UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

For the quarterly period ended March 31, 2024

For the transition period from ______________ to ______________

Commission File Number 001-41705

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) | |||||||

(Address of principal executive offices and zip code)

(Registrant’s telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

Large accelerated filer | ☐ | Accelerated filer | ☐ | ||||||||

| ☒ | Smaller reporting company | ||||||||||

Emerging growth company | |||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The number of shares of the registrant's common stock outstanding as of May 9, 2024 was 28,804,643 .

AZITRA, INC.

TABLE OF CONTENTS

| Page | ||||||||

F-1 | ||||||||

| Item 1. | F-1 | |||||||

F-1 | ||||||||

F-3 | ||||||||

F-4 | ||||||||

F-5 | ||||||||

F-6 | ||||||||

| Item 2. | Management's Discussion and Analysis of Financial Condition and Results of Operations | 1 | ||||||

| Item 3. | Quantitative and Qualitative Disclosures about Market Risk | 7 | ||||||

| Item 4. | Controls and Procedures | 8 | ||||||

| PART II - OTHER INFORMATION | 9 | |||||||

| Item 1A. | Risk Factors | 9 | ||||||

| Item 6. | Exhibits | 10 | ||||||

i

PART I FINANCIAL INFORMATION

ITEM 1. Financial Statements.

AZITRA, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

| March 31, 2024 | December 31, 2023 | ||||||||||

| ASSETS | (Unaudited) | ||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Accounts receivable | |||||||||||

| Accounts receivable - related party | |||||||||||

| Tax credits receivable | |||||||||||

| Income tax receivable | |||||||||||

| Deferred offering costs | |||||||||||

| Prepaid expenses | |||||||||||

| Total current assets | |||||||||||

| Property and equipment, net | |||||||||||

| Financing lease right-of-use asset | |||||||||||

| Operating lease right-of-use asset | |||||||||||

| Intangible assets, net | |||||||||||

| Deferred patent costs | |||||||||||

| Other assets | |||||||||||

| Total assets | $ | $ | |||||||||

| LIABILITIES, PREFERRED STOCK, AND STOCKHOLDERS' EQUITY | |||||||||||

| Current liabilities: | |||||||||||

| Accounts payable | |||||||||||

| Current financing lease liability | |||||||||||

| Current operating lease liability | |||||||||||

| Accrued expenses | |||||||||||

| Total current liabilities | |||||||||||

| Long-term financing lease liability | |||||||||||

| Long-term operating lease liability | |||||||||||

| Warrant liability | |||||||||||

| Total liabilities | |||||||||||

| Commitments and contingencies (Note 12) | |||||||||||

| Preferred stock: | |||||||||||

Series A convertible preferred stock; $ | |||||||||||

F-1

PART I FINANCIAL INFORMATION

ITEM 1. Financial Statements.

AZITRA, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

Series A-1 convertible preferred stock; $ | |||||||||||

Series B convertible preferred stock; $ | |||||||||||

| Stockholders' equity | |||||||||||

Common stock; $ | |||||||||||

| Additional paid-in capital | |||||||||||

| Accumulated deficit | ( | ( | |||||||||

| Total stockholders' equity | |||||||||||

| Total liabilities, preferred stock, and stockholders' equity | $ | $ | |||||||||

F-2

AZITRA, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

| For the Three Months | For the Three Months | |||||||||||||

| March 31, 2024 | March 31, 2023 | |||||||||||||

| $ | $ | |||||||||||||

| Total revenue | ||||||||||||||

| Operating expenses: | ||||||||||||||

| General and administrative | ||||||||||||||

| Research and development | ||||||||||||||

| Total operating expenses | ||||||||||||||

| Loss from operations | ( | ( | ||||||||||||

| Other income (expense): | ||||||||||||||

| Interest income | ||||||||||||||

| Interest expense | ( | ( | ||||||||||||

| Change in fair value of convertible note | ( | |||||||||||||

Change in fair value of warrants | ||||||||||||||

| Other income (expense) | ( | ( | ||||||||||||

| Total other income (expense) | ( | |||||||||||||

| Loss before income taxes | ( | ( | ||||||||||||

| Income tax expense | ( | |||||||||||||

| Net loss | ( | ( | ||||||||||||

| Dividends on preferred stock | ( | |||||||||||||

| Net loss attributable to common shareholders | $ | ( | $ | ( | ||||||||||

| Net loss per share, basic and diluted | $ | ( | $ | ( | ||||||||||

| Weighted average common stock outstanding, basic and diluted | ||||||||||||||

F-3

AZITRA, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY (DEFICIT) (UNAUDITED)

| Series A Convertible Preferred Stock | Series A-1 Convertible Preferred Stock | Series B Convertible Preferred Stock | Common Stock | Additional Paid-in-Capital | Accumulated Deficit | Total Stockholders' Equity (Deficit) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Shares | Amount | Shares | Amount | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance - December 31, 2022 | $ | $ | $ | $ | $ | $ | ( | $ | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Issuance of Series B Convertible Preferred Stock | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Exercise of stock options | — | — | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | — | — | — | — | — | — | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance, March 31, 2023 | $ | $ | $ | $ | $ | $ | ( | $ | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Series A Convertible Preferred Stock | Series A-1 Convertible Preferred Stock | Series B Convertible Preferred Stock | Common Stock | Additional Paid-in-Capital | Accumulated Deficit | Total Stockholders' Equity (Deficit) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Shares | Amount | Shares | Amount | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance - December 31, 2023 | $ | $ | $ | $ | $ | $ | ( | $ | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Follow-on public offering, net of issuance costs of $ | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Exercise of stock options | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | — | — | — | — | — | — | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance, March 31, 2024 | $ | $ | $ | $ | $ | $ | ( | $ | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

F-4

AZITRA, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

| For the Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| Cash flows from operating activities: | |||||||||||

| Net loss | $ | ( | $ | ( | |||||||

| Adjustments to reconcile net loss to net cash used in operating activities: | |||||||||||

| Depreciation and amortization | |||||||||||

| Amortization of right-of-use assets | |||||||||||

| Change in foreign currency rates on remeasurement of Canadian fixed assets | |||||||||||

| Accrued interest on convertible notes | |||||||||||

| Stock based compensation | |||||||||||

| Change in fair value of warrant liability | ( | ( | |||||||||

| Change in fair value of convertible notes | |||||||||||

| Changes in operating assets and liabilities: | |||||||||||

| Accounts receivable | |||||||||||

| Prepaid expenses | |||||||||||

| Other assets | ( | ||||||||||

| Tax credits receivable | ( | ( | |||||||||

| Income tax receivable | ( | ||||||||||

| Accounts payable and accrued expenses | ( | ||||||||||

| Operating lease liability | ( | ( | |||||||||

| Contract liabilities | ( | ||||||||||

| Net cash used in operating activities | ( | ( | |||||||||

| Cash flows from investing activities: | |||||||||||

| Purchases of property and equipment | ( | ||||||||||

| Capitalization of deferred patent costs | ( | ( | |||||||||

| Capitalization of licenses | ( | ||||||||||

| Net cash used in investing activities | ( | ( | |||||||||

| Cash flows from financing activities | |||||||||||

| Payment of deferred offering costs | ( | ||||||||||

| Principal payments on finance leases | ( | ||||||||||

| Proceeds from public offering, net | |||||||||||

| Proceeds from exercise of stock options | |||||||||||

| Net cash provided by (used in) financing activities | ( | ||||||||||

| Net change in cash and cash equivalents | ( | ||||||||||

| Cash and cash equivalents at beginning of period | |||||||||||

| Cash and cash equivalents at end of period | $ | $ | |||||||||

| Supplemental disclosure of non-cash investing and financing information: | |||||||||||

| Conversion of note to Series B Convertible Preferred Stock | $ | $ | |||||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

F-5

AZITRA, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

1. Organization and Nature of Operations

Azitra, Inc. was founded on January 2, 2014. It is a synthetic biology company focused on screening and genetically engineering microbes of the skin. The mission is to discover and develop novel therapeutics to create a new paradigm for treating skin disease. The Company’s discovery platform is screened for naturally occurring bacterial cells with beneficial effects. These microbes are then genomically sequenced and engineered to make cellular therapies, recombinant therapeutic proteins, peptides and small molecules for precision treatment of dermatology diseases. On May 17, 2023, the Company changed its name to from “Azitra Inc” to “Azitra, Inc.”

The Company maintains a location in Montreal, Canada for certain research activities. The Company also opened a manufacturing and laboratory space in Groton, Connecticut during 2021.

Forward Stock Split, Change in Par Value, and Initial and Follow-on Public Offerings

In June 2023, the Company completed its initial public offering (IPO) in which it issued and sold 1,500,000 shares of its common stock at a price to the public of $5.00 per share. The shares began trading on the NYSE American on June 16, 2023 under the symbol “AZTR”. The net proceeds received by the Company from the offering were $6.0 million, after deducting underwriting discounts, commissions and other offering expenses.

Immediately prior to the effectiveness of the Company’s registration statement, the Company effected a 7.1 -for-1 forward stock split of its issued and outstanding shares of common stock (the Forward Stock Split). On May 17, 2023, the Company changed the par value of its capital stock from $0.01 to $0.0001 . Accordingly, all share and per share amounts for all periods presented in the accompanying unaudited consolidated financial statements and notes thereto have been adjusted retroactively, where applicable, to reflect the effect of the Forward Stock Split. Refer to Note 7 for additional details relating to the Forward Stock Split.

In February 2024, the Company completed a follow-on public offering in which it issued and sold 16,667,000 shares of its common stock at a price to the public of $0.30 per share. The net proceeds received by the Company from the follow-on public offering were $4.3 million, after deducting underwriting discounts, commissions and other offering expenses.

Going Concern Matters

The unaudited condensed financial statements have been prepared on the going concern basis, which assumes that the Company will continue in operation for the foreseeable future and which contemplates the realization of assets and liquidation of liabilities in the normal course of business. However, management has identified the following conditions and events that created an uncertainty about the ability of the Company to continue as a going concern. As of and for the three months ended March 31, 2024, the Company has an accumulated deficit of $51.5 million, a loss from operations of $3.0 million, used $3.0 million to fund operations and had approximately $2.3 million of working capital. These factors among others raise substantial doubt about the Company’s ability to continue as a going concern.

The Company will require a significant amount of additional funds to complete the development of its product and to fund additional losses which the Company expects to incur over the next few years. The Company is still in its pre-commercialization phase and therefore does not yet have product revenue. Management plans to continue to raise funds through equity and debt financing to fund operating and working capital needs, however, there can be no assurance that the Company will be successful in securing additional financing, if needed, to meet its operating needs.

These conditions and events create substantial doubt about the ability of the Company to continue as a going concern for twelve months from the date that the financial statements are available to be issued. The financial statements do not include any adjustments that might be necessary should the Company be unable to continue as a going concern.

F-6

AZITRA, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

2. Summary of Significant Accounting Policies

Basis of Accounting

The financial statements of the Company are prepared in accordance with United States generally accepted accounting principles (“U.S. GAAP”).

Unaudited Interim Financial Information

The unaudited interim financial statements and related notes have been prepared in accordance with U.S. GAAP for interim financial information, within the rules and regulations of the United States Securities and Exchange Commission (the “SEC”). Certain information and disclosures normally included in the annual financial statements prepared in accordance with U.S. GAAP have been condensed or omitted pursuant to such rules and regulations. The unaudited interim financial statements have been prepared on a basis consistent with the audited financial statements and in the opinion of management, reflect all adjustments, consisting of only normal recurring adjustments, necessary for the fair presentation of the results for the interim periods presented and of the financial condition as of the date of the interim balance sheet. The financial data and the other information disclosed in these notes to the interim financial statements related to the three months are unaudited. Unaudited interim results are not necessarily indicative of the results for the full fiscal year. These unaudited interim financial statements should be read in conjunction with the financial statements of the Company for the year ended December 31, 2023, and notes thereto that are included in the Company’s Annual Report on Form 10-K, as filed with the SEC on March 15, 2024.

Deferred Offering Costs

The Company capitalized deferred offering costs, which primarily consisted of direct, incremental legal, professional, accounting, and other third-party fees relating to the Company’s initial public offering and follow-on offering. In June 2023 and February 2024, the Company consummated its IPO and follow-on offering, respectively and recorded such amounts against the gross proceeds of these offerings within the statements of stockholders’ equity during the periods ended March 31, 2024 and December 31, 2023.

Leases

In February 2016, the Financial Accounting Standards Board (“FASB”) issued ASU No. 2016-02, Leases (“Topic 842”). ASU 2016-02 requires lessees to present right-of-use (“ROU”) assets and lease liabilities on the balance sheet for all leases with terms longer than 12 months. See Note 2 – Recently Adopted Accounting Pronouncements.

In calculating the effect of ASU 2016-02, the Company elected the transition method thereby not restating comparable periods. The Company elected to account for non-lease components as part of the lease component to which they relate. Lease accounting involves significant judgments, including making estimates related to the lease term, lease payments, and discount rate. In accordance with the guidance, the Company recognized ROU assets and lease liabilities for all leases with a term greater than 12 months. Leases are classified as either operating or financing leases based on the economic substance of the agreement.

The Company has operating leases for buildings. Currently, the Company has 3 operating leases with a ROU asset and lease liability totaling $1,418,502 as of January 1, 2022. The basis, terms and conditions of the leases are determined by the individual agreements. The Company’s option to extend certain leases ranges from 36 – 52 months. All options to extend have been included in the calculation of the ROU asset and lease liability. The leases do not contain residual value guarantees, restrictions, or covenants that could incur additional financial obligations to the Company. There are no subleases, sale-leaseback, or related party transactions.

At March 31, 2024, the Company had operating right-of-use assets with a net value of $750,363 and current and long-term operating lease liabilities of $310,929 and $456,315 , respectively.

In 2023, the Company entered into a lease for the use of certain equipment that is classified as a finance lease. The finance lease has a term of 36 months. At March 31, 2024, the Company had financing right-of-use assets with a net value of $36,132 and current and long-term operating lease liabilities of $14,954 and $22,296 , respectively.

Research and Development

The Company accounts for research and development costs in accordance with Accounting Standards Codification (ASC) subtopic 730-10, Research and Development. Accordingly, internal research and development costs are expensed as incurred. Research and development costs consist of costs related to labor, materials and supplies. Research and development costs incurred were $1,472,970 and $829,035 during the three months ended March 31, 2024 and March 31, 2023, respectively.

At March 31, 2024 and December 31, 2023, the Company has a state tax credit receivable of $86,778

F-7

AZITRA, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Company has $19,619 and $20,040 , respectively for pending refunds related to Canadian Scientific Research and Experimental Development (SRED) credits. At March 31, 2024 and December 31, 2023, the Company has also recorded $19,119 and $11,565 , respectively, related to refunds of Canadian Goods and Services Tax (GST) and Quebec Sales Tax (QST). Receipts of refunds are recorded in research and development on the statements of operations.

Certain Risks and Uncertainties

The Company’s activities are subject to significant risks and uncertainties including the risk of failure to secure additional funding to properly execute the Company’s business plan. The Company is subject to risks that are common to companies in the pharmaceutical industry, including, but not limited to, development by the Company or its competitors of new technological innovations, dependence on key personnel, reliance on third party manufacturers, protection of proprietary technology, and compliance with regulatory requirements.

Recent Accounting Pronouncements

Management does not believe that any other recently issued, but not yet effective, accounting standards could have a material effect on the accompanying financial statements. As new accounting pronouncements are issued, the Company will adopt those that are applicable under the circumstances.

3. Property and Equipment

Property and equipment consisted of the following at March 31, 2024 and December 31, 2023:

| March 31, 2024 | December 31, 2023 | |||||||||||||

| Laboratory equipment | $ | $ | ||||||||||||

| Computers and office equipment | ||||||||||||||

| Furniture and fixtures | ||||||||||||||

| Leasehold improvements | ||||||||||||||

| Building equipment | ||||||||||||||

| Total property and equipment | ||||||||||||||

| Less accumulated depreciation & amortization | ( | ( | ||||||||||||

| Total property, plant, and equipment, net | $ | $ | ||||||||||||

4. Intangible Assets

Intangible assets consisted of the following at:

March 31, 2024:

| Estimated Useful Life | Gross Amount | Accumulated Amortization | Impairment | Net Amount | |||||||||||||||||||||||||

| Trademarks | Indefinite | $ | $ | $ | $ | ||||||||||||||||||||||||

| Patents | |||||||||||||||||||||||||||||

| Intangible assets | $ | $ | $ | $ | |||||||||||||||||||||||||

December 31, 2023:

| Estimated Useful Life | Gross Amount | Accumulated Amortization | Impairment | Net Amount | |||||||||||||||||||||||||

| Trademarks | Indefinite | $ | $ | $ | $ | ||||||||||||||||||||||||

| Patents | |||||||||||||||||||||||||||||

| Intangible assets | $ | $ | $ | $ | |||||||||||||||||||||||||

F-8

AZITRA, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

During the three months ended March 31, 2024 and March 31, 2023, amortization expense related to intangible assets was $2,511 and $1,597 , respectively.

5. Accrued Expenses

Accrued expenses consisted of the following at:

| March 31, 2024 | December 31, 2023 | ||||||||||

| Accrued expenses: | |||||||||||

| Employee payroll and bonuses | $ | $ | |||||||||

| Vacation | |||||||||||

| Research and development projects | |||||||||||

| Professional fees | |||||||||||

| Other | |||||||||||

| Total accrued expenses | $ | $ | |||||||||

The Company accrues expenses related to development activities performed by third parties based on an evaluation of services received and efforts expended pursuant to the terms of the contractual arrangements. Payments under some of these contracts depend on research and non-clinical trial milestones. There may be instances in which payments made to the Company’s vendors will exceed the level of services provided and result in a prepayment of expense. In accruing service fees, the Company estimates the period over which services will be performed and the level of effort to be expended in each period. If the actual timing of the performance of services or the level of effort varies from the estimate, the Company will adjust the accrual or prepaid expense accordingly. The Company has not experienced any material differences between accrued costs and actual costs incurred since its inception.

6. Convertible Debt

Effective January 5, 2021, the Company entered into a Note Purchase Agreement to issue up to $2,000,000 of convertible promissory notes. On the same date, the Company entered into a convertible promissory note (2021 Convertible Note) with one investor for $1,000,000 . The 2021 Convertible Note bears interest at a rate of 6 % per annum and is due and payable in full on January 5, 2023. The 2021 Convertible Note automatically converts upon a qualified equity financing, as defined in the note agreement to the number of shares equal to all principal and accrued interest divided by the conversion price of $48.00 , which is subject to adjustment as defined in the note agreement. The 2021 Convertible Note is also optionally convertible as defined in the note agreement for certain non-qualified financing, a change in control, or upon the maturity date of the 2021 Convertible Note. The Company incurred issuance costs of $15,613 related to the 2021 Convertible Note, which has been recorded as a debt discount and will be amortized over the term of the 2021 Convertible Note.

In September 2022, the Company entered into a Convertible Note Purchase Agreement (the Agreement) to issue up to $4,500,000 convertible promissory notes. On the same day, the Company entered into convertible promissory notes (2022 Convertible Notes) with three investors totaling $4,350,000 . The 2022 Convertible Notes mature on January 13, 2023 or the occurrence of an Event of Default (as defined) and bear interest at a rate of 8 % per annum which shall accrue but is not due and payable until conversion or full repayment of outstanding principal. The principal and interest outstanding under the 2022 Convertible Notes is automatically converted a) upon the closing of a Qualified Financing resulting in gross proceeds to the Company of at least $20 million into securities issued in connection with the Qualified Financing, at a discount of 30 % per share; b) upon the closing of a Change of Control event into shares of capital stock of the Company or Series B preferred stock; and c) upon the closing of a Public Company Event, into shares of capital stock being issued to investors equal to two-times (2 x) the amount of the outstanding principal and accrued interest then outstanding divided by the public offering price per share. The principal and interest outstanding under the 2022 Convertible Notes is convertible, at the option of the holders, at the maturity date into a new class of Company’s Preferred Stock (Series C Preferred) equal to the quotient of the outstanding principal amount plus interest divided by the Capped Price, which is defined as the price per share equal to the Valuation Cap of $30 million divided by the Company Capitalization, as defined in the Agreement.

In January 2023, the Company elected to convert the 2021 Convertible Note, including interest accrued but not yet paid of $124,759 at a conversion price of $48.00 into 23,432 shares of its Series B Preferred Stock in accordance with the terms outlined in the Note Purchase Agreement.

F-9

AZITRA, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

In February 2023, the 2022 Convertible Notes were amended to extend the maturity date to March 31, 2023 and to change the conversion price upon a Qualified Financing or Change in Control event to $30 million divided by the number of shares of the Company’s common stock issued and outstanding, on a fully diluted basis, immediately prior to the close of the Qualified Financing or Change in Control event.

During April and June 2023, the 2022 Convertible Notes were further amended to extend the maturity date to September 30, 2023 and allow for the sale of additional notes of $500,000 4,850,000

Effective June 21, 2023, the 2022 Convertible Notes were converted to 1,846,020 shares of the Company’s common stock equal to $9,494,887 . During the three months ended March 31, 2023, the Company recorded a change in the fair value of $800,000 .

7. Stockholders’ Equity

On May 17, 2023, the Company effected a 7.1 -for-1 forward stock split (the “Forward Stock Split”) of its issued and outstanding shares of common stock and a proportional adjustment to the existing conversion ratios for each series of the Company’s preferred stock. The par value of the common stock was adjusted as a result of the Forward Stock Split from $0.01 to $0.0001 and the authorized shares were increased to 100,000,000 shares of common stock in connection with the Forward Stock Split. Fractional shares resulting from the Forward Stock Split were rounded down to the next whole share and in lieu of any fractional shares and the Company paid a cash amount to the holder of such fractional share. The accompanying financial statements and notes to the financial statements give retroactive effect to the Forward Stock Split for all periods presented. Shares of common stock underlying outstanding stock-based awards and other equity instruments were proportionately increased and the respective per share value and exercise prices, if applicable, were proportionately decreased in accordance with the terms of the agreements governing such securities.

Common Stock

At March 31, 2024 and December 31, 2023, per the Company’s amended and restated Certificate of Incorporation, the Company was authorized to issue 100,000,000 0.0001

Each share of common stock entitles the holder to one vote on all matters submitted to a vote of the Company’s stockholders and the holders of the Common Stock are entitled to elect one director of the Corporation.

The Company currently has 2,238,671 shares of common stock reserved for future issuance for the potential exercise of stock options and warrants outstanding at March 31, 2024.

Preferred Stock

At March 31, 2024 and December 31, 2023, per the Company’s amended and restated Certificate of Incorporation, the Company has authorized 10,000,000 0.0001

Upon the close of the Company’s IPO in June 2023, all of the outstanding preferred stock converted to common stock, resulting in the issuance of 1,458,233 , 2,964,849 , and 3,284,553 shares of common stock in exchange for outstanding Series A, Series A-1, and Series B Preferred Stock, respectively. There was no gain or loss upon conversion.

8. Warrants

The Company issued warrants to purchase 6,745 shares of common stock in 2018 in conjunction with convertible debt financing that have a redemption provision providing the holder the right to have the Company redeem all or any portion of the warrant (or shares it has converted into) at a purchase price equal to the fair market value of the shares as determined by the board of directors or an independent appraiser. As a result of this redemption provision, the warrants have been classified as a liability in the financial statements based on ASC 480 – Distinguishing Liabilities from Equity. These warrants have an exercise price of $0.48 per share and a term of 10 years. The warrants are marked to market each reporting period. The fair value is $7,298 and $35,453 at March 31, 2024 and December 31, 2023, respectively.

The Company issued 60,000 and 666,680 warrants to its underwriters as part of our initial public offering in fiscal 2023 and follow-on offering in fiscal 2024, respectively. The underwriter warrants have a term of 10 years.

F-10

AZITRA, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

The Company also issued warrants in 2016 , 2019, 2023, and 2024 which did not meet the criteria under ASC 480 to be classified as a liability, and instead meet equity classification criteria.

The following table summarizes information about warrants outstanding at March 31, 2024:

| Warrants Outstanding | Warrant Exercisable | |||||||||||||||||||||||||||||||||||||||||||

| Year Granted | Exercise Price | Number of Warrants at 03/31/2024 | Weighted Average Remaining Contractual Life | Weighted Average Exercise Price | Number of Warrants at 03/ 31/2024 | Weighted Average Remaining Contractual Life | Weighted Average Exercise Price | |||||||||||||||||||||||||||||||||||||

| 2018 | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||||

| 2019 | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||||

| 2023 | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||||

| 2024 | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||||

| $ | $ | |||||||||||||||||||||||||||||||||||||||||||

9. Stock Options

In March 2023, the Company’s Board of Directors and stockholders approved the 2023 Stock Incentive Plan (“2023 Plan”). The 2023 Plan allows the Committee to grant up to 2,000,000 shares of Common Stock in the form of incentive and non-statutory stock options, restricted stock awards, restricted stock units, and other stock-based awards to employees, directors, and non-employees. As of March 31, 2024, options to purchase 40,000 shares of common stock had been granted and were outstanding under the 2023 Plan and 1,960,000 shares of common stock were available for grant under the plan.

During 2016, the Company established the Azitra Inc. 2016 Stock Incentive Plan ("2016 Plan") which provides for the grant up to 1,490,595 shares of Common Stock in the form of stock options and restricted shares to the Company’s employees, officers, directors, advisors and consultants. As of March 31, 2024, options to purchase 1,208,255 shares of common stock had been granted and 223,702 shares of common stock were available for grant under the 2016 Plan.

During the three months ended March 31, 2024 and March 31, 2023, the Company did not grant any equity awards under the 2016 or 2023 Plans. During the three months ended March 31, 2024 and March 31, 2023, the Company recognized stock compensation expense of $34,171 and $38,794 , respectively, relating to the issuance of service-based stock options. At March 31, 2024, there was $292,268 of unamortized compensation expense that will be amortized over the remaining vesting period. At March 31, 2024 and 2023, there were 13,120 109,551

The following table summarizes information about options outstanding and exercisable at March 31, 2024:

F-11

AZITRA, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| Options Outstanding | Options Exercisable | |||||||||||||||||||||||||||||||||||||

| Exercise Price | Number of Options at March 31, 2024 | Weighted Average Remaining Contractual Life | Weighted Average Exercise Price | Number of Options at March 31, 2024 | Weighted Average Remaining Contractual Life | Weighted Average Exercise Price | ||||||||||||||||||||||||||||||||

| $ | $ | $ | ||||||||||||||||||||||||||||||||||||

| $ | $ | $ | ||||||||||||||||||||||||||||||||||||

| $ | $ | $ | ||||||||||||||||||||||||||||||||||||

| $ | $ | $ | ||||||||||||||||||||||||||||||||||||

Total stock option activity for the three months ended March 31, 2024, is summarized as follows:

| Shares | Weighted Average Exercise Price | |||||||||||||

| Outstanding at December 31, 2023 | $ | |||||||||||||

| Granted | ||||||||||||||

| Exercised | ( | |||||||||||||

| Forfeited | ||||||||||||||

| Outstanding at March 31, 2024 | $ | |||||||||||||

10. Fair Value Measurements

The following tables summarize the fair values and levels within the fair value hierarchy in which the fair value measurements fall for assets and liabilities measured on a recurring basis as of:

March 31, 2024

| Description | Level 1 | Level 2 | Level 3 | Total | |||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||

| Common stock warrants | $ | $ | $ | $ | |||||||||||||||||||||||||

| Total | $ | $ | $ | $ | |||||||||||||||||||||||||

December 31, 2023

| Description | Level 1 | Level 2 | Level 3 | Total | |||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||

| Common stock warrants | $ | $ | $ | $ | |||||||||||||||||||||||||

| Total | $ | $ | $ | $ | |||||||||||||||||||||||||

The following table presents the changes in Level 3 instruments measured on a recurring basis for the period ended March 31, 2024:

F-12

AZITRA, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| Balance at December 31, 2023 | $ | |||||||

| Changes in fair value of warrants | ( | |||||||

| Balance at March 31, 2024 | $ | |||||||

At March 31, 2024 and December 31, 2023, the Company estimated the fair value of the warrants using the Black-Scholes option pricing model with the following assumptions:

| March 31, 2024 | December 31, 2023 | |||||||

| Underlying common stock value | $ | $ | ||||||

| Expected term (years) | ||||||||

| Expected volatility | % | % | ||||||

| Risk free interest rate | % | % | ||||||

| Dividend yield | % | % | ||||||

Fluctuation in the fair value of the Company’s Common stock is the primary driver for the change in the common stock warrant liability valuation during each year. As the fair value of the Common stock increases the value to the holder of the instrument generally increases.

Prior to their redemption, fluctuations in the various inputs, including the enterprise value, time to liquidity, volatility, and discount rate are the primary drivers for the changes in valuation of the 2022 Convertible Notes each reporting period. As the fair value of the enterprise value, estimated time to liquidity, volatility, and discount rate increase, the value to the holder of the 2022 Convertible Notes generally increases.

11. Net Loss Per Share

Basic and diluted net loss per share were calculated as follows:

The denominator is as follows for the three months ended March 31, 2024 and March 31, 2023,:

| Three Months Ended | |||||||||||

| 2024 | 2023 | ||||||||||

| Weighted average common stock outstanding, basic and diluted | |||||||||||

| $0.01 warrants | |||||||||||

| Total | |||||||||||

The following potential common stock equivalents, presented based on amounts outstanding at each period end, were excluded from the calculation of diluted net loss per share for the periods indicated because including them would have had an anti-dilutive effect:

| March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| Options to purchase shares of common stock | |||||||||||

| Warrants outstanding | |||||||||||

| Total | |||||||||||

12. Commitments and Contingencies

Legal

The Company is subject to legal proceedings or claims which arise in the ordinary course of its business. Although occasional adverse decisions or settlements may occur, the Company believes that the final disposition of such matters should not have a material adverse effect on its financial position, results of operations or liquidity.

F-13

AZITRA, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

License Agreement

Effective January 26, 2022, the Company entered into an Exclusive License Agreement (the License Agreement) with an unrelated third party. Under the License Agreement, the Company is granted an exclusive license for certain patents and a non-exclusive license for certain know-how. The License Agreement continues until the later of the expiration of the last to expire licensed patent or ten years after the first commercial sale of the first licensed therapeutic or non-therapeutic product. The Company may terminate the License Agreement at any time by providing at least 30 days written notice to the third party. The License Agreement is also terminated upon breach of a material obligation under the agreement or bankruptcy. Upon any termination of the License Agreement, neither party is relieved of obligations incurred prior to the termination.

During the three months ended March 31, 2024 and March 31, 2023, the Company capitalized payments made under this license agreement in the amount of $0 and $3,858 , respectively.

Operating Leases

The Company leases office and lab space in Branford, CT; Groton, CT; and Montreal, Quebec. The Company’s leases expire at various dates through May 31, 2027. Most leases are for a fixed term and for a fixed amount.

During 2019, the Company entered into a new lease agreement for office and laboratory space in Montreal, Quebec. The Montreal lease required monthly payments of $6,906 , CAD which increases approximately 4 % in each of the following years. The Montreal lease was increased to $8,130 CAD in 2021 upon leasing additional space. The Montreal lease was initially for a one-year term, renewable annually. The Montreal lease also requires the Company to pay additional common area maintenance.

During 2020, the Company entered into a new lease agreement for the Company’s primary office and laboratory space in Branford, CT. The Branford lease requires monthly payments of $13,033 for the first year of the lease, which increases approximately 2 % in each of the following years. The Branford lease also requires the Company to pay a pro-rata share of common area maintenance.

During May 2021, the Company entered into a new lease for office and laboratory space in Groton, CT. The Groton lease required monthly payments of $4,234 , which was increased to $6,824 in September 2021 upon leasing additional space. The Groton lease is initially for a one-year term, renewable annually for up to additional years.

Future minimum payments under non-cancelable operating leases with initial or remaining terms in excess of one year during each of the next five years follow:

| 2024 (Remaining 9 months) | $ | ||||

| 2025 | |||||

| 2026 | |||||

| 2027 | |||||

| 2028 | |||||

| Thereafter | |||||

| Total future undiscounted lease payments | |||||

| Less interest | ( | ||||

| Present value of minimum lease payments | $ | ||||

Rent expense for all operating leases was $84,714 2.7 4.25

Finance Leases

During 2023, the Company entered into an agreement with Hewlett Packard to lease equipment. The lease requires monthly payments of $1,478 , including tax. The lease is for a 3 years term with option of purchase or extension at term end. The remaining lease term is 2.3 years and the discount rate is 9.60 %.

F-14

AZITRA, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

The following is a schedule showing the future minimum lease payments under finance leases by years and the present value of the minimum payments as of March 31, 2024.

| 2024 (Remaining 9 months) | $ | ||||

| 2025 | |||||

| 2026 | |||||

| 2027 | |||||

| Thereafter | |||||

| Total future undiscounted lease payments | |||||

| Less interest | ( | ||||

| Present value of minimum lease payments | $ | ||||

13. Retirement Plan

Effective January 1, 2019, the Company sponsors a 401(k) plan that covers substantially all employees. In order to be eligible to participate, an employee must complete consecutive months of service and work a minimum of two hundred fifty hours or work 1,000 hours in their first year of service. Employees may make pre-tax deferrals upon meeting the Plan eligibility requirements. Effective January 1, 2020, the Plan was transitioned to a safe harbor plan in which highly compensated employees are not eligible for matching contributions and non-highly compensated employees earn 100 % match on first 3 % contributed and 50 % on the next 2 % contributed. Total employer matching contributions were $4,126 and $2,191 for the three months ended March 31, 2024 and March 31, 2023, respectively.

14. Concentration of Credit Risk

Financial instruments that potentially subject the Company to credit risk consist principally of cash and accounts receivable.

For the three months ended March 31, 2023, all service revenue was from one customer.

The cash balance identified in the balance sheet is held in an account with a financial institution and insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 . At times, cash maintained on deposit may be in excess of FDIC limits.

15. Related Parties

Total related party revenue was $0 and $113,300 for the three months ended March 31, 2024 and March 31, 2023, respectively. Accounts receivable due from the related party was $0 and $90,000 at March 31, 2024 and December 31, 2023, respectively.

In September 2022 the Company entered into a convertible promissory note totaling $4,350,000 of which $4,000,000 was attributable to an entity who was also an investor in the Company’s Series A, A-1, and B Preferred Stock financing (See Note 6). This entity received 1,697,490 shares of common stock upon conversion of the promissory notes for principal and interest of $4,243,726 .

16. Subsequent Events

The Company has evaluated events subsequent to the balance sheet date through May 9, 2024, the date these condensed financial statements are issued.

F-15

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Cautionary Statement

The following discussion and analysis should be read in conjunction with our unaudited condensed consolidated financial statements and the related notes thereto contained elsewhere in this report. The information contained in this quarterly report on Form 10-Q is not a complete description of our business or the risks associated with an investment in our common stock. We urge you to carefully review and consider the various disclosures made by us in this report and in our other filings with the Securities and Exchange Commission, or SEC, including our Form 10-K for the year ended December 31, 2023 and filed with the SEC on March 15, 2024.

In this report we make, and from time to time we otherwise make written and oral statements regarding our business and prospects, such as projections of future performance, statements of management’s plans and objectives, forecasts of market trends, and other matters that are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Statements containing the words or phrases “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimates,” “projects,” “believes,” “expects,” “anticipates,” “intends,” “target,” “goal,” “plans,” “objective,” “should” or similar expressions identify forward-looking statements, which may appear in our documents, reports, filings with the SEC, and news releases, and in written or oral presentations made by officers or other representatives to analysts, stockholders, investors, news organizations and others, and in discussions with management and other of our representatives.

Our future results, including results related to forward-looking statements, involve a number of risks and uncertainties, including those risks included in the “Risk Factors” section in our Form 10-K for the year ended December 31, 2023 and filed with the SEC on March 15, 2024. No assurance can be given that the results reflected in any forward-looking statements will be achieved. Any forward-looking statement speaks only as of the date on which such statement is made. Our forward-looking statements are based upon assumptions that are sometimes based upon estimates, data, communications and other information from suppliers, government agencies and other sources that may be subject to revision. Except as required by law, we do not undertake any obligation to update or keep current either (i) any forward-looking statement to reflect events or circumstances arising after the date of such statement or (ii) the important factors that could cause our future results to differ materially from historical results or trends, results anticipated or planned by us, or which are reflected from time to time in any forward-looking statement.

General

We were formed in January 2014 as a biopharmaceutical company focused on developing innovative therapies for precision dermatology using engineered proteins and live biotherapeutic products. We are an early-stage clinical biopharmaceutical company and have not commenced commercial operations.

To date, we have capitalized our operations primarily through a series of private placements of our convertible preferred stock and convertible promissory notes and our initial public offering, IPO, of common stock which closed on June 21, 2023. In connection with our IPO, we issued 1.5 million shares of our common stock at a public offering price of $5 per share. Concurrent with the close of our IPO, all of our outstanding shares of convertible preferred stock and convertible promissory notes converted into a total of 8,951,526 shares of our common stock. In February 2024, we completed a follow-on public offering in which we issued and sold 16,667,000 shares of our common stock at a price to the public of $0.30 per share. As of May 9, 2024, we had 28,804,643 shares of our common stock issued and outstanding. Except as otherwise indicated, all share and share price this report gives effect to a forward stock split effected on May 17, 2023 at a ratio of 7.1-for-1.

Overview

We focused on developing innovative therapies for precision dermatology using engineered proteins and topical live biotherapeutic products. We have built a proprietary platform that includes a microbial library comprised of approximately 1,500 unique bacterial strains that can be screened for unique therapeutic characteristics. The platform is augmented by an artificial intelligence and machine learning technology that analyzes, predicts and helps screen our library of strains for drug like molecules. The platform also utilizes a licensed genetic engineering technology, which can enable the transformation of previously genetically intractable strains. Our initial focus is on the development of genetically engineered strains of Staphylococcus epidermidis, or S. epidermidis, which we consider to be an optimal therapeutic candidate species for engineering of dermatologic therapies. The particular species demonstrates a number of well-described properties in the skin. As of the date of this report, we have identified

1

among our microbial library over 60 distinct bacterial species that we believe are capable of being engineered to create living organisms or engineered proteins with significant therapeutic effect.

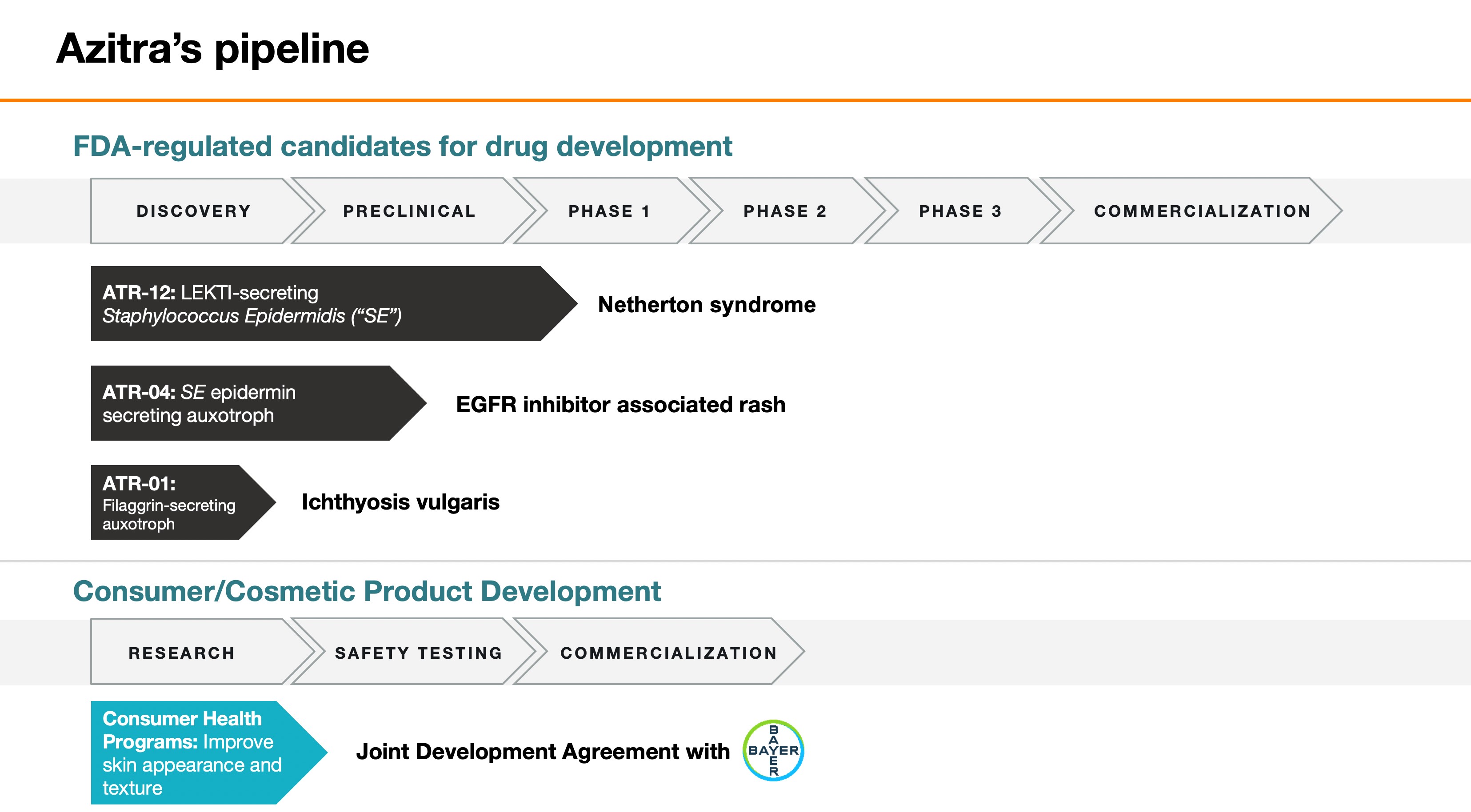

We are a pioneer in genetically engineered bacteria for therapeutic use in dermatology. Our goal is to leverage our platforms and internal microbial library bacterial strains to create new therapeutics that are either engineered living organisms or engineered proteins or peptides to treat skin diseases. Our initial focus is on the development of our current product candidates, including:

•ATR-12, a genetically modified strain of S. epidermidis for treating the orphan disease, Netherton syndrome, a chronic and sometimes fatal disease of the skin estimated to affect approximately one in every 100,000, but its prevalence may be underestimated due to misdiagnosis caused by similarities to other skin diseases. We received Pediatric Rare Disease Designation for ATR-12 by the United States Food and Drug Administration, or FDA, in 2019. In December 2022, we submitted an investigational new drug application, or IND, for a Phase 1b clinical trial of ATR-12 in Netherton syndrome patients, and on January 27, 2023 we received notification from the FDA that the “study may proceed” with respect to the proposed Phase 1b clinical trial. After submitting post-IND manufacturing reports, we have commenced operating activities for our Phase 1b clinical trial in December 2023. We expect to report initial safety results in the second half of 2024.

•ATR-04, a genetically modified strain of S. epidermidis for treating the papulopustular rash experienced by cancer patients undergoing epidermal growth factor receptor inhibitor, or EGFRi, targeted therapy. We intend to submit an IND for a Phase 1b clinical trial in certain cancer patients undergoing EGFRi targeted therapy by mid-2024. Subject to FDA clearance of our IND, we expect to commence our Phase 1b clinical trial in the fourth quarter of 2024.

•ATR-01, a genetically modified strain of S. epidermidis that expresses an engineered recombinant human filaggrin protein for treating ichthyosis vulgaris, a chronic, xerotic (abnormally dry), scaly skin disease with an estimated incidence and prevalence of 1 in 250, which suggests a total patient population of 1.3 million in the United States. We are planning to complete lead optimization and IND-enabling studies in 2024 to support an IND filing targeted for the second half of 2025.

•Two separate strains of bacterial microbes being investigated and developed by us and Bayer Consumer Care AG, the consumer products division of Bayer AG, or Bayer, the international life science company. We entered into a Joint Development Agreement, or JDA, with Bayer in December 2019. Under the terms of the JDA, we are responsible for testing our library of bacterial strains and their natural products for key preclinical properties. After screening through hundreds of strains, we and Bayer have selected two particular strains to move forward into further development. Bayer holds the exclusive option to license the patent rights to these strains. In December 2020, Bayer purchased $8 million of our Series B preferred stock, which converted into 1,449,743 shares of our common stock.

2

We also have established partnerships with teams from Carnegie Mellon University and the Fred Hutchinson Cancer Center, or Fred Hutch, two of the premier academic centers in the United States. Our collaboration with the Carnegie Mellon based team also takes advantage of the power of whole genome sequencing. This partnership is mining our proprietary library of bacterial strains for novel, drug like peptides and proteins. The artificial intelligence/machine learning technology developed by this team predicts the molecules made by microbes from their genetic sequences. The system then compares the predictions to the products actually made through tandem mass spectroscopy and/or nuclear magnetic resonance imaging to refine future predictions. The predictions can be compared to publicly available 2D and 3D protein databases to select drug like structures.

We hold an exclusive, worldwide license from Fred Hutch regarding the use of its patented SyngenicDNA Minicircle Plasmid, or SyMPL, technologies for all fields of genetic engineering, including to discover, develop and commercialize engineered microbial therapies and microbial-derived peptides and proteins for skin diseases. We are utilizing our licensed patent rights to build plasmids in order to make genetic transformations that have never been previously achieved. To date, our team has successfully engineered our lead therapeutic candidates without the SyMPL technology. However, we believe that SyMPL will open up the ability to make genetic transformations of an expanded universe of microbial species, and we expect that some or all of our future product candidates will incorporate the SyMPL technology.

Our Strategy

Beyond our three lead product candidates and collaboration with Bayer, our goal is to develop a broad portfolio of product candidates focused on expanding the application of our platforms for precision dermatology. We believe that we have established a unique position in advancing the development of biologics for precision dermatology.

We intend to create a broad portfolio of product candidates for precision dermatology through our development of genetically engineered proteins selected from our proprietary microbial library of approximately 1,500 unique bacterial strains. Our strategy is as follows:

•Build a sustainable precision dermatology company. Our goal is to build a leading precision dermatology company with a sustainable pipeline of product candidates. To that end, we are focused on rapidly advancing our current pipeline of live biotherapeutic candidates while actively developing additional product candidates. Each of our current product candidates are

3

proprietary and subject to pending patent applications. We expect that most, if not all, genetically engineered product candidates we develop will be eligible for patent protection.

•Advance our lead product candidates, ATR-12 and ATR-04, through clinical trials. In 2022, we obtained pre-IND correspondence with the FDA for purposes of discussing our proposed regulatory pathway for ATR-12 and obtaining guidance from the FDA on the preclinical plan leading to the filing and acceptance of an IND for ATR-12. In December 2022, we filed an IND for a first-in-human trial of ATR-12 in Netherton syndrome patients. On January 27, 2023, we received notification from the FDA that the “study may proceed” with respect to the proposed Phase 1b clinical trial. In April 2024, we held a pre-IND meeting with the FDA to discuss an IND filing for a first-in-human Phase 1b/2a clinical trial in patients with EGFRi-associted rash. We expect to report initial safety results of our Phase 1b clinical trial for our ATR-12 in Netherton syndrome patients in the second half of 2024 and are currently planning to commence a Phase 1b trial of our ATR-04 in certain cancer patients undergoing EGFRi therapy in the fourth quarter of 2024. We have a cleared IND for ATR-12 and expect to file an IND for ATR-04 in mid-2024.

•Broaden our platform by selectively exploring strategic partnerships that maximize the potential of our precision dermatology programs. We intend to maintain significant rights to all of our core technologies and product candidates. However, we will continue to evaluate partnering opportunities in which a strategic partner could help us to accelerate development of our technologies and product candidates, provide access to synergistic combinations, or provide expertise that could allow us to expand into the treatment of different types of skin diseases. We may also broaden the reach of our platform by selectively in-licensing technologies or product candidates. In addition, we will consider potentially out-licensing certain of our proprietary technologies for indications and industries that we are not ourselves pursuing. We believe our genetic engineering techniques and technologies have applicability outside of the field of medicine, including cosmetics and in the generation of clean fuels and bioremediation.

•Leverage our academic partnerships. We currently have partnerships with investigators at the Fred Hutchinson Cancer Center, Yale University, Jackson Laboratory for Genomic Medicine, and Carnegie Mellon University. We expect to leverage these partnerships and potentially expand them or form other academic partnerships to bolster our engineering platforms and expand our research and development pipeline.

•Expand on our other potential product candidates. Beyond our three lead product candidates, our goal is to develop a broad portfolio of product candidates focused on expanding the application of our platforms for precision dermatology. We have a proprietary platform for discovering and developing therapeutic products for precision dermatology. Our platform is built around a microbial library comprised of approximately 1,500 unique bacterial strains to allow screening for unique therapeutic characteristics and utilizes a microbial genetic technology that analyzes, predicts and engineers the proteins, peptides and molecules made by skin microbes. Our ability to genetically engineer intractable microbial species is uniquely leveraged by our exclusive license to the SyMPL technology.

Results of Operations

We are an early-stage clinical biopharmaceutical company, formed in January 2014, and have limited operating history. We have not commenced revenue-producing operations apart from limited service revenue derived through our JDA with Bayer. Under the terms of the JDA, we are responsible for testing our library of microbial strains and their natural products for key preclinical properties and Bayer reimburses us for our development costs. To date, our operations have consisted of the development of our proprietary microbial library, the identification, characterization and testing of certain bacterial species from our microbial library that we believe are capable of being engineered to provide significant therapeutic effect and the development of our initial product candidates.

Three Months Ended March 31, 2024 Compared to Three Months Ended March 31, 2023

The following table summarizes our results of operations with respect to the items set forth below for the three months ended March 31, 2024 and 2023, together with the percentage change for those items.

4

| Three Months Ended March 31, | ||||||||||||||||||||||||||

| 2024 | 2023 | $ Change | % Change | |||||||||||||||||||||||

| Service revenue - related party | $ | — | $ | 113,300 | $ | (113,300) | (100) | % | ||||||||||||||||||

| Total revenue | — | 113,300 | (113,300) | (100) | % | |||||||||||||||||||||

| Operating expenses: | ||||||||||||||||||||||||||

| General and administrative | 1,488,527 | 843,012 | 645,515 | 77 | % | |||||||||||||||||||||

| Research and development | 1,472,970 | 829,035 | 643,935 | 78 | % | |||||||||||||||||||||

| Total operating expenses | 2,961,497 | 1,672,047 | 1,289,450 | 77 | % | |||||||||||||||||||||

| Loss from operations | (2,961,497) | (1,558,747) | (1,402,750) | 90 | % | |||||||||||||||||||||

| Other income (expense): | ||||||||||||||||||||||||||

| Interest income | 7,609 | 285 | 7,324 | 2,570 | % | |||||||||||||||||||||

| Interest expense | (915) | (89,832) | 88,917 | (99) | % | |||||||||||||||||||||

| Change in fair value of convertible note | — | (800,000) | 800,000 | (100) | % | |||||||||||||||||||||

| Change in fair value of warrants | 28,255 | 5,621 | 22,634 | 403 | % | |||||||||||||||||||||

| Other income (expense) | (6,327) | (4,792) | (1,535) | 32 | % | |||||||||||||||||||||

| Total other income (expense) | 28,622 | (888,718) | 917,340 | (103) | % | |||||||||||||||||||||

| Loss before income taxes | (2,932,875) | (2,447,465) | (485,410) | 20 | % | |||||||||||||||||||||

| — | — | % | ||||||||||||||||||||||||

| Income tax expense | — | (9,715) | 9,715 | (100) | % | |||||||||||||||||||||

| Net loss | (2,932,875) | (2,457,180) | (475,695) | 19 | % | |||||||||||||||||||||

| Dividends on preferred stock | — | (712,080) | 712,080 | (100) | % | |||||||||||||||||||||

| Net loss attributable to common shareholders | $ | (2,932,875) | $ | (3,169,260) | $ | 236,385 | (7) | % | ||||||||||||||||||

Service Revenue - Related Party

We generated $0 of service revenue under the Bayer JDA during the first quarter of fiscal 2024 compared to service revenue of $113,300 under the JDA for the comparable period in fiscal 2023. The decrease of $113,300 in service revenue is attributable to a decrease in the amount of reimbursable development costs incurred in 2024.

General and Administrative

General and administrative costs during the first quarter of fiscal 2024 increased by $645,515, or 77%, to $1,488,527 from the comparable prior period. The increase was primarily related to an increase of $641,842 in payroll and related costs due to the hiring of our chief operating officer, legal fees, listing fees with NYSE American Stock Exchange, premiums for our directors and officers insurance, investor and public relations costs, conference costs and a net increase of $3,673 in other overhead expenses.

Research and Development

Research and development expenses include salaries and benefits of all research personnel, payments to contract research organizations, payments to research consultants, and the purchase of lab supplies. These expenses are offset by income earned from government grant payments and research and development tax credits. We generate grant revenue on contracts with various federal agencies and nonprofit research institutions for general research conducted by us. These grant arrangements also do not meet the

5

criteria for revenue recognition and amounts earned under these grant contracts are recorded as a negative research and development expense.

During the first quarter of fiscal 2024, research and development expenses increased by $643,935, or 78%, to $1,472,970 from the comparable prior period. The increase was primarily related to an increase of $237,794 in research and development related costs attributable to our efforts in moving our Netherton program into the clinic, $382,215 in research and development related costs attributable to advancing our CTAR program and a net increase of $23,926 in other miscellaneous costs. There was $0 and $1,145 government and nonprofit grant revenue received for the periods ended March 31, 2024 and 2023, respectively. There were no refundable tax credits for the periods ended March 31, 2024 and 2023.

We expect our research and development expenses to significantly increase in the future due primarily to our planned clinical trial activity and continued development of product candidates.

Other Income (Expense)

Our other income (expense) consists of interest income, change in fair value of convertible notes, interest expense, valuation of warrants, and loss on foreign currency. During the first quarter of fiscal 2024, other income (expense) decreased by $917,340, or 103%, compared to the comparable period in fiscal 2023. The decrease was primarily related to an decrease of $800,000 attributable to the change in fair value of the convertible note, a decrease of $89,832 attributable to interest expense, and by a net decrease of $27,508 attributable to other income and expense.

Financial Condition

As of March 31, 2024, we had total assets of approximately $6.1 million and working capital of approximately $2.3 million. As of March 31, 2024, our liquidity included approximately $3.0 million of cash and cash equivalents. We believe that our cash on-hand will not be sufficient to cover our proposed plan of operations over the next twelve months. We intend to seek additional funds through various financing sources, including the sale of our equity and debt securities, licensing fees for our technology and joint ventures with industry partners. In addition, we will consider alternatives to our current business plan that may enable us to achieve revenue producing operations and meaningful commercial success with a smaller amount of capital. However, there can be no guarantees that such funds will be available on commercially reasonable terms, if at all. If such financing is not available on satisfactory terms, we may be unable to further pursue our business plan and we may be unable to continue operations.

To the extent that we raise additional capital through the sale of equity or convertible debt securities, our common stockholders’ ownership interests will be diluted, and the terms of these securities may include liquidation or other preferences that adversely affect rights as a common stockholder. Debt financing and preferred equity financing, if available, may involve agreements that include covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, making acquisitions or capital expenditures or declaring dividends. If we raise additional funds through collaborations, strategic alliances or marketing, distribution or licensing arrangements with third parties, we may have to relinquish valuable rights to our technologies, future revenue streams, research programs or product candidates, or grant licenses on terms that may not be favorable to us. If we are unable to raise additional funds through equity or debt financings or other arrangements when needed, we may be required to delay, limit, reduce or terminate our research, product development or future commercialization efforts, or grant rights to develop and market product candidates that we would otherwise prefer to develop and market ourselves.

As of the date of this filing, management has determined there is substantial doubt about our ability to continue as a going concern based on our lack of revenue from commercial operations, significant losses, and the need to raise additional capital to support ongoing operations.

6

Cash Flows

The following table shows a summary of our cash flows for the periods indicated:

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| Net cash used in operating activities | $ | (3,020,922) | $ | (1,304,348) | |||||||

| Net cash used in investing activities | $ | (81,078) | $ | (82,834) | |||||||

| Net cash provided by (used in) financing activities | $ | 4,306,255 | $ | (272,080) | |||||||

| Net increase (decrease) in cash | $ | 1,204,255 | $ | (1,659,262) | |||||||

Operating Activities

During the first three months of fiscal 2024, operating activities used $3.0 million of cash primarily driven by our net loss of $2.9 million and by non-cash items of $0.1 million. During the comparable period of fiscal 2023, operating activities used $1.3 million of cash primarily driven by our net loss of 2.5 million offset by non-cash items of $1.2 million.

Investing Activities

During the first three months of fiscal 2024, investing activities used $81,078 of cash driven by $81,078 of trademark and patent costs. During the comparable period of fiscal 2023, investing activities used $82,834 of cash primarily driven by $64,584 of trademark and patent costs, $14,392 for the purchase of furniture and equipment, and $3,858 of license costs.

Financing Activities

During the first three months of fiscal 2024, financing activities provided $4.3 million in cash primarily driven by proceeds from our follow-on public offering. During the comparable period of fiscal 2023, financing activities used $0.3 million in cash primarily driven by deferred offering costs for the follow-on public offering.

Critical Accounting Policies

During the three months ended March 31, 2024, there were no material changes to our critical accounting policies previously disclosed in our Form 10-K dated December 31, 2023 and filed with the SEC on March 15, 2024.

Critical Accounting Estimates

Our management’s discussion and analysis of our financial condition and results of operations are based on our consolidated financial statements, which have been prepared in accordance with U.S. generally accepted accounting principles. The preparation of these consolidated financial statements requires us to make judgments and estimates that affect the reported amounts of assets, liabilities, and expenses and the disclosure of contingent assets and liabilities in our consolidated financial statements. We base our estimates on historical experience, known trends and events, and various other factors that are believed to be reasonable under the circumstances. Actual results may differ from these estimates under different assumptions or conditions. On an ongoing basis, we evaluate our judgments and estimates in light of changes in circumstances, facts and experience. The effects of material revisions in estimates, if any, will be reflected in the consolidated financial statements prospectively from the date of change in estimates. There were no material changes to our critical accounting estimates as reported in our Form 10-K for the year ended December 31, 2023 and filed with the SEC on March 15, 2024.

Item 3. Quantitative and Qualitative Disclosures about Market Risk

Not applicable.

7

Item 4. Controls and Procedures

Evaluation of Disclosure Controls and Procedures

Our management, with the participation of our chief executive officer and chief financial officer, evaluated the effectiveness of the design and operation of our disclosure controls and procedures, pursuant to Rule 13a-15 of the Securities Exchange Act of 1934, as of March 31, 2024. In the course of that evaluation, we identified a material weakness as it relates to a lack of adequate segregation of accounting functions. We intend to increase staffing within our accounting infrastructure sufficient to facilitate proper segregation of accounting functions and to enable appropriate review of our internally prepared financial statements. Based upon the foregoing, our chief executive officer and chief financial officer concluded that our disclosure controls and procedures were not effective as of March 31, 2024.

Changes in Internal Control Over Financial Reporting

There were no changes in our internal control over financial reporting that occurred during the three months ended March 31, 2024, that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

8

PART II. OTHER INFORMATION

Item 1A. Risk Factors

This Quarterly Report on Form 10-Q contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Those forward-looking statements include our expectations, beliefs, intentions and strategies regarding the future. You should carefully consider the risk factors discussed in the “Risk Factors” section in our Form 10-K for the year ended December 31, 2023 as, in light of those risks, the forward-looking events and circumstances discussed in this report may not occur and actual results could differ materially and adversely from those anticipated or implied in our forward-looking statements. There have been no material changes in the risk factors included in our 2023 Form 10-K. The risk factors described in our 2023 Form 10-K are not the only risks facing our company. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial also may materially adversely affect our business, financial condition or future results.

9

Item 6. Exhibits

| Exhibit Number | Description | Method of Filing | ||||||||||||

| 3.1 | Incorporated by reference from the Registrant’s Current Report on Form 8-K filed on June 21, 2023 | |||||||||||||

| 3.2 | Incorporated by reference from the Registrant’s Current Report on Form 8-K filed on June 21, 2023 | |||||||||||||

| 31.1 | Filed electronically herewith | |||||||||||||

| 31.2 | Filed electronically herewith | |||||||||||||

| 32.1 | Filed electronically herewith | |||||||||||||

| 101 INS | Inline XBRL Instance Document. | Filed electronically herewith | ||||||||||||

| 101.SCH | Inline XBRL Taxonomy Extension Schema Document. | Filed electronically herewith | ||||||||||||

| 101.CAL | Inline XBRL Taxonomy Extension Calculation Linkbase Document. | Filed electronically herewith | ||||||||||||

| 101.DEF | Inline XBRL Taxonomy Extension Definition Linkbase Document. | Filed electronically herewith | ||||||||||||

| 101.LAB | Inline XBRL Taxonomy Extension Label Linkbase Document. | Filed electronically herewith | ||||||||||||

| 101.PRE | Inline XBRL Taxonomy Extension Presentation Linkbase Document. | Filed electronically herewith | ||||||||||||

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101). | Filed electronically herewith | ||||||||||||

10

SIGNATURES

In accordance with the requirements of the Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| AZITRA, INC. | ||||||||

Date: May 9, 2024 | By: | /s/ Francisco D. Salva | ||||||

| Francisco D. Salva, | ||||||||

| President and Chief Executive Officer | ||||||||

| (Principal Executive Officer) | ||||||||

| Date: May 9, 2024 | By: | /s/ Norman Staskey | ||||||

| Norman Staskey | ||||||||

| Chief Financial Officer | ||||||||

| (Principal Financial Officer) | ||||||||

11