UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE |

| |

| SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

|

| For the fiscal year ended |

|

|

|

|

| OR |

|

|

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE |

| |

| SECURITIES EXCHANGE ACT OF 1934 |

|

Commission file number:

(Exact name of registrant as specified in its charter) |

| ||

(State or other jurisdiction of |

| (I.R.S. Employer |

incorporation or organization) |

| Identification No.) |

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: +

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Title of each class

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

☐ | Smaller reporting company | ||

|

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

Common Stock |

| Outstanding at March 31, 2022 |

Common Stock, $0.001 par value per share |

|

The aggregate market value of the 7,156,645 shares of Common Stock of the registrant held by non-affiliates on June 30, 2021, the last business day of the registrant’s second quarter, computed by reference to the closing price reported by the Over-the-Counter Bulletin Board on that date is $

DOCUMENTS INCORPORATED BY REFERENCE: None

TABLE OF CONTENTS.

i |

| Table of Contents |

INTRODUCTORY COMMENT

We are a Nevada holding company with operations conducted through our wholly owned subsidiaries based in Hong Kong and Singapore. Our investors hold shares of common stock in Cosmos Group Holdings Inc., the Nevada holding company. This structure presents unique risks as our investors may never directly hold equity interests in our Hong Kong subsidiary and will be dependent upon contributions from our subsidiaries to finance our cash flow needs. Our ability to obtain contributions from our subsidiaries are significantly affected by regulations promulgated by Hong Kong and Singaporean authorities. Any change in the interpretation of existing rules and regulations or the promulgation of new rules and regulations may materially affect our operations and or the value of our securities, including causing the value of our securities to significantly decline or become worthless. For a detailed description of the risks facing the Company associated with our structure, please refer to “Risk Factors – Risk Relating to Doing Business in Hong Kong.” set forth herein.

Cosmos Group Holdings Inc. and our Hong Kong subsidiaries are not required to obtain permission from the Chinese authorities including the China Securities Regulatory Commission, or CSRC, or Cybersecurity Administration Committee, or CAC, to operate or to issue securities to foreign investors. However, in light of the recent statements and regulatory actions by the People’s Republic of China (“the PRC”) government, such as those related to Hong Kong’s national security, the promulgation of regulations prohibiting foreign ownership of Chinese companies operating in certain industries, which are constantly evolving, and anti-monopoly concerns, we may be subject to the risks of uncertainty of any future actions of the PRC government in this regard including the risk that we inadvertently conclude that such approvals are not required, that applicable laws, regulations or interpretations change such that we are required to obtain approvals in the future, or that the PRC government could disallow our holding company structure, which would likely result in a material change in our operations, including our ability to continue our existing holding company structure, carry on our current business, accept foreign investments, and offer or continue to offer securities to our investors. These adverse actions could cause the value of our common stock to significantly decline or become worthless. We may also be subject to penalties and sanctions imposed by the PRC regulatory agencies, including the Chinese Securities Regulatory Commission, if we fail to comply with such rules and regulations, which would likely adversely affect the ability of the Company’s securities to continue to trade on the Over-the-Counter Bulletin Board, which would likely cause the value of our securities to significantly decline or become worthless.

There may be prominent risks associated with our operations being in Hong Kong. For example, as a U.S.-listed Hong Kong public company, we may face heightened scrutiny, criticism and negative publicity, which could result in a material change in our operations and the value of our common stock. It could also significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless. Additionally, changes in Chinese internal regulatory mandates, such as the M&A rules, Anti-Monopoly Law, and Data Security Law, may target the Company's corporate structure and impact our ability to conduct business in Hong Kong, accept foreign investments, or list on an U.S. or other foreign exchange. Recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement, The business of our subsidiaries are not subject to cybersecurity review with the Cyberspace Administration of China, or CAC, given that: (i) we do not have one million individual online users of our products and services in Hong Kong; (ii) we do not possess a large amount of personal information in our business operations. In addition, we are not subject to merger control review by China’s anti-monopoly enforcement agency due to the level of our revenues which provided from us and audited by our auditor and the fact that we currently do not expect to propose or implement any acquisition of control of, or decisive influence over, any company with revenues within China of more than Renminbi (“RMB”) 400 million. Currently, these statements and regulatory actions have had no impact on our daily business operations, the ability to accept foreign investments and list our securities on an U.S. or other foreign exchange. However, since these statements and regulatory actions are new, it is highly uncertain how soon legislative or administrative regulation making bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any, and the potential impact such modified or new laws and regulations will have on our daily business operation, the ability to accept foreign investments and list our securities on an U.S. or other foreign exchange. For a detailed description of the risks facing the Company and associated with our operations in Hong Kong, please refer to “Risk Factors – Risk Factors Relating to Doing Business in Hong Kong.” set forth herein.

The recent joint statement by the SEC and PCAOB, and the Holding Foreign Companies Accountable Act (HFCAA) all call for additional and more stringent criteria to be applied to emerging market companies upon assessing the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. Trading in our securities may be prohibited under the HFCAA if the PCAOB determines that it cannot inspect or investigate completely our auditor, and that as a result, an exchange may determine to delist our securities. On June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act which would reduce the number of consecutive non-inspection years required for triggering the prohibitions under the HFCAA from three years to two thus reducing the time before our securities may be prohibited from trading or being delisted. On December 2, 2021, the U.S. Securities and Exchange Commission adopted rules to implement the HFCAA. Pursuant to the HFCAA, the Public Company Accounting Oversight Board (PCAOB) issued its report notifying the Commission that it is unable to inspect or investigate completely accounting firms headquartered in mainland China or Hong Kong due to positions taken by authorities in mainland China and Hong Kong. Our auditor is based in Kuala Lumpur, Malaysia and is subject to PCAOB inspection. It is not subject to the determinations announced by the PCAOB on December 16, 2021. However, in the event the Malaysian authorities subsequently take a position disallowing the PCAOB to inspect our auditor, then we would need to change our auditor to avoid having our securities delisted. Furthermore, due to the recent developments in connection with the implementation of the HFCAA, we cannot assure you whether the SEC or other regulatory authorities would apply additional and more stringent criteria to us after considering the effectiveness of our auditor’s audit procedures and quality control procedures, adequacy of personnel and training, or sufficiency of resources, geographic reach or experience as it relates to the audit of our financial statements. The requirement in the HFCAA and the Accelerating Holding Foreign Companies Act that the PCAOB be permitted to inspect the issuer’s public accounting firm within two or three years, may result in the delisting of our securities from applicable trading markets in the U.S, in the future if the PCAOB is unable to inspect our accounting firm at such future time. Please see “Risk Factors - The Holding Foreign Companies Accountable Act requires the Public Company Accounting Oversight Board (PCAOB) to be permitted to inspect the issuer's public accounting firm within three years. This three-year period will be shortened to two years if the Accelerating Holding Foreign Companies Accountable Act is enacted. There are uncertainties under the PRC Securities Law relating to the procedures and requisite timing for the U.S. securities regulatory agencies to conduct investigations and collect evidence within the territory of the PRC. If the U.S. securities regulatory agencies are unable to conduct such investigations, they may suspend or de-register our registration with the SEC and delist our securities from applicable trading market within the US.” set forth herein.

ii |

| Table of Contents |

In addition to the foregoing risks, we face various legal and operational risks and uncertainties arising from doing business in Hong Kong as summarized below and in “Risk Factors — Risks Relating to Doing Business in Hong Kong” set forth herein.

| · | Adverse changes in economic and political policies of the PRC government could have a material and adverse effect on overall economic growth in China and Hong Kong, which could materially and adversely affect our business. Please see “Risk Factors - We face the risk that changes in the policies of the PRC government could have a significant impact upon the business we may be able to conduct in Hong Kong and the profitability of such business.” and “Substantial uncertainties and restrictions with respect to the political and economic policies of the PRC government and PRC laws and regulations could have a significant impact upon the business that we may be able to conduct in the PRC and accordingly on the results of our operations and financial condition.” set forth herein. |

| · | We are a holding company with operations conducted through our wholly owned subsidiaries based in Hong Kong and Singapore. This structure presents unique risks as our investors may never directly hold equity interests in our Hong Kong subsidiary and will be dependent upon contributions from our subsidiaries to finance our cash flow needs. Any limitation on the ability of our subsidiaries to make payments to us could have a material adverse effect on our ability to conduct business. We do not anticipate paying dividends in the foreseeable future; you should not buy our stock if you expect dividends. Please see ”Risk Factors - Because our holding company structure creates restrictions on the payment of dividends, our ability to pay dividends is limited. |

| · | PRC regulation of loans to and direct investments in PRC entities by offshore holding companies may delay or prevent us from using the proceeds of this offering to make loans or additional capital contributions to our operating subsidiaries in Hong Kong. Substantial uncertainties exist with respect to the interpretation of the PRC Foreign Investment Law and how it may impact the viability of our current corporate structure, corporate governance and business operations. Please see ‘Risk Factors - PRC regulation of loans to and direct investment in PRC entities by offshore holding companies and governmental control of currency conversion may delay or prevent us from using the proceeds we receive from offshore financing activities to make loans to or make additional capital contributions to our Hong Kong subsidiaries, which could materially and adversely affect our liquidity and our ability to fund and expand business.” set forth herein. |

| · | In light of China’s extension of its authority into Hong Kong, the Chinese government can change Hong Kong’s rules and regulations at any time with little to no advance notice, and can intervene and influence our operations and business activities in Hong Kong. We are currently not required to obtain approval from Chinese authorities to list on U.S. exchanges. However, if our subsidiaries or the holding company were required to obtain approval in the future, or we erroneously conclude that approvals were not required, or we were denied permission from Chinese authorities to operate or to list on U.S. exchanges, we will not be able to continue listing on a U.S. exchange and the value of our common stock would likely significantly decline or become worthless, which would materially affect the interest of the investors. There is a risk that the Chinese government may intervene or influence our operations at any time, or may exert more control over offerings conducted overseas and/or foreign investment in Hong Kong-based issuers, which could result in a material change in our operations and/or the value of our securities. Further, any actions by the Chinese government to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers would likely significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless. Please see “Risk Factors - We face the risk that changes in the policies of the PRC government could have a significant impact upon the business we may be able to conduct in the Hong Kong and the profitability of such business.” and “Substantial uncertainties and restrictions with respect to the political and economic policies of the PRC government and PRC laws and regulations could have a significant impact upon the business that we may be able to conduct in Hong Kong and accordingly on the results of our operations and financial condition.” and “The Chinese government exerts substantial influence over the manner in which we must conduct our business activities. We are currently not required to obtain approval from Chinese authorities to list on U.S. exchanges. However, to the extent that the Chinese government exerts more control over offerings conducted overseas and/or foreign investment in China-based issuers over time and if our PRC subsidiaries or the holding company were required to obtain approval in the future and were denied permission from Chinese authorities to list on U.S. exchanges, we will not be able to continue listing on U.S. exchange and the value of our common stock may significantly decline or become worthless, which would materially affect the interest of the investors.” set forth herein. |

iii |

| Table of Contents |

| · | Governmental control of currency conversion may limit our ability to utilize our revenues effectively and affect the value of your investment. |

| · | We may become subject to a variety of laws and regulations in the PRC regarding privacy, data security, cybersecurity, and data protection. We may be liable for improper use or appropriation of personal information provided by our customers. Please see “Risk Factors - The Chinese government exerts substantial influence over the manner in which we must conduct our business activities. We are currently not required to obtain approval from Chinese authorities to list on U.S exchanges. However, to the extent that the Chinese government exerts more control over offerings conducted overseas and/or foreign investment in China-based issuers over time and if our PRC subsidiaries or the holding company were required to obtain approval in the future and were denied permission from Chinese authorities to list on U.S. exchanges, we will not be able to continue listing on U.S. exchange and the value of our common stock may significantly decline or become worthless, which would materially affect the interest of the investors.” set forth herein. |

| · | Under the Enterprise Income Tax Law of the PRC (“EIT Law”), we may be classified as a “Resident Enterprise” of China. Such classification will likely result in unfavorable tax consequences to us and our non-PRC shareholders. Please see “Risk Factors - Our global income may be subject to PRC taxes under the PRC Enterprise Income Tax Law, which could have a material adverse effect on our results of operations.” set forth herein. |

| · | Failure to comply with PRC regulations relating to the establishment of offshore special purpose companies by PRC residents may subject our PRC resident Shareholders to personal liability, may limit our ability to acquire Hong Kong and PRC companies or to inject capital into our Hong Kong subsidiary, may limit the ability of our Hong Kong subsidiaries to distribute profits to us or may otherwise materially and adversely affect us. |

| · | The recent joint statement by the SEC and PCAOB, and the HFCAA all call for additional and more stringent criteria to be applied to emerging market companies upon assessing the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. Trading in our securities may be prohibited under the HFCAA if the PCAOB determines that it cannot inspect or investigate completely our auditor, and that as a result an exchange may determine to delist our securities. On June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act which would reduce the number of consecutive non-inspection years required for triggering the prohibitions under the HFCAA from three years to two thus reducing the time before our securities may be prohibited from trading or being delisted. On December 2, 2021, the U.S. Securities and Exchange Commission adopted rules to implement the HFCAA. Pursuant to the HFCAA, the Public Company Accounting Oversight Board (PCAOB) issued its report notifying the Commission that it is unable to inspect or investigate completely accounting firms headquartered in mainland China or Hong Kong due to positions taken by authorities in mainland China and Hong Kong. Our auditor is not subject to the determinations announced by the PCAOB on December 16, 2021. However, in the event the Malaysian authorities subsequently take a position disallowing the PCAOB to inspect our auditor, then we would need to change our auditor to avoid having our securities delisted. Please see “Risk Factors - The Holding Foreign Companies Accountable Act requires the Public Company Accounting Oversight Board (PCAOB) to be permitted to inspect the issuer's public accounting firm within three years. This three-year period will be shortened to two years if the Accelerating Holding Foreign Companies Accountable Act is enacted. There are uncertainties under the PRC Securities Law relating to the procedures and requisite timing for the U.S. securities regulatory agencies to conduct investigations and collect evidence within the territory of the PRC. If the U.S. securities regulatory agencies are unable to conduct such investigations, they may suspend or de-register our registration with the SEC and delist our securities from applicable trading market within the US.” set forth herein. |

| · | You may be subject to PRC income tax on dividends from us or on any gain realized on the transfer of shares of our common stock. Please see “Risk Factors - Dividends payable to our foreign investors and gains on the sale of our shares of common stock by our foreign investors may become subject to tax by the PRC.” set forth herein. |

| · | We face uncertainties with respect to indirect transfers of equity interests in PRC resident enterprises by their non-PRC holding companies. Please see “Risk Factors - We and our shareholders face uncertainties with respect to indirect transfers of equity interests in PRC resident enterprises by their non-PRC holding companies.” set forth herein. |

| · | We are organized under the laws of the State of Nevada as a holding company that conducts its business through a number of subsidiaries organized under the laws of foreign jurisdictions such as Hong Kong, Singapore and the British Virgin Islands. This may have an adverse impact on the ability of U.S. investors to enforce a judgment obtained in U.S. Courts against these entities, bring actions in Hong Kong against us or our management or to effect service of process on the officers and directors managing the foreign subsidiaries. Please see “Risk Factors - It may be difficult for stockholders to enforce any judgment obtained in the United States against us, which may limit the remedies otherwise available to our stockholders.” set forth herein. |

| · | U.S. regulatory bodies may be limited in their ability to conduct investigations or inspections of our operations in China. |

| · | There are significant uncertainties under the EIT Law relating to the withholding tax liabilities of our PRC subsidiary, and dividends payable by our PRC subsidiary to our offshore subsidiaries may not qualify to enjoy certain treaty benefits. Please see “Risk Factors - Our global income may be subject to PRC taxes under the PRC Enterprise Income Tax Law, which could have a material adverse effect on our results of operations.” set forth herein. |

References in this registration statement to the “Company,” “COSG,” “we,” “us” and “our” refer Cosmos Group Holdings Inc., a Nevada company and all of its subsidiaries on a consolidated basis. Where reference to a specific entity is required, the name of such specific entity will be referenced.

iv |

| Table of Contents |

Transfers of Cash to and from Our Subsidiaries

Cosmos Group Holdings Inc. is a Nevada holding company with no operations of its own. We conduct our operations in Hong Kong primarily through our subsidiaries in Hong Kong and Singapore. We may rely on dividends to be paid by our Hong Kong and Singapore subsidiaries to fund our cash and financing requirements, including the funds necessary to pay dividends and other cash distributions to our shareholders, to service any debt we may incur and to pay our operating expenses. In order for us to pay dividends to our shareholders, we will rely on payments made from our Hong Kong and Singapore subsidiaries to Cosmos Group Holdings Inc. To date, our subsidiaries have not made any transfers, dividends or distributions to Cosmos Group Holdings Inc. and Cosmos Group Holdings Inc. has not made any transfers, dividends or distributions to our subsidiaries or to U.S. investors.

We do not intend to make dividends or distributions to investors of Cosmos Group Holdings Inc. in the foreseeable future.

We currently intend to retain all available funds and future earnings, if any, for the operation and expansion of our business and do not anticipate declaring or paying any dividends in the foreseeable future. Any future determination related to our dividend policy will be made at the discretion of our board of directors after considering our financial condition, results of operations, capital requirements, contractual requirements, business prospects and other factors the board of directors deems relevant, and subject to the restrictions contained in any future financing instruments.

Cosmos Group Holdings Inc. (Nevada corporation)

Subject to the Nevada Revised Statutes and our bylaws, our board of directors may authorize and declare a dividend to shareholders at such time and of such an amount as they think fit if they are satisfied, on reasonable grounds, that immediately following the dividend the value of our assets will exceed our liabilities and we will be able to pay our debts as they become due. There is no further Nevada statutory restriction on the amount of funds which may be distributed by us by dividend. Accordingly, Cosmos Group Holdings Inc. is permitted under the Nevada laws to provide funding to our subsidiaries in Singapore and Hong Kong through loans or capital contributions without restrictions on the amount of the funds, subject to satisfaction of applicable government registration, approval and filing requirements.

Singapore and Hong Kong Subsidiaries

Our Hong Kong subsidiaries and our Singapore subsidiary are also permitted under the laws of Hong Kong and Singapore to provide funding to Cosmos Group Holdings Inc. through dividend distribution without restrictions on the amount of the funds. If our Hong Kong and Singapore subsidiaries incur debt on their own behalf in the future, the instruments governing the debt may restrict their ability to pay dividends or make other distributions to us. To date, our subsidiaries have not made any transfers, dividends or distributions to Cosmos Group Holdings Inc. and Cosmos Group Holdings Inc. has not made any transfers, dividends or distributions to our subsidiaries.

Under the current practice of the Inland Revenue Department of Hong Kong, no tax is payable in Hong Kong in respect of dividends paid by us. The laws and regulations of the PRC do not currently have any material impact on transfer of cash from Cosmos Group Holdings Inc. to our Hong Kong subsidiaries or from our Hong Kong subsidiaries to Cosmos Group Holdings Inc. There are no restrictions or limitation under the laws of Hong Kong imposed on the conversion of HK dollar into foreign currencies and the remittance of currencies out of Hong Kong or across borders and to U.S investors.

PRC Laws

Current PRC regulations permit PRC subsidiaries to pay dividends to Hong Kong subsidiaries only out of their accumulated profits, if any, determined in accordance with Chinese accounting standards and regulations. In addition, each of our subsidiaries in China is required to set aside at least 10% of its after-tax profits each year, if any, to fund a statutory reserve until such reserve reaches 50% of its registered capital. Each of such entity in China is also required to further set aside a portion of its after-tax profits to fund the employee welfare fund, although the amount to be set aside, if any, is determined at the discretion of its board of directors. Although the statutory reserves can be used, among other ways, to increase the registered capital and eliminate future losses in excess of retained earnings of the respective companies, the reserve funds are not distributable as cash dividends except in the event of liquidation. As of the date of this report, we do not have any PRC subsidiaries.

v |

| Table of Contents |

The PRC government also imposes controls on the conversion of RMB into foreign currencies and the remittance of currencies out of the PRC. Therefore, we may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency for the payment of dividends from our profits, if any. Furthermore, if our subsidiaries in the PRC incur debt on their own in the future, the instruments governing the debt may restrict their ability to pay dividends or make other payments. If we or our subsidiaries are unable to receive all of the revenues from our operations, we may be unable to pay dividends on our common stock.

Cash dividends, if any, on our common stock will be paid in U.S. dollars. If we are considered a PRC tax resident enterprise for tax purposes, any dividends we pay to our overseas shareholders may be regarded as China-sourced income and as a result may be subject to PRC withholding tax at a rate of up to 10.0%.

If in the future we have PRC subsidiaries, certain payments from such PRC subsidiaries to Hong Kong subsidiaries will be subject to PRC taxes, including business taxes and VAT. As of the date of this report, we do not have any PRC subsidiaries and our Hong Kong subsidiaries have not made any transfers, dividends or distributions nor do we expect to make such transfers, dividends or distributions in the foreseeable future.

Pursuant to the Arrangement between Mainland China and the Hong Kong Special Administrative Region for the Avoidance of Double Taxation and Tax Evasion on Income, or the Double Tax Avoidance Arrangement, the 10% withholding tax rate may be lowered to 5% if a Hong Kong resident enterprise owns no less than 25% of a PRC entity. However, the 5% withholding tax rate does not automatically apply and certain requirements must be satisfied, including, without limitation, that (a) the Hong Kong entity must be the beneficial owner of the relevant dividends; and (b) the Hong Kong entity must directly hold no less than 25% share ownership in the PRC entity during the 12 consecutive months preceding its receipt of the dividends. In current practice, a Hong Kong entity must obtain a tax resident certificate from the Hong Kong tax authority to apply for the 5% lower PRC withholding tax rate. As the Hong Kong tax authority will issue such a tax resident certificate on a case-by-case basis, we cannot assure you that we will be able to obtain the tax resident certificate from the relevant Hong Kong tax authority and enjoy the preferential withholding tax rate of 5% under the Double Taxation Arrangement with respect to dividends to be paid by a PRC subsidiary to its immediate holding company. As of the date of this report, we do not have a PRC subsidiary. In the event that we acquire or form a PRC subsidiary in the future and such PRC subsidiary desires to declare and pay dividends to our Hong Kong subsidiary, our Hong Kong subsidiary will be required to apply for the tax resident certificate from the relevant Hong Kong tax authority. In such event, we plan to inform the investors through SEC filings, such as a current report on Form 8-K, prior to such actions. See “Risk Factors – Risk Factors Relating to Doing Business in Hong Kong.” set forth herein.

vi |

| Table of Contents |

CAUTIONARY NOTE CONCERNING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K includes "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended that are not historical facts, and involve risks and uncertainties that could cause actual results to differ materially from those expected and projected. All statements, other than statements of historical facts, included in this Form 10-K including, without limitation, statements in the “Market Overview” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” regarding the Company’s market projections, financial position, business strategy and the plans and objectives of management for future operations, events or developments which the Company expects or anticipates will or may occur in the future, including such things as future capital expenditures (including the amount and nature thereof); expansion and growth of the Company's business and operations; and other such matters are forward-looking statements. These statements are based on certain assumptions and analyses made by the Company in light of its experience and its perception of historical trends, current conditions and expected future developments, as well as other factors it believes are appropriate under the circumstances. However, whether actual results or developments will conform with the Company's expectations and predictions is subject to a number of risks and uncertainties, including general economic, market and business conditions; the business opportunities (or lack thereof) that may be presented to and pursued by the Company; changes in laws or regulation; and other factors, most of which are beyond the control of the Company.

These forward-looking statements can be identified by the use of predictive, future-tense or forward-looking terminology, such as "believes," "anticipates," "expects," "estimates," "plans," "may," "will," or similar terms. These statements appear in a number of places in this filing and include statements regarding the intent, belief or current expectations of the Company, and its directors or its officers with respect to, among other things: (i) trends affecting the Company's financial condition or results of operations for its limited history; (ii) the Company's business and growth strategies; and, (iii) the Company's financing plans. Investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve significant risks and uncertainties, and that actual results may differ materially from those projected in the forward-looking statements as a result of various factors. Such factors that could adversely affect actual results and performance include, but are not limited to, the Company's limited operating history, potential fluctuations in quarterly operating results and expenses, government regulation, technological change and competition. For information identifying important factors that could cause actual results to differ materially from those anticipated in the forward-looking statements, please refer to the Risk Factors section herein.

Consequently, all of the forward-looking statements made in this Form 10-K are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated by the Company will be realized or, even if substantially realized, that they will have the expected consequence to or effects on the Company or its business or operations. The Company assumes no obligations to update any such forward-looking statements.

vii |

| Table of Contents |

PART I

ITEM 1. DESCRIPTION OF BUSINESS.

History

We were incorporated in the state of Nevada on August 14, 1987, under the name Shur De Cor, Inc. and engaged in developing certain mining claims. In April 1999, Shur De Cor merged with Interactive Marketing Technology, a New Jersey corporation that was engaged in the business of developing and direct marketing of consumer products. As the surviving company, Shur De Cor changed its name to Interactive Marketing Technology, Inc. Shur De Cor's then management resigned and the management of Interactive New Jersey became the Company’s management. The prior management of Shur De Cor retained Shur De Cor’s business and assets. After that acquisition, the Company, through a wholly owned subsidiary, IMT's Plumber, Inc., produced, marketed, and sold a licensed product called the Plumber's Secret, which was discontinued in fiscal 2001. In May 2002, the Company ceased to actively pursue its product development and marketing business and actively sought to either acquire a third party, merge with a third party or pursue a joint venture with a third party in order to re-enter its former business of development and direct marketing of proprietary consumer products in the United States and worldwide.

On November 17, 2004, the Company acquired MPL, a company organized under the laws of the British Virgin Islands, and its subsidiaries in accordance with the terms of a Share Exchange Agreement executed by the parties (the “2004 Agreement”). In connection with the acquisition, the Company issued an aggregate of 109,623,006 shares of its common stock to Imperial International Limited, a company incorporated under the laws of the British Virgin Islands (“Imperial”), the sole shareholder of MPL, in exchange for 100% of the issued and outstanding shares of MPL capital stock (the "2004 Share Exchange"). Upon completion of the share exchange, MPL became the Company's wholly owned subsidiary and the Company’s former owner transferred control of the Company to Imperial. The Company relied on Rule 506 of Regulation D of the Securities Act of 1933, as amended (the "Act"), in regard to the shares that we issued pursuant to the 2004 Share Exchange. The Company treated this transaction as a qualified "business combination" as defined by Rule 501(d). The Company relied on the exemption from registration pursuant to Section 4(2) of, and Regulation D promulgated under, the Act in issuing the Company’s securities.

In connection with the 2004 Share Exchange, the Company: (i) changed its name from Interactive Marketing Technology, Inc. to China Artists Agency, Inc.; (ii) obtained a new stock symbol, "CAAY", and CUSIP Number, effective on December 21, 2004; (iii) increased its authorized common stock to 200,000,000 shares; (iv) effectuated a 1 for 1.69 reverse stock split; and (v) spun off the Company’s existing business into a separate public company, All Star Marketing, Inc., a Nevada corporation ("All Star"). All Star was formed as a wholly owned subsidiary of the Company. The Spin-off was satisfied by means of a pro-rata share dividend to the Company's shareholders of record as of December 10, 2004. The purpose of the Spin-Off was to allow the subsidiary to operate as a separate public company and raise working capital through the sale of its own equity. This allowed the Company’s management to focus on its business, while at the same time, allowing the spun-off company to have greater exposure by trading as an independent public company. Additionally, the shareholders and the market would then more easily identify the results and performance of the Company as a separate entity from that of All Star. In August 2005, the Company changed its name to China Entertainment Group, Inc. and effective August 9, 2005, obtained a new stock symbol "CGRP", and CUSIP Number.

Effective July 22, 2010, the Company merged with Safe and Secure TV Channel, LLC, a Delaware limited liability company (the “Merger”). In connection with the Merger, the management of the Company resigned and was replaced by the management and principals of Safe and Secure TV Channel, LLC. The holders of interests in Safe and Secure TV Channel, LLC exchanged their interests for approximately 50.2% of the issued and outstanding stock of the Company. In September 2010, the Company effectuated a 9.85 for one stock split to shareholders of record as of August 23, 2010. After the Merger, the Company became a television network and multimedia information and distribution company focused on serving the homeland security and emergency preparedness industry.

On February 15, 2016, the Company sold to Asia Cosmos Group Limited, a private limited liability company incorporated under the laws of British Virgin Islands (“ACOSG”), 10,000,000 shares of its common stock at a per share price of $0.027. ACOSG’s sole shareholder is Miky Wan. The Company relied on the exemption from registration pursuant to Section 4(2) of, and Regulation D and/or Regulation S promulgated under the Act in selling the Company’s securities to ACOSG. In connection with the private placement to ACOSG, a change of control occurred and Bryan Glass resigned from his position as President, Secretary, Treasurer and Chairman of the Company.

Miky Wan was appointed to serve as Chief Executive Officer, Chief Operating Officer, President and Director, effective February 19, 2016.

Effective February 26, 2016, the Company changed its name to Cosmos Group Holdings Inc. and filed a Certificate of Amendment to such effect with the Nevada Secretary of State. The name change and the related stock symbol change to “COSG” were approved by the Financial Industry Regulatory Authority on March 31, 2016. The Company also increased the number of its authorized common stock, par value $0.001, from 90,000,0000 shares to 500,000,000 and its preferred stock, par value $0.001, from 10,000,000 to 30,000,000 shares.

| 1 |

| Table of Contents |

On January 13, 2017, the Company sold 200,000,000 shares of its common stock to ACOSG at a per share price of $0.001 per share for aggregate consideration of US $200,000. The Company relied on the exemption from registration pursuant to Section 4(2) of, and Regulation D and/or Regulation S promulgated under the Act in selling the Company’s securities to ACOSG.

Acquisition of Lee Tat, Our Logistics Business

On May 12, 2017, the Company acquired all of the issued and outstanding shares of Lee Tat from Mr. Koon Wing Cheung, Lee Tat’s sole shareholder, in exchange for 219,222,938 shares of its issued and outstanding common stock. In connection with the Lee Tat acquisition, Miky Wan resigned from her positions as Chief Executive Officer and Chief Operating Officer and Koon Wing Cheung and Yongwei Hu were appointed to serve as our Chief Executive Officer and Chief Operating Officer, respectively, and also as directors of the Company. The Company relied on the exemption from registration pursuant to Section 4(2) of, and Regulation D and/or Regulation S promulgated under the Act in selling the Company’s securities to the shareholders of Lee Tat.

Termination of Our Artificial Intelligence Educational Content Business

Acquisition and Rescission of Acquisition of HKHL

On July 19, 2019, the Company acquired 5,100 Ordinary Shares of Hong Kong Healthtech Limited, a limited company organized under the laws of Hong Kong (“HKHL”), from Wing Lok Jonathan So pursuant to the terms of a Share Exchange Agreement (the “Share Exchange Agreement”). Such securities represented approximately 51% of the issued and outstanding securities of HKHL. As consideration, the Company issued 6,232,951 shares of its common stock, at a per share price of US$8.99. As a result of such acquisition, the Company entered into the AI Education business of developing and delivering educational content.

In connection with the Share Exchange, we entered into employment agreements with the following individuals in connection with their appointment to the offices set forth next to their names:

Tze Wai Albert Yip | Chief Financial Officer |

Wing Lok Jonathan So | Chief Strategy Officer |

Kai Chi Wong | Chief Operating Officer |

On December 27, 2019, the parties mutually terminated the Share Exchange Agreement and IP License Agreement. As a result, 5,100 Ordinary Shares of HKHL were returned to Wing Lok Jonathan So and the 6,232,951 shares of our common stock issued in exchange therefor were returned to us for cancellation. In connection with the termination, on December 30, 2019, Kai Chi Wong resigned from his position as Chief Operating Officer of the Company. Koon Wing Cheung transferred to Kai Chi Wong 215,369 shares of Common Stock of the Company as a token of appreciation of Mr. Wong’s contribution to the Company.

The Company ultimately exited from the AI Education business in the first quarter of 2020. As a result,

· | The Employment Agreement, dated July 19, 2019, by and between Cosmos Group Holdings Inc. and Wing Lok Jonathan So was terminated by the parties thereto effective on March 31, 2020, and Mr. Tze Wai Albert Yip resigned from his position as the Chief Financial Officer, effective on 30 April 2020. |

· | Syndicate Capital (Asia) Limited returned 1,503,185 shares of the Company’s common stock (of the 2,149,293, shares previously transferred to Syndicate Capital (Asia) Limited from Koon Wing Cheung), with the balance of the 646,108 shares retained by Syndicate Capital (Asia) Limited as consideration for Mr. Tze Wai Albert Yip’s contributions to the Company. |

Change in Control

On June 14, 2021, Asia Cosmos Group Limited, an entity controlled by our former Chief Executive Officer, and Koon Wing Cheung agreed to sell 6,230,618 and 8,149,670 shares, respectively, of our common stock to Chan Man Chung for a total purchase price of four hundred twenty thousand dollars (US$420,000). The common stock being sold constitutes sixty-six and seventy-seven hundredth percent (66.77%) of the issued and outstanding shares of our common stock. The sellers relied on the exemption from registration pursuant to Section 4(2) of, and Regulation D and/or Regulation S promulgated under the Act in selling the Company’s securities to Dr. Chan. The funds came from the personal funds of Dr. Chan, and was not the result of a loan. The closing occurred June 28, 2021.

In connection with such sale, Miky Wan, our former CEO, President and CFO resigned from her positions as a director and sole executive officer of the Company. Concurrently therewith, Messrs. Chan Man Chung, Lee Ying Chiu Herbert and Tan Tee Soo were appointed to the Company’s Board of Directors and Chan Man Chung was appointed to serve as the CEO, CFO and Secretary of the Company.

| 2 |

| Table of Contents |

Acquisition of Massive Treasure Limited and Entities

On June 17, 2021, the Company entered into a Share Acquisition Agreement (the “Share Acquisition Agreement”), by and among the Company, Massive Treasure Limited (“Massive Treasure”), a British Virgin Islands corporation, and the holders of ordinary shares of Massive Treasure. Under the terms and conditions of the Share Acquisition Agreement, the Company offered to issue 1,078,269,470 shares of common stock of the Company, in consideration for all the issued and outstanding shares in Massive Treasure. Lee Ying Chiu Herbert, our director, is the beneficial holder of 47,500 common shares, or 95%, of the issued and outstanding shares of Massive Treasure. The Company will also issue 55,641,014 shares to complete the acquisitions of 12 business entities with Massive Treasure has signed.

As of the date of this report, these acquisitions consummated on September 17, 2021 with 800,000,000 shares of common stock pending to be issued to Lee Ying Chiu Herbert.

Acquisition of Art Collectibles

Recent Purchases of Collectibles and Acquisition of subsidiaries

On July 23, 2021, the Company and Lee Ying Chiu Herbert, our director, entered into a Sale and Purchase Agreement pursuant to which the Company agreed to purchase Fifty-Five (55) sets of art collectibles for HK$10,344,000, payable through the issuance of 180,855 shares of common stock of the Company (the “Shares”). The sale consummated on August 13, 2021. It is our understanding that Dr. Lee is not a U.S. Person within the meaning of Regulations S. Accordingly, the Shares were sold pursuant to the exemption provided by Section 4(a)(2) of the Securities Act of 1933, as amended, and Regulation S promulgated thereunder.

On October 15, 2021, Massive Treasure, a subsidiary of Cosmos Group Holdings Inc., the Company, NFT Limited (“NFT”), a British Virgin Island limited liability company, and the shareholders of NFT (collectively, the “NFT Shareholders”) agreed to entered into a Share Exchange Agreement Version 2021001 (the “Agreement”) which is available on the web site of http://www.coinllectibles.art, pursuant to which Massive Treasure agreed to acquire 51% of NFT through the issuance of 2,350,229 shares of common stock of the Company (the “Shares”). The specifics of such share exchange are further set forth in that certain Confirmation dated October 15, 2021, by and among the Shareholders, NFT, the Company and Massive Treasure (the “Confirmation”). The consummation of the Agreement occurred upon the issuance of the Shares to the NFT Shareholders on October 22, 2021. NFT beneficially owns Talk+, a messaging and cryptocurrency-focused mobile application which seeks to simplify the crypto usage experience by allowing users to send crypto through instant messages to other individuals. We hope that the inclusion of Talk+ will enable us to attract more non-crypto native users and broaden our community reach.

On October 25, 2021, Coinllectibles Private Limited (“Coinllectibles”), a subsidiary of Cosmos Group Holdings Inc., and the Company entered into two Sale and Purchase Agreements (the “Agreements”) with two artists, pursuant to which Coinllectibles agreed to purchase collectible art items for £260,000 and US$100,000, payable through the issuance of 43,633 and 12,500 shares of common stock of the Company respectively, at a per share price of $4.00, and £130,000 and US$50,000 in cash payable after the respective collectible art item has been sold by Coinllectibles. The consummation of the Agreements occurs upon the issuance of the Shares to the respective artists on October 29, 2021.

On February 10, 2022, we consummated the acquisition of 80% of the issued and outstanding securities of Grand Gallery Limited, a Hong Kong limited liability company engaged in the business of selling traditional art and collectible pieces, through the issuance of 153,060 shares of our common stock, at a valuation of $4.00 per share. We believe that this acquisition will strengthen our DOT business by expanding our access to buyers of arts and collectibles.

Other Activities

In March 2022, we launched a new sports division in our MetaMall and partnering with a former NBA basketball player as president of Coinllectible Sports. We hope to exploit our DOT technology and the metaverse to bring innovation to the sports space, bridge the intersection of our DOT technology and Sports memorabilia to improve experiences for fans, athletes, teams, events and partners.

3 |

Our Business

We are a Nevada holding company with operations conducted through our subsidiaries based in Singapore and Hong Kong. The Company, through its subsidiaries, is engaged in two business segments: (i) the physical arts and collectibles business, and (ii) the financing/money lending business.

Through our physical arts and collectibles business, we provide authentication, valuation and certification (“AVC”) service, sale and purchase, hire purchase, financing, custody, security and exhibition (“CSE”) services to art and collectibles buyers through traditional methods as well as through leveraging blockchain technology through the creation of Digital Ownership Tokens (“DOTs”). We initially intend to focus on customers located in Hong Kong and expand throughout Asia and the rest of the world.

We conduct our DOT operations from Singapore. In Singapore, cryptocurrencies and the custodianship of such cryptocurrencies are not specifically regulated. Cryptocurrency exchanges and trading of cryptocurrencies are legal, but not considered legal tender. To the extent that cryptocurrencies or tokens are considered “capital market products” such as securities, spot foreign exchange contracts, derivatives and the like, they will be subject to the jurisdiction of the Monetary Authority of Singapore (“MAS”), Securities and Futures Act, anti-money laundering and combating the financing of terrorism laws and requirements. To the extent that tokens are deemed “digital payment tokens,” they will be subject to the Payment Services Act of 2019 which, among other things, require compliance with anti-money laundering and combating the financing of terrorism laws and requirements. According to the Payment Services Act of 2019, “digital payment token” means any digital representation of value (other than an excluded digital representation of value) that (a) is expressed as a unit; (b) is not denominated in any currency, and is not pegged by its issuer to any currency; (c) is, or is intended to be, a medium of exchange accepted by the public, or a section of the public, as payment for goods or services or for the discharge of a debt; (d) can be transferred, stored or traded electronically; and (e) satisfies such other characteristics as the Authority may prescribe. Our DOTs, therefore, are not securities or digital payment tokens subject to these acts.

We receive fiat and cryptocurrency from the sale of art and collectibles and collection of transaction fees derived from the secondary and subsequent sales of the collectibles. In order to minimize the risk of price fluctuation in cryptocurrency, after we receive the cryptocurrencies we will recognize the value by immediately exchange them into US dollar or stable currencies that are pegged with US dollar.

We conduct our financing/money lending business through our Hong Kong subsidiaries which are licensed under Hong Kong’s Money Lenders Ordinance. We primarily provide unsecured personal loan financings to private individuals. We also have a small portfolio of mortgage loans. Revenue is generated from interest received from the provision of loans to private individual customers.

There may be prominent risks associated with our operations being in Hong Kong. We may be subject to the risks of uncertainty of any future actions of the PRC government including the risk that the PRC government could disallow our holding company structure, which may result in a material change in our operations, including our ability to continue our existing holding company structure, carry on our current business, accept foreign investments, and offer or continue to offer securities to our investors. These adverse actions could change the value of our common stock to significantly decline or become worthless. We may also be subject to penalties and sanctions imposed by the PRC regulatory agencies, including the Chinese Securities Regulatory Commission, if we fail to comply with such rules and regulations, which could adversely affect the ability of the Company’s securities to continue to trade on the Over-the-Counter Bulletin Board, which may cause the value of our securities to significantly decline or become worthless.

As a U.S.-listed company with operations in Hong Kong, we may face heightened scrutiny, criticism and negative publicity, which could result in a material change in our operations and the value of our common stock. It could also significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless. Additionally, changes in Chinese internal regulatory mandates, such as the M&A rules, Anti-Monopoly Law, and the soon to be effective Data Security Law, may target the Company’s corporate structure and impact our ability to conduct business in Hong Kong, accept foreign investments, or list on an U.S. or other foreign exchange. For a detailed description of the risks facing the Company and the offering associated with our operations in Hong Kong, please refer to “Risk Factors – Risk Factors Relating to Our Operations in Hong Kong” as herein.

4 |

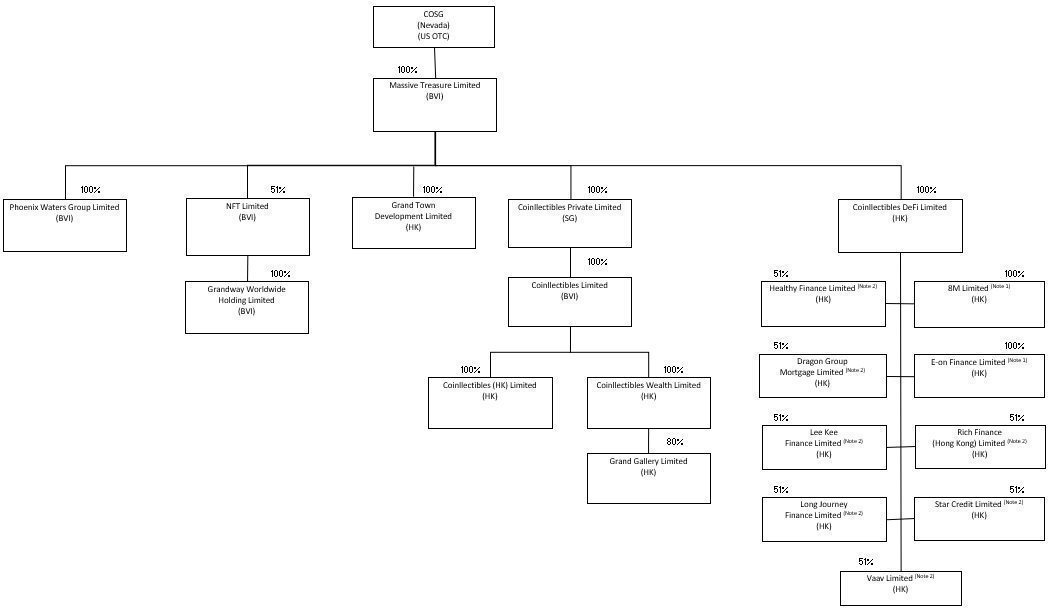

Our corporate organization chart is below.

Note 1: In May 2021, Massive Treasure entered into a Share Swap Letter Agreement (the “100% Share Swap Letter”) with the shareholders of each of E-on Finance Limited (“E-on”) and 8M Limited ("8M") to acquire 100% of each of E-on and 8M for 20,110,604 and 10,055,302 shares of common stock of COSG respectively based upon the closing price of the common stock of COSG as of the date of signing of the 100% Share Swap Letter and determined in accordance with the terms of the 100% Share Swap Letter on the date. The acquisition of E-on and 8M consummated in May 2021. Thereon, COSG issued 10,256,409 shares and 5,128,204 shares to the shareholders of E-on and 8M respectively.

COSG is obligated to issue 9,854,195 and 4,927,098 shares on the first anniversary of the closing of the acquisition to the former shareholders of E-on and 8M respectively, subject to certain clawback provisions. E-on and 8M are obligated to meet certain financial milestones in each of the two year anniversaries following the closing. Failure to meet such milestones will result in a clawback of the shares issued to the former shareholders. On the second anniversary of the closing, if E-on or 8M exceeds the aggregate financial milestone set for the two years, the former shareholders thereof shall be entitled to additional shares of COSG as determined in accordance with the 100% Share Swap Letter.

Note 2: In May and June 2021, Massive Treasure entered into a Share Swap Letter Agreement (the “51% Share Swap Letter”) with the shareholders of each of the entities to acquire 51% of the issued and outstanding securities of the entities for an aggregate amount of 23,589,736 shares of COSG’s common stock as set forth below (the “First Tranche Shares”), based upon the closing price of the common stock of COSG as of the date of signing the 51% Share Swap Letter and determined in accordance with the terms of the 51% Share Swap Letter. The acquisition of the entities consummated in May and June 2021. Thereon, COSG issued the First Tranche Shares.

On the first anniversary of the closing, COSG is obligated to issue a second tranche of shares of its common stock, based upon the closing price of its shares as of the fifth business day prior to such first anniversary as determined in accordance with the terms of the 51% Share Swap Letter (the “Second Tranche Shares”). Upon the issuance of the Second Tranche Shares, each of the entities will deliver the remaining 49% of the issued and outstanding securities to COSG to become wholly owned subsidiaries of COSG. Each of the entities are obligated to meet certain financial milestones in each of the two year anniversaries following the closing. Failure to meet such milestones will result in a clawback of the shares issued to the former shareholders. On the second anniversary of the closing, if any entity exceeds the aggregate financial milestone set for the two years, the former shareholders thereof shall be entitled to additional shares of COSG as determined in accordance with the 51% Share Swap Letter.

We are a Nevada holding company with operations conducted through our wholly owned subsidiaries based in Hong Kong and Singapore. This structure presents unique risks as our investors may never directly hold equity interests in our Hong Kong subsidiaries and will be dependent upon contributions from our subsidiaries to finance our cash flow needs. Cosmos Group Holdings Inc. and its Hong Kong subsidiaries are not required to obtain permission from the Chinese authorities including the China Securities Regulatory Commission (“CSRC”), or Cybersecurity Administration Committee (“CAC”), to operate or to issue securities to foreign investors. However, in light of the recent statements and regulatory actions by the PRC government, such as those related to Hong Kong’s national security, the promulgation of regulations prohibiting foreign ownership of Chinese companies operating in certain industries, which are constantly evolving, and anti-monopoly concerns, we (the parent company and our subsidiaries) may be subject to the risks of uncertainty of any future actions of the PRC government in this regard including the risk that we inadvertently conclude that such approvals are not required, that applicable laws, regulations or interpretations change such that we are required to obtain approvals in the future, or that the PRC government could disallow our holding company structure, which would likely result in a material change in our operations, including our ability to continue our existing holding company structure, carry on our current business, accept foreign investments, and offer or continue to offer securities to our investors. These adverse actions would likely change the value of our common stock to significantly decline or become worthless. We may also be subject to penalties and sanctions imposed by the PRC regulatory agencies, including the CSRC, if we fail to comply with such rules and regulations, which would likely adversely affect the ability of the Company’s securities to continue to trade on the Over-the-Counter Bulletin Board, which would likely cause the value of our securities to significantly decline or become worthless. For a detailed description of the risks facing the Company associated with our operations in Hong Kong, please refer to “Risk Factors – Risk Relating to Doing Business in Hong Kong.”

We reported a net loss of $25,149,399 and net income of $467,725 for the years ended December 31, 2021 and 2020, respectively. We had current assets of $23,981,701 and current liabilities of $22,748,075 as of December 31, 2021. As of December 31, 2020, our current assets and current liabilities were $14,721,331 and $15,271,366, respectively. The financial statements for the years ended December 31, 2021 and 2020 have been prepared assuming that we will continue as a going concern. Our continuation as a going concern is dependent upon improving our profitability and the continuing financial support from our stockholders.

On December 31, 2021, the Company entered into an Equity Purchase Agreement with Williamsburg Venture Holdings, LLC, a Nevada limited liability company (“Investor”), pursuant to which the Investor agreed to invest up to Thirty Million Dollars ($30,000,000) over a 36-month period in accordance with the terms and conditions of that Equity Purchase Agreement (the “Equity Purchase Commitment”).

5 |

Our sources of capital in the past have included the sale of equity securities, which include common stock sold in private transactions to our executive officers or existing shareholders, capital leases and short-term and long-term debts. We expect to finance future acquisitions through a combination of these. While we believe that existing shareholders and our officers and directors will continue to provide the additional cash to make acquisitions and to meet our obligations as they become due or that we will obtain external financing, if necessary, there can be no assurance that we will be able to raise such additional capital resources on satisfactory terms. We believe that our current cash and other sources of liquidity discussed below are adequate to support operations for at least the next 12 months.

We are organized under the laws of the State of Nevada as a holding company that conducts its business through number of subsidiaries organized under the laws of foreign jurisdictions such as Singapore, Hong Kong and the British Virgin Islands. This may have an adverse impact on the ability of U.S. investors to enforce a judgment obtained in U.S. Courts against these entities, or to effect service of process on the officers and directors managing the foreign subsidiaries.

Market Overview

According to The Art Basel and UBS Global Art Market Report 2021, the global arts market annual transactional volume is estimated to be $50.1 billion for 2020. According to Forbes, the global collectibles market reached $370 billion in 2016. Reuters reported that the collectible NFT market is approximately $13.7 million in the first half of 2020. Our DOT builds on top of the blockchain NFT technologies as the underlying technology infrastructure, even though we are still in the early stages in adoption of our DOTs, the trading volume of NFTs as reported by Reuters for the first half of 2021 has already reached approximately at $2.5 billion. Building on top of the blockchain NFT technologies, we believe DOTs have the potential to be as revolutionary and widely adopted as the internet. The unique properties of DOTs position them as a digital alternative to representing ownership of art and collectible pieces. We expect the DOT ecosystem to expand into the mainstream of art community around the world in the coming decades.

Our Products and Services

A few of the challenges with collecting physical arts and collectibles are provenance of the piece, authenticity and valuation. The vision of Coinllectibles is to modernize the way we buy, collect and trade art and collectible pieces to provide a more pleasurable, transparent, and value enhancing experience for the collector and artist communities.

Coinllectibles intends to leverage blockchain technology to help resolve the issues of provenance, authenticity and ownership in the arts and collectibles market. We intend to embed into the blockchain for each art or collectible piece an independently apprised valuation, a 3D rendering of the piece, high-definition photo of the piece, AI recognition file of the piece and a set of legal documents to provide proof of ownership and provenance of the piece to the blockchain. Each piece will be minted into an individual DOT with the list of items embedded. The DOTs are intended to provide assurance on the authenticity of art or collectible pieces as well as act as a record of ownership transfers using blockchain technology to establish provenance of the piece. We believe this type of DOT would address some of the key challenges collectors presently face with arts and collectibles.

We currently provide several services, including authentication, valuation and certification (“AVC”) service, sale and purchase, hire purchase, financing services, and custody, security and exhibition (“CSE”) services.

AVC Services

As part of our AVC services, we conduct authentication appraisal and valuation assessment of arts and collectibles through a panel of independent third-party appraisers. The appraisers will appraise the items and produce a certification showing whether the collectible piece is authentic with their estimated value. Once the item has been authenticated, it will undergo a scanning process to build a 3D model and a unique “fingerprint ID” for the item will be created through proprietary AI technology for future verification.

For Coinllectibles to be able to digitize the art and collectible pieces using blockchain technology, we first purchase the pieces from its current owner. We then charge the owner a fee for digitizing the pieces. Once the pieces are minted into DOTs, we work with our partner channels to distribute and sell the DOTs.

| 6 |

| Table of Contents |

Hire Purchase Services; Financing

We facilitate the purchase of arts and collectibles by offering certain of our buyers the option of taking possession of the arts and collectibles while paying on an installment basis. Prior to receipt of full payment, ownership of the arts and collectibles will remain with Coinllectibles. Once the buyer makes the last payment, the ownership of the arts and collectibles will transfer to the buyer once full payment has been received.

CSE Services

For collectors who have been purchasing our arts and collectibles and do not wish to take collection of the pieces, we intend to offer custodian services and have these arts and collectibles stored and safely secured until the collector elects to take possession. We also intend to allow the collectors to subscribe for additional security services for their art pieces be it when it is in our custody or when the item is on the move either to be delivered or collected from the collector. We will also introduce exhibition services to collectors and artist to organize exhibitions of artworks and collections in our gallery or other specialized art events.

Our Distribution Channels

We have or expect to distribute and sell our DOTs through the following channels:

| · | Traditional sales channels: Institutions and wealthy individuals who may be prospective art and collectibles purchasers. |

|

|

|

| · | Auction houses such as Spink & Sons, that have an existing pool of prospective collectors. We will explore opportunities to collaborate with reputable auction houses, such as Christie’s, Sotheby’s and Macey & Son. |

|

|

|

| · | Our metaverse platform (MetaMall) – coinllectibles.art allows collectors to efficiently buy and sell Fusion DOTs using fiat and cryptocurrency. We recognize that there are distinct groups of crypto natives and non-crypto natives who share the same interest in acquiring collectibles. To make their experience more seamless and user-friendly, we work with various crypto exchanges to accept their currencies as payment for the Fusion DOTs collectibles. In addition, we have also set up a payment gateway which accepts credit / debit card payments for the same purpose. |

|

|

|

| · | NFT-supported marketplaces such as OpenSea, SuperRare and Rarible that have been educating the public about digital art and collectibles, we will seek the best options to place our pieces in these marketplaces. We believe we can collaborate with these platforms to educate their collectors on physical arts and collectibles. This not only helps artist to expand their audience pool, it also helps these collectors to expand their collection range. |

|

|

|

| · | Crypto exchanges such as Coinbase, Binance, OKEx, Huobi and FTX as they have a ready pool of users that we can immediately engage to educate and share about physical arts and collectibles. In year 2021, we started to work with OKEx, and we further expand to Binance in the first quarter of 2022. |

We use a wide range of social media channels such as Facebook, Instagram, Twitter, LinkedIn, Telegram and held Ask Me Anything sessions through social media channels to reach out to the general community to announce our art exhibitions, the DOTs attached to the pieces and news about our partnerships with artists. Coinllectibles will also participate in arts and collectibles events and exhibitions to promote us as a firm and the DOTs that we will be launching.

Pricing determination

Pricing of our products and services is based on our operating costs, volume of product / service, fees charged by strategic partners and suppliers, market condition and competition. We also participate in a profit-sharing arrangement with our joint venture partners in which we have pre-set mechanism. Based on the above factors and conditions, we may evaluate and adjust our pricing from time to time.

In light of the competitive nature over the market and industry, we believe that our success will depend upon the reliability and quality of products & services provided and cost management. In general, we strive to maintain top class of high-quality products and services as well as to meet customers’ satisfaction. We are dedicated to establishing systems and operating procedures to achieve service standardization and quality control over the products and services provided by Coinllectibles. We expect to continuously monitor and seek to improve on a series of key service quality indicators (“KPI”) to maintain a competitive advantage in the market and industry.

Our Business Plan

On October 22, 2021, Massive Treasure, a subsidiary of Cosmos Group Holdings Inc., acquired 51% of NFT Limited (“NFT”) through the issuance of 2,350,229 shares of common stock of the Company. NFT beneficially owns Talk+, a messaging and cryptocurrency-focused mobile application which seeks to simplify the crypto usage experience by allowing users to send crypto through instant messages to other individuals. We hope that the inclusion of Talk+ will enable us to attract more non-crypto native users and broaden our community reach.

In late December 2021, we launched our metaverse platform (“MetaMall”), which we believe is an important step to further engage with our growing community of collectors and partners. Our MetaMall will feature pieces from an increasing range of artists and sportsmen. We hope to bring more limited-edition collectibles to more people through MetaMall. We believe that our DOTs will bridge the virtual and physical world in art and collectible ownership and enjoyment. Our DOT is a virtual token that represents the ownership of an asset and is the foundation of Coinllectibles™️ metaverse that Coinllectibles™️ defines as a multiverse where the real world interacts seamlessly with the emerging virtual dimensions.

In late January 2022, we partnered with Spink & Sons, an art auction house, on its inaugural DOT offering, where we created a hybrid- DOT to a physical collectible piece. We intend to pursue additional similar partnership opportunities in the future.

On February 10, 2022, we consummated the acquisition of 80% of the issued and outstanding securities of Grand Gallery Limited, a Hong Kong limited liability company engaged in the business of selling traditional art and collectible pieces, through the issuance of 153,060 shares of our common stock, at a valuation of $4.00 per share. We believe that this acquisition will strengthen our DOT business by expanding our access to buyers of arts and collectibles.

In March 2022, we launch a new sports division in our MetaMall and partnering with a former NBA basketball player as president of Coinllectibles Sports. We hope to exploit our DOT technology and the metaverse to bring innovation to the sports space, bridge the intersection of our DOT technology and sports memorabilia to improve experiences for fans, athletes, teams, events and partners.

| 7 |

| Table of Contents |

Major Customers

We are not a party to any long-term agreements with our customers. As opportunities arise, we may enter into long term contracts with customers.

For the year ended December 31, 2021 and 2020, there was no single customer whose revenue exceeded 10% of the revenue.

|

| Year ended December 31, 2021 |

|

|

| December 31, 2021 |

| |||||||

Customer |

| Revenues |

|

| Percentage of revenues |

|

|

| Accounts receivable |

| ||||

|

|

| – |

|

|

| – |

|

|

|

|

| – |

|

Total: |

| $ | – |

|

|

| – |

|

| Total: |

| $ | – |

|

|

| Year ended December 31, 2020 |

|

|

|

| December 31, 2020 |

| ||||||

Customer |

| Revenues |

|

| Percentage of revenues |

|

|

|

| Accounts receivable |

| |||

|

|

| – |

|

|

| – |

|

|

|

|

| – |

|

Total: |

| $ | – |

|

|

| – |

|

| Total: |

| $ | – |

|

All customers are located in Hong Kong and rest of the world.

Major Suppliers/Vendors

For the lending business segment during the year ended December 31, 2021 and 2020, there is no major supplier or vendor required in order to support our services.

For the ACT segment during the year ended December 31, 2021 and 2020, the following supplier accounted for 10% or more out of our total cost of revenue

|

| Year ended December 31, 2021 |

|

|

|

| December 31, 2021 |

| ||||||

Supplier |

| Cost of revenue |

|

| Percentage of cost of revenue |

|

|

|

| Accounts payable |

| |||

Lee Ying Chiu Herbert |

|

| 993,021 |

|

|

| 56.59 | % |

|

|

|

| – |

|

|

|

| – |

|

|

| – |

|

|

|

|

| – |

|

Total: |

| $ | 993,021 |

|

|

| 56.59 | % |

| Total: |

| $ | – |

|

|

| Year ended December 31, 2020 |

|

|

|

| December 31, 2020 |

| ||||||

Supplier |

| Revenues |

|

| Percentage of revenues |

|

|

|

| Accounts receivable |

| |||

|

|

| – |

|

|

| – |

|

|

|

|

| – |

|

Total: |

| $ | – |

|

|

| – |

|

| Total: |

| $ | – |

|

Dr. Lee joined us as our Director on June 28, 2021.

Insurance