UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2019

☐ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to ___________

Commission file number: 001-38793

INMUNE BIO INC.

(Exact name of registrant as specified in its charter)

| Nevada | 47-5205835 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

INMUNE BIO INC.

David Moss

1200 Prospect Street, Suite 525

La Jolla, CA 92037

Phone: (858) 964 3720

(Address of principal executive offices)(Zip Code)

(858) 964 3720

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

| Title of each class | Name of Market Where Traded | |

| Common Stock ($.001 par value) | The Nasdaq Stock Market LLC |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by checkmark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging Growth Company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the registrant's common stock held by non-affiliates of the registrant was approximately $35 million as of the last business day of the registrant's most recently completed second fiscal quarter (June 30, 2019), based upon the closing sale price for the registrant's common stock on that day as reported by the NASDAQ Capital Market. Shares of common stock held by each officer and director of the registrant on June 30, 2019 have been excluded in that such persons may be deemed to be affiliates.

As of March 3, 2020, there are 10,746,948 shares of common stock, $0.001 par value per share outstanding.

FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2019

TABLE OF CONTENTS

i

All brand names or trademarks appearing in this report are the property of their respective holders. Unless the context requires otherwise, references in this report to “INmune Bio” the “Company,” “we,” “us,” and “our” refer to INmune Bio, Inc., a Nevada corporation.

This Annual Report on Form 10-K (this “Annual Report”) contains “forward-looking statements” Forward-looking statements reflect our current view about future events. When used in this Report, the words “anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,” “plan,” or the negative of these terms and similar expressions, as they relate to us or our management, identify forward-looking statements. Such statements include, but are not limited to, statements contained in this Report relating to our business strategy, our future operating results and liquidity and capital resources outlook. Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward–looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Our actual results may differ materially from those contemplated by the forward-looking statements. They are neither statements of historical fact nor guarantees of assurance of future performance. We caution you therefore against relying on any of these forward-looking statements. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, without limitation, our ability to raise capital to fund continuing operations; our ability to protect our intellectual property rights; the impact of any infringement actions or other litigation brought against us; competition from other providers and products; our ability to develop and commercialize products and services; changes in government regulation; our ability to complete capital raising transactions; and other factors (including the risks contained in the section of this Annual Report entitled “Risk Factors”) relating to our industry, our operations and results of operations. Actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our Strategy

Our objective is to develop and commercialize our product candidates to treat diseases where the innate immune system is not functioning normally and contributing to the patient’s disease. This can be in cancer where Natural Killer (“NK”) cells are inactive and contribute to a tumor’s evasion of the immune system and/or disease progression while expression of MUC4 and cells of the tumor microenvironment such as Myeloid Derived Suppressor Cells (“MDSC”) proliferate to protect the tumor from attack by the patient’s immune system or this can be other diseases such as neurologic and metabolic diseases where chronic inflammation results in innate immune system dysfunction and disease progression. Our initial focus will be the treatment of cancer, treatment of Alzheimer’s Disease (“AD”) and non-alcoholic steatohepatitis (“NASH”). In cancer, we plan to pursue two parallel development programs: (1) with INKmune we will initially focus on treating resistant disease women with relapse refractory ovarian carcinoma and patients with high risk myelodysplastic syndrome (high risk MDS); (2) with INB03, we will treat patients with advanced cancers with elevated biomarkers of inflammation in their blood and evidence of disease that is resistant to immunotherapy including women with metastatic HER2+ breast cancer. Our third drug candidate XPro1595, targets Alzheimer’s Disease which we initiated once we received a non-dilutive funding from the Alzheimer’s Association as a $1 million US dollar Part-the-Cloud Award (as described below). is progressing through Phase I trials. Our fourth drug candidate, LivNate, will be used to treat patients with NASH. The principal components of our strategy to achieve this objective are to:

| ● |

pursue development strategies and regulatory approval pathways that allow the treatment of oncology patients with our lead product candidates, INKmune and INB03; | |

| ● | pursue development strategies and regulatory approval pathways that allow the treatment of neurodegenerative diseases in patients with our lead product candidates, XPro1595; | |

| ● | pursue development strategies and regulatory approval pathways that allow the treatment of NASH in patients with our lead product candidates, LivNate; | |

| ● | adopt a product development strategy that solidifies our existing intellectual property (“IP”) to prevent competition and expand our IP suite into related immunotherapeutic areas; | |

| ● | provide clear value propositions to third-party payers, such as managed care companies or government programs like Medicare, to merit reimbursement for our product candidates; and | |

| ● | Collaborate with other pharmaceutical companies with respect to, among other things, our INKmune and the DN-TNF platform that includes INB03, XPro 1595 and LivNate product candidates and other products that will benefit from development or marketing beyond our current resources. |

1

Pursue development and regulatory approval pathways. We believe INKmune, INB03 and XPro1595 may be approvable under pathways that are potentially shorter than those typically available for drug products based on novel active ingredients, including as an orphan drug under the Orphan Drug Act and approval under the Food and Drug Administration (the “FDA”) Accelerated Approval Program (see “Government Regulation”). We have not yet had a discussion with the Medicines and Healthcare Products Regulatory Agency (“MHRA”) and/or FDA regarding such designation, but plan to do so in 2020. We believe both our INB03 HER2+ metastatic breast cancer program, high risk MDS and ovarian carcinoma treatment programs fit the criteria used by the FDA to grant these regulatory designations. We believe that it would take a minimum of six months to receive Orphan Drug status once we submit an application and a minimum of 12 months to receive a designation once we submit an application. We might never have these discussions, submit applications under the Orphan Drug Act as the FDA Accelerated Approval Program or have these applications approved if we do.

Adopt a two-pronged patent strategy. We are pursuing a two-pronged product development strategy that will seek to solidify our existing IP to prevent competition and expand our IP suite into related immunotherapeutic areas. We are confident that our core in-licensed IP (see “Intellectual Property”) will allow us both freedom-to-operate and provide robust protection from outside competition. We will continue to invest in expanding our patent suite. We will also seek to further to strengthen our IP position by looking to in-license IP related to immunotherapeutic strategies focused on the innate immune system.

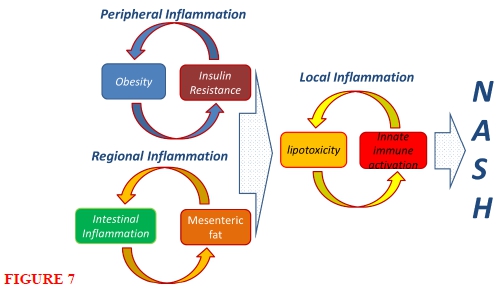

Provide clear value propositions to third-party payors to merit reimbursement for our product candidates. We are designing our clinical development programs to demonstrate compelling, competitive advantages to patients and prescribers, and to demonstrate value propositions to third-party payors. We believe the use of INKmune and/or INB03 in patients with a high risk of tumor progression and death from tumor should prolong survival, improve the patient’s quality of life and decrease the total cost of care for patients with these lethal malignancies. For example, ovarian cancer patients relapse frequently. Each relapse requires an expensive, hospital-based treatment regimen that has decreasing benefits. Treatment with INKmune as an out-patient may provide a more durable remission and limit the need for treatment-associated hospitalizations. At the patient level, we believe INKmune and INB03 therapy, once approved, should improve survival and quality of life. At the payor level, we believe INKmune, once approved, should provide more predictable costs and outcomes. Therapies for Alzheimer’s disease are needed for medical, social and economic reasons. The cost of Alzheimer’s disease to the government is large and growing. The cost to families and care givers is real and burdensome. We believe treatment of patients with dementia, including Alzheimer’s disease, may provide a strategy to alter the costly dynamic of this disease in society today. NASH, a silent epidemic in the US due to the high incidence of obesity, is expected to be the most common cause of liver transplant 2030. There are no approved therapies for the NASH at this time.

Collaborate to maximize the value of our technology. We believe there are two reasons for us to enter collaborations with other companies. The first is the further development of INKmune, INB03, LivNate and XPro1595 by either providing additional innovations to the product, including combination therapy strategies, and/or providing resources to improve the speed and breadth of the development process. The second is to optimize the commercialization of our products either globally or regionally. The ideal partner will benefit us in both ways.

We continue to look for ways to utilize our unique capabilities to optimize clinical application of cell therapies. We believe that we have identified a way to manufacture human mesenchymal stem cells for the medical research and biotech community that offers large volumes of high-quality, low passage human umbilical cord mesenchymal stem cells with minimal batch-to-batch variability. We believe this may solve the problem associated with supplying an adequate supply of human mesenchymal stem cells for clinical applications. The process to produce pooled, human umbilical cord mesenchymal stem cells was developed at University College London. We have established a reliable supply of human umbilical cords based on our agreement with the Anthony Nolan Cord Blood Bank in the United Kingdom. We have developed a validated manufacturing process that reliably produces contract manufacturer of the clinical grade (“cGMP”) quality mesenchymal stem cells. The manufacturing process can be performed at a contract manufacturing site under the direction of Mark Lowdell, the Company’s CSO. We have negotiated an exclusive 10-year license to the manufacturing process from University College London Business, the licensing organization of University College London. We will seek academic laboratories and biopharma companies who need a reliable source of high quality pooled human umbilical cord mesenchymal stem cells for research of and development of clinical products. Once identified, we plan to act as a cGMP for the development of therapeutic products by utilizing contract manufacturers. Because the production of the product is not continuous, we do not expect to engage a contract manufacturer until we have a customer identified. We have identified several contract manufacturers in the UK that have the capability to produce cGMP stem cells. We expect the commercial arrangement with academic laboratories or biopharma companies to be a combination of fee-for-service and licensing that does not require additional investment by us. We will be opportunistic in pursuing therapeutic opportunities for our own portfolio with this platform in the future if resources become available. The regulatory path for therapeutic applications of the mesenchymal stem cell products is well established and similar to the regulatory approval process for other cell therapies. We will only be responsible for regulatory compliance related to manufacturing of the mesenchymal stem cells when the product is being developed by a third party. When developing a therapeutic product for the Company’s commercial portfolio, the Company will be responsible for all aspects of the regulatory process.

2

Overview of Immunotherapy for Cancer

The immune system has two parts, innate and adaptive. The innate immune system is the body’s first line of defense against an infection, providing immediate, non-specific responses to eliminate harmful cells in the body. Components of the innate immune system include cytokines, chemokines, macrophages, neutrophils and NK cells, among others.

The adaptive immune system is often initially triggered by the innate immune system, mounts a delayed response against diseased cells and plays a role protecting against re-infection. An adaptive immune response is highly specific to a pathogen or antigen and is developed or learned from prior exposure. Key components of the adaptive immune system include antibodies which bind to antigens and mark them for destruction by other immune cells, B-cells which produce these antibodies upon exposure to antigens, and T-cells which attack and eliminate the diseased cells.

The biopharmaceutical industry has made significant advances in harnessing specific components of innate and adaptive immune systems for therapeutic use. Some of these approaches are summarized below.

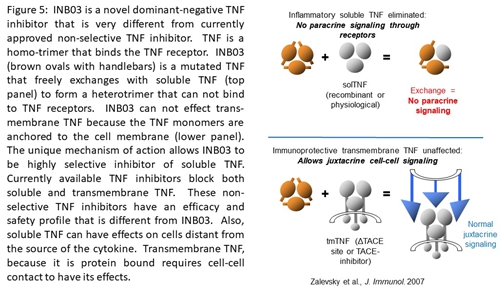

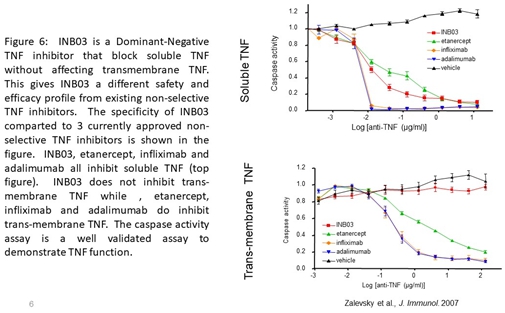

Cytokines. One of the early applications of immunotherapy is the use of cytokines, including interferons and interleukin-2 (“IL-2”). Interferons are molecules that inhibit the growth and replication of diseased cells and stimulate innate immune cells to attack them. They have been used as standard of care for hepatitis B and C and multiple sclerosis, and to a lesser extent, as treatment for certain cancers, including chronic myeloid leukemia, cutaneous T-cell lymphoma, myeloma and non-Hodgkin’s lymphoma. However, the use of interferons has generally decreased over the years due to serious adverse events (e.g., flu-like symptoms and dramatic weight loss) and introduction of new therapies with higher efficacy, better safety profiles and more convenient administration although Alpha-interferon remains the treatment of choice for some hematological conditions such as polycythemia. IL-2 activates T-cells and NK cells to attack diseased cells. IL-2 has been used to treat select cancers, but due to its relatively poor safety profile, physicians often only resort to this therapy for the most advanced settings. Tumor Necrosis Factor alpha (“TNF”) is the focus of INB03. TNF biology has four elements that include two cytokines, soluble TNF and trans-membrane TNF (“sTNF” and “tmTNF,” respectively), and two receptors, TNF Receptor 1 and 2 (“TNFR1” and “TNFR2”). The biology of TNF ligation of TNFR varies dramatically based on what elements of the TNF system that are used. sTNF binding to TNFR1 is responsible for inflammation and cell death while sTNF binding to TNFR2 promotes proliferation of regulatory T cells (“Treg”). In patients with advanced cancers, increased sTNF is not favorable to long-term survival. tmTNF can bind either TNFR to improve the immune response, promote cell survival and stimulate remyelination. In brief, sTNF is the “bad” TNF and tmTNF is the “good” TNF. In patients with cancer, infection or neurologic disease, blockade of tmTNF function has negative consequences such as immunosuppression, increased infection and demyelination.

Antibody therapy. Antibodies exist in three formats; monoclonal (“mAbs”), oligo/polyclonal and antibody-drug conjugates. mAbs represent an effective therapeutic modality and are important to the treatment paradigm of various diseases. Drug manufacturers have leveraged mAbs’ ability to induce an antibody-dependent cell-mediated cytotoxicity, or ADCC effect to develop better treatments that prolong survival and quality of life of patients. In addition, mAbs designed to inhibit specific checkpoints in the immune system have overcome in vivo immune suppression and the resulting immune responses have led to profound therapeutic benefit in some patients. However, the degree of efficacy of these therapies is heavily reliant on the immune system of patients, many of whom are severely immuno-compromised. For example, despite over $1.0 billion of sales generated by recently launched PD-1 and PDL1 checkpoint inhibitors, they are reported to be generally only effective in approximately 10% to 25% of the addressable patient population. In addition, mAbs are manufactured through a complex process that requires purification of cell products created from a cell line. Polyspecific antibodies, for example bi-specific antibodies, are able to target more than one antigen. These are often used to bring and effector T cell in contact with a target cell. Antibody drug conjugates are mAbs attached to a toxin, chemotherapy or radio therapy that delivers the cancer killing payload directly to the cancer.

3

Dendritic Cell Therapies. This approach is designed to indirectly stimulate a patient’s T-cells by leveraging the role of dendritic cells in presenting antigens to T-cells. Cancer vaccines are the most common application of dendritic cells. The only FDA-approved dendritic cell therapy is PROVENGE, which entails collecting monocytes from the patient, maturing them into dendritic cells, “loading” ex vivo with the patient’s cancer antigens, and then re-infusing in the patient. Currently, this process is cumbersome and expensive, and again, relies on an intact and effective immune system of the patient. There are additional ongoing preclinical studies and clinical trials being conducted by our competitors aimed at addressing certain of the limitations associated with this approach. To date, current clinical results of dendritic cell therapies have been mixed.

CAR-T and TCR Therapies. T-cells recognize diseased cells by receptors engaging with antigens that are present on or inside the diseased cells. CAR-T therapy entails genetically engineering T-cells to express synthetic CARs that direct T-cells to antigens on the surface of cancer cells. TCR therapy modifies T-cells to express high-affinity tumor specific TCRs that recognize intra-cellular antigens that must be presented on the surface of target cells. In early clinical trials, CAR-T and TCR therapies have demonstrated impressive anti-tumor activity in a narrow spectrum of hematologic cancers and garnered significant attention by research institutions and biopharmaceutical companies. We believe a key limitation of adaptive autologous immunotherapy is the need to retrieve non-compromised immune cells from a cancer patient which requires a complex and costly manufacturing process to develop the therapy. The complexity of this personalized process is reflected in the price of the two approved therapies. CAR-T therapies - tisagenlecleucel and axicabtagene ciloleucel for advanced leukemia and lymphoma respectively. The cost of a single therapy is many hundreds of thousands of dollars. As a consequence of this need to harvest active T-cells, current Phase I clinical trials for autologous CAR-T cell therapy in large part enroll patients from highly selected, often relatively early-stage disease in a narrow spectrum of cancers, including bulky hematological cancers. In addition, Phase I clinical trials of CAR-T cell immunotherapy have reported severe adverse toxicities of cytokine release syndrome and neurotoxicity, requiring hospitalization, pre-conditioning and, in some instances, intensive care unit admission following side effects associated with cytokine release syndrome. As a result, though our competitors continue to develop their CAR-T and TCR product candidates with the goal of addressing certain of the limitations associated with these approaches, we believe these serious challenges may limit their potential and use in a variety of indications, including solid tumors.

Checkpoint Inhibitors. Immune cells express proteins that are immune checkpoints that control and down-regulate the immune response. These are best defined in T lymphocytes and include PD-1, CTLA-4, TIM-3 and LAG3. Tumor cells express the ligands to these receptors. When T cells bind the ligand to these proteins on the tumor cells, the T cell is turned off and does not attempt to attack the tumor cell. Thus, checkpoint inhibitors (“CPI”) are part of the complex strategy used by the tumor to evade the patient’s immune system and are responsible for resistance to immunotherapy. Biopharmaceutical companies have successfully developed CPI that block the receptor/ligand interaction to promote the adaptive immune response to the tumor. Six CPI are currently approved, pembrolizumab, nivolumab, atezolizumab, avelumab, durvalumab, and ipilimumab for a wide variety of solid tumors including melanoma, lung, bladder, gastric cancers and others. More CPI are in development and more tumor types will be added to the list of sensitive tumors over the next years. CPI have become the backbone of cancer therapy and are expected to be the best -selling class of drugs by 2027.

NK Cells. NK cells typically represent approximately 2% to 13% of circulating lymphocytes and are a critical component of the immune system responsible for innate immunity. Unlike adaptive immune cells, they are ever present and ready to attack, having the inherent ability to detect and eliminate diseased cells without the need for antigen presentation, which is why they are called “natural killers.”

NK cells bind to stress ligands expressed by the diseased cells and directly eliminate them. This binding induces NK cells to release cytokines, including, interferons and GM-CSF, which are integral in recruiting additional innate and adaptive immune responses by the host. NK cells also represent a critical effector cell for ADCC, whereby target cells bound with human antibodies, whether made by the patient’s body or administered, are selectively destroyed by the NK cells.

MDSC Cells: MDSC are present in very low quantities in healthy patients. MDSC develop and proliferate in patients with chronic infection and with cancer. In cancer, MDSC are a unique and well-defined cell population that home to the cancer and secrete immunosuppressive cytokines that provide a protective, immunosuppressive shield to the tumor. This protective immunosuppressive shield prevents the patient’s immune system from attacking the tumor. The presence of MDSC in the tumor microenvironment and/or circulating in the patient’s blood predict for more advanced disease, resistance to immunotherapy and a worse patient survival.

4

INKmune: Our NK cell Directed Product Candidate

INKmune is our lead product candidate that converts resting NK cells into primed NK cells, an essential step in them becoming activated cancer-killing NK cells. We have shown this works ex vivo in human tissue cell cultures, and we believe that this will work in vivo which is the purpose of our planned clinical trials.

| ● | Cancers grow and relapse because they evade the immune system. NK cells are the most important cell for the elimination of residual disease that causes cancer relapse. NK cells target cells based on a series of complex antigens on the cancer cell surface that signal the NK cells to activate and kill the cancer cell. We call these cancer antigens “priming signals” and “triggering signals” respectively. An NK cell must receive a series of multiple signals through a network of cell surface receptors constituting of both priming and triggering signals. Crucially, we have shown that the priming signals can be delivered independent of the triggering such that one cell, such as INKmune, may deliver priming signals and the patient cancer cell deliver the second set and induce killing. Cancer cells defective in priming signals evade NK killing so the cancer cell survives and grows. Both priming and triggering signals are not a single surface molecule on the NK cell, but a complex combination of signals from multiple cell surface ligands which lead to NK priming and triggering respectively. Cancer cells also express molecules which can inhibit NK cell priming and triggering and the final outcome of the NK-cancer cell conjugation is a balance of all of these signals. In summary, INKmune shifts that balance of stimulating and inhibitory signals to enhance the ability of resting NK cells to kill a wide range of patient cancers. [Sabry Lowdell Frontiers, North et al JI and Sabry et al JI and Tsirogianni et al AmJ Hematol]. This concept is shown in the schematic form in Figure 1 below. |

| ● | The main “job” of a cancer cell is to survive and grow. Unfortunately, the “successful” cancer cell ultimately kills the host. The first priority for survival is to evade NK cell killing. The vast majority, >98%, of cancer cells do this by downregulating expression of priming ligands. When an NK cell interrogates a cancer cell lacking sufficient priming signals the NK cell is unable to trigger lysis. This allows the cancer to evade NK cell killing to grow, and, we believe, is one of the causes of cancer relapse. | |

| ● | We have described the functional biology underlying the interaction of NK cells and cancer cells. We believe that we have learned to counteract the loss of the priming signals by artificially providing these signaling ligands to the resting NK cell by exposure to a proprietary tumor cell line which constitutively expresses them. We call this product candidate INKmune. When we deliver INKmune to a resting NK cell, it provides priming signals to convert the resting NK cell into a tumor primed NK cell (“TpNK”). TpNK are poised to kill any cancer cell that expresses adequate triggering ligands. Based on our extensive pre-clinical testing, we believe this covers a large and heterogenous array of primary human cancers including hematologic malignancies such as acute myelogenous leukemia, multiple myeloma, lymphoma, and solid tumors such as breast, prostate, renal, lung, and ovarian cancer. The TpNK binds to the cancer cell, becomes an activated NK cell that will kill the cancer cell that was previously resistant to NK cell killing. Based on the pre-clinical data, we believe INKmune will convert the patient’s resting NK cells to primed NK cells will allow the patient’s NK cells to kill their tumor. |

5

| ● | We believe there are advantages of NK cells primed with INKmune (TpNK) compared to cytokine primed NK cells (“LAK”) or monoclonal antibody targeted NK cells (“MabNK”). Both LAK and MabNK require the priming/targeting agent to be present at all times for the NK cell to be a cancer killing cell. As soon as the cytokine or Mab are removed, the NK cell becomes a resting NK cell that cannot kill the cancer cell. INKmune provides a sustained “on” switch even after the INKmune reagent has been removed. Once INKmune causes the resting NK cell to become a TpNK, the NK cell remains primed and ready to kill until its lytic capacity has been exhausted by lysis of tumor cells. The second advantage is that TpNK can prime resting NK cells by contact-dependent activation and thus enhance the initial INKmune-mediated priming. Third, TpNK do not require a specific target compared to MabNK. Trastuzumab (Herceptin™), a Mab targeting HER2 on breast cancer is an illustrative example. Women with HER2 positive breast cancer, 20% of all women with breast cancer, can be treated with and benefit from Herceptin immunotherapy. Unfortunately, the other 80% who are HER2 negative, have a worse survival rate because they can not avail themselves to Trastuzumab immunotherapy. INKmune may benefit the women with HER2 negative breast cancer. We believe the pre-clinical and clinical data using tumor primed NK cells indicates that signals delivered by cancer cells are adequate to provide priming and activation of NK cells to kill the cancer and possibly eliminate the need for MabNK. |

| ● | We have demonstrated TpNK killing of many tumor types in laboratory studies. Tumor priming is effective regardless of the source of the NK cells and in many types of tumors – both cell lines and primary tumors from patients. The principle of TpNK killing has also been demonstrated in two Phase I trials in patient with acute myelogenous leukemia (“AML”). These trials were not supported by us and used a first-generation personalized cell therapy product. In these trials, haplo-identical NK cells obtained from a first degree relative by leukapheresis were primed ex-vivo using a lysate of the parent cell line from which we derived INB16 - INKMune. Once the TpNK therapy has been produced and passed quality testing, the patient received conditioning therapy with chemotherapy (cyclophosphamide and fludarabine), the primed haplo-identical NK cells were given to patients by intravenous infusion. Two Phase I clinical trials have been performed using the first-generation treatment strategy. An investigator initiated trial performed at the Royal Free Hospital in London 2009 was funded by a UK charity. Fifteen patients with relapsed, high-risk AML were enrolled in the trial. Because of drop-out due to disease progression, delays in product production and complications of conditioning therapy, only 7 of the fifteen patients were treated with the TpNK cell product. Four of seven patients showed clear benefit from the treatment with the TpNK product with prolonged relapse free remission and, in one patient, conversion of a partial remission to full remission. None of the remissions were durable; all patients ultimately died from disease progression. The safety of the product was found to be a combination of toxicity from the chemotherapy conditioning regimen and the TpNK therapy. In general, the complications were well tolerated although did require medical intervention including prolonged periods of aplasia in two heavily pretreated patients that resolved with supportive care. The results of this study have been published in a medical journal (PLoS One. 2015 Jun 10;10(6):e0123416. doi: 10.1371/journal.pone.0123416. eCollection 2015). In 2013, a second open label, multi-center trial was performed in the US using virtually the same product and procedures but targeting a slightly different patient population. In the second trial, 12 patients in first remission with AML were treated with the haplo-identical TpNK product produced using the first generation ex-vivo priming process. After conditioning with chemotherapy, the patients received TpNK in three dosing cohorts – 3x10^5, 1x10^6 or 3x10^6 TpNK per kilogram. Patients were followed for safety and relapse free survival. This trial confirmed the safety of the TpNK treatment in patients with AML and reinforced many of the efficacy findings seen in the first trial with none of the previously experienced side effects. Patients benefited from haplo-identical TpNK therapy with prolonged relapse free survival including two patients that remain in remission more than 42 months after treatment. This trial has been published. (Biol Blood Marrow Transplant. 2018 Mar 26. pii: S1083-8791(18)30132-0. doi: 10.1016/j.bbmt.2018.03.019.) The results of the laboratory and Phase I studies provide evidence that our strategy for treating residual disease is sensible but unproven. | |

| ● | Because INKmune primes NK cells to target naturally occurring antigens, we believe INKmune can be used in to treat a wide variety of cancers including hematologic malignancy (AML, MM, CML, high risk MDS) and solid tumors (renal, prostate, breast, ovarian, pancreas and lung). We expect the list of INKmune sensitive tumors to continue to expand. | |

| ● | The primary role for INKmune will be an immunotherapy targeting residual disease in patients after debulking cancer therapies such as cytotoxic chemotherapy and surgery. At this time, we plan to give INKmune as monotherapy. We do not rule out the possibility of using INKmune as part of combination therapy in the future. We do not expect to need to modify INKmune to treat these additional types of cancer, because we believe INKmune is a universal cancer therapy where “one size fits all”. We believe for INKmune to receive regulatory approval for each cancer indication, clinical trials will need to be performed which demonstrate its safety and effectiveness as a treatment for each such cancer. We believe the difficulty and cost of achieving these labels extensions will decline with each successive approval, if and when achieved. For example, if INKmune is proven to be effective therapy in patients with ovarian cancer and high-risk MDS, we will need to perform separate pivotal trials for approval in lung, prostate or renal cancer. |

6

Three step process to preparation for INKmune human clinical trials:

INKmune GMP scale-up for Phase I/II clinical material

We contracted with Advent Bioservices, a contract manufacturing organization, to produce the master cell bank for INKmune using good manufacturing practice, or GMP, clinical material. Advent Bioservices used GMP manufacturing facilities leased from the Centre of Cell, Gene and Tissue Therapeutics (“CCGTT”) at the Royal Free Hospital. The working cell banks and individual INKmune product to be used in the patients for the clinical trial will be produced at the Royal Free Hospital in the CCGTT to full cGMP (MHRA MIA(IMP)11149). All manufacturing has been under the direction of Professor Mark Lowdell. The Company is able to produce enough INKmune to complete both Phase I clinical trials in women with ovarian cancer and in patients with high-risk MDS as required and in advance. We have validated storage of INKmune for up to 12 months in vapour phase nitrogen and have a fully scalable, closed system manufacturing process which can produce up to 6 patient doses per week during phase I and II trials. At intermediate scale we can manufacture 40 doses per week in a single 80 litre bioreactor. Importantly, we have validated the storage of INKMune at -80oC for up to three months which greatly facilitates the delivery and local storage of the drug for clinical trials and post commercialization. In contrast, all other NK cell therapies and T cell therapies require complex shipping of drug products in vapor phase nitrogen below -150oC and specialized arrangements for ongoing storage at the clinical sites. We may need additional INKmune for future clinical trials. Planning for site of manufacture and the financing for that manufacturing has not been made at this point.

INKmune Biomarker Development Program

We have discovered two biomarker strategies that we believe can be used to demonstrate: i) who should receive INKmune therapy; ii) if the INKmune therapy is working; and iii) when INKmune therapy should be repeated. For the initial Phase I/II trials in patients with ovarian cancer, we expect the biomarker testing will be performed in a single laboratory under our direction. In the near future, we will develop assay systems with standard operating procedures to ensure uniform testing of the biomarker across clinical sites. This will facilitate expansion of the clinical programs to multiple sites. We anticipate that, in the future, the biomarker program may be a surrogate marker for both clinical effectiveness and marketing purposes.

Interaction with Regulatory Authorities Regarding INKmune Development

We met with the Medicines and Healthcare Products Regulatory Agency (“MHRA”), the UK version of the FDA as part of a Scientific Advice Meeting in September 2017. The purpose of the meeting was to explain to the MHRA our manufacturing process and clinical plan for the development of INKmune in a Phase I/II trial in relapse/refractory ovarian cancer. We submitted a Clinical Trial Authorization (“CTA”) in the fourth quarter of 2018 to support the ovarian cancer Phase I/II trial in the United Kingdom, which was accepted on December 18, 2018. We are in the process of completing the steps to open two clinical sites to perform the Phase I portion of the clinical trial and the protocol modification for the phase I-only trial will be submitted to MHRA for approval in Q1 2020. We have not chosen sites for the Phase II portion of the clinical trial.

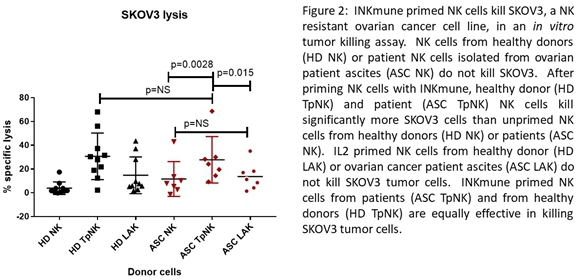

INKmune Product Development Path Proposed Phase I Study in patients with ovarian cancer

During 2020, we plan to initiate an open label Phase I cancer study in patients with ovarian carcinoma. Patients will be enrolled who have a low burden of relapse refractory disease and have peripheral blood or ascites NK cells which can respond to INKmune in a laboratory test on NK function. The study design agreed upon after discussion with the MHRA on September 12, 2017 was for a two-step Phase I/II study but this has been modified to an classic Phase I study followed by a randomized phase II. At present we anticipate the Phase I to be performed under the modified CTA at a single UK site, Sheffield University Hospital. We expect to initiate trial by the third quarter of 2020.In the Phase I trial, women with relapse refractory ovarian cancer will be treated with INKmune, given as an intra-peritoneal infusion through an indwelling peritoneal catheter in a traditional open label study to demonstrate safety and determine the dose of INKmune to be carried into the larger Phase II portion of the study. Based on pre-clinical studies that indicate that women with relapsed/refractory ovarian cancer have NK cells in their peritoneal cavity that response to INKmune to kill SKOV3, an NK-resistant ovarian cell line, we believe intra-peritoneal delivery of INKmune will be therapeutically effective. Three clinical trials support this observation. Two clinical trials have been performed using the first generation haplo-identical TpNK product in patients with AML. Both of those studies have been published (PLoS One. 2015 Jun 10;10(6):e0123416. doi: 10.1371/journal.pone.0123416. eCollection 2015) and (Biol Blood Marrow Transplant. 2018 Mar 26. pii: S1083-8791(18)30132-0. doi: 10.1016/j.bbmt.2018.03.019.). In summary, the studies showed that TpNK therapy, when delivered by intravenous infusion after conditioning therapy, was effective in providing prolong remissions with a toxicity profile that was manageable. TpNK therapy has not been delivered via intraperitoneal infusion, but a similar treatment strategy is used for the delivery of TALL-104 cells. TALL-104 is a replication incompetent human MHC non-restricted cytotoxic T-cell leukemic cell line that has been extensively studied and used to treat a number of cancers. Currently, Galileo Research, an Italian biotech company, has used TALL-104 in a Phase II clinical trial to treat women with ovarian cancer (http://www.galileoresearch.it/en/pipeline/TALL-104.html). In that study, TALL-104 is delivered via intraperitoneal infusion. Although the efficacy of the therapy is not yet known, the therapy is well tolerated with toxicities mainly related to the infusion catheter, not related to the TALL-104 infusion. The primary end points of the INKmune Phase I trial are safety and determining the dose of INKmune to take into the Phase II portion of the clinical trial. The key secondary efficacy end-points to be studied are i) increased NK cell priming as determined by multicolor flow cytometry of NK cells from the patient; ii) increased NK cell killing of SKOV3 tumor in a bioassay as shown in Figure 2 below; and iii) a decrease in tumor burden as measured by CA125 levels in the blood. Once safety and the optimal INKmune dose have been determined, a randomized study of women treated with INKmune will be compared to a group of control patients who receive only standard of care. We expect to treat six patients in the Phase I portion of the trial, but this number can increase by as many as 18.

7

INKmune Product Development Path Proposed Phase I Study in patients with high risk MDS

During 2020, we plan to initiate an open label Phase I cancer study in patients with high risk myelodysplastic syndrome (MDS). Patients will be enrolled who have a low burden of disease after completion of conventional therapy and have peripheral blood NK cells which can respond to INKmune in a laboratory test of NK function. At present we anticipate the Phase I to be performed at a single UK site, University Hospital Southampton. A UK contract research organization has been appointed and we expect to initiate trial by the second quarter of 2020.In the Phase I trial, patients with detectable residual disease in bone marrow and/or peripheral blood (<15% blasts by conventional tests) will be treated with intravenous infusions of INKmune and monitored for changes in peripheral blood NK activation, NK function and changes in residual blast counts in blood and bone marrow. We and others have previously shown that MDS patients with inadequate NK function have statistically significantly poorer prognosis than matched patients with normal levels of NK function (Tsirogianni et al 2019) and we have shown in laboratory experiments that the functional activity of NK cells from MDS patients can be enhanced by exposure to INKmune. Moreover, INKmune-primed NK cells are not inhibited by the hypoxic conditions of the diseased bone marrow microenvironment.

INKmune Registration Studies and/or Partnering

After completion of proof-of-concept Phase II studies with INKmune, we will decide whether to continue to develop INKmune as a treatment for ovarian carcinoma indication and/or high risk MDS. Other solid cancers are of interest including nasopharyngeal cancer (“NPC”) which is a known target for NK cells and an important unmet clinical need in emerging markets such as mainland China. We expect to have biopharma partners participate in this decision. We may also seek to be acquired at this stage or partner INKmune. Although our development strategy is focused on North America and Europe, we believe INKmune will also be attractive for markets on the Pacific Rim, South Asia and South America, but will wait for partners to help with the development in those regions, however, at this time, we are not negotiating with any potential partners.

Importantly, we have published data demonstrating INKmune efficacy at priming allogeneic NK cells ex-vivo (described above) and this includes priming of NK cells differentiated from cord-blood derived hematopoietic stem cells (Domogala et al Cytotherapy 2017: 19:710-720). Numerous companies are developing therapeutic strategies using cord blood derived NK cell products and one or more may wish to partner with us to potentiate their product by co-incubation or co-administration with INKmune.

8

INKmune Regulatory Strategy

INKmune is a new therapy for the treatment of cancer that will need to be proven safe and effective by well-designed clinical trials that show a meaningful clinical benefit to patients. We believe that registration trials will need to be designed as randomized trials in patients with cancer where one group of patients received INKmune and another receive best available care. We received advice from the MHRA on September 12, 2017 on the design clinical trial for ovarian cancer. And have used that advice to plan both current phase I trials. We plan to perform the Phase I trials with INKmune in the United Kingdom under two clinical trials authorizations (“CTA”) – one for each indication. If either phase I elicits “positive” data we plan to open one or more Phase II programs to additional sites in the United Kingdom and the US. We will meet with the FDA once we have data from the Phase I trials. Because there are no therapies similar to INKmune approved in any market, we plan to take advantage of the regulatory opportunities afforded to therapies that treat small markets with a high unmet need. In the U.S., this includes Orphan Drug Designation and expedited programs for approval including Accelerated Approval, Breakthrough Therapy Designation, Fast Track Designation, and priority review (see “Government Regulation”). We cannot predict which of these programs we will benefit from, if any at all, without further discussions with the FDA. Similar programs exist in the EU with the European Medicines Agencies (“EMA”).

Emerging Market Opportunity

The cancer therapy market is large, diverse and competitive. Although the concept of immunotherapy with monoclonal antibodies has been around for more than 20 years, the concept that patient derived immunosuppressive factors was a barrier to effective cancer treatment was recently recognized and had its first therapy approved just four years ago (ipilimumab, Yervoy, BMS, March 2011). Since then, five additional “check point” inhibitors have been approved, but the market is in its infancy. Most of the focus on strategies for modulating tumor-based immunosuppression focus is on the adaptive immune system (“T-cells”). The role of, and the importance of manipulating the innate immune system has more recently become a target of therapeutic development. NK cells are part of the innate immune system and are critical in both tumor surveillance (prevention) and treatment (killing). MDSCs are part of the innate immune system that only appear once the patient has chronic inflammation, a common occurrence in patients with cancer. The main role of the MDSC is to protect the tumor from attack by the patient’s immune system. Because T-cell focused strategies do not have an effect on the innate immune system, patient’s receiving such treatments may fail to recruit half of the patient’s immune system, the innate immune system, to attack the patient’s cancer. Clinicians increasingly recognize that durable responses to cancer require a coordinated attack by the patient’s adaptive and innate immune system. Normalizing the response of the innate immune system requires eliminating the dysregulated innate immune response that decreases the patient’s ability to see and attack the cancer as well as mechanisms the protect the cancer from immunologic attack (effector and protector function respectively). INKmune primes NK cells to enable them to attack the tumor. INB03, by decreasing the proliferation and function of MDSC, will lessen the immunosuppressive shield that protects the tumor from immunologic attack and, through NK/DC crosstalk, recruit the adaptive immune system to the fight.

Challenges in the Market for Our Product Candidates

The market for new oncology therapies is busy, complicated and rapidly evolving. We will be competing with companies that are older, larger, better financed and have greater experience. There are two types of drug companies – development companies and commercial companies. Development companies take the risk of developing new products to proof-of-concept. Once proof-of-concept has been achieved, if the drug provides clinical benefit, the product is usually acquired by a commercial company, which completes the drug’s clinical development and markets the product. We are a development company which will seek to develop products such as INKmune from the bench to the bedside to demonstrate proof-of-concept. The goal for us is to successfully develop such products to the point where they are attractive targets for potential partners/acquirers.

According to a recent Markets and Markets report, the immunotherapy market is growing rapidly at an annual rate of over 13%. Recently, the market is biased towards T cell-based immunotherapies including bi-specific antibody therapies, checkpoint inhibitors and CAR-T cell-based therapies. There are substantial numbers of clinical trials that are focused on the adaptive immune system versus clinical trials that are focused on the innate immune system for the treatment of cancer. Our challenge will be to educate partners on the value of NK cell-based therapeutic strategies. The need to educate people of the importance of INB03 is equally challenging. At the academic level, there is recognition that therapies targeting MDSC are needed to improve the results of immunotherapies. Investors and potential partners are only now learning about MDSC. We will be responsible for educating them on the importance of MDSC and why INB03 may be an important addition to the oncologist’s armamentarium. We believe educating investors and partners about new therapeutic opportunities is an easier task than trying to differentiate our company from the many other cancer immunotherapy companies. We plan to use a combination of publication, presentation and investor relations to promote INKmune and INB03 and to educate the clinical, biopharma and investor community on the value of these novel therapeutic approaches.

9

INKmune Competition

Our industry is highly competitive and subject to rapid and significant technological change. Our potential competitors include large pharmaceutical and biotechnology companies, specialty pharmaceutical and generic drug companies, academic institutions, government agencies and research institutions. We believe that key competitive factors that will affect the development and commercial success of our product candidates are efficacy, safety, tolerability, reliability, price and reimbursement level. Many of our potential competitors, including many of the organizations named below, have substantially greater financial, technical and human resources than we do and significantly greater experience in the discovery and development of product candidates, obtaining FDA and other regulatory approvals of products and the commercialization of those products. Accordingly, our competitors may be more successful than us in obtaining FDA approval for and achieving widespread market acceptance of their drugs. Our competitors’ drugs may be more effective, or more effectively marketed and sold, than any drug we may commercialize and may render our product candidates obsolete or non-competitive before we can recover the expenses of developing and commercializing any of our product candidates. We anticipate that we will face intense and increasing competition as new drugs enter the market and advanced technologies become available. Further, the development of new treatment methods for the conditions we are targeting could render our drugs non-competitive or obsolete.

INKmune is an immunotherapy that harnesses the biology of NK cells for the treatment of cancer. There is a long list of immunotherapy strategies for the treatment of cancer and the immunotherapy for cancer market is growing rapidly. There are at least three ways to classify immunotherapy for cancer. The list below classifies immunotherapy strategies beginning with those that are most closely related to INKmune:

| 1. | Companies in the NK cell therapy business; | |

| 2. | Companies in the personalized immune-oncology business; and | |

| 3. | Companies in the precision immuno-oncology business. |

We are not aware of any approved treatments that are classified as NK cell therapies. We are aware of three public companies in the NK cell therapy business: NantKwest, Fate Therapeutics and Glycostem. These companies are developing products that involve replacing or supplementing NK cells of the patient for the treatment cancer. Their product requires extensive ex-vivo cell manipulations which, with respect to NantKwest and Fate Therapeutics, may include gene therapy. The next larger group of companies are in the personalized immuno-oncology business with products focused on T cell activation strategies. The most popular are the CAR-T cell therapies which are a patient specific ex-vivo gene therapy approach to a single disease (for example: pediatric ALL). CAR-T therapy has become wildly popular of late and includes many private companies, newer public companies such as Bluebird, Juno Therapeutics and Mustang Bio as well as established companies such as Novartis and Gilead. For many of the companies, CAR-T cell therapies is their only business. For the latter two, CAR-T cell therapies is a newly in-licensed program with marketing authorization in the US. Finally, the precision immune-oncology category also includes companies with anti-cancer antibody products and the newer “check-point” inhibitors. Antibody therapies are all about “illuminating” the cancer to the innate immune system (NK cells). Monoclonal antibodies were the original immunotherapy that drove the growth of well-known biopharma companies including Genentech/Roche, Amgen, Merck and others. Each of these products is disease specific (ie: treat only HER2+ breast cancer). Modern therapeutic antibodies are much more complicated bi-specific and tri-specific antibodies that attempt to connect the cancer with activated T-cells of the adaptive immune system. Check-point inhibitors are currently the most rapidly expanding product category in immuno-oncology. These CTLA-4 (ipilimumab) and PD-1 inhibitors (pembrolizumab and nivolumab) specifically block a mechanism that shields cancers from T-cell killing. The two companies in this business are Merck (pembrolizumab) and GSK (ipilimumab and nivolumab). There are many others trying to join this promising therapeutic area including large companies such as BMS and Roche.

10

There are a number of FDA approved drugs that improve the ability of the innate immune system (NK-cells) to treat cancer including mono-clonal antibody therapies (for example: Rituximab®; Avastin® and Herceptin® marketed by Roche/Genentech); and “check-point” inhibitors (Yervoy® and Opdivo®, BMS, Keytruda®, Merck and others). There is a large amount of development activity in the immune checkpoint inhibitor field from both pharmaceutical giants including AstraZeneca, Merck & Co, Pfizer, Merck KGaA, Roche, GSK, Novartis and Amgen and many start-ups, small companies and university spin-offs which have emerged in the past two years. Examples (in alphabetical order) include Agenus, Alligator Bioscience, Ambrx, AnaptysBio, argenx, Bioceros, BioNovion, Cellerant Therapeutics, Checkpoint Therapeutics, Compugen, CureTech, Enumeral, Five Prime Therapeutics, Genmab, GITR, ImmuNext, IOmet Pharma, iTeos Therapeutics, Jounce Therapeutics, KAHR Medical, Multimeric Biotherapeutics, Nativis, Orega Biotech, Pelican Therapeutics, Pieris Pharmaceuticals, Prima BioMed, Redx Pharma, Sorrento Therapeutics, Tesaro, TG Therapeutics, Theravectys and ToleroTech active in the field. The list of companies with poly-specific antibodies that attempt to link the cancer with a cytotoxic T cell is long, includes both private and public companies (Amgen, Xencor, F-Star, Merus and many others). Finally, two CAR-T cell therapies were just approved for the treatment of ALL – Kymriah™ (Novartis) and Yescarta™ (Gilead). We expect additional drugs to gain marketing authorization in the immune-oncology space.

To our knowledge, there are three companies with NK cell immunotherapies in development. NantKwest, (NASDAQ Global Select Market) is an early stage biotech company that is using a genetically engineering strategy of a NK cell line to produce a live, off-the-shelf NK cell product to treat a variety of cancers. The clinical data for this product is sparse at this time. Fate-NK 100 and Engineered hnCD16iNK from Fate Therapeutics are product candidates designed to replace or supplement NK cells in patients with cancer. Glycostem is a biotech company with proprietary technology for the differentiation and expansion of allogeneic NK cells from CD34+ hematopoietic stem cells from unused umbilical cord blood units. It has conducted a single trial in AML in a center in the Netherlands. The company has perfected its manufacturing process and expects to open clinical trials in myeloma in 2021.

To our knowledge, there are no innate immune check-point inhibitors in development that have the unique characteristics of INB03 that neutralize sTNF to: i) decreases the proliferation of MDSC; ii) decreasing local and systemic immunosuppression caused by MDSC by stopping production of immunosuppressive cytokines and; iii) improving NK/DC cross-talk to recruit the adaptive immune system to fight the cancer.

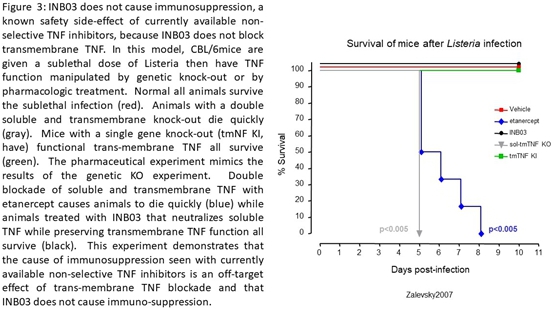

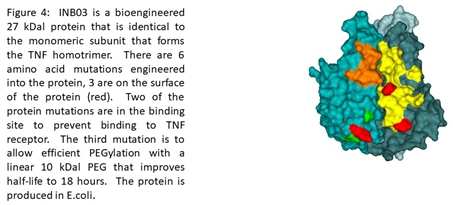

INB03 Competition

To our knowledge, there are no other innate immune system check-point inhibitors in development that combine the characteristics of decreasing the population and function of MDSC while promoting NK/DC crosstalk that expands and recruits the adaptive immune response to attack the patient’s tumor. Lilly is developing LY3022855, a human IgG1 monoclonal antibody designed to target the CSF1R that should inhibit MDSC from receiving CSF1 signals, decreasing their survival and relieving the effect of MDSC in the tumor. Daiichi Sankyo Inc., in collaboration with Bristol Myers Squibb, is testing DS-8273a, a TRIAL-R2 agonistic antibody in combination with a PDL1 inhibitor to decrease the number of MDSC in patients with colorectal cancer. Rgenix Inc., is developing RGX-104, an orally bioavailable small molecule immunotherapy that targets LXR (liver X Receptor). RGX-104 reportedly depletes MDSC. Syntrix Biosystems is developing SX-682. SX-682 is a small-molecule dual-inhibitor of CXCR1 and CXCR2, the chemokine receptors pivotal to tumor metastasis, therapy-resistance, and myeloid cell suppression of cancer surveillance by the adaptive immune system. By blocking the CXCR1/2 pathway, SX-682 may prevent recruitment of MDSC to the tumor microenvironment. The University of Minnesota has a trivalent antibody program aimed at treating patients with advanced hematologic malignancies. This CD16/IL-15/CD33 (161533) Tri-Specific Killer Engagers (TriKes) product may target CD33+ MDSC. Siamab Therapeutics is developing an anti-sialyl-Tn monoclonal antibody that targets MDSC in some tumor types. Clathera Biosciences, in collaboration with Incyte, a US based biotech, is developing CB-1158 (INCB01158), an arginase inhibitor to decreases MDSC. A Phase II clinical trial is open that combines CB-1158 with nivolumab, an anti-PD1 CPI marketed by Bristol Myers Squib. Reata Pharmaceuticals is testing omaveloxolone (RTA 408) in the phase Ib/II REVEAL trial in combination with either ipilimumab (Yervoy) or nivolumab (Opdivoo) in patients with advanced unresectable or metastatic melanoma. Currently approved non-selective TNF inhibitors, infliximab, etanercept, adalimumab and others, are not considered direct competitors of INB03 in the treatment of cancer because of their mechanism of action and safety side effects. Non- selective TNF inhibitors block the function of both sTNF and tmTNF. Blockade of tmTNF is immunosuppressive increasing the risk of infection and cancer in patients. This is shown in Figure 3 below where maintaining function to tmTNF by genetic or pharmacologic means results in an immunocompetent animal that can protect itself against infection. Blockade or knock-out of both sTNF and tmTNF results in death from infection.

11

Intellectual Property

The INKmune product candidate is protected by a family of patents pending in the United States Patent & Trademark Office (the “USPTO”), in the International Bureau of the World Intellectual Property Organization (“WIPO”) under the Patent Cooperation Treaty (“PCT”), and in patent offices for various foreign jurisdictions. We generally enter national stage under the PCT in Australia, Canada, Europe, and Japan, sometimes in China and/or Korea. The following table summarizes our pending and granted patent positions at the time of preparing this document:

INKmune (Cancer)

The INKmune product candidate is protected by a family of patents pending in the United States Patent & Trademark Office (“USPTO”), in the International Bureau of the World Intellectual Property Organization (“WIPO”) under the Patent Cooperation Treaty (“PCT”), and in patent offices for various foreign jurisdictions. We generally enter national stage under the PCT in Australia, Canada, Europe, and Japan, sometimes in China and/or Korea. The following table summarizes our pending and granted patent positions at the time of preparing this document:

| Patent/ Application |

Number | Name | Jurisdiction | Ownership | Type | Expiration Date | ||||||

| Application | 15/268,399 | “IN VIVO PRIMING OF NATURAL KILLER CELLS” | USA | Licensed | Method | TBD | ||||||

| Application | PCT/US2016/061835 | “IN VIVO PRIMING OF NATURAL KILLER CELLS” | PCT-GLOBAL | Licensed | Method | N/A | ||||||

| Application | CA3009171A | “IN VIVO PRIMING OF NATURAL KILLER CELLS” | CA | Licensed | Method | TBD | ||||||

| Application | EP16847576A | “IN VIVO PRIMING OF NATURAL KILLER CELLS” | EP | Licensed | Method | TBD | ||||||

| Application | 2018534524 | “IN VIVO PRIMING OF NATURAL KILLER CELLS” | JP | Licensed | Method | TBD | ||||||

| Application | PCT/US2018/022722 | “IN VIVO PRIMING OF NATURAL KILLER CELLS” | PCT-GLOBAL | Licensed | Method | N/A | ||||||

| Application | AU2018203469A | “IN VIVO PRIMING OF NATURAL KILLER CELLS” | AU | Licensed | Method | TBD | ||||||

| Application | CA3056631A | “IN VIVO PRIMING OF NATURAL KILLER CELLS” | CA | Licensed | Method | TBD | ||||||

| Application | CN201880028522A | “IN VIVO PRIMING OF NATURAL KILLER CELLS” | CN | Licensed | Method | TBD | ||||||

| Application | KR20197030017A | “IN VIVO PRIMING OF NATURAL KILLER CELLS” | KR | Licensed | Method | TBD | ||||||

| Application | EP18768024A | “IN VIVO PRIMING OF NATURAL KILLER CELLS” | EP | Licensed | Method | TBD | ||||||

| Application | 16/494,713 | “IN VIVO PRIMING OF NATURAL KILLER CELLS” | US | Licensed | Method | TBD |

12

INB03 (Cancer) & XPro1595 (Neurologic Diseases)

The patent suite for INB03 covers patents related to DN-TNF technology, including XPro1595. This patent suite continues to expand with active prosecution on use of INB03 in cancer and neurologic diseases. We will continue to expand the use of this therapy to other areas.

| Patent/ Application |

Number | Name | Jurisdiction | Ownership | Type | Expiration Date | ||||||

| Patent | US 7662367 | PHARMACEUTICAL COMPOSITIONS FOR THE TREATMENT OF TNF-ALPHA RELATED DISORDERS | USA | Licensed | Composition | 12/19/2026 | ||||||

| Patent | US 7446174 | PROTEIN BASED TNF-ALPHA VARIANTS FOR THE TREATMENT OF TNF-ALPHA RELATED DISORDERS | USA | Licensed | Composition | 8/9/2026 | ||||||

| Patent | EP 1578988 | PROTEIN BASED TNF-ALPHA VARIANTS FOR THE TREATMENT OF TNF-ALPHA RELATED DISORDERS | EPO | Licensed | Composition | 4/14/2025 | ||||||

| Patent | JP 4353802 | PROTEIN BASED TNF-ALPHA VARIANTS FOR THE TREATMENT OF TNF-ALPHA RELATED DISORDERS | JPO | Licensed | Composition | 4/14/2025 | ||||||

| Patent | US 7687461 | TREATMENT OF TNF-ALPHA RELATED DISORDERS WITH TNF-ALPHA VARIANT PROTEINS | USA | Licensed | Composition | 11/17/2026 | ||||||

| Patent | US 7244823 | TNF-ALPHA VARIANTS PROTEINS FOR THE TREATMENT OF TNF-ALPHA RELATED DISORDERS | USA | Licensed | Composition | 3/31/2024 | ||||||

| Patent | US 7056695 | NOVEL TNF-a VARIANTS | USA | Licensed | Composition | 3/2/2021 | ||||||

| Application | 14/427,279 | METHODS OF TREATING NEUROLOGICAL DISEASES | USA | Licensed | Method | TBD | ||||||

| Application | EP13766804A | METHODS OF TREATING NEUROLOGICAL DISEASES | EUROPE | Licensed | Method | TBD | ||||||

| Application | PCT/US2018/053227 | TREATMENT OF COMPLICATIONS RELATED TO ACUTE OR CHRONIC HYPERGLYCEMIA | USA | Jointly-Owned | Method | N/A | ||||||

| Application | 62/804,133 | METHODS FOR TREATING NEURO INFLAMMATION | USA | Owned | Method | N/A | ||||||

| Patent | US 10,543,264 | “CANCER PREVENTION AND THERAPY BY INHIBITING SOLUBLE TUMOR NECROSIS FACTOR” | US | Licensed | Method | 7/7/2038 | ||||||

| Application | 16/688,930 | “CANCER PREVENTION AND THERAPY BY INHIBITING SOLUBLE TUMOR NECROSIS FACTOR” | US | Licensed | Method | TBD | ||||||

| Application | 2016876541 | “CANCER PREVENTION AND THERAPY BY INHIBITING SOLUBLE TUMOR NECROSIS FACTOR” | EP | Licensed | Method | TBD | ||||||

| Application | 2016371907 | “CANCER PREVENTION AND THERAPY BY INHIBITING SOLUBLE TUMOR NECROSIS FACTOR” | AU | Licensed | Method | TBD | ||||||

| Application | 3006767 | “CANCER PREVENTION AND THERAPY BY INHIBITING SOLUBLE TUMOR NECROSIS FACTOR” | CA | Licensed | Method | TBD | ||||||

| Application | 20168073849 | “CANCER PREVENTION AND THERAPY BY INHIBITING SOLUBLE TUMOR NECROSIS FACTOR” | CN | Licensed | Method | TBD | ||||||

| Application | 1020187020449 | “CANCER PREVENTION AND THERAPY BY INHIBITING SOLUBLE TUMOR NECROSIS FACTOR” | KR | Licensed | Method | TBD | ||||||

| Application | 2018531185 | “CANCER PREVENTION AND THERAPY BY INHIBITING SOLUBLE TUMOR NECROSIS FACTOR” | JP | Licensed | Method | TBD |

13

Our commercial success depends in part on obtaining and maintaining patent protection and trade secret protection of our current and future product candidates and the methods used to manufacture them, as well as successfully defending these patents against third-party challenges. Our ability to stop third parties from making, using, selling, offering to sell or importing our products depends on the extent to which we have rights under valid and enforceable patents or trade secrets that cover these activities. We cannot assure you that our pending patent applications will result in issued patents.

| ● | “N/A” is used above with respect to provisional patent applications and international PCT patent applications, each of which is only temporary in nature, and does not mature into a valid enforceable patent by itself, but instead serves to establish a chain of priority rights for subsequently filed patent applications. | |

| ● | “TBD” is used above with respect to pending patent applications which are undergoing ordinary patent prosecution and may eventually issue as a valid enforceable patent. |

International PCT patent applications cover all 152 nations which are signatories of the PCT. However, our IP strategy generally recognizes the United States, United Kingdom, European Union, Canada, Japan, Australia and China as targets for extending patent protection under the PCT. Decisions regarding which countries to extend patent coverage under the PCT is taken on a case by case basis, subject to normal business considerations such as value and return on investment

On July 04, 2017, the USPTO allowed U.S. Trademark Serial No. 87/124,324 for the mark “INB16” in I.C. 001 & 005. We intend to complete registration upon use of the mark in commerce.

On February 21, 2017, the USPTO allowed U.S. Trademark Serial No. 87/124,324 for the mark “INKMUNE” in I.C. 001 & 005. We intend to complete registration upon use of the mark in commerce.

On February 03, 2020, we filed U.S. Trademark Application Serial No. 88/783,595 for the mark “INmune Bio” in I.C. 044. The Application remains pending and awaiting examination by a USPTO examining attorney.

Immune Ventures, LLC License Agreement

On October 29, 2015, we entered into an exclusive license agreement with Immune Ventures, LLC, the owner of all the rights related to our principal patent (the “Immune Ventures Agreement”). Pursuant to the Immune Ventures Agreement, we were granted exclusive worldwide, sub-licensable, royalty-bearing licenses (collectively “Patent Rights”) as well as all applications (the “Field”) of the Patent Rights, including rights to incorporate any improvements or additions to the patents that may be developed in the future to the following patents and patent applications:

Patent Applications:

| Property No. | Patent Application Serial No. | Filing Date: | Title: | |||

| (1) | US 62/219,652 | 09/16/2015 | IN VIVO ACTIVATION OF NATURAL KILLER CELLS | |||

| (2) | US 62/263,951 | 12/07/2015 | IN VIVO ACTIVATION OF NATURAL KILLER CELLS | |||

| (3) | US 15/268,399 | 09/16/2016 | IN VIVO PRIMING OF NATURAL KILLER CELLS | |||

| (4) | PCT/US2016/061835 | 11/14/2016 | IN VIVO PRIMING OF NATURAL KILLER CELLS | |||

| (5) | US 62/471,953 | 03/15/2017 | IN VIVO PRIMING OF NATURAL KILLER CELLS | |||

| (6) | CA 3,009,171 | 06/19/2018 | IN VIVO PRIMING OF NATURAL KILLER CELLS | |||

| (7) | EP 16847576.2 | 04/16/2018 | IN VIVO PRIMING OF NATURAL KILLER CELLS | |||

| (8) | JP 2018-534524 | 04/16/2018 | IN VIVO PRIMING OF NATURAL KILLER CELLS | |||

| (9) | PCT/US2018/022722 | 03/15/2018 | IN VIVO PRIMING OF NATURAL KILLER CELLS | |||

| (10) | AU 2018203469 | 05/16/2018 | IN VIVO PRIMING OF NATURAL KILLER CELLS | |||

| (11) | CA 3,056,631 | 03/15/2018 | IN VIVO PRIMING OF NATURAL KILLER CELLS | |||

| (12) | CN 201880028522 | 03/15/2018 | IN VIVO PRIMING OF NATURAL KILLER CELLS | |||

| (13) | KR 20197030017 | 03/15/2018 | IN VIVO PRIMING OF NATURAL KILLER CELLS | |||

| (14) | EP 18768024.4 | 03/15/2018 | IN VIVO PRIMING OF NATURAL KILLER CELLS | |||

| (15) | US 16/494,713 | 03/15/2018 | IN VIVO PRIMING OF NATURAL KILLER CELLS |

14

Patents:

| Property No. | Patent No. | Issue Date: | Title: | |||

| (N/A) | N/A | N/A | N/A |

In consideration for the Patent Rights, we agreed to the following milestone payments (of which none have been incurred as of December 31, 2019):

| Each Phase I initiation | $ | 25,000 | ||

| Each Phase II initiation | $ | 250,000 | ||

| Each Phase III initiation | $ | 350,000 | ||

| Each NDA/EMA filing | $ | 1,000,000 | ||

| Each NDA/EMA awarded | $ | 9,000,000 |

In addition, we agreed to pay the licensor a royalty of 1% of net sales during the life of each patent granted to us. The Licensor is owned by Raymond J. Tesi, our President and a member of our Board of Directors, David Moss, our Chief Financial Officer and Treasurer and Mark Lowdell, our Chief Scientific Officer. In countries where a claim of an issued and unexpired patent or a pending claim in a pending patent application within the Patent Rights exists a royalty of nine percent of net sales of each of each licensed product shall be paid for the remaining life of each patent on a country by country basis.

The term of the Immune Ventures Agreement began on October 29, 2015 and, if not terminated sooner pursuant to the agreement, ends on a country by country basis on the date of the expiration of the last to expire patent rights where patent rights exists. Subject to granting, prosecution-related patent term adjustments, and requirements for maintenance and renewals, the latest to expire patent is scheduled to expire on March 15, 2038 (“Natural Expiration”). Upon Natural Expiration of the Immune Ventures Agreement, we shall have a fully paid up, perpetual, royalty-free license without further obligation to Immune Ventures. The Immune Ventures Agreement can be terminated by Immune Ventures if, after 60 days from our receipt of notice that we have not made a payment under the Immune Ventures Agreement we still do not make this payment. Under the agreement and an amendment to the agreement dated July 20, 2018, we are required achieve the following milestones:

Initiation of Phase 1 clinical or equivalent trials by October 29, 2020

Initiation of Phase II clinical trials or equivalent by October 29, 2022;

Initiation of Phase III clinical trials or equivalent by October 29, 2024; and

Filing of NDA or equivalent by October 29, 2025 or equivalent.

If we don’t achieve the above milestones, we are required to negotiate in good faith with Immune Ventures to determine how we can either remedy the failure or achieve an alternate development. If we fail to make any required efforts or if the efforts do not remedy the situation within 60 days of written notice by Immune Ventures then Immune Ventures may provide notice to terminate the license or convert it to a non-exclusive license.

University of Pittsburg License Agreement

On October 3, 2017, the Company entered into an Assignment and Assumption Agreement with Immune Ventures related to intellectual property licensed from the University of Pittsburgh. Pursuant to the Assignment and Assumption Agreement (the “Assignment Agreement”), Immune Ventures assigned all of its rights, obligations and liabilities under an Exclusive License Agreement between the University of Pittsburgh – Of the Commonwealth System of Higher Education (“Licensor”) and Immune Ventures to INmune Bio (“Licensee”), (the “PITT Agreement”).

15

Consideration under the PITT Agreement includes: (i) annual maintenance fees, (ii) royalty payments based on the sale of products making use of the licensed technology, and (iii) milestone payments.

Annual maintenance fees under the PITT Agreement include: $5,000 due June 26 of each year 2020-2022; $10,000 due on June 26 of each year 2023-2024; and $25,000 due on June 26 of each year 2025 and annually thereafter until first commercial sale. The Company is current on its annual maintenance fees pursuant to the PITT Agreement.

| June 26 of each year 2020-2022 | $ | 5,000 | ||

| June 26 of each year 2023-2024 | $ | 10,000 | ||

| June 26 of each year 2025 until first commercial sale | $ | 25,000 |

Upon first commercial sale of a product making use of the licensed technology under the PITT Agreement, the Licensee is required to pay royalties equal to 2.5% of Net Sales each calendar quarter.

Moreover, under the PITT Agreement the Licensee is required to make milestone payments as follows:

| Each Phase I initiation | $ | 50,000 | ||

| Each Phase III initiation | $ | 500,000 | ||

| First commercial sale of product making use of licensed technology | $ | 1,250,000 |

The Company made a $50,000 milestone payment to the University of Pittsburgh in March 2019 as a result of the initiation of a Phase I clinical trial. The PITT Agreement expires upon the earlier of: (i) expiration of the last claim of the Patent Rights forming the subject matter of the PITT Agreement; or (ii) the date that is 20 years from the effective date of the agreement (June 26, 2037).

The Company may terminate the PITT Agreement upon 3 months prior written notice provided all payments under the license are current. Licensor may terminate the PITT Agreement upon written notice if: (i) the Company defaults as to performance of material obligations which have not been cured within 60 days after receiving written notice; or (ii) the Company ceases to carry out its business, becomes bankrupt or insolvent, applies for or consents to the appointment of a trustee, receiver or liquidator of its assets or seeks relief under any law for the aid of debtors.

Xencor License Agreement