UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| [X] | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2019

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____ to ______

000-55735

(Commission file number)

VERONI BRANDS CORP.

(Exact name of registrant as specified in its charter)

| Delaware | 81-4664596 | |

(State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

2275 Half Day Rd. Suite 346, Bannockburn, IL 60015

(Address of principal executive offices) (Zip Code)

(888)794-2999

(Registrant’s telephone number, including area code)

Not applicable

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

| Emerging growth company [X] |

If an emerging growth company, indicate by the check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: 26,738,362 shares as of November 14, 2019.

VERONI BRANDS CORP.

FORM 10-Q

FOR THE QUARTER ENDED

September 30, 2019

INDEX

| Page | ||

| PART I. FINANCIAL INFORMATION | ||

| Item 1. | Financial Statements: | |

| Condensed Balance Sheets (Unaudited) | 3 | |

| Statements of Operations (Unaudited) | 4 | |

| Statement of Changes in Stockholders’ Equity (Unaudited) | 5 | |

| Statements of Cash Flows (Unaudited) | 6 | |

| Notes to Unaudited Condensed Financial Statements | 7 | |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 15 |

| Item 3. | Quantitative and Qualitative Disclosures about Market Risk | 18 |

| Item 4. | Controls and Procedures | 18 |

| PART II. OTHER INFORMATION | ||

| Item 1. | Legal Proceedings | 20 |

| Item 1A. | Risk Factors | 20 |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 20 |

| Item 3. | Defaults Upon Senior Securities | 20 |

| Item 4. | Mine Safety Disclosures | 20 |

| Item 5. | Other Information | 20 |

| Item 6. | Exhibits | 20 |

| SIGNATURES | 21 | |

| 2 |

CONDENSED BALANCE SHEETS

September 30, 2019 and December 31, 2018

| 2019 | 2018 | |||||||

| (Unaudited) | * | |||||||

| ASSETS | ||||||||

| Current Assets | ||||||||

| Cash & equivalents | $ | 109,702 | $ | 2,999 | ||||

| Accounts Receivable, net allowance for doubtful accounts of $0 and $9,448 respectively | 203,715 | 13,160 | ||||||

| Contract Receivables with recouse | 1,021,167 | - | ||||||

| Inventory | 483,801 | 208,369 | ||||||

| Prepaid expenses and other current assets | 35,917 | 106,317 | ||||||

| Total Current Assets | 1,854,302 | 330,845 | ||||||

| Deposits | 9,310 | - | ||||||

| Total Assets | $ | 1,863,612 | $ | 330,845 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current Liabilities | ||||||||

| Accounts payable | $ | 255,045 | $ | 43,713 | ||||

| Notes payable - related parties including interest | 61,370 | 157,059 | ||||||

| Notes payable - other | 173,663 | - | ||||||

| Contract receivables liability with recourse | 865,577 | - | ||||||

| Accrued liabilities | 113,601 | 23,921 | ||||||

| Total Current Liabilities | 1,469,256 | 224,693 | ||||||

| STOCKHOLDERS’ DEFICIT | ||||||||

| Preferred Stock, $0.0001 par value; 20,000,000 shares authorized; none outstanding as of September 30, 2019 and December 31, 2018. | - | - | ||||||

| Common Stock, $0.0001 par value; 100,000,000 shares authorized;26,951,397 and 26,568,400 shares issued and outstanding as of September 30, 2019 and December 31, 2018, respectively | 2,695 | 2,656 | ||||||

| Additional paid-in capital | 696,892 | 409,683 | ||||||

| ACCUMULATED DEFICIT | (305,231 | ) | (306,187 | ) | ||||

| Total Stockholders’ Equity | 394,356 | 106,152 | ||||||

| Total Liabilities and Stockholders’ Equity | $ | 1,863,612 | $ | 330,845 | ||||

* derived from audited information

The accompanying notes are an integral part of these financial statements

| 3 |

STATEMENTS OF OPERATIONS

For the three and nine months ended September 30, 2019 and 2018

(Unaudited)

| For the three months ended | For the nine months ended | |||||||||||||||

| September 30, 2019 | September 30, 2018 | September 30, 2019 | September 30, 2018 | |||||||||||||

| Revenue | $ | 1,899,828 | $ | 9,951 | $ | 5,230,968 | $ | 21,020 | ||||||||

| Cost of sales | 1,589,780 | 3,614 | 4,285,793 | 8,686 | ||||||||||||

| Gross Profit | 310,048 | 6,337 | 945,175 | 12,334 | ||||||||||||

| Selling expenses | 57,231 | 12,706 | 388,032 | 71,352 | ||||||||||||

| General and administrative expenses | 154,788 | 19,977 | 324,934 | 111,068 | ||||||||||||

| Total operating expenses | 212,019 | 32,683 | 712,966 | 182,420 | ||||||||||||

| Net income (loss) from operations | 98,029 | (26,346 | ) | 232,209 | (170,086 | ) | ||||||||||

| Interest expense | 94,625 | - | 230,253 | - | ||||||||||||

| Interest expense - related party | 1,000 | - | 1,000 | - | ||||||||||||

| Total other expense | 95,625 | - | 231,253 | - | ||||||||||||

| Income (loss) before income taxes | 2,404 | (26,346 | ) | 956 | (170,086 | ) | ||||||||||

| Income taxes | - | - | - | - | ||||||||||||

| Net income (loss) | $ | 2,404 | $ | (26,346 | ) | $ | 956 | $ | (170,086 | ) | ||||||

| Net loss per share: | ||||||||||||||||

| Basic and diluted | $ | ** | $ | ** | $ | ** | $ | (0.01 | ) | |||||||

| Weighted average shares outstanding: | ||||||||||||||||

| Basic and diluted | 26,951,398 | 27,710,384 | 26,804,622 | 27,390,308 | ||||||||||||

** Less than $.01

The accompanying notes are an integral part of these financial statements

| 4 |

STATEMENT OF STOCKHOLDERS’ EQUITY

For the nine months ended September 30, 2019

(Unaudited)

| Additional | Total | |||||||||||||||||||

| Common Stock | Paid-in | Accumulated | Stockholders’ | |||||||||||||||||

| Shares | Amount | Capital | Deficit | Equity | ||||||||||||||||

| Balance, December 31, 2018 | 26,568,400 | $ | 2,656 | $ | 409,683 | $ | (306,187 | ) | $ | 106,152 | ||||||||||

| Issuance of common stock for cash | 203,000 | 21 | 152,229 | - | 152,250 | |||||||||||||||

| Issuance of common stock for services | 29,997 | 3 | 22,495 | - | 22,498 | |||||||||||||||

| Net loss for the quarter | - | - | - | (2,959 | ) | (2,959 | ) | |||||||||||||

| Balance, March 31, 2019 | 26,801,397 | $ | 2,680 | $ | 584,407 | $ | (309,146 | ) | $ | 277,941 | ||||||||||

| Issuance of common stock, in lieu of interest | 150,000 | 15 | 112,485 | 112,500 | ||||||||||||||||

| Net income for the quarter | - | - | - | 1,511 | 1,511 | |||||||||||||||

| Balance, June 30, 2019 | 26,951,397 | $ | 2,695 | $ | 696,892 | $ | (307,635 | ) | $ | 391,952 | ||||||||||

| Net income for the quarter | - | - | - | 2,404 | 2,404 | |||||||||||||||

| Balance, September 30, 2019 | 26,951,397 | $ | 2,695 | $ | 696,892 | $ | (305,231 | ) | $ | 394,356 | ||||||||||

Veroni Brands Corp.

STATEMENT OF STOCKHOLDERS’ EQUITY

For the nine months ended September 30, 2018

(Unaudited)

| Additional | Total | |||||||||||||||||||

| Common Stock | Paid-in | Accumulated | Stockholders’ | |||||||||||||||||

| Shares | Amount | Capital | Deficit | Deficit | ||||||||||||||||

| Balance, December 31, 2017 | 18,300,000 | $ | 1,830 | $ | 83,826 | $ | (47,357 | ) | $ | 38,299 | ||||||||||

| Issuance of common stock for cash | 10,096,600 | 1,010 | 191,420 | - | 192,430 | |||||||||||||||

| Net loss for the quarter | - | - | - | (30,157 | ) | (30,157 | ) | |||||||||||||

| Balance, March 31, 2018 | 28,396,600 | 2,840 | 275,246 | (77,514 | ) | 200,572 | ||||||||||||||

| Issuance of common stock for cash | 119,300 | 12 | 89,463 | - | 89,475 | |||||||||||||||

| Net income for the quarter | - | - | - | (113,583 | ) | (113,583 | ) | |||||||||||||

| Balance, June 30, 2018 | 28,515,900 | $ | 2,852 | $ | 364,709 | $ | (191,097 | ) | $ | 176,464 | ||||||||||

| Buy back of common stock for cash | (2,020,000 | ) | (202 | ) | (19,998 | ) | (20,200 | ) | ||||||||||||

| Issuance of common stock for cash | 48,500 | 5 | 36,370 | - | 36,375 | |||||||||||||||

| Net income for the quarter | - | - | - | (26,346 | ) | (26,346 | ) | |||||||||||||

| Balance, September 30, 2018 | 26,544,400 | $ | 2,655 | $ | 381,081 | $ | (217,443 | ) | $ | 166,493 | ||||||||||

The accompanying notes are an integral part of these financial statements

| 5 |

STATEMENTS OF CASH FLOW

For the nine months ended September 30, 2019 and 2018

| 2019 | 2018 | |||||||

| (Unaudited) | ||||||||

| Cash flow from operating activities: | ||||||||

| Net income (loss) | $ | 956 | $ | (170,086 | ) | |||

| Adjustments to reconcile net loss to: | ||||||||

| Stock issued for services | 22,498 | - | ||||||

| Discount amortization | 71,163 | - | ||||||

| Change in net cash used in operating activities: | ||||||||

| Trade accounts receivable | (190,555 | ) | (12,988 | ) | ||||

| Contract receivables | (1,021,167 | ) | - | |||||

| Inventory | (275,432 | ) | (164,939 | ) | ||||

| Prepaid expenses | 111,720 | 43,765 | ||||||

| Deposits | (9,310 | ) | - | |||||

| Accounts payable | 211,334 | 10,241 | ||||||

| Accrued liabilities | 89,680 | (750 | ) | |||||

| Accounts payable and accrued interest - related party | 3,312 | - | ||||||

| Net cash used in operating activities | (985,801 | ) | (294,757 | ) | ||||

| Cash flows from financing activities: | ||||||||

| Repayment of shareholders loans | (99,000 | ) | - | |||||

| Repayment of notes payable | (191,320 | ) | - | |||||

| Proceeds from advance from related party | - | 1,059 | ||||||

| Subscription receivable | - | 210 | ||||||

| Payment for redeemed shares | - | (20,200 | ) | |||||

| Proceeds from issuance of common stock | 152,247 | 318,280 | ||||||

| Proceeds from issuance of notes payable | 365,000 | - | ||||||

| Proceeds from contract receivables with recourse | 865,577 | - | ||||||

| Net cash provided by financing activities | 1,092,504 | 299,349 | ||||||

| Net change in cash | 106,703 | 4,592 | ||||||

| Cash at the beginning of the period | 2,999 | 595 | ||||||

| Cash at the end of the period | $ | 109,702 | $ | 5,187 | ||||

| Supplemental disclosure of cash flow information: | ||||||||

| Cash paid for: | ||||||||

| Interest | $ | 20,583 | $ | - | ||||

| Taxes | $ | - | $ | - | ||||

The accompanying notes are an integral part of these financial statements

| 6 |

Notes to Financial Statements

September 30, 2019 and 2018

Note 1 - Nature of Operations and Financial Condition

Veroni Brands Corp. (formerly European CPG Acquisition Corp. or Echo Sound Acquisition Corporation) (the “Company”) was incorporated on December 7, 2016 under the laws of the state of Delaware to engage in any lawful corporate undertaking, including, but not limited to, selected mergers and acquisition.

On August 31, 2017, the Company effected a change in control by the redemption of 19,750,000 shares of the then outstanding 20,000,000 shares of common stock. The then current officers and directors resigned and Igor Gabal was named the sole officer and director of the Company. Pursuant to the change in control, the Company changed its name to European CPG Acquisition Corp. On September 1, 2017, the Company issued l0,000,000 shares of its common stock to two shareholders at par value of $0.000l and recorded share compensation of $1,000. On November 1, 2017, the name of the Company was changed to Veroni Brands Corp.

The Company has been formed to acquire, operate, develop, grow and import premium European products into the U.S. market. Veroni Brands was created to search out unique, remarkable and desirable premium products across Europe and make them accessible to discerning consumers in the U.S. Veroni Brands strives to import the extraordinary and delight its consumers with experiences that had previously only been attainable in Europe. The Company became an exclusive importer and distributor of “Iron Energy” by Mike Tyson. The beverage became available to consumers in select Chicago area markets in May 2018 in three different flavors such as “Mojito,” “Zero Sugar” and “Original.” The Company will be introducing other flavors of “Iron Energy” in 2019. The Company takes pride in the products it imports and is proud to share them with its consumers. The Company expanded into imports and distribution of chocolate and related products sold to U.S. national retailers.

Basis of presentation: unaudited interim financial information

The accompanying interim condensed financial statements are unaudited. In opinion of management, the accompanying unaudited condensed financial statements contain all of the normal recurring adjustments necessary to present fairly the financial position and results of operations as of and for the periods presented. The interim results are not necessarily indicative of the results to be expected for the full year or any future period.

Certain information and footnote disclosures normally included in the condensed financial statements prepared in accordance with

accounting principles generally accepted in the United States have been condensed or omitted pursuant to the rules and regulations

of the Securities and Exchange Commission (“SEC”). The Company believes that the disclosures are adequate to make

the interim information presented not misleading. These condensed financial statements should be read in conjunction with the

Company’s audited financial statements and the notes thereto included in the Company’s Report on Form 10-K filed on

April 16, 2019 for the year ended December 31, 2018.

Going Concern

The Company has commenced the generation of revenue this year of approximately $5.2 million and incurred net income of $956 for the nine months ending September 30, 2019 but has an accumulated deficit of $305,231 since its inception. As of September 30, 2019, the Company had a cash balance available of approximately $109,702, which is not sufficient to meet its operating requirements for the next twelve months. Therefore, the Company’s ability to continue as a going concern is dependent on its ability to grow its revenue and generate sufficient cash flows from operations to meet its obligations and/or obtaining additional financing from its shareholders or other sources, as may be required.

The accompanying unaudited financial statements have been prepared assuming that the Company will continue as a going concern; however, the above condition raises substantial doubt about the Company’s ability to continue as a going concern. The unaudited financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classifications of liabilities that may result should the Company be unable to continue as a going concern.

| 7 |

VERONI BRANDS CORP.

Notes to Financial Statements

September 30, 2019 and 2018

Note 1 - Nature of Operations and Financial Condition (continued)

The Company failed to meet its minimum purchase requirements under the FoodCare Sp. z.o.o. (“FoodCare”) contract and could lose its exclusive rights to distribute in the U.S. Market. The Company is currently re-negotiating the agreement.

The Company is continuing to evaluate various financing options in order to continue the funding of the startup of its operations and expand the products being offered and its customer base. The Company has established a relationship with a manufacturer to import and distribute chocolate and other related products.

Note 2 – Summary of Significant Accounting Policies

Reclassifications

Certain reclassifications have been made in the 2018 financial statements to conform to the 2019 presentation. These reclassifications have no effect on net loss for 2018.

Advertising

The Company’s policy is to expense advertising costs as incurred. Advertising expense for the nine months ending September 30, 2019 and 2018 is $45,551 and $46,564, respectively.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting periods. Significant items subject to such estimates and assumptions include the carrying amount of inventory and associated reserves, and allowances in regards to receivables and revenue. Actual results could differ from those estimates.

Revenue Recognition

The majority of the Company’s revenue is recognized when it satisfies a single performance obligation by transferring control of its products to a customer. Control is generally transferred when the Company’s products are either shipped or delivered based on the terms contained within the underlying contracts or agreements. Given the startup nature of the Company, many distributors will require that the Company operate under consignment arrangements in the beginning of its contracts, generally for the first 90 days or until customer demand is established for the product.

Under consignment, the Company retains control of the inventory located at the distributor and only records revenues when the distributor sells through to the ultimate retail establishment. As of September 30, 2019, approximately 4% of the Company’s inventory is classified as consignment.

The Company’s general payment terms are short-term in duration. The Company does not have significant financing components or payment terms. The Company did not have any material unsatisfied performance obligations as of September 30, 2019.

Distribution expenses to transport the Company’s products, where applicable, and warehousing expense is included in cost of sales.

| 8 |

VERONI BRANDS CORP.

Notes to Financial Statements

September 30, 2019 and 2018

Note 2 – Summary of Significant Accounting Policies (Continued)

Cash and Cash Equivalents

Cash and cash equivalents include cash on hand and on deposit at banking institutions as well as all highly liquid short-term investments with original maturities of 90 days or less.

Concentration of Risk

Financial instruments that potentially subject the Company to concentrations of credit risk consist principally of cash. The Company places its cash with high quality banking institutions. The Company did not have cash balances in excess of the Federal Deposit Insurance Corporation limit as of September 30, 2019 and December 31, 2018, respectively.

Accounts Receivable and Concentration of Credit Risk

Accounts receivable are recorded at the invoiced amounts less an allowance for doubtful accounts. The allowance for doubtful accounts is based on the Company’s estimate of the amount of probable credit losses in its accounts receivable. The Company determines the allowance for doubtful accounts based upon an aging of accounts receivable, historical experience and management judgment. Accounts receivable balances are periodically reviewed for collectability, and balances are charged off against the allowance when the Company determines that the potential for recovery is remote. An allowance for doubtful accounts of approximately $0 and $9,900 is reserved as of September 30, 2019 and December 31, 2018, respectively.

We are exposed to credit risk in the normal course of business, primarily related to accounts receivable. To limit credit risk, management periodically reviews and evaluates the financial condition of its customers and maintains an allowance for doubtful accounts. As of September 30, 2019, the Company had one customer that comprised approximately 68% of its combined accounts receivables and contract receivables with recourse and the combined amount is approximately $838,306.

During the nine months ended September 30, 2019, the Company had four customers whose sales accounted for approximately 92% of revenue.

Distribution Agreements -Supplier Concentration

In January 2018, the Company entered into a distributor agreement with FoodCare, which was amended and restated on January 30, 2018. FoodCare is a company organized under the laws of Poland. FoodCare is a manufacturer and supplier of desserts, cereals, energy drinks and other beverage products. FoodCare manufactures the “Iron Energy” drink, a product sponsored by celebrity Mike Tyson.

Under the terms of the distribution agreement, the Company became the exclusive distributor of FoodCare products in the United States, Puerto Rico and the U.S. Virgin Islands. FoodCare is the sole supplier of Iron Energy to the Company. The term of the agreement is for ten years and gives the Company exclusive rights to distribute FoodCare products within the U.S. market, so long as the Company purchases the required quantity of product from FoodCare. The distribution agreement is terminable: (1) upon mutual consent of the parties; (2) by either party in writing, without justification, if an issue is not amicable resolved within 30 days of such issue by providing 180 days notice and, in such case, the distributor shall lose it exclusivity rights; or (3) immediately in the event of notice of an uncured breach in the terms of the agreement.

The Company failed to meet its minimum purchases in 2018 and is currently re-negotiating the contract.

The Company’s only business line in 2018 was the distribution of “Iron Energy” drink that continues to be part of the Company’s product offering in 2019. The cancelation of the “Iron Energy” drink distribution agreement will require the Company to secure replacement product(s) to continue its beverage product sales.

| 9 |

VERONI BRANDS CORP.

Notes to Financial Statements

September 30, 2019 and 2018

Note 2 – Summary of Significant Accounting Policies (Continued)

Income Taxes

Under ASC 740, Income Taxes, deferred tax assets and liabilities are recognized for the future tax consequences attributable to temporary differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. Valuation allowances are established when it is more likely than not that some or all of the deferred tax assets will not be realized. As of December 31, 2018 and 2017, there were no net deferred tax assets, as the Company setup a 100% valuation allowance, due to the uncertainty of the realization of net operating loss carryforwards prior to their expiration.

Loss Per Common Share

Basic loss per common share excludes dilution and is computed by dividing net loss by the weighted average number of common shares outstanding during the period. Diluted loss per common share reflect the potential dilution that could occur if securities or other contracts to issue common stock were exercised or converted into common stock or resulted in the issuance of common stock that then shared in the loss of the entity. As of September 30, 2019 and 2018, there are no outstanding dilutive securities.

Fair Value of Financial Instruments

The Company follows guidance for accounting for fair value measurements of financial assets and financial liabilities and for fair value measurements of nonfinancial items that are recognized or disclosed at fair value in the financial statements on a recurring basis. Additionally, the Company adopted guidance for fair value measurement related to nonfinancial items that are recognized and disclosed at fair value in the financial statements on a nonrecurring basis. The guidance establishes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to measurements involving significant unobservable inputs (Level 3 measurements). The three levels of the fair value hierarchy are as follows:

Level 1 inputs are quoted prices (unadjusted) in active markets for identical assets or liabilities that the Company has the ability to access at the measurement date.

Level 2 inputs are inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly.

Level 3 inputs are unobservable inputs for the asset or liability. The carrying amounts of financial assets such as cash approximate their fair values because of the short maturity of these instruments.

The carrying amounts of the Company’s financial instruments, which include cash and cash equivalents and accounts payable approximate their fair values at September 30, 2019 and December 31, 2018 due to their short-term nature and management’s belief that their carrying amounts approximate the amount for which the assets could be sold or the liabilities could be settled.

| 10 |

VERONI BRANDS CORP.

Notes to Financial Statements

September 30, 2019 and 2018

Note 2 – Summary of Significant Accounting Policies (Continued)

Share-Based Compensation

The Company accounts for stock-based compensation issued to non-employees and consultants in accordance with the provisions of ASC 505-50, Equity–Based Payments to Non-Employees. Measurement of share-based payment transactions with non-employees is based on the fair value of whichever is more reliably measurable: (a) the goods or services received; or (b) the equity instruments issued. The fair value of the share-based payment transaction is determined at the earlier of performance commitment date or performance completion date. In June 2018, the Financial Accounting Standards Board adopted Accounting Standards Update 2018-07 Compensation – Stock Compensation (Topic 718): Improvements to Nonemployee Share-Based Payment Accounting. In that update, ASC 505 has been rescinded in its entirety and share based compensation issued to nonemployees will now fall under ASC 718 and its associated fair value measurements. Due to the Emerging Growth Company (see below) status of the Company, the Company expects it will adopt the update on January 1, 2020.

Emerging Growth Company

The Company has elected to be an emerging growth company as defined under the Jumpstart Our Business Startups Act of 2012 (“Jobs Act”). Included with this election, the Company has also elected to use the provisions within the Jobs Act that allow companies that go public to continue to use the private company adoption date rules for new accounting policies. Should the Company obtain revenues in excess of $1 billion on an annual basis, have its non-affiliated market capitalization increase to over $700 million as of the last day of its second quarter, or raise in excess of $1 billion in public offerings of its equity or instruments directly convertible into its equity, it will forfeit its status under the Jobs Act as an emerging growth company.

New Accounting Pronouncements

In 2014, the FASB issued guidance on revenue recognition, with final amendments issued in 2016. The guidance provides for a five-step model to determine the revenue recognized for the transfer of goods or services to customers that reflects the expected entitled consideration in exchange for those goods or services. It also provides clarification for principal versus agent considerations and identifying performance obligations. In addition, the FASB introduced practical expedients related to disclosures of remaining performance obligations, as well as other amendments related to guidance on collectability, non-cash consideration and the presentation of sales and other similar taxes. Financial statement disclosures required under the guidance will enable users to understand the nature, amount, timing, judgments and uncertainty of revenue and cash flows relating to customer contracts. The two permitted transition methods under the guidance are the full retrospective approach or a cumulative effect adjustment to the opening retained earnings in the year of adoption (cumulative effect approach).

The Company will utilize a comprehensive approach to assess the impact of the guidance on its contract portfolio by reviewing its current accounting policies and practices to identify potential differences that would result from applying the new requirements to its revenue contracts, including evaluation of its performance obligations.

In 2016, the FASB issued guidance on leases, with amendments issued in 2018. The guidance requires lessees to recognize most leases on the balance sheet but record expenses in the income statement in a manner similar to current accounting. For lessors, the guidance modifies the classification criteria and the accounting for sales-type and direct financing leases. The two permitted transition methods under the guidance are the modified retrospective transition approach, which requires application of the guidance for all comparative periods presented, and the cumulative effect adjustment approach, which requires prospective application at the adoption date.

In November 2015, the FASB issued ASU 2015-17, Income Taxes (Topic 740) which simplifies the presentation of deferred income taxes. This update requires that deferred tax liabilities and assets be classified as noncurrent in a classified statement of financial position. The amendments in this update are effective for annual periods beginning after December 15, 2017.

| 11 |

VERONI BRANDS CORP.

Notes to Financial Statements

September 30, 2019 and 2018

Note 2 – Summary of Significant Accounting Policies (Continued)

Early adoption is permitted, and the amendments may be applied prospectively or retrospectively for all periods presented. Early application is permitted.

In June 2018, an accounting update was issued to simplify the accounting for nonemployee share-based payment transactions resulting from expanding the scope of ASC Topic 718, Compensation-Stock Compensation, to include share-based payment transactions for acquiring goods and services from nonemployees. An entity should apply the requirements of ASC Topic 718 to nonemployee awards except for specific guidance on inputs to an option pricing model and the attribution of cost (that is, the period of time over which share-based payment awards vest and the pattern of cost recognition over that period). The amendments specify that ASC Topic 718 applies to all share-based payment transactions in which a grantor acquires goods or services to be used or consumed in a grantor’s own operations by issuing share-based payment awards. The amendments also clarify that ASC Topic 718 does not apply to share-based payments used to effectively provide: (1) financing to the issuer; or (2) awards granted in conjunction with selling goods or services to customers as part of a contract accounted for under ASC Topic 606, Revenue from Contracts with Customers. The amendments in this accounting update are effective for public business entities for fiscal years beginning after December 15, 2018, including interim periods within that fiscal year. Early adoption is permitted, but no earlier than an entity’s adoption date of ASC Topic 606.

Under the JOBS Act, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. The Company intends to take advantage of this extended transition period. Since the Company will not be required to comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for other public companies, the financial statements may not be comparable to financial statements of companies that comply with public company effective dates. The Company has determined that no other recent accounting pronouncements apply to its operations or could otherwise have a material impact on its consolidated financial statements.

Note 3 – Inventory

Finished Goods inventory consist of “Iron Energy” energy drinks, chocolates, and related products imported from Poland and is stated at the lower of actual cost (first-in, first-out method) or net realizable value. Cost includes freight costs to its warehouse, import fees and handling fees. Inventory is as follows:

| September 30, 2019 | December 31, 2018 | |||||||

| Finished goods – in warehouse | $ | 464,137 | $ | 192,318 | ||||

| Finished goods - consignment | 19,664 | 16,051 | ||||||

| $ | 483,801 | $ | 208,369 | |||||

During the third quarter, the Company removed some beverage product from inventory due to reaching the end of its shelf life and became unsaleable. As of September 30, 2019, the total unsaleable product removed from inventory totaled approximately $71,400.

Note 4 – Prepaid Expenses

Prepaid inventory

The Company’s foreign supplier will generally require that the Company pay in advance of an inventory shipment to it from Europe. The Company’s current agreement with FoodCare includes provisions in which title for the inventory passes upon FoodCare loading the product onto truck transport for delivery to the seaports in Poland. Amounts transferred to the Company’s suppliers to secure future delivery, but prior to transfer of title of those shipments, are recorded as prepaid inventory.

| 12 |

VERONI BRANDS CORP.

Notes to Financial Statements

September 30, 2019 and 2018

Note 4 – Prepaid Expenses (Continued)

| September 30, 2019 | December 31, 2018 | |||||||

| Prepaid services | $ | 1,910 | $ | 3,674 | ||||

| Prepaid Rent | 4,655 | - | ||||||

| Prepaid inventory | 29,352 | 102,643 | ||||||

| $ | 35,917 | $ | 106,317 | |||||

Note 5 – Notes Payable Other

On February 6, 2019 the Company issued a promissory note in the amount of $150,000, bearing interest at 4 percent monthly or the equivalent of 48 percent per annum rate. The note was paid back on April 30, 2019. Current unpaid interest as of September 30, 2019 is approximately $20,200 that is accrued by the Company.

On February 22, 2019, the Company entered into a promissory note in the amount of $215,000. The note matures on December 31, 2019 and can be converted in shares of the Company’s common stock at $0.75 per share during the term of the note. The Company agreed to issue to the lender 150,000 shares of the Company’s common stock on or before December 31, 2019 as a one-time consideration for making the loan in lieu of a cash payment of interest. The common stock issuable under the term of the promissory note was valued at $112,500 and is being amortized over the term of the note. Through September 30, 2019 approximately $71,200 has been amortized and recorded as Interest Expense.

On March 11, 2019, the Company issued a promissory note in the amount of $65,000. The note accrued interest at 5 percent every 45 days on the unpaid principal balance or the equivalent of 40.6% per annum rate. The loan was paid back as of on June 11, 2019. Current unpaid interest as of September 30, 2019 is approximately $7,400 that is accrued by the Company.

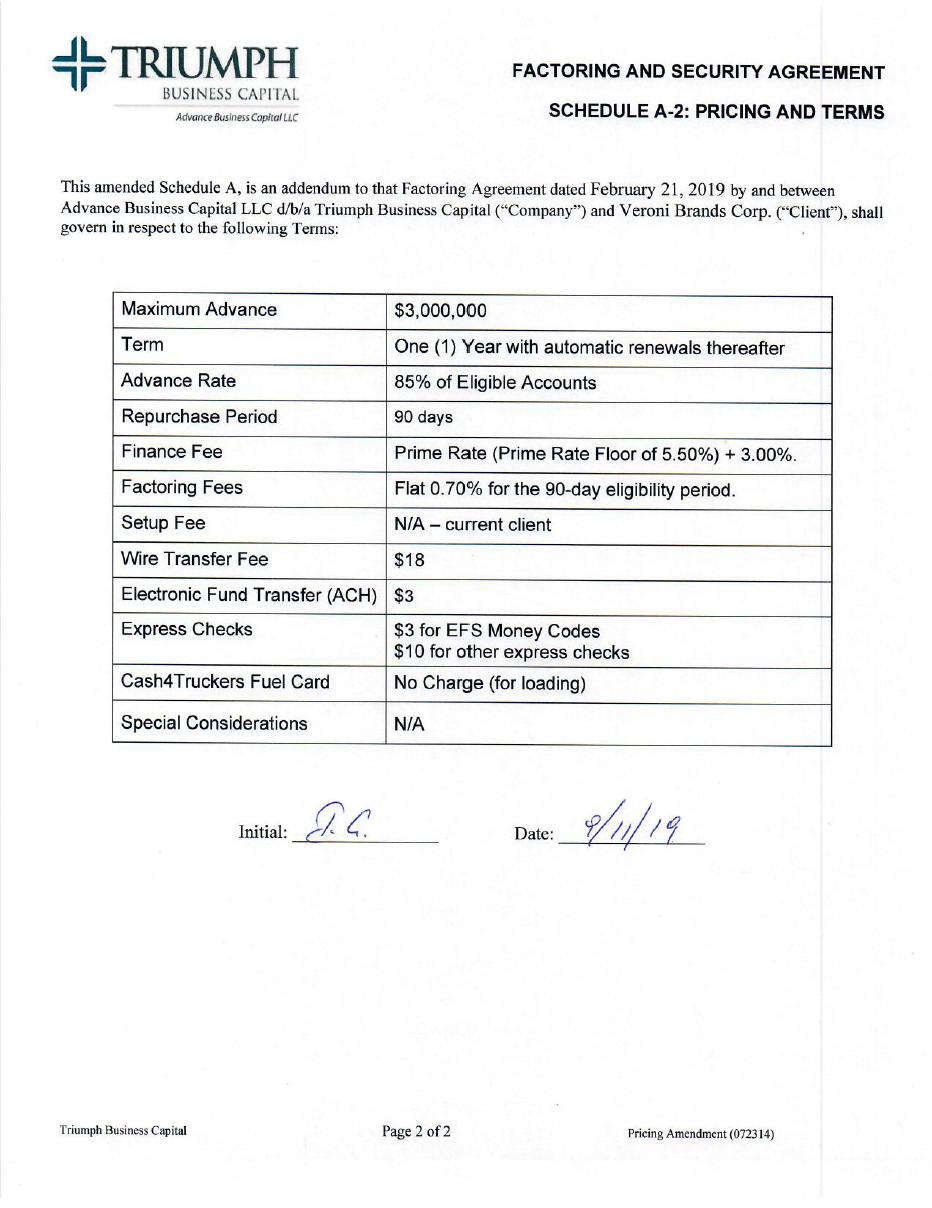

Note 6 – Contract Receivables Liability with Recourse

On February 21, 2019, the Company entered into a factoring agreement with Advance Business Capital d/b/a Interstate Capital for a term of one year. On September 11, 2019, the lender (now doing business as Triumph Business Capital), entered into an amended agreement with the Company which lowered the interest rate charged by the lender from 0.49% for every 10 days to prime plus 3%. As of September 30, 2019 the Company owes $865,577 for advances on their receivables. The Company bears all credit risk related to the receivables factored. The Company has given a security interest in substantially all of its assets and the president of the Company and a major shareholder have guaranteed the debt.

Note 7 – Stockholders’ Equity

The Company is authorized to issue 100,000,000 shares of common stock and 20,000,000 shares of preferred stock.

January 1, 2018 through March 31, 2018 the Company issued 10,096,600 shares of common stock in consideration of cash proceeds of $192,430.

April 1, 2018 through June 30, 2018 the Company issued 119,300 shares of common stock in consideration of cash proceeds of $89,475.

July 1, 2018 through September 30, 2018 the Company issued 48,500 shares of common stock in consideration of cash proceeds of $36,375 and redeemed 2,020,000 of its common stock for $20,200.

January 1, 2019 through March 31, 2019, the Company issued 203,000 shares of common stock in consideration of cash proceeds of $152,250 and issued 29,997 shares of common stock for services rendered with a value of $22,498.

| 13 |

VERONI BRANDS CORP.

Notes to Financial Statements

September 30, 2019 and 2018

Note 7 – Stockholders’ Equity (Continued)

April 1, 2019 through June 30, 2019 the Company issued 150,000 common stock valued at $112,500 in consideration of financing provided to the Company.

Note 8 –Related Party Transactions

During 2018, two significant shareholders of the Company advanced the Company $157,059. The advance was evidenced by two individual notes totaling $155,000 which were due on or before August 1, 2019 and a payable of $2,059. The two notes have a fixed interest fee of $1,000 for each of the notes. One shareholder was repaid its promissory note and accrued interest which totaled $61,000. The due date for the second shareholder note has been extended to be due on or before August 1, 2020. As of September 30, 2019, $39,000 has been repaid leaving an outstanding loan balance of $56,000 and a payable of $4,370. Unpaid interest of $1,000 has been accrued as of September 30, 2019 for the remaining promissory note.

Note 9– Office Lease

On February 4, 2019, the Company entered into a sublease for office space located in Bannockburn, Illinois. The sublease terminates on September 30, 2022. Rent for the nine months ending September 30, 2019 was $36,575. The annual rent per the sublease is as follows:

| First lease year | $ | 55,860 | ||

| Second lease year | 57,536 | |||

| Third lease year | 59,262 | |||

| Final lease year | 61,039 |

The Company also paid a security deposit of $9,310.

Note 10– Commitments and Contingencies

The Company’s operations are subject to the Federal Food, Drug and Cosmetic Act; the Bioterrorism Act; and regulations created by the U.S. Food and Drug Administration (“FDA”). The FDA regulates manufacturing and holding requirements for foods, specifies the standards of identity for certain foods and prescribes the format and content of certain information that must appear on food product labels. In addition, the published applicable rules under the Food Safety Modernization Act (“FSMA”) regulates food products imported into the United States and provides the FDA with mandatory recall authority.

For the purchase of products harvested or manufactured outside the United States, and for the shipment of products to customers located outside of the United States, the Company is subject to customs laws regarding the import and export of shipments. The Company’s activities, including working with customs brokers and freight forwarders, are subject to regulation by U.S. Customs and Border Protection, part of the Homeland Security.

Note 11 – Subsequent Events

During October 2019, the related party outstanding loan balance was reduced by $17,000.

Subsequent to the quarter ended September 30, 2019, the Company repurchased 125,000 shares of its common stock for $25,000, which shares will be cancelled. An additional 125,000 shares of common stock were surrendered to the Company for cancellation. The Company also issued 26,965 shares of its common stock as payment of the interest due on the note dated February 6, 2019 in the amount of $150,000 and 10,000 shares of common stock as payment of interest due on the note dated March 11, 2019 in the amount of $65,000. See Note 5 - Notes Payable Other. These shares were valued at $0.75 per share.

| 14 |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Overview

Veroni Brands Corp. (formerly “Echo Sound Acquisition Corporation”) (“Veroni” or the “Company”) was incorporated on December 7, 2016, under the laws of the state of Delaware. The business purpose of the Company is to facilitate the sales and distribution of premium food and beverage products from Europe, most notably its Iron Energy beverage product.

On January 30, 2018, the Company entered into a distribution agreement with FoodCare. Under the terms of the Distribution Agreement, the Company became the exclusive importer and distributor of FoodCare’s products in the United States, Puerto Rico and the U.S. Virgin Islands (the “U.S. market”). The term of the Distribution Agreement is for a period of 10 years during which Veroni will have the exclusive right to distribute FoodCare products within the U.S. market, so long as Veroni purchases the required quantity of product from FoodCare. The Distribution Agreement is terminable upon (1) mutual consent of the parties, (2) by either party in writing without justification, if an issue is not amicably resolved in 30 days of such issue, by providing 180 days’ notice (in which case the Company would lose its exclusivity rights), or (3) immediately in the event of notice of an uncured breach in the terms of the Distribution Agreement. FoodCare Sp. z o.o., a company organized under the laws of the Poland, is a manufacturer and supplier of desserts, cereals, energy drinks and other beverage products. Notably, FoodCare manufactures the “Iron Energy” drink, a product sponsored by celebrity and former boxer Mike Tyson.

The Company failed to meet its minimum purchase requirements in 2018 and is currently re-negotiating the contract.

In summer 2018, the Company introduced the Iron Energy beverage to various retailers and distributors nationwide and since then been working with many retailers and distributors to bring the product to market. As of the date of this report, the Company has commitments from major convenience stores, as well as national distributors to sell and distribute the Iron Energy product to its retailers.

For the fiscal year ended December 31, 2018, the Company’s independent auditors issued a report raising substantial doubt about the Company’s ability to continue as a going concern. As of December 31, 2018, the Company had minimal operations and the continuation of the Company as a going concern is dependent upon financial support from its principal stockholders, its ability to obtain necessary equity and/or debt financing, or its ability to sell its products to generate consistent profitability.

In January 2019, the Company established a relationship with another manufacturer, ZWC Millano, to import snacks and chocolate products for distribution to major retailers throughout the United States. The Company recently became the vendor of record for these products with Family Dollar, Dollar General, Costco and few other retailers.

In February 2019, the Company established a relationship with Port Jersey Logistics to better serve its customers throughout the United States. Management believes that this partnership will give the Company a tremendous opportunity to support its growth, as it will be able to store and transport products and fulfill its purchase orders received from its customers.

The Company has generated approximately $5.2 million in revenue for the nine months ended September 30, 2019 and income of $956. At September 30, 2019, the Company had sustained net losses of $305,231 since inception.

Revenues and Losses

The Company was in the development stage in 2018 and therefore the comparison of 2019 results with those of the comparable 2018 periods is of limited benefit.

Three Months Ended September 30, 2019. During the three months ended September 30, 2019 and 2018, the Company generated revenues of $1,899,828 and a gross profit of $310,048, compared to revenues of $9,951 and gross profit of $6,337 in 2018. The increase in revenue relates to the Company’s sales and marketing efforts. Prior to 2018, the Company had focused its efforts on identifying business opportunities, and devoted little attention or resources to sales and marketing or generating near-term revenues and profits. During 2018, the Company began distribution of various products.

| 15 |

Operating expenses of $212,019 during the three months ended September 30, 2019 consisted of selling expenses of $57,231 and general and administrative costs of $154,788. For the comparable 2018 period, selling expenses and general and administrative costs were $12,706 and $19,977, respectively, for a total of $32,683 in operating expenses. The increase in operating expenses is directly related to the increase in marketing and selling expenses, which resulted in the increase in sales.

The Company also incurred interest expense of $94,625 for the three months ended September 30, 2019, as compared to $-0- for the 2018 period. The increase interest expense relates to an increase in short term borrowing and fees related to factoring the Company’s receivables. The Company also incurred interest expense to a related party of $1,000. Accordingly, for the three months ended September 30, 2019, the Company generated net income of $2,404, as compared to a net loss of $26,346 for 2018.

Nine Months Ended September 30, 2019. During the nine months ended September 30, 2019 and 2018, the Company generated revenues of $5,230,968 and a gross profit of $945,175, compared to revenues of $21,020 and gross profit of $12,334 in 2018. The increase in revenue relates to the Company’s sales and marketing efforts.

Operating expenses of $712,966 during the nine months ended September 30, 2019 consisted of selling expenses of $388,032 and general and administrative costs of $324,934. For the comparable 2018 period, selling expenses and general and administrative costs were $71,352 and $111,068, respectively, for a total of $182,420 in operating expenses. The increase in operating expenses is directly related to the increase in marketing and selling expenses, which resulted in the increase in sales.

The Company also incurred interest expense of $230,253 for the nine months ended September 30, 2019, as compared to $-0- for the 2018 period. The increase interest expense relates to an increase in short term borrowing and fees related to factoring the Company’s receivables. The Company also incurred interest expense to a related party of $1,000. Accordingly, for the nine months ended September 30, 2019, the Company generated net income of $956, as compared to a net loss of $170,086 for 2018. The modest income from operations in 2019 relates to the increase in sales.

Liquidity and Capital Resources

Since its inception through December 2018, the Company had devoted most of its efforts to business planning, research and development, recruiting management and staff and raising capital. Accordingly, the Company was in the development stage during that period.

During the nine months ended September 30, 2019, the Company used net cash of $985,801 in its operating activities, primarily for increases in its trade and contract accounts receivable of $1,211,722, notes and accounts receivable – related party including interest of $3,311, and inventory in the amount of $275,432, offset by increases in accounts payable of $211,334, accrued liabilities of $89,680, and decrease of prepaid expenses of $111,720 for that period. Net cash provided by financing activities totaled $1,092,504 from the proceeds of contract receivables with recourse of $865,577 and notes payable of $365,000, as well as the sale and issuance of its common stock in private placements of $152,247 less repayment of note payable and shareholder loans of $191,320 and $99,000 respectively. The Company had a cash balance of $109,702 and working capital of $385,046 as of September 30, 2019, as compared to cash and working capital of $2,999 and $106,152, as of December 31, 2018.

The Company’s proposed activities will necessitate significant uses of capital into and beyond 2019, particularly for the financing of inventory. While the Company has recently entered into a factoring arrangement, sales of equity securities in the Company would result in reduced financing costs. Since the beginning of 2018 and through the date of this report, the Company has engaged in sales of its equity securities in private placements. Through September 30, 2019, a total of 10,467,400 shares have been sold for total gross proceeds of $473,530, and a total of 2,020,000 shares were redeemed for $20,200.

| 16 |

Plan of Operations

For the next few months, the Company will be focusing on obtaining visibility for the products by contacting convenience store locations and small distributors to those types of locations. The Company is targeting metropolitan areas, such as Chicago, Los Angeles, Las Vegas and cities in New Jersey, New York and Miami.

Currently, these efforts are being funded through the proceeds of the Company’s private placements, as discussed above, as well as short-term borrowing from the Company’s shareholders and third parties. As part of the Company’s efforts to gain visibility and to raise capital, it proposes to establish a trading market for its shares. Management of Veroni believes that having a trading market for the Company’s common stock will make other sources of financing available and assist it in engaging with larger distributors.

There is no assurance that the Company’s activities will generate sufficient revenues to sustain its operations without additional capital, or if additional capital is needed, that such funds, if available, will be obtainable on terms satisfactory to the Company. Accordingly, given the Company’s limited cash and cash equivalents on hand, the Company will be unable to implement its business plans and proposed operations unless it obtains additional financing or otherwise is able to generate revenues and profits. In 2019, the Company entered into a factoring agreement covering its accounts receivable (see below). The Company may raise additional capital through sales of debt or equity, obtain loan financing or develop and consummate other alternative financial plans. In the near term, the Company plans to rely on its primary stockholder to continue his commitment to fund the Company’s continuing operating requirements. Management anticipates a total capital raise of up to $5,000,000 over the course of the following four consecutive quarters; provided, however, that the Company will require a minimum of $600,000 for the next 12 months to fund its operations, which will be used to fund expenses related to operations, office supplies, travel, salaries and other incidental expenses. Management believes that this capital would allow the Company to meet its operating cash requirements, and would facilitate the Company’s business of selling and distributing its products. Management also believes that the acquisition of such assets would generate revenue to cover overhead cost and general liabilities of the Company, and allow the Company to achieve overall sustainable profitability.

Accounts Receivable Financing

On February 21, 2019, the Company entered into a factoring agreement with an unrelated third party, Advance Business Capital LLC, dba Interstate Capital (“ICC”), pursuant to which the Company sells its accounts receivable to ICC for 85% of the value of the receivable. The term of the agreement is for 12 months and automatically renews for additional 12-month periods. The accounts receivable are sold with recourse back to the Company, meaning that the Company bears the risk of non-payment by the account debtor. To secure its obligations to ICC, the Company has granted a blanket security interest in its other assets, such as inventory, equipment, machinery, furniture, fixtures, contract rights, and general intangibles and provided personal guarantees from stockholders. On September 11, 2019, the Company entered into an amended agreement with the lender (now doing business as Triumph Business Capital), which lowered the interest rate charged by the lender from 0.49% for every 10 days to prime plus 3%.

Potential Revenue

The Company expects to generate revenue from selling its products, most notably the “Iron Energy” drink, snacks and chocolate products. Further, depending on the market environment, the Company plans on acquiring the rights to sell and distribute other food and beverage products.

Alternative Financial Planning

The Company has no alternative financial plans at the moment. If the Company is not able to successfully raise monies as needed through a private placement or other securities offering (including, but not limited to, a primary public offering of securities), or continue to generate sales and net income, the Company’s ability to survive as a going concern and implement any part of its business plan or strategy will be severely jeopardized.

| 17 |

Critical Accounting Policies

The financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires making estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. The estimates are based on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis of making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

Off-Balance Sheet Arrangements

The Company has no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on its financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources.

Item 3. Quantitative and Qualitative Disclosures about Market Risk

Not applicable to smaller reporting companies.

Item 4. Controls and Procedures

Evaluation of Disclosure Controls and Procedures and Changes in Internal Controls

We maintain disclosure controls and procedures designed to provide reasonable assurance that information required to be disclosed in our reports filed pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”), is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms, and that such information is accumulated and communicated to our management, as appropriate, to allow timely decisions regarding required disclosures. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance the objectives of the control system are met.

As of September 30, 2019, our management carried out an evaluation of the effectiveness of our disclosure controls and procedures as such term is defined in Rule 13a-15(e) or 15d-15(e) under the Exchange Act. Based on this evaluation, the President and Chief Financial Officer concluded that the Company’s disclosure controls and procedures were not effective as of September 30, 2019, because of the identification of the material weakness in internal control over financial reporting described below. Notwithstanding the material weakness that existed as of September 30, 2019, our President and Chief Financial Officer has concluded that the financial statements included in this Quarterly Report on Form 10-Q present fairly, in all material respects, the financial position, results of operations and cash flows of the Company and its subsidiaries in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

Management’s Report on Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting. Internal control over financial reporting is a set of processes designed by, or under the supervision of, a company’s principal executive and principal financial officers, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with GAAP and includes those policies and procedures that:

| ● | Pertain to the maintenance of records that in reasonable detail accurately and fairly reflect our transactions and dispositions of our assets; |

| 18 |

| ● | Provide reasonable assurance our transactions are recorded as necessary to permit preparation of our financial statements in accordance with GAAP, and that receipts and expenditures are being made only in accordance with authorizations of our management and directors; and | |

| ● | Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of our assets that could have a material effect on the financial statements. |

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. It should be noted that any system of internal control, however well designed and operated, can provide only reasonable, and not absolute, assurance that the objectives of the system will be met. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Under the supervision and with the participation of our management, we conducted an assessment of the effectiveness of our internal control over financial reporting based on criteria established in “Internal Control-Integrated Framework” issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) in 1992, as of September 30, 2019.

As a result of our material weakness described below, management has concluded that, as of September 30, 2019, our internal control over financial reporting was not effective based on the criteria in “Internal Control-Integrated Framework” issued by COSO.

Material Weakness in Internal Control over Financial Reporting

A material weakness is a deficiency or combination of deficiencies in internal control over financial reporting, such that there is a reasonable possibility, that a material misstatement of the Company’s annual or interim financial statements will not be prevented or detected on a timely basis. In connection with its assessment, management identified the following material weaknesses at September 30, 2019:

| ● | There is a lack of segregation of duties within the accounting and financial reporting process. | |

| ● | Since we use external consultants to prepare our financial statements and provide sufficient documentation of such preparation and review procedures, our officer must rely on such documentation. | |

| ● | We had only one executive officer at September 30, 2019. |

Due to our limited resources as just having emerged from being a development stage company, we expect these weaknesses in internal control to continue while we implement our business plan.

Changes in Internal Control over Financial Reporting

During the period covered by this quarterly report, there were no changes in our internal control over financial reporting that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

| 19 |

We are not currently involved in any pending or threatened legal proceedings.

Not applicable to smaller reporting companies.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

None.

Item 3. Defaults Upon Senior Securities

None.

Item 4. Mine Safety Disclosures

Not applicable.

Not applicable.

| Regulation S-K Number |

Document | |

| 3.1 | Certificate of Incorporation (1) | |

| 3.2 | Certificate of Amendment to Certificate of Incorporation (2) | |

| 3.3 | Bylaws (1) | |

| 10.1 | Contract between FoodCare Sp. z o.o. and Veroni Brands Corp. dated January 30, 2018 (3) | |

| 10.2 | Promissory Note dated October 2, 2018 to Igor Gabal (4) | |

| 10.3 | Promissory Note dated October 3, 2018 to Tomasz Kotas (4) | |

| 10.4 | Amendment 2 to Factoring and Security Agreement with Triumph Business Capital dated September 11, 2019 | |

| 31.1 | Rule 13a-14(a) Certification of Igor Gabal | |

| 32.1 | Certifications of Igor Gabal Pursuant to 18 U.S.C. Section 1350, as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 | |

| 101* | Financial statements from the Quarterly Report on Form 10-Q of Veroni Brands Corp. for the quarterly period ended September 30, 2019, formatted in XBRL: (i) the Balance Sheets; (ii) the Statements of Operations; (iii) the Statements of Cash Flows; and (iv) the Notes to Financial Statements |

| (1) | Filed as an exhibit to the registration statement on Form 10, filed January 18, 2017, file number 000-55735. | |

| (2) | Filed as an exhibit to the Current Report on Form 8-K dated November 22, 2017, filed November 30, 2017. | |

| (3) | Filed as an exhibit to the Current Report on Form 8-K dated February 2, 2018, filed February 2, 2018. | |

| (4) | Filed as an exhibit to the Annual Report on Form 10-K for the fiscal year ended December 31, 2018, filed April 16, 2019, file number 000-55735. |

*In accordance with Rule 406T of Regulation S-T, the information in these exhibits shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to liability under that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, except as expressly set forth by specific reference in such filing.

| 20 |

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| VERONI BRANDS CORP. | ||

| Dated: November 14, 2019 | By: | /s/ Igor Gabal |

Igor Gabal, President and Chief Financial Officer | ||

| 21 |

8TB?:=FY"Q);!15ZDYYS6?)X!L

MEU>ZO;.^U&R@O9/-O;*VF"PW+'[Q8$$@GOM(S[5UH88..U&Y30!S$_@V!M0U

M.Y@U"\MH=35%N[>+9M<*@0;3M+)\@P<'ITP>:?9^$;?3]=BU.TN[B&.*T6RC

MLT5/)6)>0.5W9!YSNS5J^\26]CXITO07MIS-J$ !A_P 4

MI!_UVN/_ $<]2>+?%%MX1T7^TKFWGN095A2"W +NS9P #[ G\*9X(./"=MW/

MFS_^CGKD?%6M7D_Q-TZ'3](N]7@T.!I[B&U9,)/,"J;MQ R$W$?[U 'HNG7\

M.IZ;:WUNV8;F%9D.?X6 (_G5#5_$EKH^J:18312O)JDY@B*8PI R2W/3Z5Y1

MHWB/6/#WPW\6Z8T$UAJ&CL&LXY@#)%;S-\AXR&VY;D<=!5G5O#%OX;\=>!DM

MM4OKF.YO':5+FX,V]U0?O%STSGG''3THL%SV<'(S1D>HKQF37+R*W/P^^VW8

MU%]:^QQW0G;SQ9G$Y??G);8=F:H^+;NXU'Q)X@@AF\3:B-/0) =/<6MMI[*F

M3NDW?.PZDD#H>O%"3 ]TR*,BO&;:]U?Q'IOPVAEUJ^MI-16Z6[F@EVO*JQGK

MV)P",X)!.1S5637]7\*'QKHEGJES-%83V45C/>OYSVWVC[Y+'J!VSP#BBP7/

M< 1ZBESQ7F]_I]UX#M;[4[/Q)>W@&GW$ILM4N?/>:5%W*\><8Q_$ ",5R-M=

M^,;)M-U:V@\237.8!S_P

MC_B0?]PF4_THNPLCHK+3[/3;;[/96T5M#N9_+B0*,L