UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Amendment No. 1 to

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July [ ], 2019 (May 15, 2019)

XYNOMIC PHARMACEUTICALS HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 001-38120 | 83-4696467 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (IRS Employer Identification No.) |

| Suite

3306, K. Wah Centre, 1010 Middle Huaihai Road, Shanghai China |

200031 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number including area code: +86 21 33566200 x 8009

Bison Capital Acquisition Corp.

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, par value $0.0001 per share. | XYN | The NASDAQ Stock Market LLC | ||

| Warrants to purchase shares of Common Stock | XYNPW | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b–2 of the Securities Exchange Act of 1934 (§ 240.12b–2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note

This Amendment No. 1 (the “Amended Report”) to our Current Report on Form 8-K filed on May 15, 2019 (the “Original Report”) is being filed voluntarily to include (1) the unaudited financial statements for Xynomic Pharmaceuticals, Inc. for the interim period ended March 31, 2019, (2) the unaudited pro forma condensed combined financial information of the Company as of March 31, 2019, and (3) the Management’s discussion and analysis of financial condition and results of operations for the same period.

Except for the foregoing amended information, this Amended Report continues to describe conditions as of the date of the Original Report and the disclosures contained herein. It does not reflect events occurring after May 15, 2019; nor does it modify or update those disclosures presented therein, except with regard to the modifications described in this Explanatory Note. As such, this Amended Report continues to speak as of May 15, 2019. Accordingly, this Amended Report should be read in conjunction with the Original Report and our other reports filed with the SEC subsequent to the filing of our Original Report, including any amendments to those filings.

TABLE OF CONTENTS

| Page No. | ||

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS | 1 | |

| EXPLANATORY NOTE | 2 | |

| Item 1.01. | Entry into a Material Definitive Agreement. | 3 |

| Item 2.01. | Completion of Acquisition of Disposition of Assets. | 5 |

| THE SHARE EXCHANGE AND RELATED TRANSACTIONS | 5 | |

| DESCRIPTION OF BUSINESS | 6 | |

| RISK FACTORS | 6 | |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 6 | |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 16 | |

| DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS | 18 | |

| EXECUTIVE COMPENSATION | 18 | |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 18 | |

| DESCRIPTION OF SECURITIES | 19 | |

| LEGAL PROCEEDINGS | 19 | |

| INDEMNIFICATION OF DIRECTORS AND OFFICERS | 19 | |

| Item 3.02. | Unregistered Sales of Equity Securities. | 20 |

| Item 3.03. | Material Modification to Rights of Security Holders. | 21 |

| Item 5.01. | Changes in Control of Registrant. | 21 |

| Item 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. | 21 |

| Item 5.06. | Change in Shell Company Status. | 21 |

| Item 5.07. | Submission of Matters to a Vote of Security Holders. | 21 |

| Item 8.01. | Other Events. | 22 |

| Item 9.01. | Financial Statements and Exhibits. | 23 |

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Current Report (the “Report”) contains forward-looking statements, including, without limitation, in the sections captioned “Description of Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Plan of Operations,” and elsewhere. Any and all statements contained in this Report that are not statements of historical fact may be deemed forward-looking statements. Terms such as “may,” “might,” “would,” “should,” “could,” “project,” “estimate,” “pro-forma,” “predict,” “potential,” “strategy,” “anticipate,” “attempt,” “develop,” “plan,” “help,” “believe,” “continue,” “intend,” “expect,” “future,” and terms of similar import (including the negative of any of the foregoing) may be intended to identify forward-looking statements. However, not all forward-looking statements may contain one or more of these identifying terms. Forward-looking statements in this Report may include, without limitation, statements regarding (i) the plans and objectives of management for future operations, (ii) a projection of income (including income/loss), earnings (including earnings/loss) per share, capital expenditures, dividends, capital structure or other financial items, (iii) our future financial performance, including any such statement contained in a discussion and analysis of financial condition by management or in the results of operations included pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”), (iv) estimates of our future revenue, expenses, capital requirements and our need for financing, and (v) the assumptions underlying or relating to any statement described in points (i), (ii), (iii), or (iv) above.

The forward-looking statements are not meant to predict or guarantee actual results, performance, events or circumstances and may not be realized because they are based upon our current projections, plans, objectives, beliefs, expectations, estimates and assumptions and are subject to a number of risks and uncertainties and other influences, many of which we have no control over. Actual results and the timing of certain events and circumstances may differ materially from those described by the forward-looking statements as a result of these risks and uncertainties. Factors that may influence or contribute to the accuracy of the forward-looking statements or cause actual results to differ materially from expected or desired results may include, without limitation:

| ● | our ability to meet anticipated clinical trial commencement, enrollment and completion dates and regulatory filing dates for our product candidates and to move new development candidates into the clinic; |

| ● | the occurrence of adverse safety events with our product candidates; |

| ● | the costs associated with our research, development, manufacturing, commercialization and other activities; |

| ● | the conduct, timing and results of preclinical and clinical studies of our product candidates, including that preclinical data and early-stage clinical data may not be replicated in later-stage clinical studies; |

| ● | the adequacy of our capital resources and the availability of additional funding; |

| ● | patent protection and third-party intellectual property claims; |

| ● | risks related to key employees, markets, economic conditions, health care reform, prices and reimbursement rates; and |

| ● | other risks and uncertainties, including those listed under the section title “Risk Factors.” |

Readers are cautioned not to place undue reliance on forward-looking statements because of the risks and uncertainties related to them and to the risk factors. We disclaim any obligation to update the forward-looking statements contained in this Report to reflect any new information or future events or circumstances or otherwise, except as required by law.

Readers should read this Report in conjunction with the discussion under the caption “Risk Factors,” our financial statements and the related notes thereto in this Report, and other documents which we may file from time to time with the SEC.

1

INTRODUCTORY NOTE

On May 15, 2019 (the “Closing Date”), the registrant consummated the previously announced business combination (the “Business Combination”) following a special meeting of shareholders held on May 14, 2019 (the “Special Meeting”) where the shareholders of Bison Capital Acquisition Corp., which, prior to the consummation of the Business Combination (as defined below), domesticated as a Delaware corporation and, immediately thereafter known as “Xynomic Pharmaceuticals Holdings, Inc.” ( the “Company”, and prior to the consummation of the Business Combination, sometimes referred to as “Bison” ), considered and approved, among other matters, a proposal to adopt that certain Agreement and Plan of Merger (as amended, the “Merger Agreement”), dated as of September 12, 2018, entered into by and among by and among (i) the Company; (ii) Bison Capital Merger Sub Inc., a Delaware corporation (“Merger Sub”) (iii) Xynomic Pharmaceuticals, Inc., a Delaware corporation (“Xynomic”); and (iv) Yinglin Mark Xu (“Stockholder Representative”), solely in his capacity as the Stockholder Representative thereunder.

Pursuant to the Merger Agreement, among other things, Merger Sub merged with and into Xynomic, with Xynomic continuing as the surviving entity and a wholly-owned subsidiary of the Company (the “Merger” and the “Surviving Company”). The Merger became effective on May 15, 2019 (the “Effective Time”).

On May 14, 2019, prior to the consummation of the Merger (the “Closing”), Bison continued out of the British Virgin Islands and domesticated as a Delaware corporation (the “Domestication”). As a result, Bison is no longer a company incorporated in the British Virgin Islands.

At the Closing, pursuant to the Backstop Agreement dated May 1, 2019 entered into by and between Bison and Yinglin Mark Xu, together with his assignee Bison Capital Holding Company Limited, has purchased from the Company 755,873 shares of common stock at a price of $10.15 per share for a total consideration of $7,672,112 (the “Backstop Shares” and “Backstop Subscription”). As a result of Backstop Subscription, Bison had at least $7,500,001 of net tangible assets remaining at the Closing after giving effect to the redemption of any Ordinary Shares by the public shareholders in connection with the Business Combination.

At the Effective Time, each share of Xynomic common stock and preferred stock issued and outstanding prior to the Effective Time was automatically converted into the right to receive, on a pro rata basis, the Closing Consideration Shares (as defined below) and the Earnout Shares (as defined below), and each option to purchase Xynomic stock that was outstanding immediately prior to the Effective Time was assumed by the Company and automatically converted into an option to purchase shares of common stock of the Company.

Under the Merger Agreement, upon the closing of the Business Combination (the “Closing”), all Xynomic stockholders received a number of newly issued shares of Company common stock equal to the Closing Merger Consideration divided by $10.15 per share (the “Closing Consideration Shares”). The Closing Merger Consideration equals to (a) $350,000,000, minus (i) the amount of Xynomic’s closing indebtedness, plus (ii) the amount of Xynomic’s closing cash, minus (iii) the amount of Xynomic’s transaction expenses, plus (iv) certain closing tax assets, plus (v) the amount, if any, by which Xynomic’s closing working capital exceeds an agreed upon target amount of working capital, minus (vi) the amount, if any, by which such target amount of working capital exceeds Xynomic’s closing working capital.

In addition to the Closing Consideration Shares, Xynomic stockholders received an additional 9,852,216 shares of common stock in aggregate (the “Earnout Shares” and, together with the Closing Consideration Shares, the “Merger Consideration Shares”). As a result, the Company issued 42,860,772 common shares as in aggregate Merger Consideration Shares to shareholders of Xynomic immediately prior to the Effective Time (the “Sellers”).

Pursuant to the Merger Agreement, 1,285,822 shares were deposited into an escrow account (the “Escrow Account”) to serve as security for, and the exclusive source of payment of, the Company’s indemnity rights under the Merger Agreement and any excess of the estimated Closing Merger Consideration over the final Closing Merger Consideration amount determined post-Closing.

As a result of the Business Combination, the Sellers, as the former shareholders of Xynomic, became the controlling shareholders of the Company and Xynomic became a subsidiary of the Company. The Business Combination was accounted for as a reverse merger, wherein Xynomic is considered the acquirer for accounting and financial reporting purposes.

2

Prior to the Business Combination, we were a “shell company” (as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended). As a result of the Business Combination, we have ceased to be a “shell company” and will continue the existing business operations of Xynomic as a publicly traded company under the name “Xynomic Pharmaceuticals Holdings, Inc.”

As used in this Report henceforward, unless otherwise stated or the context clearly indicates otherwise, the terms the “Registrant,” “Company,” “we,” “us” and “our” refer to Xynomic Pharmaceuticals Holdings, Inc., and its subsidiaries at and after the Closing, giving effect to the Business Combination.

| Item 1.01. | Entry into a Material Definitive Agreement. |

The information contained in Item 2.01 below is incorporated herein by reference.

Registration Rights Agreement

Upon closing of the Business Combination, the Company entered into an amended and restated Registration Rights Agreement (the “Registration Rights Agreement”) with certain existing investors of Bison (including its sponsor), Mark Yinglin Xu (together with his assignee, the “Backstop Investor”) and the Sellers.

Under the Registration Rights Agreement, the shareholders were granted registration rights that obligate the Company to register for resale under the Securities Act of 1933, as amended (the “Securities Act”), (1) all or any portion of the 1,509,375 shares of common stock of Bison issued to certain existing investors (the “Founder Shares”), (2) 432,063 private units issued by Bison to certain existing investors in conjunction with the consummation of its initial public offering (the “Private Units”), (3) any private units which may be issued by Bison in payment of working capital loans made to Bison (the “Working Capital Units”, together with Founder Shares, Private Units, the “Existing Registrable Securities”), (4) the Backstop Shares, and (5) the Merger Consideration Share (the “Newly Issued Shares”). The Backstop Shares, Newly issued Shares and the Existing Registrable Securities and any securities of Bison issued as a dividend or distribution with respect thereto or in exchange therefor are referred as the “Registrable Securities”. At any time and from time to time on or after (i) the one month anniversary of the Closing with respect to the Private Units or Working Capital Units, (ii) three months prior to the release of the Founder Shares under the terms of a certain escrow agreement; (iii) the Closing Date with respect to the Backstop Shares, or (iv) nine months after the Closing with respect to the Newly Issued Shares, the holders of a majority of (i) all of the Existing Registrable Securities, (ii) all of the Backstop Shares, or (iii) all of the Newly Issued Shares, calculated on an as-converted basis, may make a written demand for registration under the Securities Act of all or part of their Registrable Securities, and other holders of the Registrable Securities will be entitled to join in such demand registration, provided that the Company shall not be obliged to effect more than two demand registrations in any one year period or more than an aggregate of three demand registrations.

Subject to certain exceptions, if at any time on or after the Closing, the Company proposes to file a registration statement under the Securities Act with respect to an offering of equity securities, under the Registration Rights Agreement, the Company shall give written notice of such proposed filing to the holders of the Registrable Securities and offer them an opportunity to register the sale of such number of Registrable Securities as such holders may request in writing, subject to customary cut-backs.

In addition, subject to certain exceptions, the holders of a majority of (i) all of the Existing Registrable Securities, (ii) all of the Backstop Shares, or (iii) all of the Newly Issued Shares, calculated on an as-converted basis, are entitled under the Registration Rights Agreement to request in writing that the Company register the resale of any or all of such Registrable Securities on Form S-3 or any similar short-form registration that may be available at such time.

The Company agrees to use commercially reasonable efforts to effect the registration and sale of such Registrable Securities in accordance with the registration rights described above as expeditiously as practicable. In addition, the Company agrees to use reasonable best efforts to cause registration with respect to the Backstop Shares to be declared effective no later than one-hundred and eighty (180) days following the Closing Date.

3

Under the Registration Rights Agreement, the Company agreed to indemnify the holders of Registrable Securities and certain persons or entities related to them, such as their officers, employees, affiliates, directors, partners, members, attorneys and agents from and against any expenses, losses, judgments, claims, damages or liabilities resulting from any untrue statement or omission of a material fact in any registration statement or prospectus pursuant to which the sale of such Registrable Securities was registered under the Securities Act, unless such liability arose from a misstatement or omission by such selling holder. Each selling holder of Registrable Securities, including Registrable Securities in any registration statement or prospectus, agreed to indemnify the Company and certain persons or entities related to the Company, such as its officers and directors and underwriters, against all losses caused by their misstatements or omissions in those documents.

The Registration Rights Agreement is filed with this Report as Exhibit 10.1 and is incorporated herein by reference. The foregoing description of the Registration Rights Agreement does not purport to be complete and is subject to, and is qualified in its entirety by, the full text of the Registration Rights Agreement.

Lock-Up Agreements

Immediately prior to the Effective Time, the Company entered into a lock-up agreement with each Seller, in substantially the form attached to the Merger Agreement (each, a “Lock-Up Agreement”), with respect to the Merger Consideration Shares received in the Merger (collectively, the “Restricted Securities”). In such Lock-Up Agreement, each holder has agreed that, subject to certain exceptions, during the period ending nine months after the Closing, it will not (i) lend, offer, pledge, hypothecate, encumber, donate, assign, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase, or otherwise transfer or dispose of, directly or indirectly, any Restricted Securities, (ii) enter into any swap, short sale, hedge or other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership of the Restricted Securities, or (iii) publicly disclose the intention to effect any transaction specified in clause (i) or (ii), or (iv) make any demand for or exercise any right with respect to the registration of any shares of the Company’s common stock; subject to certain exceptions.

The agreed form of the Lock-Up Agreement is filed with this Report as Exhibit 10.2 and is incorporated herein by reference. The foregoing description of the Lock-Up Agreement does not purport to be complete and is subject to, and is qualified in its entirety by, the full text of the Lock-Up Agreement.

Non-Competition and Non-Solicitation Agreement

At the Closing, the Company entered into a Non-Competition and Non-Solicitation Agreement with certain Xynomic stockholders actively involved with Xynomic management (each, a “Subject Party”) in favor of Bison, Xynomic and their respective successors and subsidiaries (the “Covered Parties”), in substantially the form attached to the Merger Agreement (each, a “Non-Competition Agreement”). Pursuant to the Non-Competition Agreement, for a period from the Closing until the later of (i) the three year anniversary of the Closing or (ii) the date on which the Subject Party is no longer a director, officer, manager, employee or independent contractor of any Covered Party (such period, the “Restricted Period”), the Subject Party and its controlled affiliates will not, without the Company’s prior written consent, anywhere in the Territory (defined below), directly or indirectly engage, other than through a Covered Party, in the business of in-licensing, developing and commercializing small molecule oncology drug candidates inhibiting HDAC, RAF or mTOR in China, the U.S. or rest of the world, as conducted by the Company as of the Closing Date (the “Business”), or own, manage, finance or control, or participate in the ownership, management, financing or control of, or become engaged or serve as an officer, director, member, partner, employee, agent, consultant, advisor or representative of, a business or entity (other than a Covered Party) that engages in the Business (a “Competitor”). However, the Subject Party and its affiliates are permitted under the Non-Competition Agreement to own passive investments of no more than 5% of any class of outstanding equity interests in a Competitor that is publicly traded, so long as the Subject Party and its affiliates and immediate family members are not involved in the management or control of such Competitor.

4

The “Territory” is the United States of America, the Peoples’ Republic of China or any other markets in which the Covered Parties are engaged, or are actively contemplating to become engaged, in the Business.

Under the Non-Competition Agreements, the Subject Party and its controlled affiliates are also subject to certain non-solicitation and non-interference obligations during the Restricted Period with respect to the Covered Parties’ respective (i) employees, independent contractors, consultants or otherwise any covered personnel (ii) customers and (iii) vendors, suppliers, distributors, agents or other service providers. The Subject Party will also be subject to non-disparagement provisions regarding the Covered Parties and confidentiality obligations with respect to the confidential information of the Covered Parties.

The agreed form of Non-Competition Agreement is filed with this Report as Exhibit 10.3 and is incorporated herein by reference. The foregoing description of the Non-Competition Agreement does not purport to be complete and is subject to, and is qualified in its entirety by, the full text of the Non-Competition Agreement.

Escrow Agreement

On May 13, 2019, prior to the Closing, the Company entered into an escrow agreement (the “Escrow Agreement”) with the Stockholder Representative and Continental Stock Transfer & Trust Company, as escrow agent (the “Escrow Agent”). Pursuant to the Escrow Agreement and the Merger Agreement, the Escrow Shares were deposited in the Escrow Account to serve as security for, and the exclusive source of payment of, the Company’s indemnity rights under the Merger Agreement and any excess of the estimated Closing Merger Consideration over the final Closing Merger Consideration amount determined post-Closing.

The Escrow Agreement is filed with this Report as Exhibit 10.4 and is incorporated herein by reference. The foregoing description of the Escrow Agreement does not purport to be complete and is subject to, and is qualified in its entirety by, the full text of the Escrow Agreement.

Letter of Transmittal

After the Closing, in order to receive the Merger Consideration Shares to which it is entitled, each Xynomic stockholder delivered to Continental Stock Transfer & Trust Company, as the exchange agent (the “Exchange Agent”), a completed and duly executed Letter of Transmittal, in substantially the form attached to the Merger Agreement (each, a “Letter of Transmittal”), with respect to its shares of Xynomic stock. In the Letter of Transmittal, each such holder has made representations and warranties with respect to itself and its shares of Xynomic stock, acknowledge its indemnification obligations and the escrow provisions under the Merger Agreement, appointed the Stockholder Representative to act on its behalf in accordance with the terms of the Merger Agreement, provided a general release to Xynomic and its affiliates and certain related persons with respect to claims relating to the holder’s capacity as a holder of Xynomic stock, and agreed to be bound by confidentiality obligations to Xynomic for two years after the Closing.

The agreed form of the Letter of Transmittal is filed with this Report as Exhibit 10.5 and is incorporated herein by reference. The foregoing description of the Letter of Transmittal does not purport to be complete and is subject to, and is qualified in its entirety by, the full text of the Letter of Transmittal.

| Item 2.01. | Completion of Acquisition of Disposition of Assets. |

THE MERGER AND RELATED TRANSACTIONS

The disclosure set forth under “Introductory Note” above is incorporated in this Item 2.01 by reference. The material terms and conditions of the Merger Agreement and its related agreements are described on pages 105 to 110 of Bison’s definitive proxy statement/prospectus on Form S-4 dated May 3, 2019 (the “Definitive Proxy Statement”) in the section entitled “The Business Combination Proposal—The Merger Agreement,” and “The Business Combination Proposal—Related Agreements,” which is incorporated by reference herein.

5

DESCRIPTION OF BUSINESS

The business of the Company after the Business Combination is described in Definitive Proxy Statement in the section entitled “Information about Xynomic” beginning on page 184 and that information is incorporated herein by reference.

Specifically, subsection “Overview” begins on page 184, “Business Strategy” begins on page 186, “Market Opportunity” begins on page 187, “Abexinostat” begins on page 188, “XP-105 and Development Strategies for XP-105” begins on page 197, “Pre-Clinical Drug Candidates” begins on page 201, “Intellectual Property” begins on page 202, “Operations” begins on page 205, “Competitions” begins on page 206, “Properties” begins on page 206, “Executive Officers and Directors” begins on page 207, “Employees” begins on page 208, “Legal Proceedings” begins on page 210, “Government Regulation and Product Approvals” begins on page 210.

RISK FACTORS

The risks associated with the Company’s business are described in the Definitive Proxy Statement in the section entitled “Risk Factors” beginning on page 40 and are incorporated herein by reference. Specifically, subsection “Risks Related to Xynomic” begins on page 40, “Risks Related to Bison and the Business Combination” begins on page 74.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Management’s Discussion and Analysis of Financial Condition and Results of Operations of Xynomic Pharmaceuticals, Inc. (“Xynomic”) for the three months ended March 31, 2018 and 2019 is set forth below. In addition, the disclosure contained in the Definitive Proxy Statement we filed on May 3, 2019 with section entitled “Xynomic Management’s Discussion And Analysis of Financial Condition And Results of Operations” beginning on page 238 is incorporated herein by reference for Management’s Discussion and Analysis of Financial Condition and Results of Operations for the years ended December 31, 2017 and 2018. Specifically, subsection “Financial Operations Overview” begins on page 241, “Critical Accounting Policies and Estimates” begins on page 242, “Results of Operations” begins on page 243, “Liquidity and Capital Resources” begins on page 244, “Off-Balance Sheet Arrangements” begins on page 247, “Quantitative and Qualitative Disclosures about Market Risk” begins on page 247.

6

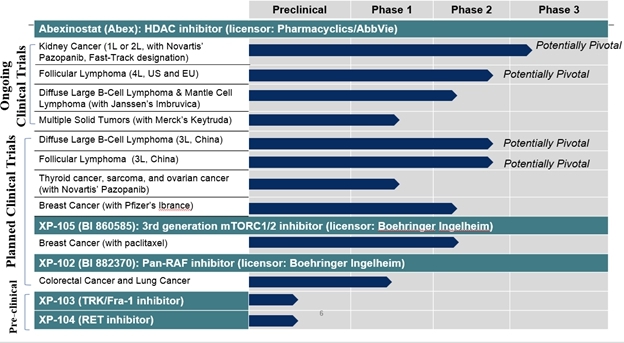

Xynomic is a clinical stage biopharmaceutical company that discovers and develops innovative small molecule drug candidates for the treatment of cancer in humans. Xynomic’s approach is to focus on drug candidates that target both hematological malignancies and solid tumors. Xynomic’s lead drug candidate is abexinostat, an orally dosed, hydroxamic acid-based small molecule histone deacetylase (“HDAC”) inhibitor. Xynomic’s other clinical stage drug candidate is XP-105, an orally bioavailable kinase inhibitor, which inhibits both raptor-mTOR complex 1 and rictor-mTOR complex 2. In addition, Xynomic has several pre-clinical oncology drug candidates in its pipeline. Among these drug candidates, XP-102 (also known as BI 882370), a selective RAF inhibitor, is the closest to clinical testing. The following is a summary of Xynomic’s product development pipeline:

Xynomic has not completed any clinical trials since its inception. With respect to the pipeline programs referenced in the above figure, all of the completed clinical trials of abexinostat were conducted by or on behalf of either Pharmacyclics LLC (“Pharmacyclics”) or Servier Laboratories and the one completed clinical trial of XP-105 was conducted by or on behalf of Boehringer Ingelheim International GmbH (“Boehringer Ingelheim” or “BII”). Xynomic has obtained exclusive rights to use all the data generated in these previously completed clinical trial.

| ● | Abexinostat – Xynomic’s most advanced drug candidate, abexinostat, has been evaluated in 18 Phase 1/2 clinical trials for lymphoma and solid tumors. In February 2017, Xynomic entered into a license agreement with Pharmacyclics for the worldwide exclusive rights to develop and commercialize abexinostat for all human and non-human diagnostic, prophylactic, and therapeutic uses. Since its in-licensing of abexinostat, Xynomic has started enrolling patients in clinical trials for three different indications: (1) in follicular lymphoma, as a monotherapy, (2) in renal cell carcinoma, in combination with pazopanib, and (3) in multiple solid tumors, in combination with Keytruda®. In addition, Xynomic plans to initiate four clinical trials of abexinostat in the next six months. |

| ● | XP-105 (also known as BI 860585) – In December 2018, Xynomic entered into a license agreement with Boehringer Ingelheim for the worldwide exclusive rights to develop and commercialize XP-105 (also known as BI 860585) for all human and non-human diagnostic, prophylactic, and therapeutic uses. Prior to this license, BII had completed one Phase 1 clinical trial for solid tumors. Xynomic plans to initiate two clinical trials of XP-105 in late 2019. |

| ● | Pre-Clinical Programs – In addition, Xynomic has several pre-clinical oncology drug candidates in its pipeline. Among these drug candidates, XP-102 (also known as BI 882370), a selective RAF inhibitor to which Xynomic obtained a worldwide exclusive license from Boehringer Ingelheim, is the closest to clinical testing. |

7

Since inception in 2016, Xynomic’s operations have focused on organizing and staffing the company, business planning, raising capital, in-licensing drug candidates, identifying kinase drug targets and potential drug candidates, establishing its intellectual property, producing drug substance and drug product materials for use in clinical trials and pre-clinical studies, and conducting clinical trials and pre-clinical studies. Xynomic does not have any drugs approved for sale, has not generated any revenue from product sales to date, and it will not generate any product revenue until it receives approval from the FDA or equivalent foreign regulatory bodies to begin selling its pharmaceutical product candidates. Developing pharmaceutical products is a lengthy and expensive process. Even assuming that Xynomic does not encounter any unforeseen safety or other issues during the course of developing its product candidates, Xynomic does not expect to complete the development of a product candidate in several years, if ever. To date, almost all of Xynomic’s development expenses have been incurred on its product candidates: abexinostat, XP-102, XP-103, XP-104, and XP-105.

From inception through March 31, 2019, Xynomic has raised an aggregate of $26.5 million of gross proceeds to fund its operations, of which $0.5 million was from the issuance of Angel Preferred Shares, $4.3 million was from the issuance of Series A-1 Preferred Shares, $2.5 million was from convertible notes, $1.4 million was from advances from a Series B shareholder, $0.9 million was from short-term loan provided by Shanghai Jingshu Venture Capital Center, $2.4 million was from financing provided by Yinglin Mark Xu, and $17 million was from issuance of Redeemable Convertible Series B Preferred Shares, including the conversion of convertible notes of US$2.5 million.

Since inception, Xynomic has incurred operating losses. Xynomic’s net losses were $618,930 and $14,144,555 for the three months ended March 31, 2018 and 2019, respectively. As of March 31, 2019, Xynomic had accumulated deficit of $48,467,724. Xynomic expects to incur significantly higher expenses and operating losses over the next several years in connection with its ongoing activities, as Xynomic:

| ● | continues pre-clinical and clinical development of its programs; |

| ● | in-licenses and subsequently develops additional oncology drug candidates; |

| ● | continues to discover, validate, and develop additional drug candidates; |

| ● | maintains, expands, and protects its intellectual property portfolio; |

| ● | hires additional research, development, and business personnel; |

| ● | if abexinostat is successfully approved for commercialization, incurs additional costs associated with filing marketing authorization applications and establishing sales and marketing infrastructure for abexinostat in the U.S., China, and other territories; and |

| ● | incurs additional costs associated with operating as a public company following the closing of the business combination with Bison (defined below). |

Since Xynomic and its subsidiaries (collectively, the “Group”) have not generated any revenues from product sales substantial additional financing will be required by the Group to continue to fund its research and development activities. No assurance can be given that any such financing will be available when needed or that the Group’s research and development efforts will be successful.

The Group’s ability to fund operations is based on its ability to attract investors and its ability to borrow funds on reasonable economic terms. Historically, the Group has relied principally on equity financing and shareholder’s borrowings to fund its operations and business development. The Group’s ability to continue as a going concern is dependent on management’s ability to successfully execute its business plan, which includes generating revenues after drug marketing, controlling operating expenses, as well as, continuing to obtain additional equity financing. On April 3, 2018, the Group issued convertible notes to Northern Light Venture Capital V, Ltd., and Bo Tan and received proceeds of US$2,500,000, which were converted into 776,633 Series B Preferred Shares in August 2018. Further in August 2018, the Group raised US$17 million by issuance of 5,281,101 Series B Preferred Shares to certain investors, including the conversion of convertible notes of US$2.5 million. On September 12, 2018, the Group entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Yinglin Mark Xu, Bison Capital Acquisition Corp., a NASDAQ listed company, (“Bison” and after the consummation of the Business Combination, sometimes referred to as “Company”), a Special Purpose Acquisition Company listed in Nasdaq, and Bison Capital Merger Sub Inc. (“Merger Sub”). Pursuant to the Merger Agreement, among other things, Merger Sub will merge with and into Xynomic, with Xynomic continuing as the surviving entity and a wholly-owned subsidiary of Bison (the “Merger” and the “Surviving Company”). On March 21, 2019, Bison’s stockholders approved the following items: (i) an amendment to the Bison’s Amended and Restated Memorandum of Association and Articles of Association extending the date by which Bison must consummate its initial business combination and the date for cessation of operations of Bison if Bison has not completed an initial business combination from March 23, 2019 to June 24, 2019 or such earlier date as determined by the Board of Directors of Bison and (ii) an amendment (the “Amendment to Trust Agreement”) to the Trust Agreement (the “Trust Agreement”) between Bison and Continental extending the date on which to commence liquidation of the Trust Account in accordance with the Trust Agreement, as amended by the Amendment to Trust Agreement, from March 23, 2019 to June 24, 2019. The Company completed the business combination with Bison on May 15, 2019. The Group also plans to attract institutional investors following the business combination. Further, the Group can adjust the pace of its clinical development and patient recruitment and control the operating expenses of the Group.

8

The Group currently does not have any commitments to obtain additional funds and may be unable to obtain sufficient funding in the future on acceptable terms, if at all. If the Group cannot obtain the necessary funding, it will need to delay, scale back or eliminate some or all of its research and development programs to: commercialize potential products or technologies that it might otherwise seek to develop or commercialize independently; consider other various strategic alternatives, including another merger or sale of the Group; or cease operations. If the Group engages in collaborations, it may receive lower consideration upon commercialization of such products than if it had not entered into such arrangements or if it entered into such arrangements at later stages in the product development process.

The Group has prepared its financial statements assuming that it will continue as a going concern, which contemplates realization of assets and the satisfaction of liabilities in the normal course of business. The Group has incurred recurring losses from operations since inception. The Group incurred a net loss of US$14,144,555 for the three months ended March 31, 2019. Further, as of March 31, 2019, the Group had net current liabilities (current assets less current liabilities) of US$19,345,343 and accumulated deficit of US$48,467,724. The Group’s ability to continue as a going concern is dependent on its ability to raise capital to fund its current research and development activities and future business plans. Additionally, volatility in the capital markets and general economic conditions in the United States may be a significant obstacle to raising the required funds. These factors raise substantial doubt about its ability to continue as a going concern. The financial statements included herein do not include any adjustments that might be necessary should the Group be unable to continue as a going concern. If the going concern basis were not appropriate for these financial statements, adjustments would be necessary in the carrying value of assets and liabilities, the reported expenses and the balance sheet classifications used.

Operations of the Group are subject to certain risks and uncertainties including various internal and external factors that will affect whether and when the Group’s product candidates become approved drugs and how significant their market share will be, some of which are outside of the Group’s control. The length of time and cost of developing and commercializing these product candidates and/or failure of them at any stage of the drug approval process will materially affect the Group’s financial condition and future operations.

Financial Operations Overview

Organization

Xynomic was incorporated on August 24, 2016, in Wyoming and was re-domiciled to Delaware on April 3, 2018. As of March 31, 2019, Xynomic has one wholly owned subsidiary in China, Xynomic Pharmaceuticals (Nanjing) Co., Ltd., which has two wholly owned subsidiaries, namely Xynomic Pharmaceuticals (Zhongshan) Co., Ltd. and Xynomic Pharmaceuticals (Shanghai) Co., Ltd. Xynomic consolidates its financial statements in accordance with U.S. GAAP.

Revenue

To date, Xynomic has not generated any revenue. In the future, Xynomic will seek to generate revenue from drug sales and potential strategic relationships. Assuming Xynomic commences abexinostat’s pivotal clinical trials in FL, one ongoing in the U.S. and Europe and another expected in China and such trials generate satisfactory efficacy and safety data to a commercialization approval, the earliest time Xynomic would seek to commercialize abexinostat in any region is 2021.

Expenses

Research and Development Expenses

Xynomic’s research and development expenses include:

| ● | the cost of discovery and development of Xynomic’s pre-clinical product candidates XP-103 and XP-104; |

9

| ● | employee-related expenses including salaries, benefits, bonuses; |

| ● | direct research and development expenses incurred under arrangements with third parties such as contract research organizations (“CROs”), contract manufacturing organizations, and consultants; |

| ● | the cost of lab supplies and acquiring, developing, and manufacturing pre-clinical study materials; and |

| ● | other operating costs. |

Research and development costs are recognized as expenses as incurred. Costs for certain activities are recognized based on an evaluation of the progress to completion of specific tasks. Non-refundable advance payments for goods or services to be received in the future for use in research and development activities are deferred and capitalized. The capitalized amounts are expensed as the related goods are delivered or the services are performed.

The successful development of Xynomic’s drug candidates is subject to substantial risks and uncertainties, which make the nature, timing, and costs of the efforts associated with the development of these drug candidates, as well as the timing or amount of any potential net cash inflows from these drug candidates, difficult to estimate. These risks and uncertainties include without limitation, risks and uncertainties associated with:

| ● | establishing an appropriate safety profile with IND-enabling toxicology studies; |

| ● | successful enrollment in, and completion of clinical trials; |

| ● | receipt of marketing approvals from applicable regulatory authorities; |

| ● | establishing commercial manufacturing capabilities or making arrangements with third-party manufacturers; |

| ● | obtaining and maintaining patent and trade secret protection and regulatory exclusivity for Xynomic’s drug candidates; |

| ● | commercializing the drug candidates, if and when approved, whether alone or in collaboration with others; and |

| ● | the acceptable safety profile of the drugs following approval. |

A change in the outcome of any of these variables with respect to the development of any of Xynomic’s drug candidates would significantly change the costs and timing associated with the development of that drug candidate.

Research and development activities are central to Xynomic’s business model. Drug candidates in later stages of clinical development generally have higher development costs than those in earlier stages of clinical development, primarily due to the increased size and duration of later-stage clinical trials. Xynomic expects research and development costs to increase significantly in the foreseeable future as its drug candidate development programs progress. Xynomic, however, does not believe that it is possible at this time to accurately project total program-specific expenses through commercialization. There are numerous factors associated with the successful commercialization of any of Xynomic’s drug candidates, including future trial design and various regulatory requirements, many of which cannot be determined with accuracy at this time based on Xynomic’s stage of development. Additionally, future commercial and regulatory factors beyond Xynomic’s control will impact Xynomic’s clinical development programs and plans.

10

A significant portion of Xynomic’s research and development costs have been external costs, predominantly incurred for abexinostat. Xynomic’s internal research and development costs are primarily personnel-related costs and supply costs. Xynomic incurred $466,402 and $5,324,310 research and development expenses for the three months ended March 31, 2018 and 2019, respectively.

General and Administrative Expenses

General and administrative expenses consist primarily of salaries, and other related costs for personnel in executive, finance, accounting, business development, legal, and human resources functions, and share based compensation expenses. Other significant costs include rent, legal fees relating to patent and corporate matters, and fees for accounting and consulting services.

Xynomic anticipates that its general and administrative expenses will increase in the future to support continued research and development activities, including the expansion of Xynomic’s ongoing clinical trials, the initiation of additional clinical trials, and increased costs of operating as a public company. The last one will likely include costs for audit, legal, regulatory, and tax-related services, director and officer insurance premiums, and investor relations costs.

Critical Accounting Policies and Estimates

Xynomic management’s discussion and analysis of financial condition and results of operations are based on Xynomic’s financial statements, which have been prepared in accordance with U.S. GAAP. The preparation of these financial statements requires Xynomic to make judgments and estimates that affect the reported amounts of assets, liabilities, and expenses and the disclosure of contingent liabilities in Xynomic’s financial statements. Xynomic bases its estimates on historical experience, known trends and events, and various other factors that are believed to be reasonable under the circumstances. Actual results may differ from these estimates under different assumptions or conditions. On an ongoing basis, Xynomic evaluates its judgments and estimates in light of changes in circumstances, facts, and experience. The effects of material revisions in estimates, if any, will be reflected in the financial statements prospectively from the date of change in estimates.

Xynomic believes the following accounting policies used in the preparation of Xynomic’s financial statements require the most significant judgments and estimates.

Share-based Compensation

The Group granted share options to its selected employee and non-employee consultants.

Share-based awards granted to employees with service conditions attached are measured at the grant date fair value and are recognized as an expense using graded vesting method over the requisite service period, which is generally the vesting period. The forfeitures are accounted when they occur.

In June 2018, the FASB issued ASU No. 2018-07, Compensation - Stock Compensation (Topic 718): Improvements to Nonemployee Share-Based Payment Accounting (“ASU 2018-07”). The new guidance largely aligns the accounting for share-based awards issued to employees and nonemployees. Existing guidance for employee awards will apply to non-employee share-based transactions with limited exceptions. Xynomic adopted this guidance on January 1, 2019.

Share-based awards granted to non-employees are measured at the grant date fair value. When no future services are required to be performed by the non-employee in exchange for an award of equity instruments, the cost of the award is expensed on the grant date.

11

Option-pricing models are adopted to measure the value of awards at each grant date. The determination of fair value is affected by the share price as well as assumptions relating to a number of complex and subjective variables, including but not limited to the expected share price volatility, actual and projected employee and non-employee share option exercise behavior, risk-free interest rates and expected dividends. The use of the option-pricing model requires extensive actual employee and non-employee exercise behavior data for the relative probability estimation purpose, and a number of complex assumptions.

Results of Operations

The following table summarizes Xynomic’s results of operations for the three months ended March 31, 2018 and 2019:

| For the Three Months Ended March 31, | ||||||||

| 2018 | 2019 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Operating expenses: | ||||||||

| Research and development | $ | 466,402 | $ | 5,324,310 | ||||

| General and administrative | 103,475 | 8,779,249 | ||||||

| General and administrative to related parties | 49,053 | 25,908 | ||||||

| Total operating expenses | 618,930 | 14,129,467 | ||||||

| Loss from operations | 618,930 | 14,129,467 | ||||||

| Interest expenses to a related party | - | 15,088 | ||||||

| Loss from operations before income tax benefit | 618,930 | 14,144,555 | ||||||

| Income tax | - | - | ||||||

| Net loss | $ | 618,930 | $ | 14,144,555 | ||||

Research and Development Expense

Research and development expense was $5.32 million for the three months ended March 31, 2019, compared to research and development expense of $466,402 for the same period in 2018, representing an increase of $4,857,908 or 1,042%. The substantial increase was mainly due to the increase of the clinical development costs associated with abexinostat, and payment to commence of manufacturing activities of XP-102 as provided in the breakdowns below.

12

Research and development expense for the three months ended March 31, 2018 was mainly comprised of the following items:

| ● | $396,838 payments to clinical development costs associated with abexinostat and XP-102; |

| ● | $62,874 payroll expenses to research and development staff. |

Research and development expense for the three months ended March 31, 2019 was mainly comprised of the following items:

| ● | $3.82 million clinical development costs associated with abexinostat; |

| ● | $0.60 million external IND-enabling pre-clinical and toxicology studies for XP-102. |

| ● | $0.46 million payments of research and development staff costs. |

General and Administrative Expense

General and administrative expense was $8.78 million for the three months ended March 31, 2019, compared to general and administrative expense of $103,475 for the same period in 2018, representing an increase of $8.68 million or 8,384%. The substantial increase was mainly due to the $7.68 million expense related to the options Xynomic issued to an employee and a consultant.

Variance of other general and administrative expenses was primarily attributable to our expanded operation in the three months ended March 31, 2019 compared to the same period of year 2018, and mainly due to the following in addition to the expense related to the options abovementioned:

| ● | professional fees including external legal fees, external auditing fees, corporate communications, and public relations costs increased $0.47 million during the three months ended March 31,2019 when compared to the same period in year 2018 due to the merger transaction with BCAC. |

| ● | there were $0.07 million listing fees including NASDAQ fee, etc. incurred in the three months ended March 31, 2019 while there was no such fee in the same period of year 2018; |

| ● | we incurred $0.03 million consulting service fee during the three months ended March 31, 2019; |

| ● | personnel salaries and employee benefits increased $0.18 million during the three months ended March 31, 2019 compared to that in the three months ended March 31, 2018; |

| ● | Xynomic’s agreements some Contract Research Organizations and Contract Manufacture Organizations include terms that interests for overdue invoices. $222,999 interest expenses was accrued for the three months ended March 31, 2019 due to the invoices that were not paid by the due dates. |

Xynomic expects that its general and administrative expense will increase in future periods as Xynomic expands its operations and incurs additional costs in connection with being a public company. These increases will likely include legal, auditing, and filing fees, additional insurance premiums, and general compliance and consulting expenses.

Interest Expense to a Related Party

Xynomic Nanjing accrued interest expense of US$15,088 for the advance from Zhongshan Bison for the three months ended March 31, 2019. There was no such loan or interest in the three months ended March 31, 2018.

Liquidity and Capital Resources

Sources of Liquidity

From inception through March 31, 2019, the Group has financed its operations primarily through gross proceeds of $21.8 million from private placements of preferred shares, and proceeds of $4.7 million from debt financing. As of March 31, 2019, the Group had cash of $1,049,561.

13

From inception through March 31, 2019, Xynomic Pharmaceuticals (Nanjing) Co., Ltd. borrowed $0.9 million from Shanghai Jingshu Venture Capital Center pursuant to a loan agreement signed in April 2018 and repaid such loan in August 2018; Xynomic Pharmaceuticals (Nanjing) Co., Ltd. borrowed $1.4 million from Zhongshan Bison Healthcare Investment Limited (Limited Partnership) pursuant to a loan agreement signed in May 2018 and has repaid $1.0 million as of March 31, 2019; the Group borrowed $2.4 million from Yinglin Mark Xu pursuant to a bridge loan agreement signed in August 2017. The Group, on a consolidated basis, had $2.87 million in outstanding principal and interest under the aforementioned loan agreements as of March 31, 2019.

The Group’s recurring losses from operations since inception and the net current liabilities (current assets less current liabilities) as of March 31, 2019 raise substantial doubt about its ability to continue as a going concern. The Group’s ability to fund operations is based on its ability to attract investors and its ability to borrow funds on reasonable economic terms.

On May 15, 2019, Xynomic closed a merger (the “Closing”), pursuant to certain Agreement and Plan of Merger (as amended, the “Merger Agreement”), dated as of September 12, 2018, entered into by and among by and among (i) Bison Capital Acquisition Corp., a British Virgin Islands company to be domesticated to Delaware immediately prior to the Merger (“Bison”, sometimes is referred as “XYN” posting the Merger); (ii) Bison Capital Merger Sub Inc., a Delaware corporation (“Merger Sub”) (iii) Xynomic; and (iv) Yinglin Mark Xu (“Stockholder Representative”), solely in his capacity as the Stockholder Representative thereunder, among other things, Merger Sub merged with and into Xynomic, with Xynomic continuing as the surviving entity and a wholly-owned subsidiary of Bison, which then changed its name to “Xynomic Pharmaceuticals Holdings, Inc.” (the “Merger” and “XYN”).

On the same day, XYN received written notice from the staff of the NASDAQ Stock Market LLC (“Nasdaq”) indicating that the Staff had determined to delist its securities from NASDAQ based upon the non-compliance with the requirement of a minimum of 300 round lot holders of and 400 round lot holders of purchase warrants and the requirement of the minimum US$5 million in stockholders’ equity. XYN intends to request a hearing before the Nasdaq Hearings Panel (the “Panel”), and such request will stay any suspension or delisting action by Nasdaq pending the completion of the hearing process and the expiration of any extension period that may be granted to XYN by the Panel. XYN intends to pursue certain actions to increase the number of round lot holders of its common stock and warrants as well as increase its stockholders’ equity as soon as practicable to meet the applicable listing requirements; however, there can be no assurances that XYN will be able to do so within the period of time that may be granted by the Panel.

The Group also plans to attract institutional investors following the business combination. Further, the Group can adjust the pace of its clinical development and patient recruitment and control the operating expenses of the Group.

The Group currently does not have any commitments to obtain additional funds and may be unable to obtain sufficient funding in the future on acceptable terms, if at all. If the Group cannot obtain the necessary funding, it will need to delay, scale back or eliminate some or all of its research and development programs to: commercialize potential products or technologies that it might otherwise seek to develop or commercialize independently; consider other various strategic alternatives, including another merger or sale of the Group; or cease operations; or its securities may be delisted from Nasdaq. If the Group engages in collaborations, it may receive lower consideration upon commercialization of such products than if it had not entered into such arrangements or if it entered into such arrangements at later stages in the product development process.

The Group has prepared its financial statements assuming that it will continue as a going concern, which contemplates realization of assets and the satisfaction of liabilities in the normal course of business. The Group has incurred recurring losses from operations since inception. The Group incurred a net loss of US$14,144,555 for the three months ended March 31, 2019. Further, as of March 31, 2019, the Group had net current liabilities (current assets less current liabilities) of US$19,345,343 and accumulated deficit of US$48,467,724. The Group’s ability to continue as a going concern is dependent on its ability to raise capital to fund its current research and development activities and future business plans. Additionally, volatility in the capital markets and general economic conditions in the United States may be a significant obstacle to raising the required funds. These factors raise substantial doubt about its ability to continue as a going concern. The financial statements included herein do not include any adjustments that might be necessary should the Group be unable to continue as a going concern. If the going concern basis were not appropriate for these financial statements, adjustments would be necessary in the carrying value of assets and liabilities, the reported expenses and the balance sheet classifications used.

Operations of the Group are subject to certain risks and uncertainties including various internal and external factors that will affect whether and when the Group’s product candidates become approved drugs and how significant their market share will be, some of which are outside of the Group’s control. The length of time and cost of developing and commercializing these product candidates and/or failure of them at any stage of the drug approval process will materially affect the Group’s financial condition and future operations.

Cash Flows

The following table provides information regarding Xynomic’s cash flows for the periods reported:

| For the

three months ended March 31, | ||||||||

| 2018 | 2019 | |||||||

| Net cash used in operating activities | $ | (551,510 | ) | $ | (3,268,589 | ) | ||

| Net cash used in investing activities | - | (92,367 | ) | |||||

| Net cash provided by/(used in) financing activities | 466,934 | (333,142 | ) | |||||

| Effect of foreign exchange rate changes on cash | (2,711 | ) | ||||||

| Net decrease in cash and cash equivalents | $ | (84,576 | ) | $ | (3,696,809 | ) | ||

14

Net Cash Used in Operating Activities

The use of cash in all periods resulted primarily from Xynomic’s net losses adjusted for non-cash charges and changes in components of working capital. Net cash used in operating activities was $551,510, and $3,268,589 for the three months ended March 31, 2018 and 2019, respectively. The net cash used in operating activities in the three months ended March 31, 2018 was mainly due to the payments to Contract Manufacture Organizations of $273,349, payments of $78,225 to Contract Research Organizations for the research and development of abexinostat, and $33,417 payment for patent maintenance. The net cash used in operating activities in the three months ended March 31, 2019 was mainly due to the payments to Contract Manufacture Organizations of $257,060, payments of $1,671,201 to Contract Research Organizations for the research and development of abexinostat, payments of $339,930 to professional service providers such as lawyers and accountants, $496,218 payments for staff salaries.

Net Cash Used in Investing Activities

Net cash used in investing activities was $0 and $92,367 for the three months ended March 31, 2018 and 2019, respectively. The net cash used in investing activities in 2019 is mainly due to the purchase of properties and equipment to be used in research and development activities.

Net Cash Provided by/(used in) Financing Activities

Net cash provided by financing activities was $466,934 for the three months ended March 31, 2018 and net cash used in financing activities was $333,142 for the three months ended March 31, 2019. Net cash provided by financing activities during three months ended March 31, 2018 was primarily from $498,222 advance from a shareholder Yinglin Mark Xu. Net cash used in financing activities during the three months ended March 31, 2018 was primarily due to a $747,189 repayment of the advance from a Series B shareholder Zhongshan Bison Healthcare Investment Limited (Limited Partnership), which was offset by $412,961 advance from a shareholder Mr.Yinglin Mark Xu.

Funding Requirements

Xynomic expects its expenses to increase in connection with its ongoing activities, particularly as Xynomic continues the research and development of, initiates clinical trials of, and seeks marketing approval for, its drug candidates. In addition, if Xynomic obtains marketing approval for any of its drug candidates, Xynomic expects to incur significant commercialization expenses related to drug sales, marketing, manufacturing, and distribution to the extent that such sales, marketing, and distribution are not the responsibility of potential collaborators. Furthermore, as a public reporting company, Xynomic starts to incur additional costs associated with operating as a public company. Accordingly, Xynomic may need to obtain substantial additional funding in connection with its continuing operations. If Xynomic is unable to raise capital when needed, or is unable to raise capital on favorable terms, Xynomic would be forced to delay, reduce, or eliminate its research and development programs or future commercialization efforts.

Xynomic’s future capital requirements will depend on many factors, including:

| ● | the scope, progress, results, and costs of drug discovery, pre-clinical development, laboratory testing, and clinical trials for Xynomic’s drug candidates; |

| ● | the scope, prioritization, and number of Xynomic’s research and development programs; |

| ● | the costs, timing, and outcome of regulatory review of Xynomic’s drug candidates; |

| ● | Xynomic’s ability to establish and maintain collaborations on favorable terms, if at all; |

| ● | the achievement of milestones or occurrence of other developments that trigger payments under any collaboration agreements Xynomic currently has and may have in the future; |

| ● | the extent to which Xynomic is obligated to reimburse, or entitled to reimbursement of, clinical trial costs under future collaboration agreements, if any; |

| ● | the costs of preparing, filing, and prosecuting patent applications, maintaining and enforcing Xynomic’s intellectual property rights, and defending intellectual property-related claims; |

| ● | the extent to which Xynomic acquires or in-licenses other drug candidates and technologies; |

| ● | the costs of securing manufacturing arrangements for commercial production; and |

| ● | the costs of establishing, or contracting for, sales and marketing capabilities if Xynomic obtains regulatory approvals to market its drug candidates. |

Identifying potential drug candidates and conducting pre-clinical testing and clinical trials is a time-consuming, expensive, and uncertain process that takes many years to complete, and Xynomic may never generate the necessary data or results required to obtain marketing approval and achieve drug sales. In addition, Xynomic’s drug candidates, if approved, may not achieve commercial success. Xynomic’s commercial revenues, if any, will be derived from sales of drugs that Xynomic does not expect to be commercially available for quite a few years, if at all. Accordingly, Xynomic will need to continue to rely on additional financing to achieve its business objectives. Adequate additional financing may not be available to Xynomic on acceptable terms, or at all.

15

Until such time, if ever, as Xynomic can generate substantial drug revenues, Xynomic expects to finance its cash needs through a combination of equity offerings, debt financings, collaborations, strategic alliances, and licensing arrangements.

If Xynomic raises funds through collaborations, strategic alliances, or licensing arrangements with third parties, Xynomic may have to relinquish valuable rights to its future revenue streams, research programs, or drug candidates or to grant licenses on terms that may not be favorable to Xynomic. If Xynomic is unable to raise additional funds through equity or debt financings when needed, Xynomic may be required to delay, limit, reduce, or terminate its drug development or future commercialization efforts or grant rights to develop and market drug candidates that Xynomic would otherwise prefer to develop and market itself.

Contractual Obligations

The following table summarizes Xynomic’s significant contractual obligations as of payment due date by period at December 31, 2018:

| Total | Less than 1 Year | 1 to 3 Years | 3 to 5 Years | More than 5 years | ||||||||||||||||

| Debt repayments (1) | $ | 3,153,088 | $ | 3,153,088 | — | — | — | |||||||||||||

| (1) | Consists of payment obligations for loan agreement with Yinglin Mark Xu and Zhongshan Bison Healthcare Investment Limited (Limited Partnership). As of December 31, 2018, Xynomic had $2,008,936 in outstanding principal under the agreement with Yinglin Mark Xu and $1,144,152 outstanding principal and interest under the agreement with Zhongshan Bison Healthcare Investment Limited (Limited Partnership). |

Xynomic also have obligations to make future payments to third party licensors that become due and payable on the achievement of certain development, regulatory and commercial milestones. This includes milestone payments associated with Xynomic’s license agreements. Possible future payments under Xynomic’s license arrangements include up to $10.5 million in payments related to abexinostat, up to $ 17.7 million related to XP-102, and up to $18 million related to XP-105. Xynomic have not included these commitments on our balance sheet or in the table above because the commitments are cancellable if the milestones are not completed and achievement and timing of these obligations are not fixed or determinable.

Xynomic enters into agreements in the normal course of business with CROs for clinical trials and clinical supply manufacturing and with vendors for pre-clinical research studies, synthetic chemistry, and other services and products for operating purposes. Xynomic has not included these payments in the table of contractual obligations above since the contracts are cancelable at any time by Xynomic, generally upon 30 days prior written notice to the vendor.

Off-Balance Sheet Arrangements

Xynomic did not have, during the periods presented, and Xynomic does not currently have, any off-balance sheet arrangements, as defined under applicable Securities and Exchange Commission rules.

Quantitative and Qualitative Disclosures about Market Risk

Xynomic is exposed to market risks related to changes in interest rates. Xynomic’s primary exposure to market risks is interest rate sensitivity, which is affected by changes in the general level of U.S. interest rates.

Xynomic is also exposed to market risk related to changes in foreign currency exchange rates. Xynomic contracts with vendors that are located in Asia and Europe, which are denominated in foreign currencies. Xynomic is subject to fluctuations in foreign currency rates in connection with these agreements. Xynomic does not currently hedge its foreign currency exchange rate risk. As of March 31, 2019, Xynomic had $2.47 million liabilities denominated in foreign currencies.

Inflation generally affects Xynomic by increasing its labor costs and clinical trial costs. Xynomic does not believe that inflation had a material effect on its business, financial condition, or results of operations since its inception.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding the beneficial ownership of our ordinary shares as of the Closing (taking in account of the redemption in connection with the Business Combination and automatic exchange of rights into common shares at the Closing), based on information obtained from the persons named below, with respect to the beneficial ownership of our common shares, by:

| ● | each person known by us to be the beneficial owner of more than 5% of our outstanding common shares; | |

| ● | each of our executive officers and directors that beneficially owns our common shares; and | |

| ● | all our executive officers and directors as a group. |

16

Unless otherwise indicated, we believe that all persons named in the table have sole voting and investment power with respect to all common shares beneficially owned by them.

| Number of Shares | % | |||||||

| Name and Address of Beneficial Owners (1) | ||||||||

| Peixin Xu (2) | 1,574,600 | 3.40 | % | |||||

| James Jiayuan Tong (3) | 391,650 | 0.85 | % | |||||

| Yinglin Mark Xu (4) | 21,009,055 | 45.40 | % | |||||

| Tingzhi Qian (5) (14) (15) | 7,517,707 | 16.25 | % | |||||

| Wentao Jason Wu (6) (12) | 5,612,618 | 12.13 | % | |||||

| Jinwei Coco Ku (7) | 0 | - | ||||||

| Adam Inglis (8) | 0 | - | ||||||

| Charles Vincent Prizzi (9) | 0 | - | ||||||

| Thomas Folinsbee (10) | 0 | - | ||||||

| Richard Peidong Wu (11) | 0 | - | ||||||

| Bison Capital Holding Company Limited (2) | 1,574,600 | 3.40 | % | |||||

| Grand Ascent Group Limited (12) | 5,612,618 | 12.13 | % | |||||

| Bridge Pharm International Inc. (13) | 2,547,146 | 5.50 | % | |||||

| Prosperico Gate I Limited (14) | 2,547,138 | 5.50 | % | |||||

| Dande Lion Limited (15) | 4,970,569 | 10.74 | % | |||||

| Ascender Prosperity Capital Co., Ltd. (16) | 2,796,078 | 6.04 | % | |||||

| Zhongshan Bison Healthcare Investment Limited (Limited Partnership) (17) | 1,318,793 | 2.85 | % | |||||

| All 5% or more beneficial owners, directors and executive officers as a group (nine individuals) | 39,874,254 | 86.17 | % | |||||

| * | Less than one percent |

| (1) | Unless otherwise indicated, the business address of each of the individuals is Suite 3306, K. Wah Centre, 1010 Middle Huaihai Road, Shanghai 200031, China. |

| (2) | Fengyun Jiang, who has 100% ownership interest in Bison Capital Holding Company Limited and is Peixin Xu’s spouse, has voting and dispositive power over the shares held by such entity. This amount includes 1,117,725 shares held by Bison Capital Holding Company Limited, which is beneficially owned by Fengyun Jiang (100%); Fengyun Jiang has voting and dispositive control over the securities held by Bison and disclaims beneficial ownership of the Ordinary Shares owned by Bison Capital Holding Company Limited, except to the extent of his pecuniary interest in such company. Mr. Xu was the Chairman of Bison but resigned at the Closing. |

| (3) | Dr. Tong is Chief Strategy Officer and a director. |

| (4) | Mr. Yinglin Mark Xu is the Chairman, Chief Executive Officer, President, and Interim Chief Financial Officer. |

| (5) | Mr. Tingzhi Qian is a director of Xynomic. Mr. Qian holds the shares through his control of Prosperico Gate I Limited and Dande Lion Limited. |

| (6) | Mr. Wentao Jason Wu is the Chief Operating Officer. |

| (7) | Ms. Kou is the Interim Chief Accounting Officer. |

| (8) | Mr. Adam Inglis is an independent director. |

| (9) | Mr. Charles Prizzi is an independent director and Chairman of the Compensation Committee. |

| (10) | Mr. Thomas Folinsbee is an independent director of Xynomic. |

| (11) | Mr. Richard Peidong Wu is an independent director and Chairman of the Audit Committee and the Corporate Governance and Nominating Committee. |

| (12) | Grand Ascent Group Limited is a healthcare focused advisory company incorporated under the laws of Hong Kong. The address of its business office is Unit 826, Ocean Centre, Harbour City, 5 Canton Road, TST, KLN, Hong Kong. The person having voting, dispositive or investment powers over Grand Ascent Group Limited is Ms. Yimei Zhang. Ms. Zhang is the close family member of Dr. Wentao Jason Wu and due do this relationship, we deem that Dr. Wu controls and/or has substantial influence on the disposition rights and voting rights of shares included herein |

17

| (13) | Bridge Pharm International Inc. is a healthcare focused advisory company incorporated under the laws of The British Virgin Islands. The address of its business office is Suite 1-301, Banxia Road, Pudong New District, Shanghai, China. The person having voting, dispositive or investment powers over Bridge Pharm International Inc. is Ms. Yanli Luo. |

| (14) | Prosperico Gate I Limited is an exempted company 100% and directly owned by Prosperico Healthcare Fund I, LP, which is a healthcare focused investment fund in the form of exempted limited partnership with no US-investors incorporated under the laws of the Cayman Islands. The address of the company is P.O. Box 31119 Grand Pavilion, Hibiscus Way, 802 West Bay Road, Grand Cayman, KY1-1205, Cayman Islands. The person having voting, dispositive or investment powers over Prosperico Gate I Limited is Mr. Tingzhi Qian. |

| (15) | DandeLion Limited is an exempted company 100% and ultimately owned by Mr. Tingzhi Qian incorporated under the laws of The Cayman Islands. The address of the company is P.O. Box 31119 Grand Pavilion, Hibiscus Way, 802 West Bay Road, Grand Cayman, KY1-1205, Cayman Islands. The person having voting, dispositive or investment powers over Dande Lion Limited is Mr. Tingzhi Qian. |

| (16) | Ascender Prosperity Capital Co., Ltd. is a healthcare focused investment company incorporated under the laws of The Cayman Islands. The address of the company is P.O. Box 31119 Grand Pavilion, Hibiscus Way, 802 West Bay Road, Grand Cayman, KY1-1205, Cayman Islands. The person having voting, dispositive or investment powers over Ascender Prosperity Capital Co., Ltd. is Mr. Qi Jun Chen. |

| (17) | Zhongshan Bison Healthcare Investment Limited (Limited Partnership) is a healthcare focused venture capital and private equity investment company incorporated under the laws of Zhongshan, Guangdong Province, China. The address of its business office is B609-610, 21st Century Tower, No. 40 Liangmaqiao Road, Chaoyang District, Beijing 100016, China. The people having voting, dispositive or investment powers over Zhongshan Bison Healthcare Investment Limited are 5 members of its investment committee. |

DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS

The disclosure contained in the Definitive Proxy Statement with section entitled “Management After the Business Combination” beginning on page 251 is incorporated herein by reference. Specifically, subsection “Management and Board of Directors” begins on page 251, “Leadership Structure and Risk Oversight” begins on page 251.

DIRECTOR COMPENSATION

The disclosure contained in the Definitive Proxy Statement with section entitled “Director Compensation” beginning on page 252 is incorporated herein by reference.

EXECUTIVE COMPENSATION

The disclosure contained in the Definitive Proxy Statement with section entitled “Executive Compensation” beginning on page 252 is incorporated herein by reference.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS