hyfm-20221231FALSE2022FY0001695295http://fasb.org/us-gaap/2022#LongTermDebtAndCapitalLeaseObligationsCurrenthttp://fasb.org/us-gaap/2022#LongTermDebtAndCapitalLeaseObligationsCurrenthttp://fasb.org/us-gaap/2022#LongTermDebtAndCapitalLeaseObligationshttp://fasb.org/us-gaap/2022#LongTermDebtAndCapitalLeaseObligationsP20D0.500016952952022-01-012022-12-3100016952952022-06-30iso4217:USD00016952952023-03-01xbrli:shares00016952952022-12-3100016952952021-12-31iso4217:USDxbrli:shares00016952952021-01-012021-12-310001695295us-gaap:CommonStockMember2020-12-310001695295us-gaap:AdditionalPaidInCapitalMember2020-12-310001695295us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001695295us-gaap:RetainedEarningsMember2020-12-3100016952952020-12-310001695295us-gaap:CommonStockMember2021-01-012021-12-310001695295us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001695295us-gaap:RetainedEarningsMember2021-01-012021-12-310001695295us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001695295us-gaap:CommonStockMember2021-12-310001695295us-gaap:AdditionalPaidInCapitalMember2021-12-310001695295us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001695295us-gaap:RetainedEarningsMember2021-12-310001695295us-gaap:CommonStockMember2022-01-012022-12-310001695295us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001695295us-gaap:RetainedEarningsMember2022-01-012022-12-310001695295us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001695295us-gaap:CommonStockMember2022-12-310001695295us-gaap:AdditionalPaidInCapitalMember2022-12-310001695295us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001695295us-gaap:RetainedEarningsMember2022-12-310001695295us-gaap:IPOMemberus-gaap:CommonStockMember2020-12-142020-12-140001695295us-gaap:CommonStockMemberus-gaap:OverAllotmentOptionMember2020-12-142020-12-140001695295us-gaap:IPOMemberus-gaap:CommonStockMember2020-12-140001695295us-gaap:IPOMemberus-gaap:CommonStockMember2021-01-012021-12-310001695295us-gaap:CommonStockMemberhyfm:FollowOnPublicOfferingMember2021-05-032021-05-030001695295hyfm:FollowOnPublicOfferingOverAllotmentOptionMemberus-gaap:CommonStockMember2021-05-032021-05-030001695295us-gaap:CommonStockMemberhyfm:FollowOnPublicOfferingMember2021-05-030001695295hyfm:InventoryWritedownMember2022-01-012022-12-310001695295us-gaap:FacilityClosingMember2022-01-012022-12-310001695295us-gaap:CostOfSalesMember2022-01-012022-12-310001695295us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-01-012022-12-31hyfm:segment0001695295hyfm:UnitedStatesMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001695295hyfm:UnitedStatesMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001695295hyfm:CanadaMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001695295hyfm:CanadaMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001695295us-gaap:IntersegmentEliminationMember2022-01-012022-12-310001695295us-gaap:IntersegmentEliminationMember2021-01-012021-12-310001695295hyfm:UnitedStatesMemberus-gaap:OperatingSegmentsMember2022-12-310001695295hyfm:UnitedStatesMemberus-gaap:OperatingSegmentsMember2021-12-310001695295hyfm:CanadaMemberus-gaap:OperatingSegmentsMember2022-12-310001695295hyfm:CanadaMemberus-gaap:OperatingSegmentsMember2021-12-310001695295us-gaap:AccountsPayableMemberhyfm:OneSupplierMemberus-gaap:SupplierConcentrationRiskMember2022-01-012022-12-31xbrli:pure0001695295us-gaap:AccountsPayableMemberhyfm:OneSupplierMemberus-gaap:SupplierConcentrationRiskMember2021-01-012021-12-310001695295srt:MinimumMemberus-gaap:BuildingAndBuildingImprovementsMember2022-01-012022-12-310001695295srt:MaximumMemberus-gaap:BuildingAndBuildingImprovementsMember2022-01-012022-12-310001695295srt:MinimumMemberus-gaap:MachineryAndEquipmentMember2022-01-012022-12-310001695295srt:MaximumMemberus-gaap:MachineryAndEquipmentMember2022-01-012022-12-310001695295srt:MinimumMemberus-gaap:ComputerEquipmentMember2022-01-012022-12-310001695295srt:MaximumMemberus-gaap:ComputerEquipmentMember2022-01-012022-12-310001695295us-gaap:FurnitureAndFixturesMember2022-01-012022-12-310001695295us-gaap:ShippingAndHandlingMember2022-01-012022-12-310001695295us-gaap:ShippingAndHandlingMember2021-01-012021-12-310001695295us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-31hyfm:acquisition0001695295us-gaap:CustomerRelationshipsMembersrt:MinimumMember2022-01-012022-12-310001695295us-gaap:CustomerRelationshipsMembersrt:MaximumMember2022-01-012022-12-310001695295hyfm:TechnologyFormulationsAndRecipesMembersrt:MinimumMember2022-01-012022-12-310001695295hyfm:TechnologyFormulationsAndRecipesMembersrt:MaximumMember2022-01-012022-12-310001695295us-gaap:ComputerSoftwareIntangibleAssetMember2022-01-012022-12-310001695295srt:MinimumMemberus-gaap:TradeNamesMember2022-01-012022-12-310001695295srt:MaximumMemberus-gaap:TradeNamesMember2022-01-012022-12-310001695295hyfm:Field16LLCMember2021-05-030001695295hyfm:Field16LLCMember2021-05-032021-05-030001695295hyfm:Field16LLCMemberus-gaap:IncomeApproachValuationTechniqueMember2021-05-030001695295hyfm:Field16LLCMemberus-gaap:ValuationTechniqueDiscountedCashFlowMember2021-05-030001695295us-gaap:CarryingReportedAmountFairValueDisclosureMemberhyfm:Field16LLCMember2021-12-310001695295hyfm:Field16LLCMember2022-01-012022-12-310001695295hyfm:HAndGEntitiesMember2021-06-010001695295hyfm:HAndGEntitiesMember2021-06-012021-06-010001695295hyfm:AuroraInnovationsLLCMember2021-07-010001695295hyfm:AuroraInnovationsLLCMember2021-07-012021-07-010001695295us-gaap:MeasurementInputDiscountRateMemberhyfm:AuroraInnovationsLLCMemberus-gaap:ValuationTechniqueDiscountedCashFlowMember2021-07-010001695295us-gaap:CarryingReportedAmountFairValueDisclosureMemberhyfm:AuroraInnovationsLLCMember2021-12-310001695295hyfm:AuroraInnovationsLLCMember2021-01-012021-12-310001695295hyfm:AuroraInnovationsLLCMember2022-01-012022-12-310001695295hyfm:AuroraInnovationsLLCMember2022-07-310001695295hyfm:GreenstarPlantProductsIncMember2021-08-030001695295hyfm:GreenstarPlantProductsIncMember2021-08-032021-08-030001695295hyfm:InnovativeGrowersEquipmentIncMember2021-11-010001695295hyfm:InnovativeGrowersEquipmentIncMember2021-11-012021-11-010001695295us-gaap:OtherIntangibleAssetsMemberhyfm:Field16LLCMember2021-05-030001695295hyfm:HAndGEntitiesMemberus-gaap:OtherIntangibleAssetsMember2021-06-010001695295us-gaap:OtherIntangibleAssetsMemberhyfm:AuroraInnovationsLLCMember2021-07-010001695295us-gaap:OtherIntangibleAssetsMemberhyfm:GreenstarPlantProductsIncMember2021-08-030001695295us-gaap:OtherIntangibleAssetsMemberhyfm:InnovativeGrowersEquipmentIncMember2021-11-010001695295us-gaap:CustomerRelationshipsMemberhyfm:Field16LLCMember2021-05-030001695295hyfm:HAndGEntitiesMemberus-gaap:CustomerRelationshipsMember2021-06-010001695295us-gaap:CustomerRelationshipsMemberhyfm:AuroraInnovationsLLCMember2021-07-010001695295us-gaap:CustomerRelationshipsMemberhyfm:GreenstarPlantProductsIncMember2021-08-030001695295us-gaap:CustomerRelationshipsMemberhyfm:InnovativeGrowersEquipmentIncMember2021-11-010001695295us-gaap:TrademarksAndTradeNamesMemberhyfm:Field16LLCMember2021-05-030001695295hyfm:HAndGEntitiesMemberus-gaap:TrademarksAndTradeNamesMember2021-06-010001695295us-gaap:TrademarksAndTradeNamesMemberhyfm:AuroraInnovationsLLCMember2021-07-010001695295us-gaap:TrademarksAndTradeNamesMemberhyfm:GreenstarPlantProductsIncMember2021-08-030001695295us-gaap:TrademarksAndTradeNamesMemberhyfm:InnovativeGrowersEquipmentIncMember2021-11-010001695295hyfm:TechnologyFormulationsAndRecipesMemberhyfm:Field16LLCMember2021-05-030001695295hyfm:HAndGEntitiesMemberhyfm:TechnologyFormulationsAndRecipesMember2021-06-010001695295hyfm:TechnologyFormulationsAndRecipesMemberhyfm:AuroraInnovationsLLCMember2021-07-010001695295hyfm:TechnologyFormulationsAndRecipesMemberhyfm:GreenstarPlantProductsIncMember2021-08-030001695295hyfm:TechnologyFormulationsAndRecipesMemberhyfm:InnovativeGrowersEquipmentIncMember2021-11-010001695295hyfm:Field16LLCMember2021-01-012021-12-310001695295hyfm:HAndGEntitiesMember2021-01-012021-12-310001695295hyfm:GreenstarPlantProductsIncMember2021-01-012021-12-310001695295hyfm:InnovativeGrowersEquipmentIncMember2021-01-012021-12-310001695295hyfm:InnovativeGrowersEquipmentIncMember2022-01-012022-12-310001695295hyfm:GreenstarPlantProductsIncMember2022-01-012022-12-310001695295hyfm:AllOtherAcquisitionsMember2022-01-012022-12-310001695295us-gaap:ComputerSoftwareIntangibleAssetMember2022-12-310001695295us-gaap:ComputerSoftwareIntangibleAssetMember2021-12-310001695295us-gaap:CustomerRelationshipsMember2022-12-310001695295us-gaap:CustomerRelationshipsMember2021-12-310001695295hyfm:TechnologyAndFormulationsRecipesMember2022-12-310001695295hyfm:TechnologyAndFormulationsRecipesMember2021-12-310001695295us-gaap:TrademarksAndTradeNamesMember2022-12-310001695295us-gaap:TrademarksAndTradeNamesMember2021-12-310001695295us-gaap:OtherIntangibleAssetsMember2022-12-310001695295us-gaap:OtherIntangibleAssetsMember2021-12-310001695295us-gaap:TradeNamesMember2022-12-310001695295us-gaap:TradeNamesMember2021-12-310001695295us-gaap:OtherIntangibleAssetsMember2022-12-310001695295us-gaap:OtherIntangibleAssetsMember2021-12-310001695295srt:WeightedAverageMemberus-gaap:ComputerSoftwareIntangibleAssetMember2022-01-012022-12-310001695295us-gaap:CustomerRelationshipsMembersrt:WeightedAverageMember2022-01-012022-12-310001695295srt:MinimumMemberhyfm:TechnologyAndFormulationsRecipesMember2022-01-012022-12-310001695295srt:MaximumMemberhyfm:TechnologyAndFormulationsRecipesMember2022-01-012022-12-310001695295srt:WeightedAverageMemberhyfm:TechnologyAndFormulationsRecipesMember2022-01-012022-12-310001695295us-gaap:TrademarksAndTradeNamesMembersrt:MinimumMember2022-01-012022-12-310001695295us-gaap:TrademarksAndTradeNamesMembersrt:MaximumMember2022-01-012022-12-310001695295us-gaap:TrademarksAndTradeNamesMembersrt:WeightedAverageMember2022-01-012022-12-310001695295us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001695295us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001695295us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001695295us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001695295us-gaap:WarrantMember2022-01-012022-12-310001695295us-gaap:WarrantMember2021-01-012021-12-310001695295hyfm:PerformanceStockUnitPSUsAndRestrictedStockUnitsRSUsMember2022-01-012022-12-310001695295hyfm:PerformanceStockUnitPSUsAndRestrictedStockUnitsRSUsMember2021-01-012021-12-310001695295hyfm:ShareBasedPaymentArrangementOptionsOutstandingMember2022-01-012022-12-310001695295hyfm:ShareBasedPaymentArrangementOptionsOutstandingMember2021-01-012021-12-310001695295us-gaap:SellingGeneralAndAdministrativeExpensesMember2021-01-012021-12-310001695295us-gaap:CostOfSalesMember2021-01-012021-12-310001695295us-gaap:MachineryAndEquipmentMember2022-12-310001695295us-gaap:MachineryAndEquipmentMember2021-12-310001695295hyfm:PeatBogsAndRelatedDevelopmentMember2022-12-310001695295hyfm:PeatBogsAndRelatedDevelopmentMember2021-12-310001695295us-gaap:BuildingAndBuildingImprovementsMember2022-12-310001695295us-gaap:BuildingAndBuildingImprovementsMember2021-12-310001695295us-gaap:LandMember2022-12-310001695295us-gaap:LandMember2021-12-310001695295us-gaap:FurnitureAndFixturesMember2022-12-310001695295us-gaap:FurnitureAndFixturesMember2021-12-310001695295us-gaap:ComputerEquipmentMember2022-12-310001695295us-gaap:ComputerEquipmentMember2021-12-310001695295us-gaap:LeaseholdImprovementsMember2022-12-310001695295us-gaap:LeaseholdImprovementsMember2021-12-310001695295hyfm:TermLoanMember2022-12-310001695295hyfm:TermLoanMember2021-12-310001695295hyfm:OtherDebtMember2022-12-310001695295hyfm:OtherDebtMember2021-12-310001695295us-gaap:SecuredDebtMemberhyfm:SeniorTermLoanMember2021-10-250001695295us-gaap:SecuredDebtMemberus-gaap:LondonInterbankOfferedRateLIBORMemberhyfm:SeniorTermLoanMember2021-10-252021-10-250001695295us-gaap:SecuredDebtMemberhyfm:SeniorTermLoanMemberus-gaap:BaseRateMember2021-10-252021-10-250001695295us-gaap:SecuredDebtMemberhyfm:SeniorTermLoanMember2022-01-012022-12-310001695295us-gaap:CarryingReportedAmountFairValueDisclosureMemberhyfm:TermLoanMemberus-gaap:FairValueInputsLevel2Member2022-12-310001695295us-gaap:CarryingReportedAmountFairValueDisclosureMemberhyfm:TermLoanMemberus-gaap:FairValueInputsLevel2Member2021-12-310001695295us-gaap:RevolvingCreditFacilityMemberhyfm:RevolvingAssetBakedCreditFacilityMemberhyfm:JPMorganCreditFacilityMember2021-03-292021-03-290001695295us-gaap:RevolvingCreditFacilityMemberhyfm:RevolvingAssetBakedCreditFacilityMemberhyfm:JPMorganCreditFacilityMember2021-03-290001695295hyfm:JPMorganCreditFacilityMember2021-08-310001695295hyfm:JPMorganCreditFacilityMember2022-12-220001695295hyfm:JPMorganCreditFacilityMember2022-01-012022-12-310001695295hyfm:JPMorganCreditFacilityMember2022-12-310001695295us-gaap:RevolvingCreditFacilityMemberhyfm:RevolvingAssetBakedCreditFacilityMemberhyfm:JPMorganCreditFacilityMember2022-12-310001695295us-gaap:RevolvingCreditFacilityMemberhyfm:RevolvingAssetBakedCreditFacilityMemberhyfm:JPMorganCreditFacilityMember2022-01-012022-12-310001695295us-gaap:RevolvingCreditFacilityMemberus-gaap:LondonInterbankOfferedRateLIBORMemberhyfm:RevolvingAssetBakedCreditFacilityMemberhyfm:JPMorganCreditFacilityMember2021-08-312021-08-310001695295us-gaap:RevolvingCreditFacilityMemberhyfm:RevolvingAssetBakedCreditFacilityMemberhyfm:JPMorganCreditFacilityMember2021-08-312021-08-310001695295us-gaap:RevolvingCreditFacilityMemberhyfm:RevolvingAssetBakedCreditFacilityMemberhyfm:JPMorganCreditFacilityMember2021-12-310001695295hyfm:JPMorganCreditFacilityMember2021-12-310001695295hyfm:RevolvingAssetBakedCreditFacilityMemberhyfm:EncinaObligorsMember2019-07-110001695295country:CAhyfm:RevolvingAssetBakedCreditFacilityMemberhyfm:EncinaObligorsMember2019-07-110001695295us-gaap:BridgeLoanMemberhyfm:EncinaObligorsMember2019-07-110001695295hyfm:RevolvingAssetBakedCreditFacilityMemberhyfm:EncinaObligorsMember2019-07-112019-07-110001695295srt:MinimumMemberus-gaap:LondonInterbankOfferedRateLIBORMemberhyfm:RevolvingAssetBakedCreditFacilityMemberhyfm:EncinaObligorsMember2019-07-112019-07-110001695295srt:MinimumMemberhyfm:RevolvingAssetBakedCreditFacilityMemberus-gaap:BaseRateMemberhyfm:EncinaObligorsMember2019-07-112019-07-110001695295us-gaap:LondonInterbankOfferedRateLIBORMembersrt:MaximumMemberhyfm:RevolvingAssetBakedCreditFacilityMemberhyfm:EncinaObligorsMember2019-07-112019-07-110001695295srt:MaximumMemberhyfm:RevolvingAssetBakedCreditFacilityMemberus-gaap:BaseRateMemberhyfm:EncinaObligorsMember2019-07-112019-07-110001695295hyfm:RevolvingAssetBakedCreditFacilityMemberhyfm:EncinaObligorsMember2021-01-012021-12-310001695295us-gaap:CommonStockMember2022-12-31hyfm:vote0001695295hyfm:InvestorWarrantsMember2021-07-190001695295hyfm:InvestorWarrantsMemberus-gaap:CommonStockMember2021-07-192021-07-190001695295hyfm:InvestorWarrantsMembersrt:MinimumMemberus-gaap:CommonStockMember2021-07-190001695295hyfm:InvestorWarrantsMember2021-07-180001695295hyfm:InvestorWarrantsMember2021-01-012021-07-180001695295hyfm:InvestorWarrantsMember2021-07-192021-07-190001695295hyfm:InvestorWarrantsMember2022-12-310001695295hyfm:InvestorWarrantsPlacementAgentsTrancheOneMember2022-12-310001695295hyfm:InvestorWarrantsPlacementAgentsTrancheTwoMember2022-12-310001695295hyfm:InvestorWarrantsPlacementAgentsTrancheOneMember2021-12-310001695295hyfm:InvestorWarrantsPlacementAgentsTrancheTwoMember2021-12-310001695295hyfm:InvestorWarrantsMemberus-gaap:CommonStockMember2021-07-19hyfm:plan0001695295hyfm:A2020EmployeeDirectorAndConsultantEquityIncentivePlanMember2022-12-310001695295hyfm:A2020EmployeeDirectorAndConsultantEquityIncentivePlanMember2020-11-300001695295hyfm:A2020EmployeeDirectorAndConsultantEquityIncentivePlanMember2020-11-012020-11-300001695295hyfm:A2020EmployeeDirectorAndConsultantEquityIncentivePlanMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2022-01-012022-12-310001695295us-gaap:ShareBasedCompensationAwardTrancheTwoMemberhyfm:A2020EmployeeDirectorAndConsultantEquityIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001695295us-gaap:ShareBasedCompensationAwardTrancheThreeMemberhyfm:A2020EmployeeDirectorAndConsultantEquityIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-31hyfm:tranche00016952952020-11-012020-11-300001695295us-gaap:RestrictedStockUnitsRSUMember2021-07-012021-07-310001695295hyfm:RestrictedStockUnitsRSUsWithPerformanceBasedVestingConditionsOnAQualifyingLiquidityEventMember2022-12-310001695295hyfm:RestrictedStockUnitsRSUsWithPerformanceBasedVestingConditionsOnAQualifyingLiquidityEventMember2021-12-310001695295us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001695295us-gaap:RestrictedStockUnitsRSUMember2022-12-310001695295us-gaap:RestrictedStockUnitsRSUMember2021-12-310001695295hyfm:A2020EmployeeDirectorAndConsultantEquityIncentivePlanMember2021-01-012021-12-310001695295us-gaap:PerformanceSharesMember2021-12-310001695295us-gaap:PerformanceSharesMember2022-01-012022-12-310001695295us-gaap:PerformanceSharesMember2022-12-310001695295us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001695295us-gaap:EmployeeStockOptionMember2021-12-310001695295srt:MinimumMemberus-gaap:EmployeeStockOptionMember2021-12-310001695295srt:MinimumMemberus-gaap:EmployeeStockOptionMember2022-01-012022-12-310001695295us-gaap:EmployeeStockOptionMember2022-12-310001695295srt:MinimumMemberus-gaap:EmployeeStockOptionMember2022-12-310001695295srt:MinimumMemberus-gaap:EmployeeStockOptionMember2021-01-012021-12-310001695295srt:MinimumMember2022-01-012022-12-310001695295srt:MinimumMember2021-01-012021-12-310001695295us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001695295us-gaap:DomesticCountryMember2022-12-310001695295us-gaap:StateAndLocalJurisdictionMember2022-12-310001695295us-gaap:DomesticCountryMember2021-12-310001695295us-gaap:StateAndLocalJurisdictionMember2021-12-310001695295us-gaap:ForeignCountryMember2022-12-310001695295us-gaap:ForeignCountryMember2021-12-310001695295hyfm:PetalumaCaliforniaMember2021-01-012021-12-310001695295us-gaap:CarryingReportedAmountFairValueDisclosureMemberhyfm:Field16LLCMember2022-12-310001695295us-gaap:CarryingReportedAmountFairValueDisclosureMemberhyfm:AuroraInnovationsLLCMember2022-12-310001695295us-gaap:EstimateOfFairValueFairValueDisclosureMemberhyfm:Field16LLCMember2022-12-310001695295us-gaap:EstimateOfFairValueFairValueDisclosureMemberhyfm:Field16LLCMember2021-12-310001695295us-gaap:EstimateOfFairValueFairValueDisclosureMemberhyfm:AuroraInnovationsLLCMember2022-12-310001695295us-gaap:EstimateOfFairValueFairValueDisclosureMemberhyfm:AuroraInnovationsLLCMember2021-12-310001695295us-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310001695295us-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2021-12-310001695295us-gaap:EstimateOfFairValueFairValueDisclosureMemberhyfm:TermLoanMemberus-gaap:FairValueInputsLevel2Member2022-12-310001695295us-gaap:EstimateOfFairValueFairValueDisclosureMemberhyfm:TermLoanMemberus-gaap:FairValueInputsLevel2Member2021-12-310001695295us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Memberhyfm:OtherDebtMember2022-12-310001695295us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Memberhyfm:OtherDebtMember2022-12-310001695295us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Memberhyfm:OtherDebtMember2021-12-310001695295us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Memberhyfm:OtherDebtMember2021-12-310001695295us-gaap:SubsequentEventMemberhyfm:CityOfEugeneCountyOfLaneStateOfOregonMember2023-01-310001695295hyfm:CityOfEugeneCountyOfLaneStateOfOregonMembersrt:ScenarioForecastMember2023-01-012023-12-310001695295hyfm:CityOfEugeneCountyOfLaneStateOfOregonMembersrt:ScenarioForecastMember2037-01-012037-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2022

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For transition period from to

Commission File Number: 001-39773

Hydrofarm Holdings Group, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 81-4895761 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification Number) |

1510 Main Street

Shoemakersville, Pennsylvania 19555

(707) 765-9990

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | | HYFM | | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☒ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filling reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐ Yes ☐ No

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): Yes ☐ No ☒

The aggregate market value of the common stock held by non-affiliates of the registrant, based on the closing price of a share of common stock on June 30, 2022, as reported by The Nasdaq Global Select Market on such date was $148 million. As of March 1, 2023, the registrant had 45,258,497 shares of common stock, $0.0001 par value per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement for its 2023 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K to the extent stated herein. Such Proxy Statement will be filed with the Securities and Exchange Commission within 120 days of the registrant’s fiscal year ended December 31, 2022.

TABLE OF CONTENTS

| | | | | | | | |

| PART I | Page |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| PART II | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| PART III | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| PART IV | |

| | |

| | |

| | |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this Annual Report on Form 10-K other than statements of historical fact, including statements concerning our business strategy and plans, future operating results and financial position, as well as our objectives and expectations for our future operations, are forward-looking statements.

In some cases, you can identify forward-looking statements by such terminology as “believe,” “may,” “will,” “potentially,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “would,” “project,” “plan,” “expect” and similar expressions that convey uncertainty of future events or outcomes, although not all forward-looking statements contain these words. Forward-looking statements include, but are not limited to, statements about:

•industry conditions, including oversupply and decreasing prices of our customers' products which, in turn, has materially adversely impacted our sales and other results of operations and which may continue to do so in the future;

•the potential for future charges associated with the impairment of our long-lived assets, inventory allowances and purchase commitment losses, and accounts receivable reserves;

•our liquidity;

•potential dilution that may result from equity financings while our stock prices are depressed;

•general economic and financial conditions, specifically in the United States and Canada;

•the conditions impacting our customers, including related crop prices and other factors impacting growers;

•the adverse effects of public health epidemics, including the ongoing COVID-19 outbreak, on our business, results of operations and financial condition;

•interruptions in the supply chain;

•federal and state legislation and regulations pertaining to the use and cultivation of cannabis in the United States and Canada;

•public perceptions and acceptance of cannabis use;

•fluctuations in the price of various crops and other factors affecting growers;

•the results of our recent acquisitions and strategic alliances;

•our long-term non-cancellable leases under which many of our facilities operate, and our ability to renew or terminate our leases;

•our reliance on, and relationships with, a limited base of key suppliers for certain products;

•our ability to keep pace with technological advances;

•our ability to execute our e-commerce business;

•the costs of being a public company;

•our ability to successfully identify appropriate acquisition targets, successfully acquire identified targets or successfully integrate the business of acquired companies;

•the success of our marketing activities;

•a disruption or breach of our information technology systems or cyber-attack;

•our current level of indebtedness;

•our dependence on third parties;

•any change to our reputation or to the reputation of our products;

•the performance of third parties on which we depend;

•the fluctuation in the prices of the products we distribute;

•competitive industry pressures;

•the consolidation of our industry;

•compliance with environmental, health and safety laws;

•our ability to protect and defend against litigation, including claims related to intellectual property and proprietary rights;

•product shortages and relationships with key suppliers;

•our ability to attract key employees;

•the volatility of the price of our common stock;

•the marketability of our common stock; and

•other risks and uncertainties, including those listed in “Risk Factors.”

We have based these forward-looking statements largely on our current expectations and described future events and trends that we believe may affect our business, financial condition, results of operations, prospects, and financial needs. These forward-looking statements speak only as of the date of this Annual Report on Form 10-K and are subject to a number of risks, uncertainties and assumptions described in the section titled “Risk Factors” and elsewhere in this Annual Report on Form 10-K. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. We disclaim any intention or obligation to publicly update or revise any forward-looking statements for any reason or to conform such statements to actual results or revised expectations, except as required by law.

“Hydrofarm” and other trade names and trademarks of ours appearing in this Annual Report on Form 10-K are our property. This Annual Report on Form 10-K contains trade names and trademarks of other companies, which are the property of their respective owners. We do not intend our use or display of other companies’ trade names or trademarks to imply an endorsement or sponsorship of us by such companies, or any relationship with any of these companies.

Unless the context otherwise indicates, references in this Annual Report on Form 10-K to the terms “Hydrofarm”, “the Company,” “we,” “our” and “us” refer to Hydrofarm Holdings Group, Inc. and its subsidiaries.

PART I

Item 1. BUSINESS

Introduction

We are a leading independent manufacturer and distributor of controlled environment agriculture ("CEA") equipment and supplies, including a broad portfolio of our own innovative and proprietary branded products. We primarily serve the U.S. and Canadian markets, and believe we are one of the leading competitors in these markets in an otherwise highly fragmented industry. For over 40 years, we have helped growers make growing easier and more productive. Our mission is to empower growers, farmers and cultivators with products that enable greater quality, efficiency, consistency and speed in their grow projects. For the 2022 fiscal year, our net sales were $345 million. From 2005 through 2022, we generated a net sales compound annual growth rate (“CAGR”) of approximately 15%.

Hydroponics is the farming of plants using soilless growing media and often artificial lighting in a controlled indoor or greenhouse environment. Hydroponics is the primary category of CEA, and we use the terms CEA and hydroponics interchangeably. Our products are used to grow, farm and cultivate cannabis, flowers, fruits, plants, vegetables, grains and herbs in controlled environment settings that allow end users to control key farming variables including temperature, humidity, CO2, light intensity spectrum, nutrient concentration and pH. Through CEA, growers are able to be more efficient with physical space, water and resources, while enjoying year-round and more rapid grow cycles as well as more predictable and abundant grow yields, when compared to other traditional growing methods.

We reach commercial farmers and consumers through a broad and diversified network of over 2,000 wholesale customer accounts, who we connect with primarily through our proprietary online ordering platform. Our products are distributed across the United States and Canada including through a diversified range of retailers of commercial and home gardening equipment and supplies. Our customers include specialty hydroponic retailers, commercial resellers and greenhouse builders, garden centers, hardware stores, and e-commerce retailers. Specialty hydroponic retailers can provide growers with specialized merchandise assortments and knowledgeable staff.

How We Serve Our Customers

Our customer value proposition is centered on two pillars. First, we strive to offer the best selection by being a branded provider of all CEA needs. Second, we seek to be the gold standard in distribution and service, leveraging our infrastructure and reach to provide customers with just-in-time (“JIT”) delivery capabilities and exceptional service across the United States and Canada.

Complete Range of Innovative CEA Products

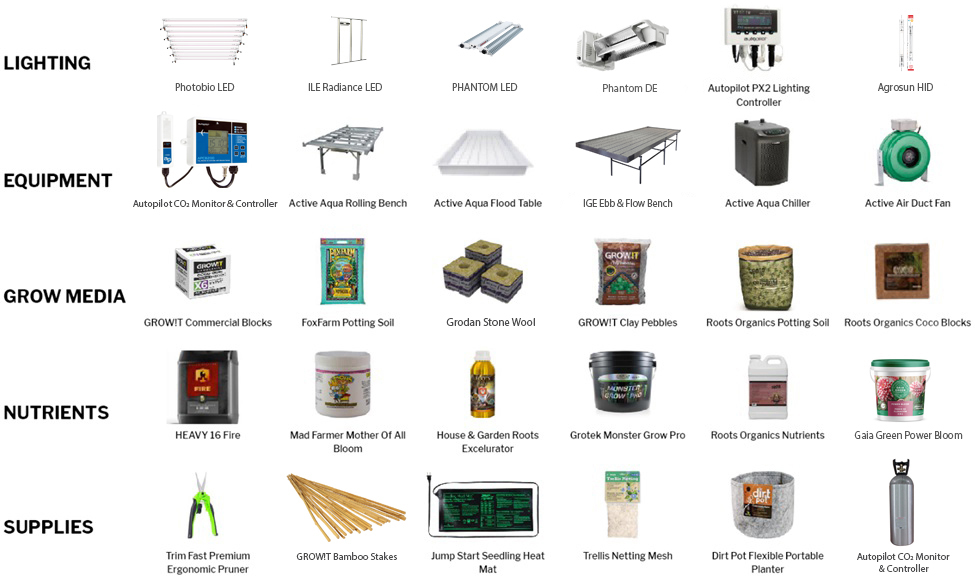

We offer thousands of innovative, branded CEA products spanning lighting solutions, growing media (i.e., premium soils and soil alternatives), nutrients, equipment and supplies.

Some of our most well-known proprietary brands include Phantom, PhotoBio, Active Aqua, Active Air, HEAVY 16, House & Garden, Mad Farmer, Roots Organics, Soul, Procision, Grotek, Gaia Green, and Innovative Growers Equipment. We estimate that approximately two-thirds of our net sales relate to recurring consumable products, including growing media, nutrients and supplies that are subject to regular replenishment. The remaining portion of our net sales relate to durable products such as hydroponic lighting and equipment. The majority of products we offer are produced by us or are supplied to us under exclusive or preferred brand relationships. These exclusive and preferred brands generally provide higher gross profit margins compared to distributed brands and provide a competitive advantage as we offer our customers a breadth of products that cannot be purchased elsewhere.

We source individual components from our supplier base to assemble certain products, and use a purchasing team in China. Raw materials used in our nutrient manufacturing operations primarily include nitrogen, potassium, and phosphate. In addition, our durables manufacturing operations primarily use steel, plastic, and aluminum as raw materials. We source these raw materials from suppliers located primarily in the United States, Canada, Europe, and China. One supplier accounted for over 10% of purchases in 2022 and 10% of purchases in 2021.

The following graphic illustrates a representative set of our market-leading products across key CEA product categories:

Infrastructure and Reach for Fast Delivery, High In-Stock Availability and Exceptional Service

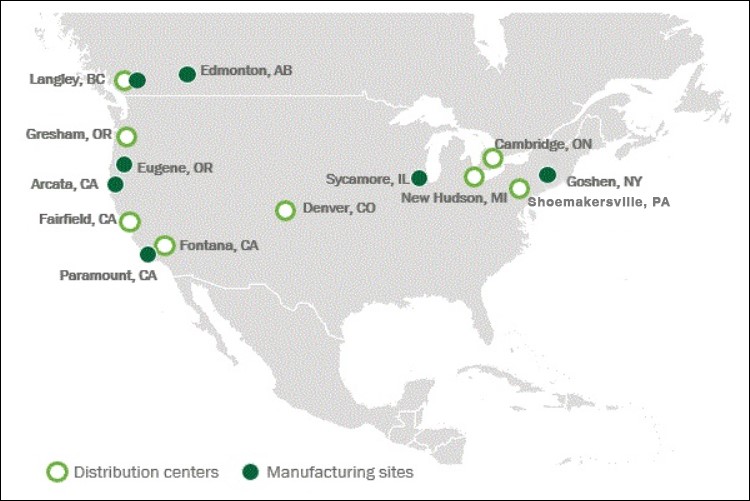

Our infrastructure and reach enables us to provide delivery and service capabilities to a highly diverse group of customers across the United States and Canada. We believe that our six U.S.-based distribution centers can reach a significant majority of our U.S. customers within 48 hours and that our two Canadian distribution centers can provide timely coverage to the full Canadian market.

In the United States, we currently operate distribution centers in Fairfield, California; Fontana, California; Gresham, Oregon; Denver, Colorado; Shoemakersville, Pennsylvania; and New Hudson, Michigan. In Canada, we currently operate distribution centers in Langley, British Columbia and Cambridge, Ontario. Outside of North America, we operate a distribution center in Zaragoza, Spain, and we maintain product quality assurance and supply chain management in Shenzhen, China. We partner with a network of third-party logistics companies that facilitate expeditious delivery to our customers across the globe. The majority of customer orders are received through our business-to-business e-commerce platform. Through our differentiated Distributor Managed Inventory (“DMI”) Program, we partner with our network of retailers and resellers to create customized, JIT supply chain solutions for large commercial end users.

In the United States, we currently operate manufacturing facilities in Paramount, California; Arcata, California; Eugene, Oregon; Goshen, New York; and Sycamore, Illinois. In Canada, we currently have manufacturing facilities in Edmonton, Alberta and Langley, British Columbia.

The CEA Industry

Our principal industry opportunity is in the wholesale distribution of CEA equipment and supplies, which generally include grow light systems; advanced heating, ventilation, and air conditioning (“HVAC”) systems; humidity and carbon dioxide monitors and controllers; water pumps, heaters, chillers, and filters; nutrient and fertilizer delivery systems; and various growing media typically made from soil, rock wool or coconut fiber, among others. Today, we believe that a majority of our products are sold for use in CEA applications.

Pictured: PHOTOBIO MX LED, Active Air Commercial Humidifier, Active Aqua Submersible Water Pump, Active Air Heavy Duty 16" Metal Wall Mount Fan, IGE Grow Racks, House & Garden Bud XL, and Roots Organics Soilless Hydroponic Coco Mix.

CEA is a component of the global commercial agriculture and consumer gardening sectors. According to industry publications, it estimated that the global CEA industry grew to total approximately $75 billion in 20221, and is expected to grow at a CAGR of 19% from 2022 to 20271. The growth of CEA crop output may subsequently drive growth in the wholesale CEA equipment and supplies industry. According to industry publications, the global hydroponic system market, which primarily represents the categories in which we operate, had an estimated total of approximately $12.1 billion in 2022 and had an expectation to grow at a CAGR of 16% from 2022 to 20272. We estimate, based upon segmentation data available in industry reports, that the North America hydroponic system market had an estimated value of approximately $3.7 billion in 20223.

Since 2005, we have grown our net sales at an approximate 15% CAGR. This historical growth is largely due to the CEA market growth, including from cannabis, and our ability to serve these markets with innovative branded products.

While the CEA cannabis market has experienced an agricultural oversupply, we believe that our industry continues to maintain future growth prospects as it matures. Expanding populations, limited natural resources and a focus on the environment and the security of our agricultural systems have illuminated the benefits of CEA compared to traditional outdoor agriculture. We believe the adoption of CEA will grow particularly in the commercial agriculture industry, where CEA can be

1 KD Market Insights Controlled Environment Agriculture Market, February 2022

2 Markets and MarketsTM Hydroponics Market Global Forecast, September 2022

3 Hydroponics Market Global Forecast to 2025, July 2020

deployed to achieve results that are simultaneously more efficient for the planet and profitable for growers. The global cannabis industry is a developing business opportunity for us, particularly as the legal market in the United States continues to expand.

Today, we believe that a majority of the CEA equipment and supplies we sell to our customers is ultimately purchased by participants in the cannabis industry, though we do not sell to cannabis growers or to retailers that sell only to the cannabis industry in the United States. As previously described, an agricultural oversupply has impacted our industry, driving cannabis wholesale prices down significantly and resulting in a decrease in indoor and outdoor cultivation. The oversupply has been impacted by increased licensing activity across the United States, as well as significant capital investment in the cannabis production marketplace over the past several years and the market impacts of the COVID-19 pandemic. Despite these current factors negatively impacting the industry, according to certain industry publications4, the U.S. cannabis market is projected to reach approximately $52.6 billion by 2026, up from approximately $33.0 billion in 2022, representing a 12.4% CAGR.

We believe this forecasted growth in the U.S. cannabis market may be attributable to (i) state initiatives for new adult use and/or medical use programs in additional U.S. states, (ii) expanded access for patients or consumers in existing state medical or adult use cannabis programs, and (iii) increased consumption driven by greater product diversity and choice, reduced stigma, and real and perceived health benefits in states with existing adult use or medical use programs. According to a November 2022 poll by Pew Research Center, public support for the legalization of cannabis in the United States has significantly increased. Approximately 59% of U.S. adults say that cannabis should be legal for recreational and medical use, while an additional 30% say it should be legal for medical use only. In addition, states with legalized adult use cannabis may offer state governments with additional taxation revenue and state job creation. A number of states are at various stages of considering implementing laws permitting cannabis use or further liberalizing their existing laws permitting such use. Our sales in U.S. states with legalized adult use recreational programs are on average several multiples higher than our sales in states without adult use recreational programs. We believe this supports the market opportunity available to us if additional U.S. states legalize adult use recreational programs.

Several key developments have contributed to an increase in cannabis product availability and breadth, including the proliferation of cannabidiol (CBD) and other cannabis-infused products, including edibles, oils, tinctures, and topical treatments. We believe that the historical stigmatization of cannabis use has diminished, driven by generally a more supportive legislative environment, a rise in progressive sociopolitical views and greater consumer awareness of the potential health benefits of cannabis consumption. According to industry publications, real and perceived health benefits extend into areas including cancer treatment, pain management, the treatment of neurological and mental conditions, and sleep management.

Benefits of CEA Adoption

Both the commercial agriculture and cannabis industries are adopting more advanced agricultural technologies in order to enhance the productivity and efficiency of operations. The benefits of CEA include:

•Greater product safety, quality and consistency;

•More reliable, climate-agnostic year-round crop supply from multiple, faster harvests per year as opposed to a single, large harvest with outdoor cultivation;

•Lower risk of crop loss from pests (and subsequently lower need for pesticides) and plant disease;

•Lower required water and pesticide use compared to conventional farming, offering incremental benefits in the form of reduced chemical runoff and lower labor requirements; and

•Potentially lower operating expenses from resource-saving technologies such as high-efficiency LED lights, precision nutrient and water systems and automation.

CEA implementation is driven by the factors listed above as well as growth in fruit and vegetable farming, consumer gardening and the adoption of vertical farming. Vertical farming, a subsector of CEA, has gained popularity mainly due to its unique advantage of maximizing yield by growing crops in layers.

While a small portion of cannabis cultivation may be grown in non-CEA settings, given the benefits of CEA cultivation, we believe CEA will continue to be the primary method of growing cannabis. In the United States and Canada there has been an increase in regulatory oversight and statutory requirements for growers and their products. These regulations

4 MJBiz Daily, June 2022

enhance product safety and transparency to consumers but usually necessitate the use of CEA in cannabis cultivation in order to meet mandated tetrahydrocannabinol (THC) content or impurity tolerances.

Increased Focus on Environmental, Social, and Governance (“ESG”) Issues

We believe certain of our CEA end-markets support ESG trends as they may preserve resources, enhance the transparency and safety of our food supply chains, and deliver superior performance characteristics versus traditional agriculture. On January 11, 2022, we released our first ESG report to stakeholders, highlighting our environmental, health and safety focus and sustainable governance practices during the 2021 fiscal year.

Our Competitive Strengths

Leading Market Position in our Industry

We are a leading independent manufacturer and distributor of CEA equipment and supplies in the United States and Canada and one of the two major consolidators in the CEA industry. The broader market is comprised of a fragmented group of smaller competitors. Over the course of our long operating history, we have developed product and market expertise that we believe has made us a leader in our industry.

Experienced Management Team with Proven Track Record

Our management team possesses significant public market experience, a history of driving long-term organic growth and a track record of successful business consolidations. Bill Toler, Chairman and Chief Executive Officer, has over 35 years of executive leadership experience in supply chain and consumer packaged goods, most recently serving as President and Chief Executive Officer of Hostess Brands from April 2014 to March 2018. Under his leadership, Hostess Brands transitioned from a private to public company, regained a leading market position within the sweet baked goods category and returned to profitability. Bill also previously served as Chief Executive Officer of AdvancePierre Foods and President of Pinnacle Foods, in addition to holding executive roles at Campbell Soup Company, Nabisco and Procter & Gamble. B. John Lindeman, Chief Financial Officer, brings us more than 25 years of finance and leadership experience. Most recently, he served as Chief Financial Officer and Corporate Secretary at Calavo Growers, Inc., a fresh food company, where he was responsible for the finance, accounting, IT and human resource functions. Prior to joining Calavo, he held various leadership positions within the finance and investment banking industries at Janney Montgomery Scott, Stifel Nicolaus, Legg Mason and PricewaterhouseCoopers LLP.

Broad Portfolio with Innovative Proprietary Offerings and Recurring Consumables Sales

We have a large equipment and consumable product offering, including lighting solutions, growing media, nutrients, equipment and supplies. We offer everything growers need to ensure their operations are maximizing efficiency, output and quality. We maintain an extensive portfolio of products which includes over 35 internally developed or acquired proprietary brands across thousands of stock keeping units ("SKUs") as well as over 60 preferred brands. Approximately 75% of our sales relate to proprietary and preferred brands. We sell proprietary and preferred brands across all of our product categories. In 2021, we completed five acquisitions of branded manufacturers of CEA products, resulting in a significant expansion of our portfolio of proprietary branded products, which generally earn a significant gross margin premium relative to distributed brands. We believe that approximately two-thirds of our net sales are generated from the sale of recurring consumable products including growing media, nutrients and supplies.

Manufacturing Capabilities

Following our 2021 acquisitions, we now maintain internal manufacturing capabilities across seven locations in North America which includes organic certified and synthetic liquid and dry nutrient blending and bottling, organic certified soil blending and bagging, perlite production, injection molding capabilities, custom and off the shelf horticulture benches and racking system fabrication, automated LED light manufacturing (LED surface mounting and light fixture assembly), and peat harvesting and baling. Our peat harvesting operation provides useful products for improving grow media and organic farming.

Supplier Relationships and Geographic Footprint

We have developed distribution relationships with a network of approximately 400 suppliers, giving us access to a best-in-class diverse product portfolio and allowing us to provide a full range of CEA solutions to our customers. We have cultivated long-term relationships with several of our main suppliers. We also maintain a geographic footprint that enables us to efficiently serve our customers across North America. We believe that our six distribution centers in the United States can reach

a significant majority of our U.S. customers within 48 hours and our two distribution centers in British Columbia and Ontario can provide timely coverage to the full Canadian market.

Solution Based Approach to Serve Our Customers

We maintain long-standing relationships with a diversified range of specialty hydroponic retailers, commercial resellers and greenhouse builders, garden centers, hardware stores, and e-commerce retailers. We serve over 2,000 wholesale customer accounts across multiple channels in North America, providing customers with the capability to purchase their entire product range from us. To better serve our customers, we are reorganizing our commercial sales team to drive a solution based approach, focusing on added competencies and product assortment gained from our recent acquisitions. DMI programs further enhance our customer capabilities, offering consultation, technical expertise, facilitated order fulfillment and JIT delivery of consumables. We leverage a seasoned sales team and our internal product category experts to provide industry insights, product capabilities and customer support. We maintain long-term relationships with the majority of our largest customers.

Our Growth and Productivity Strategies

Capitalizing on the Growing CEA Market

Our customers benefit from macroeconomic factors driving the growth of CEA, including expanded adoption of CEA by commercial growers and consumers, as well as the growth in cannabis, and other end-markets. Industry publications estimate that the global CEA industry will grow at a 19% CAGR from 2022 to 2027. Moreover, the North America hydroponic system market had an estimated value of approximately $3.7 billion in 2022, and is projected to grow at a CAGR of 16% from 2022 to 2027.

Strategic Enhancements to our Product Offering

We significantly expanded the breadth of our proprietary product assortment through five acquisitions in 2021:

•Heavy 16, a manufacturer of plant nutrients and additives, in May 2021;

•House & Garden, a manufacturer of plant nutrients and additives, in June 2021;

•Aurora Innovations, a manufacturer of soil, grow media, plant nutrients and additives, in July 2021;

•Greenstar Plant Products, a manufacturer of plant nutrients and additives, in August 2021; and

•Innovative Growers Equipment, a manufacturer of horticultural benches, racks and grow lights, in November 2021.

Our proprietary brands generally provide for higher gross profit margins compared to distributed brands and a competitive advantage as we offer products that cannot be purchased elsewhere. We invest in research and development to improve our products and manufacturing processes and to expand our overall brand value. We have launched several new product lines over the last two years, most notably PhotoBio LED lighting equipment. Through recent acquisitions, we have expanded our proprietary brands to include Heavy 16, House & Garden, Mad Farmer, Roots Organics, Soul, Procision, Grotek, Gaia Green, and Innovative Growers Equipment. In addition, we selectively add distributed products when the brand or technology provides us with a more comprehensive assortment to satisfy our customers' needs. In the fourth quarter of 2022, we strategically identified products and brands to exit from our portfolio, enabling to better focus on higher value proprietary products and solutions for our customers.

Enabling Wholesaler Network to Effectively Serve Commercial Growers

Working with our wholesale network, we are leveraging our sophisticated product experts and technical sales team to provide our wholesale network the ability to address the needs, demanding requirements and higher volume of their larger-scale commercial customers. Establishing these relationships with our channel provides us with insight and access to growers’ evolving demands, leading to both increased equipment sales and recurring sales of consumables through our wholesale network. Our commercial grower outreach program, our analytically driven supply chain function and DMI capabilities enable our wholesaler network to anticipate customer demand for products and ensure their availability. The goal of these efforts is to maintain long-term relationships with our wholesalers by helping them be successful in providing cultivation square footage savings and access to JIT inventory to their customer base. We believe this can result in profitability for our wholesalers’ customers on consumables and equipment. We also believe that increasing the value to our wholesale network will allow us to grow within key accounts and expand sales of our products and services to new accounts.

Expanding our Offerings within CEA Food and Floral Markets and Garden Centers

CEA offers a more sustainable and secure alternative to traditional outdoor agriculture, allowing food to be grown closer to where it is ultimately consumed, thereby reducing supply chain-related risks and food waste. Additionally, we believe consumer gardening can be an important driver of future CEA growth, as many U.S. households participate in lawn and gardening activities today. To that end, we have reorganized our sales efforts, including added competencies and product assortment from our recent acquisitions, to focus on the CEA food and floral market, and the consumer gardening markets, where we are well suited to expand our business.

Acquiring Value-Enhancing Businesses

The hydroponics industry is highly fragmented, which we believe presents an opportunity for growth through acquisitions. We utilize clear investment criteria to make disciplined M&A decisions with the goal of accelerating sales and EBITDA growth, increasing competitive strength and market share and expanding our proprietary brand portfolio. We pursue opportunities to grow our business through acquisitions of strategically complementary businesses. We aim primarily to acquire companies that have a competitive market position with the potential to increase market share, a strong brand, high recurring revenue and strong margin potential. We seek acquisition targets that can accelerate our growth and generate significant cash flows over time. As previously discussed, we completed five acquisitions in fiscal 2021. Refer to Part II, Item 8, Financial Statements, Note 10 - Debt, for details regarding certain covenants in our JPMorgan Revolving Loan Facility that currently limit the Company's ability to consummate acquisitions.

Acquisitions involve a number of risks and may not achieve our expectations; and, therefore, we could be adversely affected by any such acquisition. There are a number of risks inherent in assessing the value, strengths, weaknesses, contingent or other liabilities, and potential profitability of acquisition candidates, as well as the challenges of integrating acquired companies and achieving potential synergies once an acquisition is consummated, that may cause an acquisition to fail.

Effects of COVID-19 on Our Business

The World Health Organization recognized COVID-19 as a global pandemic on March 11, 2020, and COVID-19 has had significant and ongoing negative impacts on global societies, workplaces, economies and health systems. Authorities throughout the world have implemented measures to contain or mitigate the spread of the virus, including at various times physical distancing, travel bans and restrictions, closure of non-essential businesses, quarantines, work-from-home directives, mask requirements, shelter-in-place orders and vaccination programs, but despite these efforts, COVID-19 has persisted, has mutated into new variants, and is expected to become endemic.

We have implemented business continuity plans and followed safety protocols as recommended by government guidelines, and we will continue to do so as the state of COVID-19 evolves. As of the filing of this Annual Report on Form 10-K, our operations are not impacted by any COVID-19 related facility closures, lockdown measures, travel restrictions or similar limitations. However, new waves of COVID-19 or its variants could cause the reinstatement of such limitations, and such limitations may adversely impact our supply chains, the manufacturing of our own products and our ability to obtain necessary materials, all of which could adversely affect our business, results of operations and financial condition. We have historically and may continue to source select products from China. We have experienced in the past, and may again in the future experience some extended lead times in our supply chain, as well as increased shipping costs, and we believe the COVID-19 pandemic is a contributing factor to those extended lead times and increased costs. Furthermore, potential suppliers or sources of materials may pass the increase in sourcing costs due to the COVID-19 pandemic to us through price increases, thereby impacting our potential future profit margins.

The extent to which the COVID-19 pandemic will ultimately impact our business, results of operations, financial condition and cash flows depends on future developments that are highly uncertain, rapidly evolving and difficult to predict at this time. It is difficult to assess or quantify with precision the impact COVID-19 has directly had on our business since we cannot precisely quantify the impacts, if any, that the various effects have had on the overall business. We believe COVID-19 may have provided a positive demand impact in 2020 and 2021 from shelter-in-place orders in the United States, a possible negative supply chain impact from workforce disruption at international and domestic suppliers, and a possible negative growth rate impact in 2022 due to agricultural oversupply initiated during the height of COVID-related shelter-in-place orders in 2020 and 2021. Management believes that COVID-19 drove a greater volume of sales by our customers in select time periods, thus creating demand for our CEA supplies and equipment. We continue to monitor the COVID-19 pandemic and will adjust our mitigation strategies as necessary to address changing health, operational or financial risks that may arise.

Government Regulation

For U.S. based operations, there is no national regulatory body providing oversight of the Hydrofarm portfolio of products. A substantial number of our products in our growing media and nutrients product lines are subject to U.S. state specific registration requirements. Organic listed products are audited by the California Department of Food and Agriculture and the Organic Materials Review Institute. Finished goods and ingredients labeled as pesticides are regulated by the Environmental Protection Agency (the “EPA”). Canadian based operations and product lines are regulated under the Canadian Food Inspection Agency. Organic certified products are attested by EcoCert. Our peat harvesting operations are regulated by provincial and municipal bodies, including Alberta Environment and Parks regulations.

Grow Media and Nutrients

Our leading product lines are growing media and nutrients products. These product lines include organic listed soils, soils without organic listings, and both organic listed and synthetic nutrients that contain ingredients requiring supplier registration with certain regulators. The use and disposal of these products in some jurisdictions are subject to regulation by various agencies. A decision by a regulatory agency to significantly restrict the use of these products impacts those companies providing us with such regulated products, and as a result, limits our ability to sell these products.

International, federal, state, provincial and local laws and regulations relating to environmental, health and safety matters affect us in several ways in light of the ingredients that are used in products included in our growing media and nutrients product line. In the United States, products containing pesticides generally must be registered with the EPA and similar state agencies before they can be sold or applied. The failure by one of our partners to obtain, or the cancellation of any such registration, or the withdrawal from the marketplace of such pesticides, could have an adverse effect on our businesses, the severity of which would depend on the products involved, whether other products could be substituted and whether our competitors were similarly affected. The pesticides we use are either granted a license by the EPA or exempt from such a license and may be evaluated by the EPA as part of its ongoing exposure risk assessment. The EPA may decide that a pesticide we distribute will be limited or will not be re-registered for use in the United States. We cannot predict the outcome or the severity of the effect on our business of any future evaluations, if any, conducted by the EPA.

In addition, the use of certain pesticide products is regulated by various international, federal, state, provincial and local environmental and public health agencies. Although we strive to comply with such laws and regulations and have processes in place designed to achieve compliance, we may be unable to prevent violations of these or other laws and regulations from occurring. Even if we are able to comply with all such laws and regulations and obtain all necessary registrations and licenses, the pesticides or other products we apply or use, or the manner in which we apply or use them, could be effected by changing regulations or changing interpretations of the regulations, could be alleged to cause injury to the environment, to people or to animals, or such products could be banned in certain circumstances.

Cannabis Industry

We sell our products through third-party retailers and resellers and not directly to cannabis growers in countries that prohibit the sale and use of cannabis, including the United States. Nonetheless, it is evident to us that the legalization of cannabis in many U.S. states and Canada has ultimately had a significant, positive impact on our industry. Accordingly, laws and regulations governing the cultivation and sale of cannabis and related products have an indirect effect on our business. Legislation and regulations pertaining to the use and growth of cannabis are enacted on both the state and federal government level within the United States. The federal and state laws and regulations governing the growth and use of cannabis are subject to change. New laws and regulations pertaining to the use or cultivation of cannabis and enforcement actions by state and federal authorities concerning the cultivation or use of cannabis could indirectly reduce demand for our products, and may impact our current and planned future operations.

Individual state laws regarding the cultivation, possession, and use of cannabis for adult and medical uses conflict with federal laws prohibiting the cultivation, possession and use of cannabis for any purpose. A number of states have passed legislation legalizing or decriminalizing cannabis for adult use, other states have enacted legislation specifically permitting the cultivation and use of cannabis for medicinal purposes, and several states have enacted legislation permitting cannabis cultivation and use for both adult and medicinal purposes.

Certain of our products may be purchased for use in new and emerging industries and/or be subject to varying, inconsistent, and rapidly changing laws, regulations, administrative practices, enforcement approaches, judicial interpretations, future scientific research and public perception.

We sell products, including hydroponic gardening products, through third-party retailers and resellers. End users may purchase these products for use in new and emerging industries, including the growing of cannabis, that may not grow or

achieve market acceptance in a manner that we can predict. The demand for these products is dependent on the growth of these industries, which is uncertain, as well as the laws governing the growth, possession, and use of cannabis by adults for both adult and medical use.

Laws and regulations affecting the U.S. cannabis industry are continually changing, which could detrimentally affect our growth, revenues, results of operations and success generally. Local, state and federal cannabis laws and regulations are broad in scope and subject to evolving interpretations, which could require the end users of certain of our products or us to incur substantial costs associated with compliance or to alter our respective business plans. In addition, violations of these laws, or allegations of such violations, could disrupt our business and result in a material adverse effect on our results of operation and financial condition.

The public’s perception of cannabis may significantly impact the cannabis industry’s success. Both the medical and adult use of cannabis are controversial topics, and there is no guarantee that future scientific research, publicity, regulations, medical opinion, and public opinion relating to cannabis will be favorable. The cannabis industry is an early-stage business that is constantly evolving with no guarantee of viability. The market for medical and adult use of cannabis is uncertain, and any adverse or negative publicity, scientific research, limiting regulations, medical opinion and public opinion (whether or not accurate or with merit) relating to the consumption of cannabis, whether in the United States or internationally, may have a material adverse effect on our operational results, consumer base, and financial results. Among other things, such a shift in public opinion could cause state jurisdictions to abandon initiatives or proposals to legalize medical or adult cannabis or adopt new laws or regulations restricting or prohibiting the medical or adult use of cannabis where it is now legal, thereby limiting the potential customers and end-users of our products who are engaged in the cannabis industry (collectively “Cannabis Industry Participants”).

Demand for our products may be negatively impacted depending on how laws, regulations, administrative practices, enforcement approaches, judicial interpretations, and consumer perceptions develop. We cannot predict the nature of such developments or the effect, if any, that such developments could have on our business.

We are subject to a number of risks, directly and indirectly through our Cannabis Industry Participants, because cannabis is illegal under federal law. Federal law and enforcement may adversely affect the implementation of medical cannabis and/or adult use cannabis laws, and may negatively impact our revenues and profits.

Under the U.S. Controlled Substances Act of 1970 (the “CSA”), the U.S. government lists cannabis as a Schedule I controlled substance (i.e., deemed to have no medical value), and accordingly the manufacturing (cultivation), sale, or possession of cannabis is federally illegal. It is also federally illegal to advertise the sale of cannabis or to sell paraphernalia designed or intended primarily for use with cannabis, unless the paraphernalia is authorized by federal, state, or local law. The U.S. Supreme Court ruled in United States v. Oakland Cannabis Buyers’ Cooperative, 532 U.S. 483 (2001), and Gonzales v. Raich, 545 U.S. 1 (2005), that the federal government has the right to regulate and criminalize cannabis, even for medical purposes. The illegality of cannabis under federal law preempts state laws that legalize or decriminalize its use. Therefore, strict enforcement of federal law regarding cannabis would likely adversely affect our revenues and results of operations.

Other laws that directly impact the cannabis growers that are end users of certain of our products include:

•Businesses trafficking in cannabis may not take tax deductions for costs beyond costs of goods sold under Code Section 280E. There is no way to predict how the federal government may treat cannabis businesses from a taxation standpoint in the future, and no assurance can be given to what extent Code Section 280E, or other tax-related laws and regulations, may be applied to cannabis businesses in the future.

•Because the manufacturing (cultivation), sale, possession and use of cannabis is illegal under federal law, cannabis businesses may have restricted intellectual property and proprietary rights, particularly with respect to obtaining and enforcing patents and trademarks. Our inability to register, or maintain, our trademarks or file for or enforce patents on any of our inventions could materially affect our ability to protect our name, brand and proprietary technologies. In addition, cannabis businesses may face court action by third parties under the Racketeer Influenced and Corrupt Organizations Act (“RICO”). Our intellectual property and proprietary rights could be impaired as a result of our retailers’ and resellers’ involvement with cannabis business, and we could be named as a defendant in an action asserting a RICO violation.

•Similar to the risks relating to intellectual property and proprietary rights, there is an argument that the federal bankruptcy courts cannot provide relief for parties who engage in cannabis. Recent bankruptcy rulings have denied bankruptcies for cannabis dispensaries upon the justification that businesses cannot violate federal law and then claim the benefits of federal bankruptcy for the same activity and upon the justification that courts cannot ask a bankruptcy trustee to take possession of, and distribute cannabis assets as such action would violate the CSA. Therefore, due to our retailers’ and resellers’ involvement with cannabis businesses, we may not be able to seek the protection of the bankruptcy courts and this could materially affect our financial performance and/or our ability to obtain or maintain credit.

•Since cannabis is illegal under federal law, there is a strong argument that banks cannot accept deposit funds from businesses involved in the cannabis industry. Consequently, businesses involved in the cannabis industry often have difficulty finding a bank willing to accept their business. Any such inability to open or maintain bank accounts may make it difficult for us to operate our business. Under the Bank Secrecy Act (“BSA”), banks must report to the federal government any suspected illegal activity, which includes any transaction associated with a cannabis business. These reports must be filed even though the business is operating legitimately under state law. In addition, due to our retailers’ and resellers’ involvement with cannabis businesses, our existing bank accounts could be closed.

•Insurance that is otherwise readily available, such as general liability and directors and officer’s insurance, may be more difficult for us to find, and more expensive, to the extent we are deemed to operate in the cannabis industry.

Any presidential administration, current or future, could change federal enforcement policy or execution and decide to enforce the federal cannabis laws more strongly. Recent administrations have disagreed on how strongly to enforce federal cannabis laws. For example, on August 29, 2013, the U.S. Department of Justice (the “DOJ”) under the Obama administration issued a memorandum (the “Cole Memorandum”), characterizing strict enforcement as an inefficient use of federal investigative and prosecutorial resources. The Cole Memorandum provided guidance to all federal prosecutors and indicated that federal enforcement of the CSA against cannabis-related conduct should be focused on specific priorities, including cannabis distribution to minors, violence in connection with cannabis distribution, cannabis cultivation on federal property, and collection of cannabis-derived revenue by criminal enterprises, gangs and cartels. On January 4, 2018, the DOJ under the Trump administration issued a memorandum (the “Sessions Memorandum”), which effectively rescinded the Cole Memorandum and directed federal prosecutors to enforce the CSA and to follow well-established principles when pursuing prosecutions related to cannabis activities. The DOJ under the Biden administration has not readopted the Cole Memorandum, but President Biden has indicated support for decriminalization of cannabis. On October 6, 2022, President Biden issued an executive order pardoning all persons convicted of simple possession of cannabis under the CSA and directed the Secretary of Health and Human Services and the Attorney General to initiate an administrative process to review the scheduling of cannabis under the CSA. Further, on December 2, 2022, President Biden signed into law the Medical Marijuana and Cannabidiol Research Expansion Act, which streamlines and expands the process for researching the medical use of cannabis. We cannot predict how the current administration or future administrations will enforce the CSA or other laws against cannabis activities. Any change in the federal government’s enforcement of current federal laws could cause significant financial damage to us. The legal uncertainty and possible future changes in law could negatively affect our growth, revenues, results of operations and success generally.

Unless and until Congress amends the CSA with respect to medical and/or adult use cannabis, there is a risk that federal prosecutors may enforce the existing CSA. Federal authorities may decide to change their current posture and begin to enforce current federal cannabis law and, if they begin to aggressively enforce such laws, it is possible that they could allege that we violated federal laws by selling products used in the cannabis industry. As a result, active enforcement of the current federal regulatory position on cannabis may directly or indirectly adversely affect our revenues and profits.

Violations of any U.S. federal laws and regulations could result in significant fines, penalties, administrative sanctions, convictions or settlements arising from civil proceedings conducted by either the U.S. federal government or private citizens, or criminal charges, including, but not limited to, disgorgement of profits, cessation of business activities or divestiture. This could have a material adverse effect on our business, including our reputation and ability to conduct business, the listing of our securities on any stock exchanges, the settlement of trades of our securities, our ability to obtain banking services, our financial position, operating results, profitability or liquidity or the market price of our publicly-traded shares. In addition, it is difficult for us to estimate the time or resources that would be needed for the investigation of any such matters or their final resolution

because, in part, the time and resources that may be needed are dependent on the nature and extent of any information requested by the applicable authorities involved, and such time or resources could be substantial.

Businesses involved in the cannabis industry, and investments in such businesses, are subject to a variety of laws and regulations related to money laundering, financial recordkeeping and proceeds of crimes.

We sell our products through third-party retailers and resellers which do not exclusively sell to the cannabis industry. Investments in the U.S. cannabis industry are subject to a variety of laws and regulations that involve money laundering, financial recordkeeping and proceeds of crime, including the BSA, as amended by the USA Patriot Act, other anti-money laundering laws, and any related or similar rules, regulations or guidelines, issued, administered or enforced by governmental authorities in the United States. In February 2014, the Financial Crimes Enforcement Network (“FinCEN”) of the Treasury Department issued a memorandum (the “FinCEN Memo”) providing guidance to banks seeking to provide services to cannabis businesses. The FinCEN Memo outlines circumstances under which banks may provide services to cannabis businesses without risking federal prosecution for violation of U.S. federal money laundering laws. It refers to supplementary guidance that Deputy Attorney General Cole issued to U.S. federal prosecutors relating to the prosecution of U.S. money laundering offenses predicated on cannabis violations of the CSA and outlines extensive due diligence and reporting requirements. The FinCEN Memo currently remains in place, but it is unclear at this time whether current or future administrations will continue to follow the guidelines of the FinCEN Memo. Any abrogation or modification of the FinCEN Memo could negatively affect the ability of certain of the end users of our products to establish and maintain banking relationships.

The U.S. House of Representatives has passed the Secure and Fair Enforcement (SAFE) Act (the “SAFE Banking Act”) numerous times, and, if enacted, this bill would protect banks and credit unions from federal prosecution for providing services to cannabis companies. However, the Senate has thus far failed to pass the SAFE Banking Act or other similar legislation, despite industry expectations that the Senate would pass the SAFE Banking Act in late 2022.

We sell our products through third-party retailers and resellers which do not exclusively sell to the cannabis industry. Some of our products are sold to Cannabis Industry Participants and used in connection with cannabis businesses that are subject to federal and state controlled substance laws and regulations. Cannabis businesses are subject to a number of risks related to controlled substances, which risks could reduce demand for our products by Cannabis Industry Participants. Such risks include, but are not limited to, the following: