Exhibit 99.1

ANNUAL INFORMATION FORM

FOR THE FINANCIAL YEAR ENDED DECEMBER 31, 2020

MARCH 19, 2021

Table of Contents

| ABOUT THIS ANNUAL INFORMATION FORM |

1 | |||

| GENERAL DEVELOPMENT OF THE BUSINESS |

5 | |||

| DESCRIPTION OF THE BUSINESS |

10 | |||

| DETAILS OF THE ROOK I PROJECT |

11 | |||

| RISK FACTORS |

31 | |||

| DIVIDENDS |

37 | |||

| DESCRIPTION OF CAPITAL STRUCTURE |

37 | |||

| MARKET FOR SECURITIES AND TRADING PRICE AND VOLUME |

38 | |||

| PRIOR SALES |

38 | |||

| DIRECTORS AND OFFICERS |

39 | |||

| AUDIT COMMITTEE DISCLOSURE |

41 | |||

| LEGAL PROCEEDINGS AND REGULATORY ACTIONS |

43 | |||

| INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS |

43 | |||

| TRANSFER AGENT AND REGISTRAR |

43 | |||

| MATERIAL CONTRACTS |

43 | |||

| INTERESTS OF EXPERTS |

44 | |||

| ADDITIONAL INFORMATION |

44 | |||

| SCHEDULE “A” |

A-1 | |||

ABOUT THIS ANNUAL INFORMATION FORM

In this annual information form (“AIF”), NexGen Energy Ltd., together with its current subsidiaries (other than IsoEnergy Ltd.), as the context requires, is referred to as the “Corporation” and “NexGen”. All information contained in this AIF is at December 31, 2020, being the date of the Corporation’s most recently completed financial year, unless otherwise stated.

This AIF has been prepared in accordance with Canadian securities laws and contains information regarding NexGen’s history, business, mineral reserves and resources, the regulatory environment in which NexGen conducts business, the risks that NexGen faces as well as other important information for the Shareholders.

This AIF incorporates by reference NexGen’s management discussion and analysis (“MD&A”) for the year ended December 31, 2020 and accompanying audited consolidated financial statements which are available under the Corporation’s profile on SEDAR (www.sedar.com) and on EDGAR (www.sec.gov/edgar.shtml) as an exhibit to the Corporation’s Form 40-F.

Financial Information

Unless otherwise specified in this AIF, all references to “dollars” or to “$” or to “C$” are to Canadian dollars and all references to “US dollars” or to “US$” are to United States of America dollars. Financial information is derived from consolidated financial statements that have been prepared in accordance with the International Financial Reporting Standards as issued by the International Accounting Standards Board.

Cautionary Note Regarding Forward-Looking Information and Statements

This AIF contains “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning of applicable Canadian securities legislation. Forward-looking information and statements include, but are not limited to, statements with respect to planned exploration and development activities, the future interpretation of geological information, the cost and results of exploration and development activities, future financings, the future price of uranium and requirements for additional capital. Generally, forward-looking information and statements can be identified by the use of forward-looking terminology such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes”, or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved” or the negative connotation thereof.

Forward-looking information and statements are based on the then current expectations, beliefs, assumptions, estimates and forecasts about NexGen’s business and the industry and markets in which it operates. Forward- looking information and statements are made based upon numerous assumptions, including among others, that the results of planned exploration and development activities are as anticipated and on time, the price of uranium, the cost of planned exploration and development activities, there will be limited changes in any project parameters as plans continue to be refined, that financing will be available if and when needed and on reasonable terms, that third-party contractors, equipment, supplies and governmental and other approvals required to conduct NexGen’s planned exploration and development activities will be available on reasonable terms and in a timely manner, that there will be no revocation of government approvals and that general business, economic, competitive, social, and political conditions will not change in a material adverse manner. Although the assumptions made by the Corporation in providing forward-looking information or making forward- looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate.

Forward-looking information and statements also involve known and unknown risks and uncertainties and other factors, which may cause actual results, performances and achievements of NexGen to differ materially from any projections of results, performances and achievements of NexGen expressed or implied by such forward- looking information or statements, including, among others, negative operating cash flow and dependence on third-party financing, uncertainty of additional financing, price of uranium, the appeal of alternate sources of energy, exploration risks, uninsurable risks, reliance upon key management and other personnel, imprecision of mineral resource estimates, potential cost overruns on any development, changes in climate or increases in

1

environmental regulation, aboriginal title and consultation issues, deficiencies in the Corporation’s title to its properties, information security and cyber threats, failure to manage conflicts of interest, failure to obtain or maintain required permits and licenses, changes in laws, regulations and policy, competition for resources and financing, volatility in market price of the Corporation’s shares, and other factors discussed or referred to in this AIF under “Risk Factors”.

Although NexGen has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information or statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended.

There can be no assurance that such information or statements will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information or statements. The forward-looking information and statements contained in this AIF are made as of the date of this AIF and, accordingly, are subject to change after such date. NexGen does not undertake to update or reissue forward-looking information as a result of new information or events except as required by applicable securities laws.

Cautionary Note to U.S. Investors

This AIF has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ materially from the requirements of United States securities laws applicable to U.S. companies. Information concerning NexGen’s mineral properties has been prepared in accordance with the requirements of Canadian securities laws, which differ in material respects from the requirements of the United States Securities and Exchange Commission (the “SEC”) applicable to domestic United States issuers. Accordingly, the disclosure in this AIF regarding the Company’s mineral properties is not comparable to the disclosure of United States issuers subject to the SEC’s mining disclosure requirements.

2

Technical Disclosure

All scientific and technical information in this AIF has been reviewed and approved by Mr. Anthony (Tony) George, P.Eng., Chief Project Officer and Mr. Troy Boisjoli, Geoscience Licensee, Vice President — Exploration & Community for NexGen. Each of Mr. George and Mr. Boisjoli is a qualified person for the purposes of National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”). Mr. Boisjoli has verified the sampling, analytical, and test data underlying the information or opinions contained herein by reviewing original data certificates and monitoring all of the data collection protocols.

For details of the Rook I Project, including the key assumptions, parameters and methods used to estimate the updated Feasibility Study (as that term is defined below) set forth below, please refer to the technical report entitled Arrow Deposit, Rook I Project, Saskatchewan, NI 43-101 Technical Report on Feasibility Study dated 10 March 2021 (the “Rook I FS Technical Report”). The Rook I FS Technical Report is filed under the Company’s profile on SEDAR (www.sedar.com) and EDGAR (www.sec.gov/edgar.shtml).

ABOUT NEXGEN

NexGen Energy Ltd. is engaged in uranium exploration and development. The Corporation’s head office is located at Suite 3150-1021 West Hastings Street, Vancouver, British Columbia, V6E 0C3 and its registered office is located at 25th Floor, 700 West Georgia Street, Vancouver, British Columbia, V7Y 1B3. NexGen’s website address is www.nexgenenergy.ca.

NexGen was incorporated on March 8, 2011 under the Business Corporations Act (British Columbia) (the “BCBCA”) as “Clermont Capital Inc.”, a “capital pool company” within the meaning of Policy 2.4 — Capital Pool Companies (the “CPC Policy”) of the TSX Venture Exchange (the “TSXV”). On August 29, 2012, the Corporation’s common shares commenced trading on the TSXV under the symbol “XYZ.P”.

On April 19, 2013, the Corporation completed its “qualifying transaction” and in connection therewith consolidated its common shares on a 2.35:1 basis and changed its name to “NexGen Energy Ltd.” On April 22, 2013, the Corporation’s common shares (the “Shares”) commenced trading on the TSXV under the symbol “NXE”.

On July 15, 2016, the Shares were delisted from the TSXV and commenced trading on the Toronto Stock Exchange (“TSX”). On May 17, 2017, the Shares ceased trading on the OTCQX and commenced trading on the NYSE American. The trading symbol for the Shares on each of the TSX and NYSE American is “NXE”.

NexGen is a reporting issuer in all of the Canadian provinces, except Quebec. The Shares are also registered under the United States Securities Exchange Act of 1934, as amended, and NexGen files periodic reports with the United States Securities and Exchange Commission.

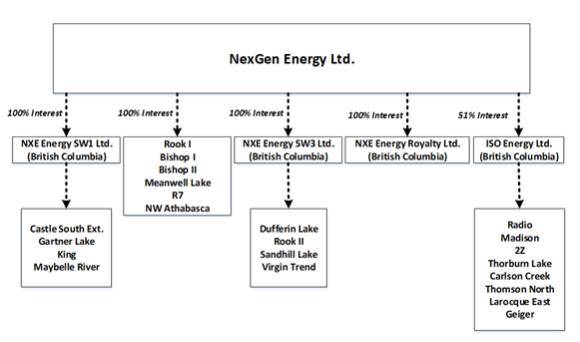

NexGen’s Corporate Structure

The Corporation has three (3) wholly-owned subsidiaries: NXE Energy Royalty Ltd., NXE Energy SW1 Ltd. and NXE Energy SW3 Ltd. (collectively, the “Subsidiaries”). The Corporation also holds 51% of the outstanding common shares of IsoEnergy Ltd. (“IsoEnergy”) as at December 31, 2020 and as of the date hereof. Each of the Subsidiaries and IsoEnergy were incorporated (and continue to exist) under the BCBCA.

3

4

GENERAL DEVELOPMENT OF THE BUSINESS

Overview

NexGen’s principal asset is currently its 100% interest in the Rook I Project, a development project in the Athabasca Basin, Saskatchewan (the “Project”), which includes the Arrow discovery in February 2014, the Bow discovery in March 2015, the Harpoon discovery in August 2016 and the South Arrow discovery in July 2017.

The Project is located in the Southwest Athabasca Basin of Saskatchewan, Canada. The Project consists of 32 contiguous mineral claims totalling 35,065 hectares.

History

Year Ended December 31, 2018

Project Development

On November 5, 2018, the Corporation announced, an updated mineral research estimate on the Project and then subsequently filed a NI 43-101 pre-feasibility on December 20, 2018.

Year Ended December 31, 2019

Permitting, Regulatory and Engagement

On April 29, 2019, the Project Description (Technical Proposal) was accepted by the Canadian Nuclear Safety Commission (“CNSC”) and the Saskatchewan Ministry of Environment (“MOE”). The acceptance marked the commencement of an Environmental Assessment (“EA”) on the Project in accordance with the requirements of both The Environmental Assessment Act (Province of Saskatchewan) and the Canadian Environmental Assessment Act, 2012 (“CEAA 2012”; Government of Canada). The EA is being conducted through a coordinated process between the MOE and the CNSC, the CNSC being the Federal life-cycle regulator for all uranium mine and mill projects in Canada.

The Corporation also filed an Initial Licence Application with the CNSC under the Nuclear Safety and Control Act in order to obtain a Licence to Prepare Site and Construction for the Project.

On December 5, 2019, the Corporation announced it reached a new milestone by successfully entering into Study Agreements with four local communities within the Project area.

The communities are all within proximity to the Project, which is currently in the process of EA under CEAA 2012. The communities are:

| - |

Clearwater River Dene Nation, |

| - |

Métis Nation Saskatchewan (MN-S) including as on behalf of the Locals of MN-S Region II, |

| - |

Birch Narrows Dene Nation, and |

| - |

Buffalo River Dene Nation. |

The Study Agreements enable the Corporation to formally engage with the communities to identify potential impacts to Aboriginal and treaty rights and socio-economic interests and identify potential avoidance and accommodation measures in relation to the Project whilst acknowledging the duty to consult remains with the Crown.

The Corporation and the communities have established respective joint working groups to support the inclusion of each community’s traditional knowledge throughout the EA process and incorporating the Traditional Land Use and Dietary studies that are designed, scoped and completed by each of the respective communities. The Corporation will provide funding for all aspects of the above including the Joint Working Groups (JWG) to lead, review and Traditional Land Use studies for inclusion into the EA.

5

Further, the Study Agreements agree that the parties will negotiate Impact Benefit Agreements in good faith and as early in the regulatory process as possible to allow the Parties greater certainty, including certainty that current and future potential concerns between the Parties can be addressed through the processes set out in the Impact Benefit Agreement.

Project Development

In the beginning of 2019, NexGen commenced the engineering phase of a feasibility study on the Project.

Corporate

On December 9, 2019, NexGen participated in a non-brokered financing with IsoEnergy purchasing 7,371,858 units of IsoEnergy (“Units”) at a price of $0.40 per Unit. Each Unit comprised one common share of IsoEnergy and one-half of one common share purchase warrant, with each whole common share purchase warrant entitling NexGen to acquire one common share of IsoEnergy at a price of $0.60 per common share for a period of 24 months following the date of issuance.

Pursuant to a transfer agreement (the “Transfer Agreement”) between IsoEnergy and NexGen, NexGen transferred to IsoEnergy on June 17, 2016 all of its interest in the Radio Project (by way of an assignment of the Radio option agreement), the Thorburn Lake Project and each of the Madison, 2Z and Carlson Creek properties, all early stage exploration properties located in the Athabasca Basin, Saskatchewan (collectively, the “Acquired Properties”) on a tax deferred basis. As consideration for the Acquired Properties, IsoEnergy issued 29 million common shares to NexGen at a price of $1.00 per common share. Pursuant to the Transfer Agreement, each of IsoEnergy and NexGen agreed to elect that, for tax purposes, the transfer price of the Acquired Properties be equal to the book value thereof.

The common shares of IsoEnergy trade on the TSXV and, as of the date hereof, NexGen holds 43,844,380 common shares of IsoEnergy (representing approximately 51% of the outstanding common shares of IsoEnergy).

Exploration

Winter 2019 Drilling

The winter 2019 drill program using ten (10) drill rigs commenced on January 5, 2019 and was a continuation of the December 2018 drilling program with Objectives I, II and III below:

| • |

Objective I – Convert High Grade Indicated Mineral Resources to Measured Mineral Resources: Drilling at a spacing sufficient to support the conversion of the then-current defined high-grade (HG) Indicated Resource to Measured Resource. Measured Mineral Resources represent the highest level of mineral resource confidence, adding Measured Mineral Resources to Arrow will further increase assurance in future technical and economic study for which the Arrow Mineral Resource forms the basis. |

| • |

Objective II – Mine Development Rock Mass Characterization: Geotechnical and hydrogeological characterization in support of validating the rock-mass within areas of the Arrow Deposit with proposed mine development. |

| • |

Objective III – Underground Tailings Management Facility (UGTMF) Rock Mass Rating Characterization: Geotechnical and hydrogeological characterization and radiological sterilization of the rock-mass around proposed area for UGTMF development. |

The winter 2019 drill program completed 125 drill holes totaling 54,054.9 metres for an overall drill program total of 57,279.4 metres in 131 drill holes inclusive of December 2018 drilling. All winter 2019 drill holes for resource conversion were collared at a steep inclination, then shallowed out before intersecting the target by utilizing the latest in directional drilling technology. All resource conversion drill holes intersected strong uranium mineralization and further demonstrate high-grade continuity of the Arrow Deposit at the highest confidence measured drill hole spacing.

6

Outside of the Arrow Deposit, four holes were completed within the UGTMF area and positively indicate the area contains suitable rock-mass and hydraulic conductivity to facilitate underground development. One hole was drilled to the Athabasca Unconformity above the proposed UGTMF for the purpose of hydrogeological characterization.

In addition to geotechnical and hydrogeological characterization, seven of the winter 2019 drill holes — four at the UGTMF area and three within the Arrow Deposit – had vibrating water piezometers (VWP) installed to facilitate ongoing monitoring of groundwater pressure changes.

Fall 2019 Drilling

In addition to the UGTMF holes completed during the winter 2019 drill program, a five-hole drill program totaling 3,107.7 metres was completed in December 2019 and was successful in further characterizing the rock-mass in and around the proposed UGTMF area beyond the Feasibility Study level. Four of the additional drill holes received VWP installations and one received a Westbay multilevel groundwater monitoring system installation.

A maiden, helicopter supported, exploration drill program was completed on the SW1 property in November 2019. Two drill rigs were utilized during the program for a total of 2,478.0 metres in four completed drill holes. Drilling identified hydrothermal alteration and brittle structural disruption consistent with those recognized in a uranium bearing system. The prospective intersections from the drilling program add value in furthering targeting efforts towards potential discovery on the SW1 property.

Year Ended December 31, 2020

Project Development

On February 22, 2021, the Corporation announced positive results from a feasibility study (the “Feasibility Study”) for the Project. Details of the Feasibility Study, including an updated mineral resource estimate and an updated mineral reserve estimate, are provided in the Rook I FS Technical Report in respect of the Rook 1 Project.

For details of the Project, including the key assumptions, parameters and methods used to estimate the Feasibility Study, please refer to the Rook I FS Technical Report dated 10 March 2021. The Rook I FS Technical Report is filed under the Company’s profile on SEDAR (www.sedar.com) and EDGAR (www.sec.gov/edgar.shtml).

Permitting, Regulatory and Engagement

On February 20, 2020, NexGen received a Record of Decision from the CNSC Commission with respect to the CNSC Commission’s Decision on the scope of an environmental assessment for the proposed Project. The Record of Decision confirmed, among other things, CNSC receipt of the April 29, 2019 submission of the Project Description and that the Project will be subject to CEAA 2012, with no additional factors. The Record of Decision confirmed that the EA will be required to consider Indigenous traditional knowledge and community knowledge, and that NexGen is required to prepare a draft environmental impact statement (“EIS”) in concordance with the Generic Guidelines for the Preparation of an Environmental Impact Assessment pursuant to the Canadian Environmental Assessment Act, 2012.

During 2020, work advanced on the EA for the Project, with continued technical, modelling and assessment work conducted in support of the development of the draft EIS submission. Similarly, work advanced on the Licence Application in order to obtain a Licence to Prepare Site and Construction for the Project.

Both the draft EIS and Initial Licence Application are expected to be completed in late 2021.

During 2020, the Corporation progressed engagement activities under the terms of the Study Agreements with four local communities within the Project area.

7

The communities are all within proximity to the Project, which is currently in the process of EA under CEAA 2012. The communities are:

| - |

Clearwater River Dene Nation, |

| - |

Métis Nation Saskatchewan (MN-S) including as on behalf of the Locals of MN-S Region II, |

| - |

Birch Narrows Dene Nation, and |

| - |

Buffalo River Dene Nation. |

The Study Agreements enable the Corporation to formally engage with the communities to identify potential impacts to Aboriginal and treaty rights and socio-economic interests and identify potential avoidance and accommodation measures in relation to the Project whilst acknowledging the duty to consult remains with the Crown. Further, during 2020 the Corporation executed a funding agreement with Ya’thi Nene Lands and Resources (YNLR) to undertake a Traditional Knowledge, Land Use Occupancy (TKLUO) study for incorporation into the Draft EIS.

The Corporation continued to engage with the respective JWG to support the inclusion of each community’s traditional knowledge throughout the EA process and commenced incorporating information from the TLU into the EA The Corporation provided funding for all aspects of the above including the JWG to review and independently confirm all studies for inclusion into the EA.

Further, the Corporation commenced negotiating Impact Benefit Agreements (IBA) with communities within proximity to the Project. The IBA negotiations were well advanced with the majority of the communities during 2020. The IBA will allow the Parties greater certainty, including certainty that current and future potential concerns between the Parties can be addressed through the processes set out in the IBA.

Financings

US$30 Million Financing

On May 27, 2020, the Corporation completed a financing with Queen’s Road Capital Ltd. (“QRC”) raising an aggregate US$30 million, comprising US$15 million of Common Shares issued at a price per share of C$1.80 for an aggregate of 11,611,667 Common Shares, and US$15 million aggregate principal amount of 7.5% unsecured convertible debentures (the “2020 Debentures”) which are convertible into Common Shares at a conversion price of C$2.34. The Corporation also issued 348,350 Common Shares at a price of C$1.80 for the establishment fees of the 7.5% debentures, and 180,270 Common Shares at a deemed price of $1.97 for a consent fee to the investors of the debentures in connection with the 7.5% debentures financing.

The 2020 Debentures bear interest at the rate of 7.5% per annum and have a five-year term ending on May 27, 2025 (the “Maturity Date”). The 2020 Debentures are convertible at the holder’s option into Common Shares at a price of $2.34 per share. Two-thirds of the interest (5% per annum) is payable in cash, while one-third (2.5% per annum) is payable in Common Shares issuable at a price equal to the 20-day volume weighted average trading price (“VWAP”) on the exchange on which the Common Shares are trading that has the greatest trading volume, ending on the day prior to the date such interest payment is due. The Corporation will be entitled, on or after the third anniversary of the date of the issuance of the 7.5% Debentures, at any time that the 20-day VWAP on the TSX exceeds 130% of the conversion price of $2.34 per Common Share, to redeem the 7.5% Debentures at par plus accrued and unpaid interest.

The Corporation and QRC entered into an investor rights agreement dated May 27, 2020 providing for similar rights and obligations as those set out in the Investor Rights Agreement disclosed in the “Material Contracts” section of this AIF, including provisions relating to voting alignment, standstill and transfer restriction covenants that will apply until such time as QRC holds less than 5% of the Common Shares (calculated on a partially-diluted basis) or until there is a change of control of the Corporation.

8

Short Form Prospectus Financing

On February 25, 2021, NexGen announced that it had entered into an agreement with a syndicate of underwriters led by BMO Capital Markets and Canaccord Genuity Corp. under which the underwriters agreed to buy on a bought deal basis 33,400,000 Common Shares at a price of $4.50 per Common Share for gross proceeds of approximately $150 million (the “Offering”). The Corporation also granted the underwriters an option, exercisable at $4.50 per Common Share for a period of 30 days following the Offering to purchase up to an additional 5,010,000 Common Shares to cover over-allotments, if any (the “Over-Allotment Option”). The Offering closed on March 11, 2021 and the Over-Allotment Option closed on March 16, 2021.

Corporate

Conversion of US$120 Million Convertible Debentures into Equity

On February 18, 2021, the Corporation received notice that the registered holders of US$120 million aggregate principal amount of debentures had elected to convert their debentures into Common Shares pursuant to the terms of the trust indentures governing the debentures. The registered holders of the debentures are affiliates of CEF Holdings Limited and its shareholders. The debentures consist of US$60 million aggregate principal amount of 7.5% unsecured convertible debentures issued by the Corporation in 2016 (the “2016 Debentures”) and US$60 million aggregate principal amount of 7.5% unsecured convertible debentures issued by the Corporation in 2017 (the “2017 Debentures” and, together with the 2016 Debentures, the “Debentures”), both due to mature on July 22, 2022.

Under their terms, the Debentures are convertible into Common Shares at a price of US$2.3261 for the 2016 Debentures and US$2.6919 for the 2017 Debentures. An aggregate of 48,083,335 Common Shares were issued in connection with the conversion of the principal amount of the Debentures. Upon issuance, CEF’s percentage ownership of the issued and outstanding Common Shares increased from ~8.7% to ~18.7%. In addition, the Company is required to pay the interest that accrued on the Debentures prior to conversion, which it intends to pay by issuing an aggregate of 177,045 Common Shares to CEF, such number of shares being calculated in accordance with the terms of the relevant trust indenture governing the Debentures. The issuance of such Common Shares is subject to the approval of the TSX.

COVID-19 Pandemic

At the commencement of the COVID-19 pandemic, the Corporation had postponed “yet to commence” work programs related to the Feasibility Study and an EA for the Project, with previously commenced “in progress” work programs (including environmental monitoring and community programs) continuing where the Corporation concluded that the function was not impacted by the applicable health authority guidelines. During the third quarter of 2020, the Corporation’s workflows that had been temporarily impacted by the COVID-19 pandemic for the Feasibility Study and EA resumed in what the Corporation believes is an orderly and safe manner. The Corporation expects the EIS to be completed in the second half of 2021. In the interim, the Corporation intends to continue to attempt to optimize all workflows in light of the current health and economic climate.

Change in Management

On February 17, 2021, the Corporation entered into an employment agreement with Harpreet Dhaliwal for the position of Chief Financial Officer. Harpreet Dhaliwal is expected to start as Chief Financial Officer on April 1, 2021. On May 12, 2020, Anthony (Tony) George was appointed to the position of Chief Project Officer. Mr. George started in his new position in mid-June and is responsible for the execution of the Project through to production.

9

Exploration

No field based exploration activity occurred in 2020. On June 5, 2020, the Saskatchewan Ministry of Energy and Resources granted mineral assessment relief in response to the pandemic. The relief waved expenditure requirements for the current term and subsequent 12 months for mineral claims and leases that were active on March 18, 2020; the date in which a state of emergency was declared in Saskatchewan. The relief period granted by the Saskatchewan Government extended the good standing date on most mineral claims for an additional 2 years. The mineral dispositions that make up the Project are in good standing until at least June 14, 2039.

General

The principal business activity of the Corporation has been, and continues to be, the development of the Project and the exploration of its portfolio of uranium properties, located in the southwestern section of the Athabasca Basin of Saskatchewan, Canada.

Principal Products

The Corporation is in the mineral exploration and development business, does not have any marketable products at this time and is not distributing any products at this time. In addition, the Corporation does not know when or if certain of its properties will reach the development stage and if so, what the estimated costs would be to reach commercial production.

Specialized Skill and Knowledge

The Corporation’s business requires specialized skill and knowledge in the areas of geology, mineral exploration and development, business negotiations, accounting and management. To date, the Corporation has been able to locate and retain such employees and consultants and believes it will continue to be able to do so. See “Risk Factors – Reliance upon Key Management and Other Personnel” below.

Competitive Conditions

The mineral exploration and development business is a competitive business. The Corporation competes with numerous other companies and individuals who may have greater financial resources in the search for and the acquisition of personnel, contractors, funding and attractive mineral properties. As a result of this competition, the Corporation may be unable to obtain additional capital or other types of financing on acceptable terms or at all, acquire properties of interest or retain qualified personnel and/or contractors. See “Risk Factors – Competition”.

Environmental Protection

The Corporation’s exploration and development activities are subject to various levels of federal and provincial laws and regulations relating to the protection of the environment. Due to the stage of the Corporation’s activities, environmental protection requirements have had a minimal impact on the Corporation’s capital expenditures and competitive position. If needed, the Corporation will make and will continue to make expenditures to ensure compliance with applicable laws and regulations. New environmental laws and regulations, amendments to existing laws and regulations, or more stringent implementations of existing laws and regulations could have a material adverse effect on the Corporation by potentially increasing capital and/or operating costs. See “Risk Factors – Environmental and Other Regulatory Requirements”.

Employees

As at December 31, 2020, the Corporation had 32 employees. The operations of the Corporation are managed by its directors and officers. NexGen engages consultants from time to time in the areas of mineral exploration and development geology and business negotiations and management. See “Risk Factors – Reliance upon Key Management and Other Personnel”.

10

Business or Seasonal Cycles

Due to the excellent infrastructure in the Athabasca Basin area of Saskatchewan, Canada, exploration can be carried out year-round. Prospecting, mapping, and surface bedrock sampling activities are however limited by snow cover during the period from December to May.

Economic Dependence

The Corporation’s business is not substantially dependent on any contract upon which its business depends. It is not expected that the Company’s business will be affected in the current financial year by the renegotiation or termination of any contracts or sub-contracts.

Foreign Operations

The Corporation is incorporated pursuant to the laws of British Columbia and is a reporting issuer in each of the provinces of Canada, except Quebec. The Corporation’s principal assets are located in the Province of Saskatchewan. The Corporation is not dependent on any foreign operations.

Social and Environmental Policies

The Corporation is committed to carrying out all of its activities in an ethical manner that prioritizes health and safety, recognizes the concerns of indigenous peoples, communities, local stakeholders and preserves the natural environment. The Corporation ensures that all employees are trained and instructed in their assigned tasks and that safety procedures are followed at all times. The importance of ethical behavior and preservation of the natural environment is stressed to all employees and contractors, and all are charged with monitoring operations to ensure they are being carried out in an environmentally-friendly manner. The Corporation ensures that it will work with and consult local communities, indigenous peoples and stakeholders, recognizing this practice as a benefit to all. To this end, the Corporation regularly engages with stakeholders and in the case of indigenous communities, provides frequent updates before and during program activity.

On February 22, 2021, the Corporation announced positive results from the Feasibility Study for the Project. Details of the Feasibility Study, including an updated mineral resource estimate and an updated mineral reserve estimate, are provided in the Rook I FS Technical Report.

The information contained in this AIF report regarding the Project, including the below summary, has been derived from the Rook I FS Technical Report (Arrow Deposit, Rook I Project, Saskatchewan, NI 43-101 Technical Report on Feasibility Study dated 10 March 2021 and authored by Mr. Mark Hatton, P.Eng., Stantec Consulting Ltd; Mr. Paul O’Hara, P.Eng., Wood Canada Limited; and Mr. Mark Mathisen, C.P.G., Roscoe Postle Associates Inc. (now a part of SLR Consulting (Canada) Ltd.), and was filed on March 10, 2021), is subject to certain assumptions, qualifications and procedures described in the Rook I FS Technical Report and is qualified in its entirety by the full text of the Rook I FS Technical Report. Reference should be made to the full text of the Rook I FS Technical Report.

Project Description, Location and Access

The Project is located in northwest Saskatchewan, approximately 40 km east of the Alberta–Saskatchewan border, 150 km north of the town of La Loche, and 640 km northwest of the city of Saskatoon. The Project can be accessed via all-weather gravel, Highway 955, which travels north-south approximately 8 km west of the Arrow Deposit. From Highway 955, a 13 km long all-weather, single-lane road provides access to the western portion of the Project, including the Arrow Deposit area.

The Project will take place in a region with a sub-arctic climate typical of mid-latitude continental areas. It is expected that mining activities will be conducted on a year-round basis.

The topography of the Project area is variable. Drumlins and lakes / wetlands dominate the northwest and southeast parts of the project area, respectively; and lowland lakes, rivers, and muskegs dominate the central part of the project area. The northwest part of the project area lies over portions of Patterson Lake and Forrest Lake, which are two of the largest waterbodies within 100 km of the Project. Elevations range from 583 metres above sea level (“masl”) on drumlins, to 480 masl in lowland lakes. The elevation of Patterson Lake is 499 masl.

11

The Project is covered by boreal forest common to the Canadian Shield. Bedrock outcrops are very rare, but are known to exist in areas of the eastern half of the project area.

The Property consists of 32 contiguous mineral claims with a total area of 35,065 ha. All claims are 100% owned by NexGen.

Six of the 32 claims are subject to a 2% net smelter return (“NSR”) royalty payable to Advance Royalty Corporation (“ARC”), and a 10% production carried interest with Terra Ventures Inc. (“Terra”). The NSR may be reduced to 1% upon payment of $1.0 million to ARC. The Arrow Deposit is located outside of these six claims.

As of December 6, 2012, mineral dispositions are defined as electronic mineral claims parcels within the Mineral Administration Registry Saskatchewan (“MARS”) using a Geographical Information System (“GIS”). MARS is a web-based, electronic tenure system used for issuing and administrating mineral permits, claims, and leases. Mineral claims are acquired via electronic map staking, and administration of the dispositions is also web-based.

As of the effective date of the Rook I FS Technical Report, all 32 mineral claims comprising the Rook I property are in good standing, and are all registered in the name of NexGen.

Surface rights are distinct from subsurface or mineral rights. The Project is located on provincial Crown land; as the owner, the Province of Saskatchewan can grant surface rights under the authority of the Forest Resources Management Act and the Provincial Lands Act. Granting surface rights for the purpose of accessing the land to extract minerals is done by issuing a mineral surface lease subject to the Crown Resource Land Regulations. Mineral surface leases have a 33-year maximum term which may be extended, as necessary.

NexGen does not currently hold surface rights of the project area. Surface rights are obtained after the ministerial review and approval of the EA, and the successful negotiation of a mineral surface lease agreement with the Province of Saskatchewan.

History

The Geological Survey of Canada in 1961 included the Rook I property as part of a larger area.

From 1968 to 1970, Wainoco Oil and Chemicals Ltd. completed airborne magnetic and radiometric surveys, and geochemical sampling programs. No structures or anomalies of interest were detected.

In 1974, Uranerz Exploration and Mining Ltd. completed geological mapping, prospecting, and lake sediment sampling around the property.

From 1976 to 1982, Canadian Occidental Petroleum Ltd. and other companies (e.g., Saskatchewan Mining and Development Corporation (SMDC, now Cameco)) completed airborne INPUT electromagnetic (“EM”) surveys. These surveys detected numerous conductors, many of which were subject to ground surveys prior to drilling.

Airborne magnetic-radiometric surveys were also completed and followed up on with prospecting, geological mapping, lake sediment surveys, and some soil and rock geochemical sampling. Few anomalies were found, other than those that were already located during the airborne and ground EM survey.

From 2005 to 2008, Titan Uranium Inc. (“Titan”) carried out airborne time-domain EM surveys using MEGATEM and Versatile Time Domain Electromagnetic (“VTEM”) systems, which detected numerous strong EM anomalies. A ground MaxMin II survey conducted in 2008 confirmed the airborne anomalies.

In 2012, pursuant to a mineral property acquisition agreement between Mega Uranium Ltd. (“Mega”) and Titan dated February 1, 2012, Mega acquired all nine dispositions comprising the Project. A gravity survey was completed over 60% of S-113921 through S-113933, which defined several regional features and some additional local smaller scale features. Simultaneously, Mega sampled organic-rich soils and prospected the same area. No soil geochemical anomalies or radioactive boulders were found.

In 2012, NexGen acquired Mega’s interest in the Rook I property.

12

Geology Setting, Mineralization and Deposit Types

The Rook I property is located along the southwestern rim of the Athabasca Basin, a large Paleoproterozoic-aged, flat-lying, intracontinental, fluvial, redbed sedimentary basin that covers much of northern Saskatchewan and part of northern Alberta. The Athabasca Basin is ovular at surface, with approximate dimensions of 450 km × 200 km. It reaches a maximum thickness of approximately 1,500 m near its centre.

The southwest portion of the Athabasca Basin is overlain by the flat-lying Phanerozoic stratigraphy of the Western Canada Sedimentary Basin, including the carbonate-rich rocks of the Lower to Middle Devonian Elk Point Group, Lower Cretaceous Manville Group sandstones and mudstones, moderately lithified diamictites, and Quaternary unconsolidated sediments.

South of the Athabasca Basin, where Athabasca sandstone cover becomes thin, paleo-valley fill and debris flow sandstones of the Devonian La Loche / Contact Rapids formation (Alberta) or Meadow Lake (Saskatchewan) formation unconformably overlie the basement rocks.

The Paleoproterozoic basement rocks of the Taltson Domain unconformably underlies the Athabasca Basin and the Phanerozoic stratigraphy within the extents of the Rook I property. The crystalline basement rocks comprise a spectrum of variably altered mafic to ultramafic, intermediate, and local alkaline rock types. The most abundant basement lithologies consist of gneissic, metasomatized-feldspar-rich granitoid rocks, and dioritic to quartz dioritic and quartz monzodioritic gneiss, with lesser granodioritic and tonalitic gneiss.

Mineralization occurs at the following seven locations on the property, and is exclusively hosted in basement lithologies below the unconformity that is overlain by the Athabasca Group.

| • |

Arrow Deposit |

| • |

South Arrow Discovery |

| • |

Harpoon occurrence |

| • |

Bow occurrence |

| • |

Cannon occurrence |

| • |

Camp East occurrence |

| • |

Area A occurrence |

Of the seven mineralized locations, the Arrow Deposit has undergone the most investigation.

The Arrow Deposit is currently interpreted as being hosted chiefly in variably altered porphyroblastic quartz-flooded quartz-feldspar-garnet-biotite (± graphite) gneiss. Mineralization at the Arrow Deposit is defined by an area comprised of several steeply dipping shears that have been labelled as the A0, A1, A2, A3, A4, and A5 shears. The A0 through A5 shears locally host high-grade (“HG”) uranium mineralization.

The Arrow Deposit is considered to be an example of a basement-hosted, vein type uranium deposit.

Exploration

Since acquiring the Rook I property in December 2012, NexGen has carried out exploration activities consisting of the following.

| • |

Ground gravity surveys |

| • |

Ground direct current (DC) resistivity and induced polarization surveys |

| • |

Airborne magnetic-radiometric- very low frequency (VLF) survey |

| • |

Airborne VTEM survey |

| • |

Airborne Z-Axis Tipper electromagnetic (ZTEM) survey |

| • |

Airborne gravity survey |

| • |

Radon-in-water geochemical survey |

| • |

Ground radiometric and boulder prospecting program. |

NexGen also conducted diamond drilling programs to test several targets on the Rook I property, which resulted in the discovery of the Arrow Deposit in drill hole AR-14-001 (formerly known as RK-14-21) in February 2014.

13

Mineralization at the Arrow Deposit is defined by an area comprising the A0 through A5 shears, which locally host HG uranium mineralization. The mineralized area is 315 m wide, with an overall strike of 980 m. Mineralization is noted to occur 100 m below surface, and it extends to a depth of 980 m. The individual shear zones vary in thickness from 2 m to 60 m. The Arrow Deposit is open in most directions and at depth.

Regional drilling completed by NexGen from 2015 — 2019 along the Patterson conductive corridor identified new uranium discoveries at the Harpoon, Bow, Cannon, Camp East, and Area A occurrences, and the South Arrow Discovery.

Drilling

As of the effective date of the Rook I FS Technical Report, NexGen and its predecessors have drilled 754 holes totalling 380,051 m. From 2013 to the effective date of the Rook I FS Technical Report, NexGen has drilled 716 holes totaling 374,917 m.

Three types of drill core samples are collected at site for geochemical analysis and uranium assay.

| • |

One-metre and 0.5-metre samples taken over intervals of elevated radioactivity, and one metre or two metres beyond radioactivity. |

| • |

Point samples taken at nominal spacings of five metres or 50 m for infill holes, which is meant to be representative of the interval or of a particular rock unit. |

| • |

Composite samples in the Devonian and Athabasca sandstone units where one-centimetre long pieces are taken and spaced throughout sample intervals ranging from one metre to 10 m long. |

Sampling, Analysis and Data Verification

Sample Preparation Methods

On-site sample preparation consists of geological technicians splitting cores under the supervision of geologists. One half of the core is placed in plastic sample bags pre-marked with the sample number, along with a sample number tag. The other half is returned to the core box and stored at the core storage area located near the logging facility on the project site. The bags containing the split samples are then placed in lidded buckets to be transported by NexGen personnel to SRC Geoanalytical Laboratories (“SRC”) in Saskatoon, Saskatchewan.

NexGen personnel perform full core bulk density measurements using standard laboratory techniques. In mineralized zones, average bulk density is measured from samples at 2.5 m intervals, where possible (i.e., approximately 20% of all mineralized samples). In order for density to be correlated with uranium grades across the data set, each density sample directly correlates with a sample sent to SRC for assay.

Samples are also collected for clay mineral identification using infrared spectroscopy in areas of clay alteration. Samples are typically collected at five-metre intervals. and consist of centimetre-long pieces of core selected by a geologist.

Security

As each hole is being drilled, drilling contractor personnel place the core in wooden boxes at the drill site and seal core boxes with screwed-on wooden lids. Core is then delivered to the Project core processing facility by the contractor twice daily. Only the contractor and NexGen geological staff are authorized to be at drill sites and in the core processing facility. After logging, sampling, and shipment preparation, samples are transported directly from the project site to SRC by NexGen staff.

SRC places a large emphasis on confidentiality and data security. Appropriate steps are taken to protect the integrity of samples at all processing stages. Access to the SRC premises is restricted by an electronic security system and patrolled by security guards 24 hours a day.

After the completion of analyses, data is sent securely via electronic transmission to NexGen. These results are provided as a series of PDFs and an Excel spreadsheet.

14

Assaying and Analytical Procedures

SRC crushes each sample until 60% is capable of passing -10 mesh. It is then riffle-split to a 200 g sample, with the remainder retained as coarse reject. The 200 g sample is then milled to 90% passing -140 mesh.

All samples are analyzed at SRC by ICP-OES or ICP-MS for 64 elements including uranium. Samples with low radioactivity are analyzed using ICP-MS. Samples with anomalous radioactivity are analyzed using ICP-OES. Partial and total digestion runs are completed for most samples. For partial digestion, an aliquot of each sample is digested in HNO3/HCl for one hour at 95 °C, and then diluted using de-ionized water. For the total digestion, an aliquot of each sample is heated in a mixture of HF/HNO3/HClO4 until completely dried, and the residue dissolved in dilute HNO3.

For uranium assays, an aliquot of sample pulp is completely digested in concentrated HCl:HNO3, and then dissolved in dilute HNO3 before being analyzed using ICP-OES. For boron, an aliquot of pulp is fused in a mixture of NaO2/NaCO3 in a muffle oven. The fused melt is dissolved in de-ionized water before being analyzed using ICP-OES.

Selected samples are also analyzed for gold, platinum, and palladium using traditional fire assay methods.

Quality Control Measures

NexGen’s quality assurance and quality control (QA/QC) program includes the following.

| • |

Standard reference materials (SRM) to determine accuracy. |

| • |

Duplicate samples to determine precision / repeatability. |

| • |

Blank samples to screen for cross-contamination between samples during preparation and analyses. |

The QA/QC program used at the Arrow Deposit included the insertion of SRMs, blanks, and duplicates into the sample stream at the frequency summarized in the table below.

Laboratory QA/QC Protocols

| QA/QC Type |

Insertion Frequency |

Acceptance Criteria | ||||

| Blank |

1 in 50 | Assay > 10% detection limit | ||||

| Field Duplicate |

1 in 50 | Relative Difference £ ±20% | ||||

| SRM |

1 in 50 | 95% of samples £ ±2 Std. Dev £ 1% of samples ³ ±3 Std. Dev | ||||

Results from the QA/QC samples are continually tracked by NexGen as certificates for each sample batch are received. If QA/QC samples of a sample batch pass within acceptable limits, the results of the sample batch are imported into the master database.

Data Verification Procedures

The QP’s data verification steps included site visits during which RPA personnel reviewed core handling, logging, sample preparation and analytical protocols, density measurement system, and storage procedures. The QP also reviewed the Leapfrog model parameters and geological interpretation, reviewed how drill hole collar locations are defined, inspected the use of directional drilling methods, observed the data management system, obtained a copy of the master database, and obtained SRC laboratory certificates for all drilling assays.

A review of the database indicated no significant issues. A separate review of the assay table determined minimal errors, and all are most likely due to rounding. Limitations were not placed on the QP’s data verification process.

Mineral Processing and Metallurgical Testing

NexGen conducted a metallurgical test program in 2018, which included a bench test program, a pilot plant, and paste backfill testing. Test work samples comprised three composite samples, consisting of low grade (“LG”), medium grade (“MG”), and high grade (“HG”) material, and ten samples of localized deposit areas.

15

Completed bench test work included the following.

| • |

Quantitative evaluation of materials by scanning electron microscopy (QEMSCAN), potential acid generation |

| • |

SAGDesignTM and Bond ball mill index |

| • |

Batch leach |

| • |

Optimization leaching |

| • |

Confirmation and variability |

| • |

Settling |

| • |

Solvent extraction (SX) |

| • |

Separating funnel shakeout |

| • |

Stripping |

| • |

Gypsum precipitation |

| • |

YC precipitation |

| • |

Preliminary sulfide flotation |

| • |

Diagnostic gravity separation |

Additionally, two pilot leaching tests were performed in 2018 using two different feed samples.

In 2019, a series of tests were carried out to advance the process design. These tests were carried out at the SRC facilities and included the following.

| • |

Bench-scale testing to recover uranium from gypsum (June 2019). |

| • |

Trade-off study / test work of dewatering and washing technologies using belt filters (July 2019). |

| • |

Trade-off study / test work of dewatering and washing technologies using centrifuges (August 2019). |

An advanced phase of the paste backfill testing program was conducted in 2019 using drill core samples from the pilot plant program. Geotechnical and geochemical evaluations were performed to validate the mine / mill design, and results will be used in for the Project’s EA. Test work included investigating the following.

| • |

Particle size distribution |

| • |

Whole rock analysis |

| • |

Mineralogy |

| • |

Static yield stress |

| • |

Rheology |

| • |

Transportable moisture limit |

| • |

Uniaxial compressive strength (UCS) |

| • |

Process water analysis |

| • |

Tailings and kinetic tests |

The Rook I FS Technical Report assumes a metallurgical steady state uranium recovery of 97.6%. This value was determined based on the results of pilot plant test work, and by compiling the performance of unit operation uranium recoveries. Pilot leach testing results indicated uranium extractions of 99.3%. The washing efficiency in the counter current decantation was greater than 99.6%. All other unit operations in the pilot testing had uranium recoveries of greater than 99.6%.

The QEMSCAN analysis identified that there were no primary molybdenum-bearing minerals present. However, molybdenum did occur in chalcopyrite and galena solid solutions. Similarly, there were no arsenic-bearing minerals identified.

Mineral Resource and Mineral Reserve Estimates

Mineral Resource Estimation

The Mineral Resource estimate for the Project was based on results from 521 diamond drill holes. It was reported using a $50/lb U3O8 price, at a cut-off grade of 0.25% U3O8.

16

| • |

Measured Mineral Resources total 2.18 million tonnes (“Mt”) at an average grade of 4.35% U3O8, for a total of 209.6 million pounds (“Mlb”) of U3O8. |

| • |

Indicated Mineral Resources total 1.57 Mt at an average grade of 1.36% U3O8, for a total of 47.1 Mlb U3O8. |

| • |

Inferred Mineral Resources total 4.40 Mt at an average grade of 0.83% U3O8, for a total of 80.7 Mlb U3O8. |

The effective date of the Mineral Resource estimate is July 19, 2019. From July 19, 2019 to the effective date of the Rook I FS Technical Report, no additional exploration drilling has occurred at the Arrow Deposit. In the QP’s opinion, as noted in the Rook I FS Technical Report, the Mineral Resource estimate remains current as of the effective date of Rook I FS Technical Report. Estimated block model grades are based on chemical assays only. The Mineral Resources were estimated by NexGen and audited by RPA. Mineral Resources are inclusive of Mineral Reserves. The QP noted, per the Rook I FS Technical Report, that the deposit is open in many directions.

The Arrow Deposit Mineral Resource estimate is based on the results of surface diamond drilling campaigns conducted from 2014–2019. The Mineral Resources of the Arrow Deposit are classified as Measured, Indicated, and Inferred based on drill hole spacing and apparent continuity of mineralization, as summarized in the following table:

Mineral Resource Estimate – 19 July 2019

| Classification |

Zone | Tonnage (t) |

Grade (% U3O8) |

Contained Metal (lb U3O8) |

||||||||||

| Measured |

A2-LG | 920,000 | 0.79 | 16,000,000 | ||||||||||

| A2-HG | 441,000 | 16.65 | 161,900,000 | |||||||||||

| A3-LG | 821,000 | 1.75 | 31,700,000 | |||||||||||

|

|

|

|

|

|||||||||||

| Measured Total |

— | 2,183,000 | 4.35 | 209,600,000 | ||||||||||

|

|

|

|

|

|||||||||||

| Indicated |

A2-LG | 700,000 | 0.79 | 12,200,000 | ||||||||||

| A2-HG | 56,000 | 9.92 | 12,300,000 | |||||||||||

| A3-LG | 815,000 | 1.26 | 22,700,000 | |||||||||||

|

|

|

|

|

|||||||||||

| Indicated Total |

— | 1,572,000 | 1.36 | 47,100,000 | ||||||||||

|

|

|

|

|

|||||||||||

| Measured + Indicated |

A2-LG | 1,620,000 | 0.79 | 28,100,000 | ||||||||||

| A2-HG | 497,000 | 15.90 | 174,200,000 | |||||||||||

| A3-LG | 1,637,000 | 1.51 | 54,400,000 | |||||||||||

|

|

|

|

|

|||||||||||

| Measured + Indicated Total |

— | 3,754,000 | 3.10 | 256,700,000 | ||||||||||

|

|

|

|

|

|||||||||||

| Inferred |

A1 | 1,557,000 | 0.69 | 23,700,000 | ||||||||||

| A2-LG | 863,000 | 0.61 | 11,500,000 | |||||||||||

| A2-HG | 3,000 | 10.95 | 600,000 | |||||||||||

| A3-LG | 1,207,000 | 1.12 | 29,800,000 | |||||||||||

| A4 | 769,000 | 0.89 | 15,000,000 | |||||||||||

|

|

|

|

|

|||||||||||

| Inferred Total |

— | 4,399,000 | 0.83 | 80,700,000 | ||||||||||

|

|

|

|

|

|||||||||||

Notes:

| 1. |

CIM (2014) definitions were followed for Mineral Resources. |

| 2. |

Mineral Resources are reported at a cut-off grade of 0.25% U3O8. |

| 3. |

Mineral Resources are estimated using a long-term uranium price of US$50/lb U3O8 and estimated mining costs. |

| 4. |

A minimum thickness of one metre was used. |

| 5. |

Tonnes are based on bulk density weighting. |

| 6. |

Mineral Resources are inclusive of Mineral Reserves. |

| 7. |

Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. |

| 8. |

Numbers may not sum due to rounding. |

| 9. |

HG = High Grade, LG = Low Grade. |

17

Per the Rook I FS Technical Report, the QP reviewed the geology, structure, and mineralization of the Arrow Deposit based on the results of 566 diamond drill holes. The QP also audited three-dimensional (“3D”) wireframe models developed by NexGen, which represent 0.05% U3O8 grade envelopes with a minimum thickness of one metre.

Of the 566 holes completed, 45 drill holes were drilled on the South Arrow Discovery and were not used for the purposes of the Mineral Resource estimate. The wireframe models representing the Arrow Deposit mineralized zones are intersected in 418 of 566 drill holes. The updated 2019 Mineral Resource estimate does not account for HG domains within A3, which were accounted for in the previous 2017 Mineral Resource estimates. The A3-HG domains were found to be of relatively LG, with average grades just above the HG modelling threshold of 5% U3O8; after the 2019 infill drilling, the variability of grades was better handled with ordinary kriging (“OK”), where the locally varying mean, in conjunction with the density of data, counters grade smearing.

Based on 5,850 dry bulk density determinations for the Arrow Deposit, NexGen developed a formula that relates bulk density to grade. This formula was used to assign a density value to each assay. Bulk density values were then used to weight the grade estimation and convert volume to tonnage.

High grade values were capped, and their influence was further restricted during the block estimation process. High grade outliers were capped at 1%, 2%, 3%, 4%, 5%, 6%, 8%, 10%, 15%, 25%, and 30% U3O8, depending on the domain. This resulted in 428 capped assay values. No outlier assay values were identified in the HG domains. Therefore, no capping was applied to the assays as each HG domain dataset was determined to be stationary and appropriate for interpolation, with the exclusion of the A2-HG8, which was capped at 30% U3O8.

Variable density and grade multiplied by density (“GxD”) were interpolated using OK in the A2-HG domains (excluding A2-HG6 and A2-HG8), the A2-LG domain that envelopes a HG domain, and two large A3-LG domains (301 and 312). Inverse distance squared (ID2) was used on all remaining mineralized domains. Estimates used a minimum of one to three composites per block estimate, to a maximum of 50 composites per block estimate. The majority of the domains used a maximum of two composites per drill hole.

Sample selection criteria were based on sensitivity testing that compared the estimated block means of each domain to the composited mean. Unsampled intervals and samples below the detection limit within the domains were assigned a grade of zero and considered to be internal dilution. Hard boundaries were used to limit the use of composites between domains. Block grade was derived by dividing the interpolated GxD value by the interpolated density value for each block.

The block model was validated by swath plots, volumetric comparison, visual inspection, and statistical comparison. The average block grade at zero cut-off was compared to the average of the composited assay data to ensure that there was no global bias.

Per the Rook I FS Technical Report, the QP was not aware of any environmental, permitting, legal, title, taxation, socio-economic, marketing, political, or other relevant factors that could materially affect the Mineral Resource estimate other than what has been described in the Rook I FS Technical Report.

Mineral Reserve Estimation

The vertical extent of the Mineral Reserves extends from approximately 320 m below surface to 680 m below surface.

Based on the cut-off grade assessment, an incremental cut-off grade of 0.30% U3O8 was applied as the input parameter for designing stopes. This cut-off grade was applied at the level of stoping solids, after inclusion of waste and fill dilution. The Mineral Reserves are limited to the A2 and A3 veins within the Arrow Deposit.

A nominal amount of material between 0.03% U3O8 (the regulatory limit between benign waste and mineralized material) and 0.26% U3O8 (which is uneconomic to process) has been included in the mine plan, in addition to 88,100 tonnes of waste used to commission the mill and to keep the mill feed grade below 5.0%.

The project assumes that both transverse stope and longitudinal retreat stope mining methods would be used. The assumed mining rate is nominally 1,300 tonnes per day (t/d). A total planned dilution of approximately 24% is projected for the longhole stopes. The unplanned or overbreak dilution is estimated at 12% total.

18

Fill dilution will occur when mining next to fill walls and mucking on fill floors; a 4% fill dilution was applied to secondary transverse stopes only, and a 1% fill dilution was applied to secondary longitudinal stopes. Extraction (mining recovery) is estimated at a combined 95.5% for longhole mining and ore development.

The Mineral Reserve estimate is reported using the 2014 CIM Definition Standards. The effective date of the Mineral Reserve estimate is 21 January 2021. The table below summarizes Mineral Reserves based on a $50/lb uranium price at a cut-off grade of 0.30% U3O8.

Factors that may affect the Mineral Reserve estimate include the following.

| • |

Commodity price assumptions. |

| • |

Changes in local interpretations of mineralization geometry and continuity of mineralization zones. |

| • |

Changes to geotechnical, hydrogeological, and metallurgical recovery assumptions. |

| • |

Input factors used to assess stope dilution. |

| • |

Assumptions that facilities such as the Underground Tailings Management Facility (UGTMF) can be permitted. |

| • |

Assumptions regarding social, permitting, and environmental conditions. |

| • |

Additional infill or step out drilling. |

Mineral Reserve Estimate

| Classification |

Recovered Ore Tonnes (thousands) | U3O8 Grade (%) | U3O8 lb (millions) | |||||||||

| Proven |

0 | 0 | 0 | |||||||||

| Probable |

4,575 | 2.37 | % | 239.6 | ||||||||

|

|

|

|

|

|

|

|||||||

| Total |

4,575 | 2.37 | % | 239.6 | ||||||||

|

|

|

|

|

|

|

|||||||

Notes:

| 1. |

CIM definitions were followed for Mineral Reserves. |

| 2. |

Mineral Reserves are reported with an effective date of 21 January 2021. |

| 3. |

Mineral Reserves include transverse and longitudinal stopes, ore development, marginal ore, special waste, and a nominal amount of waste required for mill ramp-up and grade control. |

| 4. |

Stopes were estimated at a cut-off grade of 0.30% U3O8. |

| 5. |

Marginal ore is material between 0.26% U3O8 and 0.30% U3O8 that must be extracted to access mining areas. |

| 6. |

Special waste in material between 0.03% and 0.26% U3O8 that must be extracted to access mining areas. 0.03% U3O8 is the limit for what is considered benign waste and material that must be treated and stockpiled in an engineered facility. |

| 7. |

Mineral Reserves are estimated using a long-term metal price of US$50/lb U3O8, and a 0.75 US$/C$ exchange rate (C$1.00 = US$0.75). The cost to ship the YC product to a refinery is considered to be included in the metal price. |

| 8. |

A minimum mining width of 3.0 m was applied for all longhole stopes. |

| 9. |

Mineral Reserves are estimated using a combined underground (UG) mining recovery of 95.5% and total dilution (planned and unplanned) of 33.8%. |

| 10. |

The density varies according to the U3O8 grade in the block model. Waste density is 2.464 t/m3. |

| 11. |

Numbers may not add due to rounding. |

Mining Operations

Access to the underground (“UG”) Arrow Deposit will be via two shafts, an 8.0 m diameter Production Shaft (intake air) and a 5.5 m diameter Exhaust Shaft (second egress). Access to the working will be from the Production Shaft with stations on 500 and 590 Levels. Levels will be spaced 30 m apart UG and will be connected via an internal ramp.

Production will be via a conventional longhole mining. The longhole mining methods and mine design discussed in this section were chosen to optimize safety performance, reduce worker exposure to physical hazards and radiation, maximize Mineral Resource extraction, and increase operational flexibility and productivity by achieving simultaneous production from multiple mining fronts.

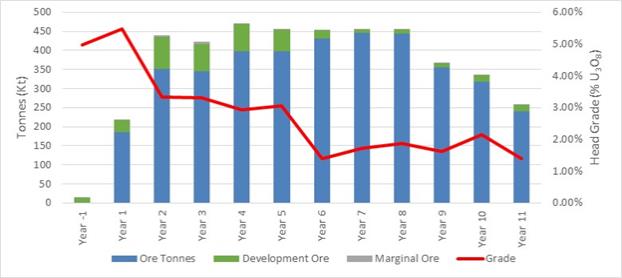

The estimated mill capacity is targeted at 1,300 tonnes per day (t/d) of ore. To realize this target, the mine plan will include longhole production on four separate mining blocks, with multiple stopes available per block. The estimated production rates of the stopes range from 250 t/d to 300 t/d. This will require approximately five stopes to be active to achieve 1,300 t/d, which will be feasible with that many stopes available. The grades will vary by mining block; this will facilitate the ability to provide a more consistent grade to the process plant with four active blocks. Production profile and head grade from UG are shown in the following figure.

19

Underground Production Profile with Grade (U3O8)

The tailings produced by the mill will be returned UG as either cemented paste backfill for the production stopes or as cemented paste tailings into stopes that will be created for this purpose. The UGTMF will be located on the north side of the deposit and will consist of approximately 97 waste stopes and related development.

The mining method will make use of mechanized equipment and conventional processes widely employed in the global mining industry.

Shaft sinking will occur through a variety of stable and unstable strata, including water saturated overburden, Devonian Sandstone, Cretaceous Shales and Athabasca Sandstones, and finally into the basement rocks. These domains consist of poor to very poor-quality rock masses; however, once these have been temporarily artificially frozen for shaft construction, these are not anticipated to be problematic. A 600 mm hydrostatic lining is considered to be the minimum practicable thickness for lining against a freeze wall. As such, a 600 mm liner will be installed to 175 m in the Production Shaft and 217 m in the Exhaust Shaft. To prevent migration of water down the back of the liner and into the shaft, a grout seal will be placed at the base of the hydrostatic pressure resisting liner.

The minimum distance between the shallowest mine excavation and the unconformity is approximately 250 m. This drastically reduces the risks associated with the crown pillar and therefore has not been investigated in detail.

The processing of uranium ore will generate several forms of waste. A portion of the waste will be used for paste backfill. The remainder will be permanently stored in purpose-built excavations / chambers in the footwall (“FW”) of the deposit, in an area that is interpreted to have relatively minimal alteration or fault or shear structures. The Rook I FS Technical Report proposes the UGTMF will consist of 97 waste stopes, each approximately 25 m wide by 25 m long by 60 m high. The excavations will be arranged in a regular pattern with a minimum of 15 m pillars between openings. The first waste stopes will be located on the 500 Level and the top of the excavations will be approximately 250 m below the unconformity.

Backfill of mined stopes is planned to use a combination of process waste, cement, potential fillers (such as fly ash), and water. The creation of paste tailings is directly proportional to the amount of material processed through the plant. For each tonne of processed material, 0.82 m3 of paste tailings will be created, along with 0.32 m3 of combined waste precipitates. Based on a steady-state production rate, the total fill produced will be nominally 373,100 m3 per year for paste tailings, and 145,600 m3 per year for combined precipitates. Tailings not used for paste backfill will be stored in the UGTMF.

20

The Arrow Deposit is planned to be accessed via two shafts. Both shafts will be located in the FW of the deposit. The first shaft will be used as a Production Shaft, and for transportation of personnel and materials into the mine and will be sunk to a depth of 650 m below surface. The Production Shaft will have divided compartments so that fresh air that comes into contact with ore being skipped to surface will be immediately exhausted within the mine. The Production Shaft will have a permanent headframe and hoisting house. The second shaft will be used as an exhaust ventilation shaft. The Exhaust Shaft will be sunk to a depth of 533 m below surface and will be equipped with a secondary emergency escapeway system.

Thirteen levels, spaced at 30 m intervals sill to sill, are planned for the Arrow Deposit. Lateral development will be concentrated in the first four years to establish the production areas, the UGTMF areas, UG infrastructure and the permanent ventilation system. In addition to the lateral development, there will be an internal ramp system that will connect all mining levels.

Mine dewatering will be completed using a clean water system on the 500 Level. The 500 Level sumps will be capable of collecting and removing all strata and operational process water from the mine infrastructure, ongoing development, operational stopes, shaft inflow, and pastefill seepage. Run-of-mine water will decant through membranes; the clean water will be pumped to surface while the residual solids and water will be collected and placed into the ore handling system.

Transverse stope mining will be used in areas of wider stopes (generally greater than 12 m), while longitudinal retreat stope mining will be used in areas of thinner stope widths. Transverse longhole mining will be completed using primary and secondary stoping sequences to avoid leaving pillars. The order in which stopes are extracted will be largely driven by the head grade, with the overarching goal of processing 30 Mlb of U3O8 annually. Primary stopes will be recovered first, followed by primary stopes on two vertical levels above, and then secondary stopes on the original level.

Two separate vertical mining blocks (the Upper Block and Lower Block) will be established, and within each vertical block, the A2 and A3 veins can be mined independently. Mining activities will commence from both the Upper Block and Lower Block, and in the A2 and A3 veins, for a total of four separate production areas. A fifth production block will be created below the 620 Level.

The ore handling system will begin with load-haul-dump (“LHD”) units loading muck in transverse and longitudinal retreat stopes. The LHDs will tram muck to centrally located ore and waste passes. The bottom of the ore pass will be located on 590 Level, where a control system will direct ore on to a grizzly equipped with a remotely operated rock breaker. The grizzly openings will be 400 mm by 450 mm. The sized ore will be loaded onto a conveyor on the 620 Level and hauled to the shaft for skip loading.

There will be two separate waste handling systems. The waste from the UGTMF will report to a rockbreaker on the 500 Level, near the Production Shaft. The sized waste rock will be loaded onto the 620 Level conveyor and hauled to the shaft for skip loading. The second waste handling system will be located near the ore body and will handle all remaining lateral development. The system will be identical to the ore handing system.

The ventilation system is designed as a predominately negative or “pull” system. Fresh air will be distributed throughout the mine from the 500 and 590 Level shaft stations from the Production Shaft and internal ramp. The auxiliary ventilation system will utilize both flow-through and extraction ventilation to exhaust contaminated air from localized areas to return air drifts and raises.

The Rook I mine will be developed using a high degree of equipment mechanization. Each of the main pieces of equipment will have remote operating capability, and in some cases will be autonomous to reduce radiation exposure. A raisebore machine will be used for development of ore and waste passes, and internal ventilation raises.

The mobile equipment UG will be captive in the mine. The maintenance facility will be equipped to repair and service all captive equipment for the life of the operation.

21

Processing and Recovery Operations

The process plant design developed by Wood for the Project is based on the metallurgical testing and on the latest unit processes successfully used in uranium process plants across the world, including plants in northern Saskatchewan. The design of tailings preparation has been improved to facilitate a more reliable tailings deposition strategy through the paste plant. The process plant will consist of the following.

| • |

Ore sorting |

| • |

Grinding |

| • |

Leaching |

| • |

Liquid-solid separation via counter current decantation and clarification |

| • |

SX |

| • |

Gypsum precipitation and washing |

| • |

YC precipitation and washing |

| • |

YC drying, calcining and packaging |

| • |

Tailings preparation and paste tailings plant |

| • |

Effluent treatment |

Plant throughput will be 1,300 t/d and design production will be 30 Mlb U3O8 per annum. It is expected that a 3-month ramp-up period will be required to reach design throughput.

Water from the settling pond and fresh water from Patterson Lake will be fed to the process plant to provide the process requirements. The amount of water recycled from the settling pond has been further optimized to reduce the amount of fresh water required by using settling pond water for counter current decantation (“CCD”) wash water and using belt filter filtrate for paste process water.

The major reagents required will include sulphur, sulphuric acid, unslaked lime, hydrogen peroxide, flocculant, kerosene, tertiary amine, isodecanol, sodium carbonate, magnesia, barium chloride and ferric sulphate.

The process plant will require approximately 7.4 megawatts (MW) of power to operate at full capacity. The paste plant will require approximately 0.9 MW of power.

Infrastructure, Permitting and Compliance Activities

Project Infrastructure

The key infrastructure contemplated for the Project includes the following.

| • |

UG mine with two vertical shafts. |

| • |

UG infrastructure, including material handling systems, maintenance facilities, fuel bay, explosives magazine, ventilation, paste backfill and paste tailings distribution system, electrical and communications facilities, UG water supply, dewatering facilities. |

| • |

UGTMF. |

| • |

Surface support infrastructure for the mine, including headframe and hoist facilities, surface explosives magazine, and ventilation fans. |

| • |

Surface support infrastructure for the mill, including process plant, SX plant, effluent treatment plant, and acid plant. |

| • |

Site support infrastructure, including accommodation camp, Liquefied Natural Gas (LNG) facilities, LNG power plant, mine and mill dry facilities, analytical and metallurgical laboratory and maintenance, warehouse and security buildings. |

| • |

Surface ore storage stockpile facility. |

| • |

Waste rock storage facilities for potentially acid generating (PAG), non-potentially acid generating (NPAG) and special waste materials. |

| • |