UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

| REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended |

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to |

OR

| SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report |

Commission file number:

(Exact name of Registrant as specified in its charter)

Nu Holdings Ltd.

(Translation of Registrant’s name into English)

(Jurisdiction of incorporation or organization)

+1 345 949 2648

(Address of principal executive offices)

Tel: +

Brazil

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Copies to:

Manuel Garciadiaz | Byron B. Rooney

Davis Polk & Wardwell LLP

450 Lexington Avenue | New York, NY 10017

Phone: (212) 450-4000 Fax: (212) 701-5800

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

The number of outstanding shares as of December 31, 2022 was Class A ordinary shares (including Class A ordinary shares underlying the BDRs), and Class B ordinary shares.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer ☐

Accelerated Filer ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements: ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b): ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this annual report:

|

U.S. GAAP ☐ |

|

Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

| Item 17 ☐ | Item 18 ☐ |

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

☐

Dear shareholder:

It has been sixteen months since Nu’s IPO in December 2021, a celebrated milestone in our history and, in hindsight, I believe one of the best financial decisions we have made as a company. The buoyancy and optimism of the post-pandemic capital markets turned around quickly in January 2022, and we suddenly found ourselves in a much more challenging scenario as interest rates climbed across Latin America and the world. We believe that the strength of our balance sheet allowed us to focus all our attention on improving the cadence and efficiency of our execution through an uncertain 2022, while continuing to strengthen our long-term mission. We are happy to report that we could not be more excited with the milestones we achieved. But first, a bit on our mission.

Our mission

Nu’s mission is to fight complexity to empower people, and our long-term strategy can be summarized in a few words: we want our customers to love us fanatically. If we manage to accomplish this feat while also enabling a profitable business model, customers will keep choosing to do business with us, and we will succeed. To pursue this mission, we believe that we have built one of the best technology company teams in the world, operating under a set of strong cultural values of ownership, efficiency, teamwork, and nonconformism. Luckily, we have been well versed in adverse and volatile macroeconomic scenarios with capital constraints since we started in 2013 in Brazil, and as we see additional volatile waters in 2023, we believe we have all the tools in our toolkit to continue pursuing this mission.

Our product strategy

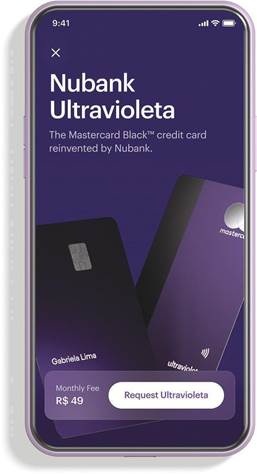

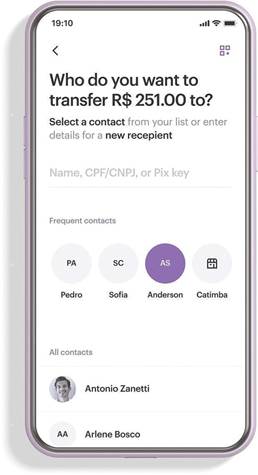

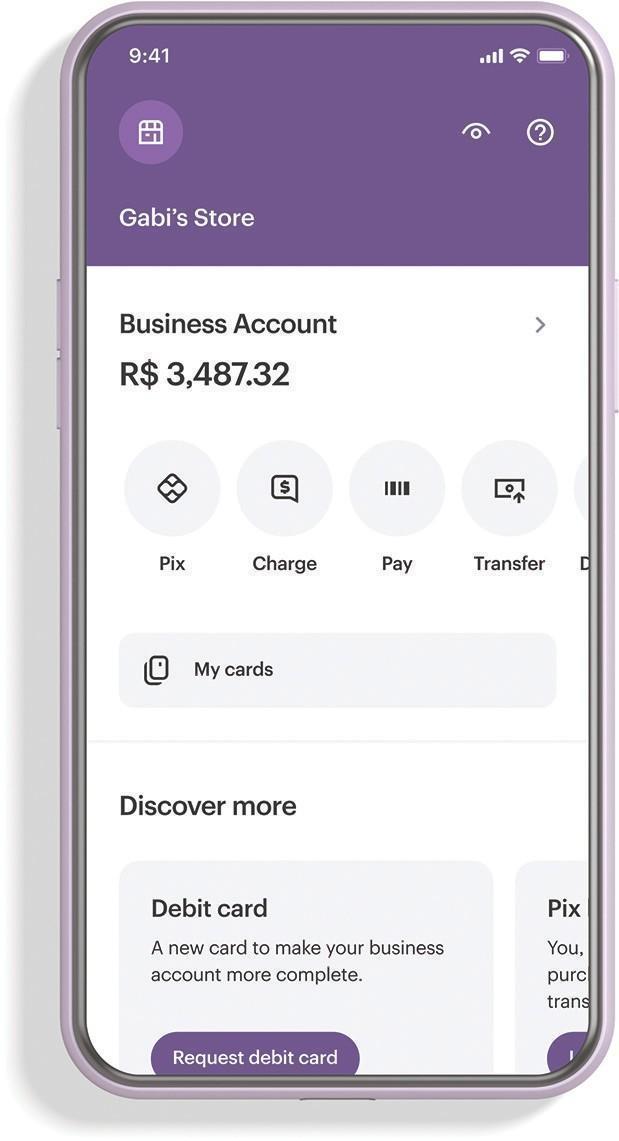

In pursuit of this mission, we decided in 2013 to begin addressing the significant consumer pain we saw in the Brazilian financial services market. We issued 12 purple credit cards, one to each member of our starting team, painstakingly committed to reinventing what used to be a completely commoditized product and seeking to leverage the benefits of being inherently digital in order to offer a product with zero fees. Since then, customer growth continues to surpass our every expectation, and we have worked tirelessly in building the significant infrastructure to help support this growth while creating a comprehensive portfolio of financial services for consumers and small businesses by working to maintain the highest Net Promoter Score in each country we operate in. We decided to begin our regional expansion by launching our credit card product in Mexico in 2019 and in Colombia in 2020, where growth has also come faster than we expected and have reached the #1 position of net cards issued for Mexico and Colombia during every month of 2022, according to the Mexican National Banking and Securities Commission (CNBV) and Financial Superintendence of Colombia (SFC).

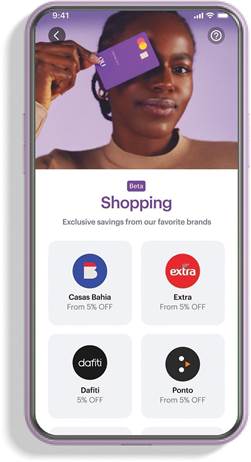

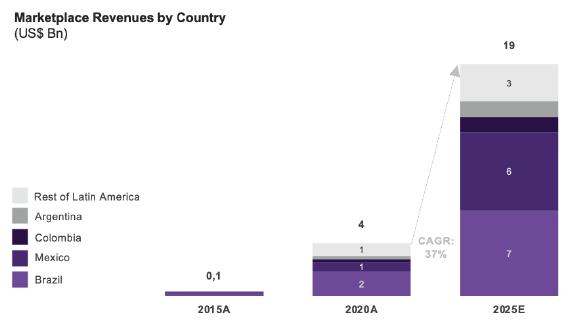

More recently in Brazil, we have taken our next step of going beyond financial services to mitigate complexity on behalf of our customers via our Marketplace, where our customers can shop at a growing number of partners with additional credit limits and benefiting from special discounts and cashback that we are able to negotiate given our scale. We see our Marketplace as a way to increase our value proposition while redefining and increasing our addressable market.

Our results

As 2022 progressed and showed a more challenging environment than most people anticipated, our team, already hardened by the significant volatility we have seen as a company since our foundation, increased execution focus and made a number of key decisions that helped us ultimately deliver results we are proud of.

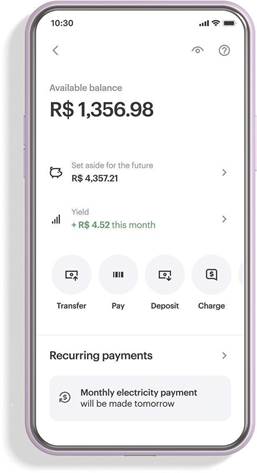

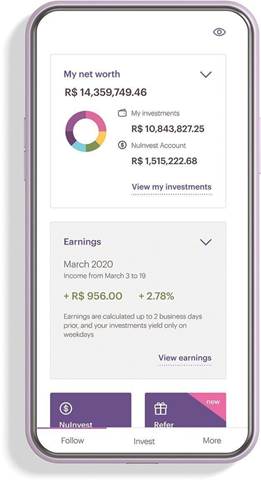

First, as we saw interest rates rising to over 14% in Brazil, we launched Money Boxes, an innovative in-app tool for customers to shift their checking account deposits into an organized investment portfolio. Six months later we were able to lower our cost of funding, with strong and sequential growth of both deposits and Money Boxes.

Second, in the context of a more challenging environment for asset quality in Brazil, we took several measures to safeguard our portfolios that included more restrictive personal loan origination while repricing our products and increasing resilience within our portfolios. In parallel, we accelerated the launch of secured lending, with the broad rollout of payroll deductible loans in Brazil recently announced, as I will detail later in this letter.

Third, we doubled down on efficiency moves to foster profitability and display the operating advantage of our model. As an example, the 2021 contingent share award was terminated, which will reduce our costs by US$70 million per year, but we believe it also shows how committed I am to accelerate value creation for all of our shareholders. We expect that our efficiency ratio will continue to improve progressively over the coming years as we seek to capture cost savings opportunities and reduce the rate of headcount growth going forward.

In addition to several product launches, such as new credit card features, Buy Now, Pay Later (“BNPL”) products, new insurance products and investment features, such as Money Boxes, other accomplishments of 2022 include:

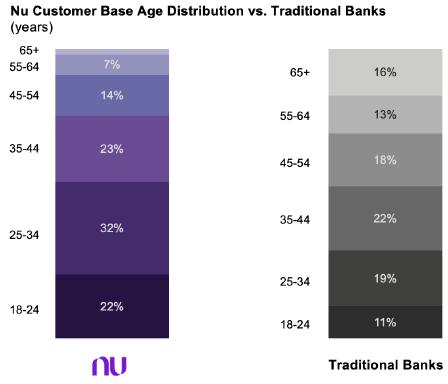

| ● | During 2022, we welcomed 20.7 million new customers on our platform, while increasing our activity rate from 76% in 2021 to 82%. With that, we achieved the impressive milestone of 70.9 million clients in Brazil, or 44% of the adult population in the country, as of December 2022. Our expansion into Mexico and Colombia has also been notable, with total clients in these countries reaching 3.2 million and 565,000, respectively, as of December 31, 2022. Meanwhile, we have become the primary banking relationship for over 58% of our active customers who had been with us for more than 12 months as of December 31, 2022, compared to less than 55% as of December 31, 2021. Our strategic goal is to be the main bank account for our customers, not just a side wallet, and we believe these levels of primary banking relationship are best-in-class industry-wide. |

| ● | We

displayed our cross-sell capabilities with checking accounts, our second product, growing

51% YoY to approximately 53 million active customers at year-end, while our initial product,

credit cards, also expanded 36% YoY to approximately 34 million active customers. We believe

that a second product that becomes even more relevant than the first is a rare achievement

for a fintech company. Other products also followed a strong growth path during 2022, with

active unsecured personal loan, investment and insurance clients growing 126%, 111% and 100%

YoY, respectively. As per our internal analysis, we have become one of the five largest MSE

(Micro and Small Enterprises) players in Brazil in number of clients, with 2.5 million MSE

customers, surpassing 13% in the number of accounts for companies in this segment. |

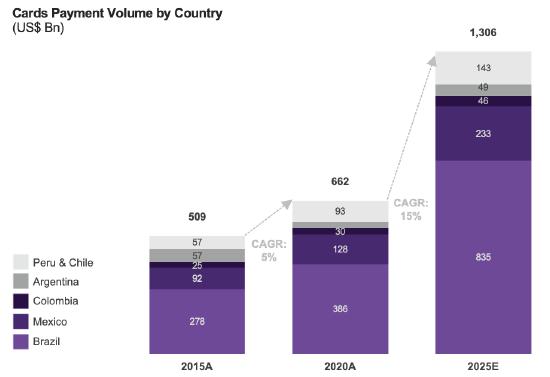

| ● | We have already become the fourth largest card issuer in Brazil as of December 31, 2022, surpassing some of the incumbent banks, with our share of the card payment volume (PV) market (including credit, debit and prepaid) at 11.9% in 2022, 8.7% in 2021, 5.7% in 2020 and 3.7% in 2019, according to data from the Brazilian Credit Cards and Services Association. |

| ● | Our

interest-earning portfolio achieved US$4.0 billion or double the US$2.0 billion posted a

year before. We believe this shows the resilience

of our credit underwriting model, especially considering our current scale and Brazil’s

ongoing credit deterioration. In the meantime, we believe we have built a strong source of

funding in Brazil, growing our retail deposits by 55% YoY on a FX Neutral basis, to US$15.8

billion. Following the launch of the money box features concurrently with the adoption of

our new deposit interest payment framework, our average quarterly cost of funding improved

to an all-time low of 78% of the interbank deposit rate (CDI) in December 2022 (compared

to 98% in December 2021). |

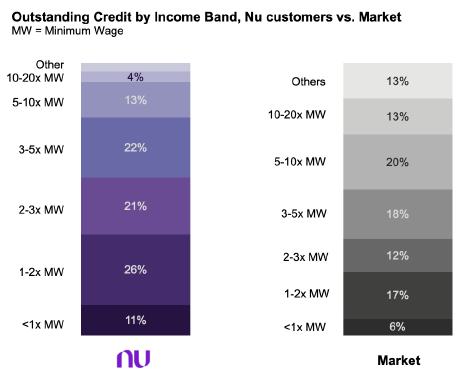

| ● | Our credit-underwriting model was put to the test, and we understand it excelled amidst significant macroeconomic volatility, with our 90-day consumer finance delinquency rate, or NPL ratio, closing the year at 5.2%. This would imply 25% lower levels when compared to the industry average, adjusted by product, growth and income distribution, according to the Central Bank of Brazil and our own estimates. We believe our main credit underwriting advantages lie in our ability to assess what we call Ability and Willingness to Pay. On Ability to Pay, considering our lower unit costs and focus on technology, we expect to be able to: (a) enter pockets of the population that other players would be unwilling or unable to serve; (b) collect significant amounts of data that feeds and improves our credit models; and (c) rely on our strong relationships with primary banking clients to enable us to manage and mitigate the risks we take. On Willingness to Pay, by focusing our underwriting on primary banking clients, we believe we not only generate higher revenues, but also experience default rates that are 48% lower than those of non-primary customers as of December 31, 2022, based on our internal research. We believe this approach allows us to provide more accessible and efficient financial services while also managing risk more effectively. |

| ● | Monthly ARPAC was US$7.8 for the year ended December 31, 2022, compared to US$4.5 for the year ended December 31, 2021 (a 66% increase YoY compared to a US$4.7 on an FX neutral basis). In the meantime, our monthly average cost to serve per active customer remained stable at US$0.8 in 2022 and 2021, reinforcing the operational leverage advantage of our model. |

| ● | Finally, our total revenue increased by 182.2% (or 167.5% on a FX Neutral basis), reaching US$4.8 billion in 2022 from US$1.7 billion in 2021, while our gross profit increased 126.9% (or 115.1% on a FX Neutral basis) reaching US$1.7 billion in 2022 from US$0.7 billion in 2021. |

As proud as I am of what we accomplished in 2022, I am equally excited about our opportunities and goals going forward.

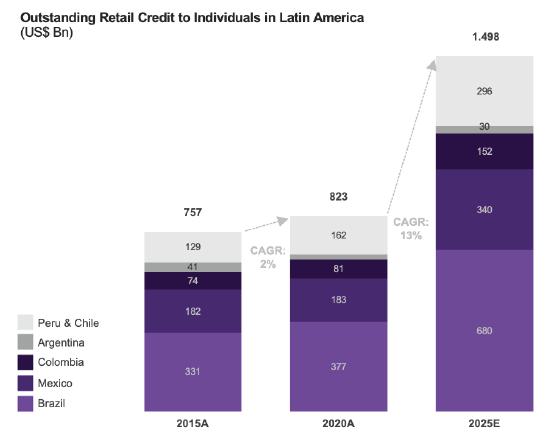

| ● | Firstly, our personal loan book, both unsecured and secured lending. On the former, we began introducing this product two years ago and have already achieved a 5% market share of outstanding receivables in Brazil, according to data from the Brazilian Central Bank. However, only 8% of our active customers in the country are active in this product with us. On the latter, we started testing this product in late 2022 and, we are commencing our full roll-out of secured lending through a fully digital distribution model that we believe is unparalleled in Brazil. We are starting this journey with federal public servants, where we are already observing promising initial indicators. |

| ● | Secondly, we prioritize “winning our fair share of wallet in the upmarket in Brazil,” with customer acquisition and then customer monetization. In terms of customer acquisition, we already have approximately 70% of Brazilians earning a monthly income above R$5,000 on our platform. Furthermore, approximately 60% of Brazilians who earn a monthly income above R$12,000 are also on our platform. This means that we have already made significant progress in the initial phase of our journey. In terms of customer monetization, we continue working to increase our share of wallet with those clients: Banking-Spending-Savings. For the first pillar, we expect upcoming launches of personal financial management services/tools to enhance user experience for this segment, helping to increase financial control and daily usage, which can foster engagement in our platform. For the second pillar, we intend to continue launching new products and enhancing credit limit adequacy. We understand this is critical for this segment, in contrast to our widespread low-and-grow credit methodology serving lower income individuals. Finally, for the third pillar, we have advanced – since the Easynvest acquisition completed two years ago – being the largest direct digital investment platform in Latin America in number of customers as of December 2022, according to our internal analysis. We expect to continue expanding our product shelf and cross sell opportunity in parallel with finalizing the integration of our investment platform into a single app. |

| ● | Thirdly, continue working on our growth model in our new geographies. We expect 2023 to be the year in which we can launch and deepen the penetration of Nu Account, our checking account product, in both Mexico and Colombia, aiming to accelerate the growth and sustainability of our platform in those countries. We understand this is important for three reasons. Firstly, we currently deny a large percentage of customer applications, between 60% and 70%, because they do not meet our credit score requirements for eligibility for our credit card product, the only product available in those countries. By introducing Nu Account, we can welcome customers who have not yet built up a credit score, thereby potentially expediting the growth of our platform with limited additional credit risk. Secondly, we believe that building a sustainable retail deposit platform, as we did in Brazil, is essential to growing our consumer credit business in concentrated markets such as Mexico and Colombia. We understand we cannot rely on wholesale funding or securitizations in the long-term. Thirdly, we expect the scale gained through the launch of Nu Account to benefit our credit underwriting model, which uses AI and machine-learning proprietary systems. We intend to continue investing significantly in both countries as we think the potential reward is substantial. |

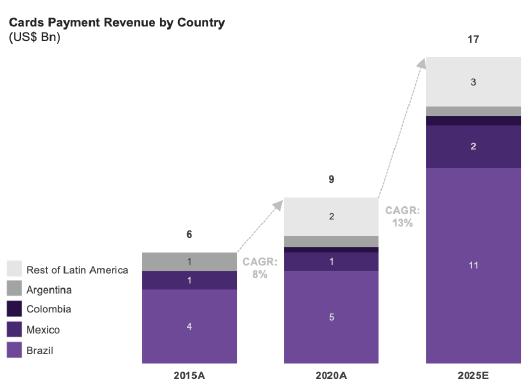

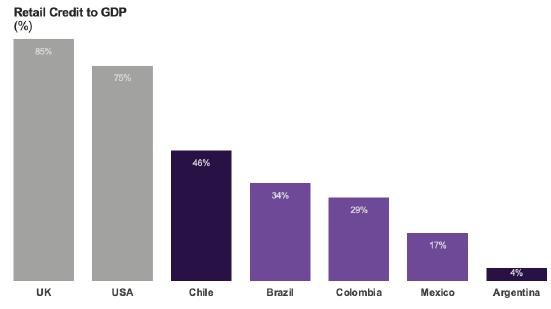

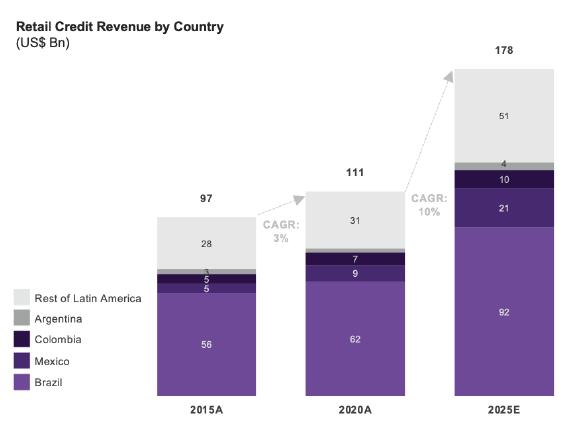

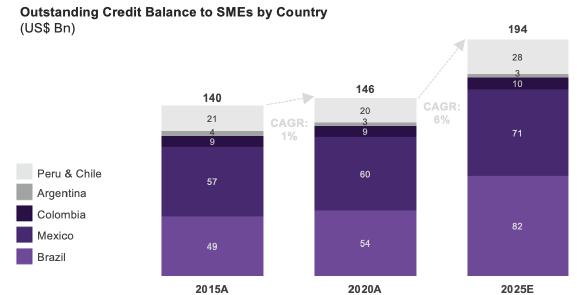

While our consumer base is already significant in Brazil, we also believe our market shares across most of the product lines in which we play are still relatively low. As of December 2022, our market shares in Brazil stood at only 12%1 in credit cards, and less than 5%2 in effectively all other product lines we have in the country – while our customers already accounted for 44% of the adult population in Brazil and keep growing month after month. Today, we believe we have a strong footing in the three largest economies of Latin America, a US$1 trillion financial services market cap industry, as of December 31, 2022, according to our internal estimates.

1 Share of the card payment volume (PV) market (including credit, debit and prepaid cards), according to data from the Brazilian Credit Cards and Services Association.

2 Shares at the end of the period. For personal loans, share of outstanding receivables; for investments, share of Assets Under Management (AUC). Securities share considers the gross written premiums of the year, and Marketplace considers the Gross Merchandise Value (GMV) of the year. Sources: Brazilian Central Bank, Brazilian Credit Cards and Services Association, Brazilian Association of Financial and Capital Market Entities (ANBIMA), Private Insurance Superintendence (SUSEP) and Brazilian Electronic Commerce Association (ABCOMM).

We believe we are defining a new fintech category globally, one that we describe internally as a “Money Platform”: a technology platform that has the optimization of money on behalf of its users at its core. We understand this concept can hold significant power as successful management and optimization of finances are crucial factors in effectively engaging the entire adult global population. Money touches every aspect of life, and its significance cannot be overstated. People often pay excessive or unnecessary interests and fees to intermediaries that can further erode financial well-being. These costs can be detrimental to the economic welfare of an entire society. We believe we have a once in a generation opportunity to tackle this societal problem and unlock value to our stakeholders.

After establishing a significant consumer base in financial services, characterized by high consumer trust, brand loyalty, frequent usage, and sustainable profitability, we will be well-positioned to expand our offerings beyond financial services to address other relevant needs of our consumers. Under the concept of the “Money Platform,” we believe we can expand our addressable market while developing an additional array of essential capabilities, further accelerating our path to becoming “the one and only indispensable app” in our market.

This all makes us excited about still being in the first minute of the first half of this game. We look forward to partnering with you in this exciting journey that has just begun.

/s/ David Vélez Osorno

Founder, Chairman and Chief Executive Officer

Table of contents

| ITEM 16I. | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | 318 |

| PART III | ||

| ITEM 17. | FINANCIAL STATEMENTS | 319 |

| ITEM 18. | FINANCIAL STATEMENTS | 320 |

| ITEM 19. | EXHIBITS | 321 |

Presentation of Financial and Other Information

All references to “U.S. dollars,” “dollars,” or “US$” are to the U.S. dollar. All references to “IFRS” are to International Financial Reporting Standards, as issued by the International Accounting Standards Board, or "IASB".

Financial Statements

Nu Holdings Ltd. ("Nu") was incorporated in the Cayman Islands on February 26, 2016, as an exempted company incorporated with limited liability.

We maintain our books and records in U.S. dollars, which is the presentation currency for our financial statements and also our functional currency. The functional currency of our Brazilian, Mexican and Colombian operating entities, respectively, is the Brazilian real, the Mexican peso and the Colombian peso. The financial statements of each of our subsidiaries are maintained using the relevant functional currency for such subsidiary, which we determine is the currency that best reflects the economic substance of the underlying events and circumstances relevant to that entity. See note 2.a to our audited consolidated financial statements, included elsewhere in this annual report, for more information about our and our subsidiaries’ functional currencies.

Our consolidated financial statements were prepared in accordance with IFRS. Unless otherwise noted, our consolidated statement of financial position data presented herein as of December 31, 2022 and 2021 and the consolidated statements of profit or loss for the years ended December 31, 2022, 2021, and 2020 is stated in U.S. dollars, our reporting currency. Our consolidated financial information contained in this annual report is derived from our audited consolidated financial statements as of December 31, 2022 and 2021 and for the years ended December 31, 2022, 2021 and 2020, together with the notes thereto.

This financial information should be read in conjunction with “Item 5. Operating and Financial Review and Prospects” and our consolidated financial statements, including the notes thereto, included elsewhere in this annual report.

Our fiscal year ends on December 31. References in this annual report to a fiscal year, such as “fiscal year 2022,” relate to our fiscal year ended on December 31 of that calendar year.

Special Note Regarding Non-IFRS Financial Measures

This annual report presents our Adjusted Net Income (Loss) and certain FX Neutral measures and their respective reconciliations for the convenience of investors, which are non-IFRS financial measures. A non-IFRS financial measure is generally defined as a numerical measure of historical or future financial performance, financial position, or cash flow that purports to measure financial performance but excludes or includes amounts that would not be so adjusted in the most comparable IFRS measure. Adjusted Net Income (Loss) and the FX Neutral measures, however, should be considered in addition to, and not as a substitute for or superior to, profit (loss), or other measures of the financial performance prepared in accordance with IFRS.

Form 20-F | 2022 | 1 |

|

Adjusted Net Income (Loss)

Adjusted Net Income (Loss) is prepared and presented to eliminate the effect of items from profit (loss) attributable to shareholders of the parent company that we do not consider indicative of our core operating performance within the period presented. We define Adjusted Net Income (Loss) as profit (loss) attributable to shareholders of the parent company, adjusted for expenses related to share-based compensation, allocated tax effects on share-based compensation, the expenses (revenue deduction) and allocated tax effects related to the IPO-related customer program (NuSócios), hedge of the tax effects on share-based compensation, finance costs with results with convertible instruments and the expense related to the termination of the 2021 Contingent Share Award (CSA) in 2022.

Adjusted Net Income (Loss) is presented because our management believes that this non-IFRS financial measure can provide useful information to investors, securities analysts and the public in their review of our operating and financial performance, although it is not calculated in accordance with IFRS or any other generally accepted accounting principles and should not be considered as a measure of performance in isolation. We also use Adjusted Net Income (Loss) as a key profitability measure to assess the performance of our business. We believe that Adjusted Net Income (Loss) is useful to evaluate our operating and financial performance for the following reasons:

| ● | Adjusted Net Income (Loss) is widely used by investors and securities analysts to measure a company’s operating performance without regard to items that can vary substantially from company to company and from period to period, depending on their accounting and tax methods, the book value and the market value of their assets and liabilities, and the method by which their assets were acquired; |

| ● | Non-cash equity grants made to executives, employees or consultants at a certain price and point in time, the income tax effects and the gains and losses of related hedges, do not necessarily reflect how our business is performing at any particular time and the related expenses are not considered to reflect our core operating performance; |

| ● | The expense related to the termination of the 2021 Contingent Share Award (CSA) is considered unusual and not expected to recur in the foreseeable future and does not necessarily reflect how our business is performing or how it is expected to perform in the future and is not considered to reflect our core operating performance; |

| ● | Expenses related to the customer program (NuSócios), and their income tax effects, do not necessarily reflect how our business is performing at any particular time as they were related to a specific marketing effort we carried out in connection with our initial public offering (IPO) and are not considered to reflect our core operating performance; and |

| ● | Finance costs with convertible instruments include fair value adjustments relating to the embedded derivative conversion feature, which are based upon subjective assumptions and do not reflect the cash cost of our convertible debt, and do not directly reflect how our business is performing at any particular time. The related expenses are not considered to reflect our core operating performance. |

Adjusted Net Income (Loss) is not a substitute for profit (loss) attributable to shareholders of the parent company, which is the IFRS measure of earnings. Additionally, our calculation of Adjusted Net Income (Loss) may be different from the calculation used by other companies, including our competitors in the technology and financial services industries, because other companies may not calculate these measures in the same manner as we do, and therefore, our measure may not be comparable to those of other companies. A reconciliation of our Adjusted Net Income (Loss) to its most directly comparable measure of income (loss) can be found in “Item 5. Operating and Financial Review and Prospects—A. Operating Results—Non-IFRS Financial Measures and Reconciliations.”

Form 20-F | 2022 | 2 |

|

FX Neutral Measures

FX Neutral measures are prepared and presented to eliminate the effect of foreign exchange, or “FX,” volatility between the comparison periods, allowing management and investors to evaluate our financial performance despite variations in foreign currency exchange rates, which may not be indicative of our core operating results and business outlook.

FX Neutral measures are presented because our management believes that these non-IFRS financial measures can provide useful information to investors, securities analysts and the public in their review of our operating and financial performance, although they are not calculated in accordance with IFRS or any other generally accepted accounting principles and should not be considered as a measure of performance in isolation.

The FX Neutral measures included in this annual report were calculated to present what such measures in preceding years would have been had exchange rates remained stable from these preceding years until the date of our most recent financial information, as detailed below.

The FX Neutral measures for the years ended December 31, 2021 and 2020 were calculated by multiplying the as reported amounts of Adjusted Net Income (Loss) and the key business metrics for such years by the average Brazilian reais/U.S. dollars exchange rates for the years ended December 31, 2021 and 2020 (R$5.415 and R$5.240 to US$1.00, respectively), and using such results to re-translate the corresponding amounts back to U.S. dollars by dividing them by the average Brazilian reais/U.S. dollars exchange rate for the year ended December 31, 2022 (R$5.133 to US$1.00), so as to present what certain of our statement of profit and loss amounts and key business metrics would have been had exchange rates remained stable from these past periods/years until the year ended December 31, 2022. The average Brazilian reais/U.S. dollar exchange rate for the year ended December, 31, 2019 (R$3.952 to 1.00) was used to calculate, using the same methodology described above, the FX Neutral Revenue for 2019 which is an input to the FX Neutral Revenue growth (%) presented for the year 2020.

The average Brazilian reais/U.S. dollars exchange rates were calculated as the average of the month-end rates for each month in the years 2022, 2021, 2020 and 2019, as reported by Bloomberg.

FX Neutral measures for deposits and interest-earning portfolio presented in this annual report were calculated by multiplying the as reported amounts as of December 31, 2021 and 2020 by the spot Brazilian reais/U.S. dollars exchange rates as of these dates (R$5.576 and R$5.199 to US$1.00, respectively), and using such results to re-translate the corresponding amounts back to U.S. dollars by dividing them by using the spot rate as of December 31, 2022 (R$5.280 to US$1.00) so as to present what these amounts would have been had exchange rates been the same as those on December 31, 2022. The Brazilian reais/U.S. dollars exchange rates were calculated using rates as of such dates as reported by Bloomberg. The spot Brazilian reais/U.S. dollar exchange rate for the year ended December 31, 2019 (R$4.030 to 1.00) was used to calculate, using the same methodology described above, the FX Neutral Deposit and FX Neutral Interest-earning portfolio as of December 31, 2019 which are inputs to the FX Neutral Deposit growth (%) and FX Neutral Interest-earning portfolio growth (%), respectively, presented for the year 2020.

FX Neutral measures do not include adjustments for any other macroeconomic effect, such as local currency inflation effects, or any price adjustment to compensate for local currency inflation or devaluation. A reconciliation of our FX Neutral measures to the most directly comparable financial measure calculated and presented in accordance with IFRS can be found in “Item 5. Operating and Financial Review and Prospects—A. Operating Results—Non-IFRS Financial Measures and Reconciliations.”

Form 20-F | 2022 | 3 |

|

Special Note Regarding Certain Operational Metrics

Customers and Active Customers

This annual report presents information regarding our number of customers and our number of monthly active customers.

Number of customers information is prepared and presented as an important indicator of the size and momentum of our business, particularly as we continue to operate at a high growth pace. We define customers for a given measurement period as the individuals or SMEs that have previously or within such measurement period opened an account with us and we exclude any such individuals or SMEs that have been charged-off or blocked or have voluntarily closed their account. Number of customers is presented because it allows us to track our capacity to attract and retain customers and can provide useful information to investors, securities analysts and the public in their review of our operating performance.

Monthly active customer information is prepared and presented as an important indicator of the size and momentum of our business based on the number of customers we consider to be active. We define monthly active customers as all customers that have generated revenue in the last 30 calendar days, for a given measurement period. Monthly active customers information is presented because it allows us to track our capacity to attract and retain active customers and can provide useful information to investors, securities analysts and the public in their review of our operating performance.

Moreover, we differentiate between total number of customers (which includes customers we consider to be non-active) and active customers, to enable our management to evaluate performance metrics exclusively on the customers that we define as active. Doing so allows us to track performance based on revenue (defined as Monthly ARPAC) and cost (defined as Monthly Average Cost to Serve). For an explanation of how we calculate Monthly ARPAC and Monthly Average Cost to Serve per Active Customer please see the “Glossary of Terms” and “Item 5. Operating and Financial Review and Prospects—A. Operating Results.”

Information regarding both total number of customers and monthly active customers should be analyzed in conjunction with other operating and financial metrics, and should not be considered as a measure of performance in isolation. Additionally, our calculation of these measures may be different from the calculation used by other companies, including our competitors in the technology and financial services industries, because other companies may not calculate these measures in the same manner as we do, and therefore, our measures may not be comparable to those of other companies.

Form 20-F | 2022 | 4 |

|

Market Share and Other Information

This annual report contains data related to economic conditions in the markets in which we operate. The information contained in this annual report concerning economic conditions is based on publicly available information from third- party sources that we believe to be reasonable. Market data and certain industry forecast data used in this annual report were obtained from internal reports and studies, where appropriate, as well as estimates, market research, publicly available information (including information available from the U.S. Securities and Exchange Commission website) and industry publications. We obtained the information included in this annual report relating to the industry in which we operate, as well as the estimates concerning market shares, through internal research; a report from October 2021 and a profit pool analysis updated using a similar methodology as of March 2023 by management consulting company Oliver Wyman Consultoria em Estratégia de Negócios Ltda. commissioned by us; public information; publications on the industry prepared by official public sources, such as the Brazilian Association of Financial and Capital Markets Entities (Associação Brasileira das Entidades dos Mercados Financeiro e de Capitais, or “ANBIMA”); the World Bank; the International Monetary Fund, or the “IMF;” the Organization for Economic Co-operation and Development, or “OECD;” the Central Bank of Brazil; the Colombian Central Bank; the Central Bank of Mexico; the Inter-American Development Bank; the Brazilian Social and Economic Development Bank (Banco Nacional de Desenvolvimento Econômico e Social, or “BNDES”); the Brazilian Institute of Geography and Statistics (Instituto Brasileiro de Geografia e Estatística, or the “IBGE”); the Institute of Applied Economic Research (Instituto de Pesquisa Econômica Aplicada, or “IPEA”), the Superintendence of Private Insurance (Superintendência de Seguros Privados, or “SUSEP”), the CVM; the Colombian National Administrative Department of Statistics (DANE – Departamento Administrativo Nacional de Estadística); the Mexican National Institute of Statistics and Geography (INEGI – Instituto Nacional de Estadística, Geografía e Informática); the Brazilian Micro and Small Business Support Service (Serviço Brasileiro de Apoio às Micro e Pequenas Empresas) or “SEBRAE;” and the GSMA; and the Brazilian Association of Credit Card and Services Companies (Associação Brasileira de Empresas de Cartões de Crédito e Serviços), or “ABECS;” as well as private sources, such as B3, Bloomberg and Forbes, consulting and research companies in the Brazilian financial services industry, and Fundação Getulio Vargas, or “FGV,” among others. We estimate that we are one of the largest digital banking platforms in the world by comparing what we believe to be the largest (by number of customers) digital banking platforms around the world (according to public statements made by these platforms and data from an independent research firm) to the number of customers on our platform.

Industry publications generally state that the information they include has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. Although we have no reason to believe any of this information or these reports are inaccurate in any material respect and believe and act as if they are reliable, we have not independently verified it. Governmental publications and other market sources, including those referred to above, generally state that their information was obtained from recognized and reliable sources, but the accuracy and completeness of that information is not guaranteed. In addition, the data that we compile internally and our estimates have not been verified by an independent source. Except as disclosed in this annual report, none of the publications, reports or other published industry sources referred to in this annual report were commissioned by us or prepared at our request. Except as disclosed in this annual report, we have not sought or obtained the consent of any of these sources to include such market data in this annual report.

Form 20-F | 2022 | 5 |

|

Calculation of Net Promoter Score

Net promoter score, or “NPS,” is a widely known survey methodology that measures the willingness of customers to recommend a company’s products and services. It is used to gauge customers’ overall satisfaction with a company’s products and services and their loyalty to the brand, and it is typically based on customer surveys. NPS measures satisfaction using a scale of zero to 10 based on a customer’s response to the following question: “How likely is it that you would recommend Nu to a friend or colleague?” Responses of nine or 10 are considered “promoters.” Responses of seven or eight are considered neutral. Responses of six or less are considered “detractors.” The NPS, a percentage expressed as a numerical value, is calculated by subtracting the percentage of respondents who are detractors from the percentage who are promoters.

Rounding

We have made rounding adjustments to some of the figures included in this annual report. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that preceded them.

Form 20-F | 2022 | 6 |

|

Cautionary Statement Regarding Forward-Looking Statements

This annual report contains forward-looking statements within the meaning of the federal securities laws, which statements involve substantial risks and uncertainties. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential,” or “continue,” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans, or intentions. Forward-looking statements contained in this annual report include statements about:

| ● | general economic, financial, political, demographic and business conditions in Brazil, Mexico and Colombia, as well as any other countries we may serve in the future and their impact on our business; |

| ● | fluctuations in interest, inflation and exchange rates in Brazil, Mexico and Colombia and any other countries we may serve in the future; |

| ● | our ability to timely and efficiently implement any measures that are necessary to combat or reduce the impacts of the COVID-19 pandemic on our business, results of operations, cash flow, prospects, liquidity and financial condition; |

| ● | competition in the consumer technology and financial services industry; |

| ● | our ability to implement our business strategy; |

| ● | our ability to adapt to the rapid pace of technological changes in the sectors in which we operate; |

| ● | the reliability, performance, functionality and quality of our products and services, reliability and performance of our suitability, risk management and business continuity policies and processes; |

| ● | the availability of government authorizations on terms and conditions and within periods acceptable to us; |

| ● | our ability to continue attracting and retaining new appropriately-skilled employees; |

| ● | our capitalization and level of indebtedness; |

| ● | the interests of our founding shareholder; |

| ● | our ability to manage our growth effectively; |

| ● | our ability to successfully expand in Latin America and other new markets; |

| ● | changes in government regulations applicable to the financial services industry in Brazil, Mexico, Colombia and elsewhere; |

| ● | our ability to compete and conduct our business in the future; |

| ● | our ability to maintain, protect and enhance our brand and intellectual property; |

Form 20-F | 2022 | 7 |

|

| ● | the success of operating initiatives, including advertising and promotional efforts and new product, service and concept development by us and our competitors; |

| ● | changes in consumer demands regarding the products and services we offer, and our ability to innovate to respond to such changes; |

| ● | changes in labor, distribution and other operating costs; |

| ● | our compliance with, and changes to, government laws, regulations and tax matters that currently apply to us; |

| ● | the size of our addressable markets, market share and market trends; |

| ● | other factors that may affect our financial condition, liquidity and results of operations; and |

| ● | other risk factors discussed under “Item 3. Key Information—D. Risk Factors.” |

We caution you that the foregoing list may not contain all of the forward-looking statements made in this annual report. You should not rely upon forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this annual report primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition, results of operations, and prospects. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties, and other factors, including those described in “Item 3. Key Information—D. Risk Factors” and elsewhere in this annual report. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this annual report. We cannot guarantee that the results, events, and circumstances reflected in the forward-looking statements will be achieved or occur, and actual results, events, or circumstances could differ materially from those described in the forward-looking statements.

Neither we nor any other person assumes responsibility for the accuracy and completeness of any of these forward- looking statements. Moreover, the forward-looking statements made in this annual report relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this annual report to reflect events or circumstances after the date of this annual report or to reflect new information or the occurrence of unanticipated events, except as required by law. We may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward- looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this annual report, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

Form 20-F | 2022 | 8 |

|

PART I

Item 1. Identity of Directors, Senior Management and Advisors

| A. | Directors and Senior Management |

Not applicable.

| B. | Advisers |

Not applicable.

| C. | Auditors |

Not applicable.

Item 2. Offer Statistics and Expected Timetable

| A. | Offer Statistics |

Not applicable.

| B. | Method and Expected Timetable |

Not applicable.

Item 3. Key Information

| A. | [Reserved.] |

| B. | Capitalization and Indebtedness |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

| D. | Risk Factors |

Risk Factors Summary

Investing in our Class A ordinary shares, including in the form of BDRs, involves risks. You should carefully consider the risks described below before making a decision to invest in our Class A ordinary shares or BDRs. If any of these risks actually materialize, our business, financial condition or results of operations would likely be materially adversely affected. In such a case, the trading price of our Class A ordinary shares and BDRs would likely decline, and you could lose all or part of your investment. The following is a summary of some of the principal risks we face:

Form 20-F | 2022 | 9 |

|

Risks Relating to Our Business and Industry

| ● | Our business depends on a well-regarded and widely known brand, and any failure to maintain, protect and enhance our brand and image, including through effective marketing strategies, would harm our business, financial condition and results of operations. |

| ● | Failure to successfully implement and improve our risk management policies, procedures and methods, including our credit risk management system, would materially and adversely affect our business, results of operations and financial condition. |

| ● | Our international expansion efforts may not be successful, or may subject our business to increased risks. |

| ● | Our business is highly dependent on the proper functioning of information technology systems, particularly at scale. Any failure of these systems would disrupt our business and impair our ability to provide our services and products effectively to our customers. |

| ● | We depend on data centers operated by third parties and third-party Internet-hosting providers and cloud computing platforms, and any disruption in the operation of these facilities or platforms or access to the Internet would adversely affect our business. |

| ● | We have incurred losses since our inception, and we may not achieve profitability. |

Risks Relating to Intellectual Property, Privacy and Cybersecurity

| ● | Unauthorized disclosure of sensitive or confidential customer information or our failure or the perception by our customers that we failed to comply with privacy laws or properly address privacy concerns could harm our business and standing with our customers. |

| ● | Unauthorized disclosure of, improper access to, or destruction or modification of data through cybersecurity breaches, computer viruses or otherwise, or disruptions to our systems or services, could expose us to liability, protracted and costly litigation and damage our reputation. |

| ● | Claims by others that we infringe their proprietary technology or other rights could have a material and adverse effect on our business, financial condition and results of operations. |

Risks Relating to Regulatory Matters and Litigation

| ● | We are subject to extensive regulation and regulatory and governmental oversight as a digital banking platform and as a payment institution. Compliance with or violation of present or future regulations could be costly, expose us to substantial liability and force us to change our business practices, any of which could harm our business and results of operations. |

| ● | Certain ongoing legislative and regulatory initiatives under discussion by the Brazilian Congress, the Central Bank of Brazil, the Ministry of Finance, and the broader payments industry may result in changes to the regulatory framework of the Brazilian payments and financial industries and may have an adverse effect on us. |

| ● | We are subject to costs and risks associated with enhanced or changing laws and regulations affecting our business, including those relating to data privacy, security and protection. Developments in laws and regulations could harm our business, financial condition or results of operations. |

Form 20-F | 2022 | 10 |

|

Risks Relating to the Countries in Which We Operate

| ● | Exchange rate and interest rate instability may have a material adverse effect on the economies of the countries in which we operate and the price of our Class A ordinary shares and BDRs. |

| ● | Disruption or volatility in global financial and credit markets could adversely affect the financial and economic environment in the countries in which we operate, most notably Brazil, Colombia and Mexico, which could have a material adverse effect on us. |

| ● | Governments have exercised, and continue to exercise, significant influence over the Brazilian economy and the other economies in which we operate. This influence, as well as political and economic conditions in Brazil and the other countries in which we operate, could harm us and the price of our Class A ordinary shares and BDRs. |

Risks Relating to Our Class A Ordinary Shares and our BDRs

| ● | An active trading market for our Class A ordinary shares may not be sustainable. If an active trading market is not maintained, you may not be able to sell your shares and you could lose a significant part of your investment. |

| ● | Our founding shareholder and CEO David Vélez owns 88.6% of our outstanding Class B ordinary shares, which represents approximately 76.1% of the voting power of our issued share capital. This concentration of ownership and voting power may limit your ability to influence corporate matters. |

| ● | We have granted the holders of our Class B ordinary shares preemptive rights to acquire shares that we may sell in the future, which may impair our ability to raise funds. |

Risks Relating to Our Business and Industry

Our business depends on a well-regarded and widely known brand, and any failure to maintain, protect and enhance our brand and image, including through effective marketing strategies, would harm our business, financial condition and results of operations.

We believe our brand has contributed significantly to the historical success of our business. Maintaining, protecting and enhancing our brand is critical to expanding our customer base, our loan portfolio and our third-party partnerships, as well as increasing engagement with our products and services. Our success in this regard will depend largely on our ability to remain – or, in markets into which we expand, become – widely known, gain and maintain our customers’ trust, be a technology leader and provide reliable, high-quality and secure products and services that continue to meet the needs of our customers at competitive prices, as well as the effectiveness of our marketing efforts and our ability to differentiate our services and platform capabilities from competitors’ products and services.

We believe that maintaining and promoting our brand in a cost-effective manner is critical to achieving widespread acceptance of our products and services and to expand our customer base. Maintaining and promoting our brand will depend largely on our ability to continue to provide useful, reliable and innovative products and services, which we may not do successfully. Our brand promotion activities may not generate customer awareness or increase revenue, and even if they do, any increase in revenue may not offset the expenses we incur in promoting our brand. If we fail to successfully promote and maintain our brand or if we incur excessive expenses in this effort, we would lose significant market share and our business would be materially and adversely affected. Further, our success in the introduction and promotion of new products and services, as well as the promotion of existing products and services, may be partly dependent on our visibility on third-party advertising platforms. Changes in the way these platforms operate or changes in their advertising prices or other terms could make the introduction and promotion of our products and services and our brand more expensive or more difficult. If we are unable to market and promote our brand on third- party platforms effectively, our ability to acquire new customers would be materially harmed, which would adversely affect our business, financial condition and results of operations.

Form 20-F | 2022 | 11 |

|

Failure to successfully implement and improve our risk management policies, procedures and methods, including our credit risk management system, would materially and adversely affect our business, results of operations and financial condition.

The management of risk is an integral part of our activities. We seek to monitor and manage our risk exposure through a variety of separate but complementary financial, credit, market, operational, compliance and legal policies, procedures and reporting systems, among others. We employ a broad and diversified set of risk monitoring and risk mitigation techniques, which may not be fully effective in mitigating our risk exposure in all economic market environments or against all types of risk, including risks that we may fail to identify or anticipate.

We use certain tools and metrics for managing market risk, including statistical models, which are based upon our use of observed historical market behavior. We apply statistical and other tools to these observations to quantify our market risk. However, in part because these tools and metrics are based on historical market behavior, and in part because the models do not take all market risks into account, they may fail to predict future market risks, including those that arise from factors we did not anticipate or correctly evaluate in our statistical models. This would limit our ability to effectively manage our market risk, which could result in our losses being significantly greater than predicted.

Because certain of our operating subsidiaries are financial or payments institutions, our business is also subject to inherent credit risk. An important feature of our credit risk management system is an internal credit score system that assesses the particular risk profile of a customer. As this process involves detailed analysis of a customer that takes into account both quantitative and qualitative factors, it is subject to error, and our internal risk models may not always be able to accurately predict the future credit risk of our customers or assign an accurate credit score, which may result in our exposure to higher credit risks than indicated by our risk management system. We also rely on certain publicly available customer credit information, information relating to credit agreements and other public sources to assess a customer’s creditworthiness. Due to limitations in the availability of information and the underdeveloped information infrastructure in the markets in which we operate, our assessment of credit risk associated with a particular customer may not be based on complete, accurate or reliable information. In addition, we cannot ensure that our credit scoring systems collect complete or accurate information reflecting the actual behavior of customers or that their credit risk can be assessed correctly. Without complete, accurate and reliable information, we have to rely on other publicly available resources and our internal resources, which may not be effective. As a result, our ability to effectively manage our credit risk and subsequently determine our credit loss allowances may be materially adversely affected.

Relatedly, we are exposed to counterparty risk, which may arise from, for example, investing in securities of third parties, entering into derivative contracts under which counterparties have obligations to make payments to us or executing securities, futures or currency trades from proprietary trading activities that fail to settle at the required time due to non-delivery by the counterparty or systems failure by clearing agents, clearing houses or other financial intermediaries. Many of the routine transactions we enter into expose us to significant risk in the event of default by one of our significant counterparties, although we do not currently face specific counterparty risk from concentration within our loan portfolio. If these risks give rise to losses, this could materially and adversely affect us. Separately, because we routinely transact with counterparties in the financial services industry, including brokers and dealers, commercial banks, investment banks and other institutional customers, defaults by, and even rumors or questions about the solvency of, certain financial institutions and the financial services industry could lead to market-wide liquidity problems that could lead to substantial losses for our business.

Form 20-F | 2022 | 12 |

|

We also face operational and foreign exchange risk. Although we have adopted policies and procedures to identify, monitor and manage our operational risk, these policies and procedures may not be fully effective. For a discussion of the risks we face with respect to foreign exchange rates, see “—Risks Relating to the Countries in Which We Operate—Exchange rate and interest rate instability may have a material adverse effect on the economies of the countries in which we operate and the price of our Class A ordinary shares and BDRs.”

If our policies and procedures are not fully effective or we are not successful in capturing all risks to which we are or may be exposed, we may suffer harm to our reputation or be subject to litigation or regulatory actions that could have a material adverse effect on our business, results of operations or financial condition. Further, if management were to rely on risk models – whether with respect to market, credit or operational risks – that were flawed or poorly developed, implemented or used, or if management were to misunderstand or use such information for purposes for which it was not designed, we may fail to adequately manage our risk. In addition, if existing or potential customers or counterparties believe our risk management is inadequate, they could take their business elsewhere or seek to limit their transactions with us. Further, certain of the models and other analytical and judgment-based estimations we use in managing risk are subject to review by, and require the approval of, our regulators. If our models do not comply with their expectations, our regulators may require us to make changes to such models, may approve them with additional capital requirements or we may be precluded from using them, any of which could limit our ability to operate our businesses.

Failure to effectively implement, consistently monitor or continuously refine our risk management systems may result in a material adverse effect on our reputation, operating results and financial condition.

Our international expansion efforts may not be successful, or may subject our business to increased risks.

We currently operate in Brazil, Mexico and Colombia, and we have information technology and support operations in Germany, the United States and Uruguay. As part of our growth strategy, we may expand our operations by offering our products and services in additional regions, as well as additional countries in Latin America, where we have little or no experience, and by expanding our business in the jurisdictions in which we currently operate. We may not be successful in expanding our operations into these or other markets in a cost-effective or timely manner, if at all, and our products and services may not experience the same market adoption in such international jurisdictions as we have enjoyed in Brazil. In particular, the expansion of our business into new geographies (or the further expansion in geographies in which we currently operate) may depend on the local regulatory environment or require a close commercial relationship with one or more local banks or other intermediaries, which could prevent, delay or limit the introductions of our products and services in such countries. Local regulatory environments may vary widely in terms of scope and sophistication.

Further, our international expansion efforts have and will continue to place a significant strain on our personnel (including management), technical, operational and financial resources, and our current resources may not be adequate to support our planned geographical expansion. We also may not be able to recoup our investments in new geographies in a timely manner, if at all. If our expansion efforts are unsuccessful, including because potential customers in a given jurisdiction fail to adopt our products and services, our reputation and brand may be harmed, and our ability to grow our business and revenue may be adversely affected.

Form 20-F | 2022 | 13 |

|

Even if our international expansion efforts are successful, international operations will subject our business to increased risks, including:

| ● | increased licensing and regulatory requirements; |

| ● | competition from service providers or other entrenched market participants that have greater experience in the local markets than we do; |

| ● | increased costs associated with and difficulty in obtaining, maintaining, processing, transmitting, storing, handling and protecting intellectual property, proprietary rights and sensitive data; |

| ● | changes to the way we do business as compared with our current operations; |

| ● | a lack of acceptance of our products and services; |

| ● | the ability to support and integrate with local third-party service providers; |

| ● | difficulties in staffing and managing foreign operations in an environment of diverse culture, language, laws and customs; |

| ● | difficulties in recruiting and retaining qualified employees and maintaining our company culture; |

| ● | increased travel, infrastructure and legal and compliance costs; |

| ● | compliance obligations under multiple, potentially conflicting and changing, legal and regulatory regimes, including those governing financial institutions, payments, data privacy, data protection, information security, anti-corruption, anti-bribery and anti-money laundering; |

| ● | compliance with complex and potentially conflicting and changing tax regimes; |

| ● | potential tariffs, sanctions, fines or other trade restrictions; |

| ● | exchange rate exposure; |

| ● | increased exposure to public health issues such as the COVID-19 pandemic, and related industry and governmental actions to address these issues; and |

| ● | regional economic and political instability. |

As a result of these risks, our international expansion efforts may not be successful or may be hampered, which would limit our ability to grow our business.

Our business is highly dependent on the proper functioning of information technology systems, particularly at scale. Any failure of these systems would disrupt our business and impair our ability to provide our services and products effectively to our customers.

Our continued growth depends in part on the ability of our existing and potential customers to access our products and platform capabilities at any time and within an acceptable amount of time. Continued access to our products and platform capabilities depends on the efficient and uninterrupted operation of numerous systems, including our computer systems, software, data centers and telecommunications networks, as well as the systems of third parties, such as credit and debit card transaction authorization providers, national financial system network infrastructure providers, back office and business process support, information technology production and support, Internet and telephone connections, network access, data center infrastructure services and cloud storage and computing. However, these systems and technologies are vulnerable to disruptions, failures or slowdowns. We have experienced, and may in the future experience, disruptions, outages and other performance problems due to a variety of factors, including infrastructure changes, introductions of new functionality, human or software errors, capacity constraints due to an overwhelming number of customers accessing our products and platform capabilities simultaneously, denial of service attacks or other security-related incidents, natural disasters, power outages, terrorist attacks, hostilities, and other events beyond our control.

Form 20-F | 2022 | 14 |

|

As our business grows, it may become increasingly difficult to maintain and improve the performance of our information technology systems, especially during peak usage times and as our products and platform capabilities become more complex and our customer traffic increases. To the extent that we do not effectively address capacity constraints, upgrade our systems as needed and continually develop our technology and network architecture to accommodate actual and anticipated changes in technology, our business, financial condition and results of operations may be adversely affected. Specifically, if our products and platform capabilities are unavailable or if our customers are unable to access our products and platform capabilities within a reasonable amount of time, we may experience a loss of customers, lost or delayed market acceptance of our platform and products, delays in payment to us by customers, injury to our reputation and brand, the diversion of our resources, additional operating and development costs, loss of revenue, legal claims against us, the loss of licenses, loss of Central Bank of Brazil authorizations or fines or other penalties imposed by the Central Bank of Brazil (including intervention, temporary special management systems, the imposition of insolvency proceedings or the out-of-court liquidation of our operating subsidiaries), or by the Brazilian National Data Protection Authority (Autoridade Nacional de Proteção de Dados, or the “ANPD”). In addition, we do not maintain insurance policies specifically for property and business interruptions, meaning we would directly and without setoff incur any losses we suffer as a result of the aforementioned occurrences. For further information, see “—Our insurance policies may not be sufficient to cover all claims.”

Our business is highly dependent on the ability of our information technology systems to accurately process a large number of highly complex transactions across numerous and diverse markets and products in a timely manner and at high processing speeds, and on our ability to rely on our digital technologies, computer and email services, software and networks, as well as on the secure processing, storage and transmission of confidential data and other information on our computer systems and networks. Specifically, the proper functioning of our financial control, risk management, accounting, customer service and other data processing systems is critical to our business and our ability to compete effectively. Any failure to deliver an effective and secure service, or any performance issue that arises with a service, could result in significant processing or reporting errors or other losses. See “—We depend on data centers operated by third parties and third-party internet-hosting providers and cloud computing platforms, and any disruption in the operation of these facilities or platforms or access to the Internet would adversely affect our business.”

We do not operate all of our systems on a real-time basis and cannot assure that our business activities would not be materially disrupted if there were a partial or complete failure of any of these primary information technology systems or communication networks. In particular, because all customer transactions on Nu’s Platforms occur on our mobile application, any failure of our mobile application would cause our platform and services to be unavailable to our customers. Such failures could be caused by, among other things, major natural catastrophes, software bugs, computer virus attacks, conversion errors due to system upgrading, security breaches caused by unauthorized access to information or systems or malfunctions, loss or corruption of data, software, hardware or other computer equipment. Any such failures would disrupt our business and impair our ability to provide our services and products effectively to our customers, which could adversely affect our reputation as well as our business, results of operations and financial condition.

Our ability to remain competitive and achieve further growth will depend in part on our ability to upgrade our information technology systems and increase our capacity on a timely and cost-effective basis. We must continually make significant investments and improvements in our information technology infrastructure in order to remain competitive. We cannot guarantee that in the future we will be able to maintain the level of capital expenditures necessary to support the improvement or upgrading of our information technology systems. Any substantial failure to improve or upgrade our information technology systems effectively or on a timely basis would materially and adversely affect our business, financial condition or results of operations.

Form 20-F | 2022 | 15 |

|

We depend on data centers operated by third parties and third-party internet-hosting providers and cloud computing platforms, and any disruption in the operation of these facilities or platforms or access to the Internet would adversely affect our business.

Our business requires the ongoing availability and uninterrupted operation of internal and external transaction processing systems and services. We primarily serve our customers from third-party data center hosting facilities provided by a third-party service provider, which we rely on to operate certain aspects of our products and services, and we depend on third-party Internet-hosting providers and third-party bandwidth providers for continuous and uninterrupted access to the Internet to operate our business. Any disruption of or interference with our use of such services would impair our ability to deliver our products and services to our customers, resulting in customer dissatisfaction, damage to our reputation, loss of customers and harm to our business. Further, we have designed our products and services and computer systems to use data processing, storage capabilities and other services provided by such third-party service providers. As such, we cannot easily switch our operations to another cloud provider, so any disruption of or interference with our use of such providers’ services would increase our operating costs and could materially and adversely affect our business, financial condition and results of operations, and we might not be able to secure service from an alternative provider on similar terms or at all.

While we maintain oversight of our third-party data center hosting facilities and Internet-hosting providers, such third parties are ultimately responsible for maintaining their own network security, disaster recovery and system management procedures, and such third-parties do not guarantee that our customers’ access to our solutions will be uninterrupted, error-free or secure. These third-party providers may experience website disruptions, outages and other performance problems, which may be caused by a variety of factors, including infrastructure changes, human or software errors, viruses, security attacks, fraud, spikes in customer usage and denial of service issues. In some instances, we may not be able to identify the cause or causes of these performance problems within an acceptable period of time. In particular, we do not control the operation of the third-party data center hosting facilities, and such facilities are vulnerable to damage or interruption from human error, intentional bad acts, power loss, hardware failures, telecommunications failures, improper operation, unauthorized entry, data loss, power loss, cyberattacks, fires, wars, terrorist attacks, floods, earthquakes, hurricanes, tornadoes, natural disasters or similar catastrophic events. They also could be subject to break-ins, computer viruses, sabotage, intentional acts of vandalism and other misconduct. The occurrence of a natural disaster or an act of terrorism, a decision to close the facilities without adequate notice or terminate our hosting arrangement or other unanticipated problems could result in lengthy interruptions in the delivery of our solutions, cause system interruptions, prevent our customers from accessing their accounts online, reputational harm and loss of critical data, prevent us from supporting our solutions or cause us to incur additional expense in arranging for new facilities and support.

If we lose the services of one or more of our Internet-hosting or bandwidth providers for any reason or if their services are disrupted, for example due to viruses or denial of service or other attacks on their systems, or due to human error, intentional bad acts, power loss, hardware failures, telecommunications failures, fires, wars, terrorist attacks, floods, earthquakes, hurricanes, tornadoes or similar catastrophic events, we could experience disruption in our ability to offer our solutions and adverse perception of our solutions’ reliability, or we could be required to retain the services of replacement providers, which could increase our operating costs and materially and adversely affect our business, financial condition and results of operations.

Form 20-F | 2022 | 16 |

|

Furthermore, prolonged interruption in the availability, or reduction in the speed or other functionality, of our products or services could materially harm our reputation and business. Frequent or persistent interruptions in our products and services could cause customers to believe that our products and services are unreliable, leading them to switch to our competitors or to avoid our products and services, and would likely permanently harm our reputation and business.

Any of the foregoing, in addition to any of the factors described in “—We are dependent on third-party service providers in our operations, any failure of a third-party service provider could disrupt our operations,” could have a material adverse effect on our business, financial condition and results of operations.

Negative publicity about us (including our directors or employees) or our industry could adversely affect our business, financial condition, results of operations and future prospects.