Table of Contents

As filed with the Securities and Exchange Commission on November 21, 2017

Registration No. 333-221307

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CHENIERE CORPUS CHRISTI HOLDINGS, LLC*

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 4924 | 47-1929160 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) 700 Milam Street, Suite 1900

Houston, Texas 77002 (713) 375-5000 |

(I.R.S. Employer Identification Number) |

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Michael J. Wortley

President and Chief Financial Officer

700 Milam Street, Suite 1900

Houston, Texas 77002

(713) 375-5000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

Brooks W. Antweil

Andrews Kurth Kenyon LLP

600 Travis, Suite 4200

Houston, TX 77002-3009

(713) 220-4200

Approximate date of commencement of proposed sale to the public: As soon as practicable following effectiveness of this registration statement.

If the securities being registered on this Form are to be offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, as amended, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ☐

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ☐

Each registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

TABLE OF ADDITIONAL REGISTRANT GUARANTORS

| * | The following are additional registrants that are guaranteeing the securities registered hereby: |

| Exact Name of Registrant Guarantor as Specified in its Charter(1) |

State or Other Jurisdiction of Incorporation or Organization |

I.R.S. Employer Identification Number | ||

| Corpus Christi Liquefaction, LLC |

Delaware | 35-2445602 | ||

| Cheniere Corpus Christi Pipeline, L.P. |

Delaware | 20-4711857 | ||

| Corpus Christi Pipeline GP, LLC |

Delaware | 47-1936771 |

| (1) | The address, including zip code, and telephone number, including area code, of each additional registrant guarantor’s executive offices is 700 Milam Street, Suite 1900, Houston, Texas 77002, (713) 375-5000. |

Table of Contents

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION DATED NOVEMBER 21, 2017

PROSPECTUS

CHENIERE CORPUS CHRISTI HOLDINGS, LLC

Offer to exchange up to

$1,500,000,000 of 5.125% Senior Secured Notes due 2027

that have been registered under the Securities Act of 1933 for

$1,500,000,000 of 5.125% Senior Secured Notes due 2027

that have not been registered under the

Securities Act of 1933

(CUSIP NOS. 16412X AE5 AND U16327 AC9)

THE EXCHANGE OFFER EXPIRES AT 12:00 MIDNIGHT, NEW YORK

CITY TIME, AT THE END OF , 2017, UNLESS WE EXTEND IT

Terms of the Exchange Offer:

| • | We are offering to exchange up to $1,500,000,000 aggregate principal amount of registered 5.125% Senior Secured Notes due 2027 (the “New Notes”) for any and all of our $1,500,000,000 aggregate principal amount of unregistered 5.125% Senior Secured Notes due 2027 (CUSIP Nos. 16412X AE5 and U16327 AC9) (the “Old Notes” and together with the New Notes, the “notes” or the “2027 Senior Notes”) that were issued on May 19, 2017. |

| • | We will exchange all outstanding Old Notes that are validly tendered and not validly withdrawn prior to the expiration of the exchange offer for an equal principal amount of New Notes, as applicable. |

| • | The terms of the New Notes will be substantially identical to those of the outstanding Old Notes, except that the New Notes will be registered under the Securities Act of 1933, as amended (the “Securities Act”), and will not contain restrictions on transfer, registration rights or provisions for additional interest. |

| • | You may withdraw tenders of Old Notes at any time prior to the expiration of the exchange offer. |

| • | The exchange of Old Notes for New Notes will not be a taxable event for U.S. federal income tax purposes. |

| • | We will not receive any cash proceeds from the exchange offer. |

| • | The Old Notes are, and the New Notes will be, secured by first-priority liens on substantially all right, title and interest in or to substantially all of our assets and the assets of our current and any future guarantors along with certain other items listed under “Description of Senior Notes” (the “Collateral”). |

| • | The Old Notes are, and the New Notes will be, guaranteed on a senior basis by all of our current and future domestic subsidiaries. |

| • | There is no established trading market for the New Notes or the Old Notes. |

| • | We do not intend to apply for listing of the New Notes on any national securities exchange or for quotation through any quotation system. |

Please read “Risk Factors” beginning on page 24 for a discussion of certain risks that you should consider prior to tendering your outstanding Old Notes in the exchange offer.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Each broker-dealer that receives New Notes for its own account pursuant to the exchange offer must acknowledge by way of letter of transmittal that it will deliver a prospectus in connection with any resale of such New Notes. The letter of transmittal states that by so acknowledging and by delivering a prospectus, such broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of New Notes received in exchange for Old Notes where such Old Notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed that, for a period of 180 days after the consummation of the exchange offer, we will make this prospectus available to any broker-dealer for use in connection with any such resale. Please read “Plan of Distribution.”

The date of this prospectus is ,

Table of Contents

| ii | ||||

| ii | ||||

| iii | ||||

| iv | ||||

| 1 | ||||

| 23 | ||||

| 24 | ||||

| 54 | ||||

| SELECTED CONSOLIDATED AND COMBINED HISTORICAL FINANCIAL DATA |

55 | |||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

56 | |||

| 69 | ||||

| 86 | ||||

| 88 | ||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

88 | |||

| 90 | ||||

| 108 | ||||

| 118 | ||||

| 169 | ||||

| 185 | ||||

| 238 | ||||

| 251 | ||||

| 253 | ||||

| 254 | ||||

| 255 | ||||

| 255 | ||||

| 255 | ||||

| 256 | ||||

| 307 | ||||

| F-1 |

This prospectus incorporates important business and financial information about us that is not included or delivered with this prospectus. We will provide this information to you at no charge upon written or oral request directed to Corporate Secretary, Cheniere Corpus Christi Holdings, LLC, 700 Milam Street, Suite 1900, Houston, Texas 77002 (telephone number (713) 375-5000). In order to ensure timely delivery of this information, any request should be made by , 2017, five business days prior to the expiration date of the exchange offer.

i

Table of Contents

This prospectus is part of a registration statement we filed with the Securities and Exchange Commission, referred to in this prospectus as the SEC. In making your decision to participate in the exchange offer, you should rely only on the information contained in this prospectus and in the accompanying letter of transmittal. We have not authorized anyone to provide you with any other information. If you receive any unauthorized information, you must not rely on it. We are not making an offer to sell these securities in any state or jurisdiction where the offer is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front cover of this prospectus.

WHERE YOU CAN FIND MORE INFORMATION

Our SEC filings will be available to the public over the Internet at the SEC’s web site at http://www.sec.gov. You may also read and copy any document we file at the SEC’s public reference room located at 100 F Street, N.E., Washington D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room and copy charges. We will provide you upon request, without charge, a copy of the notes and the indenture governing the notes. You may request copies of these documents by contacting us at:

Cheniere Corpus Christi Holdings, LLC

Attention: Corporate Secretary

700 Milam Street, Suite 1900

Houston, Texas, 77002

(713) 375-5000

ii

Table of Contents

In this prospectus, we rely on and refer to information and statistics regarding our industry. We obtained this market data from independent industry publications or other publicly available information. Although we believe that these sources are reliable, we have not independently verified and do not guarantee the accuracy or completeness of this information.

In this prospectus, unless the context otherwise requires:

| • | Bcf means billion cubic feet; |

| • | Bcf/d means billion cubic feet per day; |

| • | Bcfe means billion cubic feet of natural gas equivalent using the ratio of six thousand cubic feet of natural gas to one barrel (or 42 U.S. gallons liquid volume) of crude oil, condensate and natural gas liquids; |

| • | Bcf/yr means billion cubic feet per year; |

| • | DOE means the U.S. Department of Energy; |

| • | Dth/d means dekatherms per day, which is equivalent to one million British thermal units, or MMBtu, per day; |

| • | EPC means engineering, procurement and construction; |

| • | FERC means the Federal Energy Regulatory Commission; |

| • | FOB means free on board; |

| • | FTA means a free trade agreement; |

| • | FTA countries means countries with which the United States has a free trade agreement providing for national treatment for trade in natural gas; |

| • | GAAP means generally accepted accounting principles in the United States; |

| • | Henry Hub means the final settlement price (in USD per MMBtu) for the New York Mercantile Exchange’s Henry Hub natural gas futures contract for the month in which a relevant cargo’s delivery window is scheduled to begin; |

| • | LIBOR means the London Interbank Offered Rate; |

| • | LNG means liquefied natural gas, a product of natural gas that, through a refrigeration process, has been cooled to a liquid state, which occupies a volume that is approximately 1/600th of its gaseous state; |

| • | MMBtu means million British thermal units, an energy unit; |

| • | MMBtu/d means million British thermal units per day; |

| • | mtpa means million tonnes per annum; |

| • | non-FTA countries means countries with which the United States does not have a free trade agreement providing for national treatment for trade in natural gas and with which trade is permitted; |

| • | SPA means an LNG sale and purchase agreement; |

| • | Tcf means trillion cubic feet; |

| • | Train means an industrial facility comprised of a series of refrigerant compressor loops used to cool natural gas into LNG; |

iii

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains certain statements that are, or may be deemed to be, “forward-looking statements.” All statements other than statements of historical or present facts or conditions, included herein or incorporated herein by reference are “forward-looking statements.” Included among “forward-looking statements” are, among other things:

| • | statements that we expect to commence or complete construction of our proposed LNG terminal, liquefaction facilities, pipeline facilities or other projects, or any expansions thereof, by certain dates, or at all; |

| • | statements regarding future levels of domestic and international natural gas production, supply or consumption or future levels of LNG imports into or exports from North America and other countries worldwide or purchases of natural gas, regardless of the source of such information, or the transportation or other infrastructure or demand for and prices related to natural gas, LNG or other hydrocarbon products; |

| • | statements regarding any financing transactions or arrangements, or our ability to enter into such transactions; |

| • | statements relating to the construction of our Trains and pipeline, including statements concerning the engagement of any engineering, procurement and construction (“EPC”) contractor or other contractor and the anticipated terms and provisions of any agreement with any such EPC or other contractor, and anticipated costs related thereto; |

| • | statements regarding any liquefied natural gas sale and purchase agreement (“SPA”) or other agreement to be entered into or performed substantially in the future, including any revenues anticipated to be received and the anticipated timing thereof, and statements regarding the amounts of total natural gas liquefaction or storage capacities that are, or may become, subject to contracts; |

| • | statements regarding counterparties to our commercial contracts, construction contracts, and other contracts; |

| • | statements regarding our planned development and construction of additional Trains and pipeline, including the financing of such Trains; |

| • | statements that our Trains, when completed, will have certain characteristics, including amounts of liquefaction capacities; |

| • | statements regarding our business strategy, our strengths, our business and operation plans or any other plans, forecasts, projections or objectives, including anticipated revenues, capital expenditures, maintenance and operating costs and cash flows, any or all of which are subject to change; |

| • | statements regarding legislative, governmental, regulatory, administrative or other public body actions, approvals, requirements, permits, applications, filings, investigations, proceedings or decisions; and |

| • | any other statements that relate to non-historical or future information. |

All of these types of statements, other than statements of historical or present facts or conditions, are forward-looking statements. In some cases, forward-looking statements can be identified by terminology such as “may,” “will,” “could,” “should,” “expect,” “plan,” “project,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “pursue,” “target,” “continue,” the negative of such terms or other comparable terminology. The forward-looking statements contained in this prospectus are largely based on our expectations,

iv

Table of Contents

which reflect estimates and assumptions made by our management. These estimates and assumptions reflect our best judgment based on currently known market conditions and other factors. Although we believe that such estimates are reasonable, they are inherently uncertain and involve a number of risks and uncertainties beyond our control. In addition, assumptions may prove to be inaccurate. We caution that the forward-looking statements contained in this prospectus are not guarantees of future performance and that such statements may not be realized or the forward-looking statements or events may not occur. Actual results may differ materially from those anticipated or implied in forward-looking statements as a result of a variety of factors, including those discussed in “Risk Factors” and elsewhere in this prospectus and in the other reports and other information that we file with the SEC. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these risk factors. These forward-looking statements speak only as of the date made, and other than as required by law, we undertake no obligation to update or revise any forward-looking statement or provide reasons why actual results may differ, whether as a result of new information, future events or otherwise.

v

Table of Contents

This summary highlights information contained elsewhere in this prospectus. It does not contain all of the information that you should consider before making an investment decision. You should carefully read this prospectus and should consider, among other things, the matters set forth under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes thereto appearing elsewhere in this prospectus. Please read “Risk Factors” beginning on page 24 of this prospectus.

Throughout this prospectus, unless we indicate otherwise or the context otherwise requires, the term “CCH” refers to Cheniere Corpus Christi Holdings, LLC, and the terms “we,” “our,” “us” and similar terms refer to CCH and its subsidiaries. Certain terms used and not defined in this section shall have the meanings attributed to such terms in the “Glossary of Certain Finance Document Terms” or the “Glossary of Certain Defined Terms” below.

Overview of the Liquefaction Project

Overview

CCH is a Delaware limited liability company formed in September 2014 by Cheniere Energy, Inc., a Houston-based energy company primarily engaged in LNG-related businesses (“Cheniere”), to develop, construct, operate, maintain and own a natural gas liquefaction and export facility (the “Liquefaction Facility”) and a pipeline facility (the “Corpus Christi Pipeline” and together with the Liquefaction Facility, the “Liquefaction Project”) on nearly 2,000 acres of land that we own or control near Corpus Christi, Texas, through wholly-owned subsidiaries Corpus Christi Liquefaction, LLC (“CCL”) and Cheniere Corpus Christi Pipeline, L.P. (“CCP”), respectively.

The Liquefaction Project is currently being developed for up to three Trains, with expected aggregate nominal production capacity, which is prior to adjusting for planned maintenance, production reliability and potential overdesign, of approximately 13.5 mtpa of LNG, three LNG storage tanks with aggregate capacity of approximately 10.1 Bcfe and two marine berths that can each accommodate vessels with nominal capacity of up to 266,000 cubic meters.

The Liquefaction Project is currently being developed in two stages:

| • | the first stage (“Stage 1”), for which we issued a full notice to proceed (“NTP”) to Bechtel under the EPC Contract (T1/T2) (each as defined below under “—Stage 1 and the Corpus Christi Pipeline”) on May 13, 2015, includes two Trains, each with an expected nominal production capacity, which is prior to adjusting for planned maintenance, production reliability and potential overdesign, of approximately 4.5 mtpa of LNG, two LNG storage tanks, each with a capacity of approximately 3.37 Bcfe, one complete marine berth that can accommodate vessels with nominal capacity of up to approximately 266,000 cubic meters, partial completion of a second berth, and all of the Liquefaction Project’s necessary infrastructure and facilities, in San Patricio County and Nueces County in the vicinity of Portland, Texas, on the La Quinta Channel on the north shore of the Corpus Christi Bay; and |

| • | the second stage (“Stage 2”), which we are currently developing but is not yet under construction, includes a third Train with an expected nominal production capacity, which is prior to adjusting for planned maintenance, production reliability and potential overdesign, of approximately 4.5 mtpa of LNG, a third LNG storage tank of approximately 3.37 Bcfe and the completion of the second berth. |

Concurrently with the construction of Stage 1, we also are developing the Corpus Christi Pipeline, a 23-mile-long bi-directional natural gas pipeline and related compressor station, meter stations and interconnects with several existing interstate and intrastate pipelines, originating at the Liquefaction Facility and terminating

1

Table of Contents

north of Sinton, Texas. The Corpus Christi Pipeline will be comprised of a 48-inch main pipeline and two 36-inch pipelines for the northern-most 1.5 mile connection to the compression station and is being designed to transport up to a maximum of 2.25 Bcf/d of natural gas feedstock to the Liquefaction Facility from the existing gas pipeline grid.

Stage 1 and the Corpus Christi Pipeline

Stage 1 of the Liquefaction Project is being designed, constructed and commissioned by Bechtel Oil, Gas and Chemicals, Inc. (“Bechtel”) pursuant to a lump sum turnkey EPC contract, dated December 6, 2013 (the “EPC Contract (T1/T2)”). The guaranteed substantial completion dates for Train One and Train Two (both as defined in the EPC Contract (T1/T2)) are October 12, 2019 and July 27, 2020, respectively. The total contract price of the EPC Contract (T1/T2), which does not include the costs of constructing the Corpus Christi Pipeline, is approximately $7.8 billion, reflecting amounts incurred under change orders through September 30, 2017. The Corpus Christi Pipeline is being constructed by third party construction firms under three separate construction contracts (the “CCP Construction Contracts”). The total target contract price of constructing the Corpus Christi Pipeline based on our CCP Construction Contracts is approximately $130 million. We estimate that the total expected capital costs for the Corpus Christi Pipeline will be between $350 million and $400 million, including the estimated contingency.

As of September 30, 2017, the overall project completion percentage for Stage 1 of the Liquefaction Project was approximately 72.4% complete, with engineering, procurement, subcontract work and construction approximately 100%, 89.4%, 49.4% and 49.2% complete, respectively. Based on our current construction schedule, we anticipate that Train One and Train Two will achieve substantial completion in the first and second half of 2019, respectively. The construction of the Corpus Christi Pipeline commenced in January 2017 and is nearing completion. We expect the Corpus Christi Pipeline to be operational prior to the commissioning of Train One.

Stage 2

Stage 2 of the Liquefaction Project is not currently under construction. We have obtained the FERC and DOE authorizations necessary to construct, operate and export LNG from Stage 2. On December 6, 2013, we entered into a lump sum turnkey EPC contract with Bechtel (the “EPC Contract (T3)”). Since we did not issue the full NTP under the contract by December 31, 2016, either party may, among other things, terminate the EPC Contract (T3), and following such termination CCL would be required to reimburse Bechtel for costs reasonably incurred by Bechtel on account of such termination and pay a lump sum of $5 million. As of the date of this prospectus, neither we nor Bechtel has provided a notification to the other to terminate the EPC Contract (T3), but this could occur at any time thereafter. The total contract price of the EPC Contract (T3) is approximately $2.4 billion. We are having ongoing negotiations with Bechtel concerning Stage 2, and if we and Bechtel ultimately extend or amend the EPC Contract (T3) to develop Stage 2, the terms of the EPC Contract (T3), including the total contract price, may change from those currently in the contract. Our debt financings and the equity financing described below under “Overview of the Funding Plan for the Liquefaction Project” are not for the construction of Stage 2, and construction of Stage 2 would constitute an “Expansion” under the terms of the indenture. As such, the commencement of construction of Stage 2 would be subject to various conditions, including a final agreement with Bechtel to extend and revise the EPC Contract (T3), conditions related to the availability of sufficient funding to cover the construction costs of Stage 2, regulatory conditions and satisfaction of certain debt service coverage ratios with respect to Senior Debt. For more information on the conditions we will need to meet in order to construct Stage 2, please see the description set forth in “Description of Senior Notes—Expansions” and “Description of Senior Notes—Incurrence of Senior Debt—Expansion Senior Debt.” We will contemplate making a final investment decision to commence construction of Stage 2 based upon, among other things, entering into acceptable commercial arrangements and obtaining adequate financing to construct the facility. Consequently, there is no assurance that we will ultimately construct Stage 2 and our current creditors and the holders of these notes should not rely on or expect that we will have any revenues from LNG produced by future Stage 2 facilities or current or future SPAs related to LNG from Stage 2.

2

Table of Contents

Subsequent Stages

We may further expand the Liquefaction Project in the future through the development of additional Trains and related facilities. For further detail, see “Business—The Liquefaction Project.”

In lieu of, or in addition to, Stage 2 or any subsequent stages or expansion of the Liquefaction Project, Cheniere or an affiliate of Cheniere may develop one or more Trains and related facilities adjacent to the Liquefaction Project as part of a separate project that is not owned by us. In this case, we may transfer and/or amend previously-obtained permits and other authorizations or applications such that they may be used by that project. We also may enter into arrangements with such a separate project to share the use and capacity of each other’s land and facilities, including pooling of capacity of the Trains, sharing of common facilities, such as storage tanks and berths, and use of capacity of the pipeline facilities, to the extent permitted under the Finance Documents. These sharing arrangements would be subject to quiet enjoyment rights both for the Project Entities and the owner of the other Train(s). Our entry into sharing arrangements of this nature will be subject to our satisfaction of the conditions related to the sharing of our land and facilities set forth in “Description of Senior Notes—Covenants Applicable to the Notes—Sharing of Project Facilities.”

3

Table of Contents

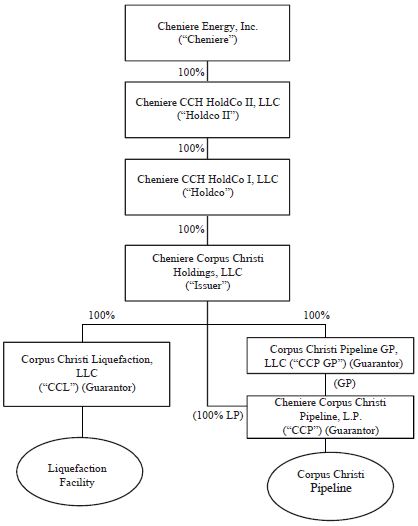

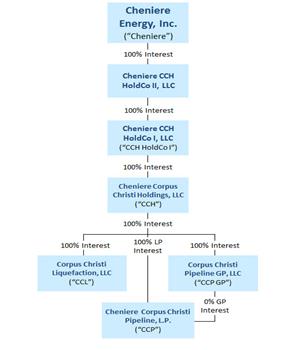

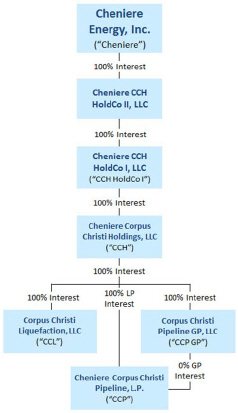

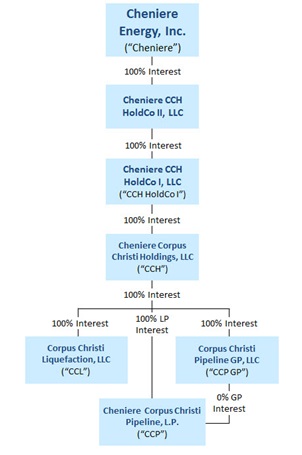

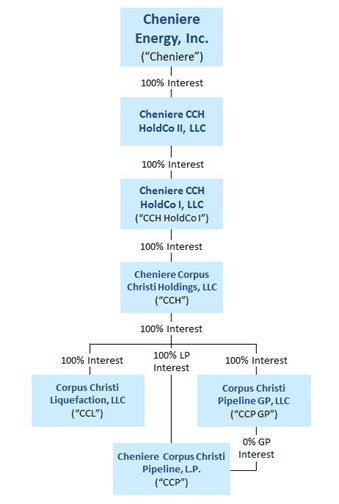

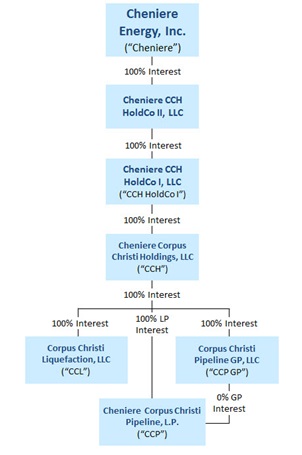

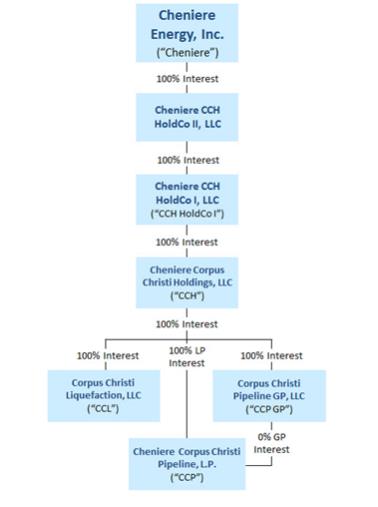

Organizational Structure

CCH owns 100% of the equity interests in (i) CCL, which owns the Liquefaction Facility, (ii) CCP, which owns the Corpus Christi Pipeline, and (iii) Corpus Christi Pipeline GP, LLC (“CCP GP” and together with CCH, CCL and CCP collectively, the “Project Entities”), which holds all of the general partner interest in CCP. CCL, CCP and CCP GP constitute all of the current subsidiaries of CCH. CCH is an indirect wholly-owned subsidiary of Cheniere.

4

Table of Contents

Overview of the Funding Plan for the Liquefaction Project

On May 13, 2015, we entered into a construction term loan facility (the “2015 CCH Credit Facility”). The 2015 CCH Credit Facility is being used to fund a portion of the costs associated with Stage 1 and the Corpus Christi Pipeline. As of September 30, 2017, we had approximately $2.4 billion of available commitments and approximately $2.2 billion of outstanding borrowings under the 2015 CCH Credit Facility. See “Description of Other Indebtedness— 2015 CCH Credit Facility” for additional information regarding our 2015 CCH Credit Facility and certain finance documents entered into in connection with the 2015 CCH Credit Facility.

On May 13, 2015, Cheniere entered into an Equity Contribution Agreement for the benefit of CCH (the “CEI Equity Contribution Agreement”) pursuant to which Cheniere agreed to provide a tiered equity contribution of approximately $2.6 billion for Stage 1 of the Liquefaction Project and the Corpus Christi Pipeline. The first tier of equity funding, approximately $1.5 billion (the “First Tier Equity Funding”), was contributed to CCH concurrently with the closing of the 2015 CCH Credit Facility. The second tier of equity funding, up to a maximum amount of approximately $1.1 billion will be contributed concurrently and pro rata with Senior Debt funding including under the 2015 CCH Credit Facility starting on the date on which further disbursements of our Senior Debt would result in a Senior Debt/Equity Ratio of greater than 75:25 (the “Second Tier Pro Rata Equity Funding”). As of September 30, 2017, CCH has received approximately $1.8 billion in contributions under the CEI Equity Contribution Agreement, of which approximately $1.5 billion was the First Tier Equity Funding and approximately $0.3 billion was part of the Second Tier Pro Rata Equity Funding. CCH anticipates that, in connection with each subsequent borrowing under the 2015 CCH Credit Facility, it will be necessary for Cheniere to provide pro rata equity funding of a portion of the Second Tier Pro Rata Funding until such amount has been fully funded. On March 2, 2017, Cheniere entered into a $750 million senior secured revolving credit facility (the “CEI Revolving Credit Facility”). The proceeds of the CEI Revolving Credit Facility are available to Cheniere, subject to certain conditions, to back-stop its obligations under the CEI Equity Contribution Agreement to provide the Second Tier Pro Rata Equity Funding to CCH and for general corporate purposes. As of September 30, 2017, there were no outstanding borrowings under the CEI Revolving Credit Facility and $750 million of available commitments.

On May 13, 2015, our indirect parent, Cheniere CCH Holdco II, LLC (“Holdco II”) issued $1.0 billion aggregate principal amount of 11% Senior Secured Notes due 2025 (the “Convertible Notes”) pursuant to an amended and restated note purchase agreement with purchasers of the Convertible Notes, including affiliates of EIG Management Company, LLC. Holdco II contributed to CCH, through its wholly-owned subsidiary Cheniere CCH HoldCo I, LLC (“Holdco”), the net proceeds of the Convertible Notes issuance, which proceeds were part of the First Tier Equity Funding provided to CCH by Cheniere under the CEI Equity Contribution Agreement.

We currently have $1.25 billion of outstanding 7.000% Senior Secured Notes due 2024 (the “2024 Senior Notes”), $1.5 billion of outstanding 5.875% Senior Secured Notes due 2025 (the “2025 Senior Notes” and together with the 2024 Senior Notes and 2027 Senior Notes, the “Senior Notes”) and $1.5 billion of outstanding 2027 Senior Notes. Interest on the Senior Notes is payable semi-annually in arrears. See “Description of Other Indebtedness— Senior Notes” and “Description of Security Documents” for additional information regarding our Senior Notes.

On December 14, 2016, we entered into a $350 million working capital facility (the “CCH Working Capital Facility”) for various working capital requirements related to the development and construction of the Liquefaction Project. As of September 30, 2017, we had issued $162.5 million of letters of credit and had no outstanding borrowings under the CCH Working Capital Facility. See “Description of Other Indebtedness—CCH Working Capital Facility” for additional information regarding our CCH Working Capital Facility.

5

Table of Contents

Total expected capital costs for Stage 1, which includes Train One and Train Two, and the Corpus Christi Pipeline are estimated to be between $9.0 billion and $10.0 billion before financing costs, and between $11.0 billion and $12.0 billion after financing costs, including, in each case, estimated owner’s costs and contingencies. We believe that with the unfunded commitments under the 2015 CCH Credit Facility, equity contributions made pursuant to the CEI Equity Contribution Agreement and the cash flows under our SPAs related to Train One and Train Two, we will have adequate financial resources available to us to complete Stage 1 and the Corpus Christi Pipeline. The net proceeds of the sale of the Senior Notes were used to prepay a portion of the principal amounts previously outstanding under our 2015 CCH Credit Facility.

6

Table of Contents

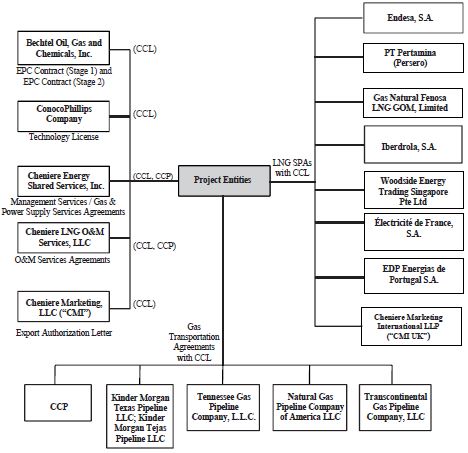

Certain Key Contractual Relationships

The following chart illustrates several of our current key contractual relationships for the Liquefaction Project. See “Description of Material Project Agreements” for additional information regarding certain of the agreements listed below.

LNG SPAs

CCL has entered into seven fixed price, 20-year SPAs with extension rights with six third parties to make available an aggregate amount of LNG that equates to approximately 7.7 mtpa of LNG, which is approximately 86% of the expected aggregate nominal production capacity of Train One and Train Two. The obligation to make LNG available under these SPAs commences from the date of first commercial delivery for Train One or Train Two, as specified in each SPA. Under these seven SPAs, the customers will purchase LNG from CCL for a price consisting of a fixed fee of $3.50 per MMBtu of LNG (a portion of which is subject to annual adjustment for inflation) plus a variable fee equal to 115% of Henry Hub per MMBtu of LNG. In certain circumstances, the customers may elect to cancel or suspend deliveries of LNG cargoes, in which case the customers would still be required to pay the fixed fee with respect to the contracted volumes that are not delivered as a result of such cancellation or suspension. The SPAs and contracted volumes to be made available under the SPAs are not tied to a specific Train. However, the term of each SPA commences upon the start of operations of a specified Train.

7

Table of Contents

As of September 30, 2017, CCL had the following third-party, fixed price SPAs in connection with Train One and Train Two, which are a part of Stage 1 of the Liquefaction Project:

| • | An SPA (“Endesa SPA No. 1”) with Endesa Generación, S.A. (which was subsequently assigned to Endesa S.A. (“Endesa”)), the term of which commences upon the date of first commercial delivery for Train One. The Endesa SPA No. 1 includes an annual contract quantity of 78,215,000 MMBtu of LNG, equating to expected annual contracted cash flow from fixed fees of $273.8 million. Endesa is organized under the laws of Spain. |

| • | An SPA (“Endesa SPA No. 2”) with Endesa, the term of which commences upon the date of first commercial delivery for Train One. The Endesa SPA No. 2 includes an annual contract quantity of 39,107,500 MMBtu of LNG, equating to expected annual contracted cash flow from fixed fees of $136.9 million. |

| • | An SPA (“Pertamina SPA”) with PT Pertamina (Persero) (“Pertamina”), the term of which commences upon the date of first commercial delivery for Train One. The Pertamina SPA includes an annual contract quantity of 39,680,000 MMBtu of LNG (plus, for the contract year in which the date of first commercial delivery for Train Two occurs and each subsequent year, an additional 39,680,000 MMBtu of LNG), equating to expected annual contracted cash flow from fixed fees of $138.9 million ($277.8 million beginning in the contract year in which Train Two becomes commercially operable). Pertamina is organized under the laws of Indonesia. |

| • | An SPA (“EDF SPA”) with Électricité de France, S.A. (“EDF”), the term of which commences upon the date of first commercial delivery for Train Two. The EDF SPA includes an annual contract quantity of 40,000,000 MMBtu of LNG, equating to expected annual contracted cash flow from fixed fees of $140.0 million. EDF is organized under the laws of France. |

| • | An SPA (“Gas Natural Fenosa SPA”) with Gas Natural Fenosa LNG SL (which was subsequently assigned to Gas Natural Fenosa LNG GOM, Limited (“Gas Natural Fenosa”)), the term of which commences upon the date of first commercial delivery for Train Two. The Gas Natural Fenosa SPA includes an annual contract quantity of 78,215,000 MMBtu of LNG, equating to expected annual contracted cash flow from fixed fees of $273.8 million. Gas Natural Fenosa is organized under the laws of Ireland. The Gas Natural Fenosa SPA is irrevocably guaranteed by Gas Natural SDG S.A., which is organized under the laws of Spain. |

| • | An SPA (“Iberdrola SPA”) with Iberdrola, S.A. (“Iberdrola”), the term of which commences upon the date of first commercial delivery for Train Two. The Iberdrola SPA includes an annual contract quantity of 39,680,000 MMBtu of LNG, equating to expected annual contracted cash flow from fixed fees of $138.9 million. In addition, CCL will provide Iberdrola with bridging volumes of 19,840,000 MMBtu of LNG per contract year, starting on the date on which Train One becomes commercially operable and ending on the date of first commercial delivery of LNG for Train Two. Iberdrola is organized under the laws of Spain. |

| • | An SPA (“Woodside SPA”) with Woodside Energy Trading Singapore Pte Ltd (“Woodside”), the term of which commences upon the date of first commercial delivery for Train Two. The Woodside SPA includes an annual contract quantity of 44,120,000 MMBtu of LNG, equating to expected annual contracted cash flow from fixed fees of $154.4 million. Woodside is organized under the laws of Singapore. The Woodside SPA is irrevocably guaranteed by Woodside Petroleum, Ltd., which is organized under the laws of Australia. |

8

Table of Contents

In aggregate, the fixed fee portion to be paid by these customers is approximately $1.4 billion annually for Train One and Train Two, with the applicable fixed fees starting from the date of first commercial delivery from the applicable Train. These fixed fees equal approximately $549.5 million and $845.9 million for Train One and Train Two, respectively. As of September 30, 2017, we had approximately $6.3 billion of long-term debt outstanding, comprising approximately $2.2 billion under our 2015 CCH Credit Facility, which has been used to fund a portion of the costs associated with the development of Stage 1 and the Corpus Christi Pipeline, and $1.25 billion under our 2024 Senior Notes, $1.5 billion under our 2025 Senior Notes and $1.5 billion under our 2027 Senior Notes, the net proceeds of which were used, at the time of the issuance of the respective series of Senior Notes, to prepay amounts outstanding under the 2015 CCH Credit Facility. As of September 30, 2017, our available commitments under our 2015 CCH Credit Facility are approximately $2.4 billion. The Senior Debt under the 2015 CCH Credit Facility and the Senior Notes has been incurred based on the revenues projected to be received under the seven third-party SPAs described above.

In connection with Train Three, which is part of Stage 2 of the Liquefaction Project, CCL has entered into one third-party, fixed price 20-year SPA (the “EDP SPA”) with EDP Energias de Portugal S.A. (“EDP”). The EDP SPA became effective as of July 9, 2015 upon waiver of certain conditions precedent to effectiveness. Under the EDP SPA, EDP will purchase LNG from CCL for a price consisting of a fixed fee of $3.50 per MMBtu of LNG (a portion of which is subject to annual adjustment for inflation) plus a variable fee equal to 115% of Henry Hub per MMBtu of LNG. In certain circumstances, EDP may elect to cancel or suspend deliveries of LNG cargoes, in which case EDP would still be required to pay the fixed fee with respect to contracted volumes that are not delivered as a result of such cancellation or suspension. The term of the EDP SPA commences upon the date of first commercial delivery of LNG for Train Three and includes an annual contract quantity of 40,000,000 MMBtu of LNG, equating to expected annual contracted cash flow from fixed fees of $140.0 million. EDP is organized under the laws of Portugal. The EDP SPA purchase commitments equate to approximately 0.8 mtpa of LNG (which is approximately 18% of the expected nominal production capacity of Train Three).

In addition to the third-party SPAs described above, CCL has entered into two fixed price 20-year SPAs with CMI UK, an indirect wholly-owned subsidiary of Cheniere. Under the first SPA (the “Amended CMI Foundation SPA”), CMI UK will purchase LNG from CCL for a price consisting of a fixed fee of $3.50 per MMBtu of LNG (a portion of which is subject to annual adjustment for inflation) plus a variable fee equal to 115% of Henry Hub per MMBtu of LNG. At CMI UK’s option, which has not been exercised yet, the term of the Amended CMI Foundation SPA commences upon the date of first commercial delivery for Train Two and includes an annual contract quantity of 40,000,000 MMBtu of LNG, equating to expected annual contracted cash flow from fixed fees of $140.0 million. Under certain circumstances and conditions, quantities of LNG to be sold under the Amended CMI Foundation SPA could be reduced by an amount equal to quantities of LNG to be sold under an SPA (the “El Campesino Contingent SPA”) entered into between CCL and Central El Campesino S.A., a Chilean sociedad anónima (“El Campesino”) on November 28, 2014, and amended and restated on December 27, 2016. See “Certain Relationships and Related Party Transactions—Cheniere Marketing International LLP SPA—Amended CMI Foundation SPA—El Campesino SPA” for more detail regarding this SPA. The second SPA (the “CMI Base SPA”) allows CMI UK to purchase, at its option, (i) up to a cumulative total of 150,000,000 MMBtu of LNG within the commissioning periods for Train One, Train Two, and Train Three, (ii) any LNG produced from the end of the commissioning period for Train One until the date of first commercial delivery of LNG from Train One, and (iii) any excess LNG produced by the Liquefaction Facility that is not committed to customers under third-party SPAs or to CMI UK under the Amended CMI Foundation SPA, as determined by us in each contract year, in each case for a price consisting of a fixed fee of $3.00 per MMBtu of LNG plus a variable fee equal to 115% of Henry Hub per MMBtu of LNG. Under the CMI Base SPA, CMI UK may, without charge, elect to cancel or suspend deliveries of cargoes (other than commissioning cargoes) scheduled for any month under the applicable annual delivery program by providing specified notice in advance. Under certain circumstances and conditions, quantities of LNG to be sold under the CMI Base SPA during the then-current contract year and, if already-scheduled, the subsequent contract years could be reduced by an amount equal to quantities of LNG to be sold under the El Campesino Contingent SPA during such contract year. See “Certain Relationships and Related Party Transactions.”

9

Table of Contents

Natural Gas Transportation and Supply

To ensure CCL is able to transport adequate natural gas feedstock to the Liquefaction Facility, CCL has entered into transportation precedent agreements to secure firm pipeline transportation capacity with CCP and certain third-party pipeline companies. See “Description of Material Project Agreements—Transportation Precedent Agreements.” CCL has entered into an agreement with a third party for firm storage services to assist in managing volatility in natural gas needs for the Liquefaction Project. CCL has also entered into enabling agreements with third parties and will continue to enter into such agreements in order to secure natural gas feedstock for the Liquefaction Project. We expect to enter into natural gas supply contracts under these enabling agreements as and when required for the Liquefaction Project. Among other things, these agreements would allow CCL to enter into natural gas purchases as and when required for the Liquefaction Project on a spot or forward basis tied to Henry Hub or other market indices.

Our Business

Strategy

Our primary objective for the Liquefaction Project is to generate stable cash flows by:

| • | completing construction and commencing operation of Train One and Train Two and the Corpus Christi Pipeline on schedule and within budget; |

| • | developing, constructing and commencing operation of Train Three; |

| • | operating and maintaining our assets safely, efficiently, reliably and in compliance with all applicable government regulations; |

| • | developing a solid portfolio of natural gas supply and transportation agreements to support our LNG liquefaction operations; |

| • | making LNG available to our long-term SPA customers to generate steady and reliable revenues and operating cash flows; and |

| • | maintaining a prudent and cost-effective capital structure. |

Summary of Regulatory

Requirements

We have obtained the FERC and DOE authorizations necessary to construct, operate and export LNG from Stage 1, Stage 2 and the Corpus Christi Pipeline.

In December 2014, the FERC issued an order granting CCL authorization under Section 3 of the Natural Gas Act (the “NGA”) to site, construct and operate Stage 1 and Stage 2 of the Liquefaction Project and issued a certificate of public convenience and necessity under Section 7(c) of the NGA authorizing CCP to construct and operate the Corpus Christi Pipeline (the “December 2014 Order”). A party to the proceeding requested a rehearing of the December 2014 Order, and in May 2015, the FERC denied rehearing (the “Order Denying Rehearing”). The party petitioned the U.S. Court of Appeals for the District of Columbia Circuit to review the December 2014 Order and the Order Denying Rehearing, and that petition was denied on November 4, 2016. This order is not subject to review.

The DOE has authorized the export of domestically produced LNG by vessel from the Liquefaction Project to FTA countries for a 25-year term and to non-FTA countries for a 20-year term of a combined total up to the equivalent of 767 Bcf/yr (approximately 15 mtpa) of natural gas. A party to the proceeding requested a rehearing of the non-FTA authorization, which was denied by the DOE in May 2016. In July 2016, the same party petitioned the U.S. Court of Appeals for the District of Columbia Circuit (the “Court of Appeals”) to review the non-FTA

10

Table of Contents

authorization and the DOE order denying the request for rehearing of the same. The Court of Appeals denied the petition in November 2017, and the time for review of the court’s denial has not yet expired. The terms of each of these export authorizations begin on the earlier of the date of first export thereunder or the date specified in the particular order, which ranges from 7 to 10 years from the date the order was issued. This would provide sufficient authorization to export the LNG produced from Stage 1 and Stage 2 of the Liquefaction Project based on their expected aggregate nominal production capacity.

We have commenced the regulatory process in respect of up to seven midscale Trains with an expected aggregate nominal production capacity of approximately 9.5mpta. These additional Trains and related facilities may be developed by us as expansions of the Liquefaction Project or through transfers or amendments of the permits, may be developed by Cheniere or one of its affiliates outside of the Liquefaction Project.

We have, or expect to obtain, all other material governmental approvals at the federal, state and local level currently necessary to complete Stage 1, Stage 2 and the Corpus Christi Pipeline.

Principal Executive Offices

Our principal executive office is located at 700 Milam Street, Suite 1900, Houston, Texas, 77002, and our telephone number is (713) 375-5000.

11

Table of Contents

The Exchange Offer

On May 19, 2017, we completed a private offering of $1,500,000,000 aggregate principal amount of the Old Notes. As part of this private offering, we entered into a registration rights agreement with the initial purchasers of the Old Notes in which we agreed, among other things, to deliver this prospectus to you and to use our reasonable best efforts to consummate the exchange offer no later than 360 days after the May 19, 2017 private offering. The following is a summary of the exchange offer.

| Old Notes |

5.125% Senior Secured Notes due 2027, which were issued on May 19, 2017. |

| New Notes |

5.125% Senior Secured Notes due 2027. The terms of the New Notes are substantially identical to the terms of the outstanding Old Notes, except that the transfer restrictions, registration rights and provisions for additional interest relating to the Old Notes will not apply to the New Notes. |

| Exchange Offer |

We are offering to exchange up to $1,500,000,000 aggregate principal amount of our New Notes that have been registered under the Securities Act for an equal amount of our outstanding Old Notes that have not been registered under the Securities Act to satisfy our obligations under the registration rights agreement. |

| The New Notes will evidence the same debt as the Old Notes for which they are being exchanged and will be issued under, and be entitled to the benefits of, the same indenture that governs the Old Notes. Holders of the Old Notes do not have any appraisal or dissenters’ rights in connection with the exchange offer. Because the New Notes will be registered, the New Notes will not be subject to transfer restrictions, and holders of Old Notes that have tendered and had their Old Notes accepted in the exchange offer will have no registration rights. |

| Expiration Date |

The exchange offer will expire at 12:00 midnight, New York City time, at the end of , 2017, unless we decide to extend the date. |

| Conditions to the Exchange Offer |

The exchange offer is subject to customary conditions, which we may waive. Please read “The Exchange Offer—Conditions to the Exchange Offer” for more information regarding the conditions to the exchange offer. |

| Procedures for Tendering Old Notes |

You must do one of the following on or prior to the expiration of the exchange offer to participate in the exchange offer: |

| • | tender your Old Notes by sending the certificates for your Old Notes, in proper form for transfer, a properly completed and duly |

12

Table of Contents

| executed letter of transmittal, with any required signature guarantees, and all other documents required by the letter of transmittal, to The Bank of New York Mellon, as registrar and exchange agent, at the address listed under the caption “The Exchange Offer—Exchange Agent”; or |

| • | tender your Old Notes by using the book-entry transfer procedures described below and transmitting a properly completed and duly executed letter of transmittal, with any required signature guarantees, or an agent’s message instead of the letter of transmittal, to the exchange agent. In order for a book-entry transfer to constitute a valid tender of your Old Notes in the exchange offer, The Bank of New York Mellon, as registrar and exchange agent, must receive a confirmation of book-entry transfer of your Old Notes into the exchange agent’s account at The Depository Trust Company (“DTC”) prior to the expiration of the exchange offer. For more information regarding the use of book- entry transfer procedures, including a description of the required agent’s message, please read the discussion under the caption “The Exchange Offer—Procedures for Tendering—Book-entry Transfer.” |

| We are not providing for guaranteed delivery procedures, and therefore you must allow sufficient time for the necessary tender procedures to be completed during normal business hours of DTC on or prior to the expiration time. If you hold your Old Notes through a broker, dealer, commercial bank, trust company or other nominee, you should consider that such entity may require you to take action with respect to the exchange offer a number of days before the expiration time in order for such entity to tender notes on your behalf on or prior to the expiration time. Tenders not completed on or prior to 12:00 midnight, New York City time, at the end of , 2017 will be disregarded and of no effect. |

| By executing the letter of transmittal or by transmitting an agent’s message in lieu thereof, you will represent to us that, among other things: |

| • | the New Notes you receive will be acquired in the ordinary course of your business; |

| • | you are not participating and you have no arrangement with any person or entity to participate in, the distribution of the New Notes; |

| • | you are not our “affiliate,” as defined under Rule 405 of the Securities Act, or a broker-dealer tendering Old Notes acquired directly from us for resale pursuant to Rule 144A or any other available exemption under the Securities Act; and |

| • | if you are not a broker-dealer, that you are not engaged in and do not intend to engage in the distribution of the New Notes. |

13

Table of Contents

| Special Procedures for Beneficial Owners |

If you are a beneficial owner whose Old Notes are registered in the name of a broker, dealer, commercial bank, trust company or other nominee and you wish to tender your Old Notes in the exchange offer, you should promptly contact the person in whose name the Old Notes are registered and instruct that person to tender on your behalf. |

| Please do not send your letter of transmittal or certificates representing your Old Notes to us. Those documents should be sent only to the exchange agent. Questions regarding how to tender and requests for information should be directed to the exchange agent. |

| If you wish to tender in the exchange offer on your own behalf, prior to completing and executing the letter of transmittal and delivering the certificates for your Old Notes, you must either make appropriate arrangements to register ownership of the Old Notes in your name or obtain a properly completed bond power from the person in whose name the Old Notes are registered. |

| Withdrawal; Non-Acceptance |

You may withdraw any Old Notes tendered in the exchange offer at any time prior to 12:00 midnight, New York City time, at the end of , 2017. If we decide for any reason not to accept any Old Notes tendered for exchange, the Old Notes will be returned to the registered holder at our expense promptly after the expiration or termination of the exchange offer. In the case of Old Notes tendered by book-entry transfer in to the exchange agent’s account at DTC, any withdrawn or unaccepted Old Notes will be credited to the tendering holder’s account at DTC. For further information regarding the withdrawal of tendered Old Notes, please read “The Exchange Offer—Withdrawal Rights.” |

| U.S. Federal Income Tax Consequences |

The exchange of New Notes for Old Notes in the exchange offer will not be a taxable event for U.S. federal income tax purposes. Please read the discussion under the caption “Material United States Federal Income Tax Consequences” for more information regarding the tax consequences to you of the exchange offer. |

| Use of Proceeds |

The issuance of the New Notes will not provide us with any new proceeds. We are making this exchange offer solely to satisfy our obligations under the registration rights agreement. |

| Fees and Expenses |

We will pay all of our expenses incident to the exchange offer. |

| Exchange Agent |

We have appointed The Bank of New York Mellon as exchange agent for the exchange offer. For the address, telephone number and fax number of the exchange agent, please read “The Exchange Offer— Exchange Agent.” |

| Resales of New Notes |

Based on interpretations by the staff of the SEC, as set forth in no-action letters issued to third parties that are not related to us, we believe that the New Notes you receive in the exchange offer may be offered for resale, resold or |

14

Table of Contents

| otherwise transferred by you without compliance with the registration and prospectus delivery provisions of the Securities Act so long as: |

| • | the New Notes are being acquired in the ordinary course of business; |

| • | you are not participating, do not intend to participate, and have no arrangement or understanding with any person to participate in the distribution of the New Notes issued to you in the exchange offer; |

| • | you are not our affiliate or an affiliate of any of our subsidiary guarantors; and |

| • | you are not a broker-dealer tendering Old Notes acquired directly from us for your account. |

| The SEC has not considered this exchange offer in the context of a no-action letter, and we cannot assure you that the SEC would make similar determinations with respect to this exchange offer. If any of these conditions are not satisfied, or if our belief is not accurate, and you transfer any New Notes issued to you in the exchange offer without delivering a resale prospectus meeting the requirements of the Securities Act or without an exemption from registration of your New Notes from those requirements, you may incur liability under the Securities Act. We will not assume, nor will we indemnify you against, any such liability. Each broker-dealer that receives New Notes for its own account in exchange for Old Notes, where the Old Notes were acquired by such broker-dealer as a result of market-making or other trading activities, must acknowledge that it will deliver a prospectus in connection with any resale of such New Notes. Please read “Plan of Distribution.” |

| Please read “The Exchange Offer—Resales of New Notes” for more information regarding resales of the New Notes. |

| Consequences of Not Exchanging Your Old Notes |

If you do not exchange your Old Notes in this exchange offer, you will no longer be able to require us to register your Old Notes under the Securities Act, except in the limited circumstances provided under the registration rights agreement. In addition, you will not be able to resell, offer to resell or otherwise transfer your Old Notes unless we have registered the Old Notes under the Securities Act, or unless you resell, offer to resell or otherwise transfer them under an exemption from the registration requirements of, or in a transaction not subject to, the Securities Act. |

| For information regarding the consequences of not tendering your Old Notes and our obligation to file a registration statement, please read “The Exchange Offer—Consequences of Failure to Exchange Outstanding Securities” and “Description of Senior Notes.” |

15

Table of Contents

Terms of the New Notes

The terms of the New Notes will be substantially identical to the terms of the Old Notes, except that the transfer restrictions, registration rights and provisions for additional interest relating to the Old Notes will not apply to the New Notes. As a result, the New Notes will not bear legends restricting their transfer and will not have the benefit of the registration rights and additional interest provisions contained in the Old Notes. The New Notes represent the same debt as the Old Notes for which they are being exchanged. The New Notes are governed by the same indenture as that which governs the Old Notes.

The following summary contains basic information about the New Notes and is not intended to be complete. For a more complete understanding of the New Notes, please refer to the section in this prospectus entitled “Description of Senior Notes.” When we use the term “notes” in this prospectus, unless the context requires otherwise, the term includes the Old Notes and the New Notes.

| Issuer |

Cheniere Corpus Christi Holdings, LLC. |

| Notes Offered |

$1,500,000,000 aggregate principal amount of 5.125% Senior Secured Notes due 2027. |

| Maturity Date |

The New Notes mature on June 30, 2027. |

| Interest |

Interest on the New Notes will accrue at a rate equal to 5.125% per annum, computed on the basis of a 360-day year comprising twelve 30-day months. |

| Interest Payment Dates |

We will pay interest on the New Notes semi-annually, in cash in arrears, on June 30 and December 31 of each year, commencing on December 31, 2017. |

| Guarantees |

The New Notes will be guaranteed by all of our existing Subsidiaries and certain of our future Domestic Subsidiaries. As of the date of this prospectus, the Guarantors consist of each of CCL, CCP and CCP GP. See “Description of Senior Notes—Guarantees of the Notes.” |

| Ranking |

The New Notes will constitute direct and unconditional senior secured obligations, and will rank pari passu in right of payment and otherwise with any of our and the Guarantors’ other senior indebtedness from time to time outstanding. |

| The New Notes will be effectively senior to all of our future junior lien obligations and future unsecured senior indebtedness, to the extent of the value of the Collateral securing the notes. |

| The New Notes will be effectively junior to any of our or our Subsidiaries’ secured indebtedness that is secured by liens on assets other than the Collateral securing the notes, to the extent of the value of such assets. |

16

Table of Contents

| The New Notes will be structurally subordinated to any future indebtedness of our non-Guarantor Subsidiaries. |

| As of September 30, 2017, we had approximately $6.3 billion of long- term debt outstanding, comprising approximately $2.2 billion of outstanding borrowings under our 2015 CCH Credit Facility, $1.25 billion under the 2024 Senior Notes, $1.5 billion under the 2025 Senior Notes and $1.5 billion under the 2027 Senior Notes. As of September 30, 2017, we also had approximately $2.4 billion of available commitments under our 2015 CCH Credit Facility. As of September 30, 2017, we had issued $162.5 million of letters of credit, had no outstanding borrowings and had $187.5 million of available commitments under the CCH Working Capital Facility. We had no other material indebtedness outstanding at September 30, 2017. Upon the issuance and sale of the Old Notes, we used the net proceeds from the sale to prepay a portion of the principal amounts currently outstanding under the 2015 CCH Credit Facility (after deducting the initial purchasers’ commissions and certain provisions, costs, prepayment premiums, fees and expenses). |

| Optional Redemption |

At any time from time to time prior to January 1, 2027 we may redeem the applicable series of New Notes, in whole or in part, at a redemption price equal to the Make-Whole Price as defined under the caption “Description of Senior Notes—Optional Redemption,” plus accrued and unpaid interest to the redemption date. We also may, at any time on or after January 1, 2027, redeem the applicable series of the New Notes, in whole or in part, at a redemption price equal to 100% of the principal amount of the New Notes to be redeemed, plus accrued and unpaid interest on the New Notes redeemed to the redemption date. See “Description of Senior Notes—Optional Redemption.” |

| Change of Control |

Upon the occurrence of a Change of Control, we must commence, within 30 days, and subsequently consummate an offer to purchase all notes then outstanding at a purchase price in cash equal to 101% of their aggregate principal amount, plus accrued and unpaid interest on the notes repurchased to the date of repurchase. After the Project Completion Date, a Change of Control shall not be deemed to have occurred if we receive rating reaffirmations from two rating agencies (or one rating agency, if only one rating agency currently rates either series of the New Notes) reaffirming the then-current rating of a series of New Notes as of the date of such change of control. We may not be able to repurchase notes upon a Change of Control in certain circumstances. See “Risk Factors—Risks Relating the Exchange Offer and the Notes—We may not be able to repurchase notes upon a Change of Control or upon the exercise of the holders’ options to require repurchase of notes if certain prepayment triggering events occur, and the occurrence of certain of these events and our repurchase of notes as a result thereof could result in an event of default under the indenture or other agreements governing our indebtedness.” |

17

Table of Contents

| Additional Offers to Purchase |

If we sell assets under certain circumstances and do not use the proceeds for certain specified purposes, if we receive insurance proceeds following a Catastrophic Casualty Event and do not use the proceeds for certain specified purposes, if we receive Performance Liquidated Damages payments under certain circumstances and do not use the proceeds for certain specified purposes, if we fail to maintain our Qualifying LNG SPAs in accordance with the terms of the indenture, or if certain of our Required Export Authorizations are Impaired, we must offer to repurchase the New Notes and may be required to make a repayment of other Senior Debt in amounts specified in the indenture and in our agreements related to our other Senior Debt. In each case, under the indenture, the purchase price of the New Notes will be equal to 100% of the principal amount of the New Notes repurchased, plus accrued and unpaid interest on the New Notes to, but excluding, the applicable repurchase date. See “Description of Senior Notes—Repurchase at the Option of Noteholders—Asset Sales,” “—Events of Loss,” “—Performance Liquidated Damages,” and “—LNG SPA Mandatory Offer.” We may not be able to repurchase the New Notes upon an Asset Sale, Event of Loss, receipt of Performance Liquidated Damages or an Indenture LNG SPA Prepayment Event in certain circumstances. See “Risk Factors—Risks Relating to the Exchange Offer and the New Notes— We may not be able to repurchase notes upon a Change of Control or upon the exercise of the holders’ options to require repurchase of notes if certain prepayment triggering events occur, and the occurrence of certain of these events and our repurchase of notes as a result thereof could result in an event of default under the indenture or other agreements governing our indebtedness.” |

| Collateral |

The New Notes will be secured by a first priority security interest in substantially all of our and the Guarantors’ assets. The Collateral securing the New Notes includes: |

| • | substantially all of our assets and the assets of our existing and any future Guarantors (including real and personal property whether owned or leased on the closing date of this exchange offer or thereafter acquired); |

| • | a pledge by Holdco of all ownership interests in CCH; |

| • | all contracts, agreements and documents, including the Material Project Agreements, hedging arrangements and insurance policies, and all of our rights thereunder; |

| • | cash flow and other revenues; and |

18

Table of Contents

| • | all other real and personal property which is subject, from time to time, to the Security Interests or liens granted by the Security Documents. |

| Pre-Completion Account Flows |

Disbursements of Loans will be deposited into a Loan Facility Disbursement Account subject to certain rules described in our common security and account agreement. See “Description of Security Documents—Common Security and Account Agreement— Pre-Completion Cash Flows.” |

| Disbursements of Senior Debt in connection with an issuance of Senior Notes under any Indenture will be made into a Senior Note Disbursement Account(s), subject to the same rules applicable to disbursements of Loans into the Loan Facility Disbursement Accounts, as described above. See “Description of Security Documents—Common Security and Account Agreement— Pre-Completion Cash Flows.” |

| Prior to the Project Completion Date, the Construction Account will be funded with any funds withdrawn and transferred from the Equity Proceeds Account and proceeds from our Senior Debt, and may from time to time be funded with any Business Interruption Insurance Proceeds and Delay Liquidated Damages payments received by us. Amounts in the Construction Account will be used to pay Project Costs in accordance with the construction budget and schedule and any Operation and Maintenance Expenses. |

| Prior to the Project Completion Date, any revenues will be deposited into the Equity Proceeds Account and may be transferred to the Construction Account. |

| Prior to the Project Completion Date, we must fund the Operating Account from the Construction Account, and must use the Operating Account to pay Operation and Maintenance Expenses that are due in a manner consistent with our obligations under our Common Terms Agreement and our Finance Documents, then in effect. |

| Post-Completion Account Flows |

After the completion of Train One and Train Two, revenues received by us will be applied in the following manner: |

| • | first, to fund the Operating Account with amounts sufficient to cover Operation and Maintenance Expenses then due and unpaid, and expected to become due and payable within the next 60 days; |

| • | second, to pay all fees, costs, charges and other amounts then due and owing to the Secured Parties, pursuant to our Common Security and Account Agreement and other Finance Documents; |

19

Table of Contents

| • | third, on each March 31, June 30, September 30, December 31, and other payment dates, initially, for payments of interest on Senior Debt and scheduled payments pursuant to Permitted Hedging Instruments secured on a pari passu basis with our Senior Debt, then to scheduled payments of principal on Senior Debt and scheduled payments of hedge termination value and gas hedge termination value to be paid by us pursuant to Permitted Hedging Instruments secured on a pari passu basis with our Senior Debt, and then for other payments pursuant to our Senior Debt Obligations, with such payments to be made from the Revenue Account, or from the Senior Debt Service Reserve Account in the case of a deficiency in funds available from the Revenue Account; |

| • | fourth, from time to time, for payments of all amounts of principal, interest, fees and other amounts due and payable on our indebtedness, other than Senior Debt and debt constituting Operation and Maintenance Expenses and pursuant to unsecured Permitted Hedging Instruments; |

| • | fifth, on each March 31, June 30, September 30, December 31, and other payment dates that occur six months after the project completion date and on any date on which we make a Restricted Payment, the amount necessary to satisfy any Senior Debt Reserve Shortfall; |

| • | sixth, on specified payment dates, the amount necessary to make any mandatory prepayments then due and payable pursuant to our Senior Debt Instruments (other than mandatory prepayments in respect of our failure to meet the conditions to restricted payments under our Common Terms Agreement for four consecutive quarters); |

| • | seventh, from time to time for certain payments permitted in an Indenture pursuant to which any Senior Notes are issued and certain payments to our affiliates to enable them to pay income tax liability with respect to income generated by us; |

| • | eighth, from time to time to make any voluntary prepayments of loans or any Senior Notes in accordance with the Senior Debt Instruments then in effect; and |

| • | ninth, to make other payments as and when permitted by our Finance Documents if the conditions for Restricted Payments under each Senior Debt Instrument are satisfied and to make certain mandatory prepayments in respect of our failure to meet the conditions to restricted payments under our Common Terms Agreement for four consecutive quarters. |

20

Table of Contents

| Covenants |

The indenture governing the New Notes will contain covenants that, among other things and subject to certain exceptions and/or conditions, limit our ability and the ability of our Restricted Subsidiaries to: |

| • | make Restricted Payments; |

| • | incur additional Indebtedness or issue preferred stock; |

| • | guarantee the obligations of others; |

| • | assume, incur, permit or suffer to exist any Lien on any asset of CCH or any Restricted Subsidiary; |

| • | create or permit to exist or become effective any consensual encumbrance or restriction on the ability of any Restricted Subsidiary to pay dividends, pay indebtedness owed to CCH or any of its Restricted Subsidiaries, make loans or advances to CCH or any of its Restricted Subsidiaries, or sell, lease or transfer any properties or assets to CCH or any of its Restricted Subsidiaries; |

| • | dissolve, liquidate, consolidate, merge, sell or lease all or substantially all of the assets or properties of CCH and its Restricted Subsidiaries taken as a whole or permit any Guarantor to dissolve, liquidate, consolidate, merge, sell or lease all or substantially all of its assets and properties; |

| • | enter into certain transactions or agreements with or for the benefit of any Affiliate of CCH or any of its Restricted Subsidiaries; |

| • | amend or modify Material Project Agreements; |

| • | enter into any lifting and balancing arrangement or Sharing Arrangement with an External Train Entity; and |

| • | amend or modify any Qualifying LNG SPA. |

| These covenants are subject to a number of important limitations and exceptions that are described in this prospectus under the caption “Description of Senior Notes—Covenants Applicable to the Notes.” |

| If the New Notes receive an investment grade rating and no Unmatured Indenture Event of Default or Indenture Event of Default shall have occurred and be Continuing, certain covenants specifically listed in this prospectus under the caption “Description of Senior Notes—Covenants Applicable to the Notes—Changes in Covenants When Notes Rated Investment Grade” will no longer be applicable to the New Notes. |

21

Table of Contents

| No Exchange Listing |

We do not intend to list the New Notes on any national securities exchange or to arrange for quotation on any automated dealer quotation systems. There can be no assurance that an active trading market will develop for the New Notes. If an active trading market does not develop, the market price and liquidity of the New Notes may be adversely affected. |

| Risk Factors |

You should refer to the section entitled “Risk Factors” beginning on page 24 of this prospectus for a discussion of factors you should carefully consider before deciding to participate in the exchange offer. |

22

Table of Contents

SUMMARY HISTORICAL FINANCIAL DATA