false2022FY000169278711111P1Y0.500.500.1P3YP1Y00016927872022-01-012022-12-3100016927872022-06-30iso4217:USD0001692787us-gaap:CommonClassAMember2023-02-28xbrli:shares0001692787us-gaap:CommonClassCMember2023-02-280001692787us-gaap:ServiceMember2022-01-012022-12-310001692787us-gaap:ServiceMember2021-01-012021-12-310001692787us-gaap:ServiceMember2020-01-012020-12-310001692787us-gaap:ProductMember2022-01-012022-12-310001692787us-gaap:ProductMember2021-01-012021-12-310001692787us-gaap:ProductMember2020-01-012020-12-310001692787us-gaap:ProductAndServiceOtherMember2022-01-012022-12-310001692787us-gaap:ProductAndServiceOtherMember2021-01-012021-12-310001692787us-gaap:ProductAndServiceOtherMember2020-01-012020-12-3100016927872021-01-012021-12-3100016927872020-01-012020-12-31iso4217:USDxbrli:shares0001692787srt:AffiliatedEntityMember2022-01-012022-12-310001692787srt:AffiliatedEntityMember2021-01-012021-12-310001692787srt:AffiliatedEntityMember2020-01-012020-12-3100016927872022-12-3100016927872021-12-310001692787us-gaap:CommonClassAMember2021-12-310001692787us-gaap:CommonClassAMember2022-12-310001692787us-gaap:CommonClassCMember2022-12-310001692787us-gaap:CommonClassCMember2021-12-310001692787apa:ApacheMidstreamAndTitusMembersrt:AffiliatedEntityMember2022-12-310001692787apa:ApacheMidstreamAndTitusMembersrt:AffiliatedEntityMember2021-12-3100016927872020-12-3100016927872019-12-310001692787apa:AltusMidstreamLPMember2022-01-012022-12-310001692787apa:AltusMidstreamLPMember2021-01-012021-12-310001692787apa:AltusMidstreamLPMember2020-01-012020-12-310001692787us-gaap:RedeemablePreferredStockMember2019-12-310001692787apa:RedeemableCommonStockMember2019-12-310001692787us-gaap:CommonStockMemberus-gaap:CommonClassAMember2019-12-310001692787us-gaap:CommonClassCMemberus-gaap:CommonStockMember2019-12-310001692787us-gaap:AdditionalPaidInCapitalMember2019-12-310001692787us-gaap:RetainedEarningsMember2019-12-310001692787apa:RedeemableCommonStockMember2020-01-012020-12-310001692787us-gaap:CommonClassCMemberus-gaap:CommonStockMember2020-01-012020-12-310001692787us-gaap:RetainedEarningsMember2020-01-012020-12-310001692787us-gaap:RedeemablePreferredStockMember2020-12-310001692787apa:RedeemableCommonStockMember2020-12-310001692787us-gaap:CommonStockMemberus-gaap:CommonClassAMember2020-12-310001692787us-gaap:CommonClassCMemberus-gaap:CommonStockMember2020-12-310001692787us-gaap:AdditionalPaidInCapitalMember2020-12-310001692787us-gaap:RetainedEarningsMember2020-12-310001692787apa:RedeemableCommonStockMember2021-01-012021-12-310001692787us-gaap:CommonClassCMemberus-gaap:CommonStockMember2021-01-012021-12-310001692787us-gaap:RetainedEarningsMember2021-01-012021-12-310001692787us-gaap:RedeemablePreferredStockMember2021-12-310001692787apa:RedeemableCommonStockMember2021-12-310001692787us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-12-310001692787us-gaap:CommonClassCMemberus-gaap:CommonStockMember2021-12-310001692787us-gaap:AdditionalPaidInCapitalMember2021-12-310001692787us-gaap:RetainedEarningsMember2021-12-310001692787us-gaap:RedeemablePreferredStockMember2022-01-012022-12-310001692787us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-01-012022-12-310001692787us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001692787apa:RedeemableCommonStockMember2022-01-012022-12-310001692787us-gaap:CommonClassCMemberus-gaap:CommonStockMember2022-01-012022-12-310001692787us-gaap:RetainedEarningsMember2022-01-012022-12-310001692787us-gaap:CommonClassAMember2022-01-012022-12-310001692787us-gaap:RedeemablePreferredStockMember2022-12-310001692787apa:RedeemableCommonStockMember2022-12-310001692787us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-12-310001692787us-gaap:CommonClassCMemberus-gaap:CommonStockMember2022-12-310001692787us-gaap:AdditionalPaidInCapitalMember2022-12-310001692787us-gaap:RetainedEarningsMember2022-12-310001692787apa:AltusMidstreamLPMember2022-02-220001692787us-gaap:CommonClassCMember2022-02-220001692787us-gaap:CommonClassAMember2022-02-220001692787apa:BCPRaptorHoldcoLLCMember2022-02-22xbrli:pure0001692787apa:ApacheMidstreamLLCMember2022-02-2200016927872022-02-220001692787us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-06-082022-06-080001692787us-gaap:CommonClassCMemberus-gaap:CommonStockMember2022-06-082022-06-08apa:power_generatorapa:Segment0001692787us-gaap:CustomerConcentrationRiskMemberapa:CustomerOneMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310001692787us-gaap:CustomerConcentrationRiskMemberapa:CustomerOneMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310001692787us-gaap:CustomerConcentrationRiskMemberapa:CustomerOneMemberus-gaap:SalesRevenueNetMember2020-01-012020-12-310001692787us-gaap:CustomerConcentrationRiskMemberapa:CustomerTwoMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310001692787us-gaap:CustomerConcentrationRiskMemberapa:CustomerTwoMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310001692787us-gaap:CustomerConcentrationRiskMemberapa:CustomerTwoMemberus-gaap:SalesRevenueNetMember2020-01-012020-12-310001692787us-gaap:CustomerConcentrationRiskMemberapa:CustomerThreeMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310001692787us-gaap:CustomerConcentrationRiskMemberapa:CustomerThreeMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310001692787us-gaap:CustomerConcentrationRiskMemberapa:CustomerThreeMemberus-gaap:SalesRevenueNetMember2020-01-012020-12-310001692787apa:CustomerFourMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310001692787apa:CustomerFourMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310001692787apa:CustomerFourMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2020-01-012020-12-310001692787apa:CustomerFiveMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310001692787apa:CustomerFiveMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310001692787apa:CustomerFiveMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2020-01-012020-12-310001692787apa:OtherCustomersMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310001692787apa:OtherCustomersMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310001692787apa:OtherCustomersMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2020-01-012020-12-310001692787us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310001692787us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310001692787us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2020-01-012020-12-310001692787us-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMemberapa:Customers14Member2022-01-012022-12-310001692787us-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMemberapa:Customers14Member2021-01-012021-12-310001692787us-gaap:CostOfGoodsProductLineMemberapa:FiveProducersMemberus-gaap:SupplierConcentrationRiskMember2022-01-012022-12-310001692787us-gaap:CostOfGoodsProductLineMemberapa:FiveProducersMemberus-gaap:SupplierConcentrationRiskMember2021-01-012021-12-310001692787us-gaap:CostOfGoodsProductLineMemberapa:ThreeProducersMemberus-gaap:SupplierConcentrationRiskMember2020-01-012020-12-310001692787us-gaap:BuildingMember2022-01-012022-12-310001692787us-gaap:GasGatheringAndProcessingEquipmentMember2022-01-012022-12-310001692787us-gaap:FurnitureAndFixturesMember2022-01-012022-12-310001692787us-gaap:VehiclesMember2022-01-012022-12-310001692787us-gaap:ComputerEquipmentMember2022-01-012022-12-310001692787us-gaap:CommonClassAMember2020-12-310001692787us-gaap:AccountingStandardsUpdate202108Member2022-01-010001692787apa:BCPAndBCPGPMember2022-12-310001692787apa:BCPAndBCPGPMember2022-02-220001692787apa:BCPAndBCPGPMember2022-01-012022-12-310001692787us-gaap:CorporateNonSegmentMember2021-01-012021-12-310001692787apa:BCPAndBCPGPMember2022-02-232022-12-310001692787apa:BCPAndBCPGPMember2021-01-012021-12-310001692787apa:GatheringAndProcessingServicesMember2022-01-012022-12-310001692787apa:GatheringAndProcessingServicesMember2021-01-012021-12-310001692787apa:GatheringAndProcessingServicesMember2020-01-012020-12-310001692787apa:NaturalGasNGLsAndCondensateSalesMember2022-01-012022-12-310001692787apa:NaturalGasNGLsAndCondensateSalesMember2021-01-012021-12-310001692787apa:NaturalGasNGLsAndCondensateSalesMember2020-01-012020-12-310001692787apa:MinimumVolumeCommitmentsMember2022-01-012022-12-310001692787apa:MinimumVolumeCommitmentsMember2021-01-012021-12-310001692787apa:MinimumVolumeCommitmentsMember2020-01-012020-12-3100016927872023-01-012022-12-3100016927872024-01-012022-12-3100016927872025-01-012022-12-3100016927872026-01-012022-12-3100016927872027-01-012022-12-3100016927872028-01-012022-12-310001692787us-gaap:GasGatheringAndProcessingEquipmentMember2022-12-310001692787us-gaap:GasGatheringAndProcessingEquipmentMember2021-12-310001692787us-gaap:VehiclesMember2022-12-310001692787us-gaap:VehiclesMember2021-12-310001692787us-gaap:ComputerEquipmentMember2022-12-310001692787us-gaap:ComputerEquipmentMember2021-12-310001692787us-gaap:ConstructionInProgressMember2022-12-310001692787us-gaap:ConstructionInProgressMember2021-12-310001692787us-gaap:LandMember2022-12-310001692787us-gaap:LandMember2021-12-310001692787us-gaap:CustomerRelationshipsMember2022-12-310001692787us-gaap:CustomerRelationshipsMember2021-12-310001692787apa:RightOfWayAssetsMember2022-12-310001692787apa:RightOfWayAssetsMember2021-12-310001692787srt:MinimumMember2022-01-012022-12-310001692787srt:MaximumMember2022-01-012022-12-310001692787apa:RightOfWayAssetsMember2022-01-012022-12-310001692787us-gaap:CustomerRelationshipsMember2022-01-012022-12-310001692787apa:PermianHighwayPipelineMember2022-12-310001692787apa:PermianHighwayPipelineMember2021-12-310001692787apa:BrevilobaLLCMember2022-12-310001692787apa:BrevilobaLLCMember2021-12-310001692787apa:GulfCoastExpressPipelineLLCMember2022-12-310001692787apa:GulfCoastExpressPipelineLLCMember2021-12-310001692787apa:EPICCrudeHoldingsLPMember2022-12-310001692787apa:EPICCrudeHoldingsLPMember2022-01-012022-12-310001692787apa:PermianHighwayPipelineMember2020-12-310001692787apa:BrevilobaLLCMember2020-12-310001692787apa:GulfCoastExpressPipelineLLCMember2020-12-310001692787apa:PermianHighwayPipelineMember2021-01-012021-12-310001692787apa:BrevilobaLLCMember2021-01-012021-12-310001692787apa:GulfCoastExpressPipelineLLCMember2021-01-012021-12-310001692787apa:PermianHighwayPipelineMember2022-01-012022-12-310001692787apa:BrevilobaLLCMember2022-01-012022-12-310001692787apa:GulfCoastExpressPipelineLLCMember2022-01-012022-12-310001692787apa:PermianHighwayPipelineMember2022-02-220001692787apa:PermianHighwayPipelineMember2022-01-012022-12-310001692787apa:BrevilobaLLCMember2022-01-012022-12-310001692787apa:GulfCoastExpressPipelineLLCMember2022-01-012022-12-310001692787apa:PermianHighwayPipelineMember2021-01-012021-12-310001692787apa:BrevilobaLLCMember2021-01-012021-12-310001692787apa:GulfCoastExpressPipelineLLCMember2021-01-012021-12-310001692787apa:PermianHighwayPipelineMember2020-01-012020-12-310001692787apa:BrevilobaLLCMember2020-01-012020-12-310001692787apa:GulfCoastExpressPipelineLLCMember2020-01-012020-12-310001692787apa:PermianHighwayPipelineMember2022-12-310001692787apa:BrevilobaLLCMember2022-12-310001692787apa:GulfCoastExpressPipelineLLCMember2022-12-310001692787apa:PermianHighwayPipelineMember2021-12-310001692787apa:BrevilobaLLCMember2021-12-310001692787apa:GulfCoastExpressPipelineLLCMember2021-12-310001692787apa:A5875SeniorNotesDue2030Memberus-gaap:SeniorNotesMember2022-06-080001692787apa:A5875SeniorNotesDue2030Memberus-gaap:SeniorNotesMember2022-06-082022-06-080001692787apa:A5875SeniorNotesDue2030Membersrt:ScenarioForecastMemberus-gaap:SeniorNotesMember2027-06-152027-06-150001692787apa:A5875SeniorNotesDue2030Membersrt:ScenarioForecastMemberapa:AdditionalIncreaseIfSustainabilityPerformanceTargetsAreMetMemberus-gaap:SeniorNotesMember2027-06-152027-06-150001692787us-gaap:UnsecuredDebtMemberus-gaap:RevolvingCreditFacilityMember2022-06-080001692787us-gaap:RevolvingCreditFacilityMemberapa:OneMonthSOFRMember2022-06-080001692787us-gaap:RevolvingCreditFacilityMemberapa:OneMonthSOFRMembersrt:MinimumMember2022-06-082022-06-080001692787us-gaap:RevolvingCreditFacilityMembersrt:MaximumMemberapa:OneMonthSOFRMember2022-06-082022-06-080001692787apa:OneThreeOrSixMonthSOFRMemberus-gaap:RevolvingCreditFacilityMember2022-06-080001692787apa:OneThreeOrSixMonthSOFRMemberus-gaap:RevolvingCreditFacilityMembersrt:MinimumMember2022-06-082022-06-080001692787apa:OneThreeOrSixMonthSOFRMemberus-gaap:RevolvingCreditFacilityMembersrt:MaximumMember2022-06-082022-06-080001692787us-gaap:RevolvingCreditFacilityMemberapa:A125BillionRevolvingCreditFacilityMember2022-06-080001692787us-gaap:UnsecuredDebtMemberus-gaap:RevolvingCreditFacilityMembersrt:MinimumMember2022-06-082022-06-080001692787us-gaap:UnsecuredDebtMemberus-gaap:RevolvingCreditFacilityMembersrt:MaximumMember2022-06-082022-06-080001692787us-gaap:UnsecuredDebtMemberapa:TermLoanCreditFacilityMember2022-06-080001692787apa:OneMonthSOFRMemberapa:TermLoanCreditFacilityMember2022-06-080001692787apa:OneMonthSOFRMembersrt:MinimumMemberapa:TermLoanCreditFacilityMember2022-06-082022-06-080001692787srt:MaximumMemberapa:OneMonthSOFRMemberapa:TermLoanCreditFacilityMember2022-06-082022-06-080001692787apa:OneThreeOrSixMonthSOFRMemberapa:TermLoanCreditFacilityMember2022-06-080001692787apa:OneThreeOrSixMonthSOFRMembersrt:MinimumMemberapa:TermLoanCreditFacilityMember2022-06-082022-06-080001692787apa:OneThreeOrSixMonthSOFRMembersrt:MaximumMemberapa:TermLoanCreditFacilityMember2022-06-082022-06-080001692787apa:TermLoanMemberapa:SustainabilityAdjustmentsMember2022-06-082022-06-080001692787us-gaap:RevolvingCreditFacilityMemberapa:SustainabilityAdjustmentsMember2022-06-082022-06-080001692787apa:TermLoanMemberapa:SustainabilityAdjustments1Member2022-06-082022-06-080001692787us-gaap:RevolvingCreditFacilityMemberapa:SustainabilityAdjustments1Member2022-06-082022-06-080001692787us-gaap:RevolvingCreditFacilityMemberapa:SustainabilityAdjustments2Member2022-06-082022-06-080001692787apa:TermLoanMemberapa:SustainabilityAdjustments2Member2022-06-082022-06-080001692787apa:SustainabilityAdjustments3Memberus-gaap:RevolvingCreditFacilityMember2022-06-082022-06-080001692787apa:SustainabilityAdjustments3Memberapa:TermLoanMember2022-06-082022-06-080001692787us-gaap:LineOfCreditMember2022-01-012022-12-310001692787apa:A20BillionUnsecuredTermLoanMemberapa:TermLoanMember2022-12-310001692787apa:A20BillionUnsecuredTermLoanMemberapa:TermLoanMember2021-12-310001692787apa:A10Billion2030SeniorUnsecuredNotesMember2022-12-310001692787apa:A10Billion2030SeniorUnsecuredNotesMember2021-12-310001692787apa:TermLoanMemberapa:A125BillionRevolvingCreditFacilityMember2022-12-310001692787apa:TermLoanMemberapa:A125BillionRevolvingCreditFacilityMember2021-12-310001692787apa:TermLoanMemberapa:A125BillionTermLoanMember2021-12-310001692787apa:TermLoanMemberapa:A125BillionTermLoanMember2022-12-310001692787apa:TermLoanMemberapa:A690MillionTermLoanMember2021-12-310001692787apa:TermLoanMemberapa:A690MillionTermLoanMember2022-12-310001692787apa:TermLoanMemberapa:A513MillionTermLoanMember2021-12-310001692787apa:TermLoanMemberapa:A513MillionTermLoanMember2022-12-310001692787apa:A125MillionRevolvingLineOfCreditMemberus-gaap:LineOfCreditMember2021-12-310001692787apa:A125MillionRevolvingLineOfCreditMemberus-gaap:LineOfCreditMember2022-12-310001692787us-gaap:RevolvingCreditFacilityMemberapa:A125BillionRevolvingCreditFacilityMember2022-12-310001692787us-gaap:RevolvingCreditFacilityMemberapa:A125BillionRevolvingCreditFacilityMember2021-12-310001692787us-gaap:RevolvingCreditFacilityMemberapa:OvernightBankFundingRateMember2022-06-082022-06-080001692787apa:TermLoanCreditFacilityMemberapa:OvernightBankFundingRateMember2022-06-082022-06-080001692787apa:PublicWarrantsMember2022-12-310001692787us-gaap:CommonStockMember2022-12-310001692787apa:PrivatePlacementWarrantMember2022-12-310001692787apa:ApacheCorporationMemberapa:PrivatePlacementWarrantMember2022-12-310001692787us-gaap:SubsequentEventMemberus-gaap:CommonClassAMember2023-01-172023-01-170001692787apa:KinetikLPMemberus-gaap:SubsequentEventMember2023-01-172023-01-170001692787us-gaap:CommonClassCMemberus-gaap:CommonStockMember2022-05-192022-05-190001692787us-gaap:CommonClassAMember2022-05-192022-05-190001692787us-gaap:CommonClassCMember2022-05-192022-05-190001692787apa:PublicWarrantsMemberus-gaap:CommonClassAMember2022-12-310001692787us-gaap:RedeemablePreferredStockMember2022-02-222022-02-220001692787us-gaap:RedeemablePreferredStockMember2022-02-220001692787apa:PaidInKindUnitsMember2022-02-220001692787apa:MandatoryRedemptionFeatureMember2022-02-222022-02-220001692787apa:PaidInKindUnitsMemberapa:PartnershipLPAMember2022-02-222022-02-220001692787apa:MandatoryRedemptionFeatureMember2022-02-232022-12-310001692787us-gaap:RedeemablePreferredStockMember2022-02-232022-12-3100016927872022-02-222022-02-220001692787us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:SwapMember2022-12-310001692787us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:SwapMember2022-12-310001692787us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:SwapMember2022-12-310001692787us-gaap:FairValueMeasurementsRecurringMemberus-gaap:SwapMember2022-12-310001692787us-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateContractMemberus-gaap:FairValueInputsLevel1Member2022-12-310001692787us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateContractMember2022-12-310001692787us-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateContractMemberus-gaap:FairValueInputsLevel3Member2022-12-310001692787us-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateContractMember2022-12-310001692787us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-12-310001692787us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310001692787us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2022-12-310001692787us-gaap:FairValueMeasurementsRecurringMember2022-12-310001692787apa:PublicWarrantsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-12-310001692787apa:PublicWarrantsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310001692787apa:PublicWarrantsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2022-12-310001692787apa:PublicWarrantsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001692787us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberapa:PrivatePlacementWarrantMember2022-12-310001692787us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberapa:PrivatePlacementWarrantMember2022-12-310001692787us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberapa:PrivatePlacementWarrantMember2022-12-310001692787us-gaap:FairValueMeasurementsRecurringMemberapa:PrivatePlacementWarrantMember2022-12-310001692787us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:SwapMember2021-12-310001692787us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:SwapMember2021-12-310001692787us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:SwapMember2021-12-310001692787us-gaap:FairValueMeasurementsRecurringMemberus-gaap:SwapMember2021-12-310001692787us-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateContractMemberus-gaap:FairValueInputsLevel1Member2021-12-310001692787us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateContractMember2021-12-310001692787us-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateContractMemberus-gaap:FairValueInputsLevel3Member2021-12-310001692787us-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateContractMember2021-12-310001692787us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2021-12-310001692787us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2021-12-310001692787us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2021-12-310001692787us-gaap:FairValueMeasurementsRecurringMember2021-12-310001692787us-gaap:InterestRateSwapMember2019-09-30apa:instrument0001692787us-gaap:InterestRateSwapMember2022-11-300001692787us-gaap:InterestRateSwapMember2022-12-310001692787us-gaap:InterestRateSwapMember2021-12-310001692787us-gaap:InterestRateSwapMember2022-01-012022-12-310001692787us-gaap:InterestRateSwapMember2021-01-012021-12-310001692787us-gaap:InterestRateSwapMember2020-01-012020-12-310001692787us-gaap:CommodityContractMember2022-12-310001692787us-gaap:CommodityContractMembersrt:NaturalGasPerThousandCubicFeetMember2022-01-012022-12-31utr:MMBTU0001692787us-gaap:CommodityContractMembersrt:CrudeOilAndNGLPerBarrelMember2022-01-012022-12-31utr:gal0001692787us-gaap:CommodityContractMember2022-01-012022-12-310001692787us-gaap:CommodityContractMember2021-12-310001692787us-gaap:CommodityContractMember2021-01-012021-12-310001692787us-gaap:CommodityContractMember2020-01-012020-12-310001692787us-gaap:CommonClassAMemberapa:ClassA1AndClassA2UnitsMember2022-02-222022-02-220001692787srt:MinimumMemberus-gaap:CommonClassAMember2022-01-012022-12-310001692787srt:MaximumMemberus-gaap:CommonClassAMember2022-01-012022-12-310001692787apa:ClassA3UnitsMemberus-gaap:CommonClassAMember2022-02-222022-02-220001692787us-gaap:CommonClassCMember2022-01-012022-12-310001692787apa:NewEmployeesMember2022-01-012022-12-310001692787us-gaap:RestrictedStockUnitsRSUMemberapa:BoardMember2022-01-012022-12-310001692787us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001692787us-gaap:RestrictedStockUnitsRSUMembersrt:MinimumMember2022-01-012022-12-310001692787srt:MaximumMemberus-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001692787us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310001692787us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001692787apa:WinterStormUriMember2021-02-282021-02-28apa:defendant0001692787apa:WinterStormUriMember2021-02-280001692787apa:WinterStormUriMember2022-12-310001692787apa:PermianGasMember2019-06-112019-06-110001692787apa:PermianGasMember2019-06-110001692787apa:PermianGasMember2022-12-310001692787apa:PermianGasMember2021-12-310001692787apa:AltusMidstreamLPMemberus-gaap:CommonClassAMember2022-02-220001692787apa:AltusMidstreamLPMemberus-gaap:CommonClassAMember2022-02-222022-02-220001692787apa:AltusMidstreamLPMemberapa:PriceOptionOneMemberus-gaap:CommonClassAMember2022-02-222022-02-220001692787apa:AltusMidstreamLPMemberapa:PriceOptionOneMemberus-gaap:CommonClassAMember2022-02-220001692787apa:PriceOptionTwoMemberapa:AltusMidstreamLPMemberus-gaap:CommonClassAMember2022-02-222022-02-220001692787apa:PriceOptionTwoMemberapa:AltusMidstreamLPMemberus-gaap:CommonClassAMember2022-02-220001692787apa:BCPRaptorAggregatorLPMembersrt:MinimumMember2022-12-310001692787srt:MinimumMemberapa:BuzzardMidstreamLLCMember2022-12-310001692787apa:BXPermianPipelineAggregatorLPMembersrt:MinimumMember2022-12-310001692787apa:BlacksoneManagementPartnersLLCMembersrt:MinimumMember2022-12-310001692787apa:ApacheMidstreamLLCMembersrt:MinimumMember2022-12-310001692787srt:AffiliatedEntityMemberapa:BrevilobaLLCMember2022-12-310001692787srt:AffiliatedEntityMemberapa:PermianHighwayPipelinePHPMember2022-12-310001692787apa:JettaPermianLPMembersrt:AffiliatedEntityMember2021-12-310001692787apa:PrimexxEnergyPartnersLtdMembersrt:AffiliatedEntityMember2021-12-310001692787apa:MidstreamLogisticsMemberus-gaap:OperatingSegmentsMember2022-12-31apa:stream0001692787apa:PipelineTransportationMemberus-gaap:OperatingSegmentsMember2022-12-31apa:pipeline0001692787apa:MidstreamLogisticsMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001692787apa:PipelineTransportationMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001692787us-gaap:CorporateNonSegmentMember2022-01-012022-12-310001692787us-gaap:MaterialReconcilingItemsMember2022-01-012022-12-310001692787apa:MidstreamLogisticsMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001692787apa:PipelineTransportationMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001692787us-gaap:MaterialReconcilingItemsMember2021-01-012021-12-310001692787apa:MidstreamLogisticsMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001692787apa:PipelineTransportationMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001692787us-gaap:CorporateNonSegmentMember2020-01-012020-12-310001692787us-gaap:MaterialReconcilingItemsMember2020-01-012020-12-310001692787apa:ProductAndServiceMemberapa:MidstreamLogisticsMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001692787apa:ProductAndServiceMemberapa:PipelineTransportationMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001692787apa:ProductAndServiceMemberus-gaap:MaterialReconcilingItemsMember2022-01-012022-12-310001692787apa:MidstreamLogisticsMemberus-gaap:ProductAndServiceOtherMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001692787apa:PipelineTransportationMemberus-gaap:ProductAndServiceOtherMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001692787us-gaap:MaterialReconcilingItemsMemberus-gaap:ProductAndServiceOtherMember2022-01-012022-12-310001692787apa:ProductAndServiceMemberapa:MidstreamLogisticsMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001692787apa:ProductAndServiceMemberapa:PipelineTransportationMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001692787apa:ProductAndServiceMemberus-gaap:MaterialReconcilingItemsMember2021-01-012021-12-310001692787apa:MidstreamLogisticsMemberus-gaap:ProductAndServiceOtherMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001692787apa:PipelineTransportationMemberus-gaap:ProductAndServiceOtherMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001692787us-gaap:MaterialReconcilingItemsMemberus-gaap:ProductAndServiceOtherMember2021-01-012021-12-310001692787apa:ProductAndServiceMemberapa:MidstreamLogisticsMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001692787apa:ProductAndServiceMemberapa:PipelineTransportationMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001692787apa:ProductAndServiceMemberus-gaap:MaterialReconcilingItemsMember2020-01-012020-12-310001692787apa:MidstreamLogisticsMemberus-gaap:ProductAndServiceOtherMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001692787apa:PipelineTransportationMemberus-gaap:ProductAndServiceOtherMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001692787us-gaap:MaterialReconcilingItemsMemberus-gaap:ProductAndServiceOtherMember2020-01-012020-12-310001692787us-gaap:OperatingSegmentsMember2022-01-012022-12-310001692787us-gaap:OperatingSegmentsMember2021-01-012021-12-310001692787us-gaap:OperatingSegmentsMember2020-01-012020-12-310001692787apa:MidstreamLogisticsMemberus-gaap:OperatingSegmentsMember2021-12-310001692787apa:PipelineTransportationMemberus-gaap:OperatingSegmentsMember2021-12-310001692787us-gaap:OperatingSegmentsMember2022-12-310001692787us-gaap:OperatingSegmentsMember2021-12-310001692787us-gaap:CorporateNonSegmentMember2022-12-310001692787us-gaap:CorporateNonSegmentMember2021-12-310001692787srt:MaximumMemberus-gaap:SubsequentEventMemberus-gaap:CommonClassAMember2023-02-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2022

or | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________ to ________

Commission file number 001-38048

KINETIK HOLDINGS INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | | | 81-4675947 |

(State or other jurisdiction of incorporation or organization) | | | | (I.R.S. Employer Identification No.) |

2700 Post Oak Boulevard, Suite 300

Houston, Texas 77056-4400

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code (713) 621-7330

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A common stock, $0.0001 par value | | KNTK | | New York Stock Exchange |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | ☐ | | Accelerated filer | | ☒ | | Emerging growth company | | ☐ |

| Non-accelerated filer | | ☐ | | Smaller reporting company | | ☐ | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act): Yes ☐ No ☒

| | | | | | | | | | | | | | |

| Aggregate market value of the voting and non-voting common equity held by non-affiliates of registrant as of June 30, 2022 | $564,554,574 |

| Number of shares of registrant’s Class A common stock, $0.0001 issued and outstanding as of February 28, 2023 | 48,954,863 | |

| Number of shares of registrant’s Class C common stock, $0.0001 issued and outstanding as of February 28, 2023 | 94,089,038 | |

Documents Incorporated By Reference

Portions of registrant’s proxy statement relating to registrant’s 2023 annual meeting of stockholders have been incorporated by reference in Part III of this Annual Report on Form 10-K.

TABLE OF CONTENTS

| | | | | | | | |

| Item | | Page |

| | |

| | |

| | |

| PART I | |

| | |

| 1 and 2. | | |

| 1A. | | |

| 1B. | | |

| | |

| 3. | | |

| | |

| | |

| PART II | |

| | |

| 5. | | |

| 6. | | |

| 7. | | |

| 7A. | | |

| 8. | | |

| 9. | | |

| 9A. | | |

| 9B. | | |

| 9C. | | |

| | |

| PART III | |

| | |

| 10. | | |

| 11. | | |

| 12. | | |

| 13. | | |

| 14. | | |

| | |

| PART IV | |

| | |

| 15. | | |

| 16. | | |

| | |

GLOSSARY

The following are abbreviations and definitions of certain terms used in this Annual Report on Form 10-K and certain terms which are commonly used in the exploration, production, and midstream sectors of the oil and natural gas industry:

•ASC. Accounting Standards Codification

•ASU. Accounting Standards Update

•Bbl. One stock tank barrel of 42 United States (“U.S.”) gallons liquid volume used herein in reference to crude oil, condensate or natural gas liquids

•Bcf. One billion cubic feet

•Bcf/d. One Bcf per day

•Btu. One British thermal unit, which is the quantity of heat required to raise the temperature of a one-pound mass of water by one degree Fahrenheit

•CODM. Chief Operating Decision Maker.

•Delaware Basin. Located on the western section of the Permian Basin. The Delaware Basin covers a 6.4M acre area

•FASB. Financial Accounting Standards Board

•Field. An area consisting of a single reservoir or multiple reservoirs all grouped on, or related to, the same individual geological structural feature or stratigraphic condition. The field name refers to the surface area, although it may refer to both the surface and the underground productive formations

•Formation. A layer of rock which has distinct characteristics that differs from nearby rock

•GAAP. United States Generally Accepted Accounting Principles

•GHG. Greenhouse gas

•LIBOR. London Interbank Offered Rate

•MBbl. One thousand barrels of crude oil, condensate or NGLs

•MBbl/d. One MBbl per day

•Mcf. One thousand cubic feet of natural gas

•Mcf/d. One Mcf per day

•MMBtu. One million British thermal units

•MMcf. One million cubic feet of natural gas

•MMcf/d. One MMcf per day

•MVC. Minimum volume commitments

•NGLs. Natural gas liquids. Hydrocarbons found in natural gas, which may be extracted as liquefied petroleum gas and natural gasoline

•Throughput. The volume of crude oil, natural gas, NGLs, water and refined petroleum products transported or passing through a pipeline, plant, terminal or other facility during a particular period

•SEC. United States Securities and Exchange Commission

•SOFR. Secured Overnight Financing Rate

•WTI. West Texas Intermediate crude oil

FORWARD-LOOKING STATEMENTS AND RISK

This Annual Report on Form 10-K includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements other than statements of historical facts included or incorporated by reference in this Annual Report on Form 10-K, including, without limitation, statements regarding our future financial position, business strategy, budgets, projected revenues, projected costs and plans, and objectives of management for future operations, are forward-looking statements. In addition, forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “could,” “expect,” “intend,” “project,” “estimate,” “anticipate,” “plan,” “believe,” “continue,” “seek,” “guidance,” “might,” “outlook,” “possibly,” “potential,” “prospect,” “should,” “would,” or similar terminology, but the absence of these words does not mean that a statement is not forward looking. Although we believe that the expectations reflected in such forward-looking statements are reasonable under the circumstances, we can give no assurance that such expectations will prove to have been correct. Important factors that could cause actual results to differ materially from our expectations include, but are not limited to, assumptions about:

•the market prices of oil, natural gas, NGLs, and other products or services;

•competition from other pipelines, terminals or other forms of transportation and competition from other service providers for gathering system capacity and availability;

•production rates, throughput volumes, reserve levels, and development success of dedicated oil and gas fields;

•our future financial condition, results of operations, liquidity, compliance with debt covenants and competitive position;

•our future revenues, cash flows and expenses;

•our access to capital and its anticipated liquidity;

•our future business strategy and other plans and objectives for future operations;

•the amount, nature and timing of our future capital expenditures, including future development costs;

•the risks associated with potential acquisitions, divestitures, new joint ventures or other strategic opportunities;

•the recruitment and retention of our officers and personnel;

•the likelihood of success of and impact of litigation and other proceedings, including regulatory proceedings;

•our assessment of our counterparty risk and the ability of our counterparties to perform their future obligations;

•the impact of federal, state, and local political, regulatory and environmental developments where we conduct our business operations;

•the occurrence of an extreme weather event, terrorist attack or other event that materially impacts project construction and our operations, including cyber or other attached on electronic systems;

•our ability to successfully implement and execute our environmental, social and governance goals and initiatives and achieve the anticipated results of such initiatives;

•our ability to successfully implement our share repurchase program;

•our ability to integrate operations or realize any anticipated benefits, savings or growth of the Transaction (as defined herein). See Note 3 — Business Combination in the Notes to our Consolidated Financial Statements set forth in this Form 10-K; •the scope, duration and reoccurrence of any epidemics or pandemics (including, specifically, the coronavirus disease 2019 (“COVID-19”) pandemic or any related variants) and the actions taken by third parties in response to such epidemics or pandemics;

•general economic and political conditions, including the armed conflict in Ukraine and the impact of continued inflation and associated changes in monetary policy; and

Other factors or events that could cause the Company’s actual results to differ materially from the Company’s expectations may emerge from time to time, and it is not possible for the Company to predict all such factors or events. All subsequent written and oral forward-looking statements attributable to the Company, or persons acting on its behalf, are expressly qualified in their entirety by the cautionary statements. All forward-looking statements speak only as of the date of this Annual Report on Form 10-K. Except as required by law, the Company disclaims any obligation to update or revise its forward-looking statements, whether based on changes in internal estimates or expectations, new information, future developments, or otherwise.

PART I

ITEMS 1 and 2. BUSINESS AND PROPERTIES

The Transaction

On February 22, 2022 (the “Closing Date”), Kinetik Holdings Inc., a Delaware corporation ( the “Company”, formerly known as Altus Midstream Company), consummated the business combination transactions contemplated by the Contribution Agreement, dated as of October 21, 2021 (the “Contribution Agreement”), by and among the Company, Altus Midstream LP (now known as Kinetik Holdings LP), a Delaware limited partnership and subsidiary of Altus Midstream Company (the “Partnership”), New BCP Raptor Holdco, LLC, a Delaware limited liability company (“Contributor”), and BCP Raptor Holdco, LP, a Delaware limited partnership (“BCP”). The transactions contemplated by the Contribution Agreement are referred to herein as the “Transaction.”

Pursuant to the Contribution Agreement, in connection with the closing of the Transaction (the “Closing”), (i) Contributor contributed all of the equity interests of BCP and BCP Raptor Holdco GP, LLC, a Delaware limited liability company and the general partner of BCP (“BCP GP” and, together with BCP, the “Contributed Entities”), to the Partnership; and (ii) in exchange for such contribution, the Partnership transferred to Contributor 50,000,000 common units representing limited partner interests in the Partnership (“Common Units”) and 50,000,000 shares of the Company’s Class C Common Stock, par value $0.0001 per share (“Class C Common Stock”).

The Company’s public stockholders immediately prior to the Closing continued to hold their shares of the Company’s Class A Common Stock, par value $0.0001 per share (“Class A Common Stock,” and together with the Company’s Class C Common Stock, “Common Stock”). As a result of the Transaction, immediately following the Closing (i) members of Contributor held approximately 75% of the issued and outstanding Common Stock, (ii) Apache Midstream LLC, a Delaware limited liability company (“Apache Midstream”), held approximately 20% of the issued and outstanding Common Stock, and (iii) the Company’s remaining stockholders held approximately 5% of the issued and outstanding Common Stock.

The Company completed a stock split in the form of a stock dividend on June 8, 2022 (the “Stock Split”). All corresponding per-share and share amounts for periods prior to June 8, 2022 have been retrospectively restated elsewhere in this Form 10-K to reflect the Stock Split. However, the number of Common Units and shares of Class C Common Stock described in this Form 10-K in relation to the Transaction are presented at pre-Stock-Split amounts to be consistent with our previous public filings and the terms of the Contribution Agreement.

In connection with the closing of the Transactions, the Company changed its name from “Altus Midstream Company” (“ALTM”) to “Kinetik Holdings Inc.” Unless the context otherwise requires, “ALTM” refers to the registrant prior to the Closing and “we,” “us,” “our,” and the “Company” refer to Kinetik Holdings Inc., the registrant and its subsidiaries following the Closing.

Prior to the Closing, the Company’s financial statements that were filed with the SEC were derived from ALTM’s accounting records. As the Transaction was determined to be a reverse merger, BCP was considered the accounting acquirer and ALTM was the legal acquirer. The accompanying Consolidated Financial Statements herein include (1) BCP’s net assets carried at historical value as of December 31, 2022 , (2) BCP’s historical results of operations prior to the Transaction, (3) the ALTM’s net assets carried at fair value as of the Closing Date and (4) the combined results of operations with the Company’s results presented within the Consolidated Financial Statements from February 22, 2022 going forward. Refer to Note 2—Business Combination to our Consolidated Financial Statements in this Form 10-K for additional discussion. Overview

We are an integrated midstream energy company in the Permian Basin providing comprehensive gathering, transportation, compression, processing and treating services. Our core capabilities include a variety of service offerings including natural gas gathering, transportation, compression, treating and processing; NGLs stabilization and transportation; produced water gathering and disposal; and crude oil gathering, stabilization, storage and transportation. We have approximately 2.0 billion cubic feet per day (“Bcf/d”) cryogenic natural gas processing capacity strategically located near the Waha Hub in West Texas. As measured by processing capacity, we are the second largest natural gas processor in the Delaware Basin and fourth largest across the entire Permian Basin. In addition, we have interests in four long-term contracted pipelines transporting natural gas, NGLs, and crude oil from the Permian Basin to the Gulf Coast.

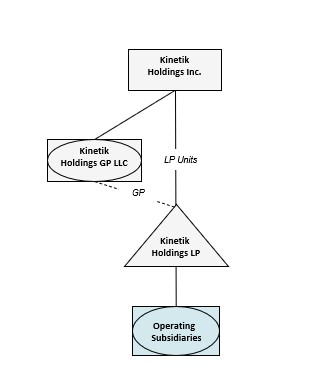

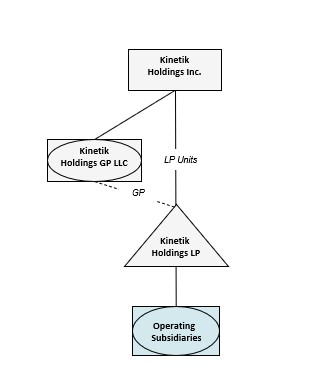

Organizational Structure

The Company operates through its wholly own subsidiary Kinetik Holdings LP and its consolidated operating subsidiaries. The Company also owns equity interests in four Permian Basin pipelines that have access to various points along the Texas Gulf Coast. The Company’s operations are strategically located in the heart of the Delaware Basin in the Permian and the Company’s operational headquarters is located at 303 Veterans Airpark Lane in Midland, Texas 79705. The Company’s corporate office is located at 2700 Post Oak Boulevard, Suite 300, Houston, Texas 77056. The following chart summarizes our organizational structure as of December 31, 2022. For simplicity, certain entities and ownership interests have not been depicted.

Our Operating Segments and Properties

We have two reportable segments which are strategic business units with differing products and services. The activities of each of our reportable segments from which the Company earns revenues, records equity income or losses and incurs expenses are described below:

Midstream Logistics

The Midstream Logistics segment provides three service offerings: 1) gas gathering and processing, 2) crude oil gathering, stabilization and storage services and 3) water gathering and disposal.

Gas Gathering and Processing

The Midstream Logistics segment provides gas gathering and processing services with approximately 1,500 miles of low and high-pressure steel pipeline located throughout the Southern Delaware Basin. Gas processing assets are centralized at five processing complexes with total cryogenic processing capacity of approximately 2.0 Bcf/d: Diamond Cryogenic complex (600 MMcf/d), the Pecos Bend complex (540 MMcf/d), the East Toyah complex (460 MMcf/d), the Pecos complex (260 MMcf/d), and the Sierra Grande complex (60 MMcf/d). The Company expects to expand the Diamond Cryogenic complex to 720 MMcf/d by the end of the second quarter of 2023. Current residue gas outlets are the El Paso Natural Gas Pipeline, Energy Transfer Comanche Trail Pipeline, ONEOK Roadrunner Pipeline, Whitewater Aqua Blanca Pipeline, Permian Highway Pipeline LLC and the Company’s wholly owned and operated Delaware Link Pipeline expected to be in service in the fourth quarter of 2023. NGLs outlets are Energy Transfer’s Lone Star NGL Pipeline, Targa’s Grand Prix NGL Pipeline and Enterprise’s Shin Oak NGL Pipeline.

Crude Oil Gathering, Stabilization, and Storage Services

The Midstream Logistics segment provides crude oil gathering, stabilization and storage services throughout the Texas Delaware Basin. Crude gathering assets are centralized at the Caprock Stampede Terminal and the Pinnacle Sierra Grande Terminal. The system includes approximately 220 miles of gathering pipeline and 90,000 barrels of crude storage. The crude facilities have connections for takeaway transportation into Plains’ 285 Central Station and State Line and Oryx’s Orla & Central Mentone facilities.

Water Gathering and Disposal

In addition, the Midstream Logistics segment provides water gathering and disposal services through assets located in northern Reeves County, Texas. The system includes approximately 80 miles of gathering pipeline and approximately 490,000 barrels per day of permitted disposal capacity.

Pipeline Transportation

As of December 31, 2022, the Company owned equity interests in four equity method interest (“EMI”) pipelines. Each EMI pipeline is operated by a third-party limited liability entity, as further described below. For a more in-depth discussion of the estimated capital resources, liquidity and timing associated with each EMI pipeline, please see Part IV, Item 15, Note 7—Equity Method Investments, set forth in this Annual Report on Form 10-K. During 2022, the Company acquired full ownership and operatorship of approximately 30 miles of 20-inch NGL pipeline connected to the Diamond Cryogenic complex called the Brandywine NGL Pipeline (“Brandywine”) and the Company’s Delaware Link Pipeline has started construction. Permian Highway Pipeline

The Company owns an approximately 53.3% equity interest in Permian Highway Pipeline LLC (“PHP”), which is also owned and operated by Kinder Morgan Texas Pipeline, LLC (“Kinder Morgan”). PHP transports natural gas from the Waha area in northern Pecos County, Texas to the Katy, Texas area with connections to Texas Gulf Coast and Mexico markets. PHP was placed in service in January 2021, with the total capacity of 2.1 Bcf/d fully subscribed under long-term contracts. In June 2022, PHP announced a final investment decision to proceed with its expansion project to increase total capacity to 2.65 Bcf/d fully subscribed under 10 year take or pay contracts. The expansion project will increase PHP’s capacity by nearly 550 MMcf/d with a target in-service date in November 2023. Approximately 67% of the funding for the expansion project will be borne by the Company and the remainder by Kinder Morgan. As a result, following the in-service date of the expansion, Kinetik’s ownership interest in PHP will increase to approximately 55.5%.

Gulf Coast Express Pipeline

The Company owns a 16% equity interest in the Gulf Coast Express Pipeline (“GCX”), which is also owned and operated by Kinder Morgan. GCX transports natural gas from the Permian Basin in West Texas to Agua Dulce near the Texas Gulf Coast. GCX was placed in service during 2019, with the total capacity of 2.0 Bcf/d fully subscribed under long-term contracts.

Breviloba, LLC

The Company owns a 33% equity interest in the Shin Oak NGL Pipeline (“Shin Oak”), which is owned by Breviloba, LLC, and operated by Enterprise Products Operating LLC. Shin Oak transports NGLs from the Permian Basin to Mont Belvieu, Texas. Shin Oak was placed in service during 2019, with total capacity of up to 550 MBbl/d.

EPIC Crude Oil Pipeline

The Company owns a 15% equity interest in the EPIC Crude oil pipeline (“EPIC”), which is operated by EPIC Consolidated Operations, LLC. EPIC transports crude oil from Orla, Texas in Northern Reeves County to the Port of Corpus Christi, Texas. EPIC was placed in service early 2020, with initial throughput capacity of approximately 600 MBbl/d.

The following table summarizes our ownership and capacity of properties in our Pipeline Transportation segment as of December 31, 2022:

| | | | | | | | | | | |

| Asset | Ownership Interest | Approximate Pipeline System Miles | Capacity |

| Pipeline Transportation | | | |

| | | |

PHP(1) | 53.3% | 430 | 2.1 Bcf/d |

| GCX | 16% | 450 | 2.0 Bcf/d |

| Shin Oak | 33% | 658 | 550 MBbl/d |

| EPIC | 15% | 700 | 650 MBbl/d |

| Brandywine | 100% | 30 | 225 MBbl/d |

Delaware Link(2) | 100% | 40 | 1.0 Bcf/d |

| | |

(1)Upon completion of PHP expansion project, the pipeline capacity will increase to 2.65 Bcf/d and the Company’s equity interest in PHP will increase to 55.5%.

(2)Delaware Link Pipeline is under construction and the project is expected to be complete in the fourth quarter of 2023.

Title to Properties and Permits

Certain of the pipelines connecting our facilities are constructed on rights-of-way granted by the apparent record owners of the property and in some instances these rights-of-way are revocable at the election of the grantor. In several instances, lands over which rights-of-way have been obtained could be subject to prior liens that have not been subordinated to the right-of-way grants. We have obtained permits from public authorities to cross over or under, or to lay pipelines in or along, watercourses, county roads, municipal streets and state highways and, in some instances, these permits are revocable at the election of the grantor. These permits may also be subject to renewal from time to time and we will generally seek renewal or arrange alternative means of transport through additional investment or commercial agreements. We have also obtained permits from railroad companies to cross over or under lands or rights-of-way, many of which are also revocable at the grantor’s election.

We believe we have satisfactory permits and/or title to all our material rights-of-way. We also believe that we have satisfactory title to all our material assets.

Competition

The business of providing gathering, compression, processing and transmission services for natural gas and NGLs is highly competitive. The Company faces strong competition in obtaining natural gas and NGL volumes, including from major integrated and independent exploration and production companies, interstate and intrastate pipelines, and other companies that gather, compress, treat, process, transmit or market natural gas and NGLs. Competition for supplies is primarily based on geographic location of facilities in relation to production or markets, the reputation, efficiency and reliability of the midstream company, and the pricing arrangements offered by the midstream company. For areas where acreage is not dedicated to the Company, the Company will compete with similar enterprises in providing additional gathering, compression, processing and transmission services in the same area of operation.

Human Capital

We recognize that people are our greatest asset and their success is our success. We support our employees so they can deliver on our commitment to the highest standards of safety, performance, integrity and customer service. We strive to retain top talent by fostering a culture that promotes health and safety, employee inclusion and diversity and employee engagement and development. As of December 31, 2022, we employed approximately 300 people that primarily support our operations. None of these employees are covered by collective bargaining agreements, and we consider our employee relations to be good.

Health and Safety. We believe that a strong health and safety program leads to less workplace accidents and injuries, enhances productivity and morale and avoids disruption to the business. The bulk of our employees are field-based workers who face potential safety risks associated with driving long distances and working with heavy equipment and flammable and pressurized hydrocarbons. The Company’s Environment, Health and Safety (“EHS”) Management System lays out our requirements, processes, and guidelines for process safety and occupational health and safety. We also have computer-based health and safety training, change management and reporting tools to make it easier to identify hazards and manage EHS issues across our business. We have a standardized, formal joint hazard analysis routine for employees. We continue to communicate regularly with our employees on health and safety issues and to provide training on various health and safety issues. We have set our safety targets for 2023 to have Total Recordable Incident Rate of less than 1.75 and total Motor Vehicle Incident Rate of less than 1.50.

Employee Inclusion and Diversity. In 2021, Kinetik introduced a Diversity, Equity and Inclusion (“DEI”) Policy as part of our ongoing commitment to build an inclusive workplace, and the majority of our employees participated in DEI training, which covered topics such as hiring and unconscious bias. We also created a program to help employees learn from one another and from community leaders of various cultural groups. To further improve workplace gender balance, the Company’s sustainability linked debt includes a target to increase the percentage of women on our senior leadership team from the current 7% to 20% by 2026. This is above our industry peer average of 17% women in senior leadership positions.

Employee Engagement and Development. We use a blend of formal and informal employee recognition strategies, including both monetary and non-monetary incentives. We recognize employee performance, service milestones and special occasions. We reward employees for operations-based milestones based on safety and regulatory compliance achievements and give awards for exceptional performance in safety, landowner engagement, innovative thinking, teamwork and customer service. We continuously enhance our training programs and provide regular performance and career development reviews to our employees to help them achieve their career goals.

Regulation of Operations

Natural Gas Pipeline Regulation

Under the Natural Gas Act (“NGA”), the Federal Energy Regulatory Commission (“FERC”) regulates the transportation of natural gas in interstate commerce. Intrastate transportation of natural gas is largely regulated by the state in which such transportation takes place. To the extent that the Company’s intrastate natural gas transportation systems transport natural gas in interstate commerce, the rates, terms and conditions of such services are subject to FERC jurisdiction under Section 311 of the Natural Gas Policy Act of 1978 (“NGPA”). The NGPA regulates, among other things, the provision of transportation services by an intrastate natural gas pipeline on behalf of a local distribution company or an interstate natural gas pipeline. Under Section 311 of the NGPA, rates charged for interstate transportation must be fair and equitable, and amounts collected in excess of fair and equitable rates are subject to refund with interest. The terms and conditions of service set forth in the Company’s statement of operating conditions for transportation service under Section 311 of the NGPA are also subject to FERC review and approval. Failure to observe the service limitations applicable to transportation services under Section 311, failure to comply with the rates approved by the FERC for Section 311 service, or failure to comply with the terms and conditions of service established in the pipeline’s FERC-approved statement of operating conditions could result in a change of jurisdictional status and/or the imposition of administrative, civil and criminal remedies.

The Company’s intrastate natural gas operations are also subject to regulation by various agencies in Texas, principally the Railroad Commission of Texas (“TRRC”). The Company’s intrastate pipeline operations are also subject to the Texas Utilities Code and the Texas Natural Resources Code, as implemented by the TRRC. Generally, the TRRC is vested with authority to ensure that rates, operations and services of gas utilities, including intrastate pipelines, are just and reasonable and not discriminatory. The rates the Company charges for transportation services are deemed just and reasonable under Texas law unless challenged in a customer or TRRC complaint. Failure to comply with the Texas Utilities Code or the Texas Natural Resources Code can result in the imposition of administrative, civil and criminal remedies.

Natural Gas Gathering Regulation

Section 1(b) of the NGA exempts natural gas gathering facilities from the jurisdiction of the FERC. The Company believes that its natural gas gathering pipelines meet the traditional tests the FERC has used to establish whether a pipeline is a gathering pipeline that is not subject to FERC jurisdiction. However, the distinction between FERC-regulated transmission services and federally unregulated gathering services has been the subject of substantial litigation and varying interpretations. In addition, the FERC’s determinations as to whether a pipeline is a gathering pipeline are made on a case-by-case basis, so the classification and regulation of the Company’s natural gas pipeline system could be subject to change based on future determinations by the FERC and the courts. State regulation of gathering facilities generally includes various safety, environmental and, in some circumstances, nondiscriminatory take requirements and complaint-based rate regulation.

The Company’s natural gas gathering facilities are subject to regulation by the TRRC under the Texas Utilities Code and the Texas Natural Resources Code in the same manner as described above for intrastate pipeline transportation facilities. The Company’s natural gas gathering pipeline system is also subject to ratable take and common purchaser statutes in Texas. The ratable take statute generally requires gatherers to take, without undue discrimination, natural gas production that may be tendered to the gatherer for handling. Similarly, the common purchaser statute generally requires gatherers to purchase without undue discrimination as to source of supply or producer. These statutes are designed to prohibit discrimination in favor of one producer over another producer or one source of supply over another source of supply.

Crude Oil and Natural Gas Liquids Pipeline Regulation

Transmission services rendered by the Company are subject to the regulation of the TRRC. The TRRC has the authority to regulate rates, though it generally has not investigated the rates or practices of intrastate pipelines in the absence of shipper complaints.

Pipeline Safety Regulations

Some of Company’s pipelines are subject to regulation by the U.S. Department of Transportation’s (“DOT”) Pipeline and Hazardous Materials Safety Administration (“PHMSA”) pursuant to the Natural Gas Pipeline Safety Act of 1968 (“NGPSA”), with respect to natural gas, and the Hazardous Liquids Pipeline Safety Act of 1979 (“HLPSA”), with respect to NGLs. The NGPSA and HLPSA regulate safety requirements in the design, construction, operation, and maintenance of natural gas, crude oil, and NGL pipeline facilities, while the Pipeline Safety Improvement Act of 2002 (“PSIA”) establishes mandatory inspections for all U.S. crude oil, NGL, and natural gas transmission pipelines in high consequence areas (“HCAs”), the violation of which can result in administrative, civil and criminal penalties, including civil fines, injunctions, or both.

PHMSA regularly revises its pipeline safety regulations. States are largely preempted by federal law from regulating pipeline safety for interstate lines but most are certified by the DOT to assume responsibility for enforcing federal intrastate pipeline regulations and inspection of intrastate pipelines. States may adopt stricter standards for intrastate pipelines than those imposed by the federal government for interstate lines; however, states vary considerably in their authority and capacity to address pipeline safety. State standards may include requirements for facility design and management in addition to requirements for pipelines. For example, recently, the TRRC adopted rules that require operators of natural gas and hazardous liquid gathering lines in rural areas to report accidents, conduct investigations and perform necessary corrective action. Due to the possibility of new or amended laws and regulations or reinterpretation of existing laws and regulations, there can be no assurance that future compliance with PHMSA or state requirements will not have a material adverse effect on the Company’s financial condition, results of operations, or cash flows.

Environmental and Occupational Health and Safety

The Company complies with the requirements of the Occupational Safety and Health Administration (“OSHA”) and comparable state laws that regulate the protection of the health and safety of workers. In addition, with respect to OSHA hazard communication standards, the Company believes that its operations are in substantial compliance with OSHA requirements, including general industry standards, hazard communication, record keeping requirements and monitoring of occupational exposure to regulated substances.

Our business operations are also subject to numerous environmental and occupational health and safety laws and regulations imposed at the federal, regional, state and local levels. The activities the Company conducts in connection with the gathering, compression, dehydration, treatment, processing and transportation of natural gas and gathering, stabilization, transportation and storage of crude oil are subject to, or may become subject to, stringent environmental regulation. The Company has implemented a number of programs and policies designed to monitor and pursue continued operation of our activities in a manner consistent with environmental and occupational health and safety laws and regulations. To that end, the Company has incurred and will continue to incur operating and capital expenditures to comply with these laws and regulations. Some of these environmental compliance costs may be material and have an adverse effect on our business, financial condition and results of operations.

Certain existing environmental and occupational health and safety laws and regulations include the following U.S. legal standards, which may be amended from time to time:

•the Clean Air Act (“CAA”), which restricts the emission of air pollutants from many sources and imposes various pre-construction, operational, monitoring and reporting requirements, and which the EPA has relied upon as authority for adopting climate change regulatory initiatives relating to GHG emissions;

•the Clean Water Act, which regulates discharges of pollutants to state and federal waters as well as establishing the extent to which waterways are subject to federal jurisdiction and rulemaking as protected waters of the United States;

•the Comprehensive Environmental Response, Compensation and Liability Act of 1980 (“CERCLA”), which imposes liability on generators, transporters and arrangers of hazardous substances at sites where releases, or threatened releases, of such hazardous substances has occurred;

•the Resource Conservation and Recovery Act (“RCRA”), which governs the generation, treatment, storage, transport and disposal of solid wastes, including hazardous wastes;

•the Oil Pollution Act, which imposes liability for removal costs and damages arising from an oil spill in waters of the United States on owners and operators of onshore facilities, pipelines and other facilities;

•the National Environmental Policy Act, which requires federal agencies to evaluate major agency actions that have the potential to significantly impact the environment, to include the preparation of an Environmental Assessment to assess potential direct, indirect, and cumulative impacts of the proposed project, and, if necessary, prepare a more detailed Environmental Impact Statement that may be made available to the public for comment;

•the Safe Drinking Water Act, which ensures the quality of the nation’s public drinking through adoption of drinking water standards and controlling the injection of waste fluids into below-ground formations that may adversely affect drinking water sources;

•the Endangered Species Act, which imposes restrictions on activities that may adversely affect federally identified endangered and threatened species or their habitats, to include the implementation of operating restrictions or a temporary, seasonal or permanent ban in affected areas;

•the Emergency Planning and Community Right-to-Know Act, which requires the implementation of a safety hazard communication program and the dissemination of information to employees, local emergency planning committees, and response departments on toxic chemicals use and inventories;

•the Occupational Safety and Health Act, which establishes workplace standards for the protection of both the health and safety of employees, to include the implementation of hazard communications programs to inform employees about hazardous substances in the workplace, the potential harmful effects of those substances and appropriate control measures; and

•the DOT regulations relating to the advancement of safe transportation of energy and hazardous materials and emergency response preparedness.

These environmental and occupational health and safety laws and regulations generally restrict the level of substances generated as a result of the Company’s operations that may be emitted to the ambient air, discharged to surface water, and disposed or released to surface and below-ground soils and groundwater. There are also state and local jurisdictions where we operate in the U.S. that have, are developing, or are considering developing, similar environmental and occupational health and safety laws. Any failure by the Company to comply with these laws and regulations could result in adverse effects upon our business to include the (i) assessment of sanctions, including administrative, civil, and criminal penalties; (ii) imposition of investigatory, remedial, and corrective action obligations or the incurrence of capital expenditures; (iii) occurrence of delays or cancellations in the permitting, development or expansion of projects; and (iv) issuance of injunctions restricting or prohibiting some or all of our activities in a particular area. Some environmental laws provide for citizen suits which allow for environmental organizations to act in place of the government and sue operators for alleged violations of environmental law. The ultimate financial impact arising from environmental laws and regulations is not clearly known nor determinable as existing standards are subject to change and new standards continue to evolve.

Environmental laws and regulations are frequently subject to change. More stringent environmental laws that apply to our operations and the operations of our customers may result in increased and material operating costs and capital expenditures for compliance, including, but not limited to, those related to the emission of GHGs and climate change. As a result, we cannot predict the scope of any final methane regulatory requirements or the cost to comply with such requirements. However, given the long-term trend toward increasing regulation, future federal GHG regulations of the oil and gas industry remain a significant possibility.

We own and operate several assets that have been used for crude oil and natural gas midstream services. Under environmental laws such as CERCLA and RCRA, the Company could incur strict, joint and several liability for remediating hydrocarbons, hazardous substances or wastes or other emerging contaminants, such as per- and poly-fluoroalkyl (PFAS), that may become subject to regulation. We could also incur costs related to the cleanup of third-party sites to which we sent regulated substances for disposal or to which we sent equipment for cleaning, and for damages to natural resources or other claims relating to releases of regulated substances at or from such third-party sites.

Trends in environmental and worker health and safety regulation over time has been to typically place increasing restrictions and limitations on activities that could result in adverse effects to the environment or expose workers to injury. These changes in environmental and worker safety laws and regulations, or reinterpretations or enforcement policies that may arise in the future and result in increasingly stringent or costly waste management or disposal, pollution control, remediation or worker health and safety-related requirements, may have a material adverse effect on our business, operations and financial condition. We may not have insurance or be fully covered by insurance against all risks relating to environmental or occupational health and safety, and we may be unable to pass on the increased cost of compliance arising from such risks to our customers. We regularly review regulatory and environmental issues as they pertain to the Company and we consider these as part of our general risk management approach.

Insurance

Our business has operating risks normally associated with the gathering, stabilization, transportation and storage of crude oil and gathering, compression, dehydration, treatment, processing and transportation of natural gas, which could cause damage to life or property. In accordance with industry practice, we maintain insurance against some, but not all, potential operating losses. For some operating risks, the Company may not obtain insurance if the cost of available insurance is excessive relative to the risks presented; in such a case, if a significant operating accident or other event occurs which is not fully covered by the insurance the Company has, this could adversely affect our operations and business. As we continue to grow, we will continue to evaluate our policy limits and deductibles as they relate to the overall cost and scope of our insurance program.

Environment, Social and Governance Considerations

Overview

The Company strongly values ethics, responsibility and integrity. The Company’s environmental, social and governance policies are designed to ensure that our employees, officers and directors conduct business with the highest standards of integrity and in compliance with all applicable laws and regulations. In July of 2022, the Company published its fiscal year 2021 Environmental, Social and Governance (“ESG”) Report after Closing of the Transaction. The Report focused on four key areas: Governance, Our Environment, People and Community Engagement.

Governance

We have a Board of Directors (the “Board”) that includes an Audit Committee, Compensation Committee and Governance and Sustainability Committee. The Company has developed an Enterprise Risk Management (“ERM”) program across all functional areas and mechanisms for identifying, prioritizing, and mitigating risks. We evaluate risks across the enterprise on a regular basis, examining the potential impact to our operating flexibility, along with the financial and reputational impact of such risks. Our Audit Committee of the Board has ultimate oversight over the ERM process, providing ongoing assessments of the company’s risk management processes and system of internal control. Our Executive Vice President, Chief Administrative Officer and Chief Accounting Officer has functional oversight of the Enterprise Risk function.

As a company that manages critical infrastructure for the energy sector, cybersecurity is of great concern to our organization, and we aim to protect our systems, networks and programs from digital attacks. We adhere to external cybersecurity standards, such as National Institute of Standards and Technology and ISO frameworks, along with Sarbanes-Oxley controls in our accounting system. We have multifactor authentications for all users, a 180-day password change policy, separation of duties in accounting systems, controlled access to network drives endpoint protection, mobile device management, device encryption and ongoing monitoring of threats. All our plant sites have devices that help control third-party access to our plant systems and also provide 24/7 monitoring of our infrastructure. We also have mandatory training for our employees on Security Awareness twice a year, using a library of cybersecurity training modules.

The Company believes that our employees, officers, directors, and contractors should conduct business with integrity and in compliance with all applicable laws, regulations and government requirements. Our Code of Business Conduct outlines the requirements that all our employees and contractors must follow to conduct business fairly and ethically. The Company also recognizes the importance of receiving, retaining and addressing concerns from our directors, officers, employees and other stakeholders seriously and expeditiously. We use a confidential third-party Ethics Hotline and a web-based message interface to enable anyone to report concerns.

Environmental Responsibility

The Company is committed to being a good steward of the environment. Our primary focus is on air quality, emissions and land use/disturbance(s) in and around our pipelines and processing facilities, both during construction and operation. Our EHS management system focuses on continuous improvement and pulls on principles identified in API RP 1173 – Pipeline Safety Management Systems and ISO 14001:2015-Environmental Management Systems. Our ongoing environmental goals include: 1) Zero fines - Operate without any fines or similar types of penalties from our regulatory agencies; 2) Continuously reduce the number of agency reportable loss of primary containment or releases compared to the prior year; 3) Extensively train all operations employees on our EHS management system, with a focus on Leak Detection and Repair (LDAR) and environmental control devices; and 4) Continuously reduce our methane intensity compared to prior years.

Methane is a potent GHG, with 25 times more heat trapping ability than carbon dioxide in the atmosphere. Therefore, we focus on ensuring that any natural gas that we transport stays in our system. We use a combination of constant and intermittent monitoring to reduce leaks, including pressurized trucks, storage tank emission control devices, LDAR, optical gas imaging cameras and participating in industry flyovers with an infrared imaging spectrometer to characterize emission sources and determine any areas for remediation and repair. To continue reducing our direct emissions from operations, we have been investing in energy efficient equipment, including electric pumps and electric drive gas and refrigeration compressors. We were the first major gathering and processing company in the Permian Basin to announce our commitment to source renewable energy for 100% of the electricity used in our operations.