According to the Interim Measures, online lending information service providers shall not engage in or accept entrustment to engage in certain activities, including, among others, (i) fund raising for the intermediaries themselves, (ii) holding investors’ fund or setting up capital pools with investors’ fund, (iii) providing security or guarantee to investors as to the principals and returns of the investment, (iv) issuing or selling any bank wealth management products, assets management products of securities companies, fund products, insurance products, trust products or other financial products, (v) mismatch between investor’s expected timing of exit and the maturity date, (vi) securitization, (vii) promoting its financing products on physical premises other than through the permitted electronic channels, such as telephones, mobile phones and internet, (viii) providing loans with its own capital, except as otherwise permitted by laws and regulations; and (ix) equity crowd-funding.

Pursuant to the Interim Measures, if an online lending information service provider violates any applicable laws, regulations or relevant regulatory provisions relating to online lending information services, sanctions could be imposed by the local financial regulatory departments or other relevant regulatory departments, including, among others, supervision interviews, regulatory warning, correction order, condemnation, credit record modification, fine up to RMB30,000 (US$4,349.6), and criminal liabilities if the act constitutes a criminal offense.

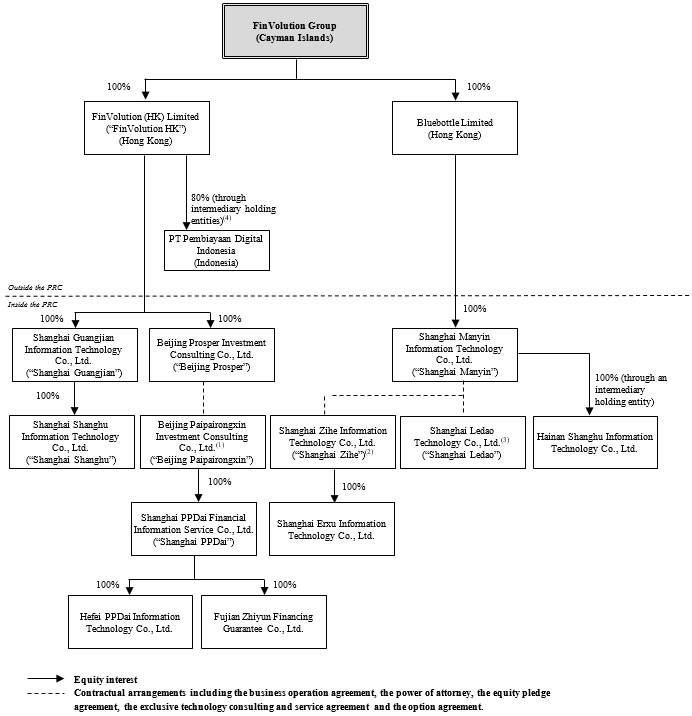

Pursuant to the aforementioned changes of laws and regulations governing online consumer finance, we have ceased facilitating new loans with funding from individual investors on our platform since October 2019 and improve our business model through acquisition of better quality borrowers and transition of our funding sources from individual investors to institutional funding partners. On January 14, 2022, the Shanghai Financial Stability Coordinating Joint Conference Office, the Shanghai Online Lending Risk Rectification Office, and other regulatory authorities jointly announced that Shanghai PPDai, among others, had declared the termination of its business operation as an online lending information intermediary and fully settled all related legacy loan products funded by individual investors.

Regulations on lending activities

The PRC Contract Law confirms the validity of loan agreement between individuals and provides that a loan agreement becomes effective when an individual lender provides loan to an individual borrower provided that the interest rates charged under the loan agreement do not violate the applicable provisions of the PRC laws and regulations.

The 13th National People’s Congress approved the Civil Code of the PRC on May 22, 2020. Upon the effectiveness of the Civil Code of the PRC on January 1, 2021, the PRC Contract Law, the General Provisions of the PRC Civil Law, and the General Principles of the PRC Civil Law have been abolished and replaced, while their provisions are generally incorporated into the Civil Code of the PRC with certain changes and supplements. It remains unclear with respect to the relevant interpretations and implementations of certain provisions of the Civil Code of the PRC and how these provisions of the Civil Code of the PRC will apply to our business operations. For example, pursuant to the Civil Code of the PRC, usurious loans are explicitly banned, but a clear definition or interpretation of “usurious loans” is not provided. We cannot rule out the possibility that certain of our operation activities would be deemed to violate or not fully comply with the Civil Code of the PRC. If that happens, our business, results of operations and financial condition would be materially and adversely affected.

On September 4, 2020, nine local governmental authorities in Shanghai jointly issued the Guidance on Further Strengthening the Administration of Financial Advertisement, which stipulates, among others, that (i) advertisements released by financial institutions and financial service providers should be within the scope permitted by the local governmental authorities; (ii) any market players without the relevant financial business qualifications cannot advertise or promote financial business; (iii) the financial advertisements should not induce purchase of improper financial products or services; and (iv) financial service provider is required to disclose name of its client when acting as an intermediary.

On February 12, 2010, the CBRC promulgated the Interim Measures on Administration of Personal Loans, or the Personal Loan Interim Measures, which provide that (i) several conditions shall be satisfied to apply for a personal loan, including but not limited to (a) the purposes of the loan shall be clear and legal, (b) the amount, term and currency of the loan as indicated in the loan application shall be reasonable, and (c) the borrower is willing and able to make repayment, and the borrower shall have a good credit standing and no record of bad credit, (ii) loan investigation shall cover, including but not limited to, the basic information of the borrower, the borrower’s earnings, the purpose of the loan, and the borrower’s source of funds and ability for repayment, and the method of repayment, and (iii) the lender shall perform the loan investigation on the borrower by itself and shall not delegate such matter to a third party. On January 6, 2023, the CBIRC issued the Draft Measures on Administration of Personal Loans for public comments, which will replace the Personal Loan Interim Measures once effective. This draft further stipulates that during the loan investigation process, the lender shall not delegate the core risk management matters such as the assessment of the genuine intention of the borrower, the borrower’s earnings, indebtedness, source of funds, and the assessment of the entry of evaluation service provider, to a third party.

91