pqg-202012310001708035--12-312020FYfalseus-gaap:PropertyPlantAndEquipmentNetus-gaap:AccruedLiabilitiesCurrentus-gaap:OtherLiabilitiesNoncurrentP3Yus-gaap:PrepaidExpenseAndOtherAssetsCurrent00017080352020-01-012020-12-31iso4217:USD00017080352020-06-30xbrli:shares00017080352021-03-1200017080352019-01-012019-12-3100017080352018-01-012018-12-31iso4217:USDxbrli:shares00017080352020-12-3100017080352019-12-310001708035us-gaap:CommonStockMember2017-12-310001708035us-gaap:AdditionalPaidInCapitalMember2017-12-310001708035us-gaap:RetainedEarningsMember2017-12-310001708035us-gaap:TreasuryStockMember2017-12-310001708035us-gaap:AccumulatedOtherComprehensiveIncomeMember2017-12-310001708035us-gaap:NoncontrollingInterestMember2017-12-3100017080352017-12-310001708035us-gaap:RetainedEarningsMember2018-01-012018-12-310001708035us-gaap:NoncontrollingInterestMember2018-01-012018-12-310001708035us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-01-012018-12-310001708035us-gaap:TreasuryStockMember2018-01-012018-12-310001708035us-gaap:AdditionalPaidInCapitalMember2018-01-012018-12-310001708035us-gaap:CommonStockMember2018-01-012018-12-310001708035us-gaap:CommonStockMember2018-12-310001708035us-gaap:AdditionalPaidInCapitalMember2018-12-310001708035us-gaap:RetainedEarningsMember2018-12-310001708035us-gaap:TreasuryStockMember2018-12-310001708035us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-310001708035us-gaap:NoncontrollingInterestMember2018-12-3100017080352018-12-310001708035srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2018-12-310001708035srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-310001708035srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2018-12-310001708035us-gaap:CommonStockMembersrt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2018-12-310001708035us-gaap:AdditionalPaidInCapitalMembersrt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2018-12-310001708035srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:RetainedEarningsMember2018-12-310001708035srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:TreasuryStockMember2018-12-310001708035srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-310001708035srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:NoncontrollingInterestMember2018-12-310001708035srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2018-12-310001708035us-gaap:RetainedEarningsMember2019-01-012019-12-310001708035us-gaap:NoncontrollingInterestMember2019-01-012019-12-310001708035us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001708035us-gaap:TreasuryStockMember2019-01-012019-12-310001708035us-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310001708035us-gaap:CommonStockMember2019-01-012019-12-310001708035us-gaap:CommonStockMember2019-12-310001708035us-gaap:AdditionalPaidInCapitalMember2019-12-310001708035us-gaap:RetainedEarningsMember2019-12-310001708035us-gaap:TreasuryStockMember2019-12-310001708035us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001708035us-gaap:NoncontrollingInterestMember2019-12-310001708035us-gaap:RetainedEarningsMember2020-01-012020-12-310001708035us-gaap:NoncontrollingInterestMember2020-01-012020-12-310001708035us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001708035us-gaap:TreasuryStockMember2020-01-012020-12-310001708035us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001708035us-gaap:CommonStockMember2020-01-012020-12-310001708035us-gaap:CommonStockMember2020-12-310001708035us-gaap:AdditionalPaidInCapitalMember2020-12-310001708035us-gaap:RetainedEarningsMember2020-12-310001708035us-gaap:TreasuryStockMember2020-12-310001708035us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001708035us-gaap:NoncontrollingInterestMember2020-12-31pqg:segment0001708035us-gaap:BuildingAndBuildingImprovementsMembersrt:MinimumMember2020-01-012020-12-310001708035us-gaap:BuildingAndBuildingImprovementsMembersrt:MaximumMember2020-01-012020-12-310001708035us-gaap:MachineryAndEquipmentMembersrt:MinimumMember2020-01-012020-12-310001708035us-gaap:MachineryAndEquipmentMembersrt:MaximumMember2020-01-012020-12-310001708035srt:MaximumMember2020-01-012020-12-310001708035us-gaap:DiscontinuedOperationsDisposedOfBySaleMember2020-12-310001708035us-gaap:DiscontinuedOperationsDisposedOfBySaleMember2020-01-012020-12-310001708035us-gaap:DiscontinuedOperationsDisposedOfBySaleMember2019-01-012019-12-310001708035us-gaap:DiscontinuedOperationsDisposedOfBySaleMember2018-01-012018-12-310001708035pqg:NewTermLoanFacilityMember2020-01-012020-12-310001708035us-gaap:DiscontinuedOperationsDisposedOfBySaleMember2019-12-31pqg:reporting_unitiso4217:EUR0001708035pqg:MagnesiumSilicateProductLineMember2020-12-310001708035pqg:MagnesiumSilicateProductLineMember2020-01-012020-12-310001708035pqg:SulfateSaltsProductLineMember2019-12-310001708035pqg:SulfateSaltsProductLineMember2020-12-310001708035pqg:SulfateSaltsProductLineMember2020-01-012020-12-310001708035pqg:SulfateSaltsProductLineMember2019-01-012019-12-310001708035pqg:RefiningServicesMemberus-gaap:OperatingSegmentsMemberpqg:IndustrialandChemicalProcessMember2020-01-012020-12-310001708035pqg:CatalystsMemberus-gaap:OperatingSegmentsMemberpqg:IndustrialandChemicalProcessMember2020-01-012020-12-310001708035pqg:PerformanceChemicalsMemberus-gaap:OperatingSegmentsMemberpqg:IndustrialandChemicalProcessMember2020-01-012020-12-310001708035us-gaap:OperatingSegmentsMemberpqg:IndustrialandChemicalProcessMember2020-01-012020-12-310001708035pqg:FuelsandEmissionControlsMemberpqg:RefiningServicesMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001708035pqg:FuelsandEmissionControlsMemberpqg:CatalystsMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001708035pqg:FuelsandEmissionControlsMemberpqg:PerformanceChemicalsMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001708035pqg:FuelsandEmissionControlsMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001708035pqg:PackagingandEngineeringPlasticsMemberpqg:RefiningServicesMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001708035pqg:PackagingandEngineeringPlasticsMemberpqg:CatalystsMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001708035pqg:PackagingandEngineeringPlasticsMemberpqg:PerformanceChemicalsMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001708035pqg:PackagingandEngineeringPlasticsMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001708035pqg:ConsumerProductsMemberpqg:RefiningServicesMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001708035pqg:ConsumerProductsMemberpqg:CatalystsMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001708035pqg:ConsumerProductsMemberpqg:PerformanceChemicalsMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001708035pqg:ConsumerProductsMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001708035pqg:NaturalResourcesMemberpqg:RefiningServicesMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001708035pqg:NaturalResourcesMemberpqg:CatalystsMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001708035pqg:NaturalResourcesMemberpqg:PerformanceChemicalsMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001708035pqg:NaturalResourcesMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001708035pqg:RefiningServicesMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001708035pqg:CatalystsMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001708035pqg:PerformanceChemicalsMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001708035us-gaap:OperatingSegmentsMember2020-01-012020-12-310001708035srt:ConsolidationEliminationsMemberpqg:RefiningServicesMember2020-01-012020-12-310001708035srt:ConsolidationEliminationsMemberpqg:CatalystsMember2020-01-012020-12-310001708035srt:ConsolidationEliminationsMemberpqg:PerformanceChemicalsMember2020-01-012020-12-310001708035srt:ConsolidationEliminationsMember2020-01-012020-12-310001708035pqg:RefiningServicesMember2020-01-012020-12-310001708035pqg:CatalystsMember2020-01-012020-12-310001708035pqg:PerformanceChemicalsMember2020-01-012020-12-310001708035pqg:RefiningServicesMemberus-gaap:OperatingSegmentsMemberpqg:IndustrialandChemicalProcessMember2019-01-012019-12-310001708035pqg:CatalystsMemberus-gaap:OperatingSegmentsMemberpqg:IndustrialandChemicalProcessMember2019-01-012019-12-310001708035pqg:PerformanceChemicalsMemberus-gaap:OperatingSegmentsMemberpqg:IndustrialandChemicalProcessMember2019-01-012019-12-310001708035us-gaap:OperatingSegmentsMemberpqg:IndustrialandChemicalProcessMember2019-01-012019-12-310001708035pqg:FuelsandEmissionControlsMemberpqg:RefiningServicesMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001708035pqg:FuelsandEmissionControlsMemberpqg:CatalystsMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001708035pqg:FuelsandEmissionControlsMemberpqg:PerformanceChemicalsMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001708035pqg:FuelsandEmissionControlsMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001708035pqg:PackagingandEngineeringPlasticsMemberpqg:RefiningServicesMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001708035pqg:PackagingandEngineeringPlasticsMemberpqg:CatalystsMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001708035pqg:PackagingandEngineeringPlasticsMemberpqg:PerformanceChemicalsMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001708035pqg:PackagingandEngineeringPlasticsMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001708035pqg:ConsumerProductsMemberpqg:RefiningServicesMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001708035pqg:ConsumerProductsMemberpqg:CatalystsMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001708035pqg:ConsumerProductsMemberpqg:PerformanceChemicalsMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001708035pqg:ConsumerProductsMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001708035pqg:NaturalResourcesMemberpqg:RefiningServicesMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001708035pqg:NaturalResourcesMemberpqg:CatalystsMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001708035pqg:NaturalResourcesMemberpqg:PerformanceChemicalsMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001708035pqg:NaturalResourcesMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001708035pqg:RefiningServicesMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001708035pqg:CatalystsMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001708035pqg:PerformanceChemicalsMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001708035us-gaap:OperatingSegmentsMember2019-01-012019-12-310001708035srt:ConsolidationEliminationsMemberpqg:RefiningServicesMember2019-01-012019-12-310001708035srt:ConsolidationEliminationsMemberpqg:CatalystsMember2019-01-012019-12-310001708035srt:ConsolidationEliminationsMemberpqg:PerformanceChemicalsMember2019-01-012019-12-310001708035srt:ConsolidationEliminationsMember2019-01-012019-12-310001708035pqg:RefiningServicesMember2019-01-012019-12-310001708035pqg:CatalystsMember2019-01-012019-12-310001708035pqg:PerformanceChemicalsMember2019-01-012019-12-310001708035pqg:RefiningServicesMemberus-gaap:OperatingSegmentsMemberpqg:IndustrialandChemicalProcessMember2018-01-012018-12-310001708035pqg:CatalystsMemberus-gaap:OperatingSegmentsMemberpqg:IndustrialandChemicalProcessMember2018-01-012018-12-310001708035pqg:PerformanceChemicalsMemberus-gaap:OperatingSegmentsMemberpqg:IndustrialandChemicalProcessMember2018-01-012018-12-310001708035us-gaap:OperatingSegmentsMemberpqg:IndustrialandChemicalProcessMember2018-01-012018-12-310001708035pqg:FuelsandEmissionControlsMemberpqg:RefiningServicesMemberus-gaap:OperatingSegmentsMember2018-01-012018-12-310001708035pqg:FuelsandEmissionControlsMemberpqg:CatalystsMemberus-gaap:OperatingSegmentsMember2018-01-012018-12-310001708035pqg:FuelsandEmissionControlsMemberpqg:PerformanceChemicalsMemberus-gaap:OperatingSegmentsMember2018-01-012018-12-310001708035pqg:FuelsandEmissionControlsMemberus-gaap:OperatingSegmentsMember2018-01-012018-12-310001708035pqg:PackagingandEngineeringPlasticsMemberpqg:RefiningServicesMemberus-gaap:OperatingSegmentsMember2018-01-012018-12-310001708035pqg:PackagingandEngineeringPlasticsMemberpqg:CatalystsMemberus-gaap:OperatingSegmentsMember2018-01-012018-12-310001708035pqg:PackagingandEngineeringPlasticsMemberpqg:PerformanceChemicalsMemberus-gaap:OperatingSegmentsMember2018-01-012018-12-310001708035pqg:PackagingandEngineeringPlasticsMemberus-gaap:OperatingSegmentsMember2018-01-012018-12-310001708035pqg:ConsumerProductsMemberpqg:RefiningServicesMemberus-gaap:OperatingSegmentsMember2018-01-012018-12-310001708035pqg:ConsumerProductsMemberpqg:CatalystsMemberus-gaap:OperatingSegmentsMember2018-01-012018-12-310001708035pqg:ConsumerProductsMemberpqg:PerformanceChemicalsMemberus-gaap:OperatingSegmentsMember2018-01-012018-12-310001708035pqg:ConsumerProductsMemberus-gaap:OperatingSegmentsMember2018-01-012018-12-310001708035pqg:NaturalResourcesMemberpqg:RefiningServicesMemberus-gaap:OperatingSegmentsMember2018-01-012018-12-310001708035pqg:NaturalResourcesMemberpqg:CatalystsMemberus-gaap:OperatingSegmentsMember2018-01-012018-12-310001708035pqg:NaturalResourcesMemberpqg:PerformanceChemicalsMemberus-gaap:OperatingSegmentsMember2018-01-012018-12-310001708035pqg:NaturalResourcesMemberus-gaap:OperatingSegmentsMember2018-01-012018-12-310001708035pqg:RefiningServicesMemberus-gaap:OperatingSegmentsMember2018-01-012018-12-310001708035pqg:CatalystsMemberus-gaap:OperatingSegmentsMember2018-01-012018-12-310001708035pqg:PerformanceChemicalsMemberus-gaap:OperatingSegmentsMember2018-01-012018-12-310001708035us-gaap:OperatingSegmentsMember2018-01-012018-12-310001708035srt:ConsolidationEliminationsMemberpqg:RefiningServicesMember2018-01-012018-12-310001708035srt:ConsolidationEliminationsMemberpqg:CatalystsMember2018-01-012018-12-310001708035srt:ConsolidationEliminationsMemberpqg:PerformanceChemicalsMember2018-01-012018-12-310001708035srt:ConsolidationEliminationsMember2018-01-012018-12-310001708035pqg:RefiningServicesMember2018-01-012018-12-310001708035pqg:CatalystsMember2018-01-012018-12-310001708035pqg:PerformanceChemicalsMember2018-01-012018-12-310001708035us-gaap:FairValueMeasurementsRecurringMember2020-12-310001708035us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001708035us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001708035us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001708035us-gaap:FairValueMeasurementsRecurringMember2019-12-310001708035us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001708035us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001708035us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001708035us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310001708035us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310001708035us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310001708035us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310001708035us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:ChangeDuringPeriodFairValueDisclosureMember2020-12-310001708035us-gaap:FairValueMeasurementsNonrecurringMember2020-10-010001708035us-gaap:FairValueMeasurementsNonrecurringMember2019-10-012019-10-010001708035us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-12-310001708035us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-12-310001708035us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2020-12-310001708035us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2019-12-310001708035us-gaap:AccumulatedTranslationAdjustmentMember2020-12-310001708035us-gaap:AccumulatedTranslationAdjustmentMember2019-12-310001708035us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetGainLossIncludingPortionAttributableToNoncontrollingInterestMember2020-01-012020-12-310001708035us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetGainLossIncludingPortionAttributableToNoncontrollingInterestMember2019-01-012019-12-310001708035us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetGainLossIncludingPortionAttributableToNoncontrollingInterestMember2018-01-012018-12-310001708035us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceIncludingPortionAttributableToNoncontrollingInterestMember2020-01-012020-12-310001708035us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceIncludingPortionAttributableToNoncontrollingInterestMember2019-01-012019-12-310001708035us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceIncludingPortionAttributableToNoncontrollingInterestMember2018-01-012018-12-310001708035us-gaap:AccumulatedDefinedBenefitPlansAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2020-01-012020-12-310001708035us-gaap:AccumulatedDefinedBenefitPlansAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2019-01-012019-12-310001708035us-gaap:AccumulatedDefinedBenefitPlansAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2018-01-012018-12-310001708035us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2020-01-012020-12-310001708035us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2019-01-012019-12-310001708035us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2018-01-012018-12-310001708035us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2020-01-012020-12-310001708035us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2019-01-012019-12-310001708035us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2018-01-012018-12-310001708035us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2018-12-310001708035us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2018-12-310001708035us-gaap:AccumulatedTranslationAdjustmentMember2018-12-310001708035us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-01-012019-12-310001708035us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2019-01-012019-12-310001708035us-gaap:AccumulatedTranslationAdjustmentMember2019-01-012019-12-310001708035us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2019-12-310001708035us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-01-012020-12-310001708035us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-01-012020-12-310001708035us-gaap:AccumulatedTranslationAdjustmentMember2020-01-012020-12-310001708035us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberpqg:AccumulatedDefinedBenefitPlansAdjustmentMemberMember2020-01-012020-12-310001708035us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberpqg:AccumulatedGainLossNetCashFlowHedgeMember2020-01-012020-12-310001708035pqg:AccumulatedTranslationAdjustmentMemberMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMember2020-01-012020-12-310001708035us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-12-310001708035us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001708035us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001708035us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001708035us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001708035us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001708035us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001708035us-gaap:InterestRateCapMemberus-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001708035us-gaap:InterestRateCapMemberus-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001708035us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMemberus-gaap:CommodityContractMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001708035us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMemberus-gaap:CommodityContractMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001708035us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001708035us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001708035us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001708035us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-3100017080352020-03-1200017080352020-12-142020-12-140001708035us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberpqg:MagnesiumSilicateProductLineMember2020-07-010001708035us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberpqg:SulfateSaltsProductLineMember2019-06-280001708035us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberpqg:SulfateSaltsProductLineMember2019-06-282019-06-280001708035us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberpqg:PropertySaleMember2019-12-190001708035us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberpqg:PropertySaleMember2019-12-192019-12-190001708035us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberpqg:PropertySaleMember2019-12-300001708035pqg:BusinessCombinationsMember2020-12-310001708035pqg:BusinessCombinationsMember2019-12-31xbrli:pure0001708035pqg:PQSilicatesLtd.Member2020-12-310001708035pqg:ZeolystInternationalMember2020-12-310001708035pqg:ZeolystC.V.Member2020-12-310001708035us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2020-12-310001708035us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2019-12-310001708035us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2020-01-012020-12-310001708035us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2019-01-012019-12-310001708035us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2018-01-012018-12-310001708035pqg:QuakerHoldingsMember2020-03-310001708035pqg:PQHoldingsEcoServicesMember2020-12-310001708035pqg:PQHoldingsEcoServicesMember2019-12-310001708035pqg:PQHoldingsEcoServicesMember2020-01-012020-12-310001708035pqg:PQHoldingsEcoServicesMember2019-01-012019-12-310001708035pqg:PQHoldingsEcoServicesMember2018-01-012018-12-310001708035us-gaap:EquityMethodInvesteeMember2020-12-310001708035us-gaap:EquityMethodInvesteeMember2019-12-310001708035us-gaap:EquityMethodInvesteeMember2020-01-012020-12-310001708035us-gaap:EquityMethodInvesteeMember2019-01-012019-12-310001708035us-gaap:EquityMethodInvesteeMember2018-01-012018-12-310001708035us-gaap:LandMember2020-12-310001708035us-gaap:LandMember2019-12-310001708035us-gaap:BuildingMember2020-12-310001708035us-gaap:BuildingMember2019-12-310001708035us-gaap:MachineryAndEquipmentMember2020-12-310001708035us-gaap:MachineryAndEquipmentMember2019-12-310001708035us-gaap:ConstructionInProgressMember2020-12-310001708035us-gaap:ConstructionInProgressMember2019-12-310001708035us-gaap:IntersegmentEliminationMember2020-01-012020-12-310001708035us-gaap:IntersegmentEliminationMember2019-01-012019-12-310001708035us-gaap:IntersegmentEliminationMember2018-01-012018-12-310001708035pqg:ZeolystJointVentureMemberpqg:CatalystsMember2020-01-012020-12-310001708035pqg:ZeolystJointVentureMemberpqg:CatalystsMember2019-01-012019-12-310001708035pqg:ZeolystJointVentureMemberpqg:CatalystsMember2018-01-012018-12-310001708035us-gaap:MaterialReconcilingItemsMember2020-01-012020-12-310001708035us-gaap:MaterialReconcilingItemsMember2019-01-012019-12-310001708035us-gaap:MaterialReconcilingItemsMember2018-01-012018-12-310001708035us-gaap:CorporateNonSegmentMember2020-01-012020-12-310001708035us-gaap:CorporateNonSegmentMember2019-01-012019-12-310001708035us-gaap:CorporateNonSegmentMember2018-01-012018-12-310001708035us-gaap:CorporateMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001708035us-gaap:CorporateMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001708035us-gaap:CorporateMemberus-gaap:OperatingSegmentsMember2018-01-012018-12-310001708035country:US2020-01-012020-12-310001708035country:US2019-01-012019-12-310001708035country:US2018-01-012018-12-310001708035country:NL2020-01-012020-12-310001708035country:NL2019-01-012019-12-310001708035country:NL2018-01-012018-12-310001708035country:GB2020-01-012020-12-310001708035country:GB2019-01-012019-12-310001708035country:GB2018-01-012018-12-310001708035pqg:OtherForeignCountriesMember2020-01-012020-12-310001708035pqg:OtherForeignCountriesMember2019-01-012019-12-310001708035pqg:OtherForeignCountriesMember2018-01-012018-12-310001708035country:US2020-12-310001708035country:US2019-12-310001708035country:NL2020-12-310001708035country:NL2019-12-310001708035country:GB2020-12-310001708035country:GB2019-12-310001708035pqg:OtherForeignCountriesMember2020-12-310001708035pqg:OtherForeignCountriesMember2019-12-310001708035pqg:RefiningServicesMember2018-12-310001708035pqg:CatalystsMember2018-12-310001708035pqg:PerformanceChemicalsMember2018-12-310001708035pqg:RefiningServicesMember2019-12-310001708035pqg:CatalystsMember2019-12-310001708035pqg:PerformanceChemicalsMember2019-12-310001708035pqg:RefiningServicesMember2020-12-310001708035pqg:CatalystsMember2020-12-310001708035pqg:PerformanceChemicalsMember2020-12-310001708035us-gaap:IntellectualPropertyMember2020-12-310001708035us-gaap:IntellectualPropertyMember2019-12-310001708035us-gaap:CustomerRelationshipsMember2020-12-310001708035us-gaap:CustomerRelationshipsMember2019-12-310001708035us-gaap:ContractualRightsMember2020-12-310001708035us-gaap:ContractualRightsMember2019-12-310001708035us-gaap:TrademarksMember2020-12-310001708035us-gaap:TrademarksMember2019-12-310001708035pqg:PermitsMember2020-12-310001708035pqg:PermitsMember2019-12-310001708035us-gaap:InProcessResearchAndDevelopmentMember2020-12-310001708035us-gaap:InProcessResearchAndDevelopmentMember2019-12-310001708035us-gaap:FiniteLivedIntangibleAssetsMember2020-12-310001708035us-gaap:FiniteLivedIntangibleAssetsMember2019-12-310001708035us-gaap:TradeNamesMember2020-12-310001708035us-gaap:TradeNamesMember2019-12-310001708035us-gaap:TrademarksMember2020-12-310001708035us-gaap:TrademarksMember2019-12-310001708035us-gaap:InProcessResearchAndDevelopmentMember2020-12-310001708035us-gaap:InProcessResearchAndDevelopmentMember2019-12-310001708035us-gaap:IntellectualPropertyMembersrt:MinimumMember2020-01-012020-12-310001708035us-gaap:IntellectualPropertyMembersrt:MaximumMember2020-01-012020-12-310001708035us-gaap:CustomerRelationshipsMembersrt:MinimumMember2020-01-012020-12-310001708035us-gaap:CustomerRelationshipsMembersrt:MaximumMember2020-01-012020-12-310001708035us-gaap:TrademarksMembersrt:MinimumMember2020-01-012020-12-310001708035us-gaap:TrademarksMembersrt:MaximumMember2020-01-012020-12-310001708035us-gaap:ContractualRightsMembersrt:MinimumMember2020-01-012020-12-310001708035srt:MaximumMemberus-gaap:ContractualRightsMember2020-01-012020-12-310001708035pqg:PermitsMember2020-01-012020-12-310001708035us-gaap:CostOfSalesMember2020-01-012020-12-310001708035us-gaap:CostOfSalesMember2019-01-012019-12-310001708035us-gaap:CostOfSalesMember2018-01-012018-12-310001708035us-gaap:OtherOperatingIncomeExpenseMember2020-01-012020-12-310001708035us-gaap:OtherOperatingIncomeExpenseMember2019-01-012019-12-310001708035us-gaap:OtherOperatingIncomeExpenseMember2018-01-012018-12-310001708035us-gaap:MediumTermNotesMember2020-12-310001708035us-gaap:MediumTermNotesMember2019-12-310001708035us-gaap:MediumTermNotesMemberpqg:NewTermLoanFacilityMember2020-12-310001708035us-gaap:MediumTermNotesMemberpqg:NewTermLoanFacilityMember2019-12-310001708035pqg:SixPointSevenFivePercentSeniorSecuredNotesdue2022Memberus-gaap:SeniorNotesMember2020-12-310001708035pqg:SixPointSevenFivePercentSeniorSecuredNotesdue2022Memberus-gaap:SeniorNotesMember2019-12-310001708035pqg:FivePointSevenFivePercentSeniorUnsecuredNotesdue2025Memberus-gaap:SeniorNotesMember2020-12-310001708035pqg:FivePointSevenFivePercentSeniorUnsecuredNotesdue2025Memberus-gaap:SeniorNotesMember2019-12-310001708035us-gaap:LineOfCreditMember2020-12-310001708035us-gaap:LineOfCreditMember2019-12-310001708035us-gaap:MediumTermNotesMemberpqg:TermLoanFacilityMember2016-05-040001708035currency:USDus-gaap:MediumTermNotesMemberpqg:TermLoanFacilityMember2016-05-040001708035us-gaap:MediumTermNotesMemberpqg:TermLoanFacilityMembercurrency:EUR2016-05-040001708035us-gaap:LineOfCreditMember2016-05-040001708035us-gaap:MediumTermNotesMemberpqg:NewTermLoanFacilityMember2018-02-080001708035us-gaap:MediumTermNotesMemberus-gaap:LondonInterbankOfferedRateLIBORMemberpqg:NewTermLoanFacilityMember2020-02-072020-02-070001708035us-gaap:MediumTermNotesMemberpqg:NewTermLoanFacilityMemberus-gaap:BaseRateMember2020-02-072020-02-070001708035us-gaap:MediumTermNotesMemberus-gaap:LondonInterbankOfferedRateLIBORMemberpqg:NewTermLoanFacilityMember2020-07-2200017080352020-07-222020-07-220001708035us-gaap:MediumTermNotesMemberus-gaap:LondonInterbankOfferedRateLIBORMemberpqg:NewTermLoanFacilityMember2020-07-222020-07-220001708035pqg:SixPointSevenFivePercentSeniorSecuredNotesdue2022Memberus-gaap:SeniorNotesMember2016-05-040001708035us-gaap:MediumTermNotesMemberpqg:NewTermLoanFacilityMember2020-07-220001708035us-gaap:MediumTermNotesMemberus-gaap:LondonInterbankOfferedRateLIBORMemberpqg:NewTermLoanFacilityMember2018-02-082018-02-080001708035us-gaap:NetInvestmentHedgingMemberus-gaap:CrossCurrencyInterestRateContractMember2018-02-280001708035us-gaap:NetInvestmentHedgingMemberus-gaap:CrossCurrencyInterestRateContractMember2019-10-010001708035us-gaap:NetInvestmentHedgingMemberus-gaap:CrossCurrencyInterestRateContractMember2020-12-310001708035us-gaap:CrossCurrencyInterestRateContractMember2019-10-312019-10-310001708035currency:USDus-gaap:LineOfCreditMember2016-05-040001708035country:CAus-gaap:LineOfCreditMember2016-05-040001708035us-gaap:LineOfCreditMembersrt:EuropeMember2016-05-040001708035us-gaap:LineOfCreditMemberus-gaap:LondonInterbankOfferedRateLIBORMembersrt:MinimumMember2016-05-042016-05-040001708035us-gaap:LineOfCreditMemberus-gaap:LondonInterbankOfferedRateLIBORMembersrt:MaximumMember2016-05-042016-05-040001708035us-gaap:LineOfCreditMembersrt:MinimumMemberus-gaap:BaseRateMember2016-05-042016-05-040001708035us-gaap:LineOfCreditMembersrt:MaximumMemberus-gaap:BaseRateMember2016-05-042016-05-040001708035us-gaap:LineOfCreditMember2016-05-042016-05-040001708035currency:USD2020-12-310001708035currency:CAD2020-12-310001708035currency:EUR2020-12-310001708035us-gaap:LineOfCreditMemberus-gaap:LondonInterbankOfferedRateLIBORMembersrt:MinimumMember2020-01-012020-12-310001708035us-gaap:LineOfCreditMemberus-gaap:LondonInterbankOfferedRateLIBORMembersrt:MaximumMember2020-01-012020-12-310001708035us-gaap:LineOfCreditMembersrt:MinimumMemberus-gaap:BaseRateMember2020-01-012020-12-310001708035us-gaap:LineOfCreditMembersrt:MaximumMemberus-gaap:BaseRateMember2020-01-012020-12-310001708035us-gaap:RevolvingCreditFacilityMember2020-12-310001708035us-gaap:RevolvingCreditFacilityMember2016-05-040001708035us-gaap:MediumTermNotesMemberpqg:NewTermLoanFacilityMember2020-01-012020-12-310001708035us-gaap:MediumTermNotesMemberpqg:NewTermLoanFacilityMember2019-01-012019-12-310001708035us-gaap:MediumTermNotesMemberpqg:TermLoanFacilityMember2020-01-012020-12-310001708035us-gaap:MediumTermNotesMemberpqg:TermLoanFacilityMember2018-01-012018-12-310001708035pqg:SixPointSevenFivePercentSeniorSecuredNotesdue2022Memberus-gaap:SeniorNotesMemberus-gaap:DebtInstrumentRedemptionPeriodTwoMember2020-01-012020-12-310001708035pqg:SixPointSevenFivePercentSeniorSecuredNotesdue2022Memberus-gaap:DebtInstrumentRedemptionPeriodThreeMemberus-gaap:SeniorNotesMember2020-01-012020-12-310001708035pqg:FivePointSevenFivePercentSeniorUnsecuredNotesdue2025Memberus-gaap:UnsecuredDebtMember2019-03-012019-03-310001708035pqg:FivePointSevenFivePercentSeniorUnsecuredNotesdue2025Memberus-gaap:UnsecuredDebtMember2020-01-012020-12-310001708035pqg:NewTermLoanFacilityMember2020-07-012020-07-010001708035pqg:FivePointSevenFivePercentSeniorUnsecuredNotesdue2025Memberus-gaap:UnsecuredDebtMember2017-12-110001708035pqg:FivePointSevenFivePercentSeniorUnsecuredNotesdue2025Memberus-gaap:UnsecuredDebtMemberpqg:EventofDefaultMembersrt:MinimumMember2019-01-012019-12-310001708035pqg:ExerciseofCallOptionMemberpqg:FivePointSevenFivePercentSeniorUnsecuredNotesdue2025Memberus-gaap:UnsecuredDebtMembersrt:MaximumMember2017-12-112017-12-110001708035pqg:FivePointSevenFivePercentSeniorUnsecuredNotesdue2025Memberus-gaap:UnsecuredDebtMember2017-12-112017-12-110001708035pqg:UnitedStatesTreasuryMemberpqg:FivePointSevenFivePercentSeniorUnsecuredNotesdue2025Memberus-gaap:UnsecuredDebtMember2017-12-112017-12-110001708035us-gaap:DebtInstrumentRedemptionPeriodOneMemberpqg:FivePointSevenFivePercentSeniorUnsecuredNotesdue2025Memberus-gaap:UnsecuredDebtMember2020-01-012020-12-310001708035pqg:FivePointSevenFivePercentSeniorUnsecuredNotesdue2025Memberus-gaap:UnsecuredDebtMemberus-gaap:DebtInstrumentRedemptionPeriodTwoMember2020-01-012020-12-310001708035us-gaap:DebtInstrumentRedemptionPeriodThreeMemberpqg:FivePointSevenFivePercentSeniorUnsecuredNotesdue2025Memberus-gaap:UnsecuredDebtMember2020-01-012020-12-310001708035pqg:FivePointSevenFivePercentSeniorUnsecuredNotesdue2025Memberus-gaap:UnsecuredDebtMemberpqg:ChangeOfControlMember2020-01-012020-12-310001708035pqg:TermLoanAndSeniorNotesMember2020-12-310001708035pqg:TermLoanAndSeniorNotesMember2019-12-310001708035pqg:July2016InterestRateCapMemberus-gaap:CashFlowHedgingMember2016-07-012016-07-310001708035pqg:July2016InterestRateCapMemberus-gaap:CashFlowHedgingMembersrt:MinimumMember2016-07-310001708035pqg:July2016InterestRateCapMembersrt:MaximumMemberus-gaap:CashFlowHedgingMember2016-07-310001708035pqg:July2016InterestRateCapMemberus-gaap:CashFlowHedgingMember2016-07-310001708035pqg:November2018InterestRateCapMemberus-gaap:CashFlowHedgingMember2018-11-130001708035pqg:November2018InterestRateCapMemberus-gaap:CashFlowHedgingMember2018-11-302018-11-300001708035pqg:November2018InterestRateCapMemberus-gaap:CashFlowHedgingMember2018-11-300001708035pqg:November2018InterestRateCapMemberus-gaap:CashFlowHedgingMember2020-02-280001708035pqg:November2018InterestRateCapMemberus-gaap:CashFlowHedgingMember2020-01-012020-12-310001708035pqg:November2018InterestRateCapMemberus-gaap:CashFlowHedgingMember2020-03-310001708035pqg:November2018InterestRateCapMemberus-gaap:CashFlowHedgingMember2020-03-012020-03-310001708035pqg:November2018InterestRateCapMemberus-gaap:CashFlowHedgingMember2018-11-012020-12-310001708035pqg:July2016InterestRateCapMemberus-gaap:CashFlowHedgingMember2020-12-310001708035us-gaap:CashFlowHedgingMemberpqg:July2020InterestRateCapMember2020-07-310001708035us-gaap:NetInvestmentHedgingMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:CrossCurrencyInterestRateContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-12-310001708035us-gaap:NetInvestmentHedgingMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:CrossCurrencyInterestRateContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2019-12-310001708035us-gaap:DesignatedAsHedgingInstrumentMember2020-12-310001708035us-gaap:DesignatedAsHedgingInstrumentMember2019-12-310001708035us-gaap:AccruedLiabilitiesMemberus-gaap:InterestRateCapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMember2020-12-310001708035us-gaap:AccruedLiabilitiesMemberus-gaap:InterestRateCapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMember2019-12-310001708035us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:InterestRateCapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMember2020-12-310001708035us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:InterestRateCapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMember2019-12-310001708035us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMember2020-12-310001708035us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMember2019-12-310001708035us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:CrossCurrencyInterestRateContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMember2020-12-310001708035us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:CrossCurrencyInterestRateContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMember2019-12-310001708035us-gaap:InterestRateCapMember2020-01-012020-12-310001708035us-gaap:InterestRateCapMemberus-gaap:InterestExpenseMember2020-01-012020-12-310001708035us-gaap:InterestRateCapMember2019-01-012019-12-310001708035us-gaap:InterestRateCapMemberus-gaap:InterestExpenseMember2019-01-012019-12-310001708035us-gaap:InterestRateCapMember2018-01-012018-12-310001708035us-gaap:InterestRateCapMemberus-gaap:InterestExpenseMember2018-01-012018-12-310001708035us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2020-01-012020-12-310001708035us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2019-01-012019-12-310001708035us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2018-01-012018-12-310001708035us-gaap:CurrencySwapMember2020-01-012020-12-310001708035us-gaap:CurrencySwapMember2019-01-012019-12-310001708035us-gaap:CurrencySwapMember2018-01-012018-12-310001708035us-gaap:SaleOfSubsidiaryGainLossMember2020-01-012020-12-310001708035us-gaap:SaleOfSubsidiaryGainLossMember2019-01-012019-12-310001708035us-gaap:SaleOfSubsidiaryGainLossMember2018-01-012018-12-310001708035pqg:InterestIncomeExpenseMember2020-01-012020-12-310001708035pqg:InterestIncomeExpenseMember2019-01-012019-12-310001708035pqg:InterestIncomeExpenseMember2018-01-012018-12-310001708035us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-01-012020-12-310001708035us-gaap:DomesticCountryMember2020-12-310001708035pqg:TaxYearsPriorto2014ChangeinControlMemberus-gaap:DomesticCountryMember2020-12-310001708035us-gaap:DomesticCountryMemberpqg:TaxYearsAfter2014ChangeinControlMember2020-12-310001708035us-gaap:StateAndLocalJurisdictionMember2020-12-310001708035us-gaap:ForeignCountryMemberus-gaap:TaxYear2019Member2020-12-310001708035pqg:TaxYear2026MemberDomainus-gaap:ForeignCountryMember2020-12-310001708035pqg:IndefiniteMemberus-gaap:ForeignCountryMember2020-12-310001708035us-gaap:ForeignCountryMember2020-12-310001708035us-gaap:DomesticCountryMember2020-01-012020-12-310001708035us-gaap:DomesticCountryMember2019-01-012019-12-310001708035us-gaap:DomesticCountryMember2018-01-012018-12-310001708035us-gaap:ForeignCountryMember2020-01-012020-12-310001708035us-gaap:ForeignCountryMember2019-01-012019-12-310001708035us-gaap:ForeignCountryMember2018-01-012018-12-31pqg:plan0001708035pqg:EcoServicesMember2020-12-310001708035pqg:PQHoldingsBenefitPlanMember2020-12-310001708035pqg:PQHoldingsBenefitPlanMemberus-gaap:ForeignPlanMember2020-12-310001708035country:USpqg:PQHoldingsBenefitPlanMember2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMember2020-01-012020-12-310001708035country:USus-gaap:PensionPlansDefinedBenefitMember2019-12-310001708035country:USus-gaap:PensionPlansDefinedBenefitMember2018-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2019-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2018-12-310001708035country:USus-gaap:PensionPlansDefinedBenefitMember2020-01-012020-12-310001708035country:USus-gaap:PensionPlansDefinedBenefitMember2019-01-012019-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2020-01-012020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2019-01-012019-12-310001708035country:USus-gaap:PensionPlansDefinedBenefitMember2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2020-12-310001708035country:USus-gaap:PensionPlansDefinedBenefitMember2018-01-012018-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2018-01-012018-12-310001708035us-gaap:UnfundedPlanMember2020-12-310001708035us-gaap:UnfundedPlanMember2019-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberpqg:PQCorporationRetirementPlanMemberus-gaap:EquitySecuritiesMember2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberpqg:PQCorporationRetirementPlanMemberus-gaap:DebtSecuritiesMember2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:EquitySecuritiesMemberpqg:EcoServicesPensionEquityPlanMember2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberpqg:EcoServicesPensionEquityPlanMemberus-gaap:DebtSecuritiesMember2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:EquitySecuritiesMemberpqg:EcoServicesHourlyPensionPlanMember2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DebtSecuritiesMemberpqg:EcoServicesHourlyPensionPlanMember2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CashAndCashEquivalentsMember2020-12-310001708035us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CashAndCashEquivalentsMember2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel2Member2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CashAndCashEquivalentsMember2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:PrivateEquityFundsDomesticMember2020-12-310001708035us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:PrivateEquityFundsDomesticMember2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:PrivateEquityFundsDomesticMemberus-gaap:FairValueInputsLevel2Member2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:PrivateEquityFundsDomesticMemberus-gaap:FairValueInputsLevel3Member2020-12-310001708035us-gaap:PrivateEquityFundsForeignMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001708035us-gaap:PrivateEquityFundsForeignMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001708035us-gaap:PrivateEquityFundsForeignMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2020-12-310001708035us-gaap:PrivateEquityFundsForeignMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasuryAndGovernmentMember2020-12-310001708035us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasuryAndGovernmentMember2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel2Member2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:USTreasuryAndGovernmentMember2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMember2020-12-310001708035us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMember2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherDebtSecuritiesMember2020-12-310001708035us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherDebtSecuritiesMember2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:OtherDebtSecuritiesMember2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberpqg:OtherInsurancePoliciesMember2020-12-310001708035us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberpqg:OtherInsurancePoliciesMember2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberpqg:OtherInsurancePoliciesMember2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberpqg:OtherInsurancePoliciesMember2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMember2020-12-310001708035us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CashAndCashEquivalentsMember2019-12-310001708035us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CashAndCashEquivalentsMember2019-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel2Member2019-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CashAndCashEquivalentsMember2019-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:PrivateEquityFundsDomesticMember2019-12-310001708035us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:PrivateEquityFundsDomesticMember2019-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:PrivateEquityFundsDomesticMemberus-gaap:FairValueInputsLevel2Member2019-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:PrivateEquityFundsDomesticMemberus-gaap:FairValueInputsLevel3Member2019-12-310001708035us-gaap:PrivateEquityFundsForeignMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001708035us-gaap:PrivateEquityFundsForeignMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001708035us-gaap:PrivateEquityFundsForeignMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2019-12-310001708035us-gaap:PrivateEquityFundsForeignMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2019-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasuryAndGovernmentMember2019-12-310001708035us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasuryAndGovernmentMember2019-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel2Member2019-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:USTreasuryAndGovernmentMember2019-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMember2019-12-310001708035us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMember2019-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2019-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2019-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherDebtSecuritiesMember2019-12-310001708035us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherDebtSecuritiesMember2019-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2019-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:OtherDebtSecuritiesMember2019-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberpqg:OtherInsurancePoliciesMember2019-12-310001708035us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberpqg:OtherInsurancePoliciesMember2019-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberpqg:OtherInsurancePoliciesMember2019-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberpqg:OtherInsurancePoliciesMember2019-12-310001708035us-gaap:PensionPlansDefinedBenefitMember2019-12-310001708035us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2019-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2019-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2018-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2020-01-012020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2019-01-012019-12-310001708035us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2020-01-012020-12-310001708035us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2019-12-310001708035us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2018-12-310001708035us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2019-01-012019-12-310001708035us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2020-12-310001708035us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2018-01-012018-12-310001708035us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-01-012020-12-310001708035us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2019-12-310001708035us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2018-12-310001708035us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2019-01-012019-12-310001708035us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-12-310001708035us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2018-01-012018-12-310001708035pqg:StockIncentivePlanMember2016-05-040001708035pqg:StockIncentivePlanMember2016-05-042017-09-300001708035pqg:TwoThousandSeventeenOmnibusPlanMemberMember2017-10-030001708035pqg:TwoThousandSeventeenOmnibusPlanMemberMember2020-04-300001708035pqg:TwoThousandSeventeenOmnibusPlanMemberMember2020-12-310001708035us-gaap:EmployeeStockOptionMember2020-01-012020-12-310001708035us-gaap:EmployeeStockOptionMember2017-12-310001708035us-gaap:EmployeeStockOptionMember2018-01-012018-12-310001708035us-gaap:EmployeeStockOptionMember2018-12-310001708035us-gaap:EmployeeStockOptionMember2019-01-012019-12-310001708035us-gaap:EmployeeStockOptionMember2019-12-310001708035us-gaap:EmployeeStockOptionMember2020-12-310001708035pqg:BlackSholesOptionPricingModelMemberus-gaap:EmployeeStockOptionMember2018-01-012018-12-310001708035srt:DirectorMemberus-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310001708035us-gaap:RestrictedStockUnitsRSUMemberpqg:EmployeeMember2020-01-012020-12-310001708035pqg:PerformanceStockUnitsMember2020-01-012020-12-310001708035srt:MinimumMemberpqg:PerformanceStockUnitsMember2020-01-012020-12-310001708035srt:MaximumMemberpqg:PerformanceStockUnitsMember2020-01-012020-12-310001708035pqg:MonteCarloSimulationMember2020-01-012020-12-310001708035us-gaap:RestrictedStockMember2017-12-310001708035us-gaap:RestrictedStockUnitsRSUMember2017-12-310001708035pqg:PerformanceStockUnitsMember2017-12-310001708035us-gaap:RestrictedStockMember2018-01-012018-12-310001708035us-gaap:RestrictedStockUnitsRSUMember2018-01-012018-12-310001708035pqg:PerformanceStockUnitsMember2018-01-012018-12-310001708035us-gaap:RestrictedStockMember2018-12-310001708035us-gaap:RestrictedStockUnitsRSUMember2018-12-310001708035pqg:PerformanceStockUnitsMember2018-12-310001708035us-gaap:RestrictedStockMember2019-01-012019-12-310001708035us-gaap:RestrictedStockUnitsRSUMember2019-01-012019-12-310001708035pqg:PerformanceStockUnitsMember2019-01-012019-12-310001708035us-gaap:RestrictedStockMember2019-12-310001708035us-gaap:RestrictedStockUnitsRSUMember2019-12-310001708035pqg:PerformanceStockUnitsMember2019-12-310001708035us-gaap:RestrictedStockMember2020-01-012020-12-310001708035us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310001708035us-gaap:RestrictedStockMember2020-12-310001708035us-gaap:RestrictedStockUnitsRSUMember2020-12-310001708035pqg:PerformanceStockUnitsMember2020-12-310001708035us-gaap:PerformanceSharesMember2020-01-012020-12-310001708035pqg:SharebasedCompensationAwardTrancheFourMemberus-gaap:PerformanceSharesMember2020-01-012020-12-310001708035us-gaap:RestrictedStockMember2020-01-012020-12-310001708035us-gaap:RestrictedStockMember2019-01-012019-12-310001708035us-gaap:RestrictedStockMember2018-01-012018-12-310001708035us-gaap:PerformanceSharesMember2020-01-012020-12-310001708035us-gaap:PerformanceSharesMember2019-01-012019-12-310001708035us-gaap:PerformanceSharesMember2018-01-012018-12-310001708035pqg:RestrictedStockRestrictedStockUnitsRSUsandPerformanceStockUnitsPSUsMember2020-01-012020-12-310001708035pqg:RestrictedStockRestrictedStockUnitsRSUsandPerformanceStockUnitsPSUsMember2019-01-012019-12-310001708035pqg:RestrictedStockRestrictedStockUnitsRSUsandPerformanceStockUnitsPSUsMember2018-01-012018-12-310001708035us-gaap:EmployeeStockOptionMember2020-01-012020-12-310001708035us-gaap:EmployeeStockOptionMember2019-01-012019-12-310001708035us-gaap:EmployeeStockOptionMember2018-01-012018-12-310001708035pqg:SoilAndGroundwaterContaminationMember2020-12-310001708035pqg:SoilAndGroundwaterContaminationMember2019-12-310001708035pqg:SubsurfaceRemediationAndWetlandsManagementMember2020-12-310001708035pqg:SubsurfaceRemediationAndWetlandsManagementMember2019-12-310001708035pqg:SubsurfaceRemediationAndSoilVaporExtractionMember2020-12-310001708035pqg:SubsurfaceRemediationAndSoilVaporExtractionMember2019-12-3100017080352014-12-010001708035us-gaap:CorporateJointVentureMemberpqg:OperatingLeaseRentalPaymentsMember2020-01-012020-12-310001708035us-gaap:CorporateJointVentureMemberpqg:OperatingLeaseRentalPaymentsMember2019-01-012019-12-310001708035us-gaap:CorporateJointVentureMemberpqg:OperatingLeaseRentalPaymentsMember2018-01-012018-12-310001708035pqg:SalesfromPartnershiptoCompanyMemberus-gaap:CorporateJointVentureMember2020-01-012020-12-310001708035pqg:SalesfromPartnershiptoCompanyMemberus-gaap:CorporateJointVentureMember2019-01-012019-12-310001708035pqg:SalesfromPartnershiptoCompanyMemberus-gaap:CorporateJointVentureMember2018-01-012018-12-310001708035pqg:ManufacturingCostsMemberus-gaap:CorporateJointVentureMember2020-01-012020-12-310001708035pqg:ManufacturingCostsMemberus-gaap:CorporateJointVentureMember2019-01-012019-12-310001708035pqg:ManufacturingCostsMemberus-gaap:CorporateJointVentureMember2018-01-012018-12-310001708035us-gaap:CorporateJointVentureMemberpqg:ServicesMember2020-01-012020-12-310001708035us-gaap:CorporateJointVentureMemberpqg:ServicesMember2019-01-012019-12-310001708035us-gaap:CorporateJointVentureMemberpqg:ServicesMember2018-01-012018-12-310001708035us-gaap:CorporateJointVentureMemberpqg:ProductDemonstrationCostsMember2020-01-012020-12-310001708035us-gaap:CorporateJointVentureMemberpqg:ProductDemonstrationCostsMember2019-01-012019-12-310001708035us-gaap:CorporateJointVentureMemberpqg:ProductDemonstrationCostsMember2018-01-012018-12-310001708035pqg:INEOSCapitalPartnersMember2020-01-012020-12-310001708035pqg:INEOSCapitalPartnersMember2019-01-012019-12-310001708035pqg:INEOSCapitalPartnersMember2018-01-012018-12-3100017080352020-01-012020-03-3100017080352020-04-012020-06-3000017080352020-07-012020-09-3000017080352020-10-012020-12-3100017080352019-01-012019-03-3100017080352019-04-012019-06-3000017080352019-07-012019-09-3000017080352019-10-012019-12-310001708035us-gaap:SubsequentEventMember2021-03-012021-03-010001708035us-gaap:SubsequentEventMember2021-02-242021-02-240001708035srt:ParentCompanyMember2020-01-012020-12-310001708035srt:ParentCompanyMember2019-01-012019-12-310001708035srt:ParentCompanyMember2018-01-012018-12-310001708035srt:ParentCompanyMember2020-12-310001708035srt:ParentCompanyMember2019-12-310001708035srt:ParentCompanyMember2018-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| | | | | |

(Mark One) |

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2020

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-38221

PQ Group Holdings Inc.

| | | | | | | | | | | |

| Delaware | | 81-3406833 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| |

| 300 Lindenwood Drive | | |

Malvern, Pennsylvania | | 19355 |

| (Address of principal executive offices) | | (Zip Code) |

| | | | | |

(610) | 651-4400 |

| (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol | Name of each exchange on which registered |

| Common stock, par value $0.01 per share | PQG | New York Stock Exchange |

| | |

| | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ý Yes ¨ No |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes ý No |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ý Yes ¨ No |

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ý Yes ¨ No |

| | | | | | | | | | | | | | | | | | | | |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. |

| Large accelerated filer | | ☐ | | Accelerated filer | | ☒ |

| | | | |

| Non-accelerated filer | | ☐ | | Smaller reporting company | | ☐ |

| | | | | | |

| | | | Emerging growth company | | ☐ |

| | | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ Yes ý No |

The aggregate market value of PQ Group Holdings Inc. voting and non-voting common equity held by non-affiliates as of June 30, 2020 (the last business day of the registrant’s most recently completed second fiscal quarter) based on the closing sale price of $13.24 per share as reported on the New York Stock Exchange was $537,729,982. |

The number of shares of common stock outstanding as of March 12, 2021 was 136,937,196. |

| | | | | | | | | | | | | | |

| | | | |

| | | | |

DOCUMENTS INCORPORATED BY REFERENCE |

Portions of the PQ Group Holdings Inc. Proxy Statement for the 2021 Annual Meeting of Stockholders are incorporated by reference into Part III of this report. |

PQ GROUP HOLDINGS INC.

INDEX—FORM 10-K

December 31, 2020

| | | | | | | | |

| | Page |

| | |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| | |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| | |

| | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| | |

| | |

| Item 15. | | |

| Item 16. | | |

| | |

| | |

| | |

PART I

Forward-looking Statements and Risk Factor Summary

This Annual Report on Form 10-K (“Form 10-K”) includes “forward-looking statements” that express our opinions, expectations, beliefs, plans, objectives, assumptions or projections regarding future events or future results. The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should” and similar expressions are intended to identify these forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy, short- and long-term business operations and objections, and financial needs. Examples of forward-looking statements include, but are not limited to, statements we make regarding the announced pending sale of our Performance Chemicals segment, the impact of the novel coronavirus (“COVID-19”) pandemic on our operations and financial results and our liquidity, including our belief that our current level of operations, cash and cash equivalents, cash flow from operations and borrowings under our credit facilities and other lines of credit will provide us adequate cash to fund the working capital, capital expenditure, debt service and other requirements for our business for the foreseeable future.

These forward-looking statements are subject to a number of risks, uncertainties and assumptions. Moreover, we operate in a very competitive and rapidly changing environment and new risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed herein may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

Some of the key factors that could cause actual results to differ from our expectations include the following risks related to our business:

•the impact of the ongoing COVID-19 pandemic on the global economy and financial markets, as well as on our business and our suppliers, and the response of governments and of our company to the outbreak;

•as a global business, we are exposed to local business risks in different countries;

•we are affected by general economic conditions and economic downturns;

•exchange rate fluctuations could adversely affect our financial condition, results of operations and cash flows;

•our international operations require us to comply with anti-corruption laws, trade and export controls and regulations of the U.S. government and various international jurisdictions in which we do business;

•alternative technology or other changes in our customers’ products may reduce or eliminate the need for certain of our products;

•our new product development and research and development efforts may not succeed and our competitors may develop more effective or successful products;

•our substantial level of indebtedness could adversely affect our financial condition;

•if we are unable to pass on increases in raw material prices, including natural gas, to our customers or to retain or replace our key suppliers, our results of operations and cash flows may be negatively affected;

•we face substantial competition in the industries in which we operate;

•we are subject to the risk of loss resulting from non-payment or non-performance by our customers;

•we rely on a limited number of customers for a meaningful portion of our business;

•multi-year customer contracts in our refining services segment are subject to potential early termination and such contracts may not be renewed at the end of their respective terms;

•our quarterly results of operations are subject to fluctuations because the demand for some of our products is seasonal;

•our growth projects may result in significant expenditures before generating revenues, if any, which may materially and adversely affect our ability to implement our business strategy;

•we may be liable to damages based on product liability claims brought against us or our customers for costs associated with recalls of our or our customers’ products;

•we are subject to extensive environmental, health and safety regulations and face various risks associated with potential non-compliance or releases of hazardous materials;

•existing and proposed regulations to address climate change by limiting greenhouse gas emissions may cause us to incur significant additional operating and capital expenses and may impact our business and results of operations;

•production and distribution of our products could be disrupted for a variety of reasons, and such disruptions could expose us to significant losses or liabilities;

•the insurance that we maintain may not fully cover all potential exposures;

•we could be subject to damages based on claims brought against us by our customers or lose customers as a result of the failure of our products to meet certain quality specifications;

•our failure to protect our intellectual property and infringement on the intellectual property rights of third parties;

•losses and damages in connection with information technology risks could adversely affect our operations; and

•the other risks and uncertainties discussed in “Item 1A—Risk Factors.”

The forward-looking statements included herein are made only as of the date hereof. You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. We undertake no obligation to update publicly any forward-looking statements for any reason after the date of this Form 10-K to conform these statements to actual results or to changes in our expectations.

ITEM 1. BUSINESS.

PQ Group Holdings Inc. (“PQ Group Holdings” or the “Company”) was incorporated in Delaware on August 7, 2015. PQ Holdings Inc. (“PQ Holdings”), a manufacturer of specialty catalysts, chemicals and services, was incorporated in Delaware on June 22, 2007. Founded in 1831, our business has a nearly 200-year history of innovation, enabling environmental improvements in areas such as fuel efficiency and emissions, and healthier personal care products, while improving the sustainability of our planet. On May 4, 2016, we consummated a series of transactions (the “Business Combination”) to reorganize and combine the businesses of PQ Holdings and Eco Services Operations LLC under a new holdings company, PQ Group Holdings. On October 3, 2017, PQ Group Holdings completed its initial public offering (“IPO”). Our common stock is listed on the New York Stock Exchange under the stock ticker “PQG”. Unless the context otherwise indicates, the terms “PQ Group Holdings Inc.,” “we,” “us,” “our,” or the “Company” mean PQ Group Holdings Inc. and our subsidiaries.

On December 14, 2020, PQ Group Holdings completed the sale of its Performance Materials business to Potters Buyer, LLC (the “Purchaser”), an affiliate of The Jordan Company, L.P., for a purchase price of $650 million, which was subject to certain adjustments for indebtedness, working capital, and cash at the closing of the transaction. The results of operations, financial condition, and cash flows for the Performance Materials businesses are presented herein as discontinued operations. Except where noted, any tables, percentages or metrics included within this filing exclude the results of our former Performance Materials business. Refer to Note 4 to our Consolidated Financial Statements for additional information.

On March 1, 2021, PQ Group Holdings announced the entry into a definitive agreement to sell its Performance Chemicals business to a partnership established by Cerberus Capital Management, L.P. and Koch Mineral & Trading LLC for a purchase price of $1.1 billion, which is subject to certain adjustments including for indebtedness, cash, working capital and transaction expenses. The transaction is expected to be completed in 2021.

Our Company

We are an integrated global provider of specialty catalysts, chemicals and services that enable environmental improvements and enhance consumer and industrial products. Our value-added products seek to address global demand trends that are often either the subject of significant environmental and safety regulations or are driven by consumer preferences for environmentally friendlier alternative products, which provides us with high-margin growth opportunities. Specifically, our products and solutions help companies produce vehicles with improved fuel efficiency and cleaner emissions. Our materials are critical ingredients in consumer products that make teeth brighter and skin softer. Because our products are predominantly inorganic and carbon-free, we believe we contribute to improving the sustainability of our planet.

We believe we are a leader in each of our business segments, holding what we estimate to be a number one or number two supply share position for products that generated more than 90% of our 2020 sales. We believe that our global footprint and efficient network of strategically located manufacturing facilities provide us with a strong competitive advantage in serving our customers both regionally as well as globally.

We believe, with our long history of established partnerships with our customers and our reputation for providing reliable, quality of products and solutions, our products deliver significant value to our customers, as demonstrated by our profit margins. Our products typically constitute a small portion of our customers’ overall end-product costs yet are critical to product performance.

We have a near 200-year track record of innovation that is reflected in our technical and production expertise in silicates, silica, zeolites and catalyst technologies.

We are highly diversified by business, geography and end use. In 2020 the majority of our sales were for applications that have historically had relatively predictable, consistent demand patterns driven by consumption or frequent replacement cycles.

As a result of our competitive strengths, we have generally maintained stable margins through changing macro economic cycles.

In 2020, we served over 2,000 customers globally across many end uses and, as of December 31, 2020, operated 40 manufacturing facilities which are strategically located across five continents.

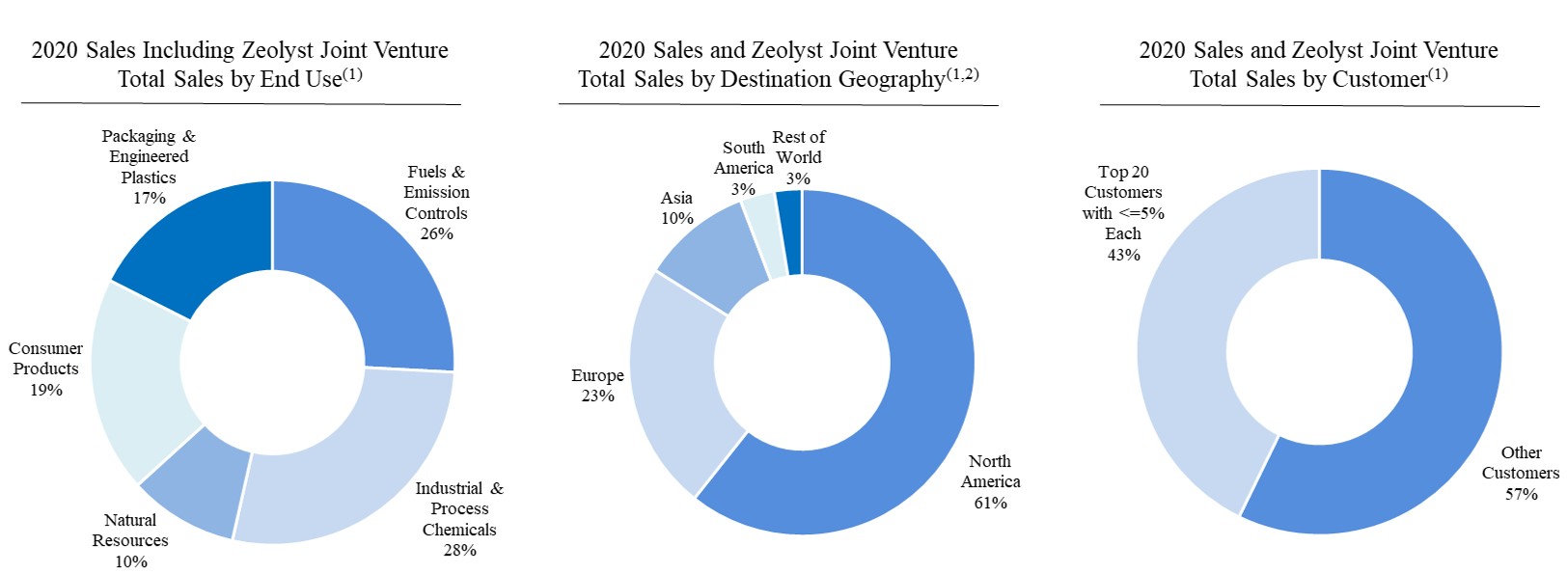

(1)Percentage calculations include $128.6 million of total sales attributable to the Zeolyst Joint Venture (“Zeolyst JV”), which represents 50% of its total sales for the year ended December 31, 2020. The Zeolyst JV sales are included in both the Fuels & Emission Controls and Packaging & Engineered Plastics end uses. Refer to “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Basis of Presentation” for a description of the treatment of the Zeolyst Joint Venture in our consolidated financial information.

(2)Based on the delivery destination for products sold in 2020.

Our Strategy

We intend to capitalize on our strong business foundation, market-based approach, and experienced management team to grow sales profitably, maintain high margins, deploy capital efficiently and generate free cash flow in order to create shareholder value. We believe that our long history of operational excellence and proven reliability, technology leadership, strong customer relationships, innovation track record and consistent business execution developed from our almost two centuries of combined industry experience positions us well to execute our business strategy.

Our Industry

Our industry is characterized by constant development of new products and the need to support customers with new product innovation and technical services to meet their needs, coupled with consistent product quality and a reliable source of supply in a safe and environmentally sustainable manner. Products sold to our customers can be high value-add even when they represent a small portion of the overall end product costs, and success can be achieved by helping customers improve their product performance, value, and quality. As a result, operating margins in this sector have historically been high and generally stable through economic cycles. In addition, many products in the specialty chemicals industry benefit from economics that favor incumbent producers because the capital cost to expand existing capacity is typically significantly less than the capital cost necessary to build a new plant. The combination of attractive operating margins and generally predictable maintenance capital expenditure requirements can produce attractive cash flows.

Our Product End Uses

The table below summarizes our key end use applications and products as well as the significant growth drivers in those applications.

| | | | | | | | | | | | | | | | | |

| Sales and Zeolyst JV Total Sales(1) | | |

| Key End Uses | 2020 | 2019 | 2018 | Significant Growth Drivers | Key PQ Products |

| Fuels & Emission Controls | 26% | 28% | 25% | • Global regulatory requirements to: | • Refinery catalysts |

| | | | • Remove nitrogen oxides from emissions | • Emission control catalysts |

| | | | • Remove sulfur from diesel and gasoline | • Catalyst recycling services |

| | | | • Increase gasoline octane in order to improve fuel efficiency while lowering vapor pressure to regulated levels | |

| | | | • Improve lubricant characteristics to improve fuel efficiencies | |

| Consumer Products | 19% | 19% | 20% | • Substitution of silicate materials for less environmentally friendly chemical additives in detergent and cleaning end uses | • Silica gels for edible oil and beer clarification |

| | | | • Demand for improved quality and shelf life of beverages | • Precipitated silicas and zeolites for the surface coating, dentifrice, and dishwasher and laundry detergent applications |

| | | | • Demand for improved oral hygiene and appearance |

| Packaging & Engineered Plastics | 17% | 17% | 17% | • Demand for increased process efficiency and reduction of by-products in production chemicals | • Catalysts for high-density polyethlene and chemicals syntheses |

| | | | • Demand for high-density polyethlene lightweighting of automotive components | • Antiblocks for film packaging |

| | | | | • Silicate for catalyst manufacturing |

| Industrial & Process Chemicals | 28% | 27% | 28% | • Demand in the tire industry for reduced rolling resistance | • Silicate precursors for the tire industry |

| | | | • Usage of silicate in municipal water treatment to inhibit corrosion in aging pipelines | |

| Natural Resources | 10% | 9% | 10% | • More environmentally friendly drilling fluids for oil and gas production | • Silicates for drilling muds |

| | | | • Recovery in global oil drilling/U.S. copper production | • Sulfuric acid for mining |

| | | | • Growing demand for lighter weight cements in oil and natural gas wells | • Silicates and alum for water treatment mining |

| | | | | • Bleaching aids for paper |

(1) Percentage calculations include $128.6 million, $170.3 million and $156.7 million of total sales attributable to the Zeolyst JV, which represents 50% of its total sales for each of the years ended December 31, 2020, 2019 and 2018, respectively. The Zeolyst JV sales are included in both the Fuels & Emission Controls and Packaging & Engineered Plastics key end uses. Refer to “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Basis of Presentation” for a description of the treatment of the Zeolyst Joint Venture in our consolidated financial information.

Competitive Business Strengths

Favorable Secular Growth Trends Across the Portfolio