UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

OR

For

the fiscal year ended

OR

OR

Date of event requiring this shell company report

For the transition period from to

Commission

file number

(Exact name of Registrant as specified in its charter)

(Jurisdiction of incorporation or organization)

People’s

Republic of

(Address of principal executive offices)

Telephone:

People’s

Republic of

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: Class A Common Shares (not including 490,000 Class A Common Shares underlying options granted to management and a consultant, of which 483,341 options have vested as of the date of this report) and Class B Common Shares.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☐ Yes ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

☐ Yes ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☒

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer, “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | |||

| Emerging

growth company |

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided

pursuant to Section 13(a) of the Exchange Act.

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ |

Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934).

☐ Yes ☒

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

☐ Yes ☐ No

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Statements in this annual report with respect to the Company’s current plans, estimates, strategies and beliefs and other statements that are not historical facts are forward-looking statements about the future performance of the Company. Forward-looking statements include, but are not limited to, those statements using words such as “believe,” “expect,” “plans,” “strategy,” “prospects,” “forecast,” “estimate,” “project,” “anticipate,” “aim,” “intend,” “seek,” “may,” “might,” “could” or “should,” and words of similar meaning in connection with a discussion of future operations, financial performance, events or conditions. From time to time, oral or written forward-looking statements may also be included in other materials released to the public. These statements are based on management’s assumptions, judgments and beliefs in light of the information currently available to it. The Company cautions investors that a number of important risks and uncertainties could cause actual results to differ materially from those discussed in the forward-looking statements, including but not limited to, our ability to continue as a going concern, product and service demand and acceptance, changes in technology, economic conditions, the impact of competition and pricing, government regulation, and other risks contained in reports filed by the company with the Securities and Exchange Commission. Therefore, investors should not place undue reliance on such forward-looking statements. Actual results may differ significantly from those set forth in the forward-looking statements.

All such forward-looking statements, whether written or oral, and whether made by or on behalf of the company, are expressly qualified by the cautionary statements and any other cautionary statements which may accompany the forward-looking statements. In addition, the company disclaims any obligation to update any forward-looking statements to reflect events or circumstances after the date hereof.

Part I

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable for annual reports on Form 20-F.

Item 2. Offer Statistics and Expected Timetable

Not applicable for annual reports on Form 20-F.

Item 3. Key Information

A. Selected Financial Data

In the table below, we provide you with historical selected financial data for the fiscal years ended June 30, 2021, 2020, and 2019. This information is derived from our consolidated financial statements included elsewhere in this annual report. Historical results are not necessarily indicative of the results that may be expected for any future period. When you read this historical selected financial data, it is important that you read it along with the historical financial statements and related notes and “Item 5. Operating and Financial Review and Prospects” included elsewhere in this annual report. Our audited consolidated financial statements are prepared and presented in accordance with Generally Accepted Accounting Principles in the United States of America, or U.S. GAAP.

| For Fiscal | For Fiscal | For Fiscal | ||||||||||

| Year Ended | Year Ended | Year Ended | ||||||||||

| June 30, | June 30, | June 30, | ||||||||||

| 2021 | 2020 | 2019 | ||||||||||

| US$ | US$ | US$ | ||||||||||

| (audited) | (audited) | (audited) | ||||||||||

| Statement of operation data: | ||||||||||||

| Revenues | 24,320,121 | $ | 19,171,358 | $ | 26,216,515 | |||||||

| Gross profit | 9,155,213 | 2,391,370 | 9,430,005 | |||||||||

| Operating expenses | 7,297,420 | 11,106,837 | 8,790,435 | |||||||||

| (Loss) Income from operations | 1,857,793 | (8,715,467 | ) | 639,570 | ||||||||

| Other income (expense) | 82,695 | 343,079 | 1,143,904 | |||||||||

| Provision for income taxes | 641,460 | 164,537 | 380,296 | |||||||||

| Net (loss) income | 1,299,028 | $ | (8,536,925 | ) | $ | 1,403,178 | ||||||

| (Loss) earnings per share, basic and diluted | 0.05 | $ | (0.33 | ) | $ | 0.05 | ||||||

| Weighted average Ordinary Shares outstanding (basic) | 27,499,367 | 25,913,631 | 25,913,631 | |||||||||

Balance sheet data:

| As of June 30, | ||||||||||||||||||||

| 2021 | 2020 | 2019 | 2018 | 2017 | ||||||||||||||||

| Current assets | $ | 14,266,131 | $ | 11,627,458 | $ | 25,922,624 | $ | 46,344,652 | $ | 8,669,463 | ||||||||||

| Total assets | 93,845,408 | 63,551,261 | 69,023,927 | 69,708,205 | 17,518,060 | |||||||||||||||

| Current liabilities | 21,262,335 | 10,769,734 | 8,072,423 | 8,968,673 | 10,160,919 | |||||||||||||||

| Total liabilities | 28,943,003 | 12,043,333 | 8,072,423 | 8,968,673 | 10,160,919 | |||||||||||||||

| Total equity | $ | 64,902,405 | $ | 51,507,928 | $ | 60,951,504 | $ | 60,739,532 | $ | 7,357,141 | ||||||||||

Exchange Rate Information

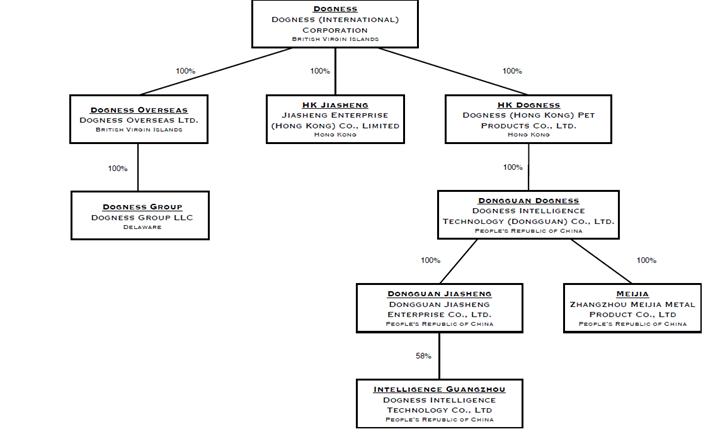

Our financial information is presented in U.S. dollars. The financial position and results of the operations of HK Dogness, HK Jiasheng, Dongguan Dogness, Dongguan Jiasheng, Meijia and Intelligence Guangzhou are determined using the Chinese Renminbi (“RMB”), the local currency, as the functional currency. Dogness Japan uses Japanese Yen as the functional currency, while Dogness Overseas and Dogness Group use U.S Dollar as their functional currency.

The results of operations and the consolidated statements of cash flows denominated in foreign currencies are translated at the average rate of exchange during the reporting period. Assets and liabilities denominated in foreign currencies at the balance sheet date are translated at the applicable rates of exchange in effect at that date. The equity denominated in the functional currency is translated at the historical rate of exchange at the time of capital contribution. Because cash flows are translated based on the average translation rate, amounts related to assets and liabilities reported on the consolidated statements of cash flows will not necessarily agree with changes in the corresponding balances on the consolidated balance sheets. Translation adjustments arising from the use of different exchange rates from period to period are included as a separate component of accumulated other comprehensive income included in consolidated statements of changes in equity. Gains and losses from foreign currency transactions are included in the consolidated statement of income and comprehensive income.

| 1 |

The relevant exchange rates are listed below:

| June 30, 2021 | June 30, 2020 | June 30, 2019 | ||||||||||||||||||||||

| Year-end spot rate | US$1=RMB 6.4566 | US$1=JPY 111.1 | US$1=RMB 7.0721 | US$1=JPY 107.5 | US$1=RMB 6.8657 | US$1=JPY 107.5 | ||||||||||||||||||

| Average rate | US$1=RMB 6.6221 | US$1=JPY 106.6 | US$1=RMB 7.0323 | US$1=JPY 107.5 | US$1=RMB 6.8226 | US$1=JPY 111.1 | ||||||||||||||||||

We make no representation that any RMB or U.S. dollar amounts could have been, or could be, converted into U.S. dollars or RMB, as the case may be, at any particular rate, or at all. The PRC government imposes control over its foreign currency reserves in part through direct regulation of the conversion of RMB into foreign exchange and through restrictions on foreign trade. We do not currently engage in currency hedging transactions.

The following table sets forth information concerning exchange rates between the RMB and the U.S. dollar for the periods indicated.

| Midpoint of Buy and Sell Prices for U.S. Dollar per RMB | ||||||||||||||||

| Period | Period-End | Average | High | Low | ||||||||||||

| 2014 | 6.1484 | 6.1458 | 6.2080 | 6.0881 | ||||||||||||

| 2015 | 6.4917 | 6.2288 | 6.4917 | 6.0933 | ||||||||||||

| 2016 | 6.9448 | 6.6441 | 7.0672 | 6.4494 | ||||||||||||

| 2017 | 6.5074 | 6.7578 | 6.9535 | 6.4686 | ||||||||||||

| 2018 | 6.8776 | 6.6163 | 7.1786 | 6.6822 | ||||||||||||

| 2019 | 6.9618 | 6.9081 | 7.1786 | 6.6822 | ||||||||||||

| 2020 | 6.5250 | 6.9042 | 7.1681 | 6.5208 | ||||||||||||

| 2021 (through October 22, 2021) | 6.3839 | 6.4668 | 6.5716 | 6.3674 | ||||||||||||

As of October 22, 2021, the exchange rate is RMB 6.3839 to $1.00.

B. Capitalization and Indebtedness

Not applicable for annual reports on Form 20-F.

C. Reasons for the Offer and Use of Proceeds

Not applicable for annual reports on Form 20-F.

D. Risk Factors

Before you decide to purchase our Class A Common Shares, you should understand the high degree of risk involved. You should consider carefully the following risks and other information in this report, including our consolidated financial statements and related notes. If any of the following risks actually occur, our business, financial condition and operating results could be adversely affected. As a result, the trading price of our Class A Common Shares could decline, perhaps significantly.

Please also read carefully the section below entitled “Cautionary Note Regarding Forward-Looking Statements.”

Risks Related to Our Business

We face risks related to health epidemics that could impact our sales and operating results.

Our business could be adversely affected by the effects of a widespread outbreak of contagious disease, including the recent outbreak of respiratory illness caused by a novel coronavirus first identified in Wuhan, Hubei Province, China. Any outbreak of contagious diseases, and other adverse public health developments, particularly in China, could have a material and adverse effect on our business operations. These could include disruptions or restrictions on our ability to resume the general shipping agency services, as well as temporary closures of our facilities and ports or the facilities of our customers and third-party service providers. Any disruption or delay of our customers or third-party service providers would likely impact our operating results and the ability of the Company to continue as a going concern. In addition, a significant outbreak of contagious diseases in the human population could result in a widespread health crisis that could adversely affect the economies and financial markets of China and many other countries, resulting in an economic downturn that could affect demand for our services and significantly impact our operating results.

| 2 |

The coronavirus disease 2019 (COVID-19) has had a significant impact on our operations since January 2020 and could materially adversely affect our business and financial results for the remaining months of the 2020 calendar year.

Our ability to manufacture and/or sell our products may be impaired by damage or disruption to our manufacturing, warehousing or distribution capabilities, or to the capabilities of our suppliers, logistics service providers or distributors as a result of the impact from the COVID-19. This damage or disruption could result from events or factors that are impossible to predict or are beyond our control, such as raw material scarcity, pandemics, government shutdowns, disruptions in logistics, supplier capacity constraints, adverse weather conditions, natural disasters, fire, terrorism or other events.

The COVID-19 pandemic, which has spread rapidly across the globe, resulted in adverse economic conditions and business disruptions. In reaction to this outbreak, governments worldwide have imposed varying degrees of preventative and protective actions, such as temporary travel bans, forced business closures, and stay-at-home orders, all in an effort to reduce the spread of the virus. Since this outbreak, business activities in China and many other countries including U.S. have been disrupted by a series of emergency quarantine measures taken by the government. The Chinese government has employed measures including city lockdowns, quarantines, travel restrictions, suspension of business activities and school closures. Due to difficulties resulting from the COVID-19 outbreak, including, but not limited to, the temporary closure of the Company’s factory and operations beginning in early February until late March 2020, limited support from the Company’s employees, delayed access to raw material supplies and inability to deliver products to customers on a timely basis, the Company’s business was negatively impacted. While the spread of the disease has gradually returned under control in China, COVID-19 could still adversely affect our business and financial results in the future. As a result, there is a possibility that the Company’s revenues and operating cash flows may be significantly lower than expected for fiscal year 2022.

We may incur liability for unpaid taxes, including interest and penalties.

In the normal course of business, our Company may be subject to challenges from various PRC taxing authorities regarding the amounts of taxes due. PRC taxing authorities may take the position that the Company owes more taxes than it has paid. The Company recorded tax liabilities of $4.4 million, $2.8 million and $2.9 million as of June 30, 2021, 2020, and 2019, respectively, for the possible underpayment of income and business taxes. It is possible that the tax liability of the Company for past taxes may be higher than those amounts, if the PRC authorities determine that we are subject to penalties or that we have not paid the correct amount. Although the Company’s management believes it may be able to negotiate with local PRC taxing authorities a reduction to any amounts that such authorities may believe are due and a reduction to any interest or penalties thereon, we have no guarantee that we will be able to negotiate such a reduction. To the extent our Company is able to negotiate such amounts, national-level taxing authorities may take the position that localities are without power to reduce such liabilities, and such PRC taxing authorities may attempt to collect unpaid taxes, interest and penalties in amounts greatly exceeding management’s estimates.

| 3 |

If our largest customers reduce their orders with us, such revenues would be very difficult to replace.

Although we have also sold our products through distributors and trading companies, some of our largest customers are Petco and Pet Valu, which are by far the largest pet specialty chains in North America. Petco has around 1600 stores in the US and Pet Valu has around 600 stores in Canada. There is not another brick-and-mortar customer that presents the opportunity that these customers present to us. As a result, if we were to lose these accounts or if these customers purchased less of our products in the future, it would be difficult to replace those lost revenues.

Our smart products have only recently entered distribution.

While we are optimistic that our smart products such as collars, harnesses, feeders and robots will be important products for our company in the future, we only recently begun to sell them and thus do not know whether they will prove popular with consumers. We have exhibited these products at expos in multiple countries and have begun to receive orders, but our revenues for all smart products was approximately $7.8 million, $4.3 million and $2.1 million during the years ended June 30, 2021, 2020 and 2019, respectively. As a result, we do not have an accurate gauge of how well accepted they will be by consumers. If consumers do not appreciate our smart products, we may not sell enough products to grow our market share in this new industry.

Our smart products are not as well-known as those of our competitors.

There are a variety of competitors providing smart collars, smart feeders and smart treaters for dogs and cats that are more well-known than our products. We are aware of more than a dozen competitors to our smart products, some of which have been on the market for several years. Because smart collars are still a relatively new industry, we do not believe that there is a single leader. Nevertheless, we face competition from more well-known products like the Whistle GPS Pet Tracker and Tractive, as well as products from more well-established, better capitalized companies in the United States such as Garmin, which produces varieties of dog training and tracking devices. Similarly, companies such as PetSafe, Petzi, Petcube, Arf Pets, and Furbo market food and treat dispensers with functionalities that in some cases are similar to our products. If we are unable to achieve recognition for our technology or if consumers opt to use products from companies they recognize more than our company, our smart collar and harness products may not be well accepted.

Our smart collars and harnesses are currently between generations.

We debuted our C2 and H2 smart collars and harnesses in 2016. These products were designed to operate over 2G telephone technology. While this platform was sufficient to meet the needs of the products, 2G speeds lag far behind currently available 4G and now 5G technology. As a result, our C2 and H2 products have thus far obtained a very limited customer base. For this reason, we have been researching and developing our next generation of smart collars and harnesses to operate with today’s higher internet speeds in mind. Before we are able to bring these products to market, we anticipate that our sales of smart collars and harnesses, along with subscriptions for ongoing cellular services for those products, will be nominal. If and when we are able to introduce our next generation of smart collars and harnesses, we are unable to predict the extent to which consumers will be drawn to such new products.

Our smart collars rely on third-party cellular telephone companies and application developers for functionality.

One of the features of our smart collars is the ability to communicate between the owner’s cell phone and the collar, even when the two are too far away to communicate directly. We achieve this by having a SIM card in the smart collar so that, so long as the collar has a cell phone signal, it will communicate with the telephone. We cooperate with cell phone companies in our target markets to provide cellular service to these SIM cards. If this cooperation were to end or if the cellular service we receive is not reliable or more expensive than we anticipate, the market for our products could be harmed.

In addition, the Dogness smartphone App on which our smart collars rely are still under development and test by a company, Dogness Network Technology Co., Ltd (“Dogness Network”), in which we have a minority interest. Our company owns 10% of Dogness Network. Dogness Network plans to derive its revenues from subscriptions for services provided through the Dogness smartphone App in the near future, and we will purchase such products from Dogness Network and resell to our customers. We may benefit only by virtue of our 10% interest in Dogness Network. In fiscal year 2021, subscription revenues were approximately $1.8 million from about 68,100 users. If Dogness Network were to stop supporting the application or impair its functionality, our smart collars and harnesses could become unusable or have decreased value to end users.

| 4 |

To the extent we were unable to cooperate with such third parties in the future, we would need to locate and cooperate with other service providers, and we cannot guarantee that we would be able to do so under terms that are satisfactory to us, if at all.

Our software platform may not interface with applications consumers want to be integrated.

In the connected home, consumers are increasingly aware of the interconnection among applications and devices, such as speakers that can turn on lights or adjust the temperature. Some customers purchase products based on how they will interact with other services and products that the customers already use. If we are unable to anticipate and accommodate these desires, customers may choose other products that do interact with their preferred services. Although we may incorporate such functionality in future generations of our products, not all of our current products integrate into Apple’s, Google’s or Amazon’s smart home platforms. Our Dogness CAM feeder, App feeder, and App mini feeder work with Amazon Alexa.

We are also dependent on third party application stores that may prevent us from timely updating our current products or uploading new products. In addition, our products interoperate with servers, mobile devices and software applications predominantly through the use of protocols, many of which are created and maintained by third parties. We therefore depend on the interoperability of our products with such third-party services, mobile devices and mobile operating systems, as well as cloud-enabled hardware, software, networking, browsers, database technologies and protocols that we do not control. Any changes in such technologies that degrade the functionality of our products or give preferential treatment to competitive services could adversely affect adoption and usage of our platform. Also, we may not be successful in developing or maintaining relationships with key participants in the mobile industry or in developing products that operate effectively with a range of operating systems, networks, devices, browsers, protocols and standards. In addition, we may face different fraud, security and regulatory risks from transactions sent from mobile devices than we do from personal computers. If we are unable to effectively anticipate and manage these risks, or if it is difficult for our customers to access and use our platform, our business, results of operations and financial condition may be harmed.

Our online platform may not be attractive to third party vendors.

We are currently developing an online platform on Chinese retail websites that will allow pet owners to purchase products from vendors that advertise and sell their products through our application. While we are hopeful that we will be able to develop a product that is appealing to vendors, we have not yet obtained any commitments from any third-party vendors to make use of the platform. Because our ultimate success in making this platform a vibrant social and shopping site depends on pet owners making use of it, is impossible to foresee whether the platform will be successful in attracting vendors and pet owners.

Price increases in raw materials and sourced products could harm the Company’s financial results.

Our primary raw materials are plastic, leather, nylon, polyester, chemical fiber blended fabric, metal, GPPS and HIPS, most of which are extracted from crude oil. These raw materials are subject to price volatility and inflationary pressures. Our success is dependent, in part, on our continued ability to reduce our exposure to increases in those costs through a variety of programs, including sales price adjustments based on adjustments in such raw material costs, while maintaining and improving margins and market share. We also rely on third-party manufacturers as a source for a minor portion of components for our products. These manufacturers are also subject to price volatility and labor cost and other inflationary pressures, which may, in turn, result in an increase in the amount we pay for sourced products. Raw material and sourced product price increases may more than offset our productivity gains and price increases and may adversely impact our financial results.

Our plan to vertically integrate our production may not provide the benefits we foresee.

Over the last several years, we have increasingly produced our products in-house. We have made this strategic decision because of our belief that it will facilitate our control over the costs of components in our products. The price of components is extremely important where the per-unit sales price is as low as it is in our industry. Thus, we believe it is important to control costs as much as possible.

| 5 |

That being said, when we produce components in-house that we previously purchased from a third-party supplier, we may not benefit from the economies of scale that a dedicated third-party supplier could see. Moreover, we invest in infrastructure for such production, such as buying machines and leasing additional facility space; in the event new technology is developed to produce components of our products more cheaply than we can with our existing infrastructure, we could find that our operating results are negatively impacted, compared with what we would see if we were purchasing from third parties. In such case, our products could be more expensive than those of our competitors that purchase from third-party suppliers, which could make our products less attractive to customers.

Our reliance on third party logistics providers may put us at risk of service failures for our customers.

We rely on third parties to ship our products from China to our customers. We compete based on price, quality and reliability, so a failure to deliver our products on time to our large customers could harm our reputation. To the extent we are unable to meet their demand for products or do not deliver products on time, we stand a substantial risk of losing key accounts. Because we rely on third parties for logistics services, we may be unable to avoid supply chain failures, even if we are able to meet our manufacturing obligations to customers.

If we fail to protect our intellectual property rights, it could harm our business and competitive position.

We rely on a combination of patent, trademark, domain name and trade secret laws and non-disclosure agreements and other methods to protect our intellectual property rights. Our Chinese subsidiaries own 117 patents and 179 trademarks in China and 85 patents and 14 trademarks outside China, all of which have been properly registered with regulatory agencies such as the State Intellectual Property Office and Trademark Office of China’s State Administration for Industry and Commerce (“SAIC”). This intellectual property has allowed our products to earn market share in the pet products industry.

The process of seeking patent protection can be lengthy and expensive, our patent applications may fail to result in patents being issued, and our existing and future patents may be insufficient to provide us with meaningful protection or commercial advantage. Our patents and patent applications may also be challenged, invalidated or circumvented.

We also rely on trade secret rights to protect our business through non-disclosure provisions in employment agreements with employees. If our employees breach their non-disclosure obligations, we may not have adequate remedies in China, and our trade secrets may become known to our competitors.

In accordance with Chinese intellectual property laws and regulations, we will have to renew our trademarks once the terms expire. However, patents are not renewable. Some of our patents, particularly utility mode and design patents, have only 10 years of protection and will end in the near future. Once these patents expire, our products may lose some market share if they are copied by our competitors. Then, our business revenue might suffer some loss as well.

Implementation of PRC intellectual property-related laws has historically been lacking, primarily because of ambiguities in the PRC laws and enforcement difficulties. Accordingly, intellectual property rights and confidentiality protections in China may not be as effective as in the United States or other western countries. Furthermore, policing unauthorized use of proprietary technology is difficult and expensive, and we may need to resort to litigation to enforce or defend patents issued to us or to determine the enforceability, scope and validity of our proprietary rights or those of others. Such litigation and an adverse determination in any such litigation, if any, could result in substantial costs and diversion of resources and management attention, which could harm our business and competitive position.

Our Chinese patents and registered marks may not be protected outside of China due to territorial limitations on enforceability.

In general, patent and trademark rights have territorial limitations in law and are valid only within the countries in which they are registered.

At present, Chinese enterprises may register their trademarks overseas through two methods. One is to file an application for trademark registration in each single country or region in which protection is desired, while the other is to apply via the Madrid system for international trademark registration. By the second way, under the provisions of the Madrid Agreement concerning the International Registration of Marks (the “Madrid Agreement”) or the Protocol Relating to the Madrid Agreement concerning the International Registration of Marks (the “Madrid Protocol”), applicants may designate their marks in one or more member countries via the Madrid system for international registration.

| 6 |

As of the date of the filing, we have registered 179 trademarks in China. We have also registered our key trademarks in Japan, Australia, Korea, Hong Kong, Taiwan and the United States.

Similar with trademarks, Chinese enterprises may also register their patents overseas through two methods. One is to file an application for patent registration in each single country or region, and the other is to file international application with the China Intellectual Property Office or the International Bureau of World Intellectual Property Organization under the Patent Cooperation Treaty. However, such international application may relate to invention or utility model patents, but does not include industrial design patents.

Currently, most of our patents and trademarks are registered in China. If we do not register them in other jurisdictions, they may not be protected outside of China. As a result, our business and competitive position could be harmed.

We may be exposed to intellectual property infringement and other claims by third parties which, if successful, could disrupt our business and have a material adverse effect on our financial condition and results of operations.

Our success depends, in large part, on our ability to use and develop our technology and know-how without infringing third party intellectual property rights. If we sell our branded products internationally, and as litigation becomes more common in China, we face a higher risk of being the subject of claims for intellectual property infringement, invalidity or indemnification relating to other parties’ proprietary rights. Our current or potential competitors, many of which have substantial resources and have made substantial investments in competing technologies, may have or may obtain patents that will prevent, limit or interfere with our ability to make, use or sell our branded products in either China or other countries, including the United States and other countries in Asia. The validity and scope of claims relating to patents in our industry involve complex scientific, legal and factual questions and analysis and, as a result, may be highly uncertain. In addition, the defense of intellectual property suits, including patent infringement suits, and related legal and administrative proceedings can be both costly and time consuming and may significantly divert the efforts and resources of our technical and management personnel. Furthermore, an adverse determination in any such litigation or proceedings to which we may become a party could cause us to:

| ● | pay damage awards; | |

| ● | seek licenses from third parties; | |

| ● | pay ongoing royalties; | |

| ● | redesign our branded products; or | |

| ● | be restricted by injunctions, |

each of which could effectively prevent us from pursuing some or all of our business and result in our customers or potential customers deferring or limiting their purchase or use of our products, which could have a material adverse effect on our financial condition and results of operations.

Outstanding bank loans may reduce our available funds.

As of June 30, 2021, we had approximately $8.0 million in outstanding bank loans, with expected repayment of approximately $1.5 million in one year, $1.4 million in two years and $3.3 million in three years. The loans are guaranteed by the fixed assets of the Company’s subsidiaries and are also personally guaranteed by our Chief Executive Officer and certain of his family members. While we believe we have sufficient capital resources to repay these bank loans with support from Mr. Silong Chen, our Chief Executive Officer, there can be no guarantee that we will be able to pay all amounts when due or to refinance the amounts on terms that are acceptable to us or at all. If we are unable to make our payments when due or to refinance such amounts, our property could be foreclosed and our business could be negatively affected.

While we do not believe they will impact our liquidity, the terms of the debt agreements impose significant operating and financial restrictions on us. These restrictions could also have a negative impact on our business, financial condition and results of operations by significantly limiting or prohibiting us from engaging in certain transactions, including but not limited to: incurring or guaranteeing additional indebtedness; transferring or selling assets currently held by us; and transferring ownership interests in certain of our subsidiaries. The failure to comply with any of these covenants could cause a default under our other debt agreements. Any of these defaults, if not waived, could result in the acceleration of all of our debt, in which case the debt would become immediately due and payable. If this occurs, we may not be able to repay our debt or borrow sufficient funds to refinance it on favorable terms, if any.

| 7 |

If the village cooperative from which we rent our factory in Dongguan fails to provide ownership certificates or construction approvals on demand, our ability to use our facilities may be impaired.

We lease our production facility from Dongguan Dongcheng District Tongsha Huanggongkeng Co-op (“Huanggongkeng”). We understand that, as is not uncommon in our area, Huanggongkeng did not obtain prior government approval before constructing the facilities and thus may be unable to provide evidence of government approval. If the local authority were to request proof of such approval, operations at our facility could be interrupted until Huanggongkeng was able to provide evidence of such approvals. If Huanggongkeng were unable to rectify this issue, we could find our operations halted indefinitely.

If the value of our property decreases, we may not be able to refinance our current debt.

All of our current debt is secured by either mortgages on real and other business property or guarantees by some of our shareholders. If the value of our real property decreases, we may find that banks are unwilling to loan money to us secured by our business property. A drop in property value could also prevent us from being able to refinance that loan when it becomes due on acceptable terms or at all.

Our new facilities in Zhangzhou and Dongguan may be more expensive than anticipated to complete.

In March 2018, we purchased all of the equity interests in Zhangzhou Meijia Metal Product Co., Ltd (“Meijia”), for a total cash consideration of approximately $11.0 million (RMB 71.0 million) (“Acquisition Cost”), which has been fully paid upon consummation of the Meijia acquisition transaction. Because Meijia had no substantial operations and its property consisted of a land use right and factory and office buildings, we accounted for the acquisition as a purchase of assets. After the acquisition, we started building our own facilities and office spaces to expand the production capacity in order to fulfill increased customer orders. Total budgeted capital expenditure to bring Meijia manufacturing facility into use was originally estimated to be completed at a cost of RMB110 million ($17.0 million). The actual costs have been adjusted based on additional works required for waterproofing, sewage pipeline and hazardous waste leakage prevention. As a result, total actual costs incurred as of June 30, 2021, amounted to RMB118.5 million ($18.4 million). Meijia plant started test operations in August 2019, and has started normal production since December 2019 upon passing the final inspection conducted by the local government. Meijia plant has reached its fully production capacity as of June 30, 2021.

In addition to our Zhangzhou facility, we are also building new manufacturing and operating facilities, which include warehouse, workshops, office building, security gate, employee apartment building, electrical transformer station and exhibition hall, etc. The total budget is approximately RMB 230.8 million ($35.8 million). As of June 30, 2021, the Company had substantially completed this project and transferred most of the related CIP to fixed assets. As of June 30, 2021, the Company has made total payments of approximately RMB 161.3 million ($25.0 million) in connection to this project, which resulted in future minimum capital expenditure payments of RMB 69.5 million ($10.8 million).

The Company’s subsidiary Dogness Culture is also working on a project to decorate a pet themed retail store. Total budget is RMB 2.2 million ($0.3 million). As of June 30, 2021, the Company has spent RMB 1.5 million ($0.2 million). This project was fully completed by June 30, 2021.

| 8 |

As a result of the above, the Company’s future capital expenditure payable on Dongguan Jiasheng and on the pet store under Dogness Culture amounted to approximately $10.9 million as of June 30, 2021. Subsequently, from July 2021 to October 2021, the Company made payment of RMB32.1 million ($5.0 million) on the above-mentioned construction projects. As a result, the Company’s future capital expenditure payable on CIP has been lowered down from approximately $10.9 million as of June 30, 2021 to approximately $5.9 million as of the date of this report.

We may find in the course of development that construction costs come in above budget, that we exceed projected timelines, and that we face other challenges and inconveniences that make our development plans less successful than we expect. If these were to occur, we could find the costs and effort of development distract our management from our business development strategies and that our financial results are negatively affected as a result.

We may require additional financing in the future and our operations could be curtailed if we are unable to obtain required additional financing when needed.

We may need to obtain additional debt or equity financing to fund future capital expenditures and initiatives. Additional debt financing may include conditions that would restrict our freedom to operate our business, such as conditions that:

● limit our ability to pay dividends or require us to seek consent for the payment of dividends;

● increase our vulnerability to general adverse economic and industry conditions;

● require us to dedicate a portion of our cash flow from operations to payments on our debt, thereby reducing the availability of our cash flow to fund capital expenditures, working capital and other general corporate purposes; and

● limit our flexibility in planning for, or reacting to, changes in our business and our industry.

We cannot guarantee that we will be able to obtain any additional financing on terms that are acceptable to us, or at all.

The loss of any of our key customers could reduce our revenues and our profitability.

Our key customers are principally retail pet specialty stores and mass merchandisers. For the year ended June 30, 2021, sales to our three largest customers amounted in the aggregate to approximately 32.0%, 9.1% and 6.9% of our total revenue. For the year ended June 30, 2020, sales to our three largest customers amounted in the aggregate to approximately 27.6%, 6.5% and 4.4% of our total revenue. For the year ended June 30, 2019, sales to our three largest customers accounted for 28.1%, 13.5% and 5.6% of the Company’s total revenue. There can be no assurance that we will maintain or improve the relationships with these customers, or that we will be able to continue to supply these customers at current levels or at all. Any failure to pay by these customers could have a material negative effect on our company’s business. In addition, having a relatively small number of customers may cause our quarterly results to be inconsistent, depending upon when these customers pay for outstanding invoices. During the years ended June 30, 2021, 2020 and 2019, we had one, one and two customers that accounted for 10% or more of our revenues.

Our bank accounts are not fully insured or protected against loss.

We maintain our cash with various banks and trust companies located in mainland China. Our cash accounts in the PRC are not insured or otherwise protected. Should any bank or trust company holding our cash deposits become insolvent, or if we are otherwise unable to withdraw funds, we would lose the cash on deposit with that particular bank or trust company.

We are substantially dependent upon our senior management and key research and development personnel.

We are highly dependent on our senior management to manage our business and operations and our key research and development personnel for the development of new products and the enhancement of our existing products and technologies. In particular, we rely substantially on our Chief Executive Officer, Mr. Silong Chen.

While we provide the legally required personal insurance for the benefit of our employees, we do not maintain key person life insurance on any of our senior management or key personnel. The loss of any one of them would have a material adverse effect on our business and operations. Competition for senior management and our other key personnel is intense, and the pool of suitable candidates is limited. We may be unable to quickly locate a suitable replacement for any senior management or key personnel that we lose. In addition, if any member of our senior management or key personnel joins a competitor or forms a competing company, they may compete with us for customers, business partners and other key professionals and staff members of our company. Although each of our senior management and key personnel has signed a confidentiality and non-competition agreement in connection with his employment with us, we cannot assure you that we will be able to successfully enforce these provisions in the event of a dispute between us and any member of our senior management or key personnel.

| 9 |

In our efforts to develop new products, we compete for qualified personnel with technology companies and research institutions. Although we have our own research and development team, we also rely heavily on our cooperation with another software development company, which has been helping us develop our high-tech products. This relationship has become an important part of our company’s business development. If this relationship becomes unstable or is terminated in the future, we may be unable to meet our business and financial goals.

Failure to manage our growth could strain our management, operational and other resources, which could materially and adversely affect our business and prospects.

Our growth strategy includes increasing market penetration of our existing products, developing new products and increasing the number and size of customers we serve. Pursuing these strategies has resulted in, and will continue to result in, substantial demands on management resources. In particular, the management of our growth will require, among other things:

| ● | continued enhancement of our research and development capabilities; | |

| ● | stringent cost controls and sufficient liquidity; | |

| ● | strengthening of financial and management controls; | |

| ● | increased marketing, sales and support activities; and | |

| ● | hiring and training of new personnel. |

If we are not able to manage our growth successfully, our business and prospects would be materially and adversely affected.

Because we rely on Hong Kong entities to fulfill orders from many of our customers, we may be exposed to claims of value-added tax underreporting.

Many of our international customers order our products by placing an order with HK Jiasheng or HK Dogness, our Hong Kong subsidiaries. These subsidiaries then procure the products from our mainland China operating companies. When these products are sold from our China operating company to our Hong Kong trading company, the price paid is set at what we believe to be a fair value. Further, we have informed the applicable tax bureaus of the pricing of products. Nevertheless, the tax bureau in the future may claim that we have engaged in transfer pricing to avoid payment of value-added tax (“VAT”) because the price our Hong Kong subsidiary charges to the customer may be higher than the price our China subsidiary charges to our Hong Kong subsidiary. Under PRC law, the VAT is refundable on export, so we believe there is limited risk in the event that we were called upon to pay VAT on such transfers from China to Hong Kong, but a failure to report proper VAT payable could expose us to penalties and interest for failing to pay it on time.

We may be subject to penalties under relevant PRC laws and regulations due to failure to make full social security and housing fund contributions for some of our employees.

In the past, contributions by some of our PRC subsidiaries for some of their employees to the social security and housing funds may not have been in compliance with relevant PRC regulations. Pursuant to the Regulation on the Administration of Housing Accumulation Funds, as amended in 2002, the relevant housing fund authority may order an enterprise to pay outstanding contributions within a prescribed time limit. Pursuant to the PRC Social Insurance Law promulgated in 2010, the social security authority may order an enterprise to pay the outstanding contributions within a prescribed time limit, and may impose penalties if there is a failure to do so. To the extent the relevant authorities determine we have underpaid, some of our PRC subsidiaries may be required to pay outstanding contributions and penalties to the extent they did not make full contributions to the social security housing funds.

| 10 |

Risks Related to Doing Business in China

Increased taxes, duties, tariffs or other restrictions on trade (including Section 301 tariffs imposed by the United States Trade Representative on imported Chinese goods), could adversely affect our financial performance.

In August 2017, the U.S. President directed the United States Trade Representative (“USTR”) to consider investigating China’s laws, policies, practices or actions affecting U.S. intellectual property and forced technology transfers. Based on the findings of the USTR in March 2018 that China’s polices are “unreasonable or discriminatory, and burden or restrict U.S. commerce”, the U.S. President signed a memorandum proposing, among other things, to implement tariffs on certain Chinese imports under Section 301 of the Trade Act of 1974. Since the announcement in May 2018 of a 25% tariff on $50 billion worth of Chinese imports to the U.S., the United States has made multiple announcements of increases in the scope of tariffs covered and the rate of tariffs charged. Current tariffs cover approximately $550 billion of Chinese products imported to the United States and have tariff rates of between 15% and 25%, with proposals to increase to up to 30%.

The U.S. government has taken a variety of actions that may lead to potential changes to U.S. and international trade policies, including recently-imposed tariffs affecting certain products manufactured in China. During the year ended June 30, 2021, our Company paid more than $32,958 in connection with such U.S. imposed tariffs. It is unknown whether and to what extent new tariffs (or other new laws or regulations) will be adopted, or the effect that any such actions would have on us or our industry and customers. Although we currently sell our products FOB Shenzhen and thus complete our sales outside the United States, any unfavorable government policies on international trade, such as capital controls or tariffs, may affect the demand for our products and services, impact the competitive position of our products or prevent us from being able to sell products in certain countries. If any new tariffs, legislation and/or regulations are implemented, or if existing trade agreements are renegotiated or, in particular, if the U.S. government takes retaliatory trade actions due to the recent U.S.-China trade tension, such changes could have an adverse effect on our business, financial condition, results of operations.

Labor laws in the PRC may adversely affect our results of operations.

On June 29, 2007, the PRC government promulgated the Labor Contract Law of the PRC, which became effective on January 1, 2008 and was further amended on December 28, 2012 (effective July 1, 2013). The Labor Contract Law imposes greater liabilities on employers and significantly affects the cost of an employer’s decision to reduce its workforce. Further, it requires certain terminations be based upon seniority and not merit. In the event we decide to significantly change or decrease our workforce, the Labor Contract Law could adversely affect our ability to enact such changes in a manner that is most advantageous to our business or in a timely and cost-effective manner, thus materially and adversely affecting our financial condition and results of operations. The Labor Contract Law also mandates that employers provide social welfare packages to all employees, increasing our labor costs. Under the Regulations on the Administration of Housing Fund effective in 1999, as amended in 2002, PRC companies must register with applicable housing fund management centers and establish a special housing fund account in an entrusted bank. Both PRC companies and their employees are required to contribute to the housing funds. To the extent competitors from outside China are not affected by such requirements, we could be at a comparative disadvantage.

Moreover, although our Chinese subsidiaries have been actively complying with China’s Labor Contract Law, some of our employees have voluntarily requested that we not provide social welfare packages to them because they do not want their salaries and bonus to be deducted proportionally as required by law. These employees are mostly migrant laborers and historically have very high turnover rates. Thus, some of our Chinese subsidiaries’ practices do not strictly comply with Labor Contract Law, even though these practices are very common and popular in many labor-intensive companies of China. Although the aggregate amount we pay these employees as salary exceeds the amount (including social welfare payment) we would be required to pay under applicable minimum wage laws, if a regulatory agency determined that this practice violated the Labor Contract Law, we may be required to pay additional compensation to affected employees.

Under the Enterprise Income Tax Law, we may be classified as a “Resident Enterprise” of China. Such classification will likely result in unfavorable tax consequences to us and our non-PRC shareholders.

China passed an Enterprise Income Tax Law (the “EIT Law”) and implementing rules, both of which became effective on January 1, 2008. Under the EIT Law, resident enterprises pay income tax at the rate of 25% for their worldwide income while non-resident enterprises pay 20% for their income generated from China. As far as the definition of resident enterprises, according to the EIT Law, an enterprise established outside of China with “de facto management bodies” within China is considered a “resident enterprise.” The implementing rules of the EIT Law define de facto management as “substantial and overall management and control over the production and operations, personnel, accounting, and properties” of the enterprise.

| 11 |

On April 22, 2009, the State Administration of Taxation of China issued the Notification 82 Concerning Relevant Issues Regarding Cognizance of Chinese Investment Controlled Enterprises Incorporated Offshore as Resident Enterprises pursuant to Criteria of De Facto Management Bodies (“Notification 82”) further interpreting the application of the EIT Law and its implementation to offshore entities controlled by a Chinese enterprise or group. Pursuant to the Notification 82, an enterprise incorporated in an offshore jurisdiction and controlled by a Chinese enterprise or group will be classified as a “non-domestically incorporated resident enterprise” if (i) its senior management in charge of daily operations reside or perform their duties mainly in China; (ii) its financial or personnel decisions are made or approved by bodies or persons in China; (iii) its substantial assets and properties, accounting books, corporate stamps, board and stockholder minutes are kept in China; and (iv) at least half of its directors with voting rights or senior management are often resident in China. A resident enterprise would have to pay a withholding tax at a rate of 10% when paying dividends to its non-PRC stockholders.

While some of our businesses are conducted in Hong Kong, Dogness International Corporate does have a PRC individual as our primary controlling shareholder. Although Notification 82 did not mention offshore companies incorporated by Chinese individuals, Notification 82 did mention that the facts-oriented recognition is more important than format in the case of recognizing de facto management. Therefore, it is highly likely that we will be classified as a Chinese-controlled offshore incorporated enterprise within the meaning of Notification 82, so we believe Notification 82 will likely apply to us.

As for our Hong Kong businesses, we do not believe that we meet some of the conditions outlined. As trading companies, the key assets and records of HK Jiasheng and HK Dogness including the resolutions and meeting minutes of our board of directors and the resolutions and meeting minutes of our shareholders, are located and maintained outside the PRC. Accordingly, we believe that HK Jiasheng and HK Dogness should not be treated as a “resident enterprise” for PRC tax purposes if the criteria for “de facto management body” as set forth in Notification 82 were deemed applicable to us. However, as the tax residency status of an enterprise is subject to determination by the PRC tax authorities and uncertainties remain with respect to the interpretation of the term “de facto management body” as applicable to our offshore entities, we will continue to monitor our tax status.

If the PRC tax authorities determine that we are a “resident enterprise” for PRC enterprise income tax purposes, a number of unfavorable PRC tax consequences could follow. First, we may be subject to the enterprise income tax at a rate of 25% on our worldwide taxable income as well as PRC enterprise income tax reporting obligations. In our case, this would mean that income such as non-China source income would be subject to PRC enterprise income tax at a rate of 25%. Second, under the EIT Law and its implementing rules, dividends paid to us from our PRC subsidiaries would qualify as “tax-exempt income.” Finally, it is possible that future guidance issued with respect to the new “resident enterprise” classification could result in a situation in which a 10% withholding tax is imposed on dividends we pay to our non-PRC stockholders and with respect to gains derived by our non-PRC stockholders from transferring our shares.

We may be exposed to liabilities under the Foreign Corrupt Practices Act and Chinese anti-corruption law.

We may be subject to the U.S. Foreign Corrupt Practices Act (“FCPA”), and other laws that prohibit improper payments or offers of payments to foreign governments and their officials and political parties by U.S. persons and issuers as defined by the statute for the purpose of obtaining or retaining business. We are also subject to Chinese anti-corruption laws, which strictly prohibit the payment of bribes to government officials. We have operations, agreements with third parties, and make sales in China, which may experience corruption. Our activities in China create the risk of unauthorized payments or offers of payments by one of the employees, consultants or distributors of our company, because these parties are not always subject to our control. We are in process of implementing an anticorruption program, which prohibits the offering or giving of anything of value to foreign officials, directly or indirectly, for the purpose of obtaining or retaining business. The anticorruption program also requires that clauses mandating compliance with our policy be included in all contracts with foreign sales agents, sales consultants and distributors and that they certify their compliance with our policy annually. It further requires that all hospitality involving promotion of sales to foreign governments and government-owned or controlled entities be in accordance with specified guidelines. In the meantime, we believe to date we have complied in all material respects with the provisions of the FCPA and Chinese anti-corruption laws.

| 12 |

However, our existing safeguards and any future improvements may prove to be less than effective, and the employees, consultants or distributors of our Company may engage in conduct for which we might be held responsible. Violations of the FCPA or Chinese anti-corruption laws may result in severe criminal or civil sanctions, and we may be subject to other liabilities, which could negatively affect our business, operating results and financial condition. In addition, the government may seek to hold our Company liable for successor liability FCPA violations committed by companies in which we invest or that we acquire.

Adverse changes in political and economic policies of the PRC government could have a material adverse effect on the overall economic growth of China, which could reduce the demand for our products and materially and adversely affect our competitive position.

Substantially all of our business operations are conducted in China. Accordingly, our business, results of operations, financial condition and prospects are subject to economic, political and legal developments in China. Although China claims that the Chinese economy is no longer a planned economy, the PRC government continues to exercise significant control over China’s economic growth through direct allocation of resources, monetary and tax policies, and a host of other government policies such as those that encourage or restrict investment in certain industries by foreign investors, control the exchange between RMB and foreign currencies, and regulate the growth of the general or specific market. These government involvements have been instrumental in China’s significant growth in the past 30 years. In response to the recent global and Chinese economic downturn, the PRC government has adopted policy measures aimed at stimulating the economic growth in China. If the PRC government’s current or future policies fail to help the Chinese economy achieve further growth or if any aspect of the PRC government’s policies limits the growth of our industry or otherwise negatively affects our business, our growth rate or strategy, our results of operations could be adversely affected as a result.

Governmental control of currency conversion may affect the value of your investment.

The PRC government imposes controls on the convertibility of the RMB into foreign currencies and, in certain cases, the remittance of currency out of China. We receive substantially most of our revenues in RMB. Under our current corporate structure, our income is primarily derived from dividend payments from our PRC subsidiaries. Shortages in the availability of foreign currency may restrict the ability of our PRC subsidiaries to remit sufficient foreign currency to pay dividends or other payments to us, or otherwise satisfy their foreign currency denominated obligations. Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and expenditures from trade-related transactions can be made in foreign currencies without prior approval from SAFE by complying with certain procedural requirements. However, approval from appropriate government authorities is required where RMB is to be converted into foreign currency and remitted out of China to pay capital expenses such as the repayment of loans denominated in foreign currencies. The PRC government may also at its discretion restrict access in the future to foreign currencies for current account transactions. If the foreign exchange control system prevents us from obtaining sufficient foreign currency to satisfy our currency demands, we may not be able to pay dividends in foreign currencies to our security-holders.

We are a holding company and we rely for funding on dividend payments from our subsidiaries, some of which are subject to restrictions under PRC laws.

We are a holding company incorporated in the British Virgin Islands, and we operate our core businesses through our subsidiaries in the PRC, Hong Kong and the United States. The availability of funds for us to pay dividends to our shareholders and to service our indebtedness depends largely upon dividends received from the PRC Subsidiaries. If the PRC Subsidiaries incur debt or losses, their ability to pay dividends or other distributions to us may be impaired. As a result, our ability to pay dividends and to repay our indebtedness will be restricted. PRC laws require that dividends be paid only out of the after-tax profit of the PRC Subsidiaries calculated according to PRC accounting principles, which differ in many aspects from generally accepted accounting principles in other jurisdictions. PRC laws also require enterprises established in the PRC to set aside part of their after-tax profits as statutory reserves. These statutory reserves are not available for distribution as cash dividends. In addition, restrictive covenants in bank credit facilities or other agreements that we or our subsidiaries may enter into in the future may also restrict the ability of our subsidiaries to pay dividends to us. These restrictions on the availability of our funding may impact our ability to pay dividends to our shareholders and to service our indebtedness.

| 13 |

Our business may be materially and adversely affected if any of the PRC Subsidiaries declares bankruptcy or becomes subject to a dissolution or liquidation proceeding.

The Enterprise Bankruptcy Law of the PRC, or the Bankruptcy Law, came into effect on June 1, 2007. The Bankruptcy Law provides that an enterprise will be liquidated if the enterprise fails to settle its debts as and when they fall due and if the enterprise’s assets are, or are demonstrably, insufficient to clear such debts.

The PRC Subsidiaries hold certain assets that are important to our business operations. If any of the PRC Subsidiaries undergoes a voluntary or involuntary liquidation proceeding, unrelated third-party creditors may claim rights to some or all of these assets, thereby hindering our ability to operate our business, which could materially and adversely affect our business, financial condition and results of operations.

According to the SAFE’s Notice of the State Administration of Foreign Exchange on Further Improving and Adjusting Foreign Exchange Administration Policies for Direct Investment, effective on December 17, 2012, and the Provisions for Administration of Foreign Exchange Relating to Inbound Direct Investment by Foreign Investors, effective May 13, 2013, if any of the PRC Subsidiaries undergoes a voluntary or involuntary liquidation proceeding, prior approval from the SAFE for remittance of foreign exchange to our shareholders abroad is no longer required, but we still need to conduct a registration process with the SAFE local branch. It is not clear whether “registration” is a mere formality or involves the kind of substantive review process undertaken by SAFE and its relevant branches in the past.

Our subsidiaries’ financial statements are prepared under different accounting standards than our consolidated financial statements.

We prepare the financial statements for each of our subsidiaries that are PRC legal entities in accordance with the requirements of generally accepted accounting principles in China, or PRC GAAP. These financial statements drive how we calculate the taxes payable for operations of these subsidiaries. By contrast, we prepare the consolidated financial statements for Dogness in accordance with generally accepted accounting principles in the United States, or U.S. GAAP. The process of consolidating the financial statements and changing from PRC GAAP to U.S. GAAP requires us to make certain adjustments on consolidation. This can result in some discrepancies between the financial statements used to prepare our tax filings in China and the financial statements audited by our independent registered accounting firm and subsequently filed with the SEC. To the extent the discrepancies between PRC GAAP and U.S. GAAP are material, we could find, for example, that a PRC subsidiary shows taxable income for which payment of taxes is due, while our U.S. GAAP-audited financial statements show taxable loss.

Fluctuations in exchange rates could adversely affect our business and the value of our securities.

Changes in the value of the RMB against the U.S. dollar, Euro and other foreign currencies are affected by, among other things, changes in China’s political and economic conditions. Any significant revaluation of the RMB may have a material adverse effect on our revenues and financial condition, and the value of, and any dividends payable on our shares in U.S. dollar terms. For example, to the extent that we need to convert U.S. dollars we receive from any securities offering in the United States into RMB for our operations, appreciation of the RMB against the U.S. dollar would have an adverse effect on RMB amount we would receive from the conversion. Conversely, if we decide to convert our RMB into U.S. dollars for the purpose of paying dividends on our Common Shares or for other business purposes, appreciation of the U.S. dollar against the RMB would have a negative effect on the U.S. dollar amount available to us. In addition, fluctuations of the RMB against other currencies may increase or decrease the cost of imports and exports, and thus affect the price-competitiveness of our products against products of foreign manufacturers or products relying on foreign inputs.

Since July 2005, the RMB is no longer pegged to the U.S. dollar. Although the People’s Bank of China regularly intervenes in the foreign exchange market to prevent significant short-term fluctuations in the exchange rate, the RMB may appreciate or depreciate significantly in value against the U.S. dollar in the medium to long term. Moreover, it is possible that in the future PRC authorities may lift restrictions on fluctuations in the RMB exchange rate and lessen intervention in the foreign exchange market.

| 14 |

Since our major operations and assets are located in the PRC, shareholders may find it difficult to enforce a U.S. judgment against the assets of our company, our directors and executive officers.

Part of our business is located in Hong Kong, but major operations and assets are located in the PRC. In addition, most of our executive officers and directors are non-residents of the U.S., and substantially all the assets of such persons are located outside the U.S. As a result, it could be difficult for investors to effect service of process in the U.S., or to enforce a judgment obtained in the U.S. against us or any of these persons. See “Enforceability of Civil Liabilities.”

Uncertainties with respect to the PRC legal system could adversely affect us.

We conduct most of our business through our subsidiaries in Hong Kong and Mainland China. Our operations in Mainland China are governed by PRC laws and regulations. Our PRC subsidiaries are generally subject to laws and regulations applicable to foreign investments in China and, in particular, laws and regulations applicable to wholly foreign-owned enterprises. The PRC legal system is based on statutes. Prior court decisions may be cited for reference but have limited precedential value. Even so, there is still high uncertainty regarding the application of law toward foreign investments.

Since 1979 when China started its reform and opening policy, PRC legislation and regulations have significantly enhanced the protections afforded to various forms of foreign investments in China. However, the interpretation and enforcement of these laws and regulations involve uncertainties due to its ruling party’s political influence. As a result, laws and regulations may vary from time to time and especially some may be subject to political interpretation. This uncertainty may bring about laws and regulations changes unfavorable to foreign investment.

If we become directly subject to the recent scrutiny, criticism and negative publicity involving U.S.-listed Chinese companies, we may have to expend significant resources to investigate and resolve the matter which could harm our business operations and our reputation and could result in a loss of your investment in our shares, especially if such matter cannot be addressed and resolved favorably.

Recently, U.S. public companies that have substantially all of their operations in China, have been the subject of intense scrutiny, criticism and negative publicity by investors, financial commentators and regulatory agencies, such as the SEC. Much of the scrutiny, criticism and negative publicity has centered around financial and accounting irregularities, a lack of effective internal controls over financial accounting, inadequate corporate governance policies or a lack of adherence thereto and, in some cases, allegations of fraud. As a result of the scrutiny, criticism and negative publicity, the publicly traded stock of many U.S. listed Chinese companies has sharply decreased in value and, in some cases, has become virtually worthless. Many of these companies are now subject to shareholder lawsuits and SEC enforcement actions and are conducting internal and external investigations into the allegations. It is not clear what effect this sector-wide scrutiny, criticism and negative publicity will have on our company and our business. If we become the subject of any unfavorable allegations, whether such allegations are proven to be true or untrue, we will have to expend significant resources to investigate such allegations and/or defend the Company. This situation may be a major distraction to our management. If such allegations are not proven to be groundless, our company and business operations will be severely hampered and your investment in our shares could be rendered worthless.

PRC regulations relating to the establishment of offshore special purpose companies by PRC residents may subject our PRC resident shareholders to penalties and limit our ability to inject capital into our PRC subsidiaries, limit our PRC subsidiaries’ ability to distribute profits to us, or otherwise adversely affect us.

The SAFE promulgated the Notice on Relevant Issues Relating to Domestic Resident’s Investment and Financing and Roundtrip Investment through Special Purpose Vehicles, or Notice 37, in July 2014 that requires PRC residents or entities to register with SAFE or its local branch in connection with their establishment or control of an offshore entity established for the purpose of overseas investment or financing. In addition, such PRC residents or entities must update their SAFE registrations when the offshore special purpose vehicle undergoes material events relating to material change of capitalization or structure of the PRC resident itself (such as capital increase, capital reduction, share transfer or exchange, merger or spin off).

| 15 |

Of our current shareholders, five pre-IPO shareholders are individual Chinese residents to whom Notice 37 applies. The remaining pre-IPO shareholders are enterprises and Hong Kong residents, to whom Notice 37 does not apply; provided, however, that to the extent the shareholders of such enterprises are themselves Chinese residents, Notice 37 would apply to such individuals. As of the date of this report, none of the shareholders who are Chinese residents who hold such shares directly or through a Hong Kong enterprise has submitted registration under Notice 37. Although such individuals have promised to complete registration at the time they pay the company’s capital contribution prior to completion of this offering, there can be no assurance such registration will be completed in a timely manner.

We have requested PRC residents whom we know hold direct or indirect interests in our company to make the necessary applications, filings and amendments as required under Notice 37 and other related rules. However, we cannot assure you that the registration will be duly and timely completed with the local SAFE branch or qualified banks. In addition, we may not be informed of the identities of all of the PRC residents holding direct or indirect interests in our company. As a result, we cannot assure you that all of our shareholders or beneficial owners who are PRC residents or entities have complied with, and will in the future make or obtain any applicable registrations or approvals required by, SAFE regulations. Failure by such shareholders or beneficial owners to comply with SAFE regulations, or failure by us to amend the foreign exchange registrations of our PRC subsidiary, could subject us to fines or legal sanctions, restrict our overseas or cross-border investment activities, limit our subsidiaries’ ability to make distributions or pay dividends or affect our ownership structure, which could adversely affect our business and prospects.