UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

OR

For the fiscal year ended

OR

OR

Date of event requiring this shell company report

For the transition period from to

Commission file number:

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

(Jurisdiction of incorporation or organization)

The People’s Republic of

(Address of principal executive offices)

The People’s Republic of

Telephone:

E-mail:

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered, pursuant to Section 12(b) of the Act

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||

| The | ||||

| * |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

| Class A ordinary shares, par value US$0.00001 each | |||||

| Class B ordinary shares, par value US$0.00001 each | |||||

Indicate by check mark if

the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐

Yes ☒

If this report is an annual

or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934. ☐ Yes ☒

Indicate by check mark whether

the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days. ☒

Indicate by check mark whether

the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T

(§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit

such files). ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer. ☐ | Accelerated filer ☐ | Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards † provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| International Financial Reporting Standards as issue by the International Accounting Standards Board ☐ | Other ☐ |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow. ☐ Item 17 ☐ Item 18

If this is an annual report,

indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐

Yes

TABLE OF CONTENTS

i

INTRODUCTION

Except where the context otherwise requires and for purposes of this annual report on Form 20-F only:

| ● | “ADSs” refers to American depositary shares, each of which represents four Class A ordinary share; |

| ● | “Affected Entities” refers to private schools within China that are affected by the Implementation Rules, entities holding such private schools as well as other enterprises within China that are affected by the Implementation Rules which are listed in “Item 4. Information on the Company—C. Organizational Structure”; |

| ● | “A-Level” or “A Levels” refers to the General Certificate of Education (Advanced Level) Examination, a subject-based qualification conferred as part of the General Certificate of Education, as well as a school leaving qualification offered by the educational bodies in the United Kingdom and the educational authorities of British Crown dependencies to students completing secondary or pre-university education; |

| ● | “BGY Education Investment” refers to BGY Education Investment Management Co., Ltd., which was historically controlled and consolidated by Bright Scholar Holdings through contractual arrangements but has been deconsolidated on August 31, 2021, and, together with its subsidiaries and schools, classified as discontinued operations; |

| ● | “Bright Scholar Holdings” refers to Bright Scholar Education Holdings Limited, our Cayman Islands holding company; |

| ● | “CAGR” refers to compound annual growth rate; |

| ● | “China” or “PRC” refers to the People’s Republic of China, excluding, for the purpose of this annual report only, Taiwan and the special administrative regions of Hong Kong and Macau; |

| ● | “Country Garden” refers to Country Garden Holdings Company Limited, a company listed on The Stock Exchange of Hong Kong Limited (stock code: 2007), a related party, and its subsidiaries; |

| ● | “fiscal year” refers to the period from September 1 of the previous calendar year to August 31 of the concerned calendar year; |

| ● | “Implementation Rules” refers to the Implementation Rules of the Law for Promoting Private Education, which was issued by the PRC State Council on May 14, 2021 and became effective on September 1, 2021; |

| ● | “learning centers” refers to entities providing after-school education training services, including English proficiency training and extracurricular programs; |

| ● | “ordinary shares” or “shares” refers to our Class A and Class B ordinary shares of par value US$0.00001 per share; |

ii

| ● | “RMB” or “Renminbi” refers to the legal currency of China; |

| ● | “school” refers to each of our international schools, bilingual schools, overseas schools and kindergartens, unless otherwise specified, before the deconsolidation of BGY Education Investment, and each of our overseas schools and domestic for-profit kindergartens, unless otherwise specified, after the deconsolidation of BGY Education Investment, as the context requires; |

| ● | “school year” refers to the annual period of instruction at each school respectively, which customarily runs from September of the previous calendar year to July of the concerned calendar year; |

| ● | “SEC” refers to the Securities and Exchange Commission of the United States; |

| ● | “US$,” “U.S. dollars,” “$” and “dollars” refers to the legal currency of the United States of America; |

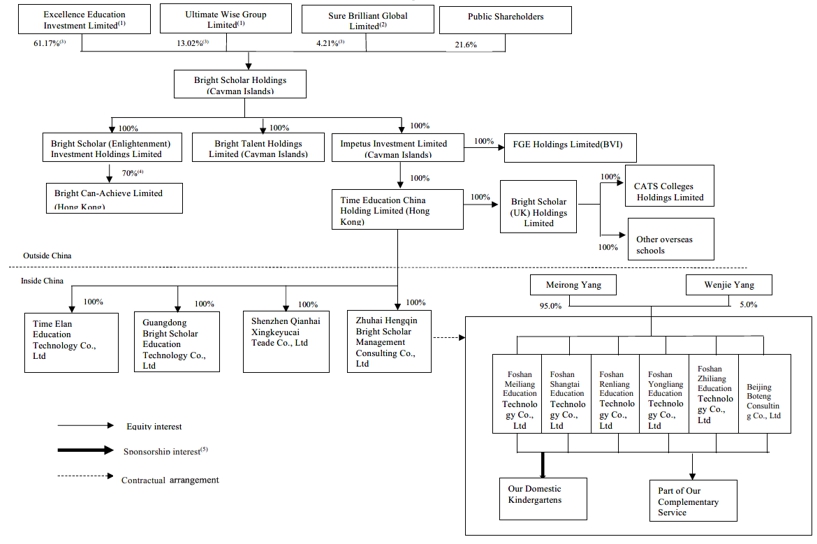

| ● | “VIEs” refers to the entities that Bright Scholar Holdings controls and consolidates or used to control and consolidate through contractual arrangements, as the context requires, including (1) BGY Education Investment and the schools and subsidiaries it held, as the context requires, prior to its deconsolidation; and (2) Foshan Meiliang Education Technology Co., Ltd., Foshan Shangtai Education Technology Co., Ltd., Foshan Renliang Education Technology Co., Ltd., Foshan Yongliang Education Technology Co., Ltd., Foshan Zhiliang Education Technology Co., Ltd., and Beijing Boteng Consulting Co., Ltd. and subsidiaries and schools they hold respectively, as the context requires, before and after the deconsolidation of BGY Education Investment; |

| ● | “we,” “us,” “our,” and “our company” refers to Bright Scholar Education Holdings Limited, its subsidiaries and its VIEs; and |

| ● | “Zhuhai Bright Scholar” refers to Zhuhai Hengqin Bright Scholar Management Consulting Co., Ltd., our wholly-owned subsidiary in China. |

Effective on August 19, 2022, we changed the ratio of the ADSs to Class A ordinary shares from the then ADS ratio of one ADS to one Class A ordinary share to a new ADS ratio of one ADS representing four Class A ordinary shares.

Names of certain companies provided in this annual report are translated or transliterated from their original Chinese legal names.

Discrepancies in any table between the amounts identified as total amounts and the sum of the amounts listed therein are due to rounding.

This annual report on Form 20-F includes our audited consolidated financial statements for the 2020, 2021 and 2022 fiscal years.

This annual report contains translations of certain Renminbi amounts into U.S. dollars at specified rates. Unless otherwise stated, the translation of Renminbi into U.S. dollars has been made at RMB6.8890 to US$1.00, the noon buying rate in effect on August 31, 2022 as set forth in the H.10 Statistical Release of the Federal Reserve Board. We make no representation that any Renminbi or U.S. dollar amounts could have been, or could be, converted into U.S. dollars or Renminbi, as the case may be, at any particular rate, the rates stated below, or at all. The PRC government imposes controls over its foreign currency reserves in part through direct regulation of the conversion of Renminbi into foreign exchange and through restrictions on foreign trade. On June 9, 2023, the noon buying rate was RMB7.1273 to US$1.00.

iii

Bright Scholar Holdings, our ultimate Cayman Islands holding company, does not have any substantive operations other than indirectly controlling the VIEs, which controls and holds our domestic kindergartens and complementary services, through certain contractual arrangements, and indirectly holding Bright Scholar (UK) Holdings Limited, through which we operate our overseas schools. Investors in the ADSs are purchasing equity securities of our ultimate Cayman Islands holding company rather than purchasing equity securities of the VIEs. We conduct our business operations through both our consolidated subsidiaries and the VIEs, which we effectively control through certain contractual arrangements. We, together with the VIEs, are subject to PRC laws relating to, among others, restrictions over foreign investments in education services set out in the Negative List (2021 Version) promulgated by the Ministry of Commerce (“MOFCOM”), and the National Development and Reform Commission (“NDRC”). As a result, we have control over the VIEs through contractual arrangements. Our VIE structure is used to replicate foreign investment in China-based companies and provide investors with exposure to foreign investment in China-based companies where the PRC law prohibits direct foreign investment in the operating companies. Neither we nor our subsidiaries own any share in the VIEs, and investors may never hold equity interests in the Chinese operating companies. Instead, we control and receive the economic benefits of the VIEs’ business operation through a series of contractual agreements with the VIEs. The contractual agreements with the VIEs are designed to provide Zhuhai Bright Scholar with the power, rights, and obligations equivalent in all material respects to those it would possess as the principal equity holder of the VIEs, including absolute control rights and the rights to the assets, property, and revenue of the VIEs. As a result of our direct ownership in Zhuhai Bright Scholar and the contractual agreements with the VIEs, we are regarded as the primary beneficiary of the VIEs. Because of our corporate structure, we are subject to risks due to uncertainty of the interpretation and the application of the PRC laws and regulations, including but not limited to limitation on control of domestic kindergarten and complementary services through variable interest vehicle, and foreign ownership of internet technology companies, and regulatory review of oversea listing of PRC companies through a special purpose vehicle, and the validity and enforcement of the contractual agreements. We are also subject to the risks of uncertainty about any future actions of the PRC government in this regard. Our contractual agreements may not be effective in providing control over the VIEs. We may also subject to sanctions imposed by PRC regulatory agencies including Chinese Securities Regulatory Commission if we fail to comply with their rules and regulations. Investors in the ADSs are not purchasing equity securities of the VIEs, but instead, are purchasing equity securities of our ultimate Cayman Islands holding company. Because of our corporate structure, we are subject to risks due to uncertainty of the interpretation and the application of the PRC laws and regulations, including but not limited to limitation on foreign ownership of private education entities, and regulatory review of oversea listing and offering of securities of PRC companies through a special purpose vehicle, and the validity and enforcement of the contractual agreements. We are also subject to the risks of uncertainty about any future actions of the PRC government in this regard. Our contractual agreements may not be effective in providing control over the VIEs. We may also subject to sanctions imposed by PRC regulatory agencies including Chinese Securities Regulatory Commission if we fail to comply with their rules and regulations.

We and the VIEs face various legal and operational risks and uncertainties related to being based in and having significant operations in China. The PRC government has significant authority to exert influence on the ability of a China-based company, such as us and the VIEs, to conduct its business, accept foreign investments or list on U.S. or other foreign exchanges. For example, we and the VIEs face risks associated with regulatory approvals of offshore offerings, oversight on cybersecurity and data privacy, as well as the uncertainty of PCAOB inspection on our auditors. Such risks could result in a material change in our operations and/or the value of the ADSs or could significantly limit or completely hinder our ability to offer ADSs and/or other securities to investors and cause the value of such securities to significantly decline or be worthless. The PRC government also has significant discretion over the conduct of the business of us and the VIEs and may intervene with or influence our operations or the development of the private education industry as it deems appropriate to further regulatory, political and societal goals. Furthermore, the PRC government has recently indicated an intent to exert more oversight and control over overseas securities offerings and foreign investment in China-based companies like us. Any such action, once taken by the PRC government, could significantly limit or completely hinder our ability to offer securities to investors and cause the value of such securities to significantly decline or in extreme cases, become worthless. For further details, see “Item 3. Key Information-D. Risk Factors-Risks Related to Our Corporate Structure” and “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China.”

iv

We are subject to a number of prohibitions, restrictions and potential delisting risk under the Holding Foreign Companies Accountable Act (the “HFCAA”). Pursuant to the HFCAA and related regulations, if we have filed an audit report issued by a registered public accounting firm that the Public Company Accounting Oversight Board (the “PCAOB”) has determined that it is unable to inspect and investigate completely, the Securities and Exchange Commission (the “SEC”) will identify us as a “Commission-identified Issuer,” and the trading of our securities on any U.S. national securities exchange, as well as any over-the-counter trading in the United States, will be prohibited if we are identified as a Commission-identified Issuer for two consecutive years. In August 2022, the PCAOB, the China Securities Regulatory Commission (the “CSRC”) and the Ministry of Finance of the PRC signed a Statement of Protocol (the “Statement of Protocol”), which establishes a specific and accountable framework for the PCAOB to conduct inspections and investigations of PCAOB-governed accounting firms in mainland China and Hong Kong. On December 15, 2022, the PCAOB announced that it was able to secure complete access to inspect and investigate PCAOB registered public accounting firms headquartered in mainland China and Hong Kong completely in 2022. The PCAOB Board vacated its previous 2021 determinations that the PCAOB was unable to inspect or investigate completely registered public accounting firms headquartered in mainland China and Hong Kong. However, whether the PCAOB will continue to be able to satisfactorily conduct inspections of PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong is subject to uncertainties and depends on a number of factors out of our and our auditor’s control. The PCAOB continues to demand complete access in mainland China and Hong Kong moving forward and is making plans to resume regular inspections in early 2023 and beyond, as well as to continue pursuing ongoing investigations and initiate new investigations as needed. The PCAOB has also indicated that it will act immediately to consider the need to issue new determinations with the HFCAA if needed. If the PCAOB is unable to inspect and investigate completely registered public accounting firms located in China and we fail to retain another registered public accounting firm that the PCAOB is able to inspect and investigate completely in 2023 and beyond, or if we otherwise fail to meet the PCAOB’s requirements, the ADSs will be delisted from the New York Stock Exchange, and our shares and ADSs will not be permitted for trading over the counter in the United States under the HFCAA and related regulations. For details, see “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China—Our ADSs will be delisted and prohibited from trading in the over-the-counter market under the Holding Foreign Companies Accountable Act, if the PCAOB is unable to inspect or investigate completely auditors located in China for two consecutive years. The delisting of the ADSs, or the threat of their being delisted, may materially and adversely affect the value of your investment.”

We listed the ADSs on the New York Stock Exchange under the symbol “BEDU” on May 18, 2017 and completed an initial public offering of 17,250,000 ADSs on June 7, 2017. We issued an additional 10,000,000 ADSs on March 2, 2018. In July 2019, we issued senior notes in the aggregate principal amount of US$300.0 million, with interests of 7.45% per annum and maturing on July 31, 2022, and listed such senior notes on the Stock Exchange of Hong Kong Limited. As of the date of this annual report, we have redeemed all outstanding senior notes matured on July 31, 2022. Upon the completion of such redemption, all senior notes have been cancelled and delisted from the official list of the Stock Exchange of Hong Kong Limited.

MARKET AND INDUSTRY DATA

Market data and certain industry forecasts used in this annual report were obtained from internal surveys, market research, publicly available information and industry publications. Industry publications generally state that the information contained therein has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. Similarly, internal surveys, industry forecasts and market research, while believed to be reliable, have not been independently verified, and we make no representation as to the accuracy of such information.

v

Explanatory note

Restatement Background

In connection with the preparation of our financial statements as of and for the year ended August 31, 2022, we determined that there were errors in the prior year financial statements relating to the identification and measurement of certain operating leases upon the initial adoption of Accounting Standards Codification 842, Lease (“ASC 842”). In addition, we identified a lease contract which was terminated in 2021, but not accounted for in the correct period. Therefore, certain information in the consolidated financial statements for the year ended August 31, 2020 and 2021 has been restated to correct for these errors, including non-current operating lease right-of-use assets, current operating lease liabilities and non-current operating lease liabilities in the consolidated balance sheets and the related items on the consolidated statements of cash flows. Because the errors were immaterial to the consolidated statements of operations and consolidated statements of shareholders’ equity for the years ended August 31, 2020 and 2021, we recorded the accumulated impact in the 2022 fiscal year.

The nature of these error corrections is as follows:

| (1) | Certain overseas operating leases were not properly determined their respective variable lease payment upon the adoption of ASC 842 and adjustments have been made to correct these errors in the 2020 and 2021 fiscal years. | |

| (2) | Two operating leases existed prior to the adoption of ASC 842 but not have been appropriately identified, adjustments have been made to correct these errors in the 2020 and 2021 fiscal years. | |

| (3) | One of the lease contracts of the Overseas Schools was early terminated in the 2021 fiscal year 2021, but it has been inappropriately accounted for as a termination in the 2022 fiscal year. Adjustment has been made to correct the error in the 2021 fiscal year. | |

| (4) | As part of the error corrections being made, the resultant classification of current operating lease liabilities and non-current operating lease liabilities was corrected. |

The restatement to our application of ASC 842 described above have limited impact on our operation metrics, and no impact on the management and operation of the business. Our risk management and compliance culture is critical to our success. We have been subject to the incremental reporting and compliance requirements of a public company, beginning with the commencement of trading of our ordinary shares on the New York Stock Exchange in May 2017.

Our management and the audit committee of our board of directors concluded that our consolidated financial statements for the 2020 and 2021 fiscal years should be restated to correct a material overstatement of non-current operating lease right-of-use assets and current operating lease liabilities, overstatement/understatement of non-current operating lease liabilities, and the related items on the consolidated statements of cash flows; definitionally, any such restatement is considered to be for the correction of a material error. We believe that presenting our consolidated financial statements for the 2022 fiscal year along with the information set forth in “—Restatement of Our Consolidated Financial Statements and Related Information” below will allow readers to review all pertinent data within a single document. Therefore, we do not plan to amend our previously filed annual reports on Form 20-F for the years ended August 31, 2020 and 2021.

The restatement of our consolidated financial statements reflected in this annual report on Form 20-F shall not be deemed an admission that the historical annual reports on Form 20-F, when filed, included any untrue statement of a material fact or omitted to state a material fact necessary to make a statement not misleading.

| vi |

Restatement of Our Consolidated Financial Statements and Related Information

The restatements to the consolidated balance sheets as of August 31, 2020 and 2021 are summarized as follows:

| August 31, 2020 | ||||||||||||

| As Reported | Adjustment | As Restated | ||||||||||

| (RMB in thousands) | ||||||||||||

| ASSETS | ||||||||||||

| Operating lease right-of-use assets –non current | 1,816,721 | (25,550 | ) | 1,791,171 | ||||||||

| Total assets | 1,816,721 | (25,550 | ) | 1,791,171 | ||||||||

| LIABILITIES | ||||||||||||

| Operating lease liabilities – current | 196,129 | (62,120 | ) | 134,009 | ||||||||

| Operating lease liabilities – non current | 1,662,928 | 36,570 | 1,699,498 | |||||||||

| Total liabilities | 1,859,057 | (25,550 | ) | 1,833,507 | ||||||||

| August 31, 2021 | ||||||||||||

| As Reported | Adjustment | As Restated | ||||||||||

| (RMB in thousands) | ||||||||||||

| ASSETS | ||||||||||||

| Operating lease right-of-use assets –non current | 1,773,773 | (80,310 | ) | 1,693,463 | ||||||||

| Total assets | 1,773,773 | (80,310 | ) | 1,693,463 | ||||||||

| LIABILITIES | ||||||||||||

| Operating lease liabilities – current | 123,215 | (220 | ) | 122,995 | ||||||||

| Operating lease liabilities – non current | 1,752,667 | (80,090 | ) | 1,672,577 | ||||||||

| Total liabilities | 1,875,882 | (80,310 | ) | 1,795,572 | ||||||||

The restatements to the consolidated statements of cash flows for the year ended August 31, 2020 and 2021 are summarized as follows:

| August 31, 2020 | ||||||||||||

| As Reported | Adjustment | As Restated | ||||||||||

| (RMB in thousands) | ||||||||||||

| Cash Flows From Operating Activities | ||||||||||||

| Adjustments to reconcile net cash flows from operating activities: | ||||||||||||

| Noncash lease expense | 142,519 | 749 | 143,268 | |||||||||

| Changes in operating assets and liabilities and other, net: | ||||||||||||

| Other receivables, deposits and other assets | 9,973 | (2,227 | ) | 7,746 | ||||||||

| Operating lease liabilities | (109,514 | ) | 1,478 | (108,036 | ) | |||||||

| Net cash provided by operating activities | 42,978 | - | 42,978 | |||||||||

| Non-cash investing and financing activities: | ||||||||||||

| Right-of-use assets obtained in exchange for the new operating lease liabilities | 75,752 | 65,248 | 141,000 | |||||||||

| Decrease of Right-of-use assets for early termination | 14,019 | - | 14,019 | |||||||||

| vii |

| August 31, 2021 | ||||||||||||

| As Reported | Adjustment | As Restated | ||||||||||

| (RMB in thousands) | ||||||||||||

| Cash Flows From Operating Activities | ||||||||||||

| Adjustments to reconcile net cash flows from operating activities: | ||||||||||||

| Noncash lease expense | 257,244 | (5,884 | ) | 251,360 | ||||||||

| Changes in operating assets and liabilities and other, net: | ||||||||||||

| Other receivables, deposits and other assets | 5,534 | (7,728 | ) | (2,194 | ) | |||||||

| Operating lease liabilities | (213,827 | ) | 13,612 | (200,215 | ) | |||||||

| Net cash provided by operating activities | 48,951 | - | 48,951 | |||||||||

| Non-cash investing and financing activities: | ||||||||||||

| Right-of-use assets obtained in exchange for the new operating lease liabilities | 228,123 | (48,155 | ) | 179,968 | ||||||||

| Decrease of Right-of-use assets for early termination | 14,415 | 9,400 | 23,815 | |||||||||

The following items in this annual report on Form 20-F contain financial information that have been amended principally as a result of, and to reflect, the restatement of our consolidated financial statements:

Part I, Item 3. Key Information

Part I, Item 5. Operating and Financial Review and Prospects

Part II, Item 15. Controls and Procedures

Part II, Item 18. Financial Statements

Considerations Relating to Internal Control Over Financial Reporting

Under the PCAOB auditing standards, a restatement of financial statements is by definition evidence of a material weakness in internal controls. Thus, in connection with our review of our consolidated financial statements leading to the restatement, we identified a material weakness in the design and implementation relating to lease accounting due to the lack of comprehensive assessment process over lease accounting in the oversea schools component in our internal control over financial reporting which failed to prevent or detect the identified misstatements requiring the restatement. As a result, we concluded that, due to the material weaknesses in our internal control over financial reporting, our internal control over financial reporting and our disclosure controls and procedures were not effective at each of August 31, 2020 and 2021. See “Item.15 Controls and procedures” for additional information with respect to material weaknesses in internal control over financial reporting and our related remediation activities.

| viii |

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. [Reserved]

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

An investment in the ADSs involves risks. You should carefully consider the risks described below, as well as the other information included or incorporated by reference in this annual report, before making an investment decision. Our business, financial condition or results of operations could be materially adversely affected by any of these risks. The market or trading price of the ADSs could decline due to any of these risks, and you may lose all or part of your investment. In addition, the risks discussed below also include forward-looking statements and our actual results may differ substantially from those discussed in these forward-looking statements. Please note that additional risks not presently known to us, that we currently deem immaterial or that we have not anticipated may also impair our business and operations.

Risk Factor Summary

Risks Related to Our Business

| ● | compliance with the Implementation Rules materially and adversely affecting our business, financial condition, results of operations and prospect in the future; |

| ● | our ability to execute our growth strategies or continue to grow as rapidly as we have in the past; |

| ● | our ability to remain profitable or increase profitability in the future; |

| ● | our corporate structure on contractual arrangements which has caused us to lose control of the Affected Entities; |

1

| ● | limitations on our ability to maintain the operation of our kindergartens and to expand our kindergarten network; |

| ● | our ability to obtain or update our learning centers’ educational permits and business licenses; |

| ● | acquisition related risks as a result of our acquisition strategy; |

| ● | our ability to manage our business expansion and integrate businesses we acquire; |

| ● | unknown or contingent liabilities related to the acquired businesses; |

| ● | our ability to meet financial obligations due to the net current liabilities as of August 31, 2022; |

| ● | our ability to secure additional capital for our future expansion; |

| ● | our ability to ramp up existing schools and successfully launch new schools; |

| ● | our ability to engage with the Affected Entities to provide education services as we expected; |

| ● | our ability to enroll and retain a sufficient number of students; |

| ● | changes in international regulations, travel restrictions and sanctions; |

| ● | accidents, injuries or other harm that may occur at our schools, learning centers or the events we organize; |

| ● | our ability to charge tuition or other fees at sufficient levels; |

Risks Related to Our Corporate Structure

| ● | ownership structure and contractual arrangements being challenged by extensive regulation over private education service business in China; |

| ● | uncertainties in the interpretation and implementation of the newly enacted PRC Foreign Investment Law and how it may impact the viability of our current corporate structure, corporate governance and business operations; |

| ● | contractual arrangements with the VIEs and their shareholders being ineffective in providing control as direct ownership; |

| ● | uncertainties in the interpretation of newly issued rules, regulatory actions and statements related to VIEs, private schools and complementary services, under which we may be unable to assert our contractual rights over the assets of the VIE; |

| ● | potential conflict of interest between us and our largest shareholders; and |

| ● | additional taxes owed by us or the VIEs due to the PRC tax authorities’ scrutiny over our contractual arrangement. |

2

Risks Related to Doing Business in China

| ● | overall economy in China or the education services market affected by PRC economic, political and social conditions, as well as changes in any government policies, laws and regulations; |

| ● | uncertainties with respect to the PRC legal system; |

| ● | any actions by the Chinese government may cause us to make material changes to the operation of our PRC subsidiaries or the VIE; |

| ● | any increase in applicable enterprise income tax rates or the discontinuation of any preferential tax treatments currently available to us; |

| ● | unfavorable tax consequences to us as a result of us being classified as a PRC “resident enterprise;” |

| ● | significant uncertainties under the PRC enterprise income tax law relating to the withholding tax liabilities of our PRC subsidiaries; |

| ● | significant uncertainties in the application and interpretation of the Law on the Promotion of Private Education, the Implementation Rules and their detailed implementation rules and regulations; |

| ● | uncertainties with respect to indirect transfers of the equity interests in PRC resident enterprises by their non-PRC holding companies; and |

| ● | restrictions on currency exchange. |

Risks Related to Our Ordinary Shares and ADSs

| ● | volatile ADS trading price; |

| ● | decline in our ADS price due to substantial future sales or perceived potential sales of the ADSs; |

| ● | decline in our ADS price due to techniques employed by short sellers; |

| ● | limitation on your ability to influence corporate matter’s due to our dual-class share structure with different voting rights; and |

| ● | decline in our ADS price due to inaccurate, unfavorable or little research about us. |

3

Risks Related to Our Business

Our compliance with the Implementation Rules has materially and adversely affected and may continue to materially and adversely affect our business, financial condition, results of operations and prospect in the future, and we have been subject to significant limitations on our ability to engage in the private for-profit education business and may otherwise be materially and adversely affected by changes in PRC laws and regulations.

The Standing Committee of the National People’s Congress amended the Law on the Promotion of Private Education on November 7, 2016, which became effective on September 1, 2017 and were further amended on December 29, 2018 (the “Amended Law”). Pursuant to the Amended Law, sponsors of private schools may choose to establish schools in China either as non-profit or for-profit schools. Sponsors of for-profit private schools are entitled to retain the profits from their schools and the operating surplus may be allocated to the sponsors pursuant to the PRC company law and other relevant laws and regulations. On the other hand, sponsors of non-profit private schools are not entitled to any distribution of profits from their schools and all revenue must be used for the operation of the schools. As a holding company, our ability to generate profits, pay dividends and other cash distributions to our shareholders under the existing and the Amended Law is affected by many factors, including but not limited to the characterizations of our schools as for-profit or non-profit schools, the profitability of our schools and other affiliated entities, and our ability to receive dividends and other distributions from our PRC subsidiary, Zhuhai Bright Scholar, which in turn depends on the service fees paid to Zhuhai Bright Scholar from our schools and other affiliated entities. If our schools are unable to be registered as for-profit private education entities, the approval of which is subject to the discretion of government authorities, our contractual arrangements with such schools may be subject to more stringent scrutiny. Furthermore, pursuant to the Amended Law, sponsors are not permitted to establish for-profit schools if such schools provide compulsory education services, which cover grades one to nine. Nevertheless, prior to the deconsolidation of BGY Education Investment, income from compulsory education services accounted for a significant portion of revenue. For further details, see “Item 4. Information on the Company—B. Business Overview— Regulations—Regulations on Private Education in the PRC—The Law for Promoting Private Education and the Implementation Rules.”

On May 14, 2021, the PRC State Council announced the Implementation Rules, which became effective on September 1, 2021. Pursuant to the Implementation Rules, (1) foreign-invested enterprises established in China and social organizations whose actual controllers are foreign parties shall not sponsor, participate in or actually control private schools that provide compulsory education, (2) social organizations or individuals shall not control any private school that provides compulsory education or any non-profit private school that provides pre-school education by means of merger, acquisition, contractual arrangements, etc., and (3) private schools providing compulsory education shall not conduct any transaction with any related party.

The Implementation Rules have significantly impacted our business operations and our results of operations. After consultation with its PRC legal counsel and external advisors, we reached the conclusion that, as a result of the effectiveness of the Implementation Rules, we have lost control over the Affected Entities, which primarily include our private schools providing compulsory education, not-for-profit kindergartens and other enterprises within China that are affected by the Implementation Rules. We have determined that, in substance, we ceased to recognize revenues for all activities related to the Affected Entities with compulsory education and discontinued all business activities with such entities, by August 31, 2021 while continuing to provide essential services to keep these schools open. As a result, our ability to engage in the private not-for-profit education in China has been materially and adversely affected, and we cannot assure you that we will be able to restore such ability, which could materially and adversely affect our business, prospects, results of operations and financial condition.

4

We may not be able to execute our growth strategies or continue to grow as rapidly as we have in the past several years.

As of the date of this annual report, the domestic school network under our continuing operations in China includes eight kindergartens in China, all of which are registered as for-profit kindergartens. The discontinuation has caused our domestic school network to shrink drastically due to the effectiveness of the Implementation Rules. We cannot assure you that we will be able to effectively expand our domestic school network, which could materially and adversely affect our business, prospects, results of operations and financial condition. For our continuing operations, we intend to enroll students, recruit teachers and educational staff, increase the utilization rates of our existing and new schools and invest in overseas and complementary businesses. However, we may not be able to continue to grow as rapidly as we did previously due to uncertainties involved in the process, for example:

| ● | we may not be able to attract and retain a sufficient number of students for our existing and new schools; |

| ● | we may not be able to successfully integrate complementary or acquired businesses with our current service offerings and achieve anticipated synergies; |

| ● | we may not be able to hire and retain principals, teachers, educational staff and other employees for our existing and new schools; |

| ● | we may require more time than expected to obtain the accreditation for the education programs, particularly the international education programs, at our schools; |

| ● | we may not be able to continue to refine our curricula and optimize our students’ academic performance; |

| ● | our business partner, Country Garden, a related party, may not be able to develop new residential communities at districts with robust demand for private education or sell residential units to a sufficient number of buyers seeking convenient access to private education; |

| ● | the development of new schools may be delayed or affected as a result of many factors, such as delays in obtaining government approvals or licenses, shortages of key construction supplies and skilled labor, construction accidents, or natural catastrophes, some of which are beyond our control; |

| ● | we may not be able to successfully build our brand name and launch schools independent of Country Garden; |

| ● | we may be subject to further limitation in our ability to engage in the private for-profit education business; and |

| ● | we may not be able to successfully execute new growth strategies. |

These risks may increase significantly when we expand into new cities or countries. Managing the growth of a geographically diverse business also involves significant risks and challenges. We may find it difficult to manage financial resources, implement uniform education standards and operational policies and maintain our operational, management and technology systems across our network. If we are unable to manage our expanding operations or successfully achieve future growth, our business, prospects, results of operations and financial condition may be materially and adversely affected.

We may not be able to achieve profitability in the future.

We may not be able to achieve profitability. In particular, some of our schools, especially those at the ramp-up stage and with comparatively low utilization rates, are currently operating at loss and we may not be able to achieve profitability for these schools. Newly launched schools may negatively impact our overall financial condition. Our ability to achieve profitability has been and will be affected by the deconsolidation of the Affected Entities due to the effectiveness of the Implementation Rules.

Our ability to achieve profitability and maintain positive cash flow will depend in large part on our ability to control our costs and expenses, which are expected to increase as we further develop and expand our school network, as well as our ability to attract and retain educational talents to promote our business success. We may incur significant losses in the future for a number of reasons, including the other risks described in this annual report. We may also further encounter unforeseen expenses, difficulties, complications, delays and other unknown events. If we fail to increase revenue at the rate we anticipate or if our expenses increase at a faster rate than the increase in our revenue, we may not be able to achieve profitability.

5

Our corporate structure is built upon a series of contractual arrangements which has caused us to lose control of the Affected Entities.

On August 17, 2020, the PRC Ministry of Education (the “MOE”), and other four ministries and commissions promulgated the Opinions on Further Standardization of Education Fee, which further strengthens the regulation of private education fees. The Opinions on Further Standardization of Education Fee stipulates that private schools must publicize the itemized fees and standards at a prominent location in the school and indicate the itemized fees and standards in the admissions brochure and admission notice. If fees that should be publicized are not publicized, or the content of the publicity is not in compliance with the relevant policies, students are entitled to refuse the payment of the fees. In addition, the Opinions on Further Standardization of Education Fee emphasizes that sponsors of non-profit schools shall not transfer proceeds generated from operating such schools by way of related party transactions that fail to meet the requirements of being open, fair or just, and other service fees charged to our students must be charged based on a reasonable basis and voluntary and non-profit principles. If the regulatory authority deems otherwise, our operations may be adversely affected.

On September 7, 2020, the MOE published the Draft Preschool Education Law for public comments which was then submitted for review to the State Council on April 12, 2021. The Draft Preschool Education Law, among other things, tightens restrictions over kindergartens in pursuing profits and prohibits social capital from controlling state-run kindergartens and non-profit kindergartens through mergers and acquisitions, entrusted operation, franchising, through variable interest entities or via contractual control, prohibits (a) kindergartens from being directly or indirectly involved as assets of a company aiming at a listing, and (b) a listed company or its controlling shareholders to invest for-profit kindergartens through capital market financing or purchase the assets of for-profit kindergartens by issuing shares or paying cash.

On July 24, 2021, the General Office of Central Committee of the Communist Party of China and the General Office of State Council jointly promulgated the Opinions on Further Alleviating the Burden of Homework and After-School Tutoring for Students in Compulsory Education (the “Alleviating Burden Opinion”). The Alleviating Burden Opinion prohibits foreign investors from controlling or holding interest (including through contractual arrangements) in institutions providing after-school tutoring services on academic subjects in relation to the compulsory education (including primary school education of six years and middle school education of three years).

In addition, pursuant to the Implementation Rules, which became effective on September 1, 2021, social organizations and individuals are prohibited from controlling a private school that provides compulsory education or a non-for-profit private school that provides pre-school education by means of merger, acquisition, contractual arrangements, etc., and private school providing compulsory education shall not conduct any transaction with any related party, and any other private school conducting any transaction with any related party shall follow the principles of openness, fairness and impartiality, fix the price reasonably and regulate the decision-making, and shall not damage the interests of the state and the school or the rights and interests of the teachers and students, which may impose restrictions on the above-mentioned related party transactions. Such prohibition has significantly affected the enforceability of the exclusive management services and business cooperation agreements with affiliated entities providing compulsory education. Therefore, we concluded that we lost control of the schools providing compulsory education, not-for-profit kindergartens, and the sponsor entities (i.e. the Affected Entities) as from August 31, 2021 and such VIE contractual arrangements with them have become invalid since then and classified them as discontinued operations. Such discontinuation has had a material and adverse impact on our business, financial condition and results of operations.

Our schools in China that are involved in related party transactions may also be subject to strict supervision by relevant government authorities, and we may need to establish corresponding information disclosure systems and incur greater compliance costs. Our contractual arrangements, which may be deemed as related-party transactions, may be subject to scrutiny against the stipulated benchmarks by relevant government authorities.

If our existing group structure or contractual arrangements are deemed to violate any rules, laws or regulations, we may be required to terminate or amend our contractual arrangement. Our license to operate private schools may be revoked, cancelled or not be renewed. We may be subject to penalties as determined by the relevant authorities. We may also be restricted from further expanding our schools or school network. For example, we may not be able to acquire non-profit private schools. If any of the foregoing occurs, our business, financial condition and results of operations would be materially and adversely affected.

6

Our ability to maintain the operation of our kindergartens and to expand our kindergarten network may be limited due to our listing status as well as the PRC laws and regulations, which may in turn affect our results of operations.

On November 7, 2018, the Central Committee of the Communist Party of China and the State Council promulgated the Opinions on Regulating the Development and Deepening of the Reform of the Pre-School Education (the “Opinions”), which limits the ability by kindergartens to obtain financing through equity financing. It is unclear whether the Opinions will be applied retrospectively. In addition, we have not been notified of or been subject to any material fines or other penalties under any PRC laws or regulations due to any alleged violation of the Opinions. However, we cannot assure you that the Opinions will not be applied retrospectively, and that we will not be subject to adverse impact under the Opinions or any laws or regulations promulgated pursuant to the Opinions in the future. Moreover, the Opinions prohibit private kindergartens from listing as public companies by themselves or through packaging with other assets and restrict public companies from acquiring for-profit kindergartens with funds raised in the capital markets. Even though the Opinions do not clearly provide whether companies listed in capital markets outside the PRC fall under such restriction, we may be subject to this restriction, which would limit our ability to carry out further expansion plans with regard to our kindergarten business.

In addition, on January 22, 2019, the General Office of the State Council issued the Circular on Initiating the Rectification of Kindergartens Affiliated to Residential Communities in Urban Areas (the “Circular on Initiating the Rectification”), which requires existing community-affiliated kindergartens to be handed over to local education authorities and shall be held by local education authorities as public kindergartens or turn into inclusive kindergartens operated by authorized social entities. It also provides that community-affiliated kindergartens shall be not-for-profit. As of the date of this annual report, the domestic school network under our continuing operations in China includes eight kindergartens in China, all of which are registered as for-profit kindergartens, as the discontinuation has caused our domestic school network to shrink drastically due to the effectiveness of the Implementation Rules. See “—Our compliance with the Implementation Rules has materially and adversely affected and may continue to materially and adversely affect our business, financial condition, results of operations and prospect in the future, and we have been subject to significant limitations on our ability to engage in the private for-profit education business and may otherwise be materially and adversely affected by changes in PRC laws and regulations.” As of the date of this annual report, we do not own any not-for-profit community-affiliated kindergartens, and we do not plan to sponsor any not-for-profit community-affiliated kindergartens in the future, as the Circular on Initiating the Rectification has significantly restricted our ability to sponsor community-affiliated kindergartens. We cannot assure you that the domestic kindergartens we currently operate will not be classified as community-affiliated kindergartens and thus become not-for-profit. If any of the kindergartens we operate is classified as a community-affiliated kindergarten, we may become unable to continue to operate such kindergarten, which could materially and adversely affect our business and results of operations. See “Item 4. Information on the Company—B. Business Overview—Regulations—Regulations on Private Education in the PRC—Opinions on Regulating the Development and Deepening of the Reform of Pre-school Education.”

Our learning centers may not be able to obtain or update the required educational permits and business licenses, which may subject us to fines and other penalties, including the suspension of operations in noncompliant learning centers and confiscation of profits derived from non-compliant operations.

According to the Amended Law, which became effective on September 1, 2017, private schools for after-school tutoring can be established as for-profit private schools at the election of the school sponsors. The Amended Law also deleted the provision stipulating that measures for administration of profit-making non-state training institutions registered with the administrative department for industry and commerce shall be separately formulated by the State Council. According to the Rules for the Implementation of Supervision and Management of For-profit Private Schools, jointly issued by the Ministry of Education, the Ministry of Human Resources and Social Security and the State Administration for Industry and Commerce, and came into force on December 30, 2016, for-profit private tutoring institutions shall be in compliance with the regulations applicable to private schools. On February 13, 2018, the General Offices of the Ministry of Education and three other ministries in China jointly issued the Notice to Launch Special Campaign towards After-school Tutoring Institutions on Practically Reducing Burdens for Primary and Middle School Students, which requires after-school tutoring institutions with satisfactory conditions to obtain school operation licenses and other permits. Further, on August 22, 2018, the State Council issued the Opinion on Supervising After-School Tutoring Institutions (the “Circular 80”), which provides detailed guidance for these after-school tutoring institutions. Pursuant to the Alleviating Burden Opinion, which was promulgated on July 24, 2021 and the Circular 80, institutions providing after-school tutoring services on academic subjects in relation to the compulsory education are required to be registered as non-profit organization and institutions providing after-school tutoring services shall obtain the private school operating permit. Council Circular 80 and the Implementation Rules further require the learning centers of a training school providing after-school tutoring services to make filings with the relevant education authorities. On September 7, 2021, to implement the Alleviating Burden Opinion, the MOE published on its website that the MOE, together with two other government authorities, issued a circular requiring all institutions providing after-school tutoring services on academic subjects in relation to the compulsory education to complete registration as non-profit by the end of 2021, and all those institutions shall, before completing such registration, suspend enrollment of students and charging fees. For the non-academic tutoring services, the Alleviating Burden Opinion requires that local governmental authorities shall administer the non-academic after-school tutoring institutions by classifying sports, culture and art, science and technology and other non-academic subjects, formulating standards among different classification of non-academic tutoring and conducting strict examination before granting permission.

Therefore, we expect that the Amended Law, accompanied with its relevant implementation rules and regulations as well as other administrative actions, will bring significant changes to our compliance environment. A certain number of our entities, through which we operate our existing learning centers, may be required to obtain new licenses and permits or update their existing ones.

As of the date of this annual report, 17 out of 18 of our learning centers in China currently in operation need to obtain and update their operating permits or business licenses required by the regulatory changes discussed above. If we fail to obtain and update such permits or licenses in any event as required by relevant laws or regulations, we may be subject to fines or confiscation of profits derived from non-compliant operations and we may be unable to continue the operations at our non-complying learning centers, which could materially and adversely affect our business and results of operations.

7

We have in the past acquired several businesses and intend to remain acquisitive while continuing our organic growth, which may expose us to acquisition related risks.

We are at all times pursuing acquisition opportunities and these processes are, at any time, in various stages of completion. For example, we have completed several acquisitions in the United Kingdom and will continue to seek opportunities in overseas markets and in complementary education services. Our targets may cover a wide range of education, including independent schools, boarding schools, art institutes, pre-university education service providers, language training centers and other education-related service providers. Our acquisition strategy exposes us to significant acquisition-related risks. If we successfully complete several of these ongoing opportunities, the overall scope of our operations could grow substantially in the near to mid-term future and would have a material impact on our business, results of operations and financial condition. While there is no certainty as to whether any of the opportunities that we are currently pursuing, or any future opportunity, will be completed, some of these opportunities may be completed in the near- or mid-term, if current challenges to the processes can be overcome. Our acquisition-related risks include:

| ● | failure to obtain sufficient financing on satisfactory commercial terms in a timely manner; |

| ● | failure to successfully manage the increased leverage, interest expense, gearing and risks of default; |

| ● | depletion of our resources and cash flows available for existing operations; |

| ● | significant reduction in our cash flow and liquidity for financing the acquisitions; |

| ● | unanticipated challenges in operating in jurisdictions in which we do not currently operate in or do not operate at a significant scale, such as failure to get accustomed to the political, cultural and legal environment of these new jurisdictions; |

| ● | unforeseen challenges in operating new types of schools or programs and the failure to obtain relevant licenses for these new businesses; |

| ● | failure to manage and integrate the acquired businesses into our current operations effectively and may require financial resources that would otherwise be available for the ongoing development or expansion of our existing operations; |

| ● | failure to adjust our current business model to manage and operate at a more sizable scale and to realize the expected benefits from economies of scale; |

| ● | diversion of our management’s attention from existing businesses as they commit significant resources and efforts to the acquisition process; |

8

| ● | incurrence of significant costs in pursuing each acquisition, even if transactions cannot be successfully pursued, such as legal and managerial costs in conducting due diligence on the targeted businesses, resulting in a deprivation of the value of the targeted businesses; |

| ● | unforeseen contingent risks and latent liabilities of the targeted businesses that are not revealed to us in the due diligence process; |

| ● | financial risks related to the acquisition processes due to the inaccuracy of our assumptions with respect to the cost of and schedule for completing the acquisitions; |

| ● | potential loss of key personnel and students of the acquired business and failure to develop new relationships with students, teachers and other third parties in the overseas market; |

| ● | failure to recover the cost of the acquisitions through the materialization of the expected value from the targeted businesses or to achieve synergistic effect; |

| ● | regulatory risks related to the acquisition processes and to the operation of the newly acquired businesses, such as trade barriers and other restrictive or protective measures of our targeted overseas markets due to our lack of experience in dealing with the relevant authorities; |

| ● | liabilities related to the acquisitions against the sellers if we are unable to fulfil our obligations to them pursuant to the relevant sell and purchase agreements resulting in unanticipated financial costs; |

| ● | unanticipated increase in financing cost for the acquisitions due to fluctuation in foreign currencies and other foreign exchange restrictions or currency controls; and |

| ● | failure to protect our minority interests in certain non-wholly owned schools or to increase our shareholdings by acquiring more equity interests and our interests may not be aligned with those of controlling shareholders’. |

We may not be able to effectively manage our business expansion and successfully integrate businesses we acquire.

In recent years, we have expanded rapidly through acquisitions in China and overseas. As part of our global expansion plan, we have been exploring merger and acquisition opportunities abroad to expand our global school network, targeting quality K-12 private education providers and reputable schools in our targeted overseas countries and jurisdictions. For further details, see “Item 4. Information on the Company—B. Business Overview—Our Expansions and Investments.”

Our rapid expansion has resulted, and will continue to result, in substantial demands on our management, personnel, operational, technological and other resources. The sustainable post-acquisition organic growth is largely dependent on our ability to integrate operations, system infrastructure, existing partnerships and management philosophies of acquired schools and businesses. The integration of acquired schools is complicated and time-consuming and requires significant resource commitment, standardized integration process, and adequate planning and implementation. We cannot assure you that the acquisitions will be as successful as intended, or at all. The main challenges involved in integrating acquired schools and businesses include the following:

| ● | implementing integration process and management systems to ensure management philosophies, group-wide strategies and evaluation benchmarks can be effectively carried out at each acquired school and business; |

| ● | demonstrating to students at our acquired schools and more importantly their parents that the acquisitions will not result in adverse changes in the service quality and business focus; |

9

| ● | retaining local existing managerial and operational teams and qualified education professionals of our acquired schools and businesses; |

| ● | integrating and streamlining different system infrastructure and data management systems; |

| ● | integrating financial reporting systems, the failure of which could cause a delay in, or impact the reliability of, our financial statements; |

| ● | maintaining adequate internal control over financial reporting and preventing failed or delayed integration of these acquired businesses into our internal control over financial reporting; |

| ● | preserving strategic, marketing or other important relationships of the acquired schools; |

| ● | obtaining requisite pre-acquisition and post-acquisition regulatory approvals in countries and jurisdictions in which our target schools and businesses are located in a timely manner or at all; and |

| ● | competing with multinational education companies. |

Therefore, we cannot assure you that we will be able to integrate the acquired schools and businesses with our existing operations in accordance with the expected timetables, and we may incur significant financial expenses and commit significant resources to streamline the operation of the acquired schools and businesses under our internal control requirements, and our pricing and profitability targets may not prove accurate or feasible, which may result in adverse impact to our financial performance. Any difficulties or delays encountered in connection with the integration of our and the acquired businesses’ operations could divert substantial management attention to the transition of the acquired schools and businesses before achieving full integration and may result in delay or deferral by our management of important strategic decisions for our existing businesses, which may adversely affect our business growth. In addition, the businesses and schools we acquire may be loss-making or have existing liabilities or other risks that we may not be able to effectively manage or may not be aware of at the time we acquire them, which may impact our ability to realize the expected benefits from the acquisition or our financial performance.

In addition, we plan to acquire additional overseas schools to expand our global network. We have announced a number of international acquisitions and may undertake future acquisitions or other corporate transactions in the future. We cannot assure you that we will be able to effectively and efficiently identify new overseas school projects, manage acquired overseas schools and our overseas operations, or integrate the acquired overseas schools with our existing operations. In addition, political and economic instabilities, tariffs, trade barriers and other restrictive actions taken by the governments of our targeted markets, fluctuations in foreign exchange rates, our insufficient experience and knowledge of the local markets as well as the relevant local laws and regulations may all affect our ability to operate our overseas schools and manage our overseas operations, which in turn may have a material and adverse effect on our business, financial position and results of operations.

10

We may be subject to unknown or contingent liabilities related to the acquired businesses, which may adversely affect our financial performance.

The businesses and schools we acquired or plan to acquire may be operating at a loss or have existing liabilities or other risks that we may not be able to effectively manage or may not be aware of at the time that we acquire them. Although consistent with industry practice, we always conduct a review of assets prior to each acquisition, such reviews are inherently incomplete as it is generally not feasible to review in depth every individual asset involved in each acquisition. Ordinarily, our due diligence focuses on higher-value businesses or assets and will only conduct a sample due diligence on the remainder. Nonetheless, even an in-depth review of all assets and records may not necessarily reveal an exhaustive list of existing and potential problems, nor will it permit us to become sufficiently familiar with the assets to assess fully their deficiencies and capabilities. As we may have no recourse, or only limited recourse, against the sellers for these unknown liabilities and risks, this may in turn affect our ability to realize the expected benefits from the acquisition or our financial performance. Furthermore, even though the sellers may be required to indemnify us with respect to breaches of the representations and warranties pursuant to the respective sell and purchase agreements, such indemnification is limited and subject to various materiality thresholds and an aggregate cap on losses. As a result, we cannot assure you that we will be able to recover any amount with respect to losses due to breaches by the sellers of their representations and warranties. In addition, the total amount of costs and expenses that may be incurred with respect to liabilities associated with the acquired business may exceed our expectations, along with other unanticipated adverse effects, all of which may adversely affect our business, results of operations and financial condition.

We may not generate sufficient profit to guarantee our ability to meet financial obligations due to the net current liabilities as of August 31, 2022.

As of August 31, 2022, we had net current liabilities of RMB380.9 million (US$55.3 million) for our continuing operations. We cannot assure you that we will not experience periods of net current liabilities in the future. We may record net current liabilities in future periods as we expand. A net current liabilities position could expose us to liquidity risks, constrain our operational flexibility and adversely affect our ability to obtain financing and expand our business. We cannot assure you that we will always be able to generate sufficient cash flow from our operations or obtain necessary funding to meet our future financial needs, including repaying our loans upon maturity and financing our capital commitments. If we fail to meet our financial obligations, our business, liquidity, financial condition and prospects could be materially and adversely affected.

As of the date of this annual report, our management has concluded that we will have sufficient financial resources to support our operations and meet our financial obligations and commitments as they become due. Therefore, our financial statements have been prepared assuming we will continue on a going concern basis. However, our ability to continue as a going concern is dependent on our ability to generate sufficient profits and/or obtain necessary funding from outside sources, and we cannot assure you that we will be able to generate such profits or obtain such funding. Failure to continue as a going concern would require that our assets and liabilities be restated on a liquidation basis, which could differ significantly from the going concern basis.

We may need additional capital for our future expansion and our leverage profile may change significantly.

To the extent our existing sources of capital are not sufficient to satisfy our existing and future needs, we may have to seek external financing sources. Our ability to obtain additional capital from external sources in the future is subject to a variety of uncertainties, including our future financial condition, results of operations and cash flows, regulatory considerations, general market conditions for capital raising activities and economic, political and other conditions in jurisdictions where we operate. In particular, future debt financing, if can be obtained, could include terms that may restrict our financial flexibility or our ability to manage our business freely, which may adversely affect our business and results of operations. In addition, we have completed several overseas acquisitions in the past, such as the acquisitions of Bournemouth Collegiate School (“BCS”), St. Michael’s School, Bosworth Independent School (“BIC”) and CATS Colleges Holdings Limited (“CATS”) and may in the future enter into agreements in relation to future overseas acquisitions, some of which may be funded by debt financing. In the event that the amount of debt drawn to fund such acquisitions is significant, this could result in a significant change to our leverage profile and financing costs, which could impact our financial position and results of operations in the future. Additional debt financing may also increase our interest expense, leverage and gearing, as well as potentially require us to dedicate a substantial portion of our cash flow from operations to debt servicing. If we fail to repay our debt in a timely manner, we may face risks of default which may also cause our other debt to be accelerated.

11

If we fail to ramp up our existing schools or successfully launch new schools, our business growth and prospects could be materially and adversely affected.

As of the date of this annual report, we have a network of eight kindergartens in China, among which five kindergartens are in the ramp-up period. As the discontinuation has caused our domestic school network to shrink drastically, due to the effectiveness of the Implementation Rules. See “—Our compliance with the Implementation Rules has materially and adversely affected and may continue to materially and adversely affect our business, financial condition, results of operations and prospect in the future, and we have been subject to significant limitations on our ability to engage in the private for-profit education business and may otherwise be materially and adversely affected by changes in PRC laws and regulations.” Four of the five domestic kindergartens currently in the ramp-up period are operating at a loss. We cannot assure you that we will be able to continue to attract a sufficient number of students to enroll in these schools, recruit additional qualified teachers and educational staff to meet the demands of the increased student enrollment or otherwise expand our operations at schools in a manner that ensures a consistently high quality of education service. We or our partners may encounter difficulty in procuring the land and obtaining the permits for construction. We cannot assure you that we will be able to apply our experience from the operation of our existing schools to new schools or that we will be able to obtain the requisite permits, licenses or accreditations or recruit a sufficient number of qualified teachers. If we fail to attract students to our existing schools or start new schools with the requisite permits, licenses and accreditations and teachers, our business growth and prospects could be materially and adversely affected.

We may be unable to engage with the Affected Entities to provide education services as we expected.

Following the effectiveness of the Implementation Rules, we have been engaging with the relevant government authorities and external advisors to seek full compliance with the Implementation Rules and other applicable PRC laws and regulations. However, we are exploring the possibility of continuing to engage with the Affected Entities in future cooperation on mutually acceptable terms and in full compliance with the Implementation Rules and other applicable PRC laws and regulations. The future cooperation may involve our provision of services to some of the Affected Entities, such as consultation for school operation, property management and maintenance, administrative management, student recruiting and school branding.

However, the future cooperation with the Affected Entities, if any, will be arm’s length transactions on mutually acceptable terms. We cannot assure you that the cooperation under contemplation will be specifically permitted by competent government authorities or that we will be able to agree on commercial terms satisfactory to us, and as such, we may be unable to effectuate the cooperation with the Affected Entities as we expect.

We had ceased to recognize revenues for all activities related to the Affected Entities with compulsory education and discontinued all business activities with such entities, by August 31, 2021 while continuing to provide essential services to keep these schools open.

Services provided to these schools primarily include marketing and consulting, procurement support, human resources, finance and legal support, and information technology support, all of which were conducted through our centralized management system. Our centralized management system provided services to the Affected Entities without charges together with other kindergartens that we charged services fee for. As we did not track the costs incurred by the centralized management system separately among different service recipients, and majority of the costs are staff costs incurred by the centralized management system, there are significant limitations for us to accurately determine the costs attributable to providing services to the Affected Entities.

It is not clear under the Implementation Rule whether the provision of such services to the Affected Entities will be considered transactions with any related parties in spite of the fact that it is free of charge. If the provision of such services to the Affected Entities is considered transactions with related parties, we may be subject to penalty for our past provision of services to these entities, and we may be prohibited from providing such services to the Affected Entities.

If we fail to enroll and retain a sufficient number of students, our business could be materially and adversely affected.

Our ability to continue to enroll and retain students for our schools is critical to the continued success and growth of our business. The success of our efforts to enroll and retain students will depend on several factors, including our ability to:

| ● | enhance existing education programs and services to respond to market changes and student demands; |