UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

|

☐ |

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended February 29, 2020.

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

OR

|

☐ |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

Commission file number: 001-38264

Four Seasons Education (Cayman) Inc.

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

Cayman Islands

(Jurisdiction of incorporation or organization)

5th Floor, Building C Jin’an 610

No. 610 Hengfeng Road, Jing’an District

Shanghai 200070

People’s Republic of China

(Address of principal executive offices)

Yi Zuo, Chief Executive Officer

Tel: +86 21 6317-8899

E-mail: ir@fsesa.com

At the address of the Company set forth above

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

American Depositary Shares, each two representing one ordinary share, par value US$0.0001 per share* |

|

FEDU |

|

New York Stock Exchange |

*Not for trading, but only in connection with the listing on the New York Stock Exchange of American depositary shares

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the Issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

23,131,195 ordinary shares, par value US$0.0001 per share, as of February 29, 2020

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.:

|

Large accelerated filer |

☐ |

|

Accelerated filer |

☐ |

|

Non-accelerated filer |

☒ |

|

|

|

|

|

|

|

Emerging growth company |

☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards † provided pursuant to Section 13(a) of the Exchange Act.☒

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ☒ International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ Other ☐

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☐ No ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

|

|

Page |

|

|

|

||

|

INTRODUCTION |

|

|

|

5 |

||

|

ITEM 1. |

5 |

|

|

ITEM 2 |

5 |

|

|

ITEM 3 |

5 |

|

|

ITEM 4. |

44 |

|

|

ITEM 4A. |

70 |

|

|

ITEM 5. |

71 |

|

|

ITEM 6. |

89 |

|

|

ITEM 7. |

98 |

|

|

ITEM 8. |

100 |

|

|

ITEM 9. |

101 |

|

|

ITEM 10. |

101 |

|

|

ITEM 11. |

114 |

|

|

ITEM 12. |

114 |

|

|

116 |

||

|

ITEM 13. |

116 |

|

|

ITEM 14. |

MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS |

116 |

|

ITEM 15. |

116 |

|

|

ITEM 16A. |

118 |

|

|

ITEM 16B. |

118 |

|

|

ITEM 16C. |

118 |

|

|

ITEM 16D. |

119 |

|

|

ITEM 16E. |

PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS |

119 |

|

ITEM 16F. |

119 |

|

|

ITEM 16G. |

119 |

|

|

ITEM 16H. |

120 |

|

|

121 |

||

|

ITEM 17 |

121 |

|

|

ITEM 18 |

121 |

|

|

ITEM 19. |

121 |

|

2

Unless otherwise indicated and except where the context otherwise requires:

|

|

• |

“Four Seasons,” “we,” “us,” “our company” and “our” refer to Four Seasons Education (Cayman) Inc., a Cayman Islands exempted company, and its subsidiaries, its VIEs and its VIEs’ affiliated entities; |

|

|

• |

“shares” or “ordinary shares” refer to our ordinary shares, par value US$0.0001 per share; |

|

|

• |

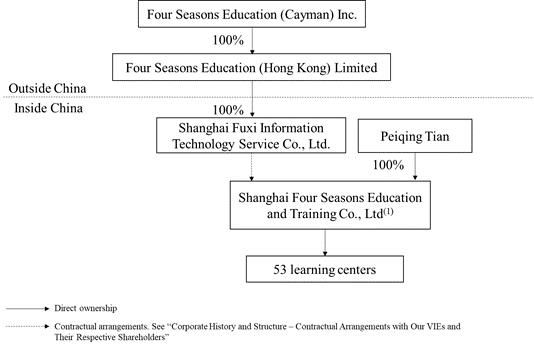

“variable interest entities” or “VIEs” refer to Shanghai Four Seasons Education and Training Co., Ltd. and Shanghai Four Seasons Education Investment Management Co., Ltd., which are PRC companies in which we do not have equity interests but whose financial results have been consolidated into our consolidated financial statements in accordance with U.S. GAAP as we have effective control over, and are the primary beneficiary of these companies; and “affiliated entities” refer to our VIEs, the VIEs’ branches and direct and indirect subsidiaries, and the VIEs’ affiliated entities that registered as private non-enterprise institutions under the PRC laws; |

|

|

• |

“attrition rate” refers to the number of teachers who left our company during a certain period divided by the average of the number of teachers at the beginning and the end of the period; |

|

|

• |

“gross billings” refer to the total amount of cash received for the sale of courses in a specific period, net of the total amount of refunds in such period but inclusive of sales tax and value-added tax, or VAT; |

|

|

• |

“K-12” refers to the three years before the first grade through the last year of high school; |

|

|

• |

“student enrollment” refers to the cumulative total number of courses enrolled in and paid for by our students during a certain period, including multiple courses enrolled in and paid for by the same student; |

|

|

• |

“learning center” refers to the physical establishment of an education facility at a specific geographic location, directly owned and operated by one of our VIEs or their affiliated entities; |

|

|

• |

“tier 1 cities” refer to the four most developed cities in the China, namely Beijing, Shanghai, Shenzhen and Guangzhou; |

|

|

• |

“the 2018 fiscal year” refers to the fiscal year ended February 28, 2018, “the 2019 fiscal year” refers to the fiscal year ended February 28, 2019 and “the 2020 fiscal year” refers to the fiscal year ended February 29, 2020; |

|

|

• |

“ADSs” refer to our American depositary shares, each two of which represents one ordinary share; |

|

|

• |

“China” or “PRC” refers to the People’s Republic of China, excluding, for the purpose of this annual report only, Taiwan, Hong Kong, and Macau; |

|

|

• |

“RMB” and “Renminbi” refers to the legal currency of China; and |

|

|

• |

“US$,” “U.S. dollars,” “$” and “dollars” refer to the legal currency of the United States. |

All discrepancies in any table between the amounts identified as total amounts and the sum of the amounts listed therein are due to rounding.

This annual report on Form 20-F includes our audited consolidated balance sheets as of February 28 or 29, 2019 and 2020 and our audited consolidated statements of operations, statements of comprehensive income (loss), statements of cash flows and statements of changes in shareholders’ equity for the years ended February 28 or 29, 2018, 2019 and 2020.

Our reporting currency is the Renminbi (“RMB”). The functional currency of our Company and subsidiaries incorporated outside the mainland China is the United States dollar (“U.S. Dollar” or “US$”). The functional currency of all the other subsidiaries and our VIEs is RMB. This annual report contains translations of certain Renminbi amounts into U.S. Dollars for the convenience of the reader. Unless otherwise stated, all translations of Renminbi into U.S. Dollars have been made at the rate of RMB6.9906 to US$1.00, being the noon buying rate in The City of New York for cable transfers in Renminbi as certified for customs purposes by the Federal Reserve Bank of New York in effect as of February 28, 2020 set forth in the H.10 statistical release of the U.S. Federal Reserve Board for translation into U.S. Dollars. We make no representation that the Renminbi or U.S. Dollar amounts referred to in this annual report could have been or could be converted into U.S. Dollars or Renminbi, as the case may be, at any particular rate or at all.

We listed our ADSs on the NYSE under the symbol “FEDU” on November 8, 2017.

3

This annual report contains forward-looking statements that involve risks and uncertainties. All statements other than statements of current or historical facts are forward-looking statements. These forward-looking statements are made under the “safe harbor” provision under Section 21E of the Securities Exchange Act of 1934, as amended, and as defined in the Private Securities Litigation Reform Act of 1995. These statements involve known and unknown risks, uncertainties and other factors, including those listed under “Item 3. Key Information—D. Risk Factors,” that may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements.

In some cases, you can identify these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “likely to” or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements include statements about:

|

|

• |

our goals and strategies; |

|

|

• |

our ability to maintain and increase our student enrollment; |

|

|

• |

our ability to continue to offer new and attractive courses and increase our course fees; |

|

|

• |

our ability to retain our teachers, as well as our ability to engage and train new teachers; |

|

|

• |

expected market demand for our learning centers; |

|

|

• |

our future business development, financial condition and results of operations; |

|

|

• |

expected changes in our revenues, costs or expenditures; |

|

|

• |

growth of and trends of competition in our industry; |

|

|

• |

the expected growth and competition of the K-12 after-school education service market in the PRC; |

|

|

• |

the expected growth of private education in the PRC; |

|

|

• |

our expectation regarding the use of proceeds from our initial public offering; |

|

|

• |

government policies and regulations relating to our industry; and |

|

|

• |

general economic and business conditions in the PRC. |

You should read this annual report and the documents that we refer to in this annual report with the understanding that our actual future results may be materially different from and worse than what we expect. Other sections of this annual report include additional factors which could adversely impact our business and financial performance. Moreover, we operate in an evolving environment. New risk factors and uncertainties emerge from time to time and it is not possible for our management to predict all risk factors and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of our forward-looking statements by these cautionary statements.

You should not rely upon forward-looking statements as predictions of future events. The forward-looking statements made in this annual report relate only to events or information as of the date on which the statements are made in this annual report. Except as required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

This annual report also contains statistical data and estimates that we obtained from industry publications and reports generated by government or third-party providers of market intelligence. Statistical data in these publications also include projections based on a number of assumptions. If one or more of the assumptions underlying the market data are later found to be incorrect, actual results may differ from the projections based on these assumptions. You should not place undue reliance on these forward-looking statements.

4

Not applicable.

Not applicable.

|

A. |

Selected Financial Data |

The following selected consolidated statements of operations data for the years ended February 28 or 29, 2018, 2019 and 2020 and selected consolidated balance sheet data as of February 28 or 29, 2019 and 2020 have been derived from our audited consolidated financial statements included elsewhere in this annual report. Our selected consolidated statements of operations data for the years ended February 28 or 29, 2016 and 2017 and our consolidated balance sheet data as of February 28 or 29, 2016, 2017 and 2018 have been derived from our audited consolidated financial statements, which are not included in this annual report. Our consolidated financial statements are prepared and presented in accordance with U.S. GAAP. The selected consolidated financial data should be read in conjunction with, and are qualified in their entirety by reference to, our audited consolidated financial statements and the related notes and the “Item 5. Operating and Financial Review and Prospects” included elsewhere in this annual report. Our historical results are not necessarily indicative of results expected for future periods.

5

|

|

|

For the Year Ended February 28 or 29 |

|

|||||||||||||||||||||

|

|

|

2016 |

|

|

2017 |

|

|

2018 |

|

|

2019 |

|

|

2020 |

|

|||||||||

|

|

|

RMB |

|

|

RMB |

|

|

RMB |

|

|

RMB |

|

|

RMB |

|

|

US$ |

|

||||||

|

|

(in thousands, except for share and per share data) |

|

||||||||||||||||||||||

|

Selected Consolidated Statements of Operations and Comprehensive Income (Loss) Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

|

93,801 |

|

|

|

203,188 |

|

|

|

300,533 |

|

|

|

335,643 |

|

|

|

389,049 |

|

|

|

55,653 |

|

|

Cost of revenue |

|

|

(54,986 |

) |

|

|

(85,349 |

) |

|

|

(109,444 |

) |

|

|

(171,822 |

) |

|

|

(200,933 |

) |

|

|

(28,743 |

) |

|

Gross profit |

|

|

38,815 |

|

|

|

117,839 |

|

|

|

191,089 |

|

|

|

163,821 |

|

|

|

188,116 |

|

|

|

26,910 |

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative expenses |

|

|

(27,725 |

) |

|

|

(42,071 |

) |

|

|

(92,932 |

) |

|

|

(128,349 |

) |

|

|

(139,370 |

) |

|

|

(19,937 |

) |

|

Sales and marketing expenses |

|

|

(4,827 |

) |

|

|

(12,563 |

) |

|

|

(36,565 |

) |

|

|

(33,783 |

) |

|

|

(34,367 |

) |

|

|

(4,916 |

) |

|

Impairment loss on intangible assets and goodwill |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(557 |

) |

|

|

(145,416 |

) |

|

|

(20,802 |

) |

|

Operating income (loss) |

|

|

6,263 |

|

|

|

63,205 |

|

|

|

61,592 |

|

|

|

1,132 |

|

|

|

(131,037 |

) |

|

|

(18,745 |

) |

|

Subsidy income |

|

|

299 |

|

|

|

579 |

|

|

|

2,432 |

|

|

|

4,150 |

|

|

|

9,572 |

|

|

|

1,369 |

|

|

Interest income, net |

|

|

1,094 |

|

|

|

3,037 |

|

|

|

5,546 |

|

|

|

6,756 |

|

|

|

5,229 |

|

|

|

748 |

|

|

Other income (expenses), net |

|

|

(1,953 |

) |

|

|

(1,089 |

) |

|

|

(1,302 |

) |

|

|

(3,311 |

) |

|

|

11,080 |

|

|

|

1,585 |

|

|

Fair value change of warrants |

|

|

(31,766 |

) |

|

|

(28,473 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Income(loss) before income taxes and loss from equity method investments |

|

|

(26,063 |

) |

|

|

37,259 |

|

|

|

68,268 |

|

|

|

8,727 |

|

|

|

(105,156 |

) |

|

|

(15,043 |

) |

|

Income tax expense |

|

|

(4,841 |

) |

|

|

(19,804 |

) |

|

|

(26,424 |

) |

|

|

(10,116 |

) |

|

|

(4,189 |

) |

|

|

(599 |

) |

|

Loss from equity method investments |

|

|

(184 |

) |

|

|

(116 |

) |

|

|

— |

|

|

|

(81 |

) |

|

|

(224 |

) |

|

|

(32 |

) |

|

Net income (loss) |

|

|

(31,088 |

) |

|

|

17,339 |

|

|

|

41,844 |

|

|

|

(1,470 |

) |

|

|

(109,569 |

) |

|

|

(15,674 |

) |

|

Net loss attributable to non-controlling interests |

|

|

(112 |

) |

|

|

(327 |

) |

|

|

(2,529 |

) |

|

|

(869 |

) |

|

|

(76 |

) |

|

|

(11 |

) |

|

Net income (loss) attributable to Four Seasons Education (Cayman) Inc. |

|

|

(30,976 |

) |

|

|

17,666 |

|

|

|

44,373 |

|

|

|

(601 |

) |

|

|

(109,493 |

) |

|

|

(15,663 |

) |

|

Net income (loss) per ordinary share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

(2.21 |

) |

|

|

0.97 |

|

|

|

2.15 |

|

|

|

(0.02 |

) |

|

|

(4.63 |

) |

|

|

(0.66 |

) |

|

Diluted |

|

|

(2.21 |

) |

|

|

0.94 |

|

|

|

1.98 |

|

|

|

(0.02 |

) |

|

|

(4.63 |

) |

|

|

(0.66 |

) |

|

Weighted average shares used in calculating net income (loss) per ordinary share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

14,000,000 |

|

|

|

14,000,000 |

|

|

|

17,057,056 |

|

|

|

24,053,492 |

|

|

|

23,668,916 |

|

|

|

23,668,916 |

|

|

Diluted |

|

|

14,000,000 |

|

|

|

14,470,129 |

|

|

|

18,524,644 |

|

|

|

24,053,492 |

|

|

|

23,668,916 |

|

|

|

23,668,916 |

|

|

Net income (loss) |

|

|

(31,088 |

) |

|

|

17,339 |

|

|

|

41,844 |

|

|

|

(1,470 |

) |

|

|

(109,569 |

) |

|

|

(15,674 |

) |

|

Foreign currency translation adjustments |

|

|

1,967 |

|

|

|

4,434 |

|

|

|

(34,771 |

) |

|

|

29,916 |

|

|

|

24,484 |

|

|

|

3,502 |

|

|

Comprehensive income (loss) |

|

|

(29,121 |

) |

|

|

21,773 |

|

|

|

7,073 |

|

|

|

28,446 |

|

|

|

(85,085 |

) |

|

|

(12,172 |

) |

|

Less: Comprehensive loss attributable to non-controlling interests |

|

|

(112 |

) |

|

|

(327 |

) |

|

|

(2,529 |

) |

|

|

(869 |

) |

|

|

(76 |

) |

|

|

(11 |

) |

|

Comprehensive income (loss) attributable to Four Seasons Education (Cayman) Inc. |

|

|

(29,009 |

) |

|

|

22,100 |

|

|

|

9,602 |

|

|

|

29,315 |

|

|

|

(85,009 |

) |

|

|

(12,161 |

) |

6

|

|

|

2016 |

|

|

2017 |

|

|

2018 |

|

|

2019 |

|

|

2020 |

|

|||||||||

|

|

|

RMB |

|

|

RMB |

|

|

RMB |

|

|

RMB |

|

|

RMB |

|

|

US$ |

|

||||||

|

Selected Consolidated Balance Sheet Data(1): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

42,328 |

|

|

|

230,968 |

|

|

|

583,424 |

|

|

|

439,580 |

|

|

|

404,652 |

|

|

|

57,885 |

|

|

Total current assets |

|

|

85,872 |

|

|

|

282,618 |

|

|

|

595,025 |

|

|

|

495,742 |

|

|

|

616,218 |

|

|

|

88,148 |

|

|

Total assets |

|

|

90,952 |

|

|

|

296,126 |

|

|

|

792,282 |

|

|

|

932,054 |

|

|

|

1,037,616 |

|

|

|

148,428 |

|

|

Total current liabilities |

|

|

52,307 |

|

|

|

124,683 |

|

|

|

134,334 |

|

|

|

164,220 |

|

|

|

213,018 |

|

|

|

30,470 |

|

|

Total liabilities |

|

|

91,899 |

|

|

|

124,683 |

|

|

|

134,334 |

|

|

|

175,123 |

|

|

|

362,664 |

|

|

|

51,877 |

|

|

Total equity |

|

|

(23,121 |

) |

|

|

7,636 |

|

|

|

657,948 |

|

|

|

756,931 |

|

|

|

674,952 |

|

|

|

96,551 |

|

Non-GAAP Measures

We use adjusted net income, a non-GAAP financial measure, in the evaluation of our operating results and in our financial and operational decision-making.

Adjusted net income represents net income before the impact of (i) share-based compensation expenses; (ii) fair value change of investments, excluding foreign currency translation adjustment and (iii) impairment loss on intangible assets and goodwill (net of tax effect). We believe that adjusted net income helps us identify underlying trends in our business that could otherwise be distorted by the effect of certain expenses that we include in net income.

Adjusted net income should not be considered in isolation or construed as an alternative to net income or any other measure of performance or as an indicator of our operating performance. Investors are encouraged to compare the historical non-GAAP financial measures with the most directly comparable GAAP measures. Adjusted net income presented here may not be comparable to similarly titled measures presented by other companies. Other companies may calculate similarly titled measures differently, limiting their usefulness as comparative measures to our data. We encourage investors and others to review our financial information in its entirety and not rely on a single financial measure.

The table below sets forth a reconciliation of our net income (loss) to adjusted net income for the periods indicated:

|

|

|

For the Year Ended February 28 or 29 |

|

|||||||||||||

|

|

|

2018 |

|

|

2019 |

|

|

2020 |

|

|||||||

|

|

|

RMB |

|

|

RMB |

|

|

RMB |

|

|

US$ |

|

||||

|

|

|

(in thousands) |

|

|||||||||||||

|

Net income (loss) |

|

|

41,844 |

|

|

|

(1,470 |

) |

|

|

(109,569 |

) |

|

|

(15,674 |

) |

|

Add: share-based compensation expenses (net of tax effect of nil) |

|

|

23,470 |

|

|

|

32,247 |

|

|

|

30,859 |

|

|

|

4,414 |

|

|

Add: fair value change of investments, excluding foreign currency translation adjustment (net of tax effect of nil) |

|

|

— |

|

|

|

4,783 |

|

|

|

(11,134 |

) |

|

|

(1,593 |

) |

|

Add: impairment loss on intangible assets and goodwill (net of tax effect 7,701 for the year ended Feb. 29, 2020) |

|

|

— |

|

|

|

557 |

|

|

|

137,715 |

|

|

|

19,700 |

|

|

Adjusted net income (non-GAAP) |

|

|

65,314 |

|

|

|

36,117 |

|

|

|

47,871 |

|

|

|

6,847 |

|

7

Not applicable.

|

C. |

Reasons for the Offer and Use of Proceeds |

Not applicable.

|

D. |

Risk Factors |

Risks Related to Our Business

If we are unable to continue to attract students to enroll in our education programs, our business and prospects will be materially and adversely affected.

The success of our business depends primarily on the number of students enrolled in our education programs. Therefore, our ability to continue to attract students and increase our student enrollment is critical to the continued success and growth of our business. This ability in turn depends on several factors, including our ability to develop new programs and courses and enhance our existing ones to respond to changes in market trends and student demand, expand our geographic reach, manage our growth while maintaining consistent and high teaching quality, effectively market our programs to a broader base of prospective students, develop additional high quality educational content and respond effectively to competitive pressure. If we are unable to continue to attract students to enroll in our programs, our revenue may decline, which may have a material adverse effect on our business prospects, financial condition and results of operations. Since the COVID-19 outbreak in China starting from late 2019, the enrollment of students in our programs has been materially and adversely affected due to the temporary closure of our schools and learning centers as mandatorily required by the PRC government. Although we have made great efforts to swiftly switch our offline operating model to online covering courses of all academic subjects, we cannot guarantee that our online courses can satisfy all our students or attract new students, nor be as effective as our offline courses. See “—The recent global COVID-19 outbreak has had a significant impact on our business, which may materially and adversely affect our operating results and financial condition.”

Students and their parents may decide not to continue to enroll in our programs for a number of reasons, including a perceived lack of improvement in students’ academic performance or general dissatisfaction with our programs, which may adversely affect our business, financial condition, results of operations and reputation.

The success of our business depends in large part on our ability to retain our students and their parents by delivering a satisfactory learning experience and improving their academic performance. Our services may fail to improve a student’s performance and a student may perform below expectations after completing our programs. Our ability to improve the academic performance of our students is largely dependent upon the ability, efforts and time commitment of each student, which are beyond our control. Additionally, our programs may not be able to meet the expectations of our students and their parents or satisfy all of their needs. Satisfaction with our services may be affected by a number of factors, many of which may not relate to the effectiveness of our course curriculum and content. A student’s learning experience may also suffer if his or her relationship with our teachers does not meet expectations. If students or parents feel that we are not providing them the experience they are seeking, they may choose to withdraw from and/or not to renew their existing programs. We generally offer refunds for remaining classes to students who decide to withdraw from a course. If an increasing number of students request refunds, our cash flow, revenue and results of operations may be adversely affected.

In addition, if a significant number of students fail to improve their performance after attending our programs or if their learning experiences with us are unsatisfactory, they may decide not to continue to enroll in our programs or refer other students to us. If our ability to retain students decreases significantly or if we otherwise fail to continue to enroll and retain new students, our business, financial condition and results of operations may be materially and adversely affected.

8

Certain of our learning centers do not possess the required educational permits and business licenses, which may subject us to fines and other penalties, including the suspension of operations in noncompliant learning centers and confiscation of profits derived from noncompliant operations.

Under current PRC laws and regulations, schools are subject to a number of licensing requirements from different governmental authorities. As of the date of this annual report, seven of our 53 fully operational learning centers did not possess the educational permit or business license that they require, representing 10.7% of our revenue in the 2020 fiscal year. We are currently in the process of obtaining educational permits and business licenses or fire safety permits required in order to qualify for educational permits or a business licenses for all of such learning centers. See “Item 4. Information on the Company — B. Business Overview — Regulations” for further details on the licensing requirements applicable to our learning centers.

Under the amended Private Education Law, schools that will operate for profit must obtain an educational permit before obtaining a business license. In addition, fire safety regulations and other relevant regulations require each learning center to obtain a fire safety permit before applying for an educational permit. See “—One of our learning centers is not in compliance with fire safety regulations.” If we are unable to obtain a fire safety permit or an educational permit, we will be unable to obtain a business license for our currently unlicensed learning centers. In addition, if we do not obtain all of the required permits and licenses, we may be subject to fines or confiscation of profits derived from noncompliant operations and we may be unable to continue operations at our noncompliant learning centers, which could materially and adversely affect our business and results of operations.

On June 1, 2017, the Shanghai People’s Political Consultative Conference Committee discussed a proposal with the Shanghai Municipal Education Commission and Shanghai Administration for Industry and Commerce regarding after-school education services. The government authorities reportedly agreed to carry out inspections of schools providing after-school education services in Shanghai. It was reported that they would first investigate schools without permits or licenses, then focus on other noncompliant schools. Schools without the required permits or licenses will have to stop recruiting new students and will only be allowed to complete their contracts with existing students. According to media reports, the Education Bureau of Xuhui District in Shanghai issued administrative notices to at least six after-school education service providers. As of the date of this annual report, we have not been contacted by the authorities or subjected to inspections.

The recent global COVID-19 outbreak has had a significant impact on our business, which may materially and adversely affect our operating results and financial condition.

The recent outbreak of COVID-19 has spread throughout the world, especially in China, the United States and Europe. On March 11, 2020, the World Health Organization declared the outbreak a global pandemic. Many businesses and social activities in China and other countries and regions have been severely disrupted, including those of our business partners, customers and employees. This global outbreak has also caused volatilities in and damage to the global financial markets. Such disruption and the potential slowdown of the world’s economy in 2020 and beyond could have a material adverse effect on our results of operations and financial condition.

In particular, the Chinese government took a number of actions in order to contain the spread of COVID-19, including mandatory quarantine requirements, shutdown of schools, travel restrictions, prohibition of public gatherings and postponed resumption of business operations. In such unusual circumstances, our offline business has been significantly affected due to the temporary closure of our schools and learning centers as mandatorily required by the PRC government. Although we have made great efforts to swiftly switch our offline operating model to online covering courses of all academic subjects, we cannot guarantee that our online courses can satisfy all our students or attract new students, nor be as effective as our offline courses.

9

In addition, we have taken a series of measures in response to the outbreak to protect our employees, students and teachers in reopened learning centers, including, among others, temporary closure of our offices, remote working arrangements and procurement of masks, hand sanitizers and other protective equipment for our employees, which reduced the capacity and efficiency of our operations and increased our operating expenses. Our business operation could also be disrupted if any of our employees are suspected of having contracted COVID-19, since it could require our employees to be quarantined or our offices to be closed down and disinfected. All of these would have a material adverse effect on our results of operations and financial condition in the near terms. Additionally, if the outbreak persists or escalates, we may be subject to further negative impact on our business operations or financial condition.

Some of our schools are restricted in their ability to distribute profits to their sponsors. The service arrangements between Shanghai Fuxi and our private schools may be regarded as circumventing this restriction.

According to the Private Education Law, prior to its amendment on November 7, 2016, the sponsor of a private school may elect to require reasonable returns. A sponsor that requires reasonable returns can receive dividends after deducting relevant payments to statutory reserves, and a sponsor that does not require reasonable returns cannot receive dividends from the private school. The amended law abolished such distinction. According to the amended Private Education Law, private schools can be established as non-profit or for-profit entities. Sponsors of for-profit schools may obtain operating profits, while sponsors of non-profit schools may not. Existing private schools must re-register as either non-profit school or for-profit schools. However, the amended Private Education Law remains silent on the specific measures for the re-registration process, which, according to the amended law, will be regulated by the corresponding laws and regulations promulgated by local authorities. As of the date of this annual report, no such local regulations have been promulgated.

Currently we have ten schools that have entered into service agreements with Shanghai Fuxi Information Technology Service Co., Ltd., or Shanghai Fuxi. The sponsor of one of these schools has elected to require reasonable returns, while the sponsors of the other schools have not. According to the relevant service agreements between these ten schools and Shanghai Fuxi, a significant portion of any profits earned by these schools will be paid to Shanghai Fuxi as service fees. As advised by Fangda Partners, our PRC counsel, our right to receive the service fees from our schools under our contractual arrangements should not be regarded as the distribution of returns, dividends or profits to the sponsors of our schools under the PRC laws and regulations, and therefore does not contravene any PRC laws and regulations. However, if the relevant PRC government authorities take a different view, for example, if the local authorities view some of these schools as non-profit schools and such service fees as “operating profits” taken by the sponsors, the authorities may find these private schools and their respective sponsors in violation of PRC laws and regulations. The authorities may seek to confiscate any or all of the service fees that have been paid by these schools to Shanghai Fuxi, or even revoke the educational permits of these schools, which may materially and adversely affect our business and financial results.

Failure to effectively and efficiently manage the expansion of our learning center network may materially and adversely affect our ability to capitalize on new business opportunities.

We have grown rapidly in the past few years, expanding our network from 10 learning centers in Shanghai as of February 28, 2015 to 53 learning centers in 11 cities in China as of February 29, 2020. We will continue to further establish our presence in existing markets, expand our operations into new markets and make efforts to increase the utilization rates of both our existing and new learning centers. However, we may not succeed in executing our growth strategies or be able to continue to grow as rapidly as we did in the past due to uncertainties involved in the process, for example:

|

|

• |

we may fail to identify new cities and areas with sufficient growth potential to expand our network; |

|

|

• |

it may be difficult to increase the number of learning centers in more developed cities or areas, such as Shanghai; |

|

|

• |

we may fail to effectively market our programs in new markets or promote our programs in existing markets; |

|

|

• |

we may not be able to replicate our successful growth model in Shanghai in other geographic markets; |

10

|

|

• |

our analysis for selecting suitable new locations may not be accurate and the demand for our services at such new locations may not materialize or increase as rapidly as we expect; |

|

|

• |

we may fail to obtain the requisite licenses and permits from local authorities necessary to open learning centers at our desired locations; |

|

|

• |

we may be unable to continue to develop or refine our curriculum and course content and improve our students’ academic performance; |

|

|

• |

we may be unable to successfully execute new growth strategies; |

|

|

• |

we may be unable to successfully cooperate with our local business partners or integrate acquired businesses with our current service offerings and achieve anticipated synergies; and |

|

|

• |

we may fail to achieve the benefits we expect from our expansion. |

These risks may increase significantly when we expand into new cities. Establishing new learning centers and managing the growth of a geographically diverse business also involves significant risks and challenges and requires us to make investments in management, capital expenditures, marketing and other resources. We may find it difficult to manage financial resources, implement a consistent service standard and operational policies and maintain our operational, management and technology systems across our network. If we are unable to manage our expanding operations or successfully achieve future growth, our business, prospects, results of operations and financial condition may be materially and adversely affected.

Implementation of the new laws and regulations in the PRC may adversely affect our business operations.

The principal regulations governing private education in China consist of the Education Law of the PRC, the Private Education Law, and the Implementation Rules for the Private Education Law. Before the amended Private Education Law came into force on September 1, 2017, no organization or individual may establish or operate a private school, which is broadly defined as schools or other educational organizations established by social organizations or individuals using non-governmental funds for commercial purposes, except for “reasonable returns.” These PRC laws and regulations also provide that, to establish a private school, one shall first apply with the relevant authorities in charge of education or labor and social welfare, as applicable, for a private school operating permit, and shall then register the private school with the Ministry of Civil Affairs or its local counterparts as a private non-enterprise institution after successfully obtaining a private school operating permit. These PRC laws and regulations on private education generally apply to the establishment and operation of all learning centers, except for the commercial private training institutions registered with the State Administration for Industry and Commerce and its local counterparts. In certain pilot areas such as Shanghai, establishing a commercial training institution requires filing applications with the local counterparts of State Administration for Industry and Commerce in Shanghai for business registration. The relevant local counterparts of State Administration for Industry and Commerce in Shanghai checks the applicants’ compliance records with the local authorities in charge of education or human resources and social welfare as it reviews such applications. On the other hand, in Jiangxi, Anhui and Jiangsu provinces, after-school learning centers shall be established and registered as private schools and to obtain private school operating permits and complete the private non-enterprise institutions registration process following the local regulations. See “Item 4. Information on the company — B. Business Overview — Regulations — Regulations Relating to Private Education” and “Item 4. Information on this Company — B. Business Overview— Regulations — Local Regulations Relating to Commercial Private Training.”

The Standing Committee of the National People’s Congress amended the Private Education Law on November 7, 2016 and December 29, 2018, and the amended Private Education Law became effective on December 29, 2018. According to the amended Private Education Law, private schools for after school tutoring can be established as for-profit private schools or non-profit private schools at the election of the school sponsors. In addition, if a school established before the promulgation of the amended Private Education Law took on September 1, 2017 chooses to become for-profit, it needs to first assess its assets, identify property ownership, pay relevant taxes and duties and then re-apply for registration before such school can continue with its operations. See “Item 4. Information on the company — B. Business Overview — Regulations — Regulations Relating to Private Education.” We expect that the amended Private Education Law, accompanied with its relevant implementation rules and regulations may bring significant changes to our compliance environment and a certain number of our

11

entities, through which we operate our existing learning centers, may be required to obtain new licenses and permits or update their existing ones. However, the specific measures on when and how existing schools can choose to be a for-profit school remains unclear. In the meantime, any implementation rules and regulations that tighten the supervision of our business operation, such as student recruitment and tuition fees, may also have material adverse effects on our business and results of operations. However, as of the date of this annual report, the implementing rules for the amended Private Education Law or the relevant local regulations have not been published to the public. It remains uncertain how the amended law will be interpreted and implemented, and impact our business operations. In addition, the local government authorities in the cities where we operate our business might implement different local rules, and we may incur unexpected expenses to comply with such local rules.

The Ministry of Justice published the Draft Amendment for Implementation Rules for the Private Education Law in August 2018 for public review and comment, which is still subject to discussion, potential revision and adoption by the State Council before it becomes effective. Accordingly, substantial uncertainty remains with respect to its final content, effective date, interpretation and implementation. Nevertheless, such Draft Amendment for Implementation Rules for the Private Education Law proposes changes, clarifications and additional requirements with respect to private schools in addition to the current effective Private Education Law and relevant implementation rules.

According to the Draft Amendment for Implementation Rules for the Private Education Law, the establishment of a private training institution that enrolls children and teenagers in kindergarten, elementary and secondary schools and provides training relating to school culture education courses, admission or examination shall be approved by the educational administrative authority of the people’s government at or above the county level.

If enacted into law in its current form, the Draft Amendment for Implementation Rules for the Private Education Law would represent a major change to the laws and regulations relating to private schools, including, among others, (i) the required composition of the board of directors of private schools, (ii) that if a private school trades with related parties, it shall follow the principles of openness, fairness and justness, and shall not damage the interests of the state, the school, the teachers and the students, and (iii) that, for a for-profit private school, 25% of its net profit per annum should be reserved as development fund. If the Draft Amendment for Implementation Rules for Private Education Law is enacted in its current form, we may be required to change our corporate governance practices and our compliance costs may increase. The Draft Amendment for Implementation Rules for the Private Education Law also expressly provides that foreign-invested enterprises established in China and social organizations with foreign parties as actual controllers shall not hold, participate in or actually control private schools that implement compulsory education.

In August 2018, the State Council issued its new opinion on the Regulation of the Development of Extracurricular Training Institutions, or the New Opinion, which primarily regulates extracurricular training institutions targeting K-12 students. The New Opinion provides certain detailed requirements for extracurricular training institutions, including, among others, requirements for licenses and permits, training premises, safety conditions, fee collection, teaching staff and curriculum content. In October 2018, the Ministry of Education launched a special supervision campaign on extracurricular training institutions and required the local competent authorities to investigate the training institutions within their jurisdictions and requested such institutions to rectify any non-compliant activities. In December, 2018, nine PRC governmental authorities, including the Ministry of Education, jointly promulgated the Notice on Measures for Alleviating the Burdens on K-12 Students, which reiterates the above requirements.

In November 2018, Ministry of Education, the SAIC and the Ministry of Emergency Management of China jointly promulgated the Notice of Several Work Mechanisms for Strengthening Special Administration and Rectification of Extracurricular Training Institutions, or the New Notice. According to the New Notice, training institutions without certificates and institutions violating other requirements of laws and regulations shall be banned, the business licenses shall be revoked, and legal representatives of these institutions shall be restricted from providing training for elementary and secondary school students. Besides, if the existing fire safety conditions of training institutions do not meet the requirements, training qualifications of these institutions shall be revoked.

In July 2019, the Ministry of Education, together with other five PRC authorities, jointly promulgated the Implementation Opinions on the Regulation of Extracurricular Online Training, which reinstates the filing requirement of extracurricular online training institution and provides that the education authorities at provincial

12

level should review the application documents submitted by extracurricular online training institutions, approve the filing applications submitted by qualified training institutions, and disclose qualified training institutions to the public. The filing information include ICP filings, approvals and licenses, personal information protection system, network security protection measures, introduction of courses, education plans, basic information of teachers, teacher qualification certificates, etc. In case of any change of the filing information, the extracurricular online training institution shall make filing of such updated information. In February, 2020, Shanghai Municipal Education Commission, together with six other Shanghai authorities, jointly promulgated the Rules for Filings of Extracurricular Online Training in Shanghai (the “Rules”), which came into effect on April 1, 2020. According to the Rules, extracurricular online training institutions shall submit filing documents through Shanghai Training Institutions Online Management Platform, and institutions shall be added into “Whitelist”, “Greylist” or “Blacklist” depends on the accuracy and completeness of filing materials and whether institutions comply with relevant laws and regulations according to the filing materials. As of the date of this annual report, we are in the process of filing and we are unable to predict the time of completion and results of filing.

In addition, in May 2020, the General Office of Ministry of Education issued the Notice on Negative List of Excessive and Advanced Training in Six Subjects of Compulsory Education (Trial) (the “Notice”). According to the Notice, after-school education institutions are prohibited from providing excessive and advanced training relating to six subjects, including Chinese, Math, English, Physics, Chemistry and Biology, for students in primary school and middle school. For example, the difficulties of education contents provided by after-school education institutions shall not exceed the difficulties of contents in textbooks used in corresponding compulsory education classes and the after-school education targeting students in primary schools shall not include contents to be taught in middle schools, and the after-school education targeting students in middle schools shall not include contents to be taught in high schools.

If we fail to comply with any regulatory requirement, our business operations may be disrupted and we may be subject to various penalties or be unable to continue our operations, all of which will materially and adversely affect our business, financial condition and results of operations.

Our operations are heavily concentrated in Shanghai, and any event negatively affecting the after-school education market in Shanghai could have a material adverse effect on our overall business and results of operations.

We derived 91.6% of our gross billings in the fiscal year of 2020 from our operations in Shanghai and we expect our services in Shanghai to continue to generate the majority of our gross billings for the foreseeable future. The concentration of our business in Shanghai exposes us to geographical concentration risks related to this region or the learning centers located in this region. Any material adverse social, economic, regulatory or political development, any changes in the local education laws and regulations, or any natural disaster or epidemic affecting this region could negatively affect the demand for and/or our ability to provide after-school education services. The occurrence of any of the foregoing could have a material adverse effect on our business, financial condition and results of operations.

We have limited operating history with our middle school and kindergarten programs. Our newer programs may not be as attractive and profitable as our elementary school math programs.

We launched our kindergarten programs in 2015 and middle school programs in 2017. As we plan to continue to expand our middle school and kindergarten programs, we may need to devote substantial resources to course design, marketing and teacher recruiting. However, our efforts to improve, expand, and promote our elementary and middle school programs may not be successful and we may not achieve comparable profitability to our elementary school programs, or at all. We also introduced other new courses and may introduce other new courses in the future, which may not achieve expected profitability, or at all.

13

Failure to adequately and promptly respond to changes in examination systems, admission standards, testing materials and technologies in Shanghai and the PRC could render our courses and services less attractive to students.

Under the PRC education system, school admissions rely heavily on entrance examination results. Students in most cases are required to take entrance exams for admission to high school, and their performance in those exams is critical to their educational career and future employment prospects. In addition, although exams are not required for entering middle schools, most middle schools still use entrance exam results as a key factor in evaluating students’ academic performance and many schools administer their own assessment tests to evaluate prospective students. It is therefore common for students to take after-school classes to improve test performance, and the success of our business to a large extent depends on the continued use of entrance exam tests by schools in their admissions. However, such heavy emphasis on exam scores may decline or fall out of favor with educational institutions or education authorities in the PRC. For example, education authorities in Yunnan Province stopped administering provincial-level high school entrance examinations in 2010. Instead, high schools in Yunnan have started to admit students based on a combination of middle school examination results that have replaced raw scores with letter grades and comprehensive evaluations of students’ aptitude and performance by their middle schools. Yunnan Province also prohibits private competitions in elementary and middle schools. Besides, education authorities in Jiangxi Province published the Suggestions on Implementation of Examination Enrollment System Reform in Senior High Schools (Trial) on April 4, 2018, which aims to adopt a new mode of admission for high schools based on a combination of middle school academic level test results and the comprehensive quality evaluation results around 2020. In November 2018, education authorities in Jiangsu Province prohibited compulsory education schools, including public schools and private schools with government public resources, from holding written examinations or interviews in any form related to admission. In March 2020, education authorities in Shanghai issued the Opinion on Implementation of Enrollment in Compulsory Education School in 2020. According to this opinion, compulsory education schools in Shanghai, including public schools and private schools, are prohibited from admitting students on the basis of or with reference to students’ performances in various examinations, competitions, training or certificates. If we fail to adjust our services to respond to any such material changes, our business may be materially and adversely affected. In addition, entrance exams and assessment tests at all grade levels in the PRC constantly undergo changes and development in terms of subject and skill focus, question type and format. A failure to track and respond to any such changes in a timely and cost-effective manner could make our courses and services less attractive to students, which may materially and adversely affect our reputation and ability to continue to attract students and in turn have a material adverse effect on our business, financial condition and results of operations.

In addition, outstanding performance in domestic and international math competitions may substantially boost a student’s chance of admission into top high schools by serving as evidence of excellence in academics and extracurricular activities, supplementing standardized entrance examination scores, or in certain circumstances qualify students for an exam-free admission into top schools. Any change in the admission policies or criteria that decreases the weight of math competition performance in the admission process as adopted by schools or mandated by government regulations may take away incentives for parents to enroll their children in our programs, materially and adversely affecting our business, results of operations and financial condition. For instance, pursuant to the Notice of Shanghai Municipal Education Commission on Strengthening the Administration of Prohibiting to Treat Various Competition Prizes as Basis for Admission by Compulsory Education Schools in the School Year of 2016 issued by Shanghai Municipal Education Commission in November 2016, certificates and prizes obtained from competitions such as Olympic math competitions and English level tests must not be treated as basis for admission by compulsory education stage schools. Furthermore, pursuant to the Management Measures of National Competitions for Elementary and Secondary School Students (Trial) issued by Ministry of Education in September 2018, competitions cannot be held for compulsory education in principle, and results of competitions must not be used as the basis for admission by elementary and middle schools.

One of our learning centers is not in compliance with fire safety regulations.

Each school must obtain a fire safety permit in order to qualify for an educational permit or a business license. As of the date of this annual report, one of our learning centers has not obtained the fire safety permit, accounting for 0.05% of our revenue in the 2020 fiscal year. We are in the process of obtaining the outstanding fire safety permit. However, if we are unable to obtain the fire safety permit as required, we may not be able to obtain an

14

educational permit or a business license for this learning center, we may be subject to fines and we may be unable to continue operations at this learning center which could adversely affect our business and results of operations. See “Item 4. Information on the company — B. Business Overview — Regulations” for further details on the fire safety regulations applicable to our learning centers.

According to PRC laws and regulations, venues for children’s activities cannot be located above the third floor of a building. As of the date of this annual report, nine of our 53 learning centers in operation were located above the third floor of a building. These nine learning centers represented 16.1% of our revenue in the 2020 fiscal year. If these learning centers are inspected, we may be subject to fines and we may be unable to continue operations at them, which could materially and adversely affect our business and results of operations.

The majority of the lease agreements for our learning centers that are located above the third floor of a building have durations of between two and ten years. Moving learning centers that are located above the third floor of a building in order to comply with fire safety regulations would require us to terminate or break our existing leases and pay any associated termination or breakage costs, in addition to the costs of relocation, renovation and decoration, and it may disrupt our scheduled courses and force us to postpone or cancel some courses and refund the related tuition fees, all of which could materially and adversely affect our financial results.

We may not be able to continue to recruit, train and retain qualified faculty members, who are critical to the success of our business and effective delivery of our education services to students.

Our faculty is critical to maintaining the quality of our education and services and our brand and reputation. Our ability to continue to attract teachers with the necessary experience and qualifications is therefore a significant contributing factor to the success of our operations. There are a limited number of teachers with the experience, expertise and qualifications to meet our requirements, not only in Shanghai, where we currently operate a majority of our learning centers, but even more so in other parts of the PRC. Further, the Measures for Punishment for Violation of Professional Ethics of Elementary and Secondary School Teachers, promulgated by the PRC Ministry of Education in 2014, prohibits teachers at elementary and secondary schools from providing paid tutoring in schools or in out-of-school learning centers. Some provinces and cities have also adopted rules which prohibit public school teachers from teaching on a part-time basis at private schools or learning centers. As a result, we currently employ all of our teachers on a full-time basis. Therefore, to recruit qualified and experienced teachers, including those with public school experience, we must provide candidates with competitive compensation packages and particularly, offer attractive career development opportunities to compete with the perceived security of a public school teaching job. Although our attrition rate of our teachers was relatively low at 12.6%, 17.0% and 14.6% in the 2018, 2019 and 2020 fiscal year, respectively, we may not be able to maintain this attrition rate as we expand our operations. In addition, we must also provide continued training to our teachers to ensure that they stay abreast of changes in student demands, academic standards and other key trends necessary to teach effectively. Although we have not experienced major difficulties in recruiting, training or retaining qualified teachers in the past, we may not always be able to recruit, train and retain enough qualified teachers in the future to keep pace with our growth while maintaining consistent teaching quality in the different markets we serve. A shortage of qualified teachers or a decline in the quality of our teachers’ classroom performance, whether actual or perceived, or a significant increase in compensation we must pay to retain qualified teachers, would have a material adverse effect on our business, financial condition and results of operations.

We may not be able to improve our existing program curriculum and content or to develop new courses on a timely basis and in a cost-effective manner.

We constantly update and improve the content of our existing courses and develop new courses to meet market demand. Changes to our curriculum and course content may not always be well received by existing or prospective students or their parents. If we cannot respond effectively to changes in market demand, our business may be adversely affected. Even if we are able to develop new courses that are well received, we may not be able to introduce them as quickly as our students may require. If we do not respond adequately to changes in market requirements, our ability to attract and retain students could be impaired and our financial results could suffer.

15

Offering new courses or modifying existing courses may require us to invest in curriculum and educational content development, train new teachers or re-train existing ones, increase marketing efforts and re-allocate resources away from other uses. We may have limited experience with new course content, particularly in subjects other than math, and may need to modify our systems and strategies to introduce new courses or content. If we are unable to improve the content of our existing courses, and offer new courses on a timely basis and in a cost-effective manner, our results of operations and financial condition could be adversely affected.

Any damage to our brand or the reputation of any of our learning centers may adversely affect our overall business, prospects, results of operations and financial condition.

We believe that market awareness of our “Four Seasons Education” brand and our solid reputation in the education industry have contributed significantly to the success of our business, and that maintaining and enhancing our brand are critical to maintaining our competitive advantage. Our brand and reputation could be adversely affected under many circumstances, including the following:

|

|

• |

our students are not satisfied with our programs and related services; |

|

|

• |

we fail to maintain the quality and consistency of our service standards as we expand our course offerings into different subjects and extend our geographic reach; |

|

|

• |

we fail to properly manage accidents or other events that injure our students; |

|

|

• |

our faculty or staff behave or are perceived to behave inappropriately or illegally; |

|

|

• |

our faculty or staff fail to appropriately supervise students under their care; |

|

|

• |

we fail to conduct proper background checks on our faculty or staff; |

|

|

• |

we lose a license, permit or other authorization to operate a learning center; |

|

|

• |

we do not maintain consistent education quality or fail to enable our students to achieve strong academic results; |

|

|

• |

our learning center facilities do not meet the standards expected by parents and students; and |

|

|

• |

learning center operators with lower quality abuse our brand name or those with brand names similar to ours by conducting fraudulent activities and creating confusion among students and their parents. |

The likelihood that any of the foregoing may occur increases as we expand our learning center network. These events could influence the perception of our learning centers not only by our students and their parents, but also by other constituencies in the education sector and the general public. Moreover, an event that directly damages the reputation of one of our learning centers could adversely affect the reputation and operations of our other learning centers. As we mainly rely on word-of-mouth referrals to attract prospective students, if our brand name or reputation deteriorates, our overall business, prospects, results of operations and financial condition could be materially and adversely affected.

Our historical financial and operating results, growth rates and profitability may not be indicative of future performance.

We have offered after-school education services since 2010, and have experienced significant growth in terms of learning centers, operations and revenue. Our revenue increased from RMB300.5 million in the 2018 fiscal year to RMB335.6 million in the 2019 fiscal year, and further to RMB389.0 million (US$55.7 million) in the 2020 fiscal year. Our net income was RMB41.8 million in the 2018 fiscal year. However, we recorded net loss of RMB1.5 million in the 2019 fiscal year and RMB109.6 million (US$15.7 million) in the 2020 fiscal year. In addition, we have been making continuous efforts to expand our course offerings, launching our Ivy programs and kindergarten programs in 2015 as well as our middle school programs in 2017. We are also expanding our learning center network to cities other than Shanghai and have established 12 learning centers outside of Shanghai since 2015. However, any evaluation of our business and our prospects must be considered in light of the risks and uncertainties encountered by companies at our stage of development. Furthermore, our results of operations may vary from period to period in response to a variety of other factors beyond our control, including general economic conditions and regulations or government actions pertaining to the after-school education service industry in the PRC, changes in spending on after-school education, our ability to control cost of revenue and operating expenses, and non-recurring charges incurred in connection with acquisitions or other extraordinary transactions or under unexpected

16

circumstances. We anticipate that our cost of revenue and operating expenses will increase in the foreseeable future as we continue to grow our business, maintain and increase our student enrollment, retain, engage and train our teachers and offer new and attractive courses and increase our course fees. These efforts may prove more costly than we currently anticipate, and we may not succeed in increasing our revenue sufficiently to offset these higher expenses. Furthermore, our financial performance is also subject to other risks and uncertainties, including but not limited to laws, regulations and policies in China. Due to the above factors, we believe that our historical financial and operating results, growth rates and profitability may not be indicative of our future performance and you should not rely on our past results or our historic growth rates as indications of our future performance. Furthermore, our net income margins may decline or we may incur additional net losses in the future and may not be able to maintain profitability on a quarterly or annual basis.

We may be unable to charge tuition at sufficient levels to be profitable or raise tuition as planned.

Our results of operations are affected in large part by the pricing of our education services. We charge tuition based on each student’s grade level and the programs that the student is enrolled in. Although we have been able to increase our tuition rates in the past, we may not be able to maintain or increase our tuition in the future without adversely affecting the demand for our services.

Furthermore, our tuition rates are subject to a number of other factors, such as the perception of our brand, the academic results achieved by our students, our ability to hire qualified teachers, and general local economic conditions. Any significant deterioration in these factors could have a material adverse effect on our ability to charge tuition at levels sufficient for us to remain profitable.

We may not be able to execute our growth strategies or continue to grow as rapidly as we have in the past several years.