0001699039DEF 14Afalse00016990392023-01-012023-12-31iso4217:USD00016990392022-01-012022-12-310001699039rngr:StuartNBoddenMember2021-01-012021-12-310001699039rngr:DarronMAndersonMember2021-01-012021-12-310001699039rngr:WilliamAustinMember2021-01-012021-12-3100016990392021-01-012021-12-310001699039ecd:PeoMemberrngr:GrantDateFairValueOfEquityAwardsGrantedDuringTheYearAdjustmentMember2023-01-012023-12-310001699039rngr:GrantDateFairValueOfEquityAwardsGrantedDuringTheYearAdjustmentMemberecd:NonPeoNeoMember2023-01-012023-12-310001699039ecd:PeoMemberrngr:GrantDateFairValueOfEquityAwardsGrantedDuringTheYearAdjustmentMember2022-01-012022-12-310001699039rngr:GrantDateFairValueOfEquityAwardsGrantedDuringTheYearAdjustmentMemberecd:NonPeoNeoMember2022-01-012022-12-310001699039ecd:PeoMemberrngr:StuartNBoddenMemberrngr:GrantDateFairValueOfEquityAwardsGrantedDuringTheYearAdjustmentMember2021-01-012021-12-310001699039rngr:DarronMAndersonMemberecd:PeoMemberrngr:GrantDateFairValueOfEquityAwardsGrantedDuringTheYearAdjustmentMember2021-01-012021-12-310001699039ecd:PeoMemberrngr:GrantDateFairValueOfEquityAwardsGrantedDuringTheYearAdjustmentMemberrngr:WilliamAustinMember2021-01-012021-12-310001699039rngr:GrantDateFairValueOfEquityAwardsGrantedDuringTheYearAdjustmentMemberecd:NonPeoNeoMember2021-01-012021-12-310001699039ecd:PeoMemberrngr:FairValueOfEquityAwardsOutstandingAndUnvestedDuringTheYearAdjustmentMember2023-01-012023-12-310001699039ecd:NonPeoNeoMemberrngr:FairValueOfEquityAwardsOutstandingAndUnvestedDuringTheYearAdjustmentMember2023-01-012023-12-310001699039ecd:PeoMemberrngr:FairValueOfEquityAwardsOutstandingAndUnvestedDuringTheYearAdjustmentMember2022-01-012022-12-310001699039ecd:NonPeoNeoMemberrngr:FairValueOfEquityAwardsOutstandingAndUnvestedDuringTheYearAdjustmentMember2022-01-012022-12-310001699039ecd:PeoMemberrngr:StuartNBoddenMemberrngr:FairValueOfEquityAwardsOutstandingAndUnvestedDuringTheYearAdjustmentMember2021-01-012021-12-310001699039rngr:DarronMAndersonMemberecd:PeoMemberrngr:FairValueOfEquityAwardsOutstandingAndUnvestedDuringTheYearAdjustmentMember2021-01-012021-12-310001699039ecd:PeoMemberrngr:WilliamAustinMemberrngr:FairValueOfEquityAwardsOutstandingAndUnvestedDuringTheYearAdjustmentMember2021-01-012021-12-310001699039ecd:NonPeoNeoMemberrngr:FairValueOfEquityAwardsOutstandingAndUnvestedDuringTheYearAdjustmentMember2021-01-012021-12-310001699039ecd:PeoMemberrngr:ChangeInFairValueOfVestedEquityAwardsGrantedInPriorYearsAdjustmentMember2023-01-012023-12-310001699039rngr:ChangeInFairValueOfVestedEquityAwardsGrantedInPriorYearsAdjustmentMemberecd:NonPeoNeoMember2023-01-012023-12-310001699039ecd:PeoMemberrngr:ChangeInFairValueOfVestedEquityAwardsGrantedInPriorYearsAdjustmentMember2022-01-012022-12-310001699039rngr:ChangeInFairValueOfVestedEquityAwardsGrantedInPriorYearsAdjustmentMemberecd:NonPeoNeoMember2022-01-012022-12-310001699039ecd:PeoMemberrngr:StuartNBoddenMemberrngr:ChangeInFairValueOfVestedEquityAwardsGrantedInPriorYearsAdjustmentMember2021-01-012021-12-310001699039rngr:DarronMAndersonMemberecd:PeoMemberrngr:ChangeInFairValueOfVestedEquityAwardsGrantedInPriorYearsAdjustmentMember2021-01-012021-12-310001699039ecd:PeoMemberrngr:WilliamAustinMemberrngr:ChangeInFairValueOfVestedEquityAwardsGrantedInPriorYearsAdjustmentMember2021-01-012021-12-310001699039rngr:ChangeInFairValueOfVestedEquityAwardsGrantedInPriorYearsAdjustmentMemberecd:NonPeoNeoMember2021-01-012021-12-310001699039ecd:PeoMemberrngr:FairValueOfEquityAwardsOutstandingAndUnvestedInPriorsYearAdjustmentMember2023-01-012023-12-310001699039ecd:NonPeoNeoMemberrngr:FairValueOfEquityAwardsOutstandingAndUnvestedInPriorsYearAdjustmentMember2023-01-012023-12-310001699039ecd:PeoMemberrngr:FairValueOfEquityAwardsOutstandingAndUnvestedInPriorsYearAdjustmentMember2022-01-012022-12-310001699039ecd:NonPeoNeoMemberrngr:FairValueOfEquityAwardsOutstandingAndUnvestedInPriorsYearAdjustmentMember2022-01-012022-12-310001699039ecd:PeoMemberrngr:StuartNBoddenMemberrngr:FairValueOfEquityAwardsOutstandingAndUnvestedInPriorsYearAdjustmentMember2021-01-012021-12-310001699039rngr:DarronMAndersonMemberecd:PeoMemberrngr:FairValueOfEquityAwardsOutstandingAndUnvestedInPriorsYearAdjustmentMember2021-01-012021-12-310001699039ecd:PeoMemberrngr:WilliamAustinMemberrngr:FairValueOfEquityAwardsOutstandingAndUnvestedInPriorsYearAdjustmentMember2021-01-012021-12-310001699039ecd:NonPeoNeoMemberrngr:FairValueOfEquityAwardsOutstandingAndUnvestedInPriorsYearAdjustmentMember2021-01-012021-12-310001699039ecd:PeoMemberrngr:FairValueOfVestedEquityAwardsGrantedDuringTheYearAdjustmentMember2023-01-012023-12-310001699039ecd:NonPeoNeoMemberrngr:FairValueOfVestedEquityAwardsGrantedDuringTheYearAdjustmentMember2023-01-012023-12-310001699039ecd:PeoMemberrngr:FairValueOfVestedEquityAwardsGrantedDuringTheYearAdjustmentMember2022-01-012022-12-310001699039ecd:NonPeoNeoMemberrngr:FairValueOfVestedEquityAwardsGrantedDuringTheYearAdjustmentMember2022-01-012022-12-310001699039ecd:PeoMemberrngr:StuartNBoddenMemberrngr:FairValueOfVestedEquityAwardsGrantedDuringTheYearAdjustmentMember2021-01-012021-12-310001699039rngr:DarronMAndersonMemberecd:PeoMemberrngr:FairValueOfVestedEquityAwardsGrantedDuringTheYearAdjustmentMember2021-01-012021-12-310001699039ecd:PeoMemberrngr:WilliamAustinMemberrngr:FairValueOfVestedEquityAwardsGrantedDuringTheYearAdjustmentMember2021-01-012021-12-310001699039ecd:NonPeoNeoMemberrngr:FairValueOfVestedEquityAwardsGrantedDuringTheYearAdjustmentMember2021-01-012021-12-310001699039rngr:ForfeituresOfEquityAwardsDuringCurrentYearAdjustmentMemberecd:PeoMember2023-01-012023-12-310001699039rngr:ForfeituresOfEquityAwardsDuringCurrentYearAdjustmentMemberecd:NonPeoNeoMember2023-01-012023-12-310001699039rngr:ForfeituresOfEquityAwardsDuringCurrentYearAdjustmentMemberecd:PeoMember2022-01-012022-12-310001699039rngr:ForfeituresOfEquityAwardsDuringCurrentYearAdjustmentMemberecd:NonPeoNeoMember2022-01-012022-12-310001699039rngr:ForfeituresOfEquityAwardsDuringCurrentYearAdjustmentMemberecd:PeoMemberrngr:StuartNBoddenMember2021-01-012021-12-310001699039rngr:DarronMAndersonMemberrngr:ForfeituresOfEquityAwardsDuringCurrentYearAdjustmentMemberecd:PeoMember2021-01-012021-12-310001699039rngr:ForfeituresOfEquityAwardsDuringCurrentYearAdjustmentMemberecd:PeoMemberrngr:WilliamAustinMember2021-01-012021-12-310001699039rngr:ForfeituresOfEquityAwardsDuringCurrentYearAdjustmentMemberecd:NonPeoNeoMember2021-01-012021-12-310001699039ecd:PeoMember2023-01-012023-12-310001699039ecd:NonPeoNeoMember2023-01-012023-12-310001699039ecd:PeoMember2022-01-012022-12-310001699039ecd:NonPeoNeoMember2022-01-012022-12-310001699039ecd:PeoMemberrngr:StuartNBoddenMember2021-01-012021-12-310001699039rngr:DarronMAndersonMemberecd:PeoMember2021-01-012021-12-310001699039ecd:PeoMemberrngr:WilliamAustinMember2021-01-012021-12-310001699039ecd:NonPeoNeoMember2021-01-012021-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| | | | | | | | |

Filed by the Registrant ý |

Filed by a Party other than the Registrant o |

| Check the appropriate box: |

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material under §240.14a-12 |

| | | | | | | | |

| Ranger Energy Services, Inc. |

| (Name of Registrant as Specified In Its Charter) |

|

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): |

| |

| ý | No fee required. |

| |

| o | Fee paid previously with preliminary materials |

| | |

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

RANGER ENERGY SERVICES, INC.

10350 Richmond Avenue, Suite 550

Houston, Texas 77042

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To the stockholders of Ranger Energy Services, Inc.:

Notice is hereby given that the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of Ranger Energy Services, Inc. (the “Company,” “we,” “us” or “our”) will be held virtually on May 10, 2024, at 10:00 a.m. Central Daylight Time. There will be no physical meeting location, as the meeting will only be conducted via live webcast. In order to attend the virtual meeting, you must register at www.proxydocs.com/RNGR prior to the start of the meeting.

The Annual Meeting is being held for the following purposes:

1. To elect two nominees, Brett T. Agee and Carla Mashinski, as Class III directors to the Company’s Board of Directors, each of whom will hold office until the 2027 Annual Meeting of Stockholders and until their successor is elected and qualified or until the earlier of death, resignation, disqualification, or removal.

2. To ratify the appointment of Grant Thornton, LLP as the Company’s independent registered public accounting firm for 2024.

3. To provide non-binding approval of our executive compensation for 2023.

4. To transact such other business as may properly come before the Annual Meeting.

Each outstanding share of the Company’s Class A Common Stock (NYSE: RNGR) entitles the holder of record at the close of business on March 13, 2024, to receive notice of and to vote at the Annual Meeting.

We are pleased to take advantage of rules promulgated by the United States Securities and Exchange Commission that allow us to furnish our proxy materials and our annual report to stockholders on the internet. We believe that posting these materials on the internet enables us to provide stockholders with the information that they need more quickly, while lowering our costs of printing and delivery and reducing the environmental impact of our Annual Meeting.

In order to attend the Annual Meeting virtually, you must register in advance at www.proxydocs.com/RNGR prior to the start of the meeting. Upon completing your registration, you will receive further instructions via e-mail, including your unique link that will allow you access to the Annual Meeting and the ability to submit questions. Please be sure to follow instructions found on your proxy card and/or voting authorization form and subsequent instructions that will be delivered to you via e-mail after successful registration. If you are planning to attend our virtual Annual Meeting, please check the website ten days prior to the Annual Meeting date. As always, we encourage you to vote your shares prior to the Annual Meeting.

It is important that you retain a copy of the control number found on the proxy card, voting instruction form or proxy notice, as such number will be required in order for stockholders to gain access to the virtual meeting.

Voting During the Meeting

You may vote shares registered directly in your name as the stockholder of record electronically during the Annual Meeting. If you choose to vote your shares online during the Annual Meeting, please follow the instructions provided on your proxy notice or the proxy card to log in to www.proxydocs.com/RNGR. You will need the control number included on your proxy notice or on your proxy card. If your shares are held in a stock brokerage account or by a bank, broker or other holder of record, you may also vote electronically during the Annual Meeting using your control number provided by your bank, broker or other holder of record.

Even if you plan to participate in the Annual Meeting, the Company strongly recommends that you vote your shares in advance by internet, telephone, or by signing, dating, and returning the proxy card (if requested) as described below so that your vote will be counted if you later decide not to participate in the Annual Meeting.

Questions

If you wish to submit a question, you may do so at the time of meeting registration by logging into the virtual meeting website at www.proxydocs.com/RNGR. Only questions pertinent to meeting matters will be answered during the meeting, subject to time constraints.

Technical Difficulties

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual Annual Meeting. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the login page.

WHETHER OR NOT YOU EXPECT TO ATTEND THE VIRTUAL ANNUAL MEETING, WE URGE YOU TO VOTE YOUR SHARES BY INTERNET, TELEPHONE, OR BY SIGNING, DATING AND RETURNING THE PROXY CARD YOU WILL RECEIVE IF YOU REQUEST PRINTED MATERIALS. IF YOU CHOOSE TO ATTEND THE VIRTUAL ANNUAL MEETING, YOU MAY STILL VOTE YOUR SHARES VIRTUALLY, EVEN THOUGH YOU HAVE PREVIOUSLY VOTED OR RETURNED YOUR PROXY BY ANY OF THE METHODS DESCRIBED IN OUR PROXY STATEMENT. IF YOUR SHARES ARE HELD IN A BANK OR BROKERAGE ACCOUNT, PLEASE REFER TO THE MATERIALS PROVIDED BY YOUR BANK OR BROKER FOR VOTING INSTRUCTIONS.

ALL STOCKHOLDERS ARE EXTENDED A CORDIAL INVITATION TO ATTEND THE VIRTUAL ANNUAL MEETING.

| | | | | |

| | By Order of the Board of Directors, |

| /s/ Stuart N. Bodden |

| | Stuart N. Bodden President, Chief Executive Officer and Director |

Houston, Texas

March 27, 2024

RANGER ENERGY SERVICES, INC.

TABLE OF CONTENTS

RANGER ENERGY SERVICES, INC.

10350 Richmond Avenue, Suite 550

Houston, Texas 77042

PROXY STATEMENT

2024 ANNUAL MEETING OF STOCKHOLDERS

The Board of Directors (the “Board of Directors” or the “Board”) of Ranger Energy Services, Inc. (the “Company,” “we,” “us” or “our”) requests your proxy for the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) that will be held on May 10, 2024, at 10:00 a.m. Central Daylight Time. The Annual Meeting will be a virtual meeting. There will be no physical meeting location, as the meeting will only be conducted via live webcast. By granting the proxy, you authorize the persons named on the proxy to represent you and vote your shares at the Annual Meeting. Those persons will also be authorized to vote your shares to adjourn the Annual Meeting from time to time and to vote your shares at any adjournments or postponements of the Annual Meeting. The Board has made this proxy statement (the “Proxy Statement”) and the accompanying Notice of Annual Meeting of Stockholders, Notice of Internet Availability of Proxy Materials (the “Notice”) and proxy card, and the Company’s 2024 Annual Report to Stockholders (collectively, the “Proxy Materials”), available on the Internet at www.proxydocs.com/RNGR. The date the Proxy Materials are first being made available to stockholders March 27, 2024.

In order to attend the Annual Meeting, you must register in advance at www.proxydocs.com/RNGR prior to May 8, 2024. Upon completing your registration, you will receive further instructions via e-mail, including your unique link that will allow you access to the Annual Meeting and the ability to submit questions. Please be sure to follow instructions found on your proxy card and/or voting authorization form and subsequent instructions that will be delivered to you via e-mail after successful registration. As always, we encourage you to vote your shares prior to the Annual Meeting.

It is important that you retain a copy of the control number found on the proxy card, voting instruction form or Notice, as such number will be required in order for stockholders to gain access to the virtual meeting.

ABOUT THE ANNUAL MEETING

Purpose of the Annual Meeting

The purpose of the Annual Meeting is for our stockholders to consider and act upon the proposals described in this Proxy Statement and any other matters that properly come before the Annual Meeting. In addition, management will report on the performance of the Company and respond to questions from stockholders.

Proposals to be Voted Upon at the Annual Meeting

At the Annual Meeting, our stockholders will be asked to consider and vote upon the following three proposals:

•Proposal 1: To elect two nominees, Brett T. Agee and Carla Mashinski, to the Board, each of whom will hold office until the 2027 Annual Meeting of Stockholders (the “2027 Annual Meeting”) and until their successor is elected and qualified or until the earlier of death, resignation, disqualification, or removal.

•Proposal 2: To ratify the appointment of Grant Thornton, LLP (“Grant Thornton”) as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024.

•Proposal 3: To provide non-binding approval of our executive compensation for 2023.

In addition, any other matters that properly come before the Annual Meeting or any adjournment or postponement thereof will be considered. As of the date of this Proxy Statement, the Board does not intend to present any matters other than those described herein at the Annual Meeting and is unaware of any matters to be presented by other parties. If other matters are properly brought before the Annual Meeting for action by the stockholders, proxies will be voted in accordance with the recommendation of the Board or, in the absence of such a recommendation, in accordance with the judgment of the proxy holder.

Recommendation of the Board

The Board recommends that you vote FOR each of the nominees to be elected as a Class III director to the Board (Proposal One), FOR the ratification of the appointment of Grant Thornton as our independent registered public accounting firm for the fiscal year ending December 31, 2024 (Proposal Two), and FOR the resolution approving the compensation of our executives as disclosed in this proxy (Proposal Three).

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on May 10, 2024: Annual Report, Notice & Proxy Statement and Proxy Card are available at www.proxydocs.com/RNGR

Pursuant to the “notice and access” rules adopted by the United States Securities and Exchange Commission (the “SEC”), we have elected to provide stockholders access to our proxy materials via the internet. The approximate date on which this Proxy Statement, accompanying Notice and proxy card and the Company’s 2024 Annual Report to Stockholders are first being made available to stockholders at www.proxydocs.com/RNGR is March 27, 2024. The Notice will be sent to all stockholders of record as of March 13, 2024 (the “Record Date”). The Notice includes instructions on how to access our proxy materials over the internet and how to request a printed copy of these materials. In addition, by following the instructions in the Notice, stockholders may request to receive proxy materials in printed form by mail or electronically by e-mail on an ongoing basis.

Choosing to receive your future proxy materials by e-mail will save the Company the cost of printing and mailing documents to you and will reduce the impact of the Company’s annual meetings on the environment. If you choose to receive future proxy materials by e-mail, you will receive an e-mail next year with instructions containing a link to those materials and a link to the proxy voting website. Your election to receive proxy materials by e-mail will remain in effect until you revoke it or are no longer eligible to receive proxy materials under SEC rules.

Our 2024 Annual Report to Stockholders and this Proxy Statement are available at www.proxydocs.com/RNGR.

Voting at the Annual Meeting

The Company’s Class A common stock, par value $0.01 per share (the “Class A Common Stock”), is the only class of securities that entitle holders to vote at meetings of the Company’s stockholders. Each share of Class A Common Stock outstanding on the Record Date entitles the holder to one vote at the Annual Meeting. To participate, vote or submit questions, you will receive further instructions via e-mail, including unique links to access the Annual Meeting and to submit questions in advance of the Annual Meeting. Stockholders may vote and submit questions during the Annual Meeting via live webcast.

If, on the Record Date, you hold shares of our Class A Common Stock that are registered directly in your name with our transfer agent, Computershare Trust Company, N.A., you are considered the stockholder of record with respect to those shares. Mediant, Inc. (“Mediant”) is sending these proxy materials directly to you on our behalf. As a stockholder of record, you may vote virtually at the Annual Meeting or by proxy. Whether or not you plan to attend the Annual Meeting virtually, you may vote via the internet by following the instructions on the Notice. If you request printed copies of the proxy materials by mail, you may also vote by signing and submitting your proxy card, or by submitting your vote by telephone. Whether or not you plan to attend the Annual Meeting, we urge you to vote by way of the internet, telephone or by completing and returning the proxy card you will receive upon request of printed materials. If you submit a proxy but do not give voting instructions as to how your shares should be voted on a particular proposal at the Annual Meeting, your shares will be voted in accordance with the recommendations of our Board stated in this Proxy Statement. Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by: (1) delivering a written notice of revocation addressed to Ranger Energy Services, Inc., Attn: Melissa Cougle, 10350 Richmond Ave., Suite 550, Houston, Texas 77042; (2) properly submitting a duly executed proxy bearing a later date; (3) voting again by internet or telephone prior to the Annual Meeting; or (4) attending the Annual Meeting and voting virtually. Your last vote or proxy will be the vote or proxy that is counted. Attendance at the Annual Meeting will not cause your previously granted proxy to be revoked unless you vote or specifically so request.

If, on the Record Date, you hold shares of our Class A Common Stock in an account with a brokerage firm, bank or other nominee, then you are a beneficial owner of the shares and hold such shares in “street name,” and these proxy materials will be forwarded to you by that organization. As a beneficial owner, you have the right to direct your broker, bank or other nominee on how to vote the shares held in their account, and the nominee has enclosed or provided voting instructions for you to use in directing how to vote your shares. The nominee that holds your shares, however, is considered the stockholder of record for purposes of voting at the Annual Meeting. Because you are not the stockholder of record, you may not vote your shares virtually at the Annual Meeting unless a legal proxy from your broker, bank or other nominee confirming your beneficial ownership of the shares as of the Record Date is obtained. Whether or not you plan to attend the Annual Meeting, we urge you to vote by following the voting instructions provided to you to ensure that your vote is counted.

If you are a beneficial owner and do not vote, and your broker, bank or other nominee does not have discretionary power to vote your shares, your shares may constitute “broker non-votes.” Broker non-votes occur when shares held by a broker for a

beneficial owner are not voted with respect to a particular proposal and generally occur because the broker (1) does not receive voting instructions from the beneficial owner, and (2) lacks discretionary authority to vote the shares. Brokers and other nominees have discretionary authority to vote on ratification of our independent registered public accounting firm for clients who have not provided voting instructions. However, without voting instructions from their clients, broker and other nominees cannot vote on “non-routine” proposals, including the election of directors. Shares that constitute broker non-votes will be counted for the purpose of establishing a quorum at the Annual Meeting.

Voting results will be tabulated and certified by the inspector of elections appointed for the Annual Meeting. If you receive more than one Notice, it is because your shares are registered in more than one name or are registered in different accounts. Please follow the instructions on each Notice received to ensure that all of your shares are voted.

A list of stockholders of record as of the Record Date will be available for inspection during ordinary business hours at our offices located at 10350 Richmond Ave., Suite 550, Houston, Texas 77042, for a period of ten days prior to the date of our Annual Meeting. You may also examine our stockholder list during the Annual Meeting by following instructions provided on the Annual Meeting website, which may be accessed at www.proxydocs.com/RNGR.

Quorum Requirement for the Annual Meeting

The presence at the Annual Meeting, whether virtually or by valid proxy, of the persons holding a majority of shares of Class A Common Stock outstanding on the Record Date will constitute a quorum, permitting us to conduct our business at the Annual Meeting. On the Record Date, there were 23,595,876 shares of Class A Common Stock held by approximately 92 stockholders of record, which does not include stockholders whose shares are held in “street name.” Abstentions (i.e., if you or your broker mark “ABSTAIN” on a proxy or voting instruction form, or if a stockholder of record attends the Annual Meeting but does not vote (either before or during the Annual Meeting)) and broker non-votes will be considered to be shares present at the meeting for purposes of a quorum.

Required Votes

Election of Directors. Each nominated director will be elected by the vote of the plurality of the votes validly cast on the election of directors at the Annual Meeting. Broker non-votes and WITHHOLD votes are not taken into account in determining the outcome of the election of directors.

Ratification of our independent registered public accounting firm. Approval of the proposal to ratify the Audit Committee’s appointment of Grant Thornton as our independent registered public accounting firm for the fiscal year ending December 31, 2024, requires the affirmative vote of the holders of at least a majority of the voting power of the shares of Common Stock (as defined below) present virtually or represented by proxy at the Annual Meeting and entitled to vote. Broker non-votes are not taken into account in determining the outcome of this proposal, and abstentions will have the effect of a vote against this proposal.

Non-binding approval of executive compensation. Approval of the proposal for the non-binding approval of executive compensation requires the affirmative vote of the holders of a majority of the shares present, virtually or by proxy, and entitled to be voted at the Annual Meeting. Votes cast FOR or AGAINST and abstentions with respect to this proposal will be counted as shares entitled to vote on the proposal. Broker non-votes are not taken into account in determining the outcome of this proposal, and abstentions will have the effect of a vote against this proposal.

Solicitation of Proxies

Solicitation of proxies may be made via the internet, mail, personal interview or telephone by officers, directors and regular employees of the Company. The Company may also request banking institutions, brokerage firms, custodians, nominees and fiduciaries to forward solicitation material to the beneficial owners of Class A Common Stock that those companies or persons hold of record, and the Company will reimburse the forwarding expenses. In addition, the Company has retained Mediant to provide various services relating to the proxies, including webhosting, printing, mailing and tabulating votes, for an aggregate fee of approximately $35,500. The Company will bear all costs of such services.

Default Voting

A proxy that is properly completed and submitted will be voted at the Annual Meeting in accordance with the instructions on the proxy. If you properly complete and submit a proxy, but do not provide any voting instructions, your shares will be voted FOR each of the director nominees listed in Proposal ONE, FOR Proposal TWO, and FOR Proposal THREE.

If any other business properly comes before the stockholders for a vote at the Annual Meeting, your shares will be voted in accordance with the discretion of the holders of the proxy. The Board of Directors knows of no matters, other than those previously stated, to be presented for consideration at the Annual Meeting.

DIRECTORS AND EXECUTIVE OFFICERS

After the Annual Meeting, assuming the stockholders elect the nominee of the Board of Directors as set forth in “Proposal One—Election of Directors,” the Board of Directors of the Company will be, and the executive officers of the Company are:

| | | | | | | | | | | | | | |

| Name | | Age | | Title |

| Stuart N. Bodden | | 54 | | President, Chief Executive Officer and Class II Director |

| Melissa Cougle | | 47 | | Chief Financial Officer |

| J. Matthew Hooker | | 60 | | Sr. Vice President of Well Services |

Brett T. Agee (2)(3) | | 50 | | Class III Director |

| Charles S. Leykum | | 46 | | Class I Director |

Krishna Shivram (1)(2) | | 61 | | Class I Director |

Michael C. Kearney (3) | | 75 | | Chairman of the Board and Class I Director |

Carla Mashinski (1)(3) | | 61 | | Class III Director |

Sean Woolverton (1)(2) | | 54 | | Class II Director |

___________________________________________

(1) Member of the Audit Committee.

(2) Member of the Compensation Committee.

(3) Member of the Nominating and Governance Committee.

The Company’s Board of Directors currently consists of seven members, and if the stockholders elect the nominees to the Board as set forth in “Proposal One—Election of Directors” above, the Board will continue to consist of seven members. The Board of Directors is divided into three classes: Class I, Class II and Class III, with each class serving staggered three-year terms. Each year, one class of directors will stand for re-election as their terms of office expire. Presented below is biographical information about each of the Company’s executive officers, directors and nominees for director.

Stuart N. Bodden—President, Chief Executive Officer and Director. Stuart Bodden has served as our President and Chief Executive Officer since September 2021. Mr. Bodden has over 20 years of experience in various executive roles in the oil and gas industry. Prior to joining the Company in September 2021, Mr. Bodden was President and Chief Executive Officer at Express Energy Services in Houston from 2016 to 2021. Mr. Bodden served as President Director for Pacific Oil and Gas in Singapore, which was later purchased by Pacific Energy Corporation Limited, from February 2010 to January 2012, where he led the upstream business and oversaw production and development of oil and gas assets, coal exploration in Sumatra and the creation of a new power business. Mr. Bodden was a Partner at McKinsey & Company in the Houston and Singapore offices, leading projects in the oilfield services and upstream oil and gas sectors during his 10+ year tenure. He currently serves on the board of BioSqueeze Inc. and Bridger Photonics. Mr. Bodden received his Bachelor of Science degree from Brown University and his Master of Business Administration from The University of Texas, Austin.

Melissa Cougle—Chief Financial Officer. Melissa Cougle has served as our Chief Financial Officer (“CFO”) since June 2022. Ms. Cougle has over 20 years of finance leadership experience in the energy and oilfield services industry, including CFO roles at Frank’s International N.V. (now Expro Group Holdings N.V.) from May 2019 to November 2021 and National Energy Services Reunited Corp. (NESR) from May 2018 to May 2019. Prior to her CFO roles, Ms. Cougle served in a variety of leadership roles at Ensco plc, and its predecessor organization, Pride International, for 13 years from 2005 to 2018 some of which included Vice President-Treasurer, Vice President-Integration, Director of Internal Audit, and Director of Finance and Administration. She currently serves on the board of Tidewater Incorporated (TDW) and the advisory board of the Energy Workforce & Technology Council. She brings a deep public company finance background including strategic planning, accounting, financial analysis, public company reporting and internal financial controls. Ms. Cougle received her Bachelor of Science degree from Louisiana State University and is a Certified Public Accountant. Ms. Cougle also holds an accreditation in Cybersecurity Oversight issued by the National Association of Corporate Directors.

J. Matthew Hooker—Sr. Vice President of Well Services. J. Matthew Hooker has served as our Sr. Vice President of Well Services since November 2018. He also served as our Chief Operating Officer from April 2017 to November 2018. Mr. Hooker served as the Senior Vice President of Business Development at Express Energy Services from July 2015 until January 2017, and Senior Vice President of Drilling Services from January 2012 to July 2015. Previously, Mr. Hooker worked at Latshaw Drilling as Vice President of Operations. Prior to that, he served as the North American Regional/Country Manager for Saxon Drilling LP. Mr. Hooker began his career at Nabors Well Services LTD, where he held various positions culminating as Vice President of US Operations.

Brett T. Agee—Director and Nominee. Brett T. Agee has served as a member of our Board of Directors since 2017. Mr. Agee served as the Chief Executive Officer of Ranger Energy Services, LLC (“Ranger Services”) from 2016 to 2017. Prior to joining us, Mr. Agee served as the Chief Executive Officer of Bayou Well Services, LLC (“Bayou Services”) from its founding in 2009 until our acquisition thereof in 2016. Mr. Agee holds a Bachelor of Science in Geography from Texas A&M University’s College of Geosciences. We believe that Mr. Agee’s extensive experience in the energy industry and with Bayou Holdings and Bayou Services, as well as his substantial business, leadership and management experience, brings important and valuable skills to our Board of Directors.

Charles S. Leykum—Director. Charles S. Leykum has served as a member of our Board of Directors since 2017 and as a member of Ranger Services’ board of directors from its founding in 2014 until 2017. Mr. Leykum founded CSL, an energy services-focused private equity firm in 2008. Prior to founding CSL, Mr. Leykum was a Portfolio Manager at Soros Fund Management LLC. Before his time at Soros, he worked in the Principal Investment Area and the Investment Banking Division of Goldman, Sachs & Co. Mr. Leykum served as a member of the board of directors of Sentinel Energy Services Inc. from 2017 to 2023. We believe that Mr. Leykum’s extensive investment experience in the energy industry and service as a director for several energy companies brings important and valuable skills to our Board of Directors. Pursuant to the Stockholders’ Agreement (as defined below), Mr. Leykum has certain rights, subject to certain exceptions, to remain a member of our Board of Directors for so long as CSL beneficially owns at least 10% of our Class A Common Stock. Mr. Leykum graduated with a Bachelor of Arts in Economics from Columbia University and a Master of Business Administration from Harvard Business School in 2004.

Krishna Shivram—Director. Mr. Shivram has served as a member of our Board of Directors since 2017. Mr. Shivram currently serves as Managing Partner of Veritec Ventures LLC, a venture capital firm focused on making investments in decarbonization and energy transition targets. Mr. Shivram served as Chief Executive Officer of Sentinel Energy Services Inc., from 2017 to 2020 and director from 2017 to 2023. Mr. Shivram served as the Executive Vice President and Chief Financial Officer of Weatherford International plc (WFRD) from November 2013 to November 2016, and as interim Chief Executive Officer of Weatherford from November 2016 to March 2017, subsequent to which he evaluated potential opportunities prior to joining us. Immediately prior to joining Weatherford, Mr. Shivram served as Vice President and Treasurer of Schlumberger Ltd. (SLB) beginning in January 2011. Prior to his serving as Vice President and Treasurer, Mr. Shivram held a number of senior management positions at Schlumberger, including Controller—Drilling Group from May 2010 to January 2011, Manager—Mergers and Acquisitions from May 2009 to April 2010 and Controller—Oilfield Services from August 2006 to April 2009. Mr. Shivram is a Chartered Accountant and we believe that his experience in financial accounting, income taxes and treasury operations, along with a strong background in corporate finance and mergers and acquisitions, bring important and valuable skills to our Board of Directors.

Michael C. Kearney—Chairman of the Board. Michael C. Kearney has served as a member of our Board of Directors since July 2018. Mr. Kearney has over 25 years of upstream energy executive and board experience, principally in the oil services sector. Mr. Kearney currently serves as Expro Group Holdings N.V.’s (XPRO) Chairman of the Board, a position he has held since November 2021. Mr. Kearney served as President and Chief Executive Officer of Frank's International N.V., a predecessor company to Expro Group Holdings, N.V. from September 2017 until October 2021. Mr. Kearney served on Frank’s International’s Supervisory Board in various roles since 2013 including Chairman (2015-2021), Lead Supervisory Director (2014-2015), Audit Committee member (2013-2017), and Compensation Committee member (2014-2016), Mr. Kearney was Frank's International’s Lead Supervisory Director from May 2014 until December 2015, when he was named Chairman. In addition, Mr. Kearney served on the Frank’s International Audit Committee from 2013 until 2017 and the Frank’s International’s Compensation Committee from 2014 until 2016. Mr. Kearney previously served as President and Chief Executive Officer of DeepFlex Inc., a privately held oilfield services company which was engaged in the manufacture of flexible composite pipe used in offshore oil and gas production, from September 2009 until June 2013, and served as the Chief Financial Officer of DeepFlex Inc. from January 2008 until September 2009. Mr. Kearney served as Executive Vice President and Chief Financial Officer of Tesco Corporation from October 2004 to January 2007. From 1998 until 2004, Mr. Kearney served as the Chief Financial Officer and Vice President-Administration of Hydril Company. In addition to his executive experience, Mr. Kearney’s oilfield services experience extends to serving on the board of directors of Core Laboratories Inc from 2004 until 2017, most recently as its Lead Director, and serving on the Board and Audit Committee of Fairmount Santrol from 2015 until its merger with Unimin Corporation in 2018. Mr. Kearney received a Bachelor of Business Administration degree from Texas A&M University, as well as a Master of Science degree in Accountancy from the University of Houston. Mr. Kearney was selected as a director because of his experience in the oil and gas industry and his experience serving on the board of directors of other companies.

Carla Mashinski —Director and Nominee. Carla Mashinski joined our Board of Directors on January 1, 2024. Ms. Mashinski is the former Chief Financial and Administrative Officer (CFAO) of Cameron LNG, LLC. Prior to joining Cameron LNG, Ms. Mashinski served as the Chief Financial Officer and VP of Finance and Information Management, North American Operations of Sasol Limited (SSL). Ms. Mashinski has more than 35 years of experience working for a number of diverse energy companies, including Shell Oil Company, Duke Energy, GulfMark Offshore and Sasol Limited. She currently serves as

a director and Audit Committee chairman of Primoris Services Corporation (PRIM) and BKV Corporation. Ms. Mashinski is a Certified Public Accountant and holds a Bachelor’s degree in Accounting from the University of Tennessee at Knoxville and an Executive MBA from the University of Texas at Dallas. She was recognized by WomenInc. as one of the Most Influential Corporate Board Directors of 2019; received the 2020 Breakthrough Award from Greater Houston Women’s Chamber of Commerce and 2020 Top 50 Most Powerful Women in Oil and Gas. Ms. Mashinski is NACD Directorship Certified by the National Association of Corporate Directors. She also authored the book Five Attributes to a Successful Career. We believe Ms. Mashinski’s oil and gas experience, financial background, and board member service will bring diversity, expertise, and knowledge to our Board of Directors.

Sean Woolverton —Director. Sean Woolverton joined our Board of Directors on January 1, 2024. Mr. Woolverton has served as the Chief Executive Officer and member of the Board of Directors of SilverBow Resources, Inc. (SBOW) since March 2017. Prior to his role at SilverBow, he worked at Samson Resources from 2013 to 2017, holding a series of positions, including the role of Chief Operating Officer. From 2007 to 2013 he served in a number of capacities of increasing responsibility at Chesapeake Energy Corporation. Earlier in his career, Mr. Woolverton held multiple engineering and management roles at Encana Corporation and Burlington Resources. Mr. Woolverton received his Bachelor of Science degree in Petroleum Engineering from Montana Tech. We believe Ms. Woolverton’s CEO experience, his board service, and his petroleum engineering background will be a valuable addition to our Board of Directors.

MEETINGS AND COMMITTEES OF DIRECTORS

The Board of Directors held nine meetings and its independent directors met in executive session nine times during 2023. During 2023, our directors attended 92% of the meetings of the Board of Directors and the meetings of the committees of the Board of Directors on which each director served.

Directors are expected and encouraged to attend the Company’s annual meeting of stockholders, and to spend the time needed and meet as frequently as necessary to properly discharge their responsibilities.

Under the Company’s Corporate Governance Guidelines, Mr. Kearney, as Chairman of the Board, will preside at, and is

responsible for preparing an agenda for, the meetings of the independent directors in executive session.

The Board of Directors currently have three standing committees, the Audit Committee, the Compensation Committee, and the Nominating and Governance Committee.

The Board of Directors and the Audit Committee each expect to meet a minimum of four times per calendar year in 2024 and future years. The Compensation Committee and Nominating and Governance Committee expects to meet a minimum of twice per calendar year in 2024 and future years.

Audit Committee. During the year ended December 31, 2023, the members of the Audit Committee were Messrs. Kearney (Chairman), Austin, and Shivram. Mr. Austin retired from the Board of Directors on December 31, 2023. As of January 1, 2024, the members of the Audit Committee are Ms. Mashinski (Chairman), Messrs. Shivram and Woolverton. The Audit Committee held five meetings during 2023. Additional information regarding the functions performed by the Audit Committee and its membership is set forth in the “Audit Committee Report” included herein and also in the “Audit Committee Charter” that is posted on the Company’s website at www.rangerenergy.com.

The Audit Committee oversees, reviews, acts and reports on various auditing and accounting matters to the Board of Directors, including the selection of the Company’s independent registered public accounting firm, the scope of annual audits, fees to be paid to the independent registered accounting firm, the performance of the Company’s independent registered public accounting firm and the Company’s accounting practices. In addition, the Audit Committee oversees the Company’s compliance programs relating to legal and regulatory requirements, and is responsible for overseeing the Company’s assessment and management of financial reporting and internal control risks, as well as other financial risks.

Compensation Committee. During the year ended December 31, 2023, Messrs. Shivram (Chairman), R. Agee and Kearney served as members of the Compensation Committee. R. Agee retired from the Board of Directors on December 31, 2023. As of January 1, 2024, the members of the Compensation Committee are Messrs. Shivram (Chairman), Woolverton and B. Agee. The Compensation Committee held two meetings during the fiscal year ended December 31, 2023. Additional information regarding the functions performed by the Compensation Committee and its membership, as well as the Compensation Committee’s authority to delegate its responsibility to one or more subcommittees, is set forth in the “Compensation Committee Charter” that is posted on the Company’s website at www.rangerenergy.com.

The Compensation Committee reviews and approves all compensation of directors and executive officers, including salaries, bonuses and compensation plans, policies and programs of the Company and administers all plans of the Company

under which shares of common stock may be acquired by directors or executive officers of the Company. The Compensation Committee has the authority to hire a compensation consultant to assist the committee in fulfilling its duties. NFP Compensation Consulting (“NFP”), formerly known as Longnecker & Associates, is our Compensation Consultant. NFP is engaged by and reports directly to the Compensation Committee and advises the Compensation Committee on various executive compensation matters, including by conducting peer reviews, assessing the total compensation of the Company’s executive officers and all exempt-level employees, reviewing the Company’s annual incentive program and long-term incentive plan, assessing director compensation relative to the market, providing market research data analysis and survey information and preparing a report to the Compensation Committee. The Compensation Committee periodically invites the Company’s CEO (also a member of the Board) and Vice President of Human Resources to observe discussions between NFP and the Compensation Committee, and the CEO and Vice President of Human Resources provide performance input and historical compensation data about the Company’s CFO and Senior Vice President of Well Services when requested by the Compensation Committee. The Company’s management does not otherwise play any role in the determination of the amount or form of executive compensation, and does not play any role in the determination of director compensation.

Nominating and Governance Committee. During the year ended December 31, 2023, Messrs. Austin (Chairman), Kearney, and R. Agee served as members of the Nominating and Governance Committee. Mr. Austin and R. Agee retired from the Board of Directors on December 31, 2023. As of January 1, 2024, the members of the Nominating and Governance Committee will be Messrs. Kearney (Chairman), B. Agee, and Ms. Mashinski. The Nominating and Governance Committee was appointed by the Board of Directors in 2021 to assist in fulfilling the Board of Directors’ oversight responsibilities. The Nominating and Governance Committee held three meetings during the fiscal year ended December 31, 2023. Additional information regarding the functions performed by the Nominating and Governance Committee and its membership is set forth in the “Nominating and Governance Committee Charter” that is posted on the Company’s website at www.rangerenergy.com.

The Nominating and Governance Committee, amongst other responsibilities, identifies individuals qualified to be members of the Board of Directors and to recommend to the Board director nominees for the next annual meeting of stockholders, advises the Board about the appropriate composition of the Board and its Committees, recommends to the Board the directors to serve on each outstanding Committee, and oversees the development and implementation of management’s succession planning.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

During 2023, our last completed fiscal year, none of our executive officers served on the board of directors or compensation committee of a company that had an executive officer who served on our Board or our Compensation Committee and participated in deliberations of the Board or the Compensation Committee concerning executive officer compensation. Further, no member of our Board was an executive officer of a company in which one of our executive officers served as a member of the board of directors or compensation committee of that company.

DIRECTOR COMPENSATION

We provided certain of our independent directors, who served during 2023, with an annual retainer of $100,000 per year, which was paid in cash, and annual equity-based compensation in the form of a Restricted Stock award which has a grant date fair value of $75,000. All members of our Board of Directors are reimbursed for certain reasonable expenses in connection with their services to us.

| | | | | | | | | | | | | | | | | | | | |

| Name | | Fees Earned or Paid in Cash (1) ($) | | Stock Awards (3) ($) | | Total

($) |

| William M. Austin | | 100,000 | | | 75,000 | | | 175,000 | |

| Krishna Shivram | | 100,000 | | | 75,000 | | | 175,000 | |

| Michael C. Kearney | | 100,000 | | | 75,000 | | | 175,000 | |

| Brett T. Agee | | 100,000 | | | 75,000 | | | 175,000 | |

| Byron A. Dunn | | 50,000 | | | — | | | 50,000 | |

| Richard E. Agee | | 100,000 | | | 75,000 | | | 175,000 | |

Charles S. Leykum(2) | | 100,000 | | | 75,000 | | | 175,000 | |

Gerald C. Cimador(2) | | 50,000 | | | — | | | 50,000 | |

| | | | | | |

_______________________________________________

(1) Represents the director cash retainer payments made during 2023.

(2) Prior to 2023, pursuant to the policies of CSL Capital Management, equity awards granted to Charles S. Leykum and Gerald C. Cimador, each of whom are affiliated with CSL Capital Management, for services provided for acting as a Director were for the benefit of CSL Capital Management, where Charles S. Leykum is an indirect beneficial owner of such shares. During 2023, the policy changed and the shares are now issued directly to Mr. Leykum. Mr. Cimador retired from the board on May 12, 2023 and did not receive a grant for 2023.

(3) Represents the aggregate grant-date fair value under accounting standards for recognition of share-based compensation expense for Restricted Stock granted to our independent directors in 2023, computed in accordance with FASB ASC Topic 718. Each of Messrs. Austin, Shivram, Kearney, B. Agee, R. Agee, and Leykum were granted 7,484 shares of restricted stock on August 1, 2023, with a fair value of $10.02 per share, which amount is based on the closing price of one share of our Class A Common Stock on the date of grant. For further discussion of the respective awards, please see “Note 8—Equity-Equity Based Compensation,” of the Consolidated Financial Statements included in our Form 10-K for the year ended December 31, 2023. The following table shows the aggregate number of stock awards and option awards outstanding for each director as of December 31, 2023.

| | | | | | | | | | | | | | |

| Name | | Aggregate Stock Awards Outstanding as of December 31, 2023 | | Aggregate Option Awards Outstanding as of December 31, 2023 |

| William M. Austin | | — | | | — | |

| Krishna Shivram | | 7,484 | | | — | |

| Michael C. Kearney | | 7,484 | | | — | |

| Brett T. Agee | | 7,484 | | | — | |

| Byron A. Dunn | | — | | | — | |

| Richard E. Agee | | — | | | — | |

Charles S. Leykum(a) | | 7,484 | | | — | |

Gerald C. Cimador (a) | | — | | | — | |

(a) Prior to 2023, pursuant to the policies of CSL Capital Management, equity awards granted to Charles S. Leykum and Gerald C. Cimador, each of whom are affiliated with CSL Capital Management, for services provided for acting as a Director were for the benefit of CSL Capital Management, where Charles S. Leykum is an indirect beneficial owner of such shares. During 2023, the policy changed and the shares are now issued directly to Mr. Leykum. Mr. Cimador retired from the board on May 12, 2023 and did not receive a grant for 2023.

Effective January 1, 2024, we changed our director compensation structure as described in the below table.

| | | | | | | | |

| Description of Fees | Annualized Cash Compensation ($) | Annualized Equity Compensation ($) |

| Base Retainer | $75,000 | — | |

| Chairman of the Board | $30,000 | — | |

| Audit Committee Chair | $15,000 | — | |

| Other Committee Chairs | $10,000 | — | |

| Committee Member | $5,000 | — | |

| Restricted Stock Grant | — | | $100,000 |

All members of our Board of Directors will continue to be reimbursed for certain reasonable expenses in connection with their services to us.

PROPOSAL ONE—ELECTION OF DIRECTORS

The Board of Directors currently consists of seven directors. In accordance with the terms of our Certificate of Incorporation and our Amended and Restated Bylaws, the Board of Directors is divided into three classes: Class I, Class II and Class III, with each class serving staggered three-year terms. Upon the expiration of the term of a class of directors, directors in that class will be eligible to be elected for a new three-year term at the annual meeting of stockholders in the year in which their term expires. Each director elected to the Board of Directors will hold office until his or her successor has been elected and qualified or until the earlier of their death, resignation, disqualification or removal. The current members of the classes of our Board are divided as follows:

•Class III (if reelected, term will expire in 2027): Brett T. Agee and Carla Mashinski

•Class I (term expires 2025): Charles S. Leykum, Michael C. Kearney and Krishna Shivram

•Class II (term expires in 2026): Stuart N. Bodden and Sean Woolverton

The Board of Directors has nominated the following individuals for election as Class III directors of the Company, to serve until the 2027 Annual Meeting, and until their successor is elected and qualified or until the earlier of death, resignation or removal:

Brett T. Agee

Carla Mashinski

Each of the above individuals are currently serving as a director of the Company. Biographical information for each individual is contained in the “Directors and Executive Officers” section above.

The Board of Directors has no reason to believe that any of its nominees will be unable or unwilling to serve if elected. If a nominee becomes unable or unwilling to accept nomination or election, either the number of the Company’s directors will be reduced or the persons acting under the proxy will vote for the election of a substitute nominee that the Board of Directors recommends.

Vote Required

The election of directors in this Proposal ONE requires the affirmative vote of a plurality of the votes validly cast at the election. Neither WITHHOLD votes nor broker non-votes will have any effect on the outcome of voting on director elections.

Recommendation

The Board of Directors unanimously recommends that stockholders vote FOR the election of each of the nominees.

PROPOSAL TWO—RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board of Directors has appointed Grant Thornton LLP (“Grant Thornton”) as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2024. The audit of the Company’s consolidated financial statements for the fiscal year ending December 31, 2023, was completed by Grant Thornton on March 5, 2024. Grant Thornton was selected as the Company’s independent registered public accounting firm following the completion of a competitive selection process and the Audit Committee’s approval of the appointment on March 8, 2023. With the appointment of Grant Thornton, the Company dismissed BDO USA, LLP (“BDO”) as the Company’s independent registered public accounting firm effective as of the filing of the Company’s Form 10-K for the year ended December 31, 2022, which occurred on March 13, 2023. The reports of BDO on the Company’s consolidated financial statements for the two most recent fiscal years ended December 31, 2022 and 2021 did not contain an adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles. In connection with the audits of the Company's consolidated financial statements for the fiscal years ended December 31, 2022 and 2021, and through March 13, 2023, there were no disagreements with BDO on any matters of accounting principles or practices, financial statement disclosure or auditing scope and procedures which, if not resolved to the satisfaction of BDO, would have caused BDO to make reference to the matter in their report. There were no reportable events of the type listed in paragraphs (A) through (D) of Item 304(a)(1)(v) of Regulation S-K during the fiscal years ended December 31, 2022 and 2021 through March 13, 2023, except for the material weaknesses in the Company’s internal control over financial reporting previously reported in Part II, Item 9A “Controls and Procedures” in the Company’s Form 10-K for the year ended December 31, 2022.

The Board of Directors is submitting the appointment of Grant Thornton for ratification at the Annual Meeting. The submission of this matter for approval by stockholders is not legally required, but the Board of Directors and the Audit Committee believe the submission provides an opportunity for stockholders, through their vote, to communicate with the Board of Directors and the Audit Committee about an important aspect of corporate governance. If the stockholders do not ratify the appointment of Grant Thornton, the Audit Committee will reconsider the appointment of that firm as the Company’s independent registered public accounting firm. The Company expects representatives of Grant Thornton will be present at the Annual Meeting to respond to appropriate questions and to make a statement if they desire to do so.

The Audit Committee has the sole authority and responsibility to retain, evaluate and replace the Company’s independent registered public accounting firm. The stockholders’ ratification of the appointment of Grant Thornton does not limit the authority of the Audit Committee to change independent registered public accounting firms at any time.

Audit and Other Fees

The table below presents the aggregate fees billed by Grant Thornton in 2023 and BDO in 2023 and 2022, the Company’s independent registered public accounting firms for each respective year, for services provided in the last two fiscal years:

| | | | | | | | | | | |

| 2023 | | 2022 |

Audit Fees (1) | $ | 775,233 | | | $ | 1,383,186 | |

Audit-Related Fees | – | | – |

Tax Fees | – | | – |

All Other Fees | – | | – |

Total | $ | 775,233 | | | $ | 1,383,186 | |

_______________________________________________

(1) The audit fees consist of the aggregate fees paid for professional services rendered for (i) the audit of our annual financial statements included in our Annual Report on Form 10-K and (ii) a review of financial statements included in our Quarterly Reports on Form 10-Q.

The charter of the Audit Committee and its pre-approval policy require that the Audit Committee review and pre-approve the plan and scope of Grant Thornton’s audit, audit-related, tax and other services. For the year ended December 31, 2023, the Audit Committee pre-approved all of the audit services described above.

Vote Required

Approval of Proposal TWO requires the affirmative vote of the holders of a majority of the shares present, virtually or by proxy, and entitled to be voted at the Annual Meeting. Votes cast FOR or AGAINST and abstentions with respect to this Proposal TWO will be counted as shares entitled to vote on the Proposal. A vote to ABSTAIN will have the effect of a vote AGAINST the Proposal.

Recommendation

The Board of Directors unanimously recommends that stockholders vote FOR the ratification of the appointment of Grant Thornton LLP as the independent registered public accounting firm of the Company for 2024.

EXECUTIVE COMPENSATION

The following discussion relates to the compensation of the individuals who served as our principal executive officer (“PEO”) and our two other most highly compensated executive officers, as determined under the rules of the SEC, based on compensation paid to or earned by such individuals for the fiscal year ended December 31, 2023. We are currently considered a “smaller reporting company” (as such term is defined in Item 10(f) of Regulation S-K) for purposes of the SEC’s executive compensation disclosure rules. In accordance with such rules, we have opted to comply with the executive compensation disclosure rules in Item 402(l)-(r) of Regulation S-K applicable to smaller reporting companies. Further, our reporting obligations generally extend only to the individuals who served as our PEO and our two other most highly compensated executive officers during fiscal year 2023. For the fiscal year ending December 31, 2023, these individuals are referred to as our “Named Executive Officers” or “NEOs,” as set forth below. The following sections provide compensation information pursuant to the scaled disclosure rules applicable to smaller reporting companies under the rules of the SEC, including reduced narrative and tabular disclosure obligations regarding executive compensation.

In accordance with the foregoing, our NEOs for fiscal year 2023 were:

| | | | | | | | |

| Name | | Current Principal Position |

| Stuart N. Bodden | | President, Chief Executive Officer and Director |

| Melissa Cougle | | Chief Financial Officer |

J. Matthew Hooker | | Senior Vice President of Well Services |

Summary Compensation Table

The following table summarizes, with respect to our NEOs, information relating to compensation earned for services rendered in all capacities during the fiscal years ended December 31, 2023, 2022, and 2021.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name and Principal Position | | Year | | Salary (1) ($) | | Bonus(2) ($) | | Stock Awards(3) ($) | | All other Compensation(4) ($) | | Total

($) |

| Stuart N. Bodden | | 2023 | | 538,462 | | | 335,674 | | | 2,016,322 | | | 15,077 | | | 2,905,535 | |

| President, Chief Executive Officer and Director | | 2022 | | 500,000 | | | 480,000 | | | 771,986 | | | 1,280 | | | 1,753,266 | |

| | 2021 | | 150,000 | | | 150,000 | | | 1,458,783 | | | 2,724 | | | 1,761,507 | |

| | | | | | | | | | | | |

Melissa Cougle | | 2023 | | 400,000 | | | 240,927 | | | 720,127 | | | 13,290 | | | 1,374,344 | |

| Chief Financial Officer | | 2022 | | 204,615 | | | 216,892 | | | 457,934 | | | 35 | | | 879,476 | |

| | | | | | | | | | | | |

J. Matthew Hooker | | 2023 | | 310,000 | | | 127,255 | | | 464,007 | | | 9,210 | | | 910,472 | |

| Senior Vice President of Well Services | | 2022 | | 310,000 | | | 148,800 | | | 383,442 | | | 700 | | | 842,942 | |

| | 2021 | | 303,462 | | | 33,750 | | | 301,444 | | | 2,765 | | | 641,421 | |

______________________________________________(1) Represents base salary earned during the respective fiscal year.

(2) Represents one-time cash bonuses earned during the applicable fiscal year.

(3) Represents the aggregate grant-date fair value under accounting standards for recognition of share-based compensation expense for the respective year. The Company issued performance-based restricted stock units (referred to as “Performance Stock Units” or “PSUs”) and restricted stock awards (“Restricted Stock” or “RSAs”) during the respective fiscal year. The amounts reflected in this column represent the grant date fair value of the PSUs and RSAs granted to the NEOs pursuant to the Company’s 2017 Long-Term Incentive Plan (“LTIP”), computed in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standard Codification (“ASC”) Topic 718. The value of the 2023 PSU awards on the grant date, assuming achievement of the maximum performance level of 200% would be: Mr. Bodden — $2,932,638; Ms. Cougle — $1,040,245; and Mr. Hooker — $649,017. For further discussion of the respective awards, please see Note 8—Equity-Equity Based Compensation of the Consolidated Financial Statements included in our Form 10-K for the year ended December 31, 2023 and “—Outstanding Equity Awards at 2023 Fiscal Year-End” below.

(4) The below table presents details regarding all other compensation that was provided to our NEOs during 2023.

| | | | | | | | | | | | | | | | | |

| Life Insurance Premiums | Company Contributions to 401(k) Plan | Company Contributions to HSA | Dividend Equivalents | Totals |

Bodden | $138 | $13,104 | $713 | $1,122 | $15,077 |

Cougle | $90 | $13,200 | — | | — | | $13,290 |

Hooker | $396 | $8,814 | — | | — | | $9,210 |

Pay versus Performance Table

The following table summarizes, with respect to our NEOs, information relating to compensation paid to our NEOs in comparison to certain Company performance metrics during the fiscal years ended December 31, 2023, 2022 and 2021.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year(1)(2) | | Summary Compen-sation Table Total for PEO ($) (Stuart N. Bodden) | | Compen-sation actually paid to PEO ($) (Stuart N. Bodden) | | Summary Compen-sation Table Total for PEO ($) (Darron M. Anderson) | | Compen-sation actually paid to PEO ($) (Darron M. Anderson) | | Summary Compen-sation Table Total for PEO ($) (William Austin) | | Compen-sation actually paid to PEO ($) (William Austin) | | Average Summary Compen-sation Table for Non-PEO NEOs ($) | | Average Compen-sation Actually Paid to Non-PEOs ($) | | Value of Initial Fixed $100 Investment Based on Total Stockholder Return ($)(3) | | Net Income

($)

(in Millions) |

| 2023 | | 2,905,535 | | | 2,408,677 | | | — | | | — | | | — | | | — | | | 1,142,408 | | | 886,456 | | | 283.79 | | | 23.8 | |

| 2022 | | 1,753,266 | | | 2,256,881 | | | — | | | — | | | — | | | — | | | 867,939 | | | 319,532 | | | 302.47 | | | 15.1 | |

| 2021 | | 1,761,507 | | | 3,054,070 | | | 382,407 | | | 382,407 | | | 306,362 | | | 496,545 | | | 611,048 | | | 1,351,489 | | | 282.14 | | | 8.6 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

(1) The PEO(s) for each year are as follows:

2023: Stuart N. Bodden

2022: Stuart N. Bodden

2021: Stuart N. Bodden, Darron M. Anderson and William Austin

(2) The Non-PEO(s) for each year are as follows:

2023: Melissa K. Cougle, J. Matthew Hooker

2022: Melissa K. Cougle, J. MatthewHooker and J. Brandon Blossman

2021: J. Matthew Hooker and J. Brandon Blossman

(3) The Company calculates TSR with a base investment of $100, including reinvestment of dividends, in a manner consistent with the stock performance graph disclosure requirements under Item 201(e) of Regulation S-K is cumulative for the measurement periods beginning on December 31, 2020 and ending on December 31 of each 2023, 2022 and 2021, respectively.

(4) Deductions from, and additions to, the total compensation of the PEOs and non-PEO NEOs as reflected in the 2023, 2022, and 2021 Summary Compensation Table by year to calculate Compensation Actually Paid consist of the following. As the NEOs do not participate in any defined benefit plans, no adjustments were required to amounts reported in the Summary Compensation Table totals related to the value of benefits under such plans.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2023 | | 2022 | | 2021 |

| Stuart N. Bodden | Average

Non-PEO NEOs | | Stuart N. Bodden | Average

Non-PEO NEOs | | Stuart N. Bodden | Darron M. Anderson | William M. Austin | Average Non-PEO NEOs |

| Total Compensation from Summary Compensation Table | $ | 2,905,535 | | $ | 1,142,408 | | | $ | 1,753,266 | | $ | 867,939 | | | $ | 1,761,507 | | $ | 382,407 | | $ | 306,362 | | $ | 611,048 | |

| Adjustments for Equity Awards | | | | | | | | | | |

Deduction of Amount reported in the “Stock Awards” columns in the Summary Compensation Table | (2,016,322) | | (592,067) | | | (771,986) | | (444,699) | | | (1,458,783) | | — | | (76,459) | | (265,981) | |

Add Year-end fair value of outstanding and unvested awards granted in the covered year | 2,049,126 | | 586,633 | | | 1,102,766 | | 332,209 | | | 2,751,346 | | — | | 100,030 | | 567,672 | |

Add Difference in fair values between prior year-end fair values and vest date fair values for awards granted in prior years | (519,448) | | (247,530) | | | 5,384 | | (339) | | | — | | — | | 166,612 | | 33,982 | |

Add Year-over-year difference of year-end fair values for unvested awards granted in prior years | (10,214) | | (2,988) | | | 167,451 | | 15,641 | | | — | | — | | — | | 404,768 | |

Add Fair values at vest date for awards granted and vested in current year | — | | — | | | — | | 92,344 | | | — | | — | | — | | — | |

Add Forfeitures during current year equal to prior year-end fair value | — | | — | | | — | | (543,563) | | | — | | — | | — | | — | |

| Total Adjustments for Equity Awards | (496,858) | | (255,952) | | | 503,615 | | (548,407) | | | 1,292,563 | | — | | 190,183 | | 740,441 | |

| Compensation Actually Paid (as calculated) | $ | 2,408,677 | | $ | 886,456 | | | $ | 2,256,881 | | $ | 319,532 | | | $ | 3,054,070 | | $ | 382,407 | | $ | 496,545 | | $ | 1,351,489 | |

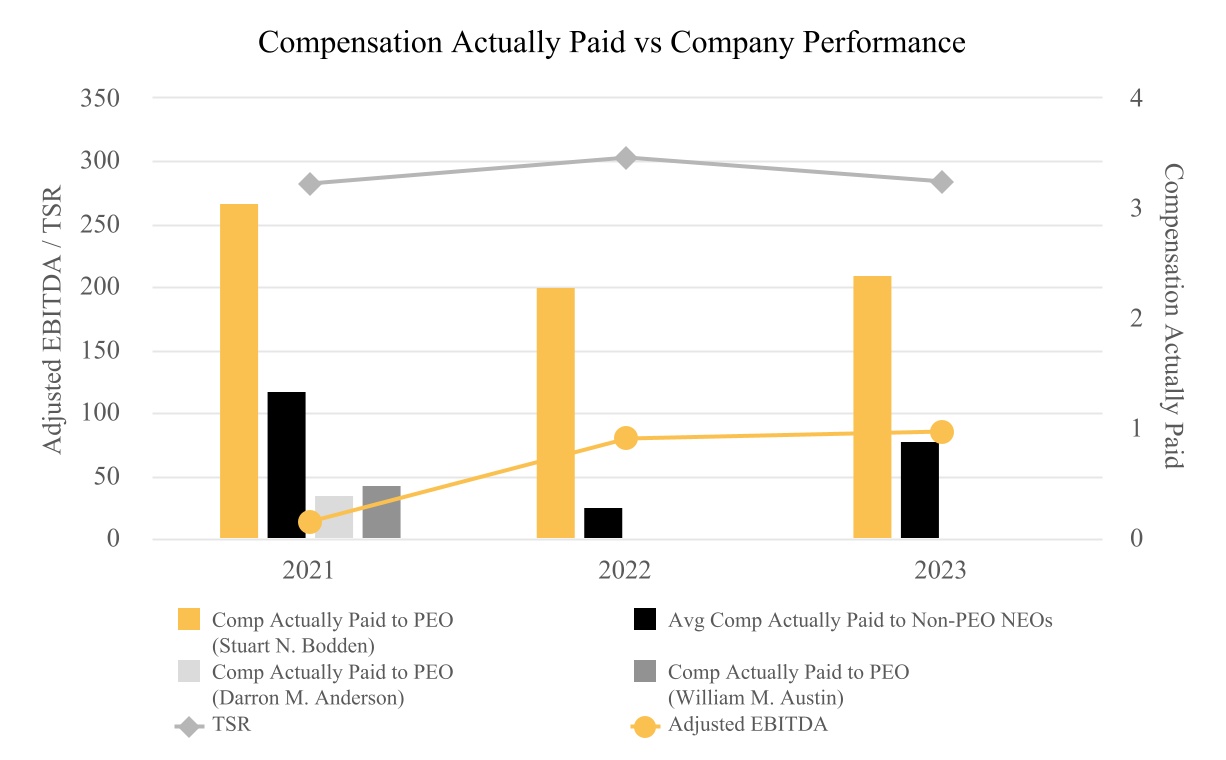

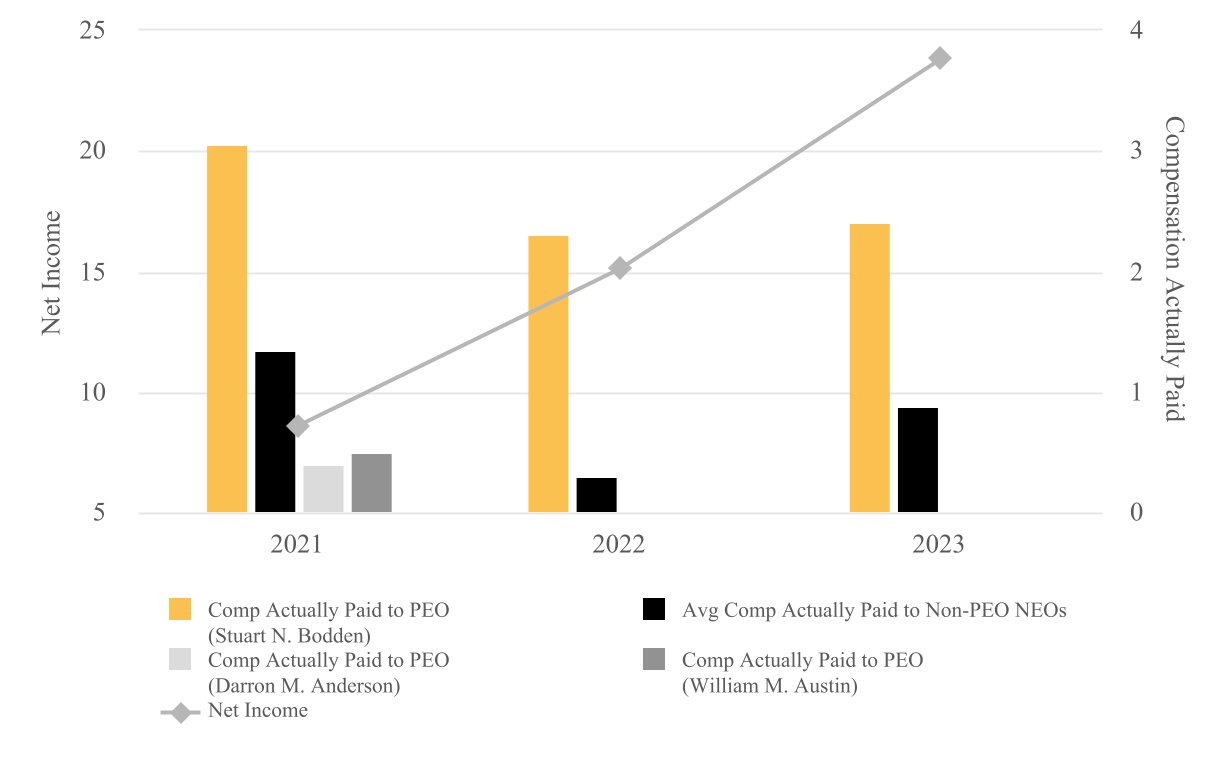

Compensation Actually Paid and Company Performance

The graphs below provide an illustration of the relationship between the Compensation Actually Paid to our PEO and the average of the Compensation Actually Paid to our Non-PEO NEOs and (i) Company TSR and (ii) Adjusted EBITDA for the fiscal years ended December 31, 2023, 2022, and 2021.

TSR amounts reported in the graph below assume an initial fixed investment of $100, including reinvestment of dividends, if such amount were invested on December 31, 2020.

Outstanding Equity Awards at 2023 Fiscal Year-End

The following table presents information regarding outstanding equity awards held by our NEOs as of December 31, 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | Stock Awards(1) |

| Name | | | | | | | | Number of Shares or Units of Stock that have not Vested (#) (2) | | Market Value of Shares or Units of Stock that have not Vested ($)(4) | | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights that have not Vested (#) (3) | | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights that have not Vested ($)(4) |

| Stuart N. Bodden | | | | | | | | | | | | | | |

| Performance Stock Units | | | | | | | | — | | | — | | | 243,502 | | | 2,491,025 | |

| Restricted Stock | | | | | | | | 89,931 | | | 919,994 | | | — | | | — | |

| | | | | | | | | | | | | | |

| Melissa Cougle | | | | | | | | | | | | | | |

| Performance Stock Units | | | | | | | | — | | | — | | | 57,145 | | | 584,593 | |

| Restricted Stock | | | | | | | | 31,182 | | | 318,992 | | | — | | | — | |

| | | | | | | | | | | | | | |

J. Matthew Hooker | | | | | | | | | | | | | | |

| Performance Stock Units | | | | | | | | — | | | — | | | 53,796 | | | 550,333 | |

| Restricted Stock | | | | | | | | 30,837 | | | 315,463 | | | — | | | — | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

_______________________________________________

(1) The amounts in this table reflect all outstanding PSUs and RSAs held by our NEOs as of December 31, 2023 as described further under “—Additional Narrative Disclosures—Performance Stock Units” and “—Additional Narrative Disclosures—Restricted Stock.”

(2) Represents time-vested Restricted Stock that generally vests in one-third increments beginning on the initial vesting date shown below:

| | | | | | | | |

| Name | Unvested Shares | Initial Vesting Date |

| Bodden | 22,431 | 9/1/2022 |

| 17,041 | 3/13/2023 |

| 50,459 | 3/15/2024 |

| Cougle | 12,833 | 3/13/2023 |

| 18,349 | 3/15/2024 |

| Hooker | 5,346 | 3/14/2022 |

| 12,693 | 3/13/2023 |

| 12,798 | 3/15/2024 |

(3) Represents Performance Stock Units granted in calendar year 2021, 2022 and 2023, which are subject to a three-year performance period ending on March 15 2024, December 31, 2024, and December 31, 2025 respectively. The actual number of Performance Stock Units that are earned will be determined in a Board meeting subsequent to the end of each respective performance period based on our total stockholder return relative to the total stockholder return of each member of a predefined peer group as described further under “—Additional Narrative Disclosures—Performance Stock Units.”

(4) The amounts reflected in these columns represent the market value of the PSUs and Restricted Stock, as applicable, held by the NEOs as of December 31, 2023, which was computed based on the closing price of our Class A Common Stock on December 31, 2023 (the last trading day of 2023), which was $10.23 per share.

Additional Narrative Disclosures

Base Salary

Each NEO’s base salary is a fixed component of compensation that does not vary depending on the level of performance achieved. Base salaries are determined for each NEO based on his or her position and responsibility. Pursuant to the employment agreements we maintain with our NEOs, each NEO’s base salary may be increased but not decreased except in connection with a reduction of up to 10% that applies to all similarly situated employees that is necessary to allow us to avoid violating one or more financial covenants contained in loan agreements or similar financing arrangements. Our Compensation Committee reviews the base salaries for each NEO annually as well as at the time of any promotion or significant change in job responsibilities and in connection with each review, our Board of Directors considers individual and company performance over the course of the applicable year.

During 2023, our NEOs who were serving as of December 31, 2023 had the following annualized base salaries: (i) Mr. Bodden—$550,000, (ii) Ms. Cougle—$400,000 and (iii) Mr. Hooker—$310,000.

Cash Bonuses

Our NEOs are eligible to receive bonuses under the Company’s Management Incentive Program (“MIP”) which was established on February 4, 2019, and last updated on March 30, 2022, and is comprised of annual targets and weighting with respect to certain performance metrics recommended by the Compensation Committee and approved by the Board during its fourth quarter meeting each year. The MIP is intended to recognize the NEOs’ significant contributions and aid in our retention efforts. Our Compensation Committee assesses the performance of each NEO against the established targets at the end of each fiscal year and recommends bonus payouts under the MIP to the Board for final approval. For fiscal years ended December 31, 2023 and 2022, our NEOs were eligible to receive bonuses under the MIP, with earned bonuses in respect of the applicable fiscal year reflected in the Summary Compensation Table.

Performance Stock Units

PSUs were granted under the LTIP to (1) Mr. Hooker during calendar years 2021, 2022 and 2023, (2) Mr. Bodden during 2021, 2022 and 2023 and (3) Ms. Cougle in 2022 and 2023. In 2021 and 2022, the target value of the PSU grants to Mr. Hooker and Ms. Cougle was approximately 45% and 50%, respectively, of each NEO’s total LTIP award. In 2023, the target value of the PSU grants to Mr. Hooker and Ms. Cougle was approximately 80% and 100%, respectively, of each NEO’s total LTIP award. In 2021 and 2022, the target value of the PSU grants to Mr. Bodden was approximately 150% of his total LTIP award. In 2023, the target value of the PSU grants to Mr. Bodden was approximately 200% of his total LTIP award.

Each PSU represents one share of the Company’s Class A Common Stock and is earned based on performance over a three-year performance cycle, which ended or will end on (i) March 15 2024 for the PSUs granted in the calendar year 2021 (the “2021 PSUs”), (ii) December 31, 2024 for PSUs granted in the calendar year 2022 (the “2022 PSUs”), and (iii) December 31, 2025 for PSUs granted in the calendar year 2023 (the “2023 PSUs”). Upon completion of the applicable three-year performance cycle, our Board of Directors will determine final payout levels, and Class A Common Stock will be distributed to each of the NEOs. Performance is determined by the relative Total Stockholder Return (“TSR”) of the Company in comparison to the applicable Peer Group and the absolute TSR of the Company. Each of the two performance measures, absolute TSR and relative TSR, are weighted equally in determining the earned award, with maximum performance in both measures resulting in an earned award of 200% of target.

The Peer Groups to which the Company’s relative TSR performance will be compared for each of the awards are as follows:

•With respect to the 2021 PSUs, the Peer Group includes: Mammoth Energy Services, Inc., Flotek Industries, Inc., Independence Contract Drilling, Inc., KLX Energy Services Holdings, Inc., Select Energy Services, Inc., Dril-Quip, Newpark, RPC, Solaris, and US Well Services, Inc.

•With respect to the 2022 PSUs, the Peer Group includes: Dril-Quip, Inc., Exterran Corporation, KLX Energy Services Holdings, Inc., Mammoth Energy Services, Inc., Multistage Holdings, Inc., Newpark Resources, Inc., RPC, Inc., Select Energy Services, Inc., Solaris Oilfield Infrastructure, Inc., and U.S. Well Services, Inc.