EXHIBIT 2A

PART II— OFFERING CIRCULAR

Bridgewell Preferred Income Fund, LP

(the “Partnership” or “Partnership”)

Preliminary Prospectus dated_______________________________

The Partnership is hereby providing the information required by Part I of Form S-11 (17 9 CFR 239.18 and are following the requirements for a smaller reporting company as it meets the definition of that term in Rule 405 (17 CFR 230.405).

An offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the offering statement filed with the Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. The Partnership may elect to satisfy its obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale that contains the URL where the Final Offering Circular or the offering statement in which such Final Offering Circular was filed may be obtained.

We are offering 50,000 Limited Partnership Interests (“Limited Partnership Interests” or “Units”) at $1,000 per Unit through our General Partner (the “Offering.”) The Limited Partnership Interests shall bear a Preferred Return (“Preferred Return”) of 7% on invested capital. Funds will be made immediately available to the Partnership once the Partnership raises a minimum of $100,000 (“Minimum Offering”) for the purposes of acquiring assets or working capital. This Offering terminates in 365 days after commencement of this Offering. There are provisions for the return of funds except pursuant to our Withdrawal Policy which is discussed at “Withdrawal, Redemption Policy and Other Events of Dissociation” on page 60. Commissions may be paid for the sale of the Units offered by the Partnership, see “USE OF PROCEEDS” on page 31.

No public market currently exists for our Units. The Partnership will be managed by Preferred Fund Manager, LLC (the “General Partner.”). The Partnership has set a minimum investment requirement of $10,000, but may accept subscriptions for less at the discretion of our General Partner. We do not intend to place the funds into a segregated account and will hold them in our corporate account until the minimum amount of $100,000 is reached. Therefore, purchasers of our Units qualified hereunder may be unable to sell their securities, because there may not be a public market for our securities. Any purchaser of our securities should be in a financial position to bear the risks of losing their entire investment.

| 1 |

We expect to use substantially all of the net proceeds from this offering to acquire: (i) real estate secured loans (fixed and variable interest rate), primarily bridge loans and other loans secured by real estate (“Mortgage Loans”).

The Partnership is considered an “emerging growth company” under Section 101(a) of the Jumpstart Our Business Startups Act as it is an issuer that had total annual gross revenues of less than $1 billion during its most recently completed fiscal year.

Our independent auditors included an explanatory paragraph in the report on our 2016 financial statements related to our ability to continue as a going concern.

See the section entitled “RISK FACTORS” beginning on page 7 for a discussion of risks to consider before purchasing our Limited Partnership Interests.

INVESTMENT IN SMALL BUSINESSES INVOLVES A HIGH DEGREE OF RISK, AND INVESTORS SHOULD NOT INVEST ANY FUNDS IN THIS OFFERING UNLESS THEY CAN AFFORD TO LOSE THEIR ENTIRE INVESTMENT. SEE THE SECTION ENTITLED “RISK FACTORS.”

IN MAKING AN INVESTMENT DECISION INVESTORS MUST RELY ON THEIR OWN EXAMINATION OF THE ISSUER AND THE TERMS OF THE OFFERING, INCLUDING THE MERITS AND RISKS INVOLVED. THESE SECURITIES HAVE NOT BEEN RECOMMENDED OR APPROVED BY ANY FEDERAL OR STATE SECURITIES COMMISSION OR REGULATORY AUTHORITY. FURTHERMORE, THESE AUTHORITIES HAVE NOT PASSED UPON THE ACCURACY OR ADEQUACY OF THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

THE U.S. SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR SELLING LITERATURE. THESE SECURITIES ARE OFFERED UNDER AN EXEMPTION FROM REGISTRATION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THESE SECURITIES ARE EXEMPT FROM REGISTRATION.

GENERALLY, NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(D)(2)(I)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO WWW.INVESTOR.GOV.

| 2 |

|

|

|

4 |

| |

|

|

|

7 |

| |

|

|

|

8 |

| |

|

|

|

39 |

| |

|

|

|

39 |

| |

|

|

|

41 |

| |

|

|

|

44 |

| |

|

|

|

45 |

| |

|

|

|

48 |

| |

|

|

|

50 |

| |

|

|

|

74 |

| |

|

|

|

76 |

| |

|

|

|

84 |

| |

|

|

|

84 |

| |

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

|

|

84 |

|

|

|

|

87 |

| |

|

|

|

87 |

| |

|

|

|

87 |

| |

|

|

|

88 |

| |

|

|

|

89 |

| |

|

|

|

F-3 |

| |

|

|

|

F-4 |

| |

|

|

|

|

|

|

|

|

|

90 |

|

| 3 |

| Table of Contents |

This summary contains basic information about the Fund and the Offering. Because it is a summary, it does not contain all the information that you should consider before investing. You should read the entire Prospectus carefully, including the risk factors and our financial statements and the related notes to those statements included in this prospectus. Except as otherwise required by the context, references in this prospectus to "we," "our," "us," “The Partnership,” “Bridgewell Preferred Income Fund,” and "Bridgewell," refer to Bridgewell Preferred Income Fund, LP.

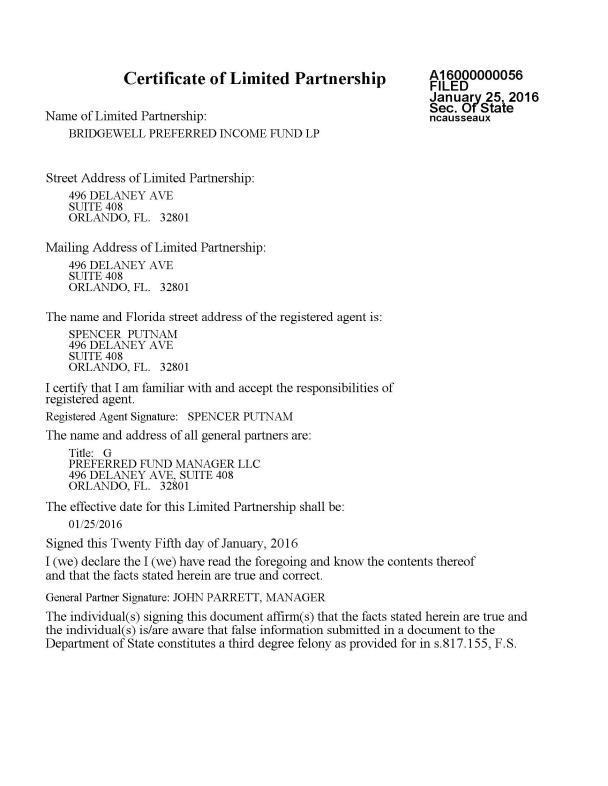

We were formed on January 25, 2016 and have not yet commenced operations.

We are not a blank check company and do not consider ourselves to be a blank check company as we:

|

|

¨ |

Have a specific business plan. We have provided a detailed plan for the next twelve (12) months throughout our Prospectus. |

|

|

¨ |

Have no intention of entering into a reverse merger with any entity in an unrelated industry in the future. |

Since our inception through December 31, 2016, we have not generated any revenues and have not incurred any expenses. We anticipate the commencement of generating revenues in the next twelve months. The capital raised in this offering has been budgeted to cover the costs associated with beginning to operate our company, marketing expense, and acquisition related costs. We intend on using the majority of the proceeds from this Offering for the acquisition of real estate related assets. However, closing and other acquisition related costs such as title insurance, professional, fees and taxes will likely require cash. We do not have the ability to quantify any of the expenses as they will all depend on size of deal, price, and place versus procuring new financing, due diligence performed (such as appraisal, environmental, property condition reports), legal and accounting, etc. There is no way to predict or otherwise detail expenses.

We intend on engaging in the following activities:

|

|

1. | Primarily, acquire real estate secured loans (fixed and variable interest rate), primarily first mortgage loans, but also potentially including second mortgage loans, mezzanine loans, subordinated mortgage loans, subordinated loans secured by real estate, preferred equity real estate investments, bridge loans, real estate secured loans where a portion of the return is dependent upon performance based metrics, owner occupant secured loans and other loans secured by real estate (“Mortgage Loans”); This consists of acquiring loans that have been made to real estate entrepreneurs for the purposes of acquiring or refinancing investment properties. These loans are often provided as mezzanine or bridge financing, but not exclusively. We intend to provide asset-based loan capital through which a borrower receives funds secured by the value of a parcel of real estate. These loans are typically issued at higher interest rates than conventional commercial or residential property loans. We intend to use a loan purchase criteria based on loan-to-value, property location, borrower experience, and other feasibility factors discussed herein. |

| 4 |

| Table of Contents |

|

|

2. | INVESTMENT POLICIES OF COMPANY on page 37, will determine whether or not the General Partner will purchase a note on behalf of the Partnership. |

|

|

|

|

|

|

3. | In the event that there is not enough supply or opportunity for us to purchase Mortgage Loans, we intend to purchase Real Estate Owned (REO) properties from banks and other institutions and other sources of wholesale-priced real estate (“REO”). REOs consist of portfolios of homes that have been foreclosed upon and packaged together to be re-sold by a bank or lending institution. Banks pool homes together as REO packages and make them available as-is for purchase as one unit. REO homes are often in disrepair, or have other problems, such as liens or back-taxes owing on them. We expect to acquire mostly single family residences with our acquisition strategy, but may also end up acquiring condominiums, small multi-family units and small commercial properties. |

|

|

|

|

|

|

4. | In the event there is not enough demand for Mortgage Loans or for REO’s, we intend to purchase notes secured by real estate that are not currently cash flow positive but have potential to be “cash flow positive” or “re-performing” through negotiations with the borrower. In order to determine when a property becomes “re-performing,” our General Partner will review the total gross receipts from the borrower and subtract any and all expenses including servicing, custodial fees, legal expenses, taxes, and other reserve expenses. |

|

|

|

|

|

|

5. | Invest in any opportunity our General Partner sees fit within the confines of the market, marketplace and economy so long as those investments are real estate related and within the investment objectives of the Partnership. |

In all cases, the debt on any given property must be such that it fits with the Investment Policies of the Partnership. We may leverage our equity capital on a 1.5 to 1 basis meaning that for every $1 of equity capital raised, we may borrow $1.50 to leverage our purchasing power.

The Partnership does not currently own any assets. Please see our “DESCRIPTION ” on page 38. We believe we will need at least $4,000 to provide working capital and $6,000 for professional fees for the next 12 months.

As of the date of this Offering, we have only one principal of our General Partner. This principal does not have any specific number of working hours dedicated to the Partnership going forward. This principal, John Parrett, through our General Partner, will be in charge of our day to day operations until such time we are able to hire other personnel. Even if we sell all the securities offered, the majority of the proceeds of the offering will be spent for the purchase of mortgage loans and, to a lesser extent, operational costs. Investors should realize that following the registration of this Offering, we will be required to raise capital to cover the costs associated with our plans of operation.

| 5 |

| Table of Contents |

Some of our Risk Factors include:

|

|

· | We are an emerging growth company with a limited operating history. |

|

|

· | Subscribers will have limited control in our company with limited voting rights. The Managing Limited Partners will manage the day to day operations of the Partnership. |

|

|

· | We may require additional financing, such as bank loans, outside of this offering in order for our operations to be successful. |

|

|

· | We have not conducted any revenue-generating activities and as such have not generated any revenue since inception. |

|

|

· | Our offering price is arbitrary and does not reflect the book value of our Limited Partnership Interests. |

|

|

· | Investments in real estate and real estate related assets are speculative and we will be highly dependent on the performance of the real estate market. |

|

|

· | Our independent auditors have noted there are risk factors associated with our ability to continue as a going partnership in the independent auditors’ report to the financial statements included in the Offering. |

|

|

· | The Partnership does not currently own any assets. |

| 6 |

| Table of Contents |

EXEMPTIONS UNDER JUMPSTART OUR BUSINESS STARTUPS ACT

We are an emerging growth company. An emerging growth company is one that had total annual gross revenues of less than $1,000,000,000 (as such amount is indexed for inflation every 5 years by the Commission to reflect the change in the Consumer Price Index for All Urban Consumers published by the Bureau of Labor Statistics, setting the threshold to the nearest 1,000,000) during its most recently completed fiscal year. We would lose our emerging growth status if we were to exceed $1,000,000,000 in gross revenues. We are not sure this will ever take place.

Because we are an emerging growth company, we have the exemption from Section 404(b) of Sarbanes-Oxley Act of 2002 and Section 14A(a) and (b) of the Securities Exchange Act of 1934. Under Section 404(b), we are now exempt from the internal control assessment required by subsection (a) that requires each independent auditor that prepares or issues the audit report for the issuer shall attest to, and report on, the assessment made by the management of the issuer. We are also not required to receive a separate resolution regarding either executive compensation or for any golden parachutes for our executives so long as we continue to operate as an emerging growth company.

We hereby elect to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1).

We will lose our status as an emerging growth company in the following circumstances:

|

|

¨ |

The end of the fiscal year in which our annual revenues exceed $1 billion. |

|

|

|

|

|

|

¨ |

The end of the fiscal year in which the fifth anniversary of our IPO occurred.

|

|

|

¨ |

The date on which we have, during the previous three-year period, issued more than $1 billion in non-convertible debt. |

|

|

|

|

|

|

¨ |

The date on which we qualify as a large accelerated filer. |

| 7 |

| Table of Contents |

Investors in the Partnership should be particularly aware of the inherent risks associated with our business. As of the date of this filing our management is aware of the following material risks.

General Risks Related to Our Business

We are an emerging growth company organized in January 2016 and have recently commenced operations, which makes an evaluation of us extremely difficult. At this stage of our business operations, even with our good faith efforts, we may never become profitable or generate any significant amount of revenues, thus potential investors have a probability of losing some or all of their investment.

We were organized in January 2016, and have not started operations other than organizational functions as of the date of this document. As a result of no start-up operations we have; (i) generated no revenues, (ii) will accumulate deficits due to organizational and start-up activities, business plan development, and professional fees since we organized. In that we have not started operations, there is nothing at this time on which to base an assumption that our business operations will prove to be successful or that we will ever be able to operate profitably. Our future operating results will depend on many factors, including our ability to raise adequate working capital, availability of properties for purchase, the level of our competition and our ability to attract and maintain key management and employees.

We are significantly dependent on BridgeWell Capital LLC (“Lender”). The loss of Lender or their services would have an adverse effect on our business, operations and prospects in that we may not be able to obtain new Lender services under the same financial arrangements, which could result in a loss of your investment.

Our business plan is significantly dependent upon the Lender. It would be difficult to replace the Lender at such an early stage of development of The Partnership. The loss of the Lender’s services would have an adverse effect on our business, operations and prospects, and could result in the loss of one's investment. There can be no assurance that we would be able to locate or replace the Lender, should their services be discontinued. In the event that we are unable to replace Lender, we would be required to cease pursuing our business plan, which could result in a loss of your investment

Our independent auditors have noted in their report there are risk factors associated with our ability to continue as a going concern.

The Partnership's ability to continue as a going concern is dependent upon its ability to generate future profitable operations and/or obtain the necessary financing to meet its obligations and repay its liabilities arising from normal business operations when they become due.

| 8 |

| Table of Contents |

You will not have the opportunity to evaluate our investments before we make them, which makes your investment more speculative.

You will be unable to evaluate the economic merit of our investments before we invest in them and will be entirely relying on the ability of Preferred Fund Manager, LLC, our General Partner, to select our investments. Furthermore, our General Partner will have broad discretion in implementing policies regarding tenant or mortgagor creditworthiness, and you will not have the opportunity to evaluate potential tenants, managers or borrowers. These factors increase the risk that your investment may not generate returns comparable to our competitors.

Our General Partner will have complete control over the Partnership and will therefore make all decisions of which Limited Partners will have no control.

Preferred Fund Manager, LLC, our General Partner, shall make certain decisions without input by the Limited Partners. Such decisions may pertain to employment decisions, including our General Partner’s compensation arrangements, the appointment of other officers and managers, and whether to enter into material transactions with related parties.

An investment in the Units is highly illiquid. You may never be able to sell or otherwise dispose of your Units.

Since there is no public trading market for our Units, you may never be able to liquidate your investment or otherwise dispose of your Units. The Partnership does currently have a redemption program, but there is no guarantee that the Partnership will ever redeem or "buy back" your Units. Further, no one is allowed to redeem their Interests until six months after the Units were purchased and up until the third year of ownership, redemption is subject to a penalty. The Partnership will only redeem Units up to 10% of the value of the assets in any giving quarter.

Risks Related to the Our Business in General

There are significant risk factors relating to our business generally.

Our business, operating results and financial condition could be adversely affected by any of the following specific risks. In addition to the risks described below, we may encounter risks that are not currently known to us or that we currently deem immaterial, which may also impair our business operations.

The Partnership is a recently formed entity with a limited operating history and no assurance of success.

The Partnership is a recently formed entity and we have generated no revenues. Our future operating results will depend on many factors, including our ability to raise adequate working capital, demand for our loan products, the level of our competition and our ability to attract and maintain key management and employees. Our ability to continue as a going concern is dependent upon our ability to raise additional capital from the sale of Interests and, ultimately, the achievement of significant operating revenues. If we are unable to continue as a going concern, you may lose your investment. You should not invest in this offering unless you can afford to lose your entire investment.

| 9 |

| Table of Contents |

We currently have not issued any commitments to make any Mortgage Loans or have no Properties under contract and those commitments or contracts we place may not be consummated.

We do not have any commitments outstanding to fund any Mortgage Loans. We do not have any Properties under contract.

We have no established investment criteria limiting the geographic concentration of our investments in Mortgage Loans.

Our Mortgage Loans may be concentrated in a limited number of geographic locations, and certain Mortgage Loans in which we invest may be secured by a single property or properties in a limited number of geographic locations. We plan to have our investment activities take place in the United States. Any weakness of economic conditions in the areas where we have a geographic concentration of mortgage loans may have a material adverse effect on our financial condition.

Our Mortgage Loans may carry the risks associated with significant geographical concentration. Therefore, it is likely that we will establish a plan in the future to limit our exposure to geographical concentration risk. If our loans are overly concentrated in certain geographic areas and become exposed to significant declines in general economic conditions in those areas, caused by inflation, overbuilding of commercial properties, recession, relocations of businesses outside the area, acts of terrorism, outbreak of hostilities or other international or domestic occurrences, unemployment, changes in securities markets or other factors could impact these local economic conditions. A deterioration of economic conditions in the geographic area in which our Mortgage Loans may be concentrated could have an adverse effect on our business, including limited the ability of tenants to pay rent, reducing the demand for new financings, limiting the ability of customers to pay financed amounts and reducing the value of our Properties and the value of the collateral securing our Mortgage Loans.

We need a substantial amount of liquidity to operate our business.

We may not be able to obtain sufficient funding for our future operations from internally generated cash flows and sales of debt, in addition to, possible funding from commercial banks, or other sources. We are a newly formed entity and our access to the capital markets and commercial bank financing may be impaired due to a lack of operating history and established earnings. As a consequence, our results of operations, financial condition and cash flows will be materially and adversely affected by our general and administrative expenses.

| 10 |

| Table of Contents |

We require a substantial amount of cash liquidity to operate our business. Among other things, we use such cash liquidity to:

|

|

· | Acquire Real Property Loans; satisfy working capital requirements and pay operating expenses; |

|

|

· | pay taxes; and |

|

|

· | pay interest expense. |

We attempt to match the maturities of our funding obligations with the estimated holding periods of our investments. There can be no assurance that we will be successful in being able to fund our Mortgage Loans with match maturity funding.

We will have fewer funds available for investments and our profitability will be reduced if we pay distributions to Limited Partners from sources other than our cash flow from operations.

We may pay distributions to Limited Partners from any source, including offering proceeds, borrowings, or sales of assets. We have not placed a cap on the use of proceeds to fund distribution payments. We intend to pay distributions to Limited Partners from cash flow from our operations. Until the proceeds from this offering are fully invested and from time to time during the operational stage, however, we may not generate sufficient cash flow from operations to pay distributions. If we pay distributions from sources other than our cash flow from operations, we will have fewer funds available for investments, and our profitability may be reduced.

Payment of fees, distributions and expense reimbursements to the General Partner and its affiliates will reduce cash available for investment and for distribution to our limited partners.

The General Partner and its affiliates perform services for us in connection with the offer and sale of our Interests, the primary source of our mortgage loan inventory, the management and servicing of our investments, and administrative and other services. These fees, distributions and expense reimbursements are substantial and reduce the amount of cash available for investment and distribution to our limited partners.

Our Results of Operations May Be Impaired if we fail to comply with regulations.

Failure to materially comply with all laws and regulations applicable to us could materially and adversely affect our ability to operate our business. Our business is subject to numerous federal and state laws and regulations, which, among other things:

|

|

· | require disclosures to our customers; |

|

|

· | define our rights to foreclose and sell real estate; and |

|

|

· | maintain safeguards designed to protect the security and confidentiality of customer information. |

| 11 |

| Table of Contents |

We believe that we are in compliance in all material respects with all such laws and regulations, and such laws and regulations have had no material adverse effect on our ability to operate our business. However, we may be materially and adversely affected if we fail to comply with:

|

|

· | applicable laws and regulations; |

|

|

· | changes in existing laws or regulations; |

|

|

· | changes in the interpretation of existing laws or regulations; or |

|

|

· | any additional laws or regulations that may be enacted in the future. |

Government intervention, legislation and regulations may limit our ability to implement certain strategies or manage certain risks.

The pervasive and fundamental economic disruptions that the global financial markets have and may continue to undergo have led to extensive and unprecedented governmental intervention. Such intervention has in certain cases been implemented on an emergency basis, suddenly and substantially eliminating market participants’ ability to continue to implement certain strategies or manage the risk of their outstanding positions. It is impossible to predict what, if any, additional interim or permanent governmental restrictions may be imposed on the markets and the effect of such restrictions on us and our results of operations. Significantly increased regulation of the financial markets could have a material impact on our operating results and financial condition.

The earnings and growth of the lending industry and ultimately of the Partnership are affected by the monetary and credit policies of governmental authorities, including the Board of Governors of the Federal Reserve System. An important function of the Federal Reserve System is to regulate the national supply of credit in order to control recessionary and inflationary pressures. Among the instruments of monetary policy used by the Federal Reserve System to implement these objectives are open market operations in U.S. Government securities, changes in the federal funds rate, changes in the discount rate of member bank borrowings, and changes in reserve requirements against member bank deposits. These means are used in varying combinations to influence overall growth of bank loans, investments and deposits and may also affect interest rates charged on loans or paid for deposits. The monetary policies of the Federal Reserve System have had a significant effect on the operating results of lending institutions in the past and are expected to continue to have such an effect in the future. In view of changing conditions in the national economy and in the money markets, as well as the effect of actions by monetary and fiscal authorities, no prediction can be made as to possible future changes in interest rates or loan demand or their effect on our business and earnings.

The Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”) mandates the most wide-ranging overhaul of financial industry regulation in decades. The Dodd-Frank Act was signed into law on July 21, 2010. The law provides a regulatory framework and requires that regulators, some of which are new regulatory bodies created by Dodd-Frank, draft, review and approve more than 200 implementing regulations and conduct numerous studies that are likely to lead to more regulations. At this time, it is difficult to predict the extent to which the Dodd-Frank Act will affect our business.

| 12 |

| Table of Contents |

Our Mortgage Loan investments may be subject to regulation by federal, state and local authorities and subject to various laws and judicial and administrative decisions. We may determine not to make or invest in Mortgage Loans in any jurisdiction in which we believe we have not complied in all material respects with applicable requirements. If we decide not to make or invest in Mortgage Loans in several jurisdictions, it could reduce the amount of income we would otherwise receive.

We believe that legislative, judicial and administrative changes will likely occur in the future and may take effect retroactively. Federal and state legislatures may consider bills with respect to the regulation of financial institutions changing the financial services industry. Compliance with these new laws and regulations may be costly and can affect our operating results. Compliance requires forms, processes, procedures, controls and the infrastructure to support these requirements. Compliance may create operational constraints and place limits on pricing. Laws in the financial services industry are designed primarily for the protection of consumers. It is possible that the U.S. Congress and/or state legislatures may adopt additional laws, including licensing laws, to govern lenders such as BridgeWell Capital LLC, our primary source of mortgage loan investments. Although we believe that we are currently in compliance with statutes and regulations applicable to our business, there can be no assurance that we will be able to maintain compliance with existing or future governmental regulations. A failure by us to qualify for any such license or to comply with such new requirements could subject us to additional regulatory scrutiny and/or an inability to continue our lending business. The failure to comply could result in significant statutory civil and criminal penalties, monetary damages, attorneys’ fees and costs, possible revocation of licenses and damage to reputation, brand and valued customer relationships.

Our results of operations may be impaired if we experience unfavorable litigation results.

We operate in a litigious society and currently are, and may in the future be, named as defendants in litigation. In some cases there will be no clear legal precedent, which increases the difficulty in predicting both the potential outcomes and costs of defending cases. We are subject to investigations, inquiries, litigation, and other actions by government bodies relating to our activities. The litigation and regulatory actions to which we are or may become subject involve or may involve potential compensatory or punitive damage claims, fines, sanctions or injunctive relief that, if granted, could require us to pay damages or make other expenditures in amounts that could have a material adverse effect on our financial position and our results of operations. We will record loss contingencies in our financial statements only for matters on which losses are probable and can be reasonably estimated. Our assessments of these matters involve significant judgments, and may change from time to time. Actual losses incurred by us in connection with judgments or settlements of these matters may be more than our associated reserves. Furthermore, defending lawsuits and responding to governmental inquiries or investigations, regardless of their merit, could be costly and divert management’s attention from the operation of our business.

| 13 |

| Table of Contents |

While we intend to vigorously defend ourselves against such proceedings, there is a chance that our results of operations, financial condition and cash flows could be materially and adversely affected by unfavorable outcomes.

Negative publicity associated with litigation, governmental investigations, regulatory actions, and other public statements could damage our reputation.

From time to time there are negative news stories about the lending industry. Such stories may follow the announcements of litigation or regulatory actions involving us or others in our industry. Negative publicity about our alleged or actual practices or about our industry generally could adversely affect our business operations and our ability to retain and attract employees.

Our results of operations may be impaired if we experience problems with our accounting or collection systems or third parties that provide these services.

We are dependent on our accounting systems, collection systems and third parties to provide these services to service our portfolio of Mortgage Loans. Such systems are vulnerable to damage or interruption from natural disasters, power loss, telecommunication failures, terrorist attacks, computer viruses and other events. A number of our systems are not redundant, and our disaster recovery planning is not sufficient for every eventuality. Our systems are also subject to break-ins, sabotage and intentional acts of vandalism by internal employees and contractors as well as third parties. Despite any precautions we may take, such problems could result in interruptions in our services, which could harm our reputation and financial condition. We do not carry business interruption insurance sufficient to compensate us for losses that may result from interruptions in our service as a result of system failures. Such systems problems could materially and adversely affect our results of operations, financial conditions and cash flows.

Our results of operations may be impaired if our Lender is unable to successfully compete with its competitors.

The real estate lending and investment business is highly competitive. Our Lender competes with a number of national, regional and local real estate lending and investment companies that include private real estate lenders and investors, commercial banks, credit unions, real estate investment trusts, insurance companies, private investment funds, hedge funds and specialty investment companies. Many of our Lender’s competitors and potential competitors possess substantially greater financial, marketing, technical, personnel and other resources than we do, including greater access to capital markets and to other funding sources which may be unavailable to us. In addition, the number of entities and the amount of funds competing for suitable investments may increase. Moreover, our future profitability will be directly related to the availability and cost of our capital relative to that of our competitors. There can be no assurance that we will be able to continue to compete successfully and, as a result, we may not be able to make or acquire Mortgage Loans at prices and with terms acceptable to us.

| 14 |

| Table of Contents |

We will compete with numerous other persons seeking to attract tenants to Property we may acquire through foreclosure or deed in lieu of foreclosure. These persons or entities may have greater experience and financial strength than us. There is no assurance that we will be able to attract tenants on favorable terms, if at all. For example, our competitors may be willing to offer space at rental rates below the Partnership’s rates, causing it to lose existing or potential tenants and pressuring it to reduce its rental rates to retain existing tenants or convince new tenants to lease space at its Properties.

Risks Associated With Mortgage Loans

Leases on our Properties or properties securing our Mortgage Loans may not be renewed on favorable terms.

The properties securing our Mortgage Loans could be negatively impacted by deteriorating economic conditions and weaker rental markets. Upon expiration or earlier termination of leases on these properties, the space may not be re-let or, if re-let, the terms of the renewal or re-letting (including the cost of required renovations or concessions to tenants) may be less favorable than past or current lease terms. In addition, poor economic conditions may reduce a tenants’ ability to make rent payments under their leases. Any of these situations may result in extended periods where there is a significant decline in revenues or no revenues generated by these properties. Additionally, if market rental rates are reduced, property-level cash flows would likely be negatively affected as existing leases renew at lower rates. Our operating cash flow could be adversely affected if the leases for these properties cannot be renewed for all or substantially all of the space at these properties, or if the rental rates upon such renewal or re-letting are significantly lower than expected.

Our investments may be illiquid and we may not be able to vary our portfolio in response to changes in economic and other conditions.

In the event we decide to sell some of our Mortgage Loans, we may not be able to sell our Mortgage Loans at a price we deem satisfactory, in our sole discretion, for several reason that would include, but not be limited to: if economic conditions deteriorate, interest rates increase, our Mortgage Loans are in default or if buyers of our Mortgage Loans believe that our Mortgage Loans are not adequately secured. A market to sell our Mortgage Loans does not exist and one is not expected to develop. As a result, our ability to vary our Mortgage Loan portfolio in response to changes in economic and other conditions may be limited.

| 15 |

| Table of Contents |

Real property is an illiquid investment. We may be unable to adjust our Property portfolio in response to changes in economic or other conditions. In addition, the real estate market is affected by many factors, such as general economic conditions, availability of financing, interest rates and other factors, including supply and demand, that are beyond our control. We cannot predict whether we will be able to sell any Property for the price or on the terms set by us, or whether any price or other terms offered by a prospective purchaser would be acceptable to us. We cannot predict the length of time needed to find a willing purchaser and to close the sale of a Property.

We may be required to expend funds to correct defects or to make improvements before a Property can be sold. We cannot assure you that we will have funds available to correct such defects or to make such improvements.

In acquiring a real property, we may agree to restrictions that prohibit the sale of that real property for a period of time or impose other restrictions, such as a limitation on the amount of debt that can be placed or repaid on that real property. Our real properties may also be subject to resale restrictions.

Our Mortgage Loans are subject to the risks typically associated with real estate.

Our Mortgage Loans are generally directly or indirectly secured by a lien on real property (or the equity interests in an entity that owns real property) that, upon the occurrence of a default on the Mortgage Loan, could result in our taking ownership of the property. The values of the properties may change after the dates of origination or acquisition of those Mortgage Loans. If the values of the underlying properties drop, our risk will increase because of the lower value of the security associated with such Mortgage Loans. In this manner, real estate values could impact the values of our Mortgage Loans.

We are subject to regulatory and public policy risks, which could affect the values of the properties that secure our Mortgage Loans.

Decisions of federal, state and local authorities may affect the values of properties that secure our Mortgage Loans. Examples of these decisions include, without limitation, zoning changes, revocation or denial of sanitation, utility and building permits, condemnations, relocations of public roadways, changes in municipal boundaries, changes in land use plans, modifications of parking or access requirements, and changes in permitted uses. Also, shifts in public policy reflected by courts, legislatures or other regulatory authorities may affect provisions of security documents and make realization upon the collateral more time-consuming and expensive. Any of these decisions or changes could cause us to recognize a loss on property securing a Mortgage Loan, which could adversely affect our financial condition and results of operations.

| 16 |

| Table of Contents |

Our Mortgage Loans could be subject to delinquency, foreclosure and loss, which could result in losses to us.

We specialize in lending money to higher risk projects, projects that require repositioning to obtain the value in the pro-forma or are to be built to realize value. Such loans entail a higher risk of non-performance, higher delinquencies and higher losses than real estate loans made on stabilized projects. While we believe that our pricing of our Mortgage Loans and the underwriting criteria and collection methods we employ enable us to control, to a degree, the higher risks inherent in lending to higher risk projects, no assurance can be given that such pricing, criteria and methods will afford adequate protection against such risks.

The ability of a borrower to repay a loan secured by an income producing property typically is dependent primarily upon the successful operation of such property rather than upon the existence of independent income or assets of the borrower. If the net operating income of the property is reduced, the borrower’s ability to repay the loan may be impaired. Net operating income of an income producing property can be affected many factors including, but not limited to:

|

|

· | tenant mix, |

|

|

· | success of tenant businesses, |

|

|

· | property management decisions, |

|

|

· | property location and condition, |

|

|

· | competition from comparable types of properties, |

|

|

· | changes in laws that increase operating expenses, |

|

|

· | changes in laws that limit rents, |

|

|

· | needs to address environmental contamination of a property, |

|

|

· | occurrence of any uninsured casualty at the property, |

|

|

· | changes in national, regional or local economic conditions, |

|

|

· | changes in specific types of industry conditions, |

|

|

· | declines in regional or local real estate values, |

|

|

· | declines in regional or local rental or occupancy rates, |

|

|

· | increases in interest rates, |

|

|

· | increases in real estate taxes, |

|

|

· | increases in other operating expenses, and |

|

|

· | changes in governmental rules, regulations and fiscal policies, including: |

|

|

o | environmental legislation, |

|

|

o | natural disasters, |

|

|

o | terrorism, |

|

|

o | social unrest, and |

|

|

o | civil disturbances |

| 17 |

| Table of Contents |

Other than interest earned on funds invested in bonds, bank certificates of deposit, money market accounts pending the use for loans and rents earned from tenants, all of our income will be generated from our Mortgage Investments. Thus, a material risk associated with our business is that persons to whom we loan money will fail to repay their Mortgage Loans or will fail to make timely payments to us. We currently do not have any Mortgage Loans placed. We consider numerous factors when deciding whether to call a loan, accept a deed in lieu of foreclosure, foreclose a property or allow a defaulting borrower to continue working through his or her problems while a loan is in default – primarily, the value of the collateral and the amount of the debt, and the plan of the defaulting borrower to repay the debt. In addition, we consider the costs and burdens that would be occasioned by calling the Mortgage Loan, such as bringing suit and/or foreclosing on collateral. There can be no guarantee that our policy of periodically working with defaulting borrowers rather than pursuing collection will not ultimately result in the need to pursue collection or make it less likely that we will not ultimately realize a loss with respect to these Mortgage Loans. It is impossible to predict whether one of our borrowers will default or what impact any one borrower’s default may have on our business.

Our remedies for collecting on a defaulted Mortgage Loan may be inadequate. Our ability to fully recover amounts due under a defaulted Mortgage Loan may be adversely affected by, among other things:

|

|

· | the financial distress or failure of our borrowers; |

|

|

· | adverse changes in the value of the real estate or other property pledged to secure our Mortgage Loans; |

|

|

· | our purchase or origination of a fraudulent Mortgage Loans; misrepresentations made to us by a borrower, broker, bank or other lender from whom we originate or acquire a Mortgage Loan; |

|

|

· | third-party disputes; and/or |

|

|

· | third-party claims with respect to security interests |

These potential future losses may be significant, may vary from current estimates or historical results and could exceed the amount of our reserves from loan losses. We do not maintain insurance covering such losses. In addition, the amount of the provision for loan losses may be either greater or less than the actual future write-offs of the Mortgage Loans relating to that provision. Any of these events could have a material adverse effect on our business.

In the event of default under a Mortgage Loan secured by real estate held by us, it will bear a risk of loss of principal which could have a material adverse effect on us. The amount of loss would be measured by the deficiency between the value of the collateral and the unpaid principal and accrued interest of the Mortgage Loan, in addition to, the expenses relating to foreclosure.

Some of the Mortgage Loans we purchase may be substantially non-recourse. We will only have recourse to the underlying assets (including any escrowed funds and reserves) collateralizing Mortgage Loans made to borrowers without recourse to a guarantor, but recourse to the Borrower (an entity.) In the case of a limited recourse Mortgage Loan, we will realize a loss if the borrower defaults and the underlying asset collateralizing the Mortgage Loan is insufficient to satisfy the outstanding balance of the Mortgage Loan, in addition to, the expenses relating to foreclosure.

Risk of loss is also present when we make recourse Mortgage Loans to borrowers. The value of the borrower’s assets may not be sufficient to repay the full amount of principal and interest due us following a default by the borrower. Further, the value of the borrower’s assets may not be sufficient to repay any deficiency remaining due us following a default by the borrower and the foreclosure or acceptance of a deed in lieu of foreclosure of the underlying asset securing the Mortgage Loan.

| 18 |

| Table of Contents |

Foreclosure of a Mortgage Loan can be an expensive and lengthy process that could have a substantial negative effect on our anticipated return on the foreclosed Mortgage Loan secured by real estate. In the event of the bankruptcy of a borrower, the Mortgage Loan to such borrower secured by real estate will be deemed to be secured only to the extent of the value of the mortgaged real estate at the time of bankruptcy (as determined by the bankruptcy court), and the lien securing the Mortgage Loan will be subject to the avoidance powers of the bankruptcy trustee or debtor-in-possession to the extent the lien is unenforceable under state law.

Variable rate Mortgage Loans may entail greater risk of default than fixed rate Mortgage Loans.

Variable rate Mortgage Loans may contribute to higher delinquency rates. Borrowers with variable rate Mortgage Loans may be exposed to increased monthly payments if interest rates increase. This increase in the borrowers’ monthly payment will increase the risk of default and the possibility that we will be required to foreclose.

Larger Mortgage Loans Result in Less Diversity and May Increase Risk

As a general rule, we can decrease risk of loss from delinquent Mortgage Loans by investing in a greater total number of Mortgage Loans. Investing in fewer, larger Mortgage Loans generally decreases diversification of the portfolio, increases risk of loss and possible reduction of our profitability in the case of a delinquency of such a Mortgage Loan. However, since larger Mortgage Loans generally will be made on better projects with better borrowers, we may determine, from time to time, that a relatively larger Mortgage Loan is advisable for us, particularly, when smaller Mortgage Loans that are appropriate for investment by us are not available.

Our underwriting standards and procedures may be more lenient than those used by conventional lenders, which exposes us to a greater risk of loss than conventional lenders.

Our underwriting standards and procedures may be more lenient than conventional lenders in that we may not require our borrowers to meet the credit standards that conventional mortgage lenders impose, which may create additional risks to your investment. We may not require a very high credit report score, we may choose to ignore a borrower’s debt to income ratio and we may be more lenient regarding a borrower’s or guarantor’s past problems than other lending institutions. We approve Mortgage Loans more quickly than other lenders. Generally, we will not spend more than 30 days assessing the character and credit history of a borrower. Due to the nature of Mortgage Loan approvals, there is a risk that the credit inquiry we perform will not reveal all material facts pertaining to the borrower and the collateral securing the Mortgage Loan. Furthermore, when the needs of the borrower dictate, we may spend substantially less than 30 days to evaluate Mortgage Loan opportunities. These factors may increase the risk that our borrowers will default under their Mortgage Loans, which may impair our ability to meet our debt obligations. Furthermore, our assessment of the quality of the Mortgage Loans we originate may be inaccurate. An incorrect analysis with respect to one or more of our Mortgage Loans could have a materially adverse impact on our profitability. Additionally, if our analysis is wrong with respect to a Mortgage Loan and we are forced to proceed against the collateral securing that Mortgage Loan, we may not recover the full amount outstanding under the Mortgage Loan. The foregoing factors could cause you to lose all or part of your investment.

| 19 |

| Table of Contents |

There are a number of factors which could adversely affect the value of such real property security, including, among other things, the following:

|

|

1. | The Partnership will primarily rely on affiliated third-party lenders such as BridgeWell Capital LLC to conduct an assessment or appraisal of value to determine the fair market value of real property used to secure Mortgage Loans purchased by the Partnership. No assurance can be given that such appraisals will, in any or all cases, be accurate. Moreover, since an appraisal fixes the value of real property at a given point in time, subsequent events could adversely affect the value of real property used to secure a Mortgage Loan. Such subsequent events may include general or local economic conditions, neighborhood values, interest rates, new construction, changes in applicable zoning laws and other restrictions. |

|

|

2. | If the borrower defaults, the Partnership may be forced to purchase the property at a foreclosure sale. If the Partnership cannot quickly sell such property, and the property does not produce any significant income, the Partnership’s profitability will be adversely affected. |

|

|

3. | The laws of the state in which the property is located and the manner in which the Partnership’s security interest in the security is enforced may preclude the Partnership from recovering any deficiency from the borrower if the real property security proves insufficient to repay amounts owing to the Partnership. |

|

|

4. | Partnership’s loans may be secured by junior deeds of trust, which are subject to greater risk than first Mortgage Loans. |

|

|

5. | The recovery of sums advanced by the Partnership in making Mortgage Loans and protecting its security may also be delayed or impaired by the operation of the federal bankruptcy laws or by irregularities in the manner in which the Mortgage Loans was made. A foreclosure sale may be delayed by the filing by the borrower of a petition in bankruptcy, which automatically stays any actions to enforce the terms of the loan. The length of the delay and the costs associated therewith may have an adverse impact on the Partnership’s profitability. If a Mortgage Loan is secured by hypothecated notes, then a bankruptcy filing by one of the borrowers under the hypothecated notes can weaken the value of the Partnership’s security for its Mortgage Loans and/or delay or impair the borrower’s collections on or enforcement efforts with respect to such hypothecated notes, even if the borrower under the Mortgage Loan is not in bankruptcy. |

| 20 |

| Table of Contents |

We will rely on information provided by others which may prove inaccurate, incomplete or intentionally false.

The success of our Real Property Investments will depend, among other things, on an accurate assessment of the creditworthiness of the borrower and the underlying value of the real property securing the Mortgage Loan, or the value of the hypothecated notes and the real property securing the hypothecated notes, or the accurate assessment of the value of the Property acquisition. While the General Partner will make an investigation regarding the real property security and the borrower, it will rely to some extent on third parties such as credit agencies, appraisers, real estate brokers, title companies, environmental consultants and the borrower itself to provide the information upon which the General Partner will base its decision to make a Mortgage Loan or Property acquisition. While the General Partner will do its best efforts to verify the stated income of the borrower, the accuracy of financial statements, federal or state income tax returns, bank and savings account balances, retirement accounts balances or any records relating to past bankruptcy and legal proceedings, the accuracy of property or tenant financial statements, federal or state income tax returns, appraisals, surveys, title searches, environmental reports or other property due diligence reports, there is no guarantee that this information will be accurate. You may lose all or part of your investment in the Partnership Interest if Partnership, the General Partner or you rely on false, misleading or unverified information supplied by a borrower or seller in a decision to close on the acquisition or origination of a Mortgage Investment.

We permit prepayment of Mortgage Loans.

Most of the loans purchased by the partnership will not have a minimum interest fee. Prepayment of Mortgage Loans purchased by us may lower our profitability, especially during periods when interest rates are declining. We may not be able to reinvest the prepaid funds in new Mortgage Investments that provide us with a yield equivalent or greater than the interest rate we were earning on the Mortgage Loan that was prepaid to us.

Our use and estimate of the “as completed” value of a Property underlying a Mortgage Loan may increase the risk that we may not be able to fully collect the amounts due under that Mortgage Loan.

Traditional commercial lenders typically limit loan amounts to a percentage of the estimated market value of the property securing the loan at the time a loan is made. When we make a Mortgage Loan, the loan-to-value ratio is based on what we believe the value of the property will be once the project is developed in accordance with the borrower’s construction, renovation and development plan. We refer to this value as the “as completed” value, and our Mortgage Loans have a LTV of no more than 80% of the “as completed” value net of selling costs. In each case, the LTV is based both on external sources of information, such as third-party valuations of the constructed or renovated property, and on our subjective valuation of the property. Our beliefs are based on various factors that are unpredictable, such as the future real estate market, , and our review of comparable properties among other completed projects in the market area. Our estimate of the “as completed” value may prove to be inaccurate, such that the value of our collateral is less than what we anticipated. Moreover, a borrower may fail to develop, construct or renovate (or fully develop, construct or renovate) a property, which could also cause the value of our collateral to be less than what we anticipated. In such cases, if a borrower were to default under a Mortgage Loan and/or we were forced to foreclose on the property securing a Mortgage Loan, we may not recover the full amount owed to us and our allowance for loan losses may prove to be insufficient to absorb our actual losses. Accordingly, our use of the “as completed” to establish the loan-to-value ratio, as opposed to using the value of the undeveloped, unconstructed or un-renovated property, increases the risks associated with our lending business, which, if realized, could materially and adversely impact our financial condition and results of operations.

| 21 |

| Table of Contents |

Many of the loans we make will have a balloon payment feature, which presents additional risks to investors and could have a material and adverse impact on our financial condition.

A loan with a balloon payment feature contemplates a large payment of principal at the maturity of the loan, with small or no principal payments during the term of the loan. Loans with balloon payment features are riskier than loans with regular scheduled payments of principal because the borrower’s ability to repay the loan at maturity generally depends on its ability to refinance the loan or sell the underlying property at a price that equals or exceeds the amount due under the loan. A substantial period of time may elapse between the time the Mortgage Loan is made and the time the Mortgage Loan matures, and the borrower’s financial condition at those times may significantly change or the market for replacement loans or the sale of the property may significantly deteriorate. As a result, there can be no assurance that our borrowers will have sufficient resources to make balloon payments when due.

Some of our Mortgage Loans will not be secured by first mortgages. Our intention is to primarily invest in first mortgages. We may acquire higher risk loans including second, third and wraparound mortgages, loans secured by leasehold interests, participation loans, B-Notes,preferred equity real estate investments and subordinated notes.

We may invest in mezzanine loans that take the form of subordinated loans secured by second mortgages on the underlying real property or loans secured by a pledge of the ownership interests of the entity owning the real property. These types of investments involve a higher degree of risk than senior mortgage lending secured by income producing real property because the investment may become unsecured as a result of foreclosure by the senior lender. Our mezzanine loan will be satisfied only after the senior debt has been paid in full, in the event the borrower defaults or declares bankruptcy. And, we may not have full recourse to the assets of a pledged entity, or the assets of the pledged entity may not be sufficient to satisfy our mezzanine loan, in the event of borrower bankruptcy when the borrower has pledged its ownership interests as security. In addition, mezzanine loans generally have higher loan to value ratios than conventional loans secured by real estate, resulting in less equity margin to absorb a decrease in property value and increasing the risk of loss.

Mortgage Loans secured by second, third and wraparound mortgages may be more risky than Mortgage Loans secured by first deeds of trust or first mortgages because they are in a subordinate position in the event of default. There could also be a requirement to cure liens of a senior loan holder and, if not done, we would lose our entire interest in the Mortgage Loan.

Mortgage Loans secured by a leasehold interest are riskier than Mortgage Loans secured by real property because the Mortgage Loan is subordinate to the lease between the property owner and the borrower, and our rights in the event the borrower defaults are limited to stepping into the position of the borrower under the lease, subject to its requirements of rents and other obligations during the period of the lease.

| 22 |

| Table of Contents |

We may enter into agreements, including shared appreciation mortgages, with our borrowers providing for our participation in the equity or cash flow of from a secured property. If a borrower defaults and claims that this participation makes the Mortgage Loan comparable to equity in a joint venture, we may lose our secured position as lender in the property. Other creditors of the borrower might then wipe out or substantially reduce our investment. We could also be exposed to the risks associated with being an owner of real property. We are presently not involved in any such arrangements.

If a third party were to assert successfully that our Mortgage Loan was actually a joint venture with the borrower, there might be a risk that we could be liable as joint venture for the wrongful acts of the borrower toward the third party.

We may invest in B-Notes. A B-Note is a loan typically (i) secured by a first mortgage on a single large commercial property or group of related properties and (ii) subordinated to an A-Note secured by the same first mortgage on the same collateral. There may not be sufficient funds remaining for B-Note holders after payment to the A-Note holders if the borrower defaults. Since each transaction is privately negotiated, B-Notes can vary in their structural characteristics and risks, therefore, we cannot predict the terms of each B-Note investment. The rights of holders of B-Notes to control the process following a borrower default may be limited in certain investments. B-Notes may represent a higher risk of loss to us due to being subordinated to an A-Note and due to terms that may include a restriction of B-Note holders to exercise their remedies without the consent of other upon a default by the borrower.

We may invest in subordinated Mortgage Loans secured by real estate. A Mortgage Loan by us that is subordinated will only be satisfied after the senior debt is paid in full, in the event the borrower defaults on the Mortgage Loan made by us or on the debt senior to our Mortgage Loan, or if the borrower declares bankruptcy. We may suffer a loss of principal and interest if a borrower defaults on a subordinated Mortgage Loan and lacks sufficient assets to repay the Mortgage Loan. In the event a borrower declares bankruptcy, we may not have full recourse to the assets of the borrower, or the assets of the borrower may not be sufficient to satisfy the Mortgage Loan.

We may invest in preferred equity issued by a borrower that owns real estate or operates a loan fund. An investment in preferred equity will only be satisfied after all the secured and unsecured debt is paid in full, in the event the borrower sells its real estate or becomes subject to a foreclosure; and after other creditor remedies, following a default or declares bankruptcy. We may suffer a loss of principal and interest if a borrower lacks sufficient assets to repay the preferred equity investment. In the event a borrower declares bankruptcy, we may not have full recourse to the assets of the borrower, or the assets of the borrower may not be sufficient to satisfy the Mortgage Loan.

Inter-creditor agreements may be entered into between senior and junior creditors both secured by the same property. An inter-creditor agreement with a senior creditor may limit our ability to amend its loan documents, assign its loan, accept prepayments, and exercise our remedies and control decisions made in bankruptcy proceedings relating to the borrower.

Subordinated Mortgage Loans may represent a higher risk of loss to us due to being subordinated to a senior lender and due to restrictive terms relating to inter-creditor agreements that may exist between senior and junior creditors.

| 23 |

| Table of Contents |

Investments in construction and rehabilitation Mortgage Loans may be riskier than loans secured by operating properties.

Construction and rehabilitation Mortgage Loans may be riskier than Mortgage Loans secured by properties with an operating history, because:

|

|

· | the application of the Mortgage Loan proceeds to the construction or rehabilitation project must be assured; |

|

|

· | borrower may experience cost overruns or may not be able to raise the funds necessary to complete construction diminishing the value of the collateral securing the Mortgage Loan; |

|

|

· | construction or rehabilitation may be delayed placing the borrower at risk that it loses a tenant scheduled to take possession of the property because the delay breaches the occupancy provisions of the lease; |

|

|

· | ; and |

|

|

· | The permanent financing or the sale of the property may be impaired by unfavorable market conditions at the completion of the project. |

Cost overruns and non-completion of the construction or renovation of the properties financed by us may materially diminish the value of the real estate securing our Mortgage Loan.

The renovation, refurbishment or expansion of a property by a borrower involves risks of cost overruns and non-completion. Costs of construction or improvements to construct or renovate a property may exceed original estimates, possibly making a project uneconomical. Other risks may include, but are not limited to, unexpected environmental, geological, or governmental risks during construction and leasing or sales risk following completion. If such construction or renovation is not completed in a timely manner, or if its costs are more than expected, the borrower may not be able to complete the project or may experience a prolonged impairment of net operating income and may not be able to pay interest and principal payments. Our mortgage recorded against an uncompleted construction project may also become subject to mechanics liens for unpaid labor and materials furnished to the project.

Cost overruns and non-completion, in addition to other construction and leasing risks, represent substantial risk to the Partnership when it lends for construction, renovation or expansion of a real property. These cost overruns and non-completion of a property can materially diminish the value of the real estate mortgaged to us.

Borrower’s financial status could weaken.

The Partnership will evaluate the creditworthiness of a borrower based on a review of financial information provided by the borrower, and by making other inquiries. However, this financial information and these inquiries will be given and made as of a particular point in time. The financial condition of the borrower could change subsequent to when this financial information and these inquiries are given and made.

Some of our borrowers will experience difficulty in obtaining permanent financing which may reduce our profits.

Many of our borrowers will rely on permanent financing from institutional lenders to repay the Mortgage Loans due us. Due to the volatility in the real estate market and the credit markets, our borrowers may experience difficulty obtaining permanent financing. In addition, a borrower who has failed, or fails in the future, to obtain permanent financing may default on the Mortgage Loans, which could lower our profitability.

| 24 |

| Table of Contents |

Delays in liquidating defaulted Real Property Investments could reduce our investment returns.

Commercial real estate loans are secured by residential or commercial property and are subject to risks of delinquency and foreclosure. The ability of a borrower to repay a Mortgage Loan secured by an income-producing property typically is dependent primarily upon the successful operation of such property rather than upon the existence of independent income or assets of the borrower. If the net operating income of the property is reduced, the borrower’s ability to repay the Mortgage Loan may be impaired. Net operating income of an income-producing property can be affected by, among other things: tenant mix, success of tenant businesses, property management decisions, property location and condition, competition from comparable types of properties, changes in laws that increase operating expenses or limit rents that may be charged, any need to address environmental contamination at the property, the occurrence of any uninsured casualty at the property, changes in national, regional or local economic conditions and/or specific industry segments, declines in regional or local real estate values, declines in regional or local rental or occupancy rates, increases in interest rates, real estate tax rates and other operating expenses, changes in governmental rules, regulations and fiscal policies (including environmental legislation), natural disasters, terrorism, social unrest and civil disturbances.

If there are defaults under our Real Property Investments, we may not be able to foreclose on or obtain a suitable remedy with respect to such investments. Specifically, if there are defaults under Mortgage Loans, we may not be able to repossess and sell the underlying properties quickly. The resulting time delay could reduce the value of our Real Property Investment. For example, an action to foreclose on a property securing a Mortgage Loan is regulated by state statutes and rules and is subject to many of the delays and expenses of lawsuits if the defendant raises defenses or counterclaims. Additionally, in the event of default by a mortgagor, these restrictions, among other things, may impede our ability to foreclose on or sell the mortgaged property or to obtain proceeds sufficient to repay all amounts due to us on the Mortgage Loan.

In the event of any default under a Mortgage Loan held directly by us, we will bear a risk of loss of principal to the extent of any deficiency between the value of the collateral and the principal and accrued interest of the Mortgage Loan, which could have a material adverse effect on our cash flow from operations. Foreclosure of a Mortgage Loan can be an expensive and lengthy process that could have a substantial negative effect on our anticipated return on the foreclosed Mortgage Loan. In the event of the bankruptcy of a Mortgage Loan borrower, the Mortgage Loan to such borrower will be deemed to be secured only to the extent of the value of the underlying collateral at the time of bankruptcy (as determined by the bankruptcy court), and the lien securing the Mortgage Loan will be subject to the avoidance powers of the bankruptcy trustee or debtor-in-possession to the extent the lien is unenforceable under state law.

The foreclosure process for a Mortgage Loan secured by a property we intend on acquiring may be lengthy, costly and we will be subject to all of the risks of owning the property on which we foreclose.

Our Mortgage Loan portfolio is and will be secured by real property. If a borrower defaults under a Mortgage Loan in our portfolio, we may have to foreclose on and take possession of the real estate collateral to protect our financial interest in the Mortgage Loan. Foreclosure of a Mortgage Loan can be an expensive and lengthy process that could have a substantial negative effect on our anticipated return on the foreclosed Mortgage Loan. If we are not able to repossess properties quickly, the resulting time delay could reduce the value of our Real Property Investment. In the event of the bankruptcy of a Mortgage Loan borrower, the Mortgage Loan to such borrower will be deemed to be secured only to the extent of the value of the property at the time of bankruptcy (as determined by the bankruptcy court), and the lien securing the Mortgage Loan will be subject to the avoidance powers of the bankruptcy trustee or debtor-in-possession to the extent the lien is unenforceable under state law.

| 25 |

| Table of Contents |

If we acquire Property by foreclosure following defaults under our mortgage loans, we will have the economic and liability risks inherent in the ownership of real property. Various factors could cause us to realize less than we anticipated or otherwise impose burdens on us that would reduce our profits. These factors include, without limitation, fluctuations in property values, occupancy rates, variations in rental schedules and operating expenses. In addition, owning and selling foreclosed Property may present additional considerations, including:

|

|

· | to facilitate a sale of the Property on which we foreclose, it may be necessary for us to finance all or a portion of the purchase price for the buyer of the Property. In such cases, we will not receive the sale price immediately but will have to rely on the purchaser’s ability to repay the Mortgage Loan, which ability is subject to the same repayment risks that are applicable to any other borrower, as discussed elsewhere in this prospectus. |

|

|

· | There is a risk that hazardous or toxic substances could be found on Properties that we take back in foreclosure. If hazardous or toxic substances are found, we may be liable for remediation costs, as well as for personal injury and property damage. Environmental laws may require us to incur substantial expenses and may materially reduce the affected property’s value or limit our ability to use or sell the affected Property. Any environmental review we undertake before taking title under any foreclosure action on real property may not be sufficient to detect all potential environmental hazards. The remediation costs and any other financial liabilities associated with an environmental hazard could have a material adverse effect on our financial condition and results of operations. |

|

|

· | We may become liable to third persons in excess of the limits covered by insurance to the extent such person or person’s property is injured or damaged while on Property acquired by us through foreclosure. |

|

|

· | Controlling operating expenses such as insurance costs, costs of maintenance and taxes. We may earn less income and reduced cash flows on foreclosed Properties than could be earned and received on Mortgage Loans. |

|

|

· | We may acquire a Property with one or more co-owners where development or sale requires written agreement or consent by all; without timely agreement or consent, we could suffer a loss from being unable to develop or sell the Property. Maintaining occupancy of the Properties. |

|

|

· | Coping with general and local market conditions. |

|

|

· |

Complying with changes in laws and regulations pertaining to taxes, use, zoning and environmental protection. |

| 26 |

| Table of Contents |

We may have difficulty protecting our rights as a lender, which may impair our ability to continue making Mortgage Loans and could have a material adverse impact on our financial condition.