Exhibit 10.1

SEVENTH AMENDMENT TO LEASE

This SEVENTH AMENDMENT TO LEASE (this “Seventh Amendment”), dated for reference purposes as of September 29, 2021 (the “Seventh Amendment Effective Date”) is made by and between DREISBACH ENTERPRISES, INC., a California corporation (hereinafter called “Lessor”), and BLUE APRON, LLC, a Delaware limited liability company (hereinafter called “Lessee”).

RECITALS:

A.Lessor and Lessee (formerly known as Blue Apron, Inc., a Delaware corporation) entered into that certain Lease dated July 15, 2013 (the “Original Lease”), as amended by (i) that certain First Amendment to Industrial Lease by and between Lessor and Lessee dated June 30, 2014 (the “First Amendment”), (ii) that certain Second Amendment to Lease by and between Lessor and Lessee dated June 29, 2015 (the “Second Amendment”), (iii) that certain Third Amendment to Lease by and between Lessor and Lessee dated April 25, 2016 (the “Third Amendment”), (iv) that certain Fourth Amendment to Lease by and between Lessor and Lessee dated May 31, 2016 (the “Fourth Amendment”), (v) that certain Fifth Amendment to Lease and Agreement to Renew by and between Lessor and Lessee dated June 1, 2016 (the “Fifth Amendment”), (vi) that certain Sixth Amendment to Lease by and between Lessor and Lessee dated January 29, 2019 (the “Sixth Amendment”) and (vii) various agreements to increase the parking areas (collectively with the Original Lease, First Amendment, Second Amendment, Third Amendment, Fourth Amendment, Fifth Amendment and Sixth Amendment referred to herein as the “Lease”).

B.Lessor and Lessee hereby desire to amend the Lease pursuant to the terms of this Seventh Amendment.

C.All capitalized terms when used herein shall have the same meaning as is given such terms in the Lease unless expressly superseded by the terms contained herein.

AGREEMENT:

In consideration of the mutual agreements contained in this Lease, Lessor and Lessee agree as follows:

1.Premises. From and after the Seventh Amendment Effective Date, the word “Premises” set forth in the Lease shall be defined as follows:

“Certain premises within the building located at 3151 Regatta Boulevard, City of Richmond, County of Contra Costa, State of California (the “Building”) and certain parking areas adjacent to the Building, described as follows: (i) approximately 12,162 rentable square feet of refrigerated space, approximately 4,000 rentable square feet of office, bathrooms, and break room space, and approximately 11,942 rentable square feet of dry space, commonly known as Building B60 and the Dry Storage, Office, Refrigerated Storage, Utility, and Dock; (ii) approximately 14,105 rentable square feet of space located at 3151-F Regatta Boulevard, Richmond, California; (iii) approximately 19,830 rentable square feet

-1- | Seventh Amendment to Lease [Dreisbach/Blue Apron] |

of space commonly known as the “Yard”; (iv) approximately 32,610 rentable square feet of space commonly known as the “Additional Yard”; (v) approximately 15,000 rentable square feet of cooler storage space (the “Cooler Room”); (vi) approximately 64,360 rentable square feet of dry storage space (the “Expansion Premises”); (vii) ”Additional Parking Areas” consisting of approximately 71,766 rentable square feet; (viii) approximately 36,302 rentable square feet of warehouse space (the “Additional Expansion Premises”); and (ix) three (3) bays (each, a “Bay” and collectively, the “Bays”) of collectively approximately 4,500 rentable square feet, all of such premises described in (i)-(ix) which are located in or around the Building (collectively, the “Premises”).”

2.Condition of the Premises. Lessee hereby acknowledges that Lessee is currently in possession of the Premises. Except as otherwise contained in Section 23 of the Original Lease (as amended and restated by Section 17 of the Sixth Amendment), (1) Lessee has accepted, and shall continue to accept the Premises and Building in their respective “as is” condition as of the date of delivery thereof to Lessee and (2) neither Lessor nor any agent of Lessor has made any representation or warranty regarding the condition of the Premises, Building and Common Areas or with respect to the suitability of any of the foregoing for the conduct of Lessee’s business and Lessor shall not be obligated to provide or pay for any improvement work or services related to the improvement of the Premises and Building. Notwithstanding anything to the contrary contained in the Lease, Lessor and Lessee acknowledge and agree that (i) the Remaining Bays (as defined in the Sixth Amendment) were never delivered to Lessee and accordingly the Remaining Bays never constituted a part of the Premises, (ii) Lessee shall not have any liability with respect to the Remaining Bays, (iii) Lessee shall continue to receive the abatement of Base Rent for the Remaining Bays described in Section 7 of the Sixth Amendment throughout the entire Term of the Lease and (iv) all other references in the Sixth Amendment to the Remaining Bays shall be of no further force or effect.

3.Use. The Premises shall be used for general offices and food distribution, production, packaging, processing and warehousing, including the manufacture and storage of dry ice, in each case as such uses are permitted under all applicable laws and ordinances. However, to the extent that any new use (i.e., a use of the Premises that was not in effect at any time prior to the Seventh Amendment Effective Date such as the manufacture of dry ice or the Wastewater Treatment Plant (as defined below)) increases the operational expenses that have been built into the gross Base Rent under the Lease, Lessor shall be entitled to recover those costs from Lessee.

4.Term. Notwithstanding anything to the contrary contained in the Lease, as of the Seventh Amendment Effective Date, (i) the Term of the Lease for the entire Premises is extended to May 31, 2027 (the “Updated New Lease Expiration Date”), and (ii) all references in the Lease to the end of the Lease term, Lease Expiration Date or New Lease Expiration Date shall be replaced with the Updated New Lease Expiration Date. Lessor or Lessee may each terminate the Lease at any time upon not less than twelve (12) months’ prior written notice to such other party (the “Early Termination Notice”); and further provided that the effective date of such termination may not be prior to December 31, 2025. Any Early Termination Notice shall be irrevocable. No later than ten (10) days after the effective date of any termination of the Lease, as amended hereby, Lessor shall return to Lessee any Prepaid Rent not yet applied or returned. Notwithstanding anything to the

-2- | Seventh Amendment to Lease [Dreisbach/Blue Apron] |

contrary contained in the Lease, Lessee shall have no right to extend the Term beyond the Updated New Lease Expiration Date.

5.Rent. Notwithstanding anything to the contrary contained in the Lease, from and after the Seventh Amendment Effective Date the Base Rent for the Premises shall remain a “gross” amount including all taxes, insurance and operating expenses incurred or paid by Lessor, and shall include utilities for and maintenance of the Premises, except (i) as expressly set forth in Section 3 above and (ii) for the “Additional Electricity” described in Section 25 of the Sixth Amendment. The total monthly Base Rent (a) shall be Three Hundred Thirty-One Thousand One Hundred Seventy-Nine and 42/100ths Dollars ($331,179.42) for the period commencing on the Seventh Amendment Effective Date and continuing until December 31, 2021, in lawful money of the United States of America, which Lessee agrees to pay to Lessor, without deduction or offset except as expressly set forth in the Lease, as amended hereby, at such place or places as may be designated from time to time by Lessor, and (b) shall be increased by three percent (3%) effective upon January 1, 2022 and each January 1st thereafter during the Term. For the avoidance of doubt, the monthly Base Rent payable pursuant to the Lease for the Premises shall be as follows:

Period |

| Monthly Rent |

Seventh Amendment Effective Date – December 31, 2021 | | $331,179.42 |

January 1, 2022 – December 31, 2022 | | $341,114.80 |

January 1, 2023 – December 31, 2023 | | $351,348.24 |

January 1, 2024 – December 31, 2024 | | $361,888.69 |

January 1, 2025 – December 31, 2025 | | $372,745.35 |

January 1, 2026 – December 31, 2026 | | $383,927.71 |

January 1, 2027 – May 31, 2027 | | $395,445.54 |

6.Wastewater Treatment Plant. Lessee has expressed an interest in building a wastewater treatment plant (the “Wastewater Treatment Plant”) at its sole cost and expense to serve the Premises. Lessee shall not be liable to Lessor for any additional charge or cost in connection with the Wastewater Treatment Plan except as set forth in Section 3 above. The Wastewater Treatment Plant may include a system for recycling and processing waste water generated in the Building and for recirculating such processed water within the Building, which may also include an on-site treatment plant for such processing of waste and any housing enclosure therefor (if any). Lessee will submit a scope of work for the Wastewater Treatment Plant to Lessor and thereafter will provide monthly updates to Lessor for informational purposes during Lessee’s design process. Lessee will then submit plans of the Wastewater Treatment Plant to Lessor for Lessor’s approval in accordance with Section 9 of the Lease. Lessee agrees that this improvement shall be made in a lien-free manner by duly licensed contractors and in compliance with all insurance requirements and with all applicable permits, building regulations, zoning laws and all other governmental rules, regulations, ordinances, statutes and laws as set forth in the Lease. Lessee may, at Lessee’s option, remove the Wastewater Treatment Plant at, or at any time prior to, the end of the Term. Lessee shall, upon the request of Lessor with at least sixty (60) days’ prior written notice to Lessee (the “WTP Restoration Notice”), remove the portions of the Wastewater Treatment Plant that are above-ground and cap the Wastewater Treatment Plant at the transfer station and pump (the “WTP Restoration Work”) at the end of the Term or the termination date triggered by an Early Termination Notice. In no event shall Lessee have less than one hundred

-3- | Seventh Amendment to Lease [Dreisbach/Blue Apron] |

twenty (120) days to perform the WTP Restoration Work from Lessee’s receipt of the WTP Restoration Notice. If Lessor provides the WTP Restoration Notice with fewer than one hundred twenty (120) days remaining in the Term, then Lessor hereby grants Lessee a license to enter the Premises at reasonable times in order to perform the WTP Restoration Work following the end of the Term (the “Post-Termination License”) and Lessee’s indemnity and insurance obligations will remain in full force and effect. Notwithstanding anything to the contrary contained in the Lease, as amended hereby, under no circumstances shall Lessee be deemed to be in holdover, including the obligations to pay Base Rent or Additional Electricity, as a result of Lessee’s exercise of the Post-Termination License. Lessee shall repair any damage caused by the installation and/or removal of the Wastewater Treatment Plant as set forth in the Lease. Lessor shall use commercially reasonable efforts, at no cost to Lessor, to cooperate with Lessee, or to cause Master Lessor to cooperate with Lessee, to obtain all governmental approvals required for installation, operation, maintenance and repair of the Wastewater Treatment Plant to the extent Lessor’s or Master Lessor’s cooperation is required. Notwithstanding the foregoing, Lessor acknowledges and agrees that Lessee may, at any time, and in Lessee’s sole discretion, cease operation of the Wastewater Treatment Plant on a temporary or permanent basis, so long as: (1) such cessation of operation will not materially adversely affect the operation, functionality or performance of the Building and (2) Lessee provides at least sixty (60) days’ prior written notice to Lessor. Notwithstanding the foregoing, Lessee shall be permitted to immediately cease operation of the Wastewater Treatment Plant if operation of the Wastewater Treatment Plant could result in health or safety concerns, harm or damage to persons or property, or otherwise violate any applicable laws, in which case Lessee shall provide Lessor with notice promptly following such cessation of operation. Lessor acknowledges that the Wastewater Treatment Plant could be adversely impacted by a change in use of any space in the Building (i.e., a use of the Building that was not in effect as of the Seventh Amendment Effective Date in which Lessor is using the Building for storage as of the Seventh Amendment Effective Date) (each, a “Changed Use”). Notwithstanding anything to the contrary contained in the Lease, as amended hereby, Lessor shall (i) provide Lessee with prior written notice of any Changed Use prior to such Changed Use going into effect so that Lessee can monitor any impacts on the Wastewater Treatment Plant and (ii) be responsible for any costs incurred by Lessee in connection with any Changed Uses, including any costs for (x) Lessee to comply with applicable law, (y) additional utilities and (z) increased monitoring and treatment of the wastewater.

7.Prepaid Rent. Pursuant to the Sixth Amendment, Lessee had prepaid to Lessor Rent in the amount of Two Million Eighty-Seven Thousand One Hundred Fifty-Five and 42/100ths Dollars ($2,087,155.42) (the “Prepaid Rent”) which amount was earned by Lessor upon receipt. If following the Seventh Amendment Effective Date Lessee reports positive EBITDA for three (3) consecutive financial quarters, one fifth (1/5) of the Prepaid Rent (i.e., Four Hundred Seventeen Thousand Four Hundred Thirty-One and 08/100ths Dollars ($417,431.08)) shall be returned by Lessor to Lessee within ten (10) days of Lessee’s demand. Once Lessee reports positive EBITDA for three (3) consecutive financial quarters, an additional one fifth (1/5) of the Prepaid Rent (i.e., Four Hundred Seventeen Thousand Four Hundred Thirty-One and 08/100ths Dollars ($417,431.08)) shall be returned by Lessor to Lessee within ten (10) days of Lessee’s demand for each financial quarter thereafter, at any time during the Term (including subsequent to Lessee’s return of any Prepaid Rent that produces a negative EBITDA as described below), that Lessee reports positive EBITDA, until a total of four fifths (4/5) of the Prepaid Rent (i.e., One Million Six Hundred Sixty-Nine Thousand Seven Hundred Twenty-Four and 34/100ths Dollars ($1,669,724.34)) has been returned by Lessor to Lessee. The final remaining one fifth (1/5) of the

-4- | Seventh Amendment to Lease [Dreisbach/Blue Apron] |

Prepaid Rent (i.e., Four Hundred Seventeen Thousand Four Hundred Thirty-One and 08/100ths Dollars ($417,431.08)) shall be retained by Lessor until applied to the last month(s) of Rent for the Term. Any of Lessee’s financial quarter’s results subsequent to the return of any Prepaid Rent that produces a negative EBITDA shall trigger repayment by Lessee to Lessor within ten (10) days of Lessor’s demand of one fifth (1/5) of the Prepaid Rent (i.e., Four Hundred Seventeen Thousand Four Hundred Thirty-One and 08/100ths Dollars ($417,431.08)) for that quarter and any quarter thereafter that Lessee reports a negative EBITDA up to the original amount of the Prepaid Rent and each such quarter shall trigger repayment by Lessee to Lessor within ten (10) days of Lessor’s demand for one fifth (1/5) of the Prepaid Rent (i.e., Four Hundred Seventeen Thousand Four Hundred Thirty-One and 08/100ths Dollars ($417,431.08)). Any remaining Prepaid Rent will be applied to the last month(s) of Rent for the Term as applicable.

8.Electrical Upgrade. Lessor is in the process of upgrading portions of the Building’s electrical systems and in connection with such upgrades Lessor shall use commercially reasonable efforts to provide Lessee with at least seven (7) days’ prior written notice for all scheduled electrical work that might result in the power to any portion of the Premises and/or Common Areas to be down, limited or otherwise inoperable.

9.Master Lease. As of the Seventh Amendment Effective Date, Lessor represents and warrants that (i) it is the lessee under a “Master Lease” for the Premises and other premises with Stephens & Stephens (Regatta), LLC, and DF/Hilltop Sub 1, LLC, collectively, as “Master Lessor”, and that Lessor has been the lessee under the Master Lease for the entirety of the Lease Term, (ii) the term of the Master Lease expires on December 23, 2031, (iii) to Lessor’s actual knowledge, there are no defaults thereunder by Lessor or Master Lessor that remain uncured, (iv) Master Lessor has actual knowledge of the existence of the Lease, and shall not require a written consent in connection with the execution and delivery of this Seventh Amendment, (v) there are no other ground leases encumbering the Premises or Building, and (vi) to Lessor’s actual knowledge (a) the only Security Instruments affecting the Premises are the “Security Documents” (as defined in the 2014 SNDA (as defined below)), and (b) that certain Subordination, Non-Disturbance and Attornment Agreement dated December 23, 2014 and recorded as Document Number 2014-0228263-00 in the Official Records of Contra Costa County (the “2014 SNDA”) with respect to such Security Instruments is in full force and effect.

10.

11.Conflict, No Further Modification. In the event of any conflict between the terms and provisions of the Lease and the terms and provisions of this Seventh Amendment, the terms and provisions of this Seventh Amendment shall prevail. Except as specifically set forth in this Seventh Amendment, all of the terms and provisions of the Lease shall remain unmodified and in full force and effect.

12.Counterparts. This Seventh Amendment may be executed in any number of counterparts, each of which, when executed, shall be an original, and all of which, taken together, shall constitute one and the same instrument as if all parties hereto had executed the same instrument; and any party or signatory hereto may execute this Seventh Amendment by signing any such counterpart.

-5- | Seventh Amendment to Lease [Dreisbach/Blue Apron] |

13.No Brokers. Lessor and Lessee hereby warrant to each other that they have had no dealings with any real estate broker or agent in connection with the negotiation of this Seventh Amendment, and that they know of no other real estate broker or agent who is entitled to a commission in connection with this Seventh Amendment.

[Signature Pages Follow This Page]

-6- | Seventh Amendment to Lease [Dreisbach/Blue Apron] |

IN WITNESS WHEREOF, the parties hereto have executed this Seventh Amendment as of the Seventh Amendment Effective Date.

LESSOR: | | |

| | |

DREISBACH ENTERPRISES, INC., | | |

a California corporation | | |

| | |

By: | /s/ Jason W. Dreisbach | |

Name: | Jason W. Dreisbach | |

Title: | President | |

[SIGNATURES CONTINUE ON FOLLOWING PAGE]

Signature Page | Seventh Amendment to Lease [Dreisbach/Blue Apron] |

LESSEE: | | |

| | |

BLUE APRON, LLC, | | |

a Delaware limited liability company | | |

| | |

By: | /s/ Randy Greben | |

Name: | Randy Greben | |

Title: | CFO | |

Signature Page | Seventh Amendment to Lease [Dreisbach/Blue Apron] |

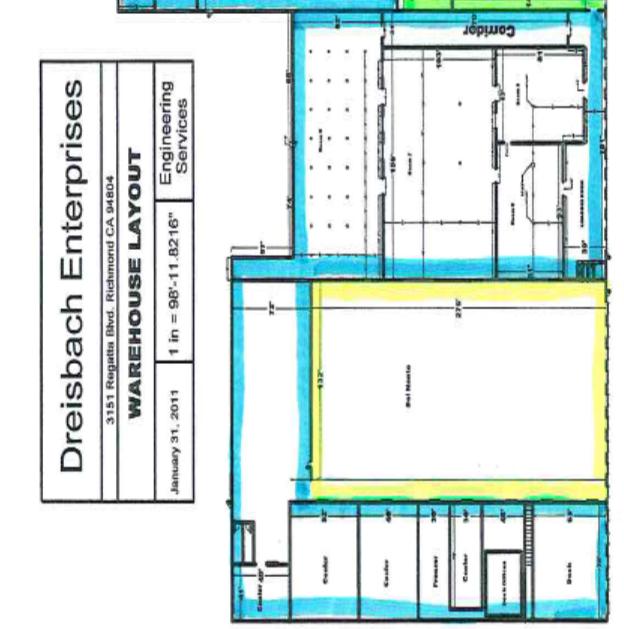

EXHIBIT A

Depiction of ROFR Space

Exhibit A | Seventh Amendment to Lease [Dreisbach/Blue Apron] |