Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23241

AllianzGI Convertible & Income 2024 Target Term Fund

(Exact name of registrant as specified in charter)

1633 Broadway, New York, NY 10019

(Address of principal executive offices) (Zip code)

Scott Whisten – 1633 Broadway, New York, New York 10019

(Name and address of agent for service)

Registrant’s telephone number, including area code: 212-739-3367

Date of fiscal year end: February 28

Date of reporting period: February 28, 2018

Table of Contents

Item 1. Report to Shareholders

AllianzGI Convertible & Income 2024 Target Term Fund

AllianzGI Convertible & Income Fund

AllianzGI Convertible & Income Fund II

Annual Report

February 28, 2018

Table of Contents

Table of Contents

Thomas J. Fuccillo

President & Chief Executive Officer

Dear Shareholder:

The US economy continued to expand during the twelve-month fiscal reporting period ended February 28, 2018. This trend also occurred outside the US, and global inflation remained well-contained. Against this backdrop, US and international equities generated very strong results. Elsewhere, the US bond market posted a modest gain during the reporting period.

For the period since it’s inception on June 30, 2017 through February 28, 2018:

| ∎ | AllianzGI Convertible & Income 2024 Target Term Fund returned 2.87% on net asset value (“NAV”) and -4.59% on market price. |

For the twelve-month reporting period ended February 28, 2018:

| ∎ | AllianzGI Convertible & Income Fund returned 7.04% on NAV and 12.22% on market price. |

| ∎ | AllianzGI Convertible & Income Fund II returned 7.33% on NAV and 10.84% on market price. |

During the twelve-month period ended February 28, 2018, the Standard & Poor’s (“S&P”) 500 Index, an unmanaged index generally representative of the US stock market, rose 17.09% and the ICE BofA Merrill Lynch High Yield Master II Index, an unmanaged index generally representative of the high yield bond market, gained 4.12%. Convertible securities, which share characteristics of both stocks and bonds, also generated strong results. The ICE BofA Merrill Lynch All Convertibles All Qualities Index, an unmanaged index generally representative of the convertible securities market, returned 10.77%.

Turning to the US economy, gross domestic product (“GDP”), the value of goods and services produced in the country, which is the broadest measure of economic activity and the principal indicator of economic performance, expanded at a 1.2% annualized pace during the first quarter of 2017. GDP growth then improved to an annual pace of 3.1% and 3.2% during the second and third quarters of 2017, respectively. Finally, the Commerce Department’s third reading — released after the reporting period had ended — showed that GDP grew at an annual pace of 2.9% for the fourth quarter of 2017.

The US Federal Reserve (the “Fed”) raised interest rates three times during the reporting period: in March 2017, June 2017 and December 2017. With the rate hike in December, the federal funds rate moved to a range between 1.25% and 1.50%. Meanwhile, in October 2017 the Fed started to gradually reduce its balance sheet — a process that will likely take several years. The Fed’s actions during the fiscal year were well telegraphed and there were minimal market disruptions. On March 21, 2018 — after the reporting period had ended — the Fed again raised rates, pushing the federal funds rate to a range between 1.50% and 1.75%.

| 2 | Annual Report | | February 28, 2018 |

Table of Contents

So, while we anticipate the scale of central bank support will diminish in 2018 — led by the Fed — we expect the overall shift to be slow and the precise actions to vary from one central bank to the next. In our view, interest rates will stay low overall in 2018. Consequently, we believe investors should continue to keep a careful eye on inflation, particularly because official data appear to understate rises in real-world costs. In addition to macroeconomic considerations, we feel several dominant investment themes, including geopolitical risk and business disruption, will persist in 2018.

Against this backdrop, we will continue to use our fundamental research and insights — and our strong global network — to help our clients balance risk and reward. Where appropriate, we will also seek to capitalize on volatility spikes and prepare to trim exposure to risky assets if cyclical data start to lose momentum.

For specific information on the Funds and their performance, please refer to the following pages. If you have any questions regarding the information provided, we encourage you to contact your financial advisor or call the Funds’ shareholder servicing agent at (800) 254-5197. In addition, a wide range of information and resources is available on our website, us.allianzgi.com/en-us/products-solutions/closed-end-funds.

On behalf of Allianz Global Investors U.S. LLC, the Funds’ investment manager, thank you for investing with us.

We remain dedicated to serving your investment needs.

Sincerely,

|

| Thomas J. Fuccillo |

| President & Chief Executive Officer |

| February 28, 2018 | | Annual Report | 3 |

Table of Contents

AllianzGI Convertible & Income 2024 Target Term Fund / AllianzGI Convertible & Income Fund /AllianzGI Convertible & Income Fund II

February 28, 2018 (unaudited)

| 4 | Annual Report | | February 28, 2018 |

Table of Contents

| February 28, 2018 | | Annual Report | 5 |

Table of Contents

| 6 | Annual Report | | February 28, 2018 |

Table of Contents

AllianzGI Convertible & Income 2024 Target Term Fund

February 28, 2018 (unaudited)

| Total Return(1): | Market Price | NAV | ||||||

| Commencement of Operations (6/30/17) to 2/28/18 |

-4.59% | 2.87% | ||||||

See “Notes to Performance & Statistics” on page 10.

| February 28, 2018 | | Annual Report | 7 |

Table of Contents

AllianzGI Convertible & Income Fund

February 28, 2018 (unaudited)

| Total Return(1): | Market Price | NAV | ||||||

| 1 Year |

12.22% | 7.04% | ||||||

| 5 Year |

6.69% | 6.44% | ||||||

| 10 Year |

7.28% | 6.82% | ||||||

| Commencement of Operations (3/31/03) to 2/28/18 |

7.72% | 7.77% | ||||||

See “Notes to Performance & Statistics” on page 10.

| 8 | Annual Report | | February 28, 2018 |

Table of Contents

Performance & Statistics

AllianzGI Convertible & Income Fund II

February 28, 2018 (unaudited)

| Total Return(1): | Market Price | NAV | ||||||

| 1 Year |

10.84% | 7.33% | ||||||

| 5 Year |

5.67% | 6.48% | ||||||

| 10 Year |

6.53% | 6.17% | ||||||

| Commencement of Operations (7/31/03) to 2/28/18 |

6.51% | 6.76% | ||||||

See “Notes to Performance & Statistics” on page 10.

| February 28, 2018 | | Annual Report | 9 |

Table of Contents

Performance and Statistics

AllianzGI Convertible & Income Funds

February 28, 2018 (unaudited)

Notes to Performance & Statistics:

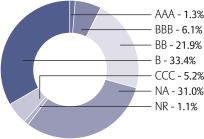

* Credit ratings apply to the underlying holdings of the Funds and not the Funds themselves and are divided into categories ranging from highest to lowest credit quality, determined for purposes of presentations in this report by using ratings provided by S&P Global Ratings (“S&P”). Presentations of credit ratings information in this report use ratings provided by S&P for this purpose, among other reasons, because of the access to background information and other materials provided by S&P, as well as the Funds’ considerations of industry practice. Securities not rated by S&P, or bonds that do not have a rating available from S&P, or bonds that had a rating withdrawn by S&P are designated as “NR” or “NA”, respectively. Credit quality ratings assigned by a rating agency are subjective opinions, not statements of fact, and are subject to change periodically, even as frequently as daily. Ratings assigned by S&P or another rating agency are not absolute standards of credit quality and do not evaluate market risk. Rating agencies may fail to make timely changes in credit ratings, and an issuer’s current financial condition may be better or worse than a rating indicates. In formulating investment decisions for the Funds, Allianz Global Investors U.S. LLC develops its own analysis of the credit quality and risks associated with individual debt instruments, rather than relying exclusively on rating agencies or third-party research.

(1) Past performance is no guarantee of future results. Total return is calculated by determining the percentage change in NAV or market price (as applicable) in the specified period. The calculation assumes that all dividends and distributions, if any, have been reinvested. Total return does not reflect broker commissions or sales charges in connection with the purchase or sale of Fund shares. Total return for a period of more than one year represents the average annual total return. Total return for a period of less than one year is not annualized.

Performance at market price will differ from results at NAV. Although market price returns tend to reflect investment results over time, during shorter periods returns at market price can also be influenced by factors such as changing views about the Funds, market conditions, supply and demand for each Fund’s shares, or changes in each Fund’s dividends.

An investment in each Fund involves risk, including the loss of principal. Total return, market price, market price yield and NAV will fluctuate with changes in market conditions. This data is provided for information purposes only and is not intended for trading purposes. Closed-end funds, unlike open-end funds, are not continuously offered. There is a one time public offering and once issued, shares of closed-end funds are traded in the open market through a stock exchange. NAV is equal to total assets attributable to common shareholders less total liabilities divided by the number of common shares outstanding. Holdings are subject to change daily.

(2) The NAV disclosed in the Funds’ financial statements may differ from this NAV due to accounting principles generally accepted in the United States of America.

(3) Market Price Yield is determined by dividing the annualized current monthly dividend per common share (comprised of net investment income) by the market price per common share at February 28, 2018.

(4) Represents amounts drawn under the short-term margin loan facility (“Leverage”) outstanding, as a percentage of total managed assets. Total managed assets refer to total assets (including assets attributable to Leverage) minus liabilities (other than liabilities representing Leverage).

(5) Represents Preferred Shares (“Leverage”) outstanding, as a percentage of total managed assets. Total managed assets refer to total assets (including assets attributable to Leverage) minus liabilities (other than liabilities representing Leverage).

| 10 | Annual Report | | February 28, 2018 |

Table of Contents

AllianzGI Convertible & Income 2024 Target Term Fund

February 28, 2018

| Principal Amount (000s) |

Value | |||||||||||

| Corporate Bonds & Notes – 58.9% | ||||||||||||

| Aerospace & Defense – 1.7% | ||||||||||||

| $1,500 | KLX, Inc., 5.875%, 12/1/22 (a)(c)(d) | $1,550,625 | ||||||||||

| 1,500 | TransDigm, Inc., 6.50%, 7/15/24 (d) | 1,550,625 | ||||||||||

| 3,101,250 | ||||||||||||

| Auto Components – 0.9% | ||||||||||||

| 1,500 | American Axle & Manufacturing, Inc., 6.625%, 10/15/22 (d) | 1,552,500 | ||||||||||

| Building Materials – 0.8% | ||||||||||||

| 1,500 | Builders FirstSource, Inc., 5.625%, 9/1/24 (a)(c)(d) | 1,531,875 | ||||||||||

| Chemicals – 3.5% | ||||||||||||

| 1,500 | Chemours Co., 6.625%, 5/15/23 (d) | 1,584,375 | ||||||||||

| 1,500 | Platform Specialty Products Corp., 6.50%, 2/1/22 (a)(c)(d) | 1,543,125 | ||||||||||

| 1,500 | Tronox Finance LLC, 7.50%, 3/15/22 (a)(c)(d) | 1,560,000 | ||||||||||

| 1,500 | Univar USA, Inc., 6.75%, 7/15/23 (a)(c)(d) | 1,565,625 | ||||||||||

| 6,253,125 | ||||||||||||

| Computers – 1.9% | ||||||||||||

| 1,500 | Dell International LLC, 7.125%, 6/15/24 (a)(c)(d) | 1,620,347 | ||||||||||

| 1,500 | Western Digital Corp., 10.50%, 4/1/24 (d) | 1,745,625 | ||||||||||

| 3,365,972 | ||||||||||||

| Diversified Financial Services – 4.4% | ||||||||||||

| 2,000 | Community Choice Financial, Inc., 10.75%, 5/1/19 (d) | 1,905,000 | ||||||||||

| 1,500 | Nationstar Mortgage LLC, 7.875%, 10/1/20 (d) | 1,540,313 | ||||||||||

| 2,000 | Navient Corp., 7.25%, 9/25/23 (d) | 2,135,000 | ||||||||||

| 2,000 | Springleaf Finance Corp., 8.25%, 10/1/23 (d) | 2,210,000 | ||||||||||

| 7,790,313 | ||||||||||||

| Electric Utilities – 0.9% | ||||||||||||

| 1,500 | NRG Energy, Inc., 6.25%, 5/1/24 (d) | 1,560,000 | ||||||||||

| Engineering & Construction – 0.9% | ||||||||||||

| 1,500 | AECOM, 5.875%, 10/15/24 (d) | 1,571,250 | ||||||||||

| Entertainment – 0.9% | ||||||||||||

| 1,500 | Cedar Fair L.P., 5.375%, 6/1/24 (d) | 1,546,875 | ||||||||||

| Healthcare-Services – 5.3% | ||||||||||||

| 1,500 | Community Health Systems, Inc., 6.25%, 3/31/23 (d) | 1,372,500 | ||||||||||

| 1,500 | DaVita, Inc., 5.125%, 7/15/24 (d) | 1,492,500 | ||||||||||

| 215 | Encompass Health Corp., 5.75%, 11/1/24 | 218,762 | ||||||||||

| 1,500 | Envision Healthcare Corp., 6.25%, 12/1/24 (a)(c)(d) | 1,586,250 | ||||||||||

| 1,500 | HCA, Inc., 7.50%, 2/15/22 (d) | 1,663,125 | ||||||||||

| 1,500 | Kindred Healthcare, Inc., 8.75%, 1/15/23 (d) | 1,612,500 | ||||||||||

| 1,500 | Tenet Healthcare Corp., 8.125%, 4/1/22 (d) | 1,584,375 | ||||||||||

| 9,530,012 | ||||||||||||

| Home Builders – 1.5% | ||||||||||||

| 1,000 | Beazer Homes USA, Inc., 8.75%, 3/15/22 (d) | 1,082,500 | ||||||||||

| 1,500 | Lennar Corp., 5.875%, 11/15/24 (a)(c) | 1,601,250 | ||||||||||

| 2,683,750 | ||||||||||||

| Internet & Catalog Retail – 0.9% | ||||||||||||

| 1,500 | Netflix, Inc., 5.875%, 2/15/25 | 1,588,665 | ||||||||||

| See accompanying Notes to Financial Statements | | February 28, 2018 | | Annual Report | 11 |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income 2024 Target Term Fund

February 28, 2018 (continued)

| Principal Amount (000s) |

Value | |||||||||||

| Iron/Steel – 1.6% | ||||||||||||

| $1,500 | AK Steel Corp., 7.50%, 7/15/23 (d) | $1,608,750 | ||||||||||

| 1,193 | United States Steel Corp., 8.375%, 7/1/21 (a)(c)(d) | 1,279,493 | ||||||||||

| 2,888,243 | ||||||||||||

| Lodging – 0.8% | ||||||||||||

| 1,500 | Wynn Las Vegas LLC, 5.50%, 3/1/25 (a)(c)(d) | 1,524,375 | ||||||||||

| Machinery-Construction & Mining – 1.1% | ||||||||||||

| 2,000 | Terex Corp., 5.625%, 2/1/25 (a)(c)(d) | 2,022,500 | ||||||||||

| Media – 5.2% | ||||||||||||

| 1,500 | CCO Holdings LLC, 5.75%, 1/15/24 (d) | 1,530,000 | ||||||||||

| 1,500 | Clear Channel Worldwide Holdings, Inc., 6.50%, 11/15/22, Ser. B (d) | 1,548,750 | ||||||||||

| 1,500 | CSC Holdings LLC, 6.75%, 11/15/21 (d) | 1,581,563 | ||||||||||

| 1,500 | DISH DBS Corp., 5.875%, 7/15/22 (d) | 1,468,125 | ||||||||||

| 1,659 | McClatchy Co., 9.00%, 12/15/22 (d) | 1,737,802 | ||||||||||

| 1,500 | Nexstar Broadcasting, Inc., 5.625%, 8/1/24 (a)(c)(d) | 1,511,250 | ||||||||||

| 9,377,490 | ||||||||||||

| Mining – 4.2% | ||||||||||||

| 1,500 | Alcoa Nederland Holding BV, 6.75%, 9/30/24 (a)(c)(d) | 1,616,250 | ||||||||||

| 2,000 | Constellium NV, 6.625%, 3/1/25 (a)(c) | 2,075,000 | ||||||||||

| 2,000 | Hudbay Minerals, Inc., 7.625%, 1/15/25 (a)(c)(d) | 2,185,000 | ||||||||||

| 1,500 | Joseph T. Ryerson & Son, Inc., 11.00%, 5/15/22 (a)(c)(d) | 1,673,775 | ||||||||||

| 7,550,025 | ||||||||||||

| Miscellaneous Manufacturing – 0.9% | ||||||||||||

| 1,500 | Koppers, Inc., 6.00%, 2/15/25 (a)(c)(d) | 1,556,250 | ||||||||||

| Oil, Gas & Consumable Fuels – 4.9% | ||||||||||||

| 1,500 | Callon Petroleum Co., 6.125%, 10/1/24 | 1,537,500 | ||||||||||

| 1,500 | Calumet Specialty Products Partners L.P., 6.50%, 4/15/21 | 1,470,000 | ||||||||||

| 1,500 | Carrizo Oil & Gas, Inc., 6.25%, 4/15/23 (d) | 1,511,250 | ||||||||||

| 1,500 | Continental Resources, Inc., 5.00%, 9/15/22 (d) | 1,526,250 | ||||||||||

| 825 | CVR Refining LLC, 6.50%, 11/1/22 | 848,719 | ||||||||||

| 280 | Noble Holding International Ltd., 7.75%, 1/15/24 | 256,200 | ||||||||||

| 1,500 | Oasis Petroleum, Inc., 6.875%, 3/15/22 (d) | 1,540,312 | ||||||||||

| 8,690,231 | ||||||||||||

| Pharmaceuticals – 2.0% | ||||||||||||

| 2,000 | Horizon Pharma, Inc., 6.625%, 5/1/23 | 2,010,000 | ||||||||||

| 1,500 | Valeant Pharmaceuticals International, Inc., 7.50%, 7/15/21 (a)(c)(d) | 1,513,125 | ||||||||||

| 3,523,125 | ||||||||||||

| Real Estate – 1.9% | ||||||||||||

| 1,500 | Kennedy-Wilson, Inc., 5.875%, 4/1/24 (d) | 1,505,625 | ||||||||||

| 1,950 | Uniti Group L.P., 8.25%, 10/15/23 (d) | 1,828,125 | ||||||||||

| 3,333,750 | ||||||||||||

| Retail – 1.1% | ||||||||||||

| 2,000 | Conn’s, Inc., 7.25%, 7/15/22 (d) | 1,990,000 | ||||||||||

| Semiconductors – 0.9% | ||||||||||||

| 1,515 | Advanced Micro Devices, Inc., 7.00%, 7/1/24 | 1,592,644 | ||||||||||

| Software – 3.5% | ||||||||||||

| 2,000 | Camelot Finance S.A., 7.875%, 10/15/24 (a)(c) | 2,125,600 | ||||||||||

| 12 | Annual Report | | February 28, 2018 | | See accompanying Notes to Financial Statements |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income 2024 Target Term Fund

February 28, 2018 (continued)

| Principal Amount (000s) |

Value | |||||||||||

| Software (continued) | ||||||||||||

| $1,500 | First Data Corp., 7.00%, 12/1/23 (a)(c)(d) | $1,580,625 | ||||||||||

| 1,000 | Rackspace Hosting, Inc., 8.625%, 11/15/24 (a)(c) | 1,045,000 | ||||||||||

| 1,500 | SS&C Technologies Holdings, Inc., 5.875%, 7/15/23 (d) | 1,584,375 | ||||||||||

| 6,335,600 | ||||||||||||

| Telecommunications – 6.3% | ||||||||||||

| 2,000 | CenturyLink, Inc., 7.50%, 4/1/24, Ser. Y (d) | 2,015,000 | ||||||||||

| 1,500 | Cincinnati Bell, Inc., 7.00%, 7/15/24 (a)(c)(d) | 1,427,250 | ||||||||||

| 2,000 | Consolidated Communications, Inc., 6.50%, 10/1/22 (d) | 1,760,000 | ||||||||||

| 2,000 | GTT Communications, Inc., 7.875%, 12/31/24 (a)(c)(d) | 2,083,750 | ||||||||||

| 1,500 | Hughes Satellite Systems Corp., 7.625%, 6/15/21 (d) | 1,620,000 | ||||||||||

| 1,500 | Sprint Corp., 7.125%, 6/15/24 (d) | 1,480,312 | ||||||||||

| 1,620 | Windstream Services LLC, 6.375%, 8/1/23 (a)(c) | 915,300 | ||||||||||

| 11,301,612 | ||||||||||||

| Transportation – 0.9% | ||||||||||||

| 1,500 | XPO Logistics, Inc., 6.50%, 6/15/22 (a)(c)(d) | 1,564,500 | ||||||||||

| Total Corporate Bonds & Notes (cost-$107,312,512) | 105,325,932 | |||||||||||

| Convertible Bonds & Notes – 56.9% | ||||||||||||

| Auto Components – 1.3% | ||||||||||||

| 2,825 | Horizon Global Corp., 2.75%, 7/1/22 (d) | 2,300,609 | ||||||||||

| Auto Manufacturers – 0.6% | ||||||||||||

| 1,000 | Navistar International Corp., 4.75%, 4/15/19 (d) | 1,040,174 | ||||||||||

| Biotechnology – 2.6% | ||||||||||||

| 2,500 | Exact Sciences Corp., 1.00%, 1/15/25 | 2,279,687 | ||||||||||

| 1,500 | Innoviva, Inc., 2.125%, 1/15/23 (d) | 1,556,471 | ||||||||||

| 1,000 | PTC Therapeutics, Inc., 3.00%, 8/15/22 (d) | 880,000 | ||||||||||

| 4,716,158 | ||||||||||||

| Commercial Services – 2.0% | ||||||||||||

| 2,500 | Macquarie Infrastructure Corp., 2.00%, 10/1/23 | 2,261,640 | ||||||||||

| 1,250 | Team, Inc., 5.00%, 8/1/23 (a)(c) | 1,350,296 | ||||||||||

| 3,611,936 | ||||||||||||

| Computers – 1.1% | ||||||||||||

| 2,000 | KeyW Holding Corp., 2.50%, 7/15/19 (d) | 1,922,236 | ||||||||||

| Distribution/Wholesale – 1.7% | ||||||||||||

| 3,000 | Titan Machinery, Inc., 3.75%, 5/1/19 (d) | 2,980,062 | ||||||||||

| Diversified Financial Services – 3.1% | ||||||||||||

| 2,550 | Encore Capital Group, Inc., 2.875%, 3/15/21 (d) | 2,541,786 | ||||||||||

| 3,000 | PRA Group, Inc., 3.00%, 8/1/20 (d) | 2,919,849 | ||||||||||

| 5,461,635 | ||||||||||||

| Electrical Equipment – 1.5% | ||||||||||||

| 3,215 | SunPower Corp., 4.00%, 1/15/23 (d) | 2,602,221 | ||||||||||

| Electronics – 0.8% | ||||||||||||

| 1,500 | OSI Systems, Inc., 1.25%, 9/1/22 (a)(c) | 1,347,188 | ||||||||||

| Energy-Alternate Sources – 3.3% | ||||||||||||

| 500 | NextEra Energy Partners L.P., 1.50%, 9/15/20 (a)(c) | 490,002 | ||||||||||

| 3,000 | Pattern Energy Group, Inc., 4.00%, 7/15/20 | 2,988,498 | ||||||||||

| 2,500 | SolarCity Corp., 1.625%, 11/1/19 (d) | 2,343,420 | ||||||||||

| 5,821,920 | ||||||||||||

| See accompanying Notes to Financial Statements | | February 28, 2018 | | Annual Report | 13 |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income 2024 Target Term Fund

February 28, 2018 (continued)

| Principal Amount (000s) |

Value | |||||||||||

| Equity Real Estate Investment Trusts (REITs) – 7.8% | ||||||||||||

| $2,850 | IAS Operating Partnership L.P., 5.00%, 3/15/18 (a)(c)(d) | $2,857,125 | ||||||||||

| 3,000 | PennyMac Corp., 5.375%, 5/1/20 (d) | 3,003,753 | ||||||||||

| 1,000 | Redwood Trust, Inc., 4.75%, 8/15/23 | 962,200 | ||||||||||

| 2,850 | Starwood Property Trust, Inc., 4.375%, 4/1/23 (d) | 2,878,372 | ||||||||||

| 2,750 | Two Harbors Investment Corp., 6.25%, 1/15/22 (d) | 2,827,146 | ||||||||||

| 1,500 | Western Asset Mortgage Capital Corp., 6.75%, 10/1/22 | 1,479,000 | ||||||||||

| 14,007,596 | ||||||||||||

| Healthcare/Healthcare Distributors – 1.5% | ||||||||||||

| 3,100 | Aceto Corp., 2.00%, 11/1/20 (d) | 2,743,199 | ||||||||||

| Insurance – 2.3% | ||||||||||||

| 1,500 | AmTrust Financial Services, Inc., 2.75%, 12/15/44 (d) | 1,319,654 | ||||||||||

| 3,000 | HCI Group, Inc., 4.25%, 3/1/37 (a)(c) | 2,724,996 | ||||||||||

| 4,044,650 | ||||||||||||

| Internet – 2.8% | ||||||||||||

| 3,000 | FireEye, Inc., 1.625%, 6/1/35, Ser. B (d) | 2,795,424 | ||||||||||

| 2,500 | Pandora Media, Inc., 1.75%, 12/1/20 (d) | 2,266,250 | ||||||||||

| 5,061,674 | ||||||||||||

| Investment Companies – 5.1% | ||||||||||||

| 2,900 | Goldman Sachs BDC, Inc., 4.50%, 4/1/22 | 2,948,395 | ||||||||||

| 3,000 | Prospect Capital Corp., 4.95%, 7/15/22 (d) | 3,006,411 | ||||||||||

| 3,000 | TPG Specialty Lending, Inc., 4.50%, 8/1/22 (a) | 3,098,169 | ||||||||||

| 9,052,975 | ||||||||||||

| Oil, Gas & Consumable Fuels – 7.2% | ||||||||||||

| 1,500 | Ensco Jersey Finance Ltd., 3.00%, 1/31/24 | 1,241,250 | ||||||||||

| 3,000 | Green Plains, Inc., 4.125%, 9/1/22 | 2,991,477 | ||||||||||

| 3,000 | Helix Energy Solutions Group, Inc., 4.25%, 5/1/22 (d) | 2,833,827 | ||||||||||

| 3,425 | Nabors Industries, Inc., 0.75%, 1/15/24 (a)(c)(d) | 2,613,200 | ||||||||||

| 3,150 | PDC Energy, Inc., 1.125%, 9/15/21 (d) | 3,188,253 | ||||||||||

| 12,868,007 | ||||||||||||

| Pharmaceuticals – 4.8% | ||||||||||||

| 2,000 | Depomed, Inc., 2.50%, 9/1/21 | 1,655,890 | ||||||||||

| 1,750 | DexCom, Inc., 0.75%, 5/15/22 (a)(c) | 1,636,607 | ||||||||||

| 3,250 | Horizon Pharma Investment Ltd., 2.50%, 3/15/22 (d) | 3,010,312 | ||||||||||

| 1,000 | Jazz Investments I Ltd., 1.50%, 8/15/24 (a)(c) | 953,798 | ||||||||||

| 1,500 | Pacira Pharmaceuticals, Inc., 2.375%, 4/1/22 (a)(c) | 1,381,760 | ||||||||||

| 8,638,367 | ||||||||||||

| Retail – 0.5% | ||||||||||||

| 1,000 | RH, zero coupon, 7/15/20 (a)(c) | 965,676 | ||||||||||

| Semiconductors – 3.7% | ||||||||||||

| 2,000 | Inphi Corp., 0.75%, 9/1/21 | 1,843,240 | ||||||||||

| 1,750 | Synaptics, Inc., 0.50%, 6/15/22 (a)(c) | 1,685,598 | ||||||||||

| 3,300 | Veeco Instruments, Inc., 2.70%, 1/15/23 (d) | 3,059,305 | ||||||||||

| 6,588,143 | ||||||||||||

| Software – 1.1% | ||||||||||||

| 2,000 | Evolent Health, Inc., 2.00%, 12/1/21 | 2,057,094 | ||||||||||

| 14 | Annual Report | | February 28, 2018 | | See accompanying Notes to Financial Statements |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income 2024 Target Term Fund

February 28, 2018 (continued)

| Principal Amount (000s) |

Value | |||||||||||

| Transportation – 2.1% | ||||||||||||

| $3,000 | Echo Global Logistics, Inc., 2.50%, 5/1/20 (d) | $3,072,003 | ||||||||||

| 750 | Teekay Corp., 5.00%, 1/15/23 (a)(c) | 719,456 | ||||||||||

| 3,791,459 | ||||||||||||

| Total Convertible Bonds & Notes (cost-$101,701,569) | 101,622,979 | |||||||||||

| Senior Loans (a)(b) – 20.3% | ||||||||||||

| Aerospace & Defense – 0.5% | ||||||||||||

| 912 | Engility Corp., 1 mo. LIBOR + 3.250%, 4.898%, 8/12/23, Term Loan B2 | 920,895 | ||||||||||

| Airlines – 0.6% | ||||||||||||

| 995 | Delta Air Lines, Inc., 1 mo. LIBOR + 2.500%, 4.09%, 10/18/18, 2018 Term Loan B1 | 1,001,046 | ||||||||||

| Automobiles – 0.5% | ||||||||||||

| Winnebago Industries, Inc., 11/8/23, 2017 Term Loan B | ||||||||||||

| 317 | 1 mo. LIBOR + 3.500%, 5.0793% | 321,655 | ||||||||||

| 598 | 3 mo. LIBOR + 3.500%, 5.0226% | 607,570 | ||||||||||

| 929,225 | ||||||||||||

| Building Materials – 0.6% | ||||||||||||

| 995 | GYP Holdings III Corp., 3 mo. LIBOR + 3.000%, 4.772%, 4/1/23, 2017 Term Loan | 1,002,296 | ||||||||||

| Building Products – 0.5% | ||||||||||||

| 839 | Ply Gem Industries, Inc., 3 mo. LIBOR + 3.000%, 4.693%, 2/1/21, Term Loan B | 843,961 | ||||||||||

| Chemicals – 0.8% | ||||||||||||

| 547 | Kraton Polymers LLC, 1 mo. LIBOR + 3.000%, 4.648%, 1/6/22, 2017 USD Term Loan B | 550,883 | ||||||||||

| 877 | Omnova Solutions Inc., 1 mo. LIBOR + 4.250%, 5.898%, 8/28/23, 2016 Term Loan B2 | 884,422 | ||||||||||

| 1,435,305 | ||||||||||||

| Commercial Services & Supplies – 0.5% | ||||||||||||

| 995 | Advanced Disposal Services, Inc., 1 Week LIBOR + 2.250%, 3.721%, 11/10/23, Term Loan B3 | 999,978 | ||||||||||

| Diversified Consumer Services – 0.4% | ||||||||||||

| 776 | Laureate Education, Inc., 1 mo. LIBOR + 3.500%, 5.148%, 4/26/24, 2017 Term Loan B | 781,569 | ||||||||||

| Electronic Equipment, Instruments & Components – 0.5% | ||||||||||||

| 841 | Zebra Technologies Corp., 3 mo. LIBOR + 2.000%, 3.753%, 10/27/21, 2017 Term Loan B | 846,062 | ||||||||||

| Electronics – 0.5% | ||||||||||||

| 975 | Kemet Electronic Corp., 1 mo. LIBOR + 6.000%, 7.648%, 4/26/24, Term Loan B | 993,281 | ||||||||||

| Food & Staples Retailing – 0.6% | ||||||||||||

| 995 | US Foods, Inc., 1 mo. LIBOR + 2.50%, 4.148%, 6/27/23, 2016 Term Loan B | 1,003,994 | ||||||||||

| Healthcare Providers & Services – 0.6% | ||||||||||||

| Select Medical Corporation, 3/6/24, 2017 Term Loan B | ||||||||||||

| 992 | 3 mo. LIBOR + 3.500%, 5.21% | 998,245 | ||||||||||

| 3 | 2 mo. LIBOR + 3.500%, 5.13% | 2,632 | ||||||||||

| – | † | PRIME + 2.500%, 7.00% | 329 | |||||||||

| 1,001,206 | ||||||||||||

| Healthcare-Products – 0.5% | ||||||||||||

| 909 | Greatbatch Ltd., 1 mo. LIBOR + 3.250%, 4.83%, 10/27/22, 2017 1st Lien Term Loan B | 918,492 | ||||||||||

| See accompanying Notes to Financial Statements | | February 28, 2018 | | Annual Report | 15 |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income 2024 Target Term Fund

February 28, 2018 (continued)

| Principal Amount (000s) |

Value | |||||||||||

| Hotels, Restaurants & Leisure – 3.3% | ||||||||||||

| 1011778 B.C. Unlimited Liability Company, 2/16/24, Term Loan B3 | ||||||||||||

| $390 | 3 mo. LIBOR + 2.250%, 3.943% | $391,403 | ||||||||||

| 607 | 1 mo. LIBOR + 2.250%, 3.898% | 608,822 | ||||||||||

| 929 | Boyd Gaming Corp., 1 Week LIBOR + 2.500%, 3.974%, 9/15/23, Term Loan B | 934,872 | ||||||||||

| 1,000 | Golden Entertainment, Inc., 1 mo. LIBOR + 3.00, 4.59%, 10/20/24, 2017 1st Lien Term Loan | 1,007,190 | ||||||||||

| Playa Resorts Holding B.V., 4/5/24, 2017 Term Loan B | ||||||||||||

| 993 | 3 mo. LIBOR + 3.25%, 5.00% | 1,000,358 | ||||||||||

| 2 | 2 mo. LIBOR + 3.25%, 4.89% | 2,517 | ||||||||||

| 998 | Scientific Games International, Inc., 3 mo. LIBOR + 2.75%, 4.324%, 8/14/24, 2017 Term Loan B4 | 1,003,241 | ||||||||||

| 948 | Travelport Finance (Luxembourg) Sarl, 3 mo. LIBOR + 2.750%, 4.589%, 9/2/21, New 2017 Term Loan D | 951,659 | ||||||||||

| 5,900,062 | ||||||||||||

| Internet – 0.6% | ||||||||||||

| 995 | Everi Payments, Inc., 1 mo. LIBOR + 3.500%, 5.148%, 5/9/24, Term Loan B | 1,004,642 | ||||||||||

| Internet Software & Services – 1.1% | ||||||||||||

| 972 | Blucora, Inc., 3 mo. LIBOR + 3.000%, 4.693%, 5/22/24, Term Loan | 979,314 | ||||||||||

| 1,000 | Match Group Inc., 1 mo. LIBOR + 2.500%, 4.088%, 11/16/22, 2017 Term Loan B | 1,007,500 | ||||||||||

| 1,986,814 | ||||||||||||

| IT Services – 1.1% | ||||||||||||

| 923 | First Data Corporation, 1 mo. LIBOR + 2.250%, 3.871%, 4/26/24, 2024 USD Term Loan | 925,912 | ||||||||||

| 995 | Xerox Business Services LLC, 1 mo. LIBOR + 3.000%, 4.648%, 12/7/23, USD Term Loan B | 1,005,547 | ||||||||||

| 1,931,459 | ||||||||||||

| Leisure – 0.6% | ||||||||||||

| Planet Fitness Holdings LLC, 3/31/21, Incremental Term Loan B | ||||||||||||

| 188 | 3 mo. LIBOR + 3.000%, 4.693% | 190,271 | ||||||||||

| 807 | 1 mo. LIBOR + 3.000%, 4.648% | 817,128 | ||||||||||

| 1,007,399 | ||||||||||||

| Machinery – 1.1% | ||||||||||||

| 998 | Gardner Denver, Inc., 3 mo. LIBOR + 2.750%, 4.443%, 7/30/24, 2017 USD Term Loan B | 1,002,148 | ||||||||||

| 997 | Harsco Corporation, 1 mo. LIBOR + 3.000%, 4.688%, 12/6/24, 2017 Term Loan B1 | 1,011,577 | ||||||||||

| 2,013,725 | ||||||||||||

| Media – 1.0% | ||||||||||||

| 995 | Gray Television, Inc., 1 mo. LIBOR + 2.250%, 3.83%, 2/7/24, 2017 Term Loan B2 | 1,002,233 | ||||||||||

| 722 | Lions Gate Entertainment Corp., 1 mo. LIBOR + 2.250%, 3.898%, 12/8/23, 2017 Term Loan B | 727,798 | ||||||||||

| 1,730,031 | ||||||||||||

| Pharmaceuticals – 1.1% | ||||||||||||

| 962 | HLF Financing Sarl, 1 mo. LIBOR + 5.500%, 7.148%, 2/15/23, Term Loan B | 969,300 | ||||||||||

| 948 | Lannett Company, Inc., 1 mo. LIBOR + 5.375%, 7.023%, 11/25/22, Term Loan B | 947,521 | ||||||||||

| 1,916,821 | ||||||||||||

| 16 | Annual Report | | February 28, 2018 | | See accompanying Notes to Financial Statements |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income 2024 Target Term Fund

February 28, 2018 (continued)

| Principal Amount (000s) |

Value | |||||||||||

| Retail – 0.6% | ||||||||||||

| CWGS Group LLC, 11/8/23, 2016 Term Loan | ||||||||||||

| $5 | 1 mo. LIBOR + 3.000%, 4.65% | $5,604 | ||||||||||

| 992 | 1 mo. LIBOR + 3.000%, 4.58% | 1,002,371 | ||||||||||

| 1,007,975 | ||||||||||||

| Road & Rail – 0.5% | ||||||||||||

| YRC Worldwide, Inc., 7/24/22, 2017 Term Loan | ||||||||||||

| 932 | 3 mo. LIBOR + 8.500%, 10.271% | 941,309 | ||||||||||

| 7 | 1 mo. LIBOR + 8.500%, 10.148% | 7,167 | ||||||||||

| 948,476 | ||||||||||||

| Semiconductors & Semiconductor Equipment – 0.5% | ||||||||||||

| 974 | Cypress Semiconductor Corp., 1 mo. LIBOR + 2.750%, 4.35%, 7/5/21, 2016 Term Loan B | 980,378 | ||||||||||

| Specialty Retail – 1.1% | ||||||||||||

| 998 | Burlington Coat Factory Warehouse Corporation, 3 mo. LIBOR + 2.500%, 4.09%, 11/17/24, 2017 Term Loan B5 | 1,001,864 | ||||||||||

| 998 | National Vision, Inc., 1 mo. LIBOR + 2.75%, 4.398%, 11/20/24, 2017 Repriced Term Loan | 1,003,580 | ||||||||||

| 2,005,444 | ||||||||||||

| Textiles, Apparel & Luxury Goods – 0.6% | ||||||||||||

| G-III Apparel Group, Ltd., 12/1/22, Term Loan B | ||||||||||||

| 753 | 3 mo. LIBOR + 5.25%, 7.063% | 762,260 | ||||||||||

| 188 | 1 mo. LIBOR + 5.25%, 6.875% | 190,565 | ||||||||||

| 188 | 3 mo. PRIME + 4.25%, 8.75% | 190,565 | ||||||||||

| 1,143,390 | ||||||||||||

| Total Senior Loans (cost-$36,168,464) | 36,253,926 | |||||||||||

| Repurchase Agreements – 1.8% | ||||||||||||

| 3,233 | State Street Bank and Trust Co., dated 2/28/18, 0.20%, due 3/1/18, proceeds $3,233,018; collateralized by U.S. Treasury Notes, 1.25%, due 7/31/23, valued at $3,300,455 including accrued interest (cost-$3,233,000) |

3,233,000 | ||||||||||

| Total Investments (cost-$248,415,545) – 137.9% | 246,435,837 | |||||||||||

| Liabilities in excess of other assets – (37.9)% | (67,675,565 | ) | ||||||||||

| Net Assets – 100.0% | $178,760,272 | |||||||||||

Notes to Schedule of Investments:

| † | Less than $500. |

| (a) | Private Placement–Restricted as to resale and may not have a readily available market. Securities with an aggregate value of $98,335,937, representing 55.0% of net assets. |

| (b) | These securities generally pay interest at rates which are periodically pre-determined by reference to a base lending rate plus a premium. These base lending rates are generally either the lending rate offered by one or more major European banks, such as the “LIBOR” or the prime rate offered by one or more major United States banks, or the certificate of deposit rate. These securities are generally considered to be restricted as the Fund is ordinarily contractually obligated to receive approval from the Agent bank and/or borrower prior to disposition. Remaining maturities of senior loans may be less than the stated maturities shown as a result of contractual or optional payments by the borrower. Such prepayments cannot be predicted with certainty. The interest rate disclosed reflects the rate in effect on February 28, 2018. |

| (c) | 144A–Exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, typically only to qualified institutional buyers. Securities with an aggregate value of $58,983,842, representing 33.0% of net assets. |

| See accompanying Notes to Financial Statements | | February 28, 2018 | | Annual Report | 17 |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income 2024 Target Term Fund

February 28, 2018 (continued)

| (d) | All or partial amount segregated for the benefit of the counterparty as collateral for long-term and short-term loan financing. |

| (e) | Fair Value Measurements-See Note 1(b) in the Notes to Financial Statements. |

| Level 1 – Quoted Prices |

Level 2 – Other Significant Observable Inputs |

Level 3 – Significant Unobservable Inputs |

Value at 2/28/18 |

|||||||||||||

| Investments in Securities – Assets |

||||||||||||||||

| Corporate Bonds & Notes |

– | $105,325,932 | – | $105,325,932 | ||||||||||||

| Convertible Bonds & Notes |

– | 101,622,979 | – | 101,622,979 | ||||||||||||

| Senior Loans |

– | 36,253,926 | – | 36,253,926 | ||||||||||||

| Repurchase Agreements |

– | 3,233,000 | – | 3,233,000 | ||||||||||||

| Totals |

– | $246,435,837 | – | $246,435,837 | ||||||||||||

Glossary:

| LIBOR | - | London Inter-Bank Offered Rate | ||

| REIT | - | Real Estate Investment Trust |

| 18 | Annual Report | | February 28, 2018 | | See accompanying Notes to Financial Statements |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income Fund

February 28, 2018

| Principal Amount (000s) |

Value | |||||||||||

| Corporate Bonds & Notes – 40.3% | ||||||||||||

| Aerospace & Defense – 1.0% | ||||||||||||

| $7,540 | TransDigm, Inc., 6.50%, 5/15/25 | $7,747,350 | ||||||||||

| 1,420 | Triumph Group, Inc., 7.75%, 8/15/25 | 1,471,475 | ||||||||||

| 9,218,825 | ||||||||||||

| Auto Manufacturers – 0.5% | ||||||||||||

| 4,660 | Navistar International Corp., 6.625%, 11/1/25 (a)(b) | 4,811,450 | ||||||||||

| Building Materials – 0.7% | ||||||||||||

| 5,665 | U.S. Concrete, Inc., 6.375%, 6/1/24 | 6,047,388 | ||||||||||

| Chemicals – 2.8% | ||||||||||||

| 7,500 | Chemours Co., 6.625%, 5/15/23 | 7,921,875 | ||||||||||

| 4,790 | Kraton Polymers LLC, 7.00%, 4/15/25 (a)(b) | 4,969,625 | ||||||||||

| 5,670 | Platform Specialty Products Corp., 6.50%, 2/1/22 (a)(b) | 5,833,013 | ||||||||||

| 6,720 | Tronox Finance LLC, 7.50%, 3/15/22 (a)(b) | 6,988,800 | ||||||||||

| 25,713,313 | ||||||||||||

| Commercial Services – 1.2% | ||||||||||||

| 8,050 | Cenveo Corp., 6.00%, 5/15/24 (a)(b)(c)(h) (acquisition cost-$11,247,777; purchased 3/22/12) |

644,000 | ||||||||||

| 7,375 | Monitronics International, Inc., 9.125%, 4/1/20 | 6,453,125 | ||||||||||

| 3,500 | United Rentals North America, Inc., 5.50%, 7/15/25 | 3,618,125 | ||||||||||

| 10,715,250 | ||||||||||||

| Computers – 1.9% | ||||||||||||

| 5,242 | DynCorp International, Inc., PIK 1.50%, 11.875%, 11/30/20 | 5,503,831 | ||||||||||

| 7,350 | Harland Clarke Holdings Corp., 9.25%, 3/1/21 (a)(b) | 7,625,625 | ||||||||||

| 3,935 | Western Digital Corp., 10.50%, 4/1/24 | 4,579,356 | ||||||||||

| 17,708,812 | ||||||||||||

| Distribution/Wholesale – 0.6% | ||||||||||||

| 5,380 | H&E Equipment Services, Inc., 5.625%, 9/1/25 (a)(b) | 5,514,500 | ||||||||||

| Diversified Financial Services – 3.7% | ||||||||||||

| Community Choice Financial, Inc., | ||||||||||||

| 10,085 | 10.75%, 5/1/19 | 9,605,962 | ||||||||||

| 7,130 | 12.75%, 5/1/20 (a)(b) | 6,096,150 | ||||||||||

| Nationstar Mortgage LLC, | ||||||||||||

| 2,500 | 7.875%, 10/1/20 | 2,567,187 | ||||||||||

| 5,300 | 9.625%, 5/1/19 | 5,427,200 | ||||||||||

| Navient Corp., | ||||||||||||

| 1,575 | 7.25%, 9/25/23 | 1,681,313 | ||||||||||

| 3,210 | 8.45%, 6/15/18 | 3,258,150 | ||||||||||

| 4,935 | Springleaf Finance Corp., 8.25%, 10/1/23 | 5,453,175 | ||||||||||

| 34,089,137 | ||||||||||||

| Electric Utilities – 0.6% | ||||||||||||

| 5,585 | NRG Energy, Inc., 6.25%, 5/1/24 | 5,808,400 | ||||||||||

| Engineering & Construction – 0.6% | ||||||||||||

| 5,100 | Tutor Perini Corp., 6.875%, 5/1/25 (a)(b) | 5,367,750 | ||||||||||

| Entertainment – 1.0% | ||||||||||||

| 4,990 | AMC Entertainment Holdings, Inc., 6.125%, 5/15/27 | 4,865,250 | ||||||||||

| 4,000 | Cedar Fair L.P., 5.375%, 6/1/24 | 4,125,000 | ||||||||||

| 8,990,250 | ||||||||||||

| See accompanying Notes to Financial Statements | | February 28, 2018 | | Annual Report | 19 |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income Fund

February 28, 2018 (continued)

| Principal Amount (000s) |

Value | |||||||||||

| Healthcare-Services – 3.1% | ||||||||||||

| $2,835 | Community Health Systems, Inc., 6.25%, 3/31/23 | $2,594,025 | ||||||||||

| 5,430 | DaVita, Inc., 5.125%, 7/15/24 | 5,402,850 | ||||||||||

| 3,860 | Envision Healthcare Corp., 6.25%, 12/1/24 (a)(b) | 4,081,950 | ||||||||||

| 3,800 | HCA, Inc., 7.50%, 2/15/22 | 4,213,250 | ||||||||||

| 7,955 | Kindred Healthcare, Inc., 8.75%, 1/15/23 | 8,551,625 | ||||||||||

| 3,500 | Tenet Healthcare Corp., 7.00%, 8/1/25 (a)(b) | 3,504,375 | ||||||||||

| 28,348,075 | ||||||||||||

| Home Builders – 0.5% | ||||||||||||

| 4,395 | Beazer Homes USA, Inc., 8.75%, 3/15/22 | 4,757,588 | ||||||||||

| Internet & Catalog Retail – 0.3% | ||||||||||||

| 2,800 | Netflix, Inc., 5.875%, 2/15/25 | 2,965,508 | ||||||||||

| Iron/Steel – 0.9% | ||||||||||||

| AK Steel Corp., | ||||||||||||

| 2,025 | 7.00%, 3/15/27 | 2,069,297 | ||||||||||

| 1,315 | 7.50%, 7/15/23 | 1,410,337 | ||||||||||

| 4,750 | United States Steel Corp., 8.375%, 7/1/21 (a)(b) | 5,094,375 | ||||||||||

| 8,574,009 | ||||||||||||

| Machinery-Construction & Mining – 0.5% | ||||||||||||

| 4,695 | Terex Corp., 5.625%, 2/1/25 (a)(b) | 4,747,819 | ||||||||||

| Media – 2.0% | ||||||||||||

| 7,370 | Cablevision Systems Corp., 8.00%, 4/15/20 | 7,850,524 | ||||||||||

| 3,740 | Gray Television, Inc., 5.875%, 7/15/26 (a)(b) | 3,716,625 | ||||||||||

| 4,671 | LiveStyle, Inc., 9.625%, 2/1/19 (a)(b)(c)(h)(j) | |||||||||||

| (acquisition cost-$4,879,905; purchased 5/7/14-2/26/15) | 93 | |||||||||||

| 6,930 | McClatchy Co., 9.00%, 12/15/22 | 7,259,175 | ||||||||||

| 18,826,417 | ||||||||||||

| Metal Fabricate/Hardware – 0.4% | ||||||||||||

| 3,830 | Park-Ohio Industries, Inc., 6.625%, 4/15/27 | 4,021,500 | ||||||||||

| Mining – 1.9% | ||||||||||||

| 5,100 | Alcoa Nederland Holding BV, 7.00%, 9/30/26 (a)(b) | 5,533,500 | ||||||||||

| 4,405 | Constellium NV, 6.625%, 3/1/25 (a)(b) | 4,570,187 | ||||||||||

| 2,775 | Hudbay Minerals, Inc., 7.625%, 1/15/25 (a)(b) | 3,031,688 | ||||||||||

| 3,950 | Joseph T. Ryerson & Son, Inc., 11.00%, 5/15/22 (a)(b) | 4,407,608 | ||||||||||

| 17,542,983 | ||||||||||||

| Oil, Gas & Consumable Fuels – 4.8% | ||||||||||||

| 2,700 | Calumet Specialty Products Partners L.P., 6.50%, 4/15/21 | 2,646,000 | ||||||||||

| 1,900 | Carrizo Oil & Gas, Inc., 6.25%, 4/15/23 | 1,914,250 | ||||||||||

| 16,950 | Cobalt International Energy, Inc., 10.75%, 12/1/21 (c) | 18,390,750 | ||||||||||

| 590 | Ensco PLC, 5.20%, 3/15/25 | 492,650 | ||||||||||

| 7,225 | EP Energy LLC, 9.375%, 5/1/20 | 6,755,375 | ||||||||||

| 2,835 | NGL Energy Partners L.P., 7.50%, 11/1/23 | 2,856,263 | ||||||||||

| 975 | Noble Holding International Ltd., 7.75%, 1/15/24 | 892,125 | ||||||||||

| 4,895 | Oasis Petroleum, Inc., 6.875%, 3/15/22 | 5,026,553 | ||||||||||

| 4,530 | Sanchez Energy Corp., 6.125%, 1/15/23 | 3,420,150 | ||||||||||

| 1,670 | Transocean, Inc., 7.50%, 1/15/26 (a)(b) | 1,686,700 | ||||||||||

| 820 | Weatherford International Ltd., 8.25%, 6/15/23 | 797,450 | ||||||||||

| 44,878,266 | ||||||||||||

| 20 | Annual Report | | February 28, 2018 | | See accompanying Notes to Financial Statements |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income Fund

February 28, 2018 (continued)

| Principal Amount (000s) |

Value | |||||||||||

| Pharmaceuticals – 1.3% | ||||||||||||

| $2,290 | Endo Finance LLC, 5.375%, 1/15/23 (a)(b) | $1,711,775 | ||||||||||

| 5,865 | Horizon Pharma, Inc., 6.625%, 5/1/23 | 5,894,325 | ||||||||||

| 4,000 | Valeant Pharmaceuticals International, Inc., 7.50%, 7/15/21 (a)(b) | 4,035,000 | ||||||||||

| 11,641,100 | ||||||||||||

| Pipelines – 0.4% | ||||||||||||

| 3,550 | Energy Transfer Equity L.P., 5.50%, 6/1/27 | 3,683,125 | ||||||||||

| Real Estate – 0.9% | ||||||||||||

| 3,085 | Kennedy-Wilson, Inc., 5.875%, 4/1/24 | 3,096,569 | ||||||||||

| 5,365 | Uniti Group L.P., 8.25%, 10/15/23 | 5,029,687 | ||||||||||

| 8,126,256 | ||||||||||||

| Retail – 2.0% | ||||||||||||

| 3,500 | Claire’s Stores, Inc., 9.00%, 3/15/19 (a)(b) | 2,397,500 | ||||||||||

| 5,980 | Conn’s, Inc., 7.25%, 7/15/22 | 5,950,100 | ||||||||||

| 2,835 | Dollar Tree, Inc., 5.75%, 3/1/23 | 2,953,716 | ||||||||||

| 1,530 | L Brands, Inc., 6.875%, 11/1/35 | 1,535,278 | ||||||||||

| 9,465 | Neiman Marcus Group Ltd. LLC, 8.00%, 10/15/21 (a)(b) | 5,773,650 | ||||||||||

| 18,610,244 | ||||||||||||

| Semiconductors – 1.1% | ||||||||||||

| 5,355 | Advanced Micro Devices, Inc., 7.00%, 7/1/24 | 5,629,444 | ||||||||||

| 4,645 | Amkor Technology, Inc., 6.375%, 10/1/22 | 4,795,962 | ||||||||||

| 10,425,406 | ||||||||||||

| Software – 0.7% | ||||||||||||

| 5,035 | Camelot Finance S.A., 7.875%, 10/15/24 (a)(b) | 5,351,198 | ||||||||||

| 1,480 | Rackspace Hosting, Inc., 8.625%, 11/15/24 (a)(b) | 1,546,600 | ||||||||||

| 6,897,798 | ||||||||||||

| Telecommunications – 4.4% | ||||||||||||

| 4,080 | Cincinnati Bell, Inc., 7.00%, 7/15/24 (a)(b) | 3,882,120 | ||||||||||

| 9,370 | Consolidated Communications, Inc., 6.50%, 10/1/22 | 8,245,600 | ||||||||||

| 5,290 | Frontier Communications Corp., 10.50%, 9/15/22 | 4,529,562 | ||||||||||

| 2,685 | GTT Communications, Inc., 7.875%, 12/31/24 (a)(b) | 2,797,434 | ||||||||||

| Hughes Satellite Systems Corp., | ||||||||||||

| 1,460 | 6.625%, 8/1/26 | 1,496,938 | ||||||||||

| 4,250 | 7.625%, 6/15/21 | 4,590,000 | ||||||||||

| 7,205 | Sprint Communications, Inc., 11.50%, 11/15/21 | 8,537,925 | ||||||||||

| 1,865 | Sprint Corp., 7.625%, 3/1/26 | 1,860,338 | ||||||||||

| 8,229 | Windstream Services LLC, 6.375%, 8/1/23 (a)(b) | 4,649,385 | ||||||||||

| 40,589,302 | ||||||||||||

| Transportation – 0.5% | ||||||||||||

| 4,830 | XPO Logistics, Inc., 6.50%, 6/15/22 (a)(b) | 5,037,690 | ||||||||||

| Total Corporate Bonds & Notes (cost-$392,648,337) | 373,658,161 | |||||||||||

| Convertible Bonds & Notes – 34.9% | ||||||||||||

| Apparel & Textiles – 1.8% | ||||||||||||

| 14,580 | Iconix Brand Group, Inc., 5.75%, 8/15/23 | 16,661,295 | ||||||||||

| Auto Components – 1.0% | ||||||||||||

| 11,855 | Horizon Global Corp., 2.75%, 7/1/22 | 9,654,416 | ||||||||||

| See accompanying Notes to Financial Statements | | February 28, 2018 | | Annual Report | 21 |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income Fund

February 28, 2018 (continued)

| Principal Amount (000s) |

Value | |||||||||||

| Auto Manufacturers – 1.0% | ||||||||||||

| $6,225 | Navistar International Corp., 4.75%, 4/15/19 | $6,475,083 | ||||||||||

| 2,850 | Tesla, Inc., 1.25%, 3/1/21 | 3,249,108 | ||||||||||

| 9,724,191 | ||||||||||||

| Biotechnology – 0.8% | ||||||||||||

| 9,625 | Intercept Pharmaceuticals, Inc., 3.25%, 7/1/23 | 7,718,509 | ||||||||||

| Building Materials – 0.5% | ||||||||||||

| 4,275 | Cemex S.A.B de C.V., 3.72%, 3/15/20 | 4,418,965 | ||||||||||

| Commercial Services – 2.6% | ||||||||||||

| 13,510 | Ascent Capital Group, Inc., 4.00%, 7/15/20 | 10,486,462 | ||||||||||

| 10,530 | Huron Consulting Group, Inc., 1.25%, 10/1/19 | 9,858,712 | ||||||||||

| 3,705 | ServiceSource International, Inc., 1.50%, 8/1/18 | 3,641,645 | ||||||||||

| 23,986,819 | ||||||||||||

| Distribution/Wholesale – 0.7% | ||||||||||||

| 6,600 | Titan Machinery, Inc., 3.75%, 5/1/19 | 6,556,136 | ||||||||||

| Diversified Financial Services – 2.4% | ||||||||||||

| 9,320 | Encore Capital Group, Inc., 3.00%, 7/1/20 | 10,447,720 | ||||||||||

| 12,165 | PRA Group, Inc., 3.00%, 8/1/20 | 11,839,988 | ||||||||||

| 22,287,708 | ||||||||||||

| Electric Utilities – 1.0% | ||||||||||||

| 9,230 | NRG Yield, Inc., 3.25%, 6/1/20 (a)(b) | 9,203,011 | ||||||||||

| Electrical Equipment – 1.1% | ||||||||||||

| SunPower Corp., | ||||||||||||

| 3,135 | 0.875%, 6/1/21 | 2,410,188 | ||||||||||

| 9,405 | 4.00%, 1/15/23 | 7,612,407 | ||||||||||

| 10,022,595 | ||||||||||||

| Electronics – 0.6% | ||||||||||||

| 5,895 | OSI Systems, Inc., 1.25%, 9/1/22 (a)(b) | 5,294,447 | ||||||||||

| Energy-Alternate Sources – 2.1% | ||||||||||||

| 3,990 | Pattern Energy Group, Inc., 4.00%, 7/15/20 | 3,974,702 | ||||||||||

| 16,800 | SolarCity Corp., 1.625%, 11/1/19 | 15,747,783 | ||||||||||

| 19,722,485 | ||||||||||||

| Engineering & Construction – 0.4% | ||||||||||||

| 3,230 | Layne Christensen Co., 4.25%, 11/15/18 | 3,266,212 | ||||||||||

| Equity Real Estate Investment Trusts (REITs) – 1.4% | ||||||||||||

| 5,400 | Two Harbors Investment Corp., 6.25%, 1/15/22 | 5,551,486 | ||||||||||

| 7,690 | Western Asset Mortgage Capital Corp., 6.75%, 10/1/22 | 7,582,340 | ||||||||||

| 13,133,826 | ||||||||||||

| Healthcare/Healthcare Distributors – 1.1% | ||||||||||||

| 11,415 | Aceto Corp., 2.00%, 11/1/20 | 10,101,168 | ||||||||||

| Insurance – 1.2% | ||||||||||||

| 12,210 | AmTrust Financial Services, Inc., 2.75%, 12/15/44 | 10,741,980 | ||||||||||

| Iron/Steel – 0.1% | ||||||||||||

| 910 | AK Steel Corp., 5.00%, 11/15/19 | 1,142,393 | ||||||||||

| Oil, Gas & Consumable Fuels – 3.0% | ||||||||||||

| 18,235 | Helix Energy Solutions Group, Inc., 3.25%, 3/15/32 | 18,270,522 | ||||||||||

| 9,980 | Whiting Petroleum Corp., 1.25%, 4/1/20 | 9,443,565 | ||||||||||

| 27,714,087 | ||||||||||||

| 22 | Annual Report | | February 28, 2018 | | See accompanying Notes to Financial Statements |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income Fund

February 28, 2018 (continued)

| Principal Amount (000s) |

Value | |||||||||||

| Pharmaceuticals – 3.5% | ||||||||||||

| $16,145 | Herbalife Ltd., 2.00%, 8/15/19 | $18,814,527 | ||||||||||

| 3,260 | Horizon Pharma Investment Ltd., 2.50%, 3/15/22 | 3,019,575 | ||||||||||

| 7,800 | Impax Laboratories, Inc., 2.00%, 6/15/22 | 7,678,773 | ||||||||||

| 3,415 | Jazz Investments I Ltd., 1.50%, 8/15/24 (a)(b) | 3,257,220 | ||||||||||

| 32,770,095 | ||||||||||||

| Pipelines – 1.1% | ||||||||||||

| 13,370 | Cheniere Energy, Inc., 4.25%, 3/15/45 | 10,362,378 | ||||||||||

| Retail – 1.1% | ||||||||||||

| 10,425 | RH, zero coupon, 6/15/19 (a)(b) | 10,303,924 | ||||||||||

| Semiconductors – 0.9% | ||||||||||||

| Cypress Semiconductor Corp., | ||||||||||||

| 845 | 2.00%, 2/1/23 (a)(b) | 928,920 | ||||||||||

| 2,850 | 4.50%, 1/15/22 | 4,100,335 | ||||||||||

| 3,935 | Veeco Instruments, Inc., 2.70%, 1/15/23 | 3,647,989 | ||||||||||

| 8,677,244 | ||||||||||||

| Software – 1.9% | ||||||||||||

| 15,785 | Avid Technology, Inc., 2.00%, 6/15/20 | 13,595,620 | ||||||||||

| 3,985 | Synchronoss Technologies, Inc., 0.75%, 8/15/19 | 3,681,419 | ||||||||||

| 17,277,039 | ||||||||||||

| Telecommunications – 1.0% | ||||||||||||

| 11,065 | Gogo, Inc., 3.75%, 3/1/20 | 9,728,636 | ||||||||||

| Tobacco – 1.6% | ||||||||||||

| Vector Group Ltd. (g), | ||||||||||||

| 5,665 | 3 mo. Cash Dividends on Common Stock + 1.75%, 1.75%, 4/15/20 | 6,200,665 | ||||||||||

| 6,215 | 3 mo. Cash Dividends on Common Stock + 2.50%, 2.50%, 1/15/19 | 8,720,801 | ||||||||||

| 14,921,466 | ||||||||||||

| Transportation – 1.0% | ||||||||||||

| 3,990 | Aegean Marine Petroleum Network, Inc., 4.25%, 12/15/21 | 2,432,304 | ||||||||||

| 4,560 | Echo Global Logistics, Inc., 2.50%, 5/1/20 | 4,669,444 | ||||||||||

| 1,995 | Teekay Corp., 5.00%, 1/15/23 (a)(b) | 1,913,754 | ||||||||||

| 9,015,502 | ||||||||||||

| Total Convertible Bonds & Notes (cost-$303,958,191) | 324,406,527 | |||||||||||

| Shares | ||||||||||||

| Convertible Preferred Stock – 21.6% | ||||||||||||

| Banks – 4.0% | ||||||||||||

| 12,080 | Bank of America Corp., 7.25%, Ser. L (e) | 15,456,723 | ||||||||||

| 16,980 | Wells Fargo & Co., 7.50%, Ser. L (e) | 21,649,500 | ||||||||||

| 37,106,223 | ||||||||||||

| Chemicals – 1.0% | ||||||||||||

| 68,495 | Rayonier Advanced Materials, Inc., 8.00%, 8/15/19, Ser. A | 9,785,538 | ||||||||||

| Commercial Services & Supplies – 0.7% | ||||||||||||

| 145,890 | Stericycle, Inc., 5.25%, 9/15/18 | 7,087,336 | ||||||||||

| Diversified Financial Services – 0.5% | ||||||||||||

| 5,700 | Cowen, Inc., 5.625%, Ser. A (e) | 4,728,777 | ||||||||||

| Diversified Telecommunication Services – 0.2% | ||||||||||||

| 155,900 | Frontier Communications Corp., 11.125%, 6/29/18, Ser. A | 1,975,253 | ||||||||||

| See accompanying Notes to Financial Statements | | February 28, 2018 | | Annual Report | 23 |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income Fund

February 28, 2018 (continued)

| Shares | Value | |||||||||||

| Electric Utilities – 2.0% | ||||||||||||

| 302,350 | Dominion Energy, Inc., 6.75%, 8/15/19, Ser. A | $14,745,609 | ||||||||||

| 66,215 | NextEra Energy, Inc., 6.123%, 9/1/19 | 3,661,690 | ||||||||||

| 18,407,299 | ||||||||||||

| Equity Real Estate Investment Trusts (REITs) – 4.2% | ||||||||||||

| 4,625 | Crown Castle International Corp., 6.875%, 8/1/20, Ser. A | 5,176,346 | ||||||||||

| 631,070 | RLJ Lodging Trust, 1.95%, Ser. A (e) | 16,401,509 | ||||||||||

| 410,065 | Sutherland Asset Management Corp., 7.00%, 8/15/23 | 10,251,625 | ||||||||||

| 141,135 | Welltower, Inc., 6.50%, Ser. I (e) | 7,691,858 | ||||||||||

| 39,521,338 | ||||||||||||

| Hand/Machine Tools – 1.8% | ||||||||||||

| 139,055 | Stanley Black & Decker, Inc., 5.375%, 5/15/20 | 16,387,632 | ||||||||||

| Healthcare Providers & Services – 2.5% | ||||||||||||

| 401,015 | Anthem, Inc., 5.25%, 5/1/18 | 23,010,241 | ||||||||||

| Healthcare-Products – 1.3% | ||||||||||||

| 199,155 | Becton Dickinson and Co., 6.125%, 5/1/20, Ser. A | 11,731,464 | ||||||||||

| Oil, Gas & Consumable Fuels – 2.2% | ||||||||||||

| 159,375 | Anadarko Petroleum Corp., 7.50%, 6/7/18 | 5,179,688 | ||||||||||

| 173,410 | Kinder Morgan, Inc., 9.75%, 10/26/18, Ser. A | 5,778,021 | ||||||||||

| 230,425 | Sanchez Energy Corp., 6.50%, Ser. B (e) | 4,114,999 | ||||||||||

| 82,895 | WPX Energy, Inc., 6.25%, 7/31/18, Ser. A | 5,100,529 | ||||||||||

| 20,173,237 | ||||||||||||

| Pharmaceuticals – 1.2% | ||||||||||||

| 30,895 | Teva Pharmaceutical Industries Ltd., 7.00%, 12/15/18 | 10,910,569 | ||||||||||

| Total Convertible Preferred Stock (cost-$214,689,387) | 200,824,907 | |||||||||||

| Preferred Stock (a)(d)(f)(i)(j) – 0.9% | ||||||||||||

| Media – 0.9% | ||||||||||||

| 8,339 | LiveStyle, Inc., Ser. A | 833,900 | ||||||||||

| 76,572 | LiveStyle, Inc., Ser. B | 7,657,200 | ||||||||||

| 6,750 | LiveStyle, Inc., Ser. B | 67 | ||||||||||

| Total Preferred Stock (cost-$15,074,564) | 8,491,167 | |||||||||||

| Common Stock (a)(d)(f)(i) – 0.3% | ||||||||||||

| Advertising – 0.3% | ||||||||||||

| 173,720 | Affinion Group Holdings, Inc., Class A (h) | |||||||||||

| (acquisition cost-$3,080,312; purchased 11/9/15-11/12/15) | 2,630,121 | |||||||||||

| Aerospace & Defense – 0.0% | ||||||||||||

| 8,295 | Erickson, Inc. | 260,380 | ||||||||||

| Media – 0.0% | ||||||||||||

| 90,407 | LiveStyle, Inc. (j) | 9 | ||||||||||

| Total Common Stock (cost-$10,187,309) | 2,890,510 | |||||||||||

| Units | ||||||||||||

| Warrants (d)(f)(i) – 0.0% | ||||||||||||

| Commercial Services – 0.0% | ||||||||||||

| 2,062,338 | Cenveo, Inc., strike price $12.00, expires 6/10/24 (b) | 361 | ||||||||||

| Media – 0.0% | ||||||||||||

| 19,500 | LiveStyle, Inc., expires 11/30/21, Ser. C. (a)(j) | 2 | ||||||||||

| Total Warrants (cost-$246,984) | 363 | |||||||||||

| 24 | Annual Report | | February 28, 2018 | | See accompanying Notes to Financial Statements |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income Fund

February 28, 2018 (continued)

| Principal Amount (000s) |

Value | |||||||||||

| Repurchase Agreements – 2.0% | ||||||||||||

| $18,273 | State Street Bank and Trust Co., dated 2/28/18, 0.20%, due 3/1/18, proceeds $18,273,102; collateralized by U.S. Treasury Notes, 1.25%, due 7/31/23, valued at $18,639,225 including accrued interest (cost-$18,273,000) |

$18,273,000 | ||||||||||

| Total Investments (cost-$955,077,772) – 100.0% | 928,544,635 | |||||||||||

| Other assets in excess of liabilities | 9,322,203 | |||||||||||

| Preferred Shares | (357,000,000 | ) | ||||||||||

| Net Assets Applicable to Common Shareholders | $580,866,838 | |||||||||||

Notes to Schedule of Investments:

| (a) | Private Placement–Restricted as to resale and may not have a readily available market. Securities with an aggregate value of $167,691,140, representing 18.1% of total investments. |

| (b) | 144A–Exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, typically only to qualified institutional buyers. Securities with an aggregate value of $156,309,822, representing 16.8% of total investments. |

| (c) | In default. |

| (d) | Fair-Valued–Securities with an aggregate value of $11,382,040, representing 1.2% of total investments. See Note 1(a) and Note 1(b) in the Notes to Financial Statements. |

| (e) | Perpetual maturity. The date shown, if any, is the next call date. |

| (f) | Level 3 security. See Note 1(a) and Note 1(b) in the Notes to Financial Statements. |

| (g) | In addition to the coupon rate shown, the issuer is expected to pay additional interest based on the actual dividends paid on its common stock. |

| (h) | Restricted. The aggregate acquisition cost of such securities is $19,207,994. The aggregate value is $3,274,214, representing 0.4% of total investments. |

| (i) | Non-income producing. |

| (j) | A member of the Fund’s portfolio management team is a member of the board of directors of LiveStyle, Inc. The Fund’s aggregate value of investments in LiveStyle, Inc. represents 0.9% of total investments. |

| (k) | Fair Value Measurements-See Note 1(b) in the Notes to Financial Statements. |

| Level 1 – Prices |

Level 2 – Other Significant Observable Inputs |

Level 3 – Significant Unobservable Inputs |

Value at 2/28/18 |

|||||||||||||

| Investments in Securities – Assets |

| |||||||||||||||

| Corporate Bonds & Notes |

– | $373,658,161 | – | $373,658,161 | ||||||||||||

| Convertible Bonds & Notes |

– | 324,406,527 | – | 324,406,527 | ||||||||||||

| Convertible Preferred Stock: |

| |||||||||||||||

| Chemicals |

– | 9,785,538 | – | 9,785,538 | ||||||||||||

| Diversified Financial Services |

– | 4,728,777 | – | 4,728,777 | ||||||||||||

| Healthcare-Products |

– | 11,731,464 | – | 11,731,464 | ||||||||||||

| Oil, Gas & Consumable Fuels |

$16,058,238 | 4,114,999 | – | 20,173,237 | ||||||||||||

| Pharmaceuticals |

– | 10,910,569 | – | 10,910,569 | ||||||||||||

| All Other |

143,495,322 | – | – | 143,495,322 | ||||||||||||

| Preferred Stock |

– | – | $ | 8,491,167 | 8,491,167 | |||||||||||

| Common Stock |

– | – | 2,890,510 | 2,890,510 | ||||||||||||

| Warrants |

– | – | 363 | 363 | ||||||||||||

| Repurchase Agreements |

– | 18,273,000 | – | 18,273,000 | ||||||||||||

| Totals |

$ | 159,553,560 | $757,609,035 | $ | 11,382,040 | $928,544,635 | ||||||||||

At February 28, 2018, there were no transfers between Levels 1 and 2.

| See accompanying Notes to Financial Statements | | February 28, 2018 | | Annual Report | 25 |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income Fund

February 28, 2018 (continued)

A roll forward of fair value measurements using significant unobservable inputs (Level 3) for year ended February 28, 2018, was as follows:

| Beginning Balance 2/28/17 |

Purchases | Sales | Accrued Discount (Premiums) |

Net Realized Gain (Loss) |

||||||||||||||||

| Investments in Securities – Assets |

||||||||||||||||||||

| Corporate Bonds & Notes: |

||||||||||||||||||||

| Commercial Services |

$7,224,875 | $ – | $ – | $(109,870 | ) | $ – | ||||||||||||||

| Preferred Stock: |

||||||||||||||||||||

| Media |

7,759,048 | – | – | – | – | |||||||||||||||

| Common Stock: |

||||||||||||||||||||

| Advertising |

2,581,479 | – | – | – | – | |||||||||||||||

| Aerospace & Defense |

– | 7,106,998 | † | – | – | – | ||||||||||||||

| Media |

9 | – | – | – | – | |||||||||||||||

| Warrants: |

||||||||||||||||||||

| Commercial Services |

449,705 | – | – | – | – | |||||||||||||||

| Media |

2 | – | – | – | – | |||||||||||||||

| Totals |

$18,015,118 | $7,106,998 | $ – | $(109,870 | ) | $ – | ||||||||||||||

| Net Change in Unrealized Appreciation/ Depreciation |

Transfers into Level 3 |

Transfers out of Level 3* |

Ending Balance 2/28/18 |

|||||||||||||

| Investments in Securities – Assets |

||||||||||||||||

| Corporate Bonds & Notes: |

||||||||||||||||

| Commercial Services |

$(6,471,005 | ) | $ – | $(644,000 | ) | $ – | ||||||||||

| Preferred Stock: |

||||||||||||||||

| Media |

732,119 | – | – | 8,491,167 | ||||||||||||

| Common Stock: |

||||||||||||||||

| Advertising |

48,642 | – | – | 2,630,121 | ||||||||||||

| Aerospace & Defense |

(6,846,618 | ) | – | – | 260,380 | |||||||||||

| Media |

– | – | – | 9 | ||||||||||||

| Warrants: |

||||||||||||||||

| Commercial Services |

(449,344 | ) | – | – | 361 | |||||||||||

| Media |

– | – | – | 2 | ||||||||||||

| Totals |

$(12,986,206 | ) | $ – | $(644,000 | ) | $11,382,040 | ||||||||||

| † | Issued via reorganization. |

| * | Transferred out of Level 3 into Level 2 because an evaluated price from a third-party independent pricing vendor was used on February 28, 2018. |

The following tables present additional information about valuation techniques and inputs used for investments that are measured at fair value and categorized within Level 3 at February 28, 2018:

| Ending Balance at 2/28/18 |

Valuation Technique Used |

Unobservable Inputs |

Input Values | |||||||||||||

| Investments in Securities – Assets |

|

|||||||||||||||

| Preferred Stock |

$8,491,100 | |

Market and Company Comparables |

|

|

EV Multiples Illiquidity Discount |

|

|

0.69x (0.24x – 1.10x) 20% |

| ||||||

| Common Stock |

$2,630,121 | |

Market and Company Comparables |

|

|

EV Multiples Illiquidity Discount |

|

|

4.00x (1.72x – 10.26x) 30% |

| ||||||

| $260,380 | |

Market and Company Comparables |

|

|

EV Multiples M&A Transaction Multiples Illiquidity Discount |

|

|

0.71x (0.48x – 1.10x) 0.87x (0.32x – 2.12x) 40% |

| |||||||

| 26 | Annual Report | | February 28, 2018 | | See accompanying Notes to Financial Statements |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income Fund

February 28, 2018 (continued)

The net change in unrealized appreciation/depreciation of Level 3 investments held at February 28, 2018, was $(6,515,201). Net change in unrealized appreciation/depreciation is reflected on the Statements of Operations.

Glossary:

| PIK | - | Payment-in-Kind | ||

| REIT | - | Real Estate Investment Trust |

| See accompanying Notes to Financial Statements | | February 28, 2018 | | Annual Report | 27 |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income Fund II

February 28, 2018

| Principal Amount (000s) |

Value | |||||||||||

| Corporate Bonds & Notes – 40.6% | ||||||||||||

| Aerospace & Defense – 1.0% | ||||||||||||

| $5,750 | TransDigm, Inc., 6.50%, 5/15/25 | $5,908,125 | ||||||||||

| 1,080 | Triumph Group, Inc., 7.75%, 8/15/25 | 1,119,150 | ||||||||||

| 7,027,275 | ||||||||||||

| Auto Manufacturers – 0.5% | ||||||||||||

| 3,560 | Navistar International Corp., 6.625%, 11/1/25 (a)(b) | 3,675,700 | ||||||||||

| Building Materials – 0.7% | ||||||||||||

| 4,335 | U.S. Concrete, Inc., 6.375%, 6/1/24 | 4,627,613 | ||||||||||

| Chemicals – 2.7% | ||||||||||||

| 5,500 | Chemours Co., 6.625%, 5/15/23 | 5,809,375 | ||||||||||

| 3,640 | Kraton Polymers LLC, 7.00%, 4/15/25 (a)(b) | 3,776,500 | ||||||||||

| 4,330 | Platform Specialty Products Corp., 6.50%, 2/1/22 (a)(b) | 4,454,487 | ||||||||||

| 5,120 | Tronox Finance LLC, 7.50%, 3/15/22 (a)(b) | 5,324,800 | ||||||||||

| 19,365,162 | ||||||||||||

| Commercial Services – 1.2% | ||||||||||||

| 5,974 | Cenveo Corp., 6.00%, 5/15/24 (a)(b)(c)(h) (acquisition cost-$8,347,108; purchased 3/22/12) |

477,920 | ||||||||||

| 5,925 | Monitronics International, Inc., 9.125%, 4/1/20 | 5,184,375 | ||||||||||

| 2,500 | United Rentals North America, Inc., 5.50%, 7/15/25 | 2,584,375 | ||||||||||

| 8,246,670 | ||||||||||||

| Computers – 1.9% | ||||||||||||

| 3,946 | DynCorp International, Inc., PIK 1.50%, 11.875%, 11/30/20 | 4,143,550 | ||||||||||

| 5,650 | Harland Clarke Holdings Corp., 9.25%, 3/1/21 (a)(b) | 5,861,875 | ||||||||||

| 3,155 | Western Digital Corp., 10.50%, 4/1/24 | 3,671,631 | ||||||||||

| 13,677,056 | ||||||||||||

| Distribution/Wholesale – 0.6% | ||||||||||||

| 4,110 | H&E Equipment Services, Inc., 5.625%, 9/1/25 (a)(b) | 4,212,750 | ||||||||||

| Diversified Financial Services – 3.7% | ||||||||||||

| Community Choice Financial, Inc., | ||||||||||||

| 7,465 | 10.75%, 5/1/19 | 7,110,412 | ||||||||||

| 5,370 | 12.75%, 5/1/20 (a)(b) | 4,591,350 | ||||||||||

| Nationstar Mortgage LLC, | ||||||||||||

| 2,000 | 7.875%, 10/1/20 | 2,053,750 | ||||||||||

| 4,250 | 9.625%, 5/1/19 | 4,352,000 | ||||||||||

| Navient Corp., | ||||||||||||

| 1,200 | 7.25%, 9/25/23 | 1,281,000 | ||||||||||

| 2,605 | 8.45%, 6/15/18 | 2,644,075 | ||||||||||

| 3,865 | Springleaf Finance Corp., 8.25%, 10/1/23 | 4,270,825 | ||||||||||

| 26,303,412 | ||||||||||||

| Electric Utilities – 0.6% | ||||||||||||

| 4,265 | NRG Energy, Inc., 6.25%, 5/1/24 | 4,435,600 | ||||||||||

| Engineering & Construction – 0.6% | ||||||||||||

| 3,900 | Tutor Perini Corp., 6.875%, 5/1/25 (a)(b) | 4,104,750 | ||||||||||

| Entertainment – 1.0% | ||||||||||||

| 3,810 | AMC Entertainment Holdings, Inc., 6.125%, 5/15/27 | 3,714,750 | ||||||||||

| 3,045 | Cedar Fair L.P., 5.375%, 6/1/24 | 3,140,156 | ||||||||||

| 6,854,906 | ||||||||||||

| 28 | Annual Report | | February 28, 2018 | | See accompanying Notes to Financial Statements |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income Fund II

February 28, 2018 (continued)

| Principal Amount (000s) |

Value | |||||||||||

| Healthcare-Services – 3.1% | ||||||||||||

| $2,165 | Community Health Systems, Inc., 6.25%, 3/31/23 | $1,980,975 | ||||||||||

| 4,125 | DaVita, Inc., 5.125%, 7/15/24 | 4,104,375 | ||||||||||

| 2,950 | Envision Healthcare Corp., 6.25%, 12/1/24 (a)(b) | 3,119,625 | ||||||||||

| 2,950 | HCA, Inc., 7.50%, 2/15/22 | 3,270,812 | ||||||||||

| 6,045 | Kindred Healthcare, Inc., 8.75%, 1/15/23 | 6,498,375 | ||||||||||

| 2,750 | Tenet Healthcare Corp., 7.00%, 8/1/25 (a)(b) | 2,753,438 | ||||||||||

| 21,727,600 | ||||||||||||

| Home Builders – 0.5% | ||||||||||||

| 3,365 | Beazer Homes USA, Inc., 8.75%, 3/15/22 | 3,642,613 | ||||||||||

| Internet & Catalog Retail – 0.3% | ||||||||||||

| 2,200 | Netflix, Inc., 5.875%, 2/15/25 | 2,330,042 | ||||||||||

| Iron/Steel – 0.9% | ||||||||||||

| AK Steel Corp., | ||||||||||||

| 1,550 | 7.00%, 3/15/27 | 1,583,906 | ||||||||||

| 1,005 | 7.50%, 7/15/23 | 1,077,863 | ||||||||||

| 3,597 | United States Steel Corp., 8.375%, 7/1/21 (a)(b) | 3,857,782 | ||||||||||

| 6,519,551 | ||||||||||||

| Machinery-Construction & Mining – 0.5% | ||||||||||||

| 3,585 | Terex Corp., 5.625%, 2/1/25 (a)(b) | 3,625,331 | ||||||||||

| Media – 2.1% | ||||||||||||

| 5,630 | Cablevision Systems Corp., 8.00%, 4/15/20 | 5,997,076 | ||||||||||

| 2,850 | Gray Television, Inc., 5.875%, 7/15/26 (a)(b) | 2,832,187 | ||||||||||

| 3,589 | LiveStyle, Inc., 9.625%, 2/1/19 (a)(b)(c)(h)(j) | |||||||||||

| (acquisition cost-$3,749,795; purchased 5/7/14-2/26/15) | 72 | |||||||||||

| 5,512 | McClatchy Co., 9.00%, 12/15/22 | 5,773,820 | ||||||||||

| 14,603,155 | ||||||||||||

| Metal Fabricate/Hardware – 0.4% | ||||||||||||

| 2,920 | Park-Ohio Industries, Inc., 6.625%, 4/15/27 | 3,066,000 | ||||||||||

| Mining – 1.9% | ||||||||||||

| 3,900 | Alcoa Nederland Holding BV, 7.00%, 9/30/26 (a)(b) | 4,231,500 | ||||||||||

| 3,365 | Constellium NV, 6.625%, 3/1/25 (a)(b) | 3,491,187 | ||||||||||

| 2,135 | Hudbay Minerals, Inc., 7.625%, 1/15/25 (a)(b) | 2,332,488 | ||||||||||

| 3,050 | Joseph T. Ryerson & Son, Inc., 11.00%, 5/15/22 (a)(b) | 3,403,343 | ||||||||||

| 13,458,518 | ||||||||||||

| Oil, Gas & Consumable Fuels – 5.0% | ||||||||||||

| 2,300 | Calumet Specialty Products Partners L.P., 6.50%, 4/15/21 | 2,254,000 | ||||||||||

| 1,420 | Carrizo Oil & Gas, Inc., 6.25%, 4/15/23 | 1,430,650 | ||||||||||

| 12,800 | Cobalt International Energy, Inc., 10.75%, 12/1/21 (c) | 13,888,000 | ||||||||||

| 450 | Ensco PLC, 5.20%, 3/15/25 | 375,750 | ||||||||||

| 6,180 | EP Energy LLC, 9.375%, 5/1/20 | 5,778,300 | ||||||||||

| 2,165 | NGL Energy Partners L.P., 7.50%, 11/1/23 | 2,181,237 | ||||||||||

| 740 | Noble Holding International Ltd., 7.75%, 1/15/24 | 677,100 | ||||||||||

| 3,745 | Oasis Petroleum, Inc., 6.875%, 3/15/22 | 3,845,647 | ||||||||||

| 3,470 | Sanchez Energy Corp., 6.125%, 1/15/23 | 2,619,850 | ||||||||||

| 1,280 | Transocean, Inc., 7.50%, 1/15/26 (a)(b) | 1,292,800 | ||||||||||

| 630 | Weatherford International Ltd., 8.25%, 6/15/23 | 612,675 | ||||||||||

| 34,956,009 | ||||||||||||

| See accompanying Notes to Financial Statements | | February 28, 2018 | | Annual Report | 29 |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income Fund II

February 28, 2018 (continued)

| Principal Amount (000s) |

Value | |||||||||||

| Pharmaceuticals – 1.3% | ||||||||||||

| $1,755 | Endo Finance LLC, 5.375%, 1/15/23 (a)(b) | $1,311,863 | ||||||||||

| 4,425 | Horizon Pharma, Inc., 6.625%, 5/1/23 | 4,447,125 | ||||||||||

| 3,000 | Valeant Pharmaceuticals International, Inc., 7.50%, 7/15/21 (a)(b) | 3,026,250 | ||||||||||

| 8,785,238 | ||||||||||||

| Pipelines – 0.4% | ||||||||||||

| 2,715 | Energy Transfer Equity L.P., 5.50%, 6/1/27 | 2,816,813 | ||||||||||

| Real Estate – 0.9% | ||||||||||||

| 2,345 | Kennedy-Wilson, Inc., 5.875%, 4/1/24 | 2,353,794 | ||||||||||

| 4,090 | Uniti Group L.P., 8.25%, 10/15/23 | 3,834,375 | ||||||||||

| 6,188,169 | ||||||||||||

| Retail – 2.0% | ||||||||||||

| 4,500 | Claire’s Stores, Inc., 9.00%, 3/15/19 (a)(b) | 3,082,500 | ||||||||||

| 4,370 | Conn’s, Inc., 7.25%, 7/15/22 | 4,348,150 | ||||||||||

| 2,165 | Dollar Tree, Inc., 5.75%, 3/1/23 | 2,255,659 | ||||||||||

| 1,170 | L Brands, Inc., 6.875%, 11/1/35 | 1,174,037 | ||||||||||

| 5,785 | Neiman Marcus Group Ltd. LLC, 8.00%, 10/15/21 (a)(b) | 3,528,850 | ||||||||||

| 14,389,196 | ||||||||||||

| Semiconductors – 1.0% | ||||||||||||

| 4,090 | Advanced Micro Devices, Inc., 7.00%, 7/1/24 | 4,299,612 | ||||||||||

| 2,875 | Amkor Technology, Inc., 6.375%, 10/1/22 | 2,968,438 | ||||||||||

| 7,268,050 | ||||||||||||

| Software – 0.8% | ||||||||||||

| 3,850 | Camelot Finance S.A., 7.875%, 10/15/24 (a)(b) | 4,091,780 | ||||||||||

| 1,135 | Rackspace Hosting, Inc., 8.625%, 11/15/24 (a)(b) | 1,186,075 | ||||||||||

| 5,277,855 | ||||||||||||

| Telecommunications – 4.4% | ||||||||||||

| 3,125 | Cincinnati Bell, Inc., 7.00%, 7/15/24 (a)(b) | 2,973,437 | ||||||||||

| 7,130 | Consolidated Communications, Inc., 6.50%, 10/1/22 | 6,274,400 | ||||||||||

| 4,045 | Frontier Communications Corp., 10.50%, 9/15/22 | 3,463,531 | ||||||||||

| 2,050 | GTT Communications, Inc., 7.875%, 12/31/24 (a)(b) | 2,135,844 | ||||||||||

| Hughes Satellite Systems Corp., | ||||||||||||

| 1,130 | 6.625%, 8/1/26 | 1,158,589 | ||||||||||

| 3,500 | 7.625%, 6/15/21 | 3,780,000 | ||||||||||

| 5,545 | Sprint Communications, Inc., 11.50%, 11/15/21 | 6,570,825 | ||||||||||

| 1,425 | Sprint Corp., 7.625%, 3/1/26 | 1,421,438 | ||||||||||

| 6,283 | Windstream Services LLC, 6.375%, 8/1/23 (a)(b) | 3,549,895 | ||||||||||

| 31,327,959 | ||||||||||||

| Transportation – 0.6% | ||||||||||||

| 3,920 | XPO Logistics, Inc., 6.50%, 6/15/22 (a)(b) | 4,088,560 | ||||||||||

| Total Corporate Bonds & Notes (cost-$300,741,968) | 286,601,553 | |||||||||||

| Convertible Bonds & Notes – 34.6% | ||||||||||||

| Apparel & Textiles – 1.8% | ||||||||||||

| 11,020 | Iconix Brand Group, Inc., 5.75%, 8/15/23 | 12,593,105 | ||||||||||

| Auto Components – 1.0% | ||||||||||||

| 8,945 | Horizon Global Corp., 2.75%, 7/1/22 | 7,284,584 | ||||||||||

| 30 | Annual Report | | February 28, 2018 | | See accompanying Notes to Financial Statements |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income Fund II

February 28, 2018 (continued)

| Principal Amount (000s) |

Value | |||||||||||

| Auto Manufacturers – 1.0% | ||||||||||||

| $4,675 | Navistar International Corp., 4.75%, 4/15/19 | $4,862,813 | ||||||||||

| 2,150 | Tesla, Inc., 1.25%, 3/1/21 | 2,451,082 | ||||||||||

| 7,313,895 | ||||||||||||

| Biotechnology – 0.8% | ||||||||||||

| 7,260 | Intercept Pharmaceuticals, Inc., 3.25%, 7/1/23 | 5,821,961 | ||||||||||

| Building Materials – 0.5% | ||||||||||||

| 3,225 | Cemex S.A.B de C.V., 3.72%, 3/15/20 | 3,333,605 | ||||||||||

| Commercial Services – 2.6% | ||||||||||||

| 10,220 | Ascent Capital Group, Inc., 4.00%, 7/15/20 | 7,932,764 | ||||||||||

| 7,960 | Huron Consulting Group, Inc., 1.25%, 10/1/19 | 7,452,550 | ||||||||||

| 2,795 | ServiceSource International, Inc., 1.50%, 8/1/18 | 2,747,206 | ||||||||||

| 18,132,520 | ||||||||||||

| Distribution/Wholesale – 0.7% | ||||||||||||

| 4,975 | Titan Machinery, Inc., 3.75%, 5/1/19 | 4,941,936 | ||||||||||

| Diversified Financial Services – 2.4% | ||||||||||||

| 7,030 | Encore Capital Group, Inc., 3.00%, 7/1/20 | 7,880,630 | ||||||||||

| 9,160 | PRA Group, Inc., 3.00%, 8/1/20 | 8,915,272 | ||||||||||

| 16,795,902 | ||||||||||||

| Electric Utilities – 1.0% | ||||||||||||

| 6,905 | NRG Yield, Inc., 3.25%, 6/1/20 (a)(b) | 6,884,810 | ||||||||||

| Electrical Equipment – 1.1% | ||||||||||||

| SunPower Corp., | ||||||||||||

| 2,365 | 0.875%, 6/1/21 | 1,818,212 | ||||||||||

| 7,095 | 4.00%, 1/15/23 | 5,742,693 | ||||||||||

| 7,560,905 | ||||||||||||

| Electronics – 0.6% | ||||||||||||

| 4,450 | OSI Systems, Inc., 1.25%, 9/1/22 (a)(b) | 3,996,656 | ||||||||||

| Energy-Alternate Sources – 2.1% | ||||||||||||

| 3,010 | Pattern Energy Group, Inc., 4.00%, 7/15/20 | 2,998,460 | ||||||||||

| 12,690 | SolarCity Corp., 1.625%, 11/1/19 | 11,895,200 | ||||||||||

| 14,893,660 | ||||||||||||

| Engineering & Construction – 0.3% | ||||||||||||

| 2,445 | Layne Christensen Co., 4.25%, 11/15/18 | 2,472,411 | ||||||||||

| Equity Real Estate Investment Trusts (REITs) – 1.4% | ||||||||||||

| 4,100 | Two Harbors Investment Corp., 6.25%, 1/15/22 | 4,215,017 | ||||||||||

| 5,810 | Western Asset Mortgage Capital Corp., 6.75%, 10/1/22 | 5,728,660 | ||||||||||

| 9,943,677 | ||||||||||||

| Healthcare/Healthcare Distributors – 1.1% | ||||||||||||

| 8,615 | Aceto Corp., 2.00%, 11/1/20 | 7,623,439 | ||||||||||

| Insurance – 1.1% | ||||||||||||

| 9,260 | AmTrust Financial Services, Inc., 2.75%, 12/15/44 | 8,146,661 | ||||||||||

| Iron/Steel – 0.1% | ||||||||||||

| 690 | AK Steel Corp., 5.00%, 11/15/19 | 866,210 | ||||||||||

| Oil, Gas & Consumable Fuels – 3.0% | ||||||||||||

| 13,775 | Helix Energy Solutions Group, Inc., 3.25%, 3/15/32 | 13,801,833 | ||||||||||

| 7,525 | Whiting Petroleum Corp., 1.25%, 4/1/20 | 7,120,524 | ||||||||||

| 20,922,357 | ||||||||||||

| See accompanying Notes to Financial Statements | | February 28, 2018 | | Annual Report | 31 |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income Fund II

February 28, 2018 (continued)

| Principal Amount (000s) |

Value | |||||||||||

| Pharmaceuticals – 3.5% | ||||||||||||

| $12,175 | Herbalife Ltd., 2.00%, 8/15/19 | $14,188,100 | ||||||||||

| 2,460 | Horizon Pharma Investment Ltd., 2.50%, 3/15/22 | 2,278,575 | ||||||||||

| 5,885 | Impax Laboratories, Inc., 2.00%, 6/15/22 | 5,793,535 | ||||||||||

| 2,585 | Jazz Investments I Ltd., 1.50%, 8/15/24 (a)(b) | 2,465,568 | ||||||||||

| 24,725,778 | ||||||||||||

| Pipelines – 1.1% | ||||||||||||