Table of Contents

As filed with the Securities and Exchange Commission on August 6, 2019

Registration No. 333-215272

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 3 TO

FORM S-11

REGISTRATION STATEMENT

Under

THE SECURITIES ACT OF 1933

Cottonwood Communities, Inc.

(Exact name of Registrant as specified in its charter)

6340 South 3000 East, Suite 500

Salt Lake City, Utah 84121

(801) 278-0700

(Address, including zip code, and telephone number, including area code, of the registrant’s principal executive offices)

Enzio Cassinis

Chief Executive Officer

Cottonwood Communities, Inc.

6340 South 3000 East, Suite 500

Salt Lake City, Utah 84121

(801) 278-0700

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Darryl Steinhause, Esq. DLA Piper LLP (US) 4365 Executive Drive, Suite 1100 San Diego, California 92121 (858) 677-1400 |

Robert H. Bergdolt, Esq. Laura K. Sirianni, Esq. DLA Piper LLP (US) 4141 Parklake Avenue, Suite 300 Raleigh, North Carolina 27612-2350 (919) 786-2000 |

Approximate date of commencement of proposed sale to public: As soon as practicable after the effectiveness of the registration statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. ☒

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ☐

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. ☐

| Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act (Check One): | ||||||

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |||

| Emerging growth company | ☒ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

This Post-Effective Amendment No. 3 consists of the following:

| 1. | The Registrant’s prospectus dated August , 2019. |

| 2. | Supplement No. 1 dated August , 2019 to the Registrant’s prospectus dated August , 2019. |

| 3. | Part II, included herewith. |

| 4. | Signature, included herewith. |

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the SEC and various states is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION

PRELIMINARY PROSPECTUS DATED AUGUST 6, 2019

Cottonwood Communities, Inc.

Maximum Offering of $750,000,000 of Shares of Common Stock

Cottonwood Communities, Inc. is a recently organized Maryland corporation that intends to qualify as a real estate investment trust beginning with the taxable year ending December 31, 2019. We operate under the direction of our board of directors. Our board of directors has retained CC Advisors III, LLC to conduct our operations and manage our portfolio of real estate investments, subject to the supervision of the board of directors. Our advisor is an affiliate of our sponsor, Cottonwood Residential II, Inc. We expect to use substantially all of the proceeds from this offering to invest primarily in existing multifamily apartment communities located throughout the United States and multifamily real estate-related assets. As of the date of this prospectus we own one multifamily community and a B note secured by a mortgage on a multifamily development project.

We are offering up to $675,000,000 of shares of our Class A and Class T common stock in our primary offering for $10.00 per share without any upfront costs or expenses charged to the investor and an aggregate of $75,000,000 of shares of our Class A and Class T common stock pursuant to our distribution reinvestment plan at a purchase price initially equal to the purchase price of the shares in the primary offering or $10.00 per share. We are offering to sell any combination of our Class A and Class T common stock, with a dollar value up to the maximum offering amount. The share classes have different selling commission structures. Any offering-related expenses are paid by our advisor without reimbursement by us.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 20 to read about risks you should consider before buying shares of our common stock. These risks include the following:

| • | No public market exists for our shares and our board of directors is not required to provide our shareholders with a liquidity event by a specified date or at all. |

| • | We set the offering price of our shares arbitrarily. This price is unrelated to the book or net value of our assets or to our expected operating income. |

| • | We have little to no operating history and except as described in a supplement to this prospectus you will not have the opportunity to evaluate our investments before we make them, as we have not identified additional investments to acquire with the proceeds of this offering and are considered to be a “blind pool.” . |

| • | We depend on our advisor and its affiliates to select investments and to conduct our operations. |

| • | We pay substantial fees to our advisor and its affiliates. These fees increase the risk that you will not earn a profit on your investment. |

| • | Our officers and certain of our directors are also officers and directors of our sponsor, advisor and their affiliates. As a result, our officers and affiliated directors are subject to conflicts of interest. |

| • | We have used and will continue to use leverage to acquire multifamily apartment communities, which increases your investment risk. |

| • | There are restrictions on the ownership and transferability of our shares of common stock. See “Description of Shares – Restriction on Ownership of Shares.” |

| • | Our charter permits us to pay distributions from any source, including offering proceeds or borrowings (which may constitute a return of capital), and our charter does not limit the amount of funds we may use from any source to pay such distributions. If we pay distributions from sources other than our cash flow from operations, we will have less funds available for investment. During the early stages of our operations, it is likely that we will use sources of funds which may constitute a return of capital to fund distributions. As of March 31, 2019, we have funded our distributions with offering proceeds. |

| • | If we raise substantially less than the maximum offering amount, we may not be able to invest in a diverse portfolio of multifamily apartment communities and multifamily real estate-related assets and the value of your investment may vary more widely with the performance of certain assets. |

Neither the Securities and Exchange Commission, the Attorney General of the State of New York nor any other state securities regulator has approved or disapproved our common stock, determined if this prospectus is truthful or complete or passed on or endorsed the merits of this offering. Any representation to the contrary is a criminal offense.

This investment involves a high degree of risk. You should purchase these securities only if you can afford a complete loss of your investment. The use of projections or forecasts in this offering is prohibited. Any representation to the contrary and any predictions, written or oral, as to the amount or certainty of any present or future cash benefit or tax consequences which may flow from an investment in this offering is not permitted.

| Price to Public(1) |

Selling Commissions(2) |

Dealer Manager Fee(2) |

Selling Commissions and Dealer Manager Fee Paid by our Advisor(2) |

Net Proceeds(2) | ||||||||||||||||

| Primary Offering(3) |

||||||||||||||||||||

| Class A Share, per share |

$ | 10.00 | $ | 0.60 | $ | 0.30 | ($ | 0.90 | ) | $ | 10.00 | |||||||||

| Class T Share, per share |

$ | 10.00 | $ | 0.60 | $ | 0.30 | ($ | 0.90 | ) | $ | 10.00 | |||||||||

| Total Maximum |

$ | 675,000,000.00 | $ |

40,500,000.00 |

|

$ | 20,250,000 | ($ | 60,750,000 | ) | $ | 675,000,000.00 | ||||||||

| Distribution Reinvestment Plan(3) |

||||||||||||||||||||

| Class A Share and Class T Share, per share |

$ | 10.00 | $ | 0.00 | $ | 0.00 | $ | 0.00 | $ | 10.00 | ||||||||||

| Total Maximum |

$ | 75,000,000.00 | $ | 0.00 | $ | 0.00 | $ | 0.00 | $ | 75,000,000.00 | ||||||||||

| (1) | Discounts are available for some categories of investors. |

| (2) | The maximum selling commissions includes the deferred selling commission paid on the shares of Class T common stock sold in the primary offering. This deferred selling commission is subject to certain limits and conditions as described in the “Plan of Distribution” and will generally be paid in an annual amount equal to 1.0% of the purchase price per Class T share sold in the primary offering for up to three years. We estimate that 85% and 15% of the gross proceeds raised in the primary offering is from the sale of Class A and Class T shares of common stock, respectively. As we are registering any combination of the two classes, this allocation is management’s best estimate based on the recommendation of our dealer manager and its perceived demand in the market for each respective class of shares. |

Our advisor is responsible for paying the upfront and deferred selling commissions, dealer manager fee, and organizational and offering expenses without reimbursement by us. We do not use any of our offering proceeds to pay such expenses. The dealer manager fee includes compensation for acting as the dealer manager and for expenses incurred in connection with marketing our shares and for wholesaler compensation. The dealer manager may re-allow some or all of the dealer manager fees to the soliciting dealers. See “Plan of Distribution.”

| (3) | We reserve the right to reallocate shares of common stock between our distribution reinvestment plan and our primary offering. |

The dealer manager, Orchard Securities, LLC, is not required to sell any specific number or dollar amount of shares. The shares are offered by our dealer manager on a “best efforts” basis. The minimum permitted purchase is $5,000.

This offering will terminate on or before August 13, 2020 (unless extended by our board of directors for an additional year or as otherwise permitted by applicable securities laws). If we decide to continue our offering beyond August 13, 2020, we will provide that information in a prospectus supplement. We may continue to offer shares under our distribution reinvestment plan after the primary offering terminates until we have sold $75,000,000 in shares through the reinvestment of distributions. In some states, we will need to renew the registration statement or file a new registration statement to continue this primary offering beyond the one-year registration period allowed in some states. We may terminate this offering at any time, and we will provide that information in a prospectus supplement.

The date of this prospectus is August , 2019.

Table of Contents

| 1 | ||||

| 3 | ||||

| 20 | ||||

| 20 | ||||

| 24 | ||||

| 26 | ||||

| 32 | ||||

| 36 | ||||

| 38 | ||||

| 41 | ||||

| 44 | ||||

| 46 | ||||

| 47 | ||||

| 47 | ||||

| 47 | ||||

| 50 | ||||

| 50 | ||||

| 51 | ||||

| 51 | ||||

| 52 | ||||

| 54 | ||||

| 54 | ||||

| 55 | ||||

| 58 | ||||

| 59 | ||||

| Limited Liability and Indemnification of Directors, Officers, Employees and Other Agents |

59 | |||

| 60 | ||||

| 60 | ||||

| 61 | ||||

| 62 | ||||

| 63 | ||||

| 67 | ||||

| 68 | ||||

| Our Affiliates’ Interests in Other Cottonwood Real Estate Programs |

68 | |||

| 70 | ||||

| Fiduciary Duties Owed by Some of Our Affiliates to Our Advisor and Our Advisor’s Affiliates |

70 | |||

| 70 | ||||

| 71 | ||||

| 75 | ||||

| 75 | ||||

| 87 | ||||

| Investment Limitations under the Investment Company Act of 1940 |

88 | |||

| 90 | ||||

| Experience and Background of Cottonwood Residential O.P., LP |

90 | |||

| 90 | ||||

| 92 | ||||

| 94 | ||||

| 94 | ||||

| 104 | ||||

| 111 | ||||

| 112 | ||||

| 113 | ||||

| 113 | ||||

| 114 | ||||

| 116 | ||||

| 116 | ||||

| 118 |

i

Table of Contents

| 118 | ||||

| 118 | ||||

| 120 | ||||

| 120 | ||||

| Advance Notice for Shareholder Nominations for Directors and Proposals of New Business |

121 | |||

| 121 | ||||

| 121 | ||||

| 123 | ||||

| 124 | ||||

| 124 | ||||

| 125 | ||||

| 126 | ||||

| 126 | ||||

| 128 | ||||

| 131 | ||||

| 132 | ||||

| 133 | ||||

| 133 | ||||

| 133 | ||||

| 133 | ||||

| 133 | ||||

| 134 | ||||

| 134 | ||||

| 134 | ||||

| 135 | ||||

| 135 | ||||

| 135 |

| APPENDICES |

||||||

| APPENDIX A |

FORM OF SUBSCRIPTION AGREEMENT | A-1 | ||||

| APPENDIX B |

AMENDED AND RESTATED DISTRIBUTION REINVESTMENT PLAN | B-1 | ||||

| APPENDIX C |

PRIOR PERFORMANCE TABLES | C-1 | ||||

ii

Table of Contents

The shares we are offering through this prospectus are suitable only as a long-term investment for persons of adequate financial means and who have no need for liquidity in this investment. Because there is no public market for our shares, you will have difficulty selling your shares.

In consideration of these factors, we have established suitability standards for investors in this offering. These suitability standards require that a purchaser of shares have either:

| • | a net worth of at least $250,000; or |

| • | gross annual income of at least $70,000 and a net worth of at least $70,000. |

In addition, the states listed below have established suitability requirements that are more stringent than ours and investors in these states are directed to the following special suitability standards:

| • | Alabama—Investors residing in Alabama may not invest more than 10% of their liquid net worth in us and our affiliates. |

| • | California and Tennessee—Investors residing in California and Tennessee may not invest more than 10% of their net worth in us. |

| • | Idaho—Investors residing in Idaho must have either (a) a liquid net worth of $85,000 and annual gross income of $85,000 or (b) a liquid net worth of $300,000. Additionally, the total investment in us shall not exceed 10% of an investor’s liquid net worth. |

| • | Iowa—Investors residing in Iowa must have either (a) an annual gross income of at least $100,000 and a net worth of at least $100,000, or (b) a net worth of at least $350,000. In addition, the aggregate investment in this offering and in the securities of other non-publicly traded real estate investment trusts (REITs) may not exceed 10% of their net worth. Purchasers who are accredited investors as defined in Regulation D under the Securities Act of 1933, as amended (the “Securities Act”), are not subject to the foregoing concentration limit. |

| • | Kansas—It is recommended by the Office of the Kansas Securities Commissioner that Kansas investors limit their aggregate investment in us and other non-traded real estate investment trusts to not more than 10% of their liquid net worth. |

| • | Kentucky—Investors residing in Kentucky may not invest more than 10% of their liquid net worth in us or our affiliates. |

| • | Maine—The Maine Office of Securities recommends that an investor’s aggregate investment in this offering and other similar direct participation investments not exceed 10% of the investor’s liquid net worth. |

| • | Massachusetts—Investors residing in Massachusetts must limit their aggregate investment in us and other illiquid direct participation programs to not more than 10% of their liquid net worth. |

| • | Missouri—No more than ten percent (10%) of any one (1) Missouri investor’s liquid net worth shall be invested in the securities being registered with the Securities Division pursuant to our registration statement. |

| • | Nebraska—Investors residing in Nebraska who do not meet the definition of “accredited investor” as defined in Regulation D under the Securities Act must limit their aggregate investment in this offering and in the securities of other non-publicly traded REITs to 10% of such investor’s net worth. |

1

Table of Contents

| • | New Jersey—Investors residing in New Jersey are required to have (a) a minimum liquid net worth of at least $100,000 and a minimum annual gross income of not less than $85,000; or (b) a minimum liquid net worth of $350,000. In addition, the total investment in us, our affiliates and other non-publicly traded direct investment programs (including REITs, business development companies, oil and gas programs, equipment leasing programs and commodity pools, but excluding unregistered, federally and state exempt private offerings) may not exceed 10% of their liquid net worth. |

| • | New Mexico—Investors residing in New Mexico may not invest more than 10% of their liquid net worth in our shares, shares of our affiliates and other non-traded real estate investment trusts. |

| • | North Dakota—Investors residing in North Dakota must have a net worth of at least ten times their investment in us. |

| • | Ohio—Investors residing in Ohio may not invest more than 10% of their liquid net worth in us, our affiliates and other non-traded real estate investment programs. For these purposes, “liquid net worth” is defined as that portion of net worth (total assets exclusive of home, home furnishings, and automobiles minus total liabilities) that is comprised of cash, cash equivalents, and readily marketable securities. |

| • | Oregon—Investors residing in Oregon may not invest more than 10% of their liquid net worth in us or our affiliates. |

| • | Pennsylvania—Investors residing in Pennsylvania may not invest more than 10% of their net worth in us. |

| • | Puerto Rico—Investors residing in Puerto Rico may not invest more than 10% of their liquid net worth in us, our affiliates, and in other non-traded REITs. For purposes of Puerto Rico’s suitability standard, “liquid net worth” is defined as that portion of net worth (total assets exclusive of primary residence, home furnishings, and automobiles minus total liabilities) consisting of cash, cash equivalents, and readily marketable securities. |

| • | Vermont—Accredited investors in Vermont, as defined in 17 C.F.R. § 230.501, may invest freely in this offering. In addition to the suitability standards described above, non-accredited Vermont investors may not purchase an amount in this offering that exceeds 10% of the investor’s liquid net worth. For these purposes, “liquid net worth” is defined as an investor’s total assets (not including home, home furnishings, or automobiles) minus total liabilities. |

In addition, because the minimum offering amount was less than $67,500,000, Pennsylvania investors are cautioned to carefully evaluate our ability to fully accomplish our stated objectives and to inquire as to the current dollar volume of subscriptions. Please refer to “Plan of Distribution—Special Notice to Pennsylvania Investors.”

For purposes of determining the suitability of an investor, “net worth” in all cases should be calculated excluding the value of an investor’s home, home furnishings and automobiles. Except as otherwise stated above, “liquid net worth” is defined as that portion of net worth that consists of cash, cash equivalents and readily marketable securities. In the case of sales to fiduciary accounts, these suitability standards must be met by the fiduciary account, by the person who directly or indirectly supplied the funds for the purchase of the shares if such person is the fiduciary or by the beneficiary of the account.

Our sponsor, those selling shares on our behalf and soliciting dealers and registered investment advisors recommending the purchase of shares in this offering must make every reasonable effort to determine that the purchase of shares in this offering is a suitable and appropriate investment for each shareholder based on information provided by the shareholder regarding the shareholder’s financial situation and investment objectives. See “Plan of Distribution—Suitability Standards” for a detailed discussion of the determinations regarding suitability that we require.

2

Table of Contents

This summary highlights information contained elsewhere in this prospectus. You should read the entire prospectus, including the information set forth in “Risk Factors,” for a more complete understanding of this offering. Except where the context suggests otherwise, the terms “we,” us” and “our” refer to Cottonwood Communities, Inc. and our subsidiaries; “Operating Partnership” refers to our operating partnership, Cottonwood Communities O.P., LP; “advisor” refers to CC Advisors III, LLC, “sponsor” refers to Cottonwood Residential II, Inc.

What is Cottonwood Communities, Inc.?

Cottonwood Communities, Inc. is a recently formed Maryland corporation that intends to invest primarily in existing multifamily apartment communities located throughout the United States and multifamily real estate-related assets. As of the date of this prospectus we own one multifamily community and a B note secured by a mortgage on a multifamily development project. Because we have a limited portfolio of investments and, except as described in a supplement to this prospectus, we have not identified any additional assets to acquire with the proceeds from this offering, we are considered to be a “blind pool.” We are an “emerging growth company” under federal securities laws.

We intend to elect to be taxed as a real estate investment trust, or REIT, under the Internal Revenue Code of 1986, as amended, beginning with the taxable year ending December 31, 2019.

We plan to own substantially all of our assets and conduct our operations through Cottonwood Communities O.P., L.P., which we refer to as our Operating Partnership in this prospectus. We are the sole general partner of the Operating Partnership and, as of the date of this prospectus, Cottonwood Communities Investor, LLC, a wholly owned subsidiary of Cottonwood Residential O.P., LP, the operating partnership of our sponsor, is the sole limited partner of the Operating Partnership. Except where the context suggests otherwise, the terms “we,” “us,” “our” and “our company” refer to Cottonwood Communities, Inc., together with its subsidiaries, including the Operating Partnership and its subsidiaries, and all assets held through such subsidiaries.

Our external advisor, CC Advisors III, LLC, conducts our operations and manages our portfolio of investments. We have no paid employees.

Our office is located at 6340 South 3000 East, Suite 500, Salt Lake City, Utah 84121, and our main telephone number is (801) 278-0700.

What are our investment objectives?

Our investment objectives are to:

| • | preserve, protect and return invested capital; |

| • | pay stable cash distributions to shareholders; |

| • | realize capital appreciation in the value of our investments over the long term; and |

| • | provide a real estate investment alternative with lower expected volatility relative to public real estate companies whose securities trade daily on a stock exchange. |

In general, our board of directors may revise our investment policies without the approval of our shareholders. However, we may not amend our charter, including any investment policies that are provided in our charter and described under “Investment Objectives and Criteria—Charter-Imposed Investment Limitations” without the concurrence of holders of a majority of the outstanding shares entitled to vote.

3

Table of Contents

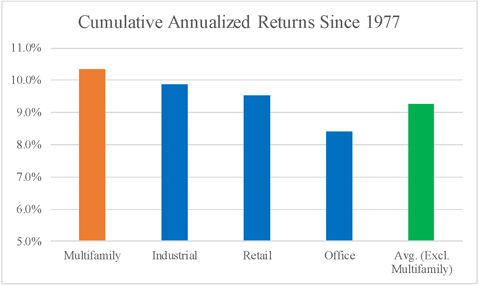

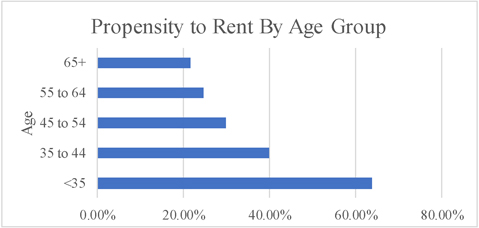

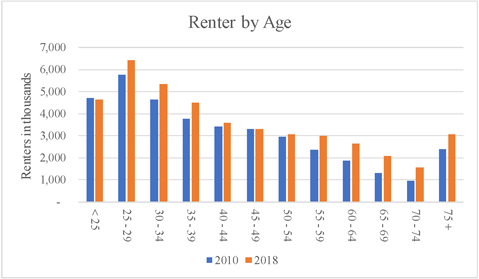

What is our investment strategy?

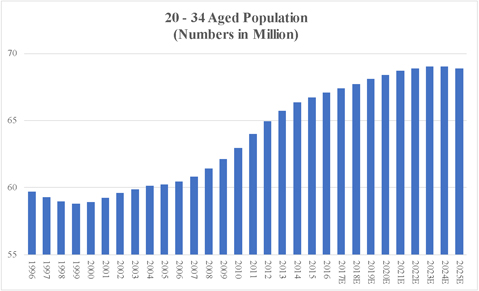

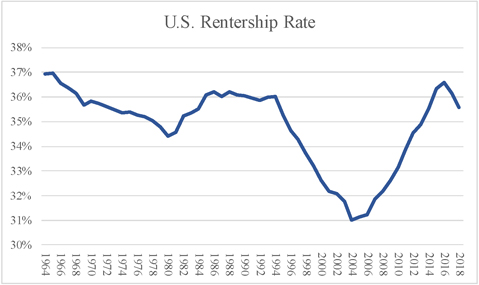

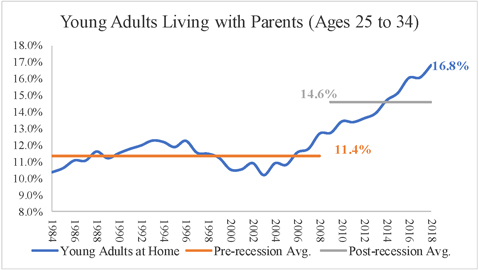

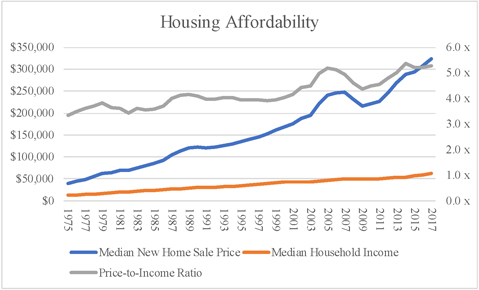

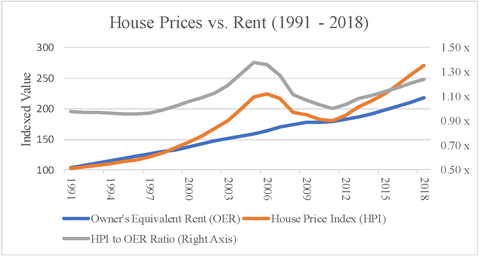

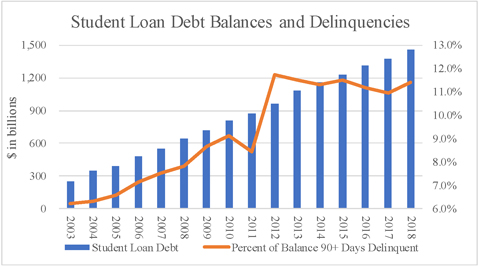

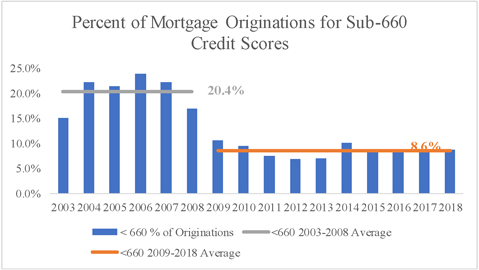

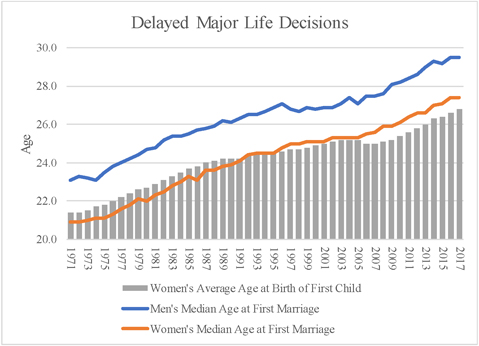

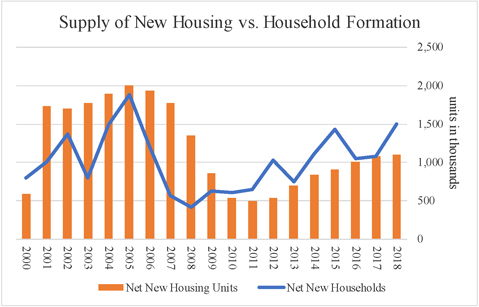

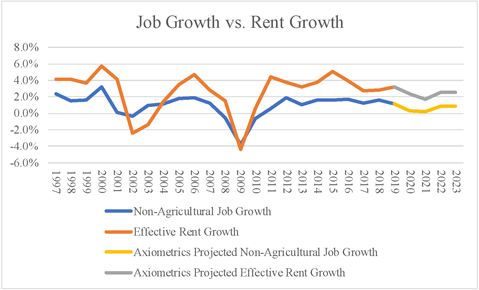

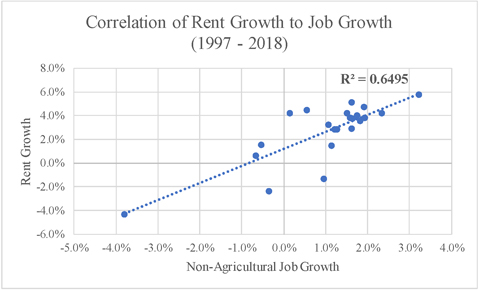

We will use the proceeds of this offering to invest directly or indirectly in multifamily apartment communities and multifamily real estate-related assets located throughout the United States. We believe that current market dynamics and underlying fundamentals suggest the positive trends in United States multifamily housing will continue. See “Investment Objectives—Multifamily Focus” for a discussion of these trends. As of the date of this prospectus we own one multifamily community and a B note secured by a mortgage on a multifamily development project. Additional information about our portfolio is available in a supplement to this prospectus.

Our primary investment vehicle is our operating partnership. In certain circumstances, we may acquire assets through joint ventures, mergers or other types of business combinations. The investments will be comprised primarily of stabilized multifamily apartment communities and land which will be developed into multifamily apartment communities. The strategy may also include mortgage or mezzanine loans to, or preferred equity investments in, entities that have been formed for the purpose of acquiring or developing multifamily apartment communities. We will seek to acquire, develop and actively manage these investments, with the objective of providing a stable source of income for our shareholders and maximizing potential returns upon disposition of the assets through capital appreciation. Generally, proceeds from the sale, financing or disposition of investments will be reinvested in a manner consistent with our investment strategy, although such proceeds may be distributed to the shareholders in order to comply with REIT requirements.

We will seek to invest at least 65% of our assets in stabilized multifamily apartment communities and up to 35% in mortgage loans, preferred equity investments, mezzanine loans or equity investments in a property or land which will be developed into a multifamily apartment community (including, by way of example, an existing multifamily apartment community that may require redevelopment capital for strategic repositioning within its market). We do not expect to be able to achieve the balance of these allocations until we have raised substantial proceeds in this offering. Prior to that time, we will balance the goal of achieving our portfolio allocation targets with the goal of carefully evaluating and selecting investment opportunities to maximize risk-adjusted returns. Notwithstanding the foregoing, the actual portfolio allocation may from time to time be outside the target levels provided above due to factors such as a large inflow of capital over a short period of time, the advisor’s or board of directors’ assessment of the relative attractiveness of opportunities, an increase or decrease in the relative value of an investment or limitations or requirements relating to our intention to be treated as a REIT for U.S. federal income tax purposes. Furthermore, our board of directors may revise the targeted portfolio allocation from time to time, if it determines that a different portfolio composition is in our shareholders’ best interests.

We will target properties located in major metropolitan areas in the United States that have, in the opinion of the advisor and our board of directors, attractive investment dynamics for multifamily apartment owners. We do not intend to designate specific geographic allocations for the portfolio. Our advisor intends to target regions where it sees the best opportunities that support our investment objectives and will attempt to acquire multifamily apartment communities in diverse locations so that we are not overly concentrated in a single area (though we are not precluded from owning multiple properties in a particular area).

What policies will you follow in implementing your investment strategy?

Our advisor operates pursuant to a philosophy that location, investment time horizon, asset-specific attributes and appropriate leverage are fundamental drivers of long-term value creation in real estate. These principles drive the material aspects of our advisor’s investment decision-making process. See “Investment Objectives—Investment Philosophy and Life Cycle” for a discussion of these principles.

Once a potential investment has been identified, our advisor will engage in a rigorous due diligence process. Although due diligence procedures are customized for specific elements of each deal, our advisor will follow traditional due diligence processes (physical, market, financial, environmental, zoning, insurance, tax, legal, etc.) in considering investments for us. Our advisor may outsource certain due diligence items to specialized consultants or third-party service providers, as needed, to support the diligence effort. Our advisor’s diligence focuses on three customary areas: financial, physical, and legal and tax. Additional information about these focuses is available at “Investment Objectives—Investment Philosophy and Life Cycle.”

4

Table of Contents

We intend to finance the purchase of multifamily apartment communities with proceeds of this offering and loans obtained from third-party lenders. We anticipate the use of moderate leverage to enhance total cash flow to our shareholders. We will target an aggregate loan-to-cost or loan-to-value ratio of 45% to 65% at the REIT level; provided, however, that we may obtain financing that is less than or exceeds such ratio in the discretion of our board of directors if the board of directors deems it to be in our best interest to obtain such financing. Although there is no limit on the amount we can borrow to acquire a single real estate investment, we may not leverage our assets with debt financing such that our borrowings are in excess of 300% of our net assets, unless a majority of our conflicts committee finds substantial justification for borrowing a greater amount and such excess borrowings are disclosed in our next quarterly report, along with the conflicts committee’s justification for such excess. Examples of such a substantial justification include obtaining funds for the following: (i) to repay existing obligations, (ii) to pay sufficient distributions to maintain REIT status, or (iii) to buy an asset where an exceptional acquisition opportunity presents itself and the terms of the debt agreement and the nature of the asset are such that the debt does not increase the risk that we would become unable to meet our financial obligations as they became due. We anticipate that all financing obtained to acquire stabilized multifamily apartment communities will be non-recourse to our operating partnership and us (however, it is possible that some of these loans will require us to enter into guaranties with respect to certain non-recourse carve-outs). We may obtain recourse debt in connection with certain development transactions.

We may obtain a line of credit or other financing that will be secured by one or more of our assets. We may use the proceeds from any line of credit or financing to bridge the acquisition of, or acquire, multifamily apartment communities and multifamily real estate-related assets if our board of directors determines that we require such funds to acquire the multifamily apartment communities or real estate-related assets. As of the date of this prospectus we are party to a credit facility in the amount of up to $36 million. Additional information regarding our current outstanding debt obligations is included in a supplement to this prospectus.

Our advisor will underwrite long-term hold periods for our investments (generally, five to ten years for stabilized operating communities and equity investments in developments, and three to four years for preferred equity or mezzanine debt investments). Our advisor will seek to avoid investment return profiles for stabilized multifamily apartment communities that depend primarily on significant appreciation, and will evaluate development opportunities that align with the overall strategic objectives of our business. We believe that holding our target assets for a long period of time will enable us to execute our business plan, generate stable cash-on-cash returns and drive long-term cash flow and net asset value growth. From time to time, at the discretion of our board of directors and advisor, we may elect to sell an investment before the end of its underwritten hold period if our advisor believes that will maximize value for us.

For more details regarding our liquidity strategy see “What is our Liquidity Strategy” below.

Do we have an allocation policy?

We rely on our advisor to identify suitable investments. Many investment opportunities that are suitable for us may also be suitable for Cottonwood Residential O.P., LP and Cottonwood Residential II, Inc. or other programs sponsored by such persons and affiliates of such persons. Our sponsor recently sponsored a $50,000,000 offering that qualified as a “Tier 2” offering pursuant to Regulation A promulgated under the Securities Act: Cottonwood Multifamily Opportunity Fund, Inc. (launched November 2017). As of the date of this prospectus this offering was fully subscribed and Cottonwood Multifamily Opportunity Fund, Inc. was investing the proceeds from its offering. It has investment objectives that overlap with ours. As of the date of this prospectus Cottonwood Multifamily Opportunity Fund, Inc. had made an initial investment in a development project for a multifamily apartment community. Our advisor and its affiliates will allocate potential investments between us and other entities that are sponsored by our advisor and its affiliates in a manner designed to meet each entity’s investment objectives by considering the investment portfolios of each entity, the cash available for investment by each entity and diversification objectives.

5

Table of Contents

Who is our advisor and property manager? What is the experience of our sponsor?

Through February 28, 2019, Cottonwood Communities Management, LLC, a limited liability company organized in the state of Delaware on February 8, 2018, acted as both our advisor and property manager. Effective March 1, 2019, as a result of the determination by Cottonwood Residential O.P., LP, to restructure the ownership of the entity that provides our advisory services, the advisory agreement was amended to remove references to property management services and assigned to a newly formed affiliate of Cottonwood Residential O.P., LP, CC Advisors III, LLC, such that our advisory services are currently provided by CC Advisors III, LLC. CC Advisors III, LLC is a recently organized limited liability company formed in the state of Delaware on January 30, 2019 and is a wholly owned subsidiary of Cottonwood Communities Advisors, LLC, a Delaware limited liability company organized on December 19, 2018. Through two different subsidiary entities Cottonwood Communities Advisors, LLC acts as the advisor to Cottonwood Multifamily REIT I and Cottonwood Multifamily REIT II, Inc., both programs that completed offerings qualified as a “Tier 2” offering pursuant to Regulation A promulgated under the Securities Act. Property management services will continue to be provided by Cottonwood Communities Management, LLC under separate property management agreements to be entered at the time we acquire a property.

CC Advisors III, LLC and Cottonwood Communities Management, LLC have little to no operating history and experience managing a public company or providing property management services, respectively. Both will rely on the expertise and experience of their affiliates to conduct our operations and manage our portfolio of multifamily apartment communities and multifamily real estate-related assets, all subject to the supervision of our board of directors. We have no paid employees. Our advisor, and the team of real estate professionals employed by our advisor and its affiliates, will make most of the decisions regarding the selection, financing and disposition of our assets.

CC Advisors III, LLC is a wholly owned subsidiary of Cottonwood Communities Advisors, LLC which is owned by Cottonwood Capital Management, Inc., a Delaware corporation formed on February 1, 2008, and two entities in which employees of Cottonwood Residential O.P., LP and its affiliates, including certain of our officers and directors have an ownership interest. Cottonwood Communities Management, LLC is a wholly owned subsidiary of Cottonwood Capital Management, Inc. Cottonwood Capital Management, Inc. has extensive experience in operating multifamily apartment communities and is controlled by its board of directors currently consisting of Daniel Shaeffer, Chad Christensen and Gregg Christensen. The sole shareholder of Cottonwood Capital Management, Inc. is Cottonwood Residential O.P., LP. which is the operating partnership of Cottonwood Residential II, Inc., our sponsor. Cottonwood Residential II, Inc. is a general partner of Cottonwood Residential O.P., LP and makes all decisions on behalf of Cottonwood Residential O.P., LP. Prior to Cottonwood Residential II, Inc.’s admission as a general partner of Cottonwood Residential O.P., LP in September 2018, Cottonwood Residential, Inc. was the sole general partner of Cottonwood Residential O.P., LP. Cottonwood Residential, Inc. remains as a nominal general partner of Cottonwood Residential O.P., LP and it is anticipated that Cottonwood Residential, Inc. will fully withdraw from Cottonwood Residential O.P., LP by the end of 2019.

As of December 31, 2018, Cottonwood Residential O.P., LP has ownership interests in 29 multifamily apartment communities and other related assets, 25 properties of which represent approximately 7,200 existing units, and 4 properties under development which represent approximately 1,000 additional units, all of which account for approximately $950.0 million in total gross asset value as of December 31, 2018. As of December 31, 2018, Cottonwood Residential O.P., LP provides property and asset management services to a platform of multifamily assets representing approximately 15,300 multifamily apartment units across 13 states with over $2.0 billion in value.

Cottonwood Residential II, Inc. is controlled by its board of directors currently consisting of Daniel Shaeffer, Chad Christensen, Gregg Christensen, Jonathan Gardner and Phillip White.

6

Table of Contents

What is the role of our board of directors?

We operate under the direction of our board of directors, the members of which are accountable to us and our shareholders as fiduciaries. Our board of directors is responsible for the management and control of our affairs, including oversight of all of our service providers. We currently have five members on our board of directors, three of whom are independent of our sponsor and its affiliates. Our charter requires that a majority of our directors be independent of our sponsor and creates a committee of our board consisting solely of all of our independent directors. This committee, which we call the conflicts committee, is responsible for reviewing the performance of our advisor and must approve other matters as set forth in our charter. The current members of our board of directors are Chad Christensen, Daniel Shaeffer, R. Brent Hardy, Gentry Jensen, and John Lunt.

What is our operating partnership?

We utilize an “umbrella partnership real estate investment trust” or “UPREIT” structure in which all our investments will be owned through our operating partnership. We are the sole general partner of the operating partnership. Cottonwood Communities Investor, LLC (a wholly owned subsidiary of Cottonwood Residential O.P., LP) is currently the sole limited partner of our operating partnership. Cottonwood Communities Investor, LLC has assigned its promotional interest in our operating partnership to Cottonwood Communities Advisors Promote, LLC, such that Cottonwood Communities Advisors Promote, LLC will be entitled to receive 15% of net income and distributions from the operating partnership even though it will not make any capital contributions to our operating partnership. This promotional interest is subordinated to the receipt by our shareholders, together as a collective group, of distributions in an amount sufficient to provide our shareholders with a 6% per year cumulative, noncompounded return on their investment plus a return of their invested capital. For each share purchased pursuant to this offering, we will acquire one common general partner unit of the operating partnership. We believe that using an UPREIT structure provides us with flexibility regarding our future acquisitions. Our operating partnership may accept contributions of property in exchange for limited partnership units in our operating partnership. If this occurs, we will amend the partnership agreement of our operating partnership.

7

Table of Contents

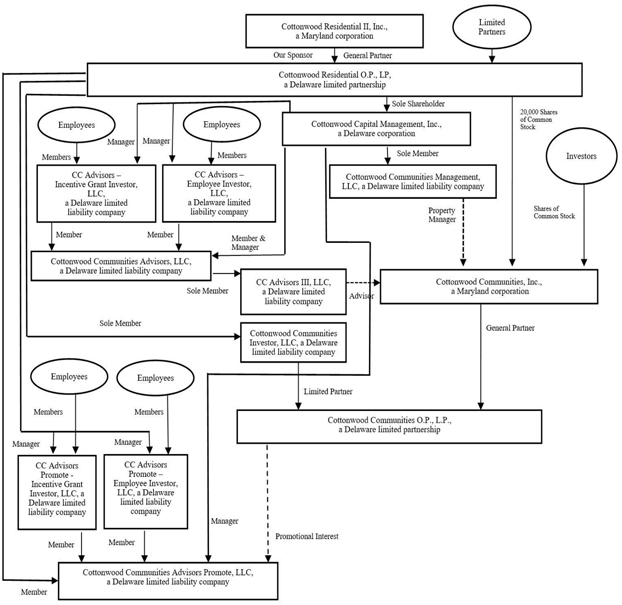

What is the structure of us, our operating partnership and our advisor?

The chart below shows the relationships among our company and various affiliates.

8

Table of Contents

What are the fees that we pay to our advisor and its affiliates?

CC Advisors III, LLC and its affiliates receive compensation and reimbursement for services relating to this offering and the investment and management of our assets. We also compensate our independent directors for their service to us. The most significant items of compensation are included in the table below. The compensation set forth below may only be increased if approved by a majority of the members of our conflicts committee. The increase of such compensation does not require approval by shareholders.

| Form of |

Determination of Amount |

Estimated Amount for | ||

| Acquisition and Development Stage | ||||

| Contingent Acquisition Fee – CC Advisors III, LLC (Our Advisor) | After our shareholders have received, or are deemed to have received (with respect to a merger or a listing), together as a collective group, aggregate distributions sufficient to provide a return of their invested capital, plus a specified cumulative, noncompounded annual return on their invested capital (a “Required Return”), our advisor will receive from us contingent acquisition fees that are a percentage of the cost of investments acquired or originated by us, or the amount to be funded by us to acquire or originate loans, including acquisition and origination expenses and any debt attributable to such investments plus significant capital expenditures related to the development, construction or improvement of the investment as follows: 1% contingent acquisition fee if shareholders receive a Required Return of 6%; and 2% additional contingent acquisition fee if shareholders receive a Required Return of 13%.

The contingent acquisition fee is payable upon satisfying each return threshold with respect to assets in the portfolio at the time the return threshold is satisfied and at the closing of acquisitions following satisfaction of the return threshold. |

$15,000,000 (maximum offering, target leverage of 55% of the cost of our investments, 6% Required Return)/ $45,000,000 (maximum offering, target leverage of 55% of the cost of our investments, 13% Required Return) | ||

| Acquisition Expense Reimbursement – CC Advisors III, LLC (Our Advisor)

Contingent Financing Fee – CC Advisors III, LLC (Our Advisor) |

Subject to the limitations contained in our charter, reimbursement from us for all out-of-pocket expenses incurred in connection with the selection and acquisition or origination of investments, whether or not we ultimately acquire the property or other real estate-related investment. After our shareholders have received, or are deemed to have received (with respect to a merger or a listing), together as a collective group, aggregate distributions sufficient to provide a return of their invested capital, plus a Required Return of 13%, our advisor will receive from us a contingent financing fee of 1% of the original principal amount of any financing obtained or assumed by us. The contingent financing fee is payable upon satisfying the return threshold with respect to any financing obtained or assumed by us prior to satisfaction of the return threshold and at the closing of new financing following satisfaction of the return threshold. |

Actual amounts are dependent upon actual expenses incurred and, therefore, cannot be determined at this time. $8,250,000 (maximum offering, target leverage of 55% of the cost of our investments, 13% Required Return). | ||

9

Table of Contents

| Form of |

Determination of Amount |

Estimated Amount for | ||

| Operational Stage | ||||

| Property Management Fees – Cottonwood Communities Management, LLC (Our Property Manager) | Cottonwood Communities Management, LLC receives from us a property management fee in an amount up to 3.5% of the annual gross revenues of our multifamily apartment communities that it manages. Cottonwood Communities Management, LLC may subcontract the performance of its property management duties to third parties and Cottonwood Communities Management, LLC will pay a portion of its property management fee to the third parties with whom it subcontracts for these services. | Actual amounts depend upon the gross revenue of the properties and therefore cannot be determined at this time. | ||

| Asset Management Fee – CC Advisors III, LLC (Our Advisor) | CC Advisors III, LLC receives from us an annual asset management fee, paid monthly, in an amount equal to 1.25% of our gross assets as of the last day of the prior month. See “Management Compensation” for a discussion of how we calculate our gross assets for purposes of calculating the asset management fee. | Actual amounts depend upon the gross offering proceeds we raise in this offering and therefore cannot be determined at this time. | ||

| Other Company Operating Expenses – CC Advisors III, LLC (Our Advisor or its affiliates) | We reimburse our advisor or its affiliates for all actual expenses paid or incurred by our advisor or its affiliates in connection with the services provided to us, including our allocable share of the advisor’s or its affiliates’ overhead, such as rent, personnel costs, utilities, cybersecurity and IT costs; provided, however, that we do not reimburse our advisor or its affiliates for salaries, wages and related benefits of personnel who perform investment advisory services for us or serve as our executive officers. In addition, subject to the approval of our board of directors we may reimburse our advisor or its affiliates for costs and fees associated with providing services to us that we would otherwise engage a third party to provide. | Actual amounts are dependent upon the results of our operations; we cannot determine these amounts at the present time. | ||

| Promotional Interest from Operating Partnership – Cottonwood Communities Advisors Promote, LLC |

Cottonwood Communities Advisors Promote, LLC will receive from the Operating Partnership a promotional interest equal to 15% of net income and cash distributions, but only after our shareholders receive, together as a collective group, distributions sufficient to provide a return of their invested capital plus a 6% cumulative, non-compounded annual return on their invested capital. Cottonwood Communities Investor, LLC, the sole limited partner of our operating partnership assigned its promotional interest to Cottonwood Communities Advisors Promote, LLC. Neither Cottonwood Communities Investor, LLC nor Cottonwood Communities Advisors Promote, LLC were required to make any capital contributions to our operating partnership in order to obtain the promotional interest.

Cottonwood Communities Advisors Promote, LLC will be entitled to a separate one-time payment payable upon (1) the listing of our common stock on a national securities exchange or (2) the occurrence of certain events that result in the termination or non-renewal of our advisory agreement, in each case for an amount that Cottonwood Communities Advisors Promote, LLC would have been entitled to receive, as described above, as if our Operating Partnership had disposed of all of its assets at the market value of our shares of common stock as of the date of the event triggering the payment. If the event triggering the payment is a listing of our shares on a national securities exchange, the market value will be calculated based on the market value of the shares issued and outstanding at listing over a period of 30 trading days selected by our advisor beginning after the first day of the 6th month, but not later than the last day of the 18th month, after the shares are first listed on a national securities exchange. If the triggering event is the termination or non-renewal of our advisory agreement the market value will be calculated based on an appraisal or valuation of our assets by an independent third party. |

Actual amounts depend on the results of the performance of the multifamily apartment communities and therefore cannot be determined at this time. | ||

10

Table of Contents

| Form of Compensation and |

Determination of Amount |

Estimated Amount for | ||

| In addition, if this separate one-time payment is owed following the termination or non-renewal of our advisory agreement for reasons unrelated to a liquidity event for our shareholders, the payment will be in the form of an interest-bearing promissory note that is payable only after our shareholders have actually received distributions in the amount required before receipt of the promotional interest. Provided, however, if the promissory note has not been repaid prior to a liquidity event for our shareholders, the promissory note shall be paid in full on the date of or immediately prior to the liquidity event. | ||||

| Independent Director Compensation | We pay each of our independent directors an annual retainer of $10,000. We also pay our independent directors for attending meetings as follows: (i) $500 for each board meeting attended and (ii) $500 for each committee meeting attended (if held at a different time or place than a board meeting). All directors receive reimbursement of reasonable out of pocket expenses incurred in connection with attendance at meetings of the board of directors. | Actual amounts are dependent upon the total number of board and committee meetings that each independent director attends and therefore cannot be determined at this time. | ||

What is a REIT?

We intend to qualify as a REIT and to be taxed as a REIT under the Internal Revenue Code of 1986, as amended, beginning with the taxable year ending December 31, 2019. In general, a REIT is an entity that:

| • | combines the capital of many investors to acquire or provide financing for real estate investments; |

| • | allows individual investors to invest in a professionally managed, large-scale diversified real estate portfolio though the purchase of interests, typically shares, in the REIT; |

| • | is required to pay to investors at least 90% of its annual REIT taxable income (computed without regard to the dividends paid deduction and excluding net capital gain); and |

| • | avoids the “double taxation” treatment of income that normally results from investments in a corporation because a REIT is not generally subject to federal corporate income taxes on that portion of its income distributed to its shareholders, provided certain income tax requirements are satisfied. |

However, under the Internal Revenue Code of 1986, as amended, REITs are subject to numerous organizational and operating requirements. If we fail to qualify for taxation as a REIT in any year after electing REIT status, our income will be taxed at regular corporate rates, and we may be precluded from qualifying for treatment as a REIT for the four-year period following our failure to qualify. Even if we qualify as a REIT for federal income tax purposes, we may still be subject to state and local taxes on our income and property and to federal and excise taxes on our undistributed income.

11

Table of Contents

Certain domestic shareholders that are individuals, trusts or estates are taxed on corporate distributions at a maximum rate of 20% (the same as long-term capital gains). With limited exceptions, however, distributions from us or from other entities that are taxed as REITs are generally not eligible for this rate and will continue to be taxed at rates applicable to ordinary income, which will be as high as 37.0%. See “—Taxation of Shareholders—Taxation of Taxable Domestic Shareholders—Distributions.” However, for taxable years prior to 2026, individual shareholders are generally allowed to deduct 20% of the aggregate amount of ordinary dividends distributed by us, subject to certain limitations, which would reduce the maximum marginal effective tax rate for individuals on the receipt of such ordinary dividends to 29.6%. The Internal Revenue Service has issued proposed regulations that would affect an individual shareholder’s ability to claim this deduction if our stock has not been held for at least 45 days prior to the payment of the dividend. Individual shareholders are urged to consult their tax advisors as to their ability to claim this deduction.

The timing and amount of distributions we pay will be determined by our board of directors in its discretion and may vary from time to time. Generally, our policy will be to make distributions from cash flow from operations. However, we expect to have little, if any, cash flow from operations available for distribution until we make substantial investments. Further, because we may receive income from interest or rents at various times during our fiscal year and because we may need cash flow from operations during a particular period to fund capital expenditures and other expenses, we expect that at least during the early stages of our development and from time to time during our operational stage, we will declare distributions in anticipation of cash flow that we expect to receive during a later period, and we expect to pay these distributions in advance of our actual receipt of these funds. In addition, to the extent our investments are in development or redevelopment projects or in properties that have significant capital requirements, our ability to make distributions may be negatively impacted, especially during our early periods of operation. In these instances, our board of directors has the authority under our organizational documents, to the extent permitted by Maryland law, to fund distributions from sources such as borrowings, advances, offering proceeds or the deferral of fees and expense reimbursements in its sole discretion. Such distributions will likely exceed our earnings or cash flow from operations for the corresponding period. We have not established a limit on the amount of proceeds we may use from this offering to fund distributions. If we make distributions from sources other than cash flow from operations, we will have fewer funds available for investments and your overall return on your investment in us may be reduced and subsequent investors will experience dilution. In addition, to the extent distributions exceed cash flow from operating activities, a shareholder’s basis in our stock will be reduced and, to the extent distributions exceed a shareholder’s basis, the shareholder may recognize capital gain.

For the three months ended March 31, 2019, we paid aggregate distributions of $58,045, including $40,024 distributions paid in cash and $18,021 of distributions reinvested through our distribution reinvestment plan. Our cumulative net loss as of the three months ended March 31, 2019 was $331,720. We funded our total distributions paid, which includes net cash distributions and distributions reinvested by shareholders, with proceeds from this offering. Additional information regarding our distributions is included in a supplement to this prospectus.

What are the terms of this offering?

We are offering up to $675,000,000 of shares of our Class A and Class T common stock in our primary offering for $10.00 per share without any upfront costs or expenses charged to the investor and an aggregate of $75,000,000 of shares of our Class A and Class T common stock pursuant to our distribution reinvestment plan at a purchase price initially equal to the purchase price of the shares in the primary offering or $10.00 per share. We are offering to sell any combination of our Class A and Class T common stock, with a dollar value up to the maximum offering amount. The share classes have different selling commission structures. Any offering-related expenses are paid by our advisor without reimbursement by us.

Our shares are not listed for trading on any securities exchange or over-the-counter market at the time you purchase the shares. It is unlikely that any public market for the shares will develop. You should expect to hold your shares for an extended period of time.

How does a “best efforts” offering work?

When shares are offered on a “best efforts” basis, the dealer manager is required to use only its best efforts to sell the shares and it has no firm commitment or obligation to purchase any of the shares. Therefore, we may sell substantially less than the all of the shares that we are offering.

12

Table of Contents

How long will this offering last?

The termination date of this offering will be August 13, 2020, unless extended by our board of directors for an additional year or as otherwise permitted by applicable securities laws. If we decide to continue our offering beyond August 13, 2020, we will provide that information in a prospectus supplement. The offering will terminate earlier if we raise the full primary offering amount of $675,000,000 before such time. We may continue to offer shares under our distribution reinvestment plan beyond the two years from the date of this prospectus until we have sold $75,000,000 of shares through the reinvestment of distributions. In many states, we will need to renew the registration statement or file a new registration statement to continue the offering beyond one year from the date of this prospectus. We may terminate this offering at any time, and we will provide that information in a prospectus supplement.

Who can buy shares?

An investment in our shares is only suitable for persons who have adequate financial means and who will not need immediate liquidity from their investment. Residents of many states can buy shares in this offering provided that they have either (1) a net worth of at least $70,000 and an annual gross income of at least $70,000 or (2) a net worth of at least $250,000. For the purpose of determining suitability, net worth does not include an investor’s home, home furnishings or personal automobiles. The minimum suitability standards are more stringent for investors in certain other states. See “Suitability Standards.”

Why are we offering two classes of our common stock and what are the differences among the classes?

The two classes of common stock offered in this offering are meant to provide broker dealers participating in this offering with more flexibility to facilitate investment in us as the two classes provide different compensation structures to participating broker dealers. Because any offering-related expenses, including upfront and deferred selling commissions, which are the only differences between the two classes, are being paid by our advisor without reimbursement by us, the two classes of common stock are effectively the same to an investor in us.

The amount of upfront selling commissions differs among Class A and Class T shares and there is a deferred selling commission with respect to Class T shares sold in the primary offering; however, we expect that the total compensation payable to broker dealers in this offering will be the same whether an investor purchases a Class A or a Class T share.

13

Table of Contents

How should you determine which class of common stock to invest in?

Because the only difference between the two classes of common stock relates to the underwriting compensation paid to the broker dealer, which compensation our advisor has agreed to pay on our behalf without any reimbursement by us, we believe the decision as to which class of common stock to invest in will be driven by your financial advisor. Some broker dealers have adopted policies that require their financial advisors to receive some portion of their compensation over time, in which case Class T would be appropriate. In addition, some financial advisors may only sell one class of our shares.

The amount of upfront selling commissions differs among Class A shares and Class T shares, and there is a deferred selling commission with respect to Class T shares sold in the primary offering; however, we expect that the total compensation paid in connection with the sale of our common stock will be the same. The following table summarizes the fees related to each class of our common stock sold in our primary offering and indicates the maximum fees payable on a hypothetical investment of $10,000 in each class of shares. Our advisor has agreed to pay all upfront and deferred selling commissions, dealer manager fees, and organization and offering expenses on our behalf without reimbursement by us.

| Class A Shares |

1,000 Class A Shares |

Class T Shares | 1,000 Class T Shares |

|||||||||||||

| Price Per Share/ Amount Invested |

$ | 10.00 | $ | 10,000 | $ | 10.00 | $ | 10,000 | ||||||||

| Upfront Selling Commissions(1) |

6.0 | % | $ | 600 | 3.0 | % | $ | 300 | ||||||||

| Dealer Manager Fees |

3.0 | % | $ | 300 | 3.0 | % | $ | 300 | ||||||||

| Deferred Selling Commission(2) |

None | $ | 0 | 1.0 | %(2) | $ | 300 | (2) | ||||||||

| (1) | The selling commission associated with shares of Class A common stock may be reduced for certain categories of purchasers. See “Plan of Distribution.” |

| (2) | Except as described in the “Plan of Distribution” section of this prospectus, an annual deferred selling commission of 1.0% of the purchase price per share for the Class T shares sold in the primary offering will be paid to our dealer manager and will accrue daily and be paid monthly in arrears. We will cease paying the deferred selling commissions with respect to individual Class T shares when they are no longer outstanding, including as a result of conversion to Class A shares and redemption or repurchase. Each Class T share held in a shareholder’s account shall automatically and without any action on the part of the holder thereof convert into a Class A share, on the earliest to occur of the following: (i) a listing of the Class A shares on a national securities exchange; (ii) a merger or consolidation of our company with or into another entity, or the sale or other disposition of all or substantially all of our assets; and (iii) the last calendar day of the month in which we and our dealer manager, in conjunction with our transfer agent, determine that the deferred selling commission paid with respect to the Class T shares held by such shareholder within such account equals or exceeds three percent of the aggregate gross purchase price of the Class T shares held by such shareholder within such account and purchased in a primary offering. In addition, after termination of a primary offering registered under the Securities Act, we will cease paying the deferred selling commission with respect to each Class T share sold in that primary offering, on the date when we, with the assistance of our dealer manager, determine that all underwriting compensation paid or incurred with respect to the primary offering covered by that registration statement from all sources, determined pursuant to the rules and guidance of FINRA, would be in excess of 10% of the aggregate purchase price of all shares sold for our account through that primary offering. Further, each Class T share sold in that primary offering, each Class T share sold under a distribution reinvestment plan pursuant to the same registration statement that was used for that primary offering, and each Class T share received as a stock dividend with respect to such shares sold in such primary offering or distribution reinvestment plan shall automatically and without any action on the part of the holder thereof convert into a class A share at the last calendar day of the month in which such determination is made. |

The deferred selling commission is only paid on Class T shares purchased in the primary offering; no deferred selling commission is paid on Class T shares purchased through the distribution reinvestment plan or issued pursuant to a stock dividend. The deferred selling commission is paid by our advisor without reimbursement by us and will have no impact on our Class T shareholders.

How do I subscribe for shares?

If you choose to purchase shares in this offering, you will need to complete and sign a subscription agreement (in the form attached to this prospectus as Appendix A) for a specific number and class of shares and pay for the shares at the time of your subscription.

14

Table of Contents

Are there risks associated with an investment in our shares?

An investment in shares of our common stock involves significant risks, including those described below.

| • | We have little to no operating history. As of the date of this prospectus we own one multifamily community and a B note secured by a mortgage on a multifamily development project. There is no assurance that we will be able to successfully achieve our investment objectives. |

| • | Our charter does not require our directors to provide our shareholders with a liquidity event by a specified date or at all. Our shares cannot be readily sold and it will be difficult for you to sell your shares. If you are able to sell your shares, you will likely sell them at a substantial discount. |

| • | There are restrictions and limitations on your ability to have all or any portion of your shares of our common stock repurchased under our share repurchase program and, if you are able to have your shares repurchased, it may be at a price that is less than the price you paid for the shares or the value of the shares at such time. |

| • | The amount of distributions we may make is uncertain. Our distributions may be paid from sources such as borrowings, offering proceeds, advances or the deferral of fees and expense reimbursements (which may constitute a return of capital). We have not established a limit on the amount of proceeds from this offering that we may use to fund distributions. Distributions from sources other than our cash flow from operations would reduce the funds available to us for investments in multifamily apartment communities and multifamily real estate-related assets, which could reduce your overall return. During the early stages of our operations, it is likely that we will use sources of funds which may constitute a return of capital to fund distributions. As of March 31, 2019, we have funded our distributions with offering proceeds. |

| • | Our officers and certain of our directors are also officers and directors of Cottonwood Residential II, Inc. and its affiliates. As a result, our officers and affiliated directors are subject to conflicts of interest. |

| • | We have not established the offering price on an independent basis and it bears no relationship to the value of our assets. |

| • | Except for investments described in a supplement to this prospectus, you will not have the opportunity to evaluate our investments prior to purchasing shares of our common stock. |

| • | Our ability to raise money and achieve our investment objectives depends on the ability of the dealer manager to successfully market our offering. If we raise substantially less than the maximum offering amount, we may not be able to invest in a diverse portfolio of assets and the value of your investment may vary more widely with the performance of certain investments. |

| • | We pay certain fees and expenses to our advisor and its affiliates. These fees were not negotiated at arm’s length and therefore may be higher than fees payable to unaffiliated third parties. |

| • | Development projects in which we invest will be subject to potential development and construction delays which will result in increased costs and risks and may hinder our operating results and ability to make distributions. |

| • | We may incur significant debt in certain circumstances. Our use of leverage increases the risk of your investment. Loans we obtain may be collateralized by some or all of our investments, which will put those investments at risk of forfeiture if we are unable to pay our debts. Principal and interest payments on these loans reduce the amount of money that would otherwise be available for other purposes. |

| • | Volatility in the debt markets could affect our ability to obtain financing for investments or other activities related to real estate assets and the diversification or value of our portfolio, potentially reducing cash available for distribution to our shareholders or our ability to make investments. In addition, if any of the loans we obtain have variable interest rates, volatility in the debt markets could negatively impact such loans. |

| • | If we fail to qualify as a REIT, it would adversely affect our operations and our ability to make distributions to our shareholders because we will be subject to United States federal income tax at regular corporate rates with no ability to deduct distributions made to our shareholders. |

Are there conflicts of interest for our board of directors and officers?

We may experience conflicts of interest with our advisor, Cottonwood Residential O.P., LP and Cottonwood Residential II, Inc. or their affiliates in connection with this offering and the management of our business. The conflicts of interest that may arise include the following:

| • | Two of our directors are also directors of Cottonwood Residential II, Inc. Such overlapping directors face conflicts of interest between their obligations to Cottonwood Residential II, Inc. and their obligations to us; |

| • | Two of our directors and officers are also directors and officers of Cottonwood Residential II, Inc. and its affiliates and must allocate their time between advising us and managing Cottonwood Residential II, Inc.’s businesses and the other real estate projects and business activities in which they may be involved; |

15

Table of Contents

| • | The compensation payable by us to our advisor and its affiliates may not be on terms that would result from arm’s-length negotiations between unaffiliated parties, and certain fees are payable regardless of the performance of our investments; |

| • | The property management fees, construction management fees and asset management fees payable to our property manager and advisor will generally be payable regardless of the quality of services provided to us; and |

| • | If we terminate our advisory agreement our advisor may be motivated to terminate its participation in the Three-Party Agreement that obligates our advisor to pay upfront and deferred selling commissions, dealer manager fees, and organization and offering expenses on our behalf without reimbursement by us. If our advisor ceases to pay our offering expenses, we may be forced to terminate this offering. |

Do we have a share repurchase program?

Our share repurchase program may provide an opportunity for our shareholders to have their shares of our common stock repurchased by us, subject to certain restrictions and limitations. Unless being repurchased in connection with the death or “complete disability” (as defined under “Description of Shares – Share Repurchase Program”) of a shareholder (together, “Exceptional Repurchases”), generally no shares can be repurchased under our share repurchase program until after the first anniversary of the date of purchase of such shares from us by the applicable investor.

Generally, the purchase price for shares repurchased under our share repurchase program are as follows:

| Share Purchase Anniversary |

Repurchase Price | |

| Less than 1 year |

No Repurchase Allowed | |

| 1 year – 2 years |

85% of Estimated Value Per Share(1) | |

| 3 years – 4 years |

90% of Estimated Value Per Share(1) | |

| 5 years and thereafter |

95% of Estimated Value Per Share(1) | |

| A shareholder’s death or complete disability, less than 2 years |

95% of Estimated Value Per Share(1) | |

| A shareholder’s death or complete disability, 2 years or more |

100% of Estimated Value Per Share(1) |

| (1) | For the purposes of our share repurchase program, the “estimated value per share” will initially be equal to the purchase price per share at which the original purchaser or purchasers of the shares bought its shares from us, and the purchase price per share will be adjusted to reflect any stock dividends, combinations, splits, recapitalizations or any similar transaction with respect to the shares outstanding. |

We plan to establish an estimated net asset value (“NAV”) per share of our common stock based on valuations of our assets and liabilities no later than May 17, 2021, and annually thereafter. Upon our establishment of an estimated NAV per share, the estimated NAV per share will be the estimated value per share pursuant to our share repurchase program.

For purposes of determining the time period a redeeming shareholder has held each share, the time period begins as of the date such shareholder acquired the shares in question (the “acquisition date”); provided, that the shares purchased by the redeeming shareholder pursuant to our distribution reinvestment plan will be deemed to have been acquired on the same date as the initial share to which the distribution reinvestment plan shares relate.

We are not obligated to repurchase shares of our common stock under our share repurchase program. We presently intend to limit the number of shares to be repurchased in any calendar year to 5% of the weighted-average number of shares of our common stock outstanding during the prior calendar year. In addition, during any calendar year, we may redeem only the number of shares that we could purchase with the amount of net proceeds from the sale of shares under our distribution reinvestment plan during the prior calendar year. There is no fee in connection with a repurchase of shares of our common stock.

Our board of directors may, in its sole discretion, amend, suspend, or terminate our share repurchase program for any reason upon 15 days’ notice to our shareholders. Therefore, shareholders may not have the opportunity to make a repurchase request prior to any potential termination or suspension of our share repurchase program.

May I reinvest my distributions in additional shares of Cottonwood Communities, Inc.?

Yes. We have adopted a distribution reinvestment plan. You may participate in our distribution reinvestment plan by checking the appropriate box on the subscription agreement or by filling out an enrollment form, which we will provide to you at your request. The purchase price of shares purchased under the distribution reinvestment plan will initially be $10.00 per

16

Table of Contents

share. Once we establish an estimated net asset value (“NAV”) per share, shares issued pursuant to our distribution reinvestment plan will be priced at the NAV per share of our stock, as determined by our board. No upfront or deferred selling commissions or dealer manager fees are payable on shares sold under our distribution reinvestment plan. We may amend or terminate the distribution reinvestment plan for any reason at any time upon 10 days’ written notice to the participants. For more information regarding our distribution reinvestment plan, see “Description of Shares – Distribution Reinvestment Plan.”

Will we register as an investment company?

We intend to conduct our operations so that neither we nor any of our subsidiaries will be required to register as an investment company under the Investment Company Act of 1940, as amended, or the Investment Company Act.

Neither we nor any of our subsidiaries intend to register as investment companies under the Investment Company Act. If we or our subsidiaries were obligated to register as investment companies, then we would have to comply with a variety of substantive requirements under the Investment Company Act that impose, among other things:

| • | limitations on capital structure; |

| • | restrictions on specified investments; |

| • | prohibitions on transactions with affiliates; and |