Document

ALTAGAS LTD.

Annual Information Form

For the year ended December 31, 2020

Dated: February 25, 2021

TABLE OF CONTENTS

AltaGas Ltd. – 2020 Annual Information Form – 1

GENERAL INFORMATION

Unless otherwise noted, the information contained in this AIF is stated as at December 31, 2020 and all dollar amounts in this AIF are in Canadian dollars. Financial information is presented in accordance with United States generally accepted accounting principles. For an explanation of certain terms and abbreviations used in this AIF, see the "Glossary" of this AIF.

FORWARD-LOOKING INFORMATION AND STATEMENTS

This AIF contains forward-looking information (forward-looking statements). Words such as "may", "can", "would", "could", "should", "will", "intend", "plan", "anticipate", "believe", "aim", "seek", "propose", "contemplate", "estimate", "focus", "strive", "forecast", "expect", "project", "target", "potential", "objective", "continue", "outlook", "vision", "opportunity", and similar expressions suggesting future events or future performance, as they relate to the Corporation or any affiliate of the Corporation, are intended to identify forward-looking statements. In particular, this AIF contains forward-looking statements with respect to, among other things, business objectives, expected growth, results of operations, performance, business projects and opportunities and financial results. Specifically, such forward-looking statements included in this document include, but are not limited to, statements with respect to the following: the Corporation’s strategy, priorities and focus with regard to its Utilities and Midstream segments; the Corporation’s 2021 strategic priorities; timing of material regulatory filings, proceedings and decisions in the Utilities business; duration of orders by Utilities regulators addressing the COVID-19 public health emergency; expected timing of costs related to merger commitments; Washington Gas’ potential remediation obligations related to real property; expected in-service and completion dates for current projects in the Midstream business; expected effective dates of material environmental legislation; and duration of the suspension of the DRIP program.

These statements involve known and unknown risks, uncertainties and other factors that may cause actual results, events, and achievements to differ materially from those expressed or implied by such statements. Such statements reflect AltaGas' current expectations, estimates, and projections based on certain material factors and assumptions at the time the statement was made. Material assumptions include: the expected duration and impacts of the COVID-19 pandemic; expected commodity supply, demand and pricing; volumes and rates; exchange rates; inflation; interest rates; credit ratings; regulatory approvals and policies; future operating and capital costs; project completion dates; capacity expectations; and the outcomes of significant commercial contract negotiation.

AltaGas’ forward-looking statements are subject to certain risks and uncertainties which could cause results or events to differ from current expectations, including, without limitation: risk related to COVID-19; health and safety risks; risks related to the integration of Petrogas; operating risks; regulatory risks; cyber security, information, and control systems; litigation risk; climate-related risks, including carbon pricing; changes in law; political uncertainty and civil unrest; infrastructure risks; service interruptions; decommissioning, abandonment and reclamation costs; reputation risk; weather data; Indigenous land and rights claims; crown duty to consult with Indigenous peoples; capital market and liquidity risks; general economic conditions; internal credit risk; foreign exchange risk; debt financing, refinancing, and debt service risk; interest rates; technical systems and processes incidents; dependence on certain partners; growth strategy risk; construction and development; transportation of petroleum products; impact of competition in AltaGas' businesses; counterparty credit risk; market risk; composition risk; collateral; rep agreements; delays in U.S. Federal Government budget appropriations; market value of common shares and other securities; variability of dividends; potential sales of additional shares; volume throughput; natural gas supply risk; risk management costs and limitations; underinsured and uninsured losses; commitments associated with regulatory approvals for the acquisition of WGL; securities class action suits and derivative suits; electricity and resource adequacy prices; cost of providing retirement plan benefits; labor relations; key personnel; failure of service providers; compliance with Section 404(a) of Sarbanes-Oxley Act; and the other factors discussed under the heading "Risk Factors" in this AIF.

AltaGas Ltd. – 2020 Annual Information Form – 2

Many factors could cause AltaGas' or any particular business segment's actual results, performance, or achievements to vary from those described in this AIF, including, without limitation, those listed above and the assumptions upon which they are based proving incorrect. These factors should not be construed as exhaustive. Should one or more of these risks or uncertainties materialize, or should assumptions underlying forward-looking statements prove incorrect, actual results may vary materially from those described in this AIF as intended, planned, anticipated, believed, sought, proposed, estimated, forecasted, expected, projected, or targeted and such forward-looking statements included in this AIF should not be unduly relied upon. The impact of any one assumption, risk, uncertainty, or other factor on a particular forward-looking statement cannot be determined with certainty because they are interdependent and AltaGas’ future decisions and actions will depend on management’s assessment of all information at the relevant time. Such statements speak only as of the date of this AIF. AltaGas does not intend, and does not assume any obligation, to update these forward-looking statements except as required by law. The forward-looking statements contained in this AIF are expressly qualified by these cautionary statements.

Financial outlook information contained in this AIF about prospective results of operations, financial position, or cash flow is based on assumptions about future events, including economic conditions and proposed courses of action, based on management's assessment of the relevant information currently available. Readers are cautioned that such financial outlook information contained in this AIF should not be used for purposes other than for which it is disclosed herein.

GLOSSARY

Unless the context otherwise requires, terms used in this AIF have the following meanings and references to agreements include any amendments, restatements, modifications, or supplements in effect as of the date hereof:

"ACI" means AltaGas Canada Inc., which has since been renamed TriSummit Utilities Inc.;

"ACI IPO" means initial public offering of common shares of ACI;

"AER" means the Alberta Energy Regulator;

"AESO" means the Alberta Electric System Operator;

"AIF" means this Annual Information Form;

"AIJVLP" means AltaGas Idemitsu Joint Venture Limited Partnership;

"AltaGas", the "Company", or the "Corporation" means AltaGas Ltd., including, where the context requires, the affiliates of AltaGas Ltd.;

"ARB" means the California Air Resources Board;

"ASC" means the Alberta Securities Commission;

"AUI" means AltaGas Utilities Inc.;

"B.C." or "BC" means the province of British Columbia in Canada;

"Bbls" means stock tank barrels of ethane and other NGLs, expressed in standard 42 U.S. gallon barrels or 34.972 imperial gallon barrels;

"Bbls/d" means Bbls per day;

AltaGas Ltd. – 2020 Annual Information Form – 3

"Bcf" means billion cubic feet or 1,000,000 Mcf of natural gas;

"Bcf/d" means Bcf per day;

"Birchcliff" means Birchcliff Energy Ltd.;

"Black Swan" means Black Swan Energy Ltd.;

"Blair Creek facility" means the Blair Creek processing facility located approximately 140 km northwest of Fort St. John, British Columbia, owned by AltaGas’ indirect wholly-owned subsidiary AltaGas Northwest Processing Limited Partnership;

"Blythe" means Blythe Energy Inc.;

"Blythe Energy Center" means the 507 MW gas-fired generation facility located near Blythe, California, together with the related 67 miles transmission lines, owned by AltaGas’ indirect wholly-owned subsidiary Blythe;

"Board of Directors" means the board of directors of AltaGas, as from time to time constituted;

"Brush II" means the 70 MW gas-fired generation facility in Colorado, owned by AltaGas’ indirect wholly-owned subsidiary AltaGas Brush Energy Inc.;

"C&I" means commercial and industrial;

"CAISO" means the California Independent System Operator;

"CBCA" means the Canada Business Corporations Act, R.S.C. 1985, c. C 44, as amended from time to time, including the regulations from time to time promulgated thereunder;

"CCAA" means the Companies’ Creditors Arrangement Act, R.S.C. 1985, c. C 36, as amended from time to time, including the regulations from time to time promulgated thereunder;

"CCEMA" means the Climate Change and Emissions Management Act, S.A. 2003, C-16.7, as amended from time to time, including the regulations from time to time promulgated thereunder;

"CCIR" means the Carbon Competitiveness Incentive Regulation, A.R. 255/2017 under the CCEMA, as amended from time to time;

"Central Penn" means the Central Penn pipeline, a 185-mile pipeline originating in Susquehanna County, Pennsylvania and extending to Lancaster County, Pennsylvania;

"CFIUS" means the Committee on Foreign Investment in the United States;

"CINGSA" means Cook Inlet Natural Gas Storage Alaska, LLC;

"CINGSA Storage facility" means the in-field storage facility in the Cook Inlet area of Alaska owned and operated by CINGSA;

"CN" means Canadian National Railway Company;

"CO2" means carbon dioxide;

"CO2e" means carbon dioxide equivalent;

AltaGas Ltd. – 2020 Annual Information Form – 4

"Common Shares" means common shares of AltaGas Ltd.;

"Constitution" means Constitution Pipeline Company, LLC, an entity formed to create a pipeline to transport natural gas from the Marcellus region in northern Pennsylvania to northeastern markets;

"COVID-19" means the 2019 novel coronavirus;

"CPI" means the Consumer Price Index;

"DBRS" means DBRS Limited and its successors;

"Degree Day" means the amount that the daily mean temperature deviates below 65 degrees Fahrenheit at SEMCO Gas, ENSTAR, and Washington Gas, such that a one degree difference equates to one Degree Day;

"Dekatherm" means 10 Therms;

"DOEE" means the District of Columbia Department of Energy and Environment;

"EEEP" means the Edmonton ethane extraction plant and related facilities, AltaGas’ interest being owned by its indirect wholly-owned subsidiary AltaGas Extraction and Transmission Limited Partnership;

"EH&S Committee" means the Environment, Health and Safety Committee of the Board of Directors;

"EHS Management System" means AltaGas’ Environmental, Health & Safety Management System;

"Enerchem" means Enerchem International Inc., a wholly owned subsidiary of Petrogas;

"ENSTAR" means the natural gas distribution business conducted by SEMCO Energy in Alaska under the name ENSTAR Natural Gas Company;

"EQM" means EQM Gathering Opco, LLC;

"EQT" means EQT Midstream Partners, LP;

"ESG" means Environment, Social & Governance;

"FERC" means the United States Federal Energy Regulatory Commission;

"Ferndale terminal" means the storage, distribution, and export facility for bulk shipments of propane, and butane located on the west coast near Ferndale, Washington, and owned by a subsidiary of Petrogas;

"FID" means final investment decision;

"Fitch" means Fitch Ratings Inc.;

"g" means grams;

"GHG" means greenhouse gas;

"GJ" means gigajoule or 1,000,000,000 joules;

AltaGas Ltd. – 2020 Annual Information Form – 5

"Gordondale facility" means the Gordondale Gas processing facility in the Gordondale area of the Montney reserve area approximately 100 km northwest of Grande Prairie, Alberta, owned by AltaGas’ indirect wholly-owned subsidiary AltaGas Northwest Processing Limited Partnership;

"GSAs" means Groundwater Sustainability Agencies;

"GWh" means gigawatt-hour or 1,000,000,000 watt-hours; the watt-hour is equal to one watt of power flowing steadily for one hour;

"Hampshire" or "Hampshire Gas" means Hampshire Gas Company, a subsidiary of WGL that provides regulated interstate natural gas storage services to Washington Gas under a FERC approved interstate storage service tariff;

"Harmattan" means the combined Harmattan gas processing facility and extraction plant and associated facilities, owned by AltaGas’ indirect wholly-owned subsidiary Harmattan Gas Processing Limited Partnership;

"HE" means Hearing Examiner;

"Heritage Gas" means Heritage Gas Limited;

"Idemitsu" means Idemitsu Kosan Co., Ltd.;

"IRIP" means the Infrastructure Reliability Improvement Program;

"JEEP" means the Joffre ethane extraction plant and related facilities;

"Kelt" means Kelt Exploration (LNG) Ltd;

"km" means kilometer;

"kWh" means kilowatt hour;

"LNG" means liquefied natural gas;

"LPG" means liquefied petroleum gas;

"Marquette Connector Pipeline" means the recently completed pipeline that is owned and operated by SEMCO Gas and connects the Great Lakes Gas Transmission pipeline to the Northern Natural Gas pipeline in Marquette, Michigan;

"Mcf" means a thousand cubic feet of natural gas at standard imperial conditions of measurement;

"Mcf/d" means Mcf per day;

"MDth" means millions of Dekatherms;

"Merger Agreement" means the agreement and plan of merger dated as of January 25, 2017, among AltaGas, Merger Sub and WGL;

"Merger Sub" means Wrangler Inc., a Virginia corporation and an indirect wholly-owned subsidiary of AltaGas;

"MGP" means manufactured gas plant;

"Mmcf" means a million cubic feet of natural gas at standard conditions of measurement;

AltaGas Ltd. – 2020 Annual Information Form – 6

"Mmcf/d" means Mmcf per day;

"Moody's" means Moody's Investor Service;

"Mountain Valley" means Mountain Valley pipeline, an equity investment of WGL Midstream;

"MPSC" means the Michigan Public Service Commission;

"MRP" means Main Replacement Program;

"MTN" means medium term notes issued from time to time under either the amended and restated trust indenture dated July 1, 2010 between AltaGas and Computershare Trust Company of Canada, as further amended, restated, supplemented or otherwise modified from time to time or the trust indenture dated September 26, 2017 between AltaGas and Computershare Trust Company of Canada, as amended, restated, supplemented or otherwise modified from time to time, as the case may be;

"MW" means megawatt; one MW is 1,000,000 watts; the watt is the basic electrical unit of power;

"MWh" means megawatt-hour or 1,000,000 watt-hours; the watt-hour is equal to one watt of power flowing steadily for one hour;

"NAESB" means North American Energy Standards Board;

"NEBC" means Northeast British Columbia;

"NFA" means No Further Action;

"NGL" or "NGLs" means natural gas liquids, which includes primarily propane, butane, and condensate;

"NGTL" means NOVA Gas Transmission Ltd.;

"Non-Ring Fenced Entities" means AltaGas and its affiliates other than Washington Gas and the SPE;

"North Pine facility" means the NGL separation facility, located approximately 40 km northwest of Fort St. John, British Columbia.

"North Pine pipelines" means two eight-inch diameter NGL supply pipelines, each approximately 40 km in length, which runs from the existing Alaska Highway truck terminal to the North Pine facility;

"Northwest Hydro facilities" means the three previously owned run-of-river hydroelectric facilities in northwest British Columbia;

"Nova Chemicals" means NOVA Chemicals Corporation;

"NOx" means nitrogen oxides;

"NTSB" means the National Transportation Safety Board;

"O2" means oxygen;

"Painted Pony" means Painted Pony Energy Ltd.;

"PEEP" means the Pembina Empress extraction plant and related facilities;

AltaGas Ltd. – 2020 Annual Information Form – 7

"Pembina" means Pembina Infrastructure and Logistics LP;

"Petrogas" means Petrogas Energy Corp., a North American integrated midstream company in which AltaGas acquired a controlling interest on December 15, 2020;

"Petrogas Acquisition" means AltaGas' acquisition of a controlling interest in Petrogas on December 15, 2020;

"Plan" means the Premium DividendTM, Dividend Reinvestment, and Optional Cash Purchase Plan of the Corporation;

"PNG" means Pacific Northern Gas Ltd.;

"Pomona" means the 44.5 MW gas-fired generation facility located in Pomona, California, which was sold during 2020;

"Pomona Energy Storage facility" means the 20 MW lithium ion battery storage facility in Pomona, California, which was sold during 2020;

"Pool" means the scheme operated by the AESO for (i) exchanges of electric energy, and (ii) financial settlement for the exchange of electric energy;

"PPA" means power purchase agreement;

"Preferred Shares" means the preferred shares of AltaGas Ltd. as a class, including, without limitation, the Series A Shares, Series B Shares, Series C Shares, Series E Shares, Series G Shares, Series H Shares, Series I Shares, and Series K Shares;

"PROJECTpipes" means Washington Gas' 40-year accelerated pipeline replacement program, that was launched in 2014 in the District of Columbia and is designed to enhance the safety and reliability of its system;

"PRPA" means Prince Rupert Port Authority;

"PSC of DC" means the Public Service Commission of the District of Columbia;

"PSC of MD" means the Maryland Public Service Commission;

"Put Notice" means the notice received by AIJVLP from SAM of its exercise of a put option with respect to its approximate one-third interest in Petrogas;

"Put Option" means the put option with respect to SAM's approximate one-third interest in Petrogas;

"RCA" means the Regulatory Commission of Alaska;

"Rep Agreements" mean the Representation, Management and Processing Agreements at Harmattan;

"RILE LP" means Ridley Island LPG Export Limited Partnership, a limited partnership of which AltaGas’ subsidiaries hold a 70 percent interest and Vopak holds a 30 percent interest;

"Ring Fenced Entities" means Washington Gas and the SPE;

"RIPET" means the Ridley Island Propane Export Terminal, the propane export terminal constructed by AltaGas' subsidiary, Ridley Island LPG Export Limited Partnership, to ship up to 1.2 million tonnes of propane per annum and to be located on a portion of land leased by Ridley Terminals Inc. from the PRPA, located on Ridley Island, near Prince Rupert, British Columbia;

AltaGas Ltd. – 2020 Annual Information Form – 8

"Ripon" means the 49.5 MW gas-fired generation facility in Ripon, California, which was sold during 2020;

"ROE" means return on equity;

"Royal Vopak" means Koninklijke Vopak N.V., a public company incorporated under the laws of the Netherlands;

"RTI" means Ridley Terminals Inc.;

"S&P" means Standard & Poor's Ratings Services and its successors;

"SAM" means Sam Holdings Ltd.;

"Sarbanes-Oxley" means the Sarbanes-Oxley Act of 2002;

"SAVE" means Steps to Advance Virginia's Energy Plan;

"SCC of VA" means the Commonwealth of Virginia State Corporation Commission;

"SCE" means Southern California Edison Company;

"SEDAR" means System for Electronic Document Analysis and Retrieval, at www.sedar.com;

"SEMCO Energy" means SEMCO Energy, Inc.;

"SEMCO Gas" means the Michigan natural gas distribution business conducted by SEMCO Energy in Michigan under the name SEMCO Energy Gas Company;

"Series A Shares" means the cumulative redeemable 5-year fixed rate reset preferred shares, Series A, of AltaGas;

"Series B Shares" means the cumulative redeemable floating rate preferred shares, Series B, of AltaGas

"Series C Shares" means the cumulative redeemable 5-year fixed rate reset preferred shares, Series C, of AltaGas (US dollar);

"Series E Shares" means the cumulative redeemable 5-year fixed rate reset preferred shares, Series E, of AltaGas;

"Series G Shares" means the cumulative redeemable 5-year fixed rate reset preferred shares, Series G, of AltaGas;

"Series H Shares" means the cumulative redeemable floating rate preferred shares, Series H, of AltaGas;

"Series I Shares" means the cumulative redeemable 5-year minimum fixed rate reset preferred shares, Series I, of AltaGas, which were redeemed by AltaGas on December 31, 2020;

"Series K Shares" means the cumulative redeemable 5-year minimum fixed rate reset preferred shares, Series K, of AltaGas;

"SGMA" means the Sustainable Groundwater Management Act;

"Share Options" means options to acquire Common Shares granted pursuant to AltaGas' share option plan;

"Shareholders" mean the holders of Common Shares;

"Shell Energy" means Shell Energy North America (US), LP;

AltaGas Ltd. – 2020 Annual Information Form – 9

"SOS" means Standard offer Service;

"SPE" means Wrangler SPE LLC, a wholly-owned special purpose entity subsidiary of WGL incorporated as a bankruptcy remote entity;

"Stonewall System" means the Stonewall Gas Gathering System;

"STRIDE" means Strategic Infrastructure Development Enhancement Plan;

"TCJA" means the Tax Cuts and Jobs Act of 2017;

"TIER" means Technology Innovation and Emissions Reduction;

"Tourmaline" means Tourmaline Oil Corp.;

"Townsend 2A" means the first 99 Mmcf/d train of the Townsend expansion, located on the existing Townsend facility site, adjacent to the currently operating Townsend facility;

"Townsend 2B" means the 198 Mmcf/d C3+ deep cut gas processing facility to be located on the existing Townsend facility site, adjacent to the currently operating Townsend facility;

"Townsend complex" means, collectively, the Townsend facility, Townsend 2A, and Townsend 2B;

"Townsend facility" means the 198 Mmcf/d Townsend shallow-cut processing facility in northeast British Columbia owned by AltaGas Northwest Processing Limited Partnership;

"Transco" means Transcontinental Gas Pipeline Company LLC;

"TSX" means the Toronto Stock Exchange;

"UESC" means Utility Energy Savings Contracts;

"United States", "US", or "U.S." means the United States of America;

"US dollar" or "US$" means currency in the form of United States dollars;

"USEPA" means United States Environmental Protection Agency;

"Vopak" means Vopak Development Canada Inc., a wholly-owned subsidiary of Royal Vopak;

"Washington Gas" means Washington Gas Light Company, a subsidiary of WGL that sells and delivers natural gas primarily to retail customers in the District of Columbia, Maryland and Virginia in accordance with tariffs approved by the PSC of DC, the PSC of MD and the SCC of VA;

"Washington Gas $4.25 Shares" means the US$4.25 series cumulative preferred shares of Washington Gas that were redeemed by Washington Gas on December 20, 2019;

"Washington Gas $4.80 Shares" means the US$4.80 series cumulative preferred shares of Washington Gas that were redeemed by Washington Gas on December 20, 2019;

"Washington Gas $5.00 Shares" means the US$5.00 series cumulative preferred shares of Washington Gas that were redeemed by Washington Gas on December 20, 2019;

AltaGas Ltd. – 2020 Annual Information Form – 10

"Washington Gas Preferred Shares" means the preferred shares of Washington Gas as a class, including, without limitation, the Washington Gas $4.25 Shares, Washington Gas $4.80 Shares and Washington Gas $5.00 Shares;

"Washington Gas Resources" means Washington Gas Resources Corporation, a subsidiary of WGL that owns the majority of the non-utility subsidiaries;

"WCSB" means Western Canada Sedimentary Basin;

"WGL" means WGL Holdings, Inc., an indirect subsidiary of AltaGas;

"WGL Acquisition" means the acquisition by AltaGas, indirectly through Merger Sub, of WGL through a merger of Merger Sub with and into WGL pursuant to the Merger Agreement, which closed on July 6, 2018;

"WGL Energy Services" means WGL Energy Services, Inc. (formerly Washington Gas Energy Services, Inc.), a subsidiary of Washington Gas Resources that sells natural gas and electricity to retail customers on an unregulated basis;

"WGL Energy Systems" means WGL Energy Systems, Inc. (formerly Washington Gas Energy Systems, Inc.), a subsidiary of Washington Gas Resources, which provides commercial energy efficient and sustainable solutions to government and commercial clients;

"WGL Midstream" means WGL Midstream, Inc., a subsidiary of Washington Gas Resources that engages in acquiring and optimizing natural gas storage and transportation assets;

"WGSW" means WGSW, Inc., a subsidiary of Washington Gas Resources that was formed to invest in certain renewable energy projects; and

"Younger" means the Younger extraction plant and related facilities, AltaGas’ interest being owned by its indirect wholly-owned subsidiary AltaGas Extraction and Transmission Limited Partnership.

METRIC CONVERSION

The following table sets forth certain standard conversions between Standard Imperial Units and the International System of Units (or metric units).

| | | | | | | | | | | | | | | | | | | | |

To Convert From | To | Multiply by | | To Convert From | To | Multiply by |

Mcf | cubic meters | 28.174 | | feet | meters | 0.305 |

cubic meters | cubic feet | 35.494 | | meters | feet | 3.281 |

Bbls | cubic meters | 0.159 | | miles | km | 1.609 |

cubic meters | Bbls | 6.29 | | km | miles | 0.621 |

tonnes | long tons | 0.98 | | gigajoule | Mcf | 0.9482 |

metric tonnes | Bbls (propane) | 12.40 | | metric tonnes | Bbls (butane) | 10.90 |

CORPORATE STRUCTURE

Incorporation

AltaGas is a Canadian corporation amalgamated pursuant to the CBCA on January 1, 2020. AltaGas and/or its predecessors began operations in Calgary, Alberta on April 1, 1994 and AltaGas continues to maintain its head, principal, and registered office in Calgary, Alberta currently located at 1700, 355 – 4th Avenue SW, Calgary, Alberta T2P 0J1. AltaGas is a public company, the Common Shares of which trade on the TSX under the symbol "ALA".

AltaGas Ltd. – 2020 Annual Information Form – 11

Amended Articles

On July 1, 2010, AltaGas filed articles of arrangement under the CBCA to effect a corporate arrangement and the amalgamation of AltaGas Ltd., AltaGas Conversion Inc., and AltaGas Conversion #2 Inc. to form AltaGas. Subsequent to the filing of the articles of arrangement, AltaGas filed articles of amendment on the following dates in connection with the creation of each series of Preferred Shares: (i) August 13, 2010 to create the first series of Preferred Shares, Series A Shares and the second series of Preferred Shares, Series B Shares; (ii) June 1, 2012 to create the third series of Preferred Shares, Series C Shares and the fourth series of Preferred Shares, Series D Shares; (iii) December 9, 2013 to create the fifth series of Preferred Shares, Series E Shares and the sixth series of Preferred Shares, Series F Shares; (iv) June 27, 2014 to create the seventh series of Preferred Shares, Series G Shares and the eighth series of Preferred Shares, Series H Shares; (v) November 17, 2015 to create the ninth series of Preferred Shares, Series I Shares and the tenth series of Preferred Shares, Series J Shares; and (vi) February 15, 2017 to create the eleventh series of Preferred Shares, Series K Shares and the twelfth series of Preferred Shares, Series L Shares. On January 1, 2020, AltaGas filed articles of amalgamation to effect the amalgamation of AltaGas with its non-operating subsidiaries AltaGas Investment Ltd., 11801376 Canada Ltd., and Northwest Triumph Contracting Ltd.

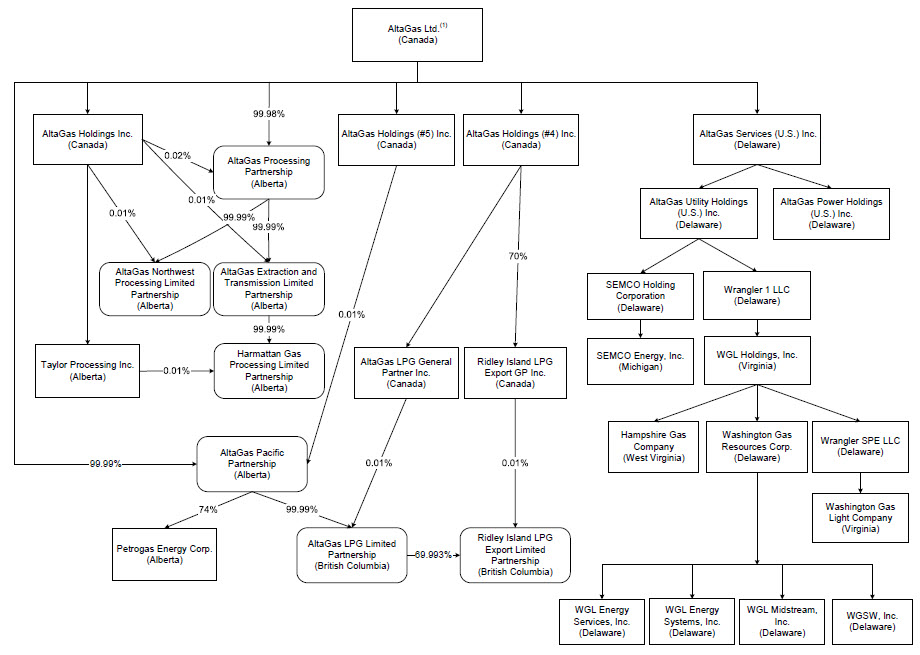

Intercorporate Relationships

The following organization diagram presents the name and the jurisdiction of incorporation of certain of AltaGas' subsidiaries as at the date of this Annual Information Form. The diagram does not include all of the subsidiaries of AltaGas. The assets and revenues of those subsidiaries omitted from the diagram individually did not exceed 10 percent, and in the aggregate did not exceed 20 percent, of the total consolidated assets or total consolidated revenues of AltaGas as at and for the year ended December 31, 2020.

(1) Updated as of the date of this Annual Information Form.

(2) Unless otherwise stated, ownership is 100%.

AltaGas Ltd. – 2020 Annual Information Form – 12

OVERVIEW OF THE BUSINESS

AltaGas, a Canadian corporation, is a leading North American energy infrastructure company that connects natural gas liquids (NGLs) and natural gas to domestic and global markets. The Corporation’s long-term strategy is to grow in attractive areas across its Utilities and Midstream business segments seeking optimal capital deployment. In the Midstream business, the Corporation is focused on optimizing the full value chain of energy exports by providing producers with solutions, including global market access off the West Coast of North America via the Corporation’s footprint in the Montney region. In the Utilities business, the Corporation seeks to grow through rate base investment and the use of accelerated rate recovery programs, while providing effective and cost-efficient service for customers.

In 2020, AltaGas revised its reportable segments to align with the structure of its business following asset sales completed as part of its 2019 asset monetization program. As a result of these changes, AltaGas has refocused on its core Utilities and Midstream segments. Consistent with Management’s strategic view of the business and the basis on which it assesses performance and allocates resources, beginning in 2020, AltaGas has two operating segments: Utilities (which now includes the WGL retail marketing business) and Midstream. These operating segments have not been aggregated in the determination of AltaGas' reportable segments. All other assets are included in the Corporate/Other segment. AltaGas' operating segments include the following:

▪Utilities, which serves approximately 1.7 million customers with a rate base of approximately US$4.3 billion through ownership of regulated natural gas distribution utilities across five jurisdictions in the United States and two regulated natural gas storage utilities in the United States, delivering affordable natural gas to homes and businesses. The Utilities business also includes storage facilities and contracts for interstate natural gas transportation and storage services, as well as the affiliated retail energy marketing business, which serves approximately 0.5 million customers; and

▪Midstream, which includes a 70 percent interest in RIPET and an approximate 74 percent interest in the Ferndale terminal, allowing AltaGas to leverage its assets along the energy value chain in Western Canada and the Western United States including natural gas gathering and processing, NGL extraction and fractionation, and natural gas and NGL marketing. The Midstream segment also includes transmission, storage, and an interest in a regulated pipeline in the Marcellus/Utica gas formation in the northeastern United States. Upon close of the acquisition of Petrogas, the Midstream business also includes a 74 percent interest in Petrogas' other operations, which include LPG exports and distribution, domestic terminals, wellsite fluids and fuels, and trucking and liquids handling.

The Corporate/Other segment consists of AltaGas' corporate activities and a small portfolio of remaining power assets, certain of which are pending sale.

AltaGas Ltd. – 2020 Annual Information Form – 13

ALTAGAS’ GEOGRAPHIC FOOTPRINT

AltaGas Ltd. – 2020 Annual Information Form – 14

OUTLOOK

In 2021, AltaGas plans to focus on progressing its long-term strategy of building a diversified Utilities and Midstream business designed to provide resilient and durable value for its stakeholders that compounds over the long-term. Specific 2021 strategic priorities include to:

▪Continue to deliver affordable natural gas and LPGs to domestic and global markets in a safe, reliable, and efficient manner;

▪Advance AltaGas' operational excellence model to improve business processes and aggressively manage costs to improve the customer experience and returns;

▪Build a world class Midstream and energy export business by maximizing the utilization of existing assets and integrating and optimizing the Petrogas business to advance AltaGas' distinctive energy export strategy; and

▪Maintain a disciplined approach to capital allocation within a self-funding model that continues to de-lever the balance sheet and increase financial flexibility over time, with incremental de-leveraging opportunities being possible from potential non-core asset sales.

GENERAL DEVELOPMENT OF ALTAGAS' BUSINESS

Below is a summary by business segment of certain acquisitions and dispositions, key development and construction projects, and other commercial arrangements not already discussed above, which have influenced the general development of the business segments of the Corporation over the last three completed financial years.

AltaGas Ltd. – 2020 Annual Information Form – 15

Development of the Utilities Business of AltaGas

On July 6, 2018, the WGL Acquisition closed and the operations of Washington Gas and Hampshire Gas, as well as the retail energy marketing business of WGL Energy Services, were added to AltaGas’ Utilities business.

With the close of the ACI IPO on October 25, 2018, the Canadian rate-regulated utility assets including PNG, AUI, and Heritage Gas ceased to be subsidiaries of AltaGas.

On July 31, 2018, Washington Gas filed an application with the SCC of VA to increase its base rates for natural gas service. A Final Order was received in December 2019. On January 9, 2020, Washington Gas filed a petition for reconsideration regarding one of the findings in the Final Order. On January 30, 2020, the SCC of VA denied this request and the rate case is now final. See "Business of the Corporation - Utilities Business - Washington Gas - Material Regulatory Developments and Approvals".

On October 15, 2019, the PSC of MD issued a Final Order approving Washington Gas' settlement agreement in their recent rate case, reflecting a US$27 million base rate increase effective October 15, 2019. See "Business of the Corporation - Utilities Business - Washington Gas - Material Regulatory Developments and Approvals".

On December 6, 2019, the MPSC issued a Final Order approving SEMCO Gas' settlement agreement in its recent rate case, reflecting a base rate increase of approximately US$20 million effective January 1, 2020. See "Business of the Corporation - Utilities Business - SEMCO Gas - Material Regulatory Developments and Approvals".

On January 13, 2020, Washington Gas filed an application with the PSC of DC for an increase in rates. See "Business of the Corporation - Utilities Business - Washington Gas - Material Regulatory Developments and Approvals".

On March 16, 2020, the Council of the District of Columbia passed legislation prohibiting the disconnection of electric and gas services for non-payment of fees during a public health emergency. See "Business of the Corporation - Utilities Business - Washington Gas - Material Regulatory Developments and Approvals".

On March 16, 2020, the Governor of Maryland issued an Executive Order which ordered regulated utilities to cease disconnections and billing of late fees for residential customers. See "Business of the Corporation - Utilities Business - Washington Gas - Material Regulatory Developments and Approvals".

On March 16, 2020, the SCC of VA issued an order which prohibited disconnections of electricity, gas, water, and sewer utility services during the coronavirus public health emergency. See "Business of the Corporation - Utilities Business - Washington Gas - Material Regulatory Developments and Approvals".

On March 31, 2020, the Public Sector Pension Investment Board and the Alberta Teachers' Retirement Fund Board acquired all the issued and outstanding common shares of ACI for $33.50 per share. AltaGas owned 11,025,000 (approximately 37 percent) of ACI's common shares and received cash proceeds of approximately $369 million upon close.

On April 10, 2020, the Governor of Alaska signed Senate Bill 241, which allows certificated utilities to record a regulatory asset for extraordinary costs and uncollectible residential utility bills that result from the COVID-19 public health disaster emergency declared by the governor on March 11, 2020. See "Business of the Corporation - Utilities Business - ENSTAR - Material Regulatory Developments and Approvals".

On April 15, 2020, the MPSC issued an order for all utilities which allows for regulatory asset accounting to capture bad debts in excess of what is in approved rates. See "Business of the Corporation - Utilities Business - SEMCO Gas - Material Regulatory Developments and Approvals".

AltaGas Ltd. – 2020 Annual Information Form – 16

On August 28, 2020, Washington Gas filed an application with the PSC of MD for an increase in rates. See "Business of the Corporation - Utilities Business - Washington Gas - Material Regulatory Developments and Approvals".

Development of the Midstream Business of AltaGas

On April 3, 2018, AltaGas entered into a long-term natural gas processing arrangement with Birchcliff at AltaGas’ deep-cut sour gas processing facility located in Gordondale, Alberta.

As a result of the closing of the WGL Acquisition on July 6, 2018, an interest in four pipelines in the U.S. (two of which have since been sold and one project for which the partners have elected not to proceed) were added to AltaGas’ Midstream business.

On August 27, 2018, AltaGas entered into definitive agreements with Kelt to provide Kelt with firm processing of 75 MMcf/d of raw gas under an initial 10 year take-or-pay agreement at the Townsend complex. In the third quarter of 2020, ConocoPhillips acquired oil and gas assets in the Inga/Fireweed/Stoddard division in the Montney area from Kelt. All operating agreements of AltaGas remain in effect.

On September 10, 2018, AltaGas entered into definitive agreements for the sale of non-core Midstream and power assets in Canada. The sale was completed in February 2019.

In October 2018, AltaGas acquired 50 percent ownership in certain existing and future natural gas processing plants of Black Swan. AltaGas and Black Swan also entered into long-term processing, transportation, and marketing agreements that include new AltaGas liquids handling infrastructure.

On May 23, 2019, the first shipment of propane to Asia departed from RIPET, the first propane marine export facility in Canada. On August 21, 2020, the Canada Energy Regulator increased AltaGas a 25-year license to export an additional 46,000 Bbls/d of propane. By December 2020, RIPET's physical volumes were approximately 54,000 Bbls/d. For further details on this project see below under the heading "Business of the Corporation – Midstream Business – Global Exports".

On May 31, 2019, AltaGas completed the disposition of WGL Midstream's entire interest in the Stonewall System to a wholly-owned subsidiary of DTE Energy for total gross proceeds of approximately $379 million (US$280 million).

On September 30, 2019, AltaGas announced that it had entered into a definitive agreement for the sale of its indirect, non-operating interest in Central Penn held by its subsidiary WGL Midstream, Inc. to Meade Pipeline Investment, LLC, a subsidiary of NextEra Energy Partners, LP. Total cash proceeds for WGL Midstream's interest were approximately $812 million (US$611 million) and the transaction closed on November 13, 2019.

On January 2, 2020, AltaGas announced that AIJVLP had received the Put Notice from SAM pursuant to which SAM exercised the Put Option with respect to SAM's approximate one-third interest in Petrogas effective December 31, 2019. On October 16, 2020, AltaGas announced that AIJVLP and SAM had entered into a definitive agreement whereby AltaGas would acquire SAM's 37 percent of Petrogas' equity for total consideration of $715 million. On December 15, 2020, AltaGas completed the acquisition, increasing its indirectly held ownership interest in Petrogas to approximately 74 percent with Idemitsu owning the remaining interest of approximately 26 percent.

On February 14, 2020, AltaGas executed a 15-year Asset Management Agreement, effective April 1, 2020, with Consolidated Edison, giving it the rights to AltaGas' 50,000 Dth per day of transportation capacity on the Transco Pipeline System in the U.S., providing additional stability to the Midstream business.

In February 2020, following evaluations of the diminished underlying economics for the proposed Constitution pipeline project, the partners of Constitution elected not to proceed with the project. AltaGas held a 10 percent equity interest in Constitution.

AltaGas Ltd. – 2020 Annual Information Form – 17

In the first half of 2020, the Company expanded its integrated northeast B.C. strategy with the completion of the North Pine and Townsend 2B expansions. The 10,000 Bbls/d North Pine expansion was completed and placed into service in the first quarter with additional capacity for the rail terminal to handle the additional volume. The Townsend 2B expansion was commissioned in the second quarter and began flowing gas in early May. In March 2020, Townsend Complex licensed capacity was increased to 550 Mmcf/d.

Development of the Corporate/Other Segment of AltaGas

On June 13, 2018, AltaGas announced that it had entered into a definitive agreement to indirectly sell 35 percent of its interest in the Northwest Hydro facilities for gross proceeds of $922 million. The transaction closed on June 22, 2018.

On July 6, 2018, as part of the WGL Acquisition, the business of WGL Energy Systems was added to AltaGas’ Corporate/Other segment.

On September 10, 2018, AltaGas entered into definitive agreements for the sale of non-core Midstream and Power assets in Canada. The sale was completed in February 2019.

On October 19, 2018, the Bear Mountain wind facility in British Columbia was sold to ACI. In addition, a 10 percent minority interest in the Northwest Hydro facilities was sold to ACI.

On November 13, 2018, the Tracy, Hanford, and Henrietta gas-fired facilities in California were sold to Middle River Power for a gross purchase price of US$299 million.

On December 11, 2018, the Busch Ranch wind asset in the United States was sold for a purchase price of approximately US$16 million.

On January 31, 2019, AltaGas completed the sale of its remaining interest of approximately 55 percent in the Northwest Hydro facilities for net cash proceeds of approximately $1.3 billion, resulting in a pre-tax gain of $688 million. AltaGas remained operator of the facilities until the expiration of an operating and maintenance agreement on January 31, 2021.

On August 13, 2019, AltaGas completed the sale of its equity ownership interests in Craven County Wood Energy LP and Grayling Generation Station LP for net proceeds of approximately $25 million (US$19 million).

On September 26, 2019, AltaGas closed the sale of its portfolio of U.S. distributed generation assets held by its subsidiaries WGL Energy Systems, Inc. and WGSW, Inc., to TerraForm Power, Inc., an affiliate of Brookfield Asset Management. Total cash proceeds received were approximately $975 million (US$735 million) and a pre-tax gain on disposition of $168 million was recorded in 2019. There is one remaining project for which legal title has not yet transferred as various consents and approvals remain outstanding. Accordingly, assets of approximately $4 million and liabilities of $1 million remain held for sale at December 31, 2020.

In October 2019, AltaGas announced the successful recontracting of the Blythe facility to SCE. Under the tolling agreement, SCE has exclusive rights to all capacity, energy, ancillary services, and resource adequacy benefits from August 1, 2020 to December 31, 2023. California Public Utilities Commission approval was received on January 16, 2020.

In the third quarter of 2020, AltaGas closed the dispositions of AltaGas Pomona Energy Storage Inc. and land related to a gas fired power generation facility in the U.S., as well as AltaGas Ripon Energy Inc. Aggregate gross proceeds for these dispositions, before working capital and other adjustments, were approximately $67 million, resulting in a pre-tax gain of $8 million.

AltaGas Ltd. – 2020 Annual Information Form – 18

BUSINESS OF THE CORPORATION

AltaGas’ revenue for the year ended December 31, 2020 was approximately $5.6 billion compared to $5.5 billion for the year ended December 31, 2019.

Note: Excluding Corporate/Other segment and intersegment eliminations

In 2020, AltaGas revised its reportable segments to align with the structure of its business following asset sales completed as part of its 2019 asset monetization program. As a result of these changes, AltaGas has refocused on its core Utilities and Midstream segments, each of which is more particularly described in the respective sections that follow. AltaGas’ business also includes the Corporate/Other segment, which consists primarily of a small portfolio of remaining power assets, certain risk management contract results, and revenues and expenses not directly identifiable with the operating businesses.

UTILITIES BUSINESS

The Utilities business contributed revenue of $3.8 billion for the year ended December 31, 2020 (2019 - $4.0 billion), representing approximately 70 percent (2019 – 76 percent) of AltaGas’ total revenue before Corporate/Other segment and intersegment eliminations.

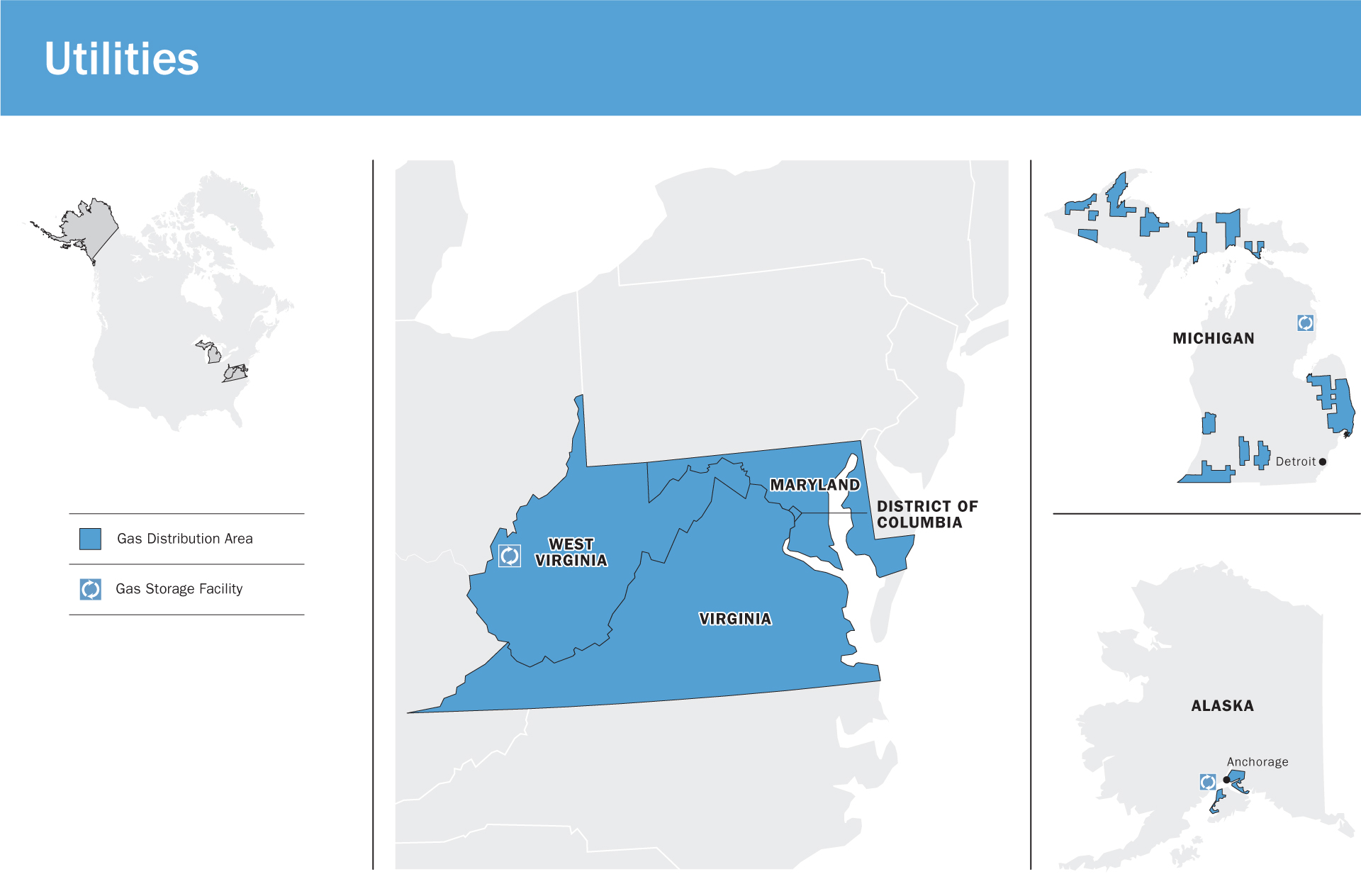

Utilities Business

The Utilities segment owns utility assets that deliver natural gas to end-users in the United States, as well as operates a retail energy marketing business. The Utilities business is comprised of Washington Gas (in the District of Columbia, Maryland, and Virginia); Hampshire Gas, a regulated natural gas storage utility in West Virginia; SEMCO Gas in Michigan; ENSTAR in Alaska; a 65 percent interest in CINGSA, a regulated natural gas storage utility in Alaska; and WGL Energy Services, which sells natural gas and electricity to retail customers on an unregulated basis.

Regulatory Process

The Utilities business predominantly operates in regulated marketplaces where, as franchise or certificate holders, regulated utilities are allowed by the regulator to charge regulated rates that provide the utilities the opportunity to recover costs and earn a return on capital. The return on capital is to reflect a fair rate of return on approved utility investments (i.e. rate base) based on a regulatory deemed or targeted capital structure. The ability of a regulated utility to recover

AltaGas Ltd. – 2020 Annual Information Form – 19

prudently incurred costs of providing service and earn the regulator-approved rate of return on equity depends on the utility achieving the cost levels established in the rate-setting processes.

SEMCO Gas and Washington Gas have accelerated pipe and infrastructure replacement programs in place in Michigan and in the District of Columbia, Maryland, and Virginia, respectively. These are long-term programs subject to both changing conditions and regulatory review and approval in multi-year increments. These programs enable SEMCO Gas and Washington Gas to accelerate pipe and infrastructure replacement to further enhance the safety and reliability of the natural gas delivery system. SEMCO Gas and Washington Gas are allowed to begin recovering the cost, including a return, for these investments immediately through approved surcharges for each accelerated pipe or infrastructure replacement program outside of a normal rate case process, mitigating regulatory lag. Once new base rates are put into effect in a given jurisdiction following approval of an application to increase rates, expenditures previously being recovered through the surcharge will be collected through the new base rates.

The Utilities business is subject to regulation over, among other things, rates, accounting procedures, and standards of service. The MPSC has jurisdiction over the regulatory matters related, directly or indirectly, to the services that SEMCO Gas provides to its Michigan customers. The RCA has jurisdiction over the regulatory matters related, directly or indirectly, to ENSTAR’s and CINGSA’s services provided to its Alaska customers. Washington Gas is regulated by the PSC of DC, the PSC of MD, and the SCC of VA, which approve its terms of service and the billing rates that it charges to its customers, regulate interactions with affiliates, and regulate retail competition for natural gas supply service. In all jurisdictions, the regulators approve distribution rates based on a cost-of-service regulatory model. In Alaska, the District of Columbia, and Maryland, rates are set using the results from a historical test year plus known and measurable changes. In Michigan and Virginia, rates are set using a projected test year. In all jurisdictions, the rates charged to utility customers are designed to provide the distribution utility with an opportunity to recover all prudently incurred operating, depreciation, income tax, and financing costs. In most jurisdictions, the rates are also designed to earn a reasonable return on its investment in the net assets used in its firm gas sales and delivery service.

Utilities Business Key Utility Metrics

The following table summarizes the average rate base for the Utilities business for the years ended December 31, 2020 and 2019:

| | | | | | | | |

(US$ millions) | 2020 | 2019 |

| | |

| | |

Rate base (1) (2) | 4,291 | | 3,865 | |

(1)Rate base is indicative of the earning potential of each utility over time. Approved revenue requirement for each utility is typically based on the rate base as approved by the regulator for the respective rate application, but may differ from the rate base indicated above.

(2)Includes SEMCO Energy’s 65 percent interest in CINGSA.

The following table summarizes the capital expenditures for the years ended December 31, 2020 and 2019:

| | | | | | | | |

(US$ millions) | 2020 | 2019 |

New business | 109 | 252 |

System betterment and gas supply | 191 | 165 |

General plant | 29 | 30 |

Accelerated Replacement Programs | 227 | 200 |

Total | 556 | 647 |

AltaGas Ltd. – 2020 Annual Information Form – 20

The following table summarizes the nature of regulation applicable to each utility:

| | | | | | | | | | | | | | | | | | | | |

Regulated Utility | Regulated Authority | % of AltaGas' Consolidated Rate Base as at December 31, 2020 | Allowed Common Equity (%) | Allowed ROE (%) 2019 | Allowed ROE (%) 2020 | Significant Features/

Material Regulatory Developments |

Washington Gas | PSC of MD SCC of VA PSC of DC | 75% | 53.5 - 55.7 | 9.2 - 9.7 | 9.2 - 9.7 | n Distribution rates approved under cost of service model. n Rate case filed in 2018 with the SCC of VA for an increase in rates. The Final Order was received in December 2019. In January 2020, a petition for reconsideration was filed and denied, and the rate case is now final. n Rate case filed in January 2020 with the PSC of DC for an increase in rates. Settlement agreement filed December 2020, pending PSC of DC approval. n Rate case filed in August 2020 with the PSC of MD for an increase in rates. Evidentiary hearing took place January 2021. Commission decision expected around late Q1 2021. |

SEMCO Gas | MPSC | 17% | 45.86 | 10.35 | 9.87 | n Distribution rates approved under cost of service model. n Use of projected test year for rate cases with 10-month limit to issue a rate order. n Rate rider provides recovery relating to the Main Replacement Program which allows SEMCO Gas to accelerate the replacement of older portions of its system. New Infrastructure Reliability Improvement Program (IRIP) was approved in the 2019 rate case for the years 2020 - 2025. Customers will be billed a surcharge beginning in 2021 for the IRIP.

|

ENSTAR | RCA | 6% | 51.81 | 11.875 | 11.875 | n Distribution rates approved under cost of service model using historical test year and allows for known and measurable changes. n In December 2020, RCA approved ENSTAR motion to extend the filing of the next rate case to June 2022 based on 2021 historical test year. |

CINGSA | RCA | 2% | 53.04 | 10.25 | 10.25 | n Distribution rates approved under cost of service model using historical test year and allows for known and measurable changes. n Rate case filed in 2018 based on 2017 historical test year. n Rate case hearing April 2019 with a decision received in August 2019. The decision included an ROE of 10.25% (compared to 11.875% requested) and 100% of Interruptible Storage Service revenues payable to customers (versus 50% requested). CINGSA filed a petition for partial reconsideration on September 3, 2019. The Commission denied the petition and on November 4, 2019 CINGSA filed an appeal with the Superior Court challenging one decision from the order. This matter is currently ongoing. |

Hampshire Gas | FERC | n/a | n/a | n/a | n/a | n Pass through cost of service tariff approved by FERC. |

AltaGas Ltd. – 2020 Annual Information Form – 21

Washington Gas

Washington Gas has been engaged in the natural gas distribution business since 1848 and provides regulated gas distribution services to end users in District of Columbia, Maryland, and Virginia. The utility has approximately 1.2 million customers across these three jurisdictions: District of Columbia (~165,000; 14 percent), Maryland (~500,000; 41 percent), and Virginia (~540,000; 45 percent). Washington Gas operations are such that the loss of any one customer or group of customers would not have a significant adverse effect on its business.

The average number of customers at Washington Gas has increased by approximately 1 percent annually during the past two years (with an increase of 1 percent in 2020).

Operations

Washington Gas obtains natural gas supplies that originate from multiple regions throughout the U.S. At December 31, 2020, it had service agreements with five pipeline companies that provided firm transportation and storage services, with contract expiration dates ranging from 2021 to 2039. Washington Gas has also contracted with various interstate pipeline and storage companies to add to its storage and transportation capacity.

The following table sets out, by customer category, Washington Gas’ deliveries:

| | | | | | | | |

| 2020 | 2019 |

Deliveries: (MDth) | | |

Residential | 62,672 | 69,660 |

Commercial | 18,845 | 21,997 |

Transport | 79,424 | 85,658 |

Total deliveries | 160,941 | 177,315 |

| | |

| 2020 | 2019 |

Customers at Year End: | | |

Residential | 978,635 | 973,549 |

Commercial | 48,464 | 47,677 |

Transport | 178,430 | 171,236 |

Total customers | 1,205,529 | 1,192,462 |

Seasonality

The natural gas distribution business in the District of Columbia, Maryland, and Virginia is seasonal, as the majority of natural gas demand occurs during the winter heating season that extends from November to March. Accordingly, annualized individual quarterly revenues and earnings are not indicative of annual results.

Forecasted volumes in the District of Columbia are set based on the 30-year rolling average Degree Days expected for the period. In Maryland and Virginia, there are billing mechanisms in place which are designed to eliminate the effects of variance in customer usage caused by weather and other factors such as conservation. In the District of Columbia, there is no weather normalization billing mechanism, nor does Washington Gas hedge to offset the effects of weather. As a result, colder or warmer weather will result in variances to financial results. See "Business of the Corporation - Utilities Business - Washington Gas - Material Regulatory Developments and Approvals - District of Columbia Jurisdiction".

AltaGas Ltd. – 2020 Annual Information Form – 22

Material Regulatory Developments and Approvals

District of Columbia Jurisdiction

Washington Gas has an Accelerated Pipe Replacement Plan (PROJECTpipes) for the replacement of higher-risk pipe associated with an aging infrastructure in its distribution system in the District of Columbia. The first phase of this plan expired in September 2019. In 2018, Washington Gas filed a request with the PSC of DC for the approval of the second phase of this plan (PROJECTpipes 2). Given the length of the proceeding, the PSC of DC approved additional extensions of the plan for the period from October 2019 to December 2020. On December 11, 2020, the PSC of DC approved a 3-year, US$150 million plan covering the period from January 1, 2021 to December 31, 2023.

On January 13, 2020, Washington Gas filed an application with the PSC of DC to increase its base rates by approximately US$35 million, including approximately US$9 million pertaining to a PROJECTpipes surcharge that customers are currently paying in the form of a rate rider. The filing requested a return on equity of 10.4 percent on allowed common equity of 52.2 percent, which is based on a US$532 million rate base value. Additionally, Washington Gas requested approval for a Revenue Normalization Adjustment mechanism to reduce customer bill fluctuations due to weather-related and conservation-related usage variations, similar to existing mechanisms in both Maryland and Virginia. On December 8, 2020, Washington Gas filed, for PSC of DC approval, a settlement agreement to resolve all issues in the case. The settling parties agreed to a US$20 million increase in base rates including PROJECTpipes surcharges previously collected as a rider and return on equity of 9.25 percent. The settling parties agree that this settlement is limited to resolving PROJECTpipes costs that are completed and in service, as of the date of Washington Gas' filed rebuttal testimony (i.e., September 14, 2020). Washington Gas' rebuttal testimony included an amount of up to approximately US$100 million of PROJECTpipes plant in service being transferred to base rates. This settlement does not set any precedent with respect to any future requests for PROJECTpipes cost recovery. Washington Gas agrees it will not file for a distribution rate increase or request any new rate or tariff mechanisms that have a related customer rate increase in the District of Columbia before August 31, 2021. On February 24, 2021, the PSC of DC approved the US$20 million base rate case recommended in the settlement agreement. The new rates will become effective on April 1, 2021.

On March 16, 2020, the Council of the District of Columbia (DC Council) passed legislation prohibiting the disconnection of electric and gas services for non-payment of fees during a public health emergency. The Mayor of the District of Columbia's public health emergency declaration and all related orders have been further extended to March 31, 2021, and the prohibition on disconnection is effective for 15 days following the end of the public health emergency. On April 15, 2020, the PSC of DC issued an order authorizing Washington Gas to establish a regulatory asset to capture and track the incremental costs related to COVID-19 that were prudently incurred beginning March 11, 2020.

Maryland Jurisdiction

On April 22, 2019, Washington Gas filed an application with the PSC of MD to increase its base rates for natural gas service, requesting a US$36 million increase in base rates, including US$5 million related to costs being collected through monthly STRIDE surcharges for system upgrades, and to increase its return on equity from 9.7 to 10.4 percent. On August 30, 2019, Washington Gas, the Staff of the PSC of MD, the Maryland Office of People’s Counsel, and the Apartment & Office Building Association of Metropolitan Washington submitted a Stipulation and Settlement designed to generate an additional US$27 million in base rates. The Stipulation stated an overall rate of return of 7.42 percent, established a return on equity of 9.70 percent, and stated a common equity ratio of 53.5 percent. On October 15, 2019, the PSC of MD issued Final Order No. 89303 which accepted the Stipulation and Settlement without change. Pursuant to Order No. 89303, Washington Gas’ revised base rates went into effect for service rendered beginning October 15, 2019.

Following the National Transportation and Safety Board (NTSB) hearing that examined the August 10, 2016, explosion and fire at an apartment complex in Silver Spring, Maryland, on September 5, 2019, the PSC of MD ordered Washington Gas to (i) provide a detailed response to the NTSB’s probable cause findings and (ii) provide evidence regarding the status of a 2003 mercury regulator replacement program and, if the program was not completed, to show cause why the

AltaGas Ltd. – 2020 Annual Information Form – 23

PSC of MD should not impose a civil penalty on Washington Gas (Show-Cause Order). Following several hearings throughout the course of 2019 and 2020, on December 18, 2020, the PSC of MD found that Washington Gas failed to file annual reports informing the PSC of MD of the status of Washington Gas' program and imposed a US$750,000 penalty on Washington Gas for reporting violations. The PSC of MD ruled that the NTSB probable cause finding constituted hearsay and could not be admitted into the record of the case and did not undertake its own inquiry into the source of the explosion. The PSC of MD did not make any safety-related findings in the case but did find that Washington Gas made an enforceable regulatory commitment to replace all mercury regulators. The US$750,000 penalty was paid in January 2021 and Washington Gas believes that there is no additional liability as a result of the ruling from the PSC of MD. In its December 18, 2020 order, the PSC of MD also found that Washington Gas’s proposed implementation plan to replace all remaining mercury regulators within five years of completing an mercury regulator survey adequately addresses the need to replace all remaining mercury regulators in Maryland, and is in the public interest. The costs of the proposed implementation program are not yet known, and the recovery of these costs must be deferred until a future rate case.

On March 16, 2020, the Governor of Maryland issued an Executive Order which ordered regulated utilities to cease disconnections and billing of late fees for residential customers through May 1, 2020, which was subsequently amended to extend the order through August 31, 2020. On September 22, 2020, the PSC of MD took action that had the effect of extending the moratorium on service disconnections through November 15, 2020. Due to the winter moratorium on disconnections (November 1 to March 31), this has the effect of delaying residential terminations until April 1, 2021. On April 9, 2020, the PSC of MD issued an order and authorized each utility company to establish a regulatory asset to record the effects of incremental collection and other costs related to COVID-19 prudently incurred beginning on March 16, 2020. On August 27 and 28, 2020, the PSC of MD held Public Conference (PC) 53 to review the impacts of the Executive Order on utilities and the services they provide. On August 31, 2020, the PSC of MD issued an order directing that: (1) Utilities may not engage in service terminations and/or charge late fees until October 1, 2020 and any notices of termination for residential accounts sent before October 1, 2020 are invalid; (2) a Public Service Company must give notice of at least 45 days before terminating service on a residential account; (3) structured payment plans offered by Public Service Companies to residential customers in arrears or unable to pay must allow a minimum of 12 months to repay, with that period extending to 24 months for customers certified as low income; (4) Public Service Companies are prohibited from collecting or requiring down payments or deposits as a condition of beginning a payment plan by any residential customer; and (5) Public Service Companies are prohibited from refusing to negotiate or denying a payment plan to a residential customer receiving service because the customer failed to meet the terms and conditions of an alternate payment plan during the past 18 months. As requested by the PSC of MD, investor-owned utilities in Maryland filed a joint proposed Arrearage Management Program (AMP) plan on October 7, 2020, which was followed by a legislative style hearing in November 2020. On December 21, 2020, the PSC of MD rejected the proposed AMP plan. It will continue to monitor the customer arrearage data provided by utilities, and may revisit this issue in the future.

On August 28, 2020, Washington Gas filed an application with the PSC of MD to increase its base rates by approximately US$28 million, including approximately US$6 million currently collected through the Strategic Infrastructure Development Enhancement Plan (STRIDE) surcharges for system upgrades. The proposed rates reflect a 10.45 percent return on equity and a 7.73 percent return on an average rate base. On December 8, 2020, Washington Gas filed rebuttal testimony with a revised revenue requirement of approximately US$27 million. On February 12, 2021, the PULJ issued a Proposed Order in the Case and an ERRATA filing correcting of the Proposed Order on February 19, 2021. The Proposed Order, as corrected, authorizes Washington Gas increase its Maryland natural gas distribution rates by approximately US$13 million (including US$5 million for the STRIDE surcharge), reflecting a return of equity of 9.70 percent. Appeals are due February 26, 2021 with an order following. Washington Gas expects new rates to be implemented in late March of 2021.

Virginia Jurisdiction

On July 31, 2018, Washington Gas filed an application with the SCC of VA to increase its base rates for natural gas service by US$38 million, which included US$15 million related to the SAVE surcharge. Additionally, the requested revenue increase incorporated the effects of the TCJA. Interim rates became effective, subject to refund, for usage in the January 2019 billing cycle. On April 12, 2019, Washington Gas filed rebuttal testimony and revised its original return on

AltaGas Ltd. – 2020 Annual Information Form – 24

equity down from 10.6 percent to 10.3 percent and its overall rate of return down from 7.94 percent to 7.81 percent. On September 16, 2019, the HE issued a report with recommendations to the SCC of VA including no incremental rate increase aside from bringing the SAVE rider to the base rate. On October 21, 2019, Washington Gas filed comments on and exceptions to the HE's report, recommending the SCC of VA reject certain of the HE's findings. On December 20, 2019, the Commission issued a Final Order adjusting certain of the HE’s findings, some of which are favorable to Washington Gas. The Final Order approved: (i) an increase in base rates of US$13 million to reflect the transfer of US$102 million of SAVE investment from the SAVE rider to rate base; (ii) an ROE range of 8.7 percent to 9.7 percent with a mid-point of 9.2 percent; (iii) the amortization of unprotected excess deferred income tax over eight years; and (iv) the refund of a US$26 million TCJA liability over a 12-month period as a sur-credit. On January 9, 2020, Washington Gas filed a petition for rehearing regarding one of the findings. On January 30, 2020, the SCC of VA denied this request and the rate case is now final.

On March 16, 2020, the State Corporation Commission of Virginia (SCC of VA) issued an order which prohibited disconnections of electricity, gas, water, and sewer utility services during the coronavirus public health emergency, and established certain consumer protection measures. While the SCC of VA order was extended, the disconnection order, but not the consumer protections expired on October 5, 2020. However, following the expiration of the disconnection order, on October 16, 2020, the Virginia General assembly approved legislation that would extend the disconnection prohibition for residential customers for nonpayment of bills or fees until the Governor determines the prohibition does not need to remain in place or until at least 60 days after the state of emergency declared on March 12, 2020 ends, whichever is sooner. The legislation also codified the consumer protection plans, requiring utilities to offer customers in arrears fee-free repayment plans without deposit or eligibility requirements. The legislation became effective in November 2020. On April 29, 2020, the SCC of VA issued an order approving a request from Washington Gas and other Virginia utilities to create a regulatory asset to record incremental prudently incurred costs and suspended late payment fees attributable to the COVID-19 pandemic. The October 16, 2020 legislation approved by the general assembly established certain reporting requirements for utilities to report bad debt information and provides utilities with certain exemptions from such requirements based on a utilities' particular facts and circumstances. On December 8, 2020, Washington Gas was awarded $US7.7 million under the Virginia CARES Relief Funding Award, to use for customer arrearages. Virginia customers need to meet the criteria established by the program to get the funds. Any unused funds will be returned to the SCC of VA by December 10, 2021.

In connection with the WGL Acquisition, AltaGas and WGL have made commitments related to the terms of the PSC of DC settlement agreement and the conditions of approval from the PSC of MD and the SCC of VA. Among other things, these commitments include rate credits distributable to both residential and non-residential customers, gas expansion and other programs, various public interest commitments, and safety programs. As at December 31, 2020, approximately US$12 million of these merger commitments have been expensed but not paid. In addition, there are certain additional regulatory commitments which were and will be expensed as the costs are incurred, including the hiring of damage prevention trainers, investing up to US$70 million over a 10-year period to further extend natural gas service, and US$8 million for leak mitigation, which has been paid as of December 31, 2020.

Hampshire Gas

Hampshire owns underground natural gas storage facilities, including pipeline delivery facilities located in and around Hampshire County, West Virginia, and operates these facilities to serve Washington Gas. Hampshire is regulated by the FERC. Washington Gas purchases all of the storage services of Hampshire, and includes the cost of the services in the commodity cost of its regulated energy bills to customers. Hampshire operates under a “pass-through” cost-of-service based tariff approved by FERC.

SEMCO Energy

SEMCO Energy’s head office is located in Port Huron, Michigan. SEMCO Energy’s primary business is a gas utility business. It operates regulated natural gas transmission and distribution divisions in Michigan, doing business as SEMCO Gas, and in Alaska, doing business as ENSTAR. SEMCO Energy’s gas utility business also includes a 65 percent

AltaGas Ltd. – 2020 Annual Information Form – 25

ownership interest in CINGSA, a regulated natural gas storage utility in Alaska. The gas utility business accounts for approximately 99 percent of SEMCO Energy’s 2020 consolidated revenues. The gas utility business purchases, transports, distributes, stores and sells natural gas and related gas distribution services to residential and C&I customers and is SEMCO Energy's largest business segment.

SEMCO Gas

In Michigan, SEMCO Gas distributes natural gas to approximately 313,000 regulated customers located in both southern Michigan and Michigan’s Upper Peninsula, approximately 92 percent of which are residential. The remaining customers include power plants, food production facilities, furniture manufacturers, and other industrial customers.

The average number of customers at SEMCO Gas has increased by an average of approximately 1 percent annually during the past three years (with an increase of 1 percent in 2020). While there may occasionally be variations in this pattern, average per customer annual gas consumption in Michigan over the longer-term has been decreasing because of, among other things, the availability of and incentive to invest in more energy efficient homes and appliances.

SEMCO Gas pursues opportunities to develop service areas that are not currently served with natural gas. Expansion opportunities that currently exist represent relatively minor asset growth, but SEMCO Gas remains committed to its strategy of pursuing expansion projects that meet management’s target return on investment.

Operations

The SEMCO Gas natural gas transmission and delivery system in Michigan includes approximately 151 miles of gas transmission pipelines and 6,175 miles of gas distribution mains. The pipelines and mains are located throughout the southern half of Michigan’s Lower Peninsula (including in and around the cities of Albion, Battle Creek, Holland, Niles, Port Huron, and Three Rivers) and also in the central, eastern, and western areas of Michigan’s Upper Peninsula.

SEMCO Gas has access to natural gas supplies throughout the U.S. and Canada via interstate and intrastate pipelines in and near Michigan. To provide gas to SEMCO Gas sales customers, SEMCO Gas has negotiated standard terms and conditions for the purchase of natural gas under the NAESB form of agreement with a variety of suppliers.

The following table sets out, by customer category, SEMCO Gas’ deliveries:

| | | | | | | | |

| 2020 | 2019 |

Deliveries: (MDth) | | |

Residential | 24,973 | 26,841 |

Commercial | 14,072 | 15,976 |

Transport | 21,422 | 22,712 |

Gas Customer Choice (1) | 3,219 | 3,719 |

Total deliveries | 63,686 | 69,248 |

| | |

| 2020 | 2019 |

Customers at Year End (2): | | |

Residential | 265,168 | 262,598 |

Commercial | 24,113 | 23,926 |

Transport | 255 | 249 |

Gas Customer Choice (1) | 22,988 | 22,758 |

Total customers | 312,524 | 309,531 |

(1)In Michigan, the MPSC has a program known as the Gas Customer Choice Program, under which gas sales customers may choose to purchase natural gas from third-party suppliers, while SEMCO Gas continues to charge these customers applicable distribution charges and customer fees, plus a balancing fee.

(2)Excludes customers from SEMCO Gas’ non-regulated business.

AltaGas Ltd. – 2020 Annual Information Form – 26

Seasonality

The natural gas distribution business in Michigan is seasonal, as the majority of natural gas demand occurs during the winter heating season that extends from November to March. Accordingly, annualized individual quarterly revenues and earnings are not indicative of annual results.

Forecasted volumes for SEMCO Gas are set based on the 15-year rolling average Degree Days expected for the period. Temperature fluctuations impact the operating results of SEMCO Gas.

Material Regulatory Developments and Approvals

As required by an order issued by the MPSC in September 2012, SEMCO Gas filed a depreciation study with the MPSC in September 2017, using 2016 data. On April 9, 2018, the MPSC issued an order approving the settlement agreement and new depreciation rates. The new rates reflect an approximately US$2 million upward adjustment to depreciation expense when compared to the current rates and were effective on January 1, 2019. SEMCO Gas is required to file a new depreciation case and updated depreciation study with the MPSC no later than September 30, 2022, using 2021 data.

On May 31, 2019, SEMCO Gas filed a request with the MPSC seeking authority to increase SEMCO Gas' base rates by approximately US$38 million on an annual basis established with a forecasted test year of 2020. The increase in rates requested captured the inflation of operations and maintenance costs from the last rate case in 2010 as well as the investment in the Marquette Connector Pipeline. With the upcoming sunset of the MRP in 2020, this case included the addition of a new MRP and the introduction of an IRIP to recover the capital costs associated with the replacement of certain mains, services, and other infrastructure through surcharges similar to the currently-enacted MRP program. In November 2019, a settlement agreement was filed for a rate increase of approximately US$20 million and an allowed return on equity of 9.87 percent. The MPSC approved the settlement in December 2019 and the new rates were effective January 1, 2020. Pursuant to the approval of the IRIP, SEMCO Gas will complete certain projects totaling US$55 million to improve the reliability of infrastructure and customers will be billed a surcharge beginning in 2021. SEMCO Gas cannot seek an increase in its general rates to take effect prior to January 1, 2023.