As submitted to the Securities and Exchange Commission on July 26, 2021

PART II – INFORMATION REQUIRED IN OFFERING CIRCULAR

An Offering Statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission (the “SEC”). Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the Offering Statement filed with the SEC is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Final Offering Circular or the Offering Statement in which such Final Offering Circular was filed may be obtained.

PRELIMINARY OFFERING CIRCULAR SUBJECT TO COMPLETION

Dated July 26, 2021

EMERALD HEALTH PHARMACEUTICALS INC.

5910 Pacific Center Blvd, Ste 320

San Diego, California 92121

(800) 268-0719

www.emeraldpharma.com

6,250,000 Shares of Common Stock

Emerald Health Pharmaceuticals Inc., a Delaware corporation (the “Company”, “EHP”, “we”, or “our”), is offering up to a maximum of 6,250,000 shares of our Common Stock, par value $0.0001 per share (the “Shares”) to be sold in this offering (the “Offering”). The Shares are being offered at a purchase price of $8.00 per Share, for gross proceeds of up to $50,000,000 (the “Maximum Amount”), pursuant to this Offering Circular (this “Offering Circular”).

We are selling the Shares on a “best efforts” basis through a Tier 2 offering pursuant to Regulation A (Regulation A+) under the Securities Act of 1933, as amended (the “Securities Act”), and we intend to sell the Shares either directly to investors or through registered broker-dealers who are paid commissions. This Offering will terminate on the earlier of (i) June 30, 2023, (ii) the date on which the Maximum Amount is sold, or (iii) when the Board of Directors of the Company elects to terminate the Offering (in each such case, the “Termination Date”).The minimum investment amount from an investor is $4,000; however, we expressly reserve the right to waive this minimum in the sole discretion of our management. See “Securities Being Offered” beginning on page 56 for a discussion of certain items required by Item 14 of Part II of Form 1-A. We will hold closings upon the receipt of investors’ subscriptions and acceptance of such subscriptions by the Company. If, on the initial closing date, we have sold less than the Maximum Amount, then we may hold one or more additional closings for additional sales of Shares, until the earlier of (i) the sale of the Maximum Amount or (ii) the Termination Date. There is no aggregate minimum requirement for the Offering to become effective; therefore, we reserve the right, subject to applicable securities laws, to begin applying the proceeds from the Offering towards our business strategy, including, without limitation, research and development expenses, offering expenses, working capital and general corporate purposes and other uses, as more specifically set forth in the “Use of Proceeds” section of this Offering Circular.

Subscriptions for Shares are irrevocable and the purchase price is non-refundable, unless the Company rejects a subscription, as expressly stated in this Offering Circular. All proceeds received by us from subscribers in this Offering will be available for use by us upon our acceptance of subscriptions for the Shares. We expect to commence the sale of Shares of our Common Stock on approximately ____ __, 2021.

Investing in the Shares involves a high degree of risk. These are speculative securities. You should purchase these securities only if you can afford a complete loss of your investment. See “Risk Factors” starting on page 5 for a discussion of certain risks that you should consider in connection with an investment in the Shares.

THE SEC DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE SEC; HOWEVER, THE SEC HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

| Price to Public | Underwriting Discount and Commissions (1) |

Proceeds to Company (2) |

Proceeds to Other | |||||||||||

| Per Share | $ | 8.00 | $ | $ | 8.00 | None | ||||||||

| Total Maximum (3) | $ | 50,000,000 | $ | $ | 50,000,000 | None | ||||||||

| (1) | The Offering may be made, in management’s discretion, directly to investors by the Company’s management on a “best efforts” basis. We reserve the right to offer the Shares through broker-dealers who are registered with the Financial Industry Regulatory Authority (“FINRA”). We will be required to retain a broker-dealer or register as an issuer-dealer and/or agent under the blue sky laws of certain states (including Arizona, Alabama, North Dakota, Washington, New Jersey, Florida and Texas) in order to make offers to sell our Shares in those states. There can be no guarantee that we will be approved as an issuer-dealer and/or agent in any or all of the states which we determine require such registration. If we do not engage a broker-dealer or register as an issuer-dealer and/or agent in the foregoing states, we will not offer and sell the Shares in such states. |

| (2) | The amounts shown are before deducting estimated Offering costs to us of approximately $1.5 million, which include legal, accounting, printing, due diligence, marketing, consulting, selling and other costs incurred in the Offering. (See “Use of Proceeds” and “Plan of Distribution.”) |

| (3) | The Shares are being offered pursuant to Regulation A of Section 3(b) of the Securities Act for Tier 2 offerings. The Shares are only issued to purchasers who satisfy the requirements set forth in Regulation A. We have the option in our sole discretion to waive the minimum investment. |

GENERALLY, NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN TEN PERCENT (10%) OF THE GREATER OF YOUR ANNUAL INCOME OR YOUR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(D)(2)(I)(C) OF REGULATION A+. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO WWW.INVESTOR.GOV.

This Offering Circular contains all of the representations by us concerning this Offering, and no person shall make different or broader statements than those contained herein. Investors are cautioned not to rely upon any information not expressly set forth in this Offering Circular.

The securities underlying this Offering Circular may not be sold until qualified by the Securities and Exchange Commission. This Offering Circular is not an offer to sell, nor soliciting an offer to buy, any Shares in any state or other jurisdiction in which such sale is prohibited.

The Company is following the “Offering Circular” format of disclosure under Regulation A+.

The date of this Preliminary Offering Circular is July 26, 2021.

TABLE OF CONTENTS

i

IMPORTANT INFORMATION ABOUT THIS OFFERING CIRCULAR

We are offering to sell, and seeking offers to buy, our securities only in jurisdictions where such offers and sales are permitted. Please carefully read the information in this Offering Circular and any accompanying offering circular supplements, which we refer to collectively as the Offering Circular. You should rely only on the information contained in this Offering Circular. We have not authorized anyone to provide you with any information other than the information contained in this Offering Circular. The information contained in this Offering Circular is accurate only as of its date or as of the respective dates of any documents or other information incorporated herein by reference, regardless of the time of its delivery or of any sale or delivery of our securities. Neither the delivery of this Offering Circular nor any sale or delivery of our securities shall, under any circumstances, imply that there has been no change in our affairs since the date of this Offering Circular. This Offering Circular will be updated and made available for delivery to the extent required by the federal securities laws.

This Offering Circular is part of an Offering Statement that we filed with the SEC using a continuous offering process pursuant to Rule 251(d)(3)(i)(F) under the Securities Act. Periodically, we may provide an offering circular supplement that would add, update or change information contained in this Offering Circular. Any statement that we make in this Offering Circular will be modified or superseded by any inconsistent statement made by us in a subsequent offering circular supplement. The Offering Statement we filed with the SEC includes exhibits that provide more detailed descriptions of the matters discussed in this Offering Circular. You should read this Offering Circular and the related exhibits filed with the SEC and any offering circular supplement, together with additional information contained in our annual reports, semi-annual reports and other reports that we will file periodically with the SEC. The offering statement and all supplements and reports that we have filed or will file in the future can be read at the SEC website, www.sec.gov.

Unless otherwise indicated, data contained in this Offering Circular concerning the business of the Company are based on information from various public sources. Although we believe that these data are generally reliable, such information is inherently imprecise, and our estimates and expectations based on these data involve a number of assumptions and limitations. As a result, you are cautioned not to give undue weight to such data, estimates or expectations.

In this Offering Circular, unless the context indicates otherwise, references to the “Company,” “EHP,” “we,” “our,” and “us” refer to the activities of and the assets and liabilities of the business and operations of Emerald Health Pharmaceuticals Inc.

ii

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements under “Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Description of Business” and elsewhere in this Offering Circular constitute forward-looking statements. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar matters that are not historical facts. In some cases, you can identify forward-looking statements by terms such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “should,” “will” and “would” or the negatives of these terms or other comparable terminology.

You should not place undue reliance on forward-looking statements. The cautionary statements set forth in this Offering Circular, including in “Risk Factors” and elsewhere, identify important factors which you should consider in evaluating our forward-looking statements. These factors include, among other things:

| ● | The success of our product candidates will require significant capital resources and years of clinical development efforts; | |

| ● | The results of clinical testing and trial activities of our products; | |

| ● | Our ability to obtain regulatory approval and market acceptance of, and reimbursement for our products; | |

| ● | Our ability to protect our intellectual property and to develop, maintain and enhance a strong brand; | |

| ● | Our ability to compete and succeed in a highly competitive and evolving industry; | |

| ● | Our limited operating history on which to judge our business prospects and management; | |

| ● | Our ability to raise capital and the availability of future financing; | |

| ● | Our ability to manage our research, development, expansion, growth and operating expenses; | |

| ● | The impact of the novel coronavirus (COVID-19) pandemic; and | |

| ● | Our reliance on third parties to conduct our research, preclinical studies, manufacturing and clinical trials. |

Although the forward-looking statements in this Offering Circular are based on our beliefs, assumptions and expectations, taking into account all information currently available to us, we cannot guarantee future transactions, results, performance, achievements or outcomes. No assurance can be made to any investor by anyone that the expectations reflected in our forward-looking statements will be attained, or that deviations from them will not be material and adverse. We undertake no obligation, other than as may be required by law, to re-issue this Offering Circular or otherwise make public statements updating our forward-looking statements.

iii

This summary highlights selected information contained elsewhere in this Offering Circular. This summary is not complete and does not contain all the information that you should consider before deciding whether to invest in our Common Stock. You should carefully read the entire Offering Circular, including the risks associated with an investment in the company discussed in the “Risk Factors” section of this Offering Circular, before making an investment decision. Some of the statements in this Offering Circular are forward-looking statements. See the section entitled “Cautionary Statement Regarding Forward-Looking Statements.”

Company Information

Emerald Health Pharmaceuticals Inc. (the Company, EHP, we, our, and us) was formed on March 2, 2017 under the laws of the State of Delaware, and is headquartered in San Diego, California. The Company was formed to acquire, discover, develop and commercialize drug candidates based on patented new chemical entities (NCEs) with a unique mechanism of action (MOA), to treat diseases with unmet medical needs.

In June 2017, the Company acquired six patents and fourteen pending patent applications covering two series of molecules consisting of 25 unique NCEs for cash consideration of $112,000, pursuant to an Intellectual Property Transfer Agreement (IPTA) with Emerald Health Biotechnology España S.L.U. (EHBE), a limited liability company formed under the laws of Spain, formerly known as VivaCell Biotechnology España S.L. Future payments are due upon completion of certain milestones and a 2.5% royalty will be paid to EHBE on all net revenues of any drug developed from the intellectual property acquired pursuant to the IPTA. The assets acquired under the IPTA were in the research stage. Concurrent with the entry into the IPTA, the Company entered into a Research Agreement with EHBE for an initial term of five years pursuant to which EHBE will perform certain functions to support the research efforts associated with our development of the acquired technology.

A significant (and former majority) stockholder of EHP is Emerald Health Sciences Inc. (EHS), a private company headquartered in Canada. As of the date of this Offering Circular, EHS owns approximately 48% of our outstanding Common Stock. Accordingly, EHS exerts and may continue to exert significant influence over us and any action requiring the approval of the holders of our Common Stock, including the election of directors and amendments to our organizational documents, such as increases in our authorized shares of Common Stock and approval of significant corporate transactions.

Our mailing address is Emerald Health Pharmaceuticals Inc., 5910 Pacific Center Blvd, Ste 320, San Diego, California 92121 and our telephone number is (800) 268-0719. Our website address is www.emeraldpharma.com. The information contained therein or accessible thereby shall not be deemed to be incorporated into this Offering Circular.

Our Business

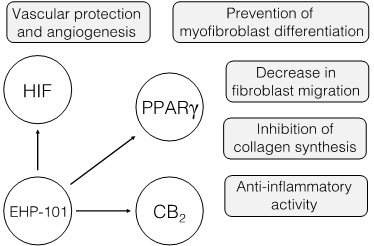

We are a pharmaceutical company focused on developing drug product candidates containing novel, patented molecules to treat various diseases with unmet medical needs, including neurodegenerative, autoimmune and other diseases. We are currently developing two initial therapeutic product candidates, EHP-101 and EHP-102, that target four initial disease indications, multiple sclerosis (MS) and systemic sclerosis (SSc, a severe form of scleroderma) with EHP-101, and Parkinson’s disease (PD) and Huntington’s disease (HD) with EHP-102. We believe treatments for these indications represent markets with underserved patient populations.

1

Our platform technology currently consists of a library of 25 novel, patented, synthetically manufactured molecules. These resulting molecules are NCEs now covered by 23 issued international patents. In addition, we have 21 pending patent applications. We believe our technology platform represents an advancement to existing therapies because current treatments for the diseases we are targeting address only a part of the disease process and mainly affect the symptoms of the diseases and our NCEs are chemically designed to target several of the main biological receptors and pathways in the body that can specifically treat these diseases. In addition, we know of no other products on the market or product candidates in development that possess the same combined MOA as the novel molecules in our lead product candidates.

Our current product pipeline includes two initial product candidates, EHP-101 and EHP-102, containing NCEs from our library of molecules. EHP-101 is our lead product candidate and is being developed as an oral formulation of one of the molecules in our portfolio, known as VCE-004.8, and is currently in Phase 2 clinical (human) development. EHP-102 is being developed as an oral formulation of another one of the molecules in our portfolio, known as VCE-003.2, and is currently in preclinical (non-human) development. Based on our studies to date, we believe that these initial product candidates have the potential to treat several diseases with unmet medical need. We are currently targeting four distinct diseases, two for each of these initial product candidates. With EHP-101, we are initially targeting MS and SSc, and with EHP-102, we are initially focusing on PD and HD. Other applications and different formulations are also being investigated with our two current product candidates, and research is ongoing with other molecules within our NCE portfolio, as well as continued discovery of additional unique molecules to add to our portfolio.

In September 2019, we successfully completed a Phase 1 clinical trial in Australia to establish EHP-101’s safety, tolerability and pharmacokinetics (PK) in healthy volunteers. During 2020, we initiated a Phase 2a safety and efficacy clinical trial with EHP-101 in SSc patients and we have commenced the initiation of activities for a Phase 2 clinical trial with EHP-101 in MS patients to begin in 2021. If such clinical trials are successful, we plan to advance the product candidates into additional clinical trials.

We have completed preclinical proof of concept (POC) studies for EHP-102. We are now in the manufacturing and formulation development stage and have initiated the nonclinical studies for HD and PD required to allow for advancement to clinical trials.

We have been granted Orphan Drug Designation (ODD) from the Food and Drug Administration (FDA) in the United States and from the European Medicines Agency (EMA) in Europe for EHP-101 for the SSc indication and for EHP-102 for the HD indication. We have also received Fast Track designation by the FDA for EHP-101 for the SSc indication.

Intellectual Property

Our intellectual property is related to the two series of molecules in our portfolio, containing 25 different and unique molecules, as well as to other molecules, some already synthesized and others in the discovery stage. We have sought and intend to continue to seek additional appropriate patent protection for our two current product candidates (EHP-101 and EHP-102) and the API in those two product candidates (VCE-004.8 and VCE-003.2, respectively), as well as for our initial portfolio and additional novel molecules and proprietary technologies, and their uses, by filing patent applications in the United States and selected other selected countries.

As of the date of this Offering Circular, we own a total of 23 issued patents and 21 pending patent applications, including composition of matter, method of use, and formulation patents. Our patent portfolio provides a relatively long window for development and commercialization. Our patents and patent applications will expire between 2030 and 2041 and may be eligible for patent term extension for delay caused by regulatory review, thereby further extending their patent terms. In addition, our patent portfolio includes use in many different indications, which we believe will allow us to develop products for additional patient populations in markets with unmet medical need.

Product Pipeline

Our current product pipeline consists of two initial product candidates, EHP-101 and EHP-102, which we are developing for four disease indications, MS, SSc, PD and HD. We own all intellectual property and all global development and marketing rights with respect to our product pipeline.

2

Competition

The biotechnology and pharmaceutical industries are subject to rapid and intense technological change. We face, and will continue to face, competition in the development and marketing of our product candidates from biotechnology and pharmaceutical companies, research institutions, government agencies and academic institutions. Competition may also arise from, among other things:

| ● | other drug development technologies; | |

| ● | methods of preventing or reducing the incidence of disease, including vaccines; and | |

| ● | new small molecule or other classes of therapeutic agents. |

Developments by others may render our product candidates or technologies obsolete or noncompetitive.

The Technology

Our molecules are synthetically manufactured NCEs designed to affect specific biological receptors and pathways in the body related to various diseases. The basic molecular structure used to design the new molecules used as the active pharmaceutical ingredient (API) in our product candidates are the molecules cannabidiol (CBD) and cannabigerol (CBG), two non-psychoactive cannabinoids. While CBD and CBG may be classified by the United States Drug Enforcement Administration (DEA) as controlled substances in the United States depending on their origin and purity, in March 2019 we received a decision from the DEA that the API (VCE-004.8) in our lead product candidate (EHP-101) is not a controlled substance. We have also received the same decision from the United Kingdom (UK) Home Office and Canada’s Controlled Substances Directorate. We plan to seek the same determination for the API (VCE-003.2) in our second product candidate (EHP-102) once it gets closer to clinical development.

Risks Related to Our Business

Our business and our ability to execute our business strategy are subject to a number of risks as more fully described in the section titled “Risk Factors” beginning on page 5. These risks include, among others:

| ● | The success of our product candidates will require significant capital resources and years of clinical development efforts; | |

| ● | The results of clinical testing and trial activities of our products; | |

| ● | Our ability to obtain regulatory approval and market acceptance of, and reimbursement for our products; | |

| ● | Our ability to protect our intellectual property and to develop, maintain and enhance a strong brand; | |

| ● | Our ability to compete and succeed in a highly competitive and evolving industry; | |

| ● | Our limited operating history on which to judge our business prospects and management; | |

| ● | Our ability to raise capital and the availability of future financing; | |

| ● | Our ability to manage our research, development, expansion, growth and operating expenses; | |

| ● | The impact of the COVID-19 pandemic; and | |

| ● | Our reliance on third parties to conduct our research, preclinical studies and expected clinical trials. |

Our financial statements have been prepared assuming we will continue as a going concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. Since inception, we have funded our operations with the proceeds from a revolving loan (which terminated in June of 2021) and advances of expenditures paid for on our behalf by our significant (former majority) stockholder, EHS, and the proceeds raised in our Regulation A, Tier 2 offering that commenced in 2019 and terminated in March of 2021. Our future viability is largely dependent upon our ability to raise additional capital to finance our operations. Our management expects that future sources of funding may include sales of equity, obtaining loans, or other strategic transactions. Although our management continues to pursue these plans, including through this Offering, there is no assurance that we will be successful with this Offering or in obtaining sufficient financing on terms acceptable to us to continue to finance our operations.

3

REGULATION A+

We are offering our Common Stock pursuant to rules of the SEC mandated under the Jumpstart Our Business Startups Act of 2012 (the JOBS Act). These offering rules are often referred to as “Regulation A+.” We are relying upon “Tier 2” of Regulation A+, which allows us to offer and sell up to $75 million in a 12-month period.

In accordance with the requirements of Tier 2 of Regulation A+, we are required to publicly file annual, semiannual, and current event reports with the SEC.

| Issuer: | Emerald Health Pharmaceuticals Inc., a Delaware corporation. | |

| Shares Offered: | A maximum of 6,250,000 Shares at an offering price of $8.00 per Share. | |

| Number of shares of Common Stock Outstanding before the Offering (1): | 22,065,147 shares of Common Stock. | |

| Number of shares of Common Stock to be Outstanding after the Offering (1): | 28,315,147 shares of Common Stock if the Maximum Amount of Shares are sold. | |

| Price per Share: | $8.00 | |

| Maximum Amount: | 6,250,000 Shares for gross proceeds of $50,000,000. | |

| Use of Proceeds: | If the Maximum Amount is sold, our net proceeds (after estimated offering expenses) will be approximately $48.5 million. We will use these net proceeds for research and development expenses (including clinical trials), working capital and general corporate purposes, and such other purposes described in the “Use of Proceeds” section of this Offering Circular. | |

| Risk Factors: | Investing in our Common Stock involves a high degree of risk. See “Risk Factors” starting on page 5. |

| (1) | In addition, there are 3,971,726 shares of Common Stock reserved for issuance under our 2018 Equity Incentive Plan, with 3,531,000 shares of Common Stock issuable pursuant to outstanding awards which will be issuable upon exercise of outstanding awards with exercise prices ranging from $2.50 per share to $6.00 per share. |

4

An investment in our Common Stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this Offering Circular, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the price of our shares of Common Stock could decline and you may lose all or part of your investment. See “Cautionary Statement Regarding Forward Looking Statements” above for a discussion of forward-looking statements and the significance of such statements in the context of this Offering Circular.

Risks Related to our Business and Industry

We are largely dependent on the success of our product candidates, EHP-101 and EHP-102, which are in clinical and preclinical development, respectively, and will require the effective execution of our business plan, significant capital resources and years of clinical development effort.

We currently have no products on the market. Our most advanced product candidate, EHP-101, completed a Phase 1 clinical trial in September 2019 and is now in Phase 2 clinical development, while our second product candidate, EHP-102, is in preclinical development. Our business plan depends almost entirely on the successful preclinical and clinical development, regulatory approval and commercialization of EHP-101 and EHP-102, and substantial clinical development and regulatory approval efforts will be required before we are permitted to commence commercialization, if ever. It could be several years before we can complete a pivotal study for EHP-101 or EHP-102, if ever. The clinical trials and manufacturing and marketing of EHP-101 and EHP-102 will be subject to extensive and rigorous review and regulation by numerous government authorities in the United States (US), Australia, New Zealand, the European Union (EU), Canada, and other jurisdictions where we intend to perform studies and, if approved, market our product candidates. Before obtaining regulatory approvals for the commercial sale of any product candidate, we must demonstrate through preclinical testing and clinical trials that the product candidate is safe and effective for use in each target indication, and potentially in specific patient populations. This process can take many years and may include post-marketing studies and surveillance, which would require the expenditure of substantial resources beyond our existing funds. Of the large number of drugs in development for approval in the US and the EU, only a small percentage successfully complete the US Food and Drug Administration (FDA) regulatory approval process or are granted a marketing authorization by the European Medicines Agency (EMA) or the other competent authorities in the EU Member States, as applicable, and are commercialized. Accordingly, even if we are able to obtain the requisite financing to continue to fund our research, development and clinical programs, we cannot assure you that any of our product candidates will be successfully developed or commercialized.

Because the results of efficacy and preclinical studies are not necessarily predictive of future results, EHP-101 and EHP-102 may not have favorable results in our planned clinical trials.

Any positive results from efficacy in preclinical testing of EHP-101 and EHP-102 may not necessarily be predictive of the results from our current and planned clinical trials. In addition, our interpretation of clinical data or our conclusions based on our preclinical in vitro and in vivo models may prove inaccurate. Many companies in the pharmaceutical and biotechnology industries have suffered significant setbacks in clinical trials after achieving positive results in preclinical development, and we cannot be certain that we will not face similar setbacks. These setbacks have been caused by, among other things, preclinical findings while clinical trials were underway or safety or efficacy observations in clinical trials, including adverse events. Moreover, preclinical data can be susceptible to varying interpretations and analyses, and many companies that believed their product candidates performed satisfactorily in preclinical studies nonetheless failed to obtain FDA approval or a marketing authorization granted by the EMA. If we fail to produce positive results in our planned clinical trials of EHP-101 and EHP-102, the development timeline and regulatory approval and commercialization prospects for EHP-101 and EHP-102, and, correspondingly, our business and financial prospects, would be materially adversely affected.

5

Failures or delays in our planned clinical trials of EHP-101 or EHP-102 could result in increased costs to us and could delay, prevent or limit our ability to generate revenue and continue our business.

EHP-101 has completed a Phase 1 clinical study and is currently in Phase 2 clinical development, while EHP-102 is advancing through preclinical development. Successful completion of preclinical studies and clinical trials is a prerequisite to submitting a new drug application (NDA) to the FDA or a marketing authorization application (MAA) to the EMA, which are required for approval for commercialization. Clinical trials are expensive, difficult to design and implement, can take many years to complete and are uncertain as to outcome. A product candidate can unexpectedly fail at any stage of clinical development. The historic failure rate for product candidates is high due to many factors, including scientific feasibility, findings related to safety and efficacy, changing regulatory standards and standards of medical care and other variables. We do not know whether our clinical trials will begin or be completed on schedule, if at all, as the commencement and completion of clinical trials can be delayed or prevented for a number of reasons, including, among others:

| ● | delays in reaching or failing to reach agreement on acceptable terms with prospective clinical trial sites, the terms of which can be subject to extensive negotiation and may vary significantly among different clinical trial sites; | |

| ● | clinical sites or investigators deviating from trial protocol, failing to conduct the trial in accordance with applicable regulatory requirements, or dropping out of a trial or failure of third-party clinical trial managers to meet their contractual obligations or deadlines; | |

| ● | delays or inability in manufacturing or obtaining sufficient quantity or quality of a product candidate or other materials necessary to conduct clinical trials due to regulatory and manufacturing constraints; | |

| ● | delay or failure in reaching agreement with the FDA or a foreign regulatory authority on the design of a given trial, or in obtaining authorization to commence a trial; | |

| ● | difficulties obtaining institutional review board (IRB), Drug Enforcement Administration (DEA) or comparable foreign regulatory authority, or ethics committee approval to conduct a clinical trial; | |

| ● | challenges in recruiting and enrolling patients to participate in clinical trials, including the size and nature of the patient population, the proximity of patients to clinical trial sites, eligibility criteria for the clinical trial, the nature of the clinical trial protocol, the availability of approved effective treatments for the relevant indication and competition from other clinical trial programs for similar indications; | |

| ● | severe or unexpected toxicities or drug-related side effects in our preclinical studies or experienced by patients in our clinical trials or by individuals using drugs similar to our product candidates; | |

| ● | DEA or comparable foreign regulatory authority-related recordkeeping, reporting or security violations at a clinical trial site, leading the DEA, state authorities or comparable foreign regulatory authorities to suspend or revoke the site’s controlled substance registration and causing a delay or termination of planned or ongoing clinical trials; | |

| ● | regulatory concerns with cannabinoid products generally and the potential for abuse of those products; | |

| ● | difficulties retaining patients who have enrolled in a clinical trial who may withdraw due to lack of efficacy, side effects, personal issues or loss of interest and difficulties having subjects return for post-treatment follow-up; | |

| ● | ambiguous or negative interim results; or | |

| ● | lack of adequate funding to continue a clinical trial. |

6

In addition, a clinical trial may be suspended or terminated by us, the FDA, an IRB, an ethics committee, a data safety monitoring board or other foreign regulatory authorities overseeing the clinical trial at issue due to a number of factors, including, among others:

| ● | failure to conduct the clinical trial in accordance with regulatory requirements or our clinical trial protocols; | |

| ● | inspection of the clinical trial operations or clinical trial sites by the FDA, the DEA, the EMA or other foreign regulatory authorities that reveals deficiencies or violations that require us to undertake corrective action, including the imposition of a clinical hold; | |

| ● | safety issues, including any issues that could be identified in our nonclincial studies; | |

| ● | adverse side effects or lack of effectiveness; and | |

| ● | changes in government regulations or administrative actions. |

If our clinical trials fail or are delayed for any of the above reasons, our development costs may increase, our approval process could be delayed and our ability to commercialize our product candidates could be materially harmed, which could have a material adverse effect on our business, financial condition or results of operations.

The regulatory approval processes of the FDA, the EMA and other comparable domestic and foreign regulatory authorities are lengthy, time-consuming and inherently unpredictable, and if we are ultimately unable to obtain timely regulatory approval for our product candidates, our business will be substantially harmed.

We are not permitted to market our product candidates in the US or the EU until we receive approval of an NDA from the FDA or an MAA from the EMA, or in any foreign countries until we receive the requisite approval from such countries. Prior to submitting an NDA to the FDA or an MAA to the EMA for approval of our product candidates we will need to complete our nonclinical studies and initiate and complete multiple clinical trials. Successfully completing our clinical program and obtaining approval of an NDA or MAA is a complex, lengthy, expensive and uncertain process, and the FDA or EMA may delay, limit or deny approval of our product candidates for many reasons, including, among others, because:

| ● | we may not be able to demonstrate that our product candidates are safe and effective in treating patients to the satisfaction of the FDA, EMA or other applicable foreign regulatory agencies; | |

| ● | the results of our clinical trials may not meet the level of statistical or clinical significance required by the FDA, EMA or other applicable foreign regulatory agencies for marketing approval; | |

| ● | the FDA, EMA or other applicable foreign regulatory agencies may disagree with the number, design, size, conduct or implementation of our clinical trials; | |

| ● | the FDA, EMA or other applicable foreign regulatory agencies may require that we conduct additional clinical trials; | |

| ● | the FDA, EMA or other applicable foreign regulatory authorities may not approve the formulation, labeling or specifications of our product candidates; |

7

| ● | the contract research organizations (CROs) and other contractors that we may retain to conduct our clinical trials may take actions outside of our control that materially adversely impact our clinical trials; | |

| ● | the FDA, EMA or other applicable foreign regulatory agencies may find the data from preclinical studies and clinical trials insufficient to demonstrate that EHP-101 or EHP-102 are safe and effective for their proposed indications; |

| ● | the FDA, EMA or other applicable foreign regulatory agencies may disagree with our interpretation of data from our preclinical studies and clinical trials; | |

| ● | the FDA, EMA or other applicable foreign regulatory agencies may not accept data generated at our clinical trial sites or may disagree with us over whether to accept efficacy results from clinical trial sites outside the US, outside the EU, or outside a specific country, as applicable, where the standard of care is potentially different from that in the US or in the EU, as applicable; | |

| ● | if and when our NDAs or MAAs or other applications for regulatory approval are submitted to the FDA, EMA, or other applicable foreign regulatory agencies, as applicable, the regulatory authorities may have difficulties scheduling the necessary review meetings in a timely manner, may recommend against approval of our application or may recommend or require, as a condition of approval, additional preclinical studies or clinical trials, limitations on approved labeling or distribution and use restrictions; | |

| ● | the FDA may require development of a Risk Evaluation and Mitigation Strategy (REMS), which would use risk minimization strategies to ensure that the benefits of certain prescription drugs outweigh their risks, as a condition of approval or post-approval, and the EMA or other applicable foreign regulatory agencies may grant only conditional marketing authorization or impose specific obligations as a condition for marketing authorization, or may require us to conduct post-authorization safety studies; | |

| ● | the FDA, DEA, EMA or other applicable foreign regulatory agencies may not approve the manufacturing processes or facilities of third-party manufacturers with which we contract, or DEA or other applicable foreign regulatory agency quotas may limit the quantities of controlled substances available to our manufacturers; or | |

| ● | the FDA, EMA or other applicable foreign regulatory agencies may change their approval policies or adopt new regulations. |

Any of these factors, many of which are beyond our control, could increase development costs, jeopardize our ability to obtain regulatory approval for and successfully market EHP-101 or EHP-102 and generate product revenue. Moreover, because our business is almost entirely dependent upon these two candidates, any such setback in our pursuit of regulatory approval would have a material adverse effect on our business and prospects.

We have conducted a Phase 1 clinical trial for EHP-101 outside the US, and we are conducting a Phase 2 clinical trial for EHP-101 inside and outside the US, and we may choose to conduct additional clinical trials for EHP-101 and EHP-102 outside the US, and the FDA may not accept data from such trials.

We completed a Phase 1 clinical trial for EHP-101 in Australia and we are conducting a Phase 2 clinical trial for EHP-101 in Australia, New Zealand and the US, and we may choose to conduct additional clinical trials for EHP-101 and EHP-102 in countries outside the US, including Australia and New Zealand, subject to applicable regulatory approval. We plan to submit NDAs for EHP-101 and EHP-102 to the FDA upon completion of all requisite clinical trials. Although the FDA may accept data from clinical trials conducted outside the US, acceptance of such study data by the FDA is subject to certain conditions. For example, the clinical trial must be conducted in accordance with Good Clinical Practice (GCP) requirements and the FDA must be able to validate the data from the clinical trial through an onsite inspection if it deems such inspection necessary. There can be no assurance the FDA will accept data from clinical trials conducted outside of the US. If the FDA does not accept any such data, it would likely result in the need for additional clinical trials, which would be costly and time-consuming and delay aspects of our development plan.

8

Even if EHP-101 or EHP-102 receive regulatory approval, they may still face future development and regulatory difficulties.

If we obtain regulatory approval for EHP-101 or EHP-102, such approval would be subject to extensive ongoing requirements by the FDA, EMA and other foreign regulatory authorities, and potentially the DEA, including requirements related to the manufacture, quality control, further development, labeling, packaging, storage, distribution, safety surveillance, import, export, advertising, promotion, recordkeeping and reporting of safety and other post-market information. The safety profile of any product will continue to be closely monitored by the FDA, EMA and other comparable foreign regulatory authorities. If the FDA, EMA, DEA or any other comparable foreign regulatory authority become aware of new safety information after approval of any of our product candidates, these regulatory authorities may require labeling changes or establishment of a Risk Evaluation and Mitigation Strategy (REMS), impose significant restrictions on a product’s indicated uses or marketing, initiate a change in the drug’s controlled substance schedule, impose ongoing requirements for potentially costly post-approval studies or post-market surveillance, impose a recall or seek to withdraw marketing approval altogether.

In addition, manufacturers of therapeutic products and their facilities are subject to continual review and periodic inspections by the FDA, the EMA and other comparable foreign regulatory authorities for compliance with current Good Manufacturing Practices (cGMPs). Further, manufacturers of controlled substances must obtain and maintain necessary DEA and state registrations and registrations with applicable foreign regulatory authorities and must establish and maintain processes to ensure compliance with DEA and state requirements and requirements of applicable foreign regulatory authorities governing, among other things, the storage, handling, security, recordkeeping and reporting for controlled substances. If we or a regulatory agency discover previously unknown problems with a product, such as adverse events of unanticipated severity or frequency, or problems with the facility where the product is manufactured, a regulatory agency may impose restrictions on that product, the manufacturing facility or us, including requiring recall or withdrawal of the product from the market or suspension of manufacturing. If we, our product candidates or the manufacturing facilities for our product candidates fail to comply with applicable regulatory requirements, a regulatory agency may, among other things, impose penalties or require us to undertake certain actions, each of which could be costly and time-consuming.

The occurrence of any event or penalty described above may inhibit our ability to commercialize our product candidates and may otherwise have a material adverse effect on our business, financial condition and results of operations.

Even if EHP-101 and EHP-102 advance through preclinical studies and clinical trials, we may experience difficulties in managing our growth and expanding our operations.

We have limited resources to carry out objectives for our current and future preclinical studies and clinical trials. Clinical trials are a time-consuming, expensive and uncertain process. In addition, while we have experienced management and expect to contract out many of the activities related to conducting these programs, we are a small company with only seventeen full-time employees and two part-time employees and therefore have limited internal resources both to conduct preclinical studies and clinical trials and to monitor third-party providers. As our product candidates advance through preclinical studies and clinical trials, we will need to expand our development, regulatory and manufacturing operations, either by expanding our internal capabilities or contracting with other organizations to provide these capabilities for us. In the future, we expect to have to manage additional relationships with collaborators or partners, suppliers and other organizations. Our ability to manage our operations and future growth will require us to continue to improve our operational, financial and management controls, reporting systems and procedures.

EHP-101 and EHP-102 may be subject to controlled substance laws and regulations; failure to receive necessary approvals may delay the launch of our products and failure to comply with these laws and regulations may adversely affect the results of our business operations.

While our novel unique molecules are NCEs and are non-psychoactive, the basic molecular architectures in these NCEs are based on CBD and CBG. Under the Controlled Substances Act (CSA), both CBD and CBG, which when naturally occurring are found in certain parts of the cannabis plant, which is considered a controlled substance that is illegal under the CSA. In 2017, the DEA clarified its position on materials or products that would be considered to fall within the 7350 drug code. The DEA’s position is now that materials or products that consist solely of parts of the cannabis plant excluded from the CSA definition of marijuana are excluded from the 7350 (marijuana) or 7360 (marijuana) drug codes.

EHP-101 and EHP-102 are formulations of the NCEs known as VCE-004.8 and VCE-003.2, respectively, that are synthetically manufactured, based on the molecular architecture of CBD and CBG, respectively. Even though our NCEs are not part of the cannabis plant, and therefore should not fall into either the 7350 or 7360 drug code, certain of these synthetically manufactured NCEs (though not all) may still be considered controlled substances under the CSA because they have the basic molecular architectures of the CBD and CBG molecules.

We have sought a decision from the US DEA regarding the controlled substance status of the API in our lead product candidate (EHP-101) and in March 2019 we received a decision from the DEA that the API (VCE-004.8) in our lead product candidate (EHP-101) is not a controlled substance, based partly on the fact that our molecule is an NCE containing no remaining CBD or other controlled substances. We have also received the same decision from the UK Home Office and Canada’s Controlled Substances Directorate. With this determination, manufacturing facilities do not require controlled substance certification for handling and dispensing the molecules and drug products. It also facilitates importation and simplifies the conduct of nonclinical and clinical studies, as contracted nonclinical research organizations and clinical sites have less administrative burden.

The determination of the controlled substance status by the DEA in the US has not yet been sought by us for our second product candidate, EHP-102. Once we advance EHP-102 further in development, we will request a similar decision from the DEA, and other regulatory agencies, for this product candidate. The scheduling process may also take one or more years beyond FDA approval, thereby significantly delaying product launch of EHP-102. However, if considered controlled substances, the DEA must issue a temporary order scheduling the drug within 90 days after FDA approves the drug and DEA receives a scientific and medical evaluation and scheduling recommendation from the Department of Health and Human Services (HHS). Furthermore, if any foreign regulatory authority determines that EHP-101 or the FDA, DEA, or any foreign regulatory authority determines EHP-102 may have potential for abuse, it may require us to generate more clinical data than that which is currently anticipated, which could increase the cost and/or delay the launch of EHP-101 or EHP-102 in those countries.

9

When pharmaceutical products are deemed controlled substances, they are subject to a high degree of regulation under the CSA, which establishes, among other things, certain registration, manufacturing quotas, security, recordkeeping, reporting, import, export and other requirements administered by the DEA. The DEA classifies controlled substances into five schedules: Schedule I, II, III, IV or V substances. Schedule I substances by definition have a high potential for abuse, have no currently “accepted medical use” in the US, lack accepted safety for use under medical supervision, and may not be prescribed, marketed or sold in the US. Pharmaceutical products approved for use in the US may be listed as Schedule II, III, IV or V, with Schedule II substances considered to present the highest potential for abuse or dependence and Schedule V substances the lowest relative risk of abuse among such substances. Schedule I and II drugs are subject to the strictest controls under the CSA, including manufacturing and procurement quotas, security requirements and criteria for importation. In addition, dispensing of Schedule II drugs is further restricted. For example, they may not be refilled without a new prescription.

If any of our molecules are considered to be controlled substances because they were derived based on a cannabinoid architecture, to conduct preclinical studies and clinical trials in the US prior to approval, each of our research sites may be required to submit a research protocol to the DEA and obtain and maintain DEA researcher registration that will allow those sites to handle and dispense the product candidates and to obtain the product from our manufacturer. If the DEA delays or denies the grant of a research registration to one or more research sites, the preclinical studies or clinical trials could be significantly delayed, and we could lose and be required to replace clinical trial sites, resulting in additional costs.

In the event any of our drug candidates are considered to be controlled substances, if they are scheduled as Schedule II or III, we will need to identify wholesale distributors with the appropriate DEA registrations and authority to distribute the products to pharmacies and other healthcare providers, and these distributors would need to obtain Schedule II or III distribution registrations. The failure to obtain, a delay in obtaining, or the loss of any of those registrations could result in increased costs to us. Furthermore, state and federal enforcement actions, regulatory requirements, and legislation intended to reduce prescription drug abuse, such as the requirement that physicians consult a state prescription drug monitoring program, may make physicians less willing to prescribe, and pharmacies to dispense, Schedule II products. Further, if any of our molecules are deemed to be a Schedule II drug, the DEA must establish an annual aggregate quota for the amount that may be manufactured or produced in the US based on the DEA’s estimate of the quantity needed to meet legitimate medical, scientific, research and industrial needs. This limited aggregate amount that the DEA allows to be produced in the US each year is allocated among individual companies, which, in turn, must annually apply to the DEA for individual manufacturing and procurement quotas. The quotas apply equally to the manufacturing of the Active Pharmaceutical Ingredients (APIs) and production of dosage forms. The DEA may adjust aggregate production quotas a few times per year, and individual manufacturing or procurement quotas from time to time during the year, although the DEA has substantial discretion in whether or not to make such adjustments for individual companies. A failure by us to obtain adequate quota could have a material adverse effect on our business, financial condition, results of operations and cash flows.

If the Department of Justice exercises its prosecutorial discretion and prosecutes companies researching, developing, marketing or selling products containing controlled substances, and it is determined that any of our product candidates contain controlled substances, the results of our business operations may be adversely affected. If we or any party which we must indemnify is prosecuted as a result, it may distract management’s attention from our primary business and result in significant litigation costs. The recent DOJ actions underscore the uncertainty and often swift changing nature of the regulatory environment surrounding the CBD and CBG drug platforms.

As with the federal controlled substance regulations, because EHP-102 is synthetically manufactured based on CBG architecture, and since under certain circumstances CBG is a controlled substance under the CSA, failure to receive regulatory approvals, or the risk of facing prosecution at either the federal or state level may hinder our operations and delay the launch of this product. We may face delays in our preclinical studies and clinical trials with EHP-102 in the US prior to approval. Under either DEA or state regulatory guidelines, each of our research sites may be required to submit a research protocol and obtain and maintain researcher registrations that would allow those sites to handle and dispense our product candidate and to obtain the product from our manufacturer. If the DEA or state regulatory body delays or denies the grant of a research registration to one or more research sites, the preclinical studies or clinical trials could be significantly delayed, and we could lose and be required to replace clinical trial sites, resulting in additional costs.

Individual states have also established controlled substance laws and regulations. Though state-controlled substance laws often mirror federal law, because the states are separate jurisdictions, they may separately schedule our product candidates as well. While some states automatically schedule a drug based on federal action, other states schedule drugs through rulemaking or a legislative action. State scheduling may delay commercial sale of any product for which we obtain federal regulatory approval and adverse scheduling could have a material adverse effect on the commercial attractiveness of such product. We or our partners must also obtain separate state registrations, permits or licenses in order to be able to obtain, handle, and distribute controlled substances for clinical trials or commercial sale, and failure to meet applicable regulatory requirements could lead to enforcement and sanctions by the states in addition to those from the DEA or otherwise arising under federal law.

The manufacture, packaging and distribution of EHP-101 and EHP-102 is currently carried out in Europe, the US and China by large-scale contract manufacturers. We have conducted a Phase 1 clinical trial for EHP-101 in Australia, we have initiated a multi-national Phase 2 clinical trial in Australia, New Zealand, and the US and we are in the initiation stage of a second Phase 2 study in Australia and the US. In addition, we may decide to develop, manufacture or commercialize our product candidates in additional countries. As a result, we may also be subject to controlled substance laws and regulations from the Therapeutic Goods Administration in Australia and from other regulatory agencies in other countries where we develop, manufacture or commercialize EHP-101 or EHP-102 in the future. We plan to submit NDAs for EHP-101 and EHP-102 to the FDA upon completion of all requisite clinical trials and may require additional DEA approvals at such time as well.

10

If any of our product candidates are determined to be controlled substances, political and social pressures and adverse publicity could lead to delays in approval of, and increased expenses for, our product candidates. These pressures could also limit or restrict the introduction and marketing of our product candidates. Adverse publicity from cannabis misuse or adverse side effects from cannabis or other cannabinoid science products may adversely affect the commercial success or market penetration achievable by our product candidates.

Product shipment delays could have a material adverse effect on our business, results of operations and financial condition.

The shipment of EHP-101 and EHP-102 may require import and export licenses. In the US, the FDA, US Customs and Border Protection, and the DEA (for EHP-102); in Europe, where EHP-101 and EHP-102 are currently manufactured, the EMA and the European Commission; in Australia, where we conduct clinical trials, the Australian Customs and Board Protection Service and the Therapeutic Goods Administration; and in other countries, similar regulatory authorities, regulate the import and export of pharmaceutical products that contain controlled substances. Specifically, the import and export processes require the issuance of import and export licenses by the relevant controlled substance authority in both the importing and exporting country. We may not be granted, or if granted, maintain, such licenses from the authorities in certain countries.

We have been granted orphan drug status by the FDA and EMA for EHP-101 for the treatment of SSc, and we have been granted orphan drug status by the FDA and EMA for EHP-102 for the treatment of HD, but we may be unable to maintain the benefits associated with orphan drug status, including market exclusivity, which may cause our revenue, if any, to be reduced.

Regulatory authorities in some jurisdictions, including the US and EU, may designate drugs for relatively small patient populations as orphan drugs. The FDA may grant orphan drug designation to drugs intended to treat a rare disease or condition that affects fewer than 200,000 individuals annually in the US, or, if the disease or condition affects more than 200,000 individuals annually in the US, if there is no reasonable expectation that the cost of developing and making the drug would be recovered from sales in the US. In the EU, the EMA’s Committee for Orphan Medicinal Products grants orphan drug designation to promote the development of products that are intended for the diagnosis, prevention or treatment of life-threatening or chronically debilitating conditions affecting not more than five in 10,000 persons in the EU. Additionally, designation is granted for products intended for the diagnosis, prevention or treatment of a life-threatening, seriously debilitating or serious and chronic condition and when, without incentives, it is unlikely that sales of the drug in the EU would be sufficient to justify the necessary investment in developing the drug.

In the US, orphan drug designation entitles a party to financial incentives, such as opportunities for grant funding towards clinical trial costs, tax credits for certain research and user fee waivers under certain circumstances. In addition, if a product receives the first FDA approval for the drug and indication for which it has orphan drug designation, the product is entitled to seven years of market exclusivity, which means the FDA may not approve any other application for the same drug for the same indication for a period of seven years, except in limited circumstances, such as a showing of clinical superiority over the product with orphan drug exclusivity. Orphan drug exclusivity does not prevent the FDA from approving a different drug for the same disease or condition, or the same drug for a different disease or condition. In the EU, orphan drug designation also entitles a party to financial incentives such as reduction of fees or fee waivers and ten years of market exclusivity following drug approval. This period may be reduced to six years if the orphan drug designation criteria are no longer met, including where it is shown that the product is sufficiently profitable so that market exclusivity is no longer justified.

As a result, even though EHP-101 has received orphan drug designation in SSc in the US and Europe, and EHP-102 has received orphan drug designation in HD in the US and Europe, the FDA can still approve other drugs that have a different active ingredient for use in treating the same indications. If EHP-101 receives orphan drug exclusivity in the EU, the EMA could also, in defined circumstances, approve a competing product. Furthermore, the FDA can waive orphan drug exclusivity if we are unable to manufacture sufficient supply of EHP-101 or if the FDA finds that a subsequent applicant for SSc demonstrates clinical superiority to EHP-101. In addition, the European Commission could reduce the term of exclusivity if EHP-101 is sufficiently profitable.

We have received orphan drug designation for EHP-101 in SSc and for EHP-102 in HD from the FDA and the EMA, but exclusive marketing rights in the US may be limited if we seek approval for an indication broader than the orphan designated indication and may be lost if the FDA or EMA later determines that the request for designation was materially defective or if the manufacturer is unable to assure sufficient quantities of the product to meet the needs of patients with the rare disease or condition.

11

Even if we are able to commercialize EHP-101 or EHP-102, the products may not receive coverage and adequate reimbursement from third-party payors, which could harm our business.

The availability of reimbursement by governmental and private payors is essential for most patients to be able to afford expensive treatments. Sales of our product candidates, if approved, will depend substantially on the extent to which the costs of these product candidates will be paid by health maintenance, managed care, pharmacy benefit and similar healthcare management organizations, or reimbursed by government health administration authorities, private health coverage insurers and other third-party payors. If reimbursement is not available, or is available only to limited levels, we may not be able to successfully commercialize EHP-101 or EHP-102. Even if coverage is provided, the approved reimbursement amount may not be high enough to allow us to establish or maintain pricing sufficient to realize a sufficient return on our investment.

There is significant uncertainty related to the insurance coverage and reimbursement of newly approved products. In the US, the principal decisions about reimbursement for new medicines are typically made by the Centers for Medicare & Medicaid Services (CMS), an agency within the HHS, as CMS decides whether and to what extent a new medicine will be covered and reimbursed under Medicare. Private payors tend to follow CMS to a substantial degree.

Outside the US, particularly in EU Member States, the pricing of prescription drugs is subject to governmental control. In these countries, pricing negotiations or the successful completion of Health Technology Assessment (HTA) procedures with governmental authorities can take considerable time after receipt of marketing authorization for a product. In addition, there can be considerable pressure by governments and other stakeholders on prices and reimbursement levels, including as part of cost containment measures. Certain countries allow companies to fix their own prices for medicines but monitor and control company profits. Political, economic and regulatory developments may further complicate pricing negotiations, and pricing negotiations may continue after reimbursement has been obtained. Reference pricing used by various EU Member States and parallel distribution, or arbitrage between low-priced and high-priced EU member states, can further reduce prices. In some countries, we or our collaborators may be required to conduct a clinical trial or other studies that compare the cost-effectiveness of our product candidates to other available therapies in order to obtain or maintain reimbursement or pricing approval. Publication of discounts by third-party payors or authorities may lead to further pressure on the prices or reimbursement levels within the country of publication and other countries. If reimbursement of any product candidate approved for marketing is unavailable or limited in scope or amount, or if pricing is set at unsatisfactory levels, our business, financial condition, results of operations or prospects could be adversely affected.

Our relationships with customers and third-party payors will be subject to applicable anti-kickback, fraud and abuse and other healthcare laws and regulations, which could expose us to criminal sanctions, civil penalties, contractual damages, reputational harm and diminished profits and future earnings.

Healthcare providers, physicians and third-party payors play a primary role in the recommendation and prescription of any product candidates for which we obtain marketing approval. Our future arrangements with third-party payors and customers may expose us to broadly applicable fraud and abuse and other healthcare laws and regulations that may constrain the business or financial arrangements and relationships through which we market, sell and distribute our products for which we obtain marketing approval. As a pharmaceutical company, even though we do not and will not control referrals of healthcare services or bill directly to Medicare, Medicaid or other third-party payors, certain federal and state healthcare laws and regulations pertaining to fraud and abuse and patients’ rights are and will be applicable to our business.

Efforts to ensure that our business arrangements with third parties will comply with applicable healthcare laws and regulations will involve substantial costs. It is possible that governmental authorities will conclude that our business practices may not comply with current or future statutes, regulations or case law involving applicable fraud and abuse or other healthcare laws and regulations. If our operations are found to be in violation of any of these laws or any other governmental regulations that may apply to us, we may be subject to significant civil, criminal and administrative penalties, damages, fines, imprisonment, exclusion from government funded healthcare programs, such as Medicare and Medicaid, and the curtailment or restructuring of our operations. If any physicians or other healthcare providers or entities with whom we expect to do business are found to not be in compliance with applicable laws, they may be subject to criminal, civil or administrative sanctions, including exclusions from government funded healthcare programs.

12

Our employees may engage in misconduct or other improper activities, including noncompliance with regulatory standards and requirements, which could subject us to significant liability and harm our reputation.

We are exposed to the risk of employee fraud or other misconduct. Misconduct by employees could include intentional failures to comply with DEA, FDA or EMA regulations or similar regulations of other foreign regulatory authorities or to provide accurate information to the DEA, FDA, EMA or other foreign regulatory authorities. In addition, misconduct by employees could include intentional failures to comply with certain manufacturing standards, to comply with US federal and state healthcare fraud and abuse laws and regulations and similar laws and regulations established and enforced by comparable foreign regulatory authorities, to report financial information or data accurately or to disclose unauthorized activities to us. Employee misconduct could also involve the improper use of information obtained in the course of clinical trials, which could result in regulatory sanctions and serious harm to our reputation. If any such actions are instituted against us, and we are not successful in defending ourselves or asserting our rights, those actions could have a significant impact on our business and results of operations, including the imposition of significant fines or other sanctions.

If we are unable to develop sales, marketing and distribution capabilities or enter into agreements with third parties to perform these functions on acceptable terms, we may be unable to generate revenue.

We do not currently have any sales, marketing or distribution capabilities. If EHP-101 or EHP-102 is approved, we will need to develop internal sales, marketing and distribution capabilities to commercialize such products, which would be expensive and time-consuming, or enter into collaborations with third parties to perform these services. If we decide to market our products directly, we will need to commit significant financial and managerial resources to develop a marketing and sales force with technical expertise and supporting distribution, administration and compliance capabilities. If we rely on third parties with such capabilities to market our products or decide to co-promote products with collaborators, we will need to establish and maintain marketing and distribution arrangements with third parties, and there can be no assurance that we will be able to enter into such arrangements on acceptable terms or at all. In entering into third-party marketing or distribution arrangements, any revenue we receive will depend upon the efforts of the third parties and there can be no assurance that such third parties will establish adequate sales and distribution capabilities or be successful in gaining market acceptance of any approved product. If we are not successful in commercializing any product approved in the future, either on our own or through third parties, our business, financial condition and results of operations could be materially adversely affected.

Our product candidates, if approved, may be unable to achieve broad market acceptance and, consequently, limit our ability to generate revenue and profits from new products.

Even when product development is successful and regulatory approval has been obtained, our ability to generate significant revenue and profits depends on the acceptance of our products by physicians and patients. The market acceptance of any product depends on a number of factors, including but not limited to awareness of a product’s availability and benefits, the indication statement and warnings approved by regulatory authorities in the product label, continued demonstration of efficacy and safety in commercial use, perceptions by members of the health care community, including physicians, about the safety and effectiveness of our drugs, physicians’ willingness to prescribe the product, reimbursement from third-party payors such as government healthcare systems and insurance companies, the price of the product, pharmacological benefit and cost-effectiveness of our products relative to competing products, the nature of any post-approval risk management plans mandated by regulatory authorities, competition, and the effectiveness of marketing and distribution efforts. Any factors preventing or limiting the market acceptance of our product candidates could have a material adverse effect on our business, results of operations and financial condition.

If we receive regulatory approvals, we intend to market EHP-101 and EHP-102 in multiple jurisdictions where we have limited or no operating experience and may be subject to increased business and economic risks that could affect our financial results.

If we receive regulatory approvals, we plan to market EHP-101 and EHP-102 in jurisdictions where we have limited or no experience in marketing, developing and distributing our products. Certain markets have substantial legal and regulatory complexities that we may not have experience navigating. We are subject to a variety of risks inherent in doing business internationally, including risks related to the legal and regulatory environment in non-US jurisdictions, including with respect to privacy and data security, trade control laws and unexpected changes in laws, regulatory requirements and enforcement, as well as risks related to fluctuations in currency exchange rates and political, social and economic instability in foreign countries. If we are unable to manage our international operations successfully, our financial results could be adversely affected. In addition, controlled substance legislation may differ in other jurisdictions and could restrict our ability to market our products internationally. Most countries are parties to the Single Convention on Narcotic Drugs 1961, which governs international trade and domestic control of narcotic substances, including cannabis extracts. Countries may interpret and implement their treaty obligations in a way that creates a legal obstacle to us obtaining marketing approval for EHP-101 or EHP-102 in those countries. These countries may not be willing or able to amend or otherwise modify their laws and regulations to permit EHP-101 or EHP-102 to be marketed, or achieving such amendments to the laws and regulations may take a prolonged period of time. We would be unable to market EHP-101 or EHP-102 in countries with such obstacles in the near future or perhaps at all without modification to laws and regulations.

13

Any inability to attract and retain qualified key management and technical personnel would impair our ability to implement our business plan.

Our success largely depends on the continued service of key management and other specialized personnel. The loss of one or more members of our management team or other key employees or consultants could delay our research and development programs and materially harm our business, financial condition, results of operations and prospects. The relationships that our team has cultivated within the life sciences industry makes us particularly dependent upon their continued employment or services with us. Because our management team is not obligated to provide us with continued service, they could terminate their employment or services with us at any time without penalty, subject to providing any required advance notice. We do not maintain key person life insurance policies for any members of our management team. Our future success and growth will depend in large part on our continued ability to attract and retain other highly qualified scientific, technical and management personnel and consultants, as well as personnel and consultants with expertise in clinical testing, manufacturing, governmental regulation and commercialization. We face competition for personnel and consultants from other companies, universities, public and private research institutions, government entities and other organizations.

We face substantial competition, which may result in others discovering, developing or commercializing products before or more successfully than we do.