Table of Contents

As filed with the Securities and Exchange Commission on June 29, 2018

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Berry Petroleum Corporation

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 1311 | 81-5410470 | ||

| (State or other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(IRS Employer Identification Number) |

5201 Truxtun Ave., Bakersfield, California

93309

(661) 616-3900

(Address, including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Arthur T. Smith

President and Chief Executive Officer

5201 Truxtun Ave., Bakersfield, California 93309

(661) 616-3900

(Name, Address, including Zip Code, and Telephone Number, including Area Code, of Agent for Service)

Copies to:

| Douglas E. McWilliams Sarah K. Morgan Vinson & Elkins L.L.P. 1001 Fannin, Suite 2500 Houston, Texas 77002-6760 (713) 758-2222 |

Gerald M. Spedale Gibson, Dunn & Crutcher LLP 811 Main Street, Suite 3000 Houston, Texas 77002-6117 (346) 718-6600 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||

| Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Offering Price(1)(2) |

Amount of Registration Fee | ||

| Common Stock, par value $0.001 per share |

$100,000,000 | $12,450 | ||

|

| ||||

|

| ||||

| (1) | Includes common stock issuable upon exercise of the underwriters’ option to purchase additional common stock. |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to rule 457(o) under the Securities Act of 1933, as amended. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. The securities described herein may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities, in any state or jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated June 29, 2018

Shares

Common Stock

This is the initial public offering of the common stock of Berry Petroleum Corporation, a Delaware corporation. We are selling shares of our common stock, and the selling stockholders are selling shares of our common stock. We will not receive any proceeds from the shares of our common stock sold by the selling stockholders.

We anticipate that the initial public offering price will be between $ and $ per share. We have applied to list our common stock on the Nasdaq Global Select Market (the “NASDAQ”) under the symbol “BRY.”

We have granted the underwriters the option to purchase up to an additional shares of common stock on the same terms and conditions set forth above if the underwriters sell more than shares of common stock in this offering.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, are eligible for reduced reporting requirements. Please see “Prospectus Summary—Emerging Growth Company Status.”

Investing in our common stock involves risks. Please see “Risk Factors” beginning on page 30 of this prospectus.

| Per Share | Total(1) | |||||||

| Public Offering Price |

$ | $ | ||||||

| Underwriting discount(1) |

$ | $ | ||||||

| Proceeds to Berry Petroleum Corporation (before expenses) |

$ | $ | ||||||

| Proceeds to the selling stockholders |

$ | $ | ||||||

| (1) | We refer you to “Underwriting (Conflicts of Interest)” beginning on page 181 of this prospectus for additional information regarding underwriting compensation. |

The underwriters expect to deliver the shares on or about , 2018

Neither the Securities and Exchange Commission (“SEC”) nor any state securities commission has approved or disapproved of the securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| Goldman Sachs & Co. LLC | Wells Fargo Securities | BMO Capital Markets |

The date of this prospectus is , 2018

Table of Contents

| 1 | ||||

| 30 | ||||

| 50 | ||||

| 52 | ||||

| 53 | ||||

| 54 | ||||

| 55 | ||||

| 57 | ||||

| 59 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

68 | |||

| 107 | ||||

| 150 | ||||

| 155 | ||||

| 164 | ||||

| 166 | ||||

| 168 | ||||

| 174 | ||||

| MATERIAL U.S. FEDERAL INCOME TAX CONSIDERATIONS FOR NON-U.S. HOLDERS |

177 | |||

| 181 | ||||

| 186 | ||||

| 186 | ||||

| 186 | ||||

| F-1 | ||||

| A-1 | ||||

| B-1 |

We, the selling stockholders and the underwriters have not authorized anyone to provide you with information different from that contained in this prospectus or any free writing prospectus. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We, the selling stockholders and the underwriters are offering to sell shares of common stock and seeking offers to buy shares of common stock only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of the common stock. Our business, financial condition, results of operations and prospects may have changed since that date. This prospectus contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. Please see “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements.”

Through and including , 2018 (the 25th day after the date of this prospectus), all dealers effecting transactions in our shares, whether or not participating in this offering, may be required to deliver a prospectus. This requirement is in addition to the dealers’ obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

BASIS OF PRESENTATION

In 2013, LINN Energy, LLC (“LINN Energy”) and LinnCo, LLC (“LinnCo” and, together with LINN Energy, the “Linn Entities”) acquired Berry Petroleum Company LLC (“Berry LLC”) in exchange for LinnCo shares and the assumption of debt with an aggregate value of $4.6 billion. A severe industry downturn coupled

i

Table of Contents

with the Linn Entities and Berry LLC’s high leverage and significant fixed charges, led the Linn Entities, and consequently, Berry LLC, to initiate petitions for reorganization in the U.S. Bankruptcy Court (the “Bankruptcy Court”) for the Southern District of Texas (collectively, the “Chapter 11 Proceeding”) on May 11, 2016. In anticipation of emergence, Berry Petroleum Corporation (“Berry Corp.”) was formed for the purpose of having all the membership interests of Berry LLC assigned to it upon Berry LLC’s emergence from bankruptcy. On February 28, 2017 (the “Effective Date”), all of Berry LLC’s outstanding membership interests were transferred to Berry Corp., and Berry LLC emerged from bankruptcy as a wholly-owned subsidiary of Berry Corp., separate from the Linn Entities. Upon our emergence, we adopted fresh-start accounting, which, with the recapitalization described above, resulted in Berry Corp. being treated as the new entity for financial reporting. Unless otherwise noted or suggested by context, all financial information and data and accompanying financial statements and corresponding notes, as contained in this prospectus, (i) on or prior to the Effective Date, reflect the actual historical results of operations and financial condition of Berry LLC for the periods presented and do not give effect to the Amended Joint Chapter 11 Plan of Reorganization of Linn Acquisition Company, LLC and Berry LLC (the “Plan”) or any of the transactions contemplated thereby or the adoption of fresh-start accounting, and (ii) following the Effective Date, reflect the actual historical results of operations and financial condition of Berry Corp. on a consolidated basis and give effect to the Plan and any of the transactions contemplated thereby and the adoption of fresh-start accounting. Thus, the financial information presented herein on or prior to the Effective Date is not comparable to information about our performance or financial condition after the Effective Date.

The financial information and certain other information presented in this prospectus have been rounded to the nearest whole number or the nearest decimal. Therefore, the sum of the numbers in a column may not conform exactly to the total figure given for that column in certain tables in this prospectus. In addition, certain percentages presented in this prospectus reflect calculations based upon the underlying information prior to rounding and, accordingly, may not conform exactly to the percentages that would be derived if the relevant calculations were based upon the rounded numbers, or may not sum due to rounding.

INDUSTRY AND MARKET DATA

The market data and certain other statistical information used throughout this prospectus are based on independent industry publications, government publications and other published independent sources. Although we believe these third-party sources are reliable as of their respective dates, neither we, the selling stockholders nor the underwriters have independently verified the accuracy or completeness of this information. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section entitled “Risk Factors.” These and other factors could cause results to differ materially from those expressed in these publications.

TRADEMARKS AND TRADE NAMES

We own or have rights to various trademarks, service marks and trade names that we use in connection with the operation of our business. This prospectus may also contain trademarks, service marks and trade names of third parties, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks, trade names or products in this prospectus is not intended to, and does not imply, a relationship with, or endorsement or sponsorship by us. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks, service marks and trade names.

ii

Table of Contents

This summary highlights information contained elsewhere in this prospectus. You should read the entire prospectus carefully, including the information under the headings “Risk Factors,” “Cautionary Note Regarding Forward-Looking Statements” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements and the notes to those financial statements appearing elsewhere in this prospectus. The information presented in this prospectus assumes an initial public offering price of $ per share (the mid-point of the price range set forth on the cover page of this prospectus) and, unless otherwise indicated, that the underwriters do not exercise their option to purchase additional shares of common stock. You should read “Risk Factors” for information about important risks that you should consider carefully before investing in our common stock.

Except as noted or as the context requires otherwise, when we use the terms “we,” “us,” “our,” the “Company,” or similar words in this prospectus, (i) on or prior to the Effective Date, we are referring to Berry LLC, and (ii) following the Effective Date, we are referring to Berry Corp. and its subsidiary, Berry LLC, as applicable. When we refer to “our predecessor company,” we are referring to Berry LLC as it existed on or prior to the Effective Date. This prospectus includes certain terms commonly used in the oil and natural gas industry, which are defined elsewhere in this prospectus in “Annex B: Glossary of Oil and Natural Gas Terms.”

Our Company

We are a California-based independent upstream energy company engaged primarily in the development and production of conventional oil reserves located in the western United States. Our long-lived, predictable and high margin asset base is uniquely positioned to support our objectives of generating top-tier corporate-level returns and positive free cash flow through commodity price cycles. We believe that executing our strategy across our low-declining production base and extensive inventory of identified drilling locations will result in long-term, capital efficient production growth as well as the ability to return excess free cash flow to stockholders.

We target onshore, low-cost, low-risk, oil-rich reservoirs in the San Joaquin basin of California and the Uinta basin of Utah, and, to a lesser extent, the low geologic risk natural gas resource play in the Piceance basin in Colorado. In the aggregate, the Company’s assets are characterized by:

| • | high oil content, which makes up approximately 81% of our production; |

| • | favorable Brent-influenced crude oil pricing dynamics; |

| • | long-lived reserves with low and predictable production decline rates; |

| • | stable and predictable development and production cost structures; |

| • | a large inventory of low-risk identified development drilling opportunities with attractive full-cycle economics; and |

| • | potential in-basin organic and strategic opportunities to expand our existing inventory with new locations of substantially similar geology and economics. |

California is and has been one of the most productive oil and natural gas regions in the world. Our asset base is concentrated in the oil-rich San Joaquin basin in California, which has more than 100 years of production history and substantial remaining oil in place. As a result of these attributes, we have a strong understanding of many of the basin’s geologic and reservoir characteristics, leading to predictable, repeatable, low-risk development opportunities.

In California, we focus on conventional, shallow reservoirs, the drilling and completion of which are relatively low-cost in contrast to modern unconventional resource plays. Our decades-old proven completion

1

Table of Contents

techniques in these reservoirs include steamflood and low-volume fracture stimulation. For example, we estimate the cost of Proved Undeveloped Reserves (“PUD”) wells drilled and completed in California will average less than $450,000 per well. In contrast, we estimate the cost of PUD wells drilled and completed in the Piceance basin will average $1.8 million per well. Using SEC Pricing as of December 31, 2017, there were approximately 80 gross PUD locations associated with projects in the Piceance basin. Subsequent to year end, as a result of increasingly negative local gas pricing differentials, we revised our current development plan to exclude these Piceance locations.

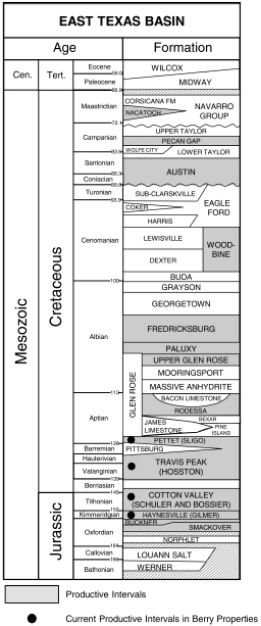

We also own assets in the Uinta basin in Utah, a stacked, multi-bench, light-oil-prone play with significant undeveloped resources where we have high operational control and additional behind pipe potential and in the East Texas basin, an extensive over-pressured natural gas cell, as well as in the Piceance basin in Colorado, a prolific low geologic risk natural gas play where we produce from a conventional, tight sandstone reservoir using proven slick water fracture stimulation techniques to increase recoveries.

We are led by an executive leadership team with over 100 years of combined energy industry experience and an average of over 25 years in the sector. Our management will leverage their collective experience, which spans domestic and international basins as well as a variety of reservoir recovery types, to enhance existing production, improve drilling and completion techniques, control costs and maximize the ultimate recovery of hydrocarbons from our assets with the ultimate objective of increasing stockholder value.

Using SEC Pricing as of December 31, 2017, we had estimated total proved reserves of 141,384 MBoe. For the three months ended March 31, 2018, we had average production of approximately 26.2 MBoe/d, of which approximately 81% was oil. In California, our average production for the three months ended March 31, 2018 was 18.8 MBoe/d, of which approximately 100% was oil.

The Berry Advantage

We believe that our combination of low production decline rates, high margin oil-weighted production, attractive development opportunities and a stable cost environment differentiates us from our competitors and provides for low-breakeven commodity prices and an ability to generate top-tier corporate level returns, positive levered free cash flow and capital-efficient growth through commodity price cycles.

Our Low Declining Production Base

Our reserves are generally long-lived and characterized by relatively low production decline rates, affording us significant capital flexibility and an ability to efficiently hedge material quantities of future expected production. For example, our PDP reserves have an estimated compound annual decline rate of approximately 13% between 2018 and 2022 based on total PDP reserves as of December 31, 2017 as reflected in our SEC reserve report, which is attached as Annex A. Our SEC reserve report is based on the estimated individual well production profiles used to determine our PDP reserves. Based on the assumptions underlying our PUD estimates, we estimate that the annual capital budget required to keep production volumes consistent each year over the next three years is approximately $110 million.

Our Oil-Weighted, High Margin Production

Our highly oil-weighted production combined with a Brent-influenced California pricing dynamic and stable cost structures has resulted, and is expected to continue to result, in strong operating margins. As of December 31, 2017, our California PUD reserves were 100% oil.

2

Table of Contents

Our Attractive Development Opportunities

Our estimated development costs associated with our PUD reserves are $8.89 per Boe on a total company basis and $10.95 per Boe in California. We believe that our estimated development costs, when combined with our operating costs, commodity mix and price realizations, present attractive breakeven economics for our development opportunities.

We expect our identified drilling locations to generate attractive rates of return. The following table presents our expected average single-well rates of return on drilling opportunities associated with our California PUD reserves based on the assumptions used in preparing our December 31, 2017 SEC reserve report, including pricing and cost assumptions, which can be found under “Primary Economic Assumptions” on page 6 of our reserve report. Using SEC Pricing as of December 31, 2017, there were approximately 23 MMBoe of PUDs associated with projects in the Piceance basin. Subsequent to year end, as a result of increasingly negative local gas pricing differentials, we revised our current development plan to exclude development in the Piceance basin. As a result, information with respect to our Colorado PUDs as of December 31, 2017 has been omitted from the table below. The table also includes a commodity price sensitivity scenario, which is based on Strip Pricing as of May 31, 2018.

| PUD Weighted-Average Economics | ||||||||||||||||

| Per Well | IRR | |||||||||||||||

| Asset |

EUR (MBOE) |

D&C ($ in thousands) |

SEC Pricing as of December 31, 2017(1) |

Strip Pricing as of May 31, 2018(2) |

||||||||||||

| California |

45 | $ | 450 | 51 | % | 65 | % | |||||||||

| (1) | Our estimated net reserves were determined using average first-day-of-the-month prices for the prior 12 months in accordance with SEC guidance. The unweighted arithmetic average first-day-of-the-month prices for the prior 12 months were $54.42 per Bbl ICE (Brent) for oil and NGLs and $2.98 per MMBtu NYMEX Henry Hub for natural gas at December 31, 2017. Prices were calculated using oil and natural gas price parameters established by current SEC guidelines and accounting rules, including adjustment by lease for quality, fuel deductions, geographical differentials, marketing bonuses or deductions and other factors affecting the price received at the wellhead. Please see “—Summary Reserves and Operating Data.” |

| (2) | Our Strip Pricing oil, natural gas and NGL reserves were determined using index prices for natural gas and oil, respectively, as of May 31, 2018 without giving effect to derivative transactions. The average future prices for benchmark commodities used in determining our Strip Pricing reserves were $74.59 per Bbl for oil and NGLs for 2018, $72.98 for 2019, $69.15 for 2020 and $66.49 for 2021 thereafter, on the ICE (Brent), and $2.94 per Mcf for natural gas for 2018, $2.75 for 2019, $2.68 for 2020 and $2.66 for 2021 thereafter, on the NYMEX Henry Hub. NGL pricing used in determining our Strip Pricing reserves was approximately 36% of future crude oil prices. Also, we have taken into account pricing differentials reflective of the current market environment. Please see “—Summary Reserves and Operating Data.” |

Our Stable California Operating and Development Cost Environment

The operating and development cost structures of our conventional California asset base are inherently stable and predictable. Our California focus largely insulates us from the cost inflation pressures experienced by our peers who operate primarily in unconventional plays. This is the result of our established infrastructure, low-intensity service requirements and lack of dependence on inventory-constrained and often highly specialized equipment. In addition, the majority of our California assets reside in the shallow steam-flood fields of the San Joaquin basin, which are lower cost to develop compared to the water flood fields of the Los Angeles and Ventura basins.

4

Table of Contents

Our Reserves and Assets

The majority of our reserves are composed of heavy crude oil in shallow, long-lived reservoirs. Approximately two-thirds of our proved reserves and approximately 90% of the PV-10 value of our proved reserves are derived from our assets in California. We also operate in the Uinta basin in Utah, a stacked, multi-bench, light-oil-prone play with significant undeveloped resources and in the East Texas basin, an extensive over-pressured natural gas cell, as well as in the Piceance basin in Colorado, a prolific natural gas play with low geologic risk.

Using SEC Pricing as of December 31, 2017, the standardized measure of discounted future net cash flows of our proved reserves and the PV-10 of our proved reserves were approximately $1.0 billion and $1.1 billion, respectively. Using Strip Pricing as of May 31, 2018, the PV-10 of our proved reserves was approximately $1.9 billion. PV-10 is a financial measure that is not calculated in accordance with U.S. generally accepted accounting principles (“GAAP”). For a definition of PV-10 and a reconciliation to the standardized measure of discounted future net cash flows, please see “—Summary Reserves and Operating Data—PV-10.”

The charts below summarize certain characteristics of our proved reserves and PV-10 of proved reserves using SEC Pricing as of December 31, 2017 and Strip Pricing as of May 31, 2018 (as described in the tables below and in “—Summary Reserves and Operating Data”):

| 1P Reserves by Commodity (SEC Pricing) (141 MMBoe) |

1P PV-10 by Area (SEC Pricing) ($1.1 billion) | |

|

|

| |

| 1P Reserves by Commodity (Strip Pricing) (115 MMBoe)

|

1P PV-10 by Area (Strip Pricing) ($1.9 billion) | |

|

|

|

5

Table of Contents

The tables below summarize our proved reserves and PV-10 by category using SEC Pricing as of December 31, 2017 and Strip Pricing as of May 31, 2018:

| SEC Pricing as of December 31, 2018(1) | ||||||||||||||||||||||||||||||||

| Oil (MMBbl) |

Natural Gas (Bcf) |

NGLs (MMBbl) |

Total (MMBoe) |

% of Proved |

% Proved Developed |

Capex(2) ($MM) |

PV-10(3) ($MM) |

|||||||||||||||||||||||||

| PDP |

63 | 100 | 1 | 81 | 57 | 93 | $ | 50 | $ | 762 | ||||||||||||||||||||||

| PDNP |

6 | — | — | 6 | 4 | 7 | 10 | 89 | ||||||||||||||||||||||||

| PUD(5) |

32 | 137 | — | 55 | 39 | — | 488 | 262 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total |

101 | 237 | 1 | 141 | 100 | 100 | $ | 548 | $ | 1,114 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Strip Pricing as of May 31, 2018(4) | ||||||||||||||||||||||||||||||||

| Oil (MMBbl) |

Natural Gas (Bcf) |

NGLs (MMBbl) |

Total (MMBoe) |

% of Proved |

% Proved Developed |

Capex(2) ($MM) |

PV-10(3) ($MM) |

|||||||||||||||||||||||||

| PDP |

64 | 67 | 1 | 77 | 67 | 93 | 50 | 1,205 | ||||||||||||||||||||||||

| PDNP |

6 | — | — | 6 | 5 | 7 | 10 | 136 | ||||||||||||||||||||||||

| PUD |

32 | — | — | 32 | 28 | — | 348 | 521 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total |

102 | 67 | 1 | 115 | 100 | 100 | 407 | 1,862 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| (1) | Our estimated net reserves were determined using average first-day-of-the-month prices for the prior 12 months in accordance with SEC guidance. The unweighted arithmetic average first-day-of-the-month prices for the prior 12 months were $54.42 per Bbl ICE (Brent) for oil and NGLs and $2.98 per MMBtu NYMEX Henry Hub for natural gas at December 31, 2017. Prices were calculated using oil and natural gas price parameters established by current SEC guidelines and accounting rules, including adjustment by lease for quality, fuel deductions, geographical differentials, marketing bonuses or deductions and other factors affecting the price received at the wellhead. Please see “—Summary Reserves and Operating Data.” |

| (2) | Represents undiscounted future capital expenditures as of December 31, 2017. |

| (3) | PV-10 is a financial measure that is not calculated in accordance with GAAP. For a definition of PV-10 and a reconciliation to the standardized measure of discounted future net cash flows, please see “—Summary Reserves and Operating Data—PV-10.” PV-10 does not give effect to derivatives transactions. |

| (4) | Our Strip Pricing oil, natural gas and NGL reserves were determined using index prices for natural gas and oil, respectively, as of May 31, 2018 without giving effect to derivative transactions. The average future prices for benchmark commodities used in determining our Strip Pricing reserves were $74.59 per Bbl for oil and NGLs for 2018, $72.98 for 2019, $69.15 for 2020 and $66.49 for 2021 thereafter, on the ICE (Brent), and $2.94 per Mcf for natural gas for 2018, $2.75 for 2019, $2.68 for 2020 and $2.66 for 2021 thereafter, on the NYMEX Henry Hub. NGL pricing used in determining our Strip Pricing reserves was approximately 36% of future crude oil prices. The decrease in reserve volumes using Strip Pricing as opposed to SEC Pricing is primarily the result of lower realized gas prices in Colorado using Strip Pricing as of May 31, 2018. Also, we have taken into account pricing differentials reflective of the current market environment. Please see “—Summary Reserves and Operating Data.” |

| (5) | Using SEC Pricing as of December 31, 2017, there were approximately 23 MMBoe of PUDs associated with projects in the Piceance basin. Subsequent to year end, as a result of increasingly negative local gas pricing differentials, we revised our current development plan to exclude the development in the Piceance basin. |

6

Table of Contents

The table below summarizes our average net daily production by basin for the three months ended March 31, 2018:

| Average Net Daily Production for the Three Months Ended March 31, 2018 |

||||||||

| (MBoe/d) | Oil (%) | |||||||

| California |

18.8 | 100 | % | |||||

| Uinta basin |

5.0 | 46 | % | |||||

| Piceance basin |

1.6 | 1 | % | |||||

| East Texas basin |

0.8 | 0 | % | |||||

|

|

|

|

|

|||||

| Total |

26.2 | 81 | % | |||||

|

|

|

|

|

|||||

Our Development Inventory

We have an extensive inventory of low-risk, high-return development opportunities. As of March 31, 2018, we identified 3,397 gross drilling locations that we anticipate drilling over the next 5 to 10 years, which we refer to as our “Tier 1” locations, and 3,656 additional gross drilling locations that are currently under review. For a discussion of how we identify drilling locations, please see “Business—Our Reserves and Production Information—Determination of Identified Drilling Locations.”

We operate over 95% of our productive wells and expect to operate a similar percentage of our identified gross drilling locations. In addition, approximately 76% of our acreage is held by production, including 99% of our acreage in California. Our high degree of operational control, together with the large portion of our acreage that is held by production, gives us flexibility over the execution of our development program, including the timing, amount and allocation of our capital expenditures, technological enhancements and marketing of production.

The following table summarizes certain information concerning our operations as of March 31, 2018:

| Acreage | Net Acreage Held By Production(%) |

Producing Wells, Gross(1)(2) |

Average Working Interest (%)(2)(4) |

Net Revenue Interest (%)(2)(5) |

Identified Drilling Locations(3) |

|||||||||||||||||||||||||||

| Gross | Net | Gross | Net | |||||||||||||||||||||||||||||

| California |

10,880 | 7,945 | 99 | % | 2,600 | 99 | % | 94 | % | 4,858 | 4,847 | |||||||||||||||||||||

| Uinta basin |

133,016 | 96,096 | 72 | % | 909 | 95 | % | 62 | % | 1,245 | 1,083 | |||||||||||||||||||||

| Piceance basin |

10,553 | 8,008 | 85 | % | 170 | 72 | % | 74 | % | 870 | 664 | |||||||||||||||||||||

| East Texas basin |

5,853 | 4,533 | 100 | % | 116 | 99 | % | 78 | % | 80 | 79 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total |

160,302 | 116,582 | 76 | % | 3,795 | 97 | % | 87 | % | 7,053 | 6,673 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| (1) | Includes 469 steamflood and waterflood injection wells in California. |

| (2) | Excludes 91 wells in the Piceance basin each with a 5% working interest and eleven wells in the Permian basin all with less than 0.1% working interest. |

| (3) | Our total identified drilling locations include approximately 790 gross (786 net) locations associated with PUDs as of December 31, 2017, including 161 gross (161 net) steamflood and waterflood injection wells. Please see “Business—Our Reserves and Production Information—Determination of Identified Drilling Locations” for more information regarding the process and criteria through which we identified our drilling locations. |

7

Table of Contents

| (4) | Represents our weighted average working interest in our active wells. |

| (5) | Represents our weighted average net revenue interest for the month of March 2018. |

Additionally, our California assets are primarily focused on the Hill Diatomite, Thermal Diatomite and Thermal Sandstones development areas. As set forth in the table below, as of March 31, 2018, we identified 3,397 Tier 1 gross drilling locations and 3,656 additional gross drilling locations that are currently under review associated with these assets. Our drilling inventory as of March 31, 2018 does not include 250 gross (250 net) locations associated with the Chevron North Midway-Sunset acquisition, which was completed in April 2018.

| Gross Drilling Locations(1) | ||||||||||||||||||||

| State |

Project Type |

Well Type |

Completion Type |

Recovery |

Tier 1(2) | Additional | Total | |||||||||||||

| California |

Hill Diatomite (non-thermal) | Vertical | Low intensity pin point fracture | Pressure depletion augmented with water injection | 311 | 585 | 896 | |||||||||||||

| California |

Thermal Diatomite | Vertical | Short interval perforations | Cyclic steam injection | 774 | 904 | 1,678 | |||||||||||||

| California |

Thermal Sandstones | Vertical / Horizontal | Perforation/Slotted liner/gravel pack | Continuous and cyclic steam injection | 1,860 | 424 | 2,284 | |||||||||||||

| Utah |

Uinta | Vertical / Horizontal | Low intensity fracture stimulation | Pressure depletion | 452 | 793 | 1,245 | |||||||||||||

| Colorado |

Piceance | Vertical | Proppantless slick water fracture stimulation | Pressure depletion | — | (3) | 870 | 870 | ||||||||||||

| Texas |

East Texas | Vertical / Horizontal |

Low intensity fracture stimulation | Pressure depletion | — | 80 | 80 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||||||

| Total |

3,397 | 3,656 | 7,053 | |||||||||||||||||

| (1) | We had 790 gross (786 net) locations associated with PUDs as of December 31, 2017 using SEC Pricing, including 161 gross (161 net) steamflood and waterflood injection wells. Of those 790 gross PUD locations, 710 are associated with projects in California and 80 are associated with the Piceance basin. Please see “Business—Our Reserves and Production Information—Determination of Identified Drilling Locations” for more information regarding the process and criteria through which we identified our drilling locations. During the three months ended March 31, 2018, we drilled 30 gross (30 net) wells that were associated with PUDs at December 31, 2017, including 5 gross (5 net) steamflood and waterflood injection wells. |

| (2) | Represents wells that we anticipate drilling over the next 5 to 10 years. |

| (3) | Using SEC Pricing as of December 31, 2017, there were 80 gross PUD locations associated with projects in the Piceance basin. Subsequent to year end, as a result of increasingly negative local gas pricing differentials, we revised our current development plan to exclude these Piceance locations. |

Other Assets

We produce oil from heavy crude reservoirs using steam to heat the oil so that it will flow. To assist in this development, we own and operate five natural gas cogeneration plants that produce steam. These plants supply approximately 23% of our steam needs and 82% of our field electricity needs in California at a discount to electricity market prices. To further offset our costs, we currently also sell surplus power produced by three of our cogeneration facilities under long-term contracts with California utility companies.

8

Table of Contents

In addition, we own gathering, treatment and storage facilities in California that currently have excess capacity, reducing our need to spend capital to develop nearby assets and generally allowing us to control certain operating costs. We also own a network of oil and gas gathering lines across our assets outside of California, and our oil and natural gas is transported through such lines and third-party gathering systems and pipelines.

We also own a natural gas processing plant with capacity of approximately 30 MMcf/d in the Brundage Canyon area, located in Duchesne County, Utah. This facility takes delivery from gathering and compression facilities we operate. Approximately 90% of the gas gathered at these facilities is produced from wells that we operate. Current throughput at the processing plant is 18 to 20 MMcf/d and sufficient capacity remains for additional large-scale development drilling.

Our Competitive Strengths

We believe that the following competitive strengths will allow us to successfully execute our business strategy.

| • | Stable, low-decline, predictable and oil-weighted conventional asset base. The majority of our interests are in properties that have produced for decades. As a result, the geology and reservoir characteristics are well understood, and new development well results are generally predictable, repeatable and present lower risk than unconventional resource plays. The properties are characterized by long-lived reserves with low production decline rates, a stable cost structure and low-risk developmental drilling opportunities with predictable production profiles. The nature of our assets provides us with a high degree of capital flexibility through commodity cycles. |

| • | Substantial inventory of low-cost, low-risk and high-return development opportunities. We expect our locations to generate highly attractive rates of return. For example, our proved undeveloped reserves in California are projected to average single-well rates of return of approximately 51%, assuming SEC Pricing as of December 31, 2017, based on the assumptions used in preparing our SEC reserve report, which can be found under “Primary Economic Assumptions” on page 6 of our reserve report, and 65% assuming Strip Pricing as of May 31, 2018, based on the assumptions found in the Strip Pricing addendum to our reserve report. Our extensive inventory consists of 3,397 Tier 1 gross drilling locations and 3,656 additional gross drilling locations that are currently under review. |

| • | Brent-influenced pricing advantage. California oil prices are Brent-influenced as California refiners import more than 50% of the state’s demand from foreign sources. There is a closer correlation of prices in California to Brent pricing than to WTI. Without the higher costs associated with importing crude via rail or supertanker, we believe our in-state production and low-cost crude transportation options, coupled with Brent-influenced pricing, will allow us to continue to realize strong cash margins in California. |

| • | Experienced, principled and disciplined management team. Our management team has significant experience operating and managing oil and gas businesses across numerous domestic and international basins, as well as reservoir and recovery types. We will employ our deep technical, operational and strategic management experience to optimize the value of our assets and the Company. We are focused on the principles of growing levered free cash flows as well as the value of our production and reserves. In doing so, we take a disciplined approach to development and operating cost management, field development efficiencies and the application of proven technologies and processes new to our properties in order to generate a sustained cost advantage. |

| • | Substantial capital flexibility derived from a high degree of operational control and stable cost environment. We operate over 95% of our productive wells and expect to operate a similar percentage of our identified gross drilling locations. In addition, approximately 76% of our acreage is held by |

9

Table of Contents

| production, including 99% of our acreage in California. Our high degree of operational control over our properties, together with the large portion of our acreage that is held by production, gives us flexibility over the execution of our development program, including the timing, amount and allocation of our capital expenditures, technological enhancements and marketing of production. We expect our operations to continue to generate sufficient levered free cash flow at current commodity prices to fund maintenance operations and growth. Also, unlike our peers who operate primarily in unconventional plays, our assets generally do not necessitate inventory-constrained and highly specialized equipment, which provides us relative insulation from cost inflation pressures. Our high degree of operational control and relatively stable cost environment provide us significant visibility and understanding of our expected cash flows. |

| • | Conservative balance sheet leverage with ample liquidity and minimal contractual obligations. In February 2018, we closed a private offering of $400 million in aggregate principal amount of 7.00% senior unsecured notes due 2026 (the “2026 Notes”), which resulted in net proceeds to us of approximately $391 million after deducting expenses and the initial purchasers’ discount. After giving effect to our sale of common stock in this offering, we expect to have approximately $ million of available liquidity, defined as cash on hand plus availability under the $1.5 billion reserves-based lending facility we entered into on July 31, 2017 (as amended, the “RBL Facility”). In addition, we have minimal long-term service or fixed-volume delivery commitments. This liquidity and flexibility permit us to capitalize on opportunities that may arise to grow and increase stockholder value. |

Our Business Strategy

The principal elements of our business strategy include the following:

| • | Grow production and reserves in a capital efficient manner using internally generated levered free cash flow. We intend to allocate capital in a disciplined manner to projects that will produce predictable and attractive rates of return. We plan to direct capital to our oil-rich and low-risk development opportunities while focusing on driving cost efficiencies across our asset base with the primary objective of internally funding our capital budget and growth plan. We may also use our capital flexibility to pursue value-enhancing, bolt-on acquisitions to opportunistically improve our positions in existing basins. |

| • | Maximize ultimate hydrocarbon recovery from our assets by optimizing drilling, completion and production techniques and investigating deeper reservoirs and areas beyond our known productive areas. While we intend to utilize proven techniques and technologies, we will also continuously seek efficiencies in our drilling, completion and production techniques in order to optimize ultimate resource recoveries, rates of return and cash flows. We will explore innovative EOR techniques to unlock additional value and have allocated capital towards next generation technologies. For example, in our South Belridge Hill non-thermal and Midway-Sunset thermal Diatomite properties, we employ both fracture stimulation and advanced thermal techniques, and in our Piceance properties, we use advanced proppantless slick water fracture stimulation techniques. In addition, we intend to take advantage of underdevelopment in basins where we operate by expanding our geologic investigation of deeper reservoirs on our acreage and adjacent acreage below existing producing reservoirs. Through these studies, we will seek to expand our development beyond our known productive areas in order to add probable and possible reserves to our inventory at attractive all-in costs. |

| • | Proactively and collaboratively engage in matters related to regulation, safety, environmental and community relations. We are committed to proactive engagement with regulatory agencies in order to realize the full potential of our resources in a timely fashion that safeguards people and the environment and complies with law and regulations. We expect our work with regulators and legislators throughout the rule making process to minimize any adverse impact that new legislation and |

10

Table of Contents

| regulations might have on our ability to maximize our resources. We have found constructive dialogue with regulatory agencies can help avert compliance issues. |

| • | Maintain balance sheet strength and flexibility through commodity price cycles. We intend to fund our capital program primarily through the use of internally generated levered free cash flow from operations. Over time, we expect to de-lever through organic growth and with excess levered free cash flow. Our objective is to achieve and maintain a long-term, through-cycle leverage ratio between 1.5x and 2.0x. |

| • | Return excess free cash flow to stockholders. Our objective is to implement a disciplined and returns-focused approach to capital allocation in order to generate excess free cash flow. We intend to return portions of that excess free cash flow to stockholders on a quarterly basis. If commodity prices increase for a sustained period of time, we would consider repaying debt obligations or returning additional capital to shareholders. For a discussion of our dividend policy, please see “Dividend Policy.” |

| • | Enhance future cash flow stability and visibility through an active and continuous hedging program. Our hedging strategy is designed to insulate our capital program from price fluctuations by securing price realizations and cash flows, including fixed-price gas purchase agreements and other hedging contracts. We have protected a portion of our anticipated production through 2020 as part of our crude oil hedging program. We will review our hedging program continuously as conditions change. |

Our Capital Budget

Following Berry LLC’s emergence from bankruptcy and separation from the Linn Entities, we increased our pace of development and have continued to do so in 2018. Our 2018 anticipated capital expenditure budget of approximately $140 to $160 million represents an increase of approximately 107% over our 2017 capital expenditures, including the successor and predecessor periods, of approximately $73 million. Our 2019 anticipated capital expenditure budget is approximately $210 to $230 million. Based on current commodity prices and a drilling success rate comparable to our historical performance, we believe we will be able to fund our 2018 and 2019 capital programs exclusively with our levered free cash flow. We expect to:

| • | employ: |

| • | three drilling rigs in California for the remainder of 2018; |

| • | one additional drilling rig assigned to drilling opportunities in Utah in the second half of 2018; and |

| • | an average of four rigs in California in 2019; and |

| • | drill approximately 180 to 190 gross development wells in 2018, of which we expect at least 175 will be in California, and 430 to 490 gross development wells in 2019, all of which we expect will be in California. |

The amount and timing of these capital expenditures is within our control and subject to our management’s discretion. We retain the flexibility to defer a portion of these planned capital expenditures depending on a variety of factors, including but not limited to the success of our drilling activities, prevailing and anticipated prices for oil, natural gas and NGLs, the availability of necessary equipment, infrastructure and capital, the receipt and timing of required regulatory permits and approvals, seasonal conditions, drilling and acquisition costs and the level of participation by other interest owners. Any postponement or elimination of our development drilling program could result in a reduction of proved reserve volumes and materially affect our business, financial condition and results of operations.

11

Table of Contents

Our Commodity Hedging Program

We expect our operations to generate substantial cash flows at current commodity prices. We have protected a portion of our anticipated cash flows through 2020 as part of our crude oil hedging program, and we target covering our operating expenses and fixed charges two years out. Our low-decline production base, coupled with our stable operating cost environment, affords us the ability to hedge a material amount of our future expected production. The chart below summarizes our derivative contracts in place as of May 31, 2018.

Hedge Volumes in MMBbls (MBbl/d)

| Weighted Average Prices |

||||||||||||

| Fixed Swap—WTI |

$ | 52.04 | $ | — | $ | — | ||||||

| Fixed Swap—Brent |

74.43 | 75.66 | — | |||||||||

| Call Option—WTI |

55.00 | — | — | |||||||||

| Put Option—Brent(2) |

— | 65.00 | 65.00 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

$ | 70.29 | $ | 67.57 | $ | 65.00 | ||||||

|

|

|

|

|

|

|

|||||||

| Brent (31-May-2018) |

$ | 76.88 | $ | 73.75 | $ | 69.15 | ||||||

| (1) | Calculations based on 214 days as of May 31, 2018. |

| (2) | Excludes deferred premium. |

Recent Developments

Chevron North Midway-Sunset Acquisition

In April 2018, we acquired from Linn Energy Holdings, LLC, a wholly owned subsidiary of Linn Energy (“Linn Holdings”), two leases on an aggregate of 214 acres and a lease option on 490 acres (the “Chevron North Midway-Sunset Acquisition”) of land owned by Chevron U.S.A. in the north Midway-Sunset field immediately adjacent to assets we currently operate. We assumed a drilling commitment for the 214 acres of approximately $34.5 million to drill 115 wells, of which none have been drilled, on or before April 1, 2020, which has been extended to April 1, 2022, and would assume an additional 40 well drilling commitment if we exercise our option on the 490 acres. We paid no other consideration for the acquisition. Our drilling commitment will be tolled for a month for each consecutive 30-day period for which the posted price of WTI is less than $45 per barrel. Our 2018 anticipated capital expenditure budget does not currently include funding for drilling wells against the

12

Table of Contents

assumed drilling commitment, but we have designated funds for drilling appraisal wells to determine whether to exercise the option. This transaction is consistent with our business strategy to investigate areas beyond our known productive areas. See “—Our Business Strategy—Maximize ultimate hydrocarbon recovery from our assets by optimizing drilling, completion and production techniques and investigating deeper reservoirs and areas beyond our known productive areas.”

Senior Unsecured Notes Offering

In February 2018, we closed the offering of $400 million in aggregate principal amount of our 2026 Notes, which resulted in net proceeds to us of approximately $391 million after deducting expenses and the initial purchasers’ discount. We used the net proceeds from the issuance of the 2026 Notes to repay borrowings under the RBL Facility and used the remainder for general corporate purposes.

Preferred Stock Conversion

In connection with this offering, we will amend the Certificate of Designation (the “Series A Certificate of Designation”) of our Series A Convertible Preferred Stock, par value $0.001 per share (the “Series A Preferred Stock”), to provide for the automatic conversion of all outstanding shares of Series A Preferred Stock. Pursuant to the amendment, each outstanding share of Series A Preferred Stock will be automatically converted into (i) 1.05 shares of common stock and (ii) the right to receive $1.75, minus the amount of any cash dividend paid by the Company on such share of Series A Preferred Stock in respect of any period commencing on or after April 1, 2018 (the “Preferred Stock Conversion”). We will use a portion of the proceeds from this offering to fund the cash payable to holders of Series A Preferred Stock in connection with the Preferred Stock Conversion. See “Use of Proceeds.”

Selected Preliminary Operating and Financial Second Quarter Results

Our unaudited condensed consolidated financial statements as of and for the three months ended June 30, 2018 are not yet available. The following estimates are based on our preliminary operating and financial results as of and for the three months ended June 30, 2018 and, as of the date of this prospectus, have not been finalized. These preliminary estimates are derived from our internal records and are based on the most current information available to management. We have prepared these estimates on a basis materially consistent with our historical financial results and in good faith based on our internal reporting as of and for the three months ended June 30, 2018. However, the preliminary financial estimates are not reviewed and are unaudited, and our normal reporting processes with respect to the following preliminary operational and financial results have not been fully completed. During the course of our review process on our operating and financial results as of and for the three months ended June 30, 2018, we could identify items that would require us to make adjustments and could affect our final results. Any such adjustments could be material. Please read “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Cautionary Note Regarding Forward-Looking Statements” for additional information regarding factors that could result in differences between the preliminary operating and financial results that are presented below and the actual results as of and for the three months ended June 30, 2018.

This summary is not intended to be a comprehensive statement of our unaudited financial results for this period. The results of operations for an interim period, including the summary preliminary financial results provided below, may not give a true indication of the results to be expected for a full year or any future period. In addition, the preliminary financial results set forth below should not be viewed as a substitute for full financial statements prepared in accordance with GAAP. Our consolidated financial statements and related notes as of and

13

Table of Contents

for the three months ended June 30, 2018 are not expected to be filed with the SEC until after this offering is completed.

| Three Months Ended June 30, 2018 |

||||||||

| Low Estimate |

High Estimate |

|||||||

| Capital Expenditures(1) |

||||||||

| Production and Operating Data: |

||||||||

| Total production (MBoe)(2) |

||||||||

| Revenues |

||||||||

| Operating expenses(3) |

||||||||

| Average per Boe: |

||||||||

| Revenues |

$ | $ | ||||||

| Operating expenses(3) |

$ | $ | ||||||

| Balance Sheet Data: |

||||||||

| Cash and cash equivalents |

||||||||

| Long-term debt |

||||||||

| (1) | On an accrual basis excluding acquisitions. |

| (2) | Natural gas volumes have been converted to Boe based on energy content of six Mcf of gas to one Bbl of oil. Barrels of oil equivalence does not necessarily result in price equivalence. The price of natural gas on a barrel of oil equivalent basis is currently substantially lower than the corresponding price for oil and has been similarly lower for a number of years. For example, in the year ended December 31, 2017, the average prices of ICE (Brent) oil and NYMEX Henry Hub natural gas were $54.82 per Bbl and $3.11 per Mcf, respectively, resulting in an oil-to-gas ratio of over 17 to 1. |

| (3) | Operating expenses include lease operating expenses, electricity generation expenses, transportation expenses and marketing expenses, net of electricity, transportation and marketing revenue. |

Risk Factors

Investing in our common stock involves risks that include the speculative nature of oil and natural gas exploration, competition, volatile commodity prices and other material factors. You could lose all or part of your investment. You should bear in mind, in reviewing this prospectus, that past experience is no guarantee of future performance. You should read carefully the section of this prospectus entitled “Risk Factors” beginning on page 30 for an explanation of these risks before investing in our common stock and “Cautionary Note Regarding Forward-Looking Statements” on page 50 of this prospectus. In particular, the following considerations may offset our competitive strengths or have a negative effect on our strategy or operating activities:

| • | Oil, natural gas and NGL prices are volatile and directly affect our results. |

| • | Our business requires substantial capital investments. We may be unable to fund these investments through operating cash flow or obtain any needed additional capital on satisfactory terms or at all, which could lead to a decline in our oil and natural gas reserves or production. Our capital investment program is also susceptible to risks, including regulatory and permitting risks, that could materially affect its implementation. |

| • | We may be unable to, or may choose not to, enter into sufficient fixed-price purchase or other hedging agreements to fully protect against decreasing spreads between the price of natural gas and oil on an energy equivalent basis or may otherwise be unable to obtain sufficient quantities of natural gas to conduct our steam operations economically or at desired levels. |

14

Table of Contents

| • | We may be unable to hedge anticipated production volumes on attractive terms or at all, which would subject us to further potential commodity price uncertainty and could adversely affect our net cash provided by operating activities, financial condition and results of operations. |

| • | Estimates of proved reserves and related future net cash flows are not precise. The actual quantities of our proved reserves and future net cash flows may prove to be lower than estimated. |

| • | Unless we replace oil and natural gas reserves, our future reserves and production will decline. |

| • | We may not drill our identified sites at the times we scheduled or at all. |

| • | We may not be able to generate sufficient cash to service all of our indebtedness and may be forced to take other actions to satisfy our obligations under our debt arrangements, which may not be successful. |

| • | We are dependent on our cogeneration facilities to produce steam for our operations. Viable contracts for the sale of surplus electricity, economic market prices and regulatory conditions affect the economic value of these facilities to our operations. |

| • | Future declines in commodity prices, changes in expected capital development, increases in operating costs or adverse changes in well performance may result in write-downs of the carrying amounts of our assets. |

| • | The inability of one or more of our customers to meet their obligations may have a material adverse effect on our business, financial condition, results of operations and cash flows. |

| • | Due to our limited operating history as an independent company following our emergence from bankruptcy in February 2017, we have been in the process of establishing our accounting and other management systems and resources. We may be unable to effectively develop a mature system of internal controls, and a failure of our control systems to prevent error or fraud may materially harm our company. |

The New Berry

Berry was founded by the entrepreneur and our namesake C. J. Berry in the late 1800s. After making his fortune working a small mining operation during the Alaskan gold rush, Mr. Berry returned to California and continued his success with oil exploration and production, founding, in the early 1900s, the business that we would later inherit. Our corporate predecessor company was formed in 1985 after merging several related entities and ultimately became publicly traded beginning in 1987.

In 2013, the Linn Entities acquired our predecessor company in exchange for LinnCo shares and the assumption of debt with an aggregate value of $4.6 billion. A severe industry downturn, coupled with high leverage and significant fixed charges, led the Linn Entities and, consequently, our predecessor company to initiate the Chapter 11 Proceeding on May 11, 2016.

On February 28, 2017, Berry LLC emerged from bankruptcy as a stand-alone company and wholly-owned subsidiary of Berry Corp. with new management, a new board of directors and new ownership. Through the Chapter 11 Proceeding, the Company significantly improved its financial and operational positions from that of Berry LLC while it was owned by the Linn Entities. These improvements included:

| • | the elimination of approximately $1.3 billion of debt and more than $76 million of annualized interest expense; |

| • | a completely new and experienced management team intently focused on operational excellence and conservative financial risk management; |

15

Table of Contents

| • | the termination of, or renegotiation of more favorable terms for, several firm transportation and oil sales contracts; |

| • | the anticipated reduction in recurring general and administrative costs as a stand-alone company by following a lean operating model; and |

| • | $335 million of new capital in exchange for preferred equity. |

Today, we foster Mr. Berry’s entrepreneurial spirit and leadership skills. We encourage our teams to apply his business ethos at every level to move us forward. We strive to have a positive presence in the communities surrounding our operations. Our employees belong to the communities where they work, which we believe aligns our interests with those of the people who live near our operations.

Emerging Growth Company Status

We are an “emerging growth company” as such term is used in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). For as long as we are an emerging growth company, unlike public companies that are not emerging growth companies, we will not be required to:

| • | provide an auditor’s attestation report on management’s assessment of the effectiveness of our system of internal control over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley Act”); |

| • | provide more than two years of audited financial statements and related management’s discussion and analysis of financial condition and results of operations; |

| • | comply with any new requirements adopted by the Public Company Accounting Oversight Board (the “PCAOB”) requiring mandatory audit firm rotation or a supplement to the auditor’s report in which the auditor would be required to provide additional information about the audit and the financial statements of the issuer; |

| • | provide certain disclosure regarding executive compensation required of larger public companies or hold stockholder advisory votes on executive compensation required by the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”); or |

| • | obtain stockholder approval of any golden parachute payments not previously approved. |

We will cease to be an emerging growth company upon the earliest of:

| • | the last day of the fiscal year in which we have $1.07 billion or more in annual revenues; |

| • | the date on which we become a “large accelerated filer” (the fiscal year-end on which the total market value of our common equity securities held by non-affiliates is $700 million or more as of June 30); |

| • | the date on which we issue more than $1.0 billion of non-convertible debt over the prior three-year period; or |

| • | the last day of the fiscal year following the fifth anniversary of our initial public offering. |

In addition, under Section 107 of the JOBS Act emerging growth companies can also delay adopting new or revised accounting standards until such time as those standards apply to private companies. We intend to take advantage of all of the reduced reporting requirements and exemptions, including the longer phase-in periods for the adoption of new or revised financial accounting standards under Section 107 of the JOBS Act until we are no longer an emerging growth company. Our election to use the phase-in periods permitted by this election may make it difficult to compare our financial statements to those of non-emerging growth companies and other

16

Table of Contents

emerging growth companies that have opted out of the longer phase-in periods under Section 107 of the JOBS Act and who will comply with new or revised financial accounting standards. If we were to subsequently elect instead to comply with these public company effective dates, such election would be irrevocable pursuant to Section 107 of the JOBS Act. For a description of the qualifications and other requirements applicable to emerging growth companies and certain elections that we have made due to our status as an emerging growth company, see “Risk Factors—Risks Related to the Offering and Our Capital Stock—We are an “emerging growth company,” and will be able take advantage of reduced disclosure requirements applicable to “emerging growth companies,” which could make our common stock less attractive to investors.”

Corporate Information

We were incorporated in Delaware in February 2017. Our principal executive offices are located at 5201 Truxtun Ave., Bakersfield, California 93309, and we have additional executive offices located at 16000 N. Dallas Pkwy, Ste 100, Dallas, Texas 75248. Our telephone number is (661) 616-3900, and our web address is www.berrypetroleum.com. Information contained in or accessible through our website is not, and should not be deemed to be, part of this prospectus.

17

Table of Contents

The Offering

| Issuer |

Berry Petroleum Corporation. |

| Common stock offered by us |

shares (or shares, if the underwriters exercise in full their option to purchase additional shares). |

| Common stock offered by the selling stockholders |

shares. |

| Common stock outstanding after this offering |

shares, including shares of common stock issued in connection with the Preferred Stock Conversion (or shares, if the underwriters exercise in full their option to purchase additional shares). |

| Option to purchase additional shares |

We have granted the underwriters a 30-day option to purchase up to an aggregate of additional shares of our common stock if the underwriters sell more than shares of common stock in this offering. |

| Use of proceeds |

Assuming the midpoint of the price range set forth on the cover of this prospectus, we expect to receive approximately $ million of net proceeds from this offering after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We will not receive any proceeds from the sale of shares by the selling stockholders. |

| We intend to use approximately $ million of the proceeds from this offering to repay borrowings under our RBL Facility, approximately $ million to fund the cash payable to holders of our Series A Preferred Stock in connection with the Preferred Stock Conversion and any remaining proceeds for general corporate purposes. Please see “Use of Proceeds.” |

| Conflicts of Interest |

Certain investment funds affiliated with , an underwriter in this offering, own in excess of 10% of our issued and outstanding common and Series A Preferred Stock and will receive, as a holder of Series A Preferred Stock, 5% or more of the net proceeds of this offering due to the cash payment in the connection with the Preferred Stock Conversion. In addition, an affiliate of each of Wells Fargo Securities, LLC and BMO Capital Markets Corp. is a lender under the RBL Facility and will receive 5% or more of the net proceeds of this offering due to the repayment of borrowings under the RBL Facility. Under the rules of the Financial Industry Regulatory Authority, Inc. (“FINRA”), each of , Wells Fargo Securities, LLC and BMO Capital Markets Corp. are deemed to have a conflict of interest with us within the meaning of FINRA Rule 5121. |

Because of the conflicts of interest, this offering is being conducted in accordance with FINRA Rule 5121, which requires, among other

18

Table of Contents

things, that a “qualified independent underwriter” participate in the preparation of, and exercise the usual standards of “due diligence” with respect to, the registration statement and this prospectus.

In accordance with this rule, has assumed the responsibilities of acting as a qualified independent underwriter. will not receive any additional fees for serving as a qualified independent underwriter in connection with this offering. , Wells Fargo Securities, LLC and BMO Capital Markets Corp. will not confirm sales of the shares to any account over which it exercises discretionary authority without the prior written approval of the customer. For more information, please see “Underwriting (Conflicts of Interest)—Conflicts of Interest.”

| Dividend policy |

We anticipate paying cash dividends on our common stock subsequent to this offering. Please see “Dividend Policy.” |

| Listing and trading symbol |

We have applied to list our common stock on the NASDAQ under the symbol “BRY.” |

| Risk factors |

You should carefully read and consider the information set forth under the heading “Risk Factors” on page 30 of this prospectus and all other information set forth in this prospectus before deciding to invest in our common stock. |

The number of shares of common stock that will be outstanding after this offering excludes shares of common stock reserved and available for issuance under the Berry Petroleum Corporation 2017 Omnibus Incentive Plan, as amended and restated (our “Restated Incentive Plan”). As of June 27, 2018, 9,832,111 of the 10,000,000 shares of common stock originally authorized for issuance under the Restated Incentive Plan may be issued in the future pursuant to awards under the Restated Incentive Plan, of which 1,477,998 shares are currently subject to outstanding awards. 167,889 shares of common stock have previously been issued pursuant to awards and are included in the number of shares of common stock that will be outstanding after this offering.

The number of shares of common stock that will be outstanding after this offering also excludes 7,080,000 shares reserved for issuance in connection with settlement of bankruptcy claims as discussed in “Shares Eligible For Future Sale—Plan of Reorganization.” To the extent that holders of unsecured claims elected to receive cash rather than common stock in settlement of their allowed claims, the stock they would have received from the reserved amount will be retained by us as treasury stock under the Plan. While we do not yet know the final amount of shares that we will issue to third parties with respect to the unsecured claims, we have entered into settlement agreements that have materially reduced the potential shares to be issued from the reserved amount. Based on the settlements we have finalized to date, we estimate that we will distribute less than million shares, and we are currently pursuing additional settlements that would further reduce the number of shares that would ultimately be issued in settlement of claims.

19

Table of Contents

Summary Historical and Pro Forma Financial Information

The following table shows the summary historical financial information, for the periods and as of the dates indicated, of our predecessor company (Berry LLC) and successor company (Berry Corp.). The summary historical financial information as of and for the year ended December 31, 2016 is derived from the audited historical financial statements of Berry LLC included elsewhere in this prospectus. The summary historical financial information as of and for the two months ended February 28, 2017 is derived from audited financial statements of Berry LLC included elsewhere in this prospectus. The summary historical financial information for the ten months ended December 31, 2017 is derived from audited consolidated financial statements of Berry Corp. included elsewhere in this prospectus. The summary historical financial information as of and for the one month ended March 31, 2017 and as of and for the three months ended March 31, 2018 is derived from unaudited consolidated financial statements of Berry Corp. included elsewhere in this prospectus.

Upon Berry LLC’s emergence from bankruptcy on February 28, 2017, or the Effective Date, in connection with the Plan, Berry LLC adopted fresh-start accounting and was recapitalized, which resulted in Berry LLC becoming a wholly-owned subsidiary of Berry Corp. and Berry Corp. being treated as the new entity for financial reporting. Upon adoption of fresh-start accounting, our assets and liabilities were recorded at their fair values as of the Effective Date. These fair values of our assets and liabilities differed materially from the recorded values of our assets and liabilities as reflected in Berry LLC’s historical balance sheet. The effects of the Plan and the application of fresh-start accounting are reflected in Berry Corp.’s consolidated financial statements as of the Effective Date and the related adjustments thereto are recorded in our consolidated statements of operations as reorganization items for the periods prior to the Effective Date. As a result, our consolidated financial statements subsequent to the Effective Date are not comparable to our financial statements prior to such date. Our financial results for future periods following the application of fresh-start accounting will be different from historical trends and the differences may be material.

The summary unaudited pro forma financial information for the year ended December 31, 2017 is derived from the audited historical financial statements of Berry LLC and Berry Corp. included elsewhere in this prospectus. The summary unaudited pro forma financial information for the three months ended March 31, 2018 is derived from the unaudited historical financial statements of Berry Corp. included elsewhere in this prospectus.

The summary unaudited pro forma financial information for the year ended December 31, 2017 has been prepared to give pro forma effect to (i) the Plan and related transactions and fresh-start accounting, (ii) our sale of an approximately 78% non-operated working interest in the Hugoton natural gas field located in southwest Kansas and the Oklahoma Panhandle on July 30, 2017 (the “Hugoton Disposition”) and (iii) the Preferred Stock Conversion and this offering, including the application of net proceeds from this offering, as if each had been completed as of January 1, 2017. The summary unaudited pro forma financial information does not give effect to the acquisition we made of the remaining approximately 84% non-operated working interest to consolidate with our existing 16% operated working interest in a South Belridge Hill property, located in Kern County, California, in the San Joaquin basin (the “Hill Acquisition”) because such transaction is not deemed significant under Rule 3-05 of the SEC’s Regulation S-X, so it is not required to be presented.