EXHIBIT 10.66

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT, MARKED BY [***], HAS BEEN OMITTED BECAUSE IT IS BOTH (I) NOT MATERIAL AND (II) IS THE TYPE THAT VIR BIOTECHNOLOGY, INC. TREATS AS PRIVATE OR CONFIDENTIAL.

LEASE

THE EXCHANGE

KRE EXCHANGE OWNER LLC

a Delaware limited liability company

as Landlord,

and

VIR BIOTECHNOLOGY, INC.,

a Delaware corporation

As Tenant.

1800 Owens Street,

San Francisco, California

North Tower

Floors 8, 9, 10, 11 and 12

Table of Contents

|

Page |

|

1 |

PREMISES, BUILDING, PROJECT AND COMMON AREAS |

5 |

2 |

LEASE TERM |

9 |

3 |

BASE RENT |

9 |

4 |

ADDITIONAL RENT |

10 |

5 |

USE OF PREMISES |

17 |

6 |

SERVICES AND UTILITIES |

24 |

7 |

REPAIRS |

28 |

8 |

ADDITIONS AND ALTERATIONS |

29 |

9 |

COVENANT AGAINST LIENS |

31 |

10 |

INSURANCE |

31 |

11 |

DAMAGE AND DESTRUCTION |

35 |

12 |

NONWAIVER |

37 |

13 |

CONDEMNATION |

37 |

14 |

ASSIGNMENT AND SUBLETTING |

38 |

15 |

SURRENDER OF PREMISES; OWNERSHIP AND REMOVAL OF TRADE FIXTURES |

42 |

16 |

HOLDING OVER |

43 |

17 |

ESTOPPEL CERTIFICATES |

43 |

18 |

SUBORDINATION |

44 |

19 |

DEFAULTS; REMEDIES |

45 |

20 |

COVENANT OF QUIET ENJOYMENT |

47 |

21 |

SECURITY DEPOSIT |

47 |

22 |

INTENTIONALLY OMITTED |

50 |

23 |

SIGNS |

50 |

24 |

COMPLIANCE WITH LAW |

51 |

25 |

LATE CHARGES |

53 |

26 |

LANDLORD’S RIGHT TO CURE DEFAULT; PAYMENTS BY TENANT |

53 |

27 |

PROJECT CONTROL BY LANDLORD; ENTRY BY LANDLORD |

53 |

28 |

TENANT PARKING |

54 |

29 |

MISCELLANEOUS PROVISIONS |

55 |

-i-

EXHIBITS

Exhibit 1.1.1-1 |

Premises |

Exhibit 1.1.1-2 |

Tenant Work Letter |

Exhibit 1.3 |

Right of First Refusal Space |

Exhibit 2.1 |

Form of Notice of Lease Term Dates |

Exhibit 4.4.3 |

Mission Bay Requirements |

Exhibit 5.2 |

Rules and Regulations |

Exhibit 5.3.1.1 |

Environmental Questionnaire |

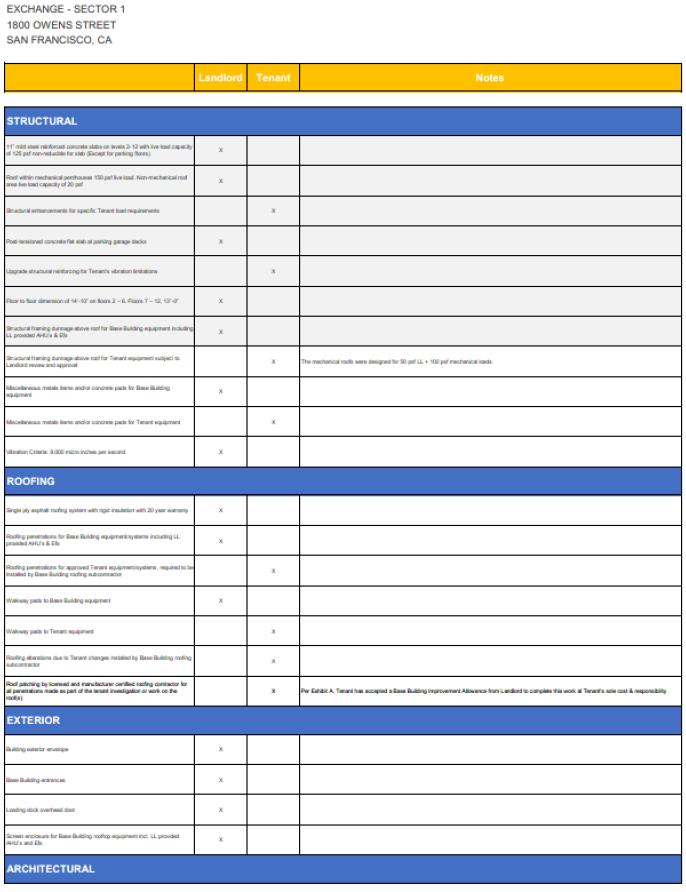

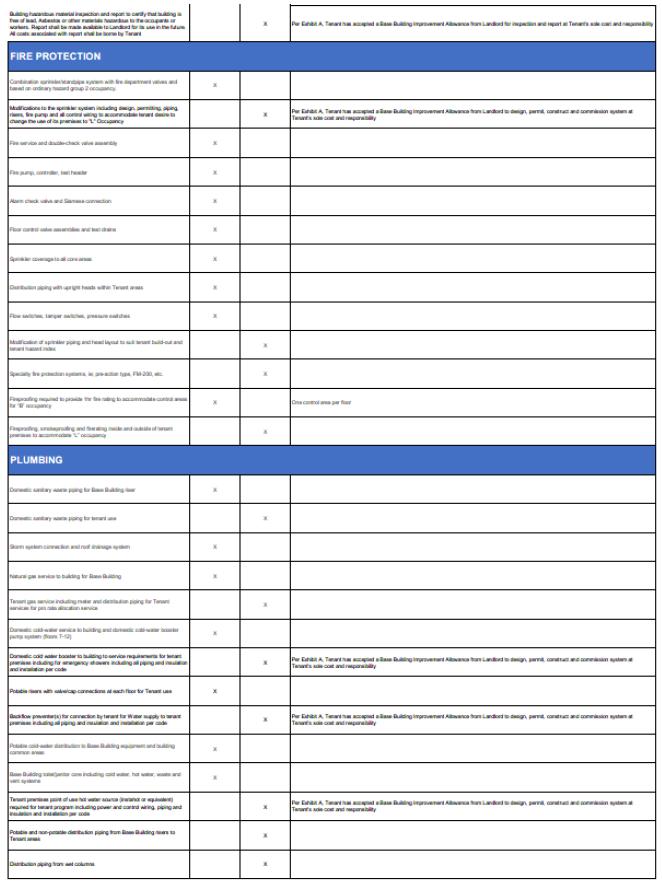

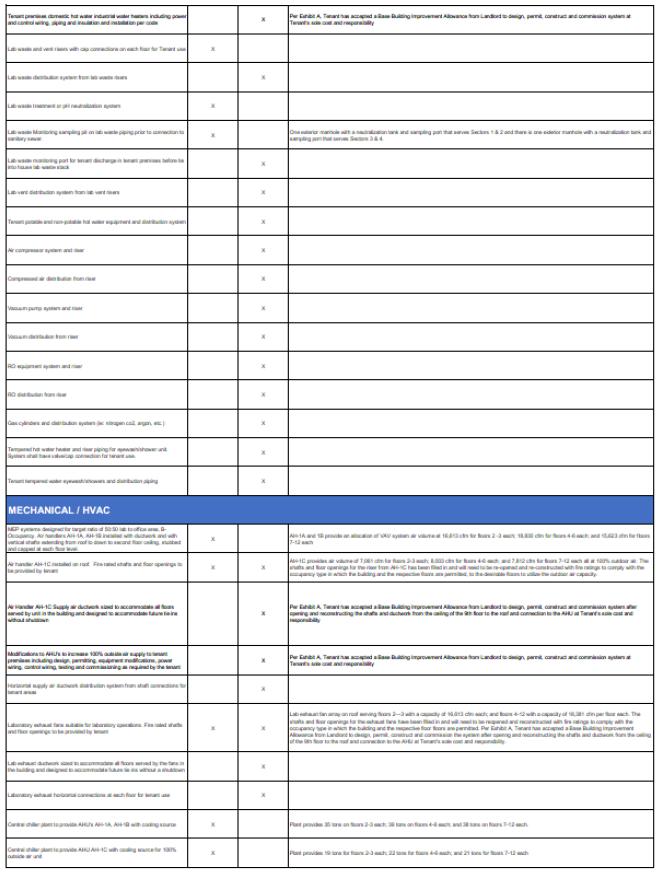

Exhibit 7.3 |

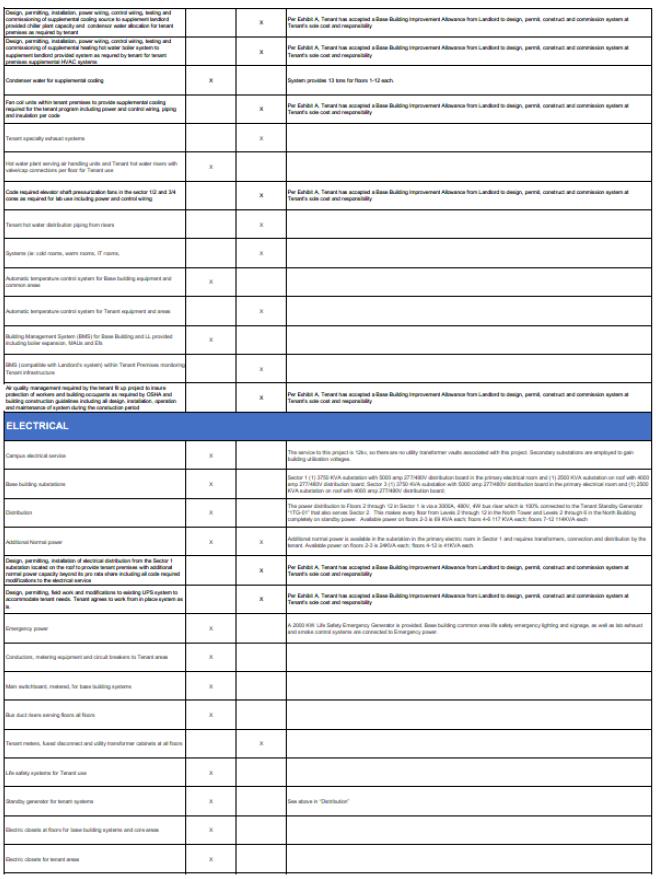

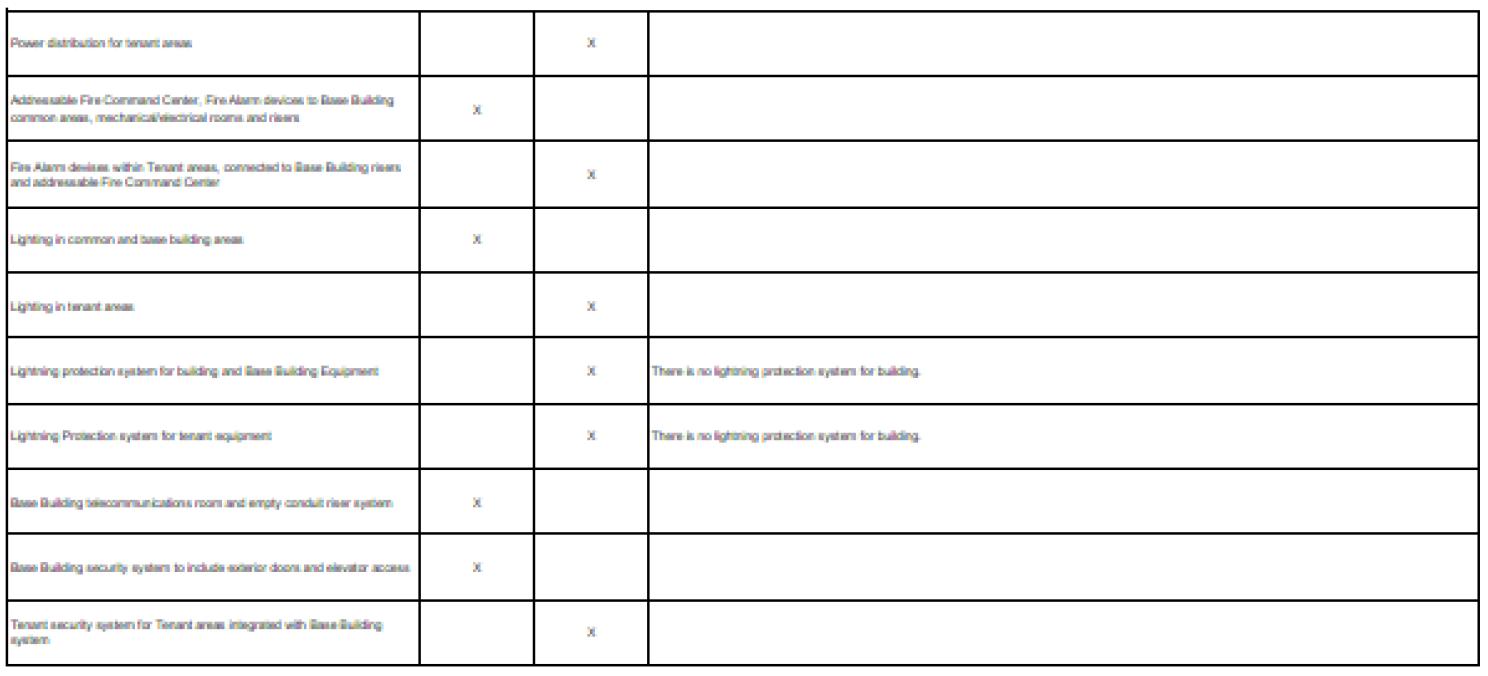

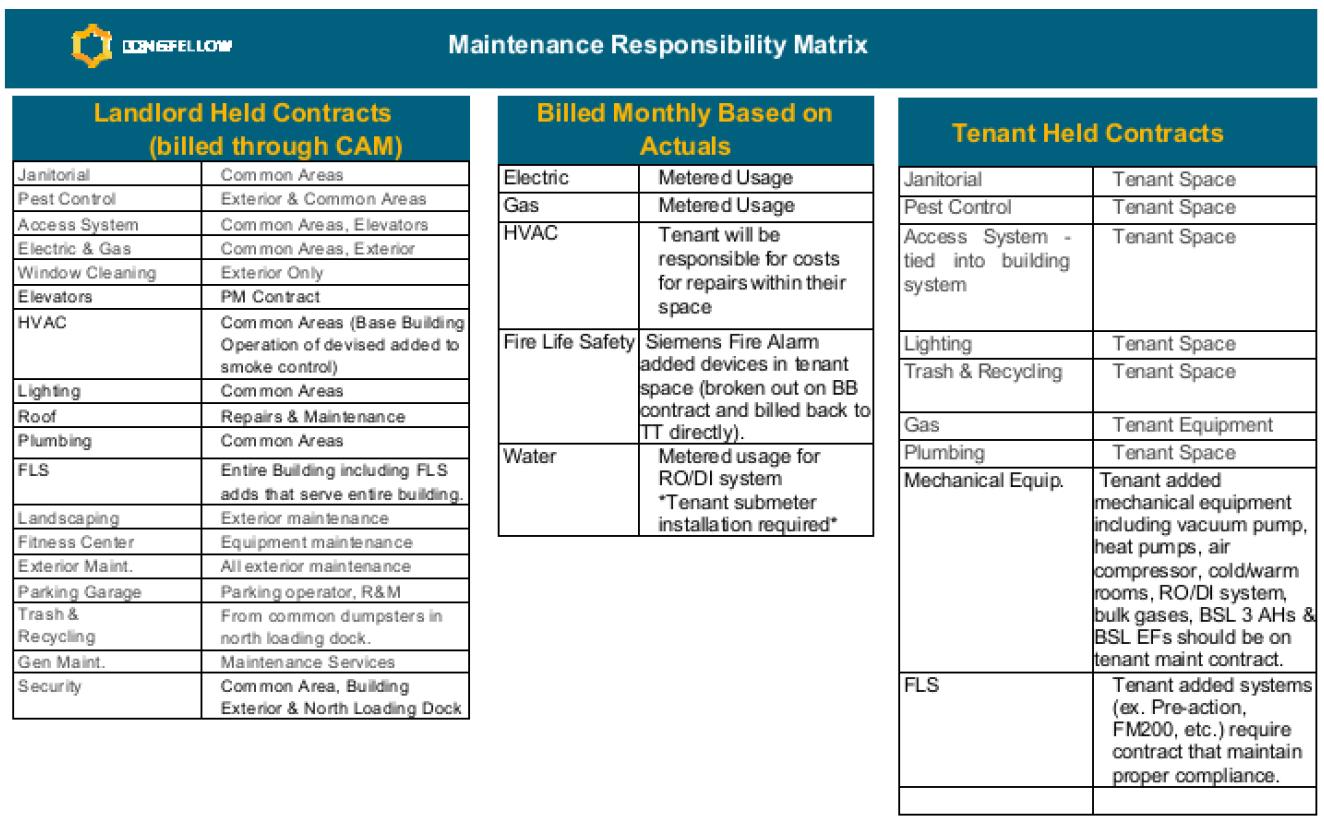

Tenant/Landlord Maintenance Responsibility Matrix |

Exhibit 17 |

Form of Tenant’s Estoppel Certificate |

Exhibit 21.1 |

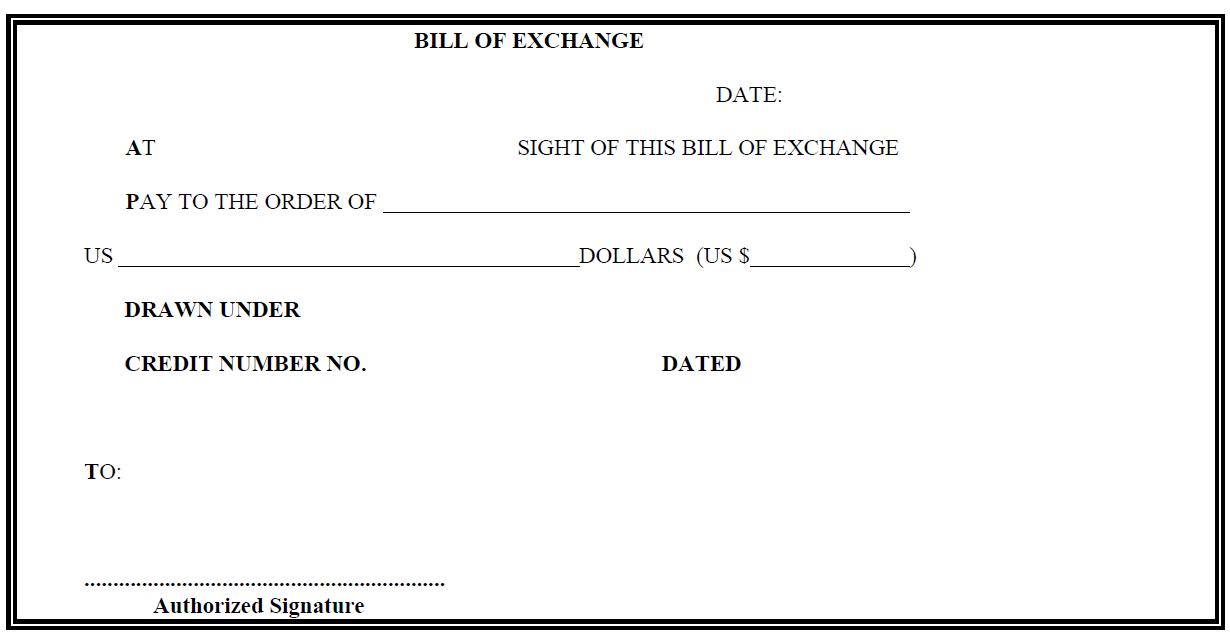

Form of Letter of Credit |

Exhibit 24.4 |

Recognition of Covenants, Conditions, and Restrictions |

Exhibit 28.6 |

Storage Area |

-ii-

Index of Defined Terms

Page |

|

Abatement Period |

3 |

Additional Rent |

10 |

Alterations |

29 |

Applicable Laws |

51 |

Audit Period |

16 |

Bank Credit Threat |

47 |

Bankruptcy Code |

48 |

Base Building |

30 |

Base Rent |

9 |

BB HVAC System |

24 |

Bicycle Improvements |

18 |

Bicycle Storage Area |

18 |

Bicycles |

17 |

Brokers |

58 |

Building |

6 |

Building Common Areas |

6 |

Building Hours |

26 |

Building Structure |

28 |

Building Systems |

28 |

CASp Report |

52 |

CC&Rs |

24 |

Claims |

23 |

Clean-up |

22 |

Closure Letter |

22 |

Code |

10 |

Common Area Meeting Spaces |

8 |

Common Areas |

6 |

Company 40 Competitor List |

51 |

Complex |

6 |

Contemplated Effective Date |

40 |

Contemplated Transfer Space |

40 |

Control |

41 |

Cost Pool |

14 |

Costs of Reletting |

46 |

Damage Termination Date |

36 |

Damage Termination Notice |

36 |

Direct Expenses |

10 |

Dropbox Amendment |

8 |

Environmental Assessment |

21 |

Environmental Laws |

20 |

Environmental Questionnaire |

18 |

Environmental Report |

22 |

Estimate |

15 |

Estimate Statement |

15 |

Estimated Direct Expenses |

15 |

Excess Hours |

24 |

Existing Sublease |

1 |

Existing Tenant |

1 |

Expense Year |

10 |

-iii-

Page |

|

Extra HVAC Costs |

24 |

First Refusal Commencement Date |

8 |

First Refusal Notice |

7 |

First Refusal Period |

7 |

First Refusal Space |

7 |

Force Majeure |

57 |

Generator |

27 |

Generator Facilities |

27 |

Governmental Approvals |

18 |

Hazardous Materials |

19 |

Hazardous Materials Claims |

20 |

HVAC |

24 |

HVAC System Hours |

24 |

Intention to Transfer Notice |

40 |

L/C Security |

47 |

Landlord |

1 |

Landlord Bicycle Storage Area |

18 |

Landlord Indemnitees |

23 |

Landlord Parties |

31 |

Landlord Repair Notice |

35 |

Landlord’s Completion Notice |

35 |

Landlord’s Hazardous Materials |

21 |

Lease |

1 |

Lease Commencement Date |

9 |

Lease Expiration Date |

9 |

Lease Term |

8 |

Lease Year |

8 |

Lender |

23 |

Lines |

60 |

Loading Dock Hours |

26 |

57 |

|

Material Service Interruption |

27 |

Mission Bay Requirements |

16 |

Net Worth |

41 |

Neutral Audit |

17 |

Non Web-Enabled Water Sensors |

61 |

North Building |

6 |

North Complex |

6 |

North Lobby |

6 |

North Tower |

5 |

Notices |

57 |

Operating Expenses |

10 |

Original Improvements |

33 |

Original Tenant |

7 |

Other Improvements |

60 |

Outside Restoration Date |

36 |

Parking Facilities |

54 |

Parking Rate |

55 |

Parking Rate Floor |

55 |

PCBs |

19 |

Permitted Assignee |

41 |

-iv-

Page |

|

Permitted Transferee |

41 |

Premises |

5 |

Prohibited Persons |

62 |

Project |

5 |

Project Common Areas |

6 |

Project Parking Use |

55 |

Project Related Parkers |

55 |

Proposition 13 |

12 |

Provider |

60 |

Public Parking Use |

55 |

Recapture Notice |

40 |

Receivership |

49 |

Redevelopment Agency |

52 |

Redevelopment Plan |

52 |

Regulations |

9 |

REIT |

57 |

Release |

19 |

Relet Term |

46 |

Renovations |

59 |

Rent |

9 |

Retail Space |

6 |

Rules and Regulations |

17 |

Security Deposit Laws |

49 |

Security Personnel |

26 |

Service Interruption |

27 |

Service Interruption Notice |

27 |

Six Month Period |

40 |

South Building |

6 |

South Complex |

6 |

South Lobby |

6 |

South Tower |

6 |

Stairwell |

18 |

Statement |

15 |

Subject Space |

38 |

Submetering Equipment |

25 |

Summary |

1 |

Supplemental HVAC Equipment |

28 |

Tax Expenses |

13 |

Tenant |

1 |

Tenant Bicycle Storage Area |

18 |

Tenant Energy Use Disclosure |

61 |

Tenant Parties |

19 |

Tenant Work Letter |

4 |

Tenant’s Off-Premises Equipment |

29 |

Tenant’s Property |

42 |

Tenant’s Security System |

26 |

-v-

Page |

|

Tenant’s Share |

14 |

Tenant’s Subleasing Costs |

40 |

Tenant-Exempt Tax Expenses |

16 |

Transfer Notice |

39 |

Transfer Premium |

39 |

Transferee |

39 |

Transfers |

39 |

Underlying Documents |

52 |

Unused L/C Proceeds |

49 |

Web-Enabled Water Sensors |

61 |

-vi-

THE EXCHANGE

LEASE

This Lease (the “Lease”), dated as of the date set forth in Section 1 of the Summary of Basic Lease Information (the “Summary”), below, is made by and between KRE EXCHANGE OWNER LLC, a Delaware limited liability company (“Landlord”), and VIR BIOTECHNOLOGY, INC., a Delaware corporation (“Tenant”).

A. Tenant presently subleases the same leased premises (as the Premises in this Lease) pursuant to that certain Sublease entered into as of November 4, 2020, by and between Dropbox, Inc., a Delaware corporation (“Dropbox”) and Tenant (the “Existing Sublease”); Landlord’s predecessor-in-interest, KR Mission Bay, LLC, a Delaware limited liability company, consented to the Existing Sublease pursuant to a certain Consent to Sublease made as of December 21, 2020.

B. Pursuant to the Existing Sublease, Tenant has been working with Dropbox and Landlord, as master landlord, to process plans for the construction of alterations to the subleased premises to accomplish a build out of the subleased premises.

C. Subject to the terms and conditions of this Lease, Tenant desires to lease the Premises directly from Landlord, terminating the Sublease and replacing it with this Lease thereby eliminating Dropbox from its role as sublandlord (and the tenant under the primary lease with Landlord).

D. Effective as of the Lease Commencement Date (as defined below), this Lease supersedes and replaces the Existing Sublease, but notwithstanding the replacement of the Existing Sublease with this Lease, Tenant will remain in occupancy of the Premises without interruption.

-1-

SUMMARY OF BASIC LEASE INFORMATION

TERMS OF LEASE

|

DESCRIPTION |

|

1. |

Dated as of: |

November 1, 2021 |

2. |

Premises |

|

|

2.1 Project: |

That certain project containing approximately 750,370 rentable square feet of space located at 1800 Owens Street, Sectors 1, 2, 3 and 4, San Francisco, California 94158. The Project is more particularly described in Section 1.1.2 below. |

|

2.2 Premises: |

Approximately 133,896 rentable square feet of space on floors 8, 9, 10, 11 and 12 of the North Tower (as defined in Section 1.1.2 below), as further set forth in Exhibit 1.1.1-1 to the Lease. |

3. |

Lease Term (Article 2). |

|

|

3.1 Length of Term: |

Twelve (12) years (i.e., one hundred forty-four (144) months). |

|

3.2 Lease Commencement Date: |

The later of (i) November 1, 2021, and (ii) the date of Lease is executed and delivered by Landlord and Tenant and the existing lease with Dropbox has either been amended to eliminate floors eight (8) through twelve (12) of the North Tower therefrom or such existing lease has been partially terminated as to such floors (such that Landlord has recaptured such floors). |

|

3.3 Rent Commencement Date: |

The same date as the Lease Commencement Date. |

|

3.4 Lease Expiration Date: |

The last day of the one hundred forty-fourth (144th) full month of the Lease Term (e.g., if the Lease Commencement Date is, in fact, December 14, 2021, then the Lease Expiration Date will be December 31, 2033. |

4. |

Base Rent (Article 3): |

|

-2-

Lease Months |

Annual |

Monthly |

Monthly Base |

1 - 71 |

$0.00 |

$0.00 |

$0.00 |

82 - 12 |

$4,251,198.00 |

$850,239.60 |

$6.35 |

13 - 24 |

$10,508,158.08 |

$875,679.84 |

$6.54 |

25 - 36 |

$10,829,508.48 |

$902,459.04 |

$6.74 |

37 - 48 |

$11,150,858.88 |

$929,238.24 |

$6.94 |

49 - 60 |

$11,488,276.80 |

$957,356.40 |

$7.15 |

61 - 72 |

$11,825,694.72 |

$985,474.56 |

$7. 36 |

73 - 84 |

$12,179,179.20 |

$1,014,931.60 |

$7.58 |

85 - 96 |

$12,548,732.40 |

$1,045,727.70 |

$7.81 |

97 - 108 |

$12,918,285.60 |

$1,076,523.80 |

$8.04 |

109 - 120 |

$13,303,905.60 |

$1,108,658.80 |

$8.28 |

121 - 132 |

$13,705,593.60 |

$1,142,132.80 |

$8.53 |

133 - 144 |

$14,123,349.60 |

$1,176,945.80 |

$8.79 |

1 Tenant shall be entitled to receive a Base Rent abatement for the first seven (7) full calendar months of the Lease Term (the “Abatement Period”). Tenant shall be obligated to pay Tenant’s Share of Direct Expenses attributable to such period. Pursuant to Section 2.1 of this Lease, any partial calendar month of Month 1 shall be excluded from the Abatement Period.

2 Tenant shall be entitled to a one-time credit against Base Rent for full calendar month 8 of the Lease Term in the amount of $693,666.03 pursuant to Section 1.3 of this Lease. Accordingly, Tenant’s payment amount for month 8’s Base Rent will be $156,573.57.

-3-

5. |

Tenant Improvement Allowance: |

$36,151,920.00, to be used by Tenant to construct improvements in the Premises in accordance with the terms of the work letter attached hereto as Exhibit 1.1.1-2 (the “Tenant Work Letter”). In addition, Tenant shall be entitled to an additional $2,343,180.00 to be used by it to construct certain additional improvements in accordance with the Tenant Work Letter. |

6. |

NNN Lease: |

In addition to the Base Rent, Tenant shall be responsible to pay Tenant’s Share of Direct Expenses in accordance with the terms of Article 4 of the Lease. |

7. |

Tenant’s Share |

Shall mean the following percentages, as applicable: (i) 100% with respect to the Operating Expenses allocated by Landlord to the Premises; (ii) 17.844% (133,896 RSF ÷ 750,370 RSF) with respect to Operating Expenses allocated by Landlord to the entire Project; (iii) 44.74% (133,896 RSF ÷ 299,255 RSF) with respect to Operating Expenses allocated by Landlord to the North Tower; and (iv) such percentage as is reasonably calculated with respect to Operating Expenses allocated by Landlord to portions of the Project that include the Premises and consist of less than the entire Project but more than the North Tower. |

8. |

Permitted Use |

The Premises shall be used only for general office and life sciences research and development, laboratory, storage and other lawful accessory uses reasonably related to and incidental to such specified uses, all (i) consistent with “Comparable Buildings” (as defined in Section 4.2.4 below) in the San Francisco, California area, and (ii) in compliance with, and subject to, Applicable Laws and the terms of this Lease. |

9. |

Security Deposit |

$5,708,655.96, in the form of a letter of credit in accordance with Article 21 of this Lease and which amount is subject to reduction in accordance with Section 21.5 of this Lease. |

10. |

Guarantor |

|

11. |

Parking Pass Ratio |

One hundred thirty-four (134) (i.e., one (1) unreserved parking spaces for every 1,000 rentable square feet of the Premises, subject to the terms of Article 28 of the Lease. |

-4-

12. |

Address of Tenant |

Vir Biotechnology, Inc. 499 Illinois Street, Suite 500 San Francisco, California 94158 Attention: General Counsel

with a copy to (which shall not constitute, nor be required for effective, notice):

Vir Biotechnology, Inc. 499 Illinois Street, Suite 500 San Francisco, California 94158 Attention: Head of Real Estate and Facilities |

13. |

Address of Landlord |

KRE Exchange Owner LLC c/o Longfellow Real Estate Partners 260 Franklin Street, Suite 1920 Boston, MA 02110 Attention: Asset Management and

KRE Exchange Owner LLC c/o Longfellow Property Management Services CA, Inc. 1800 Owens Street, Suite 350 San Francisco, CA 94158 Attention: Property Management

and

KRE Exchange Owner LLC c/o Longfellow Property Management Services CA, Inc. 1800 Owens Street, Suite 350 San Francisco, CA 94158 Attention: General Manager |

14. |

Broker(s) |

Newmark Knight Frank, representing the Tenant exclusively |

1. PREMISES, BUILDING, PROJECT AND COMMON AREAS

1.1 Premises, Building, Project and Common Areas.

1.1.1 The Premises. Landlord hereby leases to Tenant and Tenant hereby leases from Landlord the premises set forth in Section 2.2 of the Summary (the “Premises”). The outlines of each floor of the Premises are set forth in Exhibit 1.1.1-1 attached hereto. The parties hereto agree that the lease of the Premises is upon and subject to the terms, covenants and conditions herein set forth, and Tenant covenants as a material part of the consideration for this Lease to keep and perform each and all of such terms, covenants and conditions by it to be kept and performed and that this Lease is made upon the condition of such performance. The parties hereto hereby acknowledge that the purpose of Exhibit 1.1.1-1 is to show the approximate location of the Premises in the “Building” (as that term is defined in Section 1.1.2 below), only, and such Exhibit is not meant to constitute an agreement, representation or warranty as to the construction of the Premises, the precise area thereof or the specific location of the “Common Areas” (as that term is defined in Section 1.1.3 below), or the elements thereof or of the accessways to the Premises or the “Project” (as that term is defined in Section 1.1.2 below). Tenant shall accept the Premises in its presently existing “as-is” condition and Landlord shall not be obligated to provide or pay for any improvement work or services related to the improvement of the Premises except as otherwise expressly set forth in this Lease or in the Tenant Work

-5-

Letter attached hereto as Exhibit 1.1.1-2. Notwithstanding the foregoing, Landlord shall deliver to Tenant the Premises with the plumbing, electrical systems, fire sprinkler and life-safety system, lighting, air conditioning and heating systems and all other building systems serving the Premises (collectively, the “Building Systems”) in good operating condition and repair, and Landlord will be responsible for all repairs at its sole cost (and not as part of Operating Expenses) during the six (6) months following the Lease Commencement Date; provided, however, if any failure of the Building Systems to be in good operating condition and repair is attributable to Tenant’s construction of improvements pursuant to the Tenant Work Letter, then Tenant shall be solely liable for the cost of any such repairs. Tenant acknowledges that neither Landlord nor any agent of Landlord has made any representation or warranty regarding the condition of the Premises, the Building or the Project or with respect to the suitability of any of the foregoing for the conduct of Tenant’s business, except as specifically set forth in this Lease and the Tenant Work Letter. The Premises shall exclude Common Areas, including without limitation exterior faces of exterior walls, the entry, vestibules and main lobby of the Building, the common stairways and stairwells, elevators and elevator wells, boiler room, sprinkler rooms, elevator rooms, mechanical rooms, loading and receiving areas, electric and telephone closets, janitor closets, and pipes, ducts, conduits, wires and appurtenant fixtures and equipment serving exclusively or in common with other parts of the Building.

1.1.2 The Building and The Project. The Premises are a part of the Project set forth in Section 2.1 of the Summary, specifically a portion of the twelve-story building known as the North Tower (the “North Tower”. The term “Project”, as used in this Lease, shall mean (i) the North Tower located at 1800 Owens Street, Sector 1, San Francisco, California, containing 299,255 rentable square feet and the Common Areas, (ii) the land (which is improved with landscaping, parking facilities and other improvements) upon which the North Tower and the Common Areas are located, as more particularly described on Exhibit 1.1.2 attached hereto, (iii) the other buildings located in the Project known as “The Exchange”, more particularly described as that certain (1) six (6)-story building (the “North Building”) located at 1800 Owens, Sector 2, San Francisco, California, containing 125,200 rentable square feet, (2) twelve (12)-story building (the “South Tower”) located at 1800 Owens, Sector 3, San Francisco, California, containing 259,551 rentable square feet, and (3) six (6)-story building (the “South Building”) located at 1800 Owens, Sector 4, San Francisco, California, containing 66,365 rentable square feet, and the land upon which such other buildings are located, and (iv) at Landlord’s discretion, any additional real property, areas, land, buildings or other improvements added thereto outside of the Complex. The North Tower and the North Building are collectively, the “North Complex” containing a total of 424,455 retable square feet. The South Tower and the South Building are collectively, the “South Complex,” containing a total of 325,916 rentable square feet. The North Complex and the South Complex are each referred to herein as a “Complex.” The North Tower, North Building, South Tower and South Building may be referred herein separately as a sub-building and together as simply the “Building.” The Project contains a total of 750,370 square feet; provided however, approximately 14,670 rentable square feet is retail space on the ground floor of the North Complex (i.e., 12,289 rentable square feet in the North Tower and 2,381 rentable square feet is retail space in the North Building (collectively, the “Retail Space”).

1.1.3 Common Areas. Tenant shall have the non-exclusive right to use in common with other tenants in the Project, and subject to the rules and regulations referred to in Article 5 of this Lease, those portions of the Project which are provided, from time to time, for use in common by Landlord, Tenant and any other tenants of the Project (such areas, together with such other portions of the Project designated by Landlord, in its discretion, including certain areas designated for the exclusive use of certain tenants, including Tenant, or to be shared by Landlord and certain tenants, including Tenant, are collectively referred to herein as the “Common Areas”). The Common Areas shall consist of the “Project Common Areas” and the “Building Common Areas.” The term “Project Common Areas”, as used in this Lease, shall mean the portion of the Project designated from time to time as such by Landlord (inclusive of any exterior landscaped areas). The term “Building Common Areas”, as used in this Lease, shall mean the portions of the Common Areas located within the Building designated from time to time as such by Landlord. The Project includes two (2) ground floor lobbies: one (1) lobby (the “North Lobby”) provides access to the North Building and North Tower, including the Retail Space; and one (1) lobby (the “South Lobby”) provides access to both the South Building and the South Tower. The North Lobby is a Building Common Area. For the sake of clarity, Tenant and each of its authorized employees and invitees shall have access to the North Lobby, the Parking Facility and the Bicycle Storage Ares in common with other occupants of the Complex. Landlord shall maintain the Common Areas in a condition consistent with Comparable Buildings. The term “Comparable Buildings” shall mean the Building and those other office and life science buildings which are comparable to the Building in terms of age (based upon the date of completion of construction or major renovation of the building), quality of construction, level of services and amenities, size and appearance, and are located in the City of San Francisco,

-6-

California. Tenant’s use of the Common Areas shall be subject to such rules, regulations and restrictions as Landlord may make from time to time in accordance with Section 5.2 below. Any rules and regulations established by the Landlord for use of the Common Areas shall not unreasonably restrict Tenant’s access to or use of the Premises for conduct of its business, nor diminish Tenant’s rights under this Lease. In the event of any conflict between such rules and regulations and the terms of this Lease, the latter shall control Landlord reserves the right to close temporarily, make alterations or additions to, or change the location of elements of the Project and the Common Areas, provided that, in connection therewith, Landlord shall perform such closures, alterations, additions or changes in a commercially reasonable manner and, in connection therewith, shall use commercially reasonable efforts to minimize any material interference with Tenant’s use of and access to the Premises.

1.2 Stipulation of Rentable Square Feet of Premises. For purposes of this Lease, the rentable square feet of the Premises and the North Tower shall be deemed to be as set forth in Section 2.2 of the Summary, and the rentable square feet of each of the North Building, South Tower and South Building shall be deemed as set forth in Section 1.1.2 above, none of which shall be subject to remeasurement or adjustment during the Lease Term unless the Premises are physically expanded or contracted.

1.3 Adjustment of Rentable Square Feet of Premises. Landlord acknowledges that the installation of the Mechanical Shaft described in Section 2.2(e) of the Tenant Work Letter will result in a reduction of approximately 669 rentable square feet of Premises, and as a consequence thereof, Landlord will give to Tenant a credit against Base Rent for month 8 of the Lease Term in the amount of $693,666.03 as full and complete compensation to Tenant for the loss of such rentable square footage (and in exchange for Tenant enjoying such rent credit, Tenant will nevertheless pay Base Rent under this Lease without any reduction or adjustment in rentable square footage of the Premises).

1.4 Right of First Refusal. Landlord hereby grants to the Tenant named in the Summary (the “Original Tenant”) and any Permitted Assignee a right of first refusal with respect to the entire seventh (7th) floor of the Building as more particularly described on Exhibit 1.4 (the “First Refusal Space”). Notwithstanding the foregoing, such first refusal right of Tenant shall commence only following the expiration or earlier termination of the Existing Lease with Dropbox of the First Refusal Space, and such right of first refusal shall be subordinate to all rights of Dropbox which are set forth in the Existing Lease as of the date hereof with respect to such First Refusal Space. Tenant’s right of first refusal shall not be applicable after the third (3rd) anniversary of the Lease Commencement Date (which three (3) year period may be referred to as the “First Refusal Period”). Tenant’s right of first refusal shall be on the terms and conditions set forth in this Section 1.4.

1.4.1 Procedure for Offer. Prior to entering any lease for all or any portion of the First Refusal Space during the First Refusal Period, Landlord shall provide a written notice to Tenant (the “First Refusal Notice”), offering to lease to Tenant the applicable portion of the First Refusal Space. The First Refusal Notice shall describe the terms on which the other prospective tenant may lease the First Refusal Space, including setting forth the rent and the other material economic terms upon which Landlord is willing to lease such space to such other tenant.

1.4.2 Procedure for Acceptance. If Tenant wishes to exercise Tenant’s right of first refusal with respect to the space described in the First Refusal Notice, then within seven (7) business days after delivery of the First Refusal Notice to Tenant, Tenant shall deliver notice to Landlord of Tenant’s election to exercise its right of first refusal with respect to the entire space described in the First Refusal Notice on the terms contained in such notice. If Tenant does not so notify Landlord within the seven (7) business day period, then Landlord shall be free to lease the space described in the First Refusal Notice to the other tenant or any affiliate thereof on generally the same terms as contained in the First Refusal Notice, provided that, prior to entering into a lease of such space on material economic terms that are more than seven and one-half percent (7.5%) more favorable to the tenant than the Base Rent set forth in the First Refusal Notice, Landlord shall first deliver another First Refusal Notice to Tenant offering such space to Tenant on such reduced terms. Tenant shall respond to any such “re-offer” within five (5) business days after delivery of such “re-offer” notice. Notwithstanding anything to the contrary contained herein, Tenant must elect to exercise its right of first refusal, if at all, with respect to all of the space covered by the First Refusal Notice, and Tenant may not elect to lease only a portion thereof. The First Refusal Space shall be leased by Tenant on all of the terms and conditions of this Lease except as set forth in the First Refusal Notice and this Section 1.3.

1.4.3 Construction In First Refusal Space. Tenant shall take the First Refusal Space in its “as is” condition unless otherwise set forth in the First Refusal Notice.

-7-

1.4.4 Amendment to Lease. If Tenant timely exercises Tenant’s right to lease the First Refusal Space as set forth herein, then the First Refusal Space shall be added to the Premises on the terms set forth herein (except that the term of any such lease shall be appropriately adjusted to be co-terminous with the Lease Term of this Lease) and, at the election of Landlord or Tenant, the parties shall promptly thereafter execute an amendment to this Lease for such First Refusal Space (but the execution of such amendment shall not be required for the lease of the First Refusal Space to become effective). Tenant shall commence payment of Rent for the First Refusal Space, and the term of the First Refusal Space shall commence upon the date of delivery of the First Refusal Space to Tenant in the condition required by the First Refusal Notice (the “First Refusal Commencement Date”) and terminate on the Lease Expiration Date.

1.4.5 Termination of Right of First Refusal. The rights contained in this Section 1.2 shall be personal to the Original Tenant (and any Permitted Assignee) and may only be exercised by the Original Tenant (and not any other assignee, sublessee or other transferee of the Original Tenant’s interest in this Lease other than a Permitted Assignee) if the Original Tenant or a Permitted Assignee occupies the entire Premises. Except as expressly set forth in this Section 1.4, the right of first refusal granted herein shall terminate as to a particular First Refusal Notice (and the First Refusal Space applicable thereto) upon the failure by Tenant to exercise its right of first refusal with respect to such First Refusal Space as offered by Landlord. Tenant shall not have the right to lease First Refusal Space, as provided in this Section 1.4, if, as of the date of the attempted exercise of any right of first refusal by Tenant, or as of the scheduled date of delivery of such First Refusal Space to Tenant, Tenant is in default under this Lease, after the expiration of any applicable notice and cure period, or Tenant has previously been in default, after the expiration of any applicable notice and cure period, under this Lease more than once during the First Refusal Period.

1.5 Condition Precedent. Tenant acknowledges and agrees that this Lease is subject to the following express conditions precedent: (i) Landlord consummating an amendment with Dropbox of its lease covering the entire Project (other than the Retail Space) so as to eliminate floors eight (8) through twelve (12) of the North Tower therefrom (such that Landlord has recaptured such floors) and converting the Project from a single tenant project to a multi-tenant project (which amendment may be referred to as the “Dropbox Amendment”) and (ii) the termination of the Existing Sublease. The terms and conditions of the Dropbox Amendment shall be satisfactory to Landlord in its sole and absolute discretion.

1.6 Meeting Rooms. So long as Tenant is not in default hereunder beyond applicable notice and cure periods, Landlord shall use commercially reasonable efforts to make available Common Area meeting rooms, if any, in the Project (collectively, the “Common Area Meeting Spaces”) for Tenant’s use for business meetings and special events. Such use shall be subject to availability, on a first come, first serve basis, and shall be upon and subject to such rules, regulations and limitations as Landlord may reasonably establish from time to time for use of the Common Area Meeting Spaces (including, without limitation, as to scheduling, catering, hours of use, the provision and cost of janitorial and security services, facility and equipment usage charges, reimbursement of Landlord’s costs and expenses reasonably incurred in facilitating such use by Tenant, and cleaning/security deposits); provided, however, that (a) Landlord shall use commercially reasonable efforts to give Tenant equitable access with other tenants to the Common Area Meeting Rooms and, accordingly, not allow other tenants of the Project to block-book the Common Area Meeting Rooms (i.e. reserve spaces for more than three (3) business days in a row unless connected to a special event); and (b) once Tenant has properly booked the use of the Common Area Meeting Spaces for a particular date and time, such booking may not be cancelled without Tenant’s prior consent. If requested by Tenant, Landlord will provide a schedule of available dates and times for use of the Common Area Meeting Spaces. In connection with its use of the Common Area Meeting Spaces, Tenant shall enter into Landlord’s then-current form of agreement for the use of such spaces. Tenant use of the Common Area Meeting Spaces shall be at Tenant’s sole risk and Tenant acknowledges and agrees that Landlord shall have no liability whatsoever to Tenant, its employees and/or visitors for personal injury or property damage or theft relating to or connected with any use of the Common Area Meeting Spaces by Tenant or its employees and/or visitors. Landlord specifically reserves the right to change the location, size, configuration, design, layout and all other aspects of the Common Area Meeting Spaces at any time and Tenant acknowledges and agrees that Landlord may from time to time, on a temporary basis, or on a permanent basis, close, close-off or restrict access to the Common Area Meeting Spaces. The right to use the Common Area Meeting Spaces may not be assigned or in any other way transferred to any other person or entity. Tenant acknowledges that the waiver of claims and indemnification provided in this Lease apply to the use of the Common Area Meeting Spaces by Tenant. Notwithstanding anything to the contrary contained in this Lease, Tenant acknowledges that, as of the date of this Lease, the Project does not have any Common Area Meeting Rooms.

-8-

2. LEASE TERM

2.1 Lease Term. The terms and provisions of this Lease shall be effective as of the date of this Lease. The term of this Lease (the “Lease Term”) shall be as set forth in Section 3.1 of the Summary, shall commence on the date set forth in Section 3.2 of the Summary (the “Lease Commencement Date”), and shall terminate on the date set forth in Section 3.4 of the Summary (the “Lease Expiration Date”) unless this Lease is sooner terminated as hereinafter provided. For purposes of this Lease, the term “Lease Year” shall mean the consecutive twelve (12) month period following and including the Lease Commencement Date and each subsequent twelve (12) month period during the Lease Term; provided, however, if the Lease Commencement Date is other than the first (1st) day of a calendar month, “Month 1” will include the first full calendar month following the Lease Commencement Date plus any partial calendar month following the Lease Commencement Date. In the event Month 1 includes any partial calendar month, Tenant shall pay the prorated amount of Monthly Base Rent for such partial calendar month pursuant to Article 3 in addition to the Monthly Base Rent for the ninth (9th) full calendar month of the Lease Term (and to the extent that Month 1 is included as part of the Abatement Period, any such partial calendar month shall be excluded from the Abatement Period). At any time during the Lease Term, Landlord may deliver to Tenant a notice in the form as set forth in Exhibit 2.1, attached hereto, as a confirmation only of the information set forth therein, which Tenant shall execute (or provide factual correction to) and return to Landlord within ten (10) business days of receipt thereof, but execution of such instrument shall not be a condition to Lease commencement or Tenant’s obligations hereunder.

3. BASE RENT

3.1 Payment of Rent. Tenant shall pay, without prior notice or demand, to Landlord’s agent at the management office of the Project or at such place as Landlord may from time to time designate in writing, by a check for currency which, at the time of payment, is legal tender for private or public debts in the United States of America or pursuant to wire or electronic payment instructions provided by Landlord, base rent (“Base Rent”) as set forth in Section 4 of the Summary, payable in equal monthly installments as set forth in Section 4 of the Summary, in advance, on or before the first day of each and every calendar month during the Lease Term, without any setoff or deduction whatsoever, except as may be expressly set forth in this Lease. Base Rent for the first full month of the Lease Term shall be paid at the time of Tenant’s execution of this Lease. If any Rent payment date (including the Lease Commencement Date) falls on a day of the month other than the first day of such month or if any payment of Rent is for a period which is shorter than one month, the Rent for any fractional month shall accrue on a daily basis for the period from the date such payment is due to the end of such calendar month or to the end of the Lease Term at a rate per day which is equal to 1/365 of the applicable annual Rent. All other payments or adjustments required to be made under the terms of this Lease that require proration on a time basis shall be prorated on the same basis. Base Rent and Additional Rent shall together be denominated “Rent”. Without limiting the foregoing, Tenant’s obligation to pay Rent shall be absolute, unconditional and independent of any Landlord covenants and shall not be discharged or otherwise affected by any law or regulation now or hereafter applicable to the Premises, or any other restriction on Tenant’s use, or (except as expressly provided herein) any casualty or taking, or any failure by Landlord to perform any covenant contained herein, or any other occurrence; and Tenant assumes the risk of the foregoing and waives all rights now or hereafter existing to terminate or cancel this Lease or quit or surrender the Premises or any part thereof (absent a judicial order providing for such termination or cancellation), or to assert any defense in the nature of constructive eviction (in which Tenant asserts that its use and enjoyment of the Premises has been disrupted due to any entry by Landlord of the Premises in accordance with Section 27.2 of this Lease, any renovation of the Project or any casualty or condemnation affecting the Project) to any action seeking to recover rent (except to the extent Tenant’s obligation to pay Base Rent may be expressly abated pursuant to Articles 11 and 13 of this Lease). Tenant’s covenants contained herein are independent and not dependent, and Tenant hereby waives the benefit of any statute or judicial law to the contrary.

3.2 Rents from Real Property. Landlord and Tenant hereby agree that it is their intent that all Base Rent, Additional Rent and other rent and charges payable to the Landlord under this Lease (hereinafter individually and collectively referred to as “Rent”) shall qualify as “rents from real property” within the meaning of Section 856(d) of the Internal Revenue Code of 1986, as amended (the “Code”), and the Department of the U.S. Treasury Regulations promulgated thereunder (the “Regulations”). Should the Code or the Regulations, or interpretations thereof by the Internal Revenue Service contained in revenue rulings or other similar public pronouncements, be changed so that any Rent no longer so qualifies as “rent from real property” for purposes of Section 856(d) of the Code and the Regulations promulgated thereunder, such Rent shall be adjusted in such manner as the Landlord may require so that it will so

-9-

qualify; provided, however, that any adjustments required pursuant to this Section 7.3 shall be made so as to produce the equivalent (in economic terms) Rent as payable prior to such adjustment.

4. ADDITIONAL RENT

4.1 General Terms. In addition to paying the Base Rent specified in Article 3 of this Lease, Tenant shall pay “Tenant’s Share” of the annual “Direct Expenses” as those terms are defined in Sections 4.2.6 and 4.2.2 of this Lease, respectively. Such payments by Tenant, together with any and all other amounts payable by Tenant to Landlord pursuant to the terms of this Lease other than Base Rent, are hereinafter collectively referred to as the “Additional Rent”. All amounts due under this Article 4 as Additional Rent shall be payable for the same periods and in the same manner as the Base Rent. Without limitation on other obligations of Tenant which survive the expiration of the Lease Term, the obligations of Tenant to pay the Additional Rent provided for in this Article 4 shall survive the expiration of the Lease Term, subject to Section 4.4.1.

4.2 Definitions of Key Terms Relating to Additional Rent. As used in this Article 4, the following terms shall have the meanings hereinafter set forth:

4.2.1 Intentionally Omitted.

4.2.2 “Direct Expenses” shall mean “Operating Expenses” and “Tax Expenses”.

4.2.3 “Expense Year” shall mean each calendar year in which any portion of the Lease Term falls, through and including the calendar year in which the Lease Term expires, provided that Landlord, upon notice to Tenant, may change the Expense Year from time to time to any other twelve (12) consecutive month period, and, in the event of any such change, Tenant’s Share of Direct Expenses shall be equitably adjusted for any Expense Year involved in any such change.

4.2.4 “Operating Expenses” shall mean all expenses, costs and amounts of every kind and nature which Landlord pays or accrues during any Expense Year because of or in connection with the ownership, management, maintenance, security, repair, replacement, restoration or operation of the Project or any portion thereof (including, without limitation, any amenities (e.g., fitness center) available to tenants within the Building or Project). Without limiting the generality of the foregoing, Operating Expenses shall specifically include any and all of the following: (i) the cost of supplying all utilities, the cost of operating, repairing, maintaining, and renovating the utility, telephone, mechanical, sanitary, storm drainage, and elevator systems, and the cost of maintenance and service contracts in connection therewith; (ii) the cost of licenses, certificates, permits and inspections and the cost of contesting any governmental enactments which may affect Operating Expenses, and the costs incurred in connection with providing a shuttle service, if any, and the costs incurred in connection with any federal, state or municipal governmentally mandated transportation demand management program or similar program; (iii) the cost of all insurance carried by Landlord in connection with the Project (including, without limitation, commercial general liability insurance, physical damage insurance covering damage or other loss caused by fire, earthquake, flood and other water damage, explosion, vandalism and malicious mischief, theft or other casualty, rental interruption insurance, and such insurance as may be required by any lessor under any present or future ground or underlying lease of the Building or Project or any holder of a mortgage, trust deed or other encumbrance now or hereafter in force against the Building or Project or any portion thereof or as required pursuant to the Underlying Documents); (iv) the cost of landscaping, re-lamping, and all supplies, tools, equipment and materials used in the operation, repair and maintenance of the Project, or any portion thereof; (v) all costs incurred in connection with the Parking Facilities; (vi) fees and other costs, including management, consulting fees, legal fees and accounting fees, of all contractors and consultants in connection with the management, operation, maintenance and repair of the Project; (vii) payments under any equipment rental agreements and the fair rental value of any management space; (viii) wages, salaries and other compensation and benefits, including taxes levied thereon, of all persons engaged in the operation, maintenance and security of the Project; (ix) costs under any instrument pertaining to the sharing of costs by the Project; (x) operation, repair, maintenance and replacement of all systems and equipment and components thereof of the Project; (xi) the cost of janitorial, alarm, security and other services, replacement of wall and floor coverings, ceiling tiles and fixtures in Common Areas, maintenance and replacement of curbs and walkways, repair to roofs and re-roofing; (xii) amortization (including reasonable interest on the unamortized cost) over such period as Landlord shall reasonably determine, of the cost of acquiring or the rental expense of personal property used in the maintenance, operation and repair of the Project or any portion thereof; (xiii) the cost of capital improvements, capital repairs or other capital costs

-10-

incurred in connection with the Project (A) which are intended to reduce expenses in the operation or maintenance of the Project, or any portion thereof, or to reduce current or future Operating Expenses or to enhance the safety or security of the Project or its occupants, (B) that are required to comply with present or anticipated mandatory energy conservation programs, (C) which are replacements or modifications of nonstructural items located in the Common Areas required to keep the Common Areas in the same good order or condition as on the Lease Commencement Date, or (D) that are required under any federal, state or municipal governmental law or regulation that was not in force or effect as of the Lease Commencement Date; provided, however, that the costs of any capital improvement shall be amortized (including with interest at the Amortization Interest Rate on the amortized cost as reasonably determined by Landlord) over the useful life of the capital item in question, as Landlord shall reasonably determine, in a manner consistent with the practices of landlords of “Comparable Buildings” (i.e., similar buildings located with the area depicted in Exhibit 4.2.4 attached hereto) and otherwise in accordance with sound real estate management and accounting practices or, with respect to cost saving capital expenditures, their recovery/payback period as Landlord shall reasonably determine, in a manner consist with the practices of landlords of Comparable Buildings and otherwise in accordance with sound real estate management and accounting practices, consistently applied; (xiv) costs, fees, charges or assessments imposed by, or resulting from any mandate imposed on Landlord by, any federal, state or municipal government for fire and police protection, trash removal, community services, or other services which do not constitute “Tax Expenses” (as that term is defined in Section 4.2.5 below); (xv) cost of tenant relation programs reasonably established by Landlord, and (xvi) payments under any Underlying Documents (as that term is defined in Article 24 below). In the event that Landlord or Landlord’s managers or agents perform services for the benefit of the Building off-site which would otherwise be performed on-site (e.g., accounting), the cost of such services shall be reasonably allocated among the properties benefitting from such service and shall be included in Operating Expenses. Notwithstanding the foregoing, for purposes of this Lease, Operating Expenses shall not, however, include:

(a) costs, including legal fees, space planners’ fees, advertising and promotional expenses, and brokerage fees incurred in connection with the original construction or development, or original or future leasing of the Project, and costs, including permit, license and inspection costs, incurred with respect to the installation of tenant improvements made for tenants or incurred in renovating or otherwise improving, decorating, painting or redecorating vacant space for tenants of the Project (excluding, however, such costs relating to any Common Areas), and any costs or expenses incurred in connection with the relocation of any tenants of the Building or Project;

(b) except as set forth in items (xii), (xiii), and (xiv) above, depreciation, interest and principal payments on mortgages and other debt costs, if any, penalties and interest, and costs of capital improvements (as distinguished from non-capital repairs or replacements);

(c) costs for which Landlord is reimbursed by any tenant or occupant of the Project (other than as Direct Expenses) or by insurance by its carrier or any tenant’s carrier or by anyone else (or would have been reimbursed if Landlord had carried the insurance Landlord is required to carry pursuant to this Lease or enforced its rights against such third-party, as applicable), and electric power costs for which any tenant directly contracts with the local public service company or pays directly to Landlord;

(d) any bad debt loss, rent loss, or reserves for bad debts or rent loss;

(e) costs associated with the operation of the business of the partnership or entity which constitutes Landlord, as the same are distinguished from the costs of operation of the Project (which shall specifically include, but not be limited to, accounting costs associated with the operation of the Project). Costs associated with the operation of the business of the partnership or entity which constitutes Landlord include costs of partnership accounting and legal matters, costs of defending any lawsuits with any mortgagee (except as the actions of Tenant may be in issue), costs of selling, syndicating, financing, mortgaging or hypothecating the Project or any of Landlord’s interest in the Project, and costs incurred in connection with any disputes between Landlord and its employees, between Landlord and Project management, or between Landlord and other tenants or occupants;

(f) the wages and benefits of any employee who does not devote substantially all of his or her employed time to the Project unless such wages and benefits are prorated to reflect time spent on operating and managing the Project vis-a-vis time spent on matters unrelated to operating and managing the Project; provided, that in no event shall Operating Expenses for purposes of this Lease include wages and/or benefits attributable to personnel above the level of Project manager;

-11-

(g) amount paid as ground rental for the Project by Landlord;

(h) except for a property management fee (and subject to the exclusion in item (q) below), overhead and profit increment paid to Landlord or to subsidiaries or affiliates of Landlord for services in the Project to the extent the same exceeds the costs of such services rendered by qualified, first-class unaffiliated third parties on a competitive basis;

(i) any compensation paid to clerks, attendants or other persons in commercial concessions operated by Landlord, provided that any compensation paid to any concierge at the Project shall be includable as an Operating Expense;

(j) all items and services for which Tenant or any other tenant in the Project reimburses (or is obligated to reimburse) Landlord (other than as Direct Expenses) or which Landlord provides selectively to one or more tenants (other than Tenant) without reimbursement;

(k) rent for any office space occupied by Project management personnel to the extent the size or rental rate of such office space exceeds the size or fair market rental value of office space occupied by management personnel of Comparable Buildings, with adjustment where appropriate for the size of the applicable project;

(l) costs incurred to comply with laws relating to the removal of Hazardous Materials (other than Hazardous Materials typically found in comparable buildings, such as recyclable materials and typical construction materials, and costs to comply with the operation and maintenance plan, if any);

(m) Landlord’s general overhead expenses not related to the Project;

(n) legal fees, accountants’ fees (other than normal bookkeeping expenses) and other expenses incurred in connection with disputes of tenants or other occupants of the Project or associated with the enforcement of the terms of any leases with tenants or the defense of Landlord’s title to or interest in the Project or any part thereof;

(o) any reserve funds;

(p) costs arising due to a violation by Landlord or any other tenant of the Project of the terms and condition of a lease, or arising from the gross negligence or willful misconduct of Landlord, or its agents, employees, vendors, contractors, or providers of materials or services;

(q) any management fee, of which Tenant’s Share in a particular Expense Year exceeds three percent (3%) of Tenant’s Base Rent (adjusted and grossed up during any period in which Tenant’s Base Rent (or portion thereof) is abated);

(r) advertising and promotional expenditures, and costs of signs in or on the Project identifying the owner of the Project or any tenant of the Project;

(s) fees, penalties and interest resulting from Landlord’s failure to pay any Operating Expense as and when due;

(t) costs to comply with Applicable Laws where such violation of Applicable Laws existed as of the date the Project was originally built (i.e., 2018); and

(u) any costs expressly excluded from Operating Expenses elsewhere in this Lease.

If Landlord is not furnishing any particular work or service (the cost of which, if performed by Landlord, would be included in Operating Expenses) to a tenant who has undertaken to perform such work or service in lieu of the performance thereof by Landlord, Operating Expenses shall be deemed to be increased by an amount equal to the additional Operating Expenses which would reasonably have been incurred during such period by Landlord if it had at its own expense furnished such work or service to such tenant. If the Project is not at least one hundred percent (100%) occupied during all or a portion of any Expense Year, Landlord shall make an appropriate adjustment to the

-12-

components of Operating Expenses for such year to determine the amount of Operating Expenses that would have been incurred had the Project been one hundred percent (100%) occupied; and the amount so determined shall be deemed to have been the amount of Operating Expenses for such year. Landlord and Tenant acknowledge and agree that the intention of this Article 4 is to facilitate Landlord’s recovery of Operating Expenses as opposed to generating a profit center.

4.2.5 Taxes.

4.2.5.1 “Tax Expenses” shall mean all federal, state, county, or local governmental or municipal taxes, fees, charges or other impositions of every kind and nature, whether general, special, ordinary or extraordinary (including, without limitation, real estate taxes, general and special assessments, transit taxes, payments in lieu of taxes, business improvement district charges, leasehold taxes or taxes based upon the receipt of rent, including gross receipts or sales taxes applicable to the receipt of rent (inclusive of any so-called “Proposition C” taxes), unless required to be paid by Tenant, personal property taxes imposed upon the fixtures, machinery, equipment, apparatus, systems and equipment, appurtenances, furniture and other personal property used by Landlord in connection with the Project, or any portion thereof), which shall be paid or accrued during any Expense Year (without regard to any different fiscal year used by such governmental or municipal authority) because of or in connection with the ownership, leasing and operation of the Project, or any portion thereof (including, without limitation, the land upon which the Building, including the Parking Facilities, are located).

4.2.5.2 Tax Expenses shall include, without limitation: (i) Any tax on the rent, right to rent or other income from the Project, or any portion thereof, or as against the business of leasing the Project, or any portion thereof; (ii) any assessment, tax, fee, levy or charge in addition to, or in substitution, partially or totally, of any assessment, tax, fee, levy or charge previously included within the definition of real property tax, it being acknowledged by Tenant and Landlord that Proposition 13 was adopted by the voters of the State of California in the June 1978 election (“Proposition 13”) and that assessments, taxes, fees, levies and charges may be imposed by governmental agencies for such services as fire protection, street, sidewalk and road maintenance, refuse removal and for other governmental services formerly provided without charge to property owners or occupants, and, in further recognition of the decrease in the level and quality of governmental services and amenities as a result of Proposition 13, Tax Expenses shall also include any governmental or private assessments or the Project’s contribution towards a governmental or private cost-sharing agreement for the purpose of augmenting or improving the quality of services and amenities normally provided by governmental agencies; (iii) any assessment, tax, fee, levy, or charge allocable to or measured by the area of the Premises or the Rent payable hereunder, including, without limitation, any business or gross income tax or excise tax with respect to the receipt of such rent, or upon or with respect to the possession, leasing, operating, management, maintenance, alteration, repair, use or occupancy by Tenant of the Premises, or any portion thereof; and (iv) any assessment, tax, fee, levy or charge, upon this transaction or any document to which Tenant is a party, creating or transferring an interest or an estate in the Premises or the improvements thereon; and (v) all of the real estate taxes and assessments imposed upon or with respect to the buildings and all of the real estate taxes and assessments imposed on the land and improvements comprising the Project, including any such taxes or assessments relating to the Underlying Documents or Mission Bay Requirements. If at any time during the Lease Term there shall be assessed on Landlord, in addition to or lieu of the whole or any part of the ad valorem tax on real or personal property, a capital levy or other tax on the gross rents or other measures of building operations, or a governmental income, franchise, excise or similar tax, assessment, levy, charge or fee measured by or based, in whole or in part, upon building valuation, gross rents or other measures of building operations or benefits of governmental services furnished to the Building, then any and all of such taxes, assessments, levies, charges and fees, to the extent so measured or based, shall be included within the term Tax Expenses, but only to the extent that the same would be payable if the Building and Land were the only property of Landlord.

4.2.5.3 Any costs and expenses (including, without limitation, reasonable attorneys’ and consultants’ fees) incurred in attempting to protest, reduce or minimize Tax Expenses in good faith shall be included in Tax Expenses in the Expense Year such expenses are incurred. Tax refunds shall be credited against Tax Expenses and refunded to Tenant regardless of when received, based on the Expense Year to which the refund is applicable, provided that in no event shall the amount to be refunded to Tenant for any such Expense Year exceed the total amount paid by Tenant as on account of Tax Expenses under this Article 4 for such Expense Year. The foregoing sentence shall survive the expiration or earlier termination of this Lease. If Tax Expenses for any period during the Lease Term or any extension thereof are increased after payment thereof for any reason, including, without limitation, escape

-13-

assessment or error or reassessment by applicable governmental or municipal authorities, Tenant shall pay Landlord Tenant’s Share of any such increased Tax Expenses within thirty (30) days after Landlord’s request, together with supporting documentation of such increase. Notwithstanding anything to the contrary contained in this Section 4.2.5, there shall be excluded from Tax Expenses (i) all excess profits taxes, franchise taxes, gift taxes, capital stock taxes, inheritance and succession taxes, estate taxes, documentary transfer taxes (incurred in connection with the sale or financing of the Project or any portion thereof, but any changes in Tax Expenses following a reassessment of the Project relating to a change in ownership shall continue to be includable in Tax Expenses), federal and state income taxes, and other taxes to the extent applicable to Landlord’s general or net income (as opposed to rents, receipts or income attributable to operations at the Project), (ii) any items included as Operating Expenses, (iii) any items paid by Tenant under Section 4.5 of this Lease, (iv) tax penalties, fees or interest incurred as a result of Landlord’s failure to make payments and/or to file any tax or informational returns when due, and (v) any assessments on real property or improvements located outside of the Project. For purposes of calculating Tax Expenses for the Project for any Expense Year, if such Tax Expenses do not reflect an assessment (or Tax Expenses) for a one hundred percent (100%) leased, completed and occupied project (such that existing or future leasing, improvements and/or occupancy may result in an increased assessment and/or increased Tax Expenses) with the Project being one hundred percent (100%) occupied by tenants paying full rent, such Tax Expenses shall adjusted, on a basis consistent with sound real estate accounting principles, to reflect an assessment for (and Tax Expenses for) a one hundred percent (100%) leased, completed and occupied project with the Project being one hundred percent (100%) occupied by tenants paying full rent.

4.2.5.4 Notwithstanding anything to the contrary set forth in this Lease, only Landlord may institute proceedings to reduce Tax Expenses and the filing of any such proceeding by Tenant without Landlord’s consent shall constitute a Default by Tenant.

4.2.6 “Tenant’s Share” is based upon the ratio that the rentable square feet of the Premises bears to the rentable square feet of the Building and initially shall mean the percentage set forth in Section 7 of the Summary, subject to adjustment in the event that Tenant physically expands or contracts the Premises within the Building. For the avoidance of doubt, and notwithstanding anything to the contrary herein, no remeasurement of the Building or Project shall result in an increase in the Base Rent payable under this Lease.

4.3 Allocation of Direct Expenses.

4.3.1 Method of Allocation. The parties acknowledge that the Project contains four (4) sub- buildings or sectors (i.e., the North Tower, the North Building, the South Tower and the South Building, each a sub- building herein and together comprising the entire Building) and that the costs and expenses incurred in connection with the Project (i.e., the Direct Expenses) should be equitably allocated among those sub-buildings comprising the Project and shared by the tenants of each of those sub-buildings. Accordingly, as set forth in Section 4.2 above, Direct Expenses (which consist of Operating Expenses and Tax Expenses) attributable only to a particular sub-building or sub-buildings, but not the Project generally, shall be included in Direct Expenses for such sub-building or sub- buildings, but excluded from Direct Expenses for any other sub-buildings, and Direct Expenses that are attributable to the Project as a whole shall be allocated among the Building pro rata based on the relative rentable square footages of each of the sub-buildings as compared to the rentable square footage of the entire Building in the aggregate. Accordingly, such portion of Direct Expenses allocated to the tenants of the sub-building shall include all Direct Expenses attributable solely to the sub-building and an equitable portion of the Direct Expenses attributable to the entire Building as a whole. Further, Landlord shall have the right, from time to time, to allocate equitably some or all of the Direct Expenses for a sub-building or the Project among different portions or occupants of the sub-building or Project, in Landlord’s reasonable discretion, in a manner reflecting commercially reasonable cost pools for such Direct Expenses so allocated. The Direct Expenses within each cost pool shall be allocated and charged to the tenants within such cost pool in an equitable manner.

4.3.2 Cost Pools. The parties acknowledge that certain of the costs and expenses incurred in connection with the Project (i.e., the Direct Expenses) should be separately allocated to the office space and the Retail Space. Direct Expenses shall be allocated between the office space and Retail Space (each, a “Cost Pool”) based on the estimated benefit derived by the space which is the subject of the Cost Pool, and such allocations shall be reasonably determined by Landlord. Accordingly, Direct Expenses shall be charged to the Retail Space and the office space by virtue of the creation of Cost Pools. Direct Expenses which apply equally to the Retail Space and the office space (such as Landlord’s insurance costs), as reasonably determined by Landlord, shall be allocated to the office

-14-

space Cost Pool and the Retail Space Cost Pool based on the square footage of each of those spaces, respectively, compared to the total square footage of the applicable Building. After the date of this Lease, Landlord may reasonably establish additional Cost Pools in connection with any new leases of the Project, such as a life sciences Cost Pool. Any costs allocated to a Cost Pool (e.g. the Retail Space Cost Pool) which does not include a portion of the Premises shall be excluded from the definition of Direct Expenses for the purposes of this Lease.

4.3.3 Costs Attributable to Laboratory Use. In addition to the payment of Tenant’s Share of Operating Expenses provided for hereinabove, Tenant shall be solely responsible for the payment of one hundred percent (100%) of any costs (whether or not otherwise included in Operating Expenses, but Tenant shall not be directly invoiced for costs already included in Operating Expenses) attributable to, or incurred or payable by Landlord as a consequence of, Tenant’s use of any portion of the Premises for the Laboratory Use, as determined by Landlord in its reasonable judgement and following the delivery of reasonable documentation supporting said additional costs as attributable to Tenant’s use of a portion of the Premises for the Laboratory Use. If not otherwise included as a special allocation to Tenant as contemplated by Section 4.3.2 above of any such costs in the Operating Expense payments made by Tenant, Landlord will invoice Tenant, on a periodic basis, for any such costs, and Tenant shall pay such costs as additional Rent hereunder within fifteen (15) days following Landlord’s delivery of any such invoice to Tenant.

4.4 Calculation and Payment of Additional Rent. Tenant shall pay to Landlord, in the manner set forth in Section 4.4.1 below, and as Additional Rent, Tenant’s Share of Direct Expenses for each Expense Year.

4.4.1 Statement of Actual Direct Expenses and Payment by Tenant. Landlord shall use commercially reasonable efforts to give to Tenant on or before May 1 following the end of each Expense Year, a statement (the “Statement”) which shall state the Direct Expenses incurred or accrued for such preceding Expense Year, and which shall indicate the amount of Tenant’s Share of Direct Expenses. Upon receipt of the Statement for each Expense Year commencing or ending during the Lease Term, Tenant shall pay, with its next installment of Base Rent due, the full amount of Tenant’s Share of Direct Expenses for such Expense Year, less the amounts, if any, paid during such Expense Year as “Estimated Direct Expenses” (as that term is defined in Section 4.4.2 below), and if Tenant paid more as Estimated Direct Expenses than the actual Tenant’s Share of Direct Expenses, Tenant shall receive a credit in the amount of Tenant’s overpayment against Rent next due under this Lease or, if Landlord elects, Landlord shall reimburse such overpayment amount to Tenant or, if the Lease Term has ended, Landlord shall refund such amount to Tenant within thirty (30) days of the date of such Statement. The failure of Landlord to timely furnish the Statement for any Expense Year shall not prejudice Landlord or Tenant from enforcing its rights under this Article 4, provided, however, that Tenant shall not be responsible for payment of any Direct Expenses first shown on a Statement delivered more than twenty-four (24) months after expiration of the applicable Expense Year. Even though the Lease Term has expired and Tenant has vacated the Premises, when the final determination is made of Tenant’s Share of Direct Expenses for the Expense Year in which this Lease terminates, Tenant shall pay to Landlord such amount within thirty (30) days after delivery of the applicable Statement to Tenant, and if Tenant paid more as Estimated Direct Expenses than the actual Tenant’s Share of Direct Expenses, Landlord shall, within thirty (30) days after delivery of the applicable Statement to Tenant, pay to Tenant the amount of the overpayment. The provisions of this Section 4.4.1 shall survive the expiration or earlier termination of the Lease Term.

4.4.2 Statement of Estimated Direct Expenses. In addition, Landlord shall use commercially reasonable efforts to give Tenant on or before May 1 following the end of each Expense Year, a yearly expense estimate statement (the “Estimate Statement”) which shall set forth Landlord’s reasonable estimate (the “Estimate”) of what the total amount of Direct Expenses for the then-current Expense Year shall be and the estimated Tenant’s Share of Direct Expenses (the “Estimated Direct Expenses”). The failure of Landlord to timely furnish the Estimate Statement for any Expense Year shall not preclude Landlord from enforcing its rights to collect any Estimated Direct Expenses under this Article 4, nor shall Landlord be prohibited from revising any Estimate Statement or Estimated Direct Expenses theretofore delivered to the extent necessary (but not more than three (3) times per Expense Year). Thereafter, Tenant shall pay, with its next installment of Base Rent due, a fraction of the Estimated Direct Expenses for the then-current Expense Year (reduced by any amounts paid pursuant to the last sentence of this Section 4.4.2). Such fraction shall have as its numerator the number of months which have elapsed in such current Expense Year, including the month of such payment, and twelve (12) as its denominator. Until a new Estimate Statement is furnished (which Landlord shall have the right to deliver to Tenant at any time [but not more than three (3) times per Expense Year]), Tenant shall pay monthly, with the monthly Base Rent installments, an amount equal to one-twelfth (1/12) of the total Estimated Direct Expenses set forth in the previous Estimate Statement delivered by Landlord to Tenant.

-15-

4.4.3 Mission Bay Requirements. As set forth in Exhibit 4.4.3 attached hereto, the Project is subject to certain covenants, requirements, and disclosures (collectively, the “Mission Bay Requirements”), which include, without limitation, certain limitations on (i) Landlord’s ability to lease space at the Project to a Tax-Exempt Entity and (ii) Landlord’s ability to obtain reductions in the assessed value of the Project below the Minimum Amount. In connection with the foregoing, to the extent that Tenant is exempt from certain Tax Expenses, but Landlord is otherwise obligated to continue to pay such Tax Expenses (the “Tenant-Exempt Tax Expenses”), then, notwithstanding Tenant’s tax-exempt status, Tenant shall continue to be obligated to pay to Landlord, as part of Direct Expenses, all such Tenant-Exempt Tax Expenses.

4.5 Taxes and Other Charges for Which Tenant Is Directly Responsible.

4.5.1 Tenant shall be liable for and shall pay before delinquency, taxes levied against Tenant’s equipment, furniture, fixtures and any other personal property located in or about the Premises. If any such taxes on Tenant’s equipment, furniture, fixtures and any other personal property are levied against Landlord or Landlord’s property or if the assessed value of Landlord’s property is increased by the inclusion therein of a value placed upon such equipment, furniture, fixtures or any other personal property and if Landlord pays the taxes based upon such increased assessment, which Landlord shall have the right to do regardless of the validity thereof but only under proper protest if requested by Tenant, Tenant shall within thirty (30) days after Landlord’s demand (together with reasonable back-up evidencing the same) repay to Landlord the taxes so levied against Landlord or the proportion of such taxes resulting from such increase in the assessment, as the case may be.

4.5.2 If the improvements in the Premises, whether installed and/or paid for by Landlord or Tenant and whether or not affixed to the real property so as to become a part thereof, are assessed for real property tax purposes at a valuation higher than the valuation at which “building standard” improvements are assessed, then the Tax Expenses levied against Landlord or the property by reason of such excess assessed valuation shall be deemed to be taxes levied against personal property of Tenant and shall be governed by the provisions of Section 4.5.1 above. Landlord and Tenant hereby agree that the valuation of Landlord’s “building standard” improvements for all tenants of the Project shall be equal to One Hundred Dollars ($100.00) per rentable square foot. Landlord and Tenant shall cooperate with respect to the information provided by either of them to the appropriate taxing authority regarding the valuation of the improvements in the Premises so as to avoid duplicative assessments being levied on such improvements.

4.5.3 Notwithstanding any contrary provision herein, Tenant shall pay prior to delinquency any (i) rent tax (e.g., gross receipts tax on commercial rents) or sales tax, service tax, transfer tax or value added tax, or any other applicable tax on the rent or services herein or otherwise respecting this Lease, or (ii) taxes assessed upon or with respect to the possession, leasing, operation, management, maintenance, alteration, repair, use or occupancy by Tenant of the Premises or any portion of the Project, including the Parking Facilities.

4.6 Landlord’s Books and Records. Following Tenant’s receipt of a Statement, Tenant shall have the right by written notice to Landlord to commence and complete an audit of Landlord’s books concerning the Direct Expenses for the Expense Year which are the subject of such Statement, within the later to occur of (x) six (6) months following the delivery of such Statement and (y) the date that is sixty (60) days after Landlord makes Landlord’s books and records available for Tenant’s audit, provided that Tenant notifies Landlord of Tenant’s intent to audit Landlord’s books and records within the six (6) month period described in clause (x) above (the “Audit Period”). Following the giving of such written notice, Tenant shall have the right during Landlord’s regular business hours taking into account the workload of Landlord’s employees involved in the audit at the time of the audit request and on reasonable prior notice, to audit, at Landlord’s corporate offices in the San Francisco Bay area, at Tenant’s sole cost, Landlord’s records, provided that Tenant is not then in Default. The audit of Landlord’s records may be conducted only by a reputable certified public accountant, subject to Landlord’s approval, which approval shall not be unreasonably withheld. Any accounting firm selected by Tenant in connection with the audit (i) shall be a reputable independent nationally or regionally recognized certified public accounting firm which has previous experience in auditing financial operating records of landlords of office/life science buildings; (ii) shall not already be providing accounting and/or lease administration services to Tenant and shall not have provided accounting and/or lease administration services to Tenant in the past three (3) years; (iii) shall not be retained by Tenant on a contingency fee basis (i.e. Tenant must be billed based on the actual time and materials that are incurred by the accounting firm in the performance of the audit), a copy of the executed audit agreement, between Tenant and auditor, shall be provided to Landlord prior to the commencement of the audit; and (iv) at Landlord’s option, both Tenant and its agent shall be

-16-