angi-20210331000170511012/312021Q1false00017051102021-01-012021-03-31xbrli:shares0001705110us-gaap:CommonClassAMember2021-04-300001705110us-gaap:CommonClassBMember2021-04-300001705110us-gaap:CommonClassCMember2021-04-30iso4217:USD00017051102021-03-3100017051102020-12-31iso4217:USDxbrli:shares0001705110us-gaap:CommonClassAMember2020-12-310001705110us-gaap:CommonClassAMember2021-03-310001705110us-gaap:CommonClassBMember2020-12-310001705110us-gaap:CommonClassBMember2021-03-310001705110us-gaap:CommonClassCMember2021-03-310001705110us-gaap:CommonClassCMember2020-12-3100017051102020-01-012020-03-310001705110us-gaap:SellingAndMarketingExpenseMember2021-01-012021-03-310001705110us-gaap:SellingAndMarketingExpenseMember2020-01-012020-03-310001705110us-gaap:GeneralAndAdministrativeExpenseMember2021-01-012021-03-310001705110us-gaap:GeneralAndAdministrativeExpenseMember2020-01-012020-03-310001705110us-gaap:ResearchAndDevelopmentExpenseMember2021-01-012021-03-310001705110us-gaap:ResearchAndDevelopmentExpenseMember2020-01-012020-03-310001705110us-gaap:CommonClassAMemberus-gaap:CommonStockMember2021-03-310001705110us-gaap:CommonStockMemberus-gaap:CommonClassBMember2021-03-310001705110us-gaap:CommonClassCMemberus-gaap:CommonStockMember2021-03-310001705110angi:RedeemableNoncontrollingInterestsMember2020-12-310001705110us-gaap:CommonClassAMemberus-gaap:CommonStockMember2020-12-310001705110us-gaap:CommonStockMemberus-gaap:CommonClassBMember2020-12-310001705110us-gaap:AdditionalPaidInCapitalMember2020-12-310001705110us-gaap:RetainedEarningsMember2020-12-310001705110us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001705110us-gaap:TreasuryStockMember2020-12-310001705110us-gaap:ParentMember2020-12-310001705110us-gaap:NoncontrollingInterestMember2020-12-310001705110angi:RedeemableNoncontrollingInterestsMember2021-01-012021-03-310001705110us-gaap:RetainedEarningsMember2021-01-012021-03-310001705110us-gaap:ParentMember2021-01-012021-03-310001705110us-gaap:NoncontrollingInterestMember2021-01-012021-03-310001705110us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-03-310001705110us-gaap:AdditionalPaidInCapitalMember2021-01-012021-03-310001705110us-gaap:CommonClassAMemberus-gaap:CommonStockMember2021-01-012021-03-310001705110us-gaap:CommonStockMemberus-gaap:CommonClassBMember2021-01-012021-03-310001705110us-gaap:TreasuryStockMember2021-01-012021-03-310001705110angi:RedeemableNoncontrollingInterestsMember2021-03-310001705110us-gaap:AdditionalPaidInCapitalMember2021-03-310001705110us-gaap:RetainedEarningsMember2021-03-310001705110us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-03-310001705110us-gaap:TreasuryStockMember2021-03-310001705110us-gaap:ParentMember2021-03-310001705110us-gaap:NoncontrollingInterestMember2021-03-310001705110angi:RedeemableNoncontrollingInterestsMember2019-12-310001705110us-gaap:CommonClassAMemberus-gaap:CommonStockMember2019-12-310001705110us-gaap:CommonStockMemberus-gaap:CommonClassBMember2019-12-310001705110us-gaap:AdditionalPaidInCapitalMember2019-12-310001705110us-gaap:RetainedEarningsMember2019-12-310001705110us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001705110us-gaap:TreasuryStockMember2019-12-310001705110us-gaap:ParentMember2019-12-310001705110us-gaap:NoncontrollingInterestMember2019-12-3100017051102019-12-310001705110angi:RedeemableNoncontrollingInterestsMember2020-01-012020-03-310001705110us-gaap:RetainedEarningsMember2020-01-012020-03-310001705110us-gaap:ParentMember2020-01-012020-03-310001705110us-gaap:NoncontrollingInterestMember2020-01-012020-03-310001705110us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-03-310001705110us-gaap:AdditionalPaidInCapitalMember2020-01-012020-03-310001705110us-gaap:CommonClassAMemberus-gaap:CommonStockMember2020-01-012020-03-310001705110us-gaap:CommonStockMemberus-gaap:CommonClassBMember2020-01-012020-03-310001705110us-gaap:TreasuryStockMember2020-01-012020-03-310001705110angi:RedeemableNoncontrollingInterestsMember2020-03-310001705110us-gaap:CommonClassAMemberus-gaap:CommonStockMember2020-03-310001705110us-gaap:CommonStockMemberus-gaap:CommonClassBMember2020-03-310001705110us-gaap:AdditionalPaidInCapitalMember2020-03-310001705110us-gaap:RetainedEarningsMember2020-03-310001705110us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-03-310001705110us-gaap:TreasuryStockMember2020-03-310001705110us-gaap:ParentMember2020-03-310001705110us-gaap:NoncontrollingInterestMember2020-03-3100017051102020-03-31angi:categoryangi:professionalangi:projectangi:segmentxbrli:pure0001705110us-gaap:CommonClassBMemberangi:AngiMemberangi:IACMember2021-03-310001705110us-gaap:USTreasurySecuritiesMember2020-12-310001705110us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2021-03-310001705110us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel2Member2021-03-310001705110us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel3Member2021-03-310001705110us-gaap:MoneyMarketFundsMember2021-03-310001705110us-gaap:FairValueInputsLevel1Memberus-gaap:USTreasurySecuritiesMember2021-03-310001705110us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasurySecuritiesMember2021-03-310001705110us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel3Member2021-03-310001705110us-gaap:USTreasurySecuritiesMember2021-03-310001705110us-gaap:BankTimeDepositsMemberus-gaap:FairValueInputsLevel1Member2021-03-310001705110us-gaap:BankTimeDepositsMemberus-gaap:FairValueInputsLevel2Member2021-03-310001705110us-gaap:BankTimeDepositsMemberus-gaap:FairValueInputsLevel3Member2021-03-310001705110us-gaap:BankTimeDepositsMember2021-03-310001705110us-gaap:FairValueInputsLevel1Memberus-gaap:USTreasurySecuritiesMember2021-03-310001705110us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasurySecuritiesMember2021-03-310001705110us-gaap:FairValueInputsLevel3Memberus-gaap:USTreasurySecuritiesMember2021-03-310001705110us-gaap:USTreasurySecuritiesMember2021-03-310001705110us-gaap:FairValueInputsLevel1Member2021-03-310001705110us-gaap:FairValueInputsLevel2Member2021-03-310001705110us-gaap:FairValueInputsLevel3Member2021-03-310001705110us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2020-12-310001705110us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel2Member2020-12-310001705110us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel3Member2020-12-310001705110us-gaap:MoneyMarketFundsMember2020-12-310001705110us-gaap:FairValueInputsLevel1Memberus-gaap:USTreasurySecuritiesMember2020-12-310001705110us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasurySecuritiesMember2020-12-310001705110us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel3Member2020-12-310001705110us-gaap:USTreasurySecuritiesMember2020-12-310001705110us-gaap:BankTimeDepositsMemberus-gaap:FairValueInputsLevel1Member2020-12-310001705110us-gaap:BankTimeDepositsMemberus-gaap:FairValueInputsLevel2Member2020-12-310001705110us-gaap:BankTimeDepositsMemberus-gaap:FairValueInputsLevel3Member2020-12-310001705110us-gaap:BankTimeDepositsMember2020-12-310001705110us-gaap:FairValueInputsLevel1Memberus-gaap:USTreasurySecuritiesMember2020-12-310001705110us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasurySecuritiesMember2020-12-310001705110us-gaap:FairValueInputsLevel3Memberus-gaap:USTreasurySecuritiesMember2020-12-310001705110us-gaap:FairValueInputsLevel1Member2020-12-310001705110us-gaap:FairValueInputsLevel2Member2020-12-310001705110us-gaap:FairValueInputsLevel3Member2020-12-310001705110us-gaap:CarryingReportedAmountFairValueDisclosureMember2021-03-310001705110us-gaap:EstimateOfFairValueFairValueDisclosureMember2021-03-310001705110us-gaap:CarryingReportedAmountFairValueDisclosureMember2020-12-310001705110us-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310001705110angi:A3875SeniorNotesMemberus-gaap:SeniorNotesMember2021-03-310001705110angi:A3875SeniorNotesMemberus-gaap:SeniorNotesMember2020-12-310001705110angi:ANGITermLoandueNovember052023Memberus-gaap:LoansPayableMember2021-03-310001705110angi:ANGITermLoandueNovember052023Memberus-gaap:LoansPayableMember2020-12-310001705110angi:ANGITermLoandueNovember052023Memberus-gaap:LondonInterbankOfferedRateLIBORMemberus-gaap:LoansPayableMember2020-01-012020-12-310001705110angi:ANGITermLoandueNovember052023Memberus-gaap:LondonInterbankOfferedRateLIBORMemberus-gaap:LoansPayableMember2021-01-012021-03-310001705110angi:ANGITermLoandueNovember052023Memberus-gaap:LoansPayableMember2021-01-012021-03-310001705110angi:ANGITermLoandueNovember052023Memberus-gaap:LoansPayableMember2020-01-012020-12-310001705110srt:MaximumMemberangi:ANGITermLoandueNovember052023Memberus-gaap:LoansPayableMember2021-01-012021-03-310001705110angi:ANGITermLoandueNovember052023Membersrt:MinimumMemberus-gaap:LoansPayableMember2021-01-012021-03-310001705110us-gaap:RevolvingCreditFacilityMemberangi:ANGIHomeservicesCreditFacilityMember2018-11-050001705110us-gaap:RevolvingCreditFacilityMemberangi:ANGIHomeservicesCreditFacilityMember2021-03-310001705110us-gaap:RevolvingCreditFacilityMemberangi:ANGIHomeservicesCreditFacilityMember2020-12-310001705110us-gaap:RevolvingCreditFacilityMemberangi:ANGIHomeservicesCreditFacilityMember2020-01-012020-12-310001705110us-gaap:RevolvingCreditFacilityMemberangi:ANGIHomeservicesCreditFacilityMember2021-01-012021-03-310001705110us-gaap:AccumulatedTranslationAdjustmentMember2020-12-310001705110us-gaap:AccumulatedTranslationAdjustmentMember2021-01-012021-03-310001705110us-gaap:AccumulatedTranslationAdjustmentMember2021-03-310001705110us-gaap:AccumulatedTranslationAdjustmentMember2019-12-310001705110us-gaap:AccumulatedTranslationAdjustmentMember2020-01-012020-03-310001705110us-gaap:AccumulatedTranslationAdjustmentMember2020-03-310001705110angi:StockOptionsWarrantsandSubsidiaryDenominatedEquityExchangeofExchangeableNotesandVestingofRSUsMember2021-01-012021-03-310001705110us-gaap:PerformanceSharesMember2021-01-012021-03-310001705110srt:NorthAmericaMember2021-01-012021-03-310001705110srt:NorthAmericaMember2020-01-012020-03-310001705110srt:EuropeMember2021-01-012021-03-310001705110srt:EuropeMember2020-01-012020-03-310001705110angi:MarketplaceConsumerConnectionMembersrt:NorthAmericaMember2021-01-012021-03-310001705110angi:MarketplaceConsumerConnectionMembersrt:NorthAmericaMember2020-01-012020-03-310001705110srt:NorthAmericaMemberangi:MarketplaceMembershipSubscriptionMember2021-01-012021-03-310001705110srt:NorthAmericaMemberangi:MarketplaceMembershipSubscriptionMember2020-01-012020-03-310001705110srt:NorthAmericaMemberangi:MarketplaceServiceOtherMember2021-01-012021-03-310001705110srt:NorthAmericaMemberangi:MarketplaceServiceOtherMember2020-01-012020-03-310001705110angi:MarketplaceMembersrt:NorthAmericaMember2021-01-012021-03-310001705110angi:MarketplaceMembersrt:NorthAmericaMember2020-01-012020-03-310001705110angi:AdvertisingandServiceOtherMembersrt:NorthAmericaMember2021-01-012021-03-310001705110angi:AdvertisingandServiceOtherMembersrt:NorthAmericaMember2020-01-012020-03-310001705110angi:ConsumerConnectionMembersrt:EuropeMember2021-01-012021-03-310001705110angi:ConsumerConnectionMembersrt:EuropeMember2020-01-012020-03-310001705110srt:EuropeMemberangi:MembershipSubscriptionMember2021-01-012021-03-310001705110srt:EuropeMemberangi:MembershipSubscriptionMember2020-01-012020-03-310001705110angi:AdvertisingandServiceOtherMembersrt:EuropeMember2021-01-012021-03-310001705110angi:AdvertisingandServiceOtherMembersrt:EuropeMember2020-01-012020-03-310001705110country:US2021-01-012021-03-310001705110country:US2020-01-012020-03-310001705110us-gaap:NonUsMember2021-01-012021-03-310001705110us-gaap:NonUsMember2020-01-012020-03-310001705110country:US2021-03-310001705110country:US2020-12-310001705110us-gaap:NonUsMember2021-03-310001705110us-gaap:NonUsMember2020-12-310001705110us-gaap:ServiceAgreementsMemberus-gaap:MajorityShareholderMember2021-01-012021-03-310001705110us-gaap:ServiceAgreementsMemberus-gaap:MajorityShareholderMember2020-01-012020-03-310001705110us-gaap:ServiceAgreementsMemberus-gaap:MajorityShareholderMember2021-03-310001705110us-gaap:ServiceAgreementsMemberus-gaap:MajorityShareholderMember2020-12-310001705110angi:SubleaseAgreementMemberus-gaap:MajorityShareholderMember2020-01-012020-03-310001705110angi:SubleaseAgreementMemberus-gaap:MajorityShareholderMember2021-01-012021-03-310001705110angi:SubleaseAgreementMemberus-gaap:MajorityShareholderMember2021-03-310001705110angi:SubleaseAgreementMemberus-gaap:MajorityShareholderMember2020-12-310001705110us-gaap:MajorityShareholderMemberangi:TaxSharingAgreementMember2020-03-310001705110us-gaap:MajorityShareholderMemberangi:TaxSharingAgreementMember2021-03-310001705110us-gaap:MajorityShareholderMemberangi:TaxSharingAgreementMember2020-01-012020-03-310001705110us-gaap:MajorityShareholderMemberangi:TaxSharingAgreementMember2021-01-012021-03-310001705110us-gaap:CommonClassBMemberus-gaap:MajorityShareholderMemberangi:EmployeeMattersAgreementMember2021-01-012021-03-310001705110us-gaap:CommonClassBMemberus-gaap:MajorityShareholderMemberangi:EmployeeMattersAgreementMember2020-01-012020-03-310001705110us-gaap:CommonClassAMemberus-gaap:MajorityShareholderMemberangi:EmployeeMattersAgreementMember2021-01-012021-03-310001705110us-gaap:CommonClassAMemberus-gaap:MajorityShareholderMemberangi:EmployeeMattersAgreementMember2020-01-012020-03-310001705110us-gaap:SubsequentEventMemberangi:ANGITermLoandueNovember052023Memberus-gaap:LoansPayableMember2021-05-062021-05-06

As filed with the Securities and Exchange Commission on May 7, 2021

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended March 31, 2021

Or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from__________to__________ |

Commission File No. 001-38220

Angi Inc.

(Exact name of Registrant as specified in its charter) | | | | | | | | |

| Delaware | | 82-1204801 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

3601 Walnut Street, Denver, CO 80205

(Address of Registrant’s principal executive offices)

(303) 963-7200

(Registrant’s telephone number, including area code)

ANGI Homeservices Inc.

(Former name or former address, if changed since last report)

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol | | Name of exchange on which registered |

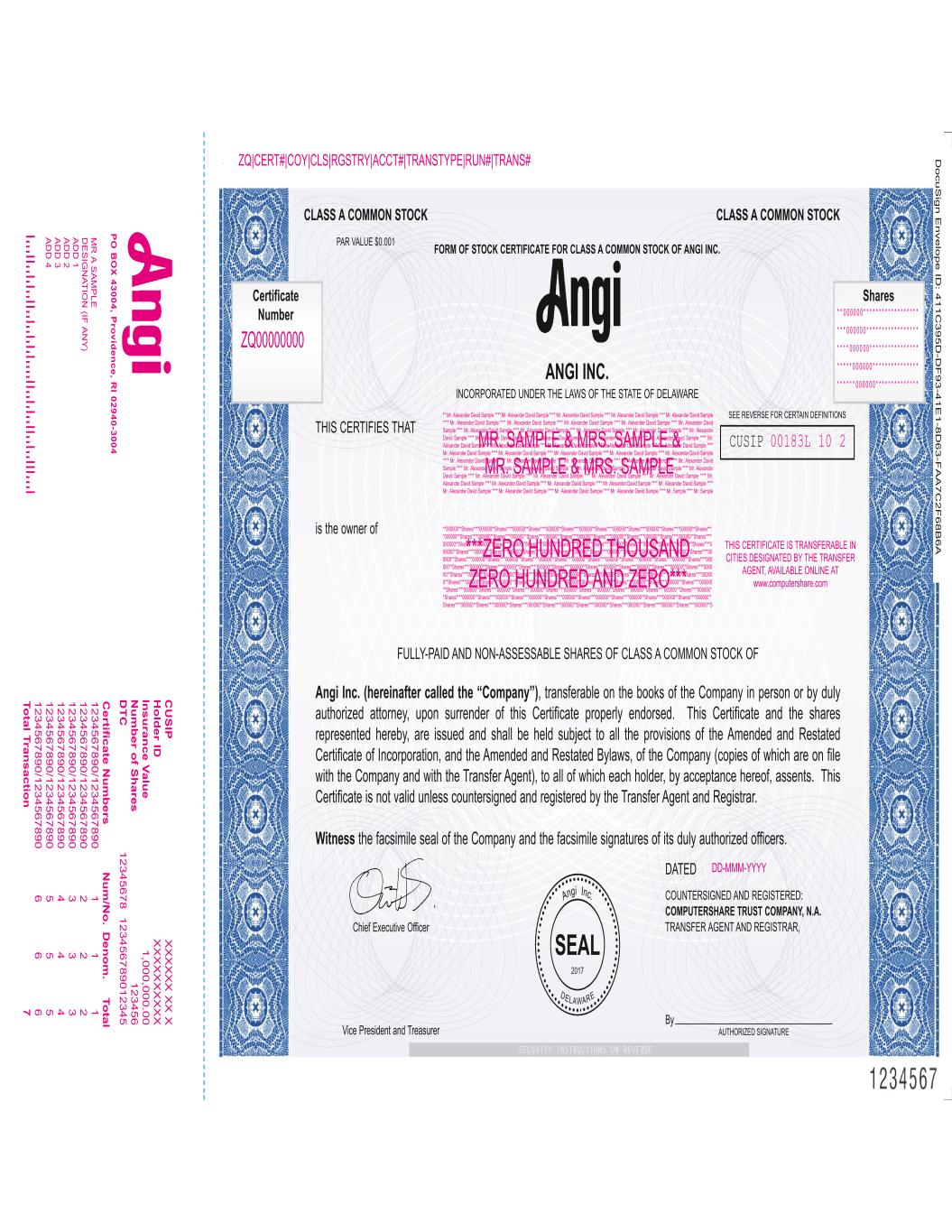

| Class A Common Stock, par value $0.001 | | ANGI | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | ☐ | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of April 30, 2021, the following shares of the Registrant’s common stock were outstanding:

| | | | | |

| Class A Common Stock | 82,445,011 | |

| Class B Common Stock | 421,958,021 | |

| Class C Common Stock | — | |

| Total outstanding Common Stock | 504,403,032 | |

PART I

FINANCIAL INFORMATION

Item 1. Consolidated Financial Statements

ANGI INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEET

(Unaudited) | | | | | | | | | | | |

| March 31, 2021 | | December 31, 2020 |

| (In thousands, except par value amounts) |

| ASSETS | | | |

| Cash and cash equivalents | $ | 777,041 | | | $ | 812,705 | |

| Marketable debt securities | — | | | 49,995 | |

Accounts receivable, net of reserves of $28,908 and $27,839, respectively | 56,915 | | | 43,148 | |

| Other current assets | 74,037 | | | 71,958 | |

| Total current assets | 907,993 | | | 977,806 | |

| | | |

| Capitalized software, leasehold improvements and equipment, net | 111,431 | | | 108,842 | |

| Goodwill | 891,286 | | | 891,797 | |

| Intangible assets, net | 204,626 | | | 209,717 | |

| | | |

| Other non-current assets | 186,253 | | | 180,020 | |

| TOTAL ASSETS | $ | 2,301,589 | | | $ | 2,368,182 | |

| | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | |

| LIABILITIES: | | | |

| | | |

| Accounts payable | 35,251 | | | 30,805 | |

| Deferred revenue | 57,675 | | | 54,654 | |

| Accrued expenses and other current liabilities | 154,394 | | | 148,219 | |

| Total current liabilities | 247,320 | | | 233,678 | |

| | | |

| Long-term debt, net | 705,987 | | | 712,277 | |

| Deferred income taxes | 1,315 | | | 1,296 | |

| Other long-term liabilities | 108,416 | | | 111,710 | |

| | | |

| Redeemable noncontrolling interests | 4,608 | | | 26,364 | |

| | | |

| Commitments and contingencies | | | |

| | | |

| SHAREHOLDERS’ EQUITY: | | | |

Class A common stock, $0.001 par value; authorized 2,000,000 shares; issued 98,408 and 94,283 shares, respectively, and outstanding 82,088 and 78,333, respectively | 98 | | | 94 | |

Class B convertible common stock, $0.001 par value; authorized 1,500,000 shares; 421,958 and 421,862 shares issued and outstanding | 422 | | | 422 | |

Class C common stock, $0.001 par value; authorized 1,500,000 shares; no shares issued and outstanding | — | | | — | |

| Additional paid-in capital | 1,333,294 | | | 1,379,469 | |

| Retained earnings | 11,680 | | | 9,749 | |

| Accumulated other comprehensive income | 4,623 | | | 4,637 | |

Treasury stock, 16,320 and 15,905 shares, respectively | (126,997) | | | (122,081) | |

| Total Angi Inc. shareholders’ equity | 1,223,120 | | | 1,272,290 | |

| Noncontrolling interests | 10,823 | | | 10,567 | |

| Total shareholders’ equity | 1,233,943 | | | 1,282,857 | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 2,301,589 | | | $ | 2,368,182 | |

The accompanying Notes to Consolidated Financial Statements are an integral part of these statements.

ANGI INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF OPERATIONS

(Unaudited)

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2021 | | 2020 |

| (In thousands, except per share data) |

| Revenue | $ | 387,029 | | | $ | 343,650 | |

| Operating costs and expenses: | | | |

| Cost of revenue (exclusive of depreciation shown separately below) | 53,828 | | | 33,229 | |

| Selling and marketing expense | 205,840 | | | 189,959 | |

| General and administrative expense | 88,162 | | | 94,556 | |

| Product development expense | 18,047 | | | 17,084 | |

| Depreciation | 15,969 | | | 12,138 | |

| Amortization of intangibles | 5,074 | | | 12,980 | |

| Total operating costs and expenses | 386,920 | | | 359,946 | |

| Operating income (loss) | 109 | | | (16,296) | |

| Interest expense | (6,617) | | | (2,274) | |

| Other (expense) income, net | (767) | | | 421 | |

| Loss before income taxes | (7,275) | | | (18,149) | |

| Income tax benefit | 9,289 | | | 8,965 | |

| Net earnings (loss) | 2,014 | | | (9,184) | |

| Net (earnings) loss attributable to noncontrolling interests | (83) | | | 226 | |

| Net earnings (loss) attributable to Angi Inc. shareholders | $ | 1,931 | | | $ | (8,958) | |

| | | |

| Per share information attributable to Angi Inc. shareholders: |

| Basic earnings (loss) per share | $ | 0.00 | | | $ | (0.02) | |

| Diluted earnings (loss) per share | $ | 0.00 | | | $ | (0.02) | |

| | | |

| Stock-based compensation expense by function: | | | |

| | | |

| Selling and marketing expense | $ | 1,017 | | | $ | 1,003 | |

| General and administrative expense | 84 | | | 22,980 | |

| Product development expense | 933 | | | 1,592 | |

| Total stock-based compensation expense | $ | 2,034 | | | $ | 25,575 | |

ANGI INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF COMPREHENSIVE OPERATIONS

(Unaudited)

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2021 | | 2020 |

| |

| Net earnings (loss) | $ | 2,014 | | | $ | (9,184) | |

| Other comprehensive income (loss): | | | |

| Change in foreign currency translation adjustment | 679 | | | (6,568) | |

| | | |

| | | |

| Comprehensive income (loss) | 2,693 | | | (15,752) | |

| Components of comprehensive (income) loss attributable to noncontrolling interests: | | | |

| Net (earnings) loss attributable to noncontrolling interests | (83) | | | 226 | |

| Change in foreign currency translation adjustment attributable to noncontrolling interests | (693) | | | (46) | |

| Comprehensive (income) loss attributable to noncontrolling interests | (776) | | | 180 | |

| Comprehensive income (loss) attributable to Angi Inc. shareholders | $ | 1,917 | | | $ | (15,572) | |

ANGI INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF SHAREHOLDERS' EQUITY

Three Months Ended March 31, 2021 and 2020

(Unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Angi Inc. Shareholders’ Equity | | | | |

| | | | Class A Common Stock $0.001 Par Value | | Class B Convertible Common Stock $0.001 Par Value | | Class C Common Stock $0.001 Par Value | | | | | | | | | | Total Angi Inc. Shareholders’ Equity | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | Accumulated Other Comprehensive Income (Loss) | | | | | | | Total Shareholders’ Equity |

| Redeemable

Noncontrolling

Interests | | | | | | | | | | | | | | | Additional Paid-in Capital | | Retained Earnings (Accumulated Deficit) | | | Treasury

Stock | | | Noncontrolling

Interests | |

| | | $ | | Shares | | $ | | Shares | | $ | | Shares | | | | | | | |

| | | (In thousands) | | |

| Balance as of December 31, 2020 | $ | 26,364 | | | | $ | 94 | | | 94,238 | | | $ | 422 | | | 421,862 | | | $ | — | | | — | | | $ | 1,379,469 | | | $ | 9,749 | | | $ | 4,637 | | | $ | (122,081) | | | $ | 1,272,290 | | | $ | 10,567 | | | $ | 1,282,857 | |

| Net (loss) earnings | (60) | | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 1,931 | | | — | | | — | | | 1,931 | | | 143 | | | 2,074 | |

| Other comprehensive income (loss) | 580 | | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (14) | | | — | | | (14) | | | 113 | | | 99 | |

| Stock-based compensation expense | — | | | | — | | | — | | | — | | | — | | | — | | | — | | | 2,542 | | | — | | | — | | | — | | | 2,542 | | | — | | | 2,542 | |

| Issuance of common stock pursuant to stock-based awards, net of withholding taxes | — | | | | 1 | | | 1,591 | | | — | | | — | | | — | | | — | | | (48,052) | | | — | | | — | | | — | | | (48,051) | | | — | | | (48,051) | |

| Issuance of common stock to IAC pursuant to the employee matters agreement | — | | | | 3 | | | 2,579 | | | — | | | 96 | | | — | | | — | | | (3) | | | — | | | — | | | — | | | — | | | — | | | — | |

| Purchase of treasury stock | — | | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (4,916) | | | (4,916) | | | — | | | (4,916) | |

| Purchase of redeemable noncontrolling interests | (22,938) | | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Adjustment of redeemable noncontrolling interests to fair value | 662 | | | | — | | | — | | | — | | | — | | | — | | | — | | | (662) | | | — | | | — | | | — | | | (662) | | | — | | | (662) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance as of March 31, 2021 | $ | 4,608 | | | | $ | 98 | | | 98,408 | | | $ | 422 | | | 421,958 | | | $ | — | | | — | | | $ | 1,333,294 | | | $ | 11,680 | | | $ | 4,623 | | | $ | (126,997) | | | $ | 1,223,120 | | | $ | 10,823 | | | $ | 1,233,943 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance as of December 31, 2019 | $ | 26,663 | | | | $ | 87 | | | 87,007 | | | $ | 422 | | | 421,570 | | | $ | — | | | — | | | $ | 1,357,075 | | | $ | 16,032 | | | $ | (1,379) | | | $ | (57,949) | | | $ | 1,314,288 | | | $ | 9,264 | | | $ | 1,323,552 | |

| Net (loss) earnings | (275) | | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (8,958) | | | — | | | — | | | (8,958) | | | 49 | | | (8,909) | |

| Other comprehensive income (loss) | 99 | | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (6,614) | | | — | | | (6,614) | | | (53) | | | (6,667) | |

| Stock-based compensation expense | 15 | | | | — | | | — | | | — | | | — | | | — | | | — | | | 22,211 | | | — | | | — | | | — | | | 22,211 | | | — | | | 22,211 | |

| Issuance of common stock pursuant to stock-based awards, net of withholding taxes | — | | | | 1 | | | 617 | | | — | | | — | | | — | | | — | | | (2,553) | | | — | | | — | | | — | | | (2,552) | | | — | | | (2,552) | |

| Issuance of common stock to IAC pursuant to the employee matters agreement | — | | | | — | | | — | | | — | | | 187 | | | — | | | — | | | (791) | | | — | | | — | | | — | | | (791) | | | — | | | (791) | |

| Purchase of treasury stock | — | | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (38,971) | | | (38,971) | | | — | | | (38,971) | |

| Purchase of redeemable noncontrolling interests | (3,165) | | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Adjustment of redeemable noncontrolling interests to fair value | 476 | | | | — | | | — | | | — | | | — | | | — | | | — | | | (476) | | | — | | | — | | | — | | | (476) | | | — | | | (476) | |

| Adjustment pursuant to the tax sharing agreement | — | | | | — | | | — | | | — | | | — | | | — | | | — | | | 3,613 | | | — | | | — | | | — | | | 3,613 | | | — | | | 3,613 | |

| Balance as of March 31, 2020 | $ | 23,813 | | | | $ | 88 | | | 87,624 | | | $ | 422 | | | 421,757 | | | $ | — | | | — | | | $ | 1,379,079 | | | $ | 7,074 | | | $ | (7,993) | | | $ | (96,920) | | | $ | 1,281,750 | | | $ | 9,260 | | | $ | 1,291,010 | |

ANGI INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF CASH FLOWS

(Unaudited)

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2021 | | 2020 |

| (In thousands) |

| Cash flows from operating activities: | | | |

| Net earnings (loss) | $ | 2,014 | | | $ | (9,184) | |

| Adjustments to reconcile net earnings (loss) to net cash provided by operating activities: | | | |

| Stock-based compensation expense | 2,034 | | | 25,575 | |

| Amortization of intangibles | 5,074 | | | 12,980 | |

| Provision for credit losses | 19,118 | | | 17,807 | |

| Depreciation | 15,969 | | | 12,138 | |

| Deferred income taxes | (10,268) | | | (8,348) | |

| | | |

| Impairment of long-lived assets | 1,854 | | | — | |

| Revenue reserves | 2,910 | | | 2,140 | |

| Other adjustments, net | 2,235 | | | 1,076 | |

| Changes in assets and liabilities, net of effects of acquisitions and dispositions: | | | |

| Accounts receivable | (34,638) | | | (21,226) | |

| Other assets | 573 | | | 3,043 | |

| Accounts payable and other liabilities | 4,539 | | | 21,008 | |

| Income taxes payable and receivable | 938 | | | (873) | |

| Deferred revenue | 2,993 | | | (230) | |

| Net cash provided by operating activities | 15,345 | | | 55,906 | |

| Cash flows from investing activities: | | | |

| | | |

| Capital expenditures | (18,743) | | | (13,236) | |

| | | |

| Proceeds from maturities of marketable debt securities | 50,000 | | | — | |

| Net proceeds from the sale of a business | — | | | 767 | |

| | | |

| | | |

| Net cash provided by (used in) investing activities | 31,257 | | | (12,469) | |

| Cash flows from financing activities: | | | |

| | | |

| Principal payments on Term Loan | (6,875) | | | (3,438) | |

| | | |

| | | |

| Purchase of treasury stock | (4,916) | | | (38,512) | |

| | | |

| Withholding taxes paid on behalf of employees on net settled stock-based awards | (48,168) | | | (3,222) | |

| | | |

| Purchase of noncontrolling interests | (22,938) | | | (3,165) | |

| | | |

| Net cash used in financing activities | (82,897) | | | (48,337) | |

| Total cash used | (36,295) | | | (4,900) | |

| Effect of exchange rate changes on cash and cash equivalents and restricted cash | 384 | | | (1,327) | |

| Net decrease in cash and cash equivalents and restricted cash | (35,911) | | | (6,227) | |

| Cash and cash equivalents and restricted cash at beginning of period | 813,561 | | | 391,478 | |

| Cash and cash equivalents and restricted cash at end of period | $ | 777,650 | | | $ | 385,251 | |

ANGI INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 1—THE COMPANY AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Nature of Operations

Angi Inc. (the “Company”), formerly ANGI Homeservices Inc., connects quality home service professionals with consumers across 500 different categories, from repairing and remodeling homes to cleaning and landscaping. Over 250,000 domestic service professionals actively sought consumer matches, completed jobs, or advertised work through Angi Inc. platforms; and consumers turned to at least one of our brands to find a professional for approximately 34 million projects during the twelve months ended March 31, 2021.

The Company has two operating segments (i) North America (United States and Canada), which includes HomeAdvisor, Angi (formerly Angie’s List), Handy, and HomeStars; and (ii) Europe, which includes Travaux, MyHammer, MyBuilder, Werkspot, and Instapro.

As used herein, “Angi Inc.,” the “Company,” “we,” “our,” “us,” and similar terms refer to Angi Inc. and its subsidiaries (unless the context requires otherwise).

At March 31, 2021, IAC/InterActiveCorp (“IAC”) owned 84.2% and 98.2% of the economic interest and voting interest, respectively, of the Company.

Basis of Presentation and Consolidation

The Company prepares its consolidated financial statements in accordance with U.S. generally accepted accounting principles (“GAAP”). The consolidated financial statements include the accounts of the Company, all entities that are wholly-owned by the Company and all entities in which the Company has a controlling financial interest. All intercompany transactions and balances between and among the Company and its subsidiaries have been eliminated. All intercompany transactions between (i) Angi Inc. and (ii) IAC and its subsidiaries, with the exception of a promissory note payable to a foreign subsidiary of IAC, are considered to be effectively settled for cash at the time the transaction is recorded. See “Note 10—Related Party Transactions with IAC” for additional information on transactions between Angi Inc. and IAC.

For the purpose of these financial statements, income taxes have been computed as if Angi Inc. filed tax returns on a standalone, separate tax return basis. Any differences between taxes currently payable to or receivable from IAC under the tax sharing agreement between the Company and IAC and the current tax provision computed on an as if standalone, separate return basis for GAAP are reflected as adjustments to additional paid-in capital and as financing activities within the statement of cash flows.

In management's opinion, the unaudited interim consolidated financial statements have been prepared on the same basis as the annual consolidated financial statements and reflect all adjustments, consisting of normal and recurring adjustments, necessary for the fair presentation of the Company's consolidated financial position, consolidated results of operations and consolidated cash flows for the periods presented. Interim results are not necessarily indicative of the results that may be expected for the full year. The accompanying unaudited interim consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto included in the Company's Annual Report on Form 10-K for the year ended December 31, 2020.

COVID-19 Update

The impact on the Company from the COVID-19 outbreak, which has been declared a “pandemic” by the World Health Organization, has been varied and volatile. The extent to which developments related to the COVID-19 outbreak and measures designed to curb its spread continue to impact the Company’s business, financial condition and results of operations will depend on future developments, all of which are highly uncertain and many of which are beyond the Company’s control, including the continuing spread of COVID-19, the development and implementation of effective preventative measures (including the global distribution of vaccines) and possible treatments, the scope of governmental and other restrictions on travel, discretionary services (including those provided by certain of our service professionals) and other activity, and public reactions to these developments. For example, these developments and measures have resulted in rapid and adverse changes to

ANGI INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

the operating environment in which we do business, as well as significant uncertainty concerning the near and long term economic ramifications of the COVID-19 outbreak, which have adversely impacted our ability to forecast our results and respond in a timely and effective manner to trends related to the COVID-19 outbreak. The longer the global outbreak and measures designed to curb the spread of the virus continue to adversely affect levels of consumer confidence, discretionary spending and the willingness of consumers to interact with other consumers, vendors and service providers face-to-face (and in turn, adversely affect demand for the Company’s various products and services), the greater the adverse impact is likely to be on the Company’s business, financial condition and results of operations and the more limited will be the Company’s ability to try and make up for delayed or lost revenues. Additionally, many service professionals’ businesses have been adversely impacted by labor and material constraints and many service professionals have limited capacity to take on new business, which has negatively impacted the Company’s ability to monetize on increased levels of service requests.

Accounting Estimates

Management of the Company is required to make certain estimates, judgments and assumptions during the preparation of its consolidated financial statements in accordance with GAAP. These estimates, judgments and assumptions impact the reported amounts of assets, liabilities, revenue and expenses and the related disclosure of contingent assets and liabilities. Actual results could differ from these estimates.

On an ongoing basis, the Company evaluates its estimates and judgments, including those related to: the fair values of cash equivalents and marketable debt securities; the carrying value of accounts receivable, including the determination of the allowance for credit losses and the determination of revenue reserves; the carrying value of right-of-use assets (“ROU assets”); the useful lives and recoverability of definite-lived intangible assets and capitalized software, leasehold improvements and equipment; the recoverability of goodwill and indefinite-lived intangible assets; unrecognized tax benefits; the valuation allowance for deferred income tax assets; and the fair value of and forfeiture rates for stock-based awards, among others. The Company bases its estimates and judgments on historical experience, its forecasts and budgets and other factors that the Company considers relevant.

General Revenue Recognition

Revenue is recognized when control of the promised services or goods is transferred to the Company’s customers and in the amount that reflects the consideration the Company expects to be entitled to in exchange for those services or goods.

Deferred Revenue

Deferred revenue consists of payments that are received or are contractually due in advance of the Company’s performance. The Company classifies deferred revenue as current when the remaining term of the applicable subscription period or expected completion of the Company’s performance obligation is one year or less. The current and non-current deferred revenue balances at December 31, 2020 were $54.7 million and $0.2 million, respectively. During the three months ended March 31, 2021, the Company recognized $34.4 million of revenue that was included in the deferred revenue balance as of December 31, 2020. During the three months ended March 31, 2020, the Company recognized $37.1 million of revenue that was included in the deferred revenue balance as of December 31, 2019. The current and non-current deferred revenue balances at March 31, 2021 are $57.7 million and $0.1 million, respectively. Non-current deferred revenue is included in “Other long-term liabilities” in the accompanying consolidated balance sheet.

Practical Expedients and Exemptions

As permitted under the practical expedient available under ASC 606 Revenue from Contracts with Customers, the Company does not disclose the value of unsatisfied performance obligations for (i) contracts with an original expected length of one year or less, (ii) contracts with variable consideration that is allocated entirely to unsatisfied performance obligations or to a wholly unsatisfied promise accounted for under the series guidance, and (iii) contracts for which the Company recognizes revenue at the amount which the Company has the right to invoice for services performed.

ANGI INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

For sales incentive programs where the customer relationship period is one year or less, the Company has elected the practical expedient to expense the costs as incurred. The amount of capitalized sales commissions where the initial customer relationship period is greater than one year is $49.2 million and $49.6 million at March 31, 2021 and December 31, 2020, respectively. The current and non-current capitalized sales commissions balances are included in “Other current assets” and “Other non-current assets” in the accompanying consolidated balance sheet and are $48.7 million and $49.2 million, and $0.5 million and $0.4 million at March 31, 2021 and December 31, 2020, respectively.

Recent Accounting Pronouncements

There are no recently issued accounting pronouncements that have not yet been adopted that are expected to have a material effect on the results of operations, financial condition or cash flows of the Company.

Reclassifications

Certain prior year amounts have been reclassified to conform to the current year presentation.

NOTE 2—INCOME TAXES

The Company is included within IAC’s tax group for purposes of federal and consolidated state income tax return filings. In all periods presented, the income tax benefit and/or provision has been computed for the Company on an as if standalone, separate return basis and payments to and refunds from IAC for the Company’s share of IAC’s consolidated federal and state tax return liabilities/receivables calculated on this basis have been reflected within cash flows from operating activities in the accompanying consolidated statement of cash flows. The tax sharing agreement between the Company and IAC governs the parties’ respective rights, responsibilities and obligations with respect to tax matters, including responsibility for taxes attributable to the Company, entitlement to refunds, allocation of tax attributes and other matters and, therefore, ultimately governs the amount payable to or receivable from IAC with respect to income taxes. Any differences between taxes currently payable to or receivable from IAC under the tax sharing agreement and the current tax provision computed on an as if standalone, separate return basis for GAAP are reflected as adjustments to additional paid-in capital and as financing activities within the statement of cash flows.

At the end of each interim period, the Company estimates the annual expected effective income tax rate and applies that rate to its ordinary year-to-date earnings or loss. The income tax provision or benefit related to significant, unusual, or extraordinary items, if applicable, that will be separately reported or reported net of their related tax effects are individually computed and recognized in the interim period in which they occur. In addition, the effect of changes in enacted tax laws or rates, tax status, judgment on the realizability of a beginning-of-the-year deferred tax asset in future years or unrecognized tax benefits is recognized in the interim period in which the change occurs.

The computation of the annual expected effective income tax rate at each interim period requires certain estimates and assumptions including, but not limited to, the expected pre-tax income (or loss) for the year, projections of the proportion of income (and/or loss) earned and taxed in foreign jurisdictions, permanent and temporary differences, and the likelihood of the realization of deferred tax assets generated in the current year. The accounting estimates used to compute the provision or benefit for income taxes may change as new events occur, more experience is acquired, additional information is obtained or the Company’s tax environment changes. To the extent that the expected annual effective income tax rate changes during a quarter, the effect of the change on prior quarters is included in income tax provision or benefit in the quarter in which the change occurs.

For the three months ended March 31, 2021, the Company recorded an income tax benefit of $9.3 million due primarily to excess tax benefits generated by the exercise and vesting for stock-based awards. For the three months ended March 31, 2020, the Company recorded an income tax benefit of $9.0 million, which represents an effective income tax rate of 49% and is higher than the statutory rate of 21% due primarily to a $5.7 million reduction to deferred taxes due to the true-up of the state tax rate for an indefinite-lived intangible asset, partially offset by unbenefited foreign losses.

The Company recognizes interest and, if applicable, penalties related to unrecognized tax benefits in the income tax provision. There are currently no accruals for interest and penalties.

ANGI INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

The Company is routinely under audit by federal, state, local and foreign authorities in the area of income tax as a result of previously filed separate company and consolidated tax returns with IAC. These audits include questioning the timing and the amount of income and deductions and the allocation of income and deductions among various tax jurisdictions. The Internal Revenue Service (“IRS”) has substantially completed its audit of IAC’s federal income tax returns for the years ended December 31, 2010 through 2017, which includes the operations of the Company. The statutes of limitations for the years 2010 through 2012 and for the years 2013 through 2017 have been extended to May 31, 2021 and June 30, 2022, respectively. Returns filed in various other jurisdictions are open to examination for various tax years beginning with 2009. Income taxes payable include unrecognized tax benefits considered sufficient to pay assessments that may result from examination of prior year tax returns. The Company considers many factors when evaluating and estimating its tax positions and tax benefits, which may not accurately anticipate actual outcomes and, therefore, may require periodic adjustment. Although management currently believes changes in unrecognized tax benefits from period to period and differences between amounts paid, if any, upon resolution of issues raised in audits and amounts previously provided will not have a material impact on liquidity, results of operations, or financial condition of the Company, these matters are subject to inherent uncertainties and management’s view of these matters may change in the future.

At March 31, 2021 and December 31, 2020, the Company has unrecognized tax benefits of $5.6 million and $5.3 million, respectively; all of which are for tax positions included in IAC’s consolidated tax return filings. If unrecognized tax benefits at March 31, 2021 are subsequently recognized, the income tax provision would be reduced by $5.4 million. The comparable amount as of December 31, 2020 is $5.1 million. The Company believes it is reasonably possible that its unrecognized tax benefits could decrease by $0.5 million by March 31, 2022 due to settlements, all of which would reduce the income tax provision.

NOTE 3—FINANCIAL INSTRUMENTS AND FAIR VALUE MEASUREMENTS

Marketable Debt Securities

The Company did not hold any available-for-sale marketable debt securities at March 31, 2021.

At December 31, 2020, current available-for-sale marketable debt securities were as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Amortized Cost | | Gross Unrealized Gains | | Gross Unrealized Losses | | Fair Value |

| (In thousands) |

| Treasury discount notes | $ | 49,995 | | | $ | — | | | $ | — | | | $ | 49,995 | |

| Total available-for-sale marketable debt securities | $ | 49,995 | | | $ | — | | | $ | — | | | $ | 49,995 | |

The contractual maturities of debt securities classified as current available-for-sale at December 31, 2020 were within one year.

Fair Value Measurements

The Company categorizes its financial instruments measured at fair value into a fair value hierarchy that prioritizes the inputs used in pricing the asset or liability. The three levels of the fair value hierarchy are:

•Level 1: Observable inputs obtained from independent sources, such as quoted market prices for identical assets and liabilities in active markets.

•Level 2: Other inputs, which are observable directly or indirectly, such as quoted market prices for similar assets or liabilities in active markets, quoted market prices for identical or similar assets or liabilities in markets that are not active and inputs that are derived principally from or corroborated by observable market data. The fair values of the Company’s Level 2 financial assets are primarily obtained from observable market prices for identical underlying securities that may not be actively traded. Certain of these securities may have different market prices from multiple market data sources, in which case an average market price is used.

ANGI INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

•Level 3: Unobservable inputs for which there is little or no market data and require the Company to develop its own assumptions, based on the best information available in the circumstances, about the assumptions market participants would use in pricing the assets or liabilities.

The following tables present the Company’s financial instruments that are measured at fair value on a recurring basis:

| | | | | | | | | | | | | | | | | | | | | | | |

| March 31, 2021 |

| Quoted Market Prices in Active Markets for Identical Assets (Level 1) | | Significant Other Observable Inputs (Level 2) | | Significant Unobservable Inputs

(Level 3) | | Total

Fair Value

Measurements |

| (In thousands) |

| Assets: | | | | | | | |

| Cash equivalents: | | | | | | | |

| Money market funds | $ | 552,024 | | | $ | — | | | $ | — | | | $ | 552,024 | |

| Treasury discount notes | — | | | 100,000 | | | — | | | 100,000 | |

| Time deposits | — | | | 1,586 | | | — | | | 1,586 | |

| Marketable debt securities: | | | | | | | |

| Treasury discount notes | — | | | — | | | — | | | — | |

| Total | $ | 552,024 | | | $ | 101,586 | | | $ | — | | | $ | 653,610 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| December 31, 2020 |

| Quoted Market Prices in Active Markets for Identical Assets (Level 1) | | Significant Other Observable Inputs (Level 2) | | Significant Unobservable Inputs

(Level 3) | | Total

Fair Value

Measurements |

| (In thousands) |

| Assets: | | | | | | | |

| Cash equivalents: | | | | | | | |

| Money market funds | $ | 374,014 | | | $ | — | | | $ | — | | | $ | 374,014 | |

| Treasury discount notes | — | | | 324,995 | | | — | | | 324,995 | |

| Time deposits | — | | | 2,721 | | | — | | | 2,721 | |

| Marketable debt securities: | | | | | | | |

| Treasury discount notes | — | | | 49,995 | | | — | | | 49,995 | |

| Total | $ | 374,014 | | | $ | 377,711 | | | $ | — | | | $ | 751,725 | |

Assets measured at fair value on a nonrecurring basis

The Company’s non-financial assets, such as goodwill, intangible assets, ROU assets, capitalized software, leasehold improvements and equipment are adjusted to fair value only when an impairment is recognized. Such fair value measurements are based predominantly on Level 3 inputs.

ANGI INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

Financial instruments measured at fair value only for disclosure purposes

The following table presents the carrying value and the fair value of financial instruments measured at fair value only for disclosure purposes:

| | | | | | | | | | | | | | | | | | | | | | | |

| March 31, 2021 | | December 31, 2020 |

| Carrying value | | Fair value | | Carrying value | | Fair value |

| (In thousands) |

| | | | | | | |

Long-term debt, net (a) | $ | (705,987) | | | $ | (710,692) | | | $ | (712,277) | | | $ | (725,700) | |

________________________

(a) At March 31, 2021 and December 31, 2020, the carrying value of long-term debt, net includes unamortized debt issuance costs of $7.1 million and $7.7 million, respectively.

The fair value of long-term debt is estimated using observable market prices or indices for similar liabilities, which are Level 2 inputs.

NOTE 4—LONG-TERM DEBT

Long-term debt consists of:

| | | | | | | | | | | |

| | March 31, 2021 | | December 31, 2020 |

| | (In thousands) |

3.875% ANGI Group Senior Notes due August 15, 2028 (“Senior Notes”); interest payable each February 15 and August 15, commencing February 15, 2021 | $ | 500,000 | | | $ | 500,000 | |

| ANGI Group Term Loan due November 5, 2023 | 213,125 | | | 220,000 | |

| Total long-term debt | 713,125 | | | 720,000 | |

| | | |

| Less: unamortized debt issuance costs | 7,138 | | | 7,723 | |

| Total long-term debt, net | $ | 705,987 | | | $ | 712,277 | |

ANGI Group Senior Notes

The ANGI Group Senior Notes were issued on August 20, 2020. At any time prior to August 15, 2023, these notes may be redeemed at a redemption price equal to the sum of the principal amount thereof, plus accrued and unpaid interest and a make-whole premium. Thereafter, these notes may be redeemed at the redemption prices set forth in the indenture governing the notes, plus accrued and unpaid interest thereon, if any, to the applicable redemption date.

The indenture governing the Senior Notes contains a covenant that would limit ANGI Group’s ability to incur liens for borrowed money in the event a default has occurred or ANGI Group’s secured leverage ratio (as defined in the indenture) exceeds 3.75 to 1.0. At March 31, 2021, there were no limitations pursuant thereto.

ANGI Group Term Loan and ANGI Group Revolving Facility

The outstanding balance of the ANGI Group Term Loan was $213.1 million and $220.0 million at March 31, 2021 and December 31, 2020, respectively. During the three months ended March 31, 2021, ANGI Group prepaid $6.9 million that was otherwise due in the first quarter of 2022, and as of May 6, 2021, the outstanding balance was repaid in its entirety. The Term Loan bore interest at LIBOR plus 2.00%, or 2.10% and 2.16% at March 31, 2021 and December 31, 2020, respectively.

The ANGI Group Credit Agreement requires ANGI Group to maintain a consolidated net leverage ratio of not more than 4.5 to 1.0 and a minimum interest coverage ratio of not less than 2.0 to 1.0. The ANGI Group Credit Agreement also contains covenants that would limit ANGI Group’s ability to pay dividends, or make distributions in the event a default has occurred or ANGI Group’s consolidated net leverage ratio exceeds 4.25 to 1.0. At March 31, 2021, there were no limitations pursuant thereto.

ANGI INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

The $250.0 million ANGI Group Revolving Facility expires on November 5, 2023. At March 31, 2021 and December 31, 2020, there were no outstanding borrowings under the ANGI Group Revolving Facility. The commitment fee, which is based on ANGI Group's consolidated net leverage ratio most recently reported and the average daily dollar amount of the available revolving commitments, was 35 basis points at both March 31, 2021 and December 31, 2020. Any future borrowings under the ANGI Group Revolving Facility would bear interest, at ANGI Group’s option, at either a base rate or LIBOR, in each case plus an applicable margin, which is based on ANGI Group’s consolidated net leverage ratio. The financial and other covenants are the same as those for the ANGI Group Term Loan.

The ANGI Group Senior Notes and the ANGI Group Credit Agreement are guaranteed by certain of ANGI Group’s wholly-owned material domestic subsidiaries and ANGI Group’s obligations under the ANGI Group Credit Agreement are secured by substantially all assets of ANGI Group and the guarantors, subject to certain exceptions. Outstanding borrowings under the ANGI Group Revolving Facility have priority over the ANGI Group Senior Notes to the extent of the value of the assets securing the borrowings under the ANGI Group Credit Agreement.

Long-term Debt Maturities:

Long-term debt maturities as of March 31, 2021 are summarized in the table below:

| | | | | | | | |

| Years Ending December 31, | | (In thousands) |

| | |

| 2022 | | $ | 20,625 | |

| 2023 | | 192,500 | |

| 2028 | | 500,000 | |

| Total | | 713,125 | |

| Less: unamortized debt issuance costs | | 7,138 | |

| Total long-term debt, net | | $ | 705,987 | |

NOTE 5—ACCUMULATED OTHER COMPREHENSIVE INCOME (LOSS)

The following tables present the components of accumulated other comprehensive income (loss):

| | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2021 |

| Foreign

Currency

Translation

Adjustment | | Accumulated Other Comprehensive Income |

| (In thousands) |

| Balance at January 1 | $ | 4,637 | | | $ | 4,637 | |

| Other comprehensive loss | (14) | | | (14) | |

| Balance at March 31 | $ | 4,623 | | | $ | 4,623 | |

| | | | | | | | | | | |

| Three Months Ended March 31, 2020 |

| Foreign

Currency

Translation

Adjustment | | Accumulated Other Comprehensive Loss |

| (In thousands) |

| Balance at January 1 | $ | (1,379) | | | $ | (1,379) | |

| Other comprehensive loss | (6,614) | | | (6,614) | |

| Balance at March 31 | $ | (7,993) | | | $ | (7,993) | |

ANGI INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

At both March 31, 2021 and 2020, there was no tax benefit or provision on the accumulated other comprehensive income (loss).

NOTE 6—EARNINGS (LOSS) PER SHARE

The following table sets forth the computation of basic and diluted earnings (loss) per share attributable to Angi Inc. Class A and Class B Common Stock shareholders:

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended March 31, |

| | 2021 | | 2020 |

| | Basic | | Diluted | | Basic | | Diluted |

| | (In thousands, except per share data) |

| Numerator: | | | | | | | |

| Net earnings (loss) | $ | 2,014 | | | $ | 2,014 | | | $ | (9,184) | | | $ | (9,184) | |

| Net (earnings) loss attributable to noncontrolling interests | (83) | | | (83) | | | 226 | | | 226 | |

| Net earnings (loss) attributable to Angi Inc. Class A and Class B Common Stock shareholders | $ | 1,931 | | | $ | 1,931 | | | $ | (8,958) | | | $ | (8,958) | |

| | | | | | | |

| Denominator: | | | | | | | |

| Weighted average basic Class A and Class B common stock shares outstanding | 500,663 | | | 500,663 | | | 499,454 | | | 499,454 | |

Dilutive securities (a) (b) (c) | — | | | 9,990 | | | — | | | — | |

| Denominator for earnings (loss) per share—weighted average shares | 500,663 | | | 510,653 | | | 499,454 | | | 499,454 | |

| | | | | | | |

| Earnings (loss) per share attributable to Angi Inc. Class A and Class B Common Stock shareholders: | |

| Earnings (loss) per share | $ | 0.00 | | | $ | 0.00 | | | $ | (0.02) | | | $ | (0.02) | |

________________________

(a) If the effect is dilutive, weighted average common shares outstanding include the incremental shares that would be issued upon the assumed exercise of stock appreciation rights, stock options and subsidiary denominated equity and vesting of restricted stock units (“RSUs”). For the three months ended March 31, 2021, 5.2 million potentially dilutive securities are excluded from the calculation of diluted earnings per share because their inclusion would have been anti-dilutive.

(b) Market-based awards and performance-based stock units are considered contingently issuable shares. Shares issuable upon exercise or vesting of market-based awards and performance-based stock units are included in the denominator for earnings per share if (i) the applicable performance or market condition(s) has been met and (ii) the inclusion of the market-based award and performance-based stock units is dilutive for the respective reporting periods. For the three months ended March 31, 2021, 1.4 million shares underlying market-based awards and performance-based stock awards were excluded from the calculation of diluted earnings per share because the performance or market condition(s) had not been met.

(c) For the three months ended March 31, 2020, the Company had a loss from operations and as a result, approximately 38.0 million potentially dilutive securities were excluded from computing dilutive earnings per share because the impact would have been anti-dilutive. Accordingly, the weighted average basic shares outstanding were used to compute all earnings per share amounts.

NOTE 7—SEGMENT INFORMATION

The overall concept that the Company employs in determining its operating segments is to present the financial information in a manner consistent with how the chief operating decision maker views the businesses. In addition, we consider how the businesses are organized as to segment management; and the focus of the businesses with regards to the types of services or products offered or the target market.

ANGI INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

The following table presents revenue by reportable segment:

| | | | | | | | | | | | | | | |

| | | Three Months Ended March 31, |

| | | | | 2021 | | 2020 |

| | | | | (In thousands) |

| Revenue: | | | | | | | |

| North America | | | | | $ | 361,041 | | | $ | 324,132 | |

| Europe | | | | | 25,988 | | | 19,518 | |

Total | | | | | $ | 387,029 | | | $ | 343,650 | |

The following table presents the revenue of the Company’s segments disaggregated by type of service:

| | | | | | | | | | | | | | | |

| | | Three Months Ended March 31, |

| | | | | 2021 | | 2020 |

| | | | | (In thousands) |

| North America | | | | | | | |

| Marketplace: | | | | | | | |

Consumer connection revenue(a) | | | | | $ | 272,353 | | | $ | 239,830 | |

| | | | | | | |

Service professional membership subscription revenue | | | | | 11,952 | | | 13,777 | |

| Other revenue | | | | | 6,745 | | | 5,169 | |

| Total Marketplace revenue | | | | | 291,050 | | | 258,776 | |

Advertising and other revenue(b) | | | | | 69,991 | | | 65,356 | |

Total North America revenue | | | | | 361,041 | | | 324,132 | |

| Europe | | | | | | | |

Consumer connection revenue(c) | | | | | 22,351 | | | 15,689 | |

| Service professional membership subscription revenue | | | | | 3,328 | | | 3,299 | |

| Advertising and other revenue | | | | | 309 | | | 530 | |

Total Europe revenue | | | | | 25,988 | | | 19,518 | |

Total revenue | | | | | $ | 387,029 | | | $ | 343,650 | |

________________________

(a) Includes fees paid by service professionals for consumer matches and revenue from Angi Services sourced through the marketplace platforms.

(b) Includes Angi revenue from service professionals under contract for advertising and Angi membership subscription fees from consumers, as well as revenue from HomeStars.

(c) Includes fees paid by service professionals for consumer matches.

Revenue by geography is based on where the customer is located. Geographic information about revenue and long-lived assets is presented below.

| | | | | | | | | | | | | | | |

| | | Three Months Ended March 31, |

| | | | | 2021 | | 2020 |

| | | | | (In thousands) |

Revenue | | | | | | | |

| United States | | | | | $ | 356,444 | | | $ | 319,821 | |

| All other countries | | | | | 30,585 | | | 23,829 | |

| Total | | | | | $ | 387,029 | | | $ | 343,650 | |

ANGI INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

| | | | | | | | | | | |

| March 31, 2021 | | December 31, 2020 |

| (In thousands) |

| Long-lived assets (excluding goodwill and intangible assets): | | | |

| United States | $ | 101,151 | | | $ | 97,841 | |

| All other countries | 10,280 | | | 11,001 | |

| Total | $ | 111,431 | | | $ | 108,842 | |

The following tables present operating income (loss) and Adjusted EBITDA by reportable segment:

| | | | | | | | | | | | | | | |

| | | Three Months Ended March 31, |

| | | | | 2021 | | 2020 |

| | | | | (In thousands) |

| Operating income (loss): | | | | | | | |

| North America | | | | | $ | 9,577 | | | $ | (8,108) | |

| Europe | | | | | (9,468) | | | (8,188) | |

| Total | | | | | $ | 109 | | | $ | (16,296) | |

| | | | | | | | | | | | | | | |

| | | Three Months Ended March 31, |

| | | | | 2021 | | 2020 |

| | | | | (In thousands) |

Adjusted EBITDA(d): | | | | | | | |

| North America | | | | | $ | 31,165 | | | $ | 41,391 | |

| Europe | | | | | $ | (7,979) | | | $ | (6,994) | |

________________________

(d) The Company’s primary financial measure is Adjusted EBITDA, which is defined as operating income (loss) excluding: (1) stock-based compensation expense; (2) depreciation; and (3) acquisition-related items consisting of amortization of intangible assets and impairments of goodwill and intangible assets, if applicable. The Company believes this measure is useful for analysts and investors as this measure allows a more meaningful comparison between the Company’s performance and that of its competitors. The above items are excluded from the Company’s Adjusted EBITDA measure because these items are non-cash in nature. Adjusted EBITDA has certain limitations because it excludes the impact of these expenses.

ANGI INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

The following tables reconcile operating income (loss) for the Company’s reportable segments and net earnings (loss) attributable to Angi Inc. shareholders to Adjusted EBITDA:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2021 |

| Operating Income (Loss) | | Stock-Based

Compensation Expense | | Depreciation | | Amortization

of Intangibles | | Adjusted

EBITDA |

| (In thousands) |

| North America | $ | 9,577 | | | $ | 1,936 | | | $ | 14,578 | | | $ | 5,074 | | | $ | 31,165 | |

| Europe | (9,468) | | | $ | 98 | | | $ | 1,391 | | | $ | — | | | $ | (7,979) | |

| Operating income (loss) | 109 | | | | | | | | | |

| Interest expense | (6,617) | | | | | | | | | |

| Other loss, net | (767) | | | | | | | | | |

| Loss before income taxes | (7,275) | | | | | | | | | |

| Income tax benefit | 9,289 | | | | | | | | | |

| Net earnings | 2,014 | | | | | | | | | |

| Net earnings attributable to noncontrolling interests | (83) | | | | | | | | | |

| Net earnings attributable to Angi Inc. shareholders | $ | 1,931 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2020 |

| Operating Loss | | Stock-Based

Compensation Expense | | Depreciation | | Amortization

of Intangibles | | Adjusted

EBITDA |

| (In thousands) |

| North America | $ | (8,108) | | | $ | 25,312 | | | $ | 11,297 | | | $ | 12,890 | | | $ | 41,391 | |

| Europe | (8,188) | | | $ | 263 | | | $ | 841 | | | $ | 90 | | | $ | (6,994) | |

| Operating loss | (16,296) | | | | | | | | | |

| Interest expense | (2,274) | | | | | | | | | |

| Other income, net | 421 | | | | | | | | | |

| Loss before income taxes | (18,149) | | | | | | | | | |

| Income tax benefit | 8,965 | | | | | | | | | |

| Net loss | (9,184) | | | | | | | | | |

| Net loss attributable to noncontrolling interests | 226 | | | | | | | | | |

| Net loss attributable to Angi Inc. shareholders | $ | (8,958) | | | | | | | | | |

ANGI INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

NOTE 8—CONSOLIDATED FINANCIAL STATEMENT DETAILS

Cash and Cash Equivalents and Restricted Cash:

The following table provides a reconciliation of cash and cash equivalents and restricted cash reported within the accompanying balance sheet to the total amounts shown in the accompanying statement of cash flows:

| | | | | | | | | | | | | | | | | | | | | | | |

| March 31, 2021 | | December 31, 2020 | | March 31, 2020 | | December 31, 2019 |

| (In thousands) |

| Cash and cash equivalents | $ | 777,041 | | | $ | 812,705 | | | $ | 384,230 | | | $ | 390,565 | |

| Restricted cash included in other current assets | 176 | | | 407 | | | 623 | | | 504 | |

| Restricted cash included in other non-current assets | 433 | | | 449 | | | 398 | | | 409 | |

| Total cash and cash equivalents, and restricted cash as shown on the consolidated statement of cash flows | $ | 777,650 | | | $ | 813,561 | | | $ | 385,251 | | | $ | 391,478 | |

Restricted cash included in other current assets at March 31, 2021 and December 31, 2020 consisted of cash reserved to fund insurance claims and cash received from customers through the marketplace platforms, representing funds collected for payments to service providers, which were not settled as of the period end.

Restricted cash included in other current assets at March 31, 2020 and December 31, 2019 primarily consisted of a deposit related to corporate credit cards.

Restricted cash included in other non-current assets at March 31, 2021 and 2020 consisted of deposits related to leases.

Credit Losses and Revenue Reserve

The following table presents the changes in the credit loss reserve for the three months ended March 31, 2021 and 2020:

| | | | | | | | | | | |

| 2021 | | 2020 |

| (In thousands) |

Balance at January 1 | $ | 26,046 | | | $ | 19,066 | |

| Current period provision for credit losses | 19,118 | | | 17,070 | |

| Write-offs charged against the credit loss reserve | (20,570) | | | (16,298) | |

Recoveries collected | 758 | | | 737 | |

Balance at March 31 | $ | 25,352 | | | $ | 20,575 | |

The revenue reserve was $3.5 million and $1.8 million at March 31, 2021 and 2020, respectively. The total allowance for credit losses and revenue reserve was $28.9 million and $22.4 million as of March 31, 2021 and 2020, respectively.

Accumulated Amortization and Depreciation

The following table provides the accumulated amortization and depreciation within the consolidated balance sheet: | | | | | | | | | | | | | | |

| Asset Category | | March 31, 2021 | | December 31, 2020 |

| | | (In thousands) |

| Right-of-use assets (included in “other non-current assets”) | | $ | 46,446 | | | $ | 40,800 | |

| Capitalized software, leasehold improvements, and equipment | | $ | 80,052 | | | $ | 95,438 | |

| Intangible assets, net | | $ | 148,319 | | | $ | 162,627 | |

ANGI INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

Other (expense) income, net

| | | | | | | | | | | |

| Three Months Ended March 31, |

| | 2021 | | 2020 |

| | (In thousands) |

| Interest income | $ | 97 | | | $ | 1,271 | |

| | | |

| Foreign exchange losses | (860) | | | (423) | |

| | | |

| Loss from acquisition/sale of a business | (4) | | | (427) | |

| Other (expense) income, net | $ | (767) | | | $ | 421 | |

Loss from acquisition/sale of a business for the three months ended March 31, 2020 includes a $0.2 million mark-to-market charge for an indemnification claim related to the Handy acquisition that was settled in Angi Inc. shares during the first quarter of 2020 and a $0.2 million charge related to the final earn-out settlement related to the sale of Felix.

NOTE 9—CONTINGENCIES

In the ordinary course of business, the Company is a party to various lawsuits. The Company establishes reserves for specific legal matters when it determines that the likelihood of an unfavorable outcome is probable and the loss is reasonably estimable. Management has not identified certain other legal matters where we believe an unfavorable outcome is probable and, therefore, no reserve is established. Although management currently believes that resolving claims against us, including claims where an unfavorable outcome is reasonably possible, will not have a material impact on the liquidity, results of operations, or financial condition of the Company, these matters are subject to inherent uncertainties and management’s view of these matters may change in the future. The Company also evaluates other contingent matters, including income and non-income tax contingencies, to assess the likelihood of an unfavorable outcome and estimated extent of potential loss. It is possible that an unfavorable outcome of one or more of these lawsuits or other contingencies could have a material impact on the liquidity, results of operations, or financial condition of the Company. See “Note 2—Income Taxes” for additional information related to income tax contingencies. NOTE 10—RELATED PARTY TRANSACTIONS WITH IAC

Angi Inc. and IAC have entered into certain agreements to govern their relationship. These agreements include: a contribution agreement; an investor rights agreement; a services agreement; a tax sharing agreement; and an employee matters agreement.

For the three months ended March 31, 2021 and 2020, the company was charged $1.1 million and $1.2 million, respectively, by IAC for services rendered pursuant to the services agreement. At March 31, 2021, the Company had outstanding payables of less than $0.1 million due to IAC, pursuant to the services agreement. There were no outstanding receivables or payables pursuant to the services agreement as of December 31, 2020.

Separately, the Company subleases office space to IAC and charged IAC $0.4 million of rent for both the three months ended March 31, 2021 and 2020. At March 31, 2021, there were no outstanding receivables pursuant to the sublease agreements. At December 31, 2020 there was an outstanding receivable of less than $0.1 million due from IAC pursuant to the sublease agreements, which was subsequently paid in full in the first quarter of 2021.

At both March 31, 2021 and December 31, 2020, the Company had outstanding payables of $0.9 million, due to IAC pursuant to the tax sharing agreement, which are included in “Accrued expenses and other current liabilities,” in the accompanying consolidated balance sheet. There were no payments to or refunds from IAC pursuant to this agreement during the three months ended March 31, 2021 and 2020.

For the three months ended March 31, 2021 and 2020, 0.1 million and 0.2 million shares, respectively, of Angi Inc. Class B common stock were issued to IAC pursuant to the employee matters agreement as reimbursement for shares of IAC common stock issued in connection with the exercise and vesting of IAC equity awards held by Angi Inc. employees. For the three months ended March 31, 2021, 2.6 million shares of Angi Inc. Class A common stock were issued to IAC pursuant to the

ANGI INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

employee matters agreement as reimbursement for IAC common stock, issued in connection with the exercise and settlement of certain Angi Inc. stock appreciation rights. There were no shares of Angi Inc. Class A common stock issued during the three months ended March 31, 2020.

NOTE 11—SUBSEQUENT EVENTS

As of May 6, 2021, the Company paid off the outstanding balance of the Term Loan of $213.1 million.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

GENERAL

Management Overview

Angi Inc., formerly ANGI Homeservices, Inc., (“Angi Inc.,” the “Company,” “we,” “our,” or “us”) connects quality home service professionals with consumers across 500 different categories, from repairing and remodeling homes to cleaning and landscaping. Over 250,000 domestic service professionals actively sought consumer matches, completed jobs, or advertised work through Angi Inc. platforms; and consumers turned to at least one of our brands to find a professional for approximately 34 million projects during the twelve months ended March 31, 2021.

The Company has two operating segments (i) North America (United States and Canada), which includes HomeAdvisor, Angi (formerly Angie’s List), Handy, and HomeStars; and (ii) Europe, which includes Travaux, MyHammer, MyBuilder, Werkspot, and Instapro.

For a more detailed description of the Company’s operating businesses, see the Company’s Annual Report on Form 10-K for the year ended December 31, 2020.

Defined Terms and Operating Metrics:

Unless otherwise indicated or as the context requires otherwise certain terms, which include the principal operating metrics we use in managing our business, used in this quarterly report are defined below:

•Marketplace Revenue primarily reflects domestic marketplace revenues, including consumer connection revenue for consumer matches, revenue from Angi Services (pre-priced) offerings sourced through marketplace platforms, and membership subscription revenue from service professionals.

•Advertising and Other Revenue primarily includes revenue from service professionals under contract for advertising and membership subscription fees from consumers.

•Marketplace Service Requests are fully completed and submitted domestic customer service requests and includes Angi Services requests sourced through the marketplace platforms in the period.

•Marketplace Monetized Transactions are fully completed and submitted domestic customer service requests that were matched to and paid for by a service professional and includes completed and in-process Angi Services jobs sourced through the marketplace platforms in the period.

•Marketplace Transacting Service Professionals (“Marketplace Transacting SPs”) are the number of marketplace service professionals that paid for consumer matches or performed an Angi Services job sourced through the marketplace platforms in the quarter.

•Advertising Service Professionals (“Advertising SPs”) are the total number of service professionals under contract for advertising at the end of the period.

•Senior Notes - On August 20, 2020, ANGI Group, LLC (“ANGI Group”), a direct wholly-owned subsidiary of the Company, issued $500.0 million of its 3.875% Senior Notes due August 15, 2028, with interest payable February 15 and August 15 of each year, commencing February 15, 2021.

•ANGI Group Term Loan - due November 5, 2023. The outstanding balance of the Term Loan as of March 31, 2021 was $213.1 million and bore interest at LIBOR plus 2.00%, or 2.10%. As of May 6, 2021, the outstanding balance of the Term Loan was repaid in its entirety.