UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☑ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2019

or

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001‑38390

Cactus, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware |

35‑2586106 |

|

(State or other jurisdiction |

(I.R.S. Employer |

|

|

|

|

920 Memorial City Way, Suite 300 Houston, Texas |

77024 |

|

(Address of principal executive offices) |

(Zip code) |

(713) 626‑8800

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

Class A Common Stock, par value $0.01 |

|

WHD |

|

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well‑known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b‑2 of the Exchange Act.

|

Large accelerated filer |

☑ |

Accelerated filer |

☐ |

|

Non-accelerated filer |

☐ |

Smaller reporting company |

☐ |

|

|

Emerging growth company |

☐ |

|

If an emerging growth company indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b‑2 of the Exchange Act). Yes ☐ No ☑

As of June 30, 2019, the aggregate market value of the common stock of the registrant held by non-affiliates of the registrant was $1.6 billion.

As of February 24, 2020, the registrant had 47,339,551 shares of Class A common stock, $0.01 par value per share, and 27,957,699 shares of Class B common stock, $0.01 par value per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

|

ii |

||

|

|

|

|

|

|

|

|

|

|

1 | |

|

|

|

|

| 1 | ||

| 9 | ||

| 23 | ||

| 23 | ||

| 23 | ||

| 23 | ||

|

|

|

|

|

|

24 | |

|

|

|

|

|

|

24

|

|

| 26 | ||

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

27 | |

| 34 | ||

| 35 | ||

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

63 | |

| 63 | ||

| 63 | ||

|

|

|

|

|

|

64 | |

|

|

|

|

| 64 | ||

| 71 | ||

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

91 | |

|

Certain Relationships and Related Transactions, and Director Independence |

94 | |

| 101 | ||

|

|

|

|

|

|

103 | |

|

|

|

|

| 103 | ||

| 106 | ||

|

|

107 | |

i

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10‑K (this “Annual Report”) contains “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). When used in this Annual Report, the words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project” and similar expressions are intended to identify forward‑looking statements, although not all forward‑looking statements contain such identifying words. These forward‑looking statements are based on our current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. When considering forward‑looking statements, you should keep in mind the risk factors and other cautionary statements described under the heading “Item 1A. Risk Factors” included in this Annual Report. These forward‑looking statements are based on management’s current belief, based on currently available information, as to the outcome and timing of future events.

Forward‑looking statements may include statements about:

|

· |

demand for our products and services, which is affected by, among other things, changes in the price of crude oil and natural gas in domestic and international markets; |

|

· |

the level of growth in number of rigs, pad sizes, well spacings and associated well count and availability of takeaway capacity; |

|

· |

capital spending discipline exercised by customers; |

|

· |

changes in the number of drilled but uncompleted wells (“DUC’s”) and the level of completion activity; |

|

· |

the size and timing of orders; |

|

· |

availability of raw materials and imported items; |

|

· |

transportation differentials associated with reduced capacity in and out of the storage hub in Cushing, Oklahoma; |

|

· |

expectations regarding raw materials, overhead and operating costs and margins; |

|

· |

availability of skilled and qualified workers; |

|

· |

potential liabilities such as warranty and product liability claims arising out of the installation, use or misuse of our products; |

|

· |

the possibility of cancellation of orders; |

|

· |

our business strategy; |

|

· |

our financial strategy, operating cash flows, liquidity and capital required for our business; |

|

· |

our future revenue, income and operating performance; |

|

· |

the ability to pay dividends and the amount of any such dividends; |

ii

|

· |

the termination of relationships with major customers or suppliers; |

|

· |

laws and regulations, including environmental regulations, that may increase our costs, limit the demand for our products and services or restrict our operations; |

|

· |

disruptions in the political, regulatory, economic and social conditions domestically or internationally; |

|

· |

outbreaks of pandemic or contagious diseases that may disrupt our suppliers or facilities or impact demand for oil and gas; |

|

· |

increases in import tariffs assessed on products from China and imported raw materials used in the manufacture of our goods in the United States which could negatively impact margins and our working capital; |

|

· |

the significance of future liabilities under the Tax Receivable Agreement (the “TRA”) we entered into with certain current or past direct and indirect owners of Cactus LLC (the “TRA Holders”) in connection with our initial public offering; |

|

· |

a failure of our information technology infrastructure or any significant breach of security; |

|

· |

potential uninsured claims and litigation against us; |

|

· |

competition within the oilfield services industry; |

|

· |

our dependence on the continuing services of certain of our key managers and employees; |

|

· |

currency exchange rate fluctuations associated with our international operations; and |

|

· |

plans, objectives, expectations and intentions contained in this Annual Report that are not historical. |

We caution you that these forward‑looking statements are subject to all of the risks and uncertainties, most of which are difficult to predict and many of which are beyond our control, incident to the operation of our business. These risks include, but are not limited to the risks described in this Annual Report under “Item 1A. Risk Factors.”

Should one or more of the risks or uncertainties described in this Annual Report occur, or should underlying assumptions prove incorrect, our actual results and plans could differ materially from those expressed in any forward‑looking statements.

All forward‑looking statements, expressed or implied, included in this Annual Report are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward‑looking statements that we or persons acting on our behalf may issue.

Except as otherwise required by applicable law, we disclaim any duty to update any forward‑looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this Annual Report.

iii

Except as otherwise indicated or required by the context, all references in this Annual Report to “the Company,” “Cactus,” “we,” “us” and “our” refer to (i) Cactus Wellhead, LLC (“Cactus LLC”) and its consolidated subsidiaries prior to the completion of our initial public offering and (ii) Cactus, Inc. (“Cactus Inc.”) and its consolidated subsidiaries (including Cactus LLC) following the completion of our initial public offering on February 12, 2018.

Our History

Cactus Inc. was incorporated on February 17, 2017 as a Delaware corporation for the purpose of completing an initial public offering of equity and related transactions (our “IPO”). Cactus LLC is a Delaware limited liability company and was formed on July 11, 2011. We began operating in August 2011, following the formation of Cactus LLC by Scott Bender and Joel Bender, who have owned or operated wellhead manufacturing businesses since the late 1970s, and Cadent Energy Partners II, L.P. (“Cadent”), an affiliate of Cadent Energy Partners LLC, as its equity sponsor. We acquired our primary manufacturing facility in Bossier City, Louisiana in September 2011 and established our other production facility, located in Suzhou, China in December 2013 through our subsidiary there. Since we began operating, we have grown to 14 U.S. service centers located in Texas, Pennsylvania, Oklahoma, North Dakota, New Mexico, Louisiana, Colorado and Wyoming as well as three service centers in Eastern Australia. Our corporate headquarters are located in Houston, Texas.

Cactus Inc. and its consolidated subsidiaries, including Cactus LLC, are primarily engaged in the design, manufacture and sale of wellhead and pressure control equipment. In addition, we maintain a fleet of frac valves and ancillary equipment for short-term rental. Our products are sold and rented principally for onshore unconventional oil and gas wells and are utilized during the drilling, completion and production phases of our customers’ wells. We also provide field services for all of our products and rental items to assist with the installation, maintenance and handling of the wellhead and pressure control equipment as well as offer repair and refurbishment services.

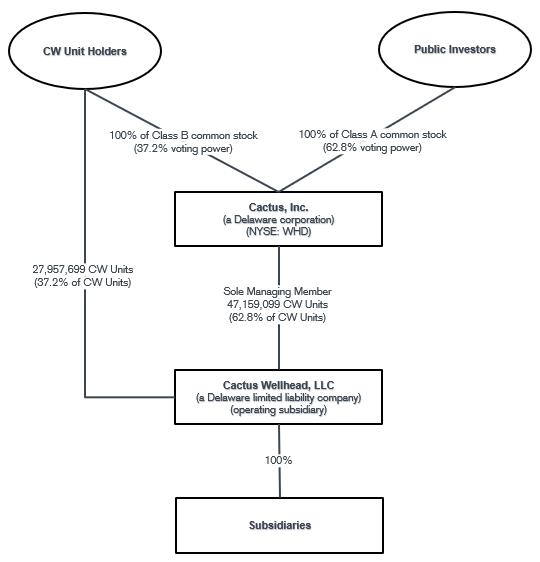

Organization Structure

On February 12, 2018, we completed our initial public offering of 23.0 million shares of Class A common stock, par value $0.01 per share (“Class A common stock”), at a price to the public of $19.00 per share. We received net proceeds of $408.0 million after deducting underwriting discounts and commissions and payment of $2.8 million in offering expenses for the IPO. We also paid $2.2 million in offering expenses during 2017. On February 14, 2018 we completed the sale of an additional 3.5 million shares of Class A common stock pursuant to the exercise in full by the underwriters of their option to purchase additional shares of Class A common stock (the “Option”), from which we received an additional $61.6 million net proceeds after deducting underwriting discounts and commissions. We contributed all of the net proceeds of our IPO (including from the Option) to Cactus LLC in exchange for CW Units. Cactus LLC used the $469.6 million of the net proceeds from our IPO to (i) repay all of the borrowings outstanding under its term loan facility, including accrued interest, of $251.0 million and (ii) redeem $216.4 million of CW Units from certain direct and indirect owners of Cactus LLC. The remaining $2.2 million was retained by Cactus LLC to cover offering expenses previously paid in 2017.

Cactus Inc. is a holding company whose only material asset is an equity interest consisting of units representing limited liability company interests in Cactus LLC (“CW Units”). Cactus Inc. became the sole managing member of Cactus LLC upon completion of our IPO and is responsible for all operational, management and administrative decisions relating to Cactus LLC’s business. The Limited Liability Company Operating Agreement of Cactus LLC was amended and restated as the First Amended and Restated Limited Liability Company Operating Agreement of Cactus LLC (the “Cactus Wellhead LLC Agreement”) to, among other things, admit Cactus Inc. as the sole managing member of Cactus LLC. Pursuant to the Cactus Wellhead LLC Agreement, holders of CW Units are entitled to redeem their CW Units, which results in a corresponding increase in Cactus Inc.’s membership interest in Cactus LLC and an increase in the number of shares of

1

Class A common stock outstanding. The following is a rollforward of ownership of legacy CW Units by legacy CW Unit Holders:

|

|

|

CW Units |

|

|

|

|

(in thousands) |

|

|

CW Units held by legacy CW Unit Holders as of February 7, 2018 |

|

|

60,558 |

|

IPO |

|

|

(12,118) |

|

July 2018 Follow-on Offering |

|

|

(11,197) |

|

Other CW Unit redemptions |

|

|

(7) |

|

CW Units held by legacy CW Unit Holders as of December 31, 2018 |

|

|

37,236 |

|

March 2019 Secondary Offering |

|

|

(8,474) |

|

Other CW Unit redemptions |

|

|

(804) |

|

CW Units held by legacy CW Unit Holders as of December 31, 2019 |

|

|

27,958 |

On July 16, 2018, we completed a public offering of 11.2 million shares (consisting of 10.0 million base shares and 1.2 million shares sold pursuant to the underwriters’ option to purchase additional shares) of Class A common stock (the “Follow-on Offering”) at a price to the public of $33.25 per share and received $359.3 million of net proceeds after deducting underwriting discounts and commissions. Cactus Inc. contributed these net proceeds to Cactus LLC in exchange for CW Units. Cactus LLC then used the net proceeds to redeem 11.2 million CW Units from certain of the owners of Cactus LLC, and Cactus Inc. canceled a corresponding number of shares of Class B common stock, par value $0.01 per share (“Class B common stock”).

On March 19, 2019, Cactus Inc. entered into an underwriting agreement by and among Cactus Inc., Cactus LLC, certain selling stockholders of Cactus (the “Selling Stockholders”) and the underwriters named therein, providing for the offer and sale of Class A common stock by the Selling Stockholders (the “March 2019 Secondary Offering”). As described in the prospectus supplement dated March 19, 2019 and filed with the Securities and Exchange Commission on March 20, 2019, in connection with the March 2019 Secondary Offering, certain Selling Stockholders owning CW Units exercised their Redemption Right with respect to 8.5 million CW Units, together with a corresponding number of shares of Class B common stock, as provided in the Cactus LLC Agreement. The March 2019 Secondary Offering closed on March 21, 2019, at which time, in exercise of its Call Right, Cactus Inc. acquired the redeemed CW Units and a corresponding number of shares of Class B common stock (which shares of Class B common stock were then canceled) and issued 8.5 million shares of Class A common stock to the underwriters at the direction of the redeeming Selling Stockholders, as provided in the Cactus LLC Agreement. In addition, certain other Selling Stockholders sold 26 thousand shares of Class A common stock in the March 2019 Secondary Offering, which shares were owned by them directly prior to the closing of this offering. Cactus did not receive any of the proceeds from the sale of common stock in the March 2019 Secondary Offering. Cactus incurred $1.0 million in offering expenses which were recorded in other income (expense), net, in the consolidated statement of income.

In this Annual Report, we refer to the owners of CW Units, other than Cactus Inc., (along with their permitted transferees) as “CW Unit Holders.” CW Unit Holders also own one share of our Class B common stock for each CW Unit such CW Unit Holder owns. As of December 31, 2019, after giving effect to our IPO, Follow-on Offering, the March 2019 Secondary Offering and additional redemptions pursuant to the Cactus Wellhead LLC Agreement, Cactus Inc. owns an approximate 62.8% interest in Cactus LLC, and the CW Unit Holders own an approximate 37.2% interest in Cactus LLC as of December 31, 2019, which is based on 47.2 million shares of Class A common stock and 28.0 million shares of Class B common stock issued and outstanding.

2

The following diagram indicates our simplified ownership structure as of December 31, 2019:

Overview

Our principal products include our Cactus SafeDrill® wellhead systems as well as frac stacks, our Cactus SafeLinkTM system, zipper manifolds and production trees that we design and manufacture. Every oil and gas well requires a wellhead, which is installed at the onset of the drilling process and remains with the well through its entire productive life. The Cactus SafeDrill® wellhead systems employ technology which allows technicians to land and secure casing strings more safely from the rig floor, reducing the need to descend into the cellar. We believe we are a market leader in the application of such technology, with thousands of our products sold and installed across the United States since 2011. During the completion phase of a well, we rent frac stacks, zipper manifolds and other high-pressure equipment that are used for well control and for managing the transmission of frac fluids and proppants during the hydraulic fracturing process. These severe service applications require robust and reliable equipment. For the subsequent production phase of a well, we sell production trees and the equipment to interface with various forms of artificial lift that regulate hydrocarbon production, which are installed on the wellhead after the frac stack has been removed. In addition, we provide mission-critical field services for all of our products and rental items, including 24-hour service crews to assist with the installation, maintenance, repair and safe handling of the wellhead and pressure control equipment.

3

Our innovative wellhead products and pressure control equipment are developed internally. We believe our close relationship with our customers provides us with insight into the specific issues encountered in the drilling and completion processes, allowing us to provide them appropriate product and service solutions. We have achieved significant market share, as measured by the percentage of total active U.S. onshore rigs that we follow (which we define as the number of active U.S. onshore drilling rigs to which we are the primary provider of wellhead products and corresponding services during drilling), and brand name recognition with respect to our engineered products, which we believe is due to our focus on safety, reliability, cost effectiveness and time saving features. We optimize our products for pad drilling (i.e., the process of drilling multiple wellbores from a single surface location) to reduce rig time and provide operators with significant efficiencies that translate to cost savings at the wellsite.

We operate through service centers in the United States, which are strategically located in the key oil and gas producing regions, including the Permian, SCOOP/STACK, Marcellus, Utica, Eagle Ford, and Bakken, among other active oil and gas regions in the United States, and in Eastern Australia. These service centers support our field services and provide equipment assembly and repair services. Our manufacturing and production facilities are located in Bossier City, Louisiana and Suzhou, China.

How We Generate Our Revenues

We operate in one business segment. Our revenues are derived from three sources: products, rentals, and field service and other. Product revenues are primarily derived from the sale of wellhead systems and production trees. Rental revenues are primarily derived from the rental and associated repair of equipment used for well control during the completion process as well as the rental of drilling tools. Field service and other revenues are primarily earned when we provide installation and other field services for both product sales and equipment rental. Additionally, other revenues are derived from providing repair and reconditioning services to customers that have previously installed wellheads or production trees on their wellsite. Items sold or rented generally have an associated service component. As a result, there is some level of correlation between field service and other revenues and revenues from product sales and rentals.

For the year ended December 31, 2019, we derived 57% of our total revenues from the sale of our products, 22% from rental and 21% from field service and other. In 2018, we derived 53% of our total revenues from the sale of our products, 25% from rental and 22% from field service and other. In 2017, we derived 55% of our total revenues from the sale of our products, 23% from rental and 22% from field service and other. We have predominantly domestic operations, with a small amount of sales being generated in Australia.

Most of our sales are made on a call out basis pursuant to agreements, wherein our clients provide delivery instructions for goods and/or services as their operations require. Such goods and/or services are most often priced in accordance with a preapproved price list. The actual pricing of our products and services is impacted by a number of factors including competitive pricing pressure, the level of utilized capacity in the oil service sector, maintenance of market share, cost of producing the product and general market conditions.

Costs of Conducting Our Business

The principal elements of cost of sales for our products are the direct and indirect costs to manufacture and supply the product, including labor, materials, machine time, tariffs and duties, freight and lease expense related to our facilities. The principal elements of cost of sales for rentals are the direct and indirect costs of supplying rental equipment, including depreciation, repairs specifically performed on such rental equipment and freight. The principal elements of cost of sales for field service and other are labor, equipment depreciation and repair, equipment lease expense, fuel and supplies.

Selling, general and administrative expense is comprised of costs such as sales and marketing, engineering, general corporate overhead, business development, compensation, employment benefits, information technology, safety and environmental, legal and professional.

Interest income (expense), net includes interest expense associated with our credit facility, finance leases and accrued interest on deferred payments under the TRA.

4

Impact of Section 232 of the Trade Expansion Act of 1962 (“Section 232”)

On March 8, 2018, the President of the United States issued two proclamations imposing tariffs on imports of certain steel and aluminum products, effective March 23, 2018. The decision was made in response to the Department of Commerce's findings and recommendations in its reports of its investigations into the impact of imported steel and aluminum on the national security of the United States pursuant to Section 232. Specifically, the President imposed a 25% global tariff on certain imported steel mill products and a 10% global tariff on certain imported aluminum products. The President subsequently has issued proclamations permanently excluding Argentina, Australia, Brazil, Canada, Mexico and South Korea from the steel tariff and Argentina, Australia, Canada and Mexico from the aluminum tariff, though imports of steel from Argentina, Brazil and South Korea, and imports of aluminum from Argentina, are subject to absolute quotas. The tariffs and quotas have caused the cost of raw materials to increase.

Impact of Section 301 of the Trade Act of 1974 (“Section 301”)

On May 10, 2019, the U.S. Trade Representative announced that it was increasing the level of tariffs on approximately $200 billion worth of Chinese imports pursuant to Section 301. The tariff rate on covered products that were exported on or after May 10, 2019 was raised from 10% to 25%. Covered products that were exported from China to the United States prior to May 10, 2019 remained subject to an additional 10% tariff if they entered the U.S. before June 15, 2019. Substantially all of the products and frac rental equipment that we import through our Chinese supply chain are subject to the tariffs. For the year ended December 31, 2019, we estimate that approximately 50% of our goods received were sourced through our Chinese supply chain.

We believe further increases in the tariff rate above 25% may adversely affect our business, but a combination of factors may mitigate some of the impact of any future increases in tariff rates on our results of operations. These include, among other things, use of product received prior to the introduction of tariffs, our negotiations with suppliers, use of alternative supply chains and favorable currency exchange movements.

Suppliers and Raw Materials

Forgings, castings and bar stock represent the principal raw materials used in the manufacture of our products and rental equipment. In addition, we require accessory items (such as elastomers, ring gaskets, studs and nuts) and machined components. We purchase these items from vendors in the United States, China and Australia. For the years ended December 31, 2019, 2018 and 2017, approximately $36.5 million, $46.7 million and $33.4 million, respectively, of machined component purchases were made from a vendor located in China, representing approximately 16%, 21% and 22%, respectively, of our total third-party vendor purchases. We do not believe that we are overly dependent on any individual vendor to supply our required materials or services. The materials and services essential to our business are normally readily available and, where we use one or a few vendors as a source of any particular materials or services, we believe that we can, within a reasonable period of time, make satisfactory alternative arrangements in the event of an interruption of supply from any vendor. We believe that our materials and services vendors have the capacity to meet additional demand should we require it, although likely at higher costs and delayed deliveries.

Manufacturing

Our manufacturing and production facilities are located in Bossier City, Louisiana and Suzhou, China. Although both facilities can produce our full range of products, our Bossier City facility has advanced capabilities and is designed to support time-sensitive and rapid turnaround orders, while our facility in China is optimized for longer lead time orders and outsources its machining requirements. Both our Bossier City and China facilities are licensed to the latest American Petroleum Institute (“API”) 6A specification for both wellheads and valves and API Q1 and ISO 9001:2015 quality management systems. Our Bossier City facility is configured to provide rapid-response production of made-to-order equipment. Where traditional manufacturing facilities are designed to run in batches with different machining processes occurring in stages, this facility uses advanced computer numeric control machines to perform multiple machining operations in a single step. We believe eliminating the setup and queue times between machining processes allows us to offer significantly shorter order-to-delivery time for equipment than our competitors, albeit at higher costs than China. Responsiveness to urgent needs strengthens our relationship with key customers.

5

Our Bossier City manufacturing facility also functions as a repair and testing facility with its API 6A certification and full Quality Assurance and Quality Control department. The facility also has the ability to perform hydrostatic testing, phosphate and oiling, copper coating and frac valve remanufacturing.

Our production facility in China is configured to efficiently produce our range of pressure control products and components for less time-sensitive, higher-volume orders. All employees in our Suzhou facility are Cactus employees, which we believe is a key factor in ensuring high quality. Our Suzhou facility currently assembles and tests machined components before shipment to Cactus facilities in the United States and Australia.

Trademarks and Other Intellectual Property

Trademarks are important to the marketing of our products. We consider the Cactus Wellhead trademark to be important to our business as a whole. The Company has numerous trademarks registered with the U.S. Patent and Trademark Office and has also applied for registration status of numerous trademarks which are pending.

We also rely on trade secret protection for our confidential and proprietary information. To protect our information, we customarily enter into confidentiality agreements with our employees and suppliers. There can be no assurance, however, that others will not independently obtain similar information or otherwise gain access to our trade secrets.

We have been awarded several U.S. patents and currently have patent applications pending. We seek to protect our technology through use of patent protections, although we do not deem patents to be critical to our success.

Cyclicality

We are substantially dependent on conditions in the oil and gas industry, including the level of exploration, development and production activity of, and the corresponding capital spending by, oil and natural gas companies. The level of exploration, development and production activity is directly affected by trends in oil and natural gas prices, which have historically been volatile, and by the availability of capital and the associated capital spending discipline exercised by customers. Declines, as well as anticipated declines, in oil and gas prices could negatively affect the level of these activities and capital spending, which could adversely affect demand for our products and services and, in certain instances, result in the cancellation, modification or rescheduling of existing and expected orders and the ability of our customers to pay us for our products and services. These factors could have an adverse effect on our revenue and profitability.

Seasonality

Our business is not significantly impacted by seasonality, although our fourth quarter has historically been impacted by holidays and our clients’ budget cycles.

Customers

We serve over 200 customers representing majors, independents and other oil and gas companies with operations in the key U.S. oil and gas producing basins including the Permian, SCOOP/STACK, Marcellus, Utica, Eagle Ford, Bakken and other active oil and gas basins, as well as in Australia. Pioneer Natural Resources represented approximately 10% of total revenues for the year ended December 31, 2019 and 11% during each of the years ended December 31, 2018 and 2017.

Competition

The markets in which we operate are highly competitive. We believe that we are one of the largest suppliers of wellheads in the United States. We compete with divisions of Schlumberger, Baker Hughes and TechnipFMC, as well as with a number of other companies. Similar to Cactus, each of Schlumberger, Baker Hughes and TechnipFMC manufacture their own engineered products.

We believe that the rental market for frac stacks and related flow control equipment is more fragmented than the wellhead product market. Cactus does not believe that any individual company represents more than 20% of the U.S. market.

6

As is the case in the wellhead market, Cactus, Schlumberger, Baker Hughes and TechnipFMC rent internally engineered and manufactured products. Other competitors generally rent foreign manufactured generic products.

We believe that the principal competitive factors in the markets we serve are technical features, equipment availability, work force competency, efficiency, safety record, reputation, experience and price. Additionally, projects are often awarded on a bid basis, which tends to create a highly competitive environment. While we seek to be competitive in our pricing, we believe many of our customers elect to work with us based on product features, safety, performance and quality of our crews, equipment and services. We seek to differentiate ourselves from our competitors by delivering the highest‑quality services and equipment possible, coupled with superior execution and operating efficiency in a safe working environment.

Environmental, Health and Safety Regulation

We are subject to stringent governmental laws and regulations, both in the United States and other countries, pertaining to protection of the environment and occupational safety and health. Compliance with environmental legal requirements in the United States at the federal, state or local levels may require acquiring permits to conduct regulated activities, incurring capital expenditures to limit or prevent emissions, discharges and any unauthorized releases, and complying with stringent practices to handle, recycle and dispose of certain wastes. These laws and regulations include, among others:

|

· |

the Federal Water Pollution Control Act (the “Clean Water Act”); |

|

· |

the Clean Air Act; |

|

· |

the Comprehensive Environmental Response, Compensation and Liability Act; |

|

· |

the Resource Conservation and Recovery Act; |

|

· |

the Occupational Safety and Health Act; and |

|

· |

national and local environmental protection laws in the People’s Republic of China. |

New, modified or stricter enforcement of environmental laws and regulations could be adopted or implemented that significantly increase our compliance costs, pollution mitigation costs, or the cost of any remediation of environmental contamination that may become necessary, and these costs could be material. Our clients are also subject to most, if not all, of the same laws and regulations relating to environmental protection and occupational safety and health in the United States and in foreign countries where we operate. Consequently, to the extent these environmental compliance costs, pollution mitigation costs or remediation costs are incurred by our clients, those clients could elect to delay, restrict or cancel drilling, exploration or production programs, which could reduce demand for our products and services and, as a result, have a material adverse effect on our business, financial condition, results of operations, or cash flows.

Consistent with our quality assurance and control principles, we have established proactive environmental and worker safety policies in the United States and foreign countries for the management, handling, recycling or disposal of chemicals and gases and other materials and wastes resulting from our operations. Substantial fines and penalties can be imposed and orders or injunctions limiting or prohibiting certain operations may be issued in connection with any failure to comply with laws and regulations relating to worker health and safety.

API Certifications. Our manufacturing facility and our production facility are currently certified by the API as being in compliance with API 6A, 21st Edition product specification for both wellheads and valves and API Q1, 9th Edition, Addendum 2, and ISO 9001:2015 quality management systems. API’s standards are subject to revision, however, and there is no guarantee that future amendments or substantive changes to the standards would not require us to modify our operations or manufacturing processes to meet the new standards. Doing so may materially affect our operational costs. We also cannot guarantee that changes to the standards would not lead to the rescission of our licenses should we be unable to make the changes necessary to meet the new standards. Furthermore, these facilities are subjected to annual audits by the API. Loss of our API licenses could materially affect demand for these products.

7

Hydraulic Fracturing. Many of our customers utilize hydraulic fracturing in their operations. Environmental concerns have been raised regarding the potential impact of hydraulic fracturing on underground water supplies and seismic activity. These concerns have led to several regulatory and governmental initiatives in the United States to restrict the hydraulic fracturing process, which could have an adverse impact on our customers’ completions or production activities.

Although we do not conduct hydraulic fracturing, increased regulation and attention given to the hydraulic fracturing process could lead to greater opposition to oil and gas production activities using hydraulic fracturing techniques. In addition, the adoption of new laws or regulations at the federal, state, local or foreign level imposing reporting obligations on, or otherwise limiting, delaying or banning, the hydraulic fracturing process or other processes on which hydraulic fracturing and subsequent hydrocarbon production relies, such as water disposal, could make it more difficult to complete oil and natural gas wells. Further, it could increase our customers’ costs of compliance and doing business, and otherwise adversely affect the hydraulic fracturing services they perform, which could negatively impact demand for our products.

Climate Change. State, national and international governments and agencies continue to evaluate, and in some instances adopt, climate-related legislation and other regulatory initiatives that would restrict emissions of greenhouse gases. Changes in environmental requirements related to greenhouse gases, climate change and alternative energy sources may negatively impact demand for our services. For example, oil and natural gas exploration and production may decline as a result of environmental requirements, including land use policies responsive to environmental concerns. Because our business depends on the level of activity in the oil and natural gas industry, existing or future laws, regulations, treaties or international agreements related to greenhouse gases and climate change, including incentives to conserve energy or use alternative energy sources, may reduce demand for oil and natural gas and could have a negative impact on our business. Likewise, such restrictions may result in additional compliance obligations that could have a material adverse effect on our business, consolidated results of operations and consolidated financial condition.

Insurance and Risk Management

We rely on customer indemnifications and third‑party insurance as part of our risk mitigation strategy. However, our customers may be unable to satisfy indemnification claims against them. In addition, we indemnify our customers against certain claims and liabilities resulting or arising from our provision of goods or services to them. Our insurance may not be sufficient to cover any particular loss or may not cover all losses. We carry a variety of insurance coverages for our operations, and we are partially self‑insured for certain claims, in amounts that we believe to be customary and reasonable. Historically, insurance rates have been subject to various market fluctuations that may result in less coverage, increased premium costs, or higher deductibles or self‑insured retentions.

Our insurance includes coverage for commercial general liability, damage to our real and personal property, damage to our mobile equipment, sudden and accidental pollution liability, workers’ compensation and employer’s liability, auto liability, foreign package policy, commercial crime, fiduciary liability employment practices, cargo, excess liability, and directors and officers’ insurance. We also maintain a partially self-insured medical plan that utilizes specific and aggregate stop loss limits. Our insurance includes various limits and deductibles or self‑insured retentions, which must be met prior to, or in conjunction with, recovery.

Employees

As of December 31, 2019, we employed over 1,100 people. Our future success will depend partially on our ability to attract, retain and motivate qualified personnel. We are not a party to any collective bargaining agreements and have not experienced any strikes or work stoppages. We consider our relations with our employees to be good.

Available Information

Our principal executive offices are located at 920 Memorial City Way, Suite 300, Houston, TX 77024, and our telephone number at that address is (713) 626‑8800. Our website address is www.CactusWHD.com. Our periodic reports and other information filed with or furnished to the Securities and Exchange Commission (“SEC”) are available, free of charge, through our website, as soon as reasonably practicable after those reports and other information are electronically filed with or furnished to the SEC. Information on our website or any other website is not incorporated by reference into this Annual Report and does not constitute a part of this Annual Report.

8

Investing in our Class A common stock involves risks. You should carefully consider the information in this Annual Report, including the matters addressed under “Cautionary Statement Regarding Forward‑Looking Statements,” and the following risks before making an investment decision. Our business, results of operations and financial condition could be materially and adversely affected by any of these risks. Additional risks or uncertainties not currently known to us, or that we deem immaterial, may also have an effect on our business, results of operations and financial condition. The trading price of our Class A common stock could decline due to any of these risks, and you may lose all or part of your investment.

Risks Related to the Oilfield Services Industry and Our Business

Demand for our products and services depends on oil and gas industry activity and customer expenditure levels, which are directly affected by trends in the demand for and price of crude oil and natural gas and availability of capital.

Demand for our products and services depends primarily upon the general level of activity in the oil and gas industry, including the number of drilling rigs in operation, the number of oil and gas wells being drilled, the depth and drilling conditions of these wells, the volume of production, the number of well completions and the level of well remediation activity, and the corresponding capital spending by oil and gas companies. Oil and gas activity is in turn heavily influenced by, among other factors, current and anticipated oil and natural gas prices locally and worldwide, which have historically been volatile.

Declines, as well as anticipated declines, in oil and gas prices could negatively affect the level of these activities and capital spending, which could adversely affect demand for our products and services and, in certain instances, result in the cancellation, modification or rescheduling of existing and expected orders and the ability of our customers to pay us for our products and services. These factors could have an adverse effect on our results of operations, financial condition and cash flows.

Factors affecting the prices of oil and natural gas include, but are not limited to, the following:

|

· |

demand for hydrocarbons, which is affected by worldwide population growth, economic growth rates and general economic and business conditions; |

|

· |

available excess production capacity within the Organization of Petroleum Exporting Countries (“OPEC”) and the level of oil and gas production by non‑OPEC countries; |

|

· |

the continued development of shale plays which may influence worldwide supply; |

|

· |

transportation differentials associated with reduced capacity in and out of the storage hub in Cushing, Oklahoma; |

|

· |

costs of exploring for, producing and delivering oil and natural gas; |

|

· |

political and economic uncertainty and sociopolitical unrest; |

|

· |

oil refining capacity and shifts in end‑customer preferences toward fuel efficiency and the use of natural gas; |

|

· |

conservation measures and technological advances affecting energy consumption; |

|

· |

potential acceleration of the commercial development of alternative energy sources (such as wind, solar, geothermal, tidal, fuel cells and biofuels); |

|

· |

access to capital and credit markets, which may affect our customers’ activity levels and spending for our products and services; |

9

|

· |

changes in laws and regulations related to hydraulic fracturing activities; |

|

· |

changes in environmental laws and regulations (including relating to the use of coal in power plants); and |

|

· |

natural disasters. |

The oil and gas industry is cyclical and has historically experienced periodic downturns, which have been characterized by diminished demand for our products and services and downward pressure on the prices we charge. These downturns cause many exploration and production (“E&P”) companies to reduce their capital budgets and drilling activity. Any future downturn or expected downturn could result in a significant decline in demand for oilfield services and adversely affect our results of operations, financial condition and cash flows.

Growth in U.S. drilling and completion activity, and our ability to benefit from such growth, could be adversely affected by any significant constraints in equipment, labor or takeaway capacity in the regions in which we operate.

Growth in U.S. drilling and completion activity may be impacted by, among other things, pressure pumping capacity, pipeline capacity, and material and labor shortages. While there is no perceived shortage in capacity, should significant growth in activity occur there could be concerns over availability of the equipment, materials and labor required to drill and complete a well, together with the ability to move the produced oil and natural gas to market. Should significant constraints develop that materially impact the economics of oil and gas producers, growth in U.S. drilling and completion activity could be adversely affected. This would have an adverse impact on the demand for the products we sell and rent, which could have a material adverse effect on our business, results of operations, financial condition and cash flows.

We may be unable to employ a sufficient number of skilled and qualified workers to sustain or expand our current operations.

The delivery of our products and services requires personnel with specialized skills and experience. Our ability to be productive and profitable will depend upon our ability to attract and retain skilled workers. In addition, our ability to expand our operations depends in part on our ability to increase the size of our skilled labor force. The demand for skilled workers is high, the supply is limited, and the cost to attract and retain qualified personnel has increased. During industry downturns, skilled workers may leave the industry, reducing the availability of qualified workers when conditions improve. In addition, a significant increase in the wages paid by competing employers could result in increases in the wage rates that we must pay. If we are not able to employ and retain skilled workers, our ability to respond quickly to customer demands or strong market conditions may inhibit our growth, which could have a material adverse effect on our business, results of operations and financial condition.

Our business is dependent on the continuing services of certain of our key managers and employees.

We depend on key personnel. The loss of key personnel could adversely impact our business if we are unable to implement certain strategies or transactions in their absence. The loss of qualified employees or an inability to retain and motivate additional highly‑skilled employees required for the operation and expansion of our business could hinder our ability to successfully maintain and expand our market share.

Equity interests in us are a substantial portion of the net worth of our executive officers and several of our other senior managers. Following the completion of our IPO, those executive officers and other senior managers have increased liquidity with respect to their equity interests in us. As a result, those executive officers and senior managers may have less incentive to remain employed by us. After terminating their employment with us, some of them may become employed by our competitors.

Political, regulatory, economic and social disruptions in the countries in which we conduct business could adversely affect our business or results of operations.

In addition to our facilities in the United States, we operate one production facility in China and have facilities in Australia that sell and rent equipment as well as provide parts, repair services and field services associated with installation. Instability and unforeseen changes in any of the markets in which we conduct business could have an adverse effect on the

10

demand for, or supply of, our products and services, our results of operations and our financial condition. These factors include, but are not limited to, the following:

|

· |

nationalization and expropriation; |

|

· |

potentially burdensome taxation; |

|

· |

inflationary and recessionary markets, including capital and equity markets; |

|

· |

civil unrest, labor issues, political instability, natural disasters, terrorist attacks, cyber‑terrorism, military activity and wars; |

|

· |

outbreaks of pandemic or contagious diseases; |

|

· |

supply disruptions in key oil producing countries; |

|

· |

tariffs, trade restrictions, trade protection measures, including those associated with Section 232 and Section 301, or price controls; |

|

· |

foreign ownership restrictions; |

|

· |

import or export licensing requirements; |

|

· |

restrictions on operations, trade practices, trade partners and investment decisions resulting from domestic and foreign laws and regulations; |

|

· |

changes in, and the administration of, laws and regulations; |

|

· |

inability to repatriate income or capital; |

|

· |

reductions in the availability of qualified personnel; |

|

· |

development and implementation of new technologies; |

|

· |

foreign currency fluctuations or currency restrictions; and |

|

· |

fluctuations in the interest rate component of forward foreign currency rates. |

Our operations and results may be negatively impacted by the coronavirus outbreak.

During January 2020, a novel strain of coronavirus surfaced in the Hubei province in China. We operate one facility in China in Suzhou, located in the Jiangsu province. While the Jiangsu province does not share any borders with the Hubei province, it is approximately 500 miles from Hubei. On January 27, 2020, in an effort to halt the outbreak, China’s State Council announced an extension of the Lunar New Year celebration and thus extended the mandatory closure of all non-essential enterprises until February 10, 2020 in the Jiangsu province. As a result of these measures, we temporarily closed our facility in Suzhou for 10 days. Although the Suzhou facility reopened on February 10, 2020, it is currently operating at a reduced capacity due to, among other reasons, employee shortages resulting in part from government-imposed travel restrictions and local statutory quarantines. We cannot be sure the Suzhou facility will not face additional closures or assess how long it will continue operating at a reduced capacity. Additionally, even once our operations at the Suzhou facility are fully restored, continued government-imposed transportation restrictions or subsequent bottlenecks in the shipment of our products may result in additional negative effects to our supply chain or our ability to transport our products to our customers. There are still too many variables and uncertainties regarding the coronavirus outbreak to fully assess the potential impact on our business, including the ultimate geographic spread of the virus, the duration and severity of the outbreak and the extent of travel restrictions and business closures imposed in China or other affected countries. We believe that our

11

existing inventory levels and other operations will be able to meet customer commitments and demand for the near future, and we do not believe that the coronavirus is likely to have a material adverse impact on our results of operations for the first quarter of 2020. However, a prolonged shutdown or reduction in capacity of our Chinese operations or other facilities in China that are engaged in our supply chain will likely have a negative effect on our results of operations, which could be material. Broader global effects of potentially reduced consumer confidence, reduced demand for oil and gas and other macro issues could also have a negative effect on our overall business.

We are dependent on a relatively small number of customers in a single industry. The loss of an important customer could adversely affect our results of operations and financial condition.

Our customers are engaged in the oil and natural gas E&P business primarily in the United States and Australia. Historically, we have been dependent on a relatively small number of customers for our revenues. For the years ended December 31, 2019 and 2018, Pioneer Natural Resources represented 10% and 11%, respectively, of our total revenue and no other customer represented more than 10% of our total revenue.

Our business, results of operations and financial condition could be materially adversely affected if an important customer ceases to engage us for our services on favorable terms or at all or fails to pay or delays in paying us significant amounts of our outstanding receivables.

Additionally, the E&P industry is characterized by frequent consolidation activity. Changes in ownership of our customers may result in the loss of, or reduction in, business from those customers, which could materially and adversely affect our business, results of operations and financial condition.

Delays in obtaining, or inability to obtain or renew, permits or authorizations by our customers for their operations could impair our business.

In both the United States and Australia, our customers are required to obtain permits or authorizations from one or more governmental agencies or other third parties to perform drilling and completion activities, including hydraulic fracturing. Such permits or approvals are typically required by state agencies but can also be required by federal and local governmental agencies or other third parties. The requirements for such permits or authorizations vary depending on the location where such drilling and completion activities will be conducted. As with most permitting and authorization processes, there is a degree of uncertainty as to whether a permit will be granted, the time it will take for a permit or approval to be issued and the conditions which may be imposed in connection with the granting of the permit. In some jurisdictions, certain regulatory authorities have delayed or suspended the issuance of permits or authorizations while the potential environmental impacts associated with issuing such permits can be studied and appropriate mitigation measures evaluated. In Texas, rural water districts have begun to impose restrictions on water use and may require permits for water used in drilling and completion activities. Permitting, authorization or renewal delays, the inability to obtain new permits or the revocation of current permits could cause a loss of revenue and potentially have a materially adverse effect on our business, results of operations and financial condition.

Competition within the oilfield services industry may adversely affect our ability to market our services.

The oilfield services industry is highly competitive and fragmented and includes numerous small companies capable of competing effectively in our markets on a local basis, as well as several large companies that possess substantially greater financial and other resources than we do. The amount of equipment available may exceed demand, which could result in active price competition. Many contracts are awarded on a bid basis, which may further increase competition based primarily on price. In addition, adverse market conditions lower demand for well servicing equipment, which results in excess equipment and lower utilization rates. If market conditions in our oil‑oriented operating areas were to deteriorate or if adverse market conditions in our natural gas‑oriented operating areas persist, the prices we are able to charge and utilization rates may decline. The competitive environment intensified in late 2014 and again in late 2019 as a result of the industry downturn and oversupply of oilfield equipment and services. Any significant future increase in overall market capacity for the products, rental equipment or services that we offer could adversely affect our business and results of operations.

12

New technology may cause us to become less competitive.

The oilfield services industry is subject to the introduction of new drilling and completions techniques and services using new technologies, some of which may be subject to patent or other intellectual property protections. Although we believe our equipment and processes currently give us a competitive advantage, as competitors and others use or develop new or comparable technologies in the future, we may lose market share or be placed at a competitive disadvantage. Further, we may face competitive pressure to develop, implement or acquire certain new technologies at a substantial cost. Some of our competitors have greater financial, technical and personnel resources that may allow them to enjoy various competitive advantages in the development and implementation of new technologies. We cannot be certain that we will be able to continue to develop and implement new technologies or products. Limits on our ability to develop, bring to market, effectively use and implement new and emerging technologies may have a material adverse effect on our business, results of operations and financial condition, including a reduction in the value of assets replaced by new technologies.

Increased costs, or lack of availability, of raw materials and other components may result in increased operating expenses and adversely affect our results of operations and cash flows.

Our ability to source low cost raw materials and components, such as steel castings and forgings, is critical to our ability to manufacture and sell our products and provide our services competitively. Our results of operations may be adversely affected by our inability to manage the rising costs and availability of raw materials and components used in our wide variety of products and systems. We cannot assure that we will be able to continue to purchase these raw materials on a timely basis or at commercially viable prices, nor can we be certain of the impact of changes to Section 232 or Section 301 and future legislation that may impact trade with China. Further, unexpected changes in the size of regional and/or product markets, particularly for short lead‑time products, could affect our results of operations and cash flows. Should our current suppliers be unable to provide the necessary raw materials or components or otherwise fail to deliver such materials and components timely and in the quantities required, resulting delays in the provision of products or services to our customers could have a material adverse effect on our business.

In accordance with Section 1502 of the Dodd‑Frank Act, the SEC’s rules regarding mandatory disclosure and reporting requirements by public companies of their use of “conflict minerals” (tantalum, tin, tungsten and gold) originating in the Democratic Republic of Congo and adjoining countries became effective in 2014. While the conflict minerals rule continues in effect as adopted, there remains uncertainty regarding how the conflict minerals rule, and our compliance obligations, will be affected in the future. Additional requirements under the rule could affect sourcing at competitive prices and availability in sufficient quantities of tungsten, which is used in the manufacture of our products or in the provision of our services. This could have a material adverse effect on our ability to purchase these products in the future. The costs of compliance, including those related to supply chain research, the limited number of suppliers and possible changes in the sourcing of these minerals, could have a material adverse effect on our results of operations and cash flows.

Our relationship with one of our vendors is important to us.

We obtain certain important materials and machining services from one of our vendors located in China. For the years ended December 31, 2019, 2018 and 2017, approximately $36.5 million, $46.7 million and $33.4 million, respectively, of purchases of machined components were made from this vendor, representing approximately 16%, 21% and 22%, respectively, of our total third party vendor purchases of raw materials, finished products, equipment, machining and other services. If we are not able to maintain our relationship or we experience supply-related issues with such vendor, our results of operations could be adversely impacted until we are able to find an alternative vendor.

We design, manufacture, sell, rent and install equipment that is used in oil and gas E&P activities, which may subject us to liability, including claims for personal injury, property damage and environmental contamination should such equipment fail to perform to specifications.

We provide products and systems to customers involved in oil and gas exploration, development and production. Some of our equipment is designed to operate in high‑temperature and/or high‑pressure environments, and some equipment is designed for use in hydraulic fracturing operations. We also provide parts, repair services and field services associated with installation at all of our facilities and service centers in the United States and Australia, as well as at customer sites. Because of applications to which our products and services are exposed, particularly those involving high pressure environments, a

13

failure of such equipment, or a failure of our customers to maintain or operate the equipment properly, could cause damage to the equipment, damage to the property of customers and others, personal injury and environmental contamination and could lead to a variety of claims against us that could have an adverse effect on our business and results of operations.

We indemnify our customers against certain claims and liabilities resulting or arising from our provision of goods or services to them. In addition, we rely on customer indemnifications, generally, and third‑party insurance as part of our risk mitigation strategy. However, our insurance may not be adequate to cover our liabilities. In addition, our customers may be unable to satisfy indemnification claims against them. Further, insurance companies may refuse to honor their policies, or insurance may not generally be available in the future, or if available, premiums may not be commercially justifiable. We could incur substantial liabilities and damages that are either not covered by insurance or that are in excess of policy limits, or incur liability at a time when we are not able to obtain liability insurance. Such potential liabilities could have a material adverse effect on our business, results of operations, financial condition and cash flows.

Our operations are subject to hazards inherent in the oil and natural gas industry, which could expose us to substantial liability and cause us to lose customers and substantial revenue.

Risks inherent in our industry include the risks of equipment defects, installation errors, the presence of multiple contractors at the wellsite over which we have no control, vehicle accidents, fires, explosions, blowouts, surface cratering, uncontrollable flows of gas or well fluids, pipe or pipeline failures, abnormally pressured formations and various environmental hazards such as oil spills and releases of, and exposure to, hazardous substances. For example, our operations are subject to risks associated with hydraulic fracturing, including any mishandling, surface spillage or potential underground migration of fracturing fluids, including chemical additives. The occurrence of any of these events could result in substantial losses to us due to injury or loss of life, severe damage to or destruction of property, natural resources and equipment, pollution or other environmental damage, clean‑up responsibilities, regulatory investigations and penalties, suspension of operations and repairs required to resume operations. The cost of managing such risks may be significant. The frequency and severity of such incidents will affect operating costs, insurability and relationships with customers, employees and regulators. In particular, our customers may elect not to purchase our products or services if they view our environmental or safety record as unacceptable, which could cause us to lose customers and substantial revenues.

Our insurance may not be adequate to cover all losses or liabilities we may suffer. Also, insurance may no longer be available to us or its availability may be at premium levels that do not justify its purchase. The occurrence of a significant uninsured claim, a claim in excess of the insurance coverage limits maintained by us or a claim at a time when we are not able to obtain liability insurance could have a material adverse effect on our ability to conduct normal business operations and on our results of operations, financial condition and cash flows. In addition, we may not be able to secure additional insurance or bonding that might be required by new governmental regulations. This may cause us to restrict our operations, which might severely impact our financial condition.

Oilfield anti-indemnity provisions enacted by many states may restrict or prohibit a party’s indemnification of us.

We typically enter into agreements with our customers governing the provision of our services, which usually include certain indemnification provisions for losses resulting from operations. Such agreements may require each party to indemnify the other against certain claims regardless of the negligence or other fault of the indemnified party; however, many states place limitations on contractual indemnity agreements, particularly agreements that indemnify a party against the consequences of its own negligence. Furthermore, certain states, including Louisiana, New Mexico, Texas, and Wyoming, have enacted statutes generally referred to as “oilfield anti-indemnity acts” expressly prohibiting certain indemnity agreements contained in or related to oilfield services agreements. Such oilfield anti-indemnity acts may restrict or void a party’s indemnification of us, which could have a material adverse effect on our business, financial condition, prospects, and results of operations.

Our operations require us to comply with various domestic and international regulations, violations of which could have a material adverse effect on our results of operations, financial condition and cash flows.

We are exposed to a variety of federal, state, local and international laws and regulations relating to matters such as environmental, workplace, health and safety, labor and employment, customs and tariffs, export and re-export controls, economic sanctions, currency exchange, bribery and corruption and taxation. These laws and regulations are complex,

14

frequently change and have tended to become more stringent over time. They may be adopted, enacted, amended, enforced or interpreted in such a manner that the incremental cost of compliance could adversely impact our results of operations, financial condition and cash flows.

Our operations outside of the United States require us to comply with numerous anti‑bribery and anti‑corruption regulations. The U.S. Foreign Corrupt Practices Act, among others, applies to us and our operations. Our policies, procedures and programs may not always protect us from reckless or criminal acts committed by our employees or agents, and severe criminal or civil sanctions may be imposed as a result of violations of these laws. We are also subject to the risks that our employees and agents outside of the United States may fail to comply with applicable laws.

In addition, we import raw materials, semi‑finished goods, and finished products into the United States, China and Australia for use in such countries or for manufacturing and/or finishing for re‑export and import into another country for use or further integration into equipment or systems. Most movement of raw materials, semi‑finished or finished products involves imports and exports. As a result, compliance with multiple trade sanctions, embargoes and import/export laws and regulations pose a constant challenge and risk to us since a portion of our business is conducted outside of the United States through our subsidiaries. Our failure to comply with these laws and regulations could materially affect our business, results of operations and financial condition.

Compliance with environmental laws and regulations may adversely affect our business and results of operations.

Environmental laws and regulations in the United States and foreign countries affect the equipment, systems and services we design, market and sell, as well as the facilities where we manufacture and produce our equipment and systems in the United States and China, and opportunities our customers pursue that create demand for our products. For example, we may be affected by such laws as the Resource Conservation and Recovery Act, the Comprehensive Environmental Response, Compensation, and Liability Act, the Clean Water Act, the Clean Air Act and the Occupational Safety and Health Act of 1970. Further, our customers may be subject to a range of laws and regulations governing hydraulic fracturing, offshore drilling, and greenhouse gas emissions.

We are required to invest financial and managerial resources to comply with environmental laws and regulations and believe that we will continue to be required to do so in the future. Failure to comply with these laws and regulations may result in the assessment of administrative, civil and criminal penalties, the imposition of remedial obligations, or the issuance of orders enjoining operations. These laws and regulations, as well as the adoption of other new laws and regulations affecting exploration and production of crude oil and natural gas by our customers, could adversely affect our business and operating results by increasing our costs, limiting the demand for our products and services or restricting our operations. Increased regulation or a move away from the use of fossil fuels caused by additional regulation could also reduce demand for our products and services.

Existing or future laws and regulations related to greenhouse gases and climate change could have a negative impact on our business and may result in additional compliance obligations with respect to the release, capture, and use of greenhouse gases that could have a material adverse effect on our business, results of operations, prospects, and financial condition.

Changes in environmental requirements related to greenhouse gas emissions and climate change may negatively impact demand for our products and services. For example, oil and natural gas E&P may decline as a result of environmental requirements, including land use policies responsive to environmental concerns. Federal, state, and local agencies have been evaluating climate-related legislation and other regulatory initiatives that would restrict emissions of greenhouse gases in areas in which we conduct business. Because our business depends on the level of activity in the oil and natural gas industry, existing or future laws and regulations related to greenhouse gases and climate change, including incentives to conserve energy or use alternative energy sources, could have a negative impact on our business if such laws or regulations reduce demand for oil and natural gas. Likewise, such restrictions may result in additional compliance obligations with respect to the release, capture, sequestration, and use of greenhouse gases that could have a material adverse effect on our business, results of operations, prospects, and financial condition. Finally, increasing concentrations of greenhouse gases in the Earth’s atmosphere may produce climate changes that could have significant physical effects, such as increased frequency and severity of storms, droughts, floods and other climatic events; if such effects were to occur, they could have an adverse impact on our operations.

15

The outcome of final actions under Section 301 of the Trade Act of 1974 may adversely affect our business.

On March 22, 2018 the President of the United States announced his decisions on the actions that the U.S. government will take based on the findings of an investigation under Section 301, which included a proposed 25% tariff on approximately $50 billion worth of imports from China. The United States has since taken subsequent actions to impose additional tariffs on imports from China, which currently include a 25% tariff on approximately $250 billion worth of Chinese imports and a 15% tariff on approximately $120 billion worth of Chinese imports. In December 2019, the Office of the United States Trade Representative announced that the United States has reached a Phase One trade deal with China, under which the U.S. suspended indefinitely the imposition of an additional 15% tariff on certain Chinese products not covered in an earlier Section 301 action, and cut the 15% tariff on $120 billion worth of Chinese goods to 7.5%. The United States will be maintaining the 25% tariff on approximately $250 billion of Chinese imports. Substantially all of the products that we import through our Chinese supply chain are subject to the 25% tariff. In the three months ended December 31, 2019, we estimate that approximately 50% of our inventory value received was sourced through our Chinese supply chain. To the extent these actions result in a decrease in demand for our products, our business may be adversely impacted. Given the uncertainty regarding the scope and duration of these trade actions by the U.S. or other countries, the impact of these trade actions on our operations or results remains uncertain.

If we are unable to fully protect our intellectual property rights or trade secrets, we may suffer a loss in revenue or any competitive advantage or market share we hold, or we may incur costs in litigation defending intellectual property rights.

While we have some patents and others pending, we do not have patents relating to many of our key processes and technology. If we are not able to maintain the confidentiality of our trade secrets, or if our competitors are able to replicate our technology or services, our competitive advantage would be diminished. We also cannot provide any assurance that any patents we may obtain in the future would provide us with any significant commercial benefit or would allow us to prevent our competitors from employing comparable technologies or processes.