UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For

the financial year ended

For the transition period from ___________ to ___________

COMMISSION

FILE NO.

(Exact name of registrant as specified in its charter)

| 8713 | ||||

| (State or Other Jurisdiction of | IRS Employer | Primary Standard Industrial | ||

| Incorporation or Organization) | Identification Number | Classification Code Number |

EvoAir

Holdings Inc.

Tel. +

(Address and telephone number of registrant’s executive office)

Copies

to:

Lawrence Venick, Esq.

Loeb & Loeb LLP

2206-19 Jardine House

1 Connaught Place, Central

Hong Kong SAR

Tel: +852.3923.1111

Fax: +852.3923.1100

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate

by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark

whether the registrant has submitted electronically every Interactive Data File required

to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter)

during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for shorter period that the registrant as required to file such reports), and (2) has

been subject to such filing requirements for the past 90 days.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes ☐ No ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ☐ | Accelerated filer ☐ | |

| Smaller

reporting company |

||

| Emerging

growth company |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial standards provided pursuant to Section 13(a) of the Exchange Act. Yes ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act) Yes ☐

The aggregate market value of the

Company’s common stock held by non-affiliates of 12,473,946 shares computed by reference to the closing bid price of the

Company’s common stock of $7.41, as of the last business day of the registrant’s most recently completed second fiscal quarter,

was approximately $

The registrant had shares of our Common Stock par value, $0.001 issued and outstanding as of December 8, 2022.

Table of Contents

| 2 | Page |

FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements. These statements relate to future events or our future financial performance. These statements often can be identified by the use of terms such as “may,” “will,” “expect,” “believe,” “anticipate,” “estimate,” “approximate” or “continue,” or the negative thereof. We intend that such forward-looking statements be subject to the safe harbors for such statements. We wish to caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. Any forward-looking statements represent management’s best judgment as to what may occur in the future. However, forward-looking statements are subject to risks, uncertainties and important factors beyond our control that could cause actual results and events to differ materially from historical results of operations and events and those presently anticipated or projected. We disclaim any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statement or to reflect the occurrence of anticipated or unanticipated events.

As used in this Annual Report, the terms “we”, “us”, “our”, “the Company”, mean EvoAir Holdings Inc., unless otherwise indicated.

As used in this Annual Report, the term “Group”, “EvoAir Group” means EvoAir Holdings Inc. and its subsidiaries, unless otherwise indicated.

All dollar amounts refer to US dollars unless otherwise indicated.

| 3 | Page |

PART I

| ITEM 1 | BUSINESS |

Organization and Business Background

EvoAir Holdings Inc., (formerly Unex Holdings Inc.) (the “Company”, “EVOH”, “we”, “us”, or “our”) is a corporation established under the corporation laws in the State of Nevada on February 17, 2017. The Company has adopted an August 31 fiscal year end.

On December 20, 2021, the Company and Low Wai Koon (“Dr. Low”) entered into a share transfer agreement, (the “EvoAir International Share Transfer Agreement”), pursuant to which Dr. Low agreed to sell all of his ordinary shares of EvoAir International Limited (“EvoAir International”) to the Company for the consideration of US$100 (“EvoAir Transaction”). EvoAir International, through its subsidiaries upon completion of the Transactions (defined hereunder), is engaged in the sale of heating, ventilation and air conditioning (“HVAC”) products in Asia.

Pursuant to the terms of a share transfer agreement dated December 20, 2021, Dr. Low, the then sole executive officer and director of the Company and the owner of 2,000,000 restricted shares of the Company’s ordinary shares representing approximately 67.34% of the Company’s then issued and outstanding shares, sold his entire shareholding of the Company to WKL Global Limited (“WKL Global”) for an aggregate consideration of $100 (the “Change of Control Transaction”). Upon completion of the Change of Control Transaction, WKL Global owned 2,000,000 shares, or approximately 67.34% of the then issued and outstanding ordinary shares of the Company, which resulted in a change of control of the Company.

On December 20, 2021, several transactions took place (together, the “Allotment Transactions”) whereby the Company issued and allotted in aggregate 98,809,323 ordinary shares of common stock to certain parties. On completion of the Allotment Transactions, the total number of issued and outstanding shares of common stock of the Company were 101,779,323 (“Enlarged Share Capital”):

| (A) | On December 20, 2021, Dr. Low and Chan Kok Wei entered into a share exchange agreement with WKL Eco Earth Holdings Pte Ltd (“WKL Eco Earth Holdings”), pursuant to which Dr. Low and Chan Kok Wei agreed to sell all their ordinary shares of WKL Green Energy Sdn Bhd (“WKL Green Energy”) to WKL Eco Earth Holdings in consideration for the allotment and issuance to WKL Global Limited and Allegro Investment (BVI) Limited of 24,000 shares and 6,000 shares of common stock, respectively, or approximately 0.02% and 0.01% of the Enlarged Share Capital, respectively. |

| (B) | On December 20, 2021, Dr. Low, Chan Kok Wei, Ong Bee Chen and certain sellers (“WKLEE Sellers”) entered into a share exchange agreement with WKL Eco Earth Holdings, pursuant to which Dr. Low, Chan Kok Wei, Ong Bee Chen and WKLEE Sellers agreed to sell all their ordinary shares of WKL Eco Earth Sdn Bhd (“WKL Eco Earth”) to WKL Eco Earth Holdings in consideration for the allotment and issuance to WKL Global Limited, Allegro Investment (BVI) Limited and WKLEE Sellers of 49,320 shares, 8,280 shares and in aggregate 14,400 shares, respectively, of the common stock of the Company, or approximately 0.05%, 0.009% and in aggregate 0.014%, respectively, of the Enlarged Share Capital. |

| (C) | On December 20, 2021, Tan Soon Hock, Ivan Oh Joon Wern and certain relevant interest holders (“Relevant Interest Holders”) entered into an investment exchange agreement with WKL Eco Earth Holdings, pursuant to which the Tan Soon Hock, Ivan Oh Joon Wern and the Relevant Interest Holders agreed to sell all relevant interests in the EvoAir and its subsidiaries (“EvoAir Group” or the “Group”) to WKL Eco Earth Holdings in consideration for the allotment and issuance of 7,037,762 shares, 2,520,000 shares and in aggregate 6,001,794 shares, respectively, of the common stock of the Company, or approximately 6.91%, 2.48% and in aggregate 5.90%, respectively, of the Enlarged Share Capital. The board of directors and majority shareholders of the Company have approved the transaction. |

| 4 | Page |

| (D) | On December 20, 2021, Dr. Low entered into two deeds of assignment of intellectual properties with WKL Eco Earth Holdings, in respect of Dr. Low’s patents relating to eco-friendly air-conditioner condenser (external unit), evoairTM and the trademarks described in the deed of assignment thereunder, and in respect of Dr. Low’s patents relating to the portable air-conditioner, e-Cond EVOTM and the trademarks as described in the deed of assignments thereunder (together, the “IP Assignments”). Pursuant to the IP Assignments, WKL Global, Allegro Investment (BVI) Limited and certain nominees shall be allotted and issued 63,362,756 shares, 14,297,259 shares and in aggregate 5,487,752 shares, respectively of the Company’s common stock or approximately 62.25%, 14.05% and in aggregate 5.39%, respectively of the Enlarged Share Capital in consideration for the IP Assignments. |

EvoAir Transaction, Change of Control Transaction and Allotment Transactions are collectively to be referred to as the “Transactions”. The closing of the Transactions (the “Closing”) occurred on December 20, 2021 (the “Closing Date”).

From and after the Closing Date, at which time EvoAir International transferred its HVAC business to the Company, the Company’s primary operations will consist of the prior operations of EvoAir International.

EvoAir International is a company incorporated in the British Virgin Islands on November 17, 2021. Effective from the December 20, 2021, it wholly owns WKL Eco Earth Holdings, a company incorporated in Singapore on July 12, 2018, which in turn wholly owns a) WKL Eco Earth, a Malaysian company incorporated on May 17, 2017, and b) WKL Green Energy a Malaysian company incorporated on October 24, 2017. WKL Eco Earth Holdings acquired (c) EvoAir Manufacturing Sdn Bhd (“EvoAir Manufacturing”) on April 19, 2021, a Malaysian company incorporated on March 22, 2019, as well as acquiring (d) WKL EcoEarth Indochina Co. Ltd. (“WKL Eco Earth Indochina”), a Cambodia company incorporated on February 4, 2021 (e) WKL Guanzhe Green Technology Guangzhou Co Ltd (“WKL Guanzhe Green Technology Guangzhou”), a Chinese company incorporated in April 6, 2021 and (f) Evo Air Marketing, a Malaysian company incorporated in February 2, 2021, is a wholly owned subsidiary of EvoAir Manufacturing.

On June 15, 2022, the Company filed a Certificate of Amendment (the “Amendment”) to the Articles of Incorporation with Nevada’s Secretary of State to change the name of the Company from Unex Holdings Inc. to EvoAir Holdings Inc. (the “Name Change”), and the Name Change became market effective on November 4, 2022. Effective on November 11, 2022, the Company’s shares began trading under the new ticker symbol “EVOH”.

Details of the Company’s subsidiaries:

| Subsidiary company name | Place and date of incorporation | Particulars of issued capital $ |

Principal activities | Proportion of ownership interest and voting power held | |||||||

| 1. | Evoair International Limited | British Virgin Islands, November 17, 2021 | 100 | Investment holding. | 100% | ||||||

Subsidiary of EvoAir International Limited | |||||||||||

| 2. | WKL Eco Earth Holdings Pte. Ltd. | Singapore, July 12, 2018 | 1 | Marketing and sale of eco-friendly HVAC products and related services. | 100% | ||||||

Subsidiaries of WKL Eco Earth Holdings Pte Ltd | |||||||||||

| 3. | WKL Eco Earth Sdn. Bhd. | Malaysia, May 17, 2017 | 74,206 | Research and development, manufacturing, marketing and sale of eco-friendly HVAC products and related services. | 100% | ||||||

| 4. | WKL Green Energy Sdn. Bhd. | Malaysia, October 24, 2017 | 27,955 | Dormant. | 100% | ||||||

| 5. | EvoAir Manufacturing (M) Sdn. Bhd. | Malaysia, March 22, 2019 | 585,374 | Research and development, manufacturing, marketing and sale of eco-friendly HVAC products and related services. | 67.5% | ||||||

| 6. | WKL EcoEarth Indochina Co. Ltd | Cambodia,

February 4, 2021 |

125,480 | Marketing and sale of eco-friendly HVAC products and related services. | 55% | ||||||

| 7. | WKL Guanzhe Green Technology Guangzhou Co. Ltd. | People’s Republic of China, April 6, 2021 | 573,609 | Manufacturing, marketing and sale of eco-friendly HVAC products and related services. | 55% | ||||||

Subsidiary of EvoAir Manufacturing (M) Sdn Bhd | |||||||||||

| 8. | Evo Air Marketing (M) Sdn. Bhd. | Malaysia, February 2, 2021 | 223 | Marketing and sale of eco-friendly HVAC products and related services. | 100% | ||||||

On June 15, 2022, the Company filed a Certificate of Amendment (the “Amendment”) to the Articles of Incorporation with Nevada’s Secretary of State to change the name of the Company from Unex Holdings Inc. to EvoAir Holdings Inc. (the “Name Change”), and the Name Change became market effective on November 4, 2022. Effective on November 11, 2022, the Company’s shares began trading under the new ticker symbol “EVOH”.

| 5 | Page |

Future development

EvoAir Group intends to continue development of its hybrid air-conditioning products to further increase its product offerings, as well as to expand its client base, especially with commercial and industrial clients. The Group plans to expand its distribution into other South East Asia markets, China and Asia markets, which has high potential demand for air-conditioning as their population gross domestic product (“GDP”) increases. Taking advantage of the global awareness and push to reduce harmful factors leading to global warming, the Group continues to market its EvoAirTM brand and e-Cond EvoTM as a truly eco-friendly product aiming to reduce emission of waste heat from the condensing unit and at the same time improving energy efficiency. The Group aims to continue its innovation through investment into research and development, to further improve on its product line, reduce its carbon emissions as it strives to become a leader in green Heating, ventilation, and air conditioning HVAC technology.

The Group also continues to improve on its production of air purifier and air-sanitizing systems in order to capitalize on increased market demand for air sanitizing products in the wake of the global coronavirus pandemic. The Group is expanding usage and application of its Ionic Nano Copper Solution (“INCU”) technology, which acts as an effective disinfectant solution into more sectors and markets as the Group foresees growth in demand for air-sanitizing products as a must-have product in general consumer households in the near future. Besides household consumers, the Group also aims to expand its commercial and industrial customer base, as well as partake in public sanitation projects. In terms of sanitation products, the company aims to expand into personal healthcare products such as formulated toiletries cleansers incorporating the INCU ionic nano copper solution as an active ingredient.

Product Lines

Hybrid Air Conditioners

e-Cond EVOTM

The Group first invented its line of eco-friendly portable air-conditioners under its e-Cond EVOTM brand in 2017.

The unit is an eco-friendly air-conditioning system with patent pending heat emission control system (“HECS”) technology, which regulates the temperature and volume of heat transferred from the air-conditioning system into the environment. This product employs an innovative hydro-refrigeration system (“HRS”) integrating evaporative cooling process with refrigeration cycle, reducing temperature of the output air by approximately 30% while achieving an optimal cooling performance of approximately 25 degree Celsius. The patent pending technology in the unit allows it to utilize up to 60% less energy than its traditional portable air-conditioning units. The portable air-conditioning systems also incorporate ionizer technology producing high concentrations of negative ions to purify the surrounding air of mold spores, pollen, pet dander, odors, cigarette smoke, bacteria, viruses, dust and other hazardous airborne particles.

The Company markets two models of the e-Cond EVOTM units: the Super King and the Outdoor King.

| 6 | Page |

EvoAirTM

The Group continued to research on incorporating its patent pending heat emission control system (“HECS”) Technology as well as various other patent pending technologies into its product line, subsequently launching its EvoAirTM hybrid air-conditioners in 2021.

The Group’s EvoAirTM hybrid air-conditioners produced less heat emission through its patent pending HECS technology, as well as increased humidity and moisture of the expelled air to allow for a comfortable environment surrounding the external condenser unit during operation. EvoAirTM hybrid air-conditioners replaced traditional outdoor condenser units cooling coils with a Coolpressor Unit that incorporates various patent pending technologies. The Group’s patent pending HECS technology contributes to a reduction in waste heat produced by the Coolpressor unit by up to 25 degrees Celsius as well as reducing energy consumption by up to 20% compared to conventional air-conditioning units that utilizes long copper coils for cooling. The Coolpressor Unit increase the humidity of the expelled air by 20%, producing comfortable humidity levels in the surrounding environment around the Coolpressor Unit. This allows the unit to become a supplementary external-use cooling system by releasing moisturized air at approximately 28 degrees Celsius with a humidity of approximately 58% while operating under outdoor conditions. The significant decrease in waste heat and reduction in energy consumption play an important role in reducing harmful effects to the environment, in line with the Group’s philosophy of producing eco-friendly products.

Air-conditioning refrigerant is harmful to the environment. The EvoAirTM system utilizes the R32 refrigerant in its operation, which is 9% lower in density than the traditionally used R410A refrigerant found in various conventional air-conditioning systems, while maintaining approximately 43-50% higher latent heat vaporization and approximately 41% higher thermal conductivity when combined with the Group’s other patent-pending technologies. EvoAirTM’s system design also allows for a further reduction in refrigerant use of at least 30% compared to conventional air-conditioning systems with traditional long copper coils by increasing the efficiency of the heat transfer in the R32 refrigerant, in doing so, further increasing refrigerant efficiency.

The EvoAirTM hybrid air-conditioning system was awarded SGS International Certification in 2021.

Manufacturing

The Group produces its Coolpressor under its EvoAirTM brand. Meanwhile, the Group partners with original equipment manufacturers (“OEM”) to produce an air-conditioner indoor unit (blower) to complement its EvoAirTM Coolpressor as well as its eco-friendly portable air-conditioner systems under its e-Cond EVOTM brand. The Group has managed to situate its manufacturing plants in both Malaysia and China through its operating subsidiaries, EvoAir Manufacturing and WKL Guanzhe Green Technology Guangzhou, respectively. The Group operates manufacturing plants and assembly lines in China and Malaysia approximately 60,000 square feet of manufacturing space. By distributing its manufacturing capacity geographically, the Group is able to maintain a flexible supply chain concentrating production of products according to demand from different regions.

Licensing, Supply and Maintenance Service

The Group licenses its various proprietary and patent pending technologies to OEMs and other brands to be incorporated in various HVAC products. The Group has also catered to industrial clients including supplying products to factory settings or real estate developments spread out across different geographical locations including Malaysia, Cambodia, Singapore as well as Thailand as well as providing maintenance and installation services of its EvoAirTM products to various commercial customers.

| 7 | Page |

Air Purifier

E-CondLife

To address the spread of the Covid-19 pandemic which arose during the end of 2019, the EvoAir Group launched a new series of air-sanitizing products during the middle of 2020.

Partnering with its supplier, the Group became an exclusive authorized distributor of Ionic Nano Copper Solution (“INCU”) technology, which involves the use of an ionic nano copper solution. The active ingredients of the solutions, Copper Sulphate Pentha-Hydrate, has a proven track record as well as having been certified and reported to inhibit larvidie, germicide, bactericide, fungicide, algaecide and virucide, while being non-toxic and safe for human and animal use. INCU has been recognized as being vital to health, as well as having proven to be effective against influenzas, bacteria such as E. Coli, bacteria groups such as MRSA as well as inhibiting against Covid-19.

The Group partnered with various OEMs to produce air-purifier products under its e-CondLife brand, in accordance to the Group’s specifications in terms of modifications to the micro-chips, magnetic control valves and systems flows to work with INCU technology. By disinfecting water in a water tank reserve through hydro-curtain technology, followed by purifying the output air in the form of water vapour or mist, E-CondLife products act as environmental disinfecting solutions for air sanitization.

The e-CondLife sanitizer system has been certified under the IECEE CB Scheme, while the INCU solution used by the system has been certified by NSF International (USA) to be compliant with NSF / ANSI60 standards for all applicable requirements. The EvoAir Group has also obtained safety test reports from TUV SUD in Singapore and ICAS Shanghai for Cytotoxicity Testing.

QCOVTM

To supplement the e-CondLife line of air purifier products, the Group partnered with various OEMs to produce small air purifier systems under its QCOVTM brand in 2021, which incorporates a diffuser to distribute the INCU ionic nano copper solution in order to sanitize the environment.

Distribution

As an exclusive authorized distributor of the INCU solution, the Group has partnered with various distributors to distribute the technology to other brands and markets. Through these various partnerships, the Group’s air purifier systems and INCU are produced and distributed to 11 countries by various distribution channels, including through several well established marketing companies with their own respective online platforms. The Group markets its brand to target customers that are attracted to the Group’s eco-friendly image, the product’s ability to inhibit bacteria and viruses, as well as to provide a clean and safe environment.

Customers

Hybrid Air-Conditioner

Building on Dr. Low’s research into green technology, the Group first invented its eco-friendly portable air-conditioning system under the e-Cond EVOTM brand in 2017, aimed at a market that is conscious of the effects of global warming and wish to pursue eco-friendly solutions.

The Group has since developed its hybrid air-conditioner systems in 2021 under the EvoAirTM in two configurations: (i) an indoor unit together with an outdoor Coolpressor unit; and (ii) an individual Coolpressor unit compatible with the customer’s pre-existing indoor unit. The Group aims to market its EvoAirTM products through 3 main channels: 1) traditional distributor and dealership point of sales model which will increase the Group’s market presence throughout the Malaysia and into other Asian markets; 2) Entry into project based contracts with housing developers, office building management, schools, government offices as well as industrial factories; and 3) E-Commerce online sales and deliveries. The Group currently focuses on the Malaysian and Singapore market as its primary markets, as it continues to expand into the China market as well as other ASEAN countries.

The Group also licenses its patent pending technology to partners in its current market, and aims to expand its licensing to partners from potential markets.

INCU Technology

As an exclusive authorized distributor of the INCU solution, the Group has partnered with various distributors to distribute the technology to other brands and markets. The Group has distributed the INCU technology across the South East Asia region, from locations including Singapore, Malaysia, China and Cambodia, Brunei, Philippines, Indonesia, South Korea, Hong Kong, Thailand and Africa. The Group focuses on marketing its brand to customers that are attracted to the Group’s eco-friendly image, the technology’s ability to inhibit bacteria and viruses, as well as its ability to provide a clean and safe environment.

| 8 | Page |

The Air Conditioner Industry

Growing demand for cooling

Based on the latest report by the International Energy Agency 2018, in 2016 there were approximately 1.6 billion units of air conditioners in use globally, and China and the United States accounted for 36% and 23% of the total consumption, respectively. In addition, total air conditioner sales in the five year period ending December 31, 2020 have averaged approximately 111 million units each year.

Air-conditioners vary in energy efficiency and their usage lead to a global consumption of approximately 2,000 terawatt hours of electricity annually. In addition, almost 20% of all the electricity used in buildings is for cooling, accounting for 14% of average peak residential electricity demand globally.

The emerging economies are expected to use more air-conditioners as income levels rise. Of the 2.8 billion people living in the hottest parts of the world, only 8% currently own air-conditioning units compared to approximately 90% ownership in the United States and Japan. By 2050, India, China and Indonesia may account for 50% of the projected growth in energy use for space cooling.

Global Emissions from the use of Air Conditioners

The efficiency of air conditioners vary widely, in all major markets today, consumers are typically buying air conditioners whose average efficiencies are less than half of what is available. Carbon dioxide emissions from cooling systems have tripled since 1990 to 1,130 million tons in 2016, and local air pollutants caused by cooling systems have also increased. Greenhouse Gases produced include Carbon Dioxide and Climate Change:

| ● | Carbon dioxide is called a greenhouse gas because it absorbs infrared energy and remits this energy back in all directions. About half of that energy goes out into space and about half of it returns to Earth as heat, contributing to the greenhouse effect and climate change | |

| ● | The four main greenhouse gases are carbon dioxide, methane, nitrous oxide and fluorinated gases. Carbon dioxide accounts for about 75% of global greenhouse gas emissions. | |

| ● | About 30% of greenhouse gas emissions come from transportation, 25% come from the production of electricity, 23% comes from industrial production, 12% comes from commercial and residential sources and 10% comes from agriculture. | |

| ● | Climate change could increase the occurrence and severity of weather events, such as heat waves, droughts and floods. These changes are likely to increase losses to property and crops and affect economic activity. | |

| ● | The usage of air conditioners has a significant impact on the environment. Air-conditioners use chemical refrigerants, usually hydrofluorocarbons in their heat exchange systems. The hydrofluorocarbons contributes significantly to global warming if leaked to the atmosphere. | |

| ● | The generation of the electricity to power the air conditioners also contribute to significant emissions, especially when fossil fuels are burnt to produce electricity. |

Urbanized areas have higher temperatures than less urbanized areas, contributing to heat islands. This is because urban areas usually have less greenery. Roads and buildings absorb and re-emit daytime heat more than forests and water bodies. As a result, urban daytime temperatures can reach approximately 1 to 7 degrees higher in Fahrenheit than the outlying areas and night-time temperatures can reach approximately 2 to 5 degrees higher in Fahrenheit. The use of air conditioners extract hot air to the outside of buildings. On high temperature days, the hot air emitted by air-conditioner units increases the outdoor temperature. This in turn increases the need for more cooling and creates a feedback loop. The use of air conditioners can increase outdoor urban temperatures by more than approximately 1 degree Celsius in some cities

Global Efforts to combat Climate Change and Global Warming

If the current rate of growth of energy use by air conditioners continues, the U.S. Energy Information Administration (“EIA”) predicts that by 2050, global energy usage for space cooling would triple to 6,200 terra watts. This would triple the amount of carbon dioxide emissions and heavy investments in electricity infrastructure to meet peak electricity demand. This could cause severe financial strain on emerging economies.

Over the years, countries around the world have come together to support policies to combat climate change. However, obtaining consensus has been challenging because of political and national circumstances. The Kigali Amendment to the Montreal Protocol, which entered into force on 1 January 2019, help protect the climate by phasing down high global warming potential hydrofluorocarbons (HFCs), which are commonly used as refrigerants. Promoting the energy efficiency of cooling technology can also significantly increase climate benefits.

| ● | From October 31 to November 12, 2021, the 26th annual UN Climate Change Conference (COP26) was held in Glasgow, Scotland. The objectives of COP26 were: |

i. Countries were called out to reach net-zero carbon emissions by 2050 and to cap the increase in global temperatures below 1.5°C from current levels;

ii. To protect and restore ecosystems and habitats and build resilient infrastructures to withstand climate change;

iii. Developed nations to mobilize $100bn in climate finance per year for poorer nations; and

iv. Parties of COP26 to finalize the agreement and rules for action and monitoring.

The Role of Air conditioners Efficiency in combating Climate Change

Intuitively, the more energy efficient air-conditioners are, the less electricity they would consume, and less fossil fuels would be burnt to produce electricity. This would lead to less carbon dioxide emissions which could reduce global warming.

The EIA highlighted one area where policy action could deliver substantial energy savings quickly — by making air conditioners equipment more efficient. Through stricter minimum energy performance standards and other measure such as labelling, the average energy efficiency of the stock of air conditioners globally could more than double in efficiency between now and 2050. This could reduce cooling-related energy demand to 3,400 terawatts in 2050 compared to 6,200 terawatts if efficiency remained at current levels. The 45% reduction in energy usage or 2,800 terawatts could reduce carbon dioxide emissions by 1,582 megatons annually. This scenario was called the Efficient Cooling Scenario by EIA.

| 9 | Page |

In addition, the use of less electricity because of more efficient air conditioners greatly reduces the need to build new generation capacity to meet peak electricity demand. In the Efficient Cooling Scenario, there would not be a need to build additional capacity deliver the 1,300 gigawatts of power with more efficient air conditioners. This is equivalent to all the coal-fired power generation in China and India today. In addition, the cumulative infrastructure, fuel and operating costs savings amounted to $2.9 trillion from 2017 to 2050. This means 45% lower electricity costs for everyone as well, compared to if there were no efficiency improvements in air conditioners

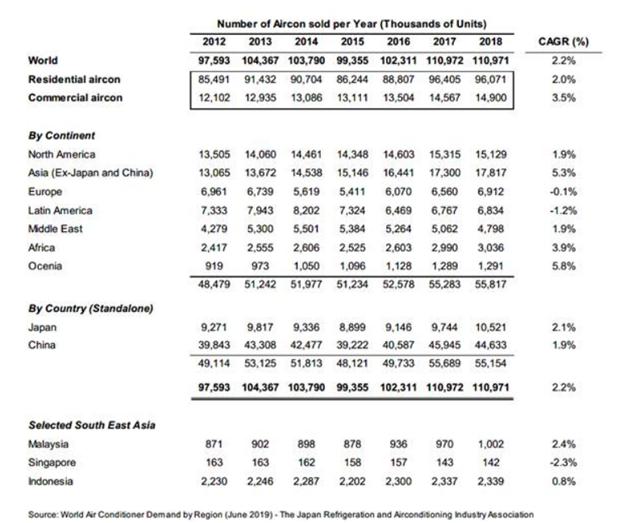

In 2018, approximately 111 million units of air conditioners were sold globally of which approximately 87% were residential units and approximately 13% were commercial units. The CAGR from 2012 to 2018 was approximately 2.2%. China was the largest consumer of air conditioners globally and it accounted for approximately 40% of all air conditioners sales. Asia (ex-Japan and China) had the highest CAGR of approximately 5.3% from 2012 to 2018 followed by Africa at approximately 3.9% CAGR. The global air conditioners systems market was valued at approximately $106.6 billion in 2020 and was expected to grow at a CAGR of approximately 6.3% from 2021 to 2028. The market size for that of China was approximately $37.0 billion in 2020 and was expected to grow at a CAGR of approximately 7.4%. The major air conditioners manufacturers globally come from Japan, South Korea, China and the USA. Daikin was the leading player globally with approximately $20.3 billion of revenues from the heating, ventilation and air conditioners segment in Financial Year ended 2020.

| 10 | Page |

Competition

The air-conditioning and air purifying industry in Asia is highly competitive. Key market players in HVAC products includes several multinational, regional and local companies, the largest of which include Daikin Industries Ltd, Midea Group Co, Trane Technologies PLC, Carrier Global Corp, LG Electronics, Inc, Panasonic Corp and Mitsubishi Electric Corp. Sales depend on price, product availability, delivery schedule, product performance, product line breadth, brand reputation, design, technical expertise and service.

The Group’s competitiveness arise from its focus on eco-friendly and highly efficient product offerings.

Intellectual Property

The Group’s success and future revenue growth depend, in part, on our ability to protect our intellectual property. The Group relies primarily on patent and trademark laws, as well as confidentiality procedures, to protect our proprietary technologies and processes.

The Group believes that the core of its business is comprised of our proprietary technologies, including its patent pending HECS technology. As a result, the Group will strive to maintain a robust intellectual property portfolio. The Group’s success and future revenue growth may depend, in part, on its ability to protect its intellectual property as products and services that are material to its operating results incorporate patented technology.

The Group believes its rights to patents and trademark rights serve to distinguish and protect its products from infringement and contribute to our competitive advantages. The Group had patents and trademarks in various stages of the registration application process in Malaysia, China, Thailand, Philippines, Vietnam, Taiwan, Japan as well as Patent Cooperation Treaty and trademarks in various stages of the registration application process in Malaysia and China.

We cannot assure you that any patents or copyrights will be issued from any of our pending applications. In addition, any rights granted under any of our existing or future patents, copyrights or trademarks may not provide meaningful protection or any commercial advantage to us. With respect to our other proprietary rights, it may be possible for third parties to copy or otherwise obtain and use proprietary technology without authorization or to develop similar technology independently. We may in the future initiate claims or litigation against third parties to determine the validity and scope of proprietary rights of others. In addition, we may in the future initiate litigation to enforce our intellectual property rights or to protect our trade secrets. Additional information about the risks relating to our intellectual property is provided under “Risk Factors—Risks Related to Intellectual Property.”

Government Approval And Regulation

Our business operations involve the development and sale of HVAC products, which are regulated by the Malaysia Energy Commission. The Group endeavours to ensure the safe and lawful operation of its facilities and distribution of its products and believes it is in compliance in all material respects with applicable laws and regulations.

Employees

As of December 8, 2022, the Group has approximately 30 employees, all of whom were full-time employees located in Malaysia, Singapore, China and Cambodia. None of the Group’s employees are represented by a labor union. We have never experienced any employment related work stoppages, and we consider our relations with our employees to be good.

Legal Proceedings

On October 8, 2021, a filing (the “Filing”) was made with the Kuala Lumpur High Court by a reseller (the “Reseller”) of the Company’s INCU ionic nano copper solution (the “Solution”) and the Reseller’s related party (together with the Reseller, the “Plaintiffs”).

The Reseller was authorized by WKL Eco Earth’s sole distributor of the Solution (the “WKL Distributor”) to resell the Solution together with a diffuser with a capacity of not more than 1000ml through a tripartite agreement (the “Tripartite Agreement”) entered into between (a) the Reseller, (b) the WKL Distributor and (c) a solution packaging company (the “Packaging Company”). WKL Eco Earth was not a party to the Tripartite Agreement and did not directly authorize or engage the Reseller in the resale of the Solution.

In the Filing, the Plaintiffs claimed against (i) WKL Eco Earth; (ii) Dr. Low; (iii) Chan Kok Wei, (iv) the Packaging Company and (v) two directors of the Packaging Company for loss and damages arising from an alleged breach of contract, defamation and tort of inducement. The Plaintiffs also alleged that pursuant to the Tripartite Agreement, WKL Eco Earth was prohibited from selling the Solution to any party other than the WKL Distributor and allow for the resale of the Solution by the Plaintiffs without limitation, and that the Plaintiffs were not confined in their resale of the Solution to a diffuser with a capacity of not more than 1000ml.

The Company believes the claims are without merit and will defend itself against the claims.

Principal Executive Offices

Our principal executive office is located at 31-A2, Jalan 5/32A, 6 ½ Miles off Jalan Kepong, 52000 Kuala Lumpur, Malaysia.

| ITEM 1A. | RISK FACTORS |

Risks Related to Our Business and Industry

If we are unable to continue to innovate, meet evolving market trends, adapt to changing customer demands and maintain our culture of innovation, our ability to sustain and grow our business may suffer.

The ongoing success of our business depends on our ability to continue to introduce innovative eco-friendly HVAC products to meet evolving market trends and satisfy changing customer demands. We must continue to adapt by innovating, improving our products and modifying our strategies, which could cause us to incur substantial costs. We may not be able to continue to innovate or adapt to changing market and customer needs in a timely and cost-effective manner, if at all. This could adversely impact our ability to expand our ecosystem and grow our business. Failure to develop new products to meet evolving market demands through innovation could cause us to lose current and potential customers and harm our operating results and financial condition.

In addition, we may not be able to maintain our culture of innovation, which has been critical to our success and has helped us create value for our shareholders, succeed as a leader in eco-friendly HVAC products, attract, retain and motivate employees and other ecosystem participants. Among other challenges, we may not be able to identify and promote people into leadership positions who share our culture and also focus on technology and innovation. Competitive pressure may also cause us to move in directions that may divert us from our mission, vision and values. If we cannot maintain our culture of innovation, our long-term business prospect could be materially and adversely affected.

We are exposed to concentration risk of heavy reliance on our largest nano copper supplier for the supply of nano copper solution for our INCU technology, and any shortage of, or delay in, the supply may significantly impact on our business and results of operation.

We source INCU nano copper solution for incorporation of our INCU technology into our air purifier products for sale to our customers from our largest nano copper supplier. As such, we rely on the ability and efficiency of our largest supplier to supply products. Our purchase from our largest nano copper supplier amounted to approximately $279,067 and $170,305 for FYE2022 and FYE 2021, respectively, representing approximately 63.24% and 29.07% of our total purchases, respectively. Our purchases from our top largest supplier accounted for a significant portion of our total purchases for FYE2022 and FYE2021.

| 11 | Page |

As we do not engage in manufacturing of INCU solution, our business, financial condition and operating results for our air purifier system depends on the continuous supply of products from our largest suppliers and our continuous supplier-customer relationship with them. Our heavy reliance on our largest supplier for the supply of INCU solution will have significant impact on our air purifier business and results of operation in the event of any shortage of, or delay in the supply. Our product supply may also be disrupted by potential labor disputes, strike action or natural disasters or other accidents affecting our largest supplier. If our largest suppliers do not supply products to us in a timely manner or in sufficient quantities, our business, financial condition and operating results may be materially and adversely affected. Any shortage of, disruption, or delay in the supply, or our inability to obtain supplies from alternative sources will have significant impact on our business and results of operation.

We entered into a long term original design manufacturer supply agreement (the “ODM Supply Agreement”) with our largest nano copper solution supplier in September, 2020. As is customary in the supply or sales arrangements, the agreements with our largest supplier are terminable by either party by giving notice. We cannot guarantee that our largest suppliers will not terminate the agreements before the expiry of the agreements. In the event that our largest suppliers terminate the agreements, we will have to source products from other suppliers and we may not be able to secure a similar supply of products with quantity and quality required to support our business or at all. Such termination may therefore have a material adverse impact on our business, financial condition and operating results if we fail to engage any other suppliers with similar standards before the termination.

There is no assurance that our major nano copper supplier and supplier of raw materials for our other products will continue to supply their products in the quantities and timeframes required by us to meet the demand of our customers or comply with their supply agreements with us. If our major supplier do not supply products to us in a timely manner or in sufficient quantities, our business, financial condition and operating results may be materially and adversely affected. Furthermore, in the event of any delay in delivery of the products to us, our cash flow or working capital may be materially and adversely affected as a result of the corresponding delay in delivery of our products to our customers, and hence the delay in our receipt of payment from our customers.

Furthermore, our largest nano copper supplier may change their existing sales or marketing strategy in respect of the products supplied to us by changing its export strategy, reducing its sales or production volume or changing its selling prices. As a result, there is no assurance that our largest supplier will not appoint other agents, dealers or distributors which may compete with us in the market where we operate. Furthermore, any significant increase in the selling prices of the products which we source from our largest suppliers will increase our costs and may materially and adversely affect our profit margin if we are not able to pass the increased costs on to our customers.

There is no assurance that there will be no deterioration in our relationship with our largest supplier which could affect our ability to secure sufficient supply of products for our business. In the event that our largest supplier change their sales or marketing strategy or otherwise appoint other dealers or distributors who may compete with us, our business, financial condition and operating results may be materially and adversely affected.

We operate in a competitive industry, and if we fail to compete effectively, our business could suffer.

The air-conditioning and air purifying industry in Asia is highly competitive. Competition in our HVAC products includes several multinational, regional and local companies, the largest players of which include Daikin Industries, Gree Electric, Trane Technologies, Johnson Controls, Lennox International, Midea Group and Mitsubishi Electric. Sales depend on price, product availability, delivery schedule, product performance, product line breadth, brand reputation, design, technical expertise and service. In addition to established players, we face competition from new market entrants. Increased competition may lead to a loss of market share, increased difficulty in launching new service offerings, reduction in revenue or increase in loss, any one of which could harm our business, financial condition and results of operations.

| 12 | Page |

In certain of our businesses, our contracts are typically awarded on a competitive basis. Our bids are based upon, among other factors, the cost to timely provide the products and services. To generate an acceptable return, we must accurately estimate our costs and schedule. If we fail to do so, the profitability of contracts may be materially and adversely affected – including because some of our contracts provide for liquidated damages if we do not perform on time – which could have a material adverse effect on our competitive position, results of operations, cash flows or financial condition.

If we are unable to create brand influence, we may not be able to maintain current or attract new users and customers for our products.

Our operational and financial performance is highly dependent on the strength of our brand. We believe brand familiarity and preference will continue to have a significant role in winning over customers. In order to further expand our customer base, we may need to substantially increase our marketing expenditures to enhance brand awareness through various online and offline means. Moreover, negative coverage in the media of our company could threaten the perception of our brand, and we cannot assure you that we will be able to defuse negative press coverage about our company to the satisfaction of our investors, customers and suppliers. If we are unable to defuse negative press coverage about our company, our brand may suffer in the marketplace, our operational and financial performance may be negatively impacted.

Currently, we sell our products, under our various product line brands, to domestic customers in Malaysia and to overseas customers. However, if our competitors initiate a lawsuit against us for infringing their trademarks, we may be forced to adopt a new brand name for our products. As a result, we may incur additional marketing cost to raise awareness of such new brand name. We may also be ordered to pay a significant amount of damages, and our business, results of operations and financial condition could be materially and adversely affected. We operate in a competitive environment and our profitability and competitive position depend on our ability to accurately estimate the costs and timing of providing our products and services.

We may be unable to protect our intellectual property rights.

We rely on intellectual property laws in Malaysia and other jurisdictions to protect our patents trademarks. We are in the process of registering patents in Malaysia, China, Thailand, Philippines, Vietnam, Taiwan, Japan as well as Patent Cooperation Treaty and trademarks in Malaysia and China. We cannot assure you that counterfeiting or imitation of our products will not occur in the future or, if it does occur, that we will be able to address the problem in a timely and effective manner. Any occurrence of counterfeiting or imitation of our products or other infringement of our intellectual property rights could negatively affect our brand and our reputation, which in turn adversely affects the results of our operations.

Litigation to prosecute infringement of our intellectual property rights could be costly and lengthy and will divert our managerial and financial resources. We will have to bear costs of the intellectual property litigation and may be unable to recover such costs from our opposite parties. Protracted litigation could also result in our customers deferring or limiting their purchase or use of our products until such litigation is resolved. The occurrence of any of the foregoing will have a material adverse effect on our business, financial condition and results of operations.

Climate change and regulations associated with climate change could adversely affect our business.

The effects of climate change, including extreme weather conditions, create financial risks to our business. The effects of climate change could disrupt our operations by impacting the availability and cost of materials and by increasing insurance and other operating costs. The effects of climate change also may impact our decisions to construct new facilities or maintain existing facilities in the areas most prone to physical risks, which could similarly increase our operating and material costs. We could also face indirect financial risks passed through the supply chain that could result in higher prices for our products and the resources needed to produce them.

There is a general consensus that greenhouse gas emissions are linked to climate change, and that these emissions must be reduced dramatically to avert its worst effects. As a result, increased public awareness and concern about climate change will likely continue to (1) generate more international, regional and/or national requirements to curtail the use of high global warming potential refrigerants (which are essential to many of our products); (2) increase building energy efficiency; and (3) cause a shift away from the use of fossil fuels as an energy source. While our products are focused to be eco-friendly, nonetheless, these requirements may render some of the existing technology, particularly some of our products that require refrigerant use, non-compliant or obsolete. While we continue to be committed to developing eco-friendly sustainable solutions for our products, there can be no assurance that our development efforts will be successful, that our products will be accepted by the market, that proposed regulations or deregulation will not have an adverse effect on our competitive position, or that economic returns will reflect our investments in new product development.

| 13 | Page |

The inconsistent international, regional and/or national requirements associated with climate change regulations also create economic and regulatory uncertainty. There is also regulatory and budgetary uncertainty associated with government incentives, which, if discontinued, could adversely impact the demand for energy-efficient buildings and could increase costs of compliance.

Our business and financial performance depend on continued and substantial investments in our information technology infrastructure, which may not yield anticipated benefits and which may be vulnerable to cyber-attacks.

The efficient operation of our business requires continued and substantial investments in information technology (“IT”) infrastructure systems. The failure to design, develop and implement new IT technology infrastructure systems in an effective and timely manner or to maintain existing systems could divert management’s attention and resources. Our information systems may also become obsolete because of inadequate investments, requiring an unplanned transition to a new platform that could be time consuming, costly, and damaging to our competitive position and could require additional management attention. Repeated or prolonged interruptions of service because of poor execution, inadequate investments or obsolescence could have a significant adverse impact on our reputation and our ability to sell products and services.

In addition, our business may be impacted by disruptions to our or third-party IT infrastructure, which could result from (among other causes) cyber-attacks, infrastructure failures or compromises to our physical security. Cyber-based risks are evolving and include attacks: (i) on our IT infrastructure (ii) targeting the security, integrity and/or availability of hardware and software; (iii) on information installed, stored or transmitted in our products (including after the purchase of those products and when they are installed into third-party products); and (iv) on facilities or similar infrastructure. Such attacks could disrupt our systems (or those of third parties) and business operations, impact the ability of our products to work as intended or result in the unauthorized access, use, disclosure, modification, or destruction of information in violation of applicable law and/or contractual obligations. We have experienced cyber-based attacks and, due to the evolving threat landscape, may continue to experience them going forward, potentially with more frequency or severity. We continue to make investments and adopt measures to enhance our protection, detection, response and recovery capabilities, and to mitigate potential risks to our technology, products, services, operations and confidential data. However, depending on the nature, sophistication and scope of cyber-attacks, it is possible that potential vulnerabilities could go undetected for an extended period. As a result, we could potentially experience: (i) production downtimes; (ii) operational delays or other detrimental impacts on our operations; (iii) destruction or corruption of data; (iv) security breaches; (v) manipulation or improper use of our or third-party systems, networks or products; and (vi) financial losses from remedial actions, loss of business, liability, penalties, fines and/or damage to our reputation—any of which could have a material adverse effect on our competitive position, results of operations, cash flows or financial condition. Due to the evolving nature of such risks, the impact of any potential incident cannot be predicted. In addition, because of the global nature of our business, our internal systems and products must comply with applicable laws, regulations and standards in a number of jurisdictions, and government enforcement actions and violations of data privacy and cybersecurity laws could be costly or interrupt our business operations. Any disruption to our business arising from such issues, or an increase in our costs to cover these issues that is greater than what we have anticipated, could have an adverse effect on our competitive position, reputation, results of operations, cash flows or financial condition.

| 14 | Page |

We depend on our intellectual property and have access to certain intellectual property and information of our customers and suppliers. Infringement of or the failure to protect that intellectual property could adversely affect our future growth and success.

The Company’s intellectual property rights are important to our business and include numerous patents, trademarks, proprietary technology, technical data, business processes and other confidential information. Although we consider our intellectual property rights in the aggregate to be valuable, we do not believe that our business is materially dependent on a single intellectual property right or any group of them. We nonetheless rely on a combination of patents, trademarks, nondisclosure agreements, customer and supplier agreements, license agreements, information technology security systems, internal controls and compliance systems and other measures to protect our intellectual property. We also rely on nondisclosure agreements, information technology security systems and other measures to protect certain customer and supplier information and intellectual property that we have in our possession or to which we have access. Our efforts to protect such intellectual property and proprietary information may not be sufficient, however.

We cannot be sure that our pending patent applications will result in the issuance of patents, that patents issued to or licensed by us in the past or in the future will not be challenged or circumvented by competitors, or that these patents will found to be valid or sufficiently broad to preclude our competitors from introducing technologies similar to those covered by our patents and patent applications.

In addition, we may be the target of competitor or other third-party patent enforcement actions seeking substantial monetary damages or seeking to prevent the sale and marketing of certain of our products. Our competitive position also may be adversely impacted by limitations on our ability to obtain possession, ownership or necessary licenses concerning data important to the development or sale of our products or service offerings, or by limitations on our ability to restrict the use by others of data related to our products or services. Any of these events or factors could subject us to judgments, penalties and significant litigation costs or temporarily or permanently disrupt our sales and marketing of the affected products or services and could have a material adverse effect on our competitive position, results of operations, cash flows or financial condition.

We use a variety of raw materials and supplier-provided parts in our business. Significant shortages, supplier capacity constraints or production disruptions, price increases, or tariffs could increase our operating costs and adversely impact the competitive positions of our products.

Our reliance on suppliers and commodity markets to secure components and raw materials (such as copper and steel as well as INCU ionic copper solution), and on service providers to deliver our products, exposes us to volatility in the prices and availability of these materials and services. That potential volatility is particularly acute in certain instances where we depend upon a single source. Issues with suppliers (such as delivery or production disruptions, capacity constraints, quality issues, consolidations, closings or bankruptcies), price increases, raw material shortages, or the decreased availability of trucks and other delivery services could have a material adverse effect on our ability to meet our commitments to customers or increase our operating costs.

We use various strategies to lock in prices of expected purchases of certain raw materials; however, these efforts could cause us to pay higher prices for a commodity when compared with the market price at the time the commodity is actually purchased or delivered. Tariffs can also increase our costs, the impact of which is difficult to predict. However, we believe that our supply management and production practices appropriately balance the foreseeable risks and the costs of alternative practices. Nonetheless, these risks may have a material adverse effect on our competitive position, results of operations, cash flows or financial condition.

| 15 | Page |

We design, manufacture and service products that incorporate advanced technologies. The introduction of new products and technologies involves risks, and we may not realize the degree or timing of benefits initially anticipated.

Our future success depends on designing, developing, producing, selling and supporting innovative products that incorporate advanced technologies. The regulations applicable to our products, as well as our customers’ product and service needs, change from time to time. Moreover, regulatory changes may render our products and technologies non-compliant. Our ability to realize the anticipated benefits of our technological advancements or product improvements – including those associated with regulatory changes – depends on a variety of factors, including: meeting development, production, and regulatory approval schedules; meeting performance plans and expectations; the availability of raw materials and parts; our suppliers’ performance; the hiring, training and deployment of qualified personnel; achieving efficiencies; identifying emerging regulatory and technological trends; validating innovative technologies; the level of customer interest in new technologies and products; and the costs and customer acceptance of our new or improved products.

Failure to achieve and maintain a high level of product and service quality could damage our reputation with customers and negatively impact our results.

Product and service quality issues could harm customer confidence in our company and our brands. If certain of our product offerings do not meet applicable safety standards or our customers’ expectations regarding safety or quality, we can experience lost sales and increased costs and we can and have been exposed to legal, financial and reputational risks. Actual, potential or perceived product safety concerns could expose us to litigation as well as government enforcement actions, which has also occurred in certain instances. In addition, when our products fail to perform as expected, we are exposed to warranty, product liability claims, personal injury and other claims.

We maintain strict quality controls and procedures. However, we cannot be certain that these controls and procedures will reveal defects in our products or their raw materials, which may not become apparent until after the products have been placed in use in the market. Accordingly, there is a risk that products will have defects, which could require a product recall. Product recalls can be expensive to implement, and may damage our reputation, customer relationships and market share.

In many jurisdictions, product liability claims are not limited to any specified amount of recovery. If any such claims or contribution requests or requirements exceed our available insurance or if there is a product recall, there could be an adverse impact on our results of operations. In addition, a recall or claim could require us to review our entire product portfolio to assess whether similar issues are present in other products, which could result in a significant disruption to our business and which could have a further adverse impact on our business, financial condition, results of operations and cash flows. There can be no assurance that we will not experience any material warranty or product liability claim losses in the future, that we will not incur significant costs to defend such claims or that we will have adequate reserves to cover any recalls, repair and replacement costs.

We are subject to litigation, environmental, and other legal and compliance risks.

We are subject to a variety of litigation, legal and compliance risks. These risks relate to, among other things, personal injuries, intellectual property rights, contract-related claims, taxes, environmental matters, employee health and safety, competition laws and laws governing improper business practices. If found responsible in connection with such matters, we could be subject to significant fines, penalties, repayments and other damages (in certain cases, treble damages), and experience reputational harm.

As a global business, we are subject to complex laws and regulations in the U.S. and other countries in which we operate. Those laws and regulations may be interpreted in different ways. They may also change from time to time, as may related interpretations and other guidance. Changes in laws or regulations could result in higher expenses. Uncertainty relating to laws or regulations may also affect how we operate, structure our investments and enforce our rights.

| 16 | Page |

Changes in environmental and climate change related-laws could require additional investments in product designs, which may be more expensive or difficult to manufacture, qualify and sell and/or may involve additional product safety risks and could increase environmental compliance expenditures.

At times we are involved in disputes with private parties over environmental issues, including litigation over the allocation of cleanup costs, alleged personal injuries and property damage. Existing and future asbestos-related claims could adversely affect our financial condition, results of operations and cash flows. Personal injury lawsuits may involve individual and purported class actions alleging that contaminants originating from our current or former products or operating facilities caused or contributed to medical conditions. Property damage lawsuits may involve claims relating to environmental damage or diminution of real estate values. Even in litigation where we believe our liability is remote, there is a risk that a negative finding or decision could have a material adverse effect on our competitive position, results of operations, cash flows or financial condition, in particular with respect to environmental claims in regions where we have, or previously had, significant operations or where certain of our products have been manufactured and used.

Our failure to comply with anti-corruption laws and regulations, or effectively manage our employees, customers and business partners, could severely damage our reputation, and materially and adversely affect our business, financial condition, results of operations and prospects.

We are subject to risks in relation to actions taken by us, our employees, third-party customers or third-party suppliers that constitute violations of the anti-corruption laws and regulations. While we adopt strict internal procedures and work closely with relevant government agencies to ensure compliance of our business operations with relevant laws and regulations, our efforts may not be sufficient to ensure that we comply with relevant laws and regulations at all times. If we, our employees, third-party customers or third-party suppliers violate these laws, rules or regulations, we could be subject to fines and/or other penalties. Actions by Malaysia regulatory authorities or the courts to provide an alternative interpretation of the laws and regulations or to adopt additional anti-bribery or anti-corruption related regulations could also require us to make changes to our operations. Our reputation, corporate image, and business operations may be materially and adversely affected if we fail to comply with these measures or become the target of any negative publicity as a result of actions taken by us, our employees, third-party customers or third-party suppliers.

Our business depends on the continued contributions made by Low Wai Koon (“Dr. Low”), as our founder, chief executive officer, and chairman of the board, the loss of who may result in a severe impediment to our business, results of operation and financial condition.

Our success is dependent upon the continued contributions made by founder, chief executive officer, and chairman of the board, Dr. Low. We rely on his expertise in business operations when we are developing our business. We have no “Key Man” insurance to cover the resulting losses in the event that any of our officer or directors should die or resign. In order to mitigate this risk, the Group has continued to invest in its personnel training as well as investment into its research and development department.

However, if Dr. Low cannot serve the Company or is no longer willing to do so, the Company may not be able to find alternatives in a timely manner or at all. This would likely result in a severe damage to our business operations and would have an adverse material impact on our financial position and operating results. To sustain our operations, the Company may have to recruit and train replacement personnel at a higher cost. In addition, if Dr. Low joins our competitors or develops similar businesses that are in competition with our Company, our business, results of operation and financial conditions may also be negatively impacted.

Our business, financial condition and results of operations have been and may continue to be adversely affected by COVID-19.

The global outbreak of COVID-19 has severely constrained economic activity and, as a result, has caused a significant contraction in the global economy. In response to this outbreak, governments have taken preventive or protective actions, including imposing restrictions on business operations and travel. Governments have also implemented economic stabilization efforts and other measures to mitigate the economic effects of the outbreak; however, the effectiveness and continuation of those measures remains uncertain. Specifically, in response to the COVID-19 pandemic and its spread, the Malaysian government has implemented intermittent lockdowns in various stages such as (i) imposing full movement control orders (“MCO”), under which, quarantines, travel restrictions, and the temporary closure of stores and facilities in Malaysia were made mandatory; (ii) easing MCO to a Conditional Movement Control Order (“CMCO”) under which most business sectors were allowed to operate under strict rules and Standard Operating Procedures mandated by the government of Malaysia; and (iii) further easing CMCO to Recovery Movement Control Order. On January 12, 2021, due to a resurgence of COVID-19 cases, the Malaysian government declared a state of emergency nationwide to combat COVID-19. On February 16, 2021, the government announced that a National COVID-19 Immunization Plan will be implemented for one year after February 2021, in which 80% of the Malaysian population will be vaccinated to achieve herd immunity. On March 5, 2021, lockdowns in most parts of the country were eased to a CMCO, however, COVID-19 cases in the country continued to rise. On May 12, 2021, the Malaysian government re-imposed a full lockdown order nationwide, until the earlier of when (i) daily COVID-19 infection cases in the country fall below 4,000; (ii) intensive care unit wards start operating at a moderate level; or (iii) 10% of the Malaysian population is fully vaccinated. The total number of COVID-19 cases in the country surpassed three million on February 13, 2022, and the number of daily cases hit a record high of 33,406 on March 5, 2022.

| 17 | Page |

The COVID-19 pandemic has had an adverse effect on our business, financial condition and results of operations. Since we lease offices in Malaysia, Cambodia and China for our business operations, the COVID-19 outbreak caused temporary office and factory closures from late March to May 2020, resulting in lower work efficiency and productivity. The nature and extent of the continuing impact of COVID-19 on our business, financial condition and results of operations is uncertain and will depend on future developments, including the recent and pending approvals of vaccines, the wide-spread distribution of vaccines and the effectiveness of such vaccines in preventing COVID-19, and the time it takes to vaccinate global populations.

The COVID-19 pandemic has created unique global and industry-wide challenges, including challenges to our business. Nonetheless, further prolonged closures and restrictions throughout the world or the rollback of reopening measures due to a resurgence of COVID-19 cases and continued decreases in the general level of economic activity may again disrupt our operations and the operations of our suppliers, distributors and customers.

As a result of the foregoing, the pandemic and its impact have also affected and could continue to affect the ability of our customers to pay for our products and services and to obtain financing for significant purchases and operations, which has resulted in, and could further result in, a decrease and/or cancellation of orders and/or payment delays or defaults. Such conditions may also adversely affect our supply base and increase the potential for one or more of our suppliers to experience financial distress or bankruptcy, which could impact our ability to fulfil orders on time or at the anticipated cost. We also may be required to raise additional capital in the future and our access to and cost of financing will depend on, among other things, global economic conditions, conditions in the global financing markets, the availability of sufficient amounts of financing, our results of operations and our credit ratings. There is no guarantee that financing will be available in the future to fund our obligations, or that it will be available on terms consistent with our expectations. Any of these factors could have a material adverse effect on our business, results of operations, cash flows and financial condition.

| 18 | Page |

The war between Russia and Ukraine could adversely affect our business, financial condition and results of operations.

On February 24, 2022, Russian military forces launched a military action in Ukraine, and sustained conflict and disruption in the region is likely. The length, impact, and outcome of this ongoing military conflict is highly unpredictable and could lead to significant market and other disruptions, including significant volatility in commodity prices and supply of energy resources, instability in financial markets, supply chain interruptions, political and social instability, trade disputes or trade barriers, changes in consumer or purchaser preferences, as well as an increase in cyberattacks and espionage.

The war has led to significant sanctions programs imposed by the U.S., the European Union, the UK, Canada, Switzerland, Japan, and other countries against Russia, Belarus, the Crimea Region of Ukraine, the so-called Donetsk People’s Republic, and the so-called Luhansk People’s Republic, including, among others:

● blocking sanctions against some of the largest state-owned and private Russian financial institutions (and their subsequent removal from the Society for Worldwide Interbank Financial Telecommunication payment system) and certain Russian businesses, some of which have significant financial and trade ties to the European Union;

● blocking sanctions against Russian and Belarusian individuals, including the Russian President, other politicians, and those with government connections or involved in Russian military activities;

● blocking of Russia’s foreign currency reserves as well as expansion of sectoral sanctions and export and trade restrictions, limitations on investments and access to capital markets, and bans on various Russian imports; and

● enhanced export controls and trade sanctions targeting Russia’s imports of technological goods as a whole, including tighter controls on exports and reexports of dual-use items, stricter licensing policy with respect to issuing export licenses, and/or increased use of “end-use” controls to block or impose licensing requirements on exports, as well as higher import tariffs and a prohibition on exporting luxury goods to Russia and Belarus.

In retaliation against new international sanctions and as part of measures to stabilize and support the volatile Russian financial and currency markets, the Russian authorities also imposed significant currency control measures aimed at restricting the outflow of foreign currency and capital from Russia, imposed various restrictions on transacting with non-Russian parties, banned exports of various products, and imposed other economic and financial restrictions. The situation is rapidly evolving, and additional sanctions by Russia on the one hand, and by the other countries on the other hand, could adversely affect the global economy, financial markets, energy supply and prices, certain critical materials and metals, supply chains, and global logistics and could adversely affect our business, financial condition, and results of operations.