see “—Non-GAAP Financial Measures.” |

| (3) | EBITDA margin is calculated by dividing EBITDA by revenues. |

| • | Educational programs COVID-19. |

| • | Franchise revenues |

| • | Other revenues |

| • | Educational programs |

| • | Franchise revenues |

| • | Other revenues |

For the Year Ended December 31, |

||||||||||||||||

2018 |

2019 |

2020 |

||||||||||||||

RMB |

RMB |

RMB |

US$ |

|||||||||||||

(thousands, except for EBITDA margin) |

||||||||||||||||

| Net income/(loss) |

142,436 |

144,560 |

(141,444 |

) |

(21,677 |

) | ||||||||||

| Add: Depreciation |

36,027 | 45,375 | 53,296 | 8,168 | ||||||||||||

| Add: Amortization |

22,199 | 24,646 | 30,953 | 4,744 | ||||||||||||

| Add: Interest expense |

33,803 | 34,093 | 23,611 | 3,619 | ||||||||||||

| Add: Income tax expense/(benefit) |

71,763 | 70,697 | (15,695 | ) | (2,406 | ) | ||||||||||

| Less: Interest income |

26,376 | 17,952 | 15,091 | 2,313 | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| EBITDA |

279,852 |

301,419 |

(64,370 |

) |

(9,865 |

) | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Add: Share-based compensation |

20,352 | 47,889 | 17,999 | 2,758 | ||||||||||||

| Add: impairment loss on long-term investment |

— | — | 37,000 | 5,670 | ||||||||||||

| Adjusted EBITDA |

300,204 |

349,308 |

(9,371 |

) |

(1,437 |

) | ||||||||||

| EBITDA margin |

22.0 | % | 19.7 | % | -6.7 | % | ||||||||||

| Adjusted EBITDA margin |

23.6 | % | 22.8 | % | -1.0 | % | ||||||||||

| Net income/(loss) |

142,436 |

144,560 |

(141,444 |

) |

(21,677 |

) | ||||||||||

| Add: Share-based compensation |

20,352 | 47,889 | 17,999 | 2,758 | ||||||||||||

| Add: Amortization of intangible assets in 2013 acquisition |

16,622 | 17,374 | 17,364 | 2,661 | ||||||||||||

| Add: impairment loss on long-term investment |

— | — | 37,000 | 5,670 | ||||||||||||

| Non-GAAP net income/(loss) |

179,410 |

209,823 |

(69,081 |

) |

(10,588 |

) | ||||||||||

| B. | Liquidity and Capital Resources |

For the Year Ended December 31, |

||||||||||||||||

2018 |

2019 |

2020 |

||||||||||||||

RMB |

RMB |

RMB |

US$ |

|||||||||||||

(thousands) |

||||||||||||||||

| Net cash generated from/(used in) operating activities |

380,034 | (39,854 | ) | (205,742 | ) | (31,531 | ) | |||||||||

| Net cash used in investing activities |

(100,875 | ) | (114,716 | ) | (111,782 | ) | (17,131 | ) | ||||||||

| Net cash used in financing activities |

(57,306 | ) | (140,732 | ) | (60,674 | ) | (9,299 | ) | ||||||||

| Effect of foreign exchange rate changes on cash and cash equivalents |

10,037 | 1,342 | (5,443 | ) | (835 | ) | ||||||||||

| Net increase/(decrease) in cash, cash equivalents and restricted cash |

231,890 | (293,960 | ) | (383,641 | ) | (58,796 | ) | |||||||||

| Cash, cash equivalents and restricted cash at beginning of period |

1,084,895 | 1,316,785 | 1,022,825 | 156,755 | ||||||||||||

| Cash, cash equivalents and restricted cash at end of period |

1,316,785 | 1,022,825 | 639,184 | 97,959 | ||||||||||||

For the Year Ended December 31, |

||||||||||||

2018 |

2019 |

2020 |

||||||||||

| Our company and our subsidiaries |

||||||||||||

| Our company and Cayman Island subsidiaries |

— | — | — | |||||||||

| Our Hong Kong subsidiaries |

2.1 | % | 1.8 | % | 2.4 | % | ||||||

| WFOE |

5.5 | % | 3.8 | % | 1.7 | % | ||||||

| Our VIE and its subsidiaries and schools |

92.4 | % | 94.4 | % | 95.9 | % | ||||||

| Total Revenues |

100 |

% |

100 |

% |

100 |

% | ||||||

For the Year Ended December 31, |

||||||||||||||||

2018 |

2019 |

2020 |

||||||||||||||

RMB |

RMB |

RMB |

US$ |

|||||||||||||

(thousands) |

||||||||||||||||

| License fees paid to our Cayman Islands subsidiaries by VIE |

17,514 | 14,080 | — | — | ||||||||||||

| Service fees paid to Rise HK* by VIE |

14,016 | — | — | — | ||||||||||||

| Service fees and license fees paid to our WFOE by VIE |

207,118 | 348,699 | 272,207 | 41,718 | ||||||||||||

| * | Starting 2019, service fees were paid by our VIE and its subsidiaries and schools to our WFOE pursuant to the service agreements and consulting service agreements entered into by our WFOE and our VIE or its subsidiaries or schools. |

For the Year Ended December 31, |

||||||||||||

2018 |

2019 |

2020 |

||||||||||

| Our company and our subsidiaries |

||||||||||||

| Our company and Cayman subsidiaries |

24 | % | 8 | % | 5 | % | ||||||

| Our Hong Kong subsidiaries |

4 | % | 10 | % | 14 | % | ||||||

| WFOE |

12 | % | 13 | % | 15 | % | ||||||

| Our VIE and its subsidiaries and schools |

60 | % | 69 | % | 66 | % | ||||||

| Total Assets |

100 |

% |

100 |

% |

100 |

% | ||||||

As of December 31, 2020 |

||||

| Number of options granted (1) |

5,431,000 | |||

| Number of options forfeited |

(2,522,330 | ) | ||

| Number of options exercised |

(195,915 | ) | ||

| Number of options outstanding |

9,380,474 | |||

| Weighted-average exercise price (US$) |

1.44 | |||

| Weighted-average remaining contractual term |

8.34 | |||

| Aggregate intrinsic value (US$) (2) |

12,439,871 | |||

| (1) | 1,314,167 options were vested during 2020. |

| (2) | The aggregate intrinsic value in the table above represents the difference between the fair value of our ordinary share as of December 31, 2020 and respective exercise price of the option. Total intrinsic value of options outstanding as of December 31, 2019 and 2020 were US$4,260,000 and US$12,439,871, respectively. |

| C. | Research and Development, Patents and Licenses, etc. |

| D. | Trend Information |

| E. | Off-balance Sheet Arrangements |

| F. | Tabular Disclosure of Contractual Obligations |

Payment Due by Period |

||||||||||||||||||||||||

Total |

Less Than 1 Year |

2-3 Years |

4-5 Years |

More than 5 Years |

||||||||||||||||||||

RMB |

US$ |

RMB |

RMB |

RMB |

RMB |

|||||||||||||||||||

(in thousands) |

||||||||||||||||||||||||

| Operating lease obligations (1) |

724,648 | 111,056 | 201,449 | 325,292 | 138,684 | 59,223 | ||||||||||||||||||

| (1) | Represented future minimum lease payments under non-cancelable operating leases in connection with the leases of offices and self-owned learning centers. |

As of December 31, 2020 |

||||||||

RMB |

US$ |

|||||||

(in thousands) |

||||||||

| Construction of leasehold improvements |

784 | 120 | ||||||

| G. | Safe Harbor |

ITEM 6. |

DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES |

| A. | Directors and Senior Management |

| Directors and Executive Officers |

Age |

Position/Title | ||

| Lihong Wang |

53 | Chairwoman, Chief Executive Officer, Director | ||

| Jonathan Jia Zhu |

58 | Director, Chairman of the corporate governance and nominating committees | ||

| Yiding Sun |

53 | Vice Chairman, Director | ||

| Zhongjue Chen |

42 | Director | ||

| Yong Chen |

60 | Independent Director | ||

| Haiping Yan |

61 | Independent Director | ||

| Weili Hong |

51 | Independent Director | ||

| Jun Yan |

38 | Independent Director | ||

| Warren Wang |

45 | Chief Financial Officer |

| B. | Compensation |

| Name |

Ordinary Shares (1) Underlying Outstanding Awards Granted |

Price (US$/Share) |

Date of Grant |

Date of Expiration |

||||||||||||

| Yiding Sun |

* | 1.44 | April 1, 2019 | October 1, 2029 | ||||||||||||

| * | Less than 1% of our total outstanding shares. |

| (1) | Represents options to purchase ordinary shares. |

| Name |

Ordinary Shares (1) Underlying Outstanding Awards Granted |

Price (2) (US$/Share) |

Date of Grant (2) |

Date of Expiration |

||||||||||||

| Lihong Wang |

* | 1.75 | August 14, 2020 | April 1, 2029 | ||||||||||||

| * | Less than 1% of our total outstanding shares. |

| (1) | Represents options to purchase ordinary shares. |

| (2) | In 2020, we amended certain options previously granted under the 2017 ESOP Plan in 2019, where the exercise price was amended from US$4.25 to US$1.75, and the date of grant was amended from April 1, 2019 to August 14, 2020. |

| Name |

Ordinary Shares (1) Underlying Outstanding Awards Granted |

Price (US$/Share) |

Date of Grant |

Date of Expiration |

||||||||||||

| Lihong Wang |

* | 1.75 | September 11, 2020 | September 11, 2030 | ||||||||||||

| * | Less than 1% of our total outstanding shares. |

| (1) | Represents options to purchase ordinary shares. |

| C. | Board Practice |

| • | selecting our independent registered public accounting firm and pre-approving all auditing and non-auditing services permitted to be performed by our independent registered public accounting firm; |

| • | reviewing with our independent registered public accounting firm any audit problems or difficulties and management’s response and approving all proposed related party transactions, as defined in Item 404 of Regulation S-K; |

| • | discussing the annual audited financial statements with management and our independent registered public accounting firm; |

| • | annually reviewing and reassessing the adequacy of our audit committee charter; |

| • | meeting separately and periodically with the management and our internal auditor and our independent registered public accounting firm; |

| • | reporting regularly to the full board of directors; |

| • | reviewing the adequacy and effectiveness of our accounting and internal control policies and procedures and any steps taken to monitor and control major financial risk exposure; and |

| • | such other matters that are specifically delegated to our audit committee by our board of directors from time to time. |

| • | reviewing and approving to the board with respect to the total compensation package for our most senior executive officers; |

| • | approving and overseeing the total compensation package for our executives other than the most senior executive officers; |

| • | reviewing and recommending to the board with respect to the compensation of our directors; |

| • | reviewing periodically and approving any long-term incentive compensation or equity plans; |

| • | selecting compensation consultants, legal counsel or other advisors after taking into consideration all factors relevant to that person’s independence from management; and |

| • | programs or similar arrangements, annual bonuses, employee pension and welfare benefit plans. |

| • | identifying and recommending nominees for election or re-election to our board of directors or for appointment to fill any vacancy; |

| • | reviewing annually with our board of directors its current composition in light of the characteristics of independence, age, skills, experience and availability of service to us; |

| • | identifying and recommending to our board the directors to serve as members of committees; |

| • | advising the board periodically with respect to significant developments in the law and practice of corporate governance as well as our compliance with applicable laws and regulations, and making recommendations to our board of directors on all matters of corporate governance and on any corrective action to be taken; and |

| • | monitoring compliance with our code of business conduct and ethics, including reviewing the adequacy and effectiveness of our procedures to ensure proper compliance. |

| • | convening shareholders’ annual general meetings and reporting its work to shareholders at such meetings; |

| • | declaring dividends and distributions; |

| • | appointing officers and determining the term of office of officers; |

| • | exercising the borrowing powers of our company and mortgaging the property of our company; and |

| • | approving the transfer of shares of our company, including the registering of such shares in our share register. |

| D. | Employees |

As of December 31, |

||||||||||||

2018 |

2019 |

2020 |

||||||||||

| Teachers |

1,911 | 2,315 | 2,049 | |||||||||

| Sales and marketing |

668 | 723 | 666 | |||||||||

| Administration |

933 | 976 | 906 | |||||||||

| |

|

|

|

|

|

|||||||

| Total |

3,512 |

4,014 |

3,621 |

|||||||||

| |

|

|

|

|

|

|||||||

| E. | Share Ownership |

| • | each of our directors and executive officers; and |

| • | each person known to us to beneficially own more than 5% of our ordinary shares. |

Ordinary Shares Beneficially Owned |

Percentage of Total Voting Power held (%†) |

|||||||

| Directors and Executive Officers: (1) |

||||||||

| Lihong Wang |

1,969,896 | 1.7 | % | |||||

| Yiding Sun (2) |

1,430,000 | 1.3 | % | |||||

| All directors and executive officers as a group |

3,399,896 | 3.0 | % | |||||

| Principal Shareholders: |

||||||||

| Bain Capital Rise Education IV Cayman Limited (3) |

70,800,808 | 62.7 | % | |||||

| Morgan Stanley (4) |

6,406,818 | 5.7 | % | |||||

| ZHAO Bingxian (5) |

6,439,702 | 5.7 | % | |||||

| † | For each person and group included in this column, percentage ownership is calculated by dividing the number of ordinary shares beneficially owned by such person or group, including shares that such person or group has the right to acquire within 60 days after the date of this annual report, by the sum of (i) 112,965,812 which is the total number of ordinary shares outstanding as of March 31, 2021, and (ii) the number of ordinary shares that such person or group has the right to acquire beneficial ownership within 60 days after the date of this annual report. |

| (1) | The business address of Mr. Zhongjue Chen and Mr. Jonathan Jia Zhu is Suite 2501, Level 25, One Pacific Place, 88 Queensway, Hong Kong, and the business address of Ms. Lihong Wang and our other directors and executive officers is c/o Room 101, Jia He Guo Xin Mansion, No. 15 Baiqiao Street, Guangqumennei, Dongcheng District, Beijing 100062, People’s Republic of China. |

| (2) | Mr. Yiding Sun is the Vice Chairman of our board of directors, and served as our chief executive officer till January 2020. |

| (3) | Bain Capital Rise Education IV Cayman Limited, or Bain Capital Entity, is owned by Bain Capital Asia Integral Investors, L.P. Bain Capital Investors, LLC, or BCI, is the general partner of Bain Capital Asia Integral Investors, L.P. The governance, investment strategy and decision-making process with respect to investments held by the Bain Capital Entity is directed by the Global Private Equity Board of BCI. As a result of the relationships described above, BCI may be deemed to share beneficial ownership of the shares held by the Bain Capital Entity. The Bain Capital Entity has an address c/o Bain Capital Private Equity, LP, 200 Clarendon Street, Boston, Massachusetts 02116. |

| (4) | Based on the information reported in the Amendment No. 2 to Schedule 13G filed by Morgan Stanley and its wholly-owned subsidiary, Morgan Stanley Capital Services LLC, on February 12, 2021. Morgan Stanley’s principal business office address, as disclosed in such Amendment No. 2 to Schedule 13G, is 1585 Broadway New York, NY 10036. |

| (5) | Based on the information reported in the Schedule 13G filed by Mr. ZHAO Bingxian on March 8, 2019. Mr. ZHAO Bingxian is the primary beneficiary of a trust of which Credit Suisse Trust Limited is the trustee, and Mr. ZHAO holds the beneficial ownership through Pioneer Best Holdings Ltd. (holding 2,741,100 ordinary shares) and its subsidiary, Sheng Tong Holdings Ltd. (holding 3,698,602 ordinary shares). Mr. ZHAO’s principal business office or residence address, as disclosed in such Schedule 13G, is Room 1905 19/F, Silver Tower, Unit 2 North Road, Dong San Huan, Chaoyang District, Beijing 10027, China. |

ITEM 7. |

MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS |

| A. | Major Shareholders |

| B. | Related Party Transactions |

| C. | Interest of Experts and Counsel |

ITEM 8. |

FINANCIAL INFORMATION |

| A. | Consolidated Statement and Other Financial Information |

| B. | Significant Changes |

ITEM 9. |

THE OFFER AND LISTING |

| A. | Offer and Listing Details |

| B. | Plan of Distribution |

| C. | Markets |

| D. | Selling Shareholders |

| E. | Dilution |

| F. | Expenses of the Issue |

ITEM 10. |

ADDITIONAL INFORMATION |

| A. | Share Capital |

| B. | Memorandum and Articles of Association |

| C. | Material Contracts |

| D. | Exchange Controls |

| E. | Taxation |

| • | an individual citizen or resident of the United States; |

| • | a corporation (or other entity treated as a corporation for United States federal income tax purposes) created or organized in or under the laws of the United States, any state thereof or the District of Columbia; |

| • | an estate the income of which is subject to United States federal income taxation regardless of its source; or |

| • | a trust if it (1) is subject to the primary supervision of a court within the United States and one or more United States persons has or have the authority to control all substantial decisions of the trust or (2) has a valid election in effect under applicable United States Treasury regulations to be treated as a United States person. |

| • | a dealer in securities or currencies; |

| • | a bank or other financial institution; |

| • | a regulated investment company; |

| • | a real estate investment trust; |

| • | an insurance company; |

| • | a tax-exempt organization; |

| • | a person holding our ordinary shares or ADSs as part of a hedging, integrated or conversion transaction, a constructive sale or a straddle; |

| • | a trader in securities that has elected the mark-to-market |

| • | a person who acquires his ADSs or ordinary shares pursuant to an employee share option or otherwise as compensation; |

| • | a person who owns or is deemed to own ADSs or shares representing 10% or more of our vote or value; |

| • | a U.S. expatriate; |

| • | an S corporation, partnership or other pass-through entity for United States federal income tax purposes; |

| • | a person subject to the base erosion and anti-abuse tax; |

| • | a person required to accelerate recognition of any item of gross income with respect to our ADSs or shares as a result of such income being recognized on an applicable financial statement; or |

| • | a person whose “functional currency” is not the United States dollar. |

| • | at least 75% of our gross income is passive income; or |

| • | at least 50% of the value (determined on the basis of a quarterly average) of our assets is attributable to assets that produce or are held for the production of passive income. |

| • | the excess distribution or gain will be allocated ratably over your holding period for the ADSs or ordinary shares; |

| • | the amount allocated to the current taxable year, and any taxable year prior to the first taxable year in which we were a PFIC, will be treated as ordinary income; and |

| • | the amount allocated to each other year will be subject to tax at the highest tax rate in effect for that year and the interest charge generally applicable to underpayments of tax will be imposed on the resulting tax attributable to each such year. |

| F. | Dividends and Paying Agents |

| G. | Statement by Experts |

| H. | Documents on Display |

| I. | Subsidiary Information |

ITEM 11. |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

ITEM 12. |

DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES |

| A. | Debt Securities |

| B. | Warrants and Rights |

| C. | Other Securities |

| D. | American Depositary Shares |

| • | a fee of U.S.$1.50 per ADR or ADRs for transfers of certificated or direct registration ADRs; |

| • | a fee of up to U.S.$0.05 per ADS for any cash distribution made pursuant to the deposit agreement; |

| • | an aggregate fee of up to U.S.$0.05 per ADS per calendar year (or portion thereof) for services performed by the depositary in administering the ADRs (which fee may be charged on a periodic basis during each calendar year and shall be assessed against holders of ADRs as of the record date or record dates set by the depositary during each calendar year and shall be payable in the manner described in the next succeeding provision); |

| • | a fee for the reimbursement of such fees, charges and expenses as are incurred by the depositary and/or any of its agents (including, without limitation, the custodian and expenses incurred on behalf of holders in connection with compliance with foreign exchange control regulations or any law or regulation relating to foreign investment) in connection with the servicing of the shares or other deposited securities, the sale of securities (including, without limitation, deposited securities), the delivery of deposited securities or otherwise in connection with the depositary’s or its custodian’s compliance with applicable law, rule or regulation (which fees and charges shall be assessed on a proportionate basis against holders as of the record date or dates set by the depositary and shall be payable at the sole discretion of the depositary by billing such holders or by deducting such charge from one or more cash dividends or other cash distributions); |

| • | a fee for the distribution of securities (or the sale of securities in connection with a distribution), such fee being in an amount equal to the $0.05 per ADS issuance fee for the execution and delivery of ADSs which would have been charged as a result of the deposit of such securities (treating all such securities as if they were shares) but which securities or the net cash proceeds from the sale thereof are instead distributed by the depositary to those holders entitled thereto; |

| • | stock transfer or other taxes and other governmental charges; |

| • | cable, telex and facsimile transmission and delivery charges incurred at your request in connection with the deposit or delivery of shares, ADRs or deposited securities; |

| • | transfer or registration fees for the registration of transfer of deposited securities on any applicable register in connection with the deposit or withdrawal of deposited securities; |

| • | in connection with the conversion of foreign currency into U.S. dollars, JPMorgan shall deduct out of such foreign currency the fees, expenses and other charges charged by it and/or its agent (which may be a division, branch or affiliate) so appointed in connection with such conversion; and |

| • | fees of any division, branch or affiliate of the depositary utilized by the depositary to direct, manage and/or execute any public and/or private sale of securities under the deposit agreement. |

ITEM 13. |

DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES |

ITEM 14. |

MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS |

| A.—D. | Material Modifications to the Rights of Security Holders |

| E. | Use of Proceeds |

ITEM 15. |

CONTROLS AND PROCEDURES |

ITEM 16A. |

AUDIT COMMITTEE FINANCIAL EXPERT |

ITEM 16B. |

CODE OF ETHICS |

ITEM 16C. |

PRINCIPAL ACCOUNTANT FEES AND SERVICES |

For the Year Ended December 31, |

||||||||

2019 |

2020 |

|||||||

(in thousands) |

||||||||

| Audit fees (1) |

$ | 1,106 | $ | 1,143 | ||||

| Tax fees (2) |

$ | 15 | $ | — | ||||

| All other fees (3) |

$ | 265 | $ | 881 | ||||

| (1) | Audit fees means the aggregate fees billed in each of the fiscal periods listed for professional services rendered by our principal auditors for the audit of our annual consolidated financial statements and assistance with and review of documents filed with the SEC. |

| (2) | Tax fees means the aggregate fees billed in each of the fiscal periods listed for professional tax services rendered by our principal auditors. |

| (3) | “All other fees” means the aggregate fees billed in each of the fiscal periods listed for professional services rendered by our principal auditors other than the professional services reported under “audit fees” and “tax fees”. In 2020, the professional services were related to permissible advisory services rendered by our principal auditors. |

ITEM 16D. |

EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES |

ITEM 16E. |

PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS |

ITEM 16F. |

CHANGE IN REGISTRANT’S CERTIFYING ACCOUNTANT |

ITEM 16G. |

CORPORATE GOVERNANCE |

| • | the requirement under Rule 5620(a) of the Nasdaq Listing Rules for holding an annual meeting of shareholders within one year of the end of each fiscal year; |

| • | the requirement under Rule 5605(b) of the Nasdaq Listing Rules that the majority of the board of directors must be comprised of Independent Directors as defined in Rule 5605(a)(2) of the Nasdaq Listing Rules; |

| • | the requirement under Rule 5605(d) of the Nasdaq Listing Rules that each compensation committee member must be an Independent Director as defined in Rule 5605(a)(2) of the Nasdaq Listing Rules; and |

| • | the requirement under Rule 5605(e) of the Nasdaq Listing Rules that each nomination committee member must be an Independent Director as defined in Rule 5605(a)(2) of the Nasdaq Listing Rules. |

ITEM 16H. |

MINE SAFETY DISCLOSURE |

ITEM 17. |

FINANCIAL STATEMENTS |

ITEM 18. |

FINANCIAL STATEMENTS |

ITEM 19. |

EXHIBITS |

| * |

Filed with this annual report on Form 20-F. | |

| ** |

Furnished with this annual report on Form 20-F. |

| RISE Education Cayman Ltd | ||

| By: | /s/ Lihong Wang | |

| Name: | Lihong Wang | |

| Title: | Chairwoman and Chief Executive Officer | |

Page |

||||

F-2 |

||||

F-3-F-4 |

||||

F-5 |

||||

F-6 |

||||

F-7-F-8 |

||||

F-9-F-10 |

||||

F-11-F-48 |

||||

As at December 31, |

||||||||||||||||

Notes |

2019 |

2020 |

2020 |

|||||||||||||

RMB |

RMB |

US$ |

||||||||||||||

ASSETS |

||||||||||||||||

Current assets: |

||||||||||||||||

Cash and cash equivalents |

||||||||||||||||

Restricted cash |

||||||||||||||||

Accounts receivable, net |

||||||||||||||||

Amounts due from related parties |

13 | |||||||||||||||

Inventories |

||||||||||||||||

Prepayments and other current assets |

6 | |||||||||||||||

Total current assets |

||||||||||||||||

Non-current assets: |

||||||||||||||||

Property and equipment, net |

7 | |||||||||||||||

Intangible assets, net |

8 | |||||||||||||||

Long-term investment |

2 | — | — | |||||||||||||

Goodwill |

9 | |||||||||||||||

Deferred tax assets, net |

12 | |||||||||||||||

Other non-current assets |

||||||||||||||||

Operating lease right-of-use assets |

2 | |||||||||||||||

Total non-current assets |

||||||||||||||||

Total assets |

||||||||||||||||

LIABILITIES AND SHAREHOLDERS’ EQUITY |

||||||||||||||||

Current liabilities |

||||||||||||||||

Current portion of long-term loan |

11 | |||||||||||||||

Accounts payable |

||||||||||||||||

Accrued expenses and other current liabilities |

10 | |||||||||||||||

Deferred revenue and customer advances |

5 | |||||||||||||||

Income taxes payable |

12 | |||||||||||||||

Current portion of operating lease liabilities |

2 | |||||||||||||||

Total current liabilities |

||||||||||||||||

As at December 31, |

||||||||||||||||

Notes |

2019 |

2020 |

2020 |

|||||||||||||

RMB |

RMB |

US$ |

||||||||||||||

| Non-current liabilitiesnon-current liabilities of the VIE without recourse to the Company amounting to RMB |

||||||||||||||||

| Long-term loan |

11 | |||||||||||||||

| Deferred revenue and customer advances |

5 | |||||||||||||||

| Operating lease liabilities |

2 | |||||||||||||||

| Deferred tax liabilities, net |

12 | |||||||||||||||

| Other non-current liabilities |

12 | |||||||||||||||

| Total non-current liabilities |

||||||||||||||||

| Total liabilities |

||||||||||||||||

| Commitments and contingencies |

17 | |||||||||||||||

| Shareholders’ equity: |

||||||||||||||||

| Ordinary shares (US$ |

||||||||||||||||

| Additional paid-in capital |

||||||||||||||||

| Statutory reserves |

14 | |||||||||||||||

| Accumulated deficit |

( |

) | ( |

) | ( |

) | ||||||||||

| Accumulated other comprehensive income |

18 | |||||||||||||||

| Total RISE Education Cayman Ltd shareholders’ equity |

||||||||||||||||

| Non-controlling interests |

||||||||||||||||

| Total equity |

||||||||||||||||

| Total liabilities, non-controlling interests and shareholders’ equity |

||||||||||||||||

For the years ended December 31, |

||||||||||||||||||||

Notes |

2018 |

2019 |

2020 |

2020 |

||||||||||||||||

RMB |

RMB |

RMB |

US$ |

|||||||||||||||||

| Revenues |

5 | |||||||||||||||||||

| Cost of revenues |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||||||

| Gross profit |

||||||||||||||||||||

| Operating expenses: |

||||||||||||||||||||

| Selling and marketing |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||||||

| General and administrative |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||||||

| Total operating expenses |

( |

) |

( |

) |

( |

) |

( |

) | ||||||||||||

| Operating income/(loss) |

( |

) |

( |

) | ||||||||||||||||

| Interest income |

||||||||||||||||||||

| Interest expense |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||||||

| Foreign currency exchange loss |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||||||

| Other income, net |

||||||||||||||||||||

| Impairment loss of long-term investment |

2 |

— | — | ( |

) | ( |

) | |||||||||||||

| Income/(loss) before income tax expense |

( |

) |

( |

) | ||||||||||||||||

| Income tax (expense)/benefit |

12 | ( |

) | ( |

) | |||||||||||||||

| Net income/(loss) |

( |

) |

( |

) | ||||||||||||||||

| Add: Net loss attributable to non-controlling interests |

||||||||||||||||||||

| Net income/(loss) attributable to RISE Education Cayman Ltd |

( |

) |

( |

) | ||||||||||||||||

| Net income/(loss) per share: |

||||||||||||||||||||

| Basic |

15 | ( |

) | ( |

) | |||||||||||||||

| Diluted |

15 | ( |

) | ( |

) | |||||||||||||||

| Net income/(loss) per ADS (1 ADS represents 2 ordinary shares): |

||||||||||||||||||||

| Basic |

15 | ( |

) | ( |

) | |||||||||||||||

| Diluted |

15 | ( |

) | ( |

) | |||||||||||||||

| Shares used in net income/(loss) per share computation |

||||||||||||||||||||

| Basic |

15 | |||||||||||||||||||

| Diluted |

15 | |||||||||||||||||||

For the years ended December 31, |

||||||||||||||||

2018 |

2019 |

2020 |

2020 |

|||||||||||||

RMB |

RMB |

RMB |

US$ |

|||||||||||||

| Net income/(loss) |

( |

) |

( |

) | ||||||||||||

| Other comprehensive income/(loss), net of tax of nil: |

||||||||||||||||

| Foreign currency translation adjustments |

( |

) | ( |

) | ( |

) | ||||||||||

| Other comprehensive income/(loss) |

( |

) |

( |

) |

( |

) | ||||||||||

| Comprehensive income/(loss) |

( |

) |

( |

) | ||||||||||||

| Add: comprehensive loss attributable to non-controlling interests |

||||||||||||||||

| Comprehensive income/(loss) attributable to RISE Education Cayman Ltd |

( |

) |

( |

) | ||||||||||||

Ordinary shares (Number) |

Ordinary Shares (Amount) |

Additional paid-in capital |

Treasury Shares |

Statutory reserves |

Accumulated deficit |

Accumulative other comprehensive income/(loss) |

Total RISE Education Cayman Ltd shareholder’s equity |

Non-controlling interests |

Total shareholders’ equity |

|||||||||||||||||||||||||||||||

| Balance at January 1, 2018 |

— |

( |

) |

( |

) |

|||||||||||||||||||||||||||||||||||

| Issuance of ordinary shares for business acquisition * |

— | — | — | — | — | |||||||||||||||||||||||||||||||||||

| Issuances in relation to share option exercise |

— | — | — | — | — | |||||||||||||||||||||||||||||||||||

| Cash-settled share-based compensation (Note 16) |

— | ( |

) | — | — | — | — | ( |

) | — | ( |

) | ||||||||||||||||||||||||||||

| Share-based compensation (Note 16) |

— | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||

| Appropriation of statutory reserves |

— | — | — | — | ( |

) | — | — | — | — | ||||||||||||||||||||||||||||||

| Repurchase of ordinary shares** |

( |

) | — | — | ( |

) | — | — | — | ( |

) | — | ( |

) | ||||||||||||||||||||||||||

| Net income |

— | — | — | — | — | — | ( |

) | ||||||||||||||||||||||||||||||||

| Effect of adoption of ASU 2014-09 (Note 5) |

— | — | — | — | — | ( |

) | — | ( |

) | — | ( |

) | |||||||||||||||||||||||||||

| Other comprehensive income |

— | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||

| Balance at December 31, 2018 |

( |

) |

( |

) |

( |

) |

||||||||||||||||||||||||||||||||||

| * | On November 1, 2017, the Group acquired |

| ** | In November 2018, the Board of Directors approved share repurchase program to purchase up to US$ |

Ordinary shares (Number) |

Ordinary Shares (Amount) |

Additional paid-in capital |

Treasury Shares |

Statutory reserves |

Accumulated deficit |

Accumulative other comprehensive income/(loss) |

Total RISE Education Cayman Ltd shareholder’s equity |

Non-controlling interests |

Total shareholders’ equity |

|||||||||||||||||||||||||||||||

| Balance at January 1, 2019 |

( |

) |

( |

) |

( |

) |

||||||||||||||||||||||||||||||||||

| Net income |

— | — | — | — | — | — | ( |

) | ||||||||||||||||||||||||||||||||

| Acquisition of subsidiary (Note 4) |

— | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||

| Share-based compensation (Note 16) |

— | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||

| Issuances in relation to share option exercise |

— | — | — | — | — | |||||||||||||||||||||||||||||||||||

| Other comprehensive income |

— | — | — | — | — | — | ( |

) | ( |

) | — | ( |

) | |||||||||||||||||||||||||||

| Repurchase of ordinary shares* |

( |

) | — | — | ( |

) | — | — | — | ( |

) | — | ( |

) | ||||||||||||||||||||||||||

| Retirement of treasury shares* |

( |

) | ( |

) | — | — | — | — | — | — | ||||||||||||||||||||||||||||||

| Appropriation of statutory reserves |

— | — | — | — | ( |

) | — | — | — | — | ||||||||||||||||||||||||||||||

| Balance at December 31, 2019 |

— |

( |

) |

|||||||||||||||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

| Share-based compensation (Note 16) |

— | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||

| Issuances in relation to share option exercise |

— | — | — | — | — | |||||||||||||||||||||||||||||||||||

| Other |

— | — | — | — | — | — | ( |

) | ( |

) | — | ( |

) | |||||||||||||||||||||||||||

| Appropriation of statutory reserves |

— | — | — | — | ( |

) | — | — | — | — | ||||||||||||||||||||||||||||||

| Balance at December 31, 2020 |

— | ( |

) | |||||||||||||||||||||||||||||||||||||

| Balance at December 31, 2020 (US$) |

— |

( |

) |

|||||||||||||||||||||||||||||||||||||

| * | In November 2018, the Board of Directors approved share repurchase program to purchase up to US$ |

For the years ended December 31, |

||||||||||||||||

2018 |

2019 |

2020 |

2020 |

|||||||||||||

RMB |

RMB |

RMB |

US$ |

|||||||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES |

||||||||||||||||

| Net income/(loss) |

( |

) | ( |

) | ||||||||||||

| Adjustments to reconcile net income/(loss) to net cash generated from operating activities: |

||||||||||||||||

| Depreciation and amortization expenses |

||||||||||||||||

| Share-based compensation |

||||||||||||||||

| (Gain)/loss on disposal of equipment |

( |

) | ( |

) | ||||||||||||

| Amortization of debt issuance cost |

||||||||||||||||

| Deferred income tax expense/(benefit) |

( |

) | ( |

) | ||||||||||||

| Impairment loss of long-term investment |

— | — | ||||||||||||||

| Changes in operating assets and liabilities: |

||||||||||||||||

| Prepayments and other current assets |

( |

) | ||||||||||||||

| Accounts receivable, net |

( |

) | ( |

) | ||||||||||||

| Amounts due from related parties |

— | ( |

) | ( |

) | |||||||||||

| Inventories |

( |

) | ||||||||||||||

| Accounts payable |

( |

) | ||||||||||||||

| Accrued expenses and other current liabilities |

( |

) | ( |

) | ( |

) | ||||||||||

| Income taxes payable |

( |

) | ( |

) | ( |

) | ||||||||||

| Deferred revenue and customer advances |

( |

) | ( |

) | ( |

) | ||||||||||

| Due to a related party |

( |

) | — | — | — | |||||||||||

| Other non-current assets |

( |

) | ( |

) | ( |

) | ||||||||||

| Other non-current liabilities |

( |

) | ||||||||||||||

| Operating lease right-of-use |

— | ( |

) | ( |

) | ( |

) | |||||||||

| Current portion of operating lease liabilities |

— | |||||||||||||||

| Operating lease liabilities |

— | ( |

) | ( |

) | |||||||||||

| Net cash generated from/(used in) operating activities |

( |

) |

( |

) |

( |

) | ||||||||||

| CASH FLOWS FROM INVESTING ACTIVITIES |

||||||||||||||||

| Proceeds from disposal of equipment |

||||||||||||||||

| Purchase of property and equipment |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

| Purchase of intangible assets |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

| Purchase of short-term investments |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

| Proceeds from maturity of short-term investments |

||||||||||||||||

| Acquisition of subsidiaries, net of cash acquired |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||