As filed with the U.S. Securities and Exchange Commission on February 5, 2024

Registration No. 333-275773

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

(Exact name of registrant as specified in its charter)

| 8000 | ||||

| (State

or other jurisdiction of incorporation or organization) |

(Primary

Standard Industrial Classification Code Number) |

(IRS

Employer Identification No.) |

EvoAir Holdings Inc.

(Address of principal executive offices, including zip code)

Registrant’s phone number, including area code

Tel.

+

c/o

Cogency Global Inc.

(

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Lawrence S. Venick, Esq. Loeb & Loeb LLP 2206-19 Jardine House 1 Connaught Place Central, Hong Kong SAR Tel: +852.3923.1111 |

John P. Yung Esq. Daniel B. Eng Esq. Lewis Brisbois Bisgaard & Smith LLP 45 Fremont Street, Suite 3000 San Francisco, CA 94105 Tel: (415) 362-2580 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer ☐ | Accelerated Filer ☐ | |

| (Do not check if a smaller reporting company) | Smaller Reporting Company | |

| Emerging Growth Company |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the U.S. Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This Registration Statement contains two prospectuses, as set forth below.

| ● | Public Offering Prospectus. A prospectus to be used for the public offering of [*] shares of common stock of the Registrant (the “Public Offering Prospectus”) through the underwriter named on the cover page of the Public Offering Prospectus. |

| ● | Resale Prospectus. A prospectus to be used for the resale by the selling stockholders set forth therein of [*] shares of common stock of the Registrant (the “Resale Prospectus”). |

The Resale Prospectus is substantively identical to the Public Offering Prospectus, except for the following principal points:

| ● | they contain different outside and inside front covers and back covers; |

| ● | they contain different Offering sections in the Prospectus Summary section beginning on page SS-2; |

| ● | they contain different Use of Proceeds sections on page SS-3; |

| ● | a Selling Stockholder section is included in the Resale Prospectus; |

| ● | a Selling Stockholder Plan of Distribution is inserted; and |

| ● | the Legal Matters section in the Resale Prospectus on page SS-7 deletes the reference to counsel for the underwriter. |

The Registrant has included in this Registration Statement a set of alternate pages after the back cover page of the Public Offering Prospectus (the “Alternate Pages”) to reflect the foregoing differences in the Resale Prospectus as compared to the Public Offering Prospectus. The Public Offering Prospectus will exclude the Alternate Pages and will be used for the public offering by the Registrant. The Resale Prospectus will be substantively identical to the Public Offering Prospectus except for the addition or substitution of the Alternate Pages and will be used for the resale offering by the selling stockholders.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED

PRELIMINARY PROSPECTUS

EVOAIR HOLDINGS INC.

of Shares of Common Stock

This is a firm commitment initial public offering of our shares of common stock, $0.001 par value per share. We anticipate that the initial public offering price of our shares will be between $ [*] and US $[*] per share. The Underwriter is obligated to take and pay for all of the shares if any such shares are taken. We have granted the Underwriter a [*]% over-allotment option, exercisable one or more times in whole or in part, to purchase up to [*] additional common stock from us at the public offering price, less the underwriting discounts, within 45 days from the date of this prospectus to cover over-allotments, if any. If the Underwriter exercises the option in full, the total underwriting discounts payable will be $[*], and the total proceeds to us, before expenses, will be $[*]. We have also agreed to issue to the Representative and its affiliates or employees warrants to purchase a number of common stock equal to 5.65% of the total number of shares of common stock sold in this offering, including any shares issued upon exercise of the underwriters’ over-allotment option.

Our common stock currently is quoted on the OTC Markets – Pink Sheets, operated by OTC Markets Group, under the symbol “EVOH.” The last reported sale price of our common stock on the OTC Markets – Pink Sheets on September 6, 2022 was $5.51 per share. Reported sale price on the OTC Markets – Pink Sheets may not be indicative of prices on a national exchange.

We will apply to list our common stock on the [Nasdaq Capital Market/ NYSE American LLC] under the symbol “EVOH”. There can be no assurance that our application will be approved. The closing of this offering is contingent upon the successful listing of our common stock on the [Nasdaq Capital Market/ NYSE American LLC].

Investing in our common stock is highly speculative and involves a significant degree of risk. See “Risk Factors” beginning on page 12 of this prospectus for a discussion of information that should be considered before making a decision to purchase our common stock.

We are an “emerging growth company” under applicable U.S. Securities and Exchange Commission rules and will be eligible for reduced public company disclosure requirements. See section titled “Prospectus Summary — Implications of Being an ‘Emerging Growth Company’ for additional information.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Price to Public | Underwriting Discount(1)(2) | Proceeds

to us | ||||||||||

| Per Share of Common Stock | $ | $ | $ | |||||||||

| Total | $ | $ | $ | |||||||||

| (1) | See “Underwriting” for additional disclosure regarding underwriting compensation payable by us. |

| (2) | We have also agreed to issue to Network 1 Financial Securities, Inc., as representative of the several underwriters named therein (the “Representative”) warrants to purchase a number of common stock equal to 5.65% of the total number of shares of common stock sold in this offering, including any shares issued upon exercise of the underwriters’ over-allotment option. The registration statement of which this prospectus forms a part also covers the issuance of the representative warrants and shares of our common stock issuable thereunder. See “Underwriting” for additional disclosure regarding underwriting compensation payable by us. |

Delivery of the shares of common stock is expected to be made on or about , 2023.

The date of this prospectus is , 2023.

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus or contained in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We have not, and the Underwriter has not, authorized anyone to provide you with information that is different from that contained in such prospectuses. We are offering to sell shares of our common stock, and seeking offers to buy shares of our common stock, only in jurisdictions where such offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

In this prospectus, we rely on and refer to information and statistics regarding our industry. We obtained this statistical, market and other industry data and forecasts from publicly available information. While we believe that the statistical data, market data and other industry data and forecasts are reliable, we have not independently verified the data.

For investors outside of the United States: neither we nor the Underwriter have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

| 2 |

Conventions That Apply to this Prospectus

Throughout this prospectus, we use a number of key terms and provide a number of key performance indicators used by management. Unless the context otherwise requires, the following definitions apply throughout where the context so admits:

| ● | “dollar,” “USD,” “US$,” or “$” are to U.S. dollars, the legal currency of the United States; and | |

| ● | “RM” and “Ringgit” are to Ringgit Malaysia, the legal currency of Malaysia. |

Any discrepancies in tables included herein between the total sum of amounts listed and the totals thereof are due to rounding. Accordingly, figures shown as totals in certain tables may not be an arithmetic aggregation of the figures that precede them.

In this prospectus, references to “our Company”, “the Company” or “EVOH”) are to EvoAir Holdings Inc. and, unless the context otherwise requires, a reference to “we”, “our”, “us,” “the Company”, “our Company”, “the Group”, “our Group” or “EvoAir Group”) or their other grammatical variations is a reference to our Company and our subsidiaries taken as a whole.

Certain of our customers and suppliers are referred to in this prospectus by their trade names. Our contracts with these customers and suppliers are typically with an entity or entities in the relevant customer or supplier’s group of companies.

Internet site addresses in this prospectus are included for reference only and the information contained in any website, including our website, is not incorporated by reference into, and does not form part of, this prospectus.

| 3 |

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. Because this is only a summary, it does not contain all of the information that may be important to you. You should read this entire prospectus and should consider, among other things, the matters set forth under “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, and our consolidated financial statements and related notes thereto appearing elsewhere in this prospectus before making your investment decision.

Overview

Evoair Holdings Inc. is a corporation established under the corporation laws in the State of Nevada on February 17, 2017. EvoAir Group is an emerging green technology focusing on eco-friendly heating, ventilation, air conditioning (“HVAC”) inventions and efforts in the environmental, social and governance (“ESG”) initiatives. The Group is principally engaged in the research and development (“R&D”), manufacturing, sale and marketing of HVAC products for residential, commercial and industrial uses, operating manufacturing facilities in China and Malaysia totaling approximately 60,000 square feet of manufacturing space.

The use of conventional air-conditioning makes the climate hotter as warmer temperatures lead to more air conditioning, in turn more air conditioning leads to warmer temperatures, resulting in a vicious cycle which lead to global warming. To counter the heat, more and more people are using air-conditioning to find relief. Air conditioning system is becoming a necessity rather than a luxury with the Earth becoming warmer with each passing year. As temperatures increase, so does our dependency on air-conditioners. However, the downside of using conventional air conditioners is that the condensing unit (outdoor unit) release unbearable hot air of approximately 60 degree Celcius, known as waste heat into our already hot atmosphere.

The global dominance of air conditioning is inevitable. According to International Energy Agency (“IEA”) (https://www.iea.org/energy-system/buildings/space-cooling#tracking), there are currently about 2 billion (1.6 billion in 2018) air conditioning units operating worldwide, and by 2050, it is predicted that there will be 5.6 billion units, which amounts to 10 new air-conditioners sold every second for the next 30 years from 2018. The amount of waste heat that will be released into the atmosphere by using air conditioners has an adverse impact on the Earth.

With the growing demand of air-conditioning globally, the amount of waste heat that will be released into the atmosphere by using air conditioners has an adverse impact on the Earth. If the problems posed by the air-conditioners on our environment are not properly addressed, we will see more natural disasters as well as climate crisis, from temperatures will continue to rise; frost season will lengthen; changes in precipitation; more droughts and heat waves; hurricane will become stronger and more intense; sea level will rise 1 to 4 feet by 2100 to artic likely to become ice-free.

EvoAir Group is of the view that one step towards solving the problem presented by conventional air conditioning - and one that does not require a complete overhaul of the modern city and change of people’s lifestyle - would be to build a better and efficient air conditioning system. Besides focusing on improving energy efficiency and reducing dependency on hydrofluorocarbon (“HFC”) as refrigerants advocated by HVAC players, our invention has also addressed another alarming global warming issue resulting from waste heat emission from conventional air-conditioner condensers to the environment.”

With the objective of embracing well-being of mankind through green living and preserving the Earth through green inventions, the Group invented breakthrough technology which redefine air conditioning system. The Group’s HVAC systems focuses on eco-friendly air-conditioning systems utilizing the group’s proprietary granted patent or utility model/ patent or utility model pending Heat Emission Control System (“HECS”) technology including eco-friendly air-conditioner brand, EvoAirTM and eco-friendly portable air-conditioner brand, e-Cond EVOTM.

The Group’s core product, EvoAirTM , is an eco-friendly air-conditioner with granted patent or utility model/ patent or utility model pending HECS proprietary technology, which turns waste heat released by conventional air-conditioner condenser (external unit) into cool and moisturised air at approximately 26oC to 32oC with a humidity of ±60%, operating under outdoor condition, which is optimal for human and living things. The re-engineering of the air-conditioning system has transformed the air-conditioner condenser (external unit) into a supplementary cooling unit or ‘Coolpressor’, which also functions as an air cooler. It also reduces energy consumption of at least 20% compared to conventional air-conditioning units.

With EvoAir Group’s granted patent or utility model/ patent or utility model pending eco-friendly air-conditioner, EvoAirTM , people can now maintain or enhance their lifestyle by enjoying air-conditioning systems both indoor and outdoor, without the sense of guilt of the emission of hot and dry air at ≥55%oC with humidity ≤10% (waste heat) to the environment by conventional air-conditioners, which contribute to global warming and climate change.

The Group also advocates the importance of promoting environmentally friendly technology and creating awareness to the public to play a part in protecting the environment. as well as creating synergy with the Group’s products and brand image. On 5 May 2023, the Company launched ‘Cool the Earth Day’ which marks the birth of the environmental movement for HVAC industry. It was a movement launched by EvoAir Group advocating that (i) everyone can enhance his/her lifestyle through green inventions while preserving the Earth; and (ii) everyone can be the ‘Ambassador of the Earth’ - everyone can do a part, be it in the smallest way in protecting our environment. ‘Cool the Earth Day’ is a movement in line with the Company’s mission to contribute to the Earth and society amidst the alarming global warming and climate change issues confronting the world and its 8 billion population through green inventions and creating awareness. We hope that through this movement, people will raise their awareness that everyone can do a part, be it in the smallest way in protecting our environment. At EvoAir, every member is an Ambassador of the Earth, sharing the same mission of protecting the Earth. The Company believes that everyone around the globe can be an Ambassador of the Earth.

In 2023, the Group collaborated with a university in Malaysia to study the effect of heat generated by outdoor condensing unit of traditional air-conditioning system towards surrounding environment, by studying the effects of air conditioning system on plant growth in a green-house setting. The study concludes that air produced by EvoAirTM outdoor condensing unit, Coolpressor, is lower in temperature and is more environmental friendly and favourable for the growth of green planted compared to hot air produced by conventional air-conditioner outdoor condensing unit. This positive outcome will surely path a new and sustainable direction in term of energy savings. The Group looks to continue embracing such promotions and is committed to creating awareness and promoting environmental sustainability. We envision becoming an international player in HVAC sector focusing on ESG efforts and initiatives in the future. See “Future Strategies” for more information.

The Company is positive towards the outlook of HVAC, in particularly environment friendly HVAC products. According to the statistics report published by the Japan Refrigeration and Air Conditioning Industry Association (“JRAIA”) (https://www.jraia.or.jp) in July 2022, the world’s total air conditioner demand in 2021 is estimated at 110 million, which represent 102% of the world demand in 2020. Looking at the 2021 world demand in terms of Japan, China and other regions, the largest demand is from China, of which demand is estimated to have reached 41.305 million, representing 98% of 2020’s demand. China’s demand accounts for 38% of the total global demand. Next to China, the Asian region (excluding Japan and China) stands at approximately 17.983 million, followed by North America with 16.515 million, Japan with 10.201 million, Europe with 8.885 million and Latin America with 6.547 million.

Our Products

Hybrid Air Conditioners

e-Cond EVOTM

With the objective of embracing well-being of mankind through green living and preserving the Earth through green inventions e-Cond EVOTM is a breakthrough invention building on the research and development (“R&D”) of Dr Low Wai Koon (“Dr. Low”), our Director, Chairman and Chief Executive Officer and his team, it is the Group;s first line of eco-friendly portable air-conditioners under its e-Cond EVOTM brand in 2017.

The unit is an eco-friendly air-conditioning system with patent pending HECS technology, which regulates the temperature and volume of heat transferred from the air-conditioning system into the environment. This product employs an innovative hydro-refrigeration system (“HRS”) integrating evaporative cooling process with refrigeration cycle, reducing temperature of the output air by approximately 30% while achieving an optimal cooling performance of approximately 25 to 28 degree Celsius. The patent pending technology in the unit allows it to utilize substantially lower energy than its traditional air-conditioning units. The portable air-conditioning systems also incorporate ionizer technology producing high concentrations of negative ions to purify the surrounding air of mold spores, pollen, pet dander, odors, cigarette smoke, bacteria, viruses, dust and other hazardous airborne particles.

EvoAirTM

The Group’s core product, EvoAirTM , is a first-of-its-kind eco-friendly air-conditioner with granted patent or utility model/ patent or utility model pending heat emission control system (“HECS”) proprietary technology, which turns waste heat released by conventional air-conditioner condenser (external unit) into cool and moisturised air at approximately 26oC to 32oC with a humidity of ±60%, operating under outdoor condition, which is optimal for human and living things. The re-engineering of the air-conditioning system has transformed the air-conditioner condenser (external unit) into a supplementary cooling unit or ‘Coolpressor’, which also functions as an air cooler. It also reduces energy consumption of at least 20% compared to conventional air-conditioning units. The significant decrease in waste heat and reduction in energy consumption play an important role in reducing harmful effects to the environment, in line with the Group’s mission of producing eco-friendly invention in protecting the Earth.

| 4 |

Air Purifier

E-CondLife

To address the spread of the Covid-19 pandemic which arose during the end of 2019, the EvoAir Group launched a new series of air-sanitizing products during the middle of 2020 under the E-CondLife brand.

The e-CondLife sanitizer system has been certified under the IECEE CB Scheme, while the INCU ionic nano copper solution used by the system has been certified by NSF International (USA) to be compliant with NSF / ANSI60 standards for all applicable requirements. The EvoAir Group has also obtained safety test reports from TUV SUD in Singapore and ICAS Shanghai for Cytotoxicity Testing.

Our Strategies

| We intend to pursue the following strategies in order to further develop and expand our business: | ||

| ○ | Continued investment in research and development in hybrid air-conditioning products | |

| ○ | Continued production of air purifier and air-sanitizing systems | |

| ○ | Geographical expansion- | |

| ○ | Promoting importance of environmental-friendly technology and creating awareness towards environmental sustainability | |

| ○ | Developing and distributing INCZN health supplement |

Our Competitive Strengths

We believe the following competitive strengths contribute to our success and differentiate us from our competitors:

| ● | First mover advantage | |

| ● | Branding with clear alignment to consumer trends | |

| ● | Green technology innovation invention track record and R&D capabilities | |

| ● | Flexible supply chain | |

| ● | Sustainable business model | |

| ● | Industry with rising demand | |

| ● | Visionary founders, management team, board of director with diverse background |

Our Challenges

Our ability to realize our mission and execute our strategies is subject to risks and uncertainties, including those relating to our ability to:

| ● | Respond to a highly competitive market; | |

| ● | Respond to concentration risk of heavy reliance on our largest supplier for the supply of products; | |

| ● | Maintain quality product and value; | |

| ● | Create brand influence; |

Please see “Risk Factors” and other information included in this prospectus for a discussion of these and other risks and uncertainties that we face.

| 5 |

Risk Factors

An investment in our common stock involves a high degree of risk. You should consider and read carefully all of the risks and uncertainties described in “Risk Factors” beginning on page 12, together with all of the other information contained in this prospectus, including our consolidated financial statements and related notes thereto appearing elsewhere in this prospectus, before investing in our common stock. These risks could materially affect our business, financial condition and results of operations and cause the trading price of our common stock to decline. You could lose part or all of your investment. You should bear in mind, in reviewing this prospectus, that past experience is no indication of future performance. You should read “Special Note Regarding Forward-Looking Statements” for a discussion of what types of statements are forward-looking statements, as well as the significance of such statements in the context of this prospectus.

Corporate Structure and History

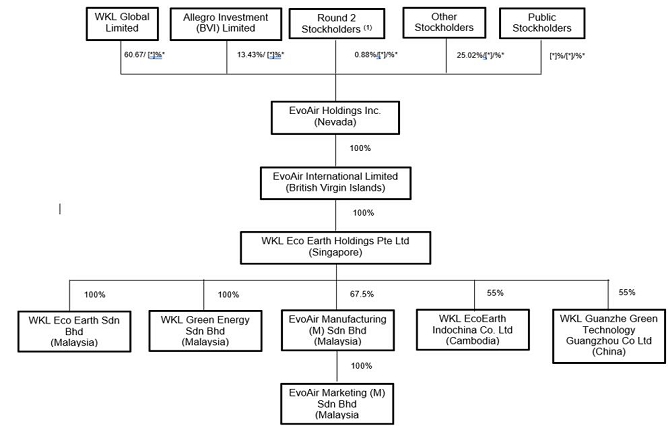

The following diagram illustrates our corporate structure as of the date of this prospectus and after giving effect to this offering:

*Chart shows shareholding before/after the Offering

(1) The Company entered into a series of offerings for an aggregate of up to 6,000,000 shares of Common Stock at a per share purchase price of $2.50. See “Round 2 Stockholders” for additional information.

The above chart assumes an Offering of [*] shares of Common Stock, and assumes that the Underwriters’ over-allotment option has not been exercised.

| 6 |

Details of the Company’s subsidiaries:

| Name | Place and date of incorporation |

Principal activities | Ownership | |||

EvoAir International Limited (“EvoAir International”)

|

British Virgin Islands, November 17, 2021

|

Investment holding. | 100% | |||

| WKL Eco Earth Holdings Pte. Ltd. (“WKL Eco Earth Holdings”) | Singapore, July 12, 2018 | Investment holding and research and development (“R&D”), marketing and sale of eco-friendly heating, ventilation, and air conditioning (“HVAC”) products and related services.

|

100% | |||

| WKL Eco Earth Sdn. Bhd. (“WKL Eco Earth”) | Malaysia, May 17, 2017 | R&D, manufacturing, marketing and sale of eco-friendly HVAC products, and the manufacture and sale of related services as well as food, pharmaceutical products, and orthopaedic goods.

|

100% | |||

WKL Green Energy Sdn Bhd (“WKL Green Energy”)

|

Malaysia, October 24, 2017 | R&D on biotechnology

|

100% | |||

| EvoAir Manufacturing (M) Sdn Bhd (“EvoAir Manufacturing”) | Malaysia, March 22, 2019

|

Holding company, R&D, manufacturing, marketing and sale of eco-friendly HVAC products and related services.

|

67.5% | |||

| WKL EcoEarth Indochina Co. Ltd (“WKL EcoEarth Indochina”) | Cambodia, |

Marketing and sale of eco-friendly HVAC products and related services | 55% | |||

WKL Guanzhe Green Technology Guangzhou Co Ltd (“WKL Guanzhe”)

|

People’s Republic of China, April 6, 2021

|

Manufacturing, marketing and sale of eco-friendly HVAC products and related services | 55% | |||

| Evo Air Marketing (M) Sdn. Bhd. (“Evo Air Marketing”) | Malaysia, February 2, 2021 | Marketing and sale of eco-friendly HVAC products and related services

|

100% |

The Company and its subsidiaries, collectively to be referred to as “EvoAir Group” or the (“Group”).

EvoAir Holdings Inc., (formerly Unex Holdings Inc.) (the “Company”, “EVOH”, “we”, “us”, or “our”) is a corporation established under the corporation laws in the State of Nevada on February 17, 2017.

On December 20, 2021, the Company and Dr. Low entered into a share transfer agreement, (the “EvoAir International Share Transfer Agreement”), pursuant to which Dr. Low agreed to sell all of his ordinary shares of EvoAir International to the Company for the consideration of $100 (“EvoAir Transaction”). EvoAir International, through its subsidiaries upon completion of the Transactions (defined hereunder), is engaged in the R&D, manufacturing, marketing and sale of eco-friendly HVAC products and related services.

Pursuant to the terms of EvoAir International Share Transfer Agreement, Dr. Low, the then sole executive officer and director of the Company and the owner of 2,000,000 restricted shares of Common Stock of the Company, representing approximately 67.34% of the Company’s then issued and outstanding shares of Common Stock, sold his entire shareholding of the Company to WKL Global Limited, a company incorporated in the British Virgin Islands and wholly owned by Dr. Low (“WKL Global”), for an aggregate consideration of $100 (the “Change of Control Transaction”). Upon completion of the Change of Control Transaction, WKL Global owned 2,000,000 shares of Common Stock, or approximately 67.34% of the then issued and outstanding shares of Common Stock of the Company (“EvoAir Shares”), which resulted in a change of control of the Company.

| 7 |

On December 20, 2021, several transactions took place (together, the “Allotment Transactions”) whereby the Company issued and allotted in aggregate 98,809,323 EvoAir Shares to certain parties. On completion of the Allotment Transactions, the total number of issued and outstanding EvoAir Shares were 101,779,323 (“Then Enlarged Share Capital”):

(A) On December 20, 2021, Dr. Low and Chan Kok Wei entered into a share exchange agreement with WKL Eco Earth Holdings, pursuant to which Dr. Low and Chan Kok Wei agreed to sell all their ordinary shares of WKL Green Energy to WKL Eco Earth Holdings in consideration for the allotment and issuance to WKL Global and Allegro Investment (BVI) Limited (“Allegro Investment”), a company incorporated in the British Virgin Islands with 50% shareholding held by Chan Kok Wei and Ong Bee Chen, respectively, of 24,000 EvoAir Shares and 6,000 EvoAir Shares, respectively, or approximately 0.02% and 0.01% of the Then Enlarged Share Capital, respectively.

(B) On December 20, 2021, Dr. Low, Chan Kok Wei, Ong Bee Chen and certain sellers (collectively, the “WKLEE Sellers”) entered into a share exchange agreement with WKL Eco Earth Holdings, pursuant to which the WKLEE Sellers agreed to sell all their ordinary shares, amounting in aggregate, 240,000 shares or 80% shareholding of WKL Eco Earth to WKL Eco Earth Holdings in consideration for the allotment and issuance to WKL Global, Allegro Investment and WKLEE Sellers of 49,320 EvoAir Shares, 8,280 EvoAir Shares and in aggregate 14,400 EvoAir Shares, respectively, or approximately 0.05%, 0.009% and in aggregate 0.014%, respectively, of the Then Enlarged Share Capital.

(C) On December 20, 2021, Tan Soon Hock, Ivan Oh Joon Wern and certain relevant interest holders (“Relevant Interest Holders”) entered into an investment exchange agreement with WKL Eco Earth Holdings, pursuant to which the Tan Soon Hock, Ivan Oh Joon Wern and the Relevant Interest Holders agreed to sell all relevant interests in the EvoAir Group to WKL Eco Earth Holdings in consideration for the allotment and issuance of 7,037,762 shares, 2,520,000 shares and in aggregate 6,001,794 shares, respectively, of the common stock of the Company, or approximately 6.91%, 2.48% and in aggregate 5.90%, respectively, of the issued and outstanding ordinary shares of the Company. The board of directors and majority shareholders of the Company have approved the transaction.

(D) On December 20, 2021, Dr. Low entered into two deeds of assignment of intellectual properties with WKL Eco Earth Holdings, in respect of Dr. Low’s patents relating to eco-friendly air-conditioner condenser (external unit), EvoAirTM and the trademarks described in the deed of assignment thereunder, and in respect of Dr. Low’s patents relating to the portable air-conditioner, e-Cond EVOTM and the trademarks as described in the deed of assignments thereunder (together, the “IP Assignments”). Pursuant to the IP Assignments, WKL Global, Allegro Investment and certain nominees shall be allotted and issued 63,362,756 EvoAir Shares, 14,297,259 EvoAir Shares and in aggregate 5,487,752 EvoAir Shares, respectively or approximately 62.25%, 14.05% and in aggregate 5.39%, respectively of the Then Enlarged Share Capital in consideration for the IP Assignments.

EvoAir Transaction, Change of Control Transaction and Allotment Transactions are collectively to be referred to as the “Transactions”. The closing of the Transactions (the “Closing”) occurred on December 20, 2021 (the “Closing Date”).

From and after the Closing Date, at which time EvoAir International transferred its HVAC business to the Company (“HVAC Business”), the Company’s primary operations consisted of the prior operations of EvoAir International.

EvoAir International is a company incorporated in the British Virgin Islands on November 17, 2021. Effective from the December 20, 2021, it wholly owns WKL Eco Earth Holdings, a company incorporated in Singapore on July 12, 2018, which in turn wholly owns (a) WKL Eco Earth; (b) WKL Green Energy; (c) 67.5% of EvoAir Manufacturing; (d) 55% of WKL EcoEarth Indochina; and (e) 55% of WKL Guanzhe. Evo Air Marketing is a wholly owned subsidiary of EvoAir Manufacturing.

On June 15, 2022, the Company filed a Certificate of Amendment (the “Amendment”) to the Articles of Incorporation with Nevada’s Secretary of State to change the name of the Company from Unex Holdings Inc. to EvoAir Holdings Inc. (the “Name Change”), and the Name Change became market effective on November 4, 2022. Effective on November 11, 2022, the Company’s shares began trading under the new ticker symbol “EVOH”.

On November 21, 2023, the Company issued in aggregate, 52,107 shares of Common Stock to 15 referral agents (“Referral Agents”) in consideration for their referral to the Company of certain investors. Each Referral Agent is a “non-U.S. Persons” as defined in Regulation S.

On November 21, 2023, the Company issued, in aggregate, 5,500 shares of Common Stock to two individuals in consideration for marketing services provided to the Company by Artisan Creative Studio, a marketing entity based in Malaysia. Each of the individuals is a “non-U.S. Persons” as defined in Regulation S.

Round 2 Stockholders

The Company entered into a series of offerings for an aggregate of up to 6,000,000 shares of Common Stock at a per share purchase price of $2.50, as follows:

| ● | On February 15, 2022, the Company entered into certain share subscription agreement with Ms. Ang Lee Kim Jane, who is a “non-U.S. Persons” (the “Investor”) as defined in Regulation S of the Securities Act of 1933, as amended (the “Securities Act”) pursuant to which the Company agreed to issue and sell 74,074 Shares, par value $0.001 per share, at a per share purchase price of $2.50, as part of a series of offerings by the Company for an aggregate of up to 6,000,000 shares of Common Stock at a per share purchase price of $2.50. The gross proceeds was $185,185. | |

| ● | On June 3, 2022, the Company entered into certain share subscription agreement with Mr. Wong Hon Wai who is a “non-U.S. Persons” (the “Investor”) as defined in Regulation S of the Securities Act of 1933, as amended (the “Securities Act”) pursuant to which the Company agreed to issue and sell 5,000 shares, par value $0.001 per share, at a per share purchase price of $2.50, as part of a series of offerings by the Company for an aggregate of up to 6,000,000 shares of Common Stock at a per share purchase price of $2.50. The gross proceeds was $12,500. | |

| ● | On October 25, 2022, the Company entered into Regulation S share subscription agreements with eight investors, each of whom represented that it was a “non-U.S. Persons” as defined in Securities Act. On the same date, the Company entered into Regulation D share subscription agreements with two investors, each of whom represented that it was an “Accredited Investors” as defined in Regulation D of the Securities Act. Pursuant to the share subscription agreements, the Company agreed to issue and sell in aggregate, (i) 129,621 shares of Common Stock, par value $0.001 per share to the Regulation S investors, and (ii) 15,000 shares of Common Stock to the Regulation D investors, respectively par value $0.001 per share, at a per share purchase price of $2.50, as part of a series of offerings by the Company for an aggregate of up to 6,000,000 shares of Common Stock at a per share purchase price of $2.50. The gross proceeds in aggregate were $361,553. | |

| ● | On February 20, 2023, the Company entered into Regulation S share subscription agreements with eleven investors, each of whom represented that it was a “non-U.S. Persons” as defined in Regulation S of the Securities Act. Pursuant to the agreements, the Company agreed to issue and sell in aggregate, (i) 57,783 shares of Common Stock, par value $0.001 per share to the Regulation S investors, at a per share purchase price of $2.50 as part of a series of the private placement offerings by the Company for an aggregate of up to 6,000,000 shares of Common Stock at a per share purchase price of $2.50. The gross proceeds in aggregate was $144,443. | |

| ● | On July 13, 2023, the Company entered into Regulation S share subscription agreements with 31 investors, each of whom represented that it was a “non-U.S. Persons” as defined in Regulation S of the Securities Act. Pursuant to the agreements, the Company agreed to issue and sell in aggregate, (i) 250,132 shares of Common Stock, par value $0.001 per share to the Regulation S Investors, at a per share purchase price of $2.50 as part of a series of the private placement offerings by the Company for an aggregate of up to 6,000,000 shares of Common Stock at a per share purchase price of $2.50. The gross proceeds in aggregate was approximately $625,330. | |

| ● | On September 7, 2023, the Company entered into Regulation S share subscription agreements with 71 investors, each of whom represented that it was a “non-U.S. Persons” as defined in Regulation S of the Securities Act. Pursuant to the agreements, the Company agreed to issue and sell in aggregate, 365,164 shares of Common Stock, par value $0.001 per share to the Regulation S investors, at a per share purchase price of $2.50 as part of a series of the private placement offerings by the Company for an aggregate of up to 6,000,000 shares of Common Stock at a per share purchase price of $2.50. The gross proceeds in aggregate was approximately $912,889. | |

| ● | On November 21, 2023, the Company entered into a Regulation S share subscription agreement with Wong Chun Shoong who represented that he was a “non-U.S. Persons” as defined in Regulation S of the Securities Act. Pursuant to the agreement, the Company agreed to issue and sell in aggregate, 8,658 shares of Common Stock, par value $0.001 per share to the Regulation S investors, at a per share purchase price of $2.50 as part of a series of the private placement offerings by the Company for an aggregate of up to 6,000,000 shares of Common Stock at a per share purchase price of $2.50. The gross proceeds in aggregate was approximately $21,645. |

| 8 |

Corporate Information

Our principal executive office is located at 31-A2, Jalan 5/32A, 6 ½ Miles off Jalan Kepong, 52000 Kuala Lumpur, Malaysia. Our telephone number at this address is +603 6243 3379. Our agent for service of process in the United States is Cogency Global Inc., located at 122 East 42nd Street, 18th Floor, New York, NY 10168. Our website is https://www.evoair.com.my/. The information contained on our website or any third-party websites is not a part of this prospectus.

Implications of Being an “Emerging Growth Company”

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As such, we are eligible, for up to five years, to take advantage of certain exemptions from various reporting requirements that are applicable to other publicly traded entities that are not emerging growth companies. These exemptions include:

| ● | the ability to include only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations disclosure; |

| ● | exemptions from the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended (the “Sarbanes-Oxley Act”), in the assessment of our internal control over financial reporting; |

| ● | to the extent that we no longer qualify as a foreign private issuer, (i) reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and (ii) exemptions from the requirement to hold a non-binding advisory vote on executive compensation, including golden parachute compensation. |

We may take advantage of these provisions until the last day of our fiscal year following the fifth anniversary of the consummation of this Offering or such earlier time that we are no longer an emerging growth company.

As a result, the information contained in this prospectus may be different from the information you receive from other public companies in which you hold shares. We do not know if some investors will find the Shares less attractive because we may rely on these exemptions. The result may be a less active trading market for the Shares, and the price of the Shares may become more volatile.

We will remain an emerging growth company until the earliest of: (1) the last day of the first fiscal year in which our annual gross revenue exceeds $1.235 billion; (2) the last day of the fiscal year following the fifth anniversary of the date of this Offering; (3) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of the Shares that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter; or (4) the date on which we have issued more than $1.00 billion in non-convertible debt securities during any three-year period.

Section 107 of the JOBS Act provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended, or the Securities Act, for complying with new or revised accounting standards. We have elected to take advantage of the extended transition period for complying with new or revised accounting standards and acknowledge such election is irrevocable pursuant to Section 107 of the JOBS Act.

| 9 |

The Offering

| Offering Price | We currently estimate that the initial public offering price will be between US $[*] and US $[*] per share | |

| Common stock offered by us | [*] of shares of common stock (or [*] shares of common stock if the Underwriter exercises its over-allotment option in full) on a firm commitment basis. | |

| Common stock to be outstanding prior to this offering | [*] shares of common stock. | |

| Common stock to be outstanding immediately after this offering | [*] shares of common stock, assuming the sale of all the shares offered in this prospectus, [*] shares if the underwriter exercise the over-allotment in full, excluding shares of common stock underlying the underwriters’ warrants. See “Underwriting – Underwriters’ Warrants”. | |

| Gross proceeds to us, net of underwriting discount but before expenses: | $[*] assuming no exercise of the underwriters’ warrant and full exercise of the over-allotment option. | |

| [Over-allotment option]: | [We have granted to the Underwriter a 15% over-allotment option, exercisable within 45 days from the closing of this offering, to purchase up to an aggregate of [*] additional shares of common stock.] | |

| Use of proceeds | We plan to use the net proceeds of this offering primarily for [*]. For more information on the use of proceeds, see “Use of Proceeds” on page 26. | |

| Lock-up | [We and each of, our officers, directors, and 10% or more stockholders, have agreed with the underwriters, subject to certain exceptions, not to sell, transfer or otherwise dispose of any shares of common stock or similar securities for a period of 180 days after the date of this prospectus. See “Shares Eligible for Future Sale” and “Underwriting” for more information.] | |

| Trading Market | Our common stock currently is quoted on the OTC Markets – Pink Sheets under the symbol “EVOH.” We will apply to list our common stock on [Nasdaq Capital Market/ NYSE American LLC] under the symbol [“EVOH”]. At this time, [Nasdaq Capital Market/ NYSE American LLC] has not yet approved our application to list our common stock. The closing of this offering is conditioned upon [Nasdaq Capital Market/ NYSE American LLC]’s final approval of our listing application, and there is no guarantee or assurance that our common stock will be approved for listing on [Nasdaq Capital Market/ NYSE American LLC]. | |

| Concentration of Ownership | Prior to this offering, our executive officers and directors beneficially own, in the aggregate, approximately [*]% of the outstanding shares of our common stock, which will become approximately [*]% upon completion of this offering assuming the sale of all the shares offered in this prospectus, no exercise of the underwriter’s warrants and full exercise of the over-allotment option. | |

Trading Symbol |

“EVOH” | |

Underwriters’ Warrants |

The registration statement of which this prospectus is a part also registers for sale the underwriters’ warrants to purchase our common stock equal to 5.65% of the total number of shares of our common stock sold in this offering, including the number of shares of common stock upon the exercise of the Underwriters’ over-allotment option, as a portion of the underwriting compensation payable to the Underwriter in connection with this offering. The underwriters’ warrants will be exercisable at any time, will be subject to lock up for 180 days from the date of issuance in accordance with FINRA Rule 5510 and will expire five years from the commencement of sales of this offering. The underwriters’ warrants will be exercisable at a price equal to 125% of the public offering price of share of our common stock sold in the offering. See “Underwriting – Underwriters’ Warrants.” | |

| Risk factors | You should read the “Risk Factors” section of this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our common stock. |

| 10 |

Summary Consolidated Financial Data

EVOAIR HOLDINGS INC.

The following tables summarize our historical consolidated financial data. We have derived the historical consolidated statements of operations data for the years ended August 31, 2023 and 2022 from our condensed consolidated financial statements included elsewhere in this prospectus. The following summary consolidated financial data should be read in conjunction with the respective section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our condensed consolidated financial statements and related notes, and consolidated financial statements and related notes included elsewhere in this prospectus. Our historical results are not necessarily indicative of the results that may be expected in the future, and our results for any interim period are not necessarily indicative of the results to be expected for a full fiscal year.

Consolidated Statements of Operations Data for the:

| Year Ended August 31, | ||||||||

| 2023 | 2022 | |||||||

| Revenue | $ | 388,038 | $ | 1,190,616 | ||||

| Net Loss | (6,317,373 | ) | (5,556,627 | ) | ||||

| Net Loss per share-(basic and diluted) | (0.06 | ) | (0.08 | ) | ||||

Consolidated Balance Sheet Data as of:

| As of | ||||||||

| August 31, 2023 | August 31, 2022 | |||||||

| Total assets | $ | 79,024,358 | $ | 83,109,876 | ||||

| Total liabilities | $ | 1,173,336 | $ | 1,265,397 | ||||

| 11 |

RISK FACTORS

Any investment in our securities involves a high degree of risk. You should carefully consider the risks described below, which we believe represent certain of the material risks to our business, together with the information contained elsewhere in this prospectus, before you make a decision to invest in our shares of Common Stock. Please note that the risks highlighted here are not the only ones that we may face. For example, additional risks presently unknown to us or that we currently consider immaterial or unlikely to occur could also impair our operations. If any of the following events occur or any additional risks presently unknown to us actually occur, our business, financial condition and operating results may be materially adversely affected. In that event, the trading price of our securities could decline and you could lose all or part of your investment.

Risks Related to Our Business and Industry

If we are unable to continue to innovate, meet evolving market trends, adapt to changing customer demands and maintain our culture of innovation, our ability to sustain and grow our business may suffer.

The ongoing success of our business depends on our ability to continue to introduce innovative eco-friendly HVAC products to meet evolving market trends and satisfy changing customer demands. We must continue to adapt by innovating, improving our products and modifying our strategies, which could cause us to incur substantial costs. We may not be able to continue to innovate or adapt to changing market and customer needs in a timely and cost-effective manner, if at all. This could adversely impact our ability to expand our ecosystem and grow our business. Failure to develop new products to meet evolving market demands through innovation could cause us to lose current and potential customers and harm our operating results and financial condition.

In addition, we may not be able to maintain our culture of innovation, which has been critical to our success and has helped us create value for our shareholders, succeed as a leader in eco-friendly HVAC products, attract, retain and motivate employees and other ecosystem participants. Among other challenges, we may not be able to identify and promote people into leadership positions who share our culture and also focus on technology and innovation. Competitive pressure may also cause us to move in directions that may divert us from our mission, vision and values. If we cannot maintain our culture of innovation, our long-term business prospects could be materially and adversely affected.

We are exposed to concentration risk of heavy reliance on our largest nano copper supplier for the supply of nano copper solution for our INCU technology, and any shortage of, or delay in, the supply may significantly impact on our business and results of operation.

We source INCU nano copper solution for incorporation of our INCU technology into our air purifier products for sale to our customers from our largest nano copper supplier. As such, we rely on the ability and efficiency of our largest supplier to supply products. Our purchase from our largest nano copper supplier amounted to approximately $Nil and $315,627 for FYE2023 and FYE 2022, respectively, representing approximately Nil% and 37% of our total purchases, respectively. Our purchases from our top largest supplier accounted for a significant portion of our total purchases for FYE2022.

As we do not engage in manufacturing of nano copper solution, our business, financial condition and operating results for our air purifier system depends on the continuous supply of nano copper solution from our largest supplier and our continuous supplier-customer relationship with them. Our heavy reliance on our largest supplier for the supply of nano copper solution will have significant impact on our air purifier business and results of operation in the event of any shortage of, or delay in the supply. Our product supply may also be disrupted by potential labor disputes, strike action or natural disasters or other accidents affecting our largest supplier. If our largest suppliers do not supply products to us in a timely manner or in sufficient quantities, our business, financial condition and operating results may be materially and adversely affected. Any shortage of, disruption, or delay in the supply, or our inability to obtain supplies from alternative sources will have a significant impact on our business and results of operation.

We entered into distribution agreement with our nano copper solution supplier in September, 2020 and December 2021. As is customary in the supply or sales arrangements, the agreements with our largest supplier are terminable by either party by giving notice. We cannot guarantee that our largest suppliers will not terminate the agreements before the expiry of the agreements. In the event that our largest suppliers terminate the agreements, we will have to source products from other suppliers and we may not be able to secure a similar supply of products with the quantity and quality required to support our business or at all. Such termination may therefore have a material adverse impact on our business, financial condition and operating results if we fail to engage any other suppliers with similar standards before the termination.

There is no assurance that our major nano copper supplier and supplier of raw materials for our other products will continue to supply their products in the quantities and timeframes required by us to meet the demand of our customers or comply with their supply agreements with us. If our major supplier does not supply products to us in a timely manner or in sufficient quantities, our business, financial condition and operating results may be materially and adversely affected. Furthermore, in the event of any delay in delivery of the products to us, our cash flow or working capital may be materially and adversely affected as a result of the corresponding delay in delivery of our products to our customers, and hence the delay in our receipt of payment from our customers.

| 12 |

Furthermore, our largest nano copper supplier may change their existing sales or marketing strategy in respect of the products supplied to us by changing its export strategy, reducing its sales or production volume or changing its selling prices. As a result, there is no assurance that our largest supplier will not appoint other agents, dealers or distributors which may compete with us in the market where we operate. Furthermore, any significant increase in the selling prices of the products which we source from our largest suppliers will increase our costs and may materially and adversely affect our profit margin if we are not able to pass the increased costs on to our customers.

There is no assurance that there will be no deterioration in our relationship with our largest supplier which could affect our ability to secure sufficient supply of products for our business. In the event that our largest supplier change their sales or marketing strategy or otherwise appoints other dealers or distributors who may compete with us, our business, financial condition and operating results may be materially and adversely affected.

We operate in a competitive industry, and if we fail to compete effectively, our business could suffer.

The air-conditioning and air purifying industry in Asia is highly competitive. Competition in our HVAC products includes several multinational, regional and local companies, the largest players of which include Daikin Industries, Gree Electric, Trane Technologies, Johnson Controls, Lennox International, Midea Group and Mitsubishi Electric. Sales depend on price, product availability, delivery schedule, product performance, product line breadth, brand reputation, design, technical expertise and service. In addition to established players, we face competition from new market entrants. Increased competition may lead to a loss of market share, increased difficulty in launching new service offerings, reduction in revenue or increase in loss, any one of which could harm our business, financial condition and results of operations.

In certain of our businesses, our contracts are typically awarded on a competitive basis. Our bids are based upon, among other factors, the cost to timely provide the products and services. To generate an acceptable return, we must accurately estimate our costs and schedule. If we fail to do so, the profitability of contracts may be materially and adversely affected – including because some of our contracts provide for liquidated damages if we do not perform on time – which could have a material adverse effect on our competitive position, results of operations, cash flows or financial condition.

If we are unable to create brand influence, we may not be able to maintain current or attract new users and customers for our products.

Our operational and financial performance is highly dependent on the strength of our brand. We believe brand familiarity and preference will continue to have a significant role in winning over customers. In order to further expand our customer base, we may need to substantially increase our marketing expenditures to enhance brand awareness through various online and offline means. Moreover, negative coverage in the media of our company could threaten the perception of our brand, and we cannot assure you that we will be able to defuse negative press coverage about our company to the satisfaction of our investors, customers and suppliers. If we are unable to defuse negative press coverage about our company, our brand may suffer in the marketplace, our operational and financial performance may be negatively impacted.

Currently, we sell our products, under our various product line brands, to domestic customers in Malaysia and to overseas customers. However, while the management does not consider the likelihood to be high, if our competitors initiate a lawsuit against us for infringing their trademarks, we may be forced to adopt a new brand name for our products. As a result, we may incur additional marketing cost to raise awareness of such new brand name. We may also be ordered to pay a significant amount of damages, and our business, results of operations and financial condition could be materially and adversely affected. We operate in a competitive environment and our profitability and competitive position depend on our ability to accurately estimate the costs and timing of providing our products and services.

| 13 |

Climate change and regulations associated with climate change could adversely affect our business.

The effects of climate change, including extreme weather conditions, create financial risks to our business. The effects of climate change could disrupt our operations by impacting the availability and cost of materials and by increasing insurance and other operating costs. The effects of climate change also may impact our decisions to construct new facilities or maintain existing facilities in the areas most prone to physical risks, which could similarly increase our operating and material costs. We could also face indirect financial risks passed through the supply chain that could result in higher prices for our products and the resources needed to produce them.

There is a general consensus that greenhouse gas emissions are linked to climate change, and that these emissions must be reduced dramatically to avert its worst effects. As a result, increased public awareness and concern about climate change will likely continue to (1) generate more international, regional and/or national concerns and result in the implementation of further requirements and restrictions at international, regional and/or national level to curtail the use of high global warming potential refrigerants (which are essential to many of our products); (2) encourage increase in building energy efficiency; and (3) cause a shift away from the use of fossil fuels as an energy source. While our products are focused on being eco-friendly, these requirements may render some of the existing technology, particularly some of our products that require refrigerant use, non-compliant or obsolete. While we continue to be committed to developing eco-friendly sustainable solutions for our products, there can be no assurance that our development efforts will be successful, that our products will be accepted by the market, that proposed regulations or deregulation will not have an adverse effect on our competitive position, or that economic returns will reflect our investments in new product development.

The inconsistent international, regional and/or national requirements associated with climate change regulations also create economic and regulatory uncertainty. There is also regulatory and budgetary uncertainty associated with government incentives, which, if discontinued, could adversely impact the demand for energy-efficient buildings and could increase costs of compliance.

Our business and financial performance depend on continued and substantial investments in our information technology infrastructure, which may not yield anticipated benefits and which may be vulnerable to cyber-attacks.

The efficient operation of our business requires continued and substantial investments in information technology (“IT”) infrastructure systems. The failure to design, develop and implement new IT technology infrastructure systems in an effective and timely manner or to maintain existing systems could divert management’s attention and resources. Our information systems may also become obsolete because of inadequate investments, requiring an unplanned transition to a new platform that could be time consuming, costly, and damaging to our competitive position and could require additional management attention. Repeated or prolonged interruptions of service because of poor execution, inadequate investments or obsolescence could have a significant adverse impact on our reputation and our ability to sell products and services.

| 14 |

In addition, our business may be impacted by disruptions to our or third-party IT infrastructure, which could result from (among other causes) cyber-attacks, infrastructure failures or compromises to our physical security. Cyber-based risks are evolving and include attacks: (i) on our IT infrastructure (ii) targeting the security, integrity and/or availability of hardware and software; (iii) on information installed, stored or transmitted in our products (including after the purchase of those products and when they are installed into third-party products); and (iv) on facilities or similar infrastructure. Such attacks could disrupt our systems (or those of third parties) and business operations, impact the ability of our products to work as intended or result in the unauthorized access, use, disclosure, modification, or destruction of information in violation of applicable law and/or contractual obligations. We have experienced cyber-based attacks and, due to the evolving threat landscape, may continue to experience them going forward, potentially with more frequency or severity. We continue to make investments and adopt measures to enhance our protection, detection, response and recovery capabilities, and to mitigate potential risks to our technology, products, services, operations and confidential data. However, depending on the nature, sophistication and scope of cyber-attacks, it is possible that potential vulnerabilities could go undetected for an extended period. As a result, we could potentially experience: (i) production downtimes; (ii) operational delays or other detrimental impacts on our operations; (iii) destruction or corruption of data; (iv) security breaches; (v) manipulation or improper use of our or third-party systems, networks or products; and (vi) financial losses from remedial actions, loss of business, liability, penalties, fines and/or damage to our reputation—any of which could have a material adverse effect on our competitive position, results of operations, cash flows or financial condition. Due to the evolving nature of such risks, the impact of any potential incident cannot be predicted. In addition, because of the global nature of our business, our internal systems and products must comply with applicable laws, regulations and standards in a number of jurisdictions, and government enforcement actions and violations of data privacy and cybersecurity laws could be costly or interrupt our business operations. Any disruption to our business arising from such issues, or an increase in our costs to cover these issues that is greater than what we have anticipated, could have an adverse effect on our competitive position, reputation, results of operations, cash flows or financial condition.

We depend on our intellectual property and have access to certain intellectual property and information of our customers and suppliers. Infringement of or the failure to protect that intellectual property could adversely affect our future growth and success.

The Company’s intellectual property rights are important to our business and include numerous patents, trademarks, proprietary technology, technical data, business processes and other confidential information. Although we consider our intellectual property rights in the aggregate to be valuable, we do not believe that our business is materially dependent on a single intellectual property right or any group of them. We nonetheless rely on a combination of patents, trademarks, nondisclosure agreements, customer and supplier agreements, license agreements, information technology security systems, internal controls and compliance systems and other measures to protect our intellectual property. We also rely on nondisclosure agreements, information technology security systems and other measures to protect certain customer and supplier information and intellectual property that we have in our possession or to which we have access. Our efforts to protect such intellectual property and proprietary information may not be sufficient, however.

We cannot be sure that our pending patent applications will result in the issuance of patents, that patents issued to or licensed by us in the past or in the future will not be challenged or circumvented by competitors, or that these patents will found to be valid or sufficiently broad to preclude our competitors from introducing technologies similar to those covered by our patents and patent applications.

In addition, we may be the target of competitor or other third-party patent enforcement actions seeking substantial monetary damages or seeking to prevent the sale and marketing of certain of our products. Our competitive position also may be adversely impacted by limitations on our ability to obtain possession, ownership or necessary licenses concerning data important to the development or sale of our products or service offerings, or by limitations on our ability to restrict the use by others of data related to our products or services. Any of these events or factors could subject us to judgments, penalties and significant litigation costs or temporarily or permanently disrupt our sales and marketing of the affected products or services and could have a material adverse effect on our competitive position, results of operations, cash flows or financial condition.

| 15 |

We use a variety of raw materials and supplier-provided parts in our business. Significant shortages, supplier capacity constraints or production disruptions, price increases, or tariffs could increase our operating costs and adversely impact the competitive positions of our products.

Our reliance on suppliers and commodity markets to secure components and raw materials (such as copper and steel as well as INCU ionic copper solution), and on service providers to deliver our products, exposes us to volatility in the prices and availability of these materials and services. That potential volatility is particularly acute in certain instances where we depend upon a single source. Issues with suppliers (such as delivery or production disruptions, capacity constraints, quality issues, consolidations, closings or bankruptcies), price increases, raw material shortages, or the decreased availability of trucks and other delivery services could have a material adverse effect on our ability to meet our commitments to customers or increase our operating costs.

We use various strategies to lock in prices of expected purchases of certain raw materials; however, these efforts could cause us to pay higher prices for a commodity when compared with the market price at the time the commodity is actually purchased or delivered. Tariffs can also increase our costs, the impact of which is difficult to predict. However, we believe that our supply management and production practices appropriately balance the foreseeable risks and the costs of alternative practices. Nonetheless, these risks may have a material adverse effect on our competitive position, results of operations, cash flows or financial condition.

We design, manufacture and service products that incorporate advanced technologies. The introduction of new products and technologies involves risks, and we may not realize the degree or timing of benefits initially anticipated.

Our future success depends on designing, developing, producing, selling and supporting innovative products that incorporate advanced technologies. The regulations applicable to our products, as well as our customers’ product and service needs, change from time to time. Moreover, regulatory changes may render our products and technologies non-compliant. Our ability to realize the anticipated benefits of our technological advancements or product improvements – including those associated with regulatory changes – depends on a variety of factors, including: meeting development, production, and regulatory approval schedules; meeting performance plans and expectations; the availability of raw materials and parts; our suppliers’ performance; the hiring, training and deployment of qualified personnel; achieving efficiencies; identifying emerging regulatory and technological trends; validating innovative technologies; the level of customer interest in new technologies and products; and the costs and customer acceptance of our new or improved products.

Failure to achieve and maintain a high level of product and service quality could damage our reputation with customers and negatively impact our results.

Product and service quality issues could harm customer confidence in our company and our brands. If certain of our product offerings do not meet applicable safety standards or our customers’ expectations regarding safety or quality, we can experience lost sales and increased costs and we can and have been exposed to legal, financial and reputational risks. Actual, potential or perceived product safety concerns could expose us to litigation as well as government enforcement actions, which has also occurred in certain instances. In addition, when our products fail to perform as expected, we are exposed to warranty, product liability claims, personal injury and other claims.

We maintain strict quality controls and procedures. However, we cannot be certain that these controls and procedures will reveal defects in our products or their raw materials, which may not become apparent until after the products have been placed in use in the market. Accordingly, there is a risk that products will have defects, which could require a product recall. Product recalls can be expensive to implement, and may damage our reputation, customer relationships and market share.

In many jurisdictions, product liability claims are not limited to any specified amount of recovery. If any such claims or contribution requests or requirements exceed our available insurance or if there is a product recall, there could be an adverse impact on our results of operations. In addition, a recall or claim could require us to review our entire product portfolio to assess whether similar issues are present in other products, which could result in a significant disruption to our business and which could have a further adverse impact on our business, financial condition, results of operations and cash flows. There can be no assurance that we will not experience any material warranty or product liability claim losses in the future, that we will not incur significant costs to defend such claims or that we will have adequate reserves to cover any recalls, repair and replacement costs.

| 16 |

We are subject to litigation, environmental, and other legal and compliance risks.

We are subject to a variety of litigation, legal and compliance risks. These risks relate to, among other things, personal injuries, intellectual property rights, contract-related claims, taxes, environmental matters, employee health and safety, competition laws and laws governing improper business practices. If found responsible in connection with such matters, we could be subject to significant fines, penalties, repayments and other damages (in certain cases, treble damages), and experience reputational harm.

On October 8, 2021, a filing (the “Filing”) was made with the Kuala Lumpur High Court by a reseller (the “Reseller”) of the Company’s INCU ionic nano copper solution (the “Solution”) and the Reseller’s related party (together with the Reseller, the “Plaintiffs”). The Reseller was authorized by WKL Eco Earth as its sole distributor of the Solution (the “WKL Distributor”) to resell the Solution together with a diffuser with a capacity of not more than 1000ml through a tripartite agreement (the “Tripartite Agreement”) entered into between (a) the Reseller, (b) the WKL Distributor and (c) a solution packaging company (the “Packaging Company”). WKL Eco Earth was not a party to the Tripartite Agreement and did not directly authorize or engage the Reseller in the resale of the Solution. In the Filing, the Plaintiffs claimed against (i) WKL Eco Earth; (ii) Dr. Low; (iii) Chan Kok Wei, (iv) the Packaging Company and (v) two directors of the Packaging Company for loss and damages arising from an alleged breach of contract, defamation and tort of inducement. The Plaintiffs also alleged that pursuant to the Tripartite Agreement, WKL Eco Earth was prohibited from selling the Solution to any party other than the WKL Distributor, and that the Tripartite Agreement allowed for the resale of the Solution by the Plaintiffs without limitation, the Plaintiffs were not confined in their resale of the Solution to a product consisting of a diffuser with a capacity of not more than 1000ml. The Company believes the claims are without merit and will defend itself against the claims.

As a global business, we are subject to complex laws and regulations in Malaysia. and other countries in which we operate. Those laws and regulations may be interpreted in different ways. They may also change from time to time, as may related interpretations and other guidance. Changes in laws or regulations could result in higher expenses. Uncertainty relating to laws or regulations may also affect how we operate, structure our investments and enforce our rights.

Changes in environmental and climate change related-laws could require additional investments in product designs, which may be more expensive or difficult to manufacture, qualify and sell and/or may involve additional product safety risks and could increase environmental compliance expenditures.

At times we are involved in disputes with private parties over environmental issues, including litigation over the allocation of cleanup costs, alleged personal injuries and property damage. Existing and future asbestos-related claims could adversely affect our financial condition, results of operations and cash flows. Personal injury lawsuits may involve individual and purported class actions alleging that contaminants originating from our current or former products or operating facilities caused or contributed to medical conditions. Property damage lawsuits may involve claims relating to environmental damage or diminution of real estate values. Even in litigation where we believe our liability is remote, there is a risk that a negative finding or decision could have a material adverse effect on our competitive position, results of operations, cash flows or financial condition, in particular with respect to environmental claims in regions where we have, or previously had, significant operations or where certain of our products have been manufactured and used.