UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

For the fiscal year ended

For the transition period from to

Commission

file number:

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

Sichuan, People’s Republic of | ||

| (Address of principal executive offices) | (Zip Code) |

Registrant’s

telephone number, including area code:

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: | Trading Symbol | Name of each exchange on which registered: | ||

| The |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes

☐

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405

of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Smaller reporting company | |

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section

12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction

of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

The registrant’s common

stock trades on the Nasdaq Capital Market under the symbol “AIHS.” The aggregate market value of the common stock held by

non-affiliates computed by reference to the price at which registrant’s common stock was last sold as of September 30, 2023,

was approximately $

As of June 24, 2024, there

were

DOCUMENTS INCORPORATED BY REFERENCE

SENMIAO TECHNOLOGY LIMITED

TABLE OF CONTENTS

i

Unless otherwise stated in this Annual Report on Form 10-K (this “Report”), references to:

| ● | “China” or the “PRC” refers to the People’s Republic of China, excluding, for the purposes of this Report only, Hong Kong, Macau and Taiwan; |

| ● | “Corenel” refers to Chengdu Corenel Technology Limited, a PRC limited liability company and wholly owned subsidiary of Senmiao Consulting; |

| ● | “Hunan Ruixi” refers to Hunan Ruixi Financial Leasing Co., Ltd., our majority owned subsidiary in China; |

| ● | “Jiekai” refers to Chengdu Jiekai Technology Ltd., a PRC limited liability company in China and a majority owned subsidiary of Corenel; |

| ● | “Jinkailong” refers to Sichuan Jinkailong Automobile Leasing Co., Ltd., a PRC limited liability company with 35% equity interest held by Hunan Ruixi; |

| ● | “Operating Entities” refers to Corenel, Hunan Ruixi, Jiekai, Senmiao Consulting, XXTX and Yicheng; |

| ● | “Partner Platforms” refers to other online ride-hailing platforms our Operating Entities cooperate with; |

| ● | “Restructuring” refers to the establishment of a wholly foreign owned entity and the execution of a series of agreements among the Company, Senmiao Consulting, Sichuan Senmiao and the equity holders of Sichuan Senmiao, pursuant to which we have gained control of and become the primary beneficiary to Sichuan Senmiao; |

| ● | “RMB” and “Renminbi” refer to the legal currency of China; |

| ● | “Senmiao” refers to Senmiao Technology Limited; |

| ● | “Senmiao Group,” “we,” “us,” “the Company”, “our company” and “our” refer to Senmiao Technology Limited. and its subsidiaries; |

| ● | “Senmiao Consulting” refers to Sichuan Senmiao Zecheng Business Consulting Co., Ltd.; |

| ● | “Sichuan Senmiao” refers to Sichuan Senmiao Ronglian Technology Co., Ltd., a PRC limited liability company, the majority owned subsidiary of Senmiao Consulting; |

| ● | “US$,” “U.S. dollars,” “$,” and “dollars” refer to the legal currency of the United States; |

| ● | “XXTX” refers to Hunan Xixingtianxia Technology Co., Ltd. and its subsidiaries, a PRC limited liability company and the wholly owned subsidiary of Senmiao Consulting; |

| ● | “Yicheng” refers to Sichuan Senmiao Yicheng Assets Management Co., Ltd., formerly named Yicheng Financial Leasing Co., Ltd., a PRC limited liability company and our wholly owned subsidiary in China; and |

We use U.S. dollars as reporting currency in our financial statements and in this Report. Monetary assets and liabilities denominated in Renminbi are translated into U.S. dollars at the rates of exchange as of the balance sheet date, equity accounts are translated at historical exchange rates, and revenues, expenses, gains and losses are translated using the average rate for the period. In other parts of this Report, any Renminbi denominated amounts are accompanied by translations. We make no representation that the Renminbi or U.S. dollar amounts referred to in this Report could have been or could be converted into U.S. dollars or Renminbi, as the case may be, at any particular rate or at all. The PRC government restricts or prohibits the conversion of Renminbi into foreign currency and foreign currency into Renminbi for certain types of transactions.

ii

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Report, including, without limitation, statements under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements can be identified by the use of forward-looking terminology, including the words “believes,” “estimates,” “anticipates,” “expects,” “intends,” “plans,” “may,” “will,” “potential,” “projects,” “predicts,” “continues,” or “should,” or, in each case, their negative or other variations or comparable terminology. There can be no assurance that actual results will not materially differ from expectations. Such statements include, but are not limited to, any statements relating to our ability to consummate any acquisition or other business combination and any other statements that are not statements of current or historical facts. These statements are based on management’s current expectations, but actual results may differ materially due to various factors, including, but not limited to:

| ● | our goals and strategies, including our ability to maintain our automobile transaction and related services business and our online ride-hailing platform services business in China; |

| ● | our management’s ability to properly develop and achieve any future business growth and any improvements in our financial condition and results of operations; |

| ● | the regulations and the impact by public health epidemics in China on the industries we operate in and our business, results of operations and financial condition; |

| ● | the growth or lack of growth in China of disposable household income and the availability and cost of credit available to finance car purchases; |

| ● | the growth or lack of growth of China’s online ride-hailing, automobile financing and leasing industries; |

| ● | taxes and other incentives or disincentives related to car purchases and ownership; |

| ● | fluctuations in the sales and price of new and used cars and consumer acceptance of financing car purchases; |

| ● | changes in online ride-hailing, transportation networks, and other fundamental changes in transportation pattern in China; |

| ● | our expectations regarding demand for and market acceptance of our products and services; |

| ● | our expectations regarding our customer base; |

| ● | our plans to invest in our automobile transaction and related services business and our online ride-hailing platform services business; |

| ● | our ability to maintain positive relationships with our business partners; |

| ● | competition in the online ride-hailing, automobile financing and leasing industries in China; |

| ● | macro-economic and political conditions affecting the global economy generally and the market in China specifically; and |

| ● | relevant Chinese government policies and regulations relating to the industries in which we operate. |

The forward-looking statements contained in this Report are based on our current expectations and beliefs concerning future developments and their potential effects on us. Future developments affecting us may not be those that we have anticipated or over which we may not have any control. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) and other assumptions that may cause actual results or performance to be materially different from those that are expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described under the heading “Risk Factors” in this Report and our other periodic reports filed by us with the SEC. Should one or more of these risks or unanticipated risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. These risks and others described in our periodic reports are not exhaustive.

By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. We caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and developments in the industry in which we operate may differ materially from those made in or suggested by the forward-looking statements contained in this Report. In addition, even if our results or operations, financial condition and liquidity, and developments in the industry in which we operate are consistent with the forward-looking statements contained in this Report, those results or developments may not be indicative of results or developments in subsequent periods.

iii

PART I

Item 1. Business

Overview

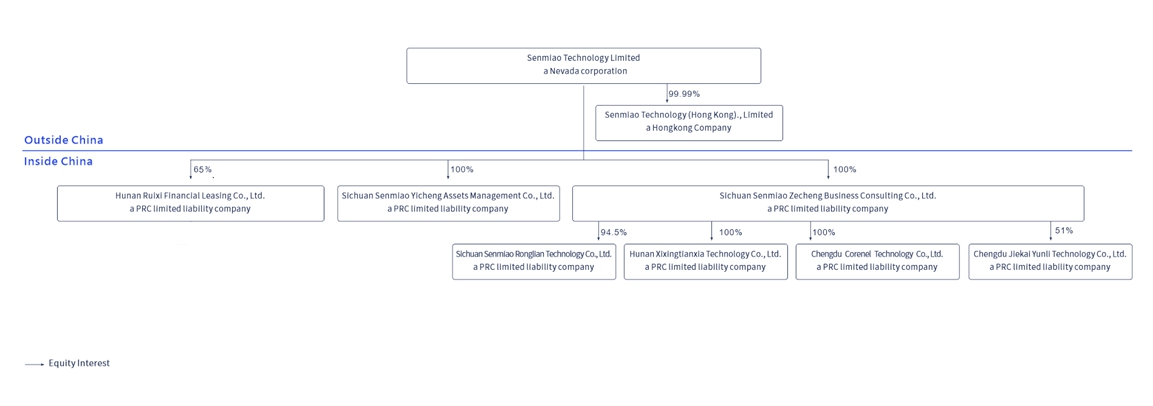

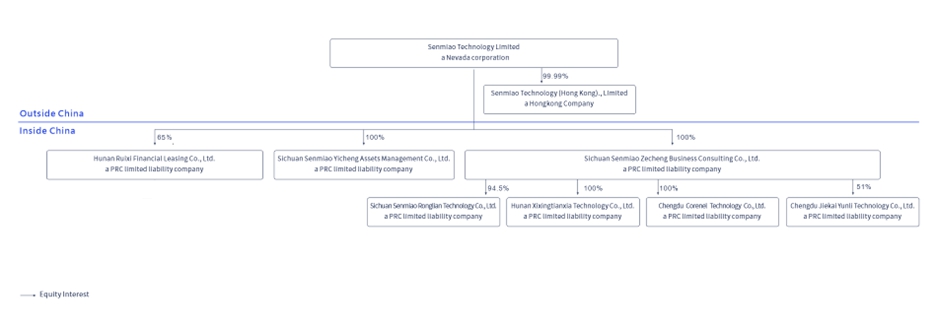

Senmiao is not a Chinese operating company but a U.S. holding company incorporated in the State of Nevada on June 8, 2017. As a holding company with no material operations of its own, Senmiao conducts a substantial majority of its operations through its operating entities established in the PRC, including its subsidiaries and the equity investee company.

Since November 2018, we have been providing automobile transaction and related services focusing on the online ride-hailing industry in the People’s Republic of China (“PRC” or “China”) through our wholly owned subsidiaries, Yicheng and Corenel, and our majority owned subsidiaries, Jiekai, and Hunan Ruixi, and its equity investee company, Jinkailong. Since October 2020, we have been operating an online ride-hailing platform through XXTX, which is a wholly owned subsidiary of Senmiao Consulting. XXTX’s platform enables qualified ride-hailing drivers to provide transportation services mainly in Chengdu, Changsha and other 20 cities in China as of the date of this Report. Our business includes Automobile Transaction and Related Services (as defined herein below) and Online Ride-hailing Platform Services, which constituted a series of services as follows:

Automobile Transactions and Related Services

Our automobile transaction and related services (the “Automobile Transaction and Related Services”) are mainly comprised of (i) automobile operating lease where we provide car rental services to individual customers to meet their personal needs with lease term no more than twelve months (the “Auto Operating Leasing”); (ii) monthly services where we provide management and related services to Partner Platforms and other companies and earn commission from them (the “Auto Commissions”); (iii) automobile financing where we provide our customers with auto finance solutions through financing leases (the “Auto Financing”); (iv) service fees from new energy vehicles (“NEVs”) leasing, automobile purchase and management services where we charge NEVs lessees or automobile purchasers for a series of the services provided to them throughout the leasing or purchase process based on the chosen product solutions, such as ride-hailing driver training, assisting with a series of administrative procedures and other consulting services (the “NEVs and Purchase Services”); (v) auto management and guarantee services provided to online ride-hailing drivers after the delivery of automobiles (the “Auto Management and Guarantee Services”); (vi) automobile sales where we sell new purchased or used cars to our customers (the “Auto Sales”); and (vii) other supporting services provided to online ride-hailing drivers. Our Operating Entities started the Purchase and NEVs Services, Auto Management and Guarantee Services, and other supporting services in November 2018, the Auto Sales in January 2019, and Auto Operating Leasing and Auto Financing in March 2019, respectively.

The following chart illustrates the constitution of our automobile transactions and related services:

1

Auto Operating Leasing

We, through our subsidiaries, Hunan Ruixi, Corenel, Jiekai and equity investee company, Jinkailong (the “Auto Business Entities”) in China, have generated revenue since March 2019 from operating lease services, where the Auto Business Entities lease their own automobiles, sublease automobiles leased from third-parties or rendered from certain online ride-hailing drivers they served before with their authorization, to other individuals, including new online ride-hailing drivers, for a lease term of no more than twelve months. We have shifted our business focus to automobile leasing in accordance with the change of market condition and industry development since the year ended March 31, 2021. Hunan Ruixi is and Jinkailong was authorized to sublease or sell these drivers’ automobiles in order to offset the repayments those drivers owed to us and the financial institutions. We also purchase and lease NEVs for subleasing with rental periods of twelve months or less. Excluding Jinkailong, our other Auto Business Entities leased over 1,400 automobiles with an average monthly rental income of approximately $485 per automobile for the year ended March 31, 2024.

Auto Commissions

Our Auto Business Entities generated monthly revenues from the management and related services provided to our Partner Platforms and other companies. We generated revenues of $196,099 from the monthly services commissions during the year ended March 31, 2024.

Auto Financing

Hunan Ruixi began offering auto financing services in March 2019. In a self-operated financing transaction, Hunan Ruixi is a lessor and a customer (i.e., online ride-hailing driver) is a lessee. Hunan Ruixi offers to the customer a selection of automobiles that were purchased by Hunan Ruixi in advance. The customer will choose the desirable automobile to be purchased and enter into a financing lease with Hunan Ruixi. During the term of the financing lease, the customer will have use rights with respect to the automobile. Hunan Ruixi will obtain title to the automobile upfront and retain such title during the term of the financing lease, as lessor. At the end of the lease term, the customer will pay a minimal price and obtain full title of the automobile after the financing lease is repaid in full. In connection with the financing lease, the customer will enter into a service agreement with Hunan Ruixi. We recognized a total interest income of $57,677 for the year ended March 31, 2024.

NEVs and Purchase Services

Our Auto Business Entities charge lease service fees to lessees who rent NEVs from us in Chengdu and Changsha. We also charge automobile purchasers services fees for a series of the services provided to them throughout the purchase process such as credit assessment, installment of GPS devices, ride-hailing driver qualification and other administrative procedures. The amount of services fees for NEVs leasing and purchase is based on the product solutions. Excluding Jinkailong, our other Auto Business Entities had revenue of services of $45,231 from NEVs leasing and $36,637 from automobile purchase, for the year ended March 31, 2024, respectively.

Auto Management and Guarantee Services

The management and guarantee services of Hunan Ruixi are provided to online ride-hailing drivers after the delivery of automobiles, covering (i) management services including, without limitation, ride-hailing driver training, assisting with purchase of insurances, insurance claims and after-sale automobile services, handling traffic violations and other consulting services; and (ii) guarantee services for the obligations of online ride-hailing drivers under their financing arrangement with financial institutions. The management and guarantee fees of Hunan Ruixi are based on the costs of our services and the results of our credit assessment of the automobile purchasers. Hunan Ruixi had revenue of $16,246 from the management and guarantee services for the year ended March 31, 2024.

2

Auto Sales

Our Auto Business Entities are also engaged in the sales of used-automobiles through Hunan Ruixi and the equity investee company, Jinkailong. Hunan Ruixi sold two used-automobiles, resulting in an income of $8,822 during the year ended March 31, 2024.

Since November 22, 2018, the acquisition date of Hunan Ruixi, and as of March 31, 2024, the Auto Business Entities have facilitated financing for an aggregate of 312 automobiles with a total value of approximately $5.3 million, sold an aggregate of 1,516 automobiles with a total value of approximately $14.5 million and delivered 1,892 automobiles under operating leases and 164 automobiles under financing leases to customers, the vast majority of whom are online ride-hailing drivers.

Ride-Hailing Platform Services

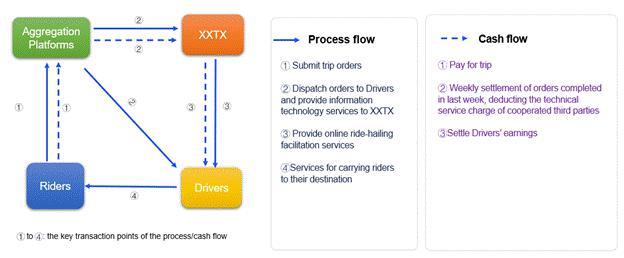

As part of our goal to provide an all-solution for online ride-hailing drivers as well as to increase our competitive power in an increasingly competitive online ride-hailing industry and to take advantage of the market potential, in October 2020, we, through XXTX, began operating an online ride-hailing platform (called Xixingtianxia) in Chengdu. Our ride hailing platform enables qualified ride-hailing drivers to provide application-based transportation services in China. XXTX holds a national online reservation taxi operating license. The platform is presently servicing ride-hailing drivers in 22 cities in China, including Chengdu, Changsha, Guangzhou and so on, providing them with a platform to view and take customer orders for rides. XXTX currently collaborates with Gaode Map, a well-known aggregation platform in China on our ride-hailing platform services. Under the collaboration, when a rider searches for taxi/ride-hailing services on the aggregation platform, the platform provides such rider a number of online ride-hailing platforms for selection, including ours and if our platform is selected by the rider, the order will then be distributed to registered drivers on our platform for viewing and acceptance. The rider may also simultaneously select multiple online ride-hailing platforms, in which case, the aggregation platform will distribute the requests to different online ride-hailing platforms which they cooperate with, based on the number of available drivers using the platform in a certain area and these drivers’ historical performance, among other things. XXTX generates revenue from providing services to online ride-hailing drivers to assist them in providing transportation services to the riders looking for taxi/ride-hailing services. XXTX earns commissions for each completed order as the difference between an upfront quoted fare and the amount earned by a driver based on actual time and distance for the ride charged to the rider (the “Online Ride-hailing Platform Services”). XXTX settles its commissions with the aggregation platforms on a weekly basis.

The following chart illustrates our typical process of our ride-hailing platform services:

During the year ended March 31, 2024, approximately 4.9 million rides with gross fare of approximately $15.1 million were completed through Xixingtianxia and an average of over 5,000 ride-hailing drivers completed rides and earned income through Xixingtianxia (the “Active Drivers”) each month. During the year ended March 31, 2024, we earned online ride-hailing platform service fees of approximately $2.5 million, after netting off approximately $0.3 million incentives paid to Active Drivers.

Our executive office is located in Chengdu City, Sichuan Province, China. Substantially all of our operations are conducted in China. We plan to expand our driver base for the platform and automobile rental business while strengthening the royalty of the drivers who both lease our cars and use our platform while expanding, but our platform is available to others.

3

Our Corporate History

Senmiao was incorporated in the State of Nevada on June 8, 2017. It established a wholly owned subsidiary, Senmiao Consulting in China in July 2017. Sichuan Senmiao, a majority owned subsidiary of Senmiao Consulting, was established in China in June 2014. Senmiao Consulting provided services to Sichuan Senmiao, pursuant to a series of contractual arrangements (the “VIE Agreements”) with Sichuan Senmiao and each of its equity holders. Senmiao Consulting became the primary beneficiary of Sichuan Senmiao. The contractual arrangements had been in place since the establishment of Senmiao Consulting (the “Restructuring”). On March 23, 2022, shareholders with 94.5% equity interests of Sichuan Senmiao and Senmiao Consulting terminated the VIE Agreements. On March 28, 2022, these shareholders further sold a total of 94.5% equity interests of Sichuan Senmiao to Senmiao Consulting with a total consideration of zero due to continuous loss. Sichuan Senmiao became the majority owned subsidiary of Senmiao Consulting accordingly.

On September 25, 2016, Sichuan Senmiao acquired a P2P platform (including website, internet content provider (“ICP”) registration, operating systems, servers, management system, employees and users) from Sichuan Chenghexin Investment and Asset Management Co., Ltd. (“Chenghexin”), which had established and operated the platform for two years prior to our acquisition (the “Acquisition”), for a total cash consideration of RMB69,690,000 (approximately $10.1 million). Prior to the Acquisition, Sichuan Senmiao was a holding company that owned a 60% equity interest in an equity investment fund management company. Sichuan Senmiao sold its 60% equity interest for a cash consideration of RMB60 million (approximately $8.9 million) immediately following the Acquisition, in order to focus on the online marketplace lending business. We ceased the online lending services business in October 2019.

On November 21, 2018, Senmiao entered into an Investment and Equity Transfer Agreement (the “Investment Agreement”) with Hunan Ruixi and all the shareholders of Hunan Ruixi, pursuant to which Senmiao acquired an aggregate of 60% of the equity interest of Hunan Ruixi with a consideration of zero. Senmiao closed the acquisition on November 22, 2018 and agreed to make a cash contribution of $6,000,000 to Hunan Ruixi, representing 60% of its registered capital, in accordance with the Investment Agreement. On February 12, 2024, Senmiao, Hunan Ruixi and its other shareholders entered into a Share Swap Agreement (the “Hunan Ruixi Share Swap Agreement”), pursuant to which, Senmiao purchased 5% equity interest from other shareholders of Hunan Ruixi at a total purchase price of $472,815, payable in the Company’s shares of common stock, par value $0.0001 per share at a per share price of the average closing price of a share of common stock reported on the Nasdaq Capital Market for ten (10) trading days immediately preceding February 1, 2024. On February 27, 2024, the issuance of shares of the Company’s common stock for this transaction has been completed and on March 28, 2024, the registration procedures for the change in shareholders was completed. As of the date of this Report, Senmiao has made the cash contributions with aggregated amount of $6,000,000 to Hunan Ruixi. Hunan Ruixi holds a business license for automobile sales and financial leasing and has been engaged in automobile financial leasing services and automobile sales since March 2019 and January 2019, respectively.

Hunan Ruixi had a wholly owned subsidiary, Ruixi Leasing, a PRC limited liability company formed in April 2018 with a registered capital of RMB10 million (approximately $1.5 million). Ruixi Leasing had no operations and was dissolved in June 2022.

Hunan Ruixi also owns 35% equity interest in Jinkailong and used to receive economic benefits of the remaining 65% equity interest through two voting agreements with other shareholders of Jinkailong. On March 31, 2022, the voting agreements were terminated by other shareholders of Jinkailong and Hunan Ruixi. As a result, Jinkailong ceased to be a VIE. Jinkailong is an automobile transaction and related services company in Chengdu City, Sichuan Province, China, which primarily targets drivers in the ride-hailing service sector, focus on automobile operating lease, and facilitates sales and financing transactions for its clients and provides relevant after-transaction services to them. Although Jinkailong was ceased from our consolidation scope since March 31, 2022, Huana Ruixi, Corenel and Jiekai continuously provide automobile transaction and related services similar to Jinkailong in Changsha and Chengdu.

In May 2019, Senmiao formed its wholly owned subsidiary, Yicheng, with a registered capital of $50 million in Chengdu City, Sichuan Province, China. Yicheng obtained its business licenses for automobiles sale and has engaged in the sales of automobiles since June 2019. Yicheng used to have a license of financial leasing, which was terminated since June 2022. As of the date of this Report, Senmiao has made contributions in an aggregate amount of $5,750,000 to Yicheng.

On September 11, 2020, Senmiao Consulting entered into an Investment Agreement relating to XXTX with all the original shareholders of XXTX, pursuant to which Senmiao Consulting would make an investment of RMB3.16 million (approximately $0.5 million) in XXTX in cash and obtain 51% equity interest accordingly. As of the date of this Report, the Company had remit approximately full amount of investment to XXTX pertained to above mentioned XXTX Investment Agreement. On October 23, 2020, the registration procedures for the change in shareholders and registered capital were completed and XXTX became a majority owned subsidiary of Senmiao Consulting. On February 5, 2021, Senmiao Consulting and all the original shareholders of XXTX entered into a supplementary agreement related to XXTX’s Investment agreement (the “XXTX Increase Investment Agreement”). Under the XXTX Increase Investment Agreement, all the shareholders of XXTX agreed to increase the total registered capital of XXTX to RMB50.8 million (approximately $7.40 million). Senmiao Consulting shall pay another investment amounted to RMB36.84 million (approximately $5.36 million) in cash in exchange of additional 27.74% of XXTX’s equity interest. As of the date of this Report, the Company had remitted approximately RMB36.60 million ($5.33 million) to XXTX pertained to above mentioned XXTX Increase Investment Agreement.

4

On October 22, 2021, the Company, Senmiao Consulting, XXTX and its other shareholders further entered into a Share Swap Agreement (the “XXTX Share Swap Agreement”), pursuant to which the Company, through Senmiao Consulting, purchased all of the remaining equity interests the original shareholders held in XXTX at a total purchase price of $3.5 million, payable in the Company’s shares of common stock, par value $0.0001 per share at a per share price of the average closing price of a share of common stock reported on the Nasdaq Capital Market for ten (10) trading days immediately preceding the date of the XXTX Share Swap Agreement. On November 9, 2021, the issuance of 533,167 (5,331,667 pre reverse split) shares of the Company’s common stock for this transaction has been completed and on December 31, 2021, the registration procedures for the change in shareholders was completed. As a result, XXTX became a wholly-owned subsidiary of Senmiao Consulting.

As of the date of this Report, Senmiao Consulting has made a cumulative capital contribution of RMB40.41 million (approximately $5.60 million) to XXTX and the remaining amount is expected to be paid before December 31, 2025. As of the date of this Report, XXTX had eight wholly owned subsidiaries and two of them have operations.

In December 2020, Senmiao Consulting formed a wholly owned subsidiary, Corenel, with a registered capital of RMB10.0 million (approximately $1.6 million) in Chengdu City, Sichuan Province. Corenel is engaged in automobile operating lease since March 2021.

In April 2021, Senmiao formed Senmiao Technology (Hong Kong), Ltd. (“Senmiao HK”), a limited liability company with a registered capital of $10,000 in Hong Kong. We hold 99.99% of the equity interests of Senmiao HK. As of the date of this Report, Senmiao HK has no operations.

In March 2022, Corenel and another company in Chengdu formed a subsidiary, Jiekai, with a registered capital of RMB500,000 (approximately $80,000) in Chengdu City, Sichuan Province. Corenel holds 51% equity interests of Jiekai. Jiekai is engaged in automobile operating lease business since April 2022.

Our Corporate Structure

The following diagram illustrates the Company’s corporate structure as of the date of this Report:

5

Former Voting Agreements with Jinkailong’s Other Shareholders

Hunan Ruixi entered into two voting agreements signed in August 2018 and February 2020, respectively, as amended (the “Voting Agreements”), with Jinkailong and other Jinkailong’s shareholders holding aggregate of 65% equity interest. Pursuant to the Voting Agreements, all other Jinkailong’s shareholders will vote in concert with Hunan Ruixi on all fundamental corporate transactions in the event of a disagreement for periods of 20 years and 18 years, respectively, ending on August 25, 2038.

On March 31, 2022, Hunan Ruixi entered into an Agreement for the Termination of the Agreement for Concerted Action by Shareholders of Jinkailong (the “Termination Agreement”), pursuant to which the Voting Agreements mentioned above shall be terminated as of the date of the Termination Agreement. The termination will not impair the past and future legitimate rights and interests of all parties in Jinkailong. As a result of the Termination Agreement, we no longer have a controlling financial interest in Jinkailong and have determined that Jinkailong was deconsolidated from our consolidated financial statements effective as of March 31, 2022. However, as Hunan Ruixi still holds 35% equity interests in Jinkailong, Jinkailong is our equity investee company since then. As of March 31, 2024, the paid-in capital of Jinkailong was zero.

Actual and Potential Impact of Coronavirus (COVID-19) in China on Our Business

Impact on the Automobile Transactions and Related Services

Our Automobile Transactions and Related Services have been gradually recovering from the adverse impact of COVID-19 pandemic. As of March 31, 2024, 108 online ride-hailing drivers Hunan Ruixi serviced rendered their automobiles to Hunan Ruixi. For the years ended March 31, 2024 and 2023, we recognized provision for credit losses of $4,209 and $0, respectively, against receivables from these purchasers served by Hunan Ruixi. As most of the leasing term of the automobiles we delivered in Changsha in prior periods has come to the end, during the year ended March 31, 2024, the number of newly rendered automobiles decreased to 0 as compared with 7 during the year ended March 31, 2023. However, our daily cash flow will be adversely impacted as a result of the unsatisfied collection from the online ride-hailing drivers and our potential guarantee expenditure pursuant to the financing agreements we guaranteed. Our cash flow has been adversely impacted by local resurgences of COVID-19 in Chengdu, Changsha and Guangzhou while China kept applying the zero-COVID policy control and prevention measures especially from September to November 2022, which had negative impact on the online ride-hailing market accordingly due to travel restriction. In addition, our automobile purchasers and lessees may be unable to generate sufficient income to make their monthly rental, which shall have significant negative impact on our revenue from automobiles leasing. If we experience a widespread default by our automobile purchasers/lessees, our cash flow and results of operations will be materially and adversely affected. As a consequence, we could face shortfalls in liquidity without extra financing resources for the foreseeable future and lose the ability to grow our business or may even be required to scale down or restructure our operations.

6

Impact on the Ride-Hailing Platform Services

XXTX commenced the operation of its online ride-hailing platform since late October 2020 and have witnessed the decrease in online ride-hailing orders in July 2021, November 2021, February 2022, September 2022 and December 2022, when Chengdu, Changsha and Guangzhou reported several confirmed COVID-19 cases, the local government usually ensured concrete and effective measures to fight against the resurgence, including suspending some traffic activities in certain medium-risk and high-risk areas. Fewer people took ride-hailing trips as a result and the average daily rides completed through our platform decreased and our income increased accordingly. Consequently, the income of our Automobile Transaction and Related Services customers who ran their business through the online ride-hailing platforms also decreased during this period.

Any of these factors related to COVID-19 and other similar or currently unforeseen factors beyond our control could have an adverse effect on our overall business environment, causing uncertainties in the regions in China where we conduct business, and causing our business to suffer in ways that we cannot predict and materially and adversely impact our business, financial condition and results of operations.

Customers

The significant majority of our Operating Entities’ customers are online ride-hailing drivers. Due to the complexity and difficulty of obtaining registration of various licenses required for driving an online ride-hailing car, our customers choose to lease automobile from us or become affiliated with us who offer them a simplified and smooth process to obtain qualified cars for online ride-hailing. The automobile lessees typically lease automobiles which meet the criteria of cars used for online ride-hailing for their own business in the industry. The automobile purchasers typically become affiliated with Hunan Ruixi through affiliation agreements pursuant to which Hunan Ruixi, as a qualified management company, provide them post-transaction management services during the affiliation period, which is usually the same as the term of the Financing Agreements. The users of Xixingtianxia platform typically use it to view and take customer orders for rides.

Our Auto Business Entities acquire customers through the network of sales teams from third-party and our related party, cooperated lease companies and our own efforts including online advertising and billboard advertising. Our operating entities also send out fliers and participate in trade shows to advertise our services. During the year ended March 31, 2024, we serviced over 2,000 customers for our Automobile Transaction and Related Services. During the year ended March 31, 2024, approximately 4.9 million rides with gross fare of approximately $15.1 million were completed through our platform orders.

Risk Management

To mitigate risk associate with our Automobile Transaction and Related Services and Online Ride-hailing Platform Services, our operating entities conduct assessments and evaluations of prospective online ride-hailing drivers and leases separately, including identity verification and background checks. For an online ride-hailing platform driver who uses our platform as well as purchases or leases automobile from our Auto Business Entities, the assessments typically involve two rounds from our subsidiaries who operate Automobile Transaction and Related Services and Online Ride-hailing Platform Services, respectively. We believe our manual review and verification process is sufficient for the requirements of our current operations.

Our Operating Entities conduct an initial screening when they receive an application from a prospective automobile buyer/lessee based on credit reports from People’s Bank of China (the “PBOC”) and third party credit rating companies, and personal information including residence, ethnicity group, driving history and involvement in legal proceeding. An automobile buyer/lessee must meet the following preliminary criteria:

| ● | be between 18-65 years old; |

| ● | reside in the mainland of China and have the local residential identification; |

| ● | have a driving history of at least three years; |

| ● | not be subject to on-going legal proceedings or enforcement; |

| ● | not be listed on a national delinquent debtor’s list; |

| ● | the value of purchased automobile matches the income of the candidate. |

7

Additionally, our Operating Entities arrange a simple in-person interview with the applicant where we gather information on marital/family status, income, assets, borrowing history and default history, if any. This interview is typically conducted by our operating entities’ risk management staff who will verify the accuracy of information on the prospective driver by cross-checking information provided by the applicant with other sources. Our Operating Entities will also assess the prospective customer’s potential repayment ability.

Applicants with any of the follow attributes will be rejected:

| ● | engaging in illegal or criminal activities; |

| ● | involvement in pornography, gambling, drug dealing and gangster activities and experiences; |

| ● | engaging in usury lending; or |

| ● | providing fraudulent information. |

Our Operating Entities also conduct an assessment and evaluation when they receive an application from a prospective online ride-hailing driver. Under our online ride-hailing platform’s standards, a qualified driver must meet certain minimum criteria:

| ● | have obtained online booking taxi driver’s license with age of 21 to 60 years old for males; 21 to 55 years old for females; |

| ● | have a driving history of at least three years with driving license of (i) A1, A2, A3, B1, B2, C1 and C2 (referring to the different classes of driver’s license in China based on vehicle types); |

| ● | must not have committed any hit-and-run accidents; |

| ● | have no record of dangerous driving, drug use, driving under alcoholic influence, and violent crime; |

| ● | have no traffic violation of 12 demerit points or more in any year of the past three years; and |

| ● | have not been investigated or disciplined for unlawfully engaging in taxi services or other passenger transportation operations within the past five years. |

XXTX’s online ride-hailing platform also sets criteria for the automobiles used for online ride-hailing business, which need to be completed before the driver commences to use the automobile for online ride-hailing business:

| ● | has obtained online booking taxi transportation certificate and be registered as “reserved taxi service” with less than 7 seats and local registered number; or in accordance with the requirements by local government; |

| ● | has installed vehicle satellite positioning device and emergency alarm device with driving record function; |

| ● | motor vehicle driving permit is still in use; |

| ● | has been covered with compulsory insurance for motor vehicle traffic accident liability and compulsory insurance for third party liability of motor vehicle, and within the insurance period, or in accordance with the requirements by local government; |

| ● | vehicle miles traveled is less than 600,000 km and the service life is less than 8 years; |

| ● | other requirements by local government. |

8

As for the Cybersecurity risk assessment as well as the mitigation measure taken by the Company, please refer to the discussion under Item 1C – Cybersecurity for more details.

Post-Financing Services and Collection Monitor

The Drivers Management department and Post Financing Management department of our Auto Business Entities are in charge of monitoring and managing monthly payments by the purchaser/lessee. Every car purchased or leased through us has a GPS device installed, which helps us locate the car. Our Drivers Management monitor the daily gross income of our served online ride-hailing drivers through our cooperated online ride-hailing platforms as well as trace the location of each car at least every day. If there is any indicator such as the driver’s daily income is far behind the average level or the trajectory is unusual, our Drivers Management department shall contact the driver immediately and deliver the case to the Post Financing Management department to repose the car if necessary. The Drivers Management also monitor the daily using expenditures of each car such as the traffic violations penalty and maintenance expenses once a week. The car shall be reposed if the accumulated amount of those expenses exceeds the threshold. After a car is repossessed, our Auto Business Entities store it in a warehouse and later re-lease it to new customers or dispose of the automobile in accordance with law and relevant contracts. If our Auto Business Entities are unable to repossess collateral from a delinquent automobile purchaser/lessee, they may commence a lawsuit against such purchaser/lessee.

Competition

The online ride-hailing industry in China is intensively competitive and full of rapid changes in technology, shifting user preferences and frequent introduction of new services and products. There were approximately 300 automobile financing and leasing companies that provide automobile purchasing and leasing services to online ride-hailing drivers in Chengdu and Changsha City as of June 2024. We face significant competition primarily from companies that operate in Chengdu City, such as Sichuan Hengchuang Times Automobile Serving Co., Ltd., and Changsha Zitai Automobile Leasing Co., Ltd.

Meanwhile, Didi Chuxing Technology Co., Ltd. (“Didi”) takes over 80% market share of the online ride-hailing platforms in China according to the public information. We choose to cooperate with well-known aggregation platforms to commence our online ride-hailing platform business rather than competing with Didi directly. As of June 2024, there were approximately 100 companies who operate their own online ride-hailing platforms and have established business relationships with Gaode in Chengdu and Changsha, our major operation cities and are engaged in the same business as ours. We face significant competition primarily from platforms that have operation in Chengdu and Changsha City, such as Caocao, Robotaxi and T3 Chuxing. We expect to have more cooperation with other aggregation platforms in the online ride-hailing industries to have more competitive advantage in the industry.

Many of our competitors are well-capitalized and offer discounted services, driver incentives, consumer discounts and promotions, innovative service and product offerings, and alternative pricing models, which may be more attractive to consumers than those that we offer. Further, some of our current or potential competitors have, and may in the future continue to have, greater resources and access to larger driver and consumer bases in a particular geographic market. In addition, our competitors in certain geographic markets enjoy substantial competitive advantages such as greater brand recognition, longer operating histories, better localized knowledge, and more supportive regulatory regimes. As a result, such competitors may be able to respond more quickly and effectively than us in such markets to new or changing opportunities, technologies, consumer preferences, regulations, or standards, which may render our products or offerings less attractive. In addition, future competitors may share in the effective benefit of any regulatory or governmental approvals and litigation victories we may achieve, without having to incur the costs we have incurred to obtain such benefits.

Regulations

This section sets forth a summary of the most significant rules and regulations that affect our business activities in China or the rights of our stockholders to receive dividends and other distributions from us.

Regulations Related to Cybersecurity, Information Security and Confidentiality of User Information

PRC government authorities have enacted laws and regulations with respect to Internet information security and protection of personal information from any abuse or unauthorized disclosure. Internet information in China is regulated and restricted from a national security standpoint.

The Ministry of Public Security of the People’s Republic of China (the “MPS”) has promulgated measures that prohibit use of the Internet in ways that, among other things, result in leaks of government secrets or the spread of socially destabilizing content. The MPS and its local counterparts have authority to supervise and inspect domestic websites to carry out its measures. Internet information service providers that violate these measures may have their licenses revoked and their websites shut down.

9

Cybersecurity and Information Security

For description of the historical regulatory landscape of Cybersecurity and Information Security, please refer to pages 15 to 19 in our annual report on Form 10-K for the fiscal year ended March 31, 2023 filed with the SEC on July 13, 2023, which is incorporate by reference herein.

On March 22, 2024, CAC adopted Regulations to Promote and Standardize Cross-Border Data Flows. The new regulation optimizes and adjusts the outbound data transfer system, including security assessment for outbound data transfer, cross-border transfer of personal information through concluding standard contract, and personal information protection certification. The new regulations appropriately relax the conditions for cross-border flow of data and narrow the scope of data outbound security assessment, so as to facilitate cross-border flow of data and reduce the compliance costs of enterprises.

Personal Information Protection

The Several Provisions on Regulating the Market Order of Internet Information Services, issued by the MIIT on December 29, 2011 and effective on March 15, 2012, stipulate that internet information service providers may not collect any user personal information or provide any such information to third parties without the consent of a user, unless otherwise stipulated by laws and administrative regulations. “User Personal information” is defined as information relevant to the users that can lead to the recognition of the identity of the users independently or in combination with other information. An internet information service provider must expressly inform the users of the method, content and purpose of the collection and processing of such user personal information and may only collect such information as necessary for the provision of its services. An internet information service provider is also required to properly store user personal information, and in case of any leak or likely leak of the user personal information, the internet information service provider must take immediate remedial measures and, in severe circumstances, make an immediate report to the telecommunications regulatory authority.

The Decision on Strengthening the Protection of Online Information, issued by the SCNPC on December 28, 2012, and the Order for the Protection of Telecommunication and Internet User Personal Information, issued by the MIIT on July 16, 2013, stipulate that any collection and use of user personal information must be subject to the consent of the user, abide by the principles of legality, rationality and necessity and be within the specified purposes, methods and scope. An internet information service provider must also keep such information strictly confidential, and is further prohibited from divulging, tampering with or destroying any such information, or selling or proving such information to other parties. An internet information service provider is required to take technical and other measures to prevent the collected personal information from any unauthorized disclosure, damage or loss. Any violation of the above decision or order may subject the internet information service provider to warnings, fines, confiscation of illegal gains, revocation of licenses, cancelation of filings, closedown of websites or even criminal liabilities.

10

With respect to the security of information collected and used by mobile apps, pursuant to the Announcement of Conducting Special Supervision against the Illegal Collection and Use of Personal Information by Apps, which was issued by the CAC, the MIIT, the Ministry of Public Security, and the State Administration for Market Regulation on January 23, 2019, app operators shall collect and use personal information in compliance with the Cybersecurity Law and shall be responsible for the security of personal information obtained from users and take effective measures to strengthen personal information protection. Furthermore, app operators shall not force their users to make authorization by means of default settings, bundling, suspending installation or use of the app or other similar means and shall not collect personal information in violation of laws, regulations or breach of user agreements. Such regulatory requirements were emphasized by the Notice on the Special Rectification of Apps Infringing upon User’s Personal Rights and Interests, which was issued by MIIT on October 31, 2019. On November 28, 2019, the CAC, the MIIT, the Ministry of Public Security and the State Administration for Market Regulation jointly issued the Methods of Identifying Illegal Acts of Apps to Collect and Use Personal Information. This regulation further illustrates certain commonly seen illegal practices of app operators in terms of personal information protection.

On March 12, 2021, the Secretary Bureau of the CAC, the General Office of the MIIT, the General Office of the MPS and the General Office of the MSA jointly issued the Provision on Scope of Necessary Personal Information for Common Types of Mobile Internet Applications, which prescribed the scope of necessary personal information that may be collected by common applications, include map navigation applications, online car booking applications and other 37 common applications. For online car booking applications, the necessary personal information includes cell phone numbers of registered users; rider’s departure place, arrival place, location information, travel track and payment information such as payment time, payment amount and payment channel. Applications shall not deny users’ access to the basic functional services if the users do not agree to provide personal information outside those necessary ones.

On August 20, 2021, the SCNPC promulgated the Personal Information Protection Law, which took effect on November 1, 2021. Pursuant to the Personal Information Protection Law, “personal information” refers to any kind of information related to an identified or identifiable individual as electronically or otherwise recorded and exclude anonymized information. The processing of personal information includes the collection, storage, use, processing, transmission, provision, disclosure and deletion of personal information. The Personal Information Protection Law applies to the processing of personal information of individuals within the territory of the PRC, as well as personal information processing activities outside the territory of PRC, for the purpose of providing products or services to natural persons located within PRC, for analyzing or evaluating the behaviors of natural persons located within PRC, or for other circumstances as prescribed by laws and administrative regulations. A personal information processor may process the personal information of this individual only under the following circumstances: (i) where consent is obtained from the individual; (ii) where it is necessary for the execution or performance of a contract to which the individual is a party, or where it is necessary for carrying out human resource management pursuant to employment rules or collective contracts made and executed in accordance with laws; (iii) where it is necessary for performing a statutory responsibility or statutory obligation; (iv) where it is necessary in response to a public health emergency, or for protecting the life, health or property of a natural person in the case of an emergency; (v) where the personal information is processed within a reasonable scope to carry out news reporting, supervision by public opinions or any other activity for public interest purposes; (vi) where the personal information, which has already been disclosed by the individual or otherwise legally disclosed, is processed within a reasonable scope; or (vii) any other circumstance as provided by laws or administrative regulations. In principle, the consent of an individual must be obtained for the processing of his or her personal information, except under the circumstances of the aforementioned items (ii) to (vii). Where personal information is to be processed based on the consent of an individual, such consent shall be a voluntary and explicit indication of intent given by such individual on a fully informed basis. If laws or administrative regulations provide that the processing of personal information shall be subject to a separate consent or written consent of the individual concerned, such provisions shall prevail. In addition, the processing of the personal information of a minor under 14 years old must obtain the consent by a parent or a guardian of such minor and the personal information processors must adopt special rules for processing personal information of minors under 14 years old.

11

In the meantime, the PRC regulatory authorities have also enhanced the supervision and regulation on cross-border data transmission. For example, on October 29, 2021, the Measures for the Security Assessment of Cross-border Data Transmission (Draft for Comment) were proposed by the CAC for public comments, which require that any data processor providing important data collected and generated during operations within the PRC or personal information that should be subject to security assessment according to law to an overseas recipient shall conduct security assessment. The final Measures was promulgated on July 7, 2022 and was effective on September 1, 2022. The measures provide five circumstances, under any of which data processors shall, through the local cyberspace administration at the provincial level, apply to the CAC for security assessment of data cross-border transfer. These circumstances include: (i) where the data to be transferred to an overseas recipient are personal information or important data collected and generated by operators of critical information infrastructure; (ii) where the data to be transferred to an overseas recipient contain important data; (iii) where a personal information processor that has processed personal information of more than one million people provides personal information overseas; (iv) where the personal information of more than 100,000 people or sensitive personal information of more than 10,000 people are transferred overseas accumulatively; or (v) other circumstances under which security assessment of data cross-border transfer is required as prescribed by the CAC. As of the date of this Report, the above measures have not been formally adopted, and substantial uncertainties still exist with respect to the enactment timetable, final content, interpretation and implementation of these measures and how they will affect our business operation.

Our Chinese subsidiaries and affiliates have incurred, and will continue to incur, significant expenses in an effort to comply with cybersecurity and information security standards and protocols imposed by law, regulation, industry standards or contractual obligations to the date of this Report in all material respects. However, changes in existing laws or regulations or adoption of new laws and regulations relating to cybersecurity and information security, particularly any new or modified laws or regulations that require enhanced protection of certain types of data or new obligations with regard to data retention, transfer or disclosure, could greatly increase the cost to us of providing our service offerings, require significant changes to our operations or even prevent us from providing certain service offerings in jurisdictions in which we currently operate or in which we may operate in the future.

Regulations Related to Online Ride-Hailing Services

Our ride hailing business is regulated by certain laws and regulations relating to online ride hailing services. As a ride hailing platform, we are required to obtain permits for an online ride hailing business in the cities in China where we operate such a business, and specific licenses and permits are also required for the drivers and vehicles on our platform engaged in our ride hailing business.

In order to manage the rapidly growing online ride-hailing service market and control relevant risks, on July 27, 2016, seven ministries and commissions, including the Ministry of Transport (the “MOT”), jointly promulgated the Interim Measures for the Administration of Online Taxi Booking Business Operations and Services, which was amended on December 28, 2019 and November 30, 2022, which legalizes online ride-hailing services such as XXTX and requires the online ride-hailing services to meet the requirements set out by the Interim Measures and obtain requisite service licenses and take full responsibility of the ride services to ensure the safety of riders. According to the Interim Measures, (i) the competent transport department of the State Council shall be responsible for guiding the administration of online ride hailing services nationwide, (ii) the competent transport department of the government of a province or an autonomous region shall be responsible for guiding the administration of online ride hailing services within its respective administrative region, and (iii) the competent transport department of a municipality directly under the central government, a city divided into districts, a county, or other competent administrative department designated by the government shall be responsible for the specific administration of online ride hailing service. Before carrying out online ride hailing services, an online ride hailing service platform must obtain a permit for the online ride hailing business and complete the record filing of internet information services with the provincial communications administration in the place of its enterprise registration. Such platform must be capable of exchanging and processing the relevant information and data with its servers located within the PRC, establish a sound operational management system, work safety management system and service quality assurance system, and fulfill other conditions as prescribed. Platforms that conduct the online ride hailing business without obtaining the necessary permit may be subject to an order of correction, a warning by the local authority, a fine of RMB10,000 (US$1,384) to RMB30,000 (US$4,155), or even criminal liabilities if a violation constitutes a crime. Vehicles used for online ride hailing services must also satisfy certain conditions in order to obtain the transportation permit for vehicles used for online ride hailing services, including, among others, installation of satellite navigation system and emergency alarm devices, and meeting certain operational safety criteria. The Interim Measures also impose certain requirements on drivers engaged in online ride hailing services, including, among others, a driving experience of more than three years and no transport or driving related or violent criminal offense or violent crime record. Drivers must meet the prescribed conditions and pass the relevant exams before they can obtain the driver’s license for online ride hailing services. Platforms may be subject to an order of correction and a fine of RMB5,000 (US$692) to RMB10,000 (US$1,384), and in severe cases a fine of RMB10,000 (US$1,384) to RMB30,000 (US$4,155), if the relevant vehicle or driver providing the online ride hailing services has not obtained the applicable permit. Furthermore, the Interim Measures also provide that competent local governmental authorities may formulate detailed implementing rules for their respective regions in accordance with the Interim Measures and in light of local conditions.

12

Following the promulgation of the Interim Measures, various local governmental authorities have promulgated implementing rules to further stipulate the detailed requirements for online ride hailing service platforms, vehicles and drivers, including the major cities of our operations. On November 5, 2016, the Municipal Communications Commission of Chengdu City and a number of municipal departments jointly issued the Implementation Rules for the Administration of Taxi Management Services for Chengdu Network, which was replace by the one promulgated on July 26, 2021. On August 10, 2017, the Transportation Commission of Chengdu further issued guidelines on compliance requirements for online ride-hailing businesses, including Working Process for the Online Appointment of Taxi Drivers Qualification Examination and Issuance and Online Appointment Taxi Transportation Certificate Issuance Process. On November 28, 2016, Guangzhou Municipal People’s Government promulgated Interim Measures for the Management of Online Ride Hailing Operation and Service in Guangzhou, as amended on November 14, 2019. On July 23, 2018, the General Office of Changsha Municipal People’s Government issued the “Detailed Rules for the Administration of Online Booking Taxi Management Services for Changsha”. On June 12, 2019, the Municipal Communications Commission of Changsha City further issued “Transfer and Registration Procedures of Changsha Online Booking of Taxi”. According to these regulations and guidelines, three licenses or certificates are required for operating the online ride-hailing business: (1) online ride-hailing service platforms such as XXTX is required to obtain the online reservation taxi operating license; (2) automobiles used for online ride-hailing are required to obtain the online reservation taxi transport certificate (the “automobile certificate”); (3) online ride-hailing drivers are required obtain the online reservation taxi driver’s license (the “driver’s license”). Those regulations also stipulate a series of detailed requirements for the online ride-hailing platforms, drivers and automobiles in different cities.

In addition to the national online reservation taxi operating license, XXTX and its subsidiaries also obtained the local online reservation taxi operating license in Chengdu and Changsha, the two major cities, and other 27 cities from April 2020 to June 2024, issued by local authorities, to operate the online ride-hailing platform services. Without a requisite automobile certificate or driver’s license, ride-hailing drivers may be suspended from providing online ride-hailing services, their illegal income may be confiscated and they may be subject to fines amounting to RMB200 (US$28) to RMB2,000 (US$277) for each offense.

However, approximately 25% of our online ride-hailing drivers had not obtained the driver’s license as of March 31, 2024 while all of the cars used for online ride-hailing services which we provided management services to have the automobile certificate. Without requisite automobile certificate or driver’s license, these drivers may be suspended from providing online ride-hailing services, confiscated their illegal income and subject to fines of up to 10 times of their illegal income.

Furthermore, according to the Interim Measures, no enterprise or individual is allowed to provide information form online ride-hailing services to unqualified vehicles and drivers. During the year ended March 31, 2024, we have been fined by approximately $76,000 by Traffic Management Bureaus in Chengdu, Changsha, Guangzhou and Tianjin, of which, approximately $30,000 was further compensated by drivers or cooperated third parties. If we are deemed in serious violation of the Interim Measures, our Online Ride-hailing Platform Services may be suspended and the relevant licenses may be revoked by certain government authorities. We are in the process of assisting the drivers to obtain the required certificate and license, such as providing registered and training services. However, there is no guarantee that all of the drivers who run their online ride-hailing business through our platform would be able to obtain all the certificates and licenses.

On February 7, 2022, the MIIT, the MPS and several other governmental authorities jointly promulgated the Notice on Strengthening the Joint Supervision of the Entire Chain of Online Ride Hailing Industry, which provides that the departments of transportation, telecommunications, public security, human resources and social security, the People’s Bank of China, taxation, market regulation and internet information shall accelerate the establishment of a collaborative supervision mechanism led by the transportation department for new forms of transportation at the provincial and municipal levels, or the joint supervision mechanism. This notice requires relevant governmental authorities to optimize service processes, strictly control industry access, and urge online ride hailing platforms not to grant access to drivers and vehicles with no valid licenses. In case certain violations by online ride hailing platforms trigger the supervisions of various governmental authorities or different provinces and have serious adverse impacts, the relevant authorities of the State Council may organize joint regulatory talks and urge the online ride hailing platforms to rectify. If the online ride hailing platforms commit serious violations but refuse to rectify, the relevant governmental authorities of the municipal level or above may initiate joint supervision and report such violations to the inter-ministerial joint meeting mechanism, and the Ministry of Transport shall take the lead and work together with the CAC, the MIIT, the MPS and other governmental authorities, or instruct their relevant local counterparts, to take measures in accordance with laws, including ordering online ride hailing platforms to suspend services in the region, suspend the release of apps or take down the apps, etc. According to this notice, the joint supervision mechanism shall apply to certain violations of laws and regulations by online ride hailing platforms, which include (i) engaging in online ride hailing business or in a disguised form without obtaining the permit for online ride hailing business; (ii) failing to secure that the vehicles and drivers providing services have relevant licenses and professional qualifications, dispatching orders to drivers and vehicles that have not obtained the corresponding licenses, failing to transmit relevant data information to online ride hailing supervision information exchange platform as required or other serious violations of laws and regulations occurring in the process of operating online ride hailing business; (iii) low-price dumping, fraud, and unreasonably differential treatment of individuals in terms of transaction conditions; (iv) endangering network security, data security, or infringing on the rights and interests of users’ personal information; (v) illegal operation of payment and settlement business; (vi) serious infringement of the labor security rights and interests of the drivers; (vii) failure to pay taxes in accordance with the law; and (viii) other serious violations that endanger public interests, disrupt social order, and affect social security and stability.

13

Regulations Related to Financial Leasing

In September 2013, the Ministry of Commerce of the People’s Republic of China (the “MOFCOM”) issued the Administration Measures of Supervision on Financing Lease Enterprises (the “Leasing Measures”), to regulate and administer the business operations of financial leasing enterprises. According to the Leasing Measures, financial leasing enterprises are allowed to carry out financial leasing businesses in such forms as direct lease, sublease, sale-and-lease-back, leveraged lease, entrusted lease and joint lease in accordance with the provisions of relevant laws, regulations and rules. However, the Leasing Measures prohibit financial leasing enterprises from engaging in financial businesses such as accepting deposits, and providing loans or entrusted loans. Without the approval from relevant authorities, financial leasing enterprises may not engage in inter-bank borrowing and other businesses. In addition, financial leasing enterprises are prohibited from carrying out illegal fund-raising activities in the name of financial leases. The Leasing Measures require financial leasing enterprises to establish and improve their financial and internal risk control systems, and a financial leasing enterprise’s risk assets may not exceed ten times that of its total net assets.

In April 2018, China Banking and Insurance Regulatory Commission, currently known as the National Financial Regulatory Administration of China (the “NFRAC”) took over the authority over supervision of financing lease companies from MOFCOM.

On May 26, 2020, NFRAC issued the Interim Measures for Supervision and Administration of Financial Leasing Companies (the “Financial Leasing Measures”), which clarified the business scope, the scope of the leased property and the prohibited business or activity of the financial leasing company, as well as other business-related definitions, such as purchase, registration, retrieval and value management of financial leasing products. Financial leasing companies may conduct some or all of the following businesses: (1) financial leasing business; (2) leasing business; (3) purchase, disposal of residual value and repair of leased assets related to financial leasing and leasing business, consulting of the leasing transaction, receipt of leasing deposit; (4) transfer of financial leases or leased assets or acceptance of financial leases or leased assets transferred; (5) fixed income securities investment business. The measures have also discussed certain regulatory standards, including the proportion of financial leasing assets, the proportion of fixed income securities investment business, business concentration and so on. Financial leasing companies shall not conduct the following businesses or activities: (1) illegal fund-raising, acceptance or disguised acceptance of deposits; (2) extension of loans or entrusted loans; (3) placements with or from other financial leasing companies or in disguise; (4) financing or transferring assets through Internet Lending Information Intermediaries, private equity funds; (5) other businesses or activities prohibited by laws and regulations, the NFRAC and local financial regulatory authorities in provinces, autonomous regions and municipalities.

The Financial Leasing Measures clarify and enumerate the scopes of the financing lease business activities, the leased properties and the activities prohibited to be conducted by the financing lease companies, and set forth the regulatory indexes applicable to financing lease companies including, among others, (i) the assets for financial leasing and other lease arrangements accounting for not less than 60% of the total assets of a financial leasing company; (ii) the risk assets of a financing lease company not exceeding eight times of its total net assets, and the term “risk assets” of a financing lease company refers to its total assets, net of cash, bank deposits, Chinese treasury bonds; (iii) the fixed-income securities investment business carried out by a financial leasing company not exceeding 20% of its net assets. The Financial Leasing Measures also requires financial leasing companies should comply with the following regulatory indicators: (1) degree of concentration of single client financing, meaning the balance of all financial leasing business of a financial leasing company to a single lessee shall not exceed 30% of its net assets; (2) degree of concentration of single group client financing, meaning the balance of all financial leasing business of a financial leasing company to a single group shall not exceed 50% of its net assets; (3) ratio of a single related client, meaning the balance of all financial leasing business of a financial leasing company to a related party shall not exceed 30% of its net assets; (4) ratio of all related parties, meaning the balance of all financial leasing business of a financial leasing company to all related parties shall not exceed 50% of its net assets, and (5) ratio of a single related shareholder, meaning the financing balance to a single shareholder and all its related parties shall not exceed the shareholder’s capital contribution in the financial leasing company, and at the same time meet the provisions of the measures on the ratio of a single related client. The NFRAC may make adjustments to the above indicators according to regulatory needs.

Financial leasing companies that were established before the implementation of the Interim Measures for the Supervision and Administration of Financial Leasing Companies are required meet the requirements stipulated in the Measures within the transition period prescribed by the provincial local financial supervision department. In principle, the transition period shall not exceed three years. Provincial local financial supervision departments can appropriately extend the transition period arrangement according to the actual situation of specific industries.

14

The PRC Civil Code promulgated by the National People’s Congress effective from January 1, 2021 regulates the civil contractual relationship among natural persons, legal persons and other organizations. Chapter 15 of the PRC Civil Code sets forth related rules about financing lease contracts including that financing lease contracts shall be in written form and normally include terms such as the name, quantity, specifications, technical performance and inspection method of the leased property, the lease term, the composition, payment term, payment method and currency of the rent and the ownership of the leased property upon expiration of the lease. The PRC Civil Code further provides that the lessor and the lessee may agree on the ownership of the leased property upon expiry of the lease term. If the ownership of the leased property is not or is not clearly agreed between the parties, and is still cannot be determined pursuant to the PRC Civil Code, the leased property shall be owned by the lessor.

As of the date of this Report, Hunan Ruixi, our proprietary financing lease subsidiary, has utilized our own capital to fund financing leases to automobile purchasers. Hunan Ruixi has not complied with all the requirements stipulated under the Financial Leasing Measures and intends to rectify and to comply with all the requirements stipulated under the Financial Leasing Measure during the transition period, failing which, Hunan Ruixi cannot carry out financial leasing business.

Regulation Related to Financing Guarantee Companies