UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2019

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____________ to _____________

Commission File Number: 001-38120

XYNOMIC PHARMACEUTICALS HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 83-4696467 | |

| (State or other jurisdiction

of incorporation or organization) |

(I.R.S. Employer Identification No.) |

Suite 3306, K. Wah Centre, 1010 Middle Huaihai Road, Shanghai, China |

200031 | |

| (Address of principal executive offices) | (Zip Code) |

+86 21 54180212

(Registrant’s telephone number, including area code)

Bison Capital Acquisition Corp.

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| N/A |

As of August 8, 2019, 46,273,846 shares of common stock, par value $0.0001 per share, were issued and outstanding.

TABLE OF CONTENTS

| Part I – FINANCIAL INFORMATION | ||

| Item 1. | Financial Statements | 1 |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 21 |

| Item 3. | Quantitative and Qualitative Disclosures about Market Risk | 34 |

| Item 4. | Controls and Procedures | 34 |

| Part II – OTHER INFORMATION | ||

| Item 1. | Legal Proceedings | 35 |

| Item 1A. | Risk Factors | 35 |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 35 |

| Item 3. | Defaults Upon Senior Securities | 35 |

| Item 4. | Mine Safety Disclosures | 35 |

| Item 5. | Other Information | 35 |

| Item 6. | Exhibits | 36 |

| SIGNATURES | 37 | |

| i |

CAUTIONARY NOTE CONCERNING FORWARD-LOOKING STATEMENTS

This Quarterly Report includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act that are not historical facts, and involve risks and uncertainties that could cause actual results to differ materially from those expected and projected. All statements, other than statements of historical fact included in this Form 10-Q including, without limitation, statements in this “Management’s Discussion and Analysis of Financial Condition and Results of Operations” regarding the Company’s financial position, business strategy and the plans and objectives of management for future operations, are forward-looking statements. Words such as “expect,” “believe,” “anticipate,” “intend,” “estimate,” “seek” and variations and similar words and expressions are intended to identify such forward-looking statements. Such forward-looking statements relate to future events or future performance, but reflect management’s current beliefs, based on information currently available. A number of factors could cause actual events, performance or results to differ materially from the events, performance and results discussed in the forward-looking statements. For information identifying important factors that could cause actual results to differ materially from those anticipated in the forward-looking statements, please refer to the Risk Factors section of the Company’s registration statement on Form S-1 (file No. 333-232598, the “Registration Statement”) filed with the U.S. Securities and Exchange Commission (the “SEC”) on July 11, 2019. The Company’s securities filings can be accessed on the EDGAR section of the SEC’s website at www.sec.gov. Except as expressly required by applicable securities law, the Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise.

| ii |

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements

XYNOMIC PHARMACEUTICALS HOLDINGS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In U.S. dollars, except share data)

| December 31, | June 30, | |||||||

| 2018 | 2019 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash | $ | 4,746,370 | $ | 1,191,944 | ||||

| Prepaid expenses | 277,750 | 155,805 | ||||||

| Total current assets | 5,024,120 | 1,347,749 | ||||||

| Property and equipment, net | 280,730 | 444,796 | ||||||

| Intangible assets, net | 1,937 | 1,450 | ||||||

| Other non-current assets | 155,176 | 219,565 | ||||||

| TOTAL ASSETS | $ | 5,461,963 | $ | 2,013,560 | ||||

| LIABILITIES, MEZZANINE EQUITY AND SHAREHOLDERS’ DEFICIT | ||||||||

| Current liabilities: | ||||||||

| Bank overdraft | $ | 4,954 | $ | 2,035 | ||||

| Accrued expenses and other current liabilities | 14,407,261 | 16,089,078 | ||||||

| Promissory note – related party | - | 404,900 | ||||||

| Amount due to shareholders | 3,233,728 | 552,873 | ||||||

| Total current liabilities | 17,645,943 | 17,048,886 | ||||||

| Total liabilities | 17,645,943 | 17,048,886 | ||||||

| Commitments and Contingencies | ||||||||

| Mezzanine equity: | ||||||||

| Angel Preferred Shares (par value US$0.0001 per share as of December 31, 2018; 23,435,379 and 0 shares authorized, issued and outstanding as of December 31, 2018 and June 30, 2019, respectively. Redemption value of US$580,256 as of December 31, 2018; Liquidation value of US$811,332 as of December 31, 2018) | 580,256 | - | ||||||

| Series A-1 Preferred Shares (par value US$0.0001 per share as of December 31, 2018; 12,147,500 and 0 shares authorized, issued and outstanding as of December 31, 2018 and June 30, 2019, respectively. Redemption value of US$4,905,780 as of December 31, 2018; Liquidation value of US$6,964,223 as of December 31, 2018) | 4,905,780 | - | ||||||

| Series B Preferred Shares (par value US$0.0001 per share as of December 31, 2018; 5,281,101 and 0 shares authorized, 5,281,101 and 0 shares issued and outstanding as of December 31, 2018 and June 30, 2019, respectively. Redemption value of US$2,424,712 as of December 31, 2018; Liquidation value of US$24,335,989 as of December 31, 2018) | 2,424,712 | - | ||||||

| Total mezzanine equity | 7,910,748 | - | ||||||

| Shareholders’ deficit: | ||||||||

| Preferred Stock (par value US$0.0001 per share as of December 31, 2018 and June 30, 2019; 50,000,000 shares authorized, 0 shares issued and outstanding as of December 31, 2018 and June 30, 2019 | - | - | ||||||

| Common stock (par value US$0.0001 per share as of December 31, 2018 and June 30, 2019; 200,000,000 shares authorized, 6,706,068 and 46,273,846 shares issued and outstanding as of December 31, 2018 and June 30, 2019, respectively) | 817 | 4,627 | ||||||

| Additional paid-in capital | 14,169,060 | 36,401,911 | ||||||

| Accumulated other comprehensive income | 58,564 | 77,613 | ||||||

| Accumulated deficit | (34,323,169 | ) | (51,519,477 | ) | ||||

| Total shareholders’ deficit | (20,094,728 | ) | (15,035,326 | ) | ||||

| TOTAL LIABILITIES, MEZZANINE EQUITY AND SHAREHOLDERS’ DEFICIT | $ | 5,461,963 | $ | 2,013,560 | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| 1 |

XYNOMIC PHARMACEUTICALS HOLDINGS, INC.

UNAUDITED CONDENSED CONSOLIDATED statements of COMPREHENSIVE lOSS

(In U.S. dollars, except share data)

| Three Months Ended | Six Months Ended | |||||||||||||||

| June 30, | June 30, | |||||||||||||||

| 2018 | 2019 | 2018 | 2019 | |||||||||||||

| Operating expenses: | ||||||||||||||||

| Research and development | $ | 3,873,804 | $ | 1,567,799 | $ | 4,340,206 | $ | 6,892,109 | ||||||||

| General and administrative | 745,286 | 1,443,731 | 848,761 | 10,222,980 | ||||||||||||

| General and administrative to related parties | 97,638 | 22,500 | 146,691 | 48,408 | ||||||||||||

| Total operating expenses | 4,716,728 | 3,034,030 | 5,335,658 | 17,163,497 | ||||||||||||

| Loss from operations | (4,716,728 | ) | (3,034,030 | ) | (5,335,658 | ) | (17,163,497 | ) | ||||||||

| Other income/(expenses) | ||||||||||||||||

| Investment income | 8,178 | - | 8,178 | - | ||||||||||||

| Interest income | 89 | - | 89 | - | ||||||||||||

| Interest expenses to a related party | - | (17,723 | ) | - | (32,811 | ) | ||||||||||

| Loss from operations before income tax benefit | (4,708,461 | ) | (3,051,753 | ) | (5,327,391 | ) | (17,196,308 | ) | ||||||||

| Income tax | - | - | - | - | ||||||||||||

| Net loss | (4,708,461 | ) | (3,051,753 | ) | (5,327,391 | ) | (17,196,308 | ) | ||||||||

| Accretion to preferred share redemption value | (100,292 | ) | - | (197,608 | ) | (1,697,978 | ) | |||||||||

| Net loss attributable to ordinary shareholders | (4,808,753 | ) | (3,051,753 | ) | (5,524,999 | ) | (18,894,286 | ) | ||||||||

| Other comprehensive income: | ||||||||||||||||

| Foreign currency translation adjustment, net of nil income taxes | - | 56,040 | - | 19,049 | ||||||||||||

| Total other comprehensive income | - | 56,040 | - | 19,049 | ||||||||||||

| Comprehensive loss attributable to ordinary shareholders | $ | (4,808,753 | ) | $ | (2,995,713 | ) | $ | (5,524,999 | ) | $ | (18,875,237 | ) | ||||

| Weighted average ordinary shares outstanding – basic and diluted | (42,860,772 | ) | (44,623,568 | ) | (42,860,772 | ) | (43,747,040 | ) | ||||||||

| Loss per share - basic and diluted | $ | (0.11 | ) | $ | (0.07 | ) | $ | (0.13 | ) | $ | (0.43 | ) | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| 2 |

XYNOMIC PHARMACEUTICALS HOLDINGS, INC.

UNAUDITED CONDENSED CONSOLIDATED CHANGES IN SHAREHOLDERS’ DEFICIT

(In U.S. dollars)

| Ordinary | Additional paid-in | Accumulated other comprehensive | Accumulated | Total Shareholders’ | ||||||||||||||||||||

| Shares | Amount | capital | income | deficit | Deficit | |||||||||||||||||||

| Balance as of December 31, 2018 | 8,165,377 | $ | 817 | $ | 14,169,060 | $ | 58,564 | $ | (34,323,169 | ) | $ | (20,094,728 | ) | |||||||||||

| Redeemable convertible preferred shares redemption value accretion | - | - | (1,697,978 | ) | - | - | (1,697,978 | ) | ||||||||||||||||

| Net loss | - | - | - | - | (14,144,555 | ) | (14,144,555 | ) | ||||||||||||||||

| Foreign currency translation adjustment, net of nil income taxes | - | - | - | (36,991 | ) | - | (36,991 | ) | ||||||||||||||||

| Share-based compensation | - | - | 7,683,282 | - | - | 7,683,282 | ||||||||||||||||||

| Balance as of March 31, 2019 | 8,165,377 | 817 | 20,154,364 | 21,573 | (48,467,724 | ) | (28,290,970 | ) | ||||||||||||||||

| Issuance of backstop common shares | 755,873 | 76 | 7,672,035 | - | - | 7,672,111 | ||||||||||||||||||

| Conversion of promissory notes and Rights to common shares | 55,000 | 5 | 499,995 | - | - | 500,000 | ||||||||||||||||||

| Conversion of Rights to common shares | 646,955 | 64 | (64 | ) | - | - | - | |||||||||||||||||

| Conversion of Preferred Shares to common shares | 34,695,395 | 3,469 | 9,605,257 | - | - | 9,608,726 | ||||||||||||||||||

| Combination with Xynomic Pharmaceuticals, Inc. | 1,955,246 | 196 | (1,499,359 | ) | - | - | (1,499,163 | ) | ||||||||||||||||

| Foreign currency translation adjustment, net of nil income taxes | - | - | - | 56,040 | - | 56,040 | ||||||||||||||||||

| Net loss | - | - | - | - | (3,051,753 | ) | (3,051,753 | ) | ||||||||||||||||

| Share-based compensation | - | - | (30,317 | ) | - | - | (30,317 | ) | ||||||||||||||||

| Balance as of June 30, 2019 | 46,273,846 | $ | 4,627 | $ | 36,401,911 | $ | 77,613 | $ | (51,519,477 | ) | $ | (15,035,326 | ) | |||||||||||

| 3 |

XYNOMIC PHARMACEUTICALS HOLDINGS, INC.

UNAUDITED CONDENSED CONSOLIDATED statements of cash flows

(In U.S. dollars)

| Six Months Ended June 30, | ||||||||

| 2018 | 2019 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

| Net loss | $ | (5,327,391) | $ | (17,196,308) | ||||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Share-based compensation | - | 7,652,965 | ||||||

| Investment income | (8,178 | ) | - | |||||

| Amortization | 203 | 491 | ||||||

| Depreciation | - | 54,593 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Prepaid expenses | (349,272 | ) | 119,758 | |||||

| Prepaid expenses to a shareholder | 93,968 | - | ||||||

| Other non-current assets | - | (64,827 | ) | |||||

| Accrued expenses and other payables | 2,583,442 | 1,500,041 | ||||||

| Amount due to shareholders | - | (48,797 | ) | |||||

| Net cash used in operating activities | (3,007,228 | ) | (7,982,084 | ) | ||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||

| Purchase of short-term investments | (4,447,904 | ) | - | |||||

| Sale of short-term investments | 2,807,199 | - | ||||||

| Purchase of property and equipment | - | (52,340 | ) | |||||

| Cash withdrawn from Trust Account | - | 63,310,884 | ||||||

| Net cash (used in)/provided by investing activities | (1,640,705 | ) | 63,258,544 | |||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||

| Bank overdraft | (33,128 | ) | (2,919 | ) | ||||

| Proceeds from advance from a Series B shareholder | 1,425,959 | - | ||||||

| Repayment of advance from a Series B shareholder | - | (746,811 | ) | |||||

| Proceeds from issuance of convertible notes | 2,500,000 | - | ||||||

| Proceeds from promissory note – related party | - | 444,900 | ||||||

| Proceeds from short-term loan | 906,810 | - | ||||||

| Proceeds from issuance of backstop ordinary shares | - | 4,971,358 | ||||||

| Redemption of ordinary shares | - | (64,070,650 | ) | |||||

| Advance from a shareholder | 536,905 | 543,296 | ||||||

| Net cash provided by/(used in) financing activities | 5,336,546 | (58,860,826 | ) | |||||

| Effect of foreign exchange rate changes on cash | - | 29,940 | ||||||

| NET INCREASE/(DECREASE) IN CASH | 688,613 | (3,554,425 | ) | |||||

| CASH, BEGINNING OF THE PERIOD | 100,344 | 4,746,370 | ||||||

| CASH, END OF THE PERIOD | $ | 788,957 | $ | 1,191,944 | ||||

| SUPPLEMENTAL INFORMATION | ||||||||

| Interest paid | $ | - | $ | - | ||||

| Income tax paid | - | - | ||||||

| Acquisition of property and equipment included in accrued expenses and other liabilities | $ | - | $ | 133,061 | ||||

The accompany notes are an integral part of these unaudited condensed consolidated financial statements.

| 4 |

XYNOMIC PHARMACEUTICALS HOLDINGS, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED JUNE 30, 2018 AND 2019

(In U.S. dollars, except share data)

| 1. | DESCRIPTION OF ORGANIZATION AND BUSINESS OPERATIONS |

Xynomic Pharmaceuticals Holdings, Inc. (formerly known as Bison Capital Acquisition Corp. , the “Company”) was a blank check company incorporated in the British Virgin Islands on October 7, 2016. The Company was formed for the purpose of acquiring, engaging in a share exchange, share reconstruction and amalgamation, purchasing all or substantially all of the assets of, entering into contractual arrangements, or engaging in any other similar business combination with one or more businesses or entities (a “Business Combination”).

All activities through May 14, 2019 relate to the Company’s formation, its initial public offering of 6,037,500 units (the “Initial Public Offering”), the simultaneous sale of 432,062 units (the “Private Units”) in a private placement to the Company’s sponsor, Bison Capital Holding Company Limited (“Bison Capital”) and EarlyBirdCapital, Inc. (“EarlyBirdCapital”) and their designees, identifying a target company for a Business Combination and activities in connection with the proposed acquisition of Xynomic Pharmaceuticals, Inc., a Delaware corporation (“Xynomic Pharma”). On March 3, 2019, the Company received a commitment from Xynomic Pharma that it has agreed to contribute to the Company as a loan $0.02 per month for each public share that is not redeemed by the Company’s shareholders (the “Contribution”) in connection with the Extension Amendment. The amount of the Contribution will not bear interest and will be repayable by the Company to Xynomic Pharma upon consummation of a Business Combination. Xynomic Pharma will have the sole discretion whether to continue extending for additional calendar months until the Combination Period and if Xynomic Pharma determines not to continue extending for additional calendar months, its obligation to make Contributions following such determination will terminate. In May 2019, $16,062 was loaned to the Company and deposited into the Trust Account, which amount is equal to $0.02 for each of the 803,080 shares that were not redeemed.

On May 15, 2019 (the “Effective Time”), each share of Xynomic Pharma’s ordinary shares and preferred shares issued and outstanding prior to the Effective Time was automatically converted into the right to receive, on a pro rata basis, the Closing Consideration Shares (as defined in the Merger Agreement) and the Earnout Shares (as defined in the Merger Agreement), and each option to purchase Xynomic Pharma’s ordinary shares that was outstanding immediately prior to the Effective Time was assumed by the Company and automatically converted into an option to purchase shares of common stock of the Xynomic Pharma. In addition to the Closing Consideration Shares, Xynomic Pharma stockholders received an additional 9,852,216 shares of common stock in aggregate (the “Earnout Shares” and, together with the Closing Consideration Shares, the “Merger Consideration Shares”, such transaction is referred as the “Merger”). As a result, the Company issued 42,860,772 common shares as in aggregate Merger Consideration Shares to shareholders of Xynomic Pharma immediately prior to the Effective Time (the “Sellers”). Pursuant to the Merger Agreement, 1,285,822 shares were deposited into an escrow account (the “Escrow Account”) to serve as security for, and the exclusive source of payment of, the Company’s indemnity rights under the Merger Agreement and any excess of the estimated Closing Merger Consideration over the final Closing Merger Consideration amount determined post-Closing.

| 5 |

Following the Merger, the Xynomic Pharma became a wholly-owned subsidiary of the Company. Xynomic Pharma was incorporated in the United States on August 24, 2016. Xynomic Pharma and its subsidiaries are primarily engaged in in-licensing, developing and commercializing oncology drug candidates in the People’s Republic of China (“PRC”), the United States, and rest of the world. As of the Effective Time, Xynomic Pharma’s subsidiaries are as following:

| Subsidiaries | Date of incorporation | Place of incorporation /establishment | Percentage of economic ownership | |||||

| Xynomic Pharmaceuticals (Nanjing) Co., Ltd.

(“Xynomic Nanjing”) | November 20, 2017 | PRC | 100 | % | ||||

| Xynomic Pharmaceuticals (Shanghai) Co., Ltd. (“Xynomic Shanghai”) | July 31, 2018 | PRC | 100 | % | ||||

| Xynomic Pharmaceuticals (Zhongshan) Co., Ltd. (“Xynomic Zhongshan”) | May 15, 2018 | PRC | 100 | % | ||||

The Merger was accounted for as a “reverse acquisition” since, immediately following the consummation of the Merger (the “Closing”), the Sellers effectively controlled the post-combination Company. For accounting purposes, Xynomic Pharma was deemed to be the accounting acquirer in the Merger and, consequently, the Merger is treated as a recapitalization of Xynomic Pharma (i.e., a capital transaction involving the issuance of shares by the Company for the shares of Xynomic Pharma). Accordingly, the consolidated assets, liabilities and results of operations of Xynomic Pharma became the historical financial statements of the Company and its subsidiaries, and the Company’s assets, liabilities and results of operations were consolidated with Xynomic Pharma beginning at the Closing. No step-up in basis or intangible assets or goodwill were recorded in the Merger.

On May 14, 2019, prior to the Closing, the Company continued out of the British Virgin Islands and domesticated as a Delaware corporation (the “Domestication”). As a result, the Company is no longer a company incorporated in the British Virgin Islands.

At the Closing, pursuant to the Backstop Agreement dated May 1, 2019 entered into by and between the Company and Yinglin Mark Xu, Yinglin Mark Xu, together with his assignee Bison Capital Holding Company Limited, purchased from the Company 755,873 shares of common stock at a price of $10.15 per share for a total consideration of $7,672,111 (the “Backstop Shares” and “Backstop Subscription”). As a result of Backstop Subscription, the Company had at least $7,500,001 of net tangible assets remaining at the Closing after giving effect to the redemption of any Ordinary Shares by the public shareholders in connection with the Merger.

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

| (a) | Basis of Presentation |

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). Certain information and footnote disclosures normally included in financial statements prepared in accordance with U.S. GAAP have been condensed or omitted as permitted by rules and regulations of the United States Securities and Exchange Commission (“SEC”). The condensed consolidated balance sheet as of December 31, 2018 was derived from the audited consolidated financial statements of Xynomic Pharmaceuticals, Inc. and its subsidiaries. The accompanying unaudited condensed consolidated financial statements should be read in conjunction with the consolidated balance sheet of the Company and Xynomic Pharma as of December 31, 2018, and the related consolidated statements of comprehensive loss, changes in equity and cash flows for the year then ended, included in the Company’s Proxy Statement/Prospectus on Form 8-K filed with the SEC on May 15, 2019.

| 6 |

In the opinion of management, all adjustments (which include normal recurring adjustments) necessary to present a fair statement of the financial position as of June 30, 2019, the results of operations for the three and six months ended June 30, 2018 and 2019 and cash flows for the six months ended June 30, 2018 and 2019, have been made.

The preparation of the unaudited condensed consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the unaudited condensed consolidated financial statements and the reported amounts of expenses during the reporting period. Significant accounting estimates include, but not limited to the fair value of the ordinary shares to determine the existence of beneficial conversion feature of the redeemable convertible preferred shares, the fair value of share-based compensation awards, depreciable lives of property and equipment, the recoverability of the carrying amounts of property and equipment and the recoverability of deferred income tax assets. Changes in facts and circumstances may result in revised estimates. Actual results could differ from those estimates, and as such, differences may be material to the unaudited condensed consolidated financial statements.

Principles of Consolidation

The accompanying condensed consolidated financial statements include the accounts of the Company and its wholly-owned subsidiary. All significant intercompany balances and transactions have been eliminated in consolidation

Going Concern

The Company and its subsidiaries Xynomic Pharma, Xynomic Nanjing, Xynomic Shanghai and Xynomic Zhongshan (the “Group”) have not generated any revenues from product sales. Substantial additional financing will be required by the Group to continue to fund its research and development activities. No assurance can be given that any such financing will be available when needed or that the Group’s research and development efforts will be successful.

The Group’s ability to fund operations is based on its ability to attract investors and its ability to borrow funds on reasonable economic terms. Historically, the Group has relied principally on equity financing and shareholder’s borrowings to fund its operations and business development. The Group’s ability to continue as a going concern is dependent on management’s ability to successfully execute its business plan, which includes generating revenues after drug marketing, controlling operating expenses, as well as, continuing to obtain additional equity financing. On April 3, 2018, Xynomic Pharma issued convertible notes to Northern Light Venture Capital V, Ltd., and Bo Tan and received proceeds of US$2,500,000, which were converted into 776,633 Series B Preferred Shares in August 2018. Further in August 2018, Xynomic Pharma raised US$17 million by issuance of 5,281,101 Series B Preferred Shares to certain investors, including the conversion of convertible notes of US$2.5 million. At the Closing of the Merger, 755,873 shares of Backstop Shares were issued for a total consideration of $7,672,111.

On May 15, 2019, the Company received written notice from the staff of the NASDAQ Stock Market LLC (“Nasdaq”) indicating that the Staff had determined to delist its securities from NASDAQ based upon the non-compliance with the requirement of a minimum of 300 round lot holders of and 400 round lot holders of purchase warrants and the requirement of the minimum US$5 million in stockholders’ equity. The Company requested a hearing before the Nasdaq Hearings Panel (the “Panel”), and such request stayed any suspension or delisting action by Nasdaq pending the completion of the hearing process and the expiration of any extension period that may be granted to the Company by the Panel. On July 15, 2019, the Company was notified in writing by the Panel at Nasdaq that they denied the Company’s request for continued listing on Nasdaq based upon the Company’s non-compliance with Nasdaq Listing Rules 5505(a)(3) and 5515(a)(4). As a result, Nasdaq suspended trading in the Company’s securities effective at the open of business on Wednesday, July 17, 2019; and the Company’s shares will subsequently commence trading on the over-the-counter markets. The Company still intends to continue with its compliance plan with the Nasdaq listing requirements and is diligently pursuing courses of action designed to remedy our noncompliance with Nasdaq’s initial listing requirements as set forth above. There can be no assurance, however, that the Company will be able to regain compliance with the mainboard listing requirements.

| 7 |

The Group currently does not have any commitments to obtain additional funds except the potential private placements in details provided in Note 16 herein below and may be unable to obtain sufficient funding in the future on acceptable terms, if at all. If the Group cannot obtain the necessary funding, it will need to delay, scale back or eliminate some or all of its research and development programs to: commercialize potential products or technologies that it might otherwise seek to develop or commercialize independently; consider other various strategic alternatives, including another merger or sale of the Group; or cease operations. If the Group engages in collaborations, it may receive lower consideration upon commercialization of such products than if it had not entered into such arrangements or if it entered into such arrangements at later stages in the product development process.

The Group has prepared its financial statements assuming that it will continue as a going concern, which contemplates realization of assets and the satisfaction of liabilities in the normal course of business. The Group has incurred recurring losses from operations since inception. The Group incurred a net loss of US$3,051,753 and US$17,196,308 for the three and six months ended June 30, 2019, respectively. Further, as of June 30, 2019, the Group had net current liabilities (current assets less current liabilities) of US$15,701,138 and accumulated deficit of US$51,519,477. The Group’s ability to continue as a going concern is dependent on its ability to raise capital to fund its current research and development activities and future business plans. Additionally, volatility in the capital markets and general economic conditions in the United States may be a significant obstacle to raising the required funds. These factors raise substantial doubt about its ability to continue as a going concern. The financial statements included herein do not include any adjustments that might be necessary should the Group be unable to continue as a going concern. If the going concern basis were not appropriate for these financial statements, adjustments would be necessary in the carrying value of assets and liabilities, the reported expenses and the balance sheet classifications used.

Operations of the Group are subject to certain risks and uncertainties including various internal and external factors that will affect whether and when the Group’s product candidates become approved drugs and how significant their market share will be, some of which are outside of the Group’s control. The length of time and cost of developing and commercializing these product candidates and/or failure of them at any stage of the drug approval process will materially affect the Group’s financial condition and future operations.

| (b) | Share-based Compensation |

The Company granted share options to its selected employees and non-employee consultants.

Share-based awards granted to employees with service conditions attached are measured at the grant date fair value and are recognized as an expense using graded vesting method over the requisite service period, which is generally the vesting period. The forfeitures are accounted when they occur.

In June 2018, the FASB issued ASU No. 2018-07, Compensation - Stock Compensation (Topic 718): Improvements to Nonemployee Share-Based Payment Accounting (“ASU 2018-07”). The new guidance largely aligns the accounting for share-based awards issued to employees and nonemployees. Existing guidance for employee awards will apply to non-employee share-based transactions with limited exceptions. The Company adopted this guidance on January 1, 2019.

| 8 |

Share-based awards granted to non-employees are measured at the grant date fair value. When no future services are required to be performed by the non-employee in exchange for an award of equity instruments, the cost of the award is expensed on the grant date.

Option-pricing models are adopted to measure the value of awards at each grant date. The determination of fair value is affected by the share price as well as assumptions relating to a number of complex and subjective variables, including but not limited to the expected share price volatility, actual and projected employee and non-employee share option exercise behavior, risk-free interest rates and expected dividends. The use of the option-pricing model requires extensive actual employee and non-employee exercise behavior data for the relative probability estimation purpose, and a number of complex assumptions.

| (c) | Concentration and risk |

Concentration of suppliers

The following suppliers for the Group’s research and development activities accounted for 10% or more of research and development expenses for the three and six months ended June 30, 2018 and 2019:

| For the Three Months Ended | For the Six Months Ended | |||||||||||||||||||||||||||||||

| June 30, | June 30, | |||||||||||||||||||||||||||||||

| 2018 | 2019 | 2018 | 2019 | |||||||||||||||||||||||||||||

| US$ | % | US$ | % | US$ | % | US$ | % | |||||||||||||||||||||||||

| Supplier A | 475,000 | 12 | % | (2,531,472 | )(1) | (162 | )% | 475,000 | 11 | % | * | * | ||||||||||||||||||||

| Supplier B | * | * | 679,436 | 43 | % | * | * | 1,358,361 | 20 | % | ||||||||||||||||||||||

| Supplier C | 2,767,441 | 71 | % | 936,542 | 60 | % | 2,767,441 | 64 | % | 1,299,032 | 19 | % | ||||||||||||||||||||

| Supplier D | * | * | 1,225,569 | 78 | % | * | * | 1,225,569 | 18 | % | ||||||||||||||||||||||

| Supplier E | * | * | 183,694 | 12 | % | * | * | * | * | |||||||||||||||||||||||

| * | Represents less than 10% of research and development expenses for the three and six months ended June 30, 2018 and 2019. |

| (1) | Supplier A offered $3.57 million credit to offset previously issued invoices to the Company during the three months ended June 30, 2019. |

| (d) | Recent accounting pronouncements |

Management does not believe that any recently issued, but not yet effective, accounting pronouncements, if currently adopted, would have a material effect on the Company’s condensed consolidated financial statements.

| 9 |

| 3. | CASH |

The Company’s cash is deposited in financial institutions at below locations:

| December 31, 2018 | June 30, 2019 | |||||||

| Financial institutions in the mainland of the PRC | ||||||||

| —Denominated in RMB | $ | 523 | $ | 61,795 | ||||

| Financial institutions in the United States | ||||||||

| —Denominated in USD | $ | 4,745,847 | $ | 1,130,149 | ||||

| Total cash balances held at financial institutions | $ | 4,746,370 | $ | 1,191,944 | ||||

| 4. | INCOME TAXES |

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| 2018 | 2019 | 2018 | 2019 | |||||||||||||

| Loss before income taxes | $ | (4,708,461 | ) | $ | (3,051,753 | ) | $ | (5,327,391 | ) | $ | (17,196,308 | ) | ||||

| Income tax expenses | - | - | - | - | ||||||||||||

| Effective income tax rate | 0 | % | 0 | % | 0 | % | 0 | % | ||||||||

The effective income tax rates for the three and six months ended June 30, 2018 and 2019 were 0% and 0%, respectively. The effective income tax rate for the three and six months ended June 30, 2018 and 2019 differs from the U.S. Federal statutory corporate income tax rate of 21% is primarily due to the increase in valuation allowance.

| 5. | PREPAID EXPENSES |

Prepaid expenses consist of the following:

| December 31, 2018 | June 30, 2019 | |||||||

| Prepaid research and development expenses | $ | 207,988 | $ | 62,980 | ||||

| Prepaid rental expenses | 66,371 | 66,709 | ||||||

| Prepaid health insurance | - | 20,658 | ||||||

| Others | 3,391 | 5,457 | ||||||

| Total prepaid expenses | $ | 277,750 | $ | 155,805 | ||||

| 6. | PROPERTY AND EQUIPMENT, NET |

December 31, 2018 | June 30, 2019 | |||||||

| Leasehold improvement | $ | 276,839 | $ | 289,470 | ||||

| Lab equipment | - | 195,586 | ||||||

| Electronic equipment | 4,379 | 14,153 | ||||||

| Property and equipment | 281,218 | 499,209 | ||||||

| Less: accumulated depreciation | (488 | ) | (54,413 | ) | ||||

| Property and equipment, net | $ | 280,730 | $ | 444,796 | ||||

| 10 |

The depreciation expense for property and equipment was nil and US$30,612 for the three months ended June 30, 2018 and 2019, respectively. The depreciation expense for property and equipment was nil and US$54,593 for the six months ended June 30, 2018 and 2019, respectively.

| 7. | OTHER NON-CURRENT ASSETS |

Other non-current assets consist of the following:

December 31, 2018 | June 30, 2019 | |||||||

| VAT input tax | $ | 52,762 | $ | 86,735 | ||||

| Prepaid insurance | 93,075 | 124,076 | ||||||

| Deposits | 9,339 | 8,754 | ||||||

| Total other non-current assets | $ | 155,176 | $ | 219,565 | ||||

| 8. | ACCRUED EXPENSES AND OTHER CURRENT LIABILITIES |

Accrued expenses and other current liabilities consist of the following:

December 31, 2018 | June 30, 2019 | |||||||

| Research and development expense-Contract Research Organizations | $ | 10,304,750 | $ | 10,288,625 | ||||

| Research and development expense-Contract Manufacture Organizations | 1,874,956 | 3,125,901 | ||||||

| License fee payable | 1,000,000 | 1,000,000 | ||||||

| Professional fee | 824,360 | 1,010,112 | ||||||

| Payroll and social insurance | 147,692 | 109,599 | ||||||

| Payables for equipment | - | 140,465 | ||||||

| Payable for leasehold improvement | 110,736 | 105,832 | ||||||

| Others | 144,767 | 308,544 | ||||||

| Total accrued expenses and other current liabilities | $ | 14,407,261 | $ | 16,089,078 | ||||

| 9. | REDEEMABLE CONVERTIBLE PREFERRED SHARES |

Redeemable convertible preferred shares were issued by Xynomic Pharma before the Closing and consist of the following:

| Angel Preferred Shares | Series A-1 Preferred Shares | Series B Preferred Shares | ||||||||||

| Balance as of December 31, 2018 | $ | 580,256 | $ | 4,905,780 | $ | 2,424,712 | ||||||

| Redemption value accretion | 11,117 | 93,984 | 1,592,877 | |||||||||

| Conversion to common shares | (591,373 | ) | (4,999,764 | ) | (4,017,589 | ) | ||||||

| Balance as of June 30, 2019 | $ | - | $ | - | $ | - | ||||||

At the Closing, all of the outstanding redeemable convertible preferred shares were converted into 34,695,395 common shares of the Company.

| 11 |

| 10. | SHAREHOLDERS’ EQUITY |

Preferred Shares — The Company is authorized to issue 50,000,000 of preferred shares with $0.0001 par value per share as of June 30, 2019. Before the re-domestication, the Company is authorized to issue an unlimited number of no par value preferred shares, divided into five classes, Class A through Class E, each with such designation, rights and preferences as may be determined by a resolution of the Company’s board of directors to amend the Memorandum and Articles of Association to create such designations, rights and preferences. Upon the re-domestication of the Company, it amended the Charter and the authorized preferred shares to 50,000,000 of preferred shares with $0.0001 par value. At June 30, 2019 and December 31, 2018, there are no preferred shares designated, issued or outstanding.

Common Stock — The Company is authorized to issue 200,000,000 common stocks with $0.0001 par value per share. Holders of the Company’s common stocks are entitled to one vote for each share.

At December 31, 2018, the Company was a blank check company incorporated in the British Virgin Islands and there were 7,978,937 ordinary shares issued and outstanding, among which, 6,037,500 ordinary shares are subject to redemption.

From January 1, 2019 to the Closing of the Business Combination, the Company’s Shareholders holding 6,023,689 public shares exercised their right to redeem such public shares for a pro rata portion of the Trust Account. The Company paid cash in the aggregate amount of $64,070,650, or approximately $10.54 per share, to redeeming shareholders.

On May 14, 2019, prior to the Closing, the Company continued out of the British Virgin Islands and domesticated as a Delaware corporation. As a result, the Company is no longer a company incorporated in the British Virgin Islands, and the ordinary shares converted common stocks with $0.0001 par value per share.

As a result, right before the Closing, the Company had 1,955,246 shares of common stock issued and outstanding, and immediately following the Closing, the Rights that were issued in the Company’s Initial Public Offering and Private Placement automatically converted into 646,955 common shares of the Company.

At the Closing, the Company issued 8,165,377 common shares to holders of Xynomic Pharma’s ordinary shares and 34,695,395 common shares to holders of Xynomic Pharma’s convertible preferred shares as the Merger Consideration Shares. At the same time, the Company issued 755,873 common shares as the Backstop Shares to Yinglin Mark XU and Bison Capital for $7,672,111 considerations, which consisted of $4,971,358 cash consideration from Mark Yinglin XU, conversion of $2,560,753 loans Mark Yinglin XU made to Xynomic Pharma, and conversion of $140,000 loans Bison Capital made to the company.

At the Closing, Bison Capital converted the promissory notes of $500,000 into 50,000 common shares of the Company, and the Right attached to the notes into 5,000 common shares of the Company.

As of June 30, 2019, there were 46,273,846 shares of common stock issued and outstanding.

| 12 |

| 11. | LOSS PER SHARE |

Basic and diluted net loss per share for each of the periods presented are calculated as follow:

| Three Months Ended | Six Months Ended | |||||||||||||||

| June 30, | June 30, | |||||||||||||||

| 2018 | 2019 | 2018 | 2019 | |||||||||||||

| Numerator: | ||||||||||||||||

| Net loss attributable to ordinary shareholders | $ | (4,808,753 | ) | $ | (3,051,753 | ) | $ | (5,524,999 | ) | $ | (918,894,286 | ) | ||||

| Denominator: | ||||||||||||||||

| Weighted average number of ordinary shares-basic and diluted | 42,860,772 | 44,623,568 | 42,860,772 | 43,747,040 | ||||||||||||

| Net loss per share-basic and diluted | $ | (0.11 | ) | $ | (0.07 | ) | $ | (0.13 | ) | $ | (0.43 | ) | ||||

When the dividends to preferred shares are not fully paid, the ordinary shares holders shall not participate in undistributed earnings. If all dividends to preferred shares holders are fully paid, the holders of the preferred shares and the holders of the ordinary shares participate in undistributed earnings on a pro rata basis, as if the preferred shares had been converted into ordinary shares.

As a result of the Group’s net loss for the three and six months ended June 30, 2018 and 2019, preferred shares and options outstanding in the respective periods were excluded from the calculation of diluted loss per share as their inclusion would have been anti-dilutive.

| 12. | LICENSES ARRANGEMENT |

License agreement with Pharmacyclics LLC (“Pharmacyclics”)

In February 2017, the Group entered into a license agreement with Pharmacyclics, under which the Group obtained an exclusive and worldwide license or sublicense under certain patents and know-how of Pharmacyclics to develop, manufacture and commercialize Pharmacyclics’s HDAC inhibitor, also known as Abexinostat, for all human and non-human diagnostic, prophylactic, and therapeutic uses.

Under the terms of the agreement, the Group made upfront payments of US$3.5 million in 2017 and 1st milestone payment of US$3.5 million in 2018 to Pharmacyclics which were recorded as research and development expenses in 2017 and 2018, respectively. In addition, the Group is obligated to pay the following development and regulatory milestone payments: 1) 2nd milestone payment of US$6,500,000 upon regulatory approval for the first indication for a licensed product in China or in the United States; 2) 3rd milestone payment of US$4,000,000 upon regulatory approval for the second indication for a licensed product in China or in the United States.

In addition, the Group will pay to Pharmacyclics royalties at a flat high-teen percentage rate on the net sales of the licensed products. The Group shall have no obligation to pay any royalty with respect to net sales of any licensed product in any country or other jurisdiction after the royalty term for such licensed product in such country or other jurisdiction has expired.

The license agreement with Pharmacyclics will remain in effect until the expiration of the royalty term and may be early terminated by either party for the other party’s uncured material breach, bankruptcy, insolvency, or similar event. Pharmacyclics has the right to terminate the agreement if the Group challenge Pharmacyclics’ patents or fails its diligent obligations to develop or commercialize the licensed product pursuant to the license agreement with Pharmacyclics. In addition, the Group may terminate this agreement for convenience with advance written notice to Pharmacyclics. In the event this license agreement is terminated for any reason other than Pharmacyclics’ material breach, the Group will be responsible for continuing, at its cost for up to six months, to conduct clinical studies it conducts at the termination and transfer the control of the clinical studies to Pharmacyclics. If such transfer is expressly prohibited by a regulatory authority, the Group will continue to conduct such clinical studies to completion, at the Group’s cost.

| 13 |

Patent assignment and licensing agreement with Boehringer Ingelheim International GMBH (“BII”) (XP-102)

In August 2017, the Group entered into a Patent assignment and licensing agreement with BII, under which the Group accepts the assignment and transfer of the patents and know-how of BII to exclusively develop, manufacture and commercialize BII’s Pan-RAF Inhibitor BI 882370, also known as Dabrafenib, for the diagnosis, prevention or treatment of any and all diseases or conditions in humans or animals. BII retains the exclusive right to use the licensed compound to conduct internal preclinical research.

Under the terms of the agreement, the Group made upfront payments to BII totaling US$0.3 million which was recorded as a research and development expense in 2017. In addition, the Group is obligated to pay the following development and regulatory milestone payments: 1) 1st milestone payment of US$ 1,700,000 upon first dosing of a patient in Phase I Clinical Trial in the US or China; 2) 2nd milestone payment of US$ 4,000,000 upon first dosing of a patient in a pivotal Phase III Clinical Trial in the first indication in the US or China; 3) 3rd milestone payment of US$2,000,000 upon first dosing of a patient in a pivotal Phase III Clinical Trial in a second indication in the US or China; 4) 4th milestone payment of US$ 7,000,000 upon the grant of the first marketing authorization of the first indication in the US; 5) 5th milestone payment of US$3,000,000 upon the grant of the first marketing authorization of the first indication in China.

In addition, the Group will pay royalties at a certain percentage of the net sales. The royalty term commences from the first commercial sale of such licensed product in such country until the later of (i) the date on which such licensed product is no longer covered by a valid claim of the assigned patents and assigned invention, (ii) the expiration of regulatory exclusivity of the licensed product in such country, or (iii) the tenth anniversary of the first launch of the respective licensed product in the country, provided the licensed know-how is still proprietary, or such licensed know-how is no longer proprietary owing to a breach of its confidentiality obligations.

The Group has the right to terminate this agreement by providing BII with written notice.

License agreement with BII (XP-105)

In December 2018, Xynomic entered into a license agreement with BII for the worldwide exclusive rights to develop and commercialize XP-105 (also known as BI 860585) for all human and non-human diagnostic, prophylactic, and therapeutic uses.

Under the terms of the agreement, as of June 30, 2019 the Group was obligated to make upfront payments to BII totaling US$1 million which was recorded as a research and development expense for the year ended December 31, 2018 and was included in accrued expenses and other current liabilities as of December 31, 2018. In addition, the Group is obligated to pay the following development and regulatory milestone payments: 1) 1st milestone payment of US$7,000,000 upon first dosing of a patient in Phase II or Phase III Clinical Trial in the first indication either of which is intended to be a pivotal trial; 2) 2nd milestone payment of US$10,000,000 upon the grant of the first Marketing Authorization of the first indication.

| 14 |

In addition, the Group will pay royalties at a certain percentage of the net sales. The royalty term commences from the first commercial sale of such licensed product in such country until the later of (i) the date on which such licensed product is no longer covered by a valid claim of the licensed patents, (ii) the expiration of regulatory exclusivity of the licensed product in such country, or (iii) the tenth anniversary of the first launch of the respective licensed product in the country in the indication, provided the licensed know-how is still proprietary, or such licensed know-how is no longer proprietary owing to a breach of its confidentiality obligations.

The Group has the right to terminate this agreement by providing BII with written notice.

| 13. | COMMITMENTS AND CONTINGENCIES |

| (a) | Lease commitments |

The Group entered into non-cancelable operating leases, primarily for office space, for initial terms of 12 to 36 months. Minimum rent payments under operating leases are recognized on a straight-line basis over the term of the lease.

Future minimum lease payments under non-cancelable operating leases with remaining lease terms in excess of one year as of June 30, 2019 are:

| Minimum Lease Payment Amount |

||||

| Year ending June 30, 2019, | ||||

| 2020 | $ | 241,099 | ||

| 2021 | 236,467 | |||

| 2022 | 129,658 | |||

| $ | 607,224 | |||

Rental expenses for operating leases for the three months ended June 30, 2018 and 2019 were US$24,249 and US$98,434, respectively. Rental expenses for operating leases for the six months ended June 30, 2018 and 2019 were US$40,275 and US$146,598, respectively.

| (b) | Registration Rights |

Upon the Closing, the Company entered into an amended and restated registration rights agreement with certain existing investors of Bison (including its sponsor), Mark Yinglin Xu (together with his assignee, the “Backstop Investor”) and the Sellers. Pursuant to this registration rights agreement, the Company has agreed to register for resale under the Securities Act of 1993, as amended (1) all or any portion of the 1,509,375 shares of common stock of Bison issued to certain existing investors (the “Founder Shares”), (2) 432,063 private units issued by Bison to certain existing investors in conjunction with the consummation of its initial public offering (the “Private Units”), (3) any private units which may be issued by Bison in payment of working capital loans made to Bison (the “Working Capital Units”, together with Founder Shares, Private Units, the “Existing Registrable Securities”), (4) the Backstop Shares, and (5) the Merger Consideration Share (the “Newly Issued Shares”). The Backstop Shares, Newly issued Shares and the Existing Registrable Securities and any securities of Bison issued as a dividend or distribution with respect thereto or in exchange therefor are referred as the “Registrable Securities”. At any time and from time to time on or after (i) the one month anniversary of the Closing with respect to the Private Units or Working Capital Units, (ii) three months prior to the release of the Founder Shares under the terms of a certain escrow agreement; (iii) the Closing Date with respect to the Backstop Shares, or (iv) nine months after the Closing with respect to the Newly Issued Shares, the holders of a majority of (i) all of the Existing Registrable Securities, (ii) all of the Backstop Shares, or (iii) all of the Newly Issued Shares, calculated on an as-converted basis, may make a written demand for registration under the Securities Act of all or part of their Registrable Securities, and other holders of the Registrable Securities will be entitled to join in such demand registration, provided that the Company shall not be obliged to effect more than two demand registrations in any one year period or more than an aggregate of three demand registrations.

Subject to certain exceptions, if at any time on or after the Closing, the Company proposes to file a registration statement under the Securities Act with respect to an offering of equity securities, under the Registration Rights Agreement, the Company shall give written notice of such proposed filing to the holders of the Registrable Securities and offer them an opportunity to register the sale of such number of Registrable Securities as such holders may request in writing, subject to customary cut-backs.

In addition, subject to certain exceptions, the holders of a majority of (i) all of the Existing Registrable Securities, (ii) all of the Backstop Shares, or (iii) all of the Newly Issued Shares, calculated on an as-converted basis, are entitled under the Registration Rights Agreement to request in writing that the Company register the resale of any or all of such Registrable Securities on Form S-3 or any similar short-form registration that may be available at such time.

The Company agrees to use commercially reasonable efforts to effect the registration and sale of such Registrable Securities in accordance with the registration rights described above as expeditiously as practicable. In addition, the Company agrees to use reasonable best efforts to cause registration with respect to the Backstop Shares to be declared effective no later than one-hundred and eighty (180) days following the Closing Date.

| 15 |

| (c) | Other commitments |

The Group is a party to or assignee of license and collaboration agreements that may require it to make future payments relating to milestone fees and royalties on future sales of licensed products (Note 12).

| (d) | Legal contingencies |

On July 12, 2019, one of the Contract Research Organizations (the “Plaintiff”) of Xynomic Pharma filed a complaint in the Complex Commercial Litigation Division of the Superior Court of the State of Delaware against Xynonmic Pharma for breach of a contract under which Xynomic Pharma engaged the Plaintiff to provide services relating to drug development research, and Xynomic Pharma allegedly failed to pay the amount due to the Plaintiff for the services performed. The Plaintiff seeks $6,992,068 from Xynomic Pharma, plus interest at the contract rate of 1% per month. Xynomic Pharma must respond to the complaint by August 19, 2019.

As of June 30, 2019, Xynomic Pharma had $7,078,037 payable to the Plaintiff, including $273,467 accrued interest according to the contract.

| 14. | RELATED PARTY TRANSACTIONS |

| (a) | Amount due to shareholders |

| i) | Payable due to a shareholder |

For the three months ended June 30, 2018 and 2019, Yinglin Mark Xu, the founder and CEO of Xynomic Pharma, advanced US$38,683 and US$130,335, respectively, to Xynomic Pharma to fund its operation. For the six months ended June 30, 2018 and 2019, Yingling Mark XU advanced US$536,905 and US$543,296, respectively.

At the Closing date, the amount due to Yingling Mark XU was $2,560,754 and was fully converted to be part of the consideration to purchase Backstop Shares.

As of December 31, 2018 and June 30, 2019, the amount due to Yinglin Mark XU was US$2,008,936 and US$0, respectively.

| ii) | Services purchased from a company affiliated with a shareholder |

Eigenbridge, Inc., a company affiliated with Yong Cui, one of Xynomic Pharma’s shareholders and Vice President of Chemistry, Manufacturing and Controls, entered into a contractor agreement with Xynomic Pharma on February 26, 2017. Pursuant to the agreement, Eigenbridge, Inc., provided specialized advisory services to Xynomic Pharma. Xynomic Pharma recognized general and administrative of US$52,723 and US$0 for the three months ended June 30, 2018 and 2019, respectively. Xynomic Pharma recognized general and administrative of US$52,723 and US$25,908 for the six months ended June 30, 2018 and 2019, respectively. The amount due to Eigenbridge, Inc., were US$80,640 and US$0 as of December 31, 2018 and June 30, 2019, respectively.

| iii) | Advances from and interest payable to a shareholder |

On May 2, 2018, as one of the potential investors of Series B financing, Zhongshan Bison Healthcare Investment Limited (Limited Partnership) (“Zhongshan Bison”) entered into a loan agreement with Xynomic Pharmaceuticals (Nanjing) Co., Ltd. (“Xynomic Nanjing”). On May 13, 2018, Zhongshan Bison made an advance of RMB9,435,000 (equivalent to US$1,425,959) to fund the operations and business development of Xynomic Nanjing. Zhongshan Bison is entitled to withdraw the advance within 5 business days after Zhongshan Bison paid the first investment of Series B financing, or if current shareholders and investors fail to subscribe shares of the Series B financing within 6 months.

| 16 |

On August 16, 2018, Zhongshan Bison became one of the Series B Preferred Shareholders.

On August 23, 2018, Xynomic Nanjing entered into a termination agreement for the advance from Zhongshan Bison. Xynomic Nanjing is required to a) repay RMB1,800,000 of the advance from Zhongshan Bison within 2 days after signing the agreement; and b) repay the remaining RMB7,635,000 of the advance from Zhongshan Bison and interest accrued at annual interest rate of 8% from signing the agreement within six months from the date of the termination agreement.

On August 23, 2018, Xynomic Nanjing repaid RMB1,800,000 (equivalent to US$262,743) of the advance from Zhongshan Bison. As of December 31, 2018, the advance from Zhongshan Bison was US$1,112,455.

On January 21, 2019, Xynomic Nanjing repaid RMB5,064,000 (equivalent to US$747,189) of the advance from Zhongshan Bison. On February 20, 2019, Zhongshan Bison agreed to extend the due date of the remaining advance of RMB2,571,000 (US$383,097) and all accrued interest to April 15, 2019. On April 12, 2019, Zhongshan Bison agreed to further extend the due date of the remaining advance of RMB2,571,000 (US$383,097) and all accrued interest to June 30, 2019. On June 30, 2019, the due date was further extended to September 15, 2019.

Xynomic Nanjing accrued interest expense of US$17,723 for the advance from Zhongshan Bison for the three months ended June 30, 2019. Xynomic Nanjing accrued interest expense of US$32,811 for the advance from Zhongshan Bison for the six months ended June 30, 2019. The interest payable to Zhongshan Bison was US$31,697 and US$64,093 as of December 31, 2018 and June 30, 2019, respectively.

| iv) | Promissory note to a shareholder |

In order to finance transaction costs in connection with a Business Combination, Bison Capital or the Company’s officers and directors or their respective affiliates may, but are not obligated to, loan the Company funds as may be required (the “Working Capital Loans”). If the Company completes a Business Combination, the Company would repay the Working Capital Loans. In the event that a Business Combination does not close, the Company may use a portion of proceeds held outside the Trust Account to repay the Working Capital Loans but no proceeds held in the Trust Account would be used to repay the Working Capital Loans. Such Working Capital Loans would be evidenced by promissory notes. The notes would either be repaid upon consummation of a Business Combination, without interest, or, at the lender’s discretion, up to $500,000 of notes may be converted upon consummation of a Business Combination into additional Private Units at a price of $10.00 per unit (the “Working Capital Units”). As of May 14, 2019, Bison Capital has loaned the Company an aggregate of $500,000, which is evidenced by a promissory note, non-interest bearing, unsecured and payable in cash or convertible in Private Units at $10.00 per unit, at Bison Capital’s discretion, on the consummation of a Business Combination.

In February 2019, $100,000 of loans from Bison Capital were converted into convertible promissory loans and is included in the $500,000 outstanding amount noted above. In addition, as of June 30, 2019, Bison Capital has loaned the Company an aggregate amount of $404,900 in order to finance transaction costs in connection with the Business Combination. The loan is non-interest bearing, unsecured and due to be paid on the consummation of a Business Combination.

At the Closing, Bison Capital converted the $500,000 convertible promissory note to 50,000 common shares of the Company, and converted the Right attached to it into 5,000 common shares of the Company.

| 17 |

At June 30, 2019, an aggregate of $404,900 is owed by the Company to Bison Capital pursuant to the above loans.

| (b) | Service purchased from a shareholder |

In June 2017, the Group paid US$295,021 to Bridge Pharm International Inc., one of the Company’s shareholders, pursuant to 20 months services agreement. Under the agreement, Bridge Pharm International Inc. provides consulting service, including business development, screening and selection of contract research organizations and contract manufacturing organizations and scouting and references of key scientific and managerial personnel to the Group. The Company recognized general and administrative of US$44,915 and nil for the three months ended June 30, 2018 and 2019, respectively. The Company recognized general and administrative of US$93,968 and nil for the six months ended June 30, 2018 and 2019, respectively. The balance related to the Bridge Pharm International Inc. was nil as of December 31, 2018 and June 30, 2019.

| (c) | Administrative Services Arrangement |

Bison Capital entered into an agreement whereby, commencing on June 19, 2017 through the earlier of the Company’s consummation of a Business Combination and its liquidation, to make available to the Company certain general and administrative services, including office space, utilities and administrative services, as the Company may require from time to time. The Company will pay Bison Capital $5,000 per month for these services. For the three months ended June 30, 2018 and 2019, the Company incurred $15,000 and $7,500, respectively, in fees for these services. or the six months ended June 30, 2018 and 2019, the Company incurred $27,500 and $22,500, respectively, in fees for these services. At June 30, 2019 and December 31, 2018, $112,500 and $90,000 in administrative fees, respectively, are included in accounts payable and accrued expenses in the accompanying condensed balance sheets.

| 15. | SHARE-BASED COMPENSATION |

2018 Stock Incentive Plan

On August 28, 2018, the Board of Directors of Xynomic Pharma approved a resolution to adopt the 2018 Stock Incentive Plan (the “2018 Plan”) that provides for the granting of options to selected employees, directors and non-employee consultants to acquire ordinary shares of the Company at exercise prices determined by the Board or the administrator appointed by the Board at the time of grant. Upon this resolution, the Board of Directors and shareholders authorized and reserved 8,908,430 ordinary shares for the issuance under the 2018 Plan. The number of ordinary shares available under the Plan shall increase annually on the first day of each fiscal year, beginning with the second fiscal year following the effective date of this Plan, and continuing until (and including) the fiscal year ending December 31, 2028, with such annual increase equal to the lesser of (i) 3,000,000 ordinary shares, (ii) 5% of the number of ordinary shares issued and outstanding on December 31 of the immediately preceding calendar year, and (iii) an amount determined by the Board. As of December 31, 2018 and June 30, 2019, 8,908,430 and 8,022,384 awards remain available for future grants under the 2018 Plan, respectively.

Under the 2018 Plan, Xynomic Pharma granted 886,046 ordinary shares of the Company with the below vesting schedule on January 21, 2019:

Granted to an employee (100,000 shares): 25% of the options is to be vested on April 30, 2019, and 1/48 of the options to be vested each month thereafter. The employee resigned from Xynomic Pharma in May 2019 and the remaining unvested 75% of the options were forfeited.

| 18 |

Granted to a non-employee (786,046 shares): 25% of the options is to be vested on August 31, 2019, and 1/48 of the options to be vested each month thereafter, subject to an acceleration vesting schedule that 75% is to be issued upon completion of Xynomic Pharma’s merger with Bison Capital Acquisition Corp, and 25% to be issued in one year after the closing of the merger. The cost of the share options granted to the non-employee was fully recognized at the grant date, as no substantive future services are required. At the Closing, each option to purchase Xynomic stock that was outstanding immediately prior to the Effective Time was assumed by the Company and automatically converted into an option to purchase shares of common stock of the Company.

Summary of Share Option Activities

The following tables summarize the Company’s share option activities for the six months ended June 30, 2019:

| Weighted | Weighted | |||||||||||||||

| average | remaining | Aggregate | ||||||||||||||

| Number of | exercise | contractual | intrinsic | |||||||||||||

| Granted to Employee | shares | price | years | value | ||||||||||||

| US$ | US$ | |||||||||||||||

| Outstanding at January 1, 2019 | - | - | - | |||||||||||||

| Granted | 100,000 | 1.00 | ||||||||||||||

| Forfeited | (75,000 | ) | 1.00 | |||||||||||||

| Outstanding at June 30, 2019 | 25,000 | 1.00 | 9.57 | 215,050 | ||||||||||||

| Exercisable as of June 30, 2019 | 25,000 | 1.00 | 9.57 | 215,050 | ||||||||||||

| Weighted | Weighted | |||||||||||||||

| average | remaining | Aggregate | ||||||||||||||

| Number of | exercise | contractual | intrinsic | |||||||||||||

| Granted to Non-employee | shares | price | years | value | ||||||||||||

| US$ | US$ | |||||||||||||||

| Outstanding at January 1, 2019 | - | - | - | |||||||||||||

| Granted | 786,046 | 0.10 | ||||||||||||||

| Forfeited | - | - | ||||||||||||||

| Outstanding at June 30, 2019 | 786,046 | 0.10 | 9.57 | 7,433,873 | ||||||||||||

| Exercisable as of June 30, 2019 | 589,535 | 0.10 | 9.57 | 5,578,436 | ||||||||||||

No options were exercised during the six months ended June 30, 2019.

Management is responsible for determining the fair value of options granted to employees and non-employees and considered a number of factors including valuations. The Company’s share-based compensation cost is measured at the fair value of the options as calculated under the binomial models.

Assumptions used in the option-pricing model are presented below:

| 2019 | ||||

| Risk-free interest rate | 2.77 | % | ||

| Expected term | 10 years | |||

| Volatility rate | 36.1 | % | ||

| Dividend yield | 0 | % | ||

| Exercise multiple | 2.8 | |||

| Fair value of underlying ordinary share | 9.5573 | |||

| 19 |

The Company estimated the risk-free rates based on the 10-year U.S. bond as at the option valuation date. Life of the share options is the contract life of the option. Based on the option agreements, the contract life of the option are 10 years from the respective grant date. The expected volatility at the option valuation date was estimated based on historical volatility of comparable companies. The Company has no history or expectation of paying dividends on its ordinary shares. The Company estimated the fair value of the ordinary shares using the equity allocation approach when valuing options granted. As the Company did not have sufficient information of past employee exercise history, the expected exercise multiple was estimated by referencing to How to Value Employee Stock Options (published by John Hull& Allen White, Financial Analysts Journal, 2004 edition), a well-accepted academic publication.

The grant date fair value of the share options granted for the six months ended June 30, 2019 was US$9.3653. Compensation expense of US$7,652,965 were recognized in general and administrative relating to the 886,046 options for the six months ended June 30, 2019. US$30,317 of the general and administrative expense was reversed during the three months ended June 30,2019 due to the employee’s resignation and the forfeiture of the unvested options.

As of June 30, 2019, there was nil unrecognized compensation expenses related to non-vested options.

| 16. | SUBSEQUENT EVENT |

Security Purchase Agreement with Accredited Investors

On or about July 10, 2019, the Company entered into certain Securities Purchase Agreement (the “SPA”) with certain “accredited investors” as defined in Rule 501(a) of Regulation D as promulgated under the Securities Act of 1933, as amended (the “Purchasers”), pursuant to which the Company agreed to sell to such Purchasers an aggregate of approximate USD$10 million of units (the “Reg. D Units”) of the Company, at a purchase price of USD$3.80 per Unit (subject to adjustment) (the “Reg. D Offering”). Each Reg. D Unit consists of one share of common stock and one-half warrant (the “Reg. D Warrant”). Each whole Reg. D Warrant can be exercised to purchase one share of the Company Stock at $7.00 per share and shall expire in three (3) years of the issuance, and have the rights and preference set forth in certain Warrant Agreement. Furthermore, the SPA provides, among other terms, a maximum offering in an aggregate of $15 million with the first closing of a minimum of $5 million upon delivery of the closing conditions set forth in the SPA, provided that no closing shall occur after September 30, 2019 subject to certain exception.

The Reg. D Units, the shares of common stock underlying the Reg. D Units (the “Reg.D Unit Shares”), the Reg. D Warrants issued in the Reg.D Offering, and shares of common stock issuable upon exercise of the Reg. D Warrants (the “Reg.D Warrant Shares”), are exempt from the registration requirements of the Securities Act, pursuant to Section 4(a)(2) of the Securities Act and/or Regulation D.

With delisting from Nasdaq occurred subsequently, the parties have started to renegotiate the terms of the SPA including potential waiver of certain closing conditions.

Delisting from Nasdaq

On July 15, 2019, the Company was notified in writing by the Panel at Nasdaq that they have denied its request for continued listing on Nasdaq based upon the Company’s non-compliance with Nasdaq Listing Rules 5505(a)(3) and 5515(a)(4), which require a minimum of 300 round lot holders of common stock and 400 round lot holders of common stock purchase warrants for initial listing on Nasdaq; as well as non-compliance with the minimum $5 million in stockholders’ equity requirement, as set forth in Nasdaq Listing Rule 5505(b)(1)(A). As a result, Nasdaq suspended trading in the Company’s securities effective at the open of business on Wednesday, July 17, 2019; and the shares subsequently commenced trading on the over-the-counter markets.

Special Meeting of Stockholders

On July 26, 2019, the Company called for a Special Meeting of its stockholders be held on August 26, 2019 for the purpose of authorizing the Company’s Board of Directors to, in its discretion, to amend the Company’s Amended and Restated Certificate of Incorporation to effect a reverse stock split at a ratio no less than 1-for-1.5 and no greater than 1-for-5 at any time prior to August 27, 2020, with the exact ratio to be set within that range at the discretion of our Board of Directors without further approval or authorization of our stockholders (“Stock Split Proposal”). The Board of Directors may alternatively elect to abandon such proposed amendment and not effect the reverse stock split authorized by stockholders, in its sole discretion.

| 20 |

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis should be read together with our financial statements and the related notes appearing elsewhere in this Form 10-Q. This discussion contains forward-looking statements reflecting our current expectations that involve risks and uncertainties. See “Cautionary Note Regarding Forward-Looking Statements” for a discussion of the uncertainties, risks and assumptions associated with these statements. Actual results and the timing of events could differ materially from those discussed in our forward-looking statements as a result of many factors, including those set forth under “Risk Factors” and elsewhere in this Form 10-Q.

Overview

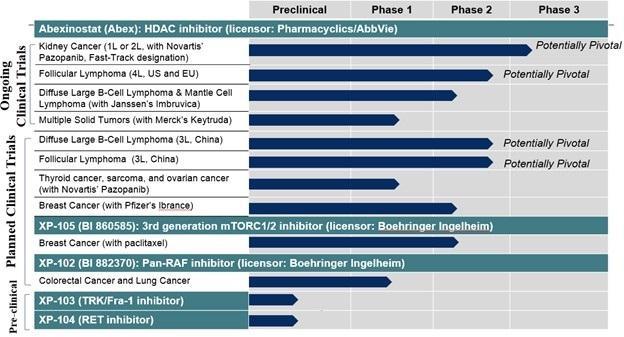

Prior to the consummation of the Business Combination with Xynomomic Pharmaceuticals, Inc., a Delaware corporation (“Xynomic”) on May 15, 2019, we were a blank check company formed for the purpose of acquiring, engaging in a share exchange, share reconstruction and amalgamation, purchasing all or substantially all of the assets of, entering into contractual arrangements, or engaging in any other similar business combination with one or more businesses or entities. As a result of the Business Combination, we now are a clinical stage biopharmaceutical company that discovers and develops innovative small molecule drug candidates for the treatment of cancer in humans. Our approach is to focus on drug candidates that target both hematological malignancies and solid tumors. Our lead drug candidate is abexinostat, an orally dosed, hydroxamic acid-based small molecule histone deacetylase (“HDAC”) inhibitor. Our other clinical stage drug candidate is XP-105, an orally bioavailable kinase inhibitor, which inhibits both raptor-mTOR complex 1 and rictor-mTOR complex 2. In addition, Xynomic has several pre-clinical oncology drug candidates in its pipeline. Among these drug candidates, XP-102 (also known as BI 882370), a selective RAF inhibitor, is the closest to clinical testing. The following is a summary of our product development pipeline:

We have not completed any clinical trials since our inception. With respect to the pipeline programs referenced in the above figure, all of the completed clinical trials of abexinostat were conducted by or on behalf of either Pharmacyclics LLC (“Pharmacyclics”) or Servier Laboratories and the one completed clinical trial of XP-105 was conducted by or on behalf of Boehringer Ingelheim International GmbH (“Boehringer Ingelheim” or “BII”). We have obtained exclusive rights to use all the data generated in these previously completed clinical trial.

| 21 |

| ● | Abexinostat – our most advanced drug candidate, abexinostat, has been evaluated in 18 Phase 1/2 clinical trials for lymphoma and solid tumors. In February 2017, Xynomic entered into a license agreement with Pharmacyclics for the worldwide exclusive rights to develop and commercialize abexinostat for all human and non-human diagnostic, prophylactic, and therapeutic uses. Since its in-licensing of abexinostat, Xynomic has started enrolling patients in clinical trials for three different indications: (1) in follicular lymphoma, as a monotherapy, (2) in renal cell carcinoma, in combination with pazopanib, and (3) in multiple solid tumors, in combination with Keytruda®. In addition, Xynomic plans to initiate four clinical trials of abexinostat in the next six months. |

| ● | XP-105 (also known as BI 860585) – In December 2018, Xynomic entered into a license agreement with Boehringer Ingelheim for the worldwide exclusive rights to develop and commercialize XP-105 (also known as BI 860585) for all human and non-human diagnostic, prophylactic, and therapeutic uses. Prior to this license, BII had completed one Phase 1 clinical trial for solid tumors. Xynomic plans to initiate two clinical trials of XP-105 in late 2019. |

| ● | Pre-Clinical Programs – In addition, Xynomic has several pre-clinical oncology drug candidates in its pipeline. Among these drug candidates, XP-102 (also known as BI 882370), a selective RAF inhibitor to which Xynomic obtained a worldwide exclusive license from Boehringer Ingelheim, is the closest to clinical testing. |