Exhibit 10.9

[*]

Certain information in this document has been omitted from this exhibit because it is both (i) not material and

(ii) would

be competitively harmful if publicly disclosed.

The George Washington University

Patent License Agreement

This Patent License Agreement (this “Agreement”) is between the George Washington University, a congressionally chartered not-for-profit corporation (“University”) located in the District of Columbia, and Hoth Therapeutics Inc., a Nevada corporation having offices at One Rockefeller Plaza, Suite 1039, New York, NY 10020 (“Company”). This Agreement is being signed on August 7, 2020 (the “Execution Date”). This Agreement will become effective as of August 7, 2020 (the “Effective Date”).

BACKGROUND

University owns certain intellectual property developed by Professor Mona Zaghloul of the University’s School of Engineering & Applied Sciencese and Professor Jean A. Jordan of the University’s School of Public Health relating to the Nanohole-Array Based Sensors technology corresponding to University’s intellectual property docket numbers [*] and [*]. University also owns certain letters patent and/or applications for letters patent relating to the intellectual property. Company desires to obtain an exclusive license under the patent rights to exploit the intellectual property. Company also desires to fund further research by Professor Mona Zaghloul and Professor Jean Jordan under a separate agreement. University has determined that the exploitation of the intellectual property by Company is in the best interest of University and is consistent with its educational and research missions and goals.

In consideration of the mutual obligations contained in this Agreement, and intending to be legally bound, the parties agree as follows:

| 1. | LICENSE |

1.1 License Grant. University grants to Company a license (the “License”) according to the exclusivity and territory terms described in Appendix A to make, have made, use, import, offer for sale and sell Licensed Products in the Field of Use during the Term (as such terms may be defined in Sections 1.2, 6.1, Appendix A). The License includes the right to sublicense as permitted by this Agreement. No other rights or licenses are granted by University.

Page 1 of 24

1.2 Related Definitions. The term “Licensed Products” means products and services that are made, made for, used, imported, offered for sale or sold by Company or its Affiliates or sublicensees and that would (i) in the absence of the License, infringe (or, in the case of pending patent applications, upon issuance, would infringe) at least one claim of the Patent Rights or (ii) use a process or machine covered by a claim of Patent Rights, whether the claim is issued or pending. The term “Sublicense” means an arms-length transaction pursuant to which Company grants an unrelated third party access to Patent Rights and/or Technology. Any delivery of Licensed Products to an End User via an Application Program Interface (API) shall be considered a Sale of Licensed Product. Under the License Agreement, University will agree that End User License Agreements will not be treated as sublicenses. The term “Patent Rights” means all of University’s patent rights represented by or issuing from: (a) the United States patents and patent applications listed in Exhibit A; (b) any continuation, divisional and re-issue applications of (a); and (c) any foreign counterparts and extensions of (a) or (b). The term “Affiliate” means a legal entity that is controlling, controlled by or under common control with Company and that has executed either this Agreement or a written Joinder Agreement agreeing to be bound by all of the terms and conditions of this Agreement. For purposes of this Section 1.2, the word “control” means (x) the direct or indirect ownership of more than fifty percent (50%) of the outstanding voting securities of a legal entity, (y) the right to receive fifty percent (50%) or more of the profits or earnings of a legal entity, or (z) the right to determine the policy decisions of a legal entity. The term “Field of Use” means the definition agreed to in Appendix A.

1.3 Reservation of Rights by University. University reserves the right to use, and to permit other non-commercial entities to use, the Patent Rights for educational and research purposes.

1.4 U.S. Government Rights. The parties acknowledge that the United States government retains rights in intellectual property funded under any grant or similar contract with a Federal agency. The License is expressly subject to all applicable United States government rights, including, but not limited to, any applicable requirement that products, which result from such intellectual property and are sold in the United States, must be substantially manufactured in the United States.

1.5 Sublicense Conditions. The Company’s right to sublicense granted by University under the License is subject to each of the following conditions:

(a) In each sublicense agreement, Company will prohibit the sublicensee from further sublicensing and require the sublicensee to comply with the terms and conditions of this Agreement.

(b) Within thirty (30) days after Company enters into a sublicense agreement, Company will deliver to University a complete and accurate copy of the entire sublicense agreement written in the English language. University’s receipt of the sublicense agreement, however, will constitute neither an approval of the sublicense nor a waiver of any right of University or obligation of Company under this Agreement.

(c) In the event that Company causes or experiences a Trigger Event (as defined in Section 6.4), all payments due to Company from its Affiliates or sublicensees under the sublicense agreement will, upon notice from University to such Affiliate or sublicensee, become payable directly to University for the account of Company. Upon receipt of any such funds, University will remit to Company the amount by which such payments exceed the amounts owed by Company to University.

(d) Company’s execution of a sublicense agreement will not relieve Company of any of its obligations under this Agreement, including its obligation to use commercially reasonable efforts to develop, commercialize, market and sell Licensed Products in a manner consistent with the Development Plan. Company is primarily liable to University for any act or omission of an Affiliate or sublicensee of Company that would be a breach of this Agreement if performed or omitted by Company, and Company will be deemed to be in breach of this Agreement as a result of such act or omission.

Page 2 of 24

No License by Implication. Nothing in this Agreement confers by estoppel implication or otherwise, any license or rights under any University patent other than the Patent Rights, regardless whether such patents are dominant or subordinate to the Patent Rights.

| 2. | DILIGENCE |

2.1 Development Plan. Company will deliver to University, within ninety (90) days after the Effective Date, a copy of an initial development plan for the Patent Rights (the “Development Plan”). The purpose of the Development Plan is (a) to demonstrate Company’s capability to bring the Patent Rights to commercialization, (b) to project the timeline for completing the necessary tasks, and (c) to measure Company’s progress against the projections. Thereafter, Company will deliver to University an annual updated Development Plan no later than December 1 of each year during the Term. The Development Plan will include, at a minimum, the information listed in Exhibit B. Company will use commercially reasonable efforts to develop, commercialize, market and sell Licensed Products in a manner consistent with the written Development Plan.

2.2 Diligence Events. The Company will use commercially reasonable efforts to achieve each of the diligence events by the applicable completion date listed in Appendix A. In addition to usual and reasonable terms for termination, the University reserves the right to terminate the Agreement if Company fails to achieve one or more diligence events on or before their respective achievement date.

2.3 Diligence Resources. Until the first commercial sale of the first Licensed Product, Company will expend resources in the development and commercialization of the Licensed Products of amounts not less than the diligence minimums specified in Appendix A in each 12-month period following the Effective Date. If Company’s total expenditures for development and commercialization of Licensed Products in any 12-month period do not meet or exceed the applicable diligence minimum, then Company will pay to University the amount of the shortfall. Company will make any payments of the shortfall to University together with the next Development Plan due to University under Section 2.1.

| 3. | FEES AND ROYALTIES |

3.1 License Initiation Fee. In partial consideration of the License, Company will pay to University no later than 30 days from the Effective Date a non-refundable, non-creditable license initiation fee as specified in Appendix A.

3.2 Equity Issuance. In partial consideration of the License, Company will issue warrants to University no later than 30 days from the Effective Date, to purchase the amount of shares of Company that can be bought for $200,000 at the strike price per share at the time of warrant issuance. The University’s warrants will vest on the following schedule: 20% at issuance, 20% each year thereafter, resulting in 100% vesting 4 years after issuance. The University’s warrants will have an expiration date 10 years or later from the date of issuance.

Page 3 of 24

3.3 Dilution Protection. Intentionally omitted.

3.4 Follow-On Investments. Intentionally omitted.

3.5 License Maintenance Fees. In partial consideration of the License, Company will pay to University, on each anniversary of the Effective Date until the first Sale (as defined in Section 3.8) of the first Licensed Product, the applicable license maintenance fee listed in Appendix A.

3.6 Milestone Payments. In partial consideration of the License, Company will pay to University the applicable milestone payment listed in Appendix A after achievement of each milestone event for each Licensed Product. Company will provide University with written notice within thirty (30) days after achieving each milestone.

For clarity, each time a milestone is achieved with respect to a Licensed Product, then any other milestone payments with respect to earlier milestones that have not yet been paid will be due and payable together with the milestone payment for the milestone that is actually achieved. For additional clarity, milestones are due and payable on Licensed Products and on products that, upon FDA approval, would become Licensed Products.

3.7 Earned Royalties. In partial consideration of the License, Company will pay to University a royalty as specified in Appendix A during the Quarter.

3.8 Related Definitions. The term “Sale” means any bona fide transaction for which consideration is received by Company or its Affiliate or sublicensee for the sale, use, lease, transfer or other disposition of a Licensed Product to a third party. A Sale is deemed completed at the time that Company or its Affiliate or sublicensee invoices, ships or receives payment for a Licensed Product, whichever occurs first. The term “Quarter” means each three-month period beginning on January 1, April 1, July 1 and October 1. The term “Net Sales” means the consideration received or expected from, or the fair market value attributable to, each Sale, less Qualifying Costs that are directly attributable to a Sale, specifically identified on an invoice or other documentation and actually borne by Company or its Affiliates or sublicensees. For purposes of determining Net Sales, the words “fair market value” means the cash consideration that Company or its Affiliates or sublicensees would realize from an unrelated buyer in an arm’s length sale of an identical item sold in the same quantity and at the time and place of the transaction. The term “Qualifying Costs” means: (a) customary discounts in the trade for quantity purchased or for wholesalers and distributors; (b) credits or refunds for claims or returns that do not exceed the original invoice amount; (c) prepaid outbound transportation expenses and transportation insurance premiums; and (d) sales and use taxes and other fees imposed by and indefeasibly paid to a governmental agency.

3.9 Minimum Royalties. In partial consideration of the License, Company will pay on a Quarterly basis to University the applicable minimum royalty listed in Appendix A, if Company’s actual earned royalties under Section 3.7 for each Quarter after the first Sale of a Licensed Product does not exceed this amount.

Page 4 of 24

3.10 Sublicense Fees. In partial consideration of the License, Company will pay to University a sublicense fee specified in Appendix A of the sum of all payments plus the fair market value of all other consideration of any kind, received by Company from sublicensees during the Quarter, excluding: (a) royalties paid to Company by a sublicensee based upon Sales or Net Sales by the sublicensee; (b) equity investments in Company by a sublicensee up to the amount of the fair market value of the equity purchased on the date of the investment; (c) loan proceeds paid to Company by a sublicensee in an arm’s length, full recourse debt financing to the extent that such loan is not forgiven; and (d) sponsored research funding paid to Company by a sublicensee in a bona fide transaction for future research to be performed by Company.

| 4. | REPORTS AND PAYMENTS |

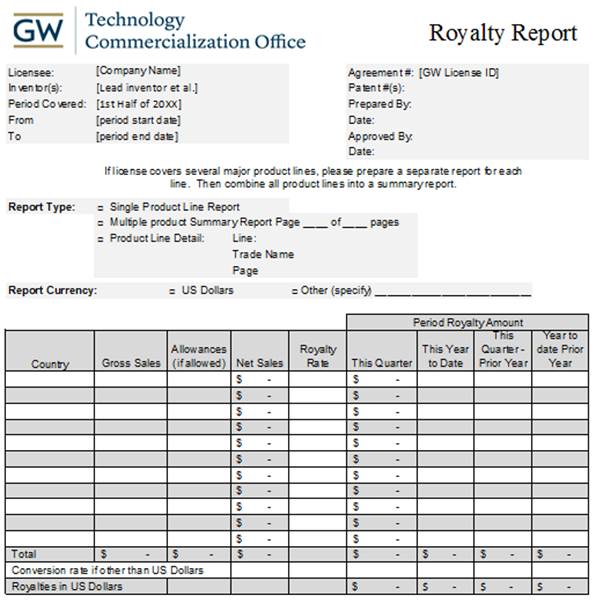

4.1 Royalty Reports. Within forty-five (45) days after the end of each Quarter following the first Sale, Company will deliver to University a report, certified by the chief financial officer of Company, detailing the calculation of all royalties, fees and other payments due to University for such Quarter. The report will include, at a minimum, the following information for the Quarter, each listed by product, by country: (a) the number of units of Licensed Products constituting Sales; (b) the gross consideration invoiced, billed or received for Sales; (c) Qualifying Costs, listed by category of cost; (d) Net Sales; (e) the gross amount of any payments and other consideration received by Company from sublicensees and the amounts of any deductions permitted by Section 3.8; (f) the royalties, fees and other payments owed to University, listed by category; and (g) the computations for any applicable currency conversions. Each royalty report will be substantially in the form of the sample report attached as Exhibit C.

4.2 Payments. Company will pay all royalties, fees and other payments due to University under Sections 3.6, 3.7, 3.8, 3.10 within forty-five (45) days after the end of the Quarter in which the royalties, fees or other payments accrued.

4.3 Records. Company will maintain, and will cause its Affiliates and sublicensees to maintain, complete and accurate books, records and related background information to verify Sales, Net Sales, and all of the royalties, fees, and other payments due or paid under this Agreement, as well as the various computations reported under Section 4.1. The records for each Quarter will be maintained for at least five (5) years after submission of the applicable report required under Section 4.1.

4.4 Audit Rights. Upon reasonable prior written notice to Company, Company and its Affiliates and sublicensees will provide University and its accountants with access to all of the books, records and related background information required by Section 4.3 to conduct a review or audit of Sales, Net Sales, and all of the royalties, fees, and other payments payable under this Agreement. Access will be made available: (a) during normal business hours; (b) in a manner reasonably designed to facilitate University’s review or audit without unreasonable disruption to Company’s business; and (c) no more than once each calendar year during the Term (as defined below) and for a period of five (5) years thereafter. Company will pay to University within 45 days the amount of any underpayment determined by the review or audit, plus accrued interest. If the review or audit determines that Company has underpaid any payment by five percent (5%) or more, then Company within 45 days will also pay the costs and expenses of University and its accountants in connection with the review or audit.

4.5 Information Rights. Company will provide to University, promptly after filing, a copy of each annual report, proxy statement, 10-K, 10-Q and other material report filed with the U.S. Securities and Exchange Commission.

Page 5 of 24

4.6 Currency. All dollar amounts referred to in this Agreement are expressed in United States dollars. All payments will be made in United States dollars. If Company receives payment from a third party in a currency other than United States dollars for which a royalty or fee is owed under this Agreement, then (a) the payment will be converted into United States dollars at the conversion rate for the foreign currency as published in the eastern edition of the Wall Street Journal as of the last business day of the Quarter in which the payment was received by Company, and (b) the conversion computation will be documented by Company in the applicable report delivered to University under Section 4.1.

4.7 Place of Payment. All payments by Company are payable to “The George Washington University” and will be made to the following addresses:

By Check:

| |

The George Washington University c/o Technology Commercialization Office 1922 F ST NW, 4TH Floor Washington, DC 20052

Attention: TCO Operations Coordinator

| |

By Electronic Transfer:

For Patent Cost Reimbursements please include: “Funds should be credited to Alias 111406, Account”

For License Fees and Royalties please include: “Funds should be credited to Alias 100035, Account”

| |

Beneficiary Account Number: Beneficiary Account Type (for ACH): Beneficiary Account Name: Beneficiary Address:

Bank’s Name: Bank’s Address:

ABA # (for ACH): ABA # (for Wires): SWIFT: |

Checking The George Washington University 1918 F ST NW Washington, DC 20052

PNC Bank, N.A. 800 17th ST, NW Washington, DC 20006 PNCCUS33 |

4.8 Interest. All amounts that are not paid by Company when due will accrue interest from the date due until paid at a rate equal to one and one-half percent (1.5%) per month (or the maximum allowed by law, if less). The payment of such interest shall not foreclose University from exercising any other rights it may have as a consequence of the lateness of any payment.

Page 6 of 24

| 5. | CONFIDENTIALITY AND USE OF UNIVERSITY’S NAME |

5.1 Confidentiality. Except as specifically permitted hereunder Parties hereby agree to hold in confidence and not use on behalf of itself or others all technology, data, samples, technical and economic information (including economic terms hereof), commercialization, clinical and research strategies, know-how and trade secrets provided by the other party (the “Disclosing Party”) (collectively the “Confidential Information”), except that the term “Confidential Information” shall not include:

| (a) | information that is or becomes part of the public domain through no fault of the non-Disclosing Party; |

| (b) | information that is obtained after the Effective Date by the non-Disclosing Party or one of its Affiliates from any third party which is lawfully in possession of such Confidential Information and not in violation of any contractual or legal obligation to the Disclosing Party with respect to such Confidential Information; |

| (c) | information that is known to the non-Disclosing Party or one or more of its Affiliates prior to the disclosure by the Disclosing Party, as evidenced by the non-Disclosing Party’s written records; and |

| (d) | information which has been independently developed by the non-Disclosing Party without the aid or use of Confidential information as shown by competent written evidence. |

The party receiving the Confidential Information may disclose the Disclosing Party’s proprietary information to the extent required to comply with, a court or administrative subpoena or a lawful court order provided that the receiving party first uses its best efforts to obtain an order preserving the confidentiality of the information of the Disclosing Party and provided the receiving party gives the Disclosing Party timely notice of the contemplated disclosure to give the Disclosing Party an opportunity to intervene to preserve the confidentiality of the information.

Upon prior review of the University, Company may disclose in a patent application or the prosecution thereof, any Confidential Information necessary to obtain or secure patent protection of the commercialized products or processes.

Each Party intends that to the extent that any confidential information is disclosed under this Agreement, such Confidential Information does not contain export control-listed technology or technical data identified on any US export control list, including the Commerce Control List (CCL) set forth in the Export Administration Regulations at 15 CFR Part 774 and the US Munitions List (USML) set forth in the International Traffic in Arms Regulations at 22 CFR Part 121. Prior to one Party providing the other Party with export control-listed information, the disclosing Party will provide advance written notice to the receiving Party regarding the export classification of such information, and the receiving Party must issue written approval to the disclosing Party prior to the transmission of such information to the receiving Party. Notwithstanding any other provision of this Agreement, the receiving Party is under no obligation to accept export control-listed information from the disclosing Party.

Page 7 of 24

5.2 Use of University’s Name. Company and its Affiliates, sublicensees, employees, and agents may not use the name, logo, seal, trademark, or service mark (including any adaptation of them) of University or any University school, organization, employee, student or representative, without the prior written consent of University.

| 6. | TERM AND TERMINATION |

6.1 Term. This Agreement will commence on Effective Date and terminate upon the later of: (a) the expiration or abandonment of the last patent to expire or become abandoned of the Patent Rights; or (b) ten (10) years after the first Sale of the first Licensed Product if no patent has issued from the Patent Rights (as the case may be, the “Term”).

6.2 Early Termination by Company. Company may terminate this Agreement at any time effective upon completion of each of the following conditions: (a) providing at least sixty (60) days prior written notice to University of such intention to terminate; (b) ceasing to make, have made, use, import, offer for sale and sell all Licensed Products; (c) terminating all sublicenses and causing all Affiliates and sublicensees to cease making, having made, using, importing, offering for sale and selling all Licensed Products; and (d) paying all amounts owed to University under this Agreement between University and Company related to the Patent Rights, through the effective date of termination.

6.3 Early Termination by University. University may terminate this Agreement if: (a) Company is more than thirty (30) days late in paying to University any amounts owed under this Agreement and does not immediately pay University in full, including accrued interest, upon demand (a “Payment Default”); (b) other than a Payment Default, Company or its Affiliate or sublicensee breaches this Agreement and does not cure the breach within forty-five (45) days after written notice of the breach; or (c) Company or its Affiliate or sublicensee experiences a Trigger Event.

6.4 Trigger Event. The term “Trigger Event” means any of the following: (a) a material default by Company under any Agreement between Company and University related to the Patent Rights (whether entered prior to, contemporaneous with, or subsequent to the Effective Date) any Sponsored Research Agreement between Company and University related to the Patent Rights (whether entered prior to, contemporaneous with, or subsequent to the Effective Date, any of the Equity Documents, or this Agreement, that is not cured during any specified cure periods; (b) if Company or its Affiliate or sublicensee (i) becomes insolvent, bankrupt or generally fails to pay its debts as such debts become due, (ii) is adjudicated insolvent or bankrupt, (iii) admits in writing its inability to pay its debts, (iv) suffers the appointment of a custodian, receiver or trustee for it or its property and, if appointed without its consent, not discharged within thirty (30) days, (v) makes an assignment for the benefit of creditors, or (vi) suffers proceedings being instituted against it under any law related to bankruptcy, insolvency, liquidation or the reorganization, readjustment or release of debtors and, if contested by it, not dismissed or stayed within ten (10) days; (c) the institution or commencement by Company or its Affiliate or sublicensee of any proceeding under any law related to bankruptcy, insolvency, liquidation or the reorganization, readjustment or release of debtors; (d) the entering of any order for relief relating to any of the proceedings described in Section 6.4(b) or (c) above; (e) the calling by Company or its Affiliate or sublicensee of a meeting of its creditors with a view to arranging a composition or adjustment of its debts; (f) the act or failure to act by Company or its Affiliate or sublicensee indicating its consent to, approval of or acquiescence in any of the proceedings described in Section 6.4(b) – (e) above; (g) the commencement by Company of any action against University, including an action for declaratory judgment, to declare or render invalid or unenforceable the Patent Rights, or any claim thereof.

Page 8 of 24

6.5 Effect of Termination. Upon the termination of this Agreement for any reason: (a) the License terminates; (b) Company and all its Affiliates and sublicensees will cease all making, having made, using, importing, offering for sale and selling all Licensed Products, except to extent permitted by Section 6.6; (c) Company will pay to University all amounts, including accrued interest, owed to University under this Agreement and any Sponsored Research Agreement related to the Patent Rights, through the date of termination, including royalties on Licensed Products invoiced or shipped through the date of termination and any sell off period permitted by Section 6.6, whether or not payment is received prior to termination or expiration of the sell off period permitted by Section 6.6; (d) Company will, at University’s request, return to University all confidential information of University and provide to University one complete copy of all data with respect to Licensed Products generated by Company during the Term that will facilitate the further development of the technology licensed under this Agreement; and (e) in the case of termination under Section 6.3, all duties of University and all rights (but not duties) of Company under this Agreement immediately terminate without further action required by either University or Company.

6.6 Inventory & Sell Off. Upon the termination of this Agreement for any reason, Company will cause physical inventories to be taken immediately of: (a) all completed Licensed Products on hand under the control of Company or its Affiliates or sublicensees; and (b) such Licensed Products as are in the process of manufacture and any component parts on the date of termination of this Agreement. Company will deliver promptly to University a copy of the written inventory, certified by an officer of the Company. Upon termination of this Agreement for any reason, Company will promptly remove, efface or destroy all references to University from any advertising, labels, web sites or other materials used in the promotion of the business of Company or its Affiliates or sublicensees, and Company and its Affiliates and sublicensees will not represent in any manner that it has rights in or to the Patent Rights or the Licensed Products. Upon the termination of this Agreement for any reason other than pursuant to Section 6.3(a) or (c), Company may sell off its inventory of Licensed Products existing on the date of termination for a period of six (6) months and pay University royalties on Sales of such inventory within thirty (30) days following the expiration of such six (6) month period.

6.7 Survival. Company’s obligation to pay all amounts, including accrued interest, owed to University under this Agreement will survive the termination of this Agreement for any reason. Sections 14.10 and 14.11 and Articles 4, 5, 6, 9, 10, and 11 will survive the termination of this Agreement for any reason in accordance with their respective terms.

| 7. | PATENT PROSECUTION AND MAINTENANCE |

7.1 Patent Control. University controls the preparation, prosecution and maintenance of the Patent Rights and the selection of patent counsel, with input from Company. For purposes of this Article 7, the word “maintenance” includes any interference negotiations, claims, or proceedings, in any forum, brought by University, Company, a third party, or the United States Patent and Trademark Office, and any requests by University or Company that the United States Patent and Trademark Office reexamine or reissue any patent in the Patent Rights.

Page 9 of 24

7.2 Payment and Reimbursement. Company agrees that the University has incurred historically accrued attorney fees, expenses, official fees and all other charges accumulated and invoiced to the University incident to the preparation, filing, prosecution and maintenance of the Patent Rights (the “Past Patent Expenses”) as specified in Appendix A. By the Past Patent Expenses Reimbursement Date identified in Appendix A, Company will reimburse University for Past Patent Expenses. For patent expenses not included in Appendix A, including, but not limited to those incurred during the Term, Company will either pay directly under a Client and Billing Agreement or reimburse University for all documented attorneys’ fees, expenses, official fees and all other charges accumulated or invoiced to the University incident to the preparation, filing, prosecution, and maintenance of the Patent Rights, within thirty (30) days after Company’s receipt of invoices for such fees, expenses and charges. University reserves the right to require the Company to provide a deposit in advance of incurring out of pocket patent expenses estimated by counsel to exceed $2,500. If Company fails to reimburse patent expenses under Paragraph 7.2, or provide a requested deposit with respect to a Patent Right, then University will be free at its discretion and expense to either abandon such applications or patents related to such Patent Right or to continue such preparation, prosecution and/or maintenance activities and to the extent University has pursued protection of any patent rights associated with such patent action will remain subject to the license granted under this Agreement. Any abandonment of patents or applications under Patent Rights by the University shall not affect Company’s obligation to pay prior royalties due under this Agreement that were accrued prior to the date of abandonment of patents or applications for such the Patent Rights.

7.3 Patent Marking. Company shall include appropriate marking on all Licensed Products made, sold or otherwise disposed of by Company, which patent marking will be in accordance with appropriate patent marking laws of the United States and any other country in which such the Licensed Products are made, sold or otherwise disposed of. Company will cause its Affiliates and/or sublicensees to similarly mark any Licensed Products made, sold or otherwise disposed of by such Affiliates or sublicensees.

| 8. | INFRINGEMENT |

8.1 Notice. Company and University will notify each other promptly, but in no event later than five days of any infringement of the Patent Rights that may come to their attention. Company and University will consult each other in a timely manner concerning any appropriate response to the infringement.

8.2 Prosecution of Infringement. Company may prosecute any infringement of the Patent Rights at Company’s expense, including defending against any counterclaims or cross claims brought by any party against Company or University regarding the Patent Rights and defending against any claim that the Patent or Patent Rights are invalid in the course of any infringement action or in a declaratory judgment action. University reserves the right to intervene voluntarily and join Company in any such infringement litigation. If University chooses not to intervene voluntarily, but University is a necessary party to the action brought by Company, then Company may join University in the infringement litigation. If Company decides not to prosecute any infringement of the Patent Rights, then University may elect to prosecute such infringement independently of Company in University’s sole discretion.

Page 10 of 24

8.3 Cooperation. In any litigation under this Article 8, either party, at the request and sole expense of the other party, will cooperate to the fullest extent reasonably possible. This Section 8.3 will not be construed to require either party to undertake any activities, including legal discovery, at the request of any third party, except as may be required by lawful process of a court of competent jurisdiction. If, however, either party is required to undertake any activity, including legal discovery, as a right of lawful process of a court of competent jurisdiction, then Company will pay all expenses incurred by Company and by University.

8.4 Control of Litigation. Company controls any litigation or potential litigation involving the prosecution of infringement claims regarding the Patent Rights in which University is not a party, including the selection of counsel, all with input from University. Company must not settle or compromise any such litigation in a manner that imposes any obligations or restrictions on University or grants any rights to the Patent Rights, other than any permitted sublicenses, without University’s prior written permission. University controls any litigation or potential litigation involving the prosecution of infringement claims regarding the Patent Rights in which University has elected to prosecute the infringement independently of Company or has voluntarily or involuntarily joined Company in the infringement litigation, including the selection of counsel, all with input from Company. In all instances in which University is a party, University reserves the right to select its own counsel. If University is involuntarily joined as a party, University retains the right to select its own counsel, but Company will be responsible for all litigation expenditures as set forth in Section 8.5.

8.5 Recoveries from Litigation. If Company prosecutes any infringement claims either without University as a party or with University involuntarily joined as a party, then Company will reimburse University for University’s litigation expenditures, including any attorneys’ fees, expenses, official fees and other charges incurred by University, even if there are no financial recoveries from the infringement action. Company will reimburse University within thirty (30) days after receiving each invoice from University. After reimbursing University for its expenditures, Company will use the financial recoveries from such claims, if any, (a) first, to reimburse Company for its litigation expenditures; and (b) second, to retain any remainder but to treat the remainder as either (i) Net Sales for the purpose of determining the royalties due to University under Section 3.7 or (ii) sublicense consideration for the purpose of determining the sublicense fees due to University under Section 3.10, whichever would result in a larger payment to University. If Company prosecutes any infringement claims with University joined as a voluntary party, then any financial recoveries from such claims will be (x) first, shared between Company and University in proportion with their respective shares of the aggregate litigation expenditures by Company and University; and (y) second, shared equally by Company and University as to any remainder after Company and University have fully recovered their aggregate litigation expenditures. If University prosecutes any infringement claims independent of Company, then University will prosecute such infringement at University’s expense and will retain any financial recoveries in their entirety.

Page 11 of 24

| 9. | DISCLAIMER OF WARRANTIES |

9.1 Disclaimer. THE PATENT RIGHTS, LICENSED PRODUCTS AND ANY OTHER TECHNOLOGY LICENSED UNDER THIS AGREEMENT ARE PROVIDED ON AN “AS IS” BASIS. UNIVERSITY MAKES NO REPRESENTATIONS OR WARRANTIES, EXPRESS OR IMPLIED, INCLUDING BUT NOT LIMITED TO ANY WARRANTY OF ACCURACY, COMPLETENESS, PERFORMANCE, MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE, COMMERCIAL UTILITY, NON-INFRINGEMENT, ABSENCE OF LATENT OR OTHER DEFECTS, WHETHER OR NOT DISCOVERABLE, OR TITLE. Specifically, and not in limitation of the foregoing, University makes no representation or warranty (i) regarding the validity or scope of the Licensed Products, and (ii) that the exploitation of the Patents or Patent Rights or Licensed Products will not infringe on any patents or other intellectual property of any third party.

| 10. | LIMITATION OF LIABILITY |

10.1 Limitation of Liability. UNIVERSITY WILL NOT BE LIABLE TO COMPANY, ITS AFFILIATES, SUBLICENSEES, SUCCESSORS OR ASSIGNS, OR ANY THIRD PARTY WITH RESPECT TO ANY CLAIM: ARISING FROM COMPANY’S USE OF THE PATENT RIGHTS, LICENSED PRODUCTS OR ANY OTHER TECHNOLOGY LICENSED UNDER THIS AGREEMENT; OR ARISING FROM THE DEVELOPMENT, TESTING, MANUFACTURE, USE OR SALE OF LICENSED PRODUCTS. UNIVERSITY WILL NOT BE LIABLE TO COMPANY, ITS AFFILIATES, SUBLICENSEES, SUCCESSORS OR ASSIGNS, OR ANY THIRD PARTY FOR LOST PROFITS, BUSINESS INTERRUPTION, OR INDIRECT, SPECIAL OR CONSEQUENTIAL DAMAGES OF ANY KIND.

| 11. | INDEMNIFICATION |

11.1 Indemnification. Company will defend, indemnify, and hold harmless each Indemnified Party from and against any and all Liabilities with respect to an Indemnification Event.

The term “Indemnified Party” means each of University and its trustees, officers, faculty, students, employees, contractors, and agents.

The term “Liabilities” means all damages, awards, deficiencies, settlement amounts, defaults, assessments, fines, dues, penalties, costs, fees, liabilities, obligations, taxes, liens, losses, lost profits and expenses (including, but not limited to, court costs, interest and reasonable fees of attorneys, accountants and other experts) that are incurred by an Indemnified Party or awarded or otherwise required to be paid to third parties by an Indemnified Party.

The term “Indemnification Event” means any Claim against one or more Indemnified Parties arising out of or resulting from:

| (a) | the development, testing, use, manufacture, promotion, sale or other disposition of any Patent Rights or Licensed Products by Company, its Affiliates, sublicensees, assignees or vendors or third parties, including, but not limited to, |

| (i) | any product liability or other Claim of any kind related to use by a third party of a Licensed Product, |

Page 12 of 24

| (ii) | any Claim by a third party that the practice of any of the Patent Rights or the design, composition, manufacture, use, sale or other disposition of any Licensed Product infringes or violates any patent, copyright, trade secret, trademark or other intellectual property right of such third party, and |

| (iii) | any Claim by a third party relating to clinical trials or studies for Licensed Products; |

| (b) | any material breach of the Transaction Agreements by Company or its Affiliates or sublicensees; |

| (c) | any Claim arising from, relating to or in connection with Company’s capital or debt raising activities, including but not limited to its private placement memorandum, stock purchase agreements, convertible purchase arrangements and/or debt instruments, and/or Company’s written or oral statements and/or representations made about University in all such capital or debt raising activities; and |

| (d) | the enforcement of this Article 11 by any Indemnified Party. |

The term “Claim” means any charges, complaints, actions, suits, proceedings, hearings, investigations, claims or demands.

11.2 Reimbursement of Costs. Company will pay directly all Liabilities incurred for defense or negotiation of any Claim or will reimburse University for all documented Liabilities incident to the defense or negotiation of any Claim within thirty (30) days after Company’s receipt of invoices for such fees, expenses and charges.

11.3 Control of Litigation. Company controls any litigation or potential litigation involving the defense of any Claim, including the selection of counsel, with input from University. University reserves the right to protect its interest in defending against any Claim by selecting its own counsel, with any attorneys’ fees and litigation expenses paid for by Company, pursuant to Sections 11.1 and 11.2.

11.4 Other Provisions. Company will not settle or compromise any Claim giving rise to Liabilities in any manner that imposes any restrictions or obligations on University or grants any rights to the Patent Rights or the Licensed Products without University’s prior written consent. If Company fails or declines to assume the defense of any Claim within thirty (30) days after notice of the Claim, or fails to reimburse an Indemnified Party for any Liabilities pursuant to Sections 11.1 and 11.2 within the thirty (30) day time period set forth in Section 11.2, then University may assume the defense of such Claim for the account and at the risk of Company, and any Liabilities related to such Claim will be conclusively deemed a liability of Company. The indemnification rights of the Indemnified Parties under this Article 11 are in addition to all other rights that an Indemnified Party may have at law, in equity or otherwise.

| 12. | INSURANCE |

12.1 Coverages. Company will procure and maintain insurance policies for the following coverages with respect to personal injury, bodily injury and property damage arising out of Company’s performance under this Agreement: (a) during the Term, comprehensive general liability, including broad form and contractual liability, in a minimum amount of $2,000,000 combined single limit per occurrence and in the aggregate; (b) prior to the commencement of clinical trials involving Licensed Products, clinical trials coverage in a minimum amount of $3,000,000 combined single limit per occurrence and in the aggregate; and (c) prior to the Sale of the first Licensed Product, product liability coverage, in a minimum amount of $2,000,000 combined single limit per occurrence and in the aggregate. University may review periodically the adequacy of the minimum amounts of insurance for each coverage required by this Section 12.1, and University reserves the right to require Company to adjust the limits accordingly. The required minimum amounts of insurance do not constitute a limitation on Company’s liability or indemnification obligations to University under this Agreement.

Page 13 of 24

12.2 Other Requirements. The policies of insurance required by Section 12.1 will be issued by an insurance carrier with an A.M. Best rating of “A” or better and will name University as an additional insured with respect to Company’s performance under this Agreement. Company will provide University with insurance certificates evidencing the required coverage within thirty (30) days after the Effective Date and the commencement of each policy period and any renewal periods. Each certificate will provide that the insurance carrier will notify University in writing at least thirty (30) days prior to the cancellation or material change in coverage.

| 13. | COMPANY’S REPRESENTATIONS AND WARRANTIES |

13.1 Organization, Good Standing and Qualification. Company is a corporation, duly organized, validly existing and in good standing under the laws of the State of Nevada and has all requisite corporate power and authority to conduct on its business, to execute and deliver this Agreement, and to consummate the transactions contemplated by this Agreement.

13.2 Authorization. All corporate action on the part of Company, its officers, directors and members or stockholders necessary for the authorization, execution and delivery of this Agreement, the performance of all obligations of Company hereunder and this Agreement, when executed and delivered by Company, will constitute valid and legally binding obligations of Company, enforceable against Company in accordance with its terms, except as limited by applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent conveyance, and other laws of general application affecting enforcement of creditors’ rights generally, and as limited by laws relating to the availability of specific performance, injunctive relief, or other equitable remedies.

| 14. | ADDITIONAL PROVISIONS |

14.1 Independent Contractors. The parties are independent contractors. Nothing contained in this Agreement is intended to create an agency, partnership or joint venture between the parties. At no time will either party make commitments or incur any charges or expenses for or on behalf of the other party.

14.2 No Discrimination. Neither University nor Company will discriminate against any employee or applicant for employment because of race, color, sex, sexual or affectional preference, age, religion, national or ethnic origin, handicap, or veteran status.

Page 14 of 24

14.3 Compliance with Laws. Company must comply with all prevailing laws, rules and regulations that apply to its activities or obligations under this Agreement. For example, Company will comply with applicable United States export laws and regulations, including, but not limited to, the export laws and regulations of the United States, and will not sell, transfer, export or re-export any such Licensed Products or information to any persons or any third parties with regard to which there exist grounds to suspect or believe that they are violating such laws. The transfer of certain technical data and commodities may require a license from the applicable agency of the United States government and/or written assurances by Company that Company will not export data or commodities to certain foreign countries without prior approval of the agency. University does not represent that no license is required, or that, if required, the license will issue.

14.4 Modification, Waiver & Remedies. This Agreement may only be modified by a written amendment that is executed by an authorized representative of each party. Any waiver must be express and in writing. No waiver by either party of a breach by the other party will constitute a waiver of any different or succeeding breach. Unless otherwise specified, all remedies are cumulative.

14.5 Assignment & Hypothecation. Company may not assign this Agreement or any part of it, either directly or by merger or operation of law, without the prior written consent of University. University will not unreasonably withhold or delay its consent, provided that: (a) at least thirty (30) days before the proposed transaction, Company gives University written notice and such background information as may be reasonably necessary to enable University to give an informed consent; (b) the assignee agrees in writing to be legally bound by this Agreement and to deliver to University an updated Development Plan within forty-five (45) days after the closing of the proposed transaction; and (c) Company provides University with a copy of assignee’s undertaking. Any permitted assignment will not relieve Company of responsibility for performance of any obligation of Company that has accrued at the time of the assignment. Company will not grant a security interest in the License or this Agreement during the Term. Any prohibited assignment or security interest will be null and void.

14.6 Notices. Any notice or other required communication (each, a “Notice”) must be in writing, addressed to the party’s respective Notice Address listed on the signature page, and delivered: (a) personally; (b) by certified mail, postage prepaid, return receipt requested; (c) by recognized overnight courier service, charges prepaid; or (d) by facsimile. A Notice will be deemed received: if delivered personally, on the date of delivery; if mailed, five (5) days after deposit in the United States mail; if sent via courier, one (1) business day after deposit with the courier service; or if sent via facsimile, upon receipt of confirmation of transmission provided that a confirming copy of such Notice is sent by certified mail, postage prepaid, return receipt requested.

14.7 Severability & Reformation. If any provision of this Agreement is held to be invalid or unenforceable by a court of competent jurisdiction, then the remaining provisions of this Agreement will remain in full force and effect. Such invalid or unenforceable provision will be automatically revised to be a valid or enforceable provision that comes as close as permitted by law to the parties’ original intent.

14.8 Headings & Counterparts. The headings of the articles and sections included in this Agreement are inserted for convenience only and are not intended to affect the meaning or interpretation of this Agreement. This Agreement may be executed in several counterparts, all of which taken together will constitute the same instrument.

Page 15 of 24

14.9 Governing Law. This Agreement and all amendments, exhibits, modifications, alterations, or supplements hereto, and the rights of the parties hereunder, shall be construed under and governed by the laws of the District of Columbia, without regard to principles of conflict of laws thereof which may require the application of the law of another jurisdiction.

14.10 Dispute Resolution. If a dispute arises between the parties concerning any right or duty under this Agreement, then the parties will confer, as soon as practicable, in an attempt to resolve the dispute. If the parties are unable to resolve the dispute amicably, then the parties will submit to the exclusive jurisdiction of, and venue in, the state and Federal courts located in the Washington, DC with respect to all disputes arising under this Agreement.

14.11 Integration. This Agreement with its Appendix and Exhibits, contain the entire agreement between the parties with respect to the Patent Rights and the License and supersede all other oral or written representations, statements, or agreements with respect to such subject matter, including but not limited to the Term Sheet.

[SIGNATURES TO FOLLOW]

Page 16 of 24

Each party has caused this Agreement to be executed by its duly authorized representative.

| THE GEORGE WASHINGTON UNIVERSITY | HOTH THERAPEUTICS, INC. | |||

| By: | /s/ Mark Diaz | By: | /s/ Robb Knie | |

| Name: | Mark Diaz | Name: | Robb Knie | |

| Title: | Executive Vice President and CFO | Title: | CEO | |

| Date: | August 7, 2020 | Date: | August 3, 2020 | |

Addresses:

| Technology Commercialization Office | Hoth Therapeutics |

| The George Washington University | One Rockefeller Plaza, Suite 1039 |

| 1922 F ST NW, 4TH Floor | New York, NY 10020 |

| Washington DC, 20052 | |

| Attention: TCO Operations Coordinator | Attention: Hayley Behrmann |

| Required copy to: | |

| The George Washington University | |

| Office of the General Counsel | |

| 2100 Pennsylvania Avenue NW, Washington DC, 20052 | |

| Attention: General Counsel | |

| 202-994-6503; ogc@gwu.edu |

Page 17 of 24

APPENDIX A – Key License Terms

| 1. | License Grant. |

| a. | Technology: |

(1). GW Docket [*] titled, “[*]” protected by U.S. Patent Application No. [*].

(2). GW Docket [*] for “[*]”

| b. | Exclusivity: exclusive |

| c. | Territory: worldwide |

| d. | Field of Use: virus sensing and detection |

| 2. | Diligence. |

| a. | Diligence Minimums: each year $[*]. |

| b. | Diligence Events: listed in the table below |

| DILIGENCE EVENT | COMPLETION DATE | |

| Commiting at least $[*] to the University in research funding for COVID-19 sensing by executing Sponsored Research Agreement | September 30, 2020 | |

| Request Meeting with Government Agency to Discuss Technology | January 30, 2021 | |

| Filing of FDA Application Fast Track | October 30, 2021 | |

| First Sale of the Licensed Product or Licensed Service | January 30, 2022 |

| 3. | Fees and Royalties. |

| a. | License Initiation Fee: $[*] |

| b. | Equity: Refer to Section 3.2 for terms related to warrants. |

| c. | License Maintenance Fees: First year: $[*]. Second year and thereafter: $[*]. |

| d. | Milestone Payments: Per table below. |

Page 18 of 24

| MILESTONE | PAYMENT | ||||

| Initiation of clinical trials | $ | [*] | |||

| Receipt of regulatory approval for commercial sales | $ | [*] | |||

| e. | Earned Royalties: [*] % of Net Sales |

| f. | Minimum Royalties: First 4 Quarters after first sale = $[*]. Next 8 Quarters = $[*]. Next 8 Quarters = $[*]. All Quarters thereafter = $[*]. |

| g. | Sublicense Fee: [*]%. |

| 4. | Patent Costs. |

| a. | Past Patent Expenses: Past Patent Expenses billed to University through August 1, 2020 that have not yet been reimbursed amount to $[*]. Past Patent Expenses may also include work incurred by University prior to Effective Date, but that has not been billed to University by Effective Date. |

| b. | By thirty (30) days after the Effective Date (the “Past Patent Expenses Reimbursement Date”) Company will reimburse University for all patent and legal expenses with respect to the Patent Rights incurred by University prior to Effective Date. |

| c. | Ongoing patent costs to be reimbursed by Company or paid directly according to Section 7.2 of this Agreement. |

Page 19 of 24

EXHIBIT INDEX

| Exhibit A | Patents and Patent Applications in Patent Rights |

| Exhibit B | Minimum Contents of Development Plan |

| Exhibit C | Format of Royalty Report |

| Exhibit D | Invoice of Past Patent Costs |

Page 20 of 24

Exhibit A

Patents and Patent Applications in Patent Rights

| GW Reference | Status | Country | Application Number |

Title | Inventors |

| [*] | [*] | [*] | [*] | [*] | [*] |

| [*] | [*] | [*] | [*] | [*] | [*] |

Page 21 of 24

Exhibit B

Minimum Contents of Development Plan

The initial Development Plan and each annual update to the Development Plan shall include, at a minimum, the following information:

| ● | The date of the Development Plan and the reporting period covered by the Development Plan. |

| ● | Identification and nature of each active relationship between Company and its Affiliates, sublicensees or subcontractors in the research, development or commercialization of Licensed Products or Patent Rights |

| ● | Significant projects completed during the reporting period by Company or its Affiliates, sublicensees or subcontractors in the research, development or commercialization of Licensed Products or Patent Rights. |

| ● | Significant projects currently being performed by Company or its Affiliates, sublicensees or subcontractors in the research, development or commercialization of Licensed Products or Patent Rights. |

| ● | Future projects expected to be undertaken during the next reporting period by Company or its Affiliates, sublicensees or subcontractors in the research, development or commercialization of Licensed Products or Patent Rights. |

| ● | Projected timelines to product launch of each Licensed Product prior to first Sale. |

| ● | Projected annual Net Sales for each Licensed Product after first Sale. |

| ● | Significant changes to the current Development Plan since the previous Development Plan and the reasons for the changes. |

| ● | Significant assumptions underlying the Development Plan and the future variables that may cause significant changes to the Development Plan. |

Page 22 of 24

Exhibit C

Format of Royalty Report

Page 23 of 24

Exhibit D

Invoice of Past Patent Costs

[*]

Page 24 of 24