U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 40-F

o REGISTRATION STATEMENT PURSUANT TO SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934.

x ANNUAL REPORT PURSUANT TO SECTION 13(a) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended: December 31, 2018 |

|

Commission File Number: 333-225606 |

ALTAGAS LTD.

(Exact name of Registrant as specified in its charter)

Canada

(Province or other jurisdiction of incorporation or organization)

|

1311 |

|

None |

1700, 355-4th Avenue SW

Calgary, Alberta T2P 0J1

(403) 691-7575

(Address and telephone number of Registrant’s principal executive offices)

AltaGas Services (U.S.) Inc.

1919 McKinney Ave.

Dallas, Texas 75201

(469) 904-5200

(Name, address (including zip code) and telephone number (including area code)

of agent for service in the United States)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

None

(Title of Class)

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

For Annual Reports indicate by check mark the information filed with this Form:

|

x Annual information form |

|

x Audited annual financial statements |

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

There were 275,224,066 Common Shares, of no par value, outstanding as of December 31, 2018.

Indicate by check mark whether the Registrant (1) has filed all reports to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files).

Yes x No o

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company o

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

This Annual Report on Form 40-F shall be incorporated by reference into or as an exhibit to, as applicable, the registrant’s Registration Statement on Form F-10 (File No. 333-225606) and under the Securities Act of 1933, as amended.

PRINCIPAL DOCUMENTS

The following documents have been filed as part of this Annual Report on Form 40-F as Appendices hereto:

A. Annual Information Form

The Annual Information Form of AltaGas Ltd. (the “Company” or “Registrant”) for the fiscal year ended December 31, 2018 is included as Appendix A of this Annual Report on Form 40-F.

B. Audited Annual Financial Statements

The Company’s audited consolidated financial statements for the fiscal year ended December 31, 2018, including the auditor’s report with respect thereto, are included as Appendix B of this Annual Report on Form 40-F.

C. Management’s Discussion and Analysis

The Company’s Management’s Discussion and Analysis for the year ended December 31, 2018 is included as Appendix C of this Annual Report on Form 40-F.

CERTIFICATIONS AND DISCLOSURE REGARDING CONTROLS AND PROCEDURES

Certifications. See Exhibits 99.2, 99.3, 99.4 and 99.5 to this Annual Report on Form 40-F.

Disclosure Controls and Procedures. The Registrant maintains disclosure controls and procedures and internal control over financial reporting designed to ensure that information required to be disclosed in the Registrant’s filings under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the rules and forms of the Securities and Exchange Commission (the “SEC”). The Registrant’s Chief Executive Officer (“CEO”) and Chief Financial Officer (“CFO”), after having evaluated the effectiveness of the Registrant’s disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) as of the end of the period covered by this report, have concluded that, as of such date, the Registrant’s disclosure controls and procedures were effective to ensure that information required to be disclosed by the Registrant in reports that the Registrant files or submits under the Exchange Act is (i) recorded, processed, summarized and reported, within the time periods specified in the SEC’s rules and forms, and (ii) accumulated and communicated to management, including its principal executive and principal financial officers, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure. However, as recommended by the SEC in its adopting release for the rules governing the disclosure and control procedures discussed above, the Registrant will continue to periodically evaluate its disclosure controls and procedures and will make modifications from time to time as deemed necessary to ensure that information is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms.

The Registrant’s disclosure controls and procedures are designed to provide reasonable assurance of achieving their objectives, and, as indicated in the preceding paragraph, the CEO and CFO believe that the Registrant’s disclosure controls and procedures are effective at that reasonable assurance level, although the CEO and CFO do not expect that the disclosure controls and procedures or internal control over financial reporting will prevent all errors and fraud. A control system, no matter how well conceived or operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met.

Management Report on Internal Control over Financial Reporting: This annual report does not include a report of management’s assessment regarding internal control over financial reporting or an attestation report of the company’s registered public accounting firm due to a transition period established by rules of the Securities and Exchange Commission for newly public companies.

Changes in Internal Control Over Financial Reporting. During the fiscal year ended December 31, 2018, there were no changes in the Registrant’s internal control over financial reporting that have materially affected, or are reasonably likely to materially affect, the Registrant’s internal control over financial reporting.

NOTICES PURSUANT TO REGULATION BTR

None.

IDENTIFICATION OF THE AUDIT COMMITTEE

The Registrant has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. The members of the audit committee are: Catherine M. Best, Allan L. Edgeworth, Robert B. Hodgins and Pentti Karkkainen.

AUDIT COMMITTEE FINANCIAL EXPERT

The board of directors of the Registrant has determined that each Catherine M. Best, Allan L. Edgeworth, Robert B. Hodgins and Pentti Karkkainen, members of the Registrant’s audit committee, qualify as audit committee financial experts for purposes of paragraph (8) of General Instruction B to Form 40-F. Details of the relevant experience of each member of the audit committee is included under the heading “Audit Committee — Relevant Education and Experience” at page 55 of the Registrant’s Annual Information Form for the fiscal year ended December 31, 2018, filed as part of this Annual Report on Form 40-F in Appendix A. The board of directors has further determined that each of Catherine M. Best, Allan L. Edgeworth, Robert B. Hodgins and Pentti Karkkainen is also independent, as that term is defined in the Corporate Governance Listing Standards of the New York Stock Exchange (the “NYSE”). The Commission has indicated that the designation of each Catherine M. Best, Allan L. Edgeworth, Robert B. Hodgins and Pentti Karkkainen as an audit committee financial

expert does not make any of them an “expert” for any purpose, impose any duties, obligations or liabilities on them that are greater than those imposed on members of the audit committee and the board of directors who do not carry this designation or affect the duties, obligations or liabilities of any other member of the audit committee or the board of directors.

ADDITIONAL DISCLOSURE

Code of Ethics.

The Registrant has adopted a “code of ethics” (as that term is defined in Form 40-F), entitled the “Code of Business Ethics”, that applies to directors, officers, employees, contractors, consultants, representatives and agents of the Registrant including its principal executive officer, principal financial officer, principal accounting officer or controller, and persons performing similar functions. In 2018, there were no waivers, including implicit waivers, or amendments granted from any provision of the Code of Business Ethics.

The Code of Business Ethics is available for viewing on the Registrant’s website at www.altagas.ca.

Principal Accountant Fees and Services.

The required disclosure is included under the heading “Audit Committee - External Auditor Service Fees by Category” of the Registrant’s Annual Information Form for the fiscal year ended December 31, 2018, filed as part of this Annual Report on Form 40-F in Appendix A.

Pre-Approval Policies and Procedures.

The Audit Committee pre-approves all audit services to be provided to us by our independent auditors. The Audit Committee’s policy regarding the pre-approval of non-audit services to be provided to us by our independent auditors is that all such services shall be pre-approved by the Audit Committee. All non-audit services performed by our auditors for the fiscal year ended December 31, 2018 have been pre-approved by our Audit Committee.

Off-Balance Sheet Arrangements.

The Registrant has no off-balance sheet arrangements as defined under Form 40-F.

Tabular Disclosure of Commitments.

The required disclosure is included under the heading “Contractual Obligations” in the registrant’s Management’s Discussion and Analysis for the year ended December 31, 2018, filed as part of this Annual Report on Form 40-F in Appendix C.

Mine Safety Disclosure.

Not applicable.

UNDERTAKING

Registrant undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the Commission staff, and to furnish promptly, when requested to do so by the Commission staff, information relating to: the securities registered pursuant to Form 40-F; the securities in relation to which the obligation to file an annual report on Form 40-F arises; or transactions in said securities.

CONSENT TO SERVICE OF PROCESS

Form F-X signed by the Registrant and its agent for service of process has been filed with the Commission together with Registrant’s Registration Statement on Form 40-F (333-225606) in connection with its securities registered on such form.

Any changes to the name or address of the agent for service of process of the Registrant shall be communicated promptly to the Commission by an amendment to the Form F-X referencing the file number of the Registrant.

SIGNATURES

Pursuant to the requirements of the Exchange Act, the Registrant certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this Annual Report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: February 28, 2019

|

|

AltaGas Ltd. | |

|

|

|

|

|

|

By: |

/s/ Randall L. Crawford |

|

|

Name: |

Randall L. Crawford |

|

|

Title: |

President and Chief Executive Officer |

EXHIBIT INDEX

|

Exhibit |

|

Description |

|

|

|

|

|

99.1 |

|

Consent of Ernst & Young LLP, Independent Registered Public Accountant |

|

|

|

|

|

99.2 |

|

Certification of Chief Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

|

|

|

|

|

99.3 |

|

Certification of Chief Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

|

|

|

|

|

99.4 |

|

Certification of Chief Executive Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

|

|

|

|

|

99.5 |

|

Certification of Chief Financial Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

|

|

|

|

|

101 |

|

Interactive Data File |

APPENDIX A

ALTAGAS LTD. ANNUAL INFORMATION FORM FOR THE FISCAL YEAR

ENDED DECEMBER 31, 2018

ALTAGAS LTD.

Annual Information Form

For the year ended December 31, 2018

Dated: February 27, 2019

TABLE OF CONTENTS

|

GENERAL INFORMATION |

2 |

|

FORWARD-LOOKING INFORMATION AND STATEMENTS |

2 |

|

GLOSSARY |

4 |

|

METRIC CONVERSION |

11 |

|

CORPORATE STRUCTURE |

11 |

|

INCORPORATION |

11 |

|

AMENDED ARTICLES |

11 |

|

INTERCORPORATE RELATIONSHIPS |

12 |

|

OVERVIEW OF THE BUSINESS |

13 |

|

ALTAGAS’ GEOGRAPHIC FOOTPRINT |

14 |

|

RECENT NOTEWORTHY TRANSACTIONS |

16 |

|

OUTLOOK |

17 |

|

GENERAL DEVELOPMENT OF ALTAGAS’ BUSINESS |

18 |

|

DEVELOPMENT OF THE UTILITIES BUSINESS OF ALTAGAS |

18 |

|

DEVELOPMENT OF THE MIDSTREAM BUSINESS OF ALTAGAS |

19 |

|

DEVELOPMENT OF THE POWER BUSINESS OF ALTAGAS |

20 |

|

BUSINESS OF THE CORPORATION |

21 |

|

UTILITIES BUSINESS |

21 |

|

MIDSTREAM BUSINESS |

31 |

|

POWER BUSINESS |

41 |

|

CORPORATE SEGMENT |

46 |

|

CAPITAL STRUCTURE |

46 |

|

DESCRIPTION OF CAPITAL STRUCTURE |

46 |

|

GENERAL |

48 |

|

EMPLOYEES |

48 |

|

DIRECTORS AND OFFICERS |

49 |

|

EXECUTIVE OFFICERS |

52 |

|

AUDIT COMMITTEE |

53 |

|

RISK FACTORS |

54 |

|

ENVIRONMENTAL AND SAFETY POLICIES AND SOCIAL RESPONSIBILITY |

69 |

|

ENVIRONMENTAL REGULATION |

69 |

|

STAKEHOLDER ENGAGEMENT AND INDIGENOUS PEOPLES POLICY |

73 |

|

DIVIDENDS |

73 |

|

MARKET FOR SECURITIES |

75 |

|

CREDIT RATINGS |

78 |

|

MATERIAL CONTRACTS |

79 |

|

INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS |

80 |

|

LEGAL PROCEEDINGS |

80 |

|

REGULATORY ACTIONS |

80 |

|

INTERESTS OF EXPERTS |

80 |

|

ADDITIONAL INFORMATION |

81 |

|

TRANSFER AGENTS AND REGISTRARS |

81 |

|

SCHEDULE A: AUDIT COMMITTEE MANDATE |

A-1 |

GENERAL INFORMATION

Unless otherwise noted, the information contained in this AIF is stated as at December 31, 2018 and all dollar amounts in this AIF are in Canadian dollars. Financial information is presented in accordance with United States generally accepted accounting principles. For an explanation of certain terms and abbreviations used in this AIF see the “Glossary” of this AIF.

FORWARD-LOOKING INFORMATION AND STATEMENTS

This AIF contains forward-looking information (forward-looking statements). Words such as “may”, “can”, “would”, “could”, “should”, “will”, “intend”, “plan”, “anticipate”, “believe”, “aim”, “seek”, “propose”, “contemplate”, “estimate”, “focus”, “strive”, “forecast”, “expect”, “project”, “target”, “potential”, “objective”, “continue”, “outlook”, “vision”, “opportunity” and similar expressions suggesting future events or future performance, as they relate to the Corporation or any affiliate of the Corporation, are intended to identify forward-looking statements. In particular, this AIF contains forward-looking statements with respect to, among other things, business objectives, expected growth, results of operations, performance, business projects and opportunities and financial results.

Specifically, such forward-looking statements included in this document include, but are not limited to, statements with respect to the following: the Corporation’s long-term strategy in regard to its Utilities, Midstream and Power segments; provision of certain administrative, corporate and operational services to ACI until June 2020; expected cost of commitments made by the Corporation in relation to the approval of the WGL Acquisition; potential effect of the Ring Fenced Entities being unavailable to the Corporation’s creditors in a bankruptcy; focus on integration activities following completion of the WGL Acquisition; expected operational date of RIPET; expected construction completion schedule, in-service date and date of returns for Marquette Connector Pipeline; additional asset sales of approximately $1.5 to $2.0 billion planned for 2019 and use of funds therefrom; term of WGL transportation and storage contracts; potential and anticipated impacts of the TCJA; filing, hearing and decision dates for pending and future rate cases and matters with PSC of MD, SCC of VA, PSC of DC, MPSC, RCA and D.C. Court of Appeals; timing for expensing and potential recovery of costs associated with regulatory commitments; potential remediation obligations; timing for additional North Pine capacity to be on-stream; timing for Townsend 2B to be on-stream and capacity of the facility; anticipated in-service date for Leidy South; timing of construction of and anticipated investment of WGL in Mountain Valley; estimated operations capacity of RIPET; expected impact of regulation on each of the Corporation’s segments; intention not to use preferred shares as a defensive tactic; and future payment and level of dividends.

These statements involve known and unknown risks, uncertainties and other factors that may cause actual results, events and achievements to differ materially from those expressed or implied by such statements. Such statements reflect AltaGas’ current expectations, estimates and projections based on certain material factors and assumptions at the time the statement was made. Material assumptions include: expected commodity supply, demand and pricing; volumes and rates; exchange rates; inflation; interest rates; credit rating; regulatory approvals and policies; future operating and capital costs; project completion dates; capacity expectations; implications of recent U.S. tax legislation changes; and the outcomes of significant commercial contract negotiation;.

AltaGas’ forward-looking statements are subject to certain risks and uncertainties which could cause results or events to differ from current expectations, including, without limitation: access to capital and increased borrowing costs; condition and overall strength of the global economy; changes in energy consumption by consumers; fluctuations in commodity prices and interest rates; changes in AltaGas’ credit ratings; foreign exchange risk; ability to service debt; market value of AltaGas’ securities; AltaGas’ ability to pay dividends; risks associated with the acquisition of WGL and the underlying business of WGL; risks in AltaGas’ growth strategy; issuance of additional shares; volume throughput and the impacts of commodity pricing, supply, composition and other market risks; counterparty credit risk; dependence on third parties; natural gas supply risk; changes in law; legislative and regulatory environment and decisions; AltaGas’ ability to economically and safely develop, contract and operate assets; potential litigation; cybersecurity risks; AltaGas’ relationships with external stakeholders, including Indigenous stakeholders; available electricity prices; interest rate risk; underinsured losses; weather, hydrology and climate changes; the potential for service interruptions; the Harmattan Rep agreements; availability of supply from Cook Inlet; health and safety risks; AltaGas’ ability to update infrastructure on a timely basis; effects of decommissioning, abandonment and reclamation costs; impact of labour relations and reliance on key personnel; availability of biomass fuel; and the other factors discussed under the heading “Risk Factors” in this AIF.

Many factors could cause AltaGas’ or any particular business segment’s actual results, performance or achievements to vary from those described in this AIF, including, without limitation, those listed above and the assumptions upon which

they are based proving incorrect. These factors should not be construed as exhaustive. Should one or more of these risks or uncertainties materialize, or should assumptions underlying forward-looking statements prove incorrect, actual results may vary materially from those described in this AIF as intended, planned, anticipated, believed, sought, proposed, estimated, forecasted, expected, projected or targeted and such forward-looking statements included in this AIF, should not be unduly relied upon. The impact of any one assumption, risk, uncertainty or other factor on a particular forward-looking statement cannot be determined with certainty because they are interdependent and AltaGas’ future decisions and actions will depend on management’s assessment of all information at the relevant time. Such statements speak only as of the date of this AIF. AltaGas does not intend, and does not assume any obligation, to update these forward-looking statements except as required by law. The forward-looking statements contained in this AIF are expressly qualified by these cautionary statements.

Financial outlook information contained in this AIF about prospective results of operations, financial position or cash flow is based on assumptions about future events, including economic conditions and proposed courses of action, based on management’s assessment of the relevant information currently available. Readers are cautioned that such financial outlook information contained in this AIF should not be used for purposes other than for which it is disclosed herein.

GLOSSARY

Unless the context otherwise requires, terms used in this AIF have the following meanings and references to agreements include any amendments, restatements, modifications or supplements in effect as of the date hereof:

“ACI” means AltaGas Canada Inc.;

“ACI IPO” means initial public offering of common shares of ACI;

“AESO” means the Alberta Electric System Operator;

“AIF” means this Annual Information Form;

“AIJVLP” means AltaGas Idemitsu Joint Venture Limited Partnership;

“AltaGas” or the “Corporation” means AltaGas Ltd., including, where the context requires, the affiliates of AltaGas Ltd.;

“Alton Natural Gas Storage Project” means the underground gas storage facility and associated pipelines located near Truro, Nova Scotia that is currently under construction and owned by AltaGas’ indirect wholly-owned subsidiary Alton Natural Gas Storage L.P.;

“ASC” means the Alberta Securities Commission;

“Astomos” means Astomos Energy Corporation;

“AUI” means AltaGas Utilities Inc.;

“Bbls” means stock tank barrels of ethane and NGLs, expressed in standard 42 U.S. gallon barrels or 34.972 imperial gallon barrels;

“Bbls/d” means Bbls per day;

“Bcf” means billion cubic feet or 1,000,000 Mcf of natural gas;

“Bcf/d” means Bcf per day;

“BC Hydro” means the British Columbia Hydro and Power Authority;

“BCOGC” means the British Columbia Oil and Gas Commission;

“BCSC” means the British Columbia Securities Commission;

“Black Swan” means Black Swan Energy Ltd.;

“Blair Creek Facility” means the Blair Creek Processing Facility located approximately 140 km northwest of Fort St. John, British Columbia, owned by AltaGas’ indirect wholly-owned subsidiary AltaGas Northwest Processing Limited Partnership;

“Blythe” means Blythe Energy Inc.;

“Blythe Energy Center” means the 507 MW gas-fired generation facility located near Blythe, California, together with the related 67 miles transmission lines, owned by AltaGas’ indirect wholly-owned subsidiary Blythe;

“Board of Directors” means the board of directors of AltaGas, as from time to time constituted;

“Bridge Facility” means the bridge facility of up to US$3.0 billion provided by a syndicate of lenders, including JPMorgan Chase Bank, N.A., The Toronto-Dominion Bank and Royal Bank of Canada;

“Brush II” means the 70 MW gas-fired generation facility in Colorado, owned by AltaGas’ indirect wholly-owned subsidiary AltaGas Brush Energy Inc.;

“C&I” means commercial and industrial;

“Cabot” means Cabot Oil & Gas Corporation;

“CAISO” means the California Independent System Operator;

“CBCA” means the Canada Business Corporations Act, R.S.C. 1985, c. C 44, as amended from time to time, including the regulations from time to time promulgated thereunder;

“CCAA” means the Companies’ Creditors Arrangement Act, R.S.C. 1985, c. C 36, as amended from time to time, including the regulations from time to time promulgated thereunder;

“CCEMA” means the Climate Change and Emissions Management Act, S.A. 2003, C-16.7, as amended from time to time, including the regulations from time to time promulgated thereunder;

“CCIR” means the Carbon Competitiveness Incentive Regulation, A.R. 255/2017 under the CCEMA, as amended from time to time;

“Central Penn” means the Central Penn pipeline, a 185 mile pipeline originating in Susquehanna County, Pennsylvania and extending to Lancaster County, Pennsylvania;

“CES” means Commercial Energy Systems;

“CINGSA” means Cook Inlet Natural Gas Storage Alaska, LLC;

“CINGSA Storage Facility” means the in-field storage facility in the Cook Inlet area of Alaska owned and operated by CINGSA;

“CN” means Canadian National Railway Company;

“Common Shares” means common shares of AltaGas Ltd.;

“Constitution” means Constitution Pipeline Company, LLC;

“Co-stream Facility” means the connection of Harmattan to the west leg of the NGTL system, and the related NGL extraction equipment, to process up to 250 Mmcf/d of natural gas at Harmattan to recover ethane and NGLs;

“CPI” means the Consumer Price Index;

“DBRS” means DBRS Limited and its successors;

“Dekatherm” means 10 Therms;

“Degree Day” means the amount that the daily mean temperature deviates below 65 degrees Fahrenheit at SEMCO Gas, ENSTAR, and Washington Gas, such that a one degree difference equates to one Degree Day;

“EEEP” means the Edmonton ethane extraction plant and related facilities, AltaGas’ interest being owned by its indirect wholly-owned subsidiary AltaGas Extraction and Transmission Limited Partnership;

“EHS Management System” means AltaGas’ Environmental, Health & Safety Management System;

“ENSTAR” means the natural gas distribution business conducted by SEMCO Energy in Alaska under the name ENSTAR Natural Gas Company;

“EH&S Committee” means the Environment, Health and Safety Committee of the Board of Directors;

“EPA” means electricity purchase agreement;

“EQM” means EQM Gathering Opco, LLC;

“EQT” means EQT Midstream Partners, LP;

“ESA” means Energy Storage Resource Adequacy Purchase Agreement;

“FERC” means the United States Federal Energy Regulatory Commission;

“Ferndale Terminal” means the storage, distribution and export facility for bulk shipments of propane, butane and iso-butane located on the west coast near Ferndale, Washington, and owned by a subsidiary of Petrogas;

“FID” means final investment decision;

“Fitch” means Fitch Ratings Inc.;

“Forrest Kerr” means the 195 MW run-of-river hydroelectric facility, one of the three run-of-river hydroelectric facilities in northwest British Columbia that forms part of the Northwest Hydro Facilities;

“GHG” means greenhouse gas;

“GJ” means gigajoule or 1,000,000,000 joules;

“Gordondale Facility” means the Gordondale Gas Processing Facility in the Gordondale area of the Montney reserve area approximately 100 km northwest of Grande Prairie, Alberta, owned by AltaGas’ indirect wholly-owned subsidiary AltaGas Northwest Processing Limited Partnership;

“GSAs” means Groundwater Sustainability Agencies;

“GWh” means gigawatt-hour or 1,000,000,000 watt-hours; the watt-hour is equal to one watt of power flowing steadily for one hour;

“Hampshire Gas” means Hampshire Gas Company, a subsidiary of WGL that provides regulated interstate natural gas storage services to Washington Gas under a FERC approved interstate storage service tariff;

“Harmattan” means the combined Harmattan gas processing facility and extraction plant and associated facilities, owned by AltaGas’ indirect wholly-owned subsidiary Harmattan Gas Processing Limited Partnership;

“Heritage Gas” means Heritage Gas Limited;

“HHCs” means heavy hydrocarbons;

“Idemitsu” means Idemitsu Kosan Co., Ltd.;

“JEEP” means the Joffre ethane extraction plant and related facilities;

“Kelt” means Kelt Exploration (LNG) Ltd;

“km” means kilometer;

“Leidy South” means the expansion of Central Penn, which WGL Midstream is participating in;

“LNG” means liquefied natural gas;

“LPG” means liquefied petroleum gas;

“m3” means a cubic meter of natural gas at standard conditions of measurement;

“Marquette Connector Pipeline” means the proposed new pipeline to be constructed, owned and operated by SEMCO Gas that will connect the Great Lakes Gas Transmission pipeline to the Northern Natural Gas pipeline in Marquette, Michigan;

“Mcf” means a thousand cubic feet of natural gas at standard imperial conditions of measurement;

“Mcf/d” means Mcf per day;

“McLymont Creek” means the 66 MW run-of-river hydroelectric facility, one of the three run-of-river hydroelectric facilities in northwest British Columbia that forms part of the Northwest Hydro Facilities;

“MDth” means millions of Dekatherms;

“Meade” means Meade Pipeline Co LLC;

“Merger Agreement” means the agreement and plan of merger dated as of January 25, 2017 among AltaGas, Merger Sub and WGL;

“Merger Sub” means Wrangler Inc., a Virginia corporation and an indirect wholly-owned subsidiary of AltaGas;

“MGP” means manufactured gas plant;

“Mmcf” means a million cubic feet of natural gas at standard conditions of measurement;

“Mmcf/d” means Mmcf per day;

“Mountain Valley” means Mountain Valley pipeline, an equity investment of WGL Midstream;

“MPSC” means the Michigan Public Service Commission;

“MTN” means medium term notes issued from time to time under either the amended and restated trust indenture dated July 1, 2010 between AltaGas and Computershare Trust Company of Canada, as further amended, restated, supplemented or otherwise modified from time to time or the trust indenture dated September 26, 2017 between AltaGas and Computershare Trust Company of Canada, as amended, restated, supplemented or otherwise modified from time to time, as the case may be;

“MW” means megawatt; one MW is 1,000,000 watts; the watt is the basic electrical unit of power;

“MWh” means megawatt-hour or 1,000,000 watt-hours; the watt-hour is equal to one watt of power flowing steadily for one hour;

“NFA” means No Further Action;

“NGL” or “NGLs” means natural gas liquids, which includes primarily propane, butane and condensate;

“NGTL” means NOVA Gas Transmission Ltd.;

“Non-Ring Fenced Entities” means AltaGas and its affiliates other than Washington Gas and the SPE;

“North Pine Facility” means the NGL separation facility, located approximately 40 km northwest of Fort St. John, British Columbia.

“North Pine Pipelines” means two eight inch diameter NGL supply pipelines, each approximately 40 km in length, which runs from the existing Alaska Highway truck terminal to the North Pine Facility;

“Northwest Hydro Facilities” means the three run-of-river hydroelectric facilities in northwest British Columbia, being Forrest Kerr, McLymont Creek and Volcano Creek;

“Nova Chemicals” means NOVA Chemicals Corporation;

“NYSDEC” means the New York State Department of Environmental Conservation;

“Painted Pony” means Painted Pony Energy Ltd.;

“PG&E” means Pacific Gas & Electric Company;

“Pembina” means Pembina Infrastructure and Logistics LP;

“Petrogas” means Petrogas Energy Corp., a privately-held leading North American integrated midstream company in which AltaGas Idemitsu Joint Venture Limited Partnership has a two-third ownership interest;

“Plan” means the Premium DividendTM, Dividend Reinvestment and Optional Cash Purchase Plan of the Corporation;

“PNG” means Pacific Northern Gas Ltd.;

“Pool” means the scheme operated by the AESO for (i) exchanges of electric energy, and (ii) financial settlement for the exchange of electric energy;

“Pomona” means the 44.5 MW gas-fired generation facility located in Pomona, California, owned by AltaGas’ indirect wholly-owned subsidiary AltaGas Pomona Energy Inc.;

“Pomona Energy Storage Facility” means the 20 MW lithium ion battery storage facility in Pomona, California, owned by AltaGas’ indirect wholly-owned subsidiary AltaGas Pomona Energy Storage Inc.;

“PPA” means power purchase agreement;

“Preferred Shares” means the preferred shares of AltaGas Ltd. as a class, including, without limitation, the Series A Shares, Series B Shares, Series C Shares, Series D Shares, Series E Shares, Series F Shares, Series G Shares, Series H Shares, Series I Shares, Series J Shares, Series K Shares, and Series L Shares;

“PRPA” means Prince Rupert Port Authority;

“PSC of DC” means the Public Service Commission of the District of Columbia;

“PSC of MD” means the Maryland Public Service Commission;

“RCA” means the Regulatory Commission of Alaska;

“RECs” means Renewable Energy Credits;

“Rep Agreements” mean the Representation, Management and Processing Agreements at Harmattan;

“RILE LP” means Ridley Island LPG Export Limited Partnership, a limited partnership of which AltaGas’ subsidiaries hold a 70 percent interest and Vopak holds a 30 percent interest;

“Ring Fenced Entities” means Washington Gas and the SPE;

“RIPET” means the Ridley Island Propane Export Terminal, the propane export terminal being constructed by AltaGas’ subsidiary, Ridley Island LPG Export Limited Partnership, to ship up to 1.2 million tonnes of propane per annum and to be located on a portion of land leased by Ridley Terminals Inc. from the PRPA, located on Ridley Island, near Prince Rupert, British Columbia;

TM Denotes trademark of Canaccord Genuity Corp

“Ripon” means the 49.5 MW gas-fired generation facility in Ripon, California, owned by AltaGas’ indirect wholly-owned subsidiary AltaGas Ripon Energy Inc.;

“ROE” means return on equity;

“Royal Vopak” means Koninklijke Vopak N.V., a public company incorporated under the laws of the Netherlands;

“RTI” means Ridley Terminals Inc.;

“S&P” means Standard & Poor’s Ratings Services and its successors;

“Sarbanes-Oxley” means the Sarbanes-Oxley Act of 2002;

“SCC of VA” means the Commonwealth of Virginia State Corporation Commission;

“SCE” means Southern California Edison Company;

“SEDAR” means System for Electronic Document Analysis and Retrieval, at www.sedar.com;

“SEMCO Energy” means SEMCO Energy, Inc.;

“SEMCO Gas” means the Michigan natural gas distribution business conducted by SEMCO Energy in Michigan under the name SEMCO Energy Gas Company;

“Series A Shares” means the cumulative redeemable 5-year fixed rate reset preferred shares, Series A, of AltaGas;

“Series B Shares” means the cumulative redeemable floating rate preferred shares, Series B, of AltaGas

“Series C Shares” means the cumulative redeemable 5-year fixed rate reset preferred shares, Series C, of AltaGas (US dollar);

“Series D Shares” means the cumulative redeemable floating rate preferred shares, Series D, of AltaGas (US dollar);

“Series E Shares” means the cumulative redeemable 5-year fixed rate reset preferred shares, Series E, of AltaGas;

“Series F Shares” means the cumulative redeemable floating rate preferred shares, Series F, of AltaGas;

“Series G Shares” means the cumulative redeemable 5-year fixed rate reset preferred shares, Series G, of AltaGas;

“Series H Shares” means the cumulative redeemable floating rate preferred shares, Series H, of AltaGas;

“Series I Shares” means the cumulative redeemable 5-year minimum fixed rate reset preferred shares, Series I, of AltaGas;

“Series J Shares” means the cumulative redeemable floating rate preferred shares, Series J, of AltaGas;

“Series K Shares” means the cumulative redeemable 5-year minimum fixed rate reset preferred shares, Series K, of AltaGas;

“Series L Shares” means the cumulative redeemable floating rate preferred shares, Series L of AltaGas;

“SGER” means the Specified Gas Emitters Regulation under the CCEMA, which was replaced with the CCIR on January 1, 2018;

“SGMA” means the Sustainable Groundwater Management Act;

“Share Options” means options to acquire Common Shares granted pursuant to AltaGas’ share option plan;

“Shareholders” mean the holders of Common Shares;

“Shell Energy” means Shell Energy North America (US), LP;

“SPE” means Wrangler SPE LLC, a wholly-owned special purpose entity subsidiary of WGL incorporated as a bankruptcy remote entity;

“Stonewall System” means the Stonewall Gas Gathering System;

“Subscription Receipts” means the subscription receipts of AltaGas that were issued in 2017, and automatically exchanged for Common Shares following the closing of the WGL Acquisition in accordance with the terms of the Subscription Receipt Agreement, and subsequently delisted from the TSX;

“Subscription Receipt Agreement” means the subscription receipt agreement dated February 3, 2017 among AltaGas, TD Securities Inc., RBC Dominion Securities Inc. and J.P. Morgan Securities Canada Inc. and Computershare Trust Company of Canada, as subscription receipt agent, governing the terms of the Subscription Receipts;

“Sundance B PPAs” means the former power purchase arrangements of ASTC Power Partnership with respect to unit 3 and unit 4 of the coal-fired Sundance plant owned by TransAlta Generation Partnership located approximately 70 km west of Edmonton, Alberta;

“TCJA” means the Tax Cuts and Jobs Act of 2017.

“Therm” is a natural gas unit of measurement that includes a standard measure for heating value. A Therm of gas contains 100,000 British thermal units of heat, or the energy equivalent of burning approximately 100 cubic feet of natural gas under normal conditions. Ten million Therms equal approximately one billion cubic feet of natural gas. One Mcf equals approximately 10.32 Therms;

“Tidewater” means Tidewater Midstream and Infrastructure Inc.;

“Townsend 2A” means the first 99 Mmcf/d train of Townsend Phase 2, a 198 Mmcf/d shallow-cut gas processing facility located on the existing Townsend Facility site, adjacent to the currently operating Townsend Facility;

“Townsend 2B” means the proposed 198 Mmcf/d C3+ deep cut gas processing facility to be located on the existing Townsend Facility site, adjacent to the currently operating Townsend Facility and anticipated to be on-stream in the fourth quarter of 2019;

“Townsend Complex” means, collectively, the Townsend Facility, Townsend 2A and Townsend 2B;

“Townsend Facility” means the 198 Mmcf/d Townsend shallow-cut processing facility in northeast British Columbia owned by AltaGas Northwest Processing Limited Partnership;

“Townsend Phase 2” means the initial expansion of the Townsend Facility in two gas processing trains;

“Transco” means Transcontinental Gas Pipeline Company LLC;

“TSX” means the Toronto Stock Exchange;

“United States” or “U.S.” means the United States of America;

“US dollar” or “US$” means currency in the form of United States dollars;

“Volcano Creek” means the 16 MW run-of-river hydroelectric facility, one of the three run-of-river hydroelectric facilities in northwest British Columbia that forms part of the Northwest Hydro Facilities;

“Vopak” means Vopak Development Canada Inc., a wholly-owned subsidiary of Royal Vopak;

“Washington Gas” means Washington Gas Light Company, a subsidiary of WGL that sells and delivers natural gas primarily to retail customers in the District of Columbia, Maryland and Virginia in accordance with tariffs approved by the Public Service Commission of the District of Columbia, the Maryland Public Service Commission and the Commonwealth of Virginia State Corporation Commission;

“Washington Gas $4.25 Shares” means the US$4.25 series cumulative preferred shares of Washington Gas;

“Washington Gas $4.80 Shares” means the US$4.80 series cumulative preferred shares of Washington Gas;

“Washington Gas $5.00 Shares” means the US$5.00 series cumulative preferred shares of Washington Gas;

“Washington Gas Preferred Shares” means the preferred shares of Washington Gas as a class, including, without limitation, the Washington Gas $4.25 Shares, Washington Gas $4.80 Shares and Washington Gas $5.00 Shares;

“Washington Gas Resources” means Washington Gas Resources Corporation, a subsidiary of WGL that owns the majority of the non-utility subsidiaries;

“WCSB” means Western Canada Sedimentary Basin;

“WGL” means WGL Holdings, Inc., an indirect subsidiary of AltaGas;

“WGL Acquisition” means the acquisition by AltaGas, indirectly through Merger Sub, of WGL through a merger of Merger Sub with and into WGL pursuant to the Merger Agreement, which closed on July 6, 2018;

“WGL Energy Services” means WGL Energy Services, Inc. (formerly Washington Gas Energy Services, Inc.), a subsidiary of Washington Gas Resources that sells natural gas and electricity to retail customers on an unregulated basis;

“WGL Energy Systems” means WGL Energy Systems, Inc. (formerly Washington Gas Energy Systems, Inc.), a subsidiary of Washington Gas Resources which provides commercial energy efficient and sustainable solutions to government and commercial clients;

“WGL Midstream” means WGL Midstream, Inc., a subsidiary of Washington Gas Resources that engages in acquiring and optimizing natural gas storage and transportation assets;

“WGSW” means WGSW, Inc., a subsidiary of Washington Gas Resources that was formed to invest in certain renewable energy projects; and

“Younger” means the Younger extraction plant and related facilities, AltaGas’ interest being owned by its indirect wholly-owned subsidiary AltaGas Extraction and Transmission Limited Partnership.

METRIC CONVERSION

The following table sets forth certain standard conversions between Standard Imperial Units and the International System of Units (or metric units).

|

To Convert From |

|

To |

|

Multiply by |

|

|

Mcf |

|

cubic meters |

|

28.174 |

|

|

cubic meters |

|

cubic feet |

|

35.494 |

|

|

Bbls |

|

cubic meters |

|

0.159 |

|

|

cubic meters |

|

Bbls |

|

6.29 |

|

|

tonnes |

|

long tons |

|

0.984 |

|

|

feet |

|

meters |

|

0.305 |

|

|

meters |

|

feet |

|

3.281 |

|

|

miles |

|

km |

|

1.609 |

|

|

km |

|

miles |

|

0.621 |

|

|

acres |

|

hectares |

|

0.405 |

|

|

hectares |

|

acres |

|

2.471 |

|

|

gigajoule |

|

Mcf |

|

0.9482 |

|

CORPORATE STRUCTURE

INCORPORATION

AltaGas is a Canadian corporation amalgamated pursuant to the CBCA on July 1, 2010. AltaGas and/or its predecessors began operations in Calgary, Alberta on April 1, 1994 and AltaGas continues to maintain its head, principal and registered office in Calgary, Alberta currently located at 1700, 355 — 4th Avenue SW, Calgary, Alberta T2P 0J1. AltaGas is a public company, the Common Shares of which trade on the TSX under the symbol “ALA”.

AMENDED ARTICLES

On July 1, 2010, AltaGas filed articles of arrangement under the CBCA to effect a corporate arrangement and the amalgamation of AltaGas Ltd., AltaGas Conversion Inc. and AltaGas Conversion #2 Inc. to form AltaGas. Subsequent to the filing of the articles of arrangement, AltaGas has filed articles of amendment on the following dates in connection with the creation of each series of Preferred Shares: (i) August 13, 2010 to create the first series of Preferred Shares, Series A Shares and the second series of Preferred Shares, Series B Shares; (ii) June 1, 2012 to create the third series of

Preferred Shares, Series C Shares and the fourth series of Preferred Shares, Series D Shares; (iii) December 9, 2013 to create the fifth series of Preferred Shares, Series E Shares and the sixth series of Preferred Shares, Series F Shares; (iv) June 27, 2014 to create the seventh series of Preferred Shares, Series G Shares and the eighth series of Preferred Shares, Series H Shares; (v) November 17, 2015 to create the ninth series of Preferred Shares, Series I Shares and the tenth series of Preferred Shares, Series J Shares; and (vi) February 15, 2017 to create the eleventh series of Preferred Shares, Series K Shares and the twelfth series of Preferred Shares, Series L Shares.

INTERCORPORATE RELATIONSHIPS

The following organization diagram presents the name and the jurisdiction of incorporation of certain of AltaGas’ subsidiaries as at the date of this Annual Information Form. The diagram does not include all of the subsidiaries of AltaGas. The assets and revenues of those subsidiaries omitted from the diagram individually did not exceed 10 percent, and in the aggregate did not exceed 20 percent, of the total consolidated assets or total consolidated revenues of AltaGas as at and for the year ended December 31, 2018.

Notes:

(1) Updated as of the date of this Annual Information Form.

(2) Unless otherwise stated, ownership is 100%

(3) AltaGas owns a direct interest of 36.8% of ACI. The remaining 63.2% interest in ACI is publicly owned.

OVERVIEW OF THE BUSINESS

AltaGas, a Canadian corporation, is a leading North American clean energy infrastructure company with strong growth opportunities and a focus on owning and operating assets to provide clean and affordable energy to its customers. The Corporation’s long-term strategy is to grow in attractive areas across its Utility, Midstream, and Power business segments seeking optimal capital deployment. In the Midstream business, the Corporation is focused on optimizing the full value chain of energy exports by providing producers with solutions, including global market access off both coasts of North America via the Corporation’s footprint in two of the most prolific gas plays — the Montney and Marcellus. To optimize capital deployment, the Corporation seeks to invest in U.S utilities located in strong growth markets with increasing construction to support customer additions, system improvement and accelerated replacement programs. In the Power business, AltaGas seeks to create innovative solutions with light capital investment utilizing the Corporation’s clean energy expertise. AltaGas has three business segments:

· Utilities, which serves approximately 1.6 million customers with a rate base of approximately US$3.7 billion through ownership of regulated natural gas distribution utilities across 5 jurisdictions in the United States and two regulated natural gas storage utilities in the United States, delivering clean and affordable natural gas to homes and businesses. The Utilities business also includes storage facilities and contracts for interstate natural gas transportation and storage services;

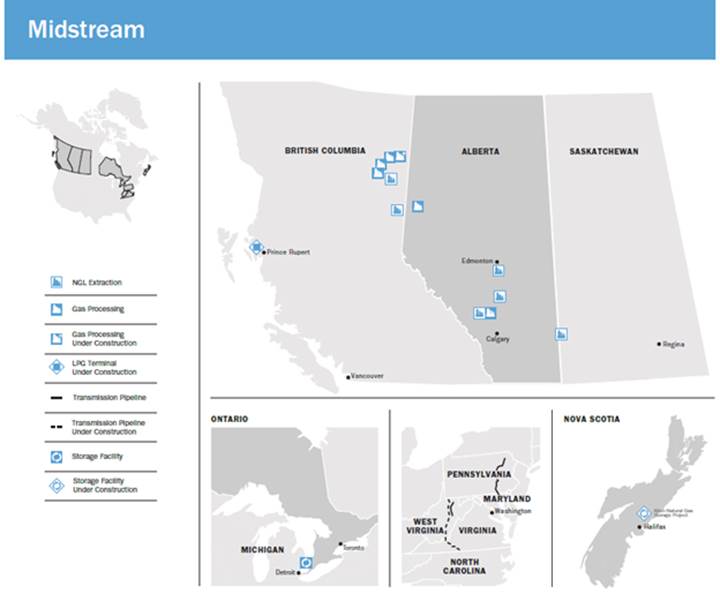

· Midstream, which, subsequent to the sale of non-core midstream assets in Canada which closed in February 2019 (See “Recent Noteworthy Transactions — Sale of Non-Core Assets”), transacts more than 1.5 Bcf/d of natural gas and includes natural gas gathering and processing, natural gas liquids (NGL) extraction and fractionation, transmission, storage, natural gas and NGL marketing, the Corporation’s 50 percent interest in AltaGas Idemitsu Joint Venture Limited Partnership (AIJVLP), an indirectly held one-third ownership investment in Petrogas Energy Corp. (Petrogas), through which AltaGas’ interest in the Ferndale Terminal is held, an interest in four regulated pipelines in the Marcellus/Utica gas formation in the northeastern United States and WGL’s retail gas marketing business; and

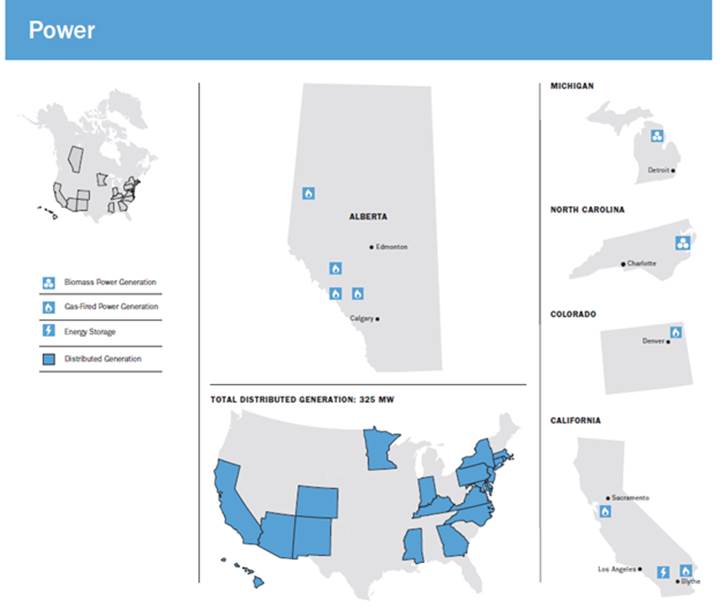

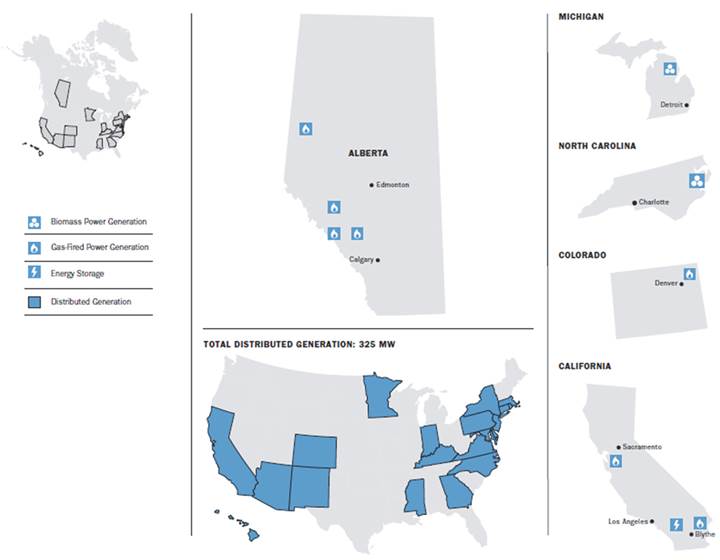

· Power, which, subsequent to the sale of non-core power assets in Canada which closed in February 2019 (See “Recent Noteworthy Transactions — Sale of Non-Core Assets”), and the sale of the remaining 55 percent interest in the Northwest Hydro Facilities which closed in January 2019 (See “Recent Noteworthy Transactions — Sale of Northwest Hydro”), includes 1,105 MW of operational gross capacity from natural gas-fired, biomass, solar, other distributed generation and energy storage assets located in Alberta, Canada and 20 states and the District of Columbia in the United States. The Power business also includes energy efficiency contracting and WGL’s retail power marketing business.

The Corporation’s long-term strategy is to leverage and enhance the strength of its asset footprint to provide customers with integrated energy solutions including global market access. Moving forward, AltaGas is targeting opportunities to develop high-quality energy assets that complement its existing integrated infrastructure footprint within these segments, and to grow its position in key markets to deliver optimal growth over the long term. In the Power segment, AltaGas will continue to seek to create innovative solutions with light capital investment utilizing the Corporation’s clean energy expertise.

RECENT NOTEWORTHY TRANSACTIONS

PUBLIC OFFERING OF ALTAGAS CANADA INC.

On September 12, 2018, ACI, then a wholly owned subsidiary of AltaGas, together with AltaGas as a promoter, filed a preliminary prospectus in relation to the ACI IPO. Prior to the completion of the ACI IPO, AltaGas and AltaGas Holdings Inc. sold certain assets, including Canadian rate-regulated natural gas distribution utility assets (including PNG, AUI and Heritage Gas) and contracted wind power in Canada, as well as an approximate 10 percent indirect equity interest in the Northwest Hydro Facilities to ACI. On October 25, 2018, the ACI IPO was successfully completed, reflecting a final price of $14.50 per common share of ACI. The over-allotment option was exercised in full, and as a result, AltaGas holds approximately 37 percent of ACI’s common shares at December 31, 2018. Net proceeds (consisting of cash and debt) to AltaGas after the deduction of underwriting fees and expenses were approximately $892 million. See “Investment in AltaGas Canada Inc.”

AltaGas has agreed to provide certain administrative, corporate and operational services to ACI pursuant to a transition services agreement for a transition period expiring June 30, 2020, unless earlier terminated.

See “Utilities Business - Investment in AltaGas Canada Inc.”

ACQUISITION OF WGL

Following the receipt of all required federal, state, and local regulatory approvals, on July 6, 2018 the Corporation acquired WGL, creating a North American leader in the clean energy economy and enhancing AltaGas’ position as a leading North American clean energy infrastructure company. The aggregate purchase price was approximately $9.3 billion (US$7.1 billion), including the assumption of approximately $3.3 billion (US$2.5 billion) of debt and $41 million (US$31 million) of preferred shares. A business acquisition report on Form 51-102F4 was filed on SEDAR on August 8, 2018 in respect of the WGL Acquisition.

The net cash consideration was approximately $6.0 billion (US$4.6 billion), which was funded through net proceeds of approximately $2.3 billion from the sale of Subscription Receipts, gross proceeds of approximately $922 million from the sale of 35 percent of AltaGas’ interest in the Northwest Hydro Facilities, draws on the Bridge Facility and existing cash on hand. The total funding included additional amounts for the payment of fees and regulatory commitments related to the WGL Acquisition. The sale of the Subscription Receipts was completed in the first quarter of 2017 and upon closing of the WGL Acquisition, the Subscription Receipts were exchanged into approximately 84.5 million Common Shares.

In connection with the WGL Acquisition, AltaGas and WGL have made commitments pursuant to the terms of the PSC of DC settlement agreement and the conditions of approval from the PSC of MD and the SCC of VA. Among other things, these commitments include rate credits distributable to both residential and non-residential customers, gas expansion and other programs, various public interest commitments, and safety programs. The total amount expensed in 2018 was approximately US$140 million, of which US$111 million has been paid as of December 31, 2018. In addition, there are certain additional regulatory commitments which will be expensed when the costs are incurred in the future, including the hiring of damage prevention trainers, investment of US$70 million over a 10 year period to further extend natural gas service, and US$8 million for leak mitigation.

The Ring Fenced Entities made certain ring fencing commitments to the PSC of DC, the PSC of MD and the SCC of VA. In order to satisfy these ring fencing commitments, the SPE was formed as a bankruptcy remote special purpose entity established for the purposes of owning the common stock of Washington Gas and of ring fencing Washington Gas, with the intention of removing Washington Gas from the bankruptcy estate of AltaGas and its affiliates other than Washington Gas and the SPE (collectively, the “Non-Ring Fenced Entities”) in the event that any Non-Ring Fenced Entity becomes the subject of bankruptcy or insolvency proceedings. The SPE is a wholly-owned subsidiary of WGL. Because of these ring fencing measures, none of the assets of the Ring Fenced Entities would be available to satisfy the debt or contractual obligations of any Non-Ring Fenced Entity, including any indebtedness or other contractual obligations of AltaGas, and the Ring Fenced Entities do not bear any liability for indebtedness or other contractual obligations of the Non-Ring Fenced Entities, and vice versa.

SALE OF NORTHWEST HYDRO

On June 13, 2018, AltaGas announced that it had entered into a definitive agreement to indirectly sell 35 percent of its interest in the Northwest Hydro Facilities for gross proceeds of $922 million. The transaction closed on June 22, 2018. On December 13, 2018, AltaGas announced that it had reached an agreement for the sale of its remaining interest of approximately 55 percent in the Northwest Hydro Facilities for gross proceeds of approximately $1.37 billion. The second closing occurred in January 2019.

SALE OF NON-CORE ASSETS

On September 10, 2018, AltaGas entered into definitive agreements for the sale of non-core midstream and power assets in Canada and power assets in the United States for total gross proceeds of approximately $560 million. The sale of the power assets in the United States was completed in the fourth quarter of 2018 and the sale of non-core midstream and power assets in Canada was completed in February 2019. AltaGas also sold 43.7 million shares of Tidewater. The sale of Tidewater shares was completed in September 2018.

IMPLEMENTATION OF BALANCED FUNDING PLAN

As part of the balanced funding plan, approximately US$2.2 billion of the Bridge Facility used to finance the WGL Acquisition was repaid in December 2018, approximately US$1.2 billion of which being refinanced with a new revolving credit facility. As of December 31, 2018, the remaining balance on the Bridge Facility was approximately US$83 million. The remaining balance was fully repaid in February 2019. In addition, the Board of Directors approved a reset of the dividend to improve the financial strength of AltaGas and ensure greater funding flexibility. The Board declared a January 2019 dividend of $0.08 per Common Share, representing a 56 percent reduction from 2018.

OUTLOOK

AltaGas made several steps in 2018 to enhance the strength of its balance sheet, create financial flexibility and focus its portfolio on the Midstream and Utilities segments. In 2019, the Corporation has identified several near-term strategic priorities.

With the acquisition of WGL completed in July 2018, AltaGas has been and remains focused on integration activities. AltaGas has identified near- and long-term integration priorities, including strategy, organizational effectiveness, growth, financial strength and people and culture, while remaining compliant with regulatory commitments. Significant progress has been made integrating the WGL leadership team, its operations, and core processes, and this will remain a priority for AltaGas in 2019.

AltaGas’ strategy is largely focused on two core and complementary business segments: Midstream and Utilities. Moving forward, AltaGas is targeting opportunities to develop high-quality energy assets that complement its existing integrated infrastructure footprint within these segments, and to grow its position in key markets to deliver optimal growth over the long term. In the Power segment, AltaGas will continue to seek to create innovative solutions with light capital investment utilizing the Corporation’s clean energy expertise.

Expanding Market Access with Integrated Midstream Footprint

RIPET is located near Prince Rupert, British Columbia, and is expected to be the first propane export facility off the west coast of Canada. After comprehensive commissioning activities, the facility is scheduled to begin its operational phase in the first quarter of 2019 with the introduction of feedstock propane and filling the refrigerated storage tank with liquefied product. First cargo is expected early in the second quarter of 2019 which aligns with the propane contract year. Once operational, the facility will provide access to new global markets for producers, while also leveraging our natural gas gathering, processing and fractionation assets in B.C. and Alberta.

Enhancing Returns in U.S. Utilities

Within its Utilities segment, AltaGas will continue to focus on strengthening operational excellence, improving the customer experience and achieving timely recovery on invested capital. For example, the Corporation’s Marquette Connector Pipeline in Michigan, which is expected to be in-service in the fourth quarter of 2019, will simultaneously provide clean and reliable natural gas delivery to thousands of homes in SEMCO Gas’ service territory while earning anticipated returns early in 2020. It will also provide additional natural gas capacity to Michigan’s Upper Peninsula to allow for growth.

2019 Planned Asset Sales and Balanced Funding Plan

Including the sale of its remaining interest of approximately 55 percent in the Northwest Hydro Facilities in British Columbia, AltaGas has successfully monetized approximately $3.8 billion of non-core assets since mid-2018, providing an efficient source of capital, reshaping its asset portfolio and prioritizing core focus areas. Additional asset sales of approximately $1.5 to $2.0 billion are planned for 2019, which are expected to further de-lever the Corporation, fund future growth, and minimize the need for any near-term common equity requirements.

GENERAL DEVELOPMENT OF ALTAGAS’ BUSINESS

Below is a summary by business segment of certain acquisitions and dispositions, key development and construction projects and other commercial arrangements not already discussed above, which have influenced the general development of the business segments of the Corporation over the last three completed financial years.

DEVELOPMENT OF THE UTILITIES BUSINESS OF ALTAGAS

In August 2017, the MPSC approved SEMCO’s application to construct, own and operate the Marquette Connector Pipeline. The Marquette Connector Pipeline is a proposed new pipeline that will connect the Great Lakes Gas Transmission pipeline to the Northern Natural Gas pipeline in Marquette, Michigan where it will provide system redundancy and increase deliverability, reliability and diversity of supply to SEMCO Gas’ approximately 35,000 customers in Michigan’s Western Upper Peninsula. The Marquette Connector Pipeline is estimated to cost between US$135 and US$140 million. Construction is expected to begin in 2019, with clearing and mobilization scheduled to begin in the first quarter of 2019 and an anticipated in-service date near the end of the fourth quarter of 2019.

On July 6, 2018, the WGL Acquisition closed and the operations of Washington Gas and Hampshire Gas were added to AltaGas’ Utilities business. For further details, see above under the heading “Recent Noteworthy Transactions”.

With the close of the ACI IPO on October 25, 2018, the Canadian rate regulated utility assets including PNG, AUI, and Heritage Gas are no longer subsidiaries of AltaGas. AltaGas’ remaining exposure to such Canadian rate regulated utility assets is through its approximate 37 percent interest in ACI.

DEVELOPMENT OF THE MIDSTREAM BUSINESS OF ALTAGAS

In July 2016, AltaGas completed construction of the Townsend Facility, together with a 25 km gas gathering pipeline, two liquids egress pipelines totaling 30 km and a truck terminal. For further details, see below under the heading “Business of the Corporation - Midstream Business — Field Gathering and Processing and Transmission — Significant Operating Areas and Customers”.

In October 2016, AltaGas reached a positive FID for the construction, ownership and operation of the North Pine Facility and the North Pine Pipelines. Commercial operations commenced at the first 10,000 Bbls/d NGL separation train of the North Pine Facility on December 1, 2017. For further details, see below under the heading “Business of the Corporation - Midstream Business — Extraction and Fractionation — Fractionation - North Pine Facility”.

In December 2016, AltaGas received approval from the BCOGC for Townsend Phase 2 and to retrofit the existing shallow-cut Townsend Facility to a deep-cut facility at a future date if AltaGas elects to do so. Commissioning of the Townsend 2A phase of Townsend Phase 2 and the field compression equipment was completed on October 1, 2017. For further details, see below under the heading “Business of the Corporation - Midstream Business — Field Gathering and Processing and Transmission - Townsend 2A”.

In January 2017, AltaGas reached a positive FID on RIPET. RIPET is expected to be the first propane export facility off the west coast of Canada. On May 5, 2017, AltaGas LPG Limited Partnership, a wholly-owned subsidiary of AltaGas, and Vopak, formed RILE LP for the development of RIPET. AltaGas’ subsidiaries hold a 70 percent interest in RILE LP, with Vopak holding the remaining 30 percent interest. Construction of RIPET began in April 2017 and first cargo is expected early in the second quarter of 2019. RIPET is expected to ship 1.2 million tonnes of propane per annum (which is equivalent to approximately 40,000 Bbls/d of export capacity). For further details on this project see below under the heading “Business of the Corporation — Midstream Business — Energy Export”.

In March 2017, AltaGas sold the Ethylene Delivery System and the Joffre Feedstock Pipeline to Nova Chemicals for net proceeds of approximately $67 million.

In June 2017, AltaGas modified its existing take-or-pay agreement with Birchcliff Energy Ltd. to incent increased utilization of the Gordondale Facility until late 2020. The modifications made apply solely to volumes above the existing take-or-pay volume commitments.

On April 3, 2018, AltaGas entered into a long-term natural gas processing arrangement with Birchcliff Energy Ltd. at AltaGas’ deep-cut sour gas processing facility located in Gordondale, Alberta.

As a result of the closing of the WGL Acquisition on July 6, 2018, an interest in four pipelines in the United States as well as the retail gas marketing business of WGL were added to AltaGas’ Midstream Business. For further details, see above under the heading “Recent Noteworthy Transactions” and below under “Midstream Business”.

On August 27, 2018, AltaGas entered into definitive agreements with Kelt to provide Kelt with firm processing of 75 MMcf/d of raw gas under an initial 10 year take-or-pay agreement at the Townsend Complex.

On September 10, 2018, AltaGas entered into definitive agreements for the sale of non-core midstream and power assets in Canada. The sale was completed in February 2019. For further details see “Recent Noteworthy Transactions — Sale of Non-Core Assets”.

In October 2018, AltaGas acquired 50 percent ownership in certain existing and future natural gas processing plants of Black Swan. The total capital investment by AltaGas is anticipated to be approximately $230 million. AltaGas and Black Swan also entered into long term processing, transportation and marketing agreements that include new AltaGas liquids handling infrastructure.

On October 4, 2018, the FERC issued its authorization to place Central Penn into service. The pipeline began operations on October 6, 2018.

DEVELOPMENT OF THE POWER BUSINESS OF ALTAGAS

Pursuant to the change in law provision of the Sundance B PPAs, ASTC Power Partnership, a joint venture partnership between TransCanada Energy Ltd. and AltaGas’ wholly-owned subsidiary, AltaGas Pipeline Partnership, exercised its right to terminate the Sundance B PPAs effective March 8, 2016. In December 2016, a definitive settlement agreement was reached with the Government of Alberta accepting termination of the Sundance B PPAs effective March 8, 2016. Under the settlement agreement, AltaGas agreed to contribute 391,879 self-generated carbon offsets and to make total cash payments in the aggregate amount of $6 million, payable in equal installments over three years starting in 2018 and the Government of Alberta granted AltaGas a full release from all obligations with respect to the Sundance B PPAs.

On December 31, 2016, AltaGas successfully commissioned the Pomona Energy Storage Facility. For further details see below under the heading “Business of the Corporation — Power Business”.

On June 13, 2018, AltaGas announced that it had entered into a definitive agreement to indirectly sell 35 percent of its interest in the Northwest Hydro Facilities for gross proceeds of $922 million. The transaction closed on June 22, 2018.

On July 6, 2018, as part of the WGL Acquisition, WGL Energy Systems and WGL Energy Services were added to AltaGas’ Power business. For further details, see above under the heading “Recent Noteworthy Transactions”.

On September 10, 2018, AltaGas entered into definitive agreements for the sale of non-core midstream and power assets in Canada. The sale was completed in February 2019. For further details see “Recent Noteworthy Transactions — Sale of Non-Core Assets”.

On October 19, 2018, the Bear Mountain wind facility in British Columbia was sold to ACI. In addition, a 10 percent minority interest in the Northwest Hydro Facilities was sold to ACI. See “Recent Noteworthy Transactions”.

On November 13, 2018, the Tracy, Hanford and Henrietta gas-fired facilities in California were sold to Middle River Power for a gross purchase price of US$299 million.

On December 11, 2018, the Busch Ranch wind asset in the United States was sold for a purchase price of approximately US$16 million.

On December 13, 2018, AltaGas announced that it had reached an agreement for the sale of its remaining interest of approximately 55 percent in the Northwest Hydro Facilities. The sale closed in January 2019.

BUSINESS OF THE CORPORATION

AltaGas’ revenue for the year ended December 31, 2018 was approximately $4.3 billion compared to $2.6 billion for the year ended December 31, 2017.

|

Revenue by Business for 2018 (1) |

|

Revenue by Business for 2017 (1) |

|

|

|

|

Note:

(1) Excluding Corporate segment and intersegment eliminations

AltaGas operates its business through three business segments: Utilities, Midstream, and Power, each of which is more particularly described in the respective sections which follow. AltaGas’ business also includes the Corporate segment, which consists primarily of opportunistic investments, certain risk management contract results and revenues and expenses not directly identifiable with the operating businesses.

UTILITIES BUSINESS

The Utilities business contributed revenue of $1.7 billion for the year ended December 31, 2018 (2017 - $1.1 billion), representing approximately 40 percent (2017 — 41 percent) of AltaGas’ total revenue before Corporate segment and intersegment eliminations.

Investment in AltaGas Canada Inc.

In the fourth quarter of 2018, the IPO of ACI, a previously wholly owned subsidiary of AltaGas, was completed. As of December 31, 2018, AltaGas had an approximate 37 percent equity interest in ACI. Subsequent to the IPO close, AltaGas’ interest in ACI is accounted for as an equity investment.

On October 18, 2018, ACI acquired the following assets from AltaGas: (i) rate-regulated natural gas distribution utility assets in Alberta (AUI, serving approximately 80,400 customers), British Columbia (PNG, serving approximately 41,900 customers) and Nova Scotia (Heritage Gas, serving approximately 7,300 customers); (ii) minority interests in entities (Inuvik Gas Ltd. and Ikhil Joint Venture) providing natural gas to the Town of Inuvik, Northwest Territories; (iii) fully contracted 102 MW wind power assets (Bear Mountain) located near Dawson Creek, British Columbia; and (iv) an approximate 10 percent indirect equity interest in the Northwest Hydro Facilities. With the ACI IPO closed, the Utilities segment no longer controls any Canadian utilities.

U.S. Utilities Business

The Utilities segment owns utility assets that deliver natural gas to end-users in the United States. The Utilities segment in the United States is comprised of Washington Gas (in the District of Columbia, Maryland and Virginia), Hampshire Gas in West Virginia, SEMCO Gas in Michigan, ENSTAR in Alaska and a 65 percent interest in CINGSA, a regulated natural gas storage utility in Alaska.

Regulatory Process

The Utilities business predominantly operates in regulated marketplaces where, as franchise or certificate holders, regulated utilities are allowed by the regulator to charge regulated rates that provide the utilities the opportunity to recover costs and earn a return on capital. The return on capital is to reflect a fair rate of return on approved utility investments (i.e. rate base) based on a regulatory deemed or targeted capital structure. The ability of a regulated utility to recover prudently incurred costs of providing service and earn the regulator-approved rate of return on equity depends on the utility achieving the forecasts established in the rate-setting processes.

SEMCO Gas and Washington Gas have accelerated pipe and infrastructure replacement programs in place in Michigan and the District of Columbia, Maryland and Virginia, respectively. These are long-term programs subject to both changing conditions and regulatory review and approval in five year increments. SEMCO Gas and Washington Gas are accelerating pipe and infrastructure replacement to further enhance the safety and reliability of the natural gas delivery system. SEMCO Gas and Washington Gas are allowed to begin recovering the cost, including a return, for these investments immediately through approved surcharges for each accelerated pipe or infrastructure replacement program. Once new base rates are put into effect in a given jurisdiction, expenditures previously being recovered through the surcharge will be collected through the new base rates.

The Utilities business is subject to regulation over, among other things, rates, accounting procedures and standards of service.

The MPSC has jurisdiction over the regulatory matters related, directly or indirectly, to the services that SEMCO Gas provides to its Michigan customers. The RCA has jurisdiction over the regulatory matters related, directly or indirectly, to ENSTAR’s and CINGSA’s services provided to its Alaska customers. Washington Gas is regulated by the PSC of DC, the PSC of MD and the SCC of VA, which approve its terms of service and the billing rates that it charges to its customers. In all jurisdictions, the regulators approve distribution rates based on a cost-of-service regulatory model. In Alaska, the District of Columbia, Maryland and Virginia, rates are set using the results from a historical test year plus known and measurable changes. In Michigan, rates are set using a projected test year. In all jurisdictions, the rates charged to utility customers are designed to provide the distribution utility with an opportunity to recover all prudently incurred operating, depreciation, income tax, and financing costs, and to earn a reasonable return on its investment in the net assets used in its firm gas sales and delivery service. The regulators attempt to ensure that tariffs are just and reasonable, provide incentives for investments, and are not unduly preferential, arbitrary, or unjustly discriminatory.

Utilities Business Key Utility Metrics

The following table summarizes the average rate base for the Utilities business for the years ended December 31, 2018 and 2017:

|

|

|

2018 |

|

2017 |

|

|

Rate base ($ millions) (1) |

|

|

|

|

|

|

Utilities Canada (2) |

|

— |

|

833 |

|

|

Utilities U.S. (3) (4) |

|

3,684 |

|

847 |

|

Notes:

(1) Rate base is indicative of the earning potential of each utility over time. Approved revenue requirement for each utility is typically based on the rate base as approved by the regulator for the respective rate application, but may differ from the rate base indicated above.

(2) The Canadian utilities were sold to ACI in 2018.

(3) In U.S. dollars.

(4) Reflects SEMCO Energy’s 65 percent interest in CINGSA.

The following table summarizes the capital expenditures for the years ended December 31, 2018 and 2017.

|

($ millions) |

|

2018 |

|

2017 |

|

|

Utilities Canada (1) |

|

|

|

|

|

|

New business |

|

15 |

|

14 |

|

|

System betterment and gas supply |

|

34 |

|

40 |

|

|

General plant |

|

7 |

|

8 |

|

|

Total |

|

56 |

|

62 |

|

|

|

|

|

|

|

|

|

Utilities U.S. (2) |

|

|

|

|

|

|

New business |

|

63 |

|

9 |

|

|

System betterment and gas supply |

|

234 |

|

37 |

|

|

General plant |

|

64 |

|

4 |

|

|

Total |

|

361 |

|

50 |

|

Notes:

(1) For the period prior to the close of the ACI IPO in October 2018.

(2) In U.S. dollars.

The following table summarizes the nature of regulation applicable to each utility:

|

Regulated Utility |

|

Regulated |

|

% of AltaGas’ |

|

Allowed |

|

Allowed |

|

Allowed |

|

Significant Features/ Material Regulatory |

|

Washington Gas |

|

PSC of MD |

|

77 |

|

51.7 – 55.7 |

|

9.46 |

|

9.25 - 9.7 |

|

- Distribution rates approved under cost of service model. - Rate cases filed in 2018 with the PSC of MD for increase in rates and accelerated pipeline replacement programs with decisions rendered in December 2018. - Rate case filed in 2018 with the SCC of VA for increase in rates. Rate case hearing and decision expected in 2019. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SEMCO Gas |

|

MPSC |

|

13 |

|

49.04 |

|

10.35 |

|

10.35 |

|

- Distribution rates approved under cost of service model. - Use of projected test year for rate cases with 10 month limit to issue a rate order. - Rate rider provides recovery relating to the Main Replacement Program which allows the company to accelerate the replacement of older portions of its system. - Last rate case settled in 2011. Next rate case expected to be filed in 2019. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ENSTAR |

|

RCA |

|

8 |

|

51.81 |

|

11.875 |

|

11.875 |

|