UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________________________________

FORM 10-K

_______________________________________________

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended December 31 , 2020

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to

Commission file number 001-38730

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation) | (I.R.S. Employer Identification No.) | ||||||||||||||||

| Surrey | | ||||||||||||||||

| (Address of principal executive offices) (Zip Code) | |||||||||||||||||

| +44 | |||||||||||||||||

| (Registrant's telephone number, including area code) | |||||||||||||||||

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: | Trading Symbol(s) | Name of each exchange on which registered: | ||||||

Securities registered pursuant to Section 12(g) of the Act: None

___________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," " smaller reporting company, " and "emerging growth company" in Rule 12b-2 of the Exchange Act.

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☑ No ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of the voting and non-voting common stock held by non-affiliates as of June 30, 2020, was approximately $111 billion (based on the closing sale price of the stock on that date as reported on the New York Stock Exchange).

At January 31, 2021, 522,836,425 ordinary shares of €0.001 nominal value per share of the Registrant were outstanding.

Documents incorporated by reference:

LINDE PLC

ANNUAL REPORT ON FORM 10-K

For the fiscal year ended December 31, 2020

TABLE OF CONTENTS

| Page | ||||||||

| Part I | ||||||||

| Item 1: | ||||||||

| Item 1A: | ||||||||

| Item 1B: | ||||||||

| Item 2: | ||||||||

| Item 3: | ||||||||

| Item 4: | ||||||||

| Part II | ||||||||

| Item 5: | ||||||||

| Item 6: | ||||||||

| Item 7: | ||||||||

| Item 7A: | ||||||||

| Item 8: | ||||||||

| Item 9: | ||||||||

| Item 9A: | ||||||||

| Item 9B: | ||||||||

| Part III | ||||||||

| Item 10: | ||||||||

| Item 11: | ||||||||

| Item 12: | ||||||||

| Item 13: | ||||||||

| Item 14: | ||||||||

| Part IV | ||||||||

| Item 15: | ||||||||

| Item 16: | ||||||||

2

FORWARD-LOOKING STATEMENTS

This document contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are identified by terms and phrases such as: anticipate, believe, intend, estimate, expect, continue, should, could, may, plan, project, predict, will, potential, forecast, and similar expressions. They are based on management’s reasonable expectations and assumptions as of the date the statements are made but involve risks and uncertainties. These risks and uncertainties include, without limitation: the performance of stock markets generally; developments in worldwide and national economies and other international events and circumstances, including trade conflicts and tariffs; changes in foreign currencies and in interest rates; the cost and availability of electric power, natural gas and other raw materials; the ability to achieve price increases to offset cost increases; catastrophic events including natural disasters, epidemics, pandemics such as COVID-19, and acts of war and terrorism; the ability to attract, hire, and retain qualified personnel; the impact of changes in financial accounting standards; the impact of changes in pension plan liabilities; the impact of tax, environmental, healthcare and other legislation and government regulation in jurisdictions in which the company operates; the cost and outcomes of investigations, litigation and regulatory proceedings; the impact of potential unusual or non-recurring items; continued timely development and market acceptance of new products and applications; the impact of competitive products and pricing; future financial and operating performance of major customers and industries served; the impact of information technology system failures, network disruptions and breaches in data security; and the effectiveness and speed of integrating new acquisitions into the business. These risks and uncertainties may cause actual future results or circumstances to differ materially from accounting principles generally accepted in the United States of America, International Financial Reporting Standards or adjusted projections, estimates or other forward-looking statements.

Linde plc assumes no obligation to update or provide revisions to any forward-looking statement in response to changing circumstances. The above listed risks and uncertainties are further described in Item 1A (Risk Factors) in this report, which should be reviewed carefully. Please consider Linde plc’s forward-looking statements in light of those risks.

3

Linde plc and Subsidiaries

PART I

ITEM 1. BUSINESS

General

Linde plc is a public limited company formed under the laws of Ireland with its principal offices in the United Kingdom. Linde is the largest industrial gas company worldwide and is a major technological innovator in the industrial gases industry. Its primary products in its industrial gases business are atmospheric gases (oxygen, nitrogen, argon, and rare gases) and process gases (carbon dioxide, helium, hydrogen, electronic gases, specialty gases, and acetylene). The company also designs and builds equipment that produces industrial gases and offers customers a wide range of gas production and processing services such as olefin plants, natural gas plants, air separation plants, hydrogen and synthesis gas plants and other types of plants.

Linde serves a diverse group of industries including healthcare, petroleum refining, manufacturing, food, beverage carbonation, fiber-optics, steel making, aerospace, chemicals, electronics and water treatment.

Linde’s sales were $27,243 million, $28,228 million, and $14,836 million for 2020, 2019, and 2018, respectively. Refer to Item 7, Management's Discussion and Analysis, for a discussion of consolidated sales and Note 18 to the consolidated financial statements for additional information related to Linde’s reportable segments.

Industrial Gases Products and Manufacturing Processes

Atmospheric gases are the highest volume products produced by Linde. Using air as its raw material, Linde produces oxygen, nitrogen and argon through several air separation processes of which cryogenic air separation is the most prevalent. Rare gases, such as krypton, neon and xenon, are also produced through cryogenic air separation. As a pioneer in the industrial gases industry, Linde is a leader in developing a wide range of proprietary and patented applications and supply systems technology. Linde also led the development and commercialization of non-cryogenic air separation technologies for the production of industrial gases. These technologies open important new markets and optimize production capacity for the company by lowering the cost of supplying industrial gases. These technologies include proprietary vacuum pressure swing adsorption (“VPSA”) and membrane separation to produce gaseous oxygen and nitrogen, respectively.

Process gases, including carbon dioxide, hydrogen, carbon monoxide, helium, specialty gases and acetylene are produced by methods other than air separation. Most carbon dioxide is purchased from by-product sources, including chemical plants, refineries and industrial processes or is recovered from carbon dioxide wells. Carbon dioxide is processed in Linde’s plants to produce commercial and food-grade carbon dioxide. Hydrogen and carbon monoxide can be produced by either steam methane reforming or auto-thermal reforming of natural gas or other feed streams such as naphtha. Hydrogen is also produced by purifying by-product sources obtained from the chemical and petrochemical industries. Acetylene is primarily sourced as a chemical by-product, but may also be produced from calcium carbide and water.

Industrial Gases Distribution

There are three basic distribution methods for industrial gases: (i) on-site or tonnage; (ii) merchant or bulk liquid; and (iii) packaged or cylinder gases. These distribution methods are often integrated, with products from all three supply modes coming from the same plant. The method of supply is generally determined by the lowest cost means of meeting the customer’s needs, depending upon factors such as volume requirements, purity, pattern of usage, and the form in which the product is used (as a gas or as a cryogenic liquid).

On-site. Customers that require the largest volumes of product (typically oxygen, nitrogen and hydrogen) and that have a relatively constant demand pattern are supplied by cryogenic and process gas on-site plants. Linde constructs plants on or adjacent to these customers’ sites and supplies the product directly to customers by pipeline. On-site product supply contracts generally are total requirement contracts with terms typically ranging from 10-20 years and containing minimum purchase requirements and price escalation provisions. Many of the cryogenic on-site plants also produce liquid products for the merchant market. Therefore, plants are typically not dedicated to a single customer. Advanced air separation processes allow on-site delivery to customers with smaller volume requirements.

Merchant. The merchant business is generally associated with distributable liquid oxygen, nitrogen, argon, carbon dioxide, hydrogen and helium. The deliveries generally are made from Linde’s plants by tanker trucks to storage containers at the customer's site which are owned and maintained by Linde and leased to the customer. Due to distribution cost, merchant oxygen and nitrogen generally have a relatively small distribution radius from the plants at which they are produced. Merchant argon, hydrogen and helium can be shipped much longer distances. The customer agreements used in the merchant business are usually three to seven-year requirement contracts.

4

Packaged Gases. Customers requiring small volumes are supplied products in metal containers called cylinders, under medium to high pressure. Packaged gases include atmospheric gases, carbon dioxide, hydrogen, helium, acetylene and related products. Linde also produces and distributes in cylinders a wide range of specialty gases and mixtures. Cylinders may be delivered to the customer’s site or picked up by the customer at a packaging facility or retail store. Packaged gases are generally sold under one to three-year supply contracts and through purchase orders.

A substantial amount of the cylinder gases sold in the United States are distributed by independent distributors that buy merchant gases in liquid form and repackage the products in their facilities. Packaged gas distributors, including Linde, also distribute hardgoods and welding equipment purchased from independent manufacturers. Over time, Linde has acquired a number of independent industrial gases and welding products distributors at various locations in the United States and continues to sell merchant gases to other independent distributors. Between its own distribution business, joint ventures and sales to independent distributors, Linde is represented in 48 states, the District of Columbia and Puerto Rico.

Engineering

Linde’s Engineering business has a global presence, with its focus on market segments such as olefin, natural gas, air separation, hydrogen and synthesis gas plants. The company utilizes its extensive process engineering know-how in the planning, design and construction of highly efficient turnkey plants for the production and processing of gases. With its state-of-the-art sustainable technologies Engineering helps customers avoid, capture and utilize CO2 emissions. Its technology portfolio covers the entire value chain for production, liquefaction, storage, distribution and application of hydrogen which supports the transition to clean energy. Its digital services and solutions increase plant efficiency and performance.

Linde's plants are used in a wide variety of fields: in the petrochemical and chemical industries, in refineries and fertilizer plants, to recover air gases, to produce synthesis gases, to treat natural gas and to produce noble gases.The Engineering business either supplies plant components directly to the customer or to the industrial gas business of Linde which operates the plants under a long-term gases supply contract.

Inventories – Linde carries inventories of merchant and cylinder gases, hardgoods and coatings materials to supply products to its customers on a reasonable delivery schedule. On-site plants and pipeline complexes have limited inventory. Inventory obsolescence is not material to Linde’s business.

Customers – Linde is not dependent upon a single customer or a few customers.

International – Linde is a global enterprise with approximately 69% of its 2020 sales outside of the United States. The company also has majority or wholly owned subsidiaries that operate in approximately 45 European, Middle Eastern and African countries (including Germany, France, Sweden, the Republic of South Africa, and the United Kingdom (U.K.)); approximately 20 Asian and South Pacific countries (including China, Australia, India, South Korea and Taiwan); and approximately 20 countries in North and South America (including Canada, Mexico and Brazil).

The company also has equity method investments operating in Europe, Asia, Africa, the Middle East, and North America.

Linde’s international business is subject to risks customarily encountered in foreign operations, including fluctuations in foreign currency exchange rates, import and export controls, and other economic, political and regulatory policies of local governments. Also, see Item 1A. “Risk Factors” and Item 7A. “Quantitative and Qualitative Disclosures About Market Risk.”

Seasonality – Linde’s business is generally not subject to seasonal fluctuations to any significant extent.

Research and Development – Linde’s research and development is directed toward development of gas processing, separation and liquefaction technologies, improving distribution of industrial gases and the development of new markets and applications for these gases. This results in the development of new advanced air separation, hydrogen, synthesis gas, natural gas, adsorption and chemical process technologies as well as the frequent introduction of new industrial gas applications. Research and development is primarily conducted at Munich, Germany, Tonawanda, New York, Burr Ridge, Illinois and Shanghai, China.

Patents and Trademarks – Linde owns or licenses a large number of patents that relate to a wide variety of products and processes. Linde’s patents expire at various times over the next 20 years. While these patents and licenses are considered important to its individual businesses, Linde does not consider its business as a whole to be materially dependent upon any one particular patent, or patent license, or family of patents. Linde also owns a large number of trademarks, of which the "Linde" trademark is the most significant.

5

Raw Materials and Energy Costs – Energy is the single largest cost item in the production and distribution of industrial gases. Most of Linde’s energy requirements are in the form of electricity, natural gas and diesel fuel for distribution. The company mitigates electricity, natural gas, and hydrocarbon price fluctuations contractually through pricing formulas, surcharges, and cost pass–through and tolling arrangements.

The supply of energy has not been a significant issue in the geographic areas where the company conducts business. However, energy availability and price is unpredictable and may pose unforeseen future risks.

For carbon dioxide, carbon monoxide, helium, hydrogen, specialty gases and surface technologies, raw materials are largely purchased from outside sources. Linde has contracts or commitments for, or readily available sources of, most of these raw materials; however, their long-term availability and prices are subject to market conditions.

Competition – Linde participates in highly competitive markets in the industrial gases, engineering and healthcare businesses, which are characterized by a mixture of local, regional and global players, all of which exert competitive pressure on the parties. In locations where Linde has pipeline networks, which enable the company to provide reliable and economic supply of products to larger customers, Linde derives a competitive advantage.

Competitors in the industrial and medical gases industry include global and regional companies such as L’Air Liquide S.A., Air Products and Chemicals, Inc., Messer Group GmbH, Mitsubishi Chemical Holdings Corporation (through Taiyo Nippon Sanso Corporation) as well as an extensive number of small to medium size independent industrial gas companies which compete locally as producers or distributors. In addition, a significant portion of the international gases market relates to customer-owned plants.

Employees and Labor Relations – The company sources talent from an ever-changing and competitive environment. The ability to source and retain qualified and committed employees is a prerequisite for the company’s success, and represents a general risk for Linde.

The Board of Directors ("Board") has established a strategic business objective to maintain world-class standards in talent management. Executive variable compensation is assessed annually based on performance in several strategic non-financial areas, including talent management. The Compensation Committee assists the Board in its oversight of Linde’s compensation and incentive policies and programs, and management development and succession, particularly in regard to reviewing executive compensation for Linde’s executive officers. The Compensation Committee also periodically reviews the company’s diversity policies and objectives, and programs to achieve those objectives. The global head of Human Resources reports to the Chief Executive Officer ("CEO"). A global leader of Diversity and Inclusion reports to the head of Human Resources.

Linde has aligned diversity and inclusion with its business strategies and implemented diversity action planning into business process and performance management. Diversity and inclusion are line management responsibilities and Linde seeks competitive advantage through proactive management of its talent pipeline, procurement and recruiting processes. Linde provides equal employment opportunity, and recruits, hires, promotes and compensates people based solely on their merit and ability.

Employees receive a competitive salary and variable compensation components based on merit and depending on their position. Linde has collective bargaining agreements with unions at numerous locations throughout the world. Additional benefits are offered such as occupational pensions and contributions towards health insurance or medical screening, reflecting regional conditions and local competition. Managers’ compensation is based on performance. Senior managers participate directly in the company’s growth in value through the Long Term Incentive Plan of Linde plc. From time to time, Linde may introduce special compensation schemes to recognize or reward specific individuals such as the one implemented in 2020 for global front-line employees. Work-life balance is promoted by providing a range of opportunities that are based on the overall local conditions. Linde also invests in professional development of its employees through formal and on-the-job training.

As of December 31, 2020, Linde had 74,207 employees worldwide comprised of approximately 27 percent women and 73 percent men.

Environment – Information required by this item is incorporated herein by reference to the section captioned “Management’s Discussion and Analysis – Environmental Matters” in Item 7 of this 10-K.

Available Information – The company makes its periodic and current reports available, free of charge, on or through its website, www.linde.com, as soon as practicable after such material is electronically filed with, or furnished to, the Securities and Exchange Commission ("SEC"). Investors may also access from the company website other investor information such as press releases and presentations. Information on the company’s website is not incorporated by

6

reference herein. In addition, the public may read and copy any materials filed with the SEC free of charge at the SEC’s website, www.sec.gov, that contains reports, proxy information statements and other information regarding issuers that file electronically.

Executive Officers – The following Executive Officers have been elected by the Board of Directors and serve at the pleasure of the Board. It is expected that the Board will elect officers annually following each annual meeting of shareholders.

Stephen F. Angel, 65, has been Chief Executive Officer and a director of Linde since 2018. Prior to that, Mr. Angel was Chairman, President and CEO of Praxair, Inc. since 2007. Mr. Angel joined Praxair in 2001 as an executive vice president and was named president and chief operating officer in February 2006. Prior to joining Praxair, Angel spent 22 years in a variety of management positions with General Electric. Angel serves on the board of directors of PPG Industries and the Hydrogen Council and is a member of The Business Council.

Kelcey E. Hoyt, age 51, became the Chief Accounting Officer of Linde in October 2018. Prior to this, she served as Vice President and Controller of Praxair, Inc. beginning in August 2016. Prior to becoming Controller, she served as Praxair’s Director of Investor Relations since 2010. She joined Praxair in 2002 and served as Director of Corporate Accounting and SEC Reporting through 2008, and later served as Controller for various divisions within Praxair’s North American Industrial Gas business. Previously, she was in audit at KPMG, LLP.

Sanjiv Lamba age 56, was appointed Chief Operating Officer of Linde effective January 1, 2021. Previously, he served as the Executive Vice President, APAC of Linde, beginning in October 2018. Prior to that, Mr. Lamba was appointed a Member of the Executive Board of Linde AG in 2011, responsible for the Asia, Pacific segment of the Gases Division, for Global Gases Businesses Helium & Rare Gases, Electronics as well as Asia Joint Venture Management. Mr. Lamba started his career 1989 with BOC India in Finance where he progressed to become Director of Finance before being appointed as Managing Director for BOC’s India’s business in 2001. Throughout his years with BOC/Linde, he has worked in various roles across a number of different geographies including Germany, the UK, Singapore and India.

Eduardo F. Menezes, age 57, has been Executive Vice President, EMEA of Linde since 2018 and will retire March 31, 2021 after 35 years of service. Mr. Menezes previously served as Executive Vice President of Praxair, Inc. since 2012, responsible for Praxair Europe, Praxair Mexico, Praxair South America and Praxair Asia. From 2010 to March 2011, he was a Vice President of Praxair with responsibility for the North American Industrial Gases business and was named senior vice president in 2011. From 2007 to 2010, he was President of Praxair Europe. He served as Managing Director of Praxair’s business in Mexico from 2004 to 2007, as Vice President and General Manager for Praxair Distribution, Inc. from 2003 to 2004 and as Vice President, U.S. West Region, for North American Industrial Gases, from 2000 to 2003.

Juergen Nowicki, 57, was appointed Executive Vice President and CEO, Linde Engineering in April 2020. Prior to this, he was Senior Vice President, Commercial, Linde Engineering. Mr. Nowicki joined Linde in 1991 as an Internal Auditor and held various positions in Finance and Controlling. In 2002, he was appointed CFO Linde Gas North America, USA, and was named Head of Finance and Control for The Linde Group in 2006. Nowicki assumed the role of Managing Director, Linde Engineering in 2011. He holds a master's degree in Industrial Engineering from the Technical University of Karlsruhe, Germany.

Dr. Andreas Opfermann, 49, became Executive Vice President of Americas in November 2019. Prior to this, from 2016-2019, he was the regional business unit leader for Linde’s North European region. Dr. Opfermann joined Linde in 2005 initially in Corporate Strategy. He has subsequently served as Head of Innovation Management from 2008 to 2010, Head of Clean Energy and Innovation Management from 2010 to 2014, and Head of Technology and Innovation from 2015 to 2016, responsible for all Linde research and development. Before joining Linde, he held positions at McKinsey & Company.

John Panikar, 53, was appointed Executive Vice President, APAC of Linde effective January 1, 2021. Previously, he served as President UK & Africa of Linde since October, 2018. From 2014 to 2018, Mr. Panikar was President of Praxair Asia. He began his career with Praxair in 1991 as an Applications Engineer. Over the years, Mr. Panikar held increasingly responsible positions including Manager of Site Services and Equipment, Business Development Director for Praxair Asia, Managing Director of Praxair India, VP, South Region, North American Industrial Gases and President, Praxair Distribution, Inc.

Matthew J. White, age 48, became Executive Vice President and Chief Financial Officer of Linde in October 2018. He previously served as the Senior Vice President and Chief Financial Officer of Praxair, Inc. since January 1, 2014. Prior to this, Mr. White was President of Praxair Canada from 2011-2014. He joined Praxair in 2004 as finance director for the company’s largest business unit, North American Industrial Gases. In 2008, he became Vice President and Controller of Praxair, Inc., then was named Vice President and Treasurer in 2010. Before joining Praxair, White was vice president,

7

finance, at Fisher Scientific and before that he held various financial positions, including group controller, at GenTek, a manufacturing and performance chemicals company.

8

ITEM 1A. RISK FACTORS

Due to the size and geographic reach of the company’s operations, a wide range of factors, many of which are outside of the company’s control, could materially affect the company’s future operations and financial performance. Management believes the following risks may significantly impact the company:

The recent novel coronavirus (COVID-19) outbreak could materially adversely affect our results of operations.

The novel strain of the coronavirus identified in China in late 2019 has globally spread and has resulted in authorities implementing numerous measures to try to contain the virus, such as travel bans and restrictions, quarantines, shelter in place orders, and shutdowns. These measures have impacted and may further impact our workforce and operations, the operations of our customers, vendors and suppliers. There is considerable uncertainty regarding such measures and potential future measures, and restrictions on our access to our manufacturing facilities or on our support operations or workforce, or similar limitations for our vendors and suppliers, and restrictions or disruptions of transportation, such as reduced availability of air transport, port closures, and increased border controls or closures, could limit our capacity to meet customer demand and have a material adverse effect on our results of operations. These restrictions and disruptions could affect our performance on our contracts.

Furthermore, COVID-19 has impacted and may further impact the broader economies of affected countries, including negatively impacting economic growth, the proper functioning of financial and capital markets, foreign currency exchange rates, and interest rates. Risks related to economic conditions are described in our Principal Risks and Uncertainties titled “Weakening economic conditions in markets in which Linde does business may adversely impact its financial results and/or cash flows” and “Macroeconomic factors may impact Linde’s ability to obtain financing or increase the cost of obtaining financing which may adversely impact Linde’s financial results and/or cash flows."

Weakening economic conditions in markets in which Linde does business may adversely impact its financial results and/or cash flows.

Linde serves a diverse group of industries across more than 100 countries, which generally leads to financial stability through various business cycles. However, a broad decline in general economic or business conditions in the industries served by its customers could adversely affect the demand for Linde’s products and impair the ability of its customers to satisfy their obligations to Linde, resulting in uncollected receivables and/or unanticipated contract terminations or project delays. For example, global political and economic uncertainty could reduce investment activities of Linde’s customers, which could adversely affect Linde’s business.

In addition, many of Linde’s customers are in businesses that are cyclical in nature, such as the chemicals, metals and energy industries. Downturns in these industries may adversely impact Linde during these cycles. Additionally, such conditions could impact the utilization of Linde’s manufacturing capacity which may require it to recognize impairment losses on tangible assets such as property, plant and equipment, as well as intangible assets such as goodwill, customer relationships or intellectual property.

Increases in the cost of energy and raw materials and/or disruption in the supply of these materials could result in lost sales or reduced profitability.

Energy is the single largest cost item in the production and distribution of industrial gases. Most of Linde’s energy requirements are in the form of electricity, natural gas and diesel fuel for distribution. Linde attempts to minimize the financial impact of variability in these costs through the management of customer contracts and reducing demand through operational productivity and energy efficiency. Large customer contracts typically have escalation and pass-through clauses to recover energy and feedstock costs. Such attempts may not successfully mitigate cost variability, which could negatively impact Linde’s financial condition or results of operations. The supply of energy has not been a significant issue in the geographic areas where Linde conducts business. However, regional energy conditions are unpredictable and may pose future risk.

For carbon dioxide, carbon monoxide, helium, hydrogen, specialty gases and surface technologies, raw materials are largely purchased from outside sources. Where feasible, Linde sources several of these raw materials, including carbon dioxide, hydrogen and calcium carbide, as chemical or industrial byproducts. In addition, Linde has contracts or

9

commitments for, or readily available sources of, most of these raw materials; however, their long-term availability and prices are subject to market conditions. A disruption in supply of such raw materials could impact Linde’s ability to meet contractual supply commitments.

Linde’s international operations are subject to the risks of doing business abroad and international events and circumstances may adversely impact its business, financial condition or results of operations.

Linde has substantial international operations which are subject to risks including devaluations in currency exchange rates, transportation delays and interruptions, political and economic instability and disruptions, restrictions on the transfer of funds, trade conflicts and the imposition of duties and tariffs, import and export controls, changes in governmental policies, labor unrest, possible nationalization and/or expropriation of assets, changes in U.S. and non-U.S. tax policies and compliance with governmental regulations. These events could have an adverse effect on the international operations of Linde in the future by reducing the demand for its products, decreasing the prices at which it can sell its products, reducing the revenue from international operations or otherwise having an adverse effect on its business.

Currency exchange rate fluctuations and other related risks may adversely affect Linde's results.

Because a significant portion of Linde's revenue is denominated in currencies other than its reporting currency, the U.S. dollar, changes in exchange rates will produce fluctuations in revenue, costs and earnings and may also affect the book value of assets and liabilities and related equity. Although the company from time to time utilizes foreign exchange forward contracts to hedge these exposures, its efforts to minimize currency exposure through such hedging transactions may not be successful depending on market and business conditions. As a result, fluctuations in foreign currency exchange rates could adversely affect Linde’s financial condition, results of operations or cash flows.

Macroeconomic factors may impact Linde’s ability to obtain financing or increase the cost of obtaining financing which may adversely impact Linde’s financial results and/or cash flows.

Volatility and disruption in the U.S., European and global credit and equity markets, from time to time, could make it more difficult for Linde to obtain financing for its operations and/or could increase the cost of obtaining financing. In addition, Linde’s borrowing costs can be affected by short- and long-term debt ratings assigned by independent rating agencies which are based, in significant part, on its performance as measured by certain criteria such as interest coverage and leverage ratios. A decrease in these debt ratings could increase the cost of borrowing or make it more difficult to obtain financing.

An impairment of goodwill or intangible assets could negatively impact the company's financial results.

As of December 31, 2020, the net carrying value of goodwill and other indefinite-lived intangible assets was $28 billion and $2 billion, respectively, primarily as a result of the business combination and the related acquisition method of accounting applied to Linde AG. In accordance with generally accepted accounting principles, the company periodically assesses these assets to determine if they are impaired. Significant negative industry or economic trends, disruptions to business, unexpected significant changes or planned changes in use of the assets, divestitures and sustained market capitalization declines may result in recognition of impairments to goodwill or other indefinite-lived assets. Any charges relating to such impairments could have a material adverse impact on Linde's results of operations in the periods recognized.

Catastrophic events could disrupt the operations of Linde and/or its customers and suppliers and may have a significant adverse impact on the results of operations.

The occurrence of catastrophic events or natural disasters such as extreme weather, including hurricanes and floods; health epidemics; and acts of war or terrorism, could disrupt or delay Linde’s ability to produce and distribute its products to customers and could potentially expose Linde to third-party liability claims. In addition, such events could impact Linde’s customers and suppliers resulting in temporary or long-term outages and/or the limitation of supply of energy and other raw materials used in normal business operations. Linde evaluates the direct and indirect business risks, consults with vendors, insurance providers and industry experts, makes investments in suitably resilient design and technology, and conducts regular reviews of the business risks with management. Despite these steps, however, these situations are outside Linde’s control and may have a significant adverse impact on its financial results.

10

The inability to attract and retain qualified personnel may adversely impact Linde’s business.

If Linde fails to attract, hire and retain qualified personnel, it may not be able to develop, market or sell its products or successfully manage its business. Linde is dependent upon a highly skilled, experienced and efficient workforce to be successful. Much of Linde’s competitive advantage is based on the expertise and experience of key personnel regarding marketing, technology, manufacturing and distribution infrastructure, systems and products. The inability to attract and hire qualified individuals or the loss of key employees in very skilled areas could have a negative effect on Linde’s financial results.

If Linde fails to keep pace with technological advances in the industry or if new technology initiatives do not become commercially accepted, customers may not continue to buy Linde’s products and results of operations could be adversely affected.

Linde’s research and development is directed toward developing new and improved methods for the production and distribution of industrial gases, the design and construction of plants and toward developing new markets and applications for the use of industrial and process gases. This results in the introduction of new applications and the development of new advanced process technologies. As a result of these efforts, Linde develops new and proprietary technologies and employs necessary measures to protect such technologies within the global geographies in which Linde operates. These technologies help Linde to create a competitive advantage and to provide a platform to grow its business. If Linde’s research and development activities do not keep pace with competitors or if Linde does not create new technologies that benefit customers, future results of operations could be adversely affected.

Risks related to pension benefit plans may adversely impact Linde’s results of operations and cash flows.

Pension benefits represent significant financial obligations that will be ultimately settled in the future with employees who meet eligibility requirements. Because of the uncertainties involved in estimating the timing and amount of future payments and asset returns, significant estimates are required to calculate pension expense and liabilities related to Linde’s plans. Linde utilizes the services of independent actuaries, whose models are used to facilitate these calculations. Several key assumptions are used in the actuarial models to calculate pension expense and liability amounts recorded in the consolidated financial statements. In particular, significant changes in actual investment returns on pension assets, discount rates, or legislative or regulatory changes could impact future results of operations and required pension contributions.

Operational risks may adversely impact Linde’s business or results of operations.

Linde’s operating results are dependent on the continued operation of its production facilities and its ability to meet customer contract requirements and other needs. Insufficient or excess capacity threatens Linde’s ability to generate competitive profit margins and may expose Linde to liabilities related to contract commitments. Operating results are also dependent on Linde’s ability to complete new construction projects on time, on budget and in accordance with performance requirements. Failure to do so may expose Linde’s business to loss of revenue, potential litigation and loss of business reputation.

Also inherent in the management of Linde’s production facilities and delivery systems, including storage, vehicle transportation and pipelines, are operational risks that require continuous training, oversight and control. Material operating failures at production, storage facilities or pipelines, including fire, toxic release and explosions, or the occurrence of vehicle transportation accidents could result in loss of life, damage to the environment, loss of production and/or extensive property damage, all of which may negatively impact Linde’s financial results.

Linde may be subject to information technology system failures, network disruptions and breaches in data security.

Linde relies on information technology systems and networks for business and operational activities, and also stores and processes sensitive business and proprietary information in these systems and networks. These systems are susceptible to outages due to fire, flood, power loss, telecommunications failures, viruses, break-ins and similar events, or breaches of security.

Linde has taken steps to address these risks and concerns by implementing advanced security technologies, internal controls, network and data center resiliency and recovery process. Despite these steps, however, operational failures and breaches of security from increasingly sophisticated cyber threats could lead to the loss or disclosure of confidential

11

information, result in business interruption or malfunction or regulatory actions and have a material adverse impact on Linde’s operations, reputation and financial results.

The inability to effectively integrate acquisitions or collaborate with joint venture partners could adversely impact Linde’s financial position and results of operations.

Linde has evaluated and expects to continue to evaluate, a wide array of potential strategic acquisitions and joint ventures. Many of these transactions, if consummated, could be material to its financial condition and results of operations. In addition, the process of integrating an acquired company, business or group of assets may create unforeseen operating difficulties and expenditures. Although historically Linde has been successful with its acquisition strategy and execution, the areas where Linde may face risks include:

•the need to implement or remediate controls, procedures and policies appropriate for a larger public company at companies that prior to the acquisition lacked these controls, procedures and policies;

•diversion of management time and focus from operating existing business to acquisition integration challenges;

•cultural challenges associated with integrating employees from the acquired company into the existing organization;

•the need to integrate each company’s accounting, management information, human resources and other administrative systems to permit effective management;

•difficulty with the assimilation of acquired operations and products;

•failure to achieve targeted synergies and cost reductions; and

•inability to retain key employees and business relationships of acquired companies.

Foreign acquisitions and joint ventures involve unique risks in addition to those mentioned herein, including those related to integration of operations across different cultures and languages, currency risks and the particular economic, political and regulatory risks associated with specific countries.

Also, the anticipated benefit of potential future acquisitions may not materialize. Future acquisitions or dispositions could result in the incurrence of debt, contingent liabilities or amortization expenses, or impairments of goodwill, any of which could adversely impact Linde’s financial results.

Linde is subject to a variety of international laws and government regulations and changes in, or failure to comply with, these laws or regulations could have an adverse impact on the company’s business, financial position and results of operations.

Linde is subject to regulations in the following areas, among others:

•environmental protection, including climate change and energy efficiency laws and policies;

•U.S. and non-U.S. tax laws and currency controls;

•safety;

•securities laws applicable in the United States, the European Union, Germany, Ireland, and other jurisdictions;

•trade and import/export restrictions, as well as economic sanctions laws;

•antitrust matters;

•data protection;

•global anti-bribery laws, including the U.S. Foreign Corrupt Practices Act; and

•healthcare regulations.

Changes in these or other regulatory areas may impact Linde’s profitability and may give rise to new or increased compliance risks: it may become more complex and costly to ensure compliance, and the level of sanctions in the event of non-compliance may rise. Noncompliance with such laws and regulations could result in penalties or sanctions, cancellation of marketing rights or restrictions on participation in, or even exclusion from, public tender proceedings, all of which could have a material adverse impact on Linde’s financial results and/or reputation.

Such changes may also restrict Linde’s ability to compete effectively in the marketplace. Changes to regulations in the areas of environmental protection and climate change, for example, may impact customer and competitor behavior driving structural changes in key end markets. While Linde will work to mitigate these risks through the pursuit of strategic

12

alliances and investment in applications technologies to capture new growth areas, given the uncertainty about the type and scope of new regulations, it is difficult to predict how such changes and their impact on market behavior will ultimately impact Linde’s business. However, such changes could have a material adverse impact on Linde's results of operations.

Doing business globally requires Linde to comply with anti-corruption, trade, compliance and economic sanctions and similar laws, and to implement policies and procedures designed to ensure that its employees and other intermediaries comply with the applicable restrictions. These restrictions include prohibitions on the sale or supply of certain products, services and any other economic resources to embargoed or sanctioned countries, governments, persons and entities. Compliance with these restrictions requires, among other things, screening of business partners. Despite its commitment to legal compliance and corporate ethics, the company cannot ensure that its policies and procedures will always protect it from intentional, reckless or negligent acts committed by employees or agents under the applicable laws. If Linde fails to comply with laws governing the conduct of international operations, Linde may be subject to criminal and civil penalties and other remedial measures, which could materially adversely affect its reputation, business and results of operations.

The outcome of litigation or governmental investigations may adversely impact the company’s business or results of operations.

Linde’s subsidiaries are party to various lawsuits and governmental investigations arising in the ordinary course of business. Adverse outcomes in some or all of the claims pending may result in significant monetary damages or injunctive relief that could adversely affect Linde’s ability to conduct business. Linde and its subsidiaries may in the future become subject to further claims and litigation, which is impossible to predict. The litigation and other claims Linde faces are subject to inherent uncertainties. Legal or regulatory judgments or agreed settlements might give rise to expenses which are not covered, or are not fully covered, by insurance benefits and may also lead to negative publicity and reputational damage. An unfavorable outcome or determination could cause a material adverse impact on the company’s results of operations.

Potential product defects or inadequate customer care may adversely impact Linde’s business or results of operations.

Risks associated with products and services may result in potential liability claims, the loss of customers or damage to Linde’s reputation. Principal possible causes of risks associated with products and services are product defects or an inadequate level of customer care when Linde is providing services.

Linde is exposed to legal risks relating to product liability in the countries where it operates, including countries such as the United States, where legal risks (in particular through class actions) have historically been more significant than in other countries. The outcome of any pending or future products and services proceedings or investigations cannot be predicted and legal or regulatory judgments or agreed settlements may give rise to significant losses, costs and expenses.

The manufacturing and sale of products as well as the construction of plants by Linde may give rise to risks associated with the production, filling, storage, handling and transport of raw materials, goods or waste. Industrial gases are potentially hazardous substances and medical gases and the related healthcare services must comply with the relevant specifications in order to not adversely affect the health of patients treated with them.

Linde’s products and services, if defective or not handled or performed appropriately, may lead to personal injuries, business interruptions, environmental damages or other significant damages, which may result, among other consequences, in liability, losses, monetary penalties or compensation payments, environmental clean-up costs or other costs and expenses, exclusion from certain market sectors deemed important for future development of the business and loss of reputation. All these consequences could have a material adverse effect on Linde’s business and results of operations.

U.S. civil liabilities may not be enforceable against Linde.

Linde is organized under the laws of Ireland and substantial portions of its assets will be located outside of the United States. In addition, certain directors and officers of Linde and its subsidiaries reside outside the United States. As a result, it may be difficult for investors to effect service of process within the United States upon Linde or such persons, or to enforce outside the United States judgments obtained against such persons in U.S. courts in any action, including actions predicated upon the civil liability provisions of the U.S. federal securities laws. In addition, it may be difficult for investors to enforce, in original actions brought in courts in jurisdictions located outside the United States, rights predicated upon the U.S. federal securities laws.

13

A judgment for the payment of money rendered by a court in the United States based on civil liability would not be automatically enforceable in Ireland. There is no treaty between Ireland and the United States providing for the reciprocal enforcement of foreign judgments. The following requirements must be met before the foreign judgment will be deemed to be enforceable in Ireland (i) the judgment must be for a definite sum, (ii) the judgment must be final and conclusive; and (iii) the judgment must be provided by a court of competent jurisdiction.

An Irish court will also exercise its right to refuse judgment if the foreign judgment (i) was obtained by fraud; (ii) violated Irish public policy; (iii) is in breach of natural justice; or (iv) if the judgment is irreconcilable with an earlier foreign judgment.

In addition, there is doubt as to whether an Irish court would accept jurisdiction and impose civil liability on Linde or such persons in an original action predicated solely upon the U.S. federal securities laws brought in a court of competent jurisdiction in Ireland against Linde or such member, officer or expert, respectively.

Changes in tax laws or policy could adversely impact the company’s financial position or results of operations.

Linde and its subsidiaries are subject to the tax rules and regulations in the U.S., Germany, Ireland, the U.K. and other countries in which they operate. Those tax rules and regulations are subject to change on a prospective or retroactive basis. Under current economic and political conditions tax rates and policies in any jurisdiction, including the U.S., the U.K. and the EU, are subject to significant changes which could result in a significant change to Linde's current and deferred income tax. In particular, since Linde is currently treated as U.K. tax resident, any potential changes in the tax rules applying to U.K. tax-resident companies would directly affect Linde.

A change in Linde’s tax residency could have a negative effect on the company’s future profitability and may trigger taxes on dividends or exit charges. If Linde ceases to be resident in the U.K. and becomes resident in another jurisdiction, it may be subject to U.K. exit charges, and/or could become liable for additional tax charges in the other jurisdiction. If Linde were to be treated as resident in more than one jurisdiction, it could be subject to duplicative taxation. Furthermore, although Linde is incorporated in Ireland and is not expected to be treated as a domestic corporation for U.S. federal income tax purposes, it is possible that the IRS could challenge this result or that changes in U.S. federal income tax law could alter this result. If the IRS successfully asserted such a position or the law were to change, significant adverse tax consequences may result for Linde, the company and Linde’s shareholders.

Changes in tax laws may result in higher tax expense and tax payments. In addition, changes in tax legislation and uncertainty about the tax environment in some regions may restrict Linde's opportunity to enforce its respective rights under the law. Linde also operates in countries with complex tax regulations which could be interpreted in different ways. Linde and its subsidiaries are subject to audits by taxing authorities in various jurisdictions or other review actions by the relevant financial or tax authorities. The ultimate tax outcome may differ from the amounts recorded in Linde’s or its subsidiaries’ financial statements and may materially affect their respective financial results for the period when such determination is made.

14

ITEM 1B. UNRESOLVED STAFF COMMENTS

Linde has received no written SEC staff comments regarding any of its Exchange Act reports which remain unresolved.

ITEM 2. PROPERTIES

Linde plc's principal executive offices are located in owned office space in Guildford, United Kingdom. Linde also owns principal administrative office space in Danbury, Connecticut and Houston, Texas, United States; and Pullach, Germany.

Due to the nature of Linde’s industrial gas products, it is generally uneconomical to transport them distances greater than a few hundred miles from the production facility. As a result, Linde operates a significant number of production facilities spread globally throughout a number of geographic regions.

The following is a description of production facilities for Linde by segment. No significant portion of these assets was leased at December 31, 2020. Generally, these facilities are utilized and are sufficient to meet the company's manufacturing needs.

Americas

The Americas segment operates production facilities primarily in the U.S., Canada, Mexico and Brazil, approximately 350 of which are mainly cryogenic air separation plants, hydrogen plants and carbon dioxide plants. There are five major pipeline complexes in North America located in northern Indiana, Houston, along the Gulf Coast of Texas, Detroit and Louisiana. Also located throughout the Americas are noncryogenic air separation plants, packaged gas facilities and other smaller plant facilities.

EMEA

The EMEA segment has production facilities primarily in Germany, France, Sweden, the Republic of South Africa, and the U.K. which include approximately 275 cryogenic air separation plants and carbon dioxide plants. Also located throughout Europe are noncryogenic air separation plants, packaged gas facilities and other smaller plant facilities.

APAC

The APAC segment has production facilities located primarily in China, Australia, India, South Korea and Thailand, approximately 230 of which are cryogenic air separation plants and carbon dioxide plants. Also located throughout Asia are noncryogenic air separation plants, hydrogen, packaged gas and other production facilities.

Engineering

The Linde Engineering business designs and constructs turnkey process plants for third-party customers as well as for the gases businesses in many locations worldwide, such as olefin plants, natural gas plants, air separation plants, hydrogen and synthesis gas plants. Plant components are produced in owned factories in Pullach and Tacherting, Germany; Hesinque, France; Oklahoma, United States; and Dalian, China.

ITEM 3. LEGAL PROCEEDINGS

Information required by this item is incorporated herein by reference to the section captioned “Notes to Consolidated Financial Statements – 17. Commitments and Contingencies” in Item 8 of this 10-K.

ITEM 4. MINE SAFETY DISCLOSURES

Not Applicable.

15

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Linde plc shares trade on the New York Stock Exchange (“NYSE”) and the Frankfurt Stock Exchange (“FSE”) under the ticker symbol “LIN”. At December 31, 2020 there were 8,947 shareholders of record.

Purchases of Equity Securities – Certain information regarding purchases made by or on behalf of the company or any affiliated purchaser (as defined in Rule 10b-18(a)(3) under the Securities Exchange Act of 1934, as amended) of its ordinary shares during the three months ended December 31, 2020 is provided below:

| Period | Total Number of Shares Purchased (Thousands) | Average Price Paid Per Share | Total Number of Shares Purchased as Part of Publicly Announced Program (1) (Thousands) | Approximate Dollar Value of Shares that May Yet be Purchased Under the Program (2) (Millions) | |||||||||||||||||||

| October 2020 | 666 | $ | 230.39 | 666 | $ | 1,549 | |||||||||||||||||

| November 2020 | 338 | $ | 249.49 | 338 | $ | 1,464 | |||||||||||||||||

| December 2020 | 746 | $ | 252.20 | 746 | $ | 1,276 | |||||||||||||||||

| Fourth Quarter 2020 | 1,750 | $ | 243.38 | 1,750 | $ | 1,276 | |||||||||||||||||

________________________

(1)On January 22, 2019 the company’s board of directors approved the repurchase of $6.0 billion of its ordinary shares ("2019 program") which could take place from time to time on the open market (and could include the use of 10b5-1 trading plans), subject to market and business conditions. The 2019 program had a maximum repurchase amount of 15% of outstanding shares and expired on February 1, 2021 and any amounts that remained available under the 2019 program also expired.

(2)As of December 31, 2020, the company repurchased $4.7 billion of its ordinary shares pursuant to the 2019 program, leaving an additional $1.3 billion authorized under the 2019 program.

On January 25, 2021 the company's board of directors approved the repurchase of $5.0 billion of its ordinary shares ("2021 program") which could take place from time to time on the open market (and could include the use of 10b5-1 trading plans), subject to market and business conditions. The 2021 program has a maximum repurchase amount of 15% of outstanding shares, began on February 1, 2021 and expires on July 31, 2023.

16

Peer Performance Table – The graph below compares the most recent five-year cumulative returns of the common stock of Praxair, the company's predecessor, through October 31, 2018 and Linde's ordinary shares for periods subsequent to October 31, 2018 with those of the Standard & Poor’s 500 Index ("SPX") and the S5 Materials Index ("S5MATR") which covers 22 companies, including Linde. The figures assume an initial investment of $100 on December 31, 2015 and that all dividends have been reinvested.

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |||||||||||||||

| LIN | $100 | $117 | $159 | $164 | $228 | $286 | ||||||||||||||

| SPX | $100 | $112 | $136 | $131 | $172 | $203 | ||||||||||||||

| S5MATR | $100 | $117 | $145 | $123 | $154 | $186 | ||||||||||||||

ITEM 6. SELECTED FINANCIAL DATA

Not applicable.

17

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion of the company’s financial condition and results of operations should be read together with its consolidated financial statements and notes to the consolidated financial statements included in Item 8 of this Form 10-K.

| Page | |||||

| Business Overview | |||||

| Executive Summary – Financial Results & Outlook | |||||

| Consolidated Results and Other Information | |||||

| Segment Discussion | |||||

| Liquidity, Capital Resources and Other Financial Data | |||||

| Off-Balance Sheet Arrangements | |||||

| Critical Accounting Policies | |||||

| New Accounting Standards | |||||

| Fair Value Measurements | |||||

| Non-GAAP Financial Measures | |||||

| Supplemental Guarantee Information | |||||

18

BUSINESS OVERVIEW

The company's primary products in its industrial gases business are atmospheric gases (oxygen, nitrogen, argon, rare gases) and process gases (carbon dioxide, helium, hydrogen, electronic gases, specialty gases, acetylene). The company also designs, engineers, and builds equipment that produces industrial gases and offers its customers a wide range of gas production and processing services such as olefin plants, natural gas plants, air separation plants, hydrogen and synthesis gas plants and other types of plants.

Linde’s industrial gas operations are managed on a geographical basis and in 2020 83% of sales were generated by Linde's three geographic segments (Americas, EMEA and APAC) and the remaining 17% are related primarily to the Engineering segment, and to a lesser extent Other (see Note 18 to the consolidated financial statements for operating segment details).

Linde serves a diverse group of industries including healthcare, petroleum refining, manufacturing, food, beverage carbonation, fiber-optics, steel making, aerospace, chemicals and water treatment. The diversity of end-markets supports financial stability for Linde in varied business cycles.

Linde generates most of its revenues and earnings in the following geographies where the company has its strongest market positions and where distribution and production operations allow the company to deliver the highest level of service to its customers at the lowest cost.

| North and South America ("Americas") | Europe, Middle East and Africa (“EMEA”) | Asia and Pacific (“APAC”) | ||||||||||||

| United States | Germany | China & Taiwan | ||||||||||||

| Brazil | United Kingdom | Australia | ||||||||||||

| Mexico | Eastern Europe | South Korea | ||||||||||||

| Canada | India | |||||||||||||

The company manufactures and distributes its industrial gas products through networks of thousands of production plants, pipeline complexes, distribution centers and delivery vehicles. Major pipeline complexes are primarily located in the United States. These networks are a competitive advantage, providing the foundation of reliable product supply to the company’s customer base. The majority of Linde’s business is conducted through long-term contracts which provide stability in cash flow and the ability to pass through changes in energy and feedstock costs to customers. The company has growth opportunities in all major geographies and in diverse end-markets such as energy, electronics, chemicals, metals, healthcare, food and beverage, and aerospace.

19

EXECUTIVE SUMMARY – FINANCIAL RESULTS & OUTLOOK

2020 Year in review

•Sales of $27,243 million were 3% below 2019 sales of $28,228 million. Volumes decreased 2% as growth from project start-ups was more than offset by the global macroeconomic slowdown as a result of the COVID-19 pandemic. Higher pricing across all geographic segments contributed 2% to sales. Unfavorable currency translation, lower cost pass-through and the net impact of acquisitions and divestitures decreased sales by 3%.

•Reported operating profit of $3,322 million was 13% above 2019. Adjusted operating profit of $5,797 million was 10% above 2019. The increase in both reported and adjusted operating profit was primarily driven by higher price and the benefit of cost reduction programs and other charges and productivity initiatives which more than offset the impact of lower volumes.*

•Income from continuing operations of $2,497 million and diluted earnings per share from continuing operations of $4.70 increased from $2,183 million and $4.00, respectively in 2019. Adjusted income from continuing operations of $4,371 million and adjusted diluted earnings per share from continuing operations of $8.23 were 9% and 12%, respectively above 2019 adjusted amounts.*

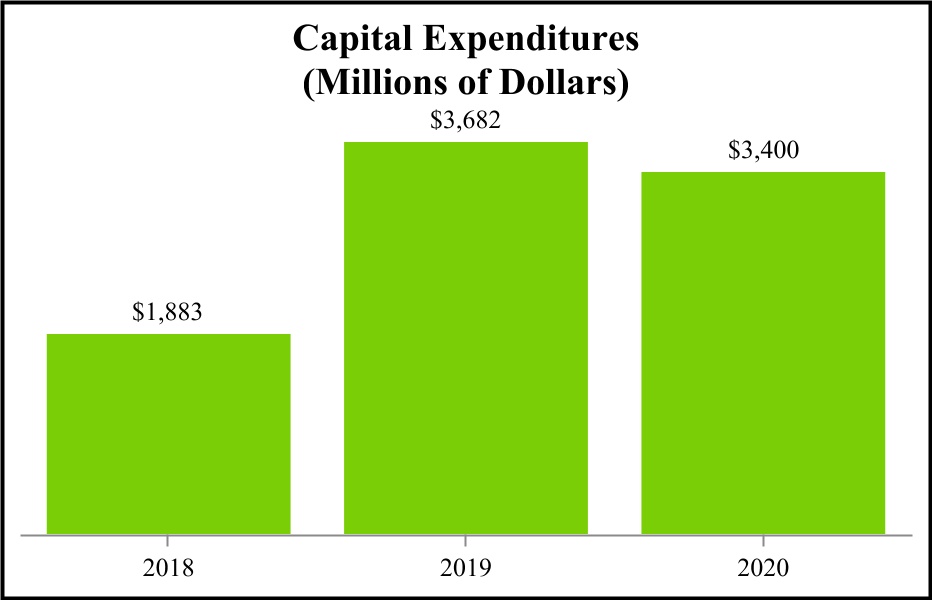

•Cash flow from operations was $7,429 million, or 27% of sales. Capital expenditures were $3,400 million; dividends paid were $2,028 million; net purchases of ordinary shares of $2,410 million; and debt borrowings, net were $1,313 million.

*A reconciliation of the adjusted amounts can be found in the "Non-GAAP Financial Measures" section in this MD&A.

2021 Outlook

Linde provides quarterly updates on operating results, material trends that may affect financial performance, and financial guidance via earnings releases and investor teleconferences. These materials are available on the company’s website, www.linde.com, but are not incorporated herein.

20

CONSOLIDATED RESULTS AND OTHER INFORMATION

The discussion that follows includes a comparison of our results of operations and liquidity and capital resources for the years ended December 31, 2020 and 2019. For the discussion comparing the years ended December 31, 2019 and 2018, refer to Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, of our Form 10-K for the year ended December 31, 2019.

The following table provides summary information for 2020 and 2019. The reported amounts are GAAP amounts from the Consolidated Statements of Income. The adjusted amounts are intended to supplement investors' understanding of the company's financial information and are not a substitute for GAAP measures.

(Millions of dollars, except per share data) Year Ended December 31, | 2020 | 2019 | Variance | ||||||||||||||

| Reported Amounts | |||||||||||||||||

| Sales | $ | 27,243 | $ | 28,228 | (3) | % | |||||||||||

| Cost of sales, exclusive of depreciation and amortization | $ | 15,383 | $ | 16,644 | (8) | % | |||||||||||

| As a percent of sales | 56.5 | % | 59.0 | % | |||||||||||||

| Selling, general and administrative | $ | 3,193 | $ | 3,457 | (8) | % | |||||||||||

| As a percent of sales | 11.7 | % | 12.2 | % | |||||||||||||

| Depreciation and amortization | $ | 4,626 | $ | 4,675 | (1) | % | |||||||||||

| Cost reduction programs and other charges (a) | $ | 506 | $ | 567 | (11) | % | |||||||||||

| Net gain on sale of businesses (b) | $ | — | $ | 164 | |||||||||||||

| Operating Profit | $ | 3,322 | $ | 2,933 | 13 | % | |||||||||||

| Operating margin | 12.2 | % | 10.4 | % | |||||||||||||

| Interest expense – net | $ | 115 | $ | 38 | 203 | % | |||||||||||

| Net pension and OPEB cost (benefit), excluding service cost | $ | (177) | $ | (32) | 453 | % | |||||||||||

| Effective tax rate | 25.0 | % | 26.3 | % | |||||||||||||

| Income from equity investments | $ | 85 | $ | 114 | (25) | % | |||||||||||

| Noncontrolling interests from continuing operations | $ | (125) | $ | (89) | 40 | % | |||||||||||

| Income from continuing operations | $ | 2,497 | $ | 2,183 | 14 | % | |||||||||||

| Diluted earnings per share from continuing operations | $ | 4.70 | $ | 4.00 | 18 | % | |||||||||||

| Diluted shares outstanding | 531,157 | 545,170 | (3) | % | |||||||||||||

| Number of employees | 74,207 | 79,886 | (7) | % | |||||||||||||

| Adjusted Amounts (c) | |||||||||||||||||

| Operating profit | $ | 5,797 | $ | 5,272 | 10 | % | |||||||||||

| Operating margin | 21.3 | % | 18.7 | % | |||||||||||||

| Income from continuing operations | $ | 4,371 | $ | 4,003 | 9 | % | |||||||||||

| Diluted earnings per share from continuing operations | $ | 8.23 | $ | 7.34 | 12 | % | |||||||||||

| Other Financial Data (c) | |||||||||||||||||

| EBITDA from continuing operations | $ | 8,033 | $ | 7,722 | 4 | % | |||||||||||

| As percent of sales | 29.5 | % | 27.4 | % | |||||||||||||

| Adjusted EBITDA from continuing operations | $ | 8,645 | $ | 8,178 | 6 | % | |||||||||||

| As percent of sales | 31.7 | % | 29.0 | % | |||||||||||||

________________________

(a)See Note 3 to the consolidated financial statements.

(b)See Note 2 to the consolidated financial statements.

(c)Adjusted amounts and Other Financial Data are non-GAAP performance measures. A reconciliation of reported amounts to adjusted amounts can be found in the "Non-GAAP Financial Measures" section of this MD&A.

Results of Operations

The following table provides a summary of changes in consolidated sales:

21

| 2020 vs. 2019 | ||||||||

| % Change | ||||||||

| Factors Contributing to Changes - Sales | ||||||||

| Volume | (2) | % | ||||||

| Price/Mix | 2 | % | ||||||

| Cost pass-through | (1) | % | ||||||

| Currency | (1) | % | ||||||

| Acquisitions/divestitures | (1) | % | ||||||

| Engineering | — | % | ||||||

| (3) | % | |||||||

2020 Compared With 2019

Sales

Reported sales decreased $985 million, or 3%, for the 2020 year versus 2019. On an adjusted basis sales decreased $920 million in 2020 compared to 2019.

On a reported and adjusted basis, sales decreased 3%. Volume decreased sales by 2% primarily driven by the impact of the macroeconomic slowdown, partially offset by new project start-ups. Higher pricing across all geographic segments contributed 2% to sales. Currency translation decreased sales by 1%, largely in the Americas, driven by the weakening of the Brazilian real against the U.S. dollar. Cost pass-through decreased sales by 1% with minimal impact on operating profit. The impact of merger-related divestitures decreased sales by $65 million in 2020. These sales have been excluded from the adjusted numbers.

Cost of sales, exclusive of depreciation and amortization

Cost of sales, exclusive of depreciation and amortization, decreased $1,261 million, or 8%, for the year primarily due to lower volumes and the impact of productivity initiatives. Cost of sales, exclusive of depreciation and amortization, was 56.5% and 59.0% of sales, respectively, in 2020 compared to 2019. The decrease as a percentage of sales was due primarily to the impact of cost reduction programs and productivity initiatives and the impact of lower cost pass-through.

Selling, general and administrative expenses

Selling, general and administrative expense ("SG&A") decreased $264 million, or 8%, in 2020 to $3,193 million. SG&A was 11.7% of sales in 2020 versus 12.2% in 2019. Currency impacts decreased SG&A by approximately $34 million in 2020. Excluding currency impacts, underlying SG&A decreased driven by the impact of cost reduction programs and productivity initiatives.

Depreciation and amortization

Reported depreciation and amortization expense decreased $49 million, or 1%, versus 2019. The decrease is primarily due to currency translation impacts.

On an adjusted basis, depreciation and amortization expense decreased $29 million, or 1%, versus 2019. The decrease is primarily due to currency translation impacts which decreased depreciation and amortization by approximately $39 million in 2020 slightly offset by new project start ups primarily in APAC and the Americas.

Cost reduction programs and other charges

Linde recorded cost reduction programs and other charges of $506 million and $567 million for 2020 and 2019, respectively, primarily associated with the company's cost reduction program, which represents charges for achieving synergies and cost efficiencies related to the merger. 2019 also included an asset impairment of approximately $73 million related to a joint venture in APAC resulting from an unfavorable arbitration ruling (see Note 3 to the consolidated financial statements).

On an adjusted basis, these costs have been eliminated in both periods.

Operating profit

Reported operating profit increased $389 million in 2020, or 13%. On an adjusted basis, operating profit increased $525 million, or 10%, for 2020 versus 2019.

On a reported basis, operating profit increased $389 million, or 13% in 2020. The increase in the year was driven by higher price and the benefit of cost reduction programs and productivity initiatives. Cost reduction programs and other charges

22

were $506 million in 2020 and $567 million in 2019. 2019 also included a $164 million one time net gain on sale of business.

On an adjusted basis, which excludes the impacts of purchase accounting, cost reduction programs and other charges and net gains from merger-related divestitures in 2019, operating profit increased $525 million, or 10%. Operating profit growth was driven by higher price and the benefit of cost reduction programs and productivity initiatives which were partially offset by lower volumes, unfavorable currency impacts and cost inflation. A discussion of operating profit by segment is included in the segment discussion that follows.

Interest expense - net

Reported interest expense – net in 2020 increased $77 million, or 203%, versus 2019 and included a $16 million charge for the early redemption of bonds due in 2021 (see Note 11 to the consolidated financial statements). On an adjusted basis interest expense increased $50 million, or 37% in 2020 as compared to 2019.

On both a reported and adjusted basis, the increase year over year included the impact of unfavorable foreign currency revaluation on unhedged intercompany loans and lower interest income, partially offset by a lower effective borrowing rate.

Net pension and OPEB cost (benefit), excluding service cost

Reported net pension and OPEB cost (benefit), excluding service cost was a benefit of $177 million in 2020 versus a benefit of $32 million in 2019. 2020 included pension settlement charges of $6 million while 2019 included pension settlement charges of $97 million and a net $8 million curtailment charge (see Note 16 to the consolidated financial statements). Excluding the impact of these charges, the net pension and OPEB benefit, excluding service cost increased $46 million in 2020, as the benefit of lower interest cost due to the low discount rate environment more than offset higher amortization of deferred losses.

Effective tax rate

The reported effective tax rate ("ETR") for 2020 was 25.0% versus 26.3% in 2019. The decrease in the reported ETR is primarily due to higher tax benefits from share option exercises and higher tax expense in 2019 related to divestitures.

On an adjusted basis, the ETR for 2020 was 23.8% versus 24.0% in 2019. The decrease in the adjusted ETR is primarily due to higher tax benefits from share option exercises.

Income from equity investments

Reported income from equity investments for 2020 was $85 million as compared to $114 million in 2019. On an adjusted basis, income from equity investments for 2020 was $142 million versus $171 million in 2019. The decrease in the reported and adjusted income from equity investments was primarily driven by unfavorable foreign currency revaluation impacts on an unhedged loan of an investment in EMEA.

Noncontrolling interests from continuing operations

At December 31, 2020, noncontrolling interests from continuing operations consisted primarily of noncontrolling shareholders’ investments in APAC (primarily in China) and surface technologies.

Reported noncontrolling interests from continuing operations increased $36 million to $125 million in 2020 from $89 million in 2019, primarily driven by the noncontrolling interest impact of $33 million for an asset impairment charge in the third quarter 2019 related to a joint venture in APAC.

Adjusted noncontrolling interests from continuing operations increased $8 million in 2020 as compared to 2019.

Income from continuing operations

Reported income from continuing operations increased $314 million, or 14%, primarily due to higher overall operating profit and a lower effective tax rate.