UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

For the quarterly period ended

For the transition period from to

Commission file number:

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| Sichuan, People’s Republic of | ||

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including

area code:

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: | Trading Symbol | Name of each exchange on which registered: | ||

| The |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether

the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

Indicate by check mark whether

the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T

(§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit

and post such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check One):

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Smaller reporting company | |

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether

the registrant is a shell company (as defined in Rule 12b 2 of the Exchange Act). Yes ☐ No

As of August 12, 2024,

there were

TABLE OF CONTENTS

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q (the “Report”), including, without limitation, statements under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements can be identified by the use of forward-looking terminology, including the words “believes,” “estimates,” “anticipates,” “expects,” “intends,” “plans,” “may,” “will,” “potential,” “projects,” “predicts,” “continues,” or “should,” or, in each case, their negative or other variations or comparable terminology. There can be no assurance that actual results will not materially differ from expectations. Such statements include, but are not limited to, any statements relating to our ability to consummate any acquisition or other business combination and any other statements that are not statements of current or historical facts. These statements are based on management’s current expectations, but actual results may differ materially due to various factors, including, but not limited to:

| ● | our goals and strategies, including our ability to maintain our automobile transaction and related services business and our online ride-hailing platform services business in China; |

| ● | our management’s ability to properly develop and achieve any future business growth and any improvements in our financial condition and results of operations; |

| ● | the regulations and the impact by public health epidemics in China on the industries we operate in and our business, results of operations and financial condition; |

| ● | the growth or lack of growth in China of disposable household income and the availability and cost of credit available to finance car purchases; |

| ● | the growth or lack of growth of China’s online ride-hailing, automobile financing and leasing industries; |

| ● | changes in online ride-hailing, transportation networks, and other fundamental changes in transportation pattern in China; |

| ● | our expectations regarding demand for and market acceptance of our products and services; |

| ● | our expectations regarding our customer base; |

| ● | our ability to maintain positive relationships with our business partners; |

| ● | competition in the online ride-hailing, automobile financing and leasing industries in China; |

| ● | macro-economic and political conditions affecting the global economy generally and the market in China specifically; and |

| ● | relevant Chinese government policies and regulations relating to the industries in which we operate. |

You should read this Report and the documents that we refer to in this Report with the understanding that our actual future results may be materially different from and worse than what we expect. Other sections of this Report and our other reports filed with the Securities and Exchange Commission (the “SEC”) include additional factors which could adversely impact our business and financial performance. Moreover, we operate in an evolving environment. New risk factors and uncertainties emerge from time to time and it is not possible for our management to predict all risk factors and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of our forward-looking statements by these cautionary statements.

You should not rely upon forward-looking statements as predictions of future events. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

This Report also contains statistical data and estimates that we obtained from industry publications and reports generated by third-parties. Although we have not independently verified the data, we believe that the publications and reports are reliable. The market data contained in this Report involves a number of assumptions, estimates and limitations. The ride-hailing and automobile financing markets in China may not grow at the rates projected by market data, or at all. The failure of these markets to grow at the projected rates may have a material adverse effect on our business and the market price of our common stock. If any one or more of the assumptions underlying the market data turns out to be incorrect, actual results may differ from the projections based on these assumptions. In addition, projections, assumptions and estimates of our future performance and the future performance of the industries in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described herein or our other reports filed with the SEC. You should not place undue reliance on these forward-looking statements.

ii

PART I – FINANCIAL INFORMATION

Item 1. Unaudited Condensed Consolidated Financial Statements

SENMIAO TECHNOLOGY LIMITED

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(Expressed in U.S. dollar, except for the number of shares)

| June 30, | March 31, | |||||||

| 2024 | 2024 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | $ | ||||||

| Restricted cash | ||||||||

| Accounts receivable, net | ||||||||

| Accounts receivable, a related party | ||||||||

| Finance lease receivables, current | ||||||||

| Prepayments, other receivables and other current assets, net | ||||||||

| Due from related parties, net, current | ||||||||

| Total current assets | ||||||||

| Property and equipment, net | ||||||||

| Other assets | ||||||||

| Operating lease right-of-use assets, net | ||||||||

| Operating lease right-of-use assets, net, a related party | ||||||||

| Financing lease right-of-use assets, net | ||||||||

| Intangible assets, net | ||||||||

| Finance lease receivable, non-current | ||||||||

| Due from a related party, net, non-current | ||||||||

| Other non-current assets | ||||||||

| Total other assets | ||||||||

| Total assets | $ | $ | ||||||

| LIABILITIES, MEZZANNIE EQUITY AND EQUITY | ||||||||

| Current liabilities | ||||||||

| Borrowings from a financial institution, current | $ | $ | ||||||

| Accounts payable | ||||||||

| Advances from customers | ||||||||

| Income tax payable | ||||||||

| Accrued expenses and other liabilities | ||||||||

| Due to related parties | ||||||||

| Operating lease liabilities, current | ||||||||

| Operating lease liabilities, a related party | ||||||||

| Financing lease liabilities, current | ||||||||

| Derivative liabilities | ||||||||

| Current liabilities - discontinued operations | ||||||||

| Total current liabilities | ||||||||

| Other liabilities | ||||||||

| Borrowings from a financial institution, non-current | ||||||||

| Operating lease liabilities, non-current | ||||||||

| Financing lease liabilities, non-current | ||||||||

| Deferred tax liability | ||||||||

| Total other liabilities | ||||||||

| Total liabilities | ||||||||

| Commitments and contingencies (note 19) | ||||||||

| Mezzanine Equity | ||||||||

| Series A convertible preferred stock (par value $ | ||||||||

| Stockholders’ equity | ||||||||

| Common stock (par value $ | ||||||||

| Additional paid-in capital | ||||||||

| Accumulated deficit | ( | ) | ( | ) | ||||

| Accumulated other comprehensive loss | ( | ) | ( | ) | ||||

| Total Senmiao Technology Limited stockholders’ equity | ||||||||

| Non-controlling interests | ||||||||

| Total equity | ||||||||

| Total liabilities, mezzanine equity and equity | $ | $ | ||||||

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements

1

SENMIAO TECHNOLOGY LIMITED

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(Expressed in U.S. dollar, except for the number of shares)

| For the Three Months Ended June 30, | ||||||||

| 2024 | 2023 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Revenues | ||||||||

| Revenues | $ | $ | ||||||

| Revenues, a related party | ||||||||

| Total revenues | ||||||||

| Cost of revenues | ||||||||

| Cost of revenues | ( | ) | ( | ) | ||||

| Cost of revenues, a related party | ( | ) | ( | ) | ||||

| Total cost of revenues | ( | ) | ( | ) | ||||

| Gross profit | ||||||||

| Operating expenses | ||||||||

| Selling, general and administrative expenses | ( | ) | ( | ) | ||||

| Provision for credit losses | ( | ) | ( | ) | ||||

| Total operating expenses | ( | ) | ( | ) | ||||

| Loss from operations | ( | ) | ( | ) | ||||

| Other (expense) income | ||||||||

| Other income, net | ||||||||

| Interest expense | ( | ) | ( | ) | ||||

| Interest expense on finance leases | ( | ) | ( | ) | ||||

| Change in fair value of derivative liabilities | ( | ) | ||||||

| Total other income, net | ||||||||

| Loss before income taxes | ( | ) | ( | ) | ||||

| Income tax benefit | ||||||||

| Net Loss | ( | ) | ( | ) | ||||

| Net loss (income) attributable to non-controlling interests | ( | ) | ||||||

| Net loss attributable to the Company’s stockholders | $ | ( | ) | $ | ( | ) | ||

| Net loss | $ | ( | ) | $ | ( | ) | ||

| Other comprehensive loss | ||||||||

| Foreign currency translation adjustment | ( | ) | ( | ) | ||||

| Comprehensive loss | ( | ) | ( | ) | ||||

| less: Total comprehensive income (loss) attributable to noncontrolling interests | ( | ) | ||||||

| Total comprehensive loss attributable to the Company’s stockholders | $ | ( | ) | $ | ( | ) | ||

| Weighted average number of common stock | ||||||||

| $ | ( | ) | $ | ( | ) | |||

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements

2

SENMIAO TECHNOLOGY LIMITED

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

For the Three Months Ended June 30, 2024 and 2023

(Expressed in U.S. dollar, except for the number of shares)

| For the Three Months Ended June 30, 2023 | ||||||||||||||||||||||||||||

| Accumulated | ||||||||||||||||||||||||||||

| Additional | other | Non- | ||||||||||||||||||||||||||

| Common stock | paid-in | Accumulated | comprehensive | controlling | Total | |||||||||||||||||||||||

| Shares | Par value | capital | deficit | loss | interest | equity | ||||||||||||||||||||||

| BALANCE, March 31, 2023 | $ | $ | $ | ( |

) | $ | ( |

) | $ | $ | ||||||||||||||||||

| Net income (loss) | — | ( |

) | ( |

) | |||||||||||||||||||||||

| Conversion of preferred stock into common stock | ||||||||||||||||||||||||||||

| Foreign currency translation adjustment | — | ( |

) | ( |

) | |||||||||||||||||||||||

| BALANCE, June 30, 2023 (Unaudited) | $ | $ | $ | ( |

) | $ | ( |

) | $ | $ | ||||||||||||||||||

| For the Three Months Ended June 30, 2024 | ||||||||||||||||||||||||||||

| Accumulated | ||||||||||||||||||||||||||||

| Additional | other | Non- | ||||||||||||||||||||||||||

| Common stock | paid-in | Accumulated | comprehensive | controlling | Total | |||||||||||||||||||||||

| Shares | Par value | capital | deficit | loss | interest | equity | ||||||||||||||||||||||

| BALANCE, March 31, 2024 | $ | $ | $ | ( |

) | $ | ( |

) | $ | $ | ||||||||||||||||||

| Net loss | — | ( |

) | ( |

) | ( |

) | |||||||||||||||||||||

| Foreign currency translation adjustment | — | ( |

) | ( |

) | |||||||||||||||||||||||

| BALANCE, June 30, 2024 (Unaudited) | $ | $ | $ | ( |

) | $ | ( |

) | $ | $ | ||||||||||||||||||

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements

3

SENMIAO TECHNOLOGY LIMITED

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Expressed in U.S. dollar, except for the number of shares)

| For the Three Months Ended June 30, | ||||||||

| 2024 | 2023 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Cash Flows from Operating Activities: | ||||||||

| Net loss | $ | ( | ) | $ | ( | ) | ||

| Adjustments to reconcile net loss to net cash provided by operating activities: | ||||||||

| Depreciation and amortization of property and equipment | ||||||||

| Amortization of right-of-use assets | ||||||||

| Amortization of intangible assets | ||||||||

| Provision for credit losses | ||||||||

| Gain on disposal of equipment | ( | ) | ( | ) | ||||

| Change in fair value of derivative liabilities | ( | ) | ||||||

| Change in operating assets and liabilities | ||||||||

| Accounts receivable | ||||||||

| Accounts receivable, a related party | ( | ) | ||||||

| Inventories | — | |||||||

| Finance lease receivables | ||||||||

| Prepayments, other receivables and other assets | ( | ) | ||||||

| Prepayment - a related party | ( | ) | ||||||

| Accounts payable | ||||||||

| Advances from customers | ||||||||

| Accrued expenses and other liabilities | ||||||||

| Due to a related party | ||||||||

| Operating lease liabilities | ( | ) | ( | ) | ||||

| Operating lease liabilities - related parties | ||||||||

| Net Cash Provided by Operating Activities | ||||||||

| Cash Flows from Investing Activities: | ||||||||

| Purchases of property and equipment | ( | ) | ( | ) | ||||

| Cash received from disposal of property and equipment | ||||||||

| Net Cash Provided by (Used in) Investing Activities | ( | ) | ||||||

| Cash Flows from Financing Activities: | ||||||||

| Borrowings from a related party | ||||||||

| Repayments from a related party | ||||||||

| Repayments to related parties and affiliates | ( | ) | ( | ) | ||||

| Repayments to financial institutions | ( | ) | ( | ) | ||||

| Principal payments of finance lease liabilities | ( | ) | ( | ) | ||||

| Net Cash Used in Financing Activities | ( | ) | ( | ) | ||||

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | ( | ) | ( | ) | ||||

| Net decrease in cash, cash equivalents and restricted cash | ( | ) | ( | ) | ||||

| Cash, cash equivalents and restricted cash, beginning of the period | ||||||||

| Cash, cash equivalents and restricted cash, end of the period | ||||||||

| Supplemental Cash Flow Information | ||||||||

| Cash paid for interest expense | $ | $ | ||||||

| Cash paid for income tax | $ | $ | ||||||

| Non-cash Transaction in Investing and Financing Activities | ||||||||

| Recognition of right-of-use assets and lease liabilities, related parties | $ | $ | ||||||

The following tables provides a reconciliation of cash, cash equivalent and restricted cash reported within the unaudited condensed consolidated balance sheets that sum to the total of the same amounts shown in the unaudited condensed consolidated statements of cash flows:

| June 30, | June 30, | |||||||

| 2024 | 2023 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Cash, cash equivalent, end of the period | $ | $ | ||||||

| Restricted cash, end of the period | ||||||||

| Total cash, cash equivalent and restricted cash shown in the unaudited condensed consolidated statements of cash flows, end of the period | $ | $ | ||||||

| June 30, | June 30, | |||||||

| 2024 | 2023 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Cash, cash equivalent, beginning of the period | $ | $ | ||||||

| Restricted cash, beginning of the period | ||||||||

| Total cash, cash equivalent and restricted cash shown in the unaudited condensed consolidated statements of cash flows, beginning of the period | $ | $ | ||||||

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements

4

SENMIAO TECHNOLOGY LIMITED

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

1. ORGANIZATION AND PRINCIPAL ACTIVITIES

Senmiao

Technology Limited (the “Company”) is a U.S. holding company incorporated in the State of Nevada on

(i) automobile transaction and related services focusing on the online ride-hailing industry in the People’s Republic of China (“PRC” or “China”) through the Company’s wholly owned subsidiary, Chengdu Corenel Technology Co., Ltd., a PRC limited liability company (“Corenel”), and its majority owned subsidiaries, Chengdu Jiekai Yunli Technology Co., Ltd. (“Jiekai”), and Hunan Ruixi Financial Leasing Co., Ltd., a PRC limited liability company (“Hunan Ruixi”), and its equity investee company (an entity 35% owned by Hunan Ruixi), Sichuan Jinkailong Automobile Leasing Co., Ltd., a PRC limited liability company (“Jinkailong”).

(ii) online ride-hailing platform services through its own platform (known as Xixingtianxia) as described further below, since October 2020, through Hunan Xixingtianxia Technology Co., Ltd., a PRC limited liability company (“XXTX”), which is a wholly owned subsidiary of Sichuan Senmiao Zecheng Business Consulting Co., Ltd. (“Senmiao Consulting”), a PRC limited liability company and wholly-owned subsidiary of the Company. The Company’s ride hailing platform enables qualified ride-hailing drivers to provide transportation services in Chengdu, Changsha and other 20 cities in China as of the filing date of these unaudited condensed consolidated financial statements.

Hunan Ruixi holds a business license for automobile sales and financial leasing and has been engaged in automobile financial leasing services and automobile sales since March 2019 and January 2019, respectively. The Company also has been engaged in operating leasing services through Hunan Ruixi, Jiekai and its equity investee company, Jinkailong since March 2019. Jinkailong used to facilitate automobile sales and financing transactions for its clients, who are primarily ride-hailing drivers and provides them operating lease and relevant after-transaction services.

As of the

filing date of these unaudited condensed consolidated financial statements, Senmiao Consulting has made a cumulative capital contribution

of RMB

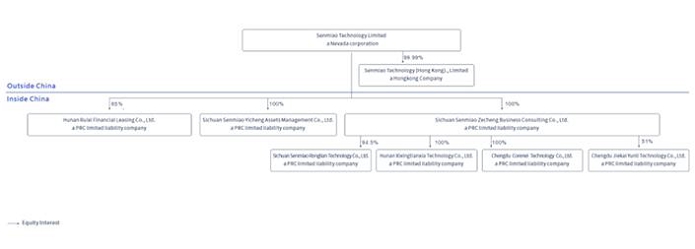

The following diagram illustrates the Company’s corporate structure as of the filing date of these unaudited condensed consolidated financial statements:

Former Voting Agreements with Jinkailong’s Other Shareholders

Hunan Ruixi

entered into two voting agreements signed in August 2018 and February 2020, respectively, as amended (the “Voting Agreements”),

with Jinkailong and other Jinkailong’s shareholders holding an aggregate of

5

SENMIAO TECHNOLOGY LIMITED

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

On March 31, 2022, Hunan Ruixi entered into an Agreement for the Termination of the Agreement for Concerted Action by Shareholders of Jinkailong (the “Termination Agreement”), pursuant to which the Voting Agreements mentioned above was terminated as of the date of the Termination Agreement. The termination will not impair the past and future legitimate rights and interests of all parties in Jinkailong. Starting from April 1, 2022, the parties no longer maintain a concerted action relationship with respect to the decision required to take concerted action at its shareholders meetings as stipulated in the Voting Agreements. Each party shall independently express opinions and exercise various rights such as voting rights and perform relevant obligations in accordance with the provisions of laws, regulations, normative documents and the Jinkailong’s articles of association.

As a result

of the Termination Agreement, the Company no longer has a controlling financial interest in Jinkailong and has determined that Jinkailong

was deconsolidated from the Company’s Unaudited condensed consolidated financial statements effective as of March 31, 2022. However,

as Hunan Ruixi still holds

As of June

30, 2024, the Company has outstanding balance due from Jinkailong amounted to $

As of June

30, 2024 and March 31, 2024, allowance for credit losses due from Jinkailong amounted to $

2. GOING CONCERN

In assessing the Company’s liquidity, the Company monitors and analyzes its cash on-hand and its operating and capital expenditure commitments. The Company’s liquidity needs are to meet its working capital requirements, operating expenses and capital expenditure obligations. Debt financing from financial institutions and equity financings have been utilized to finance the working capital requirements of the Company.

The Company’s

business is capital intensive. The Company’s management has considered whether there is substantial doubt about its ability to continue

as a going concern due to (1) the net loss of approximately $

Management has determined there is substantial doubt about its ability to continue as a going concern. If the Company is unable to generate significant revenue, the Company may be required to curtail or cease its operations. Management is trying to alleviate the going concern risk through the following sources:

| ● | Equity financing to support its working capital; |

| ● | Other available sources of financing (including debt) from PRC banks and other financial institutions; and |

| ● | Financial support and credit guarantee commitments from the Company’s related parties. |

6

SENMIAO TECHNOLOGY LIMITED

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

There is no assurance that the Company will be successful in implementing the foregoing plans or that additional financing will be available to the Company on commercially reasonable terms, or at all. There are a number of factors that could potentially arise that could undermine the Company’s plans, such as (i) changes in the demand for the Company’s services, (ii) PRC government policies, (iii) economic conditions in China and worldwide, (iv) competitive pricing in the automobile transaction and related service and ride-hailing industries, (v) changes in the Company’s relationships with key business partners, (vi) the ability of financial institutions in China to provide continued financial support to the Company’s customers, and (vii) the perception of PRC-based companies in the U.S. capital markets. The Company’s inability to secure needed financing when required could require material changes to the Company’s business plans and could have a material adverse effect on the Company’s ability to continue as a going concern and results of operations. The unaudited condensed consolidated financial statements have been prepared on a going concern basis, which contemplates the realization of assets and liquidation of liabilities in the normal course of business. The unaudited condensed consolidated financial statements do not include any adjustments that might result from the outcome of such uncertainties.

3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(a) Basis of presentation

The unaudited condensed consolidated financial statements, including the unaudited condensed consolidated balance sheets as of June 30, 2024, the unaudited condensed consolidated statements of operations and comprehensive loss, the unaudited condensed consolidated statements of changes in equity, and the unaudited condensed consolidated statements of cash flows for the three months ended June 30, 2024 and 2023, as well as other information disclosed in the accompanying notes, have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”), and pursuant to the rules and regulations of the SEC and pursuant to Regulation S-X. The interim unaudited condensed financial statements and accompanying notes should be read in conjunction with the audited consolidated financial statements and the notes thereto, included in the Form 10-K for the fiscal year ended March 31, 2024, which was filed with the SEC on June 27, 2024.

The unaudited condensed consolidated financial statements and the accompanying notes have been prepared on the same basis as the annual consolidated financial statements and, in the opinion of management, reflect all adjustments, which include only normal recurring adjustments, necessary for a fair statement of the results of operations for the periods presented. The consolidated results of operations for any interim period are not necessarily indicative of the results to be expected for the full year or for any other future years or interim periods.

(b) Foreign currency translation

Transactions denominated in currencies other than the functional currency are translated into the functional currency at the exchange rates prevailing on the dates of the transaction. Monetary assets and liabilities denominated in currencies other than the functional currency are translated into the functional currency using the applicable exchange rates on the date of the balance sheet. The resulting exchange differences are recorded in the statement of operations.

The reporting currency of the Company and its subsidiaries is U.S. dollars (“US$”) and the unaudited condensed consolidated financial statements have been expressed in US$. However, the Company maintains the books and records in its functional currency, Chinese Renminbi (“RMB”), being the functional currency of the economic environment in which its operations are conducted.

In general, for consolidation purposes, assets and liabilities of the Company and its subsidiaries whose functional currency is not the US$, are translated into US$, using the exchange rate on the balance sheet date. Revenues and expenses are translated at average rates prevailing during the period. The gains and losses resulting from translation of financial statements of the Company and its subsidiaries are recorded as a separate component of accumulated other comprehensive loss within the unaudited condensed consolidated statements of changes in stockholders’ equity.

| June 30, | March 31, | |||||||

| 2024 | 2024 | |||||||

| Balance sheet items, except for equity accounts – RMB: US$ | ||||||||

For

the three months ended | ||||||||

| 2024 | 2023 | |||||||

| Items in the statements of operations and comprehensive loss, and cash flows – RMB: US$ | ||||||||

7

SENMIAO TECHNOLOGY LIMITED

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(c) Use of estimates

In presenting the unaudited condensed consolidated financial statements in accordance with U.S. GAAP, management makes estimates and assumptions that affect the amounts reported and related disclosures. Estimates, by their nature, are based on judgment and available information. Accordingly, actual results could differ from those estimates. On an ongoing basis, management reviews these estimates and assumptions using the currently available information. Changes in facts and circumstances may cause the Company to revise its estimates. The Company bases its estimates on past experience and on various other assumptions that are believed to be reasonable, the results of which form the basis for making judgments about the carrying values of assets and liabilities. Estimates are used when accounting for items and matters including, but not limited to, revenue recognition, residual values of property and equipment, lease liabilities, right-of-use assets, determinations of the useful lives and valuation of long-lived assets, estimates of allowances for credit losses for receivables and due from related parties, estimates of impairment of long-lived assets, valuation of deferred tax assets and valuation of derivative liabilities.

(d) Fair values of financial instruments

Accounting Standards Codification (“ASC”) Topic 825, Financial Instruments (“Topic 825”) requires disclosure of fair value information of financial instruments, whether or not recognized in the balance sheets, for which it is practicable to estimate that value. In cases where quoted market prices are not available, fair values are based on estimates using present value or other valuation techniques. Those techniques are significantly affected by the assumptions used, including the discount rate and estimates of future cash flows. Topic 825 excludes certain financial instruments and all nonfinancial assets and liabilities from its disclosure requirements. Accordingly, the aggregate fair value amounts do not represent the underlying value of the Company. The three levels of valuation hierarchy are defined as follows:

Level 1 Inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets.

Level 2 Inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the assets or liability, either directly or indirectly, for substantially the full term of the financial instruments.

Level 3 Inputs to the valuation methodology are unobservable and significant to the fair value.

The following table sets forth by level within the fair value hierarchy our financial assets and liabilities that were accounted for at fair value on a recurring basis as of June 30, 2024 and March 31, 2024:

| Carrying Value as of | Fair Value Measurement as of | |||||||||||||||

| June 30, | June 30, 2024 | |||||||||||||||

| 2024 | Level 1 | Level 2 | Level 3 | |||||||||||||

| (Unaudited) | ||||||||||||||||

| Derivative liabilities | $ | $ | $ | $ | ||||||||||||

| Carrying Value as of | Fair Value Measurement as of | |||||||||||||||

| March 31, | March 31, 2024 | |||||||||||||||

| 2024 | Level 1 | Level 2 | Level 3 | |||||||||||||

| Derivative liabilities | $ | $ | $ | $ | ||||||||||||

8

SENMIAO TECHNOLOGY LIMITED

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 2019 Registered Direct Offering | August 2020 Underwritten Public | February 2021 Registered Direct | May 2021 Registered Direct Offering | November 2021 Private Placement | ||||||||||||||||||||||||||||||||

| Series A Warrants | Placement Warrants | Offering Warrants | Offering Warrants | Investors Warrants | Placement Warrants | Investors Warrants | Placement Warrants | Total | ||||||||||||||||||||||||||||

| BALANCE as of March 31, 2023 | $ | $ | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||

| Change in fair value of derivative liabilities | — | — | ( | ) | ( | ) | ( | ) | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||||||||||||||

| Warrant forfeited due to expiration | ( | ) | ( | ) | ( | ) | ||||||||||||||||||||||||||||||

| BALANCE as of March 31, 2024 | ||||||||||||||||||||||||||||||||||||

| Change in fair value of derivative liabilities | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||||||||||||||||||||||

| BALANCE as of June 30, 2024 (unaudited) | $ | $ | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||

| June 20, 2019 | August 4, 2020 | February 10, 2021 | May 13, 2021 | November 10, 2021 | ||||||||||||||||||||||||||||||||||||

| Series A | Series B | Placement Agent | Underwriters’ | Placement Agent | ROFR | Investor | Placement Agent | Investor | Placement Agent | |||||||||||||||||||||||||||||||

| Warrants | Warrants | Warrants | Warrants | Warrants | Warrants | Warrants | Warrants | Warrants | Warrants | |||||||||||||||||||||||||||||||

| # of shares exercisable* | ||||||||||||||||||||||||||||||||||||||||

| Valuation date | ||||||||||||||||||||||||||||||||||||||||

| Exercise price* | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||

| Stock price* | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||

| Expected term (years) | ||||||||||||||||||||||||||||||||||||||||

| Risk-free interest rate | % | % | % | % | % | % | % | % | % | % | ||||||||||||||||||||||||||||||

| Expected volatility | % | % | % | % | % | % | % | % | % | % | ||||||||||||||||||||||||||||||

9

SENMIAO TECHNOLOGY LIMITED

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| As of June 30, 2024 | ||||||||||||||||||||||||||||

| August 4, 2020 | February 10, 2021 | May 13, 2021 | November 10, 2021 | |||||||||||||||||||||||||

| Placement | Placement | Placement | ||||||||||||||||||||||||||

| Underwriters’ | Agent | ROFR | Investor | Agent | Investor | Agent | ||||||||||||||||||||||

| Granted Date | Warrants | Warrants | Warrants | Warrants | Warrants | Warrants | Warrants | |||||||||||||||||||||

| (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | ||||||||||||||||||||||

| # of shares exercisable | ||||||||||||||||||||||||||||

| Valuation date | ||||||||||||||||||||||||||||

| Exercise price | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||

| Stock price | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||

| Expected term (years) | ||||||||||||||||||||||||||||

| Risk-free interest rate | % | % | % | % | % | % | % | |||||||||||||||||||||

| Expected volatility | % | % | % | % | % | % | % | |||||||||||||||||||||

| As of March 31, 2024 | ||||||||||||||||||||||||||||

| August 4, 2020 | February 10, 2021 | May 13, 2021 | November 10, 2021 | |||||||||||||||||||||||||

| Placement | Placement | Placement | ||||||||||||||||||||||||||

| Underwriters’ | Agent | ROFR | Investor | Agent | Investor | Agent | ||||||||||||||||||||||

| Granted Date | Warrants | Warrants | Warrants | Warrants | Warrants | Warrants | Warrants | |||||||||||||||||||||

| # of shares exercisable | ||||||||||||||||||||||||||||

| Valuation date | ||||||||||||||||||||||||||||

| Exercise price | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||

| Stock price | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||

| Expected term (years) | ||||||||||||||||||||||||||||

| Risk-free interest rate | % | % | % | % | % | % | % | |||||||||||||||||||||

| Expected volatility | % | % | % | % | % | % | % | |||||||||||||||||||||

| * |

10

SENMIAO TECHNOLOGY LIMITED

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

As of June 30, 2024 and March 31, 2024, financial instruments of the Company comprised primarily current assets and current liabilities including cash and cash equivalents, restricted cash, accounts receivable, finance lease receivables, prepayments, other receivables and other assets, due from related parties, accounts payable, advance from customers, lease liabilities, accrued expenses and other liabilities, due to related parties, and operating and financing lease liabilities, which approximate their fair values because of the short-term nature of these instruments, and current liabilities of borrowings from a financial institution, which approximate their fair values because of the stated loan interest rate to the rate charged by similar financial institutions.

The non-current portion of finance lease receivables, operating and financing lease liabilities and borrowings from a financial institution were recorded at the gross amount adjusted for the interest using the effective interest rate method. The Company believes that the effective interest rates underlying these instruments approximate their fair values because the Company used its incremental borrowing rate to recognize the present value of these instruments as of June 30, 2024 and March 31, 2024.

Other than as listed above, the Company did not identify any assets or liabilities that are required to be presented on the balance sheet at fair value.

(e) Segment reporting

Operating segments are reported in a manner consistent

with the internal reporting provided to the chief operating decision maker (the “CODM”), which is comprised of certain members

of the Company’s management team. During the years ended March 31, 2019 and 2021, the Company acquired Hunan Ruixi and XXTX, respectively.

The Company evaluated how the CODM manages the businesses of the Company to maximize efficiency in allocating resources and assessing

performance. Consequently, the Company presents

(f) Cash and cash equivalents

Cash and cash equivalents primarily consist of bank deposits with original maturities of three months or less, which are unrestricted as to withdrawal and use. Cash and cash equivalents also consist of funds received from automobile purchasers as payments for automobiles, funds received from automobile lessees as payments for rentals, which were held at the third-party platforms’ fund accounts and which are unrestricted and immediately available for withdrawal and use.

(g) Restricted cash

Restricted cash consists of fund

held in the bank accounts of Corenel was frozen by a court order with a prior business partner whom Corenel had cooperation with. The

restricted cash of Corenel was $

(h) Accounts receivable, net

Accounts

receivable are recorded at the invoiced amount less an allowance for any uncollectible accounts and do not bear interest, and are due

on demand. The carrying value of accounts receivable is reduced by an allowance that reflects the Company’s best estimate of the

amounts that will not be collected. An allowance for credit losses is recorded in the period when a loss is probable based on an assessment

of specific evidence indicating collection is unlikely, historical bad debt rates, accounts aging, financial conditions of the customer

and industry trends. Starting from April 1, 2023, the Company adopted ASU No.2016-13 “Financial Instruments – Credit Losses

(Topic 326): Measurement of Credit Losses on Financial Instruments” (“ASC Topic 326”). Management also periodically

evaluates individual customer’s financial condition, credit history, and the current economic conditions to make adjustments in

the allowance when it is considered necessary. Account balances are charged off against the allowance after all means of collection have

been exhausted and the potential for recovery is considered remote. The Company’s management continues to evaluate the reasonableness

of the valuation allowance policy and update it if necessary. As of June 30, 2024 and March 31, 2024, the Company record allowance for

credit losses of $

(i) Finance lease receivables

Finance lease receivables, which result from sales-type leases, are measured at discounted present value of (i) future minimum lease payments, (ii) any residual value not subject to a bargain purchase option as finance lease receivables on its balance sheet and (iii) accrued interest on the balance of the finance lease receivables based on the interest rate inherent in the applicable lease over the term of the lease. Management also periodically evaluates individual customer’s financial condition, credit history and the current economic conditions to make adjustments in the allowance for credit losses when necessary. Finance lease receivables is charged off against the allowance for credit losses after all means of collection have been exhausted and the potential for recovery is considered remote. As of June 30, 2024 and March 31, 2024, the Company determined allowance for credit losses was necessary for finance lease receivables.

11

SENMIAO TECHNOLOGY LIMITED

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| June 30, | March 31, | |||||||

| 2024 | 2024 | |||||||

| (Unaudited) | ||||||||

| Minimum lease payments receivable | $ | $ | ||||||

| Less: Unearned interest | ( | ) | ( | ) | ||||

| Financing lease receivables | $ | $ | ||||||

| Finance lease receivables, current | $ | $ | ||||||

| Finance lease receivables, non-current | $ | $ | ||||||

| Minimum future payments receivable | ||||

| Twelve months ending June 30, 2025 | $ | |||

| Twelve months ending June 30, 2026 | ||||

| Twelve months ending June 30, 2027 | ||||

| Total | $ | |||

(j) Property and equipment, net

Property

and equipment primarily consist of automobiles, leasehold improvements, computers and other equipment, which are stated at cost less accumulated

depreciation and amortization less any provision required for impairment in value. Depreciation and amortization is computed using the

straight-line method with no residual value based on the estimated useful life.

| Categories | Useful life | |

| Leasehold improvements | ||

| Computer equipment | ||

| Office equipment, fixture and furniture | ||

| Automobiles |

The Company reviews property and equipment for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. An asset is considered impaired if its carrying amount exceeds the future net undiscounted cash flows that the asset is expected to generate. If such asset is considered to be impaired, the impairment recognized is the amount by which the carrying amount of the asset, if any, exceeds its fair value determined using a discounted cash flow model. For the three months ended June 30, 2024 and 2023, the Company did not recognize impairment for property and equipment.

Costs of repairs and maintenance are expensed as incurred and asset improvements are capitalized. The cost and related accumulated depreciation and amortization of assets disposed of or retired are removed from the accounts, and any resulting gain or loss is reflected in the unaudited condensed consolidated statements of operations and comprehensive loss.

(k) Loss per share

Basic loss per share is computed by dividing net loss attributable to stockholders by the weighted average number of outstanding shares of common stock, adjusted for outstanding shares of common stock that are subject to repurchase.

For the calculation of diluted loss per share, net loss attributable to stockholders for basic loss per share is adjusted by the effect of dilutive securities, including share-based awards, under the treasury stock method and convertible securities under the if-converted method. Potentially dilutive securities, of which the amounts are insignificant, have been excluded from the computation of diluted net loss per share if their inclusion is anti-dilutive.

12

SENMIAO TECHNOLOGY LIMITED

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

As of June

30, 2024, the Company’s dilutive securities from the outstanding series A convertible preferred stock are convertible into

(l) Derivative liabilities

A contract is designated as an asset or a liability and is carried at fair value on the Company’s balance sheet, with any changes in fair value recorded in the Company’s results of operations. The Company then determines which options, warrants and embedded features require liability accounting and records the fair value as a derivative liability. The changes in the values of these instruments are shown in the unaudited condensed consolidated statements of operations and comprehensive loss as “change in fair value of derivative liabilities”.

(m) Revenue recognition

The Company recognized its revenue under Accounting Standards Codification (ASC) Topic 606, Revenue from Contracts with Customers (ASC 606). ASC 606 establishes principles for reporting information about the nature, amount, timing and uncertainty of revenue and cash flows arising from the entity’s contracts to provide goods or services to customers. The core principle requires an entity to recognize revenue to depict the transfer of goods or services to customers in an amount that reflects the consideration that it expects to be entitled to receive in exchange for those goods or services recognized as performance obligations are satisfied. It also requires the Company to identify contractual performance obligations and determine whether revenue should be recognized at a point in time or over time, based on when control of goods and services transfers to a customer.

To achieve that core principle, the Company applies the five steps defined under ASC 606: (i) identify the contract(s) with a customer, (ii) identify the performance obligations in the contract, (iii) determine the transaction price, (iv) allocate the transaction price to the performance obligations in the contract, and (v) recognize revenue when (or as) the entity satisfies a performance obligation.

The Company accounts for a contract with a customer when the contract is entered into by the parties, the rights of the parties, including payment terms, are identified, the contract has commercial substance and consideration to collect is substantially probable.

| For the Three Months Ended | ||||||||

| June 30, | ||||||||

| 2024 | 2023 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Automobile Transaction and Related Services | ||||||||

| - Operating lease revenues from automobile rentals | $ | $ | ||||||

| - Monthly services commissions | ||||||||

| - Financing revenues | ||||||||

| - Service fees from NEVs leasing | ||||||||

| - Service fees from automobile purchase services | ||||||||

| - Revenues from sales of automobiles | ||||||||

| - Other service fees | ||||||||

| Total revenues from Automobile Transaction and Related Services | ||||||||

| Online Ride-hailing Platform Services | ||||||||

| Total Revenues from Operations | $ | $ | ||||||

Automobile transaction and related services

Operating lease revenues from automobile rentals –The Company generates revenue from sub-leasing automobiles to some online ride-hailing drivers or third-parties and leasing its own automobiles. The Company recognizes revenue wherein an automobile is transferred to the lessees and the lessees has the ability to control the asset, is accounted for under ASC Topic 842. Rental transactions are satisfied over the rental period and is recognized over time. As the operating lease revenue are variable in nature which is based on online ride-hailing drivers or third-parties’ performance for a certain period, the Company recognized the revenue from operating lease by using the output method based on periodic settlement between the Company and the online ride-hailing drivers or third-parties when such revenue is probable that a significant reversal in the amount of cumulative revenue recognized will not occur. Rental periods are short term in nature, generally are twelve months or less.

13

SENMIAO TECHNOLOGY LIMITED

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Monthly services commissions – Commissions from the services generated from the management and related services provided to Partner Platforms and other companies, which are settled on a monthly basis. The Company recognizes revenues at a point in time when performance obligations are completed and the commission amount is confirmed by the Partner Platforms and other companies, based on their evaluations on the services provided by the Company.

Financing revenues – Interest income from the lease arising from the Company’s sales-type leases and bundled lease arrangements are recognized as financing revenues over the lease term based on the effective rate of interest in the lease.

Service fees from NEVs leasing and automobile purchase services - Services fees from NEVs leasing and automobile purchase services are paid by some lessees who rent new energy electric vehicles from the Company or automobile purchasers for a series of the services provided to them throughout the purchase process such as credit assessment, installment of GPS devices, ride-hailing driver qualification and other administrative procedures. The amount of services fees for NEVs leasing is based on the product solutions while the fees for purchase is based on the sales price of the automobiles and relevant services provided. The Company recognizes revenue at a point in time when above mentioned services are completed, and corresponding an automobile is delivered to the lessee or purchaser. Accounts receivable related to the revenue from NEVs leasing and automobile purchase services is collected upon the automobiles are delivered to lessees or purchaser.

Sales of automobiles – The Company generated revenue from sales of automobiles to the customers of Hunan Ruixi. The control over the automobile is transferred to the purchaser along with the delivery of automobiles. The amount of the revenue is based on the sale price agreed by Hunan Ruixi and the customers. The Company recognizes revenues when an automobile is delivered and control is transferred to the purchaser at a point in time. Accounts receivable related to the revenue are being collected within 12 months.

Other service fees – The Company generated other revenues such as miscellaneous service fees charged to its customers for some supporting services provided to online ride-hailing drivers. The Company recognizes revenues at a point in time when performance obligations are completed and the collectability is probable from the customers.

Leases - Lessor

The Company

recognized revenue as lessor in accordance with ASC 842. The two primary accounting provisions the Company uses to classify transactions

as sales-type or operating leases are: (i) a review of the lease term to determine if it is for the major part of the economic life of

the underlying equipment (defined as greater than )%; and (ii) a review of the present value of the lease payments to determine

if they are equal to or greater than substantially all of the fair market value of the equipment at the inception of the lease (defined

as greater than

The Company excludes from the measurement of its lease revenues any tax assessed by a governmental authority that is both imposed on and concurrent with a specific revenue-producing transaction and collected from a customer.

The Company considers the economic life of most of the automobiles to be to years, since this represents the most common long-term lease term for its automobiles and the automobiles will be used for online ride-hailing services. The Company believes three to years is representative of the period during which an automobile is expected to be economically usable, with normal service, for the purpose for which it is intended.

The Company’s

lease pricing interest rates, which are used in determining customer payments in a bundled lease arrangement, are developed based upon

the local prevailing rates in the marketplace where its customer will be able to obtain an automobile loan under similar terms from the

bank. The Company reassesses its pricing interest rates quarterly based on changes in the local prevailing rates in the marketplace. As

of June 30, 2024, the Company’s pricing interest rate was

14

SENMIAO TECHNOLOGY LIMITED

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Online ride-hailing platform services

The Company generates revenue from providing services to online ride-hailing drivers (“Drivers”) to assist them in providing transportation services to riders (“Riders”) looking for taxi/ride-hailing services. The Company earns commissions for each completed ride in an amount equal to the difference between an upfront quoted fare and the amount earned by a Driver based on actual time and distance for the ride charged to the Rider. As a result, the Company bears a single performance obligation in the transaction of connecting Drivers with Riders to facilitate the completion of a successful transportation service for Riders. The Company recognizes revenue upon completion of a ride as the single performance obligation is satisfied and the Company has the right to receive payment for the services rendered upon the completion of the ride. The Company evaluates the presentation of revenue on a gross or net basis based on whether it controls the service provided to the Rider and is the principal (i.e., “gross”), or it arranges for other parties to provide the service to the Rider and is an agent (i.e., “net”). Since the Company is not primarily responsible for ride-hailing services provided to Riders, it does not have discretion in establishing the price of the online ride-hailing service and inventory risk related to the services as the Company earns commissions for each completed order as the difference between an upfront quote fare and the amount earned by a driver based on actual time and distance for ride charged to the rider. Thus, the Company recognizes revenue at a net basis. Incentives paid to Drivers are similar to retrospective volume-based rebates and represent variable consideration that is typically settled weekly or monthly. The Company recorded it as a reduction to revenue by the amount of the incentives to be paid upon completion of the performance criteria.

(n) Significant risks and uncertainties

| 1) | Credit risk |

| a. | Assets that potentially subject the Company to significant concentration of credit risk primarily consist

of cash and cash equivalents. The maximum exposure of these assets to credit risk is their carrying amounts as of the balance sheet dates.

As of June 30, 2024 and March 31, 2024, approximately $ |

The Company’s operations are carried out entirely in mainland China. Accordingly, the Company’s business, financial condition and results of operations may be influenced by the social, political, economic and legal environments in the PRC as well as by the general state of the PRC economy. In addition, the Company’s business may be influenced by changes in PRC government laws, rules and policies with respect to, among other matters, anti-inflationary measures, currency conversion and remittance of currency outside of China, rates and methods of taxation and other factors.

| b. | In measuring the credit risk of accounts receivable due from the automobile purchasers (the “customers”), the Company mainly reflects the “probability of default” by the customer on its contractual obligations and considers the current financial position of the customer and the risk exposures to the customer and its likely future development. |

Historically,

most of the automobile purchasers would pay the Company their previously defaulted amounts within one to three months. As a result, the

Company would provide full provisions on accounts receivable if the customers default on repayments for over three months. As of June

30, 2024 and March 31, 2024, the Company record allowance for credit losses of $

| 2) | Foreign currency risk |

As

of June 30, 2024 and March 31, 2024 substantially all of the Company’s operating activities and major assets and liabilities,

except for the cash deposit of approximately $

15

SENMIAO TECHNOLOGY LIMITED

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(o) Recent accounting pronouncements not yet adopted

The Company considers the applicability and impact of all accounting standards updates (“ASUs”). Management periodically reviews new accounting standards that are issued. Under the Jumpstart Our Business Startups Act of 2012, as amended (the “JOBS Act”), the Company meets the definition of an emerging growth company and has elected the extended transition period for complying with new or revised accounting standards, which delays the adoption of these accounting standards until they would apply to private companies.

In October 2023, the FASB issued ASU 2023-06, Disclosure Improvements — codification amendments in response to SEC’s disclosure Update and Simplification initiative which amend the disclosure or presentation requirements of codification subtopic 230-10 Statement of Cash Flows—Overall, 250-10 Accounting Changes and Error Corrections— Overall, 260-10 Earnings Per Share— Overall, 270-10 Interim Reporting— Overall, 440-10 Commitments—Overall, 470-10 Debt—Overall, 505-10 Equity—Overall, 815-10 Derivatives and Hedging—Overall, 860-30 Transfers and Servicing—Secured Borrowing and Collateral, 932-235 Extractive Activities— Oil and Gas—Notes to Financial Statements, 946-20 Financial Services— Investment Companies— Investment Company Activities, and 974-10 Real Estate—Real Estate Investment Trusts—Overall. The amendments represent changes to clarify or improve disclosure and presentation requirements of above subtopics. Many of the amendments allow users to more easily compare entities subject to the SEC’s existing disclosures with those entities that were not previously subject to the SEC’s requirements. Also, the amendments align the requirements in the Codification with the SEC’s regulations. For entities subject to existing SEC disclosure requirements or those that must provide financial statements to the SEC for securities purposes without contractual transfer restrictions, the effective date aligns with the date when the SEC removes the related disclosure from Regulation S-X or Regulation S-K. Early adoption is not allowed. For all other entities, the amendments will be effective two years later from the date of the SEC’s removal. The Company is currently evaluating the impact of the update on the Company’s unaudited condensed consolidated financial statements and related disclosures.

In November 2023, the FASB issued ASU 2023-07, which is an update to Topic 280, Segment Reporting: Improvements to reportable Segment Disclosures (“ASU 2023-07”), which enhances the disclosure required for reportable segments in annual and interim consolidated financial statements, including additional, more detailed information about a reportable segment’s expenses. ASU 2023-07 will be effective for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024. Early adoption is permitted. The Company is currently evaluating the impact of the pending adoption of AUS 2023-07 on its unaudited condensed consolidated financial statements.

In December 2023, the FASB issued ASU 2023-09, which is an update to Topic 740, Income Taxes. The amendments in this update enhances the transparency and decision usefulness of income tax disclosures. ASU 2023-09 will be effective for fiscal years beginning after December 15, 2024. Early adoption is permitted for annual financial statements that have not yet been issued or made available for issuance. The amendments in this Update should be applied on a prospective basis. Retrospective application is permitted. The Company is currently evaluating the impact the adoption of ASU 2023-07 will have on its annual and interim disclosures

16

SENMIAO TECHNOLOGY LIMITED

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

4. DISCONTINUED OPERATIONS

Since October,

2019, the Company has discontinued its online P2P lending services business.

| June 30, | March 31, | |||||||

| 2024 | 2024 | |||||||

| (Unaudited) | ||||||||

| Current liabilities | ||||||||

| Accrued expenses and other liabilities | $ | $ | ||||||

5. ACCOUNTS RECEIVABLE, NET

Accounts receivable include online ride-hailing services fees due from online ride-hailing drivers and rental receivables due from operating lessees. It also includes a portion of bundled lease arrangements on fixed minimum monthly payments to be paid by the automobile purchasers arising from automobile sales and services fees, net of unearned interest income, discounted using the Company’s lease pricing interest rates.

| June 30, | March 31, | |||||||

| 2024 | 2024 | |||||||

| (Unaudited) | ||||||||

| Receivables of online ride hailing fees from online ride-hailing drivers | $ | $ | ||||||

| Receivables of operating lease | ||||||||

| Receivables of automobile sales due from automobile purchasers | ||||||||

| Less: Allowance for credit losses | ( | ) | ( | ) | ||||

| Accounts receivable, net | $ | $ | ||||||

| June 30, | March 31, | |||||||

| 2024 | 2024 | |||||||

| (Unaudited) | ||||||||

| Beginning balance | $ | $ | ||||||

| Addition | ||||||||

| Translation adjustment | ( | ) | ( | ) | ||||

| Ending balance | $ | $ | ||||||

6. PREPAYMENTS, OTHER RECEIVABLES AND OTHER CURRENT ASSETS, NET

| June 30, | March 31, | |||||||

| 2024 | 2024 | |||||||

| (Unaudited) | ||||||||

| Prepaid expenses (i) | $ | $ | ||||||

| Deposits (ii) | ||||||||

| Receivables from aggregation platforms (iii) | ||||||||

| Value added tax (“VAT”) recoverable (iv) | ||||||||

| Due from automobile purchasers, net (v) | ||||||||

| Employee advances | ||||||||

| Others | ||||||||

| Less: Allowance for credit losses | ( | ) | ( | ) | ||||

| Total prepayments, other receivables and other current assets, net | $ | $ | ||||||

17

SENMIAO TECHNOLOGY LIMITED

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| June 30, | March 31, | |||||||

| 2024 | 2023 | |||||||

| (Unaudited) | ||||||||

| Beginning balance | $ | $ | ||||||

| Addition | ||||||||

| Translation adjustment | ( | ) | ( | ) | ||||

| Ending balance | $ | $ | ||||||

| (i) | Prepaid expense |

The balance of prepaid expense represented automobile purchase prepayments, automobile liability insurance premium for automobiles for operating lease and other miscellaneous expense such as office lease, office remodel expense, etc. that will expire within one year.

| (ii) | Deposits |

The

balance of deposits mainly represented the security deposit made by the Company to various automobile leasing companies, financial institutions

and Didi Chuxing Technology Co., Ltd., who runs an online ride-hailing platform. As of June 30, 2024 and

March 31, 2024, the allowance for credit losses of $

| (iii) | Receivables from aggregation platforms |

The balance of receivables from aggregation platforms represented the amount due from the collaborated aggregation platforms based on the confirmed billings, which will be disbursed to the drivers who completed their rides through the Company’s online ride-hailing platform.

| (iv) | Value added tax (“VAT”) recoverable |

The balance represented the amount of VAT, which resulted from historical purchasing activities and could be further used for deducting future VAT in PRC.

| (v) | Due from automobile purchasers, net |

The

balance due from automobile purchasers represented the payments of automobiles and related insurances and taxes made on behalf of the

automobile purchasers. The balance is expected to be collected from the automobile purchasers in installments. As of June 30, 2024

and March 31, 2024, the allowance for credit losses recorded against receivables due from automobile

purchasers was $

8. PROPERTY AND EQUIPMENT, NET

| June 30, | March 31, | |||||||

| 2024 | 2024 | |||||||

| (Unaudited) | ||||||||

| Leasehold improvements | $ | $ | ||||||

| Computer equipment | ||||||||

| Office equipment, fixtures and furniture | ||||||||

| Automobiles | ||||||||

| Subtotal | ||||||||

| Less: accumulated depreciation and amortization | ( | ) | ( | ) | ||||

| Total property and equipment, net | $ | $ | ||||||

Depreciation

and amortization expense for the three months ended June 30, 2024 and 2023 amounted to $

18

SENMIAO TECHNOLOGY LIMITED

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

9. INTANGIBLE ASSETS, NET

| June 30, | March 31, | |||||||

| 2024 | 2024 | |||||||

| (Unaudited) | ||||||||

| Software | $ | $ | ||||||

| Online ride-hailing platform operating licenses | ||||||||

| Subtotal | ||||||||

| Less: accumulated amortization | ( | ) | ( | ) | ||||

| Total intangible assets, net | $ | $ | ||||||

Amortization

expense for the three months ended June 30, 2024 and 2023 amounted to $

| Amortization expenses | ||||

| Twelve months ending June 30, 2025 | $ | |||

| Twelve months ending June 30, 2026 | ||||

| Twelve months ending June 30, 2027 | ||||

| Twelve months ending June 30, 2028 | ||||

| Twelve months ending June 30, 2029 | ||||

| Thereafter | ||||

| Total | $ | |||

10. OTHER NON-CURRENT ASSETS

| June 30, | March 31, | |||||||

| 2024 | 2024 | |||||||

| (Unaudited) | ||||||||

| Prepayments of automobiles purchased (i) | $ | $ | ||||||

| (i) |

19

SENMIAO TECHNOLOGY LIMITED

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

11. BORROWINGS FROM A FINANCIAL INSTITUTION

| Maturity | Interest | June 30, | March 31, | |||||||||||

| Bank name | date | rate | 2024 | 2024 | ||||||||||

| (Unaudited) | ||||||||||||||

| WeBank* | % | $ | $ | |||||||||||

| Borrowing from a financial institution, current | $ | $ | ||||||||||||

| Borrowing from a financial institution, non-current | $ | $ | ||||||||||||

| * |

The

total interest expense for the three months ended June 30, 2024 and 2023 was $

12. ACCRUED EXPENSES AND OTHER LIABILITIES

| June 30, | March 31, | |||||||

| 2024 | 2024 | |||||||

| (Unaudited) | ||||||||

| Accrued payroll and welfare | $ | $ | ||||||

| Payables to drivers from aggregation platforms (i) | ||||||||

| Deposits (ii) | ||||||||

| Accrued expenses | ||||||||

| Other taxes payable | ||||||||

| Payables for expenditures on automobile transaction and related services (iii) | ||||||||

| Other payables | ||||||||

| Total accrued expenses and other liabilities | ||||||||

| Total accrued expenses and other liabilities – discontinued operations | ( | ) | ( | ) | ||||

| Total accrued expenses and other liabilities – continuing operations | $ | $ | ||||||

| (i) | Payables to drivers from aggregation platforms |

The balance of payables to drivers from aggregation platforms represented the amount the Company collected on behalf of drivers who completed their transaction through the Company’s online ride-hailing platform base on the confirmed billings.

| (ii) | Deposits |

The balance of deposits represented the security deposit from operating and finance lease customers to cover lease payment and related automobile expense in case the customers’ accounts are in default. The balance is refundable at the end of the lease term, after deducting any missed lease payment and applicable fee.

| (iii) | Payables for expenditures on automobile transaction and related services |

The balance of payables for expenditures on automobile transaction and related services represented the payables balance to the miscellaneous expenses related to the daily operations of automobiles.

13. EMPLOYEE BENEFIT PLAN

The Company has made employee benefit plan in accordance with relevant PRC regulations, including retirement insurance, unemployment insurance, medical insurance, housing fund, work injury insurance and maternity insurance.

The

contributions made by the Company were $

As

of June 30, 2024 and March 31, 2024, the Company did not make adequate employee benefit contributions

in the amount of $

20

SENMIAO TECHNOLOGY LIMITED

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

14. EQUITY

Warrants

Warrants in Offerings

The Company adopted the provisions of ASC 815 on determining what types of instruments or embedded features in an instrument held by a reporting entity can be considered indexed to its own stock for the purpose of evaluating the first criteria of the scope exception in ASC 815. Warrants issued in connection with the direct equity offering with exercise prices denominated in US dollars are no longer considered indexed to the Company’s stock, as their exercise prices are not in the Company’s functional currency (RMB), and therefore no longer qualify for the scope exception and must be accounted for as a derivative. These warrants are classified as liabilities under the caption “Derivative liabilities” in the unaudited condensed consolidated statements of balance sheets and recorded at estimated fair value at each reporting date, computed using the Black-Scholes valuation model. Changes in the liability from period to period are recorded in the unaudited condensed consolidated statements of operations and comprehensive loss under the caption “Change in fair value of derivative liabilities.”

August 2020 Underwriters’ Warrants

As

of June 30, 2024 and March 31, 2024, there were

February 2021 Registered Direct Offering Warrants

As

of June 30, 2024 and March 31, 2024, there were

May 2021 Registered Direct Offering Warrants

As

of June 30, 2024 and March 31, 2024, there were

November 2021 Private Placement Warrants

As

of June 30, 2024 and March 31, 2024, there were

21

SENMIAO TECHNOLOGY LIMITED

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| Weighted | Average | |||||||||||||||

| Average | Remaining | |||||||||||||||

| Warrants | Warrants | Exercise | Contractual | |||||||||||||

| Outstanding | Exercisable | Price | Life | |||||||||||||

| Balance, March 31, 2023 | $ | |||||||||||||||

| Forfeited | ( | ) | ( | ) | ||||||||||||

| Balance, March 31, 2024 | $ | |||||||||||||||

| Exercised | ||||||||||||||||

| Balance, June 30, 2024 (unaudited) | $ | |||||||||||||||

Restricted Stock Units

On

October 29, 2020, the Board approved the issuance of an aggregate of

Equity Incentive Plan

At

the 2018 Annual Meeting of Stockholders of the Company held on November 8, 2018, the Company’s stockholders approved the Company’s

2018 Equity Incentive Plan for employees, officers, directors and consultants of the Company and its affiliates. In March 2023 and April

2024, the Annual Meeting of Stockholders of Company for the years ended March 31, 2022 and 2023 further approved the amendments to the

2018 Equity Incentive Plan, to increase the number of shares of common stock reserved under the Plan to

1-for-10 shares reverse split on common stock

The Company

considered the above transactions after giving a retroactive effect to a

Conversion Price Adjustment for November 2021 Preferred Shares

Pursuant

to the Certificate of Designation for the series A convertible preferred stock signed by the Company and certain institutional investors

in November 2021 Private Placement, the initial conversion price of the series A Convertible Preferred Shares was $

22

SENMIAO TECHNOLOGY LIMITED

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

15. INCOME TAXES

The United States of America

The Company

is incorporated in the State of Nevada in the U.S., and is subject to U.S. federal corporate income taxes with tax rate of

On December 22, 2017, the U.S. government enacted comprehensive tax legislation commonly referred to as the Tax Cuts and Jobs Act (the “Tax Act”). The Tax Act imposes a one-time transition tax on deemed repatriation of historical earnings of foreign subsidiaries, and future foreign earnings are subject to U.S. taxation. The Tax Act also established the Global Intangible Low-Taxed Income (GILTI), a new inclusion rule affecting non-routine income earned by foreign subsidiaries. For the three months ended June 30, 2024 and 2023, the Company’s foreign subsidiaries in China were operating at loss and as such, did not record a liability for GILTI tax.

The Company’s net operating loss for U.S.

income taxes from U.S for both the three months ended June 30, 2024 and 2023 amounted to approximately $

PRC

Senmiao

Consulting, Sichuan Senmiao Ronglian Technology Co., Ltd. (“Sichuan Senmiao”), Hunan Ruixi, Sichuan Senmiao Yicheng Assets

Management Co., Ltd. (“Yicheng”), Corenel, Jiekai and XXTX and its subsidiaries are subject to PRC Enterprise Income Tax (“EIT”)

on the taxable income in accordance with the relevant PRC income tax laws. The EIT rate for companies operating in the PRC is

| For the Three Months Ended | ||||||||

| June 30, | ||||||||

| 2024 | 2023 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| U.S. | $ | ( | ) | $ | ( | ) | ||

| PRC | ( | ) | ( | ) | ||||

| Total net loss before income tax | $ | ( | ) | $ | ( | ) | ||

| For the Three Months Ended | ||||||||

| June 30, | ||||||||

| 2024 | 2023 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Current income tax | $ | $ | ||||||

| Deferred tax benefit | ||||||||

| Income tax benefit | $ | $ | ||||||

| June 30, | March 31, | |||||||

| 2024 | 2024 | |||||||

| Deferred Tax Assets | (Unaudited) | |||||||

| Net operating loss carryforwards in the PRC | $ | $ | ||||||

| Net operating loss carryforwards in the U.S. | ||||||||

| Allowance for credit losses | ||||||||

| Others | ||||||||

| Less: valuation allowance | ( | ) | ( | ) | ||||

| Deferred tax assets, net | $ | $ | ||||||

| Deferred tax liabilities: | ||||||||

| Capitalized intangible assets cost | $ | $ | ||||||

| Deferred tax liabilities, net | $ | $ | ||||||

23

SENMIAO TECHNOLOGY LIMITED

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

As of both June 30, 2024 and March 31, 2024, the

Company’s PRC entities associated with discontinued operations had net operating loss carryforwards of approximately $

| June 30, 2024 | March 31, 2024 | |||||||

| (Unaudited) | ||||||||

| Net operating loss carry forwards in the PRC | $ | $ | ||||||

| Less: valuation allowance | ( | ) | ( | ) | ||||

| Total | $ | $ | ||||||

Uncertain tax positions

The

Company evaluates each uncertain tax position (including the potential application of interest and penalties) based on the technical merits,

and measure the unrecognized benefits associated with the tax positions. As of June 30, 2024

and March 31, 2024, the Company did not have any unrecognized uncertain tax positions and the Company does not believe that its unrecognized

tax benefits will change over the next twelve months. For the three months ended June 30, 2024 and 2023, the Company did not incur any

interest and penalties related to potential underpaid income tax expenses. According to PRC Tax Administration and Collection Law, the

statute of limitations is three years if the underpayment of taxes is due to computational errors made by the taxpayer or withholding

agent. The statute of limitations will be extended five years under special circumstances, which are not clearly defined (but an underpayment

of tax liability exceeding RMB

16. CONCENTRATION

Major Suppliers

For

the three months ended June 30, 2024,

For

the three months ended June 30, 2023,

17. RELATED PARTY TRANSACTIONS AND BALANCES

1. Related Party Balances

1) Accounts receivable, a related party

As

of June 30, 2024 and March 31, 2024, accounts receivable from a related party amounted to

$