UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended December 31 , 2020

or

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to

Commission file number 001-38183

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||

(713 ) 895-8900

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||||||||

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.:

| Large accelerated filer ☐ | Accelerated filer ☐ | |||||||||||||

Smaller reporting company | Emerging growth company | |||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the Registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☐ No ☒

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of June 30, 2020, the aggregate market value of the Class A Common Stock of Ranger Energy Services, Inc. held by non-affiliates of the Registrant was $14.4 million, based on the closing market price as reported on the New York Stock Exchange of $2.95. As of February 24, 2021, the Registrant had 8,541,915 shares of Class A Common Stock and 6,866,154 shares of Class B Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for the 2021 Annual Meeting of Stockholders, to be filed no later than 120 days after the end of the fiscal year to which this Annual Report on Form 10-K relates, are incorporated by reference into Part III of this Annual Report on Form 10-K.

RANGER ENERGY SERVICES, INC.

TABLE OF CONTENTS

| Item | Page | |||||||||||||

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The information in this Annual Report on Form 10-K (“Annual Report”) includes “forward‑looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Exchange Act of 1934, as amended (the “Exchange Act”). All statements, other than statements of historical fact included in this Annual Report, regarding our strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management are forward‑looking statements. When used in this Annual Report, the words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project” and similar expressions are intended to identify forward‑looking statements, although not all forward‑looking statements contain such identifying words. These forward‑looking statements are based on our current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events.

Forward‑looking statements may include statements about:

•competition and government regulations, including new and proposed legislation by the Biden Administration aimed at reducing the impact of climate change;

•our business strategy;

•our operating cash flows, the availability of capital and our liquidity;

•our future revenue, income and operating performance;

•the volatility in global crude oil demand and crude oil prices for an uncertain period of time that may lead to a significant reduction of domestic crude oil and natural gas production;

•global or national health concerns, including pandemics such as the outbreak of COVID-19;

•uncertainty regarding future actions of foreign oil producers, such as Saudi Arabia and Russia, and the risk that they take actions that will cause an over-supply of crude oil;

•our ability to sustain and improve our utilization, revenues and margins;

•our ability to maintain acceptable pricing for our services;

•our future capital expenditures;

•our ability to finance equipment, working capital and capital expenditures;

•our ability to obtain permits and governmental approvals;

•pending legal or environmental matters;

•marketing of oil and natural gas;

•business or asset acquisitions;

•general economic conditions;

•credit markets;

•our ability to successfully develop our research and technology capabilities and implement technological developments and enhancements;

•uncertainty regarding our future operating results; and

•plans, objectives, expectations and intentions contained in this Annual Report that are not historical.

We caution you that these forward‑looking statements are subject to all of the risks and uncertainties, most of which are difficult to predict and many of which are beyond our control. These risks include, but are not limited to, the risks described under “Part I, Item 1A. Risk Factors” in this Annual Report. Should one or more of the risks or uncertainties described occur, or should underlying assumptions prove incorrect, our actual results and plans could differ materially from those expressed in any forward‑looking statements.

All forward‑looking statements, expressed or implied, included in this Annual Report are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward‑looking statements that we or persons acting on our behalf may issue. Except as otherwise required by applicable law, we disclaim any duty to update any forward‑looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this Annual Report.

Summary of our Risk Factors

The risk factors summarized below could materially harm our business, operating results and/or financial condition, impair our future prospects and/or cause the price of our common stock to decline. These are not all of the risks we face and other factors not presently known to us or that we currently believe are immaterial may also affect our business if they occur. Material risks that may affect our business, operating results and financial condition include, but are not limited to, those relating to:

Risks Related to our Operations

•the novel coronavirus (COVID-19) outbreak and other future or unforeseen epidemics;

•reductions in capital spending within the oil and natural gas industry;

•the volatility of oil and natural gas pricing, as well as fuel conservation measures, impacting the supply and demand of oil and natural gas;

•significant capital expenditures that we may incur for new equipment as we grow our operations or as technological advances take place within the industry;

•difficulties we may have managing the growth of our business;

•the intense competition we face that may cause us to lose market share;

•our reliance upon a few large customers;

•customers may be forced to curtail or shut in production due to a lack of storage capacity;

•our reliance on a few key employees whose absence or loss could adversely affect our business;

•unsatisfactory safety performance may negatively affect our current and future customer relationships;

•claims for personal injury and property damages;

•changes to various federal or state regulations, including new and proposed legislation of the Biden Administration, creating delays or restrictions in services we provide; and

•interruptions, failures or attacks in our information technology systems.

Risks Related to our Ownership and Capital Structure

•the ability of CSL to direct the voting of a majority of our voting stock, and their interests may conflict with those of our other shareholders;

•certain of our directors and officers may have a conflict of interest in allocating their time or pursuing business opportunities;

•CSL and Bayou Holdings and their respective affiliates are not limited in their ability to compete with us and they could benefit from corporate opportunities that might otherwise be available to us;

•we are required to make payments under the Tax Receivable Agreement (“TRA”) for certain tax benefits that we may claim and such payments may be accelerated and/or significantly exceed the actual benefits, if any, and we will not be reimbursed if such benefits are subsequently disqualified;

•in the event cash payment obligations are accelerated under the TRA in connection with a change of control (such as certain mergers), the consideration payable to Class A Common Stockholders could be substantially reduced;

•our sole material asset is our equity interest in Ranger LLC and we are accordingly dependent upon distributions from Ranger LLC to pay our expenses (including taxes);

•we could face difficulties obtaining financing for targeted acquisitions and the potential for increased leverage or debt service requirements;

•certain restrictions under the terms of our Credit Facility on our ability to pay cash dividends;

•future issuance of additional Class A Common Stock in the public market, or the perception that such sales may occur, could reduce our stock price;

•we may issue preferred or common stock in the future, which could adversely affect the voting power and/or value of our Class A Common Stock;

•within the meaning of NYSE rules, we are a “controlled company,” thereby qualify for and rely upon exemptions from certain corporate governance requirements; and

•within the meaning of SEC regulations, we are an “emerging growth company” and a “smaller reporting company,” therefore we are not required to comply with certain reporting requirements that apply to other public companies.

PART I

Except as otherwise indicated or required by the context, all references in this Annual Report to the “Company,” “Ranger,” “we,” “us” or “our” relate to Ranger Energy Services, Inc. (“Ranger, Inc.”) and its consolidated subsidiaries. References in this Annual Report to “Ranger LLC” refer to RNGR Energy Services, LLC, which owns our operating subsidiaries. References in this Annual Report to the “Legacy Owners” refer to Ranger Energy Holdings, LLC (“Ranger Holdings”), Ranger Energy Holdings II, LLC (“Ranger Holdings II”), Torrent Energy Holdings, LLC (“Torrent Holdings”) and Torrent Energy Holdings II, LLC (“Torrent Holdings II”), the entities through which our legacy investors, including CSL Capital Management, LLC (“CSL”), certain members of our management and other investors own their retained interest in us and Ranger LLC.

Item 1. Business

Overview

Ranger Energy Services, Inc. is a provider of onshore high specification (“high-spec”) well service rigs, wireline completion services and additional complementary services in the United States. We provide an extensive range of well site services to leading U.S. exploration and production (“E&P”) companies that are fundamental to establishing and enhancing the flow of oil and natural gas throughout the productive life of a well. Our focus has been positioning ourselves to serve a high-quality customer base by leveraging our young fleet, improving systems and streamlining processes, making Ranger an operator of choice for U.S. E&P companies that require completion and production services.

Our service offerings consist of well completion support, workover, well maintenance, wireline, fluid management, other complementary services, as well as installation, commissioning and operating of modular equipment, which are conducted in three reportable segments, as follows:

•High Specification Rigs. Provides high-spec well service rigs and complementary equipment and services to facilitate operations throughout the lifecycle of a well.

•Completion and Other Services. Provides wireline completion services necessary to bring a well on production and other ancillary services often utilized in conjunction with our high-spec rig services to enhance the production of a well.

•Processing Solutions. Provides proprietary, modular equipment for the processing of natural gas.

We operate in most of the active oil and natural gas basins in the United States, including the Permian Basin, Denver-Julesburg Basin, Bakken Shale, Eagle Ford Shale, Haynesville Shale, Gulf Coast, South Central Oklahoma Oil Province and Sooner Trend Anadarko Basin Canadian and Kingfisher Counties plays. For further information related to our services and financial results of our operating segments, see “Part I, Item 1. Business—Our Segments,” “Part II, Item 7. Management Discussion and Analysis—Operating Results,” and “Part II, Item 8. Financial Statements and Supplementary Data—Note 15 — Segment Reporting.”

Organization

Ranger Inc. was incorporated as a Delaware corporation in February 2017. In conjunction with the Offering of Class A Common Stock, par value $0.01 per share (“Class A Common Stock”), which closed on August 16, 2017, and the corporate reorganization, we underwent in connection with the Offering, we became a holding company, the sole material assets of which consist of membership interests in Ranger LLC. Ranger LLC owns all of the outstanding equity interests in Ranger Energy Services, LLC (“Ranger Services”) and Torrent Energy Services, LLC (“Torrent Services”), the subsidiaries through which it operates its assets. Through the consummation of the corporate reorganization, Ranger LLC is the sole managing member of, and is responsible for all operational, management and administrative decisions relating to, Ranger Services and Torrent Services’ business and consolidates the financial results of Ranger Services and Torrent Services and their subsidiaries.

1

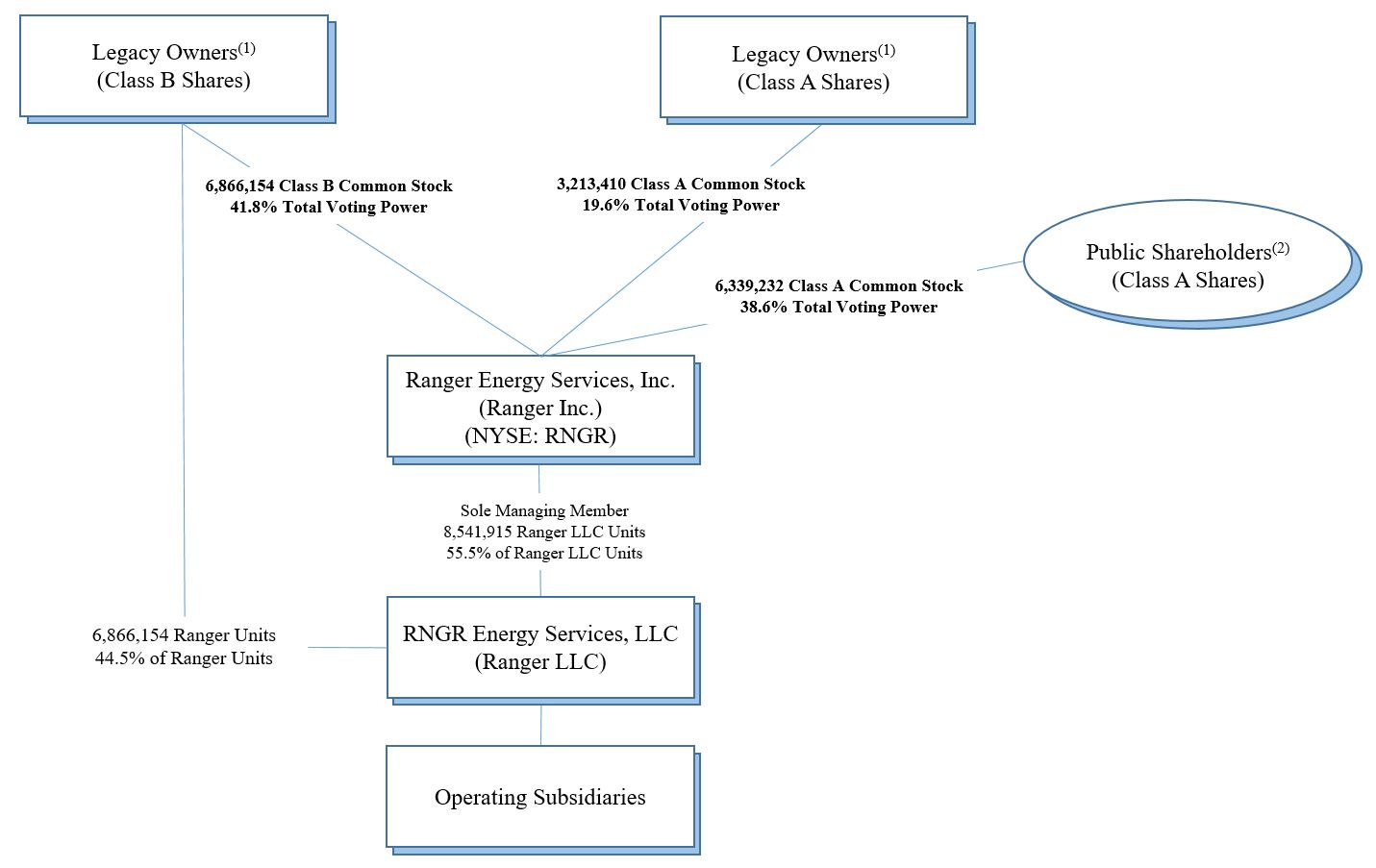

The following diagram indicates our ownership structure as of February 24, 2021:

_________________________

(1) CSL, Bayou Well Holdings Company, LLC, certain members of our management and other investors own all of the equity interests in the Legacy Owners, where CSL holds a majority of the voting interests in each of the Legacy Owners.

(2) Inclusive of unvested restricted share awards.

Our Segments

We conduct our operations through multiple business lines that are organized into three reporting segments: High Specification Rigs, Completion and Other Services and Processing Solutions. The following provides additional detail on our reportable segments and the business lines within each segment.

High Specification Rigs

Our High Specification Rig segment provides high-spec well and complementary equipment and services to facilitate operations throughout the lifecycle of a well. We provide these advanced services to E&P companies, particularly to those operating in unconventional oil and natural gas reservoirs and requiring technically and operationally advanced services. Our high‑spec well service rigs are designed to support U.S. horizontal well demands.

Specifically, our high-spec rig services consist of the following:

•Well completion support. Our well completion support services are utilized subsequent to hydraulic fracturing operations but prior to placing a well into production, and primarily include unconventional well completion operations, including milling out composite plugs, frac sand or other downhole debris or obstructions that were introduced in the well as part of the completion process and installing production tubing and other permanent downhole equipment necessary to facilitate production.

•Workovers. Our workover services primarily facilitate major well repairs or modifications required to sustain the flow of oil and natural gas in a producing well. Workovers, which may require a few days to several weeks to complete and generally require additional auxiliary equipment, are typically more complex and more time consuming than well maintenance operations. Workover operations include major subsurface repairs such as the repair or replacement of well casing, recovery or replacement of tubing and removal of foreign objects from the wellbore. All of our high‑spec well service rigs are designed to perform complex workover operations.

2

•Well maintenance. Our well maintenance services provide periodic maintenance required throughout the life of a well to sustain optimal levels of oil and natural gas production. Our well maintenance services primarily include the removal and replacement of downhole production equipment, including artificial lift components such as sucker rods and downhole pumps, the repair of failed production tubing and the repair and removal of other downhole production‑related byproducts such as frac sand or paraffin that impair well productivity. These and similar routine maintenance services involve relatively low‑cost, short‑duration operations that generally experience relatively stable demand notwithstanding changes in drilling activity.

In addition to our core well service rig operations, we also offer well service‑related equipment rentals, as described below.

•Well Service‑Related Equipment Rentals. Our well service‑related equipment rentals consist of a diverse fleet of rental items, including fluid pumps (various horsepower pumping equipment utilized to circulate fluid in and out of wellbores), power swivels (hydraulic motor‑driven, pipe‑rotating machines used to deliver shock‑free torque to the workstring or tubing during well service rig operations), well control packages (equipment used to ensure formation pressure is maintained within the wellbore during well service rig operations), hydraulic catwalks (mechanized lifting devices used to raise and lower drill pipe and tubing to and from the well service rig work floor), frac tanks, pipe racks and pipe handling tools. Our well service‑related equipment rentals are typically used in conjunction with the services provided by our high-spec well services.

We have a fleet of 136 well service rigs, which we believe to be among the newest and most advanced in the industry and are considered to be high-spec rigs, with high operating horsepower (“HP”) (450 HP or greater) and tall mast heights (102 feet or higher).

The high‑spec well service rigs in our fleet, the substantial majority of which has been built since 2010, have an average age of approximately seven years and feature modern operating components sourced from leading U.S. manufacturers. Approximately 63% of our existing high‑spec well service rigs were manufactured by NOV, with the remaining manufactured by Dragon/Cooper, Service King, Rig Works, Taylor, Mustang and Stewart & Stevenson Crown. The following table provides a summary of information regarding our high-spec well service rig fleet.

HP Rating (1) | Mast Height | Mast Rating (2) | Number of High-Spec Rigs | |||||||||||||||||

| 550 — 600 | 112’ — 117’ | 250,000 — 300,000’ | 58 | |||||||||||||||||

| 500 | 104’ — 108’ | 240,000 — 250,000’ | 58 | |||||||||||||||||

| 450 — 475 | 102’ — 104’ | 200,000 — 250,000’ | 20 | |||||||||||||||||

| Total High-Spec Rigs | 136 | |||||||||||||||||||

______________________

(1) Per manufacturer.

(2) The mast ratings of our high-spec well service rigs complement their high operating HP and tall mast heights by allowing such rigs to safely support the higher weights associated with the long tubing strings used in long-lateral well completion operations and is measured in pounds.

The composition of our well service rig fleet makes it particularly well-suited to provide both completion-oriented services, the demand for which generally increases along with increased capital spending by E&P operators, and production-oriented services, the demand for which is less influenced, on a comparative basis, by such capital spending. The ability of our well service rigs to accommodate the needs of our E&P customers in a variety of economic conditions has historically allowed us to maintain relatively high rig utilization.

In connection with the operations of our high‑spec well service rigs, we also maintain a supply of additional service and rental equipment, including accumulators, acid and frac tanks, motor vehicles, trailers, tractors, catwalks, cementing units, pipe racks, power swivels, ram block assemblies, fluid pumps and related items.

Completion and Other Services

Our Completion and Other Services segment provides wireline completion services necessary to bring a well on production and other ancillary services often utilized in conjunction with our high-spec rig services to enhance the production of a well. Our completion and other services, as described in further detail below, strategically enhance our operating footprint by creating operational efficiencies for our customers and allow us to capture a greater portion of their spending across the lifecycle of a well.

3

•Wireline Services. Our wireline services involve the use of wireline trucks equipped with a spool of cable that is unwound and lowered into oil and natural gas wells to convey specialized tools or equipment primarily for well completion, but also for well intervention, pipe recovery, plugging and abandonment purposes.

•Fluid Management Services. Our fluid management services consist of the hauling of oilfield fluids, including drilling mud, fresh water and saltwater used or produced in well drilling, completion and production. Additionally, we rent tanks to store such fluids at the wellsite.

•Snubbing Services. Our snubbing services consist of using our snubbing units together with our well service rigs in order to perform well completion, workover or maintenance activities. Our snubbing services enable operators to safely run or remove pipe and other associated downhole tools into pressurized or highly deviated wellbores.

•Decommissioning. Our decommissioning services primarily include plugging and abandonment, in which our well service rigs and wireline and cementing equipment are used to prepare non‑economic oil and natural gas wells to be permanently sealed or temporarily shut in. Decommissioning work is typically less sensitive to oil and natural gas prices than our other well service rig operations as a result of decommissioning obligations imposed by state regulations.

Services provided within our High Specification Rig and Completion and Other Services segments, as described above, are fundamental to establishing and enhancing the flow of oil and natural gas throughout the productive life of a well.

We have a fleet of wireline and high-pressure pump trucks that are utilized in our Completion and related services. Our wireline services utilize high-pressure pump trucks to pump fracturing plugs and perforating guns into extended reach horizontal wells for pump down perforating completion purposes. We perform snubbing services, which utilizes specialized trucks and equipment units to enable operators to safely run or remove pipe and other downhole tools from a pressurized well. Our fluid management services utilize trucks, pumps and other tools and equipment to control and separate completion fluids and to haul oilfield fluids used in production.

Processing Solutions

Our Processing Solutions segment engages in the rental, installation, commissioning, start‑up, operation and maintenance of Mechanical Refrigeration Units (“MRU”), Nitrogen Gas Liquid (“NGL”) stabilizer units, NGL storage units and related equipment. Our Processing Solutions segment provides a range of proprietary, modular equipment for the processing of rich natural gas streams at the wellhead or central gathering points in basins where drilling and completion activity has outpaced the development of permanent processing infrastructure.

We have developed a premium offering that includes proprietary designs and modern processing equipment, including modular MRU’s. Our modular units provide flexibility across a broad range of project requirements and operating environments, and are designed to allow for quick mobilization to minimize downtime and increase utilization, particularly in conjunction with the operational support provided by our expert field personnel. Our natural gas processing solutions assist our customers with meeting pipeline specifications, extracting higher value NGLs, providing fuel gas for wellsites and facilities and reducing emissions at the flare tip. Our modular units provide flexibility to match a broad range of project requirements and are designed to allow for quick mobilization and demobilization.

In addition to our proprietary natural gas and NGL processing equipment, we offer full transportation, installation and ongoing operation services in the field. Our turn‑key mobilization services include in‑bound transportation, site offloading, installation, commissioning, startup and training of field personnel. Our ongoing operations and maintenance services include daily onsite and callout services, daily field reports and NGL transportation and marketing arrangements. We also employ full‑time process and mechanical engineers with significant experience in designing gas treating and processing solutions to provide quality service to our customers.

We have a fleet of 33 MRUs that are modern, reliable and equipped to handle large volumes of natural gas while operating across a broad array of oilfield conditions with minimal downtime and maintenance. Our MRUs are constructed and assembled by third‑party vendors in accordance with our proprietary designs and with our oversight of sourcing and procurement. Our MRUs can be stacked and scaled to handle a range of projects and natural gas volumes and can generate temperatures downwards of -20 degrees Fahrenheit. In addition, we own and operate five auxiliary NGL stabilizer units (designed to assist our MRUs that require additional capacity to separate and capture valuable NGLs), 78 NGL storage tanks with bulkhead delivery systems and capacities of 18,000 gallons, 13 trailer‑mounted natural gas generators and additional supporting auxiliary equipment. Our proprietary natural gas and NGL processing equipment is generally designed to be mobile and purpose‑built to increase efficiency and productivity while reducing safety risks. We also own and operate 50 gas

4

coolers, which reduces the temperatures of the natural gas stream to allow further processing and meet pipeline specifications.

Other

We incur general corporate and administrative costs that are not attributable to any of the operating segments or business lines, which are reported as Other. For further information regarding the results of operations for each segment, please see “Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations” and “Part II, Item 8. Financial Statements and Supplementary Data- Note 15 — Segment Reporting.”

Competition

We provide services in various geographic regions across the United States, which are highly competitive. Our competitors include many large and small oilfield service providers. Our largest competitors in the high specification rig and completion services market include Basic Energy Services, Inc., Forbes Energy Services Ltd., Key Energy Services, Inc., KLX Energy Services, Nine Energy Service, Inc. and Pioneer Energy Services Corp. In the processing solutions market our primary competitors include GTUIT, LLC and Kinder Morgan Treating LP. In addition, our industry is highly fragmented and we compete regionally with a significant number of smaller service providers.

We believe that the principal competitive factors in the markets we serve are technical expertise, equipment capacity, work force competency, efficiency, safety record, reputation, experience and price. Additionally, projects are often awarded on a bid basis, which tends to create a highly competitive environment. We seek to differentiate ourselves from our competitors by delivering the highest-quality services and equipment possible, coupled with superior execution and operating efficiency in a safe working environment.

Cyclical Nature of Industry

We operate in a highly cyclical industry and the key factor driving demand for our services is the level of drilling activity by E&P companies. In turn, the level of drilling depends largely on the current and anticipated economics of new well completions. Global supply and demand for oil and the domestic supply and demand for natural gas are critical in assessing industry outlook. Demand for oil and natural gas is cyclical and subject to large, rapid fluctuations. E&P companies tend to increase capital expenditures in response to increases in oil and natural gas prices, which generally results in greater revenues and profits for oilfield service companies. Increased capital expenditures also lead to greater production, which historically has resulted in increased inventories and reduced prices, consequently reducing demand for oilfield services. The results of our operations, therefore, may fluctuate from period to period, and these fluctuations may distort comparisons of results across periods.

Seasonality

Our results of operations have historically reflected seasonal tendencies relating to holiday seasons, inclement weather and the conclusion of our customers’ annual drilling and completion of capital expenditure budgets. Our most notable declines generally occur in the fourth quarter of the calendar year. Additionally, some of the areas in which we have operations, including the Denver-Julesburg Basin and the Bakken Shale, are adversely affected by seasonal weather conditions, primarily during the winter months. During periods of heavy snow, ice, wind or rain, we may be unable to move our equipment between locations, thereby reducing our ability to provide services and generate revenues, or we could suffer weather-related damage to our facilities and equipment resulting in delays in operations.

Sales and Marketing

Our sales and marketing activities typically are performed through local operations in each geographical region and are supported by sales representatives at our corporate headquarters. Our senior management takes an active role in supporting our sales and marketing personnel. We believe our field sales personnel understand the region‑specific issues and customer operating procedures and therefore can more effectively target marketing activities. Our sales representatives work closely with our managers and field sales personnel to target market opportunities.

Significant Customers

We have strong relationships with a broad customer base, including EOG Resources, Inc., ConocoPhillips and Pioneer Natural Resources Company. During the year ended December 31, 2020, EOG Resources, Inc. and Concho Resources accounted for approximately 21% and 17%, respectively, of our consolidated revenues where we provided services for approximately 130 distinct customers. During the year ended December 31, 2019, EOG Resources, Inc. and Concho Resources, Inc. accounted for approximately 17% and 14%, respectively, of our consolidated revenues. For the years ended December 31, 2020 and 2019, our top five customers represented approximately 57% and 49% of our consolidated revenues and no other customer represented more than 10% of our consolidated revenues.

5

Suppliers

Our internal supply chain team manages sourcing and logistics to ensure flexibility and continuity of supply in a cost effective manner across all areas of our operations. We have built long‑term relationships with multiple industry leading suppliers of materials and equipment. We purchase a wide variety of materials, parts and components that are manufactured and supplied for our operations. We are not dependent on any single source of supply for those parts, supplies or materials. We have generally been able to obtain the equipment, parts and supplies necessary to support our operations on a timely basis.

Human Capital

We combine our services offerings with a highly skilled and experienced workforce, enabling us to consistently deliver exceptional service while maintaining high health, safety and environmental standards. We invest in attracting, developing and retaining talented personnel and believe we have good relationships with our employees. Our personnel are dedicated to redefining services for our customers, driving new thinking, raising standards and rising to challenges. We believe that our efficient operational performance, executed at a high level of integrity, strong safety record and low leverage provides a competitive advantage. As of December 31, 2020, we had approximately 700 full-time and part-time employees and we hire independent contractors on an as-needed basis. We are not a party to collective bargaining agreements, nor did we have any unionized labor.

Environmental and Occupational Safety and Health Matters

Our operations, which support the oil and natural gas exploration, development and production activities pursued by our customers, are subject to stringent and comprehensive federal, regional, state and local laws and regulations governing occupational safety and health, the discharge of materials into the environment, solid and hazardous waste management, fluid transportation and disposal and environmental protection. These laws and regulations may, among other things (i) limit or prohibit our operations on certain lands lying within wilderness, wetlands and other protected areas; (ii) require remedial measures to mitigate or clean-up pollution from former and ongoing operations; (iii) impose restrictions on the types, quantities and concentrations of various substances that can be released into the environment or injected in formations in connection with oil and natural gas drilling and production activities; (iv) impose specific safety and health standards or criteria addressing worker protection; and (v) impose substantial liabilities for pollution resulting from our operations.

Numerous governmental entities, including the U.S. Environmental Protection Agency (“EPA”) and analogous state agencies, have the power to enforce compliance with these laws and regulations and the permits issued under them. Any failure to comply with these laws and regulations may result in the assessment of sanctions, including administrative, civil and criminal penalties, the imposition of investigatory, remedial or corrective action obligations or the incurrence of capital expenditures; the occurrence of delays in the permitting or performance of projects; the issuance of orders enjoining performance of some or all of our operations in a particular area; and governmental or private claims for personal injury or property or natural resource damages.

The trend in environmental regulation has been to place more restrictions and limitations on activities that may adversely affect the environment, and thus any changes in environmental laws and regulations or re-interpretation of enforcement policies that result in more stringent and costly regulatory requirements could have a material adverse effect on our business, liquidity position, financial condition, results of operations and prospects. We may be unable to pass on such increased compliance costs to our customers. Moreover, accidental releases or spills may occur in the course of our operations, and we cannot assure you that we will not incur significant costs and liabilities as a result of such releases or spills, including any third-party claims for damage to property, natural resources or persons. Our customers may also incur increased costs or delays or restrictions in permitting or operating activities as a result of more stringent environmental laws and regulations, which may result in a curtailment of exploration, development or production activities that would reduce the demand for our services.

Worker Health and Safety

We are subject to the requirements of the federal Occupational Safety and Health Act (“OSHA”), and comparable state statutes that regulate the protection of the health and safety of workers. In addition, the OSHA hazard communication standard requires that information be maintained about hazardous materials used or produced in operations and that this information be provided to employees, state and local government authorities and the public.

Radioactive Materials

Naturally Occurring Radioactive Materials (“NORM”) may contaminate extraction and processing equipment used in the oil and natural gas industry, most often in the form of scale. The waste resulting from such contamination is regulated by federal and state laws. Standards have been developed for worker protection, treatment, storage, and disposal of NORM and NORM waste, management of NORM-contaminated waste piles, containers and tanks and limitations on the relinquishment

6

of NORM-contaminated land for unrestricted use under the Resource Conservation and Recovery Act (“RCRA”) and state laws. We may incur significant costs or liabilities associated with elevated levels of NORM.

Hazardous Substances and Wastes and Naturally Occurring Radioactive Materials

The RCRA, and comparable state statutes, regulate the generation, treatment, storage, transportation, disposal and clean-up of hazardous and non-hazardous wastes. Pursuant to rules issued by the EPA, individual states can have delegated authority to administer some or all of the provisions of RCRA, sometimes in conjunction with their own, more stringent requirements. In the course of our operations, we generate industrial wastes, such as paint wastes, waste solvents and oils that are regulated as hazardous materials. Drilling fluids, produced waters and other wastes associated with the exploration, development and production of oil or natural gas, if properly handled, are currently exempt from regulation as hazardous waste under RCRA and, instead, are regulated under RCRA’s less stringent non-hazardous waste provisions, or other state or federal laws.

However, it is possible that certain oil and natural gas drilling and production wastes now classified as non-hazardous could be classified as hazardous wastes in the future. Reclassification of drilling fluids, produced waters and related wastes as hazardous under RCRA could result in an increase in our, as well as the oil and natural gas E&P industries’, costs to manage and dispose of generated wastes, which could have a material adverse effect on our business, liquidity position, financial condition, results of operations and prospects. Additionally, other wastes handled at E&P sites or generated in the course of providing well services may not fall within this exclusion.

The Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”) and comparable state laws impose strict, joint and several liability for environmental contamination and damages to natural resources without regard to fault or the legality of the original conduct on certain classes of persons. These persons include owners and operators of real property impacted by a release of hazardous substances and any company that transported, disposed of or arranged for the transport or disposal of hazardous substances to or at the site. Under CERCLA, such persons may be liable for, among other things, the costs of remediating the hazardous substances that have been released into the environment, damages to natural resources and the costs of certain health studies. In addition, where contamination may be present, it is not uncommon for the neighboring landowners and other third parties to file claims for personal injury, property damage and recovery of response costs.

Water Discharges and Discharges into Belowground Formations

The Federal Water Pollution Control Act, also known as the Clean Water Act (“CWA”), and analogous state laws, impose restrictions and strict controls with respect to the discharge of pollutants, including spills and leaks of oil and hazardous substances, into state waters and waters of the United States. The discharge of pollutants into regulated waters is prohibited, except in accordance with the terms of a permit issued by the EPA or an analogous state agency. Spill prevention, control and countermeasure plan requirements imposed under the CWA require appropriate containment berms and similar structures to help prevent the contamination of navigable waters in the event of a petroleum hydrocarbon tank spill, rupture or leak. In addition, the CWA and analogous state laws require individual permits or coverage under general permits for discharges of storm water runoff from certain types of facilities. The CWA also prohibits the discharge of dredge and fill material in regulated waters, including wetlands, unless authorized by permit. There has been substantial uncertainty regarding the scope of regulated waters in recent years, and any expansion in this scope could result in increased costs or timeframes to complete activities. The CWA and analogous state laws also may impose substantial civil and criminal penalties for non-compliance including spills and other non-authorized discharges.

The Oil Pollution Act of 1990 (“OPA”) sets minimum standards for prevention, containment and cleanup of oil spills. The OPA applies to vessels, offshore facilities and onshore facilities, including exploration and production facilities that may affect waters of the United States. Under the OPA, responsible parties including owners and operators of onshore facilities may be held strictly liable for oil cleanup costs and natural resource damages as well as a variety of public and private damages that may result from oil spills. The OPA also requires owners or operators of certain onshore facilities to prepare Facility Response Plans for responding to a worst-case discharge of oil into waters of the United States.

Our oil and natural gas producing customers dispose of flowback and produced water or certain other oilfield fluids gathered from oil and natural gas producing operations in accordance with permits issued by government authorities overseeing such disposal activities. While these permits are issued pursuant to existing laws and regulations, these legal requirements are subject to change based on concerns of the public or governmental authorities regarding such disposal activities. One such concern relates to recent seismic events near underground disposal wells used for the disposal by injection of flowback and produced water or certain other oilfield fluids resulting from oil and natural gas activities. When caused by human activity, such events are called induced seismicity. In response to concerns regarding induced seismicity, regulators in some states have imposed, or are considering imposing, additional requirements in the permitting of produced water disposal wells or otherwise to assess any relationship between seismicity and the use of such wells. States may, from

7

time to time, develop and implement plans directing certain wells where seismic incidents have occurred to restrict or suspend disposal well operations. In addition, ongoing lawsuits allege that disposal well operations have caused damage to neighboring properties or otherwise violated state and federal rules regulating waste disposal. These developments could result in additional regulation and restrictions on the use of injection wells by our customers to dispose of flowback and produced water and certain other oilfield fluids. Increased regulation and attention given to induced seismicity also could lead to greater opposition to, and litigation concerning, oil and natural gas activities utilizing injection wells for waste disposal.

Any one or more of these developments may necessitate that our customers limit disposal well volumes, rates or locations, or may require our customers or third party disposal well operators that dispose of customer wastewater to shut down disposal wells, which could adversely affect our customers’ business and result in a corresponding decrease in the need for our services, which could have a material adverse impact on our business, liquidity position, financial condition, results of operations and prospects.

Air Emissions

Some of our operations also result in emissions of regulated air pollutants. The federal Clean Air Act (“CAA”) and analogous state laws require permits for certain facilities that have the potential to emit substances into the atmosphere that could adversely affect environmental quality. These laws and their implementing regulations also impose limitations on air emissions and require adherence to maintenance, work practice, reporting and record keeping and other requirements. Failure to obtain a permit or to comply with permit or other regulatory requirements could result in the imposition of sanctions, including administrative, civil and criminal penalties. In addition, we or our customers could be required to shut down or retrofit existing equipment, leading to additional capital or operating expenses and operational delays.

Many of these regulatory requirements, including New Source Performance Standards (“NSPS”) and Maximum Achievable Control Technology standards, are expected to be made more stringent over time as a result of stricter ambient air quality standards and other air quality protection goals adopted by the EPA. Compliance with these or other new regulations could, among other things, require installation of new emission controls on some of our equipment, result in longer permitting timelines and significantly increase our capital expenditures and operating costs, which could adversely impact our business. For example, in June 2016, the EPA published additional final rules establishing new emissions standards for methane and additional standards for Volatile Organic Compounds from certain new, modified and reconstructed equipment and processes in the oil and natural gas source category, including production, processing, transmission and storage activities. In September 2020, the EPA finalized amendments which removed the transmission and storage segment from the oil and natural gas source category and rescinded the methane-specific requirements for production and processing facilities. However, several lawsuits have been filed challenging these amendments, and on January 20, 2021, President Biden signed an executive order calling for the suspension, revision, or rescission of the September 2020 rule, and the reinstatement or issuance of methane emissions standards for new, modified, and existing oil and gas facilities. Therefore, the extent of future implementation of these standards is uncertain at this time. In addition, some of our customers may operate on federal or tribal lands, and are subject to further regulation, including by tribal authorities and the federal Bureau of Land Management (“BLM”). Potentially applicable regulations include EPA’s June 2016 Federal Implementation Plan (“FIP”) to implement the Federal Minor New Source Review Program on tribal lands for oil and gas production. The FIP creates a permit-by-rule process for minor sources that also incorporates emission limits and other requirements under various federal air quality standards, applying them to a range of equipment and processes used in oil and gas production. In April 2018, the EPA proposed revisions to reportedly streamline the FIP. Neither the FIP nor the revisions apply in areas of ozone non-attainment, except, as the result of a May 2019 rule, to the Indian country portion of the Uinta Basin Ozone Nonattainment Area. As a result, the EPA may impose area-specific regulations in certain areas identified as tribal lands that may require additional emissions controls on existing equipment. Such requirements will likely result in increased operating and compliance costs for our customers in these regions.

In November 2016, the BLM finalized a rule regulating the venting and flaring of natural gas, leak detection, air emissions from equipment, well maintenance and unloading, drilling and completions and royalties potentially owed for loss of such emissions from oil and natural gas facilities producing on federal and tribal leases. In September 2018, the BLM issued a final rule rescinding the agency’s 2016 methane rule. However, in July 2020 and October 2020, federal district courts in California and Wyoming, respectively, vacated the rule, and on January 20, 2021, President Biden published an executive order calling for the review and potential revision of the September 2018 rule. Because of the foregoing, methane requirements on federal land remain uncertain at this time. Compliance with this and other air pollution control and permitting requirements has the potential to delay the development of oil and natural gas projects and increase costs for us and our customers. Moreover, our business could be materially affected if these or other similar requirements increase the cost of doing business for us and our customers, or reduce the demand for the oil and natural gas our customers produce, and thus have an adverse effect on the demand for our services.

8

Climate Change

The threat of climate change continues to attract considerable attention in the United States and in foreign countries. Numerous proposals have been made and could continue to be made at the international, national, regional and state levels of government to monitor and limit existing emissions of greenhouse gases (“GHG”) as well as to restrict or eliminate such future emissions. As a result, our operations as well as the operations of our oil and natural gas exploration and production customers are subject to a series of regulatory, political, litigation, and financial risks associated with the production and processing of fossil fuels and emission of GHG.

In the United States, no comprehensive climate change legislation has been implemented at the federal level. However, President Biden has highlighted addressing climate change as a priority of his administration, which includes certain initiatives for climate change legislation to be proposed and passed into law. Additionally, on January 27, 2021, President Biden issued an executive order that calls for substantial action on climate change, calling for, among other things, the increased use of zero-emission vehicles by the federal government, increased production of offshore wind energy, the elimination of subsidies provided to the fossil fuel industry, and the suspension of the issuance of new leases for oil & gas development on federal lands to the extent permitted by law. Moreover, following the U.S. Supreme Court finding that GHG emissions constitute a pollutant under the CAA, the EPA has adopted rules that, among other things, establish construction and operating permit reviews for GHG emissions from certain large stationary sources, require the monitoring and annual reporting of GHG emissions from certain petroleum and natural gas system sources in the United States, and together with the U.S. Department of Transportation (“DOT”), implement GHG emissions limits on vehicles manufactured for operation in the United States. Additionally, various states and groups of states have adopted or are considering adopting legislation, regulations or other regulatory initiatives that are focused on such areas as GHG cap and trade programs, carbon taxes, reporting and tracking programs, and restriction of emissions. At the international level, the United Nations-sponsored Paris Agreement requires member states to submit non-binding individually-determined reduction goals every five years after 2020. Although the United States withdrew from the Paris Agreement on November 4, 2020, President Biden signed an Executive Order on January 20, 2021 recommitting the United States to the Paris Agreement. However, the impacts of this executive order and the terms of any legislation or regulation to implement the United States’ commitment remain unclear at this time.

Governmental, scientific and public concern over the threat of climate change arising from GHG emissions has resulted in increasing political risks in the United States, including climate change related pledges made by certain candidates for political office. These have included promises to pursue actions to limit emissions and curtail the production of oil and gas on federal land. For more information, see our regulatory disclosure titled “Hydraulic Fracturing.” Other actions that could be pursued by the Biden Administration may include the imposition of more restrictive requirements for the establishment of pipeline infrastructure or the permitting of LNG export facilities, as well as more restrictive GHG emission limitations for oil and gas facilities. Litigation risks are also increasing, as a number of cities and other local governments have sought to bring suit against the largest oil and natural gas companies in state or federal court, alleging, among other things, that such companies created public nuisances by producing fuels that contributed to climate change or alleging that companies have been aware of the adverse effects of climate change for some time but defrauded their investors or customers by failing to adequately disclose those impacts.

There are also increasing financial risks for fossil fuel producers as shareholders currently invested in fossil-fuel energy companies concerned about the potential effects of climate change may elect in the future to shift some or all of their investments into non-energy related sectors. Institutional lenders who provide financing to fossil-fuel energy companies also have become more attentive to sustainable lending practices and some of them may elect not to provide funding for fossil fuel energy companies. Additionally, the lending practices of institutional lenders have been the subject of intensive lobbying efforts in recent years, oftentimes public in nature, by environmental activists, proponents of the international Paris Agreement, and foreign citizenry concerned about climate change not to provide funding for fossil fuel producers. Limitation of investments in and financings for fossil fuel energy companies could result in the restriction, delay or cancellation of drilling programs or development or production activities.

The adoption and implementation of new or more stringent international, federal or state legislation, regulations or other regulatory initiatives that impose more stringent standards for GHG emissions from the oil and natural gas sector or otherwise restrict the areas in which this sector may produce oil and natural gas or generate GHG emissions could result in increased costs of compliance or costs of consuming, and thereby reduce demand for, oil and natural gas, which could reduce demand for our services and products. Additionally, political, litigation and financial risks may result in our oil and natural gas customers restricting or cancelling production activities, incurring liability for infrastructure damages as a result of climatic changes, or impairing their ability to continue to operate in an economic manner, which also could reduce demand for our services and products. One or more of these developments could have a material adverse effect on our business, financial condition and results of operation.

9

Hydraulic Fracturing

Our customers are reliant on hydraulic fracturing services in connection with their production of oil and natural gas. Hydraulic fracturing stimulates production of oil and/or natural gas from dense subsurface rock formations by injecting water, sand and chemicals under pressure into the formation to fracture the surrounding rock and stimulate production.

Hydraulic fracturing typically is regulated by state oil and natural gas commissions, however the EPA has asserted federal regulatory authority pursuant to the Safe Drinking Water Act over certain hydraulic fracturing activities involving the use of diesel fuel and issued permitting guidance in February 2014 that applies to such activities. The EPA also finalized rules in June 2016 that prohibit the discharge of wastewater from hydraulic fracturing operations to publicly owned wastewater treatment plants. In addition, the EPA released its final report on the potential impacts of hydraulic fracturing on drinking water resources in December 2016. The final report concluded that “water cycle” activities associated with hydraulic fracturing may impact drinking water resources “under some circumstances,” noting that the following hydraulic fracturing water cycle activities and local- or regional-scale factors are more likely than others to result in more frequent or more severe impacts: water withdrawals for fracturing in times or areas of low water availability; surface spills during the management of fracturing fluids, chemicals or produced water; injection of fracturing fluids into wells with inadequate mechanical integrity; injection of fracturing fluids directly into groundwater resources; discharge of inadequately treated fracturing wastewater to surface waters; and disposal or storage of fracturing wastewater in unlined pits.

Additionally, the BLM finalized a rule in March 2015 establishing standards for hydraulic fracturing on federal and American Indian lands, but subsequently repealed the rule in December 2017. BLM’s repeal of the rule has been challenged in federal court. In addition, various state and local governments have implemented, or are considering, increased regulatory oversight of hydraulic fracturing through additional permit requirements, operational restrictions, disclosure requirements, well construction and temporary or permanent bans on hydraulic fracturing in certain areas. For example, Texas, Colorado and North Dakota, among others, have adopted regulations that impose new or more stringent permitting, disclosure, disposal and well construction requirements on hydraulic fracturing operations.

In addition to state laws, local land use restrictions, such as city ordinances, may restrict drilling in general and/or hydraulic fracturing in particular. If new federal, state or local laws or regulations that significantly restrict hydraulic fracturing are adopted, such legal requirements could result in delays, eliminate certain drilling and injection activities and make it more difficult or costly to perform hydraulic fracturing. Any such regulations limiting or prohibiting hydraulic fracturing could result in decreased oil and natural gas E&P activities and, therefore, adversely affect demand for our services and our business. Such laws or regulations could also materially increase our costs of compliance and doing business.

Historically, our environmental compliance costs have not had a material adverse effect on our business, liquidity position, financial condition, results of operations and prospects, however, there can be no assurance that such costs will not be material in the future. It is possible that substantial costs for compliance or penalties for non-compliance may be incurred in the future. Moreover, it is possible that other developments, such as the adoption of stricter environmental laws, regulations and enforcement policies, could result in additional costs or liabilities that we cannot currently quantify.

State and Local Regulation

Our operations, and the operations of our customers, are subject to a variety of state and local environmental review and permitting requirements. Some states have state laws similar to major federal environmental laws and thus our operations are also subject to state requirements that may be more stringent than those imposed under federal law. For example, initiatives have been underway in the State of Colorado to limit or ban crude oil and natural gas exploration, development or operations. On April 16, 2019, the Governor of Colorado signed Senate Bill 19-181 (“SB 181”) into law. The legislation makes sweeping changes in Colorado oil and gas law, including, among other matters, requiring the Colorado Oil and Gas Conservation Commission (“COGCC”) to prioritize public health and environmental concerns in its decisions, instructing the COGCC to adopt rules to minimize emissions of methane and other air contaminants, and delegating considerable new authority to local governments to regulate surface impacts. Some local communities have adopted additional restrictions for oil and gas activities, such as requiring greater setbacks, and other groups have sought a cessation of permit issuances entirely until the COGCC publishes new rules in keeping with SB 181. Additionally, activist groups have submitted new ballot proposals for the 2020 election year, including proposals for increased drilling setbacks and increased bonding requirements.

Our operations may require state-law based permits in addition to federal permits, requiring state agencies to consider a range of issues, many the same as federal agencies, including, among other things, a project’s impact on wildlife and their habitats, historic and archaeological sites, aesthetics, agricultural operations and scenic areas. Texas has specific permitting and review processes for oilfield service operations, and state agencies may impose different or additional monitoring or mitigation requirements than federal agencies. The development of new sites and our existing operations also are subject to a variety of local environmental and regulatory requirements, including land use, zoning, building and transportation requirements.

10

Motor Carrier Operations

We operate as a motor carrier and therefore are subject to regulation by DOT and various state agencies. These regulatory authorities exercise broad powers, governing activities such as the authorization to engage in motor carrier operations; regulatory safety; hazardous materials labeling, placarding and marking; financial reporting; and certain mergers, consolidations and acquisitions. There are additional regulations specifically relating to the trucking industry, including requirements related to testing and weight and dimension specifications of equipment, drug testing and product handling. The trucking industry is subject to possible regulatory and legislative changes that may affect the economics of the industry by requiring changes in operating practices or by changing the demand for common or contract carrier services or the cost of providing truckload services. Some of these possible changes include increasingly stringent environmental regulations and fuel economy requirements, changes in the hours of service regulations which govern the amount of time driven in any specific period and requiring onboard black box recorder devices or limits on vehicle weight and size.

Interstate motor carrier operations are subject to safety requirements prescribed by DOT. Intrastate motor carrier operations are subject to safety regulations that often mirror federal regulations. Such matters as weight and dimension of equipment are also subject to federal and state regulations. DOT regulations also mandate drug testing of drivers. From time to time, various legislative proposals are introduced, including proposals to increase federal, state or local taxes, including taxes on motor fuels, which may increase our costs or adversely impact the recruitment of drivers. We cannot predict whether, or in what form, any increase in such taxes applicable to us will be enacted.

Available Information

Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the U.S. Securities Exchange Act of 1934 are available free of charge at our website at http://www.rangerenergy.com, as soon as reasonably practicable after having been electronically filed or furnished to the U.S. Securities and Exchange Commission (the “SEC”). The SEC maintains an internet site that contains reports, proxy, information statements and other information regarding issuers that file electronically with the SEC at http:www.sec.gov, including us.

11

Item 1A. Risk Factors

You should carefully consider the information in this Annual Report, including the matters addressed under “Cautionary Statement Regarding Forward‑Looking Statements” and the following risks before making an investment decision. If any of the following risks actually occur, the trading price of our Class A Common Stock could decline, and you may lose all or part of your investment. Additional risks not presently known to us or that we currently deem immaterial could also materially affect our business.

Risks Related to Our Operations

Macroeconomic Conditions

The COVID-19 outbreak and its potential adverse effect on business operations and financial condition.

The outbreak of COVID-19 has spread across the globe and was declared a public health emergency by the WHO and a National Emergency by the President of the United States. Most states and municipalities in the United States, including Texas, declared public health emergencies and announced aggressive actions to reduce the spread of the disease, including limiting non-essential gatherings of people, ceasing all non-essential travel, ordering certain businesses and government agencies to cease non-essential operations at physical locations and issuing “shelter-in-place” orders. To the extent COVID-19 continues or worsens, governments may impose additional similar restrictions.

The COVID-19 pandemic has resulted, and is likely to continue to result, in significant economic disruption and has, and will likely continue to, adversely affect the operations of the Company’s business, as the significantly reduced global and national economic activity has resulted in reduced demand for oil and natural gas and an oversupply of crude oil. Many E&P companies have announced significant cuts in capital spending and production in response to reduced demand and declining prices. There has been a general slowdown in E&P company activity due to the significantly reduced demand for oil and natural gas as a result of the COVID-19 pandemic and the oversupply of oil and natural gas in the market. The direct impact to the Company’s operations began to take affect at the close of the first quarter ended March 31, 2020, and have continued through the year ended December 31, 2020, however, the extent to which the COVID-19 outbreak impacts our results will depend on future developments that are highly uncertain and cannot be predicted, including new information that may emerge concerning the severity of the virus and the actions to contain its impact, newly discovered strains of the virus and uncertainty surrounding the vaccine supplies and implementation. At the time of this filing, cases of COVID-19 in the U.S. remain high, particularly in Texas, where we conduct significant operations.

Our operations are subject to inherent risks, some of which are beyond our control. These risks may be self‑insured, or may not be fully covered under our insurance policies.

Our operations are subject to hazards inherent in the oil and natural gas industry, such as, but not limited to, accidents, blowouts, explosions, craterings, fires, oil spills and releases of drilling, completion or fracturing fluids or hazardous materials into the environment. These conditions can cause:

•disruption or suspension of operations;

•substantial repair or replacement costs;

•personal injury or loss of human life;

•significant damage to or destruction of property and equipment;

•environmental pollution, including groundwater contamination;

•unusual or unexpected geological formations or pressures and industrial accidents; and

•substantial revenue loss.

In addition, our operations are subject to, and exposed to, employee/employer liabilities and risks such as wrongful termination, discrimination, labor organizing, retaliation claims and general human resource‑related matters.

The occurrence of a significant event or adverse claim in excess of the insurance coverage that we maintain or that is not covered by insurance could have a material adverse effect on our business, liquidity position, financial condition, results of operations and prospects and may increase our costs. Claims for loss of oil and natural gas production and damage to formations can occur in the well services industry. Litigation arising from a catastrophic occurrence at a location where our equipment and services are being used may result in our being named as a defendant in lawsuits asserting large claims. Similarly, our operations involve the storage, handling and use of explosives. Accidents resulting from the use of explosives

12

in our operations could expose us to reputational risks and liability for damages or otherwise adversely impact our operations or the operations of our customers. Any such occurrneces could have a material adverse effect on our operating results, financial condition and cash flows.

We do not have insurance against all risks, either because insurance is not available or because of the high premium costs. The occurrence of an event not fully insured against or the failure of an insurer to meet its insurance obligations could result in substantial losses. In addition, we may not be able to maintain adequate insurance in the future at rates we consider reasonable. Insurance may not be available to cover any or all of the risks to which we are subject, or, even if available, it may be inadequate, or insurance premiums or other costs could rise significantly in the future so as to make such insurance prohibitively expensive.

Seasonal weather conditions and natural disasters could severely disrupt normal operations and harm our business.

Our operations are located in different regions of the United States. Some of these areas, including the Denver‑Julesburg Basin and the Bakken Shale, are adversely affected by seasonal weather conditions. During periods of heavy snow, ice, wind or rain, we may be unable to move our equipment between locations, thereby reducing our ability to provide services and generate revenues, or we could suffer weather‑related damage to our facilities and equipment, resulting in delays in operations. The exploration activities of our customers may also be affected during such periods of adverse weather conditions. Additionally, extended drought conditions in our operating regions could impact our ability or our customers’ ability to source sufficient water or increase the cost for such water. As a result, a natural disaster or inclement weather conditions could severely disrupt the normal operation of our business and adversely impact our financial condition and results of operations.

In addition, some scientists have concluded that increasing concentrations of GHG in the atmosphere may produce climate changes that have significant physical effects, such as increased frequency and severity of storms, droughts, and floods and other climate events that could have an adverse effect on our operations and the operations of our customers.

A terrorist attack, armed conflict or civil unrest could harm our business.

The occurrence or threat of terrorist attacks in the United States or other countries, anti‑terrorist efforts and other armed conflicts involving the United States or other countries, including continued hostilities in the Middle East or domestic civil unrest, may adversely affect the United States and global economies and could prevent us from meeting our financial and other obligations. If any of these events occur, the resulting political instability and societal disruption could reduce overall demand for oil and natural gas, potentially putting downward pressure on demand for our services and causing a reduction in our revenues. Oil and natural gas‑related facilities could be direct targets of terrorist attacks, and our operations could be adversely impacted if infrastructure integral to our customers’ operations is destroyed or damaged. Costs for insurance and other security may increase as a result of these threats, and some insurance coverage may become more difficult to obtain, if available at all.

Industry Conditions and Competition

Our business depends on domestic capital spending by the oil and natural gas industry, and reductions in such capital spending could have a material adverse effect on our business, liquidity position, financial condition, results of operations and prospects.

Our business is directly affected by our customers’ capital spending to explore for, develop and produce oil and natural gas in the United States. The significant decline in oil and natural gas prices that began in mid-2014 has caused a reduction in the exploration, development and production activities of most of our customers and their spending on our services. These cuts in spending have curtailed drilling programs, which resulted in a reduction in the demand for our services as compared to activity levels in early 2014, as well as in the prices we can charge. In addition, certain of our customers could become unable to pay their vendors and service providers, including us, as a result of the decline in commodity prices. Reduced discovery rates of new oil and natural gas reserves in our areas of operation as a result of decreased capital spending may also have a negative long‑term impact on our business, even in an environment of stronger oil and natural gas prices, to the extent the reduced number of wells that need our services or equipment more than offsets new drilling and completion activity and complexity. Any of these conditions or events could adversely affect our operating results. If the recent recovery does not continue or our customers fail to further increase their capital spending, it could have a material adverse effect on our business, liquidity position, financial condition, results of operations and prospects.

Industry conditions are influenced by numerous factors over which we have no control, including:

•domestic and foreign economic conditions and supply of and demand for oil and natural gas;

•the level of prices, and expectations about future prices, of oil and natural gas;

13

•the level and cost of global and domestic oil and natural gas exploration, production, transportation of reserves and delivery;

•taxes and governmental regulations, including the policies of governments regarding the exploration for and production and development of their oil and natural gas reserves;

•political and economic conditions in oil and natural gas producing countries;

•actions by the members of the Organization of Petroleum Exporting Countries (“OPEC”) and other countries, such as Russia and Saudi Arabia, with respect to oil production levels and announcements of potential changes in such levels, including the failure of such countries to comply with production cuts;

•sanctions and other restrictions placed on oil producing countries, such as Iran and Venezuela;

•global weather conditions and natural disasters;

•worldwide political, military and economic conditions;

•the discovery rates of new oil and natural gas reserves;

•shareholder activism or activities by non‑governmental organizations to restrict the exploration, development and production of oil and natural gas; and

•uncertainty in capital and commodities markets.

The volatility of oil and natural gas prices may adversely affect the demand for our services and negatively impact our results of operations.

The demand for our services is primarily determined by current and anticipated oil and natural gas prices and the related levels of capital spending and drilling activity in the areas in which we have operations. Volatility, or the perception that oil or natural gas prices will decrease, affects the spending patterns of our customers and may result in the drilling of fewer new wells. This could lead to decreased demand for our services and lower utilization of our assets. We have, and may in the future, experience significant fluctuations in operating results as a result of the reactions of our customers to changes in oil and natural gas prices.