UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

For the fiscal year ended

or

For the transition period from to

Commission file number

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of | (I.R.S. Employer |

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including

area code:

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant

is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark whether the registrant

is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report.

If securities are registered pursuant to Section

12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction

of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No

The aggregate market value of the registrant’s

common stock, par value $0.001 per share, held by non-affiliates of the registrant, as computed by reference to the September 30, 2022

closing price reported by Nasdaq, was approximately $

The number of the registrant’s shares of

common stock, $0.001 par value per share, outstanding on June 27, 2023 was

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s proxy statement for its 2023 Annual Meeting of Stockholders are incorporated by reference in Part III of this Annual Report on Form 10-K.

Table of Contents

i

PART I

Item 1. Business.

Overview

Jerash Holdings (US), Inc. (“Jerash Holdings”), through its wholly owned operating subsidiaries (together the “Group,” “we,” “us,” or “our”), is principally engaged in the manufacturing and exporting of customized, ready-made sportswear and outerwear from knitted fabric and personal protective equipment (“PPE”) produced in its facilities in the Hashemite Kingdom of Jordan (“Jordan”). Our website address is http://www.jerashholdings.com. Information available on our website is not a part of, and is not incorporated into, this Annual Report on Form 10-K.

We are a manufacturer for many well-known brands and retailers, such as VF Corporation (which owns brands such as The North Face, Timberland, and Vans), New Balance, G-III (which licenses brands such as Calvin Klein, Tommy Hilfiger, DKNY, and Guess), American Eagle, and Skechers. Our production facilities comprise six factories and five warehouses and we currently employ approximately 5,000 people. The total annual capacity at our facilities was approximately 14 million pieces (average for product categories including t-shirts, polo shirts, pants, shorts, and jackets, and excluding PPE) as of March 31, 2023.

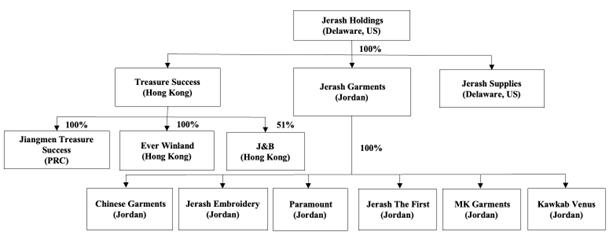

Organizational Structure

Jerash Holdings is a holding company incorporated in Delaware in January 2016. As of the date of this annual report, Jerash Holdings has the following wholly owned subsidiaries: (i) Jerash Garments and Fashions Manufacturing Co., Ltd. (“Jerash Garments”), an entity formed under the laws of Jordan, (ii) Treasure Success International Limited (“Treasure Success”), an entity formed under the laws of Hong Kong Special Administrative Region of the People’s Republic of China (“Hong Kong” or “HK”), (iii) Chinese Garments and Fashions Manufacturing Co., Ltd. (“Chinese Garments”), an entity formed under the laws of Jordan and a wholly owned subsidiary of Jerash Garments, (iv) Jerash for Industrial Embroidery Co., Ltd. (“Jerash Embroidery”), an entity formed under the laws of Jordan and a wholly owned subsidiary of Jerash Garments, (v) Al-Mutafaweq Co. for Garments Manufacturing Ltd. (“Paramount”), an entity formed under the laws of Jordan and a wholly owned subsidiary of Jerash Garments, (vi) Mustafa and Kamal Ashraf Trading Company (Jordan) for the Manufacture of Ready-Make Clothes LLC (“MK Garments”), an entity formed under the laws of Jordan and a wholly owned subsidiary of Jerash Garments; (vii) Jiangmen Treasure Success Business Consultancy Co., Ltd. (“Jiangmen Treasure Success”), an entity incorporated under the laws of the People’s Republic of China (“China” or the “PRC”) and a wholly owned subsidiary of Treasure Success, (viii) Jerash The First Medical Supplies Manufacturing Company Limited (“Jerash The First”), an entity formed under the laws of Jordan and a wholly owned subsidiary of Jerash Garments, (ix) Jerash Supplies, LLC (“Jerash Supplies”), an entity formed under the laws of the State of Delaware, (x) Kawkab Venus Dowalyah Lisenaet Albesah (“Kawkab Venus”), a limited liability company established in Amman, Jordan, and (xi) Ever Winland Limited (“Ever Winland”), a limited liability company organized in Hong Kong. As of the date of this annual report, Treasure Success owns 51% of the equity interests in J&B International Limited (“J&B”), a company with limited liability incorporated under the laws of Hong Kong. P. T. Eratex (Hong Kong) Limited (“Eratex”), a company formed in Hong Kong, owns the remaining 49%.

1

This chart reflects our organizational structure as of the date of this annual report:

Jerash Garments was established in Jordan on November 26, 2000 and operates out of our factory in Al Tajamouat Industrial City, a Development Zone in Amman, Jordan. Jerash Garments’ principal activities are to house management offices and to operate production lines and printing, sewing, ironing, packing, and quality control units, as well as house our trims and finished products warehouses. We also operate our factory in Al-Hasa County (as discussed below) under Jerash Garments.

Chinese Garments was established in Jordan on June 13, 2013 and operates out of our factory in Al Tajamouat Industrial City. Chinese Garments’ principal activities are to house administration, human resources, finance, and management offices and to operate additional production lines and sewing, ironing, and packing units, as well as house our trims warehouse.

Jerash Embroidery was established in Jordan on March 11, 2013 and operates out of our factory in Al Tajamouat Industrial City. Jerash Embroidery’s principal activities are to perform the cutting and embroidery for our products.

Paramount was established in Jordan on October 24, 2004 and operates out of our factory in Al Tajamouat Industrial City. Paramount’s principal activities are to manufacture garments per customer orders.

MK Garments was established in Jordan on January 23, 2003. On June 24, 2021, Jerash Garments and the sole shareholder of MK Garments entered into an agreement, pursuant to which Jerash Garments acquired all of the outstanding stock of MK Garments. As of October 7, 2021, MK Garments became a subsidiary of Jerash Garments. MK Garments operates out of our factory in Al Tajamouat Industrial City. MK Garments’ principal activities are to manufacture garments per customer orders.

Treasure Success was established in Hong Kong on July 5, 2016 and operates in Hong Kong. Treasure Success’s primary activities are sales of garments and to employ sales and merchandising staff and supporting personnel in Hong Kong to support the business of Jerash Garments and its subsidiaries.

Jiangmen Treasure Success was established in Jiangmen City of Guangdong Province in the PRC on August 28, 2019 and operates in the PRC. Jiangmen Treasure Success’s primary activities are to provide support in sales and marketing, sample development, merchandising, procurement, and other areas.

Jerash The First was established in Jordan on July 6, 2020 and operate out of our factory in Al-Hasa County. Jerash The First’s principal activities are to manufacture PPE products.

Jerash Supplies was formed in Delaware on November 20, 2020. Jerash Supplies is engaged in the trading of PPE products.

Kawkab Venus was established in Amman, Jordan, on January 15, 2015 with a declared capital of JOD 50,000. It holds land with factory premises, which are leased to MK Garments. On July 14, 2021, Jerash Garments and the sole shareholder of Kawkab Venus entered into an agreement, pursuant to which Jerash Garments acquired all of the outstanding stock of Kawkab Venus. Apart from the land and factory premises, Kawkab Venus had no other significant assets or liabilities and no operation activities or employees at the time of acquisition, so the acquisition was accounted for an asset acquisition. As of August 21, 2022, Kawkab Venus became a subsidiary of Jerash Garments.

2

Ever Winland was organized in Hong Kong on December 3, 2020. It holds office premises, which are leased to Treasure Success. On June 22, 2022, Treasure Success and the shareholders of Ever Winland entered into an agreement, pursuant to which Treasure Success acquired all of the outstanding stock of Ever Winland. Apart from the office premises used by Treasure Success, Ever Winland had no other significant assets or liabilities and no operating activities or employees at the time of this acquisition, so this transaction was accounted for as an asset acquisition. As of August 29, 2022, Ever Winland became a subsidiary of Treasure Success.

J&B is a joint venture company established in Hong Kong on January 10, 2023. On March 20, 2023, Treasure Success and Eratex entered into a Joint Venture and Shareholders’ Agreement, pursuant to which Treasure Success acquired 51% of the equity interests in J&B on April 11, 2023. J&B engages in the business of garment trading and manufacturing for orders from customers.

Products

As a garment manufacturing group, we specialize in manufacturing sportswear and outerwear. Our sportswear and outerwear product offering consists of jackets, polo shirts, t-shirts, pants, and shorts. Our primary product offering in the fiscal year ended March 31, 2023 was shorts, pants, and vests, which accounted for approximately 49% of our total shipped pieces. In the fiscal year ended March 31, 2022, our primary product offering was jackets, which accounted for approximately 35% of our total shipped pieces.

In response to high demand for PPE due to the COVID-19 pandemic, we started manufacturing PPE in 2020. Our PPE product offering consists of branded (washable) and disposable face masks, medical scrubs, protective coveralls, and surgical gowns. In order to advance our PPE market development efforts, we incorporated a new entity, Jerash The First, which received temporary permission from Jordan’s Food and Drug Administration to manufacture and export non-surgical PPE. Our production facility for PPE needs to meet certain structural requirements before we can receive a permanent permission and we are still planning the production facility. In September 2020, we successfully registered as a medical device manufacturing facility with the U.S. Food and Drug Administration for the sale and export of our PPE products to the United States. We also received an ISO 13485 designation covering the manufacturing, packing, and selling of medical supplies. The sale and export of PPE products did not contribute to our total revenue in the fiscal year ended March 31, 2023.

Manufacturing and Production

Our production facilities are located in Al Tajamouat Industrial City and in Al-Hasa County in the Tafilah Governorate of Jordan.

Our production facilities in Al Tajamouat Industrial City comprise five factories and five warehouses. Effective as of January 1, 2019, the government of the Hashemite Kingdom of Jordan converted Al Tajamouat Industrial City into a Development Zone. Following this change, we continued to operate under benefits similar to the Qualifying Industrial Zone designation, but were subject to a 10% corporate income tax plus a 1% social contribution. Starting from January 1, 2020, the corporate income tax rate increased to 14% plus a 1% social contribution. On January 1, 2021, the corporate income tax rate increased to 16% plus a 1% social contribution. On January 1, 2022, the corporate income tax rate increased to 18% or 20% plus a 1% social contribution. Effective January 1, 2023, we have been subject to a 19% or 20% corporate income tax rate plus a 1% social contribution. Currently, the first factory, which we own, employs approximately 1,400 people. Its primary functions are to house our management offices, as well as production lines, trims warehouse, and printing, sewing, ironing, and packaging units. The second factory, which we lease, employs approximately 1,400 people. Its primary function is to house our administrative and human resources personnel, merchandising and accounting departments, embroidery, printing, additional production lines, trims and finished products warehouses, and sewing, ironing, packing and quality control units. The third factory, which we lease, employs approximately 200 people. Its primary functions are to perform the cutting for our products. The fourth factory (under Paramount), which we lease, currently employs approximately 1,100 people. Its primary functions are to house additional production lines. The fifth factory (under MK Garments) currently employs approximately 600 people. Its primary function is to manufacture garments for orders from customers.

3

Our production facility in Al-Hasa County in the Tafilah Governorate of Jordan comprises a factory, which currently employs approximately 300 people and its primary functions are to manufacture garment products per customer orders. We commenced the construction of this factory in 2018 and we started operations in November 2019. This is a joint project with the Jordanian Ministry of Labor and the Jordanian Education and Training Department. According to our agreement with these government agencies, we used this factory without paying rent through December 2022. We have continued to use the factory without paying rent since January 2023 as new arrangements with the Jordanian Ministry of Labor are still being made. See “Item 2. Properties” below for more information regarding this factory.

In 2015, we commenced a project to build a 4,800 square-foot workshop in the Tafilah Governorate of Jordan, which was originally intended to be used as a sewing workshop for Jerash Garments. Construction was temporarily suspended in March 2020 due to the COVID-19 pandemic and was subsequently completed and ready for use as of September 30, 2021 and the building is now used as a dormitory to house management and supervisory staff who work at the factory in Al-Hasa County.

In April 2021, we commenced a construction on a 189,000 square-foot housing facility for our multi-national workforce, situated on a 49,000 square-foot site owned by us, in Al Tajamouat Industrial City. We anticipate the completion and occupancy of the new building for August 2023. To meet increasing demand, we are also completing plans to construct an additional project on a nearby separate 133,000 square-foot parcel that we purchased in 2019 for $1.2 million, with 2/3 of the land allocated for our seventh factory and 1/3 for housing. We have resumed our work with engineering consultants on the architectural design of the building with the consideration of business growth potential bought about by the new business collaboration with Busana Apparel Group.

Total annual capacity at our existing facilities was approximately 14 million pieces (average for product categories including t-shirts, polo shirts, pants, shorts, and jackets, and excluding PPE) as of March 31, 2023. Our production flow begins in the cutting department of our factory. Then the product is sent to the embroidery department for embroidery if applicable. From there, the product moves to be processed by the sewing unit, finishing department, quality control, and finally the ironing and packing units.

We do not have long-term supply contracts or arrangements with our suppliers. Most of our ultimate suppliers for raw materials, such as fabric, zippers, and labels, are designated by customers and we purchase such materials on a purchase order basis.

Employees

As of March 31, 2023, we had an aggregate of approximately 5,500 employees located in Jordan, Hong Kong, the People’s Republic of China, and the United States of America, all of which are full-time employees.

Customers

The following table outlines the dollar amount and percentage of total sales to our customers for the fiscal years ended March 31, 2023 (“fiscal 2023”) and March 31, 2022 (“fiscal 2022”).

| Fiscal 2023 | Fiscal 2022 | |||||||||||||||

| Sales | Sales | |||||||||||||||

| (USD, in thousands) | % | (USD, in thousands) | % | |||||||||||||

| VF Corporation(1) | $ | 82,661 | 59.9 | % | $ | 96,450 | 67.3 | % | ||||||||

| New Balance | 24,124 | 17.5 | % | 34,506 | 24.1 | % | ||||||||||

| Jiangsu Guotai Huasheng Industrial Co (HK)., Ltd | 9,454 | 6.8 | % | 3,245 | 2.3 | % | ||||||||||

| Dynamic | 8,175 | 5.9 | % | 2,235 | 1.6 | % | ||||||||||

| G-III | 5,589 | 4.0 | % | 2,758 | 1.9 | % | ||||||||||

| Classic | 1,596 | 1.2 | % | - | 0 | % | ||||||||||

| Soriana | 954 | 0.7 | % | 1,487 | 1.0 | % | ||||||||||

| Others | 5,510 | 4.0 | % | 2,674 | 1.8 | % | ||||||||||

| Total | $ | 138,063 | 100.0 | % | $ | 143,355 | 100.0 | % | ||||||||

| (1) | Most of our products are sold under The North Face and Timberland brands owned by VF Corporation. |

4

In fiscal 2023 and fiscal 2022, we depended on a few key customers for our sales, and most of our sales in fiscal 2023 and 2022 were to one customer, VF Corporation.

We started producing garments for VF Corporation in 2012. Most of the products we manufacture are sold under The North Face and Timberland brands which are owned by VF Corporation. Currently, we manufacture primarily outerwear for The North Face. Approximately 60% and 67% of our sales in fiscal 2023 and 2022 were derived from the sale of manufactured products to VF Corporation, respectively. We are not party to any long-term contracts with VF Corporation or our other customers, and our sales arrangements with our customers do not have minimum purchase requirements. As is common in our industry, VF Corporation and our other customers place purchase orders with us after we complete detailed sample development and approval processes that we and our customers have agreed upon for their purchase of the relevant manufactured garments. It is through the sample development and approval processes that we and VF Corporation and our other customers agree on the purchase and manufacture of the garments. For fiscal 2023, VF Corporation issued approximately 10,500 purchase orders to us in amounts ranging from approximately $6 to $372,000. For fiscal 2022, VF Corporate issued approximately 9,500 purchase orders to us in amounts ranging from approximately $5 to $684,000.

Our customers are in the retail industry, which is subject to substantial cyclical variations. Consequently, there can be no assurance that sales to current customers will continue at the current rate or at all. In addition, our annual and quarterly results may vary, which may cause our profits and the market price of our common stock to decline.

We continue to seek to expand and strengthen our relationship with our current customers and other brand names. However, we cannot assure you that these brands will continue to buy our products in the same volumes or on the same terms as they did in the past or that we will be successful in expanding our relationship with other brand names.

Competition

The markets for the manufacturing of sportswear and outerwear are highly competitive. The competition in those markets is focused primarily on the price and quality of the product and the level of customer service. Our products compete with products of other apparel manufacturers in Asia, Israel, Europe, the United States, and South and Central America.

Competition with other manufacturers in the clothing industry focuses on reducing production costs, reducing supply lead time, design, product quality, and efficiency of supply to the customer. Since production costs depend to a large extent on labor costs, in recent years most production in the industry has been moved to countries where labor costs are low. Some of our competitors have lower cost bases, longer operating histories, larger customer bases, and other advantages over us which allow them to compete with us. As described in more detail under “—Conditions in Jordan” below, we are able to sell our products manufactured at our facilities in Jordan to the United States free from customs duties and import quotas under certain conditions. These favorable terms enable us to remain competitive on the basis of price. According to the Association Agreement between the European Union (the “EU”) and Jordan, which came into force in May 2002, and the joint initiative on rules of origin reviewed and improved in December 2018 by the EU and Jordan, goods manufactured by us in Jordan that are subsequently shipped to EU countries are shipped free from customs duties.

5

Conditions in Jordan

Our manufacturing facilities are located in Jordan. Accordingly, we are directly affected by political, security, and economic conditions in Jordan.

From time to time Jordan has experienced instances of civil unrest, terrorism, and hostilities among neighboring countries, including Syria and Israel. A peace agreement between Israel and Jordan was signed in 1994. Terrorist attacks, military activity, rioting, or civil or political unrest in the future could influence the Jordanian economy and our operations by disrupting operations and communications and making travel within Jordan more difficult and less desirable. Political or social tensions also could create a greater perception that investments in companies with Jordanian operations involve a high degree of risk, which could adversely affect the market and price for our common stock.

Jordan is a constitutional monarchy, but the King holds wide executive and legislative powers. The ruling family has taken initiatives that support the economic growth of the country. However, there is no assurance that such initiatives will be successful or will continue. The rate of economic liberalization could change, and specific laws and policies affecting manufacturing companies, foreign investments, currency exchange rates, and other matters affecting investments in Jordan could change as well.

Trade Agreements

Because of the United States-Jordan Free Trade Agreement, which came into force on December 17, 2001, and was implemented fully on January 1, 2010, and the Association Agreement between the EU and Jordan, which came into force in May 2002, we are able to sell our products manufactured at our facilities in Jordan to the U.S. free from customs duties and import quotas under certain conditions and to EU countries free from customs duties.

Income Tax Incentives

Effective January 1, 2019, Jordan’s government converted the geographical area where Jerash Garments and its subsidiaries are located from a Free Zone to a Development Zone. Development Zones are industrial parks that house manufacturing operations in Jordan. In accordance with applicable law, Jerash Garments and its subsidiaries began paying corporate income tax in Jordan at a rate of 10% plus 1% social contribution. Starting from January 1, 2020, the corporate income tax rate in Jordan increased to 14% plus 1% social contribution. Effective January 1, 2021, this rate increased to 16% plus 1% social contribution. On January 1, 2022, this rate further increased to 18% or 20% plus 1% social contribution. On January 1, 2023, this rate further increased to 19% or 20% plus a 1% social contribution. For more information, see “Note 2—Summary of Significant Accounting Policies—Income and Sales Taxes.”

In addition, Jerash Garments and its subsidiaries are subject to local sales tax of 16%. However, Jerash Garments was granted a sales tax exemption from the Jordanian Investment Commission for the period June 1, 2015 to June 1, 2018 that allowed Jerash Garments to make purchases with no sales tax charge. This exemption was extended to February 5, 2024.

Government Regulation

Our manufacturing and other facilities in Jordan and our subsidiaries outside of Jordan are subject to various local regulations relating to the maintenance of safe working conditions and manufacturing practices. Management believes that we are currently in compliance in all material respects with all such regulations. We are not subject to governmental approval of our products or manufacturing process.

Item 1A. Risk Factors.

The following are factors that could have a significant impact on our operations and financial results and could cause actual results or outcomes to differ materially from those discussed in any forward-looking statements.

6

Risks Related to Our Business and Our Industry

We rely on one key customer for most of our revenue. We cannot assure you that this customer or any other customer will continue to buy our products in the same volumes or on the same terms.

Our sales to VF Corporation (which owns brands such as The North Face, Timberland, and Vans), directly and indirectly, accounted for approximately 60% and 67% of our total sales in fiscal 2023 and fiscal 2022, respectively. From an accounting perspective, we are considered the principal in our arrangement with VF Corporation. We bear the inventory risk before the specified goods are transferred to a customer, and we have the right to determine the price and to change our product during the sample development process with customers in which we determine factors including material usage and manufacturing costs before confirming orders. Therefore, we present the sales and related manufacturing activities on a gross basis.

We are not party to any long-term contracts with VF Corporation or our other customers, and our sales arrangements with our customers do not have minimum purchase requirements. As is common in our industry, VF Corporation and our other customers place purchase orders with us after we complete detailed sample development and approval processes. It is through these sample development and approval processes that we and VF Corporation agree on the purchase and manufacture of the garments in question. From April 1, 2021 to March 31, 2022, VF Corporation issued approximately 9,500 purchase orders to us in amounts ranging from approximately $5 to $684,000. From April 1, 2022 to March 31, 2023, VF Corporation issued approximately 10,500 purchase orders to us in amounts ranging from approximately $6 to $372,000.

We cannot assure you that our customers will continue to buy our products at all or in the same volumes or on the same terms as they have in the past. The failure of VF Corporation to continue to buy our products in the same volumes and on the same terms as in the past may significantly reduce our sales and our earnings.

A material decrease in the quantity of sales made to our principal customers, a material adverse change in the terms of such sales or a material adverse change in the financial condition of our principal customers could significantly reduce our sales and our earnings.

We cannot assure you that VF Corporation will continue to purchase our merchandise at the same historical rate, or at all, in the future, or that we will be able to attract new customers. In addition, because of our reliance on VF Corporation as our key customer and their bargaining power with us, VF Corporation has the ability to exert significant control over our business decisions, including prices.

Any adverse change in our relationship with VF Corporation and its The North Face and Timberland brands, or with their strategies or reputation, would have a material adverse effect on our results of operations.

Most of our products are sold under The North Face and Timberland brands, which are owned by VF Corporation. Any adverse change in our relationship with VF Corporation would have a material adverse effect on our results of operations. In addition, our sales of those products could be materially and adversely affected if the image, reputation, or popularity of either VF Corporation, The North Face, or Timberland were to be negatively impacted.

If we lose our key customer and are unable to attract new customers, then our business, results of operations, and financial condition would be adversely affected.

If our key customer, VF Corporation, fails to purchase our merchandise at the same historical rate, or at all, we will need to attract new customers and we cannot assure you that we will be able to do so. We do not currently invest significant resources in marketing our products, and we cannot assure you that any new investments in sales and marketing will lead to the acquisition of additional customers or increased sales or profitability consistent with prior periods. If we are unable to attract new customers or customers that generate comparable profit margins to VF Corporation, then our results of operations and financial condition could be materially and adversely affected.

If we lose our larger brand name customers, or the customers fail to purchase our products at anticipated levels, our sales and operating results will be adversely affected.

Our results of operations depend to a significant extent upon the commercial success of our larger brand name customers. If we lose these customers, these customers fail to purchase our products at anticipated levels, or our relationships with these customers or the brands and retailers they serve diminishes, it may have an adverse effect on our results and we may lose a primary source of revenue. In addition, we may not be able to recoup development and inventory costs associated with these customers and we may not be able to collect our receivables from them, which would negatively impact our financial condition and results of operations.

7

If the market share of our customers declines, our sales and earnings may decline.

Our sales can be adversely affected in the event that our direct and indirect customers do not successfully compete in the markets in which they operate. In the event that the sales of one of our major customers decline for any reason, regardless of whether it is related to us or to our products, our sales to that customer may also decline, which could reduce our overall sales and our earnings.

Our financial condition, results of operations, and cash flows in fiscal 2020 and 2021 were adversely affected by the COVID-19 pandemic.

In December 2019, COVID-19 was first identified in Wuhan, China. Less than four months later, on March 11, 2020, the World Health Organization declared COVID-19 a pandemic—the first pandemic caused by a coronavirus. The outbreak has reached more than 160 countries, including Jordan and the United States, resulting in the implementation of significant governmental measures, including lockdowns, closures, quarantines, and travel bans, intended to control the spread of the virus. On March 17, 2020, the country of Jordan announced a shutdown of non-essential activities as part of its proactive national efforts to limit the spread of COVID-19. On April 4, 2020, we resumed operations of our main production facilities in Al Tajamouat Industrial City under the condition that only migrant workers, living in dormitories in Al Tajamouat Industrial City, were allowed to go to work in the factories under strict hygienic precautionary measures, pursuant to an approval from the Jordanian government dated April 1, 2020. Our Al-Hasa factory was also allowed to restart operation on April 26, 2020. Eventually, local employees were also allowed to resume work starting June 1, 2020.

Owing to the national shutdown in Jordan between March 18 and March 31, 2020, the shipment of approximately $1.6 million of our orders which were scheduled to be shipped by March 31, 2020, the end of fiscal 2020, was postponed. We shipped these orders in the first quarter of fiscal 2021. There was also loss of productivity in the shutdown period which negatively impacted our first quarter and full year profitability in fiscal 2021. In fiscal 2022, our production facilities resumed full operation with additional medical and hygienic measures in place. The COVID-19 pandemic did not materially adversely affect our business operations and condition and operating results for fiscal 2023. The Company currently expects that its operation results for the fiscal year ending March 31, 2024 would not be significantly impacted by the COVID-19 pandemic. However, there is still significant uncertainty around the breadth and duration of business disruptions related to the COVID-19 pandemic, as well as its impact on the U.S. and international economies. Given the dynamic nature of these circumstances, should there be resurgence of COVID-19 cases globally and should the U.S. government or the Jordan government implement new restrictions to contain the spread, the Company’s business would be negatively impacted.

We may require additional financing to fund our operations and capital expenditures.

As of March 31, 2023, we had cash and cash equivalents of approximately $17.8 million and restricted cash of approximately $1.6 million. There can be no assurance that our available cash, together with resources from our operations, will be sufficient to fund our operations and capital expenditures. In addition, our cash position may decline in the future, and we may not be successful in maintaining an adequate level of cash resources.

Pursuant to a facility letter (the “SCBHK facility”) dated June 15, 2018 issued to Treasure Success by Standard Chartered Bank (Hong Kong) Limited (“SCBHK”), SCBHK offered to provide an import facility of up to $3,000,000 to Treasure Success. The SCBHK facility covers import invoice financing and pre-shipment financing under export orders with a combined limit of $3,000,000. SCBHK charges interest at 1.3% per annum over SCBHK’s cost of funds. In consideration for arranging the SCBHK facility, Treasure Success paid SCBHK HKD50,000. We were informed by SCBHK on January 31, 2019 that the SCBHK facility had been activated. As of March 31, 2022, there was no outstanding amount under the SCBHK facility. In June 2022, we were informed by SCBHK that the facility was cancelled due to persistently low usage and zero loan outstanding.

8

Pursuant to the DBS facility letter dated January 12, 2022, DBS Bank (Hong Kong) Limited (“DBSHK”) provided a bank facility of up to $5.0 million to Treasure Success. Pursuant to the agreement, DBSHK agreed to finance cargo receipt, trust receipt, account payable financing, and certain type of import invoice financing up to an aggregate of $5.0 million. The DBSHK facility bears interest at 1.5% per annum over Hong Kong Interbank Offered Rate (“HIBOR”) for HKD bills and 1.3% per annum over DBSHK’s cost of funds for foreign currency bills. The facility is guaranteed by Jerash Holdings and became available to the Company on June 17, 2022.

In addition, we may be required to seek additional debt or equity financing in order to support our growing operations. We may not be able to obtain additional financing on satisfactory terms, or at all, and any new equity financing could have a substantial dilutive effect on our existing stockholders. If we cannot obtain additional financing, we may not be able to achieve our desired sales growth, and our results of operations would be negatively affected.

We may have conflicts of interest with our affiliates and related parties, and in the past we have engaged in transactions and entered into agreements with affiliates that were not negotiated at arms’ length.

We have engaged, and may in the future engage, in transactions with affiliates and other related parties. These transactions may not have been, and may not be, on terms as favorable to us as they could have been if obtained from non-affiliated persons. While an effort has been made and will continue to be made to obtain services from affiliated persons and other related parties at rates and on terms as favorable as would be charged by others, there will always be an inherent conflict of interest between our interests and those of our affiliates and related parties. Through his wholly owned entity Merlotte Enterprise Limited, Mr. Choi, our chairman, chief executive officer, president, treasurer, and a significant stockholder, has an indirect ownership interest in Jiangmen V-Apparel Manufacturing Limited, with which we have entered into, or in the future may enter into, agreements or arrangements. See also “Note 11—Related Party Transactions.” If we engage in related party transactions on unfavorable terms, our operating results will be negatively impacted.

We are dependent on a product segment comprised of a limited number of products.

Presently, we generate revenue primarily from manufacturing and exporting sportswear and outerwear. A shift in demand from such products may reduce the growth of new business for our products, and reduce existing business in those products. If demand in sportswear and outerwear were to decline, we may endeavor to expand or transition our product offerings to other segments of the clothing retail industry. There can be no assurance that we would be able to successfully make such an expansion or transition, or that our sales and margins would not decline in the event we made such an expansion or transition.

Our revenue and cash requirements are affected by the seasonal nature of our business.

A significant portion of our revenue is received during the first six months of our fiscal year, or from April through September. A majority of our VF Corporation orders are derived from winter season fashions, the sales of which occur in the spring and summer and are merchandized by VF Corporation during the autumn months (September through November). As such, the second half of our fiscal year reflect lower sales in anticipation of the spring and summer seasons. In addition, due to the nature of our relationships with customers and our use of purchase orders to conduct our business, our revenue may vary from period to period.

Changes in our product mix and the geographic destination of our products or source of our supplies may impact our cost of goods sold, net income, and financial position.

From time to time, we experience changes in the product mix and the geographic destination of our products. To the extent our product mix shifts from higher revenue items, such as jackets, to lower revenue items, such as pants, our cost of goods sold as a percentage of gross revenue will likely increase. In addition, if we sell a higher proportion of products in geographic regions where we do not benefit from free trade agreements or tax exemptions, our gross margins will fall. If we are unable to sustain consistent product mix and geographic destinations for our products, we could experience negative impacts to our financial condition and results of operations.

9

Our direct and indirect customers are in the clothing retail industry, which is subject to substantial cyclical variations and could have a material adverse effect on our results of operations.

Our direct and indirect customers are in the clothing retail industry, which is subject to substantial cyclical variations and is strongly affected by any downturn or slowdown in the general economy. Factors in the clothing retail industry that may influence our operating results from quarter to quarter include:

| ● | the volume and timing of customer orders we receive during the quarter; | |

| ● | the timing and magnitude of our customers’ marketing campaigns; | |

| ● | the loss or addition of a major customer or of a major retailer nomination; | |

| ● | the availability and pricing of materials for our products; | |

| ● | the increased expenses incurred in connection with introducing new products; | |

| ● | currency fluctuations; | |

| ● | political factors that may affect the expected flow of commerce; and | |

| ● | delays caused by third parties. |

In addition, uncertainty over future economic prospects could have a material adverse effect on our results of operations. Many factors affect the level of consumer spending in the clothing retail industry, including, among others:

| ● | general business conditions; | |

| ● | interest rates; | |

| ● | the availability of consumer credit; | |

| ● | taxation; and | |

| ● | consumer confidence in future economic conditions. |

Consumer purchases of discretionary items, including our products, may decline during recessionary periods and also may decline at other times when disposable income is lower. Consequently, our customers may have larger inventories of our products than expected, and to compensate for any downturn they may reduce the size of their orders, change the payment terms, limit their purchases to a lower price range, and try to change their purchase terms, all of which may have a material adverse effect on our financial condition and results of operations.

The clothing retail industry is subject to changes in fashion preferences. If our customers misjudge a fashion trend or the price which consumers are willing to pay for our products decreases, our revenue could be adversely affected.

The clothing retail industry is subject to changes in fashion preferences. We design and manufacture products based on our customers’ judgment as to what products will appeal to consumers and what price consumers would be willing to pay for our products. Our customers may not be successful in accurately anticipating consumer preferences and the prices that consumers would be willing to pay for our products. Our revenue will be reduced if our customers are not successful, particularly if our customers reduce the volume of their purchases from us or require us to reduce the prices at which we sell our products.

10

If we experience product quality or late delivery problems, or if we experience financial problems, our business will be negatively affected.

We may from time to time experience difficulties in making timely delivery of products of acceptable quality. Such difficulties may result in cancellation of orders, customer refusal to accept deliveries, or reductions in purchase prices, any of which could have a material adverse effect on our financial condition and results of operations. There can be no assurance that we will not experience difficulties with manufacturing our products.

We face intense competition in the worldwide apparel manufacturing industry.

We compete directly with a number of manufacturers of sportswear and outerwear. Some of these manufacturers have lower cost bases, longer operating histories, larger customer bases, greater geographical proximity to customers, or greater financial and marketing resources than we do. Increased competition, direct or indirect, could reduce our revenue and profitability through pricing pressure, loss of market share, and other factors. We cannot assure you that we will be able to compete successfully with existing or new competitors, as the market for our products evolves and the level of competition increases. We believe that our business will depend upon our ability to provide apparel products of good quality and meeting our customers’ pricing and delivery requirements, and our ability to maintain relationships with our major customers. There can be no assurance that we will be successful in this regard.

We may not be successful in integrating acquired businesses.

Our growth and profitability could be adversely affected if we acquire businesses or assets of other businesses and are unable to integrate the business or assets into our current business. To grow effectively, we must find acquisition candidates that meet our criteria and successfully integrate the acquired business into ours. If acquired businesses do not achieve expected levels of production or profitability, we are unable to integrate the business or assets into our business, or we are unable to adequately manage our growth following the acquisition, our results of operations and financial condition would be adversely affected.

Our results of operations are subject to fluctuations in currency exchange rates.

Exchange rate fluctuations between the U.S. dollar and Jordanian Dinar (“JOD”), Hong Kong dollar, or Chinese Yuan (“CNY”), as well as inflation in Jordan, Hong Kong, or the PRC, may negatively affect our earnings. A substantial majority of our revenue and a substantial portion of our expenses are denominated in U.S. dollars. However, a significant portion of the expenses associated with our Jordanian, Hong Kong, or PRC operations, including personnel and facilities-related expenses, are incurred in JOD, Hong Kong dollars, or CNY, respectively. Consequently, inflation in Jordan, Hong Kong, or the PRC will have the effect of increasing the dollar cost of our operations in Jordan, Hong Kong, or the PRC, respectively, unless it is offset on a timely basis by a devaluation of JOD, Hong Kong dollar, or CNY, as applicable, relative to the U.S. dollar. We cannot predict any future trends in the rate of inflation in Jordan, Hong Kong, or the PRC or the rate of devaluation of JOD, Hong Kong dollar, or CNY, as applicable, against the U.S. dollar. In addition, we are exposed to the risk of fluctuation in the value of JOD, Hong Kong dollar, and CNY vis-a-vis the U.S. dollar. There can be no assurance that JOD or Hong Kong dollar will remain effectively pegged to the U.S. dollar. Any significant appreciation of JOD, Hong Kong dollar, or CNY against the U.S. dollar would cause an increase in our JOD, Hong Kong dollar, or CNY expenses, as applicable, as recorded in our U.S. dollar denominated financial reports, even though the expenses denominated in JOD, Hong Kong dollars, or CNY, as applicable, will remain unchanged. In addition, exchange rate fluctuations in currency exchange rates in countries other than Jordan where we operate and do business may also negatively affect our earnings.

We are subject to the risks of doing business abroad.

All of our products are manufactured outside the United States, at our subsidiaries’ production facilities in Jordan. Foreign manufacturing is subject to a number of risks, including work stoppages, transportation delays and interruptions, political instability, foreign currency fluctuations, economic disruptions, expropriation, nationalization, the imposition of tariffs and import and export controls, changes in governmental policies (including U.S. policies towards Jordan), and other factors, which could have an adverse effect on our business. In addition, we may be subject to risks associated with the availability of and time required for the transportation of products from foreign countries. The occurrence of certain of these factors may delay or prevent the delivery of goods ordered by customers, and such delay or inability to meet delivery requirements would have a severe adverse impact on our results of operations and could have an adverse effect on our relationships with our customers.

11

Our ability to benefit from the lower labor costs in Jordan will depend on the political, social, and economic stability of Jordan and in the Middle East in general. We cannot assure you that the political, economic, or social situation in Jordan or in the Middle East in general will not have a material adverse effect on our operations, especially in light of the potential for hostilities in the Middle East. The success of the production facilities also will depend on the quality of the workmanship of laborers and our ability to maintain good relations with such laborers in these countries. We cannot guarantee that our operations in Jordan or any new locations outside of Jordan will be cost-efficient or successful.

Our business could suffer if we violate labor laws or fail to conform to generally accepted labor standards or the ethical standards of our customers.

We are subject to labor laws issued by the Jordanian Ministry of Labor for our facilities in Jordan. In addition, many of our customers require their manufacturing suppliers to meet their standards for working conditions and other matters. If we violate applicable labor laws or generally accepted labor standards or the ethical standards of our customers by, for example, using forced or indentured labor or child labor, failing to pay compensation in accordance with local law, failing to operate our factories in compliance with local safety regulations, or diverging from other labor practices generally accepted as ethical, we could suffer a loss of sales or customers. In addition, such actions could result in negative publicity and may damage our reputation and discourage retail customers and consumers from buying our products.

Our products may not comply with various industry and governmental regulations and our customers may incur losses in their products or operations as a consequence of our non-compliance.

Our products are produced under strict supervision and controls to ensure that all materials and manufacturing processes comply with the industry and governmental regulations governing the markets in which these products are sold. However, if our controls fail to detect or prevent non-compliant materials from entering the manufacturing process, our products could cause damages to our customers’ products or processes and could also result in fines being incurred. The possible damages, replacement costs, and fines could significantly exceed the value of our products and these risks may not be covered by our insurance policies.

We depend on our suppliers for machinery and maintenance of machinery. We may experience delays or additional costs satisfying our production requirements due to our reliance on these suppliers.

We purchase machinery and equipment used in our manufacturing process from third-party suppliers. If our suppliers are not able to provide us with maintenance or additional machinery or equipment as needed, we might not be able to maintain or increase our production to meet any demand for our products, which would negatively impact our financial condition and results of operations.

We are a holding company and rely on dividends, distributions, and other payments, advances, and transfers of funds from our subsidiaries to meet our obligations.

We are a holding company that does not conduct any business operations of our own. As a result, we rely on cash dividends and distributions and other transfers from our operating subsidiaries to meet our obligations. The deterioration of income from, or other available assets of, our operating subsidiaries for any reason could limit or impair their ability to pay dividends or other distributions to us, which in turn could adversely affect our financial condition and results of operations.

Periods of sustained economic adversity and uncertainty could negatively affect our business, results of operations, and financial condition.

Disruptions in the financial markets, such as what occurred in the global markets in 2008, may adversely impact the availability and cost of credit for our customers and prospective customers, which could result in the delay or cancellation of customer purchases. In addition, disruptions in the financial markets may have an adverse impact on regional and world economies and credit markets, which could negatively impact the availability and cost of capital for us and our customers. These conditions may reduce the willingness or ability of our customers and prospective customers to commit funds to purchase our services or products, or their ability to pay for our services after purchase. These conditions could result in bankruptcy or insolvency for some customers, which would impact our revenue and cash collections. These conditions could also result in pricing pressure and less favorable financial terms to us and our ability to access capital to fund our operations.

12

Risks Related to Operations in Jordan

We are affected by conditions to, and possible reduction of, free trade agreements.

Because of the United States-Jordan Free Trade Agreement and the Association Agreement between the EU and Jordan, we are able to sell our products manufactured at our facilities in Jordan to the U.S. free from customs duties and import quotas under certain conditions and to EU countries free from customs duties. If there is a change in such benefits or if any such agreements were terminated, our profitability may be reduced.

Former President Donald Trump expressed antipathy towards trade agreements, and took a starkly protectionist approach that included withdrawal and renegotiation of trade agreements and trade wars with China and U.S. allies alike. President Joe Biden has expressed no desire to withdraw from existing agreements, presumably indicating that his policy will be less protectionist than former President Donald Trump’s. On the other hand, President Biden’s Buy American plan will make it harder for foreign manufacturers to sell goods in the U.S. and his insistence on strong labor provisions in trade agreements will likely prevent them from being implemented or protect U.S. industries when they are. It remains unclear what specifically President Biden would or would not do with respect to trade agreements, tariffs, and duties relating to products manufactured in Jordan. If President Biden takes action or publicly speaks out about the need to terminate or re-negotiate existing free trade agreements on which we rely, or in favor of restricting free trade or increasing tariffs and duties applicable to our products, such actions may adversely affect our sales and have a material adverse impact on our business, results of operations, and cash flows.

Our results of operations would be materially and adversely affected in the event we are unable to operate our principal production facilities in Jordan.

All of our manufacturing process is performed in a complex of production facilities located in Jordan. We have no effective back-up for these operations and, in the event that we are unable to use the production facilities located in Jordan as a result of damage or for any other reason, our ability to manufacture a major portion of our products and our relationships with customers could be significantly impaired, which would materially and adversely affect our results of operation.

Our operations in Jordan may be adversely affected by social and political uncertainties or change, military activity, health-related risks, or acts of terrorism.

From time to time, Jordan has experienced instances of civil unrest, terrorism, and hostilities among neighboring countries, including Syria and Israel. A peace agreement between Israel and Jordan was signed in 1994. Terrorist attacks, military activity, rioting, or civil or political unrest in the future could influence the Jordanian economy and our operations by disrupting operations and communications and making travel within Jordan more difficult and less desirable. In late May 2018, protests about a proposed tax bill began throughout Jordan. On June 5, 2018, King Abdullah II of Jordan responded to the protests by removing and replacing Jordan’s prime minister. If political uncertainty rises in Jordan, our business, financial condition, results of operations, and cash flows may be negatively impacted.

Political or social tensions also could create a greater perception that investments in companies with Jordanian operations involve a high degree of risk, which could adversely affect the market price of our common stock. We do not have insurance for losses and interruptions caused by terrorist attacks, military conflicts, and wars, which could subject us to significant financial losses. The realization of any of these risks could cause a material adverse effect on our business, financial condition, results of operations, and cash flows.

13

We may face interruption of production and services due to increased security measures in response to terrorism.

Our business depends on the free flow of products and services through the channels of commerce. In response to terrorists’ activities and threats aimed at the United States, transportation, mail, financial, and other services may be slowed or stopped altogether. Extensive delays or stoppages in transportation, mail, financial, or other services could have a material adverse effect on our business, results of operations, and financial condition. Furthermore, we may experience an increase in operating costs, such as costs for transportation, insurance, and security as a result of the activities and potential delays. We may also experience delays in receiving payments from payors that have been affected by the terrorist activities. The United States economy in general may be adversely affected by terrorist activities and any economic downturn could adversely impact our results of operations, impair our ability to raise capital, or otherwise adversely affect our ability to grow our business.

We are subject to regulatory and political uncertainties in Jordan.

We conduct substantially all of our business and operations in Jordan. Consequently, government policies and regulations, including tax policies, in Jordan will impact our financial performance and the market price of our common stock.

Jordan is a constitutional monarchy, but the King holds wide executive and legislative powers. The ruling family has taken initiatives that support the economic growth of the country. However, there is no assurance that such initiatives will be successful or will continue. The rate of economic liberalization could change, and specific laws and policies affecting manufacturing companies, foreign investments, currency exchange rates, and other matters affecting investments in Jordan could change as well. A significant change in Jordan’s economic policy or any social or political uncertainties that impact economic policy in Jordan could adversely affect business and economic conditions in Jordan generally and our business and prospects.

If we violate applicable anti-corruption laws or our internal policies designed to ensure ethical business practices, we could face financial penalties and reputational harm that would negatively impact our financial condition and results of operations.

We are subject to anti-corruption and anti-bribery laws in the United States and Jordan. Jordan’s reputation for potential corruption and the challenges presented by Jordan’s complex business environment, including high levels of bureaucracy, red tape, and vague regulations, may increase our risk of violating applicable anti-corruption laws. We face the risk that we, our employees, or any third parties such as our sales agents and distributors that we engage to do work on our behalf may take action determined to be in violation of anti-corruption laws in any jurisdiction in which we conduct business, including the Foreign Corrupt Practices Act of 1977 (the “FCPA”). Any violation of the FCPA or any similar anti-corruption law or regulation could result in substantial fines, sanctions, civil or criminal penalties, and curtailment of operations that might harm our business, financial condition, or results of operations.

Our stockholders may face difficulties in protecting their interests and exercising their rights as a stockholder of ours because we conduct substantially all of our operations in Jordan and certain of our officers and directors reside outside of the United States.

Certain of our officers and directors reside outside the United States. Therefore, our stockholders may experience difficulties in effecting service of legal process, enforcing foreign judgments, or bringing original actions in any of these jurisdictions based upon U.S. laws, including the federal securities laws or other foreign laws against us, our officers, and directors. Furthermore, we conduct substantially all of our operations in Jordan through our operating subsidiaries. Because the majority of our assets are located outside the United States, any judgment obtained in the United States against us or certain of our directors and officers may not be collectible within the United States.

14

Risk Factors Relating to our Securities

If we fail to comply with the continuing listing standards of the Nasdaq, our common stock could be delisted from the exchange.

If we were unable to meet the continued listing requirements of the Nasdaq Stock Market (“Nasdaq”), our common stock could be delisted from the Nasdaq. Any such delisting of our common stock could have an adverse effect on the market price of, and the efficiency of the trading market for, our common stock, not only in terms of the number of shares that can be bought and sold at a given price, but also through delays in the timing of transactions and less coverage of us by securities analysts, if any. Also, if in the future we were to determine that we need to seek additional equity capital, being delisted from Nasdaq could have an adverse effect on our ability to raise capital in the public or private equity markets.

Future sales and issuances of our common stock or rights to purchase common stock could result in additional dilution of the percentage ownership of our stockholders and could cause the market price of our common stock to decline.

We may issue additional securities in the future. Pursuant to our amended and restated 2018 Stock Incentive Plan, we may issue up to 1,784,250 shares of common stock to certain members of our management and key employees.

Future sales and issuances of our common stock or rights to purchase our common stock could result in substantial dilution to our existing stockholders. We may sell common stock, convertible securities, and other equity securities in one or more transactions at prices and in a manner as we may determine from time to time. If we sell any such securities, our stockholders may be materially diluted. New investors in any future transactions could gain rights, preferences, and privileges senior to those of holders of our common stock.

If securities or industry analysts do not publish research or reports about us, or if they adversely change their recommendations regarding our common stock, our stock price and trading volume of our common stock could decline.

The trading market for our common stock will be influenced by the research and reports that industry or securities analysts publish about us, our industry, and our market. If no analyst elects to cover us and publish research or reports about us, the market for our common stock could be severely limited and our stock price could be adversely affected. In addition, if one or more analysts ceases coverage of us or fails to regularly publish reports on us, we could lose visibility in the financial markets, which in turn could cause our stock price or trading volume to decline. If one or more analysts who elect to cover us issue negative reports or adversely change their recommendations regarding our common stock, the market price of our common stock could decline.

15

The requirements of being a public company, including compliance with the reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the requirements of the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley Act”), may strain our resources, increase our costs, and distract management, and we may be unable to comply with these requirements in a timely or cost-effective manner.

We are required to comply with the laws, regulations, requirements, and certain corporate governance provisions under the Exchange Act and the Sarbanes-Oxley Act. Complying with these statutes, regulations, and requirements occupies a significant amount of time of our board of directors and management, significantly increases our costs and expenses, and makes some activities more time-consuming and costly. As a reporting company, we are:

| ● | instituting a more comprehensive compliance function; | |

| ● | preparing and distributing periodic and current reports under the federal securities laws; | |

| ● | establishing and enforcing internal compliance policies, such as those related to insider trading; and | |

| ● | involving and retaining outside counsel and accountants to a greater degree than before we became a reporting company. |

Our ongoing compliance efforts will increase general and administrative expenses and may divert management’s time and attention from the development of our business, which may adversely affect our financial condition and results of operations.

During the course of the audit of our consolidated financial statements, we identified material weaknesses in our internal control over financial reporting. If we are unable to effectively implement and maintain our internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act, our ability to accurately and timely report our financial results or prevent fraud may be adversely affected, and investor confidence and the market price of our common stock may be adversely impacted.

We have been required to evaluate our internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act beginning with the annual report on Form 10-K for the fiscal year ended March 31, 2019. The process of designing and implementing internal controls over financial reporting may divert our internal resources and take a significant amount of time and expense to complete.

In connection with the preparation and external audit of our consolidated financial statements for the fiscal year ended March 31, 2023, we identified certain material weaknesses in our internal control over financial reporting and have formulated plans for remedial measures. See “Item 9A. Controls and Procedures.” Measures that we implement may not fully address the material weaknesses in our internal control over financial reporting and we may not be able to conclude that the material weaknesses have been fully remedied.

Failure to correct the material weaknesses and other control deficiencies or failure to discover and address any other control deficiencies could result in inaccuracies in our consolidated financial statements and could also impair our ability to comply with applicable financial reporting requirements and make related regulatory filings on a timely basis. As a result, our business, financial condition, results of operations, and prospects, as well as the trading price of our common stock, may be materially and adversely affected. Due to the material weaknesses in our internal control over financial reporting as described above, our management concluded that our internal control over financial reporting was not effective as of March 31, 2023. This could adversely affect the market price of our common stock due to a loss of investor confidence in the reliability of our reporting processes.

The reduced disclosure requirements applicable to emerging growth companies may make our common stock less attractive to investors, which may lead to volatility and a decrease in the market price of our common stock.

For as long as we continue to be an emerging growth company, we may take advantage of exemptions from reporting requirements that apply to other public companies that are not emerging growth companies. Investors may find our common stock less attractive because we may rely on these exemptions, which include not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. If investors find our common stock less attractive as a result of exemptions and reduced disclosure requirements, there may be a less active trading market for our common stock and our stock price may be more volatile or may decrease.

We are currently operating in a period of economic uncertainty and capital market disruption, which has been significantly impacted by geopolitical instability due to the ongoing military conflict between Russia and Ukraine. Our business, financial condition, and results of operations could be materially adversely affected by any negative impact on the global economy and capital markets resulting from the conflict in Ukraine or any other geopolitical tensions.

U.S. and global markets are experiencing volatility and disruption following the escalation of geopolitical tensions and the start of the military conflict between Russia and Ukraine. On February 24, 2022, a full-scale military invasion of Ukraine by Russian troops was reported. Although the length and impact of the ongoing military conflict is highly unpredictable, the conflict in Ukraine could lead to market disruptions, including significant volatility in commodity prices, credit and capital markets, and supply chain interruptions.

16

The military conflict in Ukraine has led to sanctions and other penalties being levied by the United States, European Union, and other countries against Russia. Additional potential sanctions and penalties have also been proposed and/or threatened. Russian military actions and the resulting sanctions could adversely affect the global economy and financial markets and lead to instability and lack of liquidity in capital markets, potentially making it more difficult for us to obtain additional funds. In addition, in managing an organization operating globally, we are subject to the risks and challenges related to the potential to subject our business to materially adverse consequences should the situation escalate beyond its current scope, including, among other potential impacts, the geographic proximity of the situation relative to the Middle East, where a material portion of our business is conducted.

Although our business has not been materially impacted by the ongoing military conflict between Russian and Ukraine to date, it is impossible to predict the extent to which our operations, or those of our suppliers and manufacturers, will be impacted in the short and long term, or the ways in which the conflict may impact our business. The extent and duration of the military action, sanctions, and resulting market disruptions are impossible to predict, but could be substantial. Any such disruptions may also magnify the impact of other risks described in this annual report.

We may be adversely affected by the effects of inflation and a potential recession.

Inflation has the potential to adversely affect our liquidity, business, financial condition, and results of operations by increasing our overall cost structure, particularly if we are unable to achieve commensurate increases in the prices we charge our customers. The existence of inflation in the economy has resulted in, and may continue to result in, higher interest rates and capital costs, shipping costs, supply shortages, increased costs of labor, weakening exchange rates, and other similar effects. As a result of inflation, we have experienced and may continue to experience, cost increases. In addition, poor economic and market conditions, including a potential recession, may negatively impact market sentiment, decreasing the demand for sportswear and outerwear, which would adversely affect our operating income and results of operations. If we are unable to take effective measures in a timely manner to mitigate the impact of the inflation as well as a potential recession, our business, financial condition, and results of operations could be adversely affected.

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties.

Jerash Garments owns an industrial building of approximately 89,300 square feet and two pieces of land totaling approximately 181,000 square feet in Al Tajamouat Industrial City. We lease additional space totaling approximately 448,000 square feet in industrial buildings in Al Tajamouat Industrial City. In addition, we lease space for our workers in dormitories located inside and outside of Al Tajamouat Industrial City.

Treasure Success leased its office space in Hong Kong from Ever Winland pursuant to a tenancy agreement dated February 26, 2021. The tenancy agreement had a term from February 26, 2021 to February 25, 2023, with a rent in the amount of HK$119,540 (approximately $15,326) per month. On August 29, 2022, Ever Winland became a subsidiary of Treasure Success. See “—Item 1. Business—Organizational Structure.”

In 2015, we commenced a project to build a 4,800 square-foot workshop in the Tafilah Governorate of Jordan, which was previously intended to be used as a sewing workshop for Jerash Garments, but which we now use as a dormitory to house management and supervisory staff who work at the factory in Al-Hasa County as discussed below. Construction was temporarily suspended in March 2020 due to the COVID-19 pandemic but subsequently completed and ready for use as of September 30, 2021.

In 2018, we commenced another project to build a 54,000 square-foot factory in Al-Hasa County in the Tafilah Governorate of Jordan, which started operation in November 2019. This project is a joint project with the Jordanian Ministry of Labor and the Employment and Training Department in Jordan. Pursuant to the agreement between these parties and us, we guaranteed up to JOD112,500 (approximately $159,000) for this project and agreed to employ at least 500 workers for the first 12 months following the completion of the project, which requirement we have complied with. The Ministry of Labor financed the building of the factory and the Employment and Training Department supported 50% of the workers’ salaries, as well as transportation and social security costs in the first 12 months following the completion of the project. We used the factory without paying rent through December 2022. We have continued to use the factory without paying rent since January 2023 as new arrangements with the Jordanian Ministry of Labor are still being made.

17

In April 2021, we commenced construction on a 189,000 square-foot housing facility for our multi-national workforce, situated on a 49,000 square-foot site owned by us, located in Al Tajamouat Industrial City. We anticipate the completion of the construction and the subsequent occupancy of the new building by August 2023. To meet increasing demand, we were also finalizing plans to construct an additional project on a nearby separate 133,000 square-foot parcel that we purchased in 2019 for $1.2 million, with 2/3 of the land allocated for the establishment of our seventh factory and 1/3 for housing purposes. We have resumed to work with engineering consultants to proceed with the architectural design of these buildings.

On July 1, 2020, Jiangmen Treasure Success and Jiangmen V-Apparel Manufacturing Limited entered into a factory lease agreement, which was a replacement of a previous lease agreement dated August 31, 2019. The new lease has a one-year term with monthly rent amount of CNY28,300 (approximately $4,100) for additional office space and sample production purposes. On April 30, 2021, the factory lease agreement between Jiangmen Treasure Success and Jiangmen V-apparel Manufacturing Limited was terminated.

On January 1, 2021, Jiangmen Treasure Success entered a factory lease agreement with an independent third party. The lease has a five-year term with monthly rent amount of CNY50,245 (approximately $7,300) for the first year, CNY60,270 (approximately $8,800) for the second year, and 5% further annual increments starting from the third year.