Table of Contents

☐ |

Preliminary Proxy Statement | |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

☒ |

Definitive Proxy Statement | |

☐ |

Definitive Additional Materials | |

☐ |

Soliciting Material under § 240.14a-12 | |

☒ |

No fee required | |

☐ |

Fee paid previously with preliminary materials | |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |

Table of Contents

Notice of 2024 Annual Meeting

of Stockholders and

Proxy Statement

2024 Annual Meeting of Stockholders:

Wednesday, May 1, 2024, at 9:00 a.m. (CT)

Virtual Meeting

(Register in advance at: www.proxydocs.com/VST)

Whether or not you will be able to attend the 2024 Annual Meeting,

please vote your shares promptly so that you may be represented at the meeting.

Table of Contents

|

Vistra Corp. 6555 Sierra Drive Irving, Texas 75039 |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

|

|

Place: Virtual Meeting Register in advance at: www.proxydocs.com/VST

|

Time and Date: 9:00 a.m. (CT) Wednesday, May 1, 2024

|

Record Date: March 22, 2024

|

|

To the Stockholders of Vistra Corp.:

The 2024 Annual Meeting of Stockholders (the “2024 Annual Meeting”) of Vistra Corp. (the “Company” or “Vistra”) will be held for the following purposes:

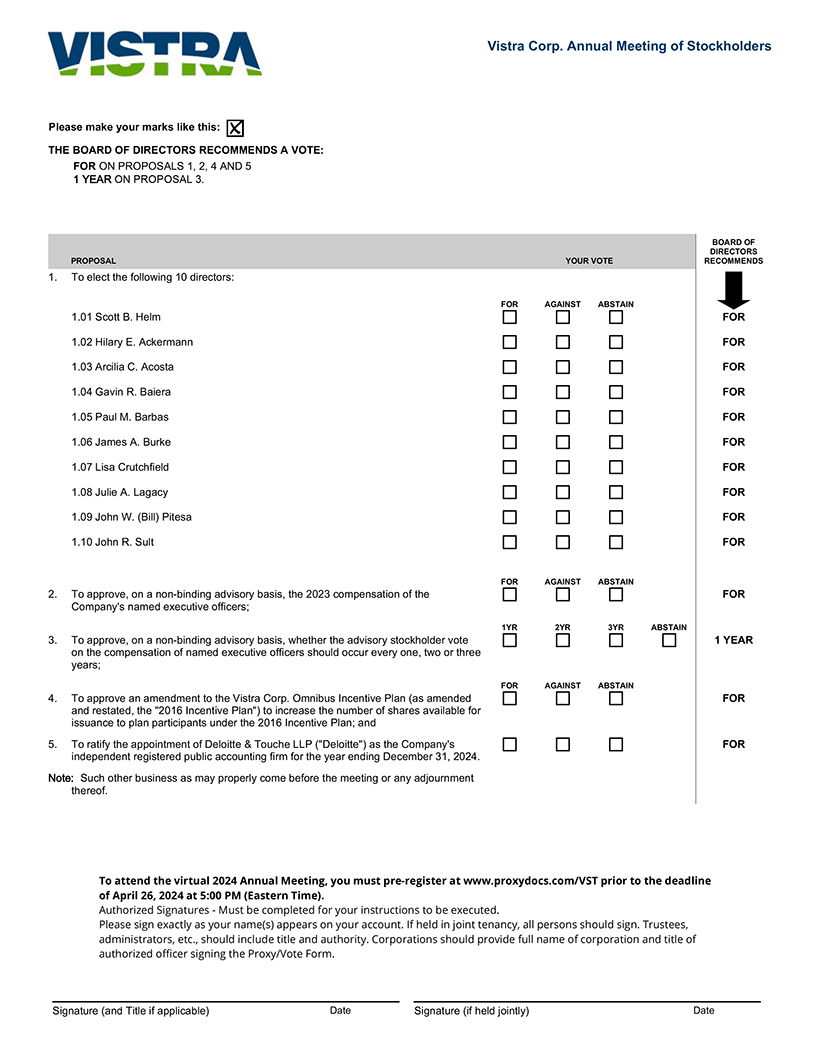

| 1. | To elect the 10 directors named in this proxy statement and nominated by the Board of Directors (the “Board”) to serve on the Board until the 2025 annual meeting of stockholders (the “2025 Annual Meeting”); |

| 2. | To approve, on a non-binding advisory basis, the 2023 compensation of the Company’s named executive officers; |

| 3. | To approve, on a non-binding advisory basis, whether the advisory stockholder vote on the compensation of named executive officers should occur every one, two or three years; |

| 4. | To approve an amendment to the Vistra Corp. 2016 Omnibus Incentive Plan (as amended and restated, the “2016 Incentive Plan”) to increase the number of shares available for issuance to plan participants under the 2016 Incentive Plan; and |

| 5. | To ratify the selection of Deloitte & Touche LLP (“Deloitte”) as the Company’s independent registered public accounting firm for the year ending December 31, 2024. |

Additionally, if needed, the stockholders may act upon any other matters that may properly come before the 2024 Annual Meeting (including a proposal to adjourn the meeting to solicit additional proxies) or any reconvened meeting after an adjournment or postponement of the meeting.

In order to attend the 2024 Annual Meeting, you must register in advance at www.proxydocs.com/VST prior to the deadline of April 26, 2024 at 5:00 p.m. (ET). Following registration, you will immediately receive a confirmation e-mail, which will include information about when you should expect to receive a unique link to gain access to the meeting. Whether or not you will be able to attend the meeting, PLEASE VOTE YOUR SHARES PROMPTLY BY EITHER SIGNING AND RETURNING THE ACCOMPANYING PROXY CARD OR CASTING YOUR VOTE VIA TELEPHONE OR THE INTERNET AS DIRECTED ON THE PROXY CARD.

| By Order of the Board of Directors, |

|

| Yuki Whitmire |

| Vice President, Associate General Counsel, and Corporate Secretary |

| April 3, 2024 |

Table of Contents

TABLE OF CONTENTS

|

2024 Proxy Statement | i |

Table of Contents

|

PROXY SUMMARY INFORMATION

|

This summary is included to provide an introduction and overview of the information contained in this Proxy Statement. This is a summary only and does not contain all of the information we have included in this Proxy Statement. You should refer to the full Proxy Statement for more information about us and the proposals you are being asked to consider.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON MAY 1, 2024

The Proxy Statement and the 2023 Annual Report to Stockholders (the “Annual Report”) are available at www.proxydocs.com/VST.

ABOUT VISTRA

Vistra (NYSE: VST) is a leading Fortune 500 integrated retail electricity and power generation company that provides essential resources to customers, businesses, and communities from California to Maine. Based in Irving, Texas, Vistra is a leader in the energy transformation with an unyielding focus on reliability, affordability, and sustainability. The company safely operates a reliable, efficient power generation fleet of natural gas, nuclear, coal, solar, and battery energy storage facilities while taking an innovative, customer-centric approach to its retail business.

|

2024 Proxy Statement | 1 |

Table of Contents

|

PROXY SUMMARY INFORMATION

|

2023 BUSINESS HIGHLIGHTS

Vistra delivered strong results in 2023, exemplifying the durability of Vistra’s integrated operations, while continuing to execute against our strategic priorities. Vistra reported 2023 Net Income of $1.492 billion and Cash Flow from Operations of $5.453 billion. Vistra navigated another volatile year in both commodities markets and weather to achieve $4.14 billion of Ongoing Operations Adjusted EBITDA* ($440 million above the original guidance midpoint) and nearly $2.50 billion of Adjusted Free Cash Flow Before Growth* ($441 million higher than the original guidance midpoint) in 2023. We summarize key highlights of our 2023 results below. On March 1, 2024, the Company successfully closed the acquisition of Energy Harbor Corp. (“Energy Harbor”). The transaction combined Energy Harbor’s nuclear and retail businesses with Vistra’s nuclear and retail businesses and certain Vistra Zero renewables and storage projects under the newly formed “Vistra Vision” subsidiary holding company. The combination accelerates the growth of Vistra’s zero-carbon operations, adding approximately 4,000 megawatts of nuclear capacity and approximately 1 million retail customers. We are excited to welcome our new colleagues to the Vistra family and look forward to serving our retail and commercial customers as one team.

| Performance Highlights | ||||||||||||||||||

| Exceeded

2023 previously revised guidance midpoints for Adj.

|

95.5%

total fleet commercial availability for 2023 managed through multiple extreme weather events across the country

|

|||||||||||||||||

| 3rd consecutive year

year-over-year organic growth in TXU Energy Customer Counts

|

||||||||||||||||||

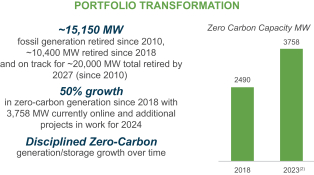

| Strategy Execution | ||||||||||||||||||||||||||

| ~1,020 MW

of battery energy storage currently online

|

350 MW

of zero-carbon generation and

|

~20,000 MW

of fossil-fueled power plants expected to retire

|

||||||||||||||||||||||||

| ~$300 million

of dividends paid in 2023

|

~$3.50 billion

shares repurchased from Nov. 2021 through Dec. 2023

|

|||||||||||||||||||||||||

| * | See Annex A for a reconciliation of non-GAAP financial measures to the most comparable GAAP measure (as defined in Annex A). |

| 2 | 2024 Proxy Statement |

|

Table of Contents

|

PROXY SUMMARY INFORMATION

|

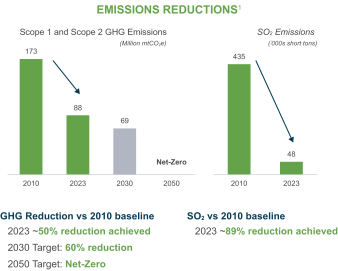

| Sustainability Highlights | ||||||||||||||||||||

|

Environmental

|

||||||||||||||||||||

| ~50%

reduction of GHG emissions achieved by year end 2023, from a 2010 baseline

|

~7,800 MW

of zero-carbon generation currently online

|

~89%

reduction of SO2 emissions achieved by year-end 2023, from a 2010 baseline

|

||||||||||||||||||

|

Governance

|

||||||||||||||||||||

| Sustainability Governance Framework

ensures full Vistra Board and committee oversight of ESG initiatives

|

ESG Metrics

incorporated into the employee and Executive Annual Incentive Plan

|

|||||||||||||||||||

|

People and Communities

|

||||||||||||||||||||

| Disability:IN

Vistra member of Disability:IN to further advance inclusion and equality. Recognized as a Best Place to Work in 2023

|

15 Employee Resource Groups

with focus on Vistra culture and the community

|

14 Facilities

recognized with OSHA VPP

|

||||||||||||||||||

| $2 million

donated in 2023 as part of our continued $10 million commitment (over 5 years) to support the advancement of business and education in diverse communities

|

>600 Employees participating in Vistra’s mentoring program

|

|||||||||||||||||||

|

Recognitions

|

||||||||||||||||||||

| Supporting veteran-owned businesses

One of 2023 Best Corporations for

|

Supporting women-owned businesses

One of 2023 America’s Top

|

Working safely

National Mining Association’s Sentinels of

|

||||||||||||||||||

|

2024 Proxy Statement | 3 |

Table of Contents

|

PROXY SUMMARY INFORMATION

|

CORPORATE GOVERNANCE BEST PRACTICES

Our corporate governance policies and structures reflect best practices, including:

|

Annual election of directors and majority voting with a resignation policy | |

|

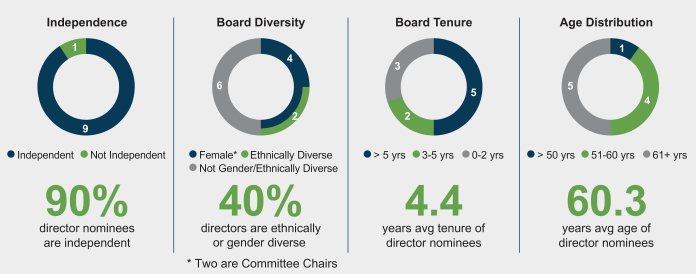

9 out of 10 director nominees are independent | |

|

Independent Audit, Social Responsibility & Compensation, Nominating & Governance, Sustainability & Risk, and Nuclear Oversight Committees | |

|

Regular executive sessions of independent directors | |

|

Separation of the Chairman of the Board (the “Chairman”) and Chief Executive Officer (“CEO”) positions | |

|

Risk oversight by full Board and committees, including Sustainability Governance Framework ensuring oversight over ESG matters and initiatives | |

|

Annually a separate Board meeting is devoted solely to the long-term strategy of the Company, in addition to regular discussions about Company strategy at meetings throughout the year | |

|

Frequent meetings of our non-management and independent directors | |

|

Directors limited to no more than two other public company boards, and the CEO limited to no more than one other public company board | |

|

Annual Board and committee assessments, including individual director interviews and assessments facilitated by third party | |

|

Tracking of Board education programs attended by directors with a recommendation that each director attend at least one Board education program every two years | |

|

Director onboarding program for new directors | |

|

Policies prohibiting pledging and hedging transactions involving the Company’s common stock, par value $0.01 per share (the “Common Stock”), by directors and executive officers, without General Counsel approval | |

|

Minimum stock ownership requirements for our directors and executive officers | |

|

Board review and public disclosure of political and lobbying contributions | |

|

Active stakeholder engagement | |

2023 COMPENSATION HIGHLIGHTS

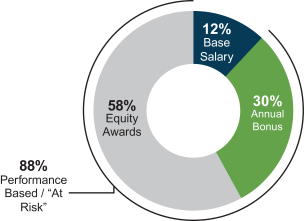

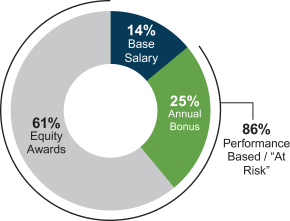

In 2023, Vistra again received strong support for its executive compensation programs, with over 83% of the vote approving, on an advisory basis, our executive compensation. In 2023, as in prior years, the Social Responsibility & Compensation Committee considered input from our stockholders and other stakeholders as part of its annual review of Vistra’s executive compensation program. Based in part on discussions with stockholders, beginning in 2023 we adopted a new development and construction index to assess progress of renewable development targets and milestones.

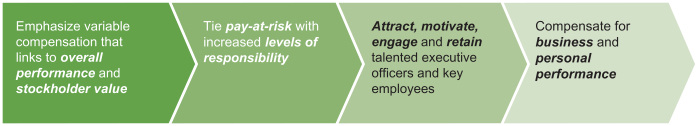

We are committed to a pay for performance compensation philosophy, designed to:

| 4 | 2024 Proxy Statement |

|

Table of Contents

|

PROXY SUMMARY INFORMATION

|

Certain key features of our executive compensation program include:

|

Clawback policy in place for performance-based incentive awards | |

|

No tax gross-ups for executive officers (other than for relocation expenses under a program that is generally available to all employees) | |

|

Stock ownership guidelines applicable to our Chief Executive Officer and President and Executive Vice Presidents, including the Named Executive Officers (“NEOs”), and non-employee directors | |

|

|

“Double trigger” change in control benefits that require both the occurrence of a change in control and a qualifying termination of the NEO, meaning that the executive cannot trigger these benefits themselves | |

|

Independent compensation consultant hired by and reporting to Social Responsibility & Compensation Committee | |

DIRECTOR NOMINEE HIGHLIGHTS

Our director nominees collectively represent an extensive and diverse mix of skills, knowledge and experiences that are well-suited to our business.

Director Nominee Expertise

|

Corporate Governance/Public Board Experience

| |||||||||||||||||||||

| 9/10 | ||||||||||||||||||||||

|

Finance/Accounting

| |||||||||||||||||||||

| 9/10 | ||||||||||||||||||||||

|

Industry Expertise

| |||||||||||||||||||||

| 9/10 | ||||||||||||||||||||||

|

Public Company Executive

| |||||||||||||||||||||

| 6/10 | ||||||||||||||||||||||

|

Risk Management/Compliance

| |||||||||||||||||||||

| 9/10 | ||||||||||||||||||||||

|

Strategy/Transactional

| |||||||||||||||||||||

| 9/10 | ||||||||||||||||||||||

|

Climate Change and Sustainable Strategy/Policy(1)

| |||||||||||||||||||||

| 5/10 | ||||||||||||||||||||||

|

Human Capital Management/DEI(2)

| |||||||||||||||||||||

| 7/10 | ||||||||||||||||||||||

| (1) | Climate Change and Sustainable Strategy/Policy: Expertise in climate change, climate-related risk management, and sustainability matters, including through formal certification programs or training or participating in significant continuing education on climate science and the technologies, stakeholders, and economic theories that have emerged to prevent climate change, or through a CEO position or other senior executive role with responsibility for managing climate change and its associated risks, and sustainability issues as business imperatives. |

| (2) | Human Capital Management/Diversity, Equity and Inclusion (“DEI”): Experience or expertise through a CEO position, human resources leadership role, or other senior executive role in the management and development of human capital, including management of a large workforce, compensation, company culture, and other human capital issues. With respect to DEI, responsibility for establishing, evaluating, overseeing, or promoting DEI goals and practices in a corporate or non-profit setting as a director or senior executive. |

|

|

|

|

|

|

|

| |||||||

| Corporate Governance / Public Board Experience |

Finance / Accounting |

Industry Expertise |

Public Company Executive |

Risk Management / Compliance |

Strategy/ Transactional |

Climate Change and Sustainable Strategy/Policy |

Human Capital Management / Diversity, Equity & Inclusion | |||||||

|

2024 Proxy Statement | 5 |

Table of Contents

|

PROXY SUMMARY INFORMATION

|

Key Attributes of Director Nominees

REFERENCES TO VISTRA

Unless otherwise indicated, references to “Vistra,” the “Company,” “we,” “our,” and “us” in the biographical and compensation information for directors and executive officers below refers to Board membership, employment, and compensation with respect to Vistra Corp.

INCORPORATION BY REFERENCE

To the extent that this Proxy Statement is incorporated by reference into any other filing by us under the Securities Act of 1933 (as amended, the “Securities Act”), or the Securities Exchange Act of 1934 (as amended, the “Exchange Act”), the sections of this Proxy Statement entitled “Social Responsibility & Compensation Committee Report” and “Audit Committee Report” will not be deemed incorporated unless specifically provided otherwise in such filing to the extent permitted by the rules of the Securities and Exchange Commission (“SEC”). Information contained on or connected to our website is not incorporated by reference into this Proxy Statement and should not be considered part of this Proxy Statement or any other filing that we make with the SEC.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

The information presented herein includes forward-looking statements within the meaning of safe harbor provisions of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, that are presented herein, that address activities, events or developments that may occur in the future (often, but not always, through the use of words such as “intend,” “plan,” “believe,” “expect,” “anticipate,” “estimate,” “should,” “may,” “predict,” “project,” “forecast,” “target,” “potential,” “goal,” “objective,” and “outlook”) are forward-looking statements. Although we believe that in making any such forward-looking statement our expectations are based on reasonable assumptions, any such forward-looking statement involves uncertainties and risks that could cause results to differ materially from those projected in or implied by any such forward-looking statement, including those additional risks and factors discussed in reports filed with the SEC by the Company from time to time, including the uncertainties and risks discussed in the sections entitled “Risk Factors” and “Forward-Looking Statements” in our most recent annual report on Form 10-K and any subsequently filed quarterly reports on Form 10-Q. Any forward-looking statement speaks only at the date on which it is made, and except as may be required by law, the Company will not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date on which it is made or to reflect the occurrence of unanticipated events or circumstances.

New factors emerge from time to time, and it is not possible for us to predict them. In addition, we may be unable to assess the impact of any such event or condition or the extent to which any such event or condition, or combination of events and conditions, may cause results to differ materially from those contained in or implied by any forward-looking statement. As such, you should not unduly rely on such forward-looking statements.

| 6 | 2024 Proxy Statement |

|

Table of Contents

PROXY STATEMENT

PROPOSALS FOR STOCKHOLDER ACTION

| For More Information |

Board Recommendation | |||

| Proposal 1: To elect 10 Directors to serve on the Board until the 2025 Annual Meeting |

Page 8 |

✓ For | ||

| Proposal 2: To approve, on a non-binding advisory basis, our 2023 compensation of named executive officers |

Page 72 |

✓ For | ||

| Proposal 3: To approve, on a non-binding advisory basis, whether the advisory stockholder vote on the compensation of named executive officers should occur every one, two or three years |

Page 81 |

✓ One Year | ||

| Proposal 4: To approve an amendment to the Vistra Corp. 2016 Omnibus Incentive Plan to increase the number of shares available for issuance to plan participants under the 2016 Incentive Plan |

Page 82 |

✓ For | ||

| Proposal 5: To ratify the appointment of Deloitte & Touche LLP (“Deloitte”) as the Company’s independent registered public accounting firm for the year ending December 31, 2024 |

Page 92 |

✓ For | ||

ANNUAL MEETING INFORMATION

| Time, Date and Place: | 9:00 a.m. (CT) on Tuesday, May 1, 2024 via a virtual meeting. Register in advance at: www.proxydocs.com/VST.

In order to attend the 2024 Annual Meeting, you must register in advance at www.proxydocs.com/VST prior to the deadline of April 26, 2024 at 5:00 p.m. (ET). Following registration, you will immediately receive a confirmation e-mail, which will include information about when you should expect to receive a unique link to gain access to the virtual meeting.

| |||||

| Record Date:

|

March 22, 2024 | |||||

| Voting Methods: |

Submit your proxy (www.proxypush.com/VST)

|

Submit your proxy (1-866-829-5001)

|

If you request a printed copy of the proxy materials, complete, sign, date and return the proxy card in the envelope provided

| |||

| Requesting Copies of Materials: |

Current and prospective investors can access our Annual Report, Proxy Statement, notice and other financial information through the Investor Relations section of our website at www.vistracorp.com. The Company will also provide, without charge, a copy of these materials upon request made by phone at (214) 812-4600 or by writing to the Corporate Secretary of the Company at 6555 Sierra Drive, Irving, Texas 75039. | |||||

|

2024 Proxy Statement | 7 |

Table of Contents

PROPOSAL 1 – ELECTION OF DIRECTORS

DIRECTOR NOMINEES

Each nominee listed below currently serves as a director of the Board. The director nominees listed below intend to serve, if elected, on the Board as directors until the 2025 Annual Meeting and until their successors have been elected and qualified.

The director nominees are set forth below:

| Experience, Qualifications & Skills(1) |

|

|

|

|

|

|

|

| ||||||||||

| Scott B. Helm Director, Chairman of the Board |

Director since: 2017 Age: 59 Independent |

🌑 |

🌑 |

🌑 |

🌑 |

🌑 |

🌑 |

🌑 |

||||||||||

| Hilary E. Ackermann Director, Chair of the Sustainability & Risk Committee |

Director since: 2018 Age: 68 Independent |

🌑 |

🌑 |

🌑 |

🌑 |

🌑 |

🌑 |

🌑 | ||||||||||

| Arcilia C. Acosta |

Director since: 2020 Age: 58 Independent |

🌑 |

🌑 |

🌑 |

🌑 |

🌑 |

🌑 | |||||||||||

| Gavin R. Baiera |

Director since: 2016 Age: 48 Independent |

🌑 |

🌑 |

🌑 |

🌑 |

🌑 | ||||||||||||

| Paul M. Barbas Director, Chair of the Nominating & Governance Committee |

Director since: 2018 Age: 67 Independent |

🌑 |

🌑 |

🌑 |

🌑 |

🌑 |

🌑 |

🌑 | ||||||||||

| James A. Burke President and Chief Executive Officer and Director |

Director since: 2022 Age: 55 |

🌑 |

🌑 |

🌑 |

🌑 |

🌑 |

🌑 |

🌑 |

🌑 | |||||||||

| Lisa Crutchfield Director, Chair of the Social Responsibility & Compensation Committee |

Director since: 2020 Age: 61 Independent |

🌑 |

🌑 |

🌑 |

🌑 |

🌑 |

🌑 |

🌑 |

||||||||||

| Julie A. Lagacy |

Director since: 2023 Age: 57 Independent |

🌑 |

🌑 |

🌑 |

🌑 |

🌑 |

🌑 |

🌑 | ||||||||||

| John W. (Bill) Pitesa Director, Chair of the Nuclear Oversight Committee |

Director since: 2024 Age: 66 Independent |

🌑 |

🌑 |

|||||||||||||||

| John R. Sult Director, Chair of the Audit Committee |

Director since: 2018 Age: 64 Independent |

🌑 |

🌑 |

🌑 |

🌑 |

🌑 |

🌑 |

🌑 | ||||||||||

| (1) | All five Board Committees are independent. |

|

The Board of Directors recommends that stockholders vote FOR the election of these director nominees to the Board. | |

|

|

|

|

|

|

|

| |||||||

| Corporate Governance / Public Board Experience |

Finance / Accounting |

Industry Expertise |

Public Company Executive |

Risk Management / Compliance |

Strategy / Transactional |

Climate Change and Sustainable Strategy / Policy |

Human Capital Management / Diversity, Equity & Inclusion | |||||||

| 8 | 2024 Proxy Statement |

|

Table of Contents

PROPOSAL 1 – ELECTION OF DIRECTORS

DIRECTOR NOMINEE BIOGRAPHIES

|

Scott B. Helm Chairman of the Board |

Experience, Qualifications & Skills • Corporate Governance/Public Board Experience • Finance/Accounting • Industry Expertise • Public Company Executive • Risk Management/Compliance • Strategy/Transactional • Climate Change and Sustainable Strategy/Policy | |||

| Director Since: 2017 Age: 59

|

Board Committees: None

| |||

Biographical Information:

Mr. Helm has served as Chairman of the Board since October 2017. For over a decade, Mr. Helm has been a private investor based out of Baltimore, Maryland. Previously, Mr. Helm was a founding partner of Energy Capital Partners, a private equity firm focused on investing in North American energy infrastructure. Before that, he served as Executive Vice President and Chief Financial Officer at Orion Power Holdings, Inc., a publicly listed company that owned and operated power plants. Mr. Helm began his career at Goldman, Sachs & Co., first working in the fixed income division, then moving to the investment banking division. Mr. Helm also serves on the board of the Chesapeake Shakespeare Company. Mr. Helm received a bachelor’s degree in business administration from Washington University in St. Louis.

Qualifications:

Mr. Helm has extensive financial and industry knowledge. His specific experience in the energy industry and significant financial and executive experience, including his service as a founding partner of an energy infrastructure private equity fund and public company chief financial officer in the utilities sector, allow him to provide valuable guidance and knowledge to the Board and enable him to lead effectively in his capacity as Chairman.

|

2024 Proxy Statement | 9 |

Table of Contents

PROPOSAL 1 – ELECTION OF DIRECTORS

|

Hilary E. Ackermann |

Experience, Qualifications & Skills • Corporate Governance/Public Board Experience • Finance/Accounting • Industry Expertise • Risk Management/Compliance • Strategy/Transactional • Climate Change and Sustainable Strategy/Policy • Human Capital Management/Diversity, Equity & Inclusion | |||

| Director Since: 2018 Age: 68

|

Board Committees: Sustainability & Risk (Chair), Nuclear Oversight

| |||

Biographical Information:

Ms. Ackermann served as a director of Dynegy Inc. (“Dynegy”) from October 2012 until Dynegy’s merger with Vistra in April 2018 and joined the Board in conjunction with the Company’s acquisition of Dynegy. Ms. Ackermann was Chief Risk Officer with Goldman Sachs Bank USA from October 2008 to 2011. Ms. Ackermann began her career at Goldman Sachs in 1985 and served as Managing Director, Credit Department of Goldman, Sachs & Co., as VP, Credit Department, and as an Associate in the Credit Department prior to her role as Chief Risk Officer. Prior to joining Goldman, Ms. Ackermann served as Assistant Department Head of the Credit Department of Swiss Bank Corporation (now known as UBS). Ms. Ackermann served on the private board of directors and audit committee of Credit Suisse Holdings (USA), Inc. from January 2017 through December 2022, and served as chair of the risk committee, of Credit Suisse Holdings (USA), Inc. She currently serves on the private board and the audit committee, and serves as chair of the risk and

compliance committee, of each of Hartford Series Fund, Inc., Hartford HLS Series Fund II, Inc., The Hartford Mutual Funds, Inc. and The Hartford Mutual Funds II, Inc. She previously served on the public board of directors of Apollo Investment Corporation. Ms. Ackermann received a bachelor’s degree in Russian from Georgetown University.

Qualifications:

Ms. Ackermann brings extensive experience assessing credit for major banking institutions, covering a variety of industries, including the power generation, electrical utilities and natural resources sectors, as well as in-depth coverage of commodities trading, including oil, natural gas and power as a risk manager. Ms. Ackermann currently serves as the Chair of the Sustainability & Risk Committee, where she contributes significantly to the review and evaluation of our enterprise risk assessment, risk management goals, management and tracking of environmental risks and opportunities, as well as external sustainability report.

| 10 | 2024 Proxy Statement |

|

Table of Contents

PROPOSAL 1 – ELECTION OF DIRECTORS

|

Arcilia C. Acosta |

Experience, Qualifications & Skills • Corporate Governance/Public Board Experience • Finance/Accounting • Industry Expertise • Risk Management/Compliance • Strategy/Transactional • Human Capital Management/Diversity, Equity & Inclusion | |||

| Director Since: 2020 Age: 58

|

Board Committees: Audit, Nominating & Governance

| |||

Biographical Information:

Ms. Acosta has served on the Board since 2020. Ms. Acosta has served as the CEO of CARCON Industries and Construction, a full-service construction firm, since 2000 and as the Founder and CEO of Southwestern Testing Laboratories, a geotechnical engineering and construction materials testing firm, since 2003. Ms. Acosta has served on the corporate boards of Magnolia Oil and Gas Corporation since 2017 and Veritex Holdings, Inc. since 2021. Prior board service includes ten years as a director of Energy Future Holdings Corporation, Legacy Texas Financial Group, N.A. from 2015 to 2019, and ONE Gas, Incorporated from July 2018 through February 2020. In addition, Governor Abbott appointed Ms. Acosta to several prominent positions: as one of three Co-Chairs of the 2023 Texas Inaugural Committee in November 2022, to the Texas Tech University Board of Regents for a six-year term in April 2021, to the Texas Higher Education Coordinating Board for a three-year term in

March 2016, and in March 2020 to the Strike Force to Open Texas for COVID-19. Ms. Acosta’s civic boards include the Communities Foundation of Texas, Junior League of Dallas Community Advisory Board, and the Dallas Citizens Council where she was recently named Chairman to serve from 2023 through 2026. Ms. Acosta graduated from Texas Tech University and completed the Harvard University Business School Corporate Governance Program.

Qualifications:

Ms. Acosta brings extensive experience in executive management, operations, safety, construction management and engineering management. In addition, she has served on the boards of directors of other publicly traded and private companies, including oversight responsibilities on matters relating to executive compensation, corporate governance, and audit. Ms. Acosta currently serves on the Company’s Audit and Nominating & Governance Committees.

|

2024 Proxy Statement | 11 |

Table of Contents

PROPOSAL 1 – ELECTION OF DIRECTORS

|

Gavin R. Baiera |

Experience, Qualifications & Skills • Corporate Governance/Public Board Experience • Finance/Accounting • Industry Expertise • Strategy/Transactional • Human Capital Management/Diversity, Equity & Inclusion | |||

| Director Since: 2016 Age: 48

|

Board Committees: Social Responsibility & Compensation, Sustainability & Risk

| |||

Biographical Information:

Mr. Baiera has served on the Board since 2016. Mr. Baiera is a senior managing director, partner, and portfolio manager at Centerbridge Partners, L.P, which is a multi-strategy private investment firm focused on private equity, credit, and real estate, and the CEO of Overland Advantage, a business development company focused on direct lending. He previously served as a managing director at Angelo, Gordon & Co., where he was the global head of the firm’s corporate credit activities and portfolio manager for its distressed funds. Mr. Baiera was also a member of the firm’s executive committee. Prior to joining Angelo, Gordon in 2008, Mr. Baiera was the co-head of the strategic finance group at Morgan Stanley, which was responsible for all origination, underwriting, and distribution of restructuring transactions. Prior to that, Mr. Baiera worked at General Electric Capital Corporation, concentrating on underwriting and investing in restructuring

transactions. Mr. Baiera has served on numerous boards of directors including, most recently, MACH Gen, Orbitz Worldwide, and Travelport Worldwide. He received a bachelor’s degree in economics and finance from Fairfield University and a Master of Business Administration from the University of Southern California.

Qualifications:

Mr. Baiera has extensive experience in corporate finance and strategic business planning activities. In addition, he has served on the boards of directors of other publicly traded and private companies, including oversight responsibilities on matters relating to executive compensation and compensation strategy, making him a valuable member of the Board and the Social Responsibility & Compensation Committee and the Sustainability & Risk Committee.

| 12 | 2024 Proxy Statement |

|

Table of Contents

PROPOSAL 1 – ELECTION OF DIRECTORS

|

Paul M. Barbas |

Experience, Qualifications & Skills • Corporate Governance/Public Board Experience • Finance/Accounting • Industry Expertise • Public Company Executive • Risk Management/Compliance • Strategy/Transactional • Human Capital Management/Diversity, Equity & Inclusion | |||

| Director Since: 2018 Age: 67

|

Board Committees: Nominating & Governance (Chair), Nuclear Oversight

| |||

Biographical Information:

Mr. Barbas has served on the Board since 2018. Mr. Barbas previously served on the board of Dynegy from October 2012 until Dynegy’s merger with Vistra in April 2018 and joined the Board in conjunction with the Company’s acquisition of Dynegy. Mr. Barbas previously served as president and chief executive of DPL Inc. and its principal subsidiary, The Dayton Power and Light Company (DP&L), and he also served on the boards of DPL Inc. and DP&L. He also previously served as executive vice president and chief operating officer of Chesapeake Utilities Corporation, a diversified utility company engaged in natural gas distribution, transmission, and marketing, propane gas distribution and wholesale marketing, and other related services, and he was executive vice president of Allegheny Power. Mr. Barbas also served on the public boards of Pepco Holdings, Inc. and El Paso Electric, Inc. Mr. Barbas also serves as a volunteer at the Scorton Creek Game Farm, helping to maintain trails and conservation land overseen by the Massachusetts Division of Fisheries and Wildlife.

Mr. Barbas received a bachelor’s degree in economics from College of the Holy Cross and a Master of Business Administration in finance and marketing from the University of Massachusetts.

Qualifications:

Mr. Barbas brings extensive utility, management and oversight experience, having served in executive management positions with various utility and other companies. He also has a broad background in finance and marketing and brings a strong understanding of power operations and energy markets. In addition, he had oversight of information technology functions while at DPL and was responsible for several financial systems implementations during his career at GE. He also brings to the Board substantive knowledge about a variety of issues related to the Company’s business and currently serves as Chair of the Nominating & Governance Committee, where he contributes significantly to the oversight responsibilities and strategic direction of the Company’s corporate governance policies.

|

2024 Proxy Statement | 13 |

Table of Contents

PROPOSAL 1 – ELECTION OF DIRECTORS

|

James A. Burke President & Chief Executive Officer |

Experience, Qualifications & Skills • Corporate Governance/Public Board Experience • Finance/Accounting • Industry Expertise • Public Company Executive • Risk Management/Compliance • Strategy/Transactional • Climate Change and Sustainable Strategy/Policy • Human Capital Management/Diversity, Equity & Inclusion | |||

| Director Since: 2022 Age: 55

|

Board Committees: None

| |||

Biographical Information:

Mr. Burke has served as the President and Chief Executive Officer since August 1, 2022. Prior to his current role he served as President and Chief Financial Officer of the Company since December 2020. Mr. Burke previously served as Executive Vice President and Chief Operating Officer of the Company since October 2016. Prior to joining the Company, he served as Executive Vice President of Energy Future Holdings Corp. (the “Predecessor”) since February 2013 and President and Chief Executive of TXU Energy, a subsidiary of the Company, since August 2005. Previously, Mr. Burke was Senior Vice President Consumer Markets of TXU Energy. Mr. Burke started his career with Deloitte Consulting, and held a variety of roles with The Coca-Cola Company, Reliant Energy and Gexa Energy prior to TXU Energy. Mr. Burke served as the Chairman of the board of directors of Marucci Sports, a privately held business which was successfully sold to private equity in 2020. Mr. Burke is currently a board member of the Nuclear Energy Institute, the United Way Foundation of Metropolitan Dallas, Ursuline Academy of Dallas, Dallas

Citizens Council, and as an advisory board member for the Tulane University Energy Institute. Mr. Burke is a graduate of Tulane University, where he earned a bachelor’s degree in economics and a master’s of business administration in finance and general management. Mr. Burke is a licensed certified public accountant and has also earned the designation as a chartered financial analyst. In addition, Mr. Burke has completed the Massachusetts Institute of Technology Nuclear Reactor Technology Course.

Qualifications:

Mr. Burke’s 20 years of serving in various senior leadership positions with the Company brings to the Board significant knowledge and understanding of the Company’s assets and operations across its generation, nuclear, retail, and renewables businesses, including climate related risk management experience. The Board believes that Mr. Burke’s service as our CEO provides the Board with an important link with management and Mr. Burke’s valuable perspectives on the Company’s business, operations, and execution of its strategic plan.

| 14 | 2024 Proxy Statement |

|

Table of Contents

PROPOSAL 1 – ELECTION OF DIRECTORS

|

Lisa Crutchfield |

Experience, Qualifications & Skills • Corporate Governance/Public Board Experience • Finance/Accounting • Industry Expertise • Public Company Executive • Risk Management/Compliance • Strategy/Transactional • Climate Change and Sustainable Strategy/Policy | |||

| Director Since: 2020 Age: 61

|

Board Committees: Social Responsibility & Compensation (Chair)

| |||

Biographical Information:

Ms. Crutchfield has served on the Board since 2020. Ms. Crutchfield is managing principal of Hudson Strategic Advisers, LLC, an economic analysis and strategic advisory firm to the energy, utility and government sectors since 2012. Prior to launching this consulting practice, she served as Executive Vice President and Chief Regulatory, Risk and Compliance Officer for the U.K.-based National Grid plc, a global energy provider, from 2008 to 2012. Ms. Crutchfield also served on the board of National Grid USA as an executive director. She has served in executive roles as Senior Vice President of Regulatory and External Affairs at PECO, an Exelon Company, from 2003 to 2008, Vice President and General Manager at TIAA-CREF, and Vice President of Energy Policy and Strategy at Duke Energy Corporation from 1997 to 2000. Ms. Crutchfield was appointed to the Pennsylvania Public Utility Commission as Vice Chairman in 1993 and served until 1997, earning the designation as an expert in liberalizing the electric and gas markets. She began her career as a commercial and investment banker. Ms. Crutchfield currently serves on the boards of two other publicly traded companies, Fulton Financial Corporation since 2014 and Fortis Inc. since 2022, and previously served on the public board of Unitil

Corporation. Ms. Crutchfield earned a bachelor’s degree in economics and political science from Yale University and a Master of Business Administration with distinction in finance from Harvard Business School. Ms. Crutchfield is also a Leadership Fellow of the National Association of Corporate Directors (NACD).

Qualifications:

Ms. Crutchfield brings extensive experience leading corporate teams and has extensive knowledge of the financial industry and business practices with expertise in risk mitigation, compliance, and regulatory matters. As demonstrated by her officer roles at Duke Energy Corporation and Exelon and as utility executive at National Grid, she has extensive experience in sustainability. In addition, she has written state and federal legislation relating to renewable energy regulation, and has advised numerous utilities on the long-term implications of a competitive energy market in their respective states. She has served on the boards of several other publicly traded and privately held companies including on their compensation, governance, and risk committees. Ms. Crutchfield currently serves as the Chair of the Social Responsibility & Compensation Committee.

|

2024 Proxy Statement | 15 |

Table of Contents

PROPOSAL 1 – ELECTION OF DIRECTORS

|

Julie A. Lagacy |

Experience, Qualifications & Skills • Corporate Governance/Public Board Experience • Finance/Accounting • Public Company Executive • Risk Management/Compliance • Strategy/Transactional • Climate Change and Sustainable Strategy/Policy • Human Capital Management/Diversity, Equity & Inclusion | |||

| Director Since: 2023 Age: 57

|

Board Committees: Social Responsibility & Compensation, Sustainability & Risk

| |||

Biographical Information:

Ms. Lagacy has served on the Board since 2023. Ms. Lagacy was chief sustainability and strategy officer at Caterpillar Inc., a manufacturer of construction and mining equipment, diesel and natural gas engines, industrial gas turbines and diesel-electric locomotives, from November 2021 through January 2023. Ms. Lagacy began her career with Caterpillar in 1988 and served as product and commercial manager from 1999 until 2004, human resources manager from 2004 until 2006, senior business resource manager (Global Mining) from 2006 until 2012, and chief financial officer (Global Mining) from 2012 until 2013. From 2013 until 2014, Ms. Lagacy served as vice president (Financial Services Division) and served as vice president of global information services and chief information officer from 2014 until 2020. Before being named Caterpillar’s chief sustainability and strategy officer, she served as vice president of enterprise strategy from 2020 to October 2021. Ms. Lagacy previously served on the public board of RPM International Inc., provider of specialty coatings, sealants, building materials and related services, from 2017 to 2023. In addition, Ms. Lagacy will stand for

election to the board of directors of Nutrien Ltd., a leading provider of crop inputs and services, at Nutrien’s annual meeting of shareholders in May 2024. Ms. Lagacy also serves on the board of the Illinois Cancer Care Charitable Foundation. She earned dual bachelor’s degrees in Management and Economics from Illinois State University, an M.B.A. degree from Bradley University, a Certificate in Cybersecurity Oversight from Carnegie Mellon University’s Software Engineering Institute, and is a Certified Management Accountant.

Qualifications:

Ms. Lagacy brings extensive executive management experience, including financial, strategic, technology, cybersecurity, ESG, sustainability, management development, acquisitions, and capital allocation. Specifically with regard to cybersecurity matters, Ms. Lagacy earned a Certificate in Cybersecurity Oversight from Carnegie Mellon University’s Software Engineering Institute. She currently serves on the Social Responsibility & Compensation Committee and the Sustainability & Risk Committee.

| 16 | 2024 Proxy Statement |

|

Table of Contents

PROPOSAL 1 – ELECTION OF DIRECTORS

|

John W. (Bill) Pitesa |

Experience, Qualifications & Skills • Industry Expertise • Risk Management/Compliance | |||

| Director Since: 2024 Age: 66

|

Board Committees: Nuclear Oversight (Chair)

| |||

Biographical Information:

Mr. Pitesa was appointed to the Board in March 2024. Mr. Pitesa has spent his entire career in the nuclear industry. From 2020 until the Merger, Mr. Pitesa served on the board of directors of Energy Harbor where he was the chair of the Nuclear Committee of Energy Harbor. He retired in 2018 after working at the Nuclear Energy Institute (NEI) as chief nuclear officer. Previously, Mr. Pitesa served as chief nuclear officer for Duke Energy where he first joined in 1980 and served in numerous management positions, including serving two years as a loaned employee to the Institute of Nuclear Power Operations (INPO). During that time, he also supported the International Atomic Energy Agency (IAEA) and the World Association of Nuclear Operators (WANO) by serving on nuclear plant review teams. Mr. Pitesa holds a Bachelor of Science degree in

electrical engineering from Auburn University. He is a registered professional engineer in North Carolina and a graduate of Harvard’s Advanced Management Program.

Qualifications:

Mr. Pitesa, through his 38 years of experience at Duke Energy, including executive experience as chief nuclear officer, brings expertise in the nuclear energy field and in leading highly-technical organizations through complex tactical and strategic decisions. His specific experiences integrating the Progress Energy and Duke Energy nuclear organizations and processes into a single, high performing nuclear fleet and serving on the Energy Harbor board of directors make him uniquely well-qualified to provide oversight to our nuclear operations and the integration of the Energy Harbor nuclear plants as Chair of our Nuclear Oversight Committee.

|

2024 Proxy Statement | 17 |

Table of Contents

PROPOSAL 1 – ELECTION OF DIRECTORS

|

John R. (J. R.) Sult |

Experience, Qualifications & Skills • Corporate Governance/Public Board Experience • Finance/Accounting • Industry Expertise • Public Company Executive • Risk Management/Compliance • Strategy/Transactional • Human Capital Management/Diversity, Equity & Inclusion | |||

| Director Since: 2018 Age: 64

|

Board Committees: Audit (Chair)

| |||

Biographical Information:

Mr. Sult has served on the Board since 2018. Mr. Sult previously served on the board of Dynegy and joined the board in conjunction with the company’s acquisition of Dynegy. Previously, he was executive vice president and chief financial officer of Marathon Oil Corporation and was executive vice president and chief financial officer of El Paso Corporation prior to that. Prior to joining El Paso, Mr. Sult served as vice president and controller of Halliburton Energy Services. Prior to joining Halliburton, Mr. Sult was an audit partner with Arthur Andersen LLP. Mr. Sult currently serves on the board and is chair of the nominating and corporate governance committee of Sitio Royalties, Corp., a public company, joining the board following the company’s merger with Brigham Minerals, Inc., a public company, where he previously served on the board. In addition, Mr. Sult previously served as a director of Jagged Peak Energy, Inc., a public company, as well as the general partner of El Paso Pipeline Partners, L.P., a public company. Mr. Sult serves as a member of the Advisory Board of Boys and Girls Country of Houston, Inc., a non-profit entity, previously serving as a member of the Executive Committee of the Board of

Directors and Chairman of the Strategic Planning Committee. Mr. Sult received a bachelor’s degree with special attainments in commerce from Washington & Lee University and is a licensed certified public accountant in the State of Texas.

Qualifications:

Mr. Sult, through his experience in senior executive financial positions with large public companies, brings significant knowledge of accounting, capital structures, finance, financial reporting, strategic planning and forecasting to the Board. Mr. Sult has extensive knowledge of the energy industry. As a CFO, he also has had leadership responsibility for the information technology organization in a Fortune 500 company. Further, he has served as an audit partner at a major accounting firm, which, in addition to his other experience, qualifies him as an “audit committee financial expert.” He currently serves as the Chair of the Audit Committee, where he contributes significantly to the oversight of the integrity of our financial statements, internal controls and ethics and compliance functions.

| 18 | 2024 Proxy Statement |

|

Table of Contents

CORPORATE GOVERNANCE

DIRECTOR QUALIFICATIONS AND NOMINATION PROCESS

Director Qualifications

In addition to each director’s individual qualifications, including his or her knowledge, skills and experience mentioned above, the Company believes that each of our directors possesses high ethical standards, acts with integrity, and exercises careful judgment. Each is committed to employing his or her skills and abilities in the long-term interests of the Company and our stockholders. Collectively, our directors are knowledgeable and experienced in business, governmental, and civic endeavors, further qualifying them for service as members of the Board.

Any director nominee is evaluated in accordance with the qualifications set forth in our Corporate Governance Guidelines and the other characteristics that we value as part of our corporate culture. We require that directors possess the highest personal and professional ethics, integrity and values and be committed to representing the long-term interests of our stockholders at large. They must also have an inquisitive and objective perspective, practical wisdom, mature judgment and sufficient personal resources such that any director compensation to be received from the Company would not be sufficiently meaningful to impact their judgment in reviewing matters coming before the Board. Finally, they must be able to work compatibly with the other members of the Board and otherwise have the experience and skills necessary to enable them to serve as productive Board members. Directors also must be willing to devote sufficient time to carrying out their fiduciary duties and other responsibilities effectively and should be committed to serve on the Board for an extended period of time. For additional information, please read our Corporate Governance Guidelines.

In connection with the director nominations for the 2024 Annual Meeting, the Nominating & Governance Committee also considered the director nominees’:

| (1) | knowledge of corporate governance issues, coupled with an appreciation of their practical application; |

| (2) | service as a director or executive of a publicly traded company and other board experience; |

| (3) | experience in the energy and utility industry and understanding of the energy and commodity markets; |

| (4) | finance and accounting expertise, including audit, internal controls, risk management and cybersecurity experience; |

| (5) | experience in and knowledge of commercial and market risk assessment and management; |

| (6) | knowledge in the areas of laws and regulations related to environmental, health, safety, regulatory and other key industry issues; |

| (7) | strategic planning skills; and |

| (8) | experience in transactional and capital markets matters. |

Each director nominee brings a strong and unique background and set of skills to the Board, giving the Board as a whole competence and experience in a wide variety of areas, including energy, nuclear generation, wholesale power generation and marketing, commodities, risk management, strategic planning, legal, corporate governance and board service, executive management, climate change and sustainability strategy, regulatory and policy development, accounting and finance, and operations. For information concerning each director’s various qualifications, attributes, skills and experience considered important by the Board in determining that such nominee should serve as a director, as well as each nominee’s principal occupation, directorships and additional biographical information, please read the section entitled “Director Skills and Experience” on page 8 and “Director Nominee Biographies” beginning on page 9.

Director Selection Process

The Nominating & Governance Committee is responsible for identifying individuals qualified to become Board members and recommending to the Board the nominees for election as directors of the Company. The Nominating & Governance Committee’s policy is to consider recommendations for such director nominees, including those submitted by current directors, members of management, or by stockholders, on the bases described below. In this regard, stockholders may recommend director nominees by writing to the Nominating & Governance Committee c/o the Corporate Secretary of the Company, 6555 Sierra Drive, Irving, Texas 75039. Any such recommendations from stockholders received by the Corporate Secretary of the Company will be promptly provided to the Nominating &

|

2024 Proxy Statement | 19 |

Table of Contents

CORPORATE GOVERNANCE

Governance Committee. Recommendations to be considered by the Nominating & Governance Committee for the 2025 Annual Meeting should be submitted as described under “Advance Notice Stockholder Proposals or Nominations” on page 99.

The Nominating & Governance Committee annually reviews the composition of the Board as a whole and recommends, if necessary, measures to be taken so that the Board reflects the appropriate balance of knowledge, experience, skills, expertise and diversity required for the Board as a whole and contains at least the minimum number of independent directors required by applicable laws and regulations.

In anticipation of the acquisition of Energy Harbor, the Nominating & Governance Committee undertook a detailed and thorough director nomination process and engaged the assistance of a third party executive search firm to identify, interview, and evaluate potential director candidates specifically with nuclear industry experience who also had executive and/or public company/corporate board experience. Following this process, the Nominating & Governance Committee recommended the appointment of Mr. Pitesa to the Board and the conversion of the Company’s existing Nuclear Oversight Advisory Board to a standing committee of the Board, renamed the Nuclear Oversight Committee, with Mr. Pitesa serving as Chair. Mr. Pitesa’s leadership, experience, and expertise in the nuclear energy field will be valuable to the Board’s continued oversight of the safe and efficient operation of the Company’s expanded nuclear fleet.

Identification of Candidates and Diversity

The Nominating & Governance Committee identifies director nominees in various ways. In identifying and evaluating director nominees, the Nominating & Governance Committee may consult with members of the Board, Company management, consultants, and other individuals likely to possess an understanding of the Company’s business and knowledge of suitable candidates. In making its recommendations, the Nominating & Governance Committee assesses the requisite skills and qualifications of director nominees and the composition of the Board as a whole in the context of the Board’s criteria and needs.

Such assessments will be consistent with the Board’s criteria for membership, including: (i) not less than a majority of directors shall satisfy the New York Stock Exchange’s (“NYSE”) independence requirements; (ii) all directors shall possess judgment, character, expertise, skills and knowledge useful to the oversight of the Company’s business; (iii) business, governmental, civic or other relevant experience; and (iv) consideration will be given to the extent to which the interplay of the director nominee’s qualifications and diversity of cultural background, gender, experience and viewpoints with those of other Board members will build a Board that is effective, in light of the Company’s business and structure. The Nominating & Governance Committee does not assign specific weights to particular criteria, and no particular criterion is necessarily applicable to all Board members. The Nominating & Governance Committee will consider diversity criteria in the context of the perceived needs of the Board as a whole and seek to achieve a diversity of backgrounds and perspectives on the Board. The Board is asked to assess whether the Board is appropriately diverse as part of the annual evaluation of the Board.

| 20 | 2024 Proxy Statement |

|

Table of Contents

CORPORATE GOVERNANCE

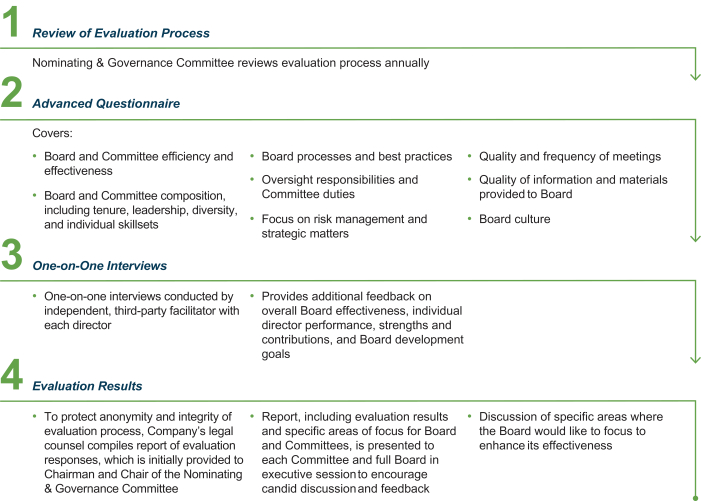

Board of Directors and Committee Evaluation Process

The Board recognizes that a rigorous evaluation process is an essential component of strong corporate governance practices and promoting ongoing Board and Committee effectiveness. Consistent with best practice, the Company’s Corporate Governance Guidelines and each of the Committees’ Charters, the Nominating & Governance Committee oversees the annual evaluation of the performance of the Board and the Committees, with the Chairman and the Chair of the Nominating & Governance Committee maintaining a substantial role in facilitating discussion among the Board and the Committees. For the 2023 evaluation year, the Nominating & Governance Committee incorporated individual director interviews facilitated by a third party which are designed to assess overall Board effectiveness as well as individual director performance. In 2023, 100% of director nominees serving on the Board in 2023 participated in the Board and Committee evaluation process.

| Feedback Incorporated

After receiving feedback from the Chairman and Chair of the Nominating & Governance Committee, the Corporate Secretary monitors any action items resulting from the Board and Committee discussions, and utilizes the results to facilitate, together with the CEO and executive management, workplans, director succession plans, committee leadership and membership refreshment plans, and board candidate evaluations for the upcoming year and thereafter. |

|

2024 Proxy Statement | 21 |

Table of Contents

CORPORATE GOVERNANCE

CORPORATE GOVERNANCE OVERVIEW

The following summarizes key elements of our corporate governance practices:

| Board Independence |

• 9 out of 10 directors standing for election are independent (CEO is sole member of management serving on the Board)

• All members of the Audit, Social Responsibility & Compensation, Nominating & Governance, Sustainability & Risk, and Nuclear Oversight Committees are independent

• Separate Chairman and CEO roles

• Outside board service requires approval from the Nominating & Governance Committee and a limit on the number of total boards on which any director may serve concurrently to two other public company boards, or one other public company board in the case of the CEO

• Personal loans or other extensions of credit to or for any director or executive officer are prohibited

| |

| Director Elections |

• Annual election of directors

• Majority voting in uncontested elections and plurality voting in contested elections, with director resignation policy

• If a director does not receive the vote of a majority of votes cast, the director is obligated to promptly tender his or her resignation to the Nominating & Governance Committee, which will become effective upon acceptance by the Board in its sole discretion within 90 days following certification of the election results

| |

| Board Best Practices |

• Nominating & Governance Committee annually reviews composition of the Board, ensuring the Board reflects an appropriate balance of knowledge, experience, diversity, skills and expertise

• Routine assessment by Nominating & Governance Committee of overall corporate governance profile and potential enhancements thereto

• Annual Board and committee self-evaluation process, including individual director interviews and assessments facilitated by a third party to further assess Board effectiveness as well as individual director performance, with identification and tracking of specific follow up actions for continuous improvement

• Access to and engagement of outside advisors and consultants to assist the Board and the Committees in the performance of their duties, as appropriate

• Director onboarding and continuing education program, including Company site visits and information sessions with Company management

• Tracking of Board education programs attended by directors with a recommendation that each director attend at least one Board education program every two years

| |

| Regular Board Engagement |

• Formal Board and Committee meetings each quarter, including an annual strategic planning meeting, and frequent telephonic meetings on emerging matters in the interim

• Committee Chairs have regular engagement with management liaison (e.g., Audit Chair with Chief Financial Officer (“CFO”), Chief Accountant and Controller, and Vice President of Internal Audit)

• Regular executive sessions of independent directors

| |

| Board Oversight |

• Sustainability Governance Framework ensuring oversight over ESG matters and initiatives

• Board oversight of cybersecurity risk and review of political and lobbying contributions

• Ongoing succession planning for the CEO and other senior management

|

| 22 | 2024 Proxy Statement |

|

Table of Contents

CORPORATE GOVERNANCE

| Stock Ownership Requirements |

• Prohibitions against directors and executive officers:

- holding our securities in a margin account or pledging our securities; or

- engaging in any hedging transaction with respect to our securities held by them, without General Counsel approval (as further described under “Insider Trading Policy and Prohibition on Hedging and Pledging” on page 41 of this Proxy Statement)

• Minimum stock ownership requirements for our directors and executive officers

• Clawback policy relating to performance-based incentive compensation of our executives following a restatement that impacts the achievement of performance targets relating to that compensation

| |

| Stockholder and Stakeholder Engagement |

• Annual advisory vote to approve executive compensation

• Regular, transparent communication with our stockholders and other stakeholders

• Our investor relations team regularly meets with stockholders, prospective stockholders and investment analysts, and frequently includes our CEO, CFO, or other members of management; the Chairman of the Board also periodically attends meetings with stockholders

• Members of our management team regularly engage with stockholders and other stakeholders to discuss our sustainability strategy and initiatives, corporate governance, and executive compensation practices, Company culture, human capital management, and to solicit feedback on these and a variety of other topics of interest

• Directors expected to attend all annual stockholder meetings absent unusual circumstances

|

DIRECTOR INDEPENDENCE

We follow the NYSE’s requirements for determining director independence. Based on the application of these standards and pursuant to the requirements of the NYSE and the SEC, the Board has determined that:

| (i) | The following directors are independent: Mses. Ackermann, Acosta, Crutchfield, and Lagacy and Messrs. Baiera, Barbas, Helm, Pitesa, and Sult. |

| (ii) | The Board has determined that each of Ms. Acosta and Mr. Sult qualify as an “Audit Committee Financial Expert” as defined in Item 401(h) of Regulation S-K promulgated under the Securities Act. |

| (iii) | The Board has determined that each of Ms. Acosta and Mr. Sult, members of the Audit Committee, possesses the necessary level of financial literacy required to enable each of them to serve effectively as an Audit Committee member and satisfies the heightened independence requirements under NYSE and SEC requirements for Audit Committee members. |

| (iv) | The Board has determined that each of Mses. Crutchfield and Lagacy and Mr. Baiera, members of the Social Responsibility & Compensation Committee, satisfies the heightened independence requirements under NYSE and SEC standards for compensation committee members. |

| (v) | Messrs. Ferraioli and Hunter were also determined to be independent and qualified under the NYSE rules to serve on their respective committees in 2023 through the Annual Meeting at which time they will not be standing for reelection. Following the effective date of the resignations of Messrs. Ferraioli and Hunter, the Nominating & Governance Committee will assess committee membership to appoint qualified independent directors to fill the vacancies on the committees, including the Audit Committee. |

BOARD LEADERSHIP STRUCTURE

As set forth in our Corporate Governance Guidelines, the Board does not have a policy with respect to the separation of the offices of the Chairman and CEO. The Board believes that this issue is part of the succession planning process and that it is in the best interests of the Company for the Board to make a determination regarding this issue any time it elects a new CEO and thereafter as deemed appropriate.

|

2024 Proxy Statement | 23 |

Table of Contents

CORPORATE GOVERNANCE

During 2023, the Company maintained separate CEO and Chairman roles. The Company has determined this to be the appropriate leadership structure at this time to maintain independent Board leadership that can still benefit from the insight of our CEO. The Chairman, among other things, (a) exercises the rights and discharges the obligations of the Chairman as set forth in the Company’s Bylaws, including presiding at meetings of stockholders and the Board, (b) collaborates with the Board and the CEO on the schedule for Board meetings and agenda items, including gathering the Board’s input on agenda items and information needs associated with those agenda items, and approves meeting schedules, agendas and associated information sent to the Board, (c) establishes agendas for executive sessions of the Board, in consultation with the CEO, (d) presides at executive sessions of the Board and coordinates feedback to the CEO regarding issues discussed in executive session, (e) coordinates new director searches, in conjunction with the Nominating & Governance Committee and CEO, and presents candidates for consideration to the Nominating & Governance Committee and the Board, (f) serves as an information resource for other directors and acts as liaison between directors, committee chairs, and management, (g) develops a positive, collaborative relationship with the CEO, (h) if requested by major stockholders, is available for consultation and direct communication, and (i) performs such other duties and responsibilities as requested by the Board.

If a different determination is made in the future regarding the separation of the Chairman and CEO positions, such that the CEO is the Chairman, a Lead Director shall be elected by the non-management directors of the Board to: (i) serve as a liaison between the Chairman and the independent directors, (ii) lead executive sessions of the Board, (iii) have authority to call meetings of the independent directors, (iv) approve Board meeting schedules, agendas and associated information sent to the Board, (v) lead the Board in discussions concerning the CEO’s employment and performance and CEO succession, (vi) if requested by major stockholders, be available for consultation and direct communication, and (vii) perform such other duties and responsibilities as requested by the Board.

MEETINGS OF THE BOARD AND ITS COMMITTEES

The standing Committees of the Board and the current membership of each Committee are shown below. The Nominating & Governance Committee reviews the composition of the committees at least annually and determines if any changes should be recommended to the Board.

Meeting Attendance and Executive Sessions

During the 2023 fiscal year, each director attended more than 75% of the total number of Board meetings and meetings of the Committees on which they served. In accordance with our Corporate Governance Guidelines, directors are expected to attend all scheduled Board meetings and meetings of the Committees of the Board on which they serve. In addition, directors are expected to attend all other Committee meetings when possible. Non-management directors meet regularly in executive sessions, and the Chairman presides over those executive sessions.

As detailed in our Corporate Governance Guidelines, Board members are expected to attend each annual meeting of stockholders absent unusual circumstances. All eleven directors that were members of the Board at the time attended the 2023 annual meeting of stockholders.

| 24 | 2024 Proxy Statement |

|

Table of Contents

CORPORATE GOVERNANCE

Committee Membership, Independence, and Qualifications

The Nominating & Governance Committee recommends committee memberships and chairpersons to the Board and considers periodically rotating directors among the committees. The current membership of the Committees of the Board with respect to the director nominees is shown in the table below.

| Audit Committee |

Social Responsibility & Compensation Committee |

Nominating & Governance Committee |

Sustainability & Risk Committee |

Nuclear Oversight Committee | ||||||

| Independent Directors: |

|

|

|

|

| |||||

| Hilary E. Ackermann |

|

|

|

Chair | Member | |||||

| Arcilia C. Acosta(1) |

Member |

|

Member |

|

| |||||

| Gavin R. Baiera |

|

Member |

|

Member |

| |||||

| Paul M. Barbas |

|

|

Chair |

|

Member | |||||

| Lisa Crutchfield |

|

Chair |

|

|

| |||||

| Brian K. Ferraioli(1)(2) |

Member |

|

Member |

|

| |||||

| Scott B. Helm(3) |

|

|

|

|

| |||||

| Jeff D. Hunter(2) |

|

Member |

|

Member |

| |||||

| Julie A. Lagacy |

|

Member |

|

Member |

| |||||

| John W. (Bill) Pitesa(4) |

|

|

|

|

Chair | |||||

| John R. Sult(1) |

Chair |

|

|

|

| |||||

| Employee Directors: |

|

|

|

|

| |||||

| James A. Burke |

|

|

|

|

| |||||

| Number of Meetings in 2023 |

5 | 6 | 3 | 4 | —(5) | |||||

| (1) | “Audit committee financial expert,” as defined by the SEC and NYSE, and as determined by the Board. Background information on each audit committee financial expert can be found in the director nominee biographies beginning on page 9. |

| (2) | Director is not standing for re-election at the 2024 Annual Meeting. |

| (3) | Mr. Helm serves as Chairman of the Board. |

| (4) | Mr. Pitesa was appointed to the Board in March 2024. |

| (5) | The Nuclear Oversight Committee was established as a standing Board committee in March 2024. The Nuclear Oversight Advisory Board, which reported to the Board on nuclear oversight matters until March 2024, met three times in 2023, including one meeting at our Comanche Peak Nuclear Power Plant. |

|

2024 Proxy Statement | 25 |

Table of Contents

CORPORATE GOVERNANCE

Board Committees

The Board has the following five standing Committees: (i) Audit, (ii) Social Responsibility & Compensation, (iii) Nominating & Governance, (iv) Sustainability & Risk, and (v) Nuclear Oversight (each, a “Committee”). The functions of each Committee are described below.

|

Audit Committee

Members: John R. Sult (Chair) Arcilia C. Acosta Brian K. Ferraioli |

Primary Responsibilities: Appoints, retains, oversees, evaluates and compensates the independent auditors; reviews the annual audited and quarterly consolidated financial statements; reviews significant matters regarding accounting principles and financial statement presentations; oversees the performance of the Company’s internal audit function; oversees the system, and annual audit, of internal controls over financial reporting; oversees the system of internal controls over accounting, legal and regulatory compliance, and ethics (including reviewing the Company’s Code of Conduct at least annually).

| |

|

The Audit Committee is a separately designated standing audit committee as required by SEC regulations and NYSE rules. For more information about the Audit Committee please see the Audit Committee Report on page 89.

| ||

|

Nominating & Governance Committee

Members: Paul M. Barbas (Chair) Arcilia C. Acosta Brian K. Ferraioli |

Primary Responsibilities: Reviews and recommends director candidates to the Board for election at each annual meeting of stockholders, periodically reviews the Corporate Governance Guidelines and recommends changes to the Board, reviews and recommends Committee composition and Chairs and recommends changes to the Board and provides guidance to the Board with respect to governance related matters.

The Nominating & Governance Committee, among its other responsibilities, (i) identifies individuals qualified to become directors and recommends to the Board the nominees to

| |

| stand for election as directors; (ii) oversees and assumes a leadership role in the governance of the Company including recommending periodic updates to the Corporate Governance Guidelines for the Board’s consideration; (iii) participates with the Chairman in the Board’s annual evaluation of its performance and of the Committees; (iv) recommends to the Board the director nominees for each annual stockholder meeting and for each Committee; and (v) oversees the orientation process for new directors and ongoing education for directors.

| ||

|

Social Responsibility & Compensation Committee

Members: Lisa Crutchfield (Chair) Gavin R. Baiera Jeff D. Hunter Julie A. Lagacy |

Primary Responsibilities: Reviews and oversees the Company’s overall compensation philosophy, oversees the development and implementation of compensation policies and programs aligned with the Company’s business strategy, and reviews and oversees the Company’s policies and practices related to human resources, DEI, talent management, culture and corporate citizenship.

With respect to compensation, the Social Responsibility & Compensation Committee (i) reviews and approves corporate goals and objectives relevant to the compensation of the CEO, evaluates the CEO’s performance in light of those goals and objectives, and | |

| determines and recommends to the Board the CEO’s compensation based on this evaluation; (ii) oversees the evaluation of executive officers (and other senior officers and key employees), other than the CEO, and reviews, determines and approves their compensation levels; (iii) oversees and makes recommendations to the Board with respect to the adoption, amendment or termination of incentive compensation, and equity-based and other executive compensation and benefits plans, policies and practices; (iv) reviews and discusses with the Board executive management succession planning; (v) makes recommendations to the Board with respect to the compensation of the Company’s outside directors; and (vi) produces the Social Responsibility & Compensation Committee’s report on executive compensation as required by the SEC to be included in the Company’s annual proxy statement.

With respect to social responsibility, the Social Responsibility & Compensation Committee (i) oversees and monitors the Company’s culture and core principles, including periodically reviewing employee engagement; (ii) oversees and monitors the Company’s strategies, initiatives, and programs relating to human capital management and talent retention; (iii) reviews the Company’s DEI philosophy, commitment, results, and effectiveness including programs relating to employees, community, and suppliers; and (iv) reviews the Company’s practices and strategies to further its corporate citizenship, including corporate social responsibility initiatives in support of charitable and community service organizations.

| ||

| 26 | 2024 Proxy Statement |

|

Table of Contents

CORPORATE GOVERNANCE

|

Sustainability & Risk Committee

Members:

Hilary E. Ackermann (Chair) Gavin R. Baiera Jeff D. Hunter Julie A. Lagacy |

Primary Responsibilities: With respect to risk, assists the Board in fulfilling its responsibilities with respect to (i) the oversight of the enterprise risk management process, including coordination, where necessary, with other Committees; (ii) the assessment of certain enterprise risks; and (iii) the review and assessment of market, commercial and risk management matters of the Company.

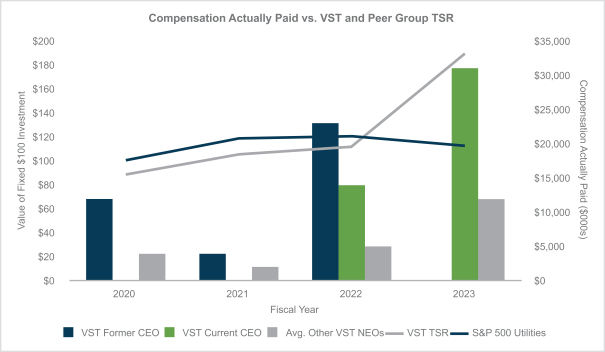

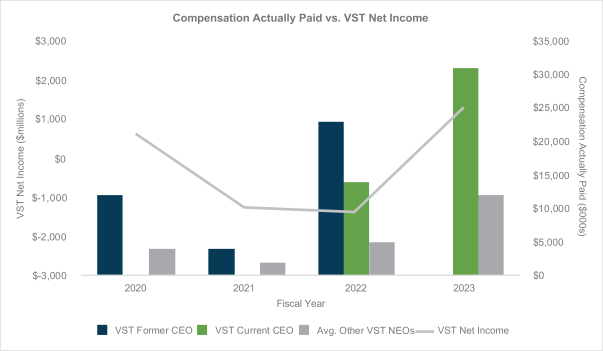

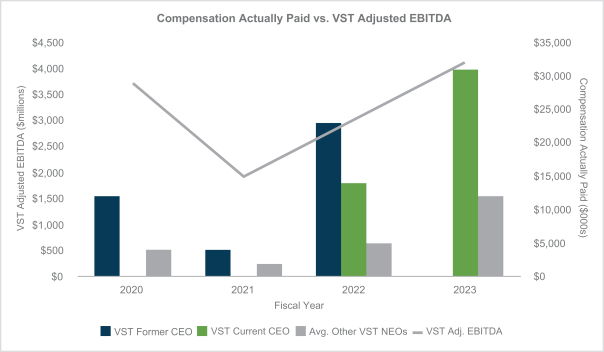

With respect to sustainability, the Committee: (i) reviews and discusses with management the Company’s strategies, policies, and practices to assist in addressing public sentiment and shaping policy to manage the Company’s sustainability efforts; (ii) at least annually, reviews and discusses with management the Company’s | |