UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2018 | |

or | |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to | |

Commission File Number: 001-38061

Warrior Met Coal, Inc.

(Exact name of registrant as specified in its charter)

Delaware (State or other jurisdiction of incorporation or organization) | 81-0706839 (I.R.S Employer Identification No.) | |

16243 Highway 216 Brookwood, Alabama (Address of principal executive offices) | 35444 (Zip Code) | |

(205) 554-6150

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class Common Stock, par value $0.01 per share | Name of each exchange on which registered New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o | |||

Emerging growth company o | ||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of voting stock held by non-affiliates of the registrant, based on the closing price of the common stock on June 30, 2018, the registrant’s most recently completed second fiscal quarter, as reported by the New York Stock Exchange, was approximately $1.2 billion.

Number of shares of common stock outstanding as of February 15, 2019: 51,555,337

Documents Incorporated By Reference

Portions of the registrant’s definitive proxy statement for its 2019 Annual Meeting of Stockholders, which will be filed with the Securities and Exchange Commission within 120 days of December 31, 2018, are incorporated by reference into Part III of this report for the year ended December 31, 2018.

TABLE OF CONTENTS

Glossary of Selected Terms | ||

Part I | ||

Item 1. | Business | |

Item 1A. | Risk Factors | |

Item 1B. | Unresolved Staff Comments | |

Item 2. | Properties | |

Item 3. | Legal Proceedings | |

Item 4. | Mine Safety Disclosures | |

Part II | ||

Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. | |

Item 6. | Selected Financial Data | |

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |

Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | |

Item 8. | Financial Statements and Supplementary Data | |

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |

Item 9A. | Controls and Procedures | |

Item 9B. | Other Information | |

Part III | ||

Item 10. | Directors, Executive Officers and Corporate Governance | |

Item 11. | Executive Compensation | |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

Item 13. | Certain Relationships and Related Transactions, and Director Independence | |

Item 14. | Principal Accounting Fees and Services | |

Part IV | ||

Item 15. | Exhibits, Financial Statement Schedules | |

Signatures | ||

Index to Financial Statements | ||

i

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Annual Report”) includes statements of our expectations, intentions, plans and beliefs that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and are intended to come within the safe harbor protection provided by those sections. These statements, which involve risks and uncertainties, relate to analyses and other information that are based on forecasts of future results and estimates of amounts not yet determinable and may also relate to our future prospects, developments and business strategies. We have used the words “anticipate,” “approximately,” “assume,” “believe,” “could,” “contemplate,” “continue,” “estimate,” “expect,” “target,” “future,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should” and similar terms and phrases, including in references to assumptions, in this Annual Report to identify forward-looking statements. These forward-looking statements are made based on expectations and beliefs concerning future events affecting us and are subject to uncertainties and factors relating to our operations and business environment, all of which are difficult to predict and many of which are beyond our control, that could cause our actual results to differ materially from those matters expressed in or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to:

• | successful implementation of our business strategies; |

• | a substantial or extended decline in pricing or demand for met coal; |

• | global steel demand and the downstream impact on met coal prices; |

• | inherent difficulties and challenges in the coal mining industry that are beyond our control; |

• | geologic, equipment, permitting, site access, operational risks and new technologies related to mining; |

• | impact of weather and natural disasters on demand and production; |

• | our relationships with, and other conditions affecting, our customers; |

• | unavailability of, or price increases in, the transportation of our met coal; |

• | competition and foreign currency fluctuations; |

• | our ability to comply with covenants in our asset-based revolving credit facility (as amended and restated, the “ABL Facility”) and our indenture governing the Notes (as defined below); |

• | our substantial indebtedness and debt service requirements; |

• | significant cost increases and fluctuations, and delay in the delivery of raw materials, mining equipment and purchased components; |

• | work stoppages, negotiation of labor contracts, employee relations and workforce availability; |

• | adequate liquidity and the cost, availability and access to capital and financial markets; |

• | any consequences related to our transfer restrictions under our certificate of incorporation; |

• | our obligations surrounding reclamation and mine closure; |

• | inaccuracies in our estimates of our met coal reserves; |

• | our ability to develop or acquire met coal reserves in an economically feasible manner; |

• | our expectations regarding our future cash tax rate as well as our ability to effectively utilize our net operating loss carryforwards (“NOLs”); |

• | challenges to our licenses, permits and other authorizations; |

1

• | challenges associated with environmental, health and safety laws and regulations; |

• | regulatory requirements associated with federal, state and local regulatory agencies, and such agencies’ authority to order temporary or permanent closure of our mines; |

• | climate change concerns and our operations’ impact on the environment; |

• | failure to obtain or renew surety bonds on acceptable terms, which could affect our ability to secure reclamation and coal lease obligations; |

• | costs associated with our pension and benefits, including post-retirement benefits; |

• | costs associated with our workers’ compensation benefits; |

• | litigation, including claims not yet asserted; |

• | our ability to continue paying our quarterly dividend or pay any special dividend; |

• | the timing and amount of any stock repurchases we make under our Stock Repurchase Program (as defined below) or otherwise; and |

• | terrorist attacks or security threats, including cybersecurity threats. |

These forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. Forward-looking statements should, therefore, be considered in light of various factors, including those set forth under “Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Part I, Item IA. Risk Factors” and elsewhere in this Annual Report, and those set forth from time to time in our other filings with the Securities and Exchange Commission (the “SEC”). These documents are available through our website or through the SEC’s Electronic Data Gathering and Analysis Retrieval system at http://www.sec.gov. In light of such risks and uncertainties, we caution you not to place undue reliance on these forward-looking statements.

When considering forward-looking statements made by us in this Annual Report or elsewhere, such statements speak only as of the date on which we make them. New risks and uncertainties arise from time to time, and it is impossible for us to predict these events or how they may affect us. We have no duty to, and do not intend to, update or revise the forward-looking statements in this Annual Report after the date of this Annual Report, except as may be required by law. In light of these risks and uncertainties, you should keep in mind that any forward-looking statement made in this Annual Report or elsewhere might not occur.

2

GLOSSARY OF SELECTED TERMS

The following is a glossary of selected terms used in the Annual Report:

Ash. Impurities consisting of silica, iron, alumina and other incombustible matter that are contained in coal. Since ash increases the weight of coal, it adds to the cost of handling and can affect the burning characteristics of coal.

Assigned reserves. Coal that is planned to be mined at an operation that is currently operating, currently idled or for which permits have been submitted and plans are eventually to develop the mine and begin mining operations.

Bituminous coal. A common type of coal with moisture content less than 20% by weight. It is dense and black and often has well-defined bands of bright and dull material.

British thermal unit (“Btu”). A measure of the thermal energy required to raise the temperature of one pound of pure liquid water one degree Fahrenheit at the temperature at which water has its greatest density (39 degrees Fahrenheit).

Coal seam. Coal deposits occur in layers. Each layer is called a “seam.”

Coke. A hard, dry carbon substance produced by heating coal to a very high temperature in the absence of air. Coke is used in the manufacture of iron and steel. Its production results in a number of useful by-products.

Continuous miner. A machine used in underground mining to cut coal from the seam and load onto conveyers or shuttle cars in a continuous operation. In contrast, a conventional mining unit must stop extracting in order to begin loading.

Continuous mining. A form of underground mining that cuts the coal from the seam and loads the coal on to a conveyor system continuously, thus eliminating the separate cycles of cutting, drilling, shooting and loading.

CSX. CSX Corporation.

EPA. Environmental Protection Agency.

Hard coking coal (“HCC”). Hard coking coal is a type of met coal that is a necessary ingredient in the production of strong coke. It is evaluated based on the strength, yield and size distribution of coke produced from such coal, which is dependent on the rank and plastic properties of the coal. Hard coking coals trade at a premium to other coals due to their importance in producing strong coke and because they are a limited resource.

Longwall mining. A form of underground mining that employs a shearer with two rotating drums pulled mechanically back and forth across a long exposed coal face. A hydraulic system supports the roof of the mine while the drums are mining the coal. Conveyors move the loosened coal to an underground mine conveyor that transports coal to the surface. Longwall mining is the most efficient underground mining method.

Metallurgical (“met”) coal. The various grades of coal with suitable carbonization properties to make coke or to be used as a pulverized injection ingredient for steel manufacture, including hard coking coal (see definition above), semi-soft coking coal and PCI coal. Met coal quality depends on four important criteria: (1) volatility, which affects coke yield; (2) the level of impurities, including sulfur and ash, which affect coke quality; (3) composition, which affects coke strength; and (4) other basic characteristics that affect coke oven safety. Met coal typically has particularly high Btu characteristics but low ash and sulfur content.

Metric ton. Equal to approximately 2,205 pounds. The international standard for quoting price per ton is based in U.S. dollars per metric ton. Unless otherwise indicated, the metric ton is the unit of measure referred to in this Annual Report and any reference to “ton(s)” or “tonnage” in this Annual Report refers to metric ton(s). One metric ton is equivalent to 1.10231 short tons.

Mineable Coal. That portion of the coal reserve base which is commercially mineable and excludes all coal that will be left, such as in pillars, fenders or property barriers.

MSHA. Mine Safety and Health Administration.

3

Overburden. Layers of earth and rock covering a coal seam. In surface mining operations, overburden must be removed prior to coal extraction.

PCI coal. Coal used by steelmakers for pulverized coal injection (PCI) into blast furnaces to use in combination with the coke used to produce steel. The use of PCI allows a steel maker to reduce the amount of coke needed in the steel making process.

Preparation plant. Preparation plants are usually located on a mine site, although one plant may serve several mines. A preparation plant is a facility for crushing, sizing and washing coal to remove impurities and prepare it for use by a particular customer. The washing process has the added benefit of removing some of the coal’s sulfur content.

Probable reserves. Reserves for which quantity and grade and/or quality are computed from information similar to that used for proven reserves, but the sites for inspection, sampling and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven reserves, is high enough to assume continuity between points of observation.

Productivity. As used in this Annual Report, refers to clean metric tons of coal produced per underground man hour worked, as published by the MSHA.

Proven reserves. Reserves for which: (a) quantity is computed from dimensions revealed in outcrops (part of a rock formation that appears at the surface of the ground), trenches, workings or drill holes; (b) grade and/or quality are computed from the results of detailed sampling; and (c) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established.

Reclamation. The process of restoring land and the environment to their original or otherwise rehabilitated state following mining activities. The process commonly includes “recontouring” or reshaping the land to its approximate original appearance, restoring topsoil and planting native grass and ground covers. Reclamation operations are usually underway before the mining of a particular site is completed. Reclamation is closely regulated by both state and federal law.

Recoverable reserves. Metric tons of mineable coal that can be extracted and marketed after deduction for coal to be left behind within the seam (i.e. pillars left to hold up the ceiling, coal not economical to recover within the mine, etc.) and adjusted for reasonable preparation and handling losses

Reserve. That part of a mineral deposit that could be economically and legally extracted or produced at the time of the reserve determination.

Roof. The stratum of rock or other mineral above a coal seam; the overhead surface of a coal working place.

SEC. Securities and Exchange Commission.

Slurry Impoundment. The entire structure used for coal slurry waste disposal, including the embankment, basin, beach, pool, and slurry. During the process of mining and cleaning coal, waste is created and must be permanently disposed of in an impoundment. Slurry, a combination of silt, dust, water, bits of coal and clay particles is the most commonly disposed of material held in an impoundment.

Subsidence. Lateral or vertical movement of surface land that occurs when the roof of an underground mine collapses. Longwall mining causes planned subsidence by the mining out of coal that supports the overlying strata.

Sulfur. One of the elements present in varying quantities in coal that contributes to environmental degradation when coal is burned. Sulfur dioxide is produced as a gaseous by-product of coal combustion.

Surface mine. A mine in which the coal lies at or near the surface and can be extracted by removing the covering layer of soil (see “Overburden”) without tunneling underground.

Ton or tonnage. See “metric ton” above.

Thermal coal. Coal used by power plants and industrial steam boilers to produce electricity, steam or both. It generally is lower in Btu heat content and higher in volatile matter than met coal.

4

Unassigned reserves. Coal that is likely to be mined in the future, but which is not considered “assigned reserves.”

Underground mine. Also known as a “deep” mine, it is usually located several hundred feet or more below the earth’s surface. An underground mine’s coal is typically removed mechanically and transferred by shuttle car, conveyor and hoist to the surface.

5

EXPLANATORY NOTE

On April 12, 2017, Warrior Met Coal, LLC, a Delaware limited liability company, converted into Warrior Met Coal, Inc., a Delaware corporation, as described in “Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations-Basis of Presentation-Factors Affecting the Comparability of our Financial Statements-Corporate Conversion and IPO.” We refer to this transaction herein as the “corporate conversion.” As used in this Annual Report, unless the context otherwise requires, references to the “Company,” “Warrior,” “we,” “us,” “our” or “Successor” refer to Warrior Met Coal, LLC, a Delaware limited liability company, and its subsidiaries for periods beginning as of April 1, 2016 and ending immediately before the completion of our corporate conversion, and to Warrior Met Coal, Inc., a Delaware corporation and its subsidiaries for periods beginning with the completion of our corporate conversion and thereafter. In the corporate conversion, 3,832,139 units of Warrior Met Coal, LLC converted into 53,442,532 shares of common stock of Warrior Met Coal, Inc. using an approximate 13.9459-to-one conversion ratio. References in this Annual Report to the “Predecessor” refer to the assets acquired and liabilities assumed by Warrior Met Coal, LLC from Walter Energy, Inc., a Delaware corporation (“Walter Energy”), in the Asset Acquisition on March 31, 2016, as further described in “Part I, Item 1. Business-Our History-Walter Energy Restructuring.” The Predecessor periods included in this Annual Report begin as of January 1, 2016 and end as of March 31, 2016.

6

Part I

Item 1. Business

Overview

We are a large scale, low-cost U.S.-based producer and exporter of premium met coal operating two highly productive underground mines in Alabama, Mine No. 4 and Mine No. 7, that have an estimated annual production capacity of 7.3 million metric tons of coal. We sell a premium met coal product to leading steel manufacturers in Europe and South America. As of December 31, 2018, based on a reserve report prepared by Marshall Miller & Associates, Inc. ("Marshall Miller"), our two operating mines had approximately 108.3 million metric tons of recoverable reserves and, based on a reserve report prepared by Stantec Consulting Services, Inc. ("Stantec"), our undeveloped Blue Creek Energy Mine contained 103.0 million metric tons of recoverable reserves. We strive to produce premium met coal in an efficient, safe and responsible manner, and environmental responsibility and sustainability are key principles in our business strategy.

Our hard coking coal (“HCC”), mined from the Southern Appalachian region of the United States, is characterized by low-to-medium volatile matter (“VM”) and high coke strength after reaction (“CSR”). These qualities make our coal ideally suited as a coking coal for the manufacture of steel. As a result of our high quality coal, our realized price has historically approximated the Platts Premium Low Volatility (“LV”) Free-On-Board (“FOB”) Australia Index price (the “Platts Index”). In contrast, coal produced in the Central Appalachian region of the United States is typically characterized by medium-to-high VM and a CSR that is below the requirements of the Australian Index price.

Our operations utilize longwall mining techniques, which is the most productive coal mining method available, and allows mining at the lowest cost per ton. We are able to utilize longwall mining as a result of the medium to thick coal seams of Mine No. 4 and Mine No. 7. Additionally, our operations benefit from a highly competitive initial Collective Bargaining Agreement (“CBA”) with the United Mine Workers of America (“UMWA”), which has enabled us to structurally reduce our cash costs.

Our two operating mines are located approximately 300 miles from our export terminal at the Port of Mobile, Alabama, which we believe to be the shortest mine-to-port distance of any U.S.-based met coal producer. Our low cost, flexible and efficient rail and barge network underpins our cost advantage and dependable access to the seaborne markets. We sell our coal to a diversified customer base of blast furnace steel producers, primarily located in Europe, South America and Asia. We enjoy a shipping time and distance advantage serving our customers throughout the Atlantic Basin relative to competitors located in Australia and Western Canada.

We operate as a single reportable segment. See the financial statements beginning on page F-1 of this Annual Report for our consolidated revenues, profit/loss and total assets.

Our History

Walter Energy Restructuring

Warrior Met Coal, LLC was formed on September 3, 2015 by certain lenders under Walter Energy’s 2011 Credit Agreement, dated as of April 1, 2011 (the “2011 Credit Agreement”), and the noteholders under Walter Energy’s 9.50% Senior Secured Notes due 2019 (such lenders and noteholders, collectively, “Walter Energy’s First Lien Lenders”) in connection with the acquisition by the Company of certain core assets of Walter Energy and certain of its wholly-owned subsidiaries (the “Walter Energy Debtors”) related to their Alabama mining operations. The acquisition was accomplished through a credit bid of the first lien obligations of the Walter Energy Debtors pursuant to section 363 of the U.S. Bankruptcy Code (the “Bankruptcy Code”) and an order by the Bankruptcy Court (I) Approving the Sale of the Acquired Assets Free and Clear of Claims, Liens, Interests and Encumbrances; (II) Approving the Assumption and Assignment of Certain Executory Contracts and Unexpired Leases; and (III) Granting Related Relief (Case No. 15-02741, Docket No. 1584) (the “Sale Order” and the transactions contemplated thereunder, the “Asset Acquisition”). Prior to the closing of the Asset Acquisition, the Company had no operations and nominal assets. The Asset Acquisition closed on March 31, 2016. Upon closing of the Asset Acquisition and in exchange for a portion of the outstanding first lien obligations of the Walter Energy Debtors, Walter Energy’s First Lien Lenders were entitled to receive, on a pro rata basis, a distribution of Class A Units in Warrior Met Coal, LLC.

In connection with the Asset Acquisition, we conducted rights offerings to Walter Energy’s First Lien Lenders and certain qualified unsecured creditors to purchase newly issued Class B Units of Warrior Met Coal, LLC, which diluted the

7

Class A Units on a pro rata basis (the “Rights Offerings”). Proceeds from the Rights Offerings were used to pay certain costs associated with the Asset Acquisition and for general working capital purposes.

Corporate Conversion and IPO

On April 12, 2017, we completed the corporate conversion pursuant to which Warrior Met Coal, LLC was converted into a Delaware corporation and renamed Warrior Met Coal, Inc.

On April 19, 2017, we completed our initial public offering (“IPO”) of 16,666,667 shares of common stock at a price to the public of $19.00 per share. All of the shares were offered and sold by selling stockholders. We did not receive any of the net proceeds from the IPO.

Our Competitive Strengths

We believe that we have the following competitive strengths:

Leading met coal producer focused on premium met coal products. Unlike other publicly-listed U.S. coal companies, substantially all of our revenue is derived from the sale of premium met coal in the global seaborne markets. All of our resources are primarily allocated to the mining, transportation and marketing of met coal. The premium HCC we produce at Mine No. 4 and Mine No. 7 is of a similar quality to the HCC produced in Australia. The premium nature of our HCC makes it ideally suited as a base feed coal for steel makers and results in price realizations near or above the Platts Index. Coal from Mine No. 7 is classified as a premium LV HCC and coal from Mine No. 4 is classified as premium LV to mid-volatility ("MV") HCC. The combination of low sulfur, low-to-medium ash, LV to MV, and other characteristics of our coal, as well as our ability to blend them, makes our HCC product an important component within our customers’ overall coking coal requirements. As a result, our realized price has historically been slightly above, in line with or at a slight discount to the Platts Index. Other publicly-listed U.S. coal companies sell a higher proportion of lower rank met coals, including high-volatility, semi-soft coking coal (“SSCC”), and pulverized coal injection (“PCI”) coal. These lower rank coals typically have lower realized prices compared to LV and MV met coals due to their relative availability and lower quality characteristics. For example, the premium LV HCC that we produce has sold at a premium of 1%, 9%, 26% and 31% of the prices realized for MV, high-volatility, PCI and SSCC coals, respectively, based on five-year average prices reported by Wood Mackenzie. Additionally, these companies typically have significant thermal coal production that further reduces their realized price and operating margin per metric ton. As a result of our premium met coal, we are able to achieve higher realized prices and operating margins relative to other U.S. met coal producers.

Highly flexible cost structure protects through-the-cycle profitability. We have “variabilized” our cost structure in our labor, royalties and logistics contracts, increasing the proportion of our cost structure that varies in response to changes in HCC prices based on a variety of indices. Our initial CBA, combined with our flexible rail, port and barge logistics and our royalty structure, results in a highly variable operating cost profile that allows our cash cost of sales to move with changes in the price we realize for our coal. Approximately two-thirds of our cash cost of sales relate to the cost of production at our mines, while the remaining one-third relates to our logistics costs from mine to port as well as royalties. Our logistics costs are structured to reduce cash requirements in lower HCC price environments and to increase cash requirements within a range with higher HCC prices. Our royalties are calculated as a percentage of the price we realize and therefore increase or decrease with changes in HCC prices. Our initial CBA includes variable elements that tie compensation to HCC prices. In addition, we can adjust our usage of continuous miner units in response to HCC pricing. Our variable cost structure dramatically lowers our cash cost of sales if our realized price falls, while being effectively capped in higher price environments allowing us to generate significant operating cash flow. Our highly flexible cost structure provides us with a key competitive advantage relative to our competitors and which we expect should allow us to remain profitable in all coal market conditions.

Significant logistical cost advantage to the seaborne market. Our two operating mines are located approximately 300 miles from our export terminal capacity in Mobile, Alabama and have alternative transportation routes to move our coal to port. These alternatives include direct rail access at the mine sites and a wholly-owned barge load-out facility, enabling us to utilize the lowest cost option between the two at any given point in time. We believe our logistics costs are highly competitive following negotiations in 2016 that led to a reduction in rail, barge and port costs. In addition, we have a contract with the Port of Mobile, Alabama, that provides us up to 8.0 million metric tons of annual port capacity through July 2026 for our coal at very competitive rates. The total annual capacity of the McDuffie Coal Terminal at the Port of Mobile, Alabama is approximately 27.2 million metric tons and this coal terminal is presently utilized for all of our coal exports. Our proximity to port contrasts with the approximately 400-mile distances for major Central Appalachian met coal producers to access their nearest port, the Port of Hampton Roads, Virginia. Our proximity to port and the flexibility of our logistics networks underpin our logistical cost advantage compared to other U.S. met coal producers.

8

We sell our coal to a diversified customer base of blast furnace steel producers, primarily located in Europe, South America and Asia. We enjoy a shipping time and distance advantage serving customers throughout the Atlantic Basin relative to competitors located in Australia and Western Canada. This advantage results in a higher margin for our met coal. Our strategic location is enhanced by our long-tenured, well-established customer portfolio, which includes significant recurring sales to multiple customers in excess of 10 years.

High realized prices and low cost structure drive industry leading margins. The coal from our mines is competitive in quality with the premium HCC produced in Australia, which is used to set pricing for the industry. The combination of low sulfur, low-to-medium ash, LV to MV and high coking strength drives our consistently high price realization relative to other U.S. met coal producers who typically focus on lower rank met coals. We believe Mine No. 4 and Mine No. 7 are two of the lowest cost met coal mines in North America. Our low cost position is derived from our operations’ favorable geology, automated long-wall mining methods, and significant flexibility allowed under our initial CBA. Additionally, given our highly flexible cost structure, we believe we will be able to maintain our industry leading margins in all coal market conditions, which we expect should allow us to continue to outperform our competitors.

Clean balance sheet and tax asset to drive robust cash flow generation. Unlike other U.S. coal producers in our peer group, we have no pension or OPEB legacy liabilities with manageable surety bond requirements. With minimal legacy liabilities, we are not burdened by the annual fixed obligations that are typically associated with these types of liabilities. Our clean balance sheet and its low sustaining capital expenditure requirements position us to generate strong cash flows across a range of met coal price environments. Additionally, we expect our cash flows to benefit from a low cash tax rate as a result of our significant NOLs. As a result of these tax assets, and the repeal of the corporate alternative minimum tax (“AMT”) beginning after December 31, 2017 (see Note 8 to our consolidated financial statements included elsewhere in this Annual Report), we believe our effective cash tax rate will be approximately 0%, exclusive of the AMT credit refunds, until our NOLs generated prior to 2018 are fully utilized or expire, which will enable strong cash conversion from our operating profits. We also expect to receive approximately $42.9 million in 2019 to 2022 as a result of the refunding of the AMT credits acquired from the Predecessor.

Disciplined financial policies to ensure stable performance. We believe maintaining financial discipline will provide us with the ability to manage the volatility in our business resulting from changes in met coal prices. We intend to preserve a strong and conservative balance sheet, with sufficient liquidity and financial flexibility to support our operations. As such, we will seek to maintain a conservative financial leverage target of 1.50-2.00x based on normalized EBITDA and seek to maintain minimum liquidity of $100 million. We plan to continually evaluate our liquidity needs based on our estimated capital needs. As of December 31, 2018, we had approximately $326.0 million of available liquidity consisting of $120.4 million of borrowing capacity under the ABL Facility and $205.6 million of cash and cash equivalents. In the event we generate cash flow in excess of the needs of our business, we plan to take a holistic approach to capital allocation and will evaluate a range of options, including debt repayment. We will seek to preserve our capital structure with low financial leverage that is largely free from legacy liabilities in order to ensure maximum free cash flow generation.

Highly experienced leadership team with deep industry expertise. Our Chief Executive Officer (“CEO”), Walter J. Scheller, III, is the former CEO of Walter Energy and has seven years of direct experience managing Mine No. 4 and Mine No. 7, and over 30 years of experience in longwall coal mining. Furthermore, following the Asset Acquisition, we hired several key personnel with extensive direct operational experience in met coal longwall mining, including our Chief Operating Officer, Jack Richardson, and our Chairman, Stephen D. Williams. We have a strong record of operating safe mines and are committed to environmental excellence. Our dedication to safety is at the core of all of our overall operations as we work to further reduce workplace incidents by focusing on policy awareness and accident prevention. Our continued emphasis on enhancing our safety performance has resulted in zero fatal incidents as compared to the national fatal incidence rate for underground coal mines in the United States of 0.02 for the nine months ended September 30, 2018 as well as total reportable incidence rates of 2.91 at Mine No. 4 and 3.35 at Mine No. 7 for the year ended December 31, 2018, which are considerably lower than the national total reportable incidence rate for all underground coal mines in the United States of 4.62 for the nine months ended September 30, 2018, which represents the latest data available.

Strong focus on reducing greenhouse gas emissions. Investors and other third parties are increasingly focused on sustainability matters, and we are committed to reducing the release of greenhouse gases (“GHG”). GHG emissions are produced as a by-product of mining activities, as operations in underground metallurgical coal mines produce coal bed methane. With a view towards being an industry leader in environmental performance, we are actively engaged in several initiatives that occur before, during and after mining to reduce GHG emissions, including the capture of coalbed methane. Currently, the Company is able to capture approximately half of the methane that is produced as part of our mining operations through direct pipelines as well as our low-quality gas plant. Much of this methane is sold into the natural gas market. The remainder of the methane is released through our mines’ ventilation systems as coal mine methane (“CMM”) emissions. These

9

emissions that are released into the environment are extremely diluted. We have also partnered with a third-party to build a demonstrator plant that destroys CMM at our fan sites, as discussed under “Our Business Strategies - Capitalize on opportunities for technological innovation to continue to reduce our impact on the environment.”

From its inception, the Company has participated in the EPA’s voluntary program aimed at CMM emission reductions. We are also proud to participate in the EPA’s voluntary GHG reporting program which the EPA is using to improve its estimates of national GHG emissions. The Company’s focus on reducing GHG emissions has proven effective, as the Company’s annual Toxic Release Inventory, which is required annually by the EPA, demonstrates that we do not have any reportable air emissions.

Our Business Strategies

Our objective is to increase stockholder value through our continued focus on asset optimization and cost management to drive profitability and cash flow generation. Our key strategies to achieve this objective are described below:

Maximize profitable production. In the year ended December 31, 2018, we produced 7.0 million metric tons of met coal from Mine No. 7 and Mine No. 4. We have the flexibility in our new initial CBA that allows us to increase annual production with minimal incremental capital expenditures. We operated at an annual combined production level of 7.3 million metric tons from Mine No. 4 and Mine No. 7 as recently as 2013. Based on our management’s operational experience, we are confident in our ability to produce at or close to this capacity in a safe and efficient manner, and with a comparable cost profile to our current costs, should market conditions warrant.

Maintain and further improve our low-cost operating cost profile. While we have already achieved significant structural cost reductions at our two operating mines, we see further opportunities to reduce our costs over time. Our initial CBA with the UMWA allows for these ongoing cost optimization initiatives. For example, in our initial CBA, we have additional flexibility in our operating days and alternative work schedules as compared to certain optional and more expensive provisions under the Walter Energy collective bargaining agreement. We have variable elements that tie compensation to HCC prices. Additionally, our CBA enables us to contract out work under certain circumstances. We believe these types of structural incentive provisions and workforce flexibility in the initial CBA are helpful to further align our organization with operational excellence and to increase the proportion of our costs that vary in response to changes in the HCC price.

Broaden our marketing reach and maintain strong correlation between realized coal prices and the Platts Index. We have implemented a strategy to improve both our sales and marketing focus, with a goal of achieving better pricing relative to the Platts Index, which includes: (i) opportunistic selling into the spot met coal market and (ii) selected instances of entering into fixed price contracts. Each of these elements is intended to further embed our coal product among a broader group of steel customers. Traditionally, we have predominantly marketed our coal to European and South American buyers. For the year ended December 31, 2018, our geographic customer mix was 55% in Europe, 31% in South America and 14% in Asia. Since February 2017, we have had an arrangement with Xcoal Energy & Resource (“Xcoal”) to serve as Xcoal’s strategic partner for exports of LV HCC. Under this arrangement, Xcoal takes title to and markets coal that we would historically have sold on the spot market, in an amount of the greater of (i) 10% of our total production during the applicable term of the arrangement or (ii) 250,000 metric tons. While the volumes being sold through this arrangement with Xcoal are relatively limited, we are positioned to potentially benefit from Xcoal’s expertise and relationships across all coal that we sell. To that end, we also have an incentive-based arrangement with Xcoal to cover other tonnage, in the event Xcoal is able to offer us a higher realized price relative to the Platts Index than we have previously achieved.

Capitalize on opportunities for technological innovation to continue to reduce our impact on the environment. As described above, the Company currently captures approximately half of the coalbed methane that is produced during our mining activities as part of our commitment to reduce the Company’s GHG emissions. We are then able to sell this gas into the natural gas market. In addition to capturing pipeline quality gas, the Company also operates a low-quality gas plant, which is able to improve the quality of ordinarily unsaleable gas that would otherwise escape to the atmosphere. The improved gas is then sold and used by consumers. This plant operates using a complex system that concentrates the methane by removing other gases such as nitrogen and oxygen. We are also exploring technologies with a third party for destroying CMM. To prove one such technology, the Company built a pilot or demonstrator plant. This plant ran for a period of time sufficient to prove the technology was successful, and a larger scale operation is currently planned to be in service by the year ended December 31, 2020. The Company’s management and board of directors are increasingly focused on these and other opportunities for technical innovation.

10

Description of Our Business

Our mining operations consist of two active underground met coal mines in Southern Appalachia’s coal seam (Mines No. 7 and No. 4) and other surface met and thermal coal mines, five of which are currently under lease to third parties and four of which are not operating and are not currently planned to be operated in the future. For a comprehensive summary of all of our coal properties and of our coal reserves and production levels as of December 31, 2018, see the tables summarizing our coal reserves and production in “Part I, Item 2. Properties-Estimated Recoverable Coal Reserves.” Our met coal production totaled 7.0 million metric tons in 2018. Our natural gas operations remove and sell natural gas from the coal seams owned or leased by us and others as a byproduct of coal production. Our degasification operations improve mining operations and safety by reducing natural gas levels in our mines.

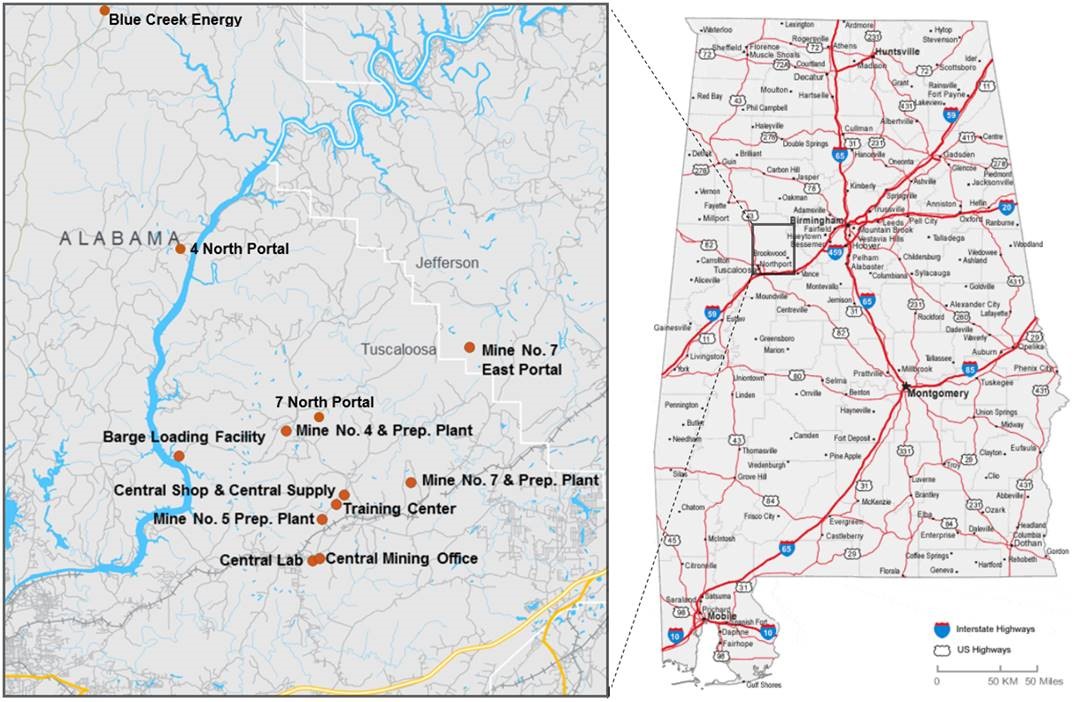

Our underground mining operations are headquartered in Brookwood, Alabama and as of December 31, 2018, based on a reserve report prepared by Marshall Miller, were estimated to have approximately 108.3 million metric tons of recoverable reserves located in west central Alabama between the cities of Birmingham and Tuscaloosa. Operating at approximately 2,000 feet below the surface, the Mines No. 4 and No. 7 are two of the deepest underground coal mines in North America. The met coal is mined using longwall extraction technology with development support from continuous miners. We extract met coal primarily from Alabama’s Blue Creek coal seam, which contains high-quality bituminous coal. Blue Creek coal offers high coking strength with low coking pressure, low sulfur and low-to-medium ash content.

The met coal from our Mines No. 4 and No. 7 is sold as a high quality LV and MV met coal. Mines No. 4 and No. 7 are located near Brookwood, Alabama, and are serviced by CSX railroad. A coal producer is typically responsible for transporting the coal from the mine to an export coal-loading facility. Exported coal is usually sold at the loading port, with the buyer responsible for further transportation from the port to their location. Both mines also have access to our barge load-out facility on the Black Warrior River. Service via both rail and barge culminates in delivery to the Port of Mobile in Mobile, Alabama, where shipments are exported to our international customers via ocean vessels. Substantially all of our met coal sales consist of sales to international customers. We also own mineral rights for approximately 103.0 million additional metric tons of recoverable reserves at our Blue Creek Energy Mine located to the northwest of Mine No. 4, based on a reserve report prepared by Stantec. The related mineral leases form the core of the project to be operated by Warrior Met Coal BCE, LLC, an indirect subsidiary of the Company, which project contemplates the development of a new underground met coal mine that has an estimated life of greater than 30 years. We refer to the underground met coal mine related to this project as the “Blue Creek Energy Mine.”

Coal Preparation and Blending

Our met coal mines have preparation and blending facilities convenient to each mine. The met coal preparation and blending facilities receive, blend, process and ship met coal that is produced from the mines. Using these facilities, we are able to ensure a consistent quality and efficiently blend our met coal to meet our customers’ specifications.

Marketing, Sales and Customers

Met coal prices can differ substantially by region and are impacted by many factors, including the overall economy, demand for steel, location, market, quality and type of met coal, mine operation costs and the cost of customer alternatives. The major factors influencing our business are the global economy and demand for steel. Our operations’ high quality met coal is considered among the highest quality met coals in the world and is preferred as a base met coal in our customers’ blends. Our marketing strategy is to focus on international markets mostly in Europe and South America where we have a shipping time and distance advantage and where our met coal is in demand.

We focus on long-term customer relationships where we have a competitive advantage. We sell most of our met coal under fixed supply contracts primarily with indexed pricing terms and volume terms of one to three years. Some of our sales of met coal can, however, occur in the spot market as dictated by available supply and market demand. Our business is not substantially dependent on any contract, such as a contract to sell the major part of our products or other agreement to use a patent, formula, trade secret, process or trade name upon which our business depends to a material extent. For more information regarding our customers, see Note 2 to our consolidated financial statements included elsewhere in this Annual Report.

We have an arrangement with Xcoal to serve as Xcoal’s strategic partner for exports of LV HCC. Xcoal has specialized marketing capabilities and deep technical expertise as the largest met coal marketer in the United States. Our arrangement with Xcoal is expected to expand the geographic reach of our customers through Xcoal’s global presence. Xcoal has 16 offices worldwide, including in Brussels, the UAE, Singapore, Beijing, Shanghai, Seoul, Mumbai, and Rio de Janeiro. We expect to be

11

able to leverage Xcoal’s more than 30 year history selling coal to key European and Asian steel customers to further improve the selling prices of our met coal relative to the global Platts Index.

Trade Names, Trademarks and Patents

As part of the Asset Acquisition, we acquired all intellectual property, including copyrights, patents, trademarks, trade names and trade secrets, owned by the Walter Energy Debtors and used or held for use in the business or our assets. Promptly following the closing of the Asset Acquisition, each Walter Energy Debtor, including Walter Energy, was required to discontinue the use of its name (and any other trade names or “d/b/a” names currently utilized by the Walter Energy Debtors) and may not subsequently change its name to or otherwise use or employ any name which includes the words “Walter.” We do not believe that any one such trademark is material to our individual segments or to the business as a whole.

Competition

Substantially all of our met coal sales are exported. Our major competitors are businesses that sell into our core business areas of Europe and South America. We primarily compete with producers of premium met coal from Australia, Canada, Russia, Mozambique and the United States. The principal factors on which we compete are met coal prices at the port of delivery, coal quality and characteristics, customer relationships and the reliability of supply. The demand for our met coal is significantly dependent on the general global economy and the worldwide demand for steel. Although there are significant challenges in the current economy, we believe that we have competitive strengths in our business areas that provide us with distinct advantages.

Suppliers

Supplies used in our business include petroleum-based fuels, explosives, tires, conveyance structure, ventilation supplies, lubricants and other raw materials as well as spare parts and other consumables used in the mining process. We use third-party suppliers for a significant portion of our equipment rebuilds and repairs, drilling services and construction. We believe adequate substitute suppliers are available and we are not dependent on any one supplier; however, we procure some equipment from a concentrated group of suppliers, and obtaining this equipment often involves long lead times. Occasionally, demand for such equipment by mining companies can be high and some types of equipment may be in short supply. We continually seek to develop relationships with suppliers that focus on reducing our costs while improving quality and service.

Environmental Responsibility and Sustainability

The Company takes pride in its environmental record and strives to be an industry leader in environmental stewardship. As noted above, we are actively engaged in the EPA’s voluntary programs to reduce and report GHG emissions and to improve estimates of national GHG emissions. With regard to the Company’s water management efforts, we have a strong environmental compliance record with the EPA’s National Pollutant Discharge Elimination System (NPDES) program, which addresses water pollution by regulating point sources that discharge pollutants into the waters of the United States. We also monitor adjacent streams and groundwater wells quarterly in order to determine if these water supplies could potentially have been affected by mining operations. Waste water, or water used for mining or processing of coal, is stored in locations such as impoundment structures or clarifying or settling ponds. Additionally, the Company performs a minimum of at least one complete inspection of all tailing impoundments at intervals not to exceed seven calendar days as required by federal regulation, and all of the Company’s tailing impoundments are classified as “low-hazard” structures. We continue to improve our land reclamation efforts, which has yielded success across all of our sites and facilities. We received approval from Alabama Surface Mining Commission (ASMC) in 2018 for the final release of 667 reclaimed acres. Finally, the Company is highly proactive in planning all ongoing and future activities to minimize negative impacts to wildlife and their habitats by mining activities. All of the Company’s permit applications are reviewed by the regional U.S. Fish and Wildlife office for potential negative impacts to any protected species or habitat within the area.

The Company has dedicated employees that oversee the Company’s efforts with respect to various environmental issues, including our efforts with respect to the programs discussed above. Through their efforts, as well as oversight by our senior management and board of directors, we continue to make significant progress in improving our environmental stewardship. The Environmental, Health & Safety Committee of the Company’s board is tasked with assessing the effectiveness of the Company’s environmental, health and safety policies, programs and initiatives, as well as reviewing and monitoring the Company’s compliance with applicable environmental, health and safety laws, rules and regulations. This committee receives quarterly reports from Company management, during which the committee reviews and discusses the Company’s various environmental, health and safety initiatives and any issues related to these areas.

12

The safety of our employees is a core value for us. Our health and safety policies and programs are the cornerstone of our operating philosophy and are integrated into all of our daily operations and activities. Our continued emphasis on enhancing our safety performance has resulted in total reportable incident rates at Mine No. 4 and Mine No. 7, based on Mine, Safety and Health Administration (“MSHA”) criteria, which are lower than the national total reportable incidence rate for all underground coal mines in the United States. This record reflects our effectiveness in protecting our employees. In 2018, the Company hired a new Vice President of Safety, who is responsible for developing and overseeing health and safety programs at the Company’s mines, and he regularly reports to the Environmental, Health & Safety Committee so that the Company’s board of directors is apprised of the Company’s safety-related efforts and challenges.

Environmental and Regulatory Matters

Our businesses are subject to numerous federal, state and local laws and regulations with respect to matters such as permitting and licensing, employee health and safety, reclamation and restoration of property and protection of the environment. In the U.S., environmental laws and regulations include, but are not limited to, the federal Clean Air Act and its state and local counterparts with respect to air emissions; the Clean Water Act and its state counterparts with respect to water discharges and dredge and fill operations; the Resource Conservation and Recovery Act and its state counterparts with respect to solid and hazardous waste generation, treatment, storage and disposal, as well as the regulation of underground storage tanks; the Comprehensive Environmental Response, Compensation and Liability Act and its state counterparts with respect to releases, threatened releases and remediation of hazardous substances; the Endangered Species Act with respect to protection of threatened and endangered species; the National Environmental Policy Act with respect to the impacts of federal actions such as the issuance of permits and licenses; and the Surface Mining Control and Reclamation Act of 1977 and its state counterparts with respect to environmental protection and reclamation standards for mining activities. Compliance with these laws and regulations may be costly and time-consuming and may delay commencement, continuation or expansion of exploration or production at our operations. These laws are constantly evolving and may become increasingly stringent. The ultimate impact of complying with existing laws and regulations is not always clearly known or determinable due in part to the fact that certain implementing regulations for these environmental laws have not yet been promulgated and in certain instances are undergoing revision or judicial review. These laws and regulations, particularly new legislative or administrative proposals (or judicial interpretations of existing laws and regulations) related to the protection of the environment, could result in substantially increased capital, operating and compliance costs and could have a material adverse effect on our operations and/or, along with analogous foreign laws and regulations, our customers’ ability to use our products.

Due in part to the extensive and comprehensive regulatory requirements, along with changing interpretations of these requirements, violations occur from time to time in our industry and at our operations. Expenditures relating to environmental compliance are a major cost consideration for our operations and environmental compliance is a significant factor in mine design, both to meet regulatory requirements and to minimize long-term environmental liabilities. To the extent that these expenditures, as with all costs, are not ultimately reflected in the prices of our products and services, operating results will be reduced. We believe that our major North American competitors are confronted by substantially similar conditions and thus do not believe that our relative position with regard to such competitors is materially affected by the impact of environmental laws and regulations. However, the costs and operating restrictions necessary for compliance with environmental laws and regulations may have an adverse effect on our competitive position with regard to foreign producers and operators who may not be required to undertake equivalent costs in their operations. In addition, the specific impact on each competitor may vary depending on a number of factors, including the age and location of its operating facilities, applicable legislation and its production methods.

Permitting and Approvals

Numerous governmental permits and approvals are required for mining and natural gas operations. We are required to prepare and present to federal, state and local authorities data pertaining to the effect or impact that any proposed exploration project for production of coal or gas may have on the environment, the public and our employees. In addition, we must also submit a comprehensive plan for mining and reclamation upon the completion of mining operations. The requirements are costly and time-consuming and may delay commencement or continuation of exploration, production or expansion at our operations. Typically, we submit necessary mining permit applications several months, or even years, before we anticipate mining a new area.

Applications for permits and permit renewals at our mining and gas operations are subject to public comment and may be subject to litigation from third parties seeking to deny issuance of a permit or to overturn the applicable agency’s grant of the permit application, which may also delay commencement, continuation or expansion of our mining and gas operations. Further, regulations provide that applications for certain permits or permit modifications in the U.S. can be delayed, refused or revoked if an officer, director or a stockholder with a 10% or greater interest in the entity is affiliated with or is in a position to control

13

another entity that has outstanding permit violations or has had a permit revoked. Significant delays in obtaining, or denial of, permits could have a material adverse effect on our business.

Mine Safety and Health

The MSHA, under the Federal Mine Safety and Health Act of 1977 (the “Mine Act”) and the Mine Improvement and New Emergency Response Act of 2006 (the “MINER Act”), as well as regulations adopted under these federal laws impose rigorous safety and health standards on mining operations. Such standards are comprehensive and affect numerous aspects of mining operations, including, but not limited to: training of mine personnel, mining procedures, ventilation, blasting, use of mining equipment, dust and noise control, communications and emergency response procedures. For instance, MSHA implemented a rule in August 2014 to reduce miners’ exposure to respirable coal dust, which reduced respirable dust standards for certain occupants and miners and required certain monitoring of shift dust levels. In August 2016, Phase III of MSHA’s respirable dust rule went into effect, further lowering the respirable dust standards. Separately, MSHA has implemented a rule imposing a requirement on certain continuous mining machines, requiring operators to provide proximity detection systems. MSHA monitors compliance with these laws and standards by regularly inspecting mining operations and taking enforcement actions where MSHA believes there to be non-compliance. These federal mine safety and health laws and regulations have a significant effect on our operating costs.

Workers’ Compensation and Black Lung

We are insured for workers’ compensation benefits for work related injuries that occur within our operations. Workers’ compensation liabilities, including those related to claims incurred but not reported, are recorded principally using annual valuations based on discounted future expected payments using historical data of the operating subsidiary or combined insurance industry data when historical data is limited. Beginning on June 1, 2018, the Company has a deductible policy where the Company is responsible for the first $0.5 million for each workers compensation related claim from any of our employees.

In addition, certain of our subsidiaries are responsible for medical and disability benefits for black lung disease under the Federal Coal Mine Health and Safety Act of 1969, the Mine Act and the Black Lung Benefits Revenue Act of 1977 and the Black Lung Benefits Reform Act of 1977 (together, the “Black Lung Benefits Act”), each as amended, and are insured under a guaranteed cost insurance policy beginning on April 1, 2016 through May 31, 2018 for black lung claims of any of our employees. Beginning on June 1, 2018, the Company has a deductible policy where the Company is responsible for the first $0.5 million for each black lung claim from any of our employees.

We also assumed all of the black lung liabilities of Walter Energy and its U.S. subsidiaries. We are self-insured for these black lung liabilities and have posted certain collateral with Department of Labor as described below. Changes in the estimated claims to be paid or changes in the amount of collateral required by the Department of Labor may have a greater impact on our profitability and cash flows in the future.” Under the Black Lung Benefits Act, as amended, each coal mine operator must make payments to a trust fund for the payment of benefits and medical expenses to claimants who last worked in the coal industry prior to January 1, 1970. The trust fund is funded by an excise tax on production; however, this excise tax does not apply to coal shipped outside the United States. Based on our limited sales of coal in the United States, we do not expect to incur a material expense related to this excise tax. However, the excise tax may result in a material expense to us in the future if our coal sales in the United States significantly increase. The Patient Protection and Affordable Care Act includes significant changes to the federal black lung program, including an automatic survivor benefit paid upon the death of a miner with an awarded black lung claim and the establishment of a rebuttable presumption with regard to pneumoconiosis among miners with 15 or more years of coal mine employment that are totally disabled by a respiratory condition. These changes could have a material impact on our costs expended in association with the federal black lung program. In addition to possibly incurring liability under federal statutes we may also be liable under state laws for black lung claims. For additional information, please see “Part I, Item 1A. Risk Factors-Risks Related to Our Business-We are responsible for medical and disability benefits for black lung disease under federal law.

Surface Mining Control and Reclamation Act

The Surface Mining Control and Reclamation Act of 1977 (“SMCRA”) requires that comprehensive environmental protection and reclamation standards be met during the course of and following completion of mining activities. Permits for all mining operations must be obtained from the Federal Office of Surface Mining Reclamation and Enforcement (“OSM”) or, where state regulatory agencies have adopted federally approved state programs under the SMCRA, the appropriate state regulatory authority. The Alabama Surface Mining Commission reviews and approves SMCRA permits in Alabama.

14

SMCRA permit provisions include requirements for coal prospecting, mine plan development, topsoil removal, storage and replacement, selective handling of overburden materials, mine pit backfilling and grading, subsidence control for underground mines, surface drainage control, mine drainage and mine discharge control, treatment and revegetation. These requirements seek to limit the adverse impacts of coal mining and more restrictive requirements may be adopted from time to time.

Before a SMCRA permit is issued, a mine operator must submit a bond or otherwise secure the performance of reclamation obligations. The Abandoned Mine Land Fund, which is part of SMCRA, imposes a general funding fee on all coal produced. The proceeds are used to reclaim mine lands closed or abandoned prior to 1977. On December 7, 2006, the Abandoned Mine Land Program was extended for another 15 years.

We maintain extensive coal refuse areas and slurry impoundments at our mining complexes. Such areas and impoundments are subject to comprehensive regulation. Structural failure of an impoundment can result in damage to the environment and natural resources, such as bodies of water that the coal slurry reaches, as well as create liability for related personal injuries, property damages and injuries to wildlife. Some of our impoundments overlie mined out areas, which can pose a heightened risk of failure and the assessment of damages arising out of such failure. If one of our impoundments were to fail, we could be subject to substantial claims for the resulting environmental contamination and associated liability, as well as for related fines and penalties.

On December 12, 2008, the OSM finalized rulemaking regarding the interpretation of the stream buffer zone provisions of SMCRA, which confirmed that excess spoil from mining and refuse from coal preparation could be placed in permitted areas of a mine site that constitute waters of the U.S. The rule was subsequently vacated based, in part, upon the fact that the U.S. Fish & Wildlife Service was not consulted with respect to possible effects on endangered species under terms of the Endangered Species Act. At present, an earlier 1983 rule is in place, which requires coal companies to keep operations 100 feet from streams or otherwise minimize any damage. On December 20, 2016, the OSM published a new, finalized “Stream Protection Rule,” setting standards for “material damage to the hydrologic balance outside the permit area” that are applicable to surface and underground mining operations. However, on February 16, 2017, President Trump signed a joint congressional resolution disapproving the Stream Protection Rule pursuant to the Congressional Review Act. Accordingly, the regulations in effect prior to the Stream Protection Rule apply, including OSM’s 1983 rule. It remains unclear whether and how additional actions by the Trump Administration could further impact regulatory or enforcement activities pursuant to the SMCRA.

Drainage flowing from or caused by mining activities can be acidic with elevated levels of dissolved metals, a condition referred to as “acid mine drainage” (“AMD”). Treatment of AMD can be costly. Although we do not currently face material costs associated with AMD, there can be no assurance that we will not incur significant costs in the future.

Surety Bonds/Financial Assurance

We use surety bonds and letters of credit to provide financial assurance for certain transactions and business activities. Federal and state laws require us to obtain surety bonds or other acceptable security to secure payment of certain long-term obligations including mine closure or reclamation costs and other miscellaneous obligations. The amount of security required to be obtained can change as the result of new federal or state laws, as well as changes to the factors used to calculate the bonding or security amounts.

Surety bond rates have increased in recent years and the market terms of such bonds have generally become less favorable. In addition, the number of companies willing to issue surety bonds has decreased. Bonding companies may also require posting of collateral, typically in the form of letters of credit to secure the surety bonds. Moreover, the changes in the market for coal used to generate electricity in recent years have led to bankruptcies involving prominent coal producers. Several of these companies relied on self-bonding to guarantee their responsibilities. In response to these bankruptcies, the OSM issued a Policy Advisory in August 2016 to state agencies that are authorized under the SMCRA to implement the act in their states, notifying those state agencies that the OSM would more closely review self-bonding arrangements. Certain states had previously announced that they would no longer accept self-bonding to secure reclamation obligations under the state mining laws. This Policy Advisory may discourage authorized states from approving self-bonding arrangements and may lead to increased demand for other forms of financial assurance, which may strain capacity for those instruments and increase our costs of obtaining and maintaining the amounts of financial assurance needed for our operations. Individually and collectively, these revised various financial assurance requirements may increase the amount of financial assurance needed and limit the types of acceptable instruments, straining the capacity of the surety markets to meet demand. This may increase the time required to obtain, and increase the cost of obtaining, the required financial assurances. Although Alabama’s regulatory framework technically allows for self-bonding, as a practical matter, due to the onerous regulatory requirements for self-bonding, mining companies in Alabama utilize surety bonds, collateral bonds, or letters of credit to meet their financial

15

assurance requirements. As of December 31, 2018, we had outstanding surety bonds with parties for post-mining reclamation at all of our mining operations totaling $44.4 million, and $2.1 million for miscellaneous purposes. Additionally, the Company had $0.8 million invested in certificate of deposits as financial assurance for post mining reclamation obligations.

Climate Change

Global climate change continues to attract considerable public and scientific attention, with widespread concern about the impacts of human activity, especially the emission of greenhouse gas (“GHG”), such as carbon dioxide and methane. Some of our operations, such as methane release resulting from met coal mining, directly emit GHGs. Further, the products that we produce result in the release of carbon dioxide into the atmosphere by end-users. Laws and regulations governing emissions of GHGs have been adopted by foreign governments, including the European Union and member countries, U.S. regulatory agencies, individual states in the U.S. and regional governmental authorities. While Congress has from time to time considered legislation to reduce emissions of GHGs, there has not been significant activity in the form of adopted legislation to reduce GHG emissions at the federal level in recent years. In the absence of such federal climate legislation, almost one-half of the states have taken legal measures to reduce emissions of GHGs primarily through the planned development of GHG emission inventories and/or regional GHG cap and trade programs. Further, numerous proposals have been made and are likely to continue to be made at the international, national, regional and state levels of government that are intended to limit emissions of GHGs by enforceable requirements and voluntary measures.

In December 2009, the EPA published findings that GHG emissions present an endangerment to public health and welfare because, according to the EPA, emissions of such gases contribute to warming of the earth’s atmosphere and other climatic changes. The EPA’s findings focus on six GHGs, including carbon dioxide and nitrous oxide (which are emitted from coal combustion) and methane (which is emitted from coal beds). The findings by the EPA allowed the agency to proceed with the adoption and implementation of regulations to restrict emissions of GHGs under existing provisions of the federal Clean Air Act, including rules that regulate emissions of GHGs from motor vehicles and certain large stationary sources of emissions such as power plants or industrial facilities. In May 2010, the EPA adopted regulations that, among other things, established Prevention of Significant Deterioration (“PSD”) and Title V permit reviews for certain large stationary sources, such as coal-fueled power plants, that are potential major sources of GHG emissions. The so-called Tailoring Rule established new GHG emissions thresholds that determine when stationary sources must obtain permits under the PSD and Title V programs of the Clean Air Act. On June 23, 2014, the Supreme Court held that stationary sources could not become subject to PSD or Title V permitting solely by reason of their GHG emissions. The Court ruled, however, that the EPA may require installation of best available control technology for GHG emissions at sources otherwise subject to the PSD or Title V programs. On August 26, 2016, the EPA proposed changes needed to bring EPA’s air permitting regulations in line with Supreme Court and D.C. Circuit decisions on greenhouse gas permitting. The proposed rule was published in the Federal Register on October 3, 2016 and the public comment period closed on December 16, 2016. It is unclear when a final rule will be issued and/or whether and how additional actions by the Trump Administration could impact further regulatory developments in this area.

In June 2010, Earthjustice petitioned the EPA to make a finding that emissions from coal mines may reasonably be anticipated to endanger public health and welfare, and to list them as a stationary source subject to further regulation of emissions. On April 30, 2013, the EPA denied the petition. Judicial challenges seeking to force the EPA to list coal mines as stationary sources have likewise been unsuccessful to date. If the EPA were to make an endangerment finding in the future, we may have to further reduce our methane emissions, install additional air pollution controls, pay certain taxes or fees for our emissions, incur costs to purchase credits that permit us to continue operations as they now exist at our underground coal mines or perhaps curtail coal production.

In addition, in August 2015, the EPA announced three separate, but related, actions to address carbon dioxide pollution from power plants, including final Carbon Pollution Standards for new, modified and reconstructed power plants, a final Clean Power Plan to cut carbon dioxide pollution from existing power plants, and a proposed federal plan to implement the Clean Power Plan emission guidelines. Upon publication of the Clean Power Plan on October 23, 2015, more than two dozen states as well as industry and labor groups challenged the Clean Power Plan in the D.C. Circuit Court of Appeals. On February 9, 2016, the U.S. Supreme Court stayed the Clean Power Plan pending disposition of the legal challenges. In addition, on March 28, 2017, President Trump signed an executive order directing the EPA to review all three actions and, if appropriate, initiate a rulemaking to rescind or revise the rules consistent with the stated policy of promoting clean and safe development of the nation’s energy resources, while at the same time avoiding regulatory burdens that unnecessarily encumber energy production. On October 16, 2017, the EPA published a proposed rule to repeal the Clean Power Plan and, on August 31, 2018 the EPA published a proposed replacement rule that would "reduce the compliance burden" of the Clean Power Plan. Also, on December 20, 2018, the EPA published a proposed rule to amend the standards for new, modified and reconstructed stationary power plants. If the Clean Power Plan is not repealed or modified by the EPA, and if it ultimately is retained in its current form, it could have a material adverse impact on the demand for thermal coal nationally. While the Clean Power Plan does not affect

16

our marketing of met coal, the continued regulatory focus could lead to future GHG regulations for the mining industry and its steelmaking customers, which ultimately could make it more difficult or costly for us to conduct our operations or adversely affect demand for our products.