| REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

LOMA NEGRA CORPORATION |

||

(Translation of Registrant’s name into English |

(Jurisdiction of Incorporation or organization) |

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

| * | Not for trading, but only in connection with the registration of American Depositary Shares pursuant to the requirements of the New York Stock Exchange. |

| Large accelerated filer | ☐ | ☒ | Non-accelerated filer |

☐ | Emerging growth company | |

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

| U.S. GAAP |

Accounting Standards Board ☒ |

Other ☐ |

| i | ||||||

| vi | ||||||

| PART I | 1 | |||||

| ITEM 1. | 1 | |||||

| A. |

1 | |||||

| B. |

1 | |||||

| C. |

1 | |||||

| ITEM 2. | 1 | |||||

| A. |

1 | |||||

| B. |

1 | |||||

| ITEM 3. | 1 | |||||

| A. |

1 | |||||

| B. |

1 | |||||

| C. |

1 | |||||

| D. |

1 | |||||

| ITEM 4. | 30 | |||||

| A. |

30 | |||||

| B. |

31 | |||||

| C. |

49 | |||||

| D. |

49 | |||||

| ITEM 4A. | 54 | |||||

| ITEM 5. | 54 | |||||

| A. |

55 | |||||

| B. |

82 | |||||

| C. |

86 | |||||

| D. |

86 | |||||

| E. |

86 | |||||

| ITEM 6. | 86 | |||||

| A. |

86 | |||||

| B. |

91 | |||||

| C. |

93 | |||||

| D. |

96 | |||||

| E. |

96 | |||||

| ITEM 7. | 97 | |||||

| A. |

97 | |||||

| B. |

98 | |||||

| C. |

99 | |||||

| ITEM 8. | 99 | |||||

| A. |

99 | |||||

| B. |

104 | |||||

| ITEM 9. | 104 | |||||

| A. |

104 | |||||

| B. |

104 | |||||

| C. |

104 | |||||

| D. |

104 | |||||

| E. |

104 | |||||

| F. |

104 | |||||

| ITEM 10. | 104 | |||||

| A. |

104 | |||||

| B. |

104 | |||||

| C. |

106 | |||||

| D. |

106 | |||

| E. |

109 | |||

| F. |

115 | |||

| G. |

115 | |||

| H. |

115 | |||

| I. |

115 | |||

| ITEM 11. | 115 | |||

| ITEM 12. | 116 | |||

| A. |

116 | |||

| B. |

116 | |||

| C. |

116 | |||

| D. |

116 | |||

| PART II | 118 | |||

| ITEM 13. | 118 | |||

| ITEM 14. | 118 | |||

| A. |

118 | |||

| B. |

118 | |||

| C. |

118 | |||

| D. |

118 | |||

| E. |

118 | |||

| ITEM 15. | 118 | |||

| ITEM 16. | 119 | |||

| ITEM 16A. | 119 | |||

| ITEM 16B. | 119 | |||

| ITEM 16C. | 119 | |||

| ITEM 16D. | 120 | |||

| ITEM 16F. | 122 | |||

| ITEM 16G. | 122 | |||

| ITEM 16H. | 123 | |||

| ITEM 16I. | 123 | |||

| 123 | ||||

| ITEM 17. | 123 | |||

| 123 | ||||

| ITEM 18. | 123 | |||

| 123 | ||||

| ITEM 19. | 123 | |||

| • | all references to “Loma Negra”, “our company”, “we”, “our”, “ours”, and “us”, or similar terms are to the registrant, Loma Negra Compañía Industrial Argentina Sociedad Anónima, a corporation organized as a Compa ñ í a Industrial Argentina Sociedad An ó nima |

| • | all references to “our controlling shareholder” or to the “InterCement Group” are to InterCement Participações S.A. and its subsidiaries; |

| • | all references to the “InterCement Brasil” are to InterCement Brasil S.A.; |

| • | all references to “Yguazú Cementos” are to Yguazú Cementos S.A.; |

| • | all references to “Cofesur” are to Cofesur S.A.U.; |

| • | all references to “Ferrosur” or “Ferrosur Roca” are to Ferrosur Roca S.A.; |

| • | all references to “Recycomb” are to Recycomb S.A.U.; |

| • | all references to “Argentina” are to the Republic of Argentina; |

| • | all references to “Paraguay” are to the Republic of Paraguay; |

| • | all references to the “Argentine government” or the “government” are to the federal government of Argentina; |

| • | all references to the “BCRA” or “Argentine Central Bank” are to the Argentine Central Bank ( Banco Central de la Rep ú blica Argentina) |

| • | all references to “CNV” refers to the Argentine securities regulator (Comisión Nacional de Valores); |

| • | all references to “U.S. dollars”, “dollars” or “US$” are to U.S. dollars; |

| • | all references to the “peso ” , , |

| • | all references to the “ Guaran í Guaran í es guaran í |

| • | all references to “IFRS” are to International Financial Reporting Standards, as issued by the International Accounting Standards Board, or the IASB; and |

| • | all references to “AFCP” are to the Argentine National Association of Portland Cement Producers ( Asociaci ó n de Fabricantes de Cementos Portland |

| • | general economic, political and business conditions, in Argentina, including government policies; |

| • | inflation, fiscal deficit, the devaluation of the peso and exchange rate risks in Argentina; |

| • | restrictions on the ability to exchange peso into foreign currencies and transfer funds abroad; |

| • | implementation of exchange controls and restrictions on capital inflows that limit credit availability; |

| • | government intervention in the Argentine economy; |

| • | developments in markets outside of Argentina that may indirectly affect the Argentine economy; |

| • | the duration and severity of the 2019 novel strain of coronavirus disease (SARS-CoV-2, “COVID-19”) outbreak and its impacts on our business and on the global and Argentine economy; |

| • | the cyclical nature of the cement industry; |

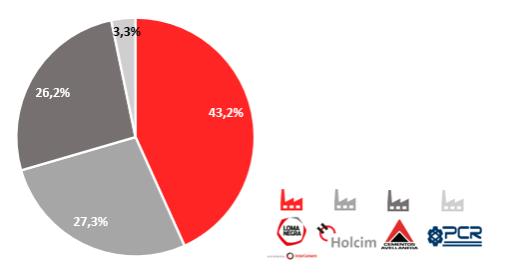

| • | the competitive nature of the industry in which we operate; |

| • | construction activity levels, particularly in the markets in which we operate; |

| • | price volatility of the raw materials we sell or purchase to use in our business; |

| • | the cost and availability of financing; |

| • | energy costs and shortages of electricity and government responses to them; |

| • | political instability or armed conflict in oil and natural gas producing regions, including the conflict in Ukraine, which increases energy costs; |

| • | transportation, storage and distribution costs; |

| • | our direction and future operation and implementation of our principal operating strategies; |

| • | the implementation of our financing strategy and capital expenditure plans; |

| • | our level of capitalization, including the levels of our indebtedness and overall leverage; |

| • | legal and administrative proceedings to which we are or become party (individually or jointly with our controlling shareholder); |

| • | existing and future governmental regulations, and our compliance therewith, including tax, labor, antitrust, pension and environmental laws and regulations in Argentina; |

| • | the estimation mistakes about the state of our mines and mineral reserves. |

| • | operational risks and insurance costs; |

| • | private investment and public spending in construction projects; |

| • | early termination of our public concessions; |

| • | industry trends and the general level of demand for, and change in the market prices of, our products and services; |

| • | market volatility and fluctuation of the price of our ADS; and |

| • | ongoing costs and risks associated with compliance with the Sarbanes-Oxley Act. |

ITEM 1. |

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

A. |

Directors and Senior Management |

B. |

Advisers |

C. |

Auditors |

ITEM 2. |

OFFER STATISTICS AND EXPECTED TIMETABLE |

A. |

Offer Statistics |

B. |

Method and Expected Timetable |

ITEM 3. |

KEY INFORMATION |

A. |

[Reserved] |

B. |

Capitalization and Indebtedness |

C. |

Reasons for the Offer and Use of Proceeds |

D. |

Risk Factors |

| • | aggravation of a financial crisis in several countries in the region; |

| • | abrupt changes in the monetary and fiscal policies of countries with prominent economies due to macroeconomic conditions; |

| • | increase in public expenses affecting the economy and fiscal deficits; |

| • | inconsistent fiscal and monetary policies; |

| • | uncertainty with respect to the Argentine public sector’s payment capacity and the potential for obtaining international financing; |

| • | low levels of investment; |

| • | changes in governmental economic or tax policies; |

| • | high levels of inflation; |

| • | abrupt changes in currency values; |

| • | high interest rates; |

| • | wage increases and price controls; |

| • | exchange and capital controls; |

| • | political and social unrest; |

| • | the growing effects of labor unions; |

| • | the significant price drop of main commodities exported by Argentina; |

| • | fluctuations in the BCRA reserves; |

| • | widespread illnesses or epidemics, including the COVID-19; and |

| • | restrictions on exports and imports. |

| • | downturns in general business and economic activity may cause demand for our products to decline; |

| • | when demand falls, we may be under competitive pressure to lower our prices; and |

| • | if we decide to expand our plants or construct new plants, we may do so based on an estimate of future demand that may never materialize or may materialize at levels lower than we predicted. |

| • | further negatively impact demand for cement, concrete and aggregates, or further lower market prices for our products, which could result in a continued reduction of our sales, operating income and cash flows; |

| • | make it more difficult or costly for us to obtain financing for our operations or investments or to refinance our debt in the future; |

| • | cause us to experience an increase in costs as a result of our emergency measures, delayed payments from our customers and uncollectable accounts; |

| • | impact our liquidity position and cost of and ability to access funds from financial institutions and capital markets; |

| • | cause delays and disruptions in the supply chain resulting in disruptions in the commercial operation dates of certain construction projects; |

| • | cause delays and disruptions in the construction of new cement facilities and the expansion of our existing facilities; |

| • | impair the financial condition of some of our customers, suppliers or counterparties, thereby increasing customer bad debts or nonperformance by suppliers or counterparties; |

| • | decrease the value of certain of our investments; and |

| • | cause other unpredictable events. |

| • | disasters or catastrophic events; |

| • | extreme weather conditions; |

| • | hostilities or political uncertainty; |

| • | strikes or other labor difficulties; |

| • | acts of terrorism; |

| • | widespread illnesses or epidemics, including the COVID-19 pandemic; and |

| • | other disruptions in means of transportation. |

| • | actual or anticipated changes in our results of operations, or failure to meet expectations of financial market analysts and investors; |

| • | investor perceptions of our prospects or our industry; |

| • | operating performance of companies comparable to us |

| • | increased competition in our industry; |

| • | new laws or regulations or new interpretations of laws and regulations applicable to our business; |

| • | general economic trends in Argentina; |

| • | departures of management and key personnel; |

| • | catastrophic events, such as earthquakes and other natural disasters; |

| • | widespread illnesses or epidemics, including the COVID-19 pandemic; and |

| • | developments and perceptions of risks in Argentina and in other countries. |

| • | the notice of such meeting; |

| • | voting instruction forms; and |

| • | a statement as to the manner in which instructions may be given by holders (including an express indication that such instructions may be deemed given upon the terms specified below). |

| • | the composition of our board of directors and, consequently, any determinations of our board with respect to our business direction and policy, including the appointment and removal of our executive officers; |

| • | determinations with respect to mergers, other business combinations and other transactions, including those that may result in a change of control; |

| • | whether dividends are paid or other distributions are made and the amount of any such dividends or distributions; |

| • | cause us to issue additional equity securities; |

| • | whether we limit the exercise of preemptive and accretion rights to holders of our ordinary shares in the event of a capital increase to the extent and terms permitted by the applicable law; |

| • | sales and dispositions of our assets; and |

| • | the amount of debt financing that we incur. |

ITEM 4. |

INFORMATION ON THE COMPANY |

A. |

History and Development of the Company |

B. |

Business Overview |

As of and for the Year Ended December 31, |

||||||||||||

2021 |

2020 |

2019 |

||||||||||

| Operating data (million tons annually) (1) |

||||||||||||

| Installed cement capacity |

||||||||||||

| Total installed cement capacity |

12.3 |

9.1 |

9.1 |

|||||||||

| Installed clinker capacity |

||||||||||||

| Total installed clinker capacity |

7.3 |

5.2 |

5.2 |

|||||||||

| Installed concrete capacity in Argentina (in m 3 ) |

0.8 | 0.9 | 1.2 | |||||||||

| Installed aggregates capacity in Argentina |

2.2 | 2.2 | 2.2 | |||||||||

| Installed lime capacity in Argentina |

0.5 | 0.5 | 0.5 | |||||||||

| Production volume (millions of tons): |

||||||||||||

| Cement, masonry and lime total |

6.0 |

5.1 |

5.4 |

|||||||||

| Clinker total |

4.1 |

2.9 |

3.6 |

|||||||||

| (1) | Annual installed capacity is based on a 365-day production per annum. |

| Name |

Location |

Annual Production of Clinker |

Annual Production of Cement, Masonry Cement and Lime |

|||||||

(in millions of tons) |

||||||||||

| Barker |

Benito Juárez | — | 0.1 | |||||||

| Catamarca |

El Alto | 0.7 | 1.1 | |||||||

| L’Amalí / LomaSer |

Olavarría/Vicente Casares |

2.6 | 2.5 | |||||||

| Olavarría |

Olavarría | 0.5 | 1.5 | |||||||

| San Juan |

San Juan | — | 0.2 | |||||||

| Zapala |

Zapala | 0.2 | 0.3 | |||||||

| Ramallo |

Ramallo | — | 0.3 | |||||||

| |

|

|

|

|||||||

| Total |

4.1 |

6.0 |

||||||||

| |

|

|

|

|||||||

| Name |

Production for the Year Ended December 31, |

|||||||||||

2021 |

2020 |

2019 |

||||||||||

(in millions of tons) |

||||||||||||

| Argentina: |

||||||||||||

| Barker |

0.1 | 0.1 | 0.1 | |||||||||

| Catamarca |

1.1 | 0.9 | 0.9 | |||||||||

| L’Amalí/ LomaSer |

2.5 | 2.0 | 2.2 | |||||||||

| Olavarría |

1.5 | 1.3 | 1.4 | |||||||||

| San Juan |

0.2 | 0.2 | 0.1 | |||||||||

| Zapala |

0.3 | 0.3 | 0.4 | |||||||||

| Ramallo |

0.3 | 0.3 | 0.2 | |||||||||

| Sierras Bayas (1) |

— | — | 0.1 | |||||||||

| |

|

|

|

|

|

|||||||

| Total |

6.0 |

5.1 |

5.4 |

|||||||||

| |

|

|

|

|

|

|||||||

(1) |

In 2021, considering the start-up of the new L’Amalí plant and also taking into account other micro and macroeconomic factors, the company decided to close permanently the Sierras Bayas Plant. |

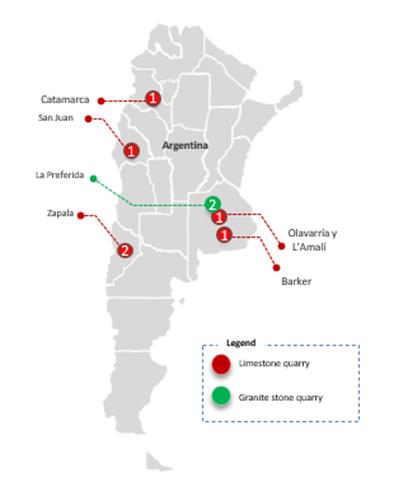

Active Mining Rights |

Inactive Mining Rights |

Total Proven & Probable |

Years to Depletion |

2021 Annualized Production |

5 year Average Annualized Production |

|||||||||||||||||||||||||||||

| Location |

Mining Property |

Number of quarries |

Proven (R1) |

Probable (R2) |

Probable (R2) |

|||||||||||||||||||||||||||||

(in millions of tons) |

(in thousands of tons) |

|||||||||||||||||||||||||||||||||

| Limestone: |

||||||||||||||||||||||||||||||||||

| Catamarca |

Doña Amalía | 1 | 53.6 | 56.2 | — | 109.8 | 81 | 1,353.2 | 1,355.1 | |||||||||||||||||||||||||

| San Juan |

Piedras Blancas | 1 | 0.3 | 0.3 | — | 0.6 | 8 | 21.6 | 71.7 | |||||||||||||||||||||||||

| Zapala |

El Salitral | 1 | 18.3 | 29.7 | — | 48.0 | 191 | 412.3 | 417.6 | |||||||||||||||||||||||||

| Cerro Bayo | 1 | 13.2 | 18.7 | — | 31.9 | |||||||||||||||||||||||||||||

| Barker |

Barker | 1 | 44.5 | 27.0 | — | 71.5 | 146 | 331.6 | 489.1 | |||||||||||||||||||||||||

| Olavarría and L’Amalí |

La Pampita y Entorno (Don Gabino - Los Abriles - SASII) | 1 | 591.4 | 35.3 | — | 626.7 | 134 | 5,674.4 | 4,691.7 | |||||||||||||||||||||||||

| Cerro Soltero I | — | — | — | 53.5 | 53.5 | — | — | — | ||||||||||||||||||||||||||

| Cerro Soltero II | — | — | — | 111.6 | 111.6 | — | — | — | ||||||||||||||||||||||||||

| El Cerro | — | — | — | 37.6 | 37.6 | — | — | — | ||||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total |

721.3 |

167.1 |

202.7 |

1,091.1 |

155 |

7,792.9 |

7,025.2 |

|||||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Granitic aggregates: |

||||||||||||||||||||||||||||||||||

| La Preferida |

2 | 61.8 | 54.2 | — | 116.0 | 114.9 | 960.9 | 1,009.6 | ||||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total |

61.8 |

54.2 |

— |

116.0 |

114.9 |

960.9 |

1,009.6 |

|||||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Region |

Sales |

Cumulative Sales |

||||||

(in percentages %) |

||||||||

| Buenos Aires |

41 | 41 | ||||||

| Center |

24 | 65 | ||||||

| Northwest |

11 | 76 | ||||||

| Northeast |

9 | 85 | ||||||

| Cuyo |

8 | 93 | ||||||

| Patagonia |

7 | 100 | ||||||

| Subsidiary |

Equity Ownership Interest (%) |

Main activity | ||

| Ferrosur Roca S.A. (1) |

80.00 | Rail freight | ||

| Recycomb S.A.U |

100.00 | Waste recycling |

(1) |

Indirect ownership (through Cofesur S.A.U., in which we have a direct 100% equity ownership interest). |

| • | Argentine National Association of Portland Cement Producers ( Asociaci ó n de Fabricantes de Cementos Portland |

| • | Argentine Institute of Portland Cement ( Instituto Argentino de Cemento Portland |

| • | Argentine National Concrete Association ( Asociaci ó n Argentina de Hormig ó n Elaborado |

| • | Argentine National Association of Industrial Gas Consumers ( Asociaci ó n de Consumidores Industriales de Gas de la Rep ú blica Argentina |

| • | Argentine National Association of Energy Power Major Users ( Asociaci ó n de Grandes Usuarios de Energ í a El é ctrica de la Rep ú blica Argentina |

| • | Latin—American Railway Association (Asociación Latinoamericana de Ferrocarriles). |

| • | American Chamber of Commerce of United States in Argentina (Cámara de Comercio de Estados Unidos en Argentina). |

| • | Argentine Business Council for Sustainable Development (Consejo Empresario Argentino para el Desarrollo Sostenible). |

| • | Argentine Chamber of Importers (Cámara Argentina de Importadores). |

| • | Chamber of environmental companies (Cámara de empresas de medio ambiente). |

| • | Inter-American Cement Federation (FICEM) |

| • | Argentine Technology Concrete Association ( Asociación Argentina de Tecnología del Hormigón |

C. |

Organizational Structure |

(1) |

Indirect ownership (through Cofesur SAU, in which we have a direct 100% equity ownership interest) |

D. |

Property, Plants and Equipment |

| Production Facility |

Type of Plant |

Location |

Commissioning Year |

|||||||||

| Argentina: |

||||||||||||

| North-east: |

||||||||||||

| Resistencia |

Warehouse | Resistencia | 2013 | |||||||||

| Center-east: |

||||||||||||

| Barker |

Cement | Benito Juárez | 1956 | |||||||||

| L’Amalí |

Cement | Olavarría | 2001 | |||||||||

| LomaSer |

Blending/Distribution | Cañuelas | 2000 | |||||||||

| Olavarría |

Cement | Olavarría | 1929 | |||||||||

| Ramallo |

Grinding Mill | Ramallo | 1998 | |||||||||

| Paraná |

Warehouse | Paraná | ||||||||||

| Patagonia: |

||||||||||||

| Zapala |

Cement | Zapala | 1970 | |||||||||

| Cuyo: |

||||||||||||

| San Juan |

Cement | San Juan | 1963 | |||||||||

| Mendoza |

Warehouse | Palmira | 2020 | |||||||||

| North-west: |

||||||||||||

| Catamarca |

Cement | El Alto | 1980 | |||

| Salta |

Warehouse | Salta | 2020 | |||

| Concrete plants under the Lomax brand: |

||||||

| Don Torcuato |

Concrete | Greater Buenos Aires area |

1998 | |||

| Sola |

Concrete | City of Buenos Aires | 1998 | |||

| Llavallol |

Concrete | Greater Buenos Aires area |

1998 | |||

| Uriburu |

Concrete | Rosario | 2010 | |||

| San Lorenzo |

Concrete | Santa Fe area | 2016 | |||

| Darsena F 1 |

Concrete | City of Buenos Aires | 2017 | |||

| Darsena F 2 |

Concrete | City of Buenos Aires | 2018 | |||

| Vicente Casares |

Concrete | Greater Buenos Aires area |

2018 | |||

| Escobar |

Concrete | Greater Buenos Aires area |

2020 | |||

| Dock Sud |

Concrete | Greater Buenos Aires area |

2021 | |||

| Aggregates plant: |

||||||

| La Preferida |

Aggregates | Olavarría | 2004 | |||

| (1) | Railway segment we actively use. |

ITEM 4A. |

UNRESOLVED STAFF COMMENTS |

ITEM 5. |

OPERATING AND FINANCIAL REVIEW AND PROSPECTS |

A. |

Operating Results |

As of and for the Year Ended December 31, |

||||||||||||

2021 |

2020 |

2019 |

||||||||||

| GDP (billions of Ps.) |

688.6 | 624.5 | 693.0 | |||||||||

| Real GDP growth |

10.3 | % | (9.9 | )% | (2.1 | )% | ||||||

| GDP per capita (in thousands of U.S. dollars) |

10.6 | 8.6 | 9.9 | |||||||||

| Private consumption growth |

10.2 | % | (13.1 | )% | (6.4 | )% | ||||||

| Average Ps./U.S. dollar exchange rate (1) |

95.2 | 70.6 | 48.2 | |||||||||

| CPI inflation |

50.9 | % | 36.1 | % | 53.8 | % | ||||||

| Private sector salary growth |

55.2 | % | 34.4 | % | 44.3 | % | ||||||

| Unemployment rate (2) |

7.0 | % | 11.0 | % | 8.9 | % | ||||||

| (1) | The average rate is calculated by using the average of the BCRA’s reported exchange rates on a daily basis. |

| (2) | As a percentage of Argentina’s economically active population. |

Official Nominal Exchange Rates |

||||||||||||||||

High (1) |

Low (1) |

Average (1)(2) |

Period-end (1) |

|||||||||||||

| 2017 |

18.8300 | 15.1742 | 16.5665 | 18.7742 | ||||||||||||

| 2018 |

40.8967 | 18.4158 | 28.0937 | 37.8083 | ||||||||||||

| 2019 |

60.0033 | 37.0350 | 48.2423 | 59.8950 | ||||||||||||

| 2020 |

84.1450 | 59.8152 | 70.5941 | 84.1450 | ||||||||||||

| 2021 |

102.7500 | 84.7033 | 95.1615 | 102.7500 | ||||||||||||

| 2022 |

||||||||||||||||

| January 2022 |

105.0150 | 103.0400 | 103.9846 | 105.0150 | ||||||||||||

| February 2022 |

107.4417 | 105.1350 | 106.3071 | 107.4417 | ||||||||||||

| March 2022 |

110.9783 | 107.9350 | 109.4585 | 110.9783 | ||||||||||||

| April 27, 2022 |

115.0050 | 111.1250 | 113.1100 | 115.0050 | ||||||||||||

| (1) | Reference exchange rate published by the Argentine Central Bank. |

| (2) | Based on daily averages. |

| • | Turnover Tax |

| • | Quarry Exploitation Fee |

| • | Tax on Bank Accounts Debits and Credits |

| • | Stamp Tax |

| • | Personal Assets Tax. |

| • | Level 1: quoted (unadjusted) market prices in active markets for identical assets or liabilities that the entity can access at the measurement date; |

| • | Level 2: valuation techniques for which the lowest level input that is significant to their value measurement is directly or indirectly observable; and |

| • | Level 3: valuation techniques for which the lowest level input that is significant to the fair value measurement is unobservable. |

| (i) | we expect to realize the asset or intend to sell or consume it during its normal operation cycle; |

| (ii) | we maintain the asset primarily for trading purposes; |

| (iii) | we expect to realize the asset within twelve months after the reporting period; or |

| (iv) | the asset is cash or cash equivalents unless the asset is restricted and may not be exchanged or used to settle a liability for at least twelve months after the reporting period. |

| (i) | we expect to settle the liability during its normal operation cycle; |

| (ii) | we maintain the liability primarily for trading purposes; |

| (iii) | the liability must be settled within the twelve months after the reporting period; or |

| (iv) | we do not have an unconditional rights to defer settlement of the liability for at least the twelve months after the reporting period. |

| • | IFRS 3 Reference to the Conceptual Framework |

| • | IAS 16 Proceeds before Intended Use of Property, Plant and Equipment |

| • | IAS 37 Cost of Fulfilling an Onerous Contract |

| • | IFRS 1—First-time Adoption of IFRS by a subsidiary |

| • | IFRS 9 Fees in the ‘10 per cent’ Test for Derecognition of Financial Liabilities |

| • | IFRS 16 Lease Incentives |

| • | IAS 41 Taxation in Fair Value Measurement |

| • | IAS 1—Classification of Liabilities as Current or Non-Current |

| • | IFRS 17 Insurance Contracts |

| • | IAS 1 and IFRS 2 Practice Statement—Disclosure of Accounting Policies |

| • | IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors |

| • | IAS 12 Income Tax |

| • | IFRS 9, IFRS 7, IFRS 4, IFRS 16, and IAS 39 Interest Rate Benchmark Reform |

| • | revenue recognition; |

| • | goodwill; |

| • | investments in other companies; |

| • | leases; |

| • | foreign currency and functional currency; |

| • | borrowing costs; |

| • | taxation; |

| • | property, plant and equipment; |

| • | intangible assets; |

| • | impairment of tangible and intangible assets; |

| • | inventories; |

| • | provisions; |

| • | financial instruments; |

| • | financial assets; |

| • | Ferrocarril Roca management trust; |

| • | financial liabilities and equity instruments; |

| • | environmental restoration; |

| • | short- and long-term employee benefits; and |

| • | stripping costs and quarry exploitation. |

| • | Raw materials and spare parts: at cost using the weighted average price method. Cost is determined at each of our plants. |

| • | Finished goods and work in progress: at the cost of direct materials and labor plus a proportion of manufacturing overheads based on normal operating capacity, but excluding borrowing costs. |

| • | The rights to receive cash flows from the asset have expired, or |

| • | We have transferred our rights to receive cash flows from the asset or have assumed an obligation to pay the received cash flows in full without material delay to a third party under a ‘pass-through’ arrangement; and either: a) we have transferred substantially all risks and rewards of the asset or b) we have neither transferred nor retained substantially all the risks and rewards of the asset, but has transferred control of the asset. |

| • | Such designation eliminates or significantly reduces a measurement or recognition inconsistency that would otherwise arise; or |

| • | Financial liabilities are part of a group of financial assets or liabilities or both, which is managed and whose performance is assessed on the basis of fair value, in accordance with the Group’s documented risk management or investment strategy, and information about the Group is provided internally on that basis; or |

| • | They are part of a contract containing one or more embedded derivatives, and IFRS 9 allows the entire combined contract to be carried at fair value through profit and loss. |

For the Year Ended December 31, |

||||||||||||

2021 |

2020 |

2019 |

||||||||||

(in percentages) |

||||||||||||

| Salaries, wages and social security charges |

15.8 | 17.6 | 18.8 | |||||||||

| Thermal energy |

13.7 | 11.1 | 16.6 | |||||||||

| Depreciation |

11.8 | 12.5 | 10.2 | |||||||||

| Freight |

10.3 | 8.8 | 7.1 | |||||||||

| Electrical power |

9.8 | 9.3 | 10.5 | |||||||||

| Preservation and maintenance costs |

9.3 | 9.3 | 9.5 | |||||||||

| Contractors |

7.4 | 6.6 | 7.9 | |||||||||

| Packaging |

4.1 | 4.9 | 3.9 | |||||||||

| Taxes, contributions and commissions |

2.0 | 2.0 | 1.8 | |||||||||

| Fees and compensation for services |

2.0 | 2.1 | 1.9 | |||||||||

| Transport and travelling expenses |

0.7 | 0.7 | 0.7 | |||||||||

| Security |

0.5 | 0.7 | 0.6 | |||||||||

| Employee benefits |

0.4 | 0.4 | 0.4 | |||||||||

| Insurance |

0.3 | 0.3 | 0.3 | |||||||||

| Leases |

0.1 | 0.1 | 0.2 | |||||||||

| Communications |

0.1 | 0.1 | 0.1 | |||||||||

| Canon (concession fee) |

0.1 | 0.1 | 0.1 | |||||||||

| Data processing |

0.0 | 0.0 | 0.1 | |||||||||

| Tolls |

0.0 | 0.4 | 0.0 | |||||||||

| Water, natural gas and energy services |

0.0 | 0.0 | 0.0 | |||||||||

| Others |

1.4 | 1.3 | 1.3 | |||||||||

| |

|

|

|

|

|

|||||||

| Production expenses |

89.9 |

88.3 |

92.0 |

|||||||||

| |

|

|

|

|

|

|||||||

| Cost of sales |

100 |

100 |

100 |

|||||||||

| |

|

|

|

|

|

|||||||

For the Year Ended December 31, |

||||||||||||

2021 |

2020 |

2019 |

||||||||||

(in percentages) |

||||||||||||

| Taxes, contributions and commissions |

24.9 | 25.4 | 26.2 | |||||||||

| Salaries, wages and social security charges |

22.7 | 24.8 | 29.3 | |||||||||

| Freight |

15.3 | 13.2 | 9.9 | |||||||||

| Managers, directors and trustees’ fees |

7.4 | 8.4 | 8.5 | |||||||||

| Depreciation and amortization |

5.9 | 8.3 | 6.1 | |||||||||

| Fees and compensation for services |

5.9 | 8.4 | 6.1 | |||||||||

| Advertising expenses |

4.9 | 2.2 | 2.2 | |||||||||

| Allowance for doubtful accounts |

3.1 | 0.2 | 1.7 | |||||||||

| Data processing |

2.9 | 1.8 | 2.0 | |||||||||

| Insurance |

2.3 | 2.2 | 1.5 | |||||||||

| Employee benefits |

0.8 | 1.0 | 1.0 | |||||||||

| Communications |

0.7 | 0.9 | 0.9 | |||||||||

| Transport and travelling expenses |

0.5 | 0.6 | 1.5 | |||||||||

| Leases |

0.4 | 0.4 | 0.6 | |||||||||

| Preservation and maintenance costs |

0.2 | 0.3 | 0.5 | |||||||||

| Security |

0.2 | 0.2 | 0.2 | |||||||||

| Water, natural gas and energy services |

0.1 | 0.1 | 0.1 | |||||||||

| Others |

1.7 | 1.7 | 1.7 | |||||||||

| |

|

|

|

|

|

|||||||

| Total selling and administrative expenses |

100 |

100 |

100 |

|||||||||

| |

|

|

|

|

|

|||||||

For the Year Ended December 31, |

Variation |

|||||||||||||||

2021 |

2020 |

Amount |

(%) |

|||||||||||||

(in millions of Ps., except percentages) |

||||||||||||||||

| Revenue |

73,668.1 | 62,826.8 | 10,841.3 | 17.3 | ||||||||||||

| Cost of sales |

(50,384.1 | ) | (43,812.9 | ) | (6,571.2 | ) | 15.0 | |||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Gross profit |

23,284.0 |

19,013.9 |

4,270.1 |

22.5 |

||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Losses from interest in companies |

0.0 | (609.5 | ) | 609.5 | n/a | |||||||||||

| Selling and administrative expenses |

(6,328.7 | ) | (5,214.5 | ) | (1,114.2 | ) | 21.4 | |||||||||

| Impairment of property, plant and equipment |

(152.8 | ) | (1,429.3 | ) | 1,276.5 | (89.3 | ) | |||||||||

| Other gains and losses |

209.4 | 222.2 | (12.8 | ) | (5.8 | ) | ||||||||||

| Tax on debits and credits to bank accounts |

(742.4 | ) | (738.7 | ) | (3.7 | ) | 0.5 | |||||||||

| Finance costs, net |

||||||||||||||||

| Exchange rate differences |

80.2 | 2,498.5 | (2,418.3 | ) | (96.8 | ) | ||||||||||

| Gain on net monetary position |

1,867.3 | 1,266.6 | 600.7 | 47.4 | ||||||||||||

| Financial income |

39.2 | 123.2 | (84.0 | ) | (68.2 | ) | ||||||||||

| Financial expenses |

(1,944.1 | ) | (2,276.6 | ) | 332.5 | (14.6 | ) | |||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Profit before taxes |

16,312.1 |

12,855.8 |

3,456.3 |

26.9 |

||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Income tax expense |

||||||||||||||||

| Current |

(6,638.5 | ) | (3,603.1 | ) | (3,035.4 | ) | 84.2 | |||||||||

| Deferred |

(3,329.3 | ) | 186.5 | (3,515.8 | ) | n/a | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Net profit from continuing operations |

6,344.3 |

9,439.2 |

(3,094.9 |

) |

(32.8 |

) | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Income from discontinued operations |

0.0 | 7,741.2 | (7,741.2 | ) | n/a | |||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Net profit |

6,344.3 |

17,180.4 |

(10,836.1 |

) |

(63.1 |

) | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| • | Cement, masonry cement and lime segment : Revenues from our cement, masonry cement and lime segment, without considering the eliminations between segments, increased Ps.8,569 million, from Ps.57,356 million in 2020 to Ps.65,925 million in 2021, mainly due to the increase of 18.7% in sales volume, and partially offset by an average sales price decrease of 3.1%. |

| • | Concrete segment: COVID-19 lock-down and economic uncertainty that impacted major private and public projects. |

| • | Railroad segment : Revenues from our railroad segment, without considering the eliminations between segments, increased Ps.553 million, from Ps.5,427 million in 2020 to Ps.5,980 million in 2021, mainly due to an increase of 14.1% in sales volume, mainly as a consequence of the rebound in frac-sand and building materials demand from last year drop due to Covid-19 restrictions, offseted by a decline of 3.4% in the average sales price. |

| • | Aggregates segment : Revenues from our aggregates segment, without considering the eliminations between segments, increased Ps.502 million, from Ps.606 million in 2020 to Ps.1,108 million in 2021, mainly due to an increase of 47.1% in sales volume and an average price increase of 24.3%. |

| • | Others segment : Revenues from Recycomb S.A.U., without considering the eliminations between segments, increased Ps.139 million, from Ps.306 million in 2020 to Ps.445 million in 2021. |

As of and for the Year Ended December 31, |

||||||||

2021 |

2020 |

|||||||

(in millions of Ps.) |

||||||||

| Purchases and production expenses for the year |

50,621.5 | 42,329.3 | ||||||

| (+) Inventories at the beginning of the year |

11,543.9 | 13,027.5 | ||||||

| (-) Inventories at the end of the year |

11,781.3 | 11,543.9 | ||||||

| |

|

|

|

|||||

| Cost of sales |

50,384.1 |

43,812.9 |

||||||

| |

|

|

|

|||||

| • | Cement, masonry cement and lime segment : |

| • | Concrete segment |

| • | Railroad segment |

| • | Aggregates segment: |

| • | Others segment: |

For the year ended December 31, |

||||||||

2021 |

2020 |

|||||||

(amounts in millions of Ps.) |

||||||||

| Profit from continuing operations before income tax expense |

16,311.9 | 12,855.8 | ||||||

| Profit from discontinued operations before income tax expense |

0.0 | 10,031.1 | ||||||

| Statutory rate |

35 | % | 30 | % | ||||

| Income tax at statutory rate |

(5,709.2 | ) | (6,866.1 | ) | ||||

| Adjustments for calculation of the effective income tax: |

||||||||

| Effect of derecognition of Yguazú Cementos S.A. |

0.0 | 970.0 | ||||||

| Impairment of recognized losses at Ferrosur Roca S.A. |

(237.2 | ) | (242.9 | ) | ||||

| Tax revaluation and inflation adjustment for accounting and tax purposes |

(169.7 | ) | 282.5 | |||||

| Change in tax rate (1) |

(3,857.9 | ) | 184.4 | |||||

| Other non-taxable income or non-deductible expense net |

6.2 | (34.5 | ) | |||||

| |

|

|

|

|||||

| Income tax expense |

(9,967.8 |

) |

(5,706.6 |

) | ||||

| |

|

|

|

|||||

| Income tax expense |

||||||||

| Current |

(6,638.5 | ) | (5,882.7 | ) | ||||

| Deferred |

(3,329.3 | ) | 176.2 | |||||

| |

|

|

|

|||||

| Total |

(9,967.8 |

) |

(5,706.6 |

) | ||||

| |

|

|

|

|||||

(1) |

Law No. 27.430 had set forth for the tax periods commencing as from January 1, 2020 that the tax rate payable by corporations as income tax would decrease from 30% to 25% and that the additional tax on dividends or earnings that are distributed to individuals in Argentina and abroad and foreign legal entities would rise from 7% to 13%. However, the Argentine Congress approved Law 27.630, which modifies: (i) the corporate tax rate for Argentine entities, by applying a sliding scale from 25% to 35%, depending on the accumulated net income obtained during the given year; and (ii) regardless of the applicable corporate tax rate, in all cases, dividends or profits will be levied at a 7% tax rate. |

For the Year Ended December 31, |

Variation |

|||||||||||||||

2020 |

2019 |

Amount |

(%) |

|||||||||||||

(in millions of Ps., except percentages) |

||||||||||||||||

| Revenue |

62,826.8 | 72,079.3 | (9,252.5 | ) | (12.8 | ) | ||||||||||

| Cost of sales |

(43,812.9 | ) | (52,386.0 | ) | 8,573.1 | (16.4 | ) | |||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Gross profit |

19,013.9 |

19,693.3 |

(679.4 |

) |

(3.4 |

) | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Loss from interest in companies |

(609.5 | ) | 0.0 | (609.5 | ) | n/a | ||||||||||

| Selling and administrative expenses |

(5,214.5 | ) | (5,743.7 | ) | 529.2 | (9.2 | ) | |||||||||

| Other gains and losses |

222.2 | 92.4 | 129.8 | 140.4 | ||||||||||||

| Impairment of property, plant and equipment |

(1,429.3 | ) | 0.0 | (1,429.3 | ) | n/a | ||||||||||

| Tax on debits and credits to bank accounts |

(738.7 | ) | (829.9 | ) | 91.2 | (11.0 | ) | |||||||||

| Finance costs, net |

||||||||||||||||

| Exchange rate differences |

2,498.5 | (2,453.3 | ) | 4,951.8 | (201.8 | ) | ||||||||||

| Gain on net monetary position |

1,266.6 | 2,291.0 | (1,024.4 | ) | (44.7 | ) | ||||||||||

| Financial income |

123.2 | 124.1 | (0.9 | ) | (0.7 | ) | ||||||||||

| Financial expenses |

(2,276.6 | ) | (3,083.2 | ) | 806.6 | (26.2 | ) | |||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Profit before taxes |

12,855.8 |

10,090.7 |

2,765.1 |

27.4 |

||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Income tax expense |

||||||||||||||||

| Current |

(3,603.1 | ) | (2,149.2 | ) | (1,453.9 | ) | 67.6 | |||||||||

| Deferred |

186.5 | (1,171.7 | ) | 1,358.2 | n/a | |||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Net profit from continuing operations |

9,439.2 |

6,769.8 |

2,669.4 |

39.4 |

||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Income from discontinued operations |

7,741.2 | 1,540.0 | 6,201.2 | 402.7 | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Net profit |

17,180.4 |

8,309.8 |

8,870.6 |

106.7 |

||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| • | Cement, masonry cement and lime segment : Revenues from our cement, masonry cement and lime segment, without considering the eliminations between segments, decreased Ps.2,856 million, from Ps.60,212 million in 2019 to Ps.57,356 million in 2020, mainly due to the decrease of 5.6% in sales volume, mostly explained by COVID-19 pandemic impacts, and partially offset by an average sales price increase of 0.9%. |

| • | Concrete segment: COVID-19 lock-down and economic uncertainty impacting major private and public projects, coupled with a lower average sales price of 19.9% as a consequence of softer demand. |

| • | Railroad segment : Revenues from our railroad segment, without considering the eliminations between segments, decreased Ps.2,066 million, from Ps.7,493 million in 2019 to Ps.5,427 million in 2020, mainly due to a decrease of 15.2% in sales volume, mainly as a consequence of the drop in the frac-sand and building materials transported volumes and a decline of 14.6% in the average sales price. |

| • | Aggregates segment : Revenues from our aggregates segment, without considering the eliminations between segments, decreased Ps.666 million, from Ps.1,272 million in 2019 to Ps.606 million in 2020, mainly due to a decline of 47.8% in sales volume and an average price decrease of 8.6%. |

| • | Others segment : Revenues from Recycomb S.A.U., without considering the eliminations between segments, decreased Ps.86 million, from Ps.392 million in 2019 to Ps.306 million in 2020. |

As of and for the Year Ended December 31, |

||||||||

2020 |

2019 |

|||||||

(in millions of Ps.) |

||||||||

| Purchases and production expenses for the year |

42,329.3 | 52,522.0 | ||||||

| (+) Inventories at the beginning of the year |

13,027.5 | 12,891.5 | ||||||

| (-) Inventories at the end of the year |

11,543.9 | 13,027.5 | ||||||

| |

|

|

|

|||||

| Cost of sales |

43,812.9 |

52,386.0 |

||||||

| |

|

|

|

|||||

| • | Cement, masonry cement and lime segment : COVID-19 pandemic, and lower costs in preservation and maintenance costs due to an adjustment of the main equipment´s overhauling schedule. |

| • | Concrete segment |

| • | Railroad segment : |

| • | Aggregates segment : |

| • | Others segment: |

For the year ended December 31, |

||||||||

2020 |

2019 |

|||||||

(amounts in millions of Ps.) |

||||||||

| Profit from continuing operations before income tax expense |

12,855.8 |

10,090.7 |

||||||

| Profit from discontinued operations before income tax expense |

10,031.1 |

1,684.6 |

||||||

| Statutory rate |

30 |

% |

30 |

% | ||||

| |

|

|

|

|||||

| Income tax at statutory rate |

(6,866.1 |

) |

(3,532.6 |

) | ||||

| Adjustments for calculation of the effective income tax: |

||||||||

| Effect of derecognition of Yguazú Cementos S.A. |

970.0 |

336.9 |

||||||

| Impairment of recognized losses at Ferrosur Roca S.A. |

(242.9 |

) |

0.0 |

|||||

| Tax revaluation |

282.5 |

(310.2 |

) | |||||

| Change in tax rate (1) |

184.4 |

(578.3 |

) | |||||

| Other non-taxable income or non-deductible expense net |

(34.5 |

) |

(1.7 |

) | ||||

| |

|

|

|

|||||

| Income tax expense |

(5,706.6 |

) |

(3,465.5 |

) | ||||

| |

|

|

|

|||||

| Income tax expense |

||||||||

| Current |

(5,882.7 |

) |

(2,267.2 |

) | ||||

| Deferred |

176.2 |

(1,198.3 |

) | |||||

| |

|

|

|

|||||

| Total |

(5,706.6 |

) |

(3,465.5 |

) | ||||

| |

|

|

|

|||||

(1) |

Law No. 27.430 had set forth for the tax periods commencing as from January 1, 2020 that the tax rate payable by corporations as income tax would decrease from 30% to 25% and that the additional tax on dividends or earnings that are distributed to individuals in Argentina and abroad and foreign legal entities would rise from 7% to 13%. The Law No. 27,541 postpones such change in tax rates and maintains the original 30% and 7% tax rates until the fiscal years starting on January 1, 2021, inclusive. However, the Argentine Congress approved Law 27.630, which modifies: (i) the corporate tax rate for Argentine entities, by applying a sliding scale from 25% to 35%, depending on the accumulated net income obtained during the given year; and (ii) regardless of the applicable corporate tax rate, in all cases, dividends or profits will be levied at a 7% tax rate. |

B. |

Liquidity and Capital Resources |

• |

our ability to generate cash flows from our operations; |

• |

the level of our outstanding indebtedness and the interest that we are obligated to pay on our indebtedness, which affect our net financial expenses; |

• |

prevailing domestic and international interest rates, which affect our debt service requirements; and |

• |

our capital expenditure requirements, which consist primarily of investments in our operations, maintenance, equipment and plant facilities. |

• |

working capital requirements; |

• |

the servicing of our indebtedness; and |

• |

capital expenditures related to investments in our operations, maintenance, equipment and plant facilities. |

For the Year Ended December 31, |

||||||||||||

2021 |

2020 |

2019 |

||||||||||

(in millions of Ps.) |

||||||||||||

| Net cash flows provided by (used in): |

||||||||||||

| Operating activities |

15,049.9 |

17,188.6 |

14,077.2 |

|||||||||

| Investing activities |

(8,845.1 |

) |

(2,157.7 |

) |

(24,109.7 |

) | ||||||

| Financing activities |

(8,759.6 |

) |

(15,853.9 |

) |

5,280.0 |

|||||||

| Effect of restating in constant currency of cash and cash equivalents |

(219.7 |

) |

(236.7 |

) |

(332.9 |

) | ||||||

| Effects of exchange rate differences on cash and cash equivalents in foreign currency |

(524.3 |

) |

4,984.1 |

397.1 |

||||||||

| |

|

|

|

|

|

|||||||

| Increase / (Decrease) in cash and cash equivalents |

(3,298.8 |

) |

3,924.4 |

(4,688.3 |

) | |||||||

| |

|

|

|

|

|

|||||||

December 31, 2021 |

||||||||||||||||||

Re. |

Company |

Rate |

Last maturity date |

Amount In millions Ps. |

||||||||||||||

| Loans in foreign currency - USD |

||||||||||||||||||

| Industrial and Commercial Bank of China |

(1) |

Loma Negra CIASA |

6-Month Libor + 4.25% |

Jan-22 |

91.8 |

|||||||||||||

| Industrial and Commercial Bank of China |

(1) |

Loma Negra CIASA |

6-Month Libor + 4.25% |

Feb-22 |

6.4 |

|||||||||||||

| Industrial and Commercial Bank of China |

(1) |

Loma Negra CIASA |

6-Month Libor + 4.25% |

Mar-22 |

41.6 |

|||||||||||||

| Industrial and Commercial Bank of China |

(2) |

Loma Negra CIASA |

6-Month Libor + 7.375% |

Jan-22 |

663.2 |

|||||||||||||

| Industrial and Commercial Bank of China |

(2) |

Loma Negra CIASA |

6-Month Libor + 7.375% |

Jan-22 |

731.8 |

|||||||||||||

| Industrial and Commercial Bank of China |

(3) |

Loma Negra CIASA |

3-Month Libor + 7.50% |

Nov-23 |

803.4 |

|||||||||||||

| |

|

|||||||||||||||||

| Total loans in foreign currency |

2338.2 |

|||||||||||||||||

| |

|

|||||||||||||||||

| Loans in local currency |

||||||||||||||||||

| Bank overdrafts |

Ferrosur Roca SA |

35.6% |

Jan-22 |

124.1 |

||||||||||||||

| Bank overdrafts |

Loma Negra CIASA |

35.6% |

Jan-22 |

48.8 |

||||||||||||||

| |

|

|||||||||||||||||

| Total loans in local currency |

172.9 |

|||||||||||||||||

| |

|

|||||||||||||||||

| Total |

2511.1 |

|||||||||||||||||

| |

|

|||||||||||||||||

(1) |

During the fiscal year ended December 31, 2020, Loma Negra C.I.A.S.A. received two disbursements of the loan agreement with Industrial and Commercial Bank of China Argentina S.A. for USD 40,919,350, the last principal payments of which maturing in January and February 2022. In addition, during the current fiscal year, we received an additional disbursement of USD 389,966, the last principal payment of which matures in March 2022. The loan accrues interest at adjusted LIBOR plus 4.25%. |

(2) |

During fiscal year 2020, Loma Negra C.I.A.S.A. signed a new loan agreement with Industrial and Commercial Bank of China for USD 13,127,766, payable upon maturity in January 2022. This loan accrues interest at adjusted LIBOR plus 7.375%, payable on a monthly basis. |

(3) |

In June 2016, Loma Negra signed a loan agreement with Industrial and Commercial Bank of China (Dubai) for a total amount of USD 50,000,000 to be paid in five equal, half-yearly installments with a one-year grace period as from the date of disbursement. Interest are accrued at a variable nominal interest rate on the basis of the LIBO rate to be paid on a quarterly basis. This loan requires the net debt / EBITDA ratio to be satisfied, which has always been satisfied from the execution of the loan. In May 2019, the Group extended the maturity dates of such loan. During the previous fiscal year we, in accordance with the lender, has amended the loan agreement and shall pay the outstanding principal in nine payments, the first one on October 2020 of USD 5,200,000 and eight more equal quarterly payments of USD 975,000, the last due in November 2023. As of December 31, 2021, the amount pending payment under this loan was Ps 803.375 million. |

Payments Due by Period |

||||||||||||||||||||

Total |

Less than 1 year |

1-3 years |

3-5 years |

More than 5 years |

||||||||||||||||

(in millions of Ps.) |

||||||||||||||||||||

| Financial borrowings (1) |

2,511.1 |

2,112.4 |

398.7 |

— |

— |

|||||||||||||||

| Accounts payable |

7,876.3 |

7,876.3 |

— |

— |

— |

|||||||||||||||

| Taxes payable |

3,345.4 |

3,345.4 |

— |

— |

— |

|||||||||||||||

| Salaries and social security contributions |

2,085.1 |

2,034.5 |

— |

50.5 |

— |

|||||||||||||||

| Lease liabilities |

314.7 |

79.5 |

105.4 |

82.1 |

47.7 |

|||||||||||||||

| Severance payment plans |

227.8 |

136.6 |

70.8 |

7.4 |

13.0 |

|||||||||||||||

| Other debts (2) |

74.7 |

23.3 |

— |

— |

51.4 |

|||||||||||||||

| Total |

16,435.1 |

15,608.1 |

574.9 |

140.0 |

112.1 |

|||||||||||||||

(1) |

Includes payments of principal only. “See – Note 25 of our audited consolidated statements for the year ended December 31, 2021 and 2020”. |

(2) |

Corresponds to our internal information. |

As of and for the Year Ended December 31, |

||||||||||||

2021 |

2020 |

2019 |

||||||||||

| Liquidity (1) |

1.15 |

0.92 |

0.58 |

|||||||||

| Solvency (2) |

2.24 |

1.78 |

1.12 |

|||||||||

| Non-current assets to total assets ratio(3) |

0.82 |

0.80 |

0.84 |

|||||||||

| Profitability (4) |

0.09 |

0.27 |

0.14 |

|||||||||

(1) |

Current assets / Current liabilities |

(2) |

Shareholder’s equity / Total liabilities |

(3) |

Non-current assets / Total assets |

(4) |

Net profit / Average shareholder’s equity |

C. |

Research and Development, Patents and Licenses, etc. |

D. |

Trend Information |

E. |

Critical Accounting Estimates |

ITEM 6. |

DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES |

A. |

Directors and Senior Management |

| Name |

Age |

Position |

Independent |

Years as a Board Member as of December 31 2021 | ||||

| Flávio Mendes Aidar |

46 |

President |

No |

3 | ||||

| Sergio Damián Faifman |

47 |

Vice-President |

No |

10 | ||||

| Livio Hagime Kuze |

42 |

Director |

No |

1 | ||||

| Paulo Diniz |

64 |

Director |

No |

5 | ||||

| Javier Enrique Patron |

60 |

Director |

No |

0 | ||||

| Carlos Boero Hughes |

56 |

Director |

Yes |

5 | ||||

| Diana Mondino |

63 |

Director |

Yes |

5 | ||||

| Sergio Daniel Alonso |

59 |

Director |

Yes |

5 | ||||

| Javier Graña |

51 |

Director |

Yes |

3 |

| Name |

Year of Birth |

Position |

Year of first Appointment | |||

| Sergio Damián Faifman |

1974 |

Chief Executive Officer |

2016 | |||

| Marcos Isabelino Gradin |

1972 |

Chief Financial Officer |

2015 | |||

| Dardo Ariel Damiano |

1963 |

Industrial Director |

2008 | |||

| Gerardo Oscar Diez |

1967 |

Commercial and Concrete Director |

2016 | |||

| Hector Fabian Gerez |

1968 |

Ferrosur Roca General Director |

2021 | |||

| Lucrecia Loureiro |

1981 |

Human Resources, EHS, Legal and Corporate Affairs Director |

2022 | |||

| Valeria Mara Loderer |

1973 |

Supply Chain and Logistics Director |

2021 |

B. |

Compensation |

(i) |

Stock Compensation Plan |

(ii) |

Total Shareholder Return Stock Compensation Plan |

C. |

Board Practices |

| Name |

Year of Appointment |

Position Held |

Age |

|||||||||

| Antonio Juan Lattuca |

2022 | Member | 77 | |||||||||

| Omar Raúl Rolotti |

2022 | Member | 73 | |||||||||

| Adriana Irene Calvo |

2022 | Member | 59 | |||||||||

| Claudio Aldo Forti |

2022 | Alternate | 59 | |||||||||

| Carlos Roberto Chiesa |

2022 | Alternate | 51 | |||||||||

| José Alanis |

2022 | Alternate | 83 | |||||||||

| Name |

Position |

Age |

Election Date |

Condition |

||||||||||||

| Carlos Boero Hughes |

Permanent | 56 | 2022 | Independent | ||||||||||||

| Diana Mondino |

Permanent | 63 | 2022 | Independent | ||||||||||||

| Sergio Daniel Alonso |

Permanent | 59 | 2022 | Independent | ||||||||||||

| Javier Graña |

Alternate | 51 | 2022 | Independent | ||||||||||||

D. |

Employees |

As of December 31, |

||||||||||||

| Business Segment |

2021 |

2020 |

2019 |

|||||||||

| Cement |

1,408 | 1,404 | 1,375 | |||||||||

| Concrete |

253 | 272 | 156 | |||||||||

| Aggregates |

53 | 44 | 61 | |||||||||

| Railroad |

1,105 | 1,151 | 1,221 | |||||||||

| Others |

30 | 29 | 31 | |||||||||

| Total |

2,849 |

2,900 |

2,844 |

|||||||||

| |

|

|

|

|

|

|||||||

E. |

Share Ownership |

ITEM 7. |

MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS |

A. |

Major Shareholders |

| • | each person or group of affiliated persons that, to our knowledge, beneficially owns 5% or more of our ordinary shares; |

| • | all of our directors and executive officers as a group. |

Shares Beneficially Owned |

||||||||

| Name of Beneficial Owner |

Number |

Percentage of our Capital Stock |

||||||

| IC Trading Inversiones Argentina, S.L. (1) |

304,233,740 | 51.0 | ||||||

| Capital International Investors. (2) |

41,373,610 | 6.9 | ||||||

| ANSES (3) |

30,987,880 | 5.2 | ||||||

| Directors and Executive Officers as a Group |

* | * | ||||||

| (1) | Based on information provided by IC Trading Inversiones. It owns and controls 100% of the voting shares of IC Trading Inversiones Argentina. InterCement Portugal S.A. owns and controls 100% of IC Trading Inversiones. InterCement Participações S.A. owns and controls 99.4% of the share capital of InterCement Portugal S.A. Mover Participações S.A. (formerly named Camargo Corrêa S.A.) owns and controls 90.58% of InterCement Participações S.A.’s voting shares. Participações Morro Vermelho S.A. owns 99.99% of the common shares and 100% of the preferred shares of Mover Participações S.A.. |

| (2) | Based on Schedule 13G filed on February 11, 2022, Capital International Investors (“CII”) is a division of Capital Research and Management Company (“CRMC”), as well as its investment management subsidiaries and affiliates Capital Bank and Trust Company, Capital International, Inc., Capital International Limited, Capital International Sarl, Capital International K.K., and Capital Group Private Client Services, Inc. (together with CRMC, the “investment management entities”). CII’s divisions of each of the investment management entities collectively provide investment management services under the name “Capital International Investors |

| (3) | The amount of shares owned by the National Social Security Association of Argentina ( Administración Nacional de la Seguridad Social |

| * | Individually each owning less than 1% of our outstanding ordinary shares. |

B. |

Related Party Transactions |

C. |

Interests of Experts and Counsel |

ITEM 8. |

FINANCIAL INFORMATION |

A. |

Consolidated Statements and Other Financial Information |

As of December 31, 2021 |

||||||||||||

Number of proceedings |

Total Claims |

Total Provisions |

||||||||||

(in millions of Ps.) |

||||||||||||

| Labor and Social Security Proceedings |

190 | 319.5 | 106.4 | |||||||||

| Civil and other proceedings |

284 | 1,143.8 | 125.4 | |||||||||

| |

|

|

|

|

|

|||||||

| Total |

474 |

1,463.3 |

231.8 |

|||||||||

| |

|

|

|

|

|

|||||||

| • | to comply with the legal reserve requirement; |

| • | to the establishment of voluntary reserves; |

| • | to pay the accrued fees of the members of our board of directors and supervisory committee; |

| • | to pay dividends on preferred shares (if at any time issued and existing); |

| • | to the distribution of dividends; and |

| • | any remaining balance to undistributed cumulated earnings or as otherwise determined by our shareholders at the annual shareholders’ meeting. |

As of December 31, |

||||||||||||

2021 |

2020 |

2019 |

||||||||||

(in millions of Ps.) |

||||||||||||

| Legal reserve |

1,450.6 | 1,450.6 | 1,188.2 | |||||||||

| Environmental reserve |

11.3 | 11.3 | 11.3 | |||||||||

| Optional reserve for future dividends |

43,926.9 | 0.0 | 95.2 | |||||||||

| Optional reserve |

0.0 | 26,793.5 | 23,104.4 | |||||||||

| Exchange differences on translating foreign operations |

0.0 | 0.0 | 678.6 | |||||||||

| |

|

|

|

|

|

|||||||

| Total reserves |

45,388.8 |

28,255.4 |

25,077.7 |

|||||||||

| |

|

|

|

|

|

|||||||

For the year ended December 31, |

||||||||||||

2021 |

2020 |

2019 |

||||||||||

(in millions of Ps.) |

||||||||||||

| Attributable to owners |

72,342.4 | 68,104.0 | 55,682.1 | |||||||||

| Non-controlling interests |

167.7 | 409.4 | 4,584.0 | |||||||||

| |

|

|

|

|

|

|||||||

| Total interest attributable to shareholders’ equity |

72,510.1 |

68,513.3 |

60,266.1 |

|||||||||

| |

|

|

|

|

|

|||||||

B. |

Significant Changes |

ITEM 9. |

THE OFFER AND LISTING |

A. |

Offer and Listing Details |

B. |

Plan of Distribution |

C. |

Markets |

D. |

Selling Shareholders |

E. |

Dilution |

F. |

Expenses of the Issue |

ITEM 10. |

ADDITIONAL INFORMATION |

A. |

Share Capital |

B. |

Memorandum and Articles of Association |

C. |

Material Contracts |

D. |

Exchange Controls |

(i) |

Prior authorization of the Argentine Central Bank is required for the access to the FX Market for the purchase of foreign currency: |

| • | For portfolio investment purposes for more than $200 per calendar month by individuals; |

| • | For portfolio investment purposes by legal entities, local governments, funds and trusts; |

| • | By non-Argentine residents, except for certain exemptions; |

| • | For payment of dividends and earnings, except that no such prior authorization is required for the payment of profits and dividends as from January 17, 2020, in an amount that (including the amount of the payment being made at the time of the access) do not exceeds 30% of the value of new capital contributions of foreign direct investments. These contributions must be made to the local company and must be transferred to Argentina and sold for Pesos through the foreign exchange market as from such date. |

| • | For the pre-payment of principal and interest on foreign financial indebtedness with an anticipation of more than three business days in advance to the scheduled maturity dates, unless certain conditions are met; |

| • | For the pre-payment of indebtedness for the import of goods and services, except for certain exemptions; |

| • | For the payment of services with related foreign parties, except for certain exemptions, and; |

| • | Until June 30, 2022 for the payment of principal under foreign financial indebtedness with related parties, except for certain exemptions. |

(ii) |

The proceeds of the disbursements of foreign financial loans incurred since September 1, 2019 must be transferred into Argentina and converted into Pesos through the FX Market in order for the Argentine resident debtor to have access to the FX Market for the payment of principal and interests under such foreign financial loan on their scheduled maturity |

(iii) |

It is prohibited to access the FX market for the purchase of foreign currency for the payment of local debts and other obligations incurred in foreign currency between Argentine residents originated as of September 1, 2019, except, among others, in the case of obligations instrumented by means of public registries or deeds dated as of August 30, 2019. |

(iv) |

The proceeds from the collections of foreign currency by Argentine residents out of Argentina for the export of the following goods since September 2, 2019 are subject to mandatory transfer into Argentina and conversion into Pesos through the FX Market, within the terms described in each case, computed from the shipment date: |

| • | 15 consecutive days for crops and soybean oil; |

| • | 30 consecutive days for hydrocarbons and derivatives; |

| • | 60 consecutive days for exports between related parties not including the goods described above and for metal ores and precious metals; |

| • | 180 consecutive days for all other goods; and |

| • | 365 consecutive days for small exports under the EXPORTA SIMPLE program for medium and small companies with annual FOB exports of less than $600,000 and individual exports of less than $15,000 each. |

(v) |

The proceeds from the collection of foreign currency by Argentine residents out of Argentina for the export of services are subject to mandatory Repatriation within the five consecutive days computed from the date they are received. |

(vi) |

As a general rule, Argentine residents may access the FX Market for the payment of imports of goods. Different requirements apply for goods with customs entry registration and goods with pending customs entry registration. The Argentine importer may access the FX Market to pay imports of goods with customs entry registration registered in the import payment tracking system (“SEPAIMPO”, after its Spanish acronym), provided that certain requirements are met, including, among others, the payment is not made before the scheduled maturity date. Payments must be made to the foreign supplier. Goods with pending customs entry registration are subject to a special follow-up regime. In addition, the prior authorization of the Argentine Central Bank is required for the import of luxury goods such as luxury cars and motorbikes, and pearls and diamonds, among other luxury goods. |

(vii) |

Pursuant to Communication “A” 7001, dated April 30, 2020, as amended, in order to gain access to the FX Market for making any kind of payments, and in addition to applicable requirements, the Argentine Central Bank requires an affidavit from the requestor, (i) stating that it has not sold in Argentina securities settled against foreign currency or transferred securities to custody accounts out of Argentina within the immediately preceding 90 consecutive days; and (ii) committing not to sell in Argentina securities to be settled against foreign currency or to transfer securities to custody accounts out of Argentina within the immediately following 90 consecutive days. |

(viii) |

Communication “A” 7030 of the Argentine Central Bank, dated May 28, 2020, requires that, for purposes of accessing the FX Market for making payments of, among others things, imports of goods, services rendered by non-Argentine residents, interests in connection with the import of goods and services, dividends and other earnings distributions, principal and interest on financial debt, payment of debt securities with public registry in Argentina, or for making international portfolio investments or transactions with derivatives by legal entities, other purchases of foreign currency for specific allocation and premium, guarantees and payments on interest hedging transactions, the party will be required to file an affidavit (i) stating, that as of such date, all of such party’s holdings of foreign currency in Argentina are deposited with Argentine financial institutions and that it does not have foreign liquid disposable assets (including, among others, foreign currency, gold and savings and checking deposits in non-Argentine financial institutions) for an equivalent of more than USD$100,000; and (ii) committing to transfer into Argentina and settle for Pesos any foreign currency payments received outside of Argentina from the collection of loans granted to third parties after May 28, 2020, time deposits made after May 28, 2020, or the sale of any asset when the asset was acquired. |

(ix) |

On September 15, 2020, the Argentine Central Bank restricted the access to FX Market for the payment of principal under foreign financial debt with third parties (other than with international or multilateral credit organizations) in excess of US$2,000,000 per month in the aggregate with maturities between October 15, 2020 and June 30, 2022 to an amount equal to up to 40% of the amount originally due; and provided that the remaining unpaid principal balance is refinanced through a new foreign financial debt with an average life of at least two years, with certain limited exceptions. The Argentine Central Bank authorized the prepayment of principal and interest under foreign financial indebtedness in connection with the refinancing described in this paragraph for up to 45 consecutive days from the original stated maturity, subject to compliance with certain additional requirements. The Argentine Central Bank also allowed the precancellation of interests on foreign financial indebtedness when such precancellation is implemented in connection with the exchange of debt securities and certain additional requirements are met. In addition, pursuant to Communication “A” 7218, dated February 4, 2021, the Argentine Central Bank allowed Argentine residents to access the FX Market for the payment of principal and interest under debt securities registered outside Argentina and issued since February 5, 2021, and that are partially subscribed for in foreign currency in Argentina, subject to certain requirements. |

(x) |

Pursuant to Communication “A” 7030, the Argentine Central Bank provides that, until June 30, 2022, with certain limited exceptions, access to the FX Market for the payment of importing certain goods or the payment of principal under imports accounts payable will be subject to the prior approval of the Argentine Central Bank, except where, among other things, the party files an affidavit stating that the aggregate amount of payments of imports made by such party since January 1, 2020 (including the payment requested) does not exceed $250,000,000. Such amount is calculated as the aggregate amount of imports nationalized by the party between January 1, 2020 and the date immediately prior to the date of access to the FX Market, plus payments made for other imports not included in the forgoing calculation, less the amount of payments pending for imports with nationalization made between September 1, 2019 and December 31, 2019. |

(xi) |

The access to the FX Market for the purchase of foreign currency for any of the payments described above is subject to compliance with the foreign indebtedness information regime before the Argentine Central Bank. |

E. |

Taxation |

• |

at least 75% of its gross income is “passive income;” or |

• |

at least 50% of the average gross fair market value of its assets is attributable to assets that produce “passive income” or are held for the production of “passive income”. |

F. |

Dividends and Paying Agents |

G. |

Statement by Experts |

H. |

Documents on Display |

I. |

Subsidiary Information |

ITEM 11. |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

ITEM 12. |

DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES |

A. |

Debt Securities |

B. |

Warrants and Rights |

C. |

Other Securities |

D. |

American Depositary Shares |

| Service |

Rate | |

Issuance of ADSs ( i.e. ADS(s)-to-share(s) |

Up to US$0.05 per ADS issued | |

Cancellation of ADSs ( i.e. ADS(s)-to-share(s) |

Up to US$0.05 per ADS cancelled | |

Distribution of cash dividends or other cash distributions ( i.e. |

Up to US$0.05 per ADS held | |

Distribution of ADSs pursuant to share dividends, free share distributions or exercise of rights |

Up to US$0.05 per ADS held | |

Distribution of securities other than ADSs or rights to purchase additional ADSs ( i.e. spin-off) |

Up to US$0.05 per ADS held | |

Depositary Services |

Up to US$0.05 per ADS held | |

• |

Fees for the transfer and registration of shares charged by the registrar and transfer agent for the shares in Argentina ( i.e. |

• |

Expenses incurred for converting foreign currency into U.S. dollars. |

• |

Expenses for cable, telex and fax, transmissions and for delivery of securities. |

• |

Fees and expenses incurred by the depositary bank in connection with compliance with exchange control regulations and other regulatory requirements applicable to ordinary shares, ADSs and ADRs. |

• |

Taxes and duties upon the transfer of securities ( i.e. |

• |

Fees and expenses incurred in connection with the delivery or servicing of shares on deposit. |

• |

Any applicable fees and penalties thereon. |

ITEM 13. |

DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES |

ITEM 14. |

MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS |

A. |

Material Modifications to the Rights of Security Holders |

B. |

Material Modifications to the Rights of any Class of Registered Securities |

C. |

Withdrawal or Substitution of a Material Amount of the Assets Securing any Class of Registered Securities |

D. |

Changes in the Trustee or Paying Agents for any Registered Securities |

E. |

Use of Proceeds |

ITEM 15. |

CONTROLS AND PROCEDURES |

ITEM 16. |

[RESERVED] |

ITEM 16A. |

AUDIT COMMITTEE FINANCIAL EXPERT |

ITEM 16B. |

CODE OF ETHICS |

ITEM 16C. |

PRINCIPAL ACCOUNTANT FEES AND SERVICES |

2021 |

2020 |

|||||||

(in thousands of Ps.) |

||||||||

| Audit fees (1) (4) |

119,333.8 |

83,683.3 |

||||||

| Audit related fees (2) (4) |

2,310.0 |

2,855.0 |

||||||

| Tax fees (3) (4) |