ALTAGAS LTD.

Annual Information Form

For the year ended December 31, 2019

Dated: February 27, 2020

TABLE OF CONTENTS

AltaGas Ltd. – 2019 Annual Information Form – 1

GENERAL INFORMATION

Unless otherwise noted, the information contained in this AIF is stated as at December 31, 2019 and all dollar amounts

in this AIF are in Canadian dollars. Financial information is presented in accordance with United States generally accepted accounting principles. For an explanation of certain terms and abbreviations used in this AIF, see the "Glossary" of this AIF.

in this AIF are in Canadian dollars. Financial information is presented in accordance with United States generally accepted accounting principles. For an explanation of certain terms and abbreviations used in this AIF, see the "Glossary" of this AIF.

FORWARD-LOOKING INFORMATION AND STATEMENTS

This AIF contains forward-looking information (forward-looking statements). Words such as "may", "can", "would", "could", "should", "will", "intend", "plan", "anticipate", "believe", "aim", "seek", "propose", "contemplate", "estimate", "focus", "strive", "forecast", "expect", "project", "target", "potential", "objective", "continue", "outlook", "vision", "opportunity", and similar expressions suggesting future events or future performance, as they relate to the Corporation or any affiliate of the Corporation, are intended to identify forward-looking statements. In particular, this AIF contains forward-looking statements with respect to, among other things, business objectives, expected growth, results of operations, performance, business projects and opportunities and financial results.

Specifically, such forward-looking statements included in this document include, but are not limited to, statements with respect to the following: the Corporation’s long-term strategy in regard to its Utilities, Midstream and Power segments; expectation that the Corporation will target opportunities to develop high-quality natural gas and NGL assets that complement its existing infrastructure; the Corporation's 2020 priorities; expectations to increase utilization and export volumes at RIPET; expected $900 million growth capital program in 2020; targeted 10 percent increase in Utilities rate base; expiration of the Northwest Hydro operating agreement in January 2021; timing of material regulatory filings, proceedings and decisions in the Utilities business; expected conditions to closing and closing date of the ACI Arrangement; expected in-service and completion dates for current projects in the Midstream business; expected effective dates of material environmental legislation; and duration of the suspension of the DRIP program. .

These statements involve known and unknown risks, uncertainties and other factors that may cause actual results, events, and achievements to differ materially from those expressed or implied by such statements. Such statements reflect AltaGas' current expectations, estimates, and projections based on certain material factors and assumptions at the time the statement was made. Material assumptions include: expected commodity supply, demand and pricing; volumes and rates; exchange rates; inflation; interest rates; credit rating; regulatory approvals and policies; future operating and capital costs; project completion dates; capacity expectations; implications of recent U.S. tax legislation changes; and the outcomes of significant commercial contract negotiation.

AltaGas’ forward-looking statements are subject to certain risks and uncertainties which could cause results or events to differ from current expectations, including, without limitation: health and safety risks; operating risks; infrastructure risks; service interruptions; regulatory risks; litigation risk; decommissioning, abandonment and reclamation costs; climate and carbon tax risks; reputation risk; weather data; Indigenous land and rights claims; crown duty to consult with Indigenous peoples; changes in laws; capital market and liquidity risks; general economic conditions; internal credit risk; foreign exchange risk; debt financing, refinancing, and debt service risk; interest rates; cyber security, information, and control systems; technical systems and processes incidents; dependence on certain partners; growth strategy risk; construction and development; RIPET rail and marine transport; impact of competition in AltaGas' Midstream and Power businesses; commitments associated with regulatory approvals for the acquisition of WGL; counterparty credit risk; composition risk; collateral; reg agreements; non-controlling interests in investments; delays in U.S. federal government budget appropriations; consumption risk; market risk; market value of common shares and other securities; variability of dividends; potential sales of additional shares; volume throughput; natural gas supply risk; risk management costs and limitations; underinsured and uninsured losses; Cook Inlet gas supply; securities class action suits and derivative suits; electricity and resource adequacy prices; cost of providing retirement plan benefits; labor relations; key personnel; failure of service providers; compliance with Section 404(a) of Sarbanes-Oxley Act; integration of WGL; and the other factors discussed under the heading "Risk Factors" in this AIF.

AltaGas Ltd. – 2019 Annual Information Form – 2

Many factors could cause AltaGas' or any particular business segment's actual results, performance, or achievements to vary from those described in this AIF, including, without limitation, those listed above and the assumptions upon which they are based proving incorrect. These factors should not be construed as exhaustive. Should one or more of these risks or uncertainties materialize, or should assumptions underlying forward-looking statements prove incorrect, actual results may vary materially from those described in this AIF as intended, planned, anticipated, believed, sought, proposed, estimated, forecasted, expected, projected, or targeted and such forward-looking statements included in this AIF should not be unduly relied upon. The impact of any one assumption, risk, uncertainty, or other factor on a particular forward-looking statement cannot be determined with certainty because they are interdependent and AltaGas’ future decisions and actions will depend on management’s assessment of all information at the relevant time. Such statements speak only as of the date of this AIF. AltaGas does not intend, and does not assume any obligation, to update these forward-looking statements except as required by law. The forward-looking statements contained in this AIF are expressly qualified by these cautionary statements.

Financial outlook information contained in this AIF about prospective results of operations, financial position, or cash flow is based on assumptions about future events, including economic conditions and proposed courses of action, based on management's assessment of the relevant information currently available. Readers are cautioned that such financial outlook information contained in this AIF should not be used for purposes other than for which it is disclosed herein.

GLOSSARY

Unless the context otherwise requires, terms used in this AIF have the following meanings and references to agreements include any amendments, restatements, modifications, or supplements in effect as of the date hereof:

"ACI" means AltaGas Canada Inc.;

"ACI IPO" means initial public offering of common shares of ACI;

"AER" means the Alberta Energy Regulator;

"AESO" means the Alberta Electric System Operator;

"AIF" means this Annual Information Form;

"AIJVLP" means AltaGas Idemitsu Joint Venture Limited Partnership;

"AltaGas", the "Company", or the "Corporation" means AltaGas Ltd., including, where the context requires, the affiliates of AltaGas Ltd.;

"ARB" means the California Air Resources Board;

"ASC" means the Alberta Securities Commission;

"AUI" means AltaGas Utilities Inc.;

"B.C." or "BC" means the province of British Columbia in Canada;

"Bbls" means stock tank barrels of ethane and other NGLs, expressed in standard 42 U.S. gallon barrels or 34.972 imperial gallon barrels;

"Bbls/d" means Bbls per day;

"Bcf" means billion cubic feet or 1,000,000 Mcf of natural gas;

AltaGas Ltd. – 2019 Annual Information Form – 3

"Bcf/d" means Bcf per day;

"Birchcliff" means Birchcliff Energy Ltd.;

"Black Swan" means Black Swan Energy Ltd.;

"Blair Creek facility" means the Blair Creek processing facility located approximately 140 km northwest of Fort St. John, British Columbia, owned by AltaGas’ indirect wholly-owned subsidiary AltaGas Northwest Processing Limited Partnership;

"Blythe" means Blythe Energy Inc.;

"Blythe Energy Center" means the 507 MW gas-fired generation facility located near Blythe, California, together with the related 67 miles transmission lines, owned by AltaGas’ indirect wholly-owned subsidiary Blythe;

"Board of Directors" means the board of directors of AltaGas, as from time to time constituted;

"Brush II" means the 70 MW gas-fired generation facility in Colorado, owned by AltaGas’ indirect wholly-owned subsidiary AltaGas Brush Energy Inc.;

"C&I" means commercial and industrial;

"CAISO" means the California Independent System Operator;

"CBCA" means the Canada Business Corporations Act, R.S.C. 1985, c. C 44, as amended from time to time, including the regulations from time to time promulgated thereunder;

"CCAA" means the Companies’ Creditors Arrangement Act, R.S.C. 1985, c. C 36, as amended from time to time, including the regulations from time to time promulgated thereunder;

"CCEMA" means the Climate Change and Emissions Management Act, S.A. 2003, C-16.7, as amended from time to time, including the regulations from time to time promulgated thereunder;

"CCIR" means the Carbon Competitiveness Incentive Regulation, A.R. 255/2017 under the CCEMA, as amended from time to time;

"Central Penn" means the Central Penn pipeline, a 185-mile pipeline originating in Susquehanna County, Pennsylvania and extending to Lancaster County, Pennsylvania;

"CFIUS" means the Committee on Foreign Investment in the United States;

"CINGSA" means Cook Inlet Natural Gas Storage Alaska, LLC;

"CINGSA Storage facility" means the in-field storage facility in the Cook Inlet area of Alaska owned and operated by CINGSA;

"CN" means Canadian National Railway Company;

"CO2" means carbon dioxide;

"CO2e" means carbon dioxide equivalent;

"Common Shares" means common shares of AltaGas Ltd.;

AltaGas Ltd. – 2019 Annual Information Form – 4

"Constitution" means Constitution Pipeline Company, LLC, an entity formed to create a pipeline to transport natural gas from the Marcellus region in northern Pennsylvania to northeastern markets;

"CPI" means the Consumer Price Index;

"CPUC" means the California Public Utilities Commission;

"DBRS" means DBRS Limited and its successors;

"Degree Day" means the amount that the daily mean temperature deviates below 65 degrees Fahrenheit at SEMCO Gas, ENSTAR, and Washington Gas, such that a one degree difference equates to one Degree Day;

"Dekatherm" means 10 Therms;

"DOEE" means the District of Columbia Department of Energy and Environment;

"EEEP" means the Edmonton ethane extraction plant and related facilities, AltaGas’ interest being owned by its indirect wholly-owned subsidiary AltaGas Extraction and Transmission Limited Partnership;

"EH&S Committee" means the Environment, Health and Safety Committee of the Board of Directors;

"EHS Management System" means AltaGas’ Environmental, Health & Safety Management System;

"ENSTAR" means the natural gas distribution business conducted by SEMCO Energy in Alaska under the name ENSTAR Natural Gas Company;

"EQM" means EQM Gathering Opco, LLC;

"EQT" means EQT Midstream Partners, LP;

"ESA" means Energy Storage Resource Adequacy Purchase Agreement;

"ESG" means Environment, Social & Governance;

"FERC" means the United States Federal Energy Regulatory Commission;

"Ferndale terminal" means the storage, distribution, and export facility for bulk shipments of propane, and butane located on the west coast near Ferndale, Washington, and owned by a subsidiary of Petrogas;

"FID" means final investment decision;

"Fitch" means Fitch Ratings Inc.;

"Forrest Kerr" means the 195 MW run-of-river hydroelectric facility, one of the three run-of-river hydroelectric facilities in northwest British Columbia that forms part of the Northwest Hydro facilities;

"g" means grams;

"GHG" means greenhouse gas;

"GJ" means gigajoule or 1,000,000,000 joules;

AltaGas Ltd. – 2019 Annual Information Form – 5

"Gordondale facility" means the Gordondale Gas processing facility in the Gordondale area of the Montney reserve area approximately 100 km northwest of Grande Prairie, Alberta, owned by AltaGas’ indirect wholly-owned subsidiary AltaGas Northwest Processing Limited Partnership;

"GSAs" means Groundwater Sustainability Agencies;

"GWh" means gigawatt-hour or 1,000,000,000 watt-hours; the watt-hour is equal to one watt of power flowing steadily for one hour;

"Hampshire" or "Hampshire Gas" means Hampshire Gas Company, a subsidiary of WGL that provides regulated interstate natural gas storage services to Washington Gas under a FERC approved interstate storage service tariff;

"Harmattan" means the combined Harmattan gas processing facility and extraction plant and associated facilities, owned by AltaGas’ indirect wholly-owned subsidiary Harmattan Gas Processing Limited Partnership;

"HE" means Hearing Examiner;

"Heritage Gas" means Heritage Gas Limited;

"Idemitsu" means Idemitsu Kosan Co., Ltd.;

"IRIP" means the Infrastructure Reliability Improvement Program;

"JEEP" means the Joffre ethane extraction plant and related facilities;

"Kelt" means Kelt Exploration (LNG) Ltd;

"km" means kilometer;

"kWh" means kilowatt hour;

"LNG" means liquefied natural gas;

"LPG" means liquefied petroleum gas;

"Marquette Connector Pipeline" means the recently completed pipeline that is owned and operated by SEMCO Gas and connects the Great Lakes Gas Transmission pipeline to the Northern Natural Gas pipeline in Marquette, Michigan;

"Mcf" means a thousand cubic feet of natural gas at standard imperial conditions of measurement;

"Mcf/d" means Mcf per day;

"McLymont Creek" means the 66 MW run-of-river hydroelectric facility, one of the three run-of-river hydroelectric facilities in northwest British Columbia that forms part of the Northwest Hydro facilities;

"MDth" means millions of Dekatherms;

"Merger Agreement" means the agreement and plan of merger dated as of January 25, 2017, among AltaGas, Merger Sub and WGL;

"Merger Sub" means Wrangler Inc., a Virginia corporation and an indirect wholly-owned subsidiary of AltaGas;

"MGP" means manufactured gas plant;

AltaGas Ltd. – 2019 Annual Information Form – 6

"Mmcf" means a million cubic feet of natural gas at standard conditions of measurement;

"Mmcf/d" means Mmcf per day;

"Moody's" means Moody's Investor Service;

"Mountain Valley" means Mountain Valley pipeline, an equity investment of WGL Midstream;

"MPSC" means the Michigan Public Service Commission;

"MRP" means Main Replacement Program;

"MRU" means Mount Royal University;

"MTN" means medium term notes issued from time to time under either the amended and restated trust indenture

dated July 1, 2010 between AltaGas and Computershare Trust Company of Canada, as further amended, restated, supplemented or otherwise modified from time to time or the trust indenture dated September 26, 2017 between AltaGas and Computershare Trust Company of Canada, as amended, restated, supplemented or otherwise modified from time to time, as the case may be;

dated July 1, 2010 between AltaGas and Computershare Trust Company of Canada, as further amended, restated, supplemented or otherwise modified from time to time or the trust indenture dated September 26, 2017 between AltaGas and Computershare Trust Company of Canada, as amended, restated, supplemented or otherwise modified from time to time, as the case may be;

"MW" means megawatt; one MW is 1,000,000 watts; the watt is the basic electrical unit of power;

"MWh" means megawatt-hour or 1,000,000 watt-hours; the watt-hour is equal to one watt of power flowing steadily for one hour;

"NAESB" means North American Energy Standards Board;

"NEBC" means Northeast British Columbia;

"NFA" means No Further Action;

"NGL" or "NGLs" means natural gas liquids, which includes primarily propane, butane, and condensate;

"NGTL" means NOVA Gas Transmission Ltd.;

"Non-Ring Fenced Entities" means AltaGas and its affiliates other than Washington Gas and the SPE;

"North Pine facility" means the NGL separation facility, located approximately 40 km northwest of Fort St. John, British Columbia.

"North Pine pipelines" means two eight-inch diameter NGL supply pipelines, each approximately 40 km in length, which runs from the existing Alaska Highway truck terminal to the North Pine facility;

"Northwest Hydro facilities" means the three run-of-river hydroelectric facilities in northwest British Columbia, being Forrest Kerr, McLymont Creek, and Volcano Creek;

"Nova Chemicals" means NOVA Chemicals Corporation;

"NOx" means nitrogen oxides;

"NTSB" means the National Transportation Safety Board;

"NYSDEC" means the New York State Department of Environmental Conservation;

AltaGas Ltd. – 2019 Annual Information Form – 7

"O2" means oxygen;

"Painted Pony" means Painted Pony Energy Ltd.;

"PEEP" means the Pembina Empress extraction plant and related facilities;

"Pembina" means Pembina Infrastructure and Logistics LP;

"Petrogas" means Petrogas Energy Corp., a privately held leading North American integrated midstream company in which AltaGas Idemitsu Joint Venture Limited Partnership has an approximate two-thirds ownership interest;

"PG&E" means Pacific Gas & Electric Company;

"Plan" means the Premium DividendTM, Dividend Reinvestment, and Optional Cash Purchase Plan of the Corporation;

"PNG" means Pacific Northern Gas Ltd.;

"Pomona" means the 44.5 MW gas-fired generation facility located in Pomona, California, owned by AltaGas’ indirect wholly-owned subsidiary AltaGas Pomona Energy Inc.;

"Pomona Energy Storage facility" means the 20 MW lithium ion battery storage facility in Pomona, California, owned by AltaGas’ indirect wholly-owned subsidiary AltaGas Pomona Energy Storage Inc.;

"Pool" means the scheme operated by the AESO for (i) exchanges of electric energy, and (ii) financial settlement for the exchange of electric energy;

"PPA" means power purchase agreement;

"Preferred Shares" means the preferred shares of AltaGas Ltd. as a class, including, without limitation, the Series A Shares, Series B Shares, Series C Shares, Series D Shares, Series E Shares, Series F Shares, Series G Shares, Series H Shares, Series I Shares, Series J Shares, Series K Shares, and Series L Shares;

"PROJECTpipes" means Washington Gas' 40-year accelerated pipeline replacement program, that was launched in 2014 in the District of Columbia and is designed to enhance the safety and reliability of its system;

"PRPA" means Prince Rupert Port Authority;

"PSC of DC" means the Public Service Commission of the District of Columbia;

"PSC of MD" means the Maryland Public Service Commission;

"Put Notice" means the notice received by AIJVLP from SAM of its exercise of a put option with respect to its approximate one-third interest in Petrogas.

"Put Option" means the put option with respect to SAM's approximate one-third interest in Petrogas;

"RCA" means the Regulatory Commission of Alaska;

"Rep Agreements" mean the Representation, Management and Processing Agreements at Harmattan;

"RILE LP" means Ridley Island LPG Export Limited Partnership, a limited partnership of which AltaGas’ subsidiaries hold a 70 percent interest and Vopak holds a 30 percent interest;

AltaGas Ltd. – 2019 Annual Information Form – 8

"Ring Fenced Entities" means Washington Gas and the SPE;

"RIPET" means the Ridley Island Propane Export Terminal, the propane export terminal constructed by AltaGas' subsidiary, Ridley Island LPG Export Limited Partnership, to ship up to 1.2 million tonnes of propane per annum and to be located on a portion of land leased by Ridley Terminals Inc. from the PRPA, located on Ridley Island, near Prince Rupert, British Columbia;

"Ripon" means the 49.5 MW gas-fired generation facility in Ripon, California, owned by AltaGas’ indirect wholly-owned subsidiary AltaGas Ripon Energy Inc.;

"ROE" means return on equity;

"Royal Vopak" means Koninklijke Vopak N.V., a public company incorporated under the laws of the Netherlands;

"RTI" means Ridley Terminals Inc.;

"S&P" means Standard & Poor's Ratings Services and its successors;

"SAM" means Sam Holdings Ltd.;

"Sarbanes-Oxley" means the Sarbanes-Oxley Act of 2002;

"SAVE" means Steps to Advance Virginia's Energy Plan;

"SCC of VA" means the Commonwealth of Virginia State Corporation Commission;

"SCE" means Southern California Edison Company;

"SEDAR" means System for Electronic Document Analysis and Retrieval, at www.sedar.com;

"SEMCO Energy" means SEMCO Energy, Inc.;

"SEMCO Gas" means the Michigan natural gas distribution business conducted by SEMCO Energy in Michigan under the name SEMCO Energy Gas Company;

"Series A Shares" means the cumulative redeemable 5-year fixed rate reset preferred shares, Series A, of AltaGas;

"Series B Shares" means the cumulative redeemable floating rate preferred shares, Series B, of AltaGas

"Series C Shares" means the cumulative redeemable 5-year fixed rate reset preferred shares, Series C, of AltaGas (US dollar);

"Series D Shares" means the cumulative redeemable floating rate preferred shares, Series D, of AltaGas (US dollar);

"Series E Shares" means the cumulative redeemable 5-year fixed rate reset preferred shares, Series E, of AltaGas;

"Series F Shares" means the cumulative redeemable floating rate preferred shares, Series F, of AltaGas;

"Series G Shares" means the cumulative redeemable 5-year fixed rate reset preferred shares, Series G, of AltaGas;

"Series H Shares" means the cumulative redeemable floating rate preferred shares, Series H, of AltaGas;

"Series I Shares" means the cumulative redeemable 5-year minimum fixed rate reset preferred shares, Series I, of AltaGas;

AltaGas Ltd. – 2019 Annual Information Form – 9

"Series J Shares" means the cumulative redeemable floating rate preferred shares, Series J, of AltaGas;

"Series K Shares" means the cumulative redeemable 5-year minimum fixed rate reset preferred shares, Series K, of AltaGas;

"Series L Shares" means the cumulative redeemable floating rate preferred shares, Series L of AltaGas;

"SGER" means the Specified Gas Emitters Regulation under the CCEMA, which was replaced with the CCIR on January 1, 2018;

"SGMA" means the Sustainable Groundwater Management Act;

"Share Options" means options to acquire Common Shares granted pursuant to AltaGas' share option plan;

"Shareholders" mean the holders of Common Shares;

"Shell Energy" means Shell Energy North America (US), LP;

"SOS" means Standard offer Service;

"SPE" means Wrangler SPE LLC, a wholly-owned special purpose entity subsidiary of WGL incorporated as a bankruptcy remote entity;

"Stonewall System" means the Stonewall Gas Gathering System;

"STRIDE" means Strategic Infrastructure Development Enhancement Plan;

"TCJA" means the Tax Cuts and Jobs Act of 2017;

"TIER" means Technology Innovation and Emissions Reduction;

"Tourmaline" means Tourmaline Oil Corp.;

"Townsend 2A" means the first 99 Mmcf/d train of the Townsend expansion, located on the existing Townsend facility site, adjacent to the currently operating Townsend facility;

"Townsend 2B" means the proposed 198 Mmcf/d C3+ deep cut gas processing facility to be located on the existing Townsend facility site, adjacent to the currently operating Townsend facility and anticipated to be on-stream in the fourth quarter of 2020;

"Townsend complex" means, collectively, the Townsend facility, Townsend 2A, and Townsend 2B;

"Townsend facility" means the 198 Mmcf/d Townsend shallow-cut processing facility in northeast British Columbia owned by AltaGas Northwest Processing Limited Partnership;

"Transco" means Transcontinental Gas Pipeline Company LLC;

"TSX" means the Toronto Stock Exchange;

"UESC" means Utility Energy Savings Contracts;

"United States", "US", or "U.S." means the United States of America;

"US dollar" or "US$" means currency in the form of United States dollars;

AltaGas Ltd. – 2019 Annual Information Form – 10

"USEPA" means United States Environmental Protection Agency;

"Volcano Creek" means the 16 MW run-of-river hydroelectric facility, one of the three run-of-river hydroelectric facilities in northwest British Columbia that forms part of the Northwest Hydro facilities;

"Vopak" means Vopak Development Canada Inc., a wholly-owned subsidiary of Royal Vopak;

"Washington Gas" means Washington Gas Light Company, a subsidiary of WGL that sells and delivers natural gas primarily to retail customers in the District of Columbia, Maryland and Virginia in accordance with tariffs approved by the Public Service Commission of the District of Columbia, the Maryland Public Service Commission and the Commonwealth of Virginia State Corporation Commission;

"Washington Gas $4.25 Shares" means the US$4.25 series cumulative preferred shares of Washington Gas that were redeemed by Washington Gas on December 20, 2019;

"Washington Gas $4.80 Shares" means the US$4.80 series cumulative preferred shares of Washington Gas that were redeemed by Washington Gas on December 20, 2019;

"Washington Gas $5.00 Shares" means the US$5.00 series cumulative preferred shares of Washington Gas that were redeemed by Washington Gas on December 20, 2019;

"Washington Gas Preferred Shares" means the preferred shares of Washington Gas as a class, including, without limitation, the Washington Gas $4.25 Shares, Washington Gas $4.80 Shares and Washington Gas $5.00 Shares;

"Washington Gas Resources" means Washington Gas Resources Corporation, a subsidiary of WGL that owns the majority of the non-utility subsidiaries;

"WCSB" means Western Canada Sedimentary Basin;

"WGL" means WGL Holdings, Inc., an indirect subsidiary of AltaGas;

"WGL Acquisition" means the acquisition by AltaGas, indirectly through Merger Sub, of WGL through a merger of Merger Sub with and into WGL pursuant to the Merger Agreement, which closed on July 6, 2018;

"WGL Energy Services" means WGL Energy Services, Inc. (formerly Washington Gas Energy Services, Inc.), a subsidiary of Washington Gas Resources that sells natural gas and electricity to retail customers on an unregulated basis;

"WGL Energy Systems" means WGL Energy Systems, Inc. (formerly Washington Gas Energy Systems, Inc.), a subsidiary of Washington Gas Resources, which provides commercial energy efficient and sustainable solutions to government and commercial clients;

"WGL Midstream" means WGL Midstream, Inc., a subsidiary of Washington Gas Resources that engages in acquiring and optimizing natural gas storage and transportation assets;

"WGSW" means WGSW, Inc., a subsidiary of Washington Gas Resources that was formed to invest in certain renewable energy projects; and

"Younger" means the Younger extraction plant and related facilities, AltaGas’ interest being owned by its indirect wholly-owned subsidiary AltaGas Extraction and Transmission Limited Partnership.

AltaGas Ltd. – 2019 Annual Information Form – 11

METRIC CONVERSION

The following table sets forth certain standard conversions between Standard Imperial Units and the International System of Units (or metric units).

To Convert From | To | Multiply by | To Convert From | To | Multiply by | |

Mcf | cubic meters | 28.174 | feet | meters | 0.305 | |

cubic meters | cubic feet | 35.494 | meters | feet | 3.281 | |

Bbls | cubic meters | 0.159 | miles | km | 1.609 | |

cubic meters | Bbls | 6.29 | km | miles | 0.621 | |

tonnes | long tons | 0.98 | gigajoule | Mcf | 0.9482 | |

million tonnes | Bbls | 12.40 | ||||

CORPORATE STRUCTURE

Incorporation

AltaGas is a Canadian corporation amalgamated pursuant to the CBCA on January 1, 2020. AltaGas and/or its predecessors began operations in Calgary, Alberta on April 1, 1994 and AltaGas continues to maintain its head, principal, and registered office in Calgary, Alberta currently located at 1700, 355 – 4th Avenue SW, Calgary, Alberta T2P 0J1. AltaGas is a public company, the Common Shares of which trade on the TSX under the symbol "ALA".

Amended Articles

On July 1, 2010, AltaGas filed articles of arrangement under the CBCA to effect a corporate arrangement and the amalgamation of AltaGas Ltd., AltaGas Conversion Inc., and AltaGas Conversion #2 Inc. to form AltaGas. Subsequent to the filing of the articles of arrangement, AltaGas filed articles of amendment on the following dates in connection with the creation of each series of Preferred Shares: (i) August 13, 2010 to create the first series of Preferred Shares, Series A Shares and the second series of Preferred Shares, Series B Shares; (ii) June 1, 2012 to create the third series of Preferred Shares, Series C Shares and the fourth series of Preferred Shares, Series D Shares; (iii) December 9, 2013 to create the fifth series of Preferred Shares, Series E Shares and the sixth series of Preferred Shares, Series F Shares; (iv) June 27, 2014 to create the seventh series of Preferred Shares, Series G Shares and the eighth series of Preferred Shares, Series H Shares; (v) November 17, 2015 to create the ninth series of Preferred Shares, Series I Shares and the tenth series of Preferred Shares, Series J Shares; and (vi) February 15, 2017 to create the eleventh series of Preferred Shares, Series K Shares and the twelfth series of Preferred Shares, Series L Shares. On January 1, 2020, AltaGas filed articles of amalgamation to effect the amalgamation of AltaGas with its non-operating subsidiaries AltaGas Investment Ltd., 11801376 Canada Ltd., and Northwest Triumph Contracting Ltd.

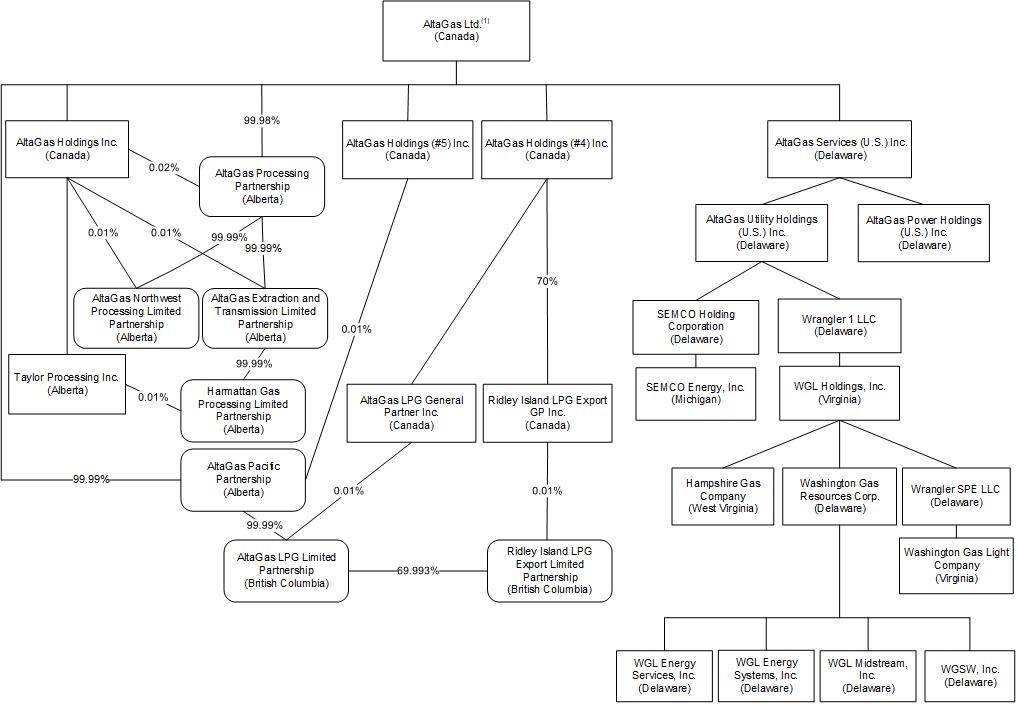

Intercorporate Relationships

The following organization diagram presents the name and the jurisdiction of incorporation of certain of AltaGas' subsidiaries as at the date of this Annual Information Form. The diagram does not include all of the subsidiaries of AltaGas. The assets and revenues of those subsidiaries omitted from the diagram individually did not exceed 10 percent, and in the aggregate did not exceed 20 percent, of the total consolidated assets or total consolidated revenues of AltaGas as at and for the year ended December 31, 2019.

AltaGas Ltd. – 2019 Annual Information Form – 12

(1) Updated as of the date of this Annual Information Form.

(2) Unless otherwise stated, ownership is 100%.

OVERVIEW OF THE BUSINESS

AltaGas, a Canadian corporation, is a leading North American energy infrastructure company that connects NGLs and natural gas to domestic and global markets. The Corporation’s long-term strategy is to grow in attractive areas across its Utilities and Midstream business segments seeking optimal capital deployment. In the Midstream business, the Corporation is focused on optimizing the full value chain of energy exports by providing producers with solutions, including global market access off the West Coast of Canada via the Corporation’s footprint in the Montney region. In the Utilities business, the Corporation seeks to grow through rate base investment and the use of accelerated rate recovery programs, while providing effective and cost-efficient service for customers. AltaGas has three business segments:

▪ | Utilities, which serves approximately 1.7 million customers with a rate base of approximately US$3.9 billion through ownership of regulated natural gas distribution utilities across five jurisdictions in the United States and two regulated natural gas storage utilities in the United States, delivering clean and affordable natural gas to homes and businesses. |

AltaGas Ltd. – 2019 Annual Information Form – 13

The Utilities business also includes storage facilities and contracts for interstate natural gas transportation and storage services;

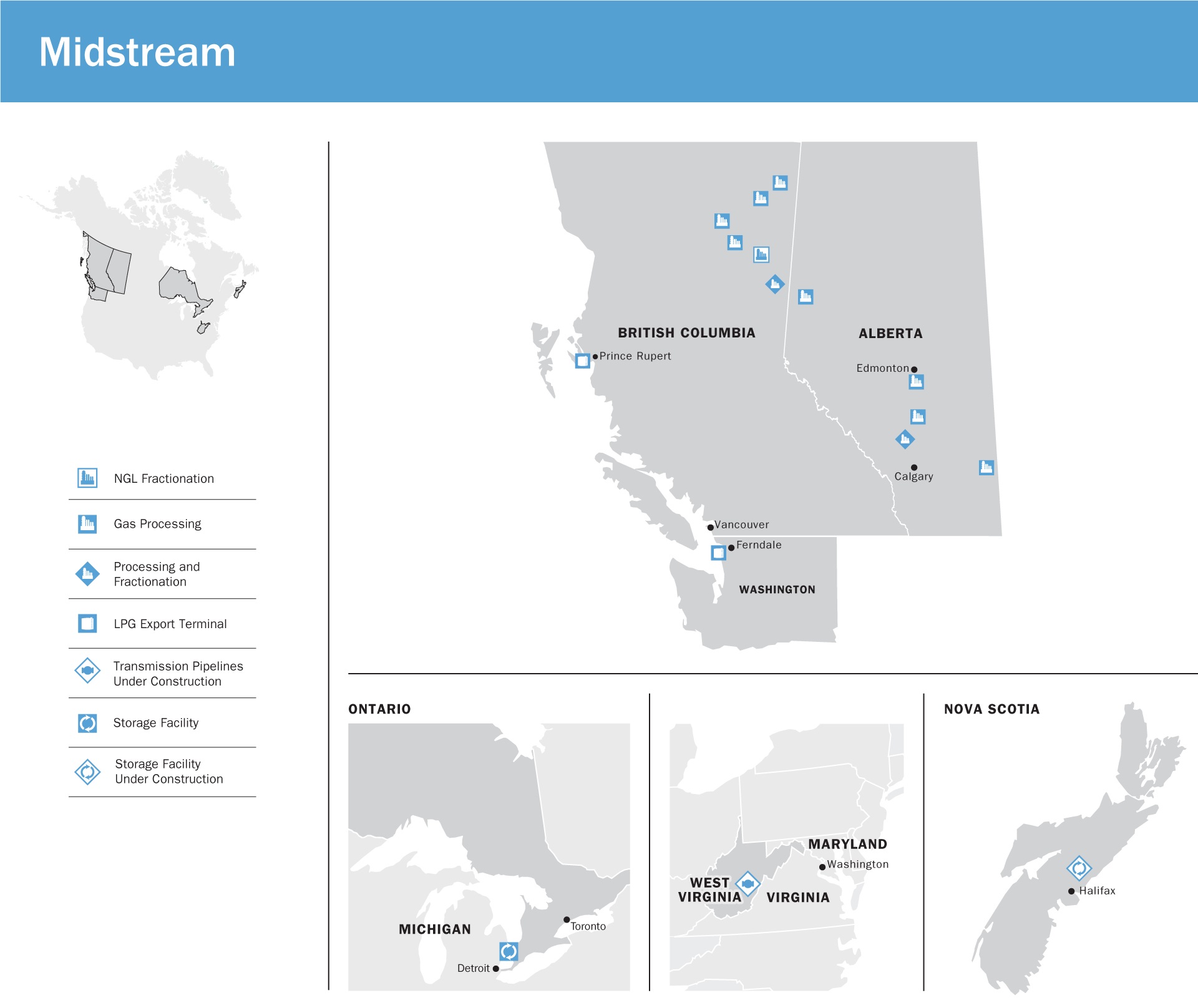

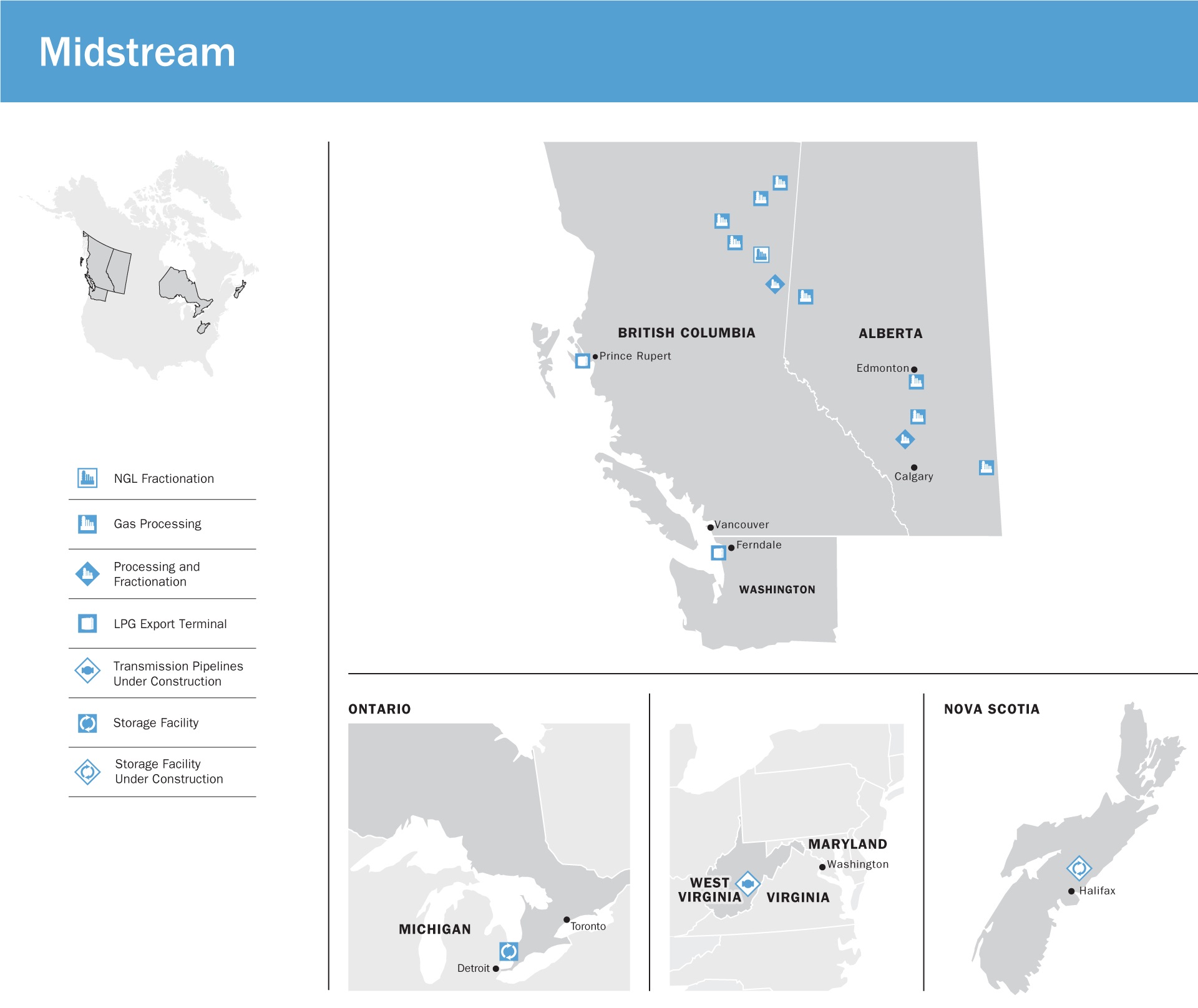

▪ | Midstream, which includes a 70 percent interest in the recently completed Ridley Island Propane Export Terminal, allowing AltaGas to leverage its assets along the energy value chain in Western Canada including natural gas gathering and processing, NGL extraction and fractionation, and natural gas and NGL marketing. The Midstream segment also includes transmission, storage, an interest in a regulated pipeline in the Marcellus/Utica gas formation in the northeastern United States, WGL’s retail gas marketing business, the Corporation’s 50 percent interest in AIJVLP, and an indirectly held approximate one-third ownership investment in Petrogas, through which AltaGas’ interest in the Ferndale terminal is held; and |

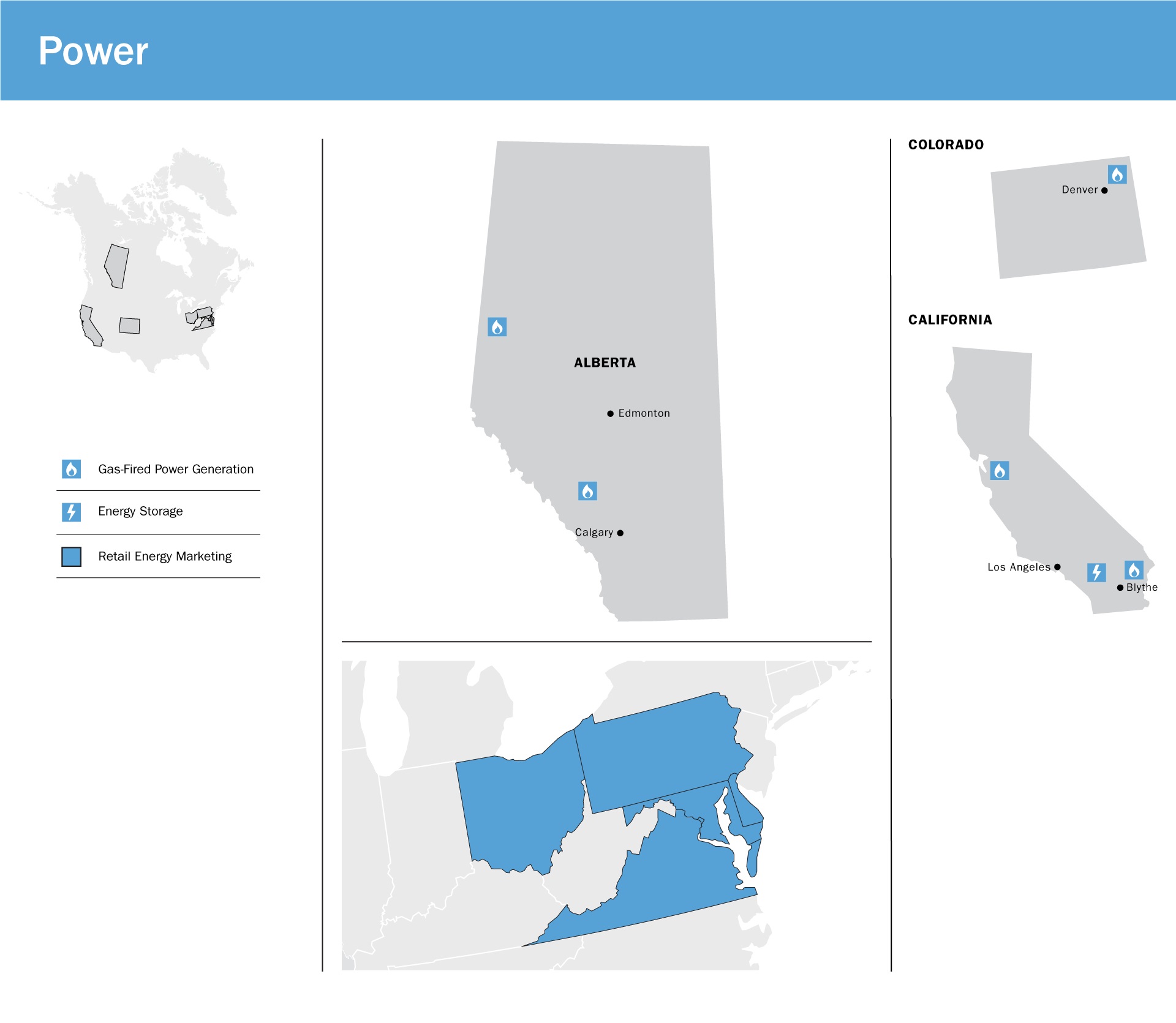

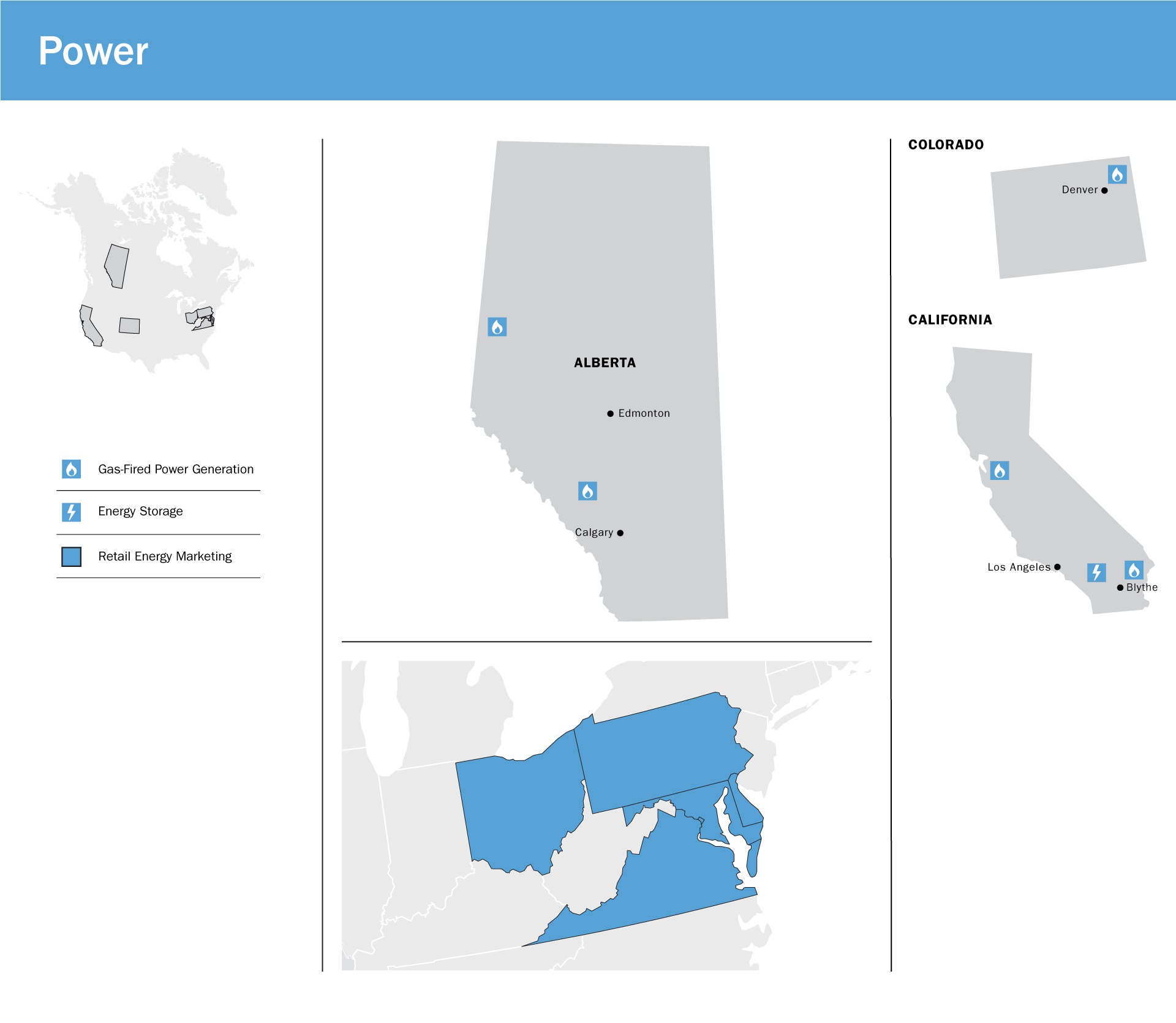

▪ | Power, which includes 710 MW of operational gross capacity from natural gas-fired, distributed generation, and energy storage assets, certain of which are pending sale, located in Alberta, Canada and the United States, primarily in California and Colorado. The Power business also includes energy efficiency contracting and WGL’s retail power marketing business. |

AltaGas Ltd. – 2019 Annual Information Form – 14

ALTAGAS’ GEOGRAPHIC FOOTPRINT

AltaGas Ltd. – 2019 Annual Information Form – 15

AltaGas Ltd. – 2019 Annual Information Form – 16

OUTLOOK

In 2019, AltaGas successfully completed its plan to refocus the Company, capture the intrinsic value of its core assets, and regain its financial footing to capitalize on the significant investment opportunities ahead. Since the acquisition of WGL in 2018, AltaGas has integrated the WGL assets, streamlined its business portfolio through approximately $5 billion of non-core asset sales, substantially simplified its business model, and significantly enhanced its financial strength and flexibility, all while continuing to deliver solid operating and financial performance.

AltaGas’ strategy is largely focused on two core businesses: Utilities and Midstream. Moving forward, AltaGas expects to target opportunities to develop high-quality natural gas and NGL assets that complement its existing integrated infrastructure footprint within these businesses, and to grow its position in key markets to deliver optimal growth over the long term.

In 2020, AltaGas plans to focus on capitalizing on the significant growth potential of its Utilities and Midstream assets. Specific priorities include to:

▪ | Ensure safe reliable operations, providing effective and cost-efficient service for customers; |

AltaGas Ltd. – 2019 Annual Information Form – 17

▪ | Enhance returns and capital efficiency through base rate cases, and facilitate timely recovery of expenditures and improve safety through increased utilization of accelerated rate recovery programs; |

▪ | Enhance the business through asset optimization and operational efficiencies to reduce costs and deliver an improved customer experience; |

▪ | Maximize the unique structural advantage within AltaGas' integrated platform in the Montney region; |

▪ | Increase utilization and export volumes at RIPET; |

▪ | Execute the planned $900 million growth capital program, including a targeted 10 percent increase in the Utilities rate base; and |

▪ | Pursue capital efficient organic growth through disciplined capital allocation while improving balance sheet strength and flexibility. |

GENERAL DEVELOPMENT OF ALTAGAS' BUSINESS

Below is a summary by business segment of certain acquisitions and dispositions, key development and construction projects, and other commercial arrangements not already discussed above, which have influenced the general development of the business segments of the Corporation over the last three completed financial years.

Development of the Utilities Business of AltaGas

In August 2017, the MPSC approved SEMCO Gas’ application to construct, own, and operate the Marquette Connector Pipeline. The Marquette Connector Pipeline is a new pipeline that connects the Great Lakes Gas Transmission pipeline to the Northern Natural Gas pipeline in Marquette, Michigan where it will provide system redundancy and increase deliverability, reliability, and diversity of supply to SEMCO Gas’ approximately 35,000 customers in Michigan’s Western Upper Peninsula. The Marquette Connector Pipeline was completed and placed in-service in December 2019.

On July 6, 2018, the WGL Acquisition closed and the operations of Washington Gas and Hampshire Gas were added to AltaGas’ Utilities business.

With the close of the ACI IPO on October 25, 2018, the Canadian rate-regulated utility assets including PNG, AUI, and Heritage Gas are no longer subsidiaries of AltaGas. AltaGas’ remaining exposure to such Canadian rate-regulated utility assets is through its approximate 37 percent interest in ACI.

On July 31, 2018, Washington Gas filed an application with the SCC of VA to increase its base rates for natural gas service. A Final Order was received in December 2019. On January 9, 2020, Washington Gas filed a petition for reconsideration regarding one of the findings in the Final Order. On January 30, 2020, the SCC of VA denied this request and the rate case is now final. See "Business of the Corporation - Utilities Business - Washington Gas - Material Regulatory Developments and Approvals".

On October 15, 2019, the PSC of MD issued a Final Order approving Washington Gas' settlement agreement in their recent rate case, reflecting a US$27 million base rate increase effective October 15, 2019. See "Business of the Corporation - Utilities Business - Washington Gas - Material Regulatory Developments and Approvals".

On October 21, 2019, ACI announced that the Public Sector Pension Investment Board and the Alberta Teachers' Retirement Fund Board (together, the "Consortium") and ACI had concluded a definitive arrangement agreement (the "Arrangement Agreement") whereby the Consortium will indirectly acquire all of the issued and outstanding common shares of ACI in an all-cash transaction for $33.50 per common share (the "Arrangement"). On December 19, 2019, the shareholders of ACI approved the Arrangement Agreement. In addition, on December 16, 2019, ACI received a "no-action letter" from the Canadian Competition Bureau confirming that the Commissioner of Competition does not at this time intend to challenge the proposed Arrangement. On December 20, 2019, ACI received the final order from the Court of Queen's Bench of Alberta approving the Arrangement. On February 18, 2020, the Alberta Utilities Commission issued a decision approving the Arrangement. The closing of the Arrangement remains subject to the receipt of approval from the British Columbia Utilities Commission,

AltaGas Ltd. – 2019 Annual Information Form – 18

and the satisfaction or waiver of other customary closing conditions. ACI and the Consortium expect to close the Arrangement in the first half of 2020. AltaGas owns 11,025,000 common shares or approximately 37 percent of the total number of common shares of ACI.

On December 6, 2019, the MPSC issued a Final Order approving SEMCO Gas' settlement agreement in its recent rate case, reflecting a base rate increase of approximately US$20 million effective January 1, 2020. See "Business of the Corporation - Utilities Business - SEMCO Gas - Material Regulatory Developments and Approvals".

On January 13, 2020, Washington Gas filed an application with the PSC of DC for an increase in rates. See "Business of the Corporation - Utilities Business - Washington Gas - Material Regulatory Developments and Approvals".

Development of the Midstream Business of AltaGas

In January 2017, AltaGas reached a positive FID on RIPET, the first propane marine export facility in Canada. On May 5, 2017, AltaGas LPG Limited Partnership, a wholly-owned subsidiary of AltaGas, and Vopak formed RILE LP for the development of RIPET. AltaGas’ subsidiaries hold a 70 percent interest in RILE LP, with Vopak holding the remaining 30 percent interest. Construction of RIPET began in April 2017 and the first shipment of propane to Asia departed on May 23, 2019. Based on production from AltaGas Midstream facilities and commercial contracts executed or currently under negotiation, RIPET's physical volumes are currently averaging approximately 40,000 Bbls/d or 1.2 million tonnes annually. For further details on this project see below under the heading "Business of the Corporation – Midstream Business – Global Exports".

In March 2017, AltaGas sold the Ethylene Delivery System and the Joffre Feedstock Pipeline to Nova Chemicals for net proceeds of approximately $67 million.

On April 3, 2018, AltaGas entered into a long-term natural gas processing arrangement with Birchcliff at AltaGas’ deep-cut sour gas processing facility located in Gordondale, Alberta.

As a result of the closing of the WGL Acquisition on July 6, 2018, an interest in four pipelines in the U.S. (two of which have since been sold and one project for which the partners have elected not to proceed) as well as the retail gas marketing business of WGL were added to AltaGas’ Midstream business.

On August 27, 2018, AltaGas entered into definitive agreements with Kelt to provide Kelt with firm processing of 75 MMcf/d of raw gas under an initial 10 year take-or-pay agreement at the Townsend complex.

On September 10, 2018, AltaGas entered into definitive agreements for the sale of non-core Midstream and Power assets in Canada. The sale was completed in February 2019.

In October 2018, AltaGas acquired 50 percent ownership in certain existing and future natural gas processing plants of Black Swan. AltaGas and Black Swan also entered into long-term processing, transportation, and marketing agreements that include new AltaGas liquids handling infrastructure.

On May 31, 2019, AltaGas completed the disposition of WGL Midstream's entire interest in the Stonewall System to a wholly-owned subsidiary of DTE Energy for total gross proceeds of approximately $379 million (US$280 million).

On September 30, 2019, AltaGas announced that it had entered into a definitive agreement for the sale of its indirect, non-operating interest in Central Penn held by its subsidiary WGL Midstream, Inc. to Meade Pipeline Investment, LLC, a subsidiary of NextEra Energy Partners, LP. Total cash proceeds for WGL Midstream's interest were approximately $812 million (US$611 million) and the transaction closed on November 13, 2019.

On January 2, 2020, AltaGas announced that AIJVLP had received the Put Notice from SAM of its exercise of the Put Option with respect to SAM's approximate one-third interest in Petrogas effective December 31, 2019. Pursuant to the Petrogas unanimous shareholders agreement, a valid exercise of the Put Option by SAM after October 1, 2019, triggers a requirement

AltaGas Ltd. – 2019 Annual Information Form – 19

for AIJVLP to purchase SAM's approximate one-third interest in Petrogas at the fair market value therefore, as determined by third party valuators.

In February 2020, following evaluations of the diminished underlying economics for the proposed Constitution pipeline project, the partners of Constitution elected not to proceed with the project. AltaGas held a 10 percent equity interest in Constitution.

Development of the Power Business of AltaGas

On June 13, 2018, AltaGas announced that it had entered into a definitive agreement to indirectly sell 35 percent of its interest in the Northwest Hydro facilities for gross proceeds of $922 million. The transaction closed on June 22, 2018.

On July 6, 2018, as part of the WGL Acquisition, WGL Energy Systems and WGL Energy Services were added to AltaGas’ Power business.

On September 10, 2018, AltaGas entered into definitive agreements for the sale of non-core Midstream and Power assets in Canada. The sale was completed in February 2019.

On October 19, 2018, the Bear Mountain wind facility in British Columbia was sold to ACI. In addition, a 10 percent minority interest in the Northwest Hydro facilities was sold to ACI.

On November 13, 2018, the Tracy, Hanford, and Henrietta gas-fired facilities in California were sold to Middle River Power for a gross purchase price of US$299 million.

On December 11, 2018, the Busch Ranch wind asset in the United States was sold for a purchase price of approximately US$16 million.

On January 31, 2019, AltaGas completed the sale of its remaining interest of approximately 55 percent in the Northwest Hydro facilities for net cash proceeds of approximately $1.3 billion, resulting in a pre-tax gain of $688 million. AltaGas remains the operator of the facilities under an operating and maintenance agreement expiring January 31, 2021.

On August 13, 2019, AltaGas completed the sale of its equity ownership interests in Craven County Wood Energy LP and Grayling Generation Station LP for net proceeds of approximately $24.5 million (US$18.5 million).

On September 26, 2019, AltaGas closed the sale of its portfolio of U.S. distributed generation assets held by its subsidiaries WGL Energy Systems, Inc. and WGSW, Inc., to TerraForm Power, Inc., an affiliate of Brookfield Asset Management. Total cash proceeds received were approximately $975 million (US$735 million) and a pre-tax gain on disposition of $168 million was recorded in 2019. There are certain projects for which legal title has not yet transferred as various consents and approvals remain outstanding. Accordingly, assets of approximately $27 million and liabilities of $4 million remain held for sale at December 31, 2019.

In October 2019, AltaGas announced the successful recontracting of the Blythe facility to SCE. Under the tolling agreement, SCE has exclusive rights to all capacity, energy, ancillary services, and resource adequacy benefits from August 1, 2020 to December 31, 2023. California Public Utilities Commission approval was received on January 16, 2020.

AltaGas Ltd. – 2019 Annual Information Form – 20

BUSINESS OF THE CORPORATION

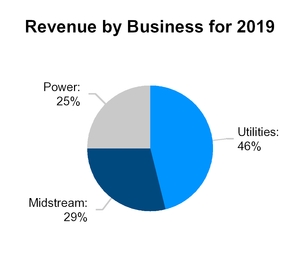

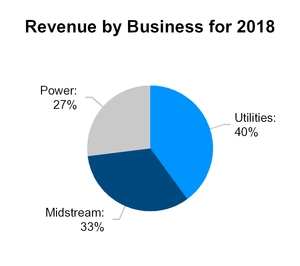

AltaGas’ revenue for the year ended December 31, 2019 was approximately $5.5 billion compared to $4.3 billion for the year ended December 31, 2018.

Note: Excluding Corporate segment and intersegment eliminations

AltaGas operates its business through three business segments: Utilities, Midstream, and Power, each of which is more particularly described in the respective sections that follow. AltaGas’ business also includes the Corporate segment, which consists primarily of opportunistic investments, certain risk management contract results, and revenues and expenses not directly identifiable with the operating businesses.

UTILITIES BUSINESS

The Utilities business contributed revenue of $2.6 billion for the year ended December 31, 2019 (2018 - $1.7 billion), representing approximately 46 percent (2018 – 40 percent) of AltaGas’ total revenue before Corporate segment and intersegment eliminations.

Utilities Business

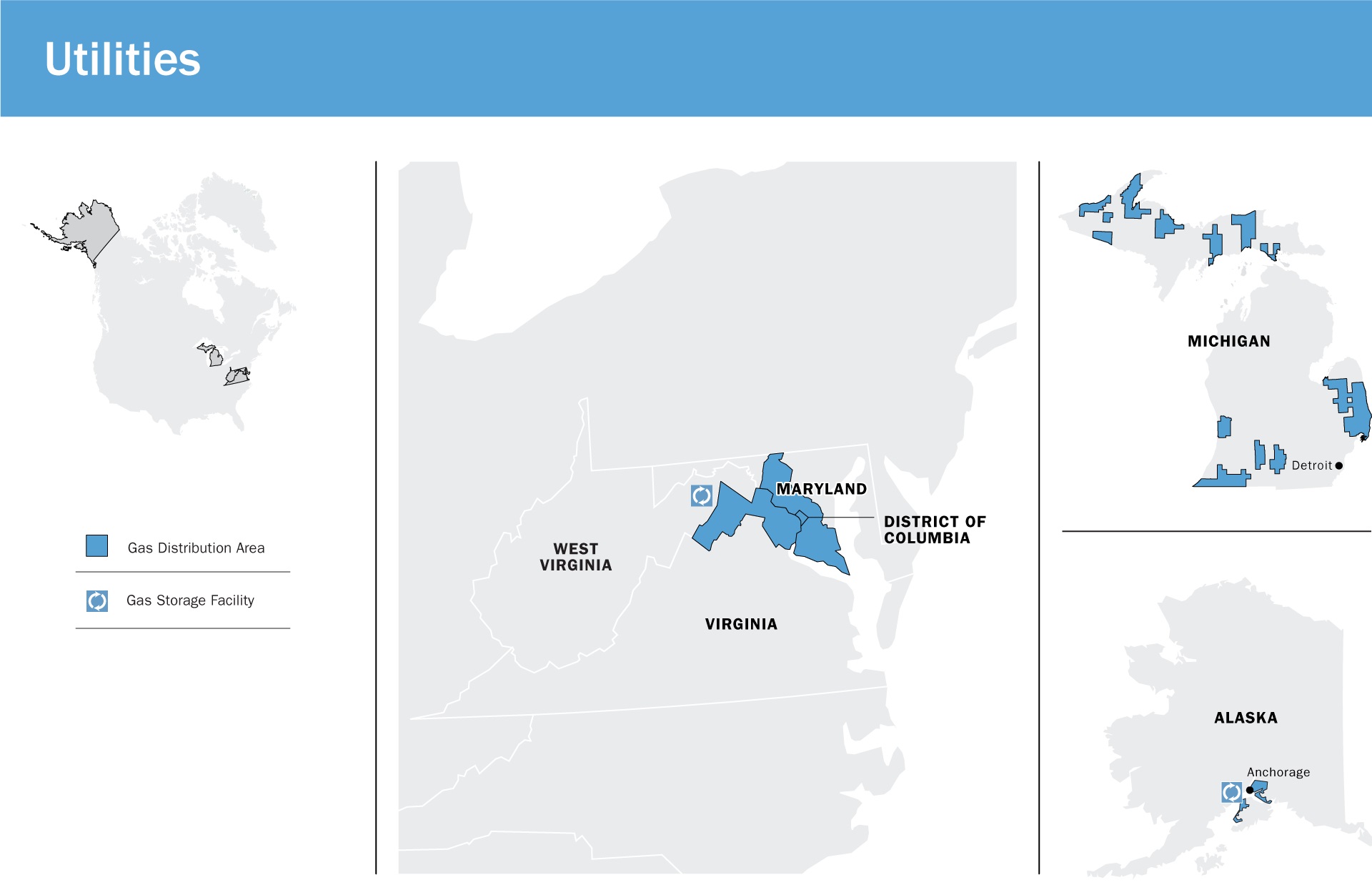

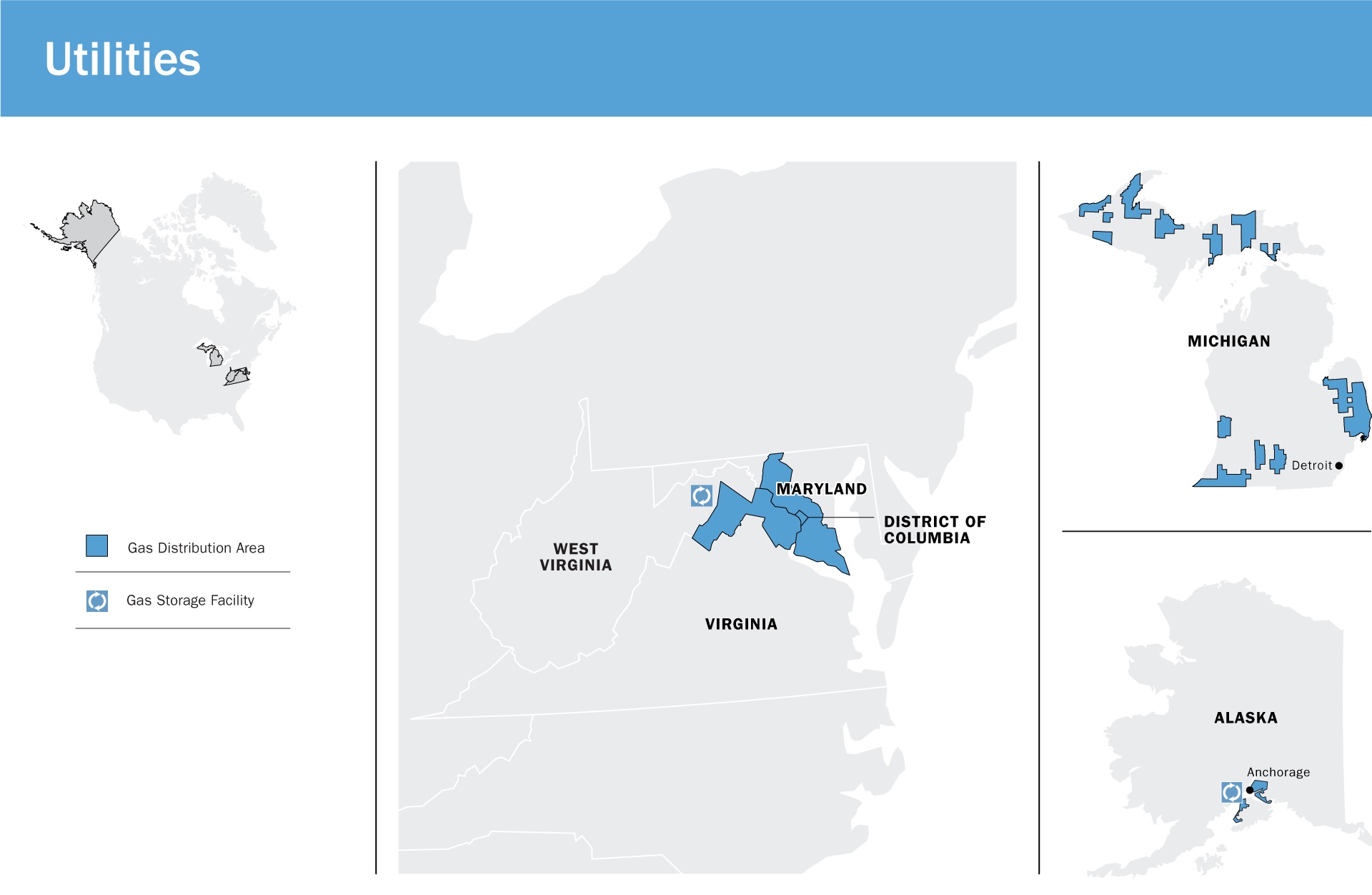

The Utilities segment owns utility assets that deliver natural gas to end-users in the United States. The Utilities segment in the United States is comprised of Washington Gas (in the District of Columbia, Maryland, and Virginia); Hampshire Gas, a regulated natural gas storage utility in West Virginia; SEMCO Gas in Michigan; ENSTAR in Alaska; and a 65 percent interest in CINGSA, a regulated natural gas storage utility in Alaska.

Regulatory Process

The Utilities business predominantly operates in regulated marketplaces where, as franchise or certificate holders, regulated utilities are allowed by the regulator to charge regulated rates that provide the utilities the opportunity to recover costs and earn a return on capital. The return on capital is to reflect a fair rate of return on approved utility investments (i.e. rate base) based on a regulatory deemed or targeted capital structure. The ability of a regulated utility to recover prudently incurred costs of providing service and earn the regulator-approved rate of return on equity depends on the utility achieving the cost levels established in the rate-setting processes.

SEMCO Gas and Washington Gas have accelerated pipe and infrastructure replacement programs in place in Michigan and in the District of Columbia, Maryland, and Virginia, respectively. These are long-term programs subject to both changing

AltaGas Ltd. – 2019 Annual Information Form – 21

conditions and regulatory review and approval in five-year increments. These programs enable SEMCO Gas and Washington Gas to accelerate pipe and infrastructure replacement to further enhance the safety and reliability of the natural gas delivery system. SEMCO Gas and Washington Gas are allowed to begin recovering the cost, including a return, for these investments immediately through approved surcharges for each accelerated pipe or infrastructure replacement program outside of a normal rate case process, mitigating regulatory lag. Once new base rates are put into effect in a given jurisdiction following approval of an application to increase rates, expenditures previously being recovered through the surcharge will be collected through the new base rates.

The Utilities business is subject to regulation over, among other things, rates, accounting procedures, and standards of service. The MPSC has jurisdiction over the regulatory matters related, directly or indirectly, to the services that SEMCO Gas provides to its Michigan customers. The RCA has jurisdiction over the regulatory matters related, directly or indirectly, to ENSTAR’s and CINGSA’s services provided to its Alaska customers. Washington Gas is regulated by the PSC of DC, the PSC of MD, and the SCC of VA, which approve its terms of service and the billing rates that it charges to its customers, regulate interactions with affiliates, and regulate retail competition for natural gas supply service. In all jurisdictions, the regulators approve distribution rates based on a cost-of-service regulatory model. In Alaska, the District of Columbia, and Maryland, rates are set using the results from a historical test year plus known and measurable changes. In Michigan and Virginia, rates are set using a projected test year. In all jurisdictions, the rates charged to utility customers are designed to provide the distribution utility with an opportunity to recover all prudently incurred operating, depreciation, income tax, and financing costs. In most jurisdictions, the rates are also designed to earn a reasonable return on its investment in the net assets used in its firm gas sales and delivery service.

Utilities Business Key Utility Metrics

The following table summarizes the average rate base for the Utilities business for the years ended December 31, 2019 and 2018:

(US$ millions) | 2019 | 2018 | ||

Rate base (1) (2) | 3,865 | 3,684 | ||

(1) | Rate base is indicative of the earning potential of each utility over time. Approved revenue requirement for each utility is typically based on the rate base as approved by the regulator for the respective rate application, but may differ from the rate base indicated above. |

(2) | Includes SEMCO Energy’s 65 percent interest in CINGSA. |

The following table summarizes the capital expenditures for the years ended December 31, 2019 and 2018:

(US$ millions) | 2019 | 2018 |

New business | 252 | 69 |

System betterment and gas supply | 165 | 140 |

General plant | 30 | 64 |

Accelerated Replacement Programs | 200 | 88 |

Total | 647 | 361 |

AltaGas Ltd. – 2019 Annual Information Form – 22

The following table summarizes the nature of regulation applicable to each utility:

Regulated Utility | Regulated Authority | % of AltaGas' Consolidated Rate Base as at December 31, 2019 | Allowed Common Equity (%) | Allowed ROE (%) 2018 | Allowed ROE (%) 2019 | Significant Features/ Material Regulatory Developments |

Washington Gas | PSC of MD SCC of VA PSC of DC | 75% | 53.5 - 55.7 | 9.25 - 9.7 | 9.2 - 9.7 | n Distribution rates approved under cost of service model. n Rate cases filed with the PSC of MD in 2018 and 2019 for increase in rates and accelerated pipeline replacement programs. Final Orders were received in 2019. n Rate case filed in 2018 with the SCC of VA for an increase in rates. The Final Order was received in December 2019. In January 2020, a petition for reconsideration was filed and denied, and the rate case is now final. n Rate case filed in January 2020 with the PSC of DC for an increase in rates. |

SEMCO Gas | MPSC | 16% | 49.04 | 10.35 | 10.35 | n Distribution rates approved under cost of service model. n Use of projected test year for rate cases with 10-month limit to issue a rate order. n Rate rider provides recovery relating to the Main Replacement Program which allows SEMCO Gas to accelerate the replacement of older portions of its system. New Infrastructure Reliability Improvement Program (IRIP) was approved in the 2019 rate case for the years 2020 - 2025. Customers will be billed a surcharge beginning in 2021 for the IRIP. n Rate case filed in May 2019. The settlement was approved in December 2019 and the new rates are effective on January 1, 2020. |

ENSTAR | RCA | 7% | 51.81 | 11.875 | 11.875 | n Distribution rates approved under cost of service model using historical test year and allows for known and measurable changes. n Rate order approving rate increase issued on September 22, 2017. Final rates effective November 1, 2017. n Required to file another rate case no later than June 1, 2021 based upon 2020 test year. |

CINGSA | RCA | 2% | 53.00 | 11.875 | 10.25 | n Distribution rates approved under cost of service model using historical test year and allows for known and measurable changes. n Rate case filed in 2018 based on 2017 historical test year. n Rate case hearing April 2019 with a decision received in August 2019. The decision included an ROE of 10.25% (compared to 11.875% requested) and 100% of Interruptible Storage Service revenues payable to customers (versus 50% requested). CINGSA filed a petition for partial reconsideration on September 3, 2019. The Commission denied the petition and on November 4, 2019 CINGSA filed an appeal with the Superior Court challenging one decision from the order. This matter is currently ongoing. |

Hampshire Gas | FERC | n/a | n/a | n/a | n/a | n Pass through cost of service tariff approved by FERC. |

AltaGas Ltd. – 2019 Annual Information Form – 23

Investment in AltaGas Canada Inc.

As of December 31, 2019, AltaGas owns 11,025,000 common shares or approximately 37 percent of the total number of common shares of ACI. AltaGas’ interest in ACI is accounted for as an equity investment.

On December 19, 2019, ACI announced that the holders of common shares of ACI approved the arrangement whereby the Consortium would together indirectly acquire all of the issued and outstanding common shares of ACI for $33.50 in cash per common share. The Arrangement is expected to close in the first half of 2020. See "General Development of AltaGas' Business - Development of the Utilities Business of AltaGas".

Washington Gas

Washington Gas has been engaged in the natural gas distribution business since 1848 and provides regulated gas distribution services to end users in District of Columbia, Maryland, and Virginia. The utility has approximately 1.2 million customers across these three jurisdictions: District of Columbia (~164,000; 14 percent), Maryland (~493,000; 41 percent), and Virginia (~535,000; 45 percent). Washington Gas operations are such that the loss of any one customer or group of customers would not have a significant adverse effect on its business.

The number of customers at Washington Gas increased by approximately 1 percent in 2019.

Operations

Washington Gas obtains natural gas supplies that originate from multiple regions throughout the U.S. At December 31, 2019, it had service agreements with four pipeline companies that provided firm transportation and storage services, with contract expiration dates ranging from 2020 to 2044. Washington Gas has also contracted with various interstate pipeline and storage companies to add to its storage and transportation capacity.

The following table sets out, by customer category, Washington Gas’ deliveries for the period since close of the WGL Acquisition to December 31, 2019:

AltaGas Ltd. – 2019 Annual Information Form – 24

2019 | 2018 | |

Deliveries: (MDth) | ||

Residential | 69,660 | 27,567 |

Commercial | 21,997 | 8,623 |

Transport | 85,658 | 39,368 |

Total deliveries | 177,315 | 75,558 |

2019 | 2018 | |

Customers at Year End: | ||

Residential | 973,549 | 962,003 |

Commercial | 47,677 | 47,772 |

Transport | 171,236 | 175,055 |

Total customers | 1,192,462 | 1,184,830 |

Seasonality

The natural gas distribution business in the District of Columbia, Maryland, and Virginia is seasonal, as the majority of natural gas demand occurs during the winter heating season that extends from November to March. Accordingly, annualized individual quarterly revenues and earnings are not indicative of annual results.

Forecasted volumes in the District of Columbia are set based on the 30-year rolling average Degree Days expected for the period. In Maryland and Virginia, there are billing mechanisms in place which are designed to eliminate the effects of variance in customer usage caused by weather and other factors such as conservation. In the District of Columbia, there is no weather normalization billing mechanism, nor does Washington Gas hedge to offset the effects of weather. As a result, colder or warmer weather will result in variances to financial results. On January 13, 2020, Washington Gas filed an application with the PSC of DC that requested approval for a weather normalization billing mechanism. See "Business of the Corporation - Utilities Business - Washington Gas - Material Regulatory Developments and Approvals - District of Columbia Jurisdiction".

Material Regulatory Developments and Approvals

District of Columbia Jurisdiction

In 2013, Washington Gas filed a revised Accelerated Pipe Replacement Plan (PROJECTpipes) with the PSC of DC in which Washington Gas proposed to replace bare and/or unprotected steel services, bare and targeted unprotected steel main, and cast iron main in its distribution system in the District of Columbia. On January 29, 2015, the PSC of DC issued an order approving the settlement agreement and approving recovery through the surcharge of total project costs up to US$110 million through September 30, 2019. On December 7, 2018, Washington Gas filed a request with the PSC of DC for approval of the PROJECTpipes 2 Plan for the period of October 1, 2019 through December 31, 2024. As of September 5, 2019, the PSC of DC had not made final ruling on PROJECTpipes 2, and issued an order extending PROJECTpipes an additional six months through March 31, 2020, in an amount not to exceed US$12.5 million, and directed the interested parties to schedule a settlement conference within 15 days of the order. On February 14, 2020, a final settlement conference report was submitted, and the PSC of DC continues to review the PROJECTpipes 2 Plan.

On January 13, 2020, Washington Gas filed an application with the PSC of DC to increase its base rates by approximately US$35 million, including approximately US$9 million pertaining to a PROJECTpipes surcharge that customers are currently paying in the form of a rate rider. The filing requested a return on equity of 10.4 percent on allowed common equity of 52.2 percent, which is based on a US$532 million rate base value. Additionally, Washington Gas requested approval for a Revenue Normalization Adjustment mechanism to reduce customer bill fluctuations due to weather-related and conservation-related usage variations, similar to existing mechanisms in both Maryland and Virginia. Washington Gas requested that new rates be implemented by January 1, 2021. A conference to discuss process schedule is expected to be held in March 2020.

Maryland Jurisdiction

On May 15, 2018, Washington Gas filed an application with the PSC of MD to increase its base rates for natural gas service for approximately US$56 million, including US$15 million pertaining to a STRIDE surcharge it was collecting in the form of a rate rider. The PSC of MD granted Washington Gas US$29 million base rate increase and increased Washington Gas' return on equity to 9.7 percent. On January 10, 2019, Washington Gas filed an application for rehearing with the PSC of MD, alleging two errors in the Commission’s Final Order. On June 25, 2019, the PSC of MD issued an order granting in part and denying in part Washington Gas’ application for a rehearing, resulting in an additional US$1 million increase in annual distribution revenues.

On June 15, 2018, Washington Gas filed an application with the PSC of MD for approval of the second phase of its accelerated natural gas pipeline initiative in Maryland, known as the STRIDE Plan. The application requested approval of approximately US$394 million in accelerated infrastructure replacements for the 2019 to 2023 period. On December 11, 2018, the PSC of MD approved a US$350 million five-year program. On January 9, 2019, Washington Gas applied to supplement its 2019 project list with an additional annual spend of approximately US$65 million. On January 25, 2019, the PSC of MD approved the 2019 revised project list and affirmed the annual spend of approximately US$65 million.

On April 22, 2019, Washington Gas filed an application with the PSC of MD to increase its base rates for natural gas service, requesting a US$36 million increase in base rates, including a US$5 million related to costs being collected through monthly STRIDE surcharges for system upgrades, and to increase its return on equity from 9.7 to 10.4 percent. On August 30, 2019, Washington Gas, the Staff of the PSC of MD, the Maryland Office of People’s Counsel, and the Apartment & Office Building Association of Metropolitan Washington submitted a Stipulation and Settlement designed to generate an additional US$27 million in base rates. The Stipulation stated an overall rate of return of 7.42 percent, established a return on equity of 9.70

AltaGas Ltd. – 2019 Annual Information Form – 25

percent, and stated a common equity ratio of 53.5 percent. On October 15, 2019, the PSC of MD issued Final Order No. 89303 which accepted the Stipulation and Settlement without change. Pursuant to Order No. 89303, Washington Gas’ revised base rates went into effect for service rendered beginning October 15, 2019.

On September 5, 2019, the PSC of MD ordered Washington Gas, within 30 days, to (i) provide a detailed response to the NTSB’s probable cause findings and (ii) provide evidence regarding the status of a 2003 mercury regulator replacement program and, if the program was not completed, to show cause why the PSC of MD should not impose a civil penalty on Washington Gas. On November 18, 2019, the Technical Staff of the PSC of MD, the MD Office of People’s Counsel (OPC), Montgomery County, MD and the Apartment and Office Building Association of Metropolitan Washington (AOBA) filed written comments on Washington Gas' response to the Show-Cause Order. Technical Staff commented that the PSC of MD may impose a civil penalty but did not expressly recommend same. Montgomery County, MD, OPC and AOBA requested that the PSC of MD impose a civil penalty on Washington Gas. On December 17, 2019, the PSC of MD held a public hearing near the apartment complex at Arliss Street, at which some residents requested that Washington Gas accelerate and complete its mercury service regulator program and that Washington Gas absorb the cost of same. Washington Gas intends to file comments with the PSC of MD responding to all written comments and resident testimony and has accrued a penalty of US$0.3 million based on a potential range of estimates.

Virginia Jurisdiction

On July 31, 2018, Washington Gas filed an application with the SCC of VA to increase its base rates for natural gas service by US$38 million, which included US$15 million related to the SAVE surcharge. Additionally, the requested revenue increase incorporated the effects of the TCJA. Interim rates became effective, subject to refund, for usage in the January 2019 billing cycle. On April 12, 2019, Washington Gas filed rebuttal testimony and revised its original return on equity down from 10.6 percent to 10.3 percent and its overall rate of return down from 7.94 percent to 7.81 percent. On September 16, 2019, the HE issued a report with recommendations to the SCC of VA including no incremental rate increase aside from bringing the SAVE rider to the base rate. On October 21, 2019, Washington Gas filed comments on and exceptions to the HE's report, recommending the SCC of VA reject certain of the HE's findings. On December 20, 2019, the Commission issued a Final Order adjusting certain of the HE’s findings, some of which are favorable to Washington Gas. The Final Order approved: (i) an increase in base rates of US$13 million to reflect the transfer of US$102 million of SAVE investment from the SAVE rider to rate base; (ii) an ROE range of 8.7 percent to 9.7 percent with a mid-point of 9.2 percent; (iii) the amortization of unprotected excess deferred income tax over eight years; and (iv) the refund of a US$26 million TCJA liability over a 12-month period as a sur-credit. On January 9, 2020, Washington Gas filed a petition for rehearing regarding one of the findings. On January 30, 2020, the SCC of VA denied this request and the rate case is now final.

In connection with the WGL Acquisition, AltaGas and WGL have made commitments related to the terms of the PSC of DC settlement agreement and the conditions of approval from the PSC of MD and the SCC of VA. Among other things, these commitments include rate credits distributable to both residential and non-residential customers, gas expansion and other programs, various public interest commitments, and safety programs. As at December 31, 2019, the cumulative amount expensed to date was approximately US$137 million, of which US$17 million had not been paid. In addition, there are certain additional regulatory commitments which will be expensed when the costs are incurred in the future, including the hiring of damage prevention trainers, investing up to US$70 million over a 10-year period to further extend natural gas service, and investing US$8 million for leak mitigation.

Hampshire Gas

Hampshire owns underground natural gas storage facilities, including pipeline delivery facilities located in and around Hampshire County, West Virginia, and operates these facilities to serve Washington Gas. Hampshire is regulated by FERC. Washington Gas purchases all of the storage services of Hampshire, and includes the cost of the services in the commodity cost of its regulated energy bills to customers. Hampshire operates under a “pass-through” cost-of-service based tariff approved by FERC.

SEMCO Energy

SEMCO Energy’s head office is located in Port Huron, Michigan. SEMCO Energy’s primary business is a gas utility business. It operates regulated natural gas transmission and distribution divisions in Michigan, doing business as SEMCO Gas, and in Alaska, doing business as ENSTAR. SEMCO Energy’s gas utility business also includes a 65 percent ownership interest

AltaGas Ltd. – 2019 Annual Information Form – 26

in CINGSA, a regulated natural gas storage utility in Alaska. The gas utility business accounts for approximately 99 percent of SEMCO Energy’s 2019 consolidated revenues. The gas utility business purchases, transports, distributes and sells natural gas and related gas distribution services to residential and C&I customers and is SEMCO Energy's largest business segment.

SEMCO Gas

In Michigan, SEMCO Gas distributes natural gas to approximately 307,000 regulated customers located in both southern Michigan and Michigan’s Upper Peninsula, approximately 85 percent of which are residential. The remaining customers include power plants, food production facilities, furniture manufacturers, and other industrial customers.

The average number of customers at SEMCO Gas has increased by an average of approximately 1 percent annually during the past three years (with an increase of 1 percent in 2019). While there may occasionally be variations in this pattern, average per customer annual gas consumption in Michigan over the longer-term has been decreasing because of, among other things, the availability of and incentive to invest in more energy efficient homes and appliances.

SEMCO Gas pursues opportunities to develop service areas that are not currently served with natural gas. Expansion opportunities that currently exist represent relatively minor asset growth, but SEMCO Gas remains committed to its strategy of pursuing expansion projects that meet management’s target return on investment.

Operations

The SEMCO Gas natural gas transmission and delivery system in Michigan includes approximately 151 miles of gas transmission pipelines and 6,175 miles of gas distribution mains. The pipelines and mains are located throughout the southern half of Michigan’s Lower Peninsula (including in and around the cities of Albion, Battle Creek, Holland, Niles, Port Huron, and Three Rivers) and also in the central, eastern, and western areas of Michigan’s Upper Peninsula.

SEMCO Gas has access to natural gas supplies throughout the U.S. and Canada via interstate and intrastate pipelines in and near Michigan. To provide gas to SEMCO Gas sales customers, SEMCO Gas has negotiated standard terms and conditions for the purchase of natural gas under the NAESB form of agreement with a variety of suppliers.

The following table sets out, by customer category, SEMCO Gas’ deliveries:

2019 | 2018 | |

Deliveries: (MDth) | ||

Residential | 26,841 | 27,278 |

Commercial | 15,976 | 13,595 |

Transport | 22,712 | 22,248 |

Gas Customer Choice (1) | 3,719 | 3,394 |

Total deliveries | 69,248 | 66,515 |

2019 | 2018 | |

Customers at Year End (2): | ||

Residential | 260,548 | 258,300 |

Commercial | 23,880 | 23,523 |

Transport | 249 | 253 |

Gas Customer Choice (1) | 22,247 | 21,102 |

Total customers | 306,924 | 303,178 |

(1) | In Michigan, the MPSC has a program known as the Gas Customer Choice Program, under which gas sales customers may choose to purchase natural gas from third-party suppliers, while SEMCO Gas continues to charge these customers applicable distribution charges and customer fees, plus a balancing fee. |

(2) | Excludes customers from SEMCO Gas’ non-regulated business. |

AltaGas Ltd. – 2019 Annual Information Form – 27

Seasonality

The natural gas distribution business in Michigan is seasonal, as the majority of natural gas demand occurs during the winter heating season that extends from November to March. Accordingly, annualized individual quarterly revenues and earnings are not indicative of annual results.

Forecasted volumes for SEMCO Gas are set based on the 15-year rolling average Degree Days expected for the period. Temperature fluctuations impact the operating results of SEMCO Gas.

Material Regulatory Developments and Approvals

As required by an order issued by the MPSC in September 2012, SEMCO Gas filed a depreciation study with the MPSC in September 2017, using 2016 data. On April 9, 2018, the MPSC issued an order approving the settlement agreement and new depreciation rates. The new rates reflect an approximately US$2 million upward adjustment to depreciation expense when compared to the current rates and were effective on January 1, 2019. SEMCO Gas is required to file a new depreciation case and updated depreciation study with the MPSC no later than September 30, 2022, using 2021 data.

On May 31, 2019, SEMCO Gas filed a request with the MPSC seeking authority to increase SEMCO Gas' base rates by approximately US$38 million on an annual basis established with a forecasted test year of 2020. The increase in rates requested captures the inflation of operations and maintenance costs from the last rate case in 2010 as well as the investment in the Marquette Connector Pipeline. With the upcoming sunset of the MRP in 2020, this case includes the addition of a new MRP and the introduction of an IRIP to recover the capital costs associated with the replacement of certain mains, services, and other infrastructure through surcharges similar to the currently-enacted MRP program. In November 2019, a settlement agreement was filed for a rate increase of approximately US$20 million and an allowed return on equity of 9.87 percent. The MPSC approved the settlement in December 2019 and the new rates are effective January 1, 2020. Pursuant to the approval of the IRIP, SEMCO Gas will complete certain projects totaling US$55 million to improve the reliability of infrastructure and customers will be billed a surcharge beginning in 2021. SEMCO Gas cannot seek an increase in its general rates to take effect prior to January 1, 2023.

ENSTAR

In Alaska, ENSTAR distributes natural gas to approximately 147,000 customers in the metropolitan Anchorage area and surrounding Cook Inlet area, approximately 91 percent of which are residential. The remaining gas sales customers include hospitals, universities, and government buildings. ENSTAR also provides gas transportation service to power plants and an LNG plant. ENSTAR’s service area encompasses over 50 percent of the population of Alaska.

The average number of customers at ENSTAR has increased by an average of approximately 1 percent annually during the past three years (with an increase of 1 percent in 2019). While there may occasionally be variations in this pattern, average per customer annual gas consumption in Alaska over the longer term has been decreasing due to the availability of and incentive to invest in more energy efficient homes and appliances.

Operations

ENSTAR’s natural gas delivery system (including SEMCO Energy’s Alaska Pipeline Company) includes approximately 446 miles of gas transmission pipelines and 3,149 miles of gas distribution mains. ENSTAR’s pipelines and mains are located in Anchorage and the Cook Inlet area of Alaska.

Historically, ENSTAR has had access to significant natural gas supplies in Cook Inlet, which are within or adjacent to its service territory. ENSTAR’s distribution system, including the Alaska Pipeline Company transmission-level pipeline system, is not linked to major interstate and intrastate pipelines and thus does not have access to natural gas supplies elsewhere in Alaska, Canada, or the lower 48 states. As a result, ENSTAR must procure its natural gas supplies under gas supply agreements from producers in and near the Cook Inlet area. Natural gas production in Cook Inlet has decreased significantly

AltaGas Ltd. – 2019 Annual Information Form – 28

in recent years as has the amount of deliverability available from Cook Inlet producers. The majority of ENSTAR’s gas supply and deliverability needs are provided by long-term contracts with Cook Inlet producers into 2023.

In order to better address the seasonal deliverability demands of ENSTAR’s customers, SEMCO Energy developed the CINGSA Storage facility.

The following table sets out, by customer category, ENSTAR’s deliveries:

2019 | 2018 | |

Deliveries: (Mmcf) | ||

Residential | 16,308 | 18,322 |

Commercial | 13,367 | 12,415 |

Transport | 24,473 | 25,041 |

Total deliveries | 54,148 | 55,778 |

2019 | 2018 | |

Customers at Year End: | ||

Residential | 133,654 | 132,270 |

Commercial | 12,940 | 12,829 |

Transport | 23 | 22 |

Total customers | 146,617 | 145,121 |

Seasonality

The natural gas distribution business in Alaska is seasonal, as the majority of natural gas demand occurs during the winter heating season that extends from November to March. Accordingly, annualized individual quarterly revenues and earnings are not indicative of annual results.

Forecasted volumes for ENSTAR are set based on the 10-year rolling average Degree Days expected for the period. Temperature fluctuations impact the operating results of ENSTAR.

Material Regulatory Developments and Approvals

On March 23, 2018, the RCA sent a letter to several investor-owned utilities in Alaska, asking for the utilities’ proposed response to the TCJA. On April 26, 2018, ENSTAR filed its proposed reduction in rates with the RCA, reflecting a US$5 million decrease from the annual revenue requirement that was determined in October 2017. On May 29, 2018, the RCA approved ENSTAR’s proposed rate decrease and the reduced rates went into effect on June 1, 2018. ENSTAR anticipates addressing excess deferred income taxes in its next rate case, which is required to be filed no later than June 1, 2021, with a test year of 2020.

On November 30, 2018, Southcentral Alaska experienced a magnitude 7.1 earthquake with an epicenter close to Anchorage, Alaska. ENSTAR experienced a large number of above and below ground gas leaks in its service territory. On December 2, 2019, ENSTAR filed a request to establish a regulatory deferred asset with the RCA to recover uninsured losses associated with the earthquake in its next rate case, which is required to be filed in 2021. As at December 31, 2019, the associated losses totaled US$2 million. ENSTAR's insurance deductible for this type of claim is US$1 million.

CINGSA